QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Allos Therapeutics, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ALLOS THERAPEUTICS, INC.

11080 CirclePoint Road, Suite 200

Westminster, CO 80020

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2003

TO THE STOCKHOLDERS OF ALLOS THERAPEUTICS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Allos Therapeutics, Inc., a Delaware corporation (the "Company"), will be held on Friday, May 23, 2003 at 8:30 a.m. local time at the Company's offices at 11080 CirclePoint Road, Suite 200, Westminster, Colorado 80020 for the following purposes:

- 1.

- To elect directors to serve for the ensuing year and until their successors are elected.

- 2.

- To approve an amendment to the Company's 2000 Stock Incentive Compensation Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 1,000,000 shares from 2,151,037 shares to a total of 3,151,037 shares.

- 3.

- To ratify the selection of PricewaterhouseCoopers LLP as independent auditors of the Company for its fiscal year ending December 31, 2003.

- 4.

- To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on April 28, 2003, as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

| | By Order of the Board of Directors |

|

/s/ Daniel R. Hudspeth |

|

Daniel R. Hudspeth

Secretary |

Westminster, Colorado

May 7, 2003

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the Annual Meeting or you may vote your shares on the Internet or by telephone by following the instructions on your proxy. If your shares are held of record by a broker, bank or other nominee, you may be able to vote on the Internet or by telephone by following the instructions provided with your voting form. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name.

ALLOS THERAPEUTICS, INC.

11080 CirclePoint Road, Suite 200

Westminster, CO 80020

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2003

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors of Allos Therapeutics, Inc., a Delaware corporation ("Allos" or the "Company"), for use at the Annual Meeting of Stockholders to be held on Friday, May 23, 2003, at 8:30 a.m. local time (the "Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Company's offices at 11080 CirclePoint Road, Suite 200, Westminster, Colorado 80020. The Company intends to mail this proxy statement and accompanying proxy card on or about May 7, 2003, to all stockholders entitled to vote at the Annual Meeting.

SOLICITATION

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

VOTING RIGHTS AND OUTSTANDING SHARES

Only holders of record of Common Stock at the close of business on April 28, 2003 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on April 28, 2003, the Company had outstanding and entitled to vote 25,884,554 shares of Common Stock. Each holder of record of Common Stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by votes at the Annual Meeting or by proxy. Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count "For" and (with respect to proposals other than the election of directors) "Against" votes, abstentions and broker non-votes (a "broker non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner, despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions). Abstentions will be counted towards the vote total for each proposal, and will have the same effect as "Against" votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the Annual Meeting or a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another date.

VOTING VIA THE INTERNET OR BY TELEPHONE

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The law of Delaware, under which the Company is incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the stockholder.

The telephone and Internet voting procedures below are designed to authenticate stockholders' identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders' instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

For Shares Registered in Your Name

Stockholders of record may go to "http://www.eproxy.com/alth" to grant a proxy to vote their shares by means of the Internet. The voter will be required to provide the company number and control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen and the voter will be prompted to submit or revise them as desired. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-435-6710 and following the recorded instructions.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive instruction for granting proxies from their banks, brokers or other agents, rather than the Company's proxy card. You may grant a proxy to vote the shares held in street name by means of the telephone or on the Internet as instructed by your broker or bank. Follow the instructions from your broker or bank included with these proxy materials.

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 11:00 p.m. Eastern Time on Thursday, May 22, 2003. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

REVOCABILITY OF PROXIES

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company's principal executive office, 11080 CirclePoint Road, Suite 200, Westminster, CO 80020, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

STOCKHOLDER PROPOSALS

The deadline for submitting a stockholder proposal for inclusion in the Company's proxy statement and form of proxy for the Company's 2004 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission is January 9, 2004. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must do so no earlier than February 22, 2004 and no later than March 24, 2004. Stockholders are also advised to

2

review the Company's Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

PROPOSAL 1

ELECTION OF DIRECTORS

There are six nominees for the six Board positions presently authorized in accordance with the Company's Bylaws. Each director to be elected will hold office until the next annual meeting of stockholders and until his successor is elected and has qualified, or until such director's earlier death, resignation or removal. Each nominee listed below is currently a director of the Company, five directors having been elected by the stockholders, and one director, Michael D. Casey, having been elected by the Board.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the six nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected and management has no reason to believe that any nominee will be unable to serve.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

NOMINEES

The names of the nominees and certain information about them, as of March 3, 2003, are set forth below:

Name

| | Age

| | Principal Occupation/

Position Held With the Company

|

|---|

| Stephen J. Hoffman, Ph.D., M.D. | | 48 | | Chairman of the Board; Principal, Techno Venture Management |

| Michael E. Hart | | 50 | | President and Chief Executive Officer |

| Donald J. Abraham, Ph.D. | | 66 | | Professor and Chairman of the Department of Medicinal Chemistry at Virginia Commonwealth University |

| Mark G. Edwards | | 45 | | Managing Director, Recombinant Capital, Inc. |

| Marvin E. Jaffe, M.D. | | 66 | | Pharmaceutical Industry Consultant |

| Michael D. Casey | | 57 | | Pharmaceutical Industry Consultant |

Stephen J. Hoffman, Ph.D., M.D. has served as a member of our Board of Directors since 1994 and as our Chairman of the Board since December 2001. From July 1994 to December 2001, Dr. Hoffman served as our President and Chief Executive Officer. Prior to that, from inception to 1994, Dr. Hoffman served as a consultant to our investor group. From 1990 to 1994, he completed a fellowship in clinical oncology and a residency/fellowship in dermatology, both at the University of Colorado. Dr. Hoffman was the scientific founder of Somatogen Inc., where he held the position of Director of Corporate Research and Vice President of Science and Technology from 1987 until 1990. Dr. Hoffman received his Ph.D. in bio-organic chemistry from Northwestern University and his M.D. from the University of Colorado School of Medicine.

Michael E. Hart has served as our President and Chief Executive Officer since December 2001. Prior to that, Mr. Hart served as our Chief Financial Officer and Senior Vice President, Operations

3

since 1999. From 1995 to 1999, Mr. Hart was Vice President and Chief Financial Officer of NeXstar Pharmaceuticals, Inc., where he also served as Chairman of the Management Committee from 1998 to 1999. From 1990 to 1995, Mr. Hart was Executive Vice President and Chief Financial Officer of Vestar, Inc. and served as Chairman, Office of the President from 1994 to 1995. From 1982 to 1990, Mr. Hart was Treasurer and Director of Finance for Avantek, Inc. and prior to that held various financial positions with high technology companies. Mr. Hart received his M.B.A from California State University, Fresno, and his undergraduate degrees in business economics and geography from the University of California, Santa Barbara.

Donald J. Abraham, Ph.D. is a founder of Allos and has served as a member of our Board of Directors since 1994. He also served as a drug development consultant to the Company from 1994 to March 2002. He has been a Professor and Chairman of the Department of Medicinal Chemistry at Virginia Commonwealth University since 1988. From 1972 to 1988, he was a Professor and Chairman of the Department of Medicinal Chemistry at the University of Pittsburgh. Dr. Abraham received his Ph.D. in organic chemistry from Purdue University. He currently is Director of the Institute for Structural Biology and Drug Discovery at the Virginia Commonwealth University.

Mark G. Edwards has served as a member of our Board of Directors since 1999. He is Managing Director of Recombinant Capital, Inc., a pharmaceutical and biotechnology consulting firm he founded in 1988. From 1999 until December 2000, he served as a General Partner of International Biomedicine Management Partners A.G., a venture capital fund based in Switzerland. Mr. Edwards received his B.A. and M.B.A. from Stanford University.

Marvin E. Jaffe, M.D. has served as a member of our Board of Directors since 1994. Since 1994, Dr. Jaffe has been a self-employed research and development consultant for the pharmaceutical industry. From 1988 to 1994, Dr. Jaffe was President of the R.W. Johnson Pharmaceutical Research Institute, a unit of Johnson & Johnson. From 1970 to 1988, Dr. Jaffe was with Merck Sharp & Dohme Research Laboratories, most recently as Senior Vice President, Medical Affairs. He is a director of several biopharmaceutical companies including Immunomedics, Inc., Vernalis Group, plc, and Celltech Group, plc. Dr. Jaffe received his M.D. from Jefferson Medical College where he also completed his residency in Neurology.

Michael D. Casey has served as a member of our Board of Directors since 2002. Since February 2002, Mr. Casey has been a self-employed consultant to the pharmaceutical industry. Previously, Mr. Casey served four years as president, chief executive officer and chairman of Matrix Pharmaceutical, Inc., until Chiron acquired the company in February 2002. Prior to joining Matrix, Mr. Casey was president of two divisions of Schein Pharmaceutical, Inc. from 1995 to 1997, and president and chief operating officer of Genetic Therapy, Inc. from 1993 to 1995 until it was sold to Sandoz (Novartis). Mr. Casey also spent 25 years with Johnson & Johnson, including vice-president of sales and marketing of Ortho Pharmaceutical Corporation and president of McNeil Pharmaceuticals. Mr. Casey is a director of Celgene Corp., Bone Care International, Inc., Sicor, Inc. and Cholestech Corporation.

4

BOARD COMMITTEES AND MEETINGS

During the fiscal year ended December 31, 2002, the Board of Directors held seven meetings and acted by unanimous written consent four times. The Board has an Audit Committee, a Compensation Committee and Nominating Committee.

The Audit Committee recommends to the Board the independent auditors to be retained; meets with the independent auditors at least annually to review the results of the annual audit and discuss the financial statements; reviews with the independent auditors and the Company's financial and accounting personnel, the adequacy and effectiveness of the Company's accounting and financial controls; and evaluates the independent auditors' performance. The current Audit Committee members are Dr. Jaffe and Messrs. Edwards and Casey. It met four times during such fiscal year. All members of the Company's Audit Committee are independent (as independence is currently defined in Rule 4200(a)(14) of the NASD listing standards). The Audit Committee has adopted a written Audit Committee Charter that was attached as Appendix A to the Company's proxy materials for its 2001 Annual Meeting of Stockholders.

The Compensation Committee reviews and approves the overall compensation strategy and policies for the Company. The Compensation Committee reviews corporate performance goals and objectives relevant to the compensation of the Company's executive officers and other senior management and approves the determination of the level of achievement of such goals by individuals of management; reviews and approves the compensation and other terms of employment of the Company's Chief Executive Officer and other Company officers; and administers the Company's stock option and purchase plans, pension and profit sharing plans, stock bonus plans, deferred compensation plans and other similar programs. The Compensation Committee also recommends to the Board the compensation for Board members, including retainer, committee and committee chair fees and stock option grants. Two non-employee directors comprise the Compensation Committee: Dr. Jaffe and Mr. Edwards. The Compensation Committee met two times during the fiscal year ended December 31, 2002 and acted by unanimous written consent once.

The Nominating Committee interviews, evaluates, nominates and recommends individuals for membership on the Company's Board of Directors and its various committees. No procedure has been established for the consideration of nominees recommended by stockholders. The current sole member of the Nominating Committee is Mr. Edwards. It did not meet during the fiscal year ended December 31, 2002.

During the fiscal year ended December 31, 2002, each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member, respectively.

5

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS (APRIL 21, 2003)(1)

- (1)

- The material in this report is not "soliciting material," is not deemed "filed" with the SEC, and is not to be incorporated by reference into any filing of the Company under the 1933 Act or 1934 Act, whether made before or after the date hereof and irrespective of any general incorporation contained in such filing.

The Audit Committee of the Board of Directors (the "Committee") is composed of three independent directors and operates under a written charter adopted by the Board of Directors. The current members of the Committee are Dr. Jaffe, Mr. Edwards and Mr. Casey. The Committee recommends to the Board of Directors, subject to stockholder ratification, the selection of the Company's independent accountants.

Management is responsible for the Company's internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company's financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Committee's responsibility is to monitor and oversee these processes.

In this context, the Committee has met and held discussions with management and the independent accountants. Management represented to the Committee that the Company's financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Committee has reviewed and discussed the financial statements with management and the independent accountants. The Committee discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company's independent accountants also provided to the Committee the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Committee discussed with the independent accountants that firm's independence.

Based on the Committee's discussion with management and the independent accountants and the Committee's review of the representation of management and the report of the independent accountants to the Committee, the Committee recommended that the Board of Directors include the audited financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 filed with the Securities and Exchange Commission.

6

PROPOSAL 2

APPROVAL OF THE AMENDMENT TO THE

2000 STOCK INCENTIVE COMPENSATION PLAN

In March 2000, the Board of Directors adopted, and the Company's stockholders approved, the Company's 2000 Stock Incentive Compensation Plan (the "Incentive Plan"). There is currently an aggregate of 2,127,208 shares of common stock reserved for issuance under the Incentive Plan. Each year on the first day of the Company's fiscal year, the share reserve under the Incentive Plan is increased by the lesser of the following: (i) 2% of the total number of shares of common stock outstanding or (ii) 440,000 shares, or (iii) such smaller number of shares as determined by the Board of Directors.

In April 2003, the Board amended the Incentive Plan, subject to stockholder approval, to increase the number of shares of common stock authorized for issuance under the Incentive Plan by 1,000,000 shares from 2,151,037 shares to a total of 3,151,037 shares. The purpose of this amendment is to ensure that the Company can continue to grant stock options to employees and consultants at levels determined appropriate by the Board of Directors and Compensation Committee. The Company believes that its ability to continue to provide employees with attractive equity-based incentives is critical in allowing it to attract and retain qualified individuals. The Company believes the grant of stock options encourages employees to build long-term stockholder value.

As of December 31, 2002, awards (net of canceled or expired awards) covering an aggregate of 1,285,526 shares of common stock had been granted under the Incentive Plan. Only 423,805 shares of common stock (plus any shares that might in the future be returned to the Incentive Plan as a result of termination or expiration of awards) remained available for future grant under the Incentive Plan. On January 1, 2003, the share reserve under the Incentive Plan was increased by an additional 440,000 shares pursuant to the terms of the Incentive Plan and options covering 1,706 shares have been canceled and returned to the Incentive Plan since January 1, 2003.

Stockholders are requested in this Proposal 2 to approve the amendment to the Incentive Plan. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to approve the amendment to the Incentive Plan. Abstentions will be counted toward the tabulation of votes cast on this matter and will have the same effect as negative votes. Broker non-votes will be counted towards a quorum, but will not be counted for any purpose in determining whether this matter has been approved.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

The essential features of the Incentive Plan are outlined below:

The Incentive Plan was adopted by the Board of Directors and approved by the Company's stockholders as of effectiveness of the Company's initial public offering on March 27, 2000.

General

The purpose of the Incentive Plan is to enhance long-term stockholder value by offering opportunities to the Company's officers, directors, employees, consultants, agents, advisors and independent contractors to participate in the Company's growth and success, and to encourage them to remain in the service of the Company and to own the Company's stock. The Incentive Plan provides

7

for awards of stock options and stock. There number of shares of common stock authorized for issuance under the Incentive Plan is increased by:

- •

- any shares returned to the Company's 1995 Stock Option Plan (the "1995 Plan") upon termination of options granted under the 1995 Plan; and

- •

- an automatic annual increase, to be added on the first day of our fiscal year beginning in 2001, equal to the least of (1) 440,000 shares, (2) 2% of the average common shares outstanding as used to calculate fully diluted earnings per share as reported in our Annual Report for the preceding year, and (3) a lesser amount determined by the Board of Directors. Any shares from increases in previous years that are not actually issued shall be added to the aggregate number of shares available for issuance under the Incentive Plan.

Terms of Stock Awards

Stock Options. The Incentive Plan provides for the granting to employees, including officers and directors, of incentive stock options within the meaning of Section 422 of the Internal Revenue Code and for the granting to employees and consultants, agents, advisors and independent contractors, including non-employee directors, of nonqualified stock options. To the extent an optionee would have the right in any calendar year to exercise for the first time one or more incentive stock options for shares having an aggregate fair market value (determined for each share as of the date the option to purchase the shares was granted) in excess of $100,000, any such excess options will be treated as nonqualified stock options. Unless terminated earlier, the Incentive Plan will terminate in March 2010.

The Incentive Plan is administered by the Board of Directors or a committee or committees of the Board of Directors. The plan administrator determines the terms of options granted under the Incentive Plan, including the number of shares subject to an option and its exercise price (which, for incentive stock options, must be at least equal to the fair market value of the common stock on the date of grant), term and exercisability.

The plan administrator determines the term of options, which may not exceed ten years (five years in the case of an incentive stock option granted to a 10% shareholder). Optionees are not able to transfer options other than by will or the laws of descent or distribution, with the provision that the plan administrator is able to grant nonqualified stock options with limited transferability rights in certain circumstances. The plan administrator determines when options vest and become exercisable. Options granted under the Incentive Plan, other than to existing employees, generally vest at the rate of 1/4(th) of the total number of shares subject to the options 12 months after the date of grant, and 1/48(th) of the total number of shares subject to the options each month thereafter until fully vested after an aggregate of four years. Additional options granted to existing employees generally vest at the rate of 1/48(th) of the total number of shares subject to the options each month after the date of grant until fully vested after an aggregate of four years.

Stock Awards. The plan administrator is authorized under the Incentive Plan to issue shares of common stock to eligible participants with terms, conditions and restrictions established by the plan administrator in its sole discretion. Restrictions may be based on continuous service with the Company or the achievement of performance goals. Holders of restricted stock will be stockholders of the Company and will have, subject to certain restrictions, all the rights of stockholders with respect to such shares.

Adjustments. The plan administrator is required to make proportional adjustments to the aggregate number of shares issuable under the Incentive Plan and to outstanding awards in the event of stock splits or other capital adjustments.

8

Corporate Transactions. In the event of the sale of all or substantially all of the Company's assets, or a merger or consolidation of the Company with or into another corporation, all options outstanding under the Incentive Plan will be required to be assumed or equivalent options substituted by the successor corporation, unless such successor corporation does not agree to such assumption or substitution, in which case each outstanding option and restricted stock award will automatically accelerate and become 100% vested and exercisable immediately before the corporate transaction, and any unexercised options will terminate upon consummation of the transaction.

OTHER EQUITY COMPENSATION PLANS

1995 Stock Option Plan

The 1995 Plan was adopted by the Board of Directors and subsequently approved by the Company's stockholders. As of December 31, 2002, options to purchase a total of 1,220,413 shares were outstanding under the 1995 Plan. In March 2000, the Board of Directors suspended the 1995 Plan such that no further options may be granted under the 1995 Plan.

2001 Employee Stock Purchase Plan

In February 2001, the Board of Directors adopted, and the Company's stockholders subsequently approved, the Company's 2001 Employee Stock Purchase Plan ("Purchase Plan") covering an aggregate of 1,500,000 shares of common stock initially reserved for issuance under the Purchase Plan. As of December 31, 2002, a total of 36,671 shares have been issued under the Purchase Plan and 1,903,329 shares remain available for future purchase. On the first day of each calendar year, commencing on January 1, 2002 and ending (and including) January 1, 2011, the share reserve will increase automatically by the lesser of (a) 2% of the number of shares of Common Stock outstanding on each January 1 (rounded to the nearest whole share and calculated on a fully diluted basis) or (b) 440,000 shares of common stock. However, the Board of Directors may provide for a lesser increase each year. Notwithstanding the foregoing, the share reserve in the aggregate shall not exceed 2,500,000 shares.

2002 Broad Based Equity Incentive Plan

In January 2002, the Board of Directors adopted the Company's 2002 Broad Based Equity Incentive Plan (the "2002 Plan"). As of December 31, 2002, options to purchase a total of 541,742 shares were outstanding under the 2002 Plan and 458,258 shares of common stock (plus any shares that might in the future be returned to the Incentive Plan as a result of termination or expiration of awards) remained available for future grant under the Incentive Plan.

9

EQUITY COMPENSATION PLAN INFORMATION

The following table provides certain information with respect to all of the Company's equity compensation plans in effect as of December 31, 2002.

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available for

issuance under equity

compensation plans

(excluding securities

reflected in column (a))

(c)(1)

| |

|---|

| Equity compensation plans approved by security holders | | 2,482,110 | | $ | 4.22 | | 2,327,134 | (2) |

| Equity compensation plans not approved by security holders | | 541,742 | | $ | 6.06 | | 458,258 | |

| | |

| |

| |

| |

| Total | | 3,021,852 | | $ | 4.56 | | 2,785,392 | (2) |

| | |

| |

| |

| |

- (1)

- Each year on the first day of the Company's fiscal year beginning in 2001, the share reserve under the Incentive Plan shall be increased by the lesser of the following: (i) 2% of the total number of shares of common stock outstanding or (ii) 440,000 shares, or (iii) such smaller number of shares as determined by the Board of Directors. On the first day of each calendar year, commencing on January 1, 2002 and ending (and including) January 1, 2011, the share reserve under the Purchase Plan will increase automatically by the lesser of: (a) 2% of the number of shares of Common Stock outstanding on each January 1 (rounded to the nearest whole share and calculated on a fully diluted basis), (b) 440,000 shares of common stock, or (c) such smaller number of shares as determined by the Board of Directors, provided that the share reserve in the aggregate shall not exceed 2,500,000 shares.

- (2)

- Includes 1,903,329 shares that remain available for future purchase under the Purchase Plan.

2002 BROAD BASED EQUITY INCENTIVE PLAN

The 2002 Plan was in effect as of December 31, 2002 and was adopted without the approval of the Company's stockholders. The essential features of the 2002 Plan are outlined below:

General

The 2002 Plan provides for the grant of nonstatutory stock options, stock bonuses and restricted stock purchase awards (collectively, "stock awards"). To date, the Company has granted only stock options under the 2002 Plan. An aggregate of 1,000,000 shares of common stock are reserved for issuance under the 2002 Plan.

Eligibility

Stock awards may be granted under the 2002 Plan to employees (including officers), directors and consultants of the Company and its affiliates. The aggregate number of shares issued pursuant to stock awards granted to officers and directors under the 2002 Plan may not exceed 49% of the number of shares underlying all stock awards granted under the 2002 Plan as determined on the third anniversary of the adoption of the 2002 Plan and each anniversary date thereafter, except that stock awards granted to officers prior to their employment by the Company as an inducement to entering into employment contracts with the Company are not included in such 49% limitation.

10

Terms of Stock Awards

Exercise Price; Payment. The exercise price of options and restricted stock purchase awards may not be less than 85% of the fair market value of the stock on the date of grant. Stock bonuses may be awarded in consideration for past services actually rendered to the Company or its affiliates.

The exercise price of options and restricted stock purchase awards granted under the 2002 Plan must be paid either in cash at the time the option is exercised or, at the discretion of the Board, (i) pursuant to a deferred payment arrangement or (ii) in any other form of legal consideration acceptable to the Board. The exercise price of options may also be paid, at the discretion of the Board, by delivery of other common stock of the Company.

Stock Award Vesting. Stock awards granted under the 2002 Plan may become exercisable (in the case of options) or released from a repurchase option in favor of the Company (in the case of stock bonuses and restricted stock purchase awards) in cumulative increments ("vest") as determined by the Board. The Board has the power to accelerate the time during which stock awards may vest or be exercised. In addition, options granted under the 2002 Plan may permit exercise prior to vesting, but in such event the participant may be required to enter into an early exercise stock purchase agreement that allows the Company to repurchase unvested shares, generally at their exercise price, should the participant's service terminate before vesting.

Term. The term of options granted under the 2002 Plan are determined by the Board in its discretion. Options under the 2002 Plan generally terminate three months after termination of the participant's service, subject to extension in certain circumstances.

11

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected PricewaterhouseCoopers LLP as the Company's independent auditors for the fiscal year ending December 31, 2003 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited the Company's financial statements since its inception in September 1992. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent auditors is not required by the Company's Bylaws or otherwise. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP. Abstentions will be counted toward the tabulation of votes cast on this matter and will have the same effect as negative votes. Broker non-votes will be counted towards a quorum, but will not be counted for any purpose in determining whether this matter has been approved.

Auditor's Fees. The following table presents the fees billed for professional audit services rendered by PricewaterhouseCoopers LLP for the audit of the Company's annual financial statements for the fiscal years ended December 31, 2001 and December 31, 2002 and for its reviews of the Company's interim financial statements, and fees billed for other services rendered by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2001 and December 31, 2002:

| | 2001

| | 2002

|

|---|

| Audit Fees | | $ | 56,050 | | $ | 74,033 |

| Tax Fees(a) | | $ | 5,650 | | $ | 6,066 |

| All Other Fees | | $ | 1,500 | | $ | 0 |

- (a)

- Includes fees for tax payment planning services and preparation of tax returns, and tax advice related to employee benefit plans.

The Audit Committee has determined the rendering of the non-audit services by PricewaterhouseCoopers LLP is compatible with maintaining the auditor's independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 3.

12

EXECUTIVE OFFICERS AND KEY EMPLOYEES

The following table sets forth certain information regarding our executive officers and key employees as of March 3, 2003:

Name

| | Age

| | Position

|

|---|

| Stephen J. Hoffman, Ph.D., M.D. | | 48 | | Chairman of the Board of Directors |

| Michael E. Hart | | 50 | | President and Chief Executive Officer |

| Daniel R. Hudspeth | | 40 | | Chief Financial Officer, Vice President of Finance, Treasurer and Secretary |

| Barbara E. Baring | | 46 | | Vice President, Human Resources |

| John O. Hackman | | 49 | | Vice President, Biometrics and Statistics |

| Markus F. Herzig | | 57 | | Vice President, Regulatory Affairs |

| Douglas G. Johnson, Ph.D. | | 46 | | Vice President, Manufacturing |

| Pablo J. Cagnoni, M.D. | | 40 | | Vice President, Clinical Development |

| Monique M. Greer | | 44 | | Vice President, Corporate Communications and Investor Relations |

| Eric D. Malek | | 38 | | Vice President, Corporate Development |

| David A. DeLong | | 48 | | Vice President, Marketing and Sales |

See "Proposal 1—Election of Directors" for the biographies of Dr. Hoffman and Mr. Hart.

Daniel R. Hudspeth has served as our Chief Financial Officer, Vice President of Finance, Treasurer and Secretary since April 2002. From 1999 to 2002, Mr. Hudspeth served as the Chief Financial Officer, Vice President of Finance, Treasurer and Secretary of Genomica Corporation, a publicly traded company that developed software for companies in the biotechnology industry. From 1997 to 1999, Mr. Hudspeth served as the Chief Financial Officer, Vice President of Finance, Treasurer and Secretary of Communications Systems International, Inc., a publicly traded telecommunications company. From 1992 to 1997, Mr. Hudspeth served as the Chief Financial Officer, Vice President of Finance, Treasurer and Secretary for various companies. From 1985 to 1992, Mr. Hudspeth worked at the accounting firm of Deloitte & Touche. Mr. Hudspeth has a B.A. in Accounting from Colorado State University and is a certified public accountant in Colorado.

Barbara E. Baring has served as our Vice President, Human Resources since March 2001 and served as Senior Director, Human Resources from March 2000 to March 2001. From 1999 to 2000, Ms. Baring was Director, Human Resources and Administration at Gilead Sciences, Inc. From 1994 to 1999, Ms. Baring was Vice President, Human Resources at NeXstar Pharmaceuticals, Inc. Ms. Baring received an M.S. in Organization and Management from the University of Colorado, and her B.A. from Metropolitan State College in Denver, Colorado.

John O. Hackman has served as our Vice President, Biometrics and Statistics since March 2003. From February 2001 to February 2003, Mr. Hackman served as our Senior Director, Biometrics and Statistics and as Director, Biometrics and Statistics from December 1997 to March 2001. Prior to joining us, Mr. Hackman was Associate Director of Biometrics at Pfizer Central Research where he directed the statistical analysis and reporting group from 1996 to 1997. He has held various positions during his 20 years of experience in the pharmaceutical industry, including positions with Pfizer Inc., Miles Inc., a division of Bayer, Rhone-Poulenc and CytRx Corporation. Mr. Hackman received his M.S. from North Carolina State University.

Markus F. Herzig has served as our Vice President, Regulatory Affairs since August 2001. Prior to joining us, Mr. Herzig was Executive Director, Regulatory Affairs and Quality Assurance of OraPharma, Inc. from January 1999 to August 2001. From January 1996 to December 1998, Mr. Herzig held key management positions at Takeda Pharmaceuticals America, Inc., Novo Nordisk

13

Pharmaceuticals Inc., Organon Inc. and Sandoz Pharmaceuticals, Corp. Mr. Herzig received his M.S. equivalent from Allgemeine Gewerbe Schule in Basel, Switzerland.

Douglas G. Johnson, Ph.D. has served as our Vice President, Manufacturing since July 2002, and served as Senior Director of Manufacturing from March 2001 to June 2002 and as Director of Manufacturing from October 1997 to March 2001. Prior to joining us, Dr. Johnson was with Baxter Healthcare, a unit of Baxter International, Inc., for over eight years. At Baxter, he was most recently manager of the Global Solutions Development Group for the Renal Division. He also worked in the I.V. Systems Division for several years developing formulations of pre-mixed drugs. Prior to joining Baxter Healthcare, Dr. Johnson worked at Argonne National Laboratory for three years. Dr. Johnson received his Ph.D. in Organic Chemistry from the University of Minnesota and conducted his postdoctoral work at the University of Chicago.

Pablo J. Cagnoni, M.D. has served as our Vice President, Clinical Development since March 2003, and served as Senior Medical Director from June 2002 to February 2003 and as Director, Clinical Development from July 2001 to June 2002. Prior to joining us, Dr. Cagnoni was Assistant Professor of Medicine at the University of Colorado and a member of the University of Colorado Cancer Center. Dr. Cagnoni received his M.D. from the University of Buenos Aires School of Medicine, Argentina. He completed Internal Medicine, Hematology, Oncology and Bone Marrow Transplant post-doctoral training in Buenos Aires, Argentina, New York City and in Denver, Colorado.

Monique M. Greer has served as our Vice President, Corporate Communications and Investor Relations since March 2003, and served as Director, Corporate Communications from April 2001 to February 2003. From 1999 to 2001, Ms. Greer managed DMG Partners LLC, a corporate communications consulting company she co-founded in 1999. From 1997 to 1999, Ms. Greer was Director of Corporate Communications at Heska Corporation, an animal health biotechnology company. From 1994 to 1996, Ms. Greer directed communication efforts at Keithley Instruments, Inc.'s software division and prior to that, she served as Director, Corporate Communications at Motorola, Inc.'s networking products division. Ms. Greer received a B.S. in Marketing and International Business from Northeastern University in Boston, Massachusetts.

Eric D. Malek has served as our Vice President, Corporate Development since March 2003, and served as Senior Director, Corporate Development from March of 2002 to March 2003, and as Director, Corporate Development from June 2000 through March 2002. From 1994 to 2000, Mr. Malek held various positions in Corporate Development at NeXstar Pharmaceuticals, Gilead Sciences, Ilex Oncology and Research Corporation Technologies. Prior to that he worked in sales at Bio-Rad Laboratories and in research as an Associate with the Janssen Research Foundation as well as a Research Assistant at both University of Michigan's Protein Chemistry Facility and at the University of Arizona Department of Pharmacology. Mr. Malek received an M.B.A. in Finance and Marketing at the University of Michigan, and a B.A. in Biochemistry at the University of Arizona.

David A. DeLong has served as our Vice President of Marketing and Sales since August 2002. Prior to joining us, Mr. DeLong managed The DevStrat Group, a biomedical consulting and commercial management company he founded in 1997. From 1992 to 1997, Mr. DeLong held several positions at SEQUUS Pharmaceuticals, serving most recently as Vice President of Sales and Commercial Operations. Prior to SEQUUS, he held key marketing and sales management positions with Genentech from 1986 until 1992, and with Key Pharmaceuticals from 1982 to 1986. Mr. DeLong has a B.S. in Economics from the University of Kentucky.

14

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company's Common Stock as of March 31, 2003 by: (i) each nominee for director; (ii) each of the executive officers named in the Summary Compensation Table below; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its Common Stock. Unless otherwise indicated, the address for each of the persons listed in the table is c/o Allos Therapeutics, Inc., 11080 CirclePoint Road, Suite 200, Westminster, CO 80020.

| | Beneficial Ownership(1)

| |

|---|

Beneficial Owner

| | Number of

Shares

| | Percent of

Total

| |

|---|

Johnson & Johnson Development Corporation

One Johnson & Johnson Plaza

New Brunswick, NJ 08933 | | 1,924,727 | | 7.44 | % |

Scott Sacane(2)

Durus Capital Management, LLC

888 Seventh Avenue, 29th Floor

New York, NY 10106 | | 5,980,873 | | 23.11 | |

Entities affiliated with Perseus-Soros BioPharmaceutical Fund(3)

2099 Pennsylvania Avenue, Suite 900

Washington, DC 20006-1813 | |

3,428,100 | |

13.24 | |

Entities affiliated with Marquette Venture Partners(4)

520 Lake Cook Road, Suite 450

Deerfield, IL 60015 | | 1,746,714 | | 6.75 | |

HBM BioVentures AG(5)

Zugerstrasse 50

6340 Baar, Switzerland | | 1,662,707 | | 6.42 | |

Morgan Stanley(6)

1585 Broadway

New York, New York 10036 | | 1,353,470 | | 5.23 | |

| Stephen J. Hoffman, Ph.D., M.D.(7) | | 830,282 | | 3.13 | |

| Michael E. Hart(8) | | 447,373 | | 1.70 | |

| Donald J. Abraham, Ph.D.(9) | | 510,200 | | 1.97 | |

| Marvin E. Jaffe, M.D.(10) | | 75,800 | | * | |

| Mark G. Edwards(11) | | 26,666 | | * | |

| Michael D. Casey(12) | | 6,666 | | * | |

| Pablo J. Cagnoni, M.D.(13) | | 38,869 | | * | |

| Markus F. Herzig(14) | | 33,268 | | * | |

| Douglas G. Johnson, Ph.D.(15) | | 70,467 | | * | |

| All executive officers and directors as a group (9 persons)(16) | | 2,039,591 | | 7.51 | % |

- *

- Less than one percent.

15

- (1)

- This table is based upon information supplied by officers, directors and principal stockholders of the Company and Schedules 13D and 13G filed with the Securities and Exchange Commission (the "SEC"). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 25,883,054 shares outstanding on March 31, 2003, adjusted as required by rules promulgated by the SEC.

- (2)

- Scott Sacane, as a managing member of Durus Capital Management LLC ("Durus"), and as portfolio manager of Perseus, LLC ("Perseus"), has filed a Schedule 13G pursuant to which he reports sole voting and dispositive power over 5,052,773 shares held by Durus and 928,100 shares held by Perseus as of December 31, 2002.

- (3)

- Includes 2,500,000 shares owned by Perseus-Soros BioPharmaceutical Fund, LP, 462,350 shares owned by Perseus Capital, LLC and 465,750 shares owned by Perseus 2000, L.L.C.

- (4)

- Includes 1,746,714 shares held by Marquette Venture Partners II, L.P. The sole general partner of Marquette Venture Partners II, L.P. is Marquette General II, L.P. Marquette General II, L.P. may be deemed to be the indirect beneficial owner of the shares reported as directly beneficially owned by Marquette Venture Partners II, L.P.

- (5)

- Includes 1,662,707 shares held by International BM Biomedicine Holdings Inc. HBM BioVentures AG is the beneficial owner of the shares reported as directly owned by BM Biomedicine Holdings Inc.

- (6)

- Morgan Stanley, as the parent company of, and indirect beneficial owner of securities held by, one of its business units, has filed a Schedule 13G pursuant to which it reports sole or shared voting and dispositive power over 1,353,470 shares owned as of December 31, 2002. Accounts that are managed on a discretionary basis by Morgan Stanley are known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from, the sale of such securities. No such account holds more than 5 percent of the class.

- (7)

- Includes 400 shares held as custodian for Dr. Hoffman's children and 603,012 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (8)

- Includes 445,373 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (9)

- Includes 20,000 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003. Includes 62,000 shares held by Nancy W. Abraham, Trustee U/A/ 12-14-94. Ms. Abraham is the spouse of Donald Abraham. Dr. Abraham is not a trustee and disclaims beneficial ownership of these shares.

- (10)

- Includes 38,600 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (11)

- Represents 26,666 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (12)

- Represents 6,666 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (13)

- Includes 38,269 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003. Includes 600 shares held by Daniela Grayeb, the spouse of Dr. Cagnoni. Dr. Cagnoni disclaims beneficial ownership of these shares.

16

- (14)

- Includes 32,536 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (15)

- Includes 67,462 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 31, 2003.

- (16)

- Includes 1,278,584 shares of Common Stock issuable upon exercise of options held by all directors and named executive officers exercisable within 60 days of March 31, 2003. See footnotes (7) through (15).

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the "1934 Act") requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2002, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

17

EXECUTIVE COMPENSATION

COMPENSATION OF DIRECTORS

During 2002, each of our non-employee directors received $2,500 for each Board meeting the director attended in person, and $2,500 for each meeting the director attended by means of telephone conference if such meeting was greater than 90 minutes in duration. Each non-employee director who served on a committee of the Board of Directors received $1,000 for each meeting the director attended in person, plus $1,000 per year if the non-employee director served as a committee chairman. As of January 2003, each of our non-employee directors receives an annual retainer of $20,000, except that the Chairman of the Audit Committee receives an annual retainer of $25,000, and such retainers are paid in four equal quarterly installments. Also, as of January 2003, each of our non-employee directors receives $2,500 for each Board meeting the director attends in person and $1,000 for each meeting the director attends by means of telephone conference, if such meeting is greater than 45 minutes in duration, and each non-employee director who serves on a committee of the Board of Directors receives $1,000 for each meeting the director attends in person or by means of telephone conference, if such meeting is greater than 45 minutes in duration, except that a non-employee director who serves as a committee chairman receives $2,000 for each such committee meeting so attended. Members of our Board of Directors are reimbursed for reasonable expenses incurred in connection with attending any Board of Directors meeting or any meeting of a committee of the Board of Directors.

Each of our non-employee directors receives stock option grants under a stock option grant program for non-employee directors (the "Directors' Program") under our 2000 Stock Incentive Compensation Plan. Under this program, each person who becomes a non-employee director is automatically granted a nonqualified stock option to purchase 20,000 shares of Common Stock on the date of his or her initial election. One-third of this option vests on each of the first, second and third anniversaries of the grant date. On the date of each annual meeting of stockholders of the Company, each non-employee director who continues to serve on the Board of Directors is granted an option to purchase 10,000 shares of Common Stock upon reelection or reappointment to the Board of Directors, which fully vests on the first anniversary of the date of grant, assuming continued service as a director during the year after the grant date. The exercise price of all options granted under the program is equal to the fair market value of the Common Stock on the grant date.

During the last fiscal year, we granted nonqualified stock options to purchase 50,000 shares of Common Stock to non-employee directors, at exercise prices from $7.20 to $8.05 per share. The fair market value of our Common Stock on the dates of grant were equal to the exercise prices, based on the closing sales price reported on the Nasdaq National Market for the date of each grant. As of March 31, 2003, no options had been exercised by our current non-employee directors pursuant to the Directors' Program.

In December 1994, we entered into a consulting agreement for scientific advisory services with Dr. Jaffe. Under the agreement, we paid Dr. Jaffe consulting fees of $2,000 per month. In March 2002, this contract was terminated. In 2002, Dr. Jaffe received $6,000 in consulting fees for services performed for us.

In January 2001, we entered into a consulting agreement for scientific advisory services with Dr. Abraham. Under the agreement, we paid Dr. Abraham consulting fees of $2,000 per month. In March 2002, this contract was terminated. In 2002, Dr. Abraham received $6,000 in consulting fees for services performed for us.

18

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The following table summarizes the compensation paid to or earned during the fiscal years ended December 31, 2000, 2001 and 2002 by our Chief Executive Officer and four other most highly compensated executive officers whose total salary and bonus exceeded $100,000 for services rendered to us in all capacities. The executive officers listed in the table below are referred to herein as the Named Executive Officers.

| |

| | Annual Compensation

| | Long-Term

Compensation

| |

| |

|---|

| |

| |

| |

| |

| | Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other

Annual

Compensation ($)

| | Securities

Underlying

Options (#)

| | All Other

Compensation

($)

| |

|---|

Stephen J. Hoffman, Ph.D., M.D.

Chairman of the Board | | 2002

2001

2000 | | 300,865

275,000

225,000 | | 57,750

32,681

68,750 | | 3,337

3,471

88,357 |

(1) | —

50,000

328,971 | | 8,590

8,590

8,648 | (2)

(2)

(2) |

Michael E. Hart

President and Chief Executive Officer |

|

2002

2001

2000 |

|

300,000

239,979

218,400 |

|

40,786

27,191

62,500 |

|

586

1,068

915 |

|

250,000

138,000

62,000 |

|

8,761

5,676

5,676 |

(3)

(3)

(3) |

Pablo J. Cagnoni, M.D.(4)

Vice President, Clinical Development |

|

2002

2001

2000 |

|

200,847

91,346

— |

|

58,688

29,000

— |

|

—

—

— |

|

7,976

75,000

— |

|

12,313

2,000

— |

(5)

(6)

|

Markus F. Herzig(7)

Vice President, Regulatory Affairs |

|

2002

2001

2000 |

|

205,387

96,689

— |

|

45,300

20,000

— |

|

—

—

— |

|

6,905

65,000

— |

|

2,000

33,490

— |

(6)

(8)

|

Douglas G. Johnson, Ph.D.

Vice President, Manufacturing |

|

2002

2001

2000 |

|

162,837

147,106

132,500 |

|

55,154

10,600

19,875 |

|

—

—

— |

|

23,810

30,500

29,760 |

|

2,000

2,000

2,000 |

(6)

(6)

(6) |

- (1)

- Includes $84,789 of loans forgiven in 2000.

- (2)

- Includes an annual 401(k) matching contribution by the Company of $2,000 each year and short-term disability/life insurance premiums paid by the Company of $6,590 in 2002 and 2001 and $6,648 in 2000.

- (3)

- Includes an annual 401(k) matching contribution by the Company of $2,000 each year and short-term disability/life insurance premiums paid by the Company of $6,761 in 2002 and $3,676 in 2001 and 2000.

- (4)

- Mr. Cagnoni's employment with the Company began in July 2001 and accordingly, no amounts are shown for 2000.

- (5)

- Includes an annual 401(k) matching contribution by the Company of $2,000, and $10,313 of income in connection with a disqualifying disposition of employee stock purchase shares.

- (6)

- Represents an annual 401(k) matching contribution.

- (7)

- Mr. Herzig's employment with the Company began in August 2001 and accordingly, no amounts are shown for 2000.

- (8)

- Includes an annual 401(k) matching contribution by the Company of $2,000 and non-tax deductible relocation expenses paid by the Company of $31,490.

19

Option Grants in Last Fiscal Year

The Company grants options to its executive officers under its 2000 Stock Incentive Compensation Plan (the "Incentive Plan") and its 2002 Broad Based Equity Incentive Plan (the "2002 Plan" and, together with the Incentive Plan, the "Plans"). As of March 31, 2003, options to purchase 1,538,386 shares were outstanding under the Plans and options to purchase 587,116 shares remained available for grant.

The following table sets forth information concerning the individual grants of stock options to each of the Named Executive Officers during the fiscal year ended December 31, 2002.

| | Individual Grants

| |

| |

| |

|

|---|

| |

| | Percent of

Total

Options

Granted to

Employees

in Fiscal

Year

(%)(2)

| |

| |

| |

| |

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted

(#)(1)

| |

| |

| |

| |

| |

| |

|

|---|

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation

for Option Terms(3)

|

|---|

Name

| | Exercise

Price

($/Sh)

| | Market

Price

($/Sh)

| | Expiration

Date

|

|---|

| | 0% ($)

| | 5% ($)

| | 10% ($)

|

|---|

| Stephen J. Hoffman, Ph.D., M.D. | | — | | — | | — | | — | | — | | — | | — | | — |

| Michael E. Hart | | 250,000 | | 25.6 | | 5.14 | | 6.11 | | 01/18/2012 | | 242,500 | | 1,203,137 | | 2,676,942 |

| Pablo J. Cagnoni, M.D. | | 7,976 | | 0.8 | | 6.00 | | — | | 03/01/2012 | | — | | 30,096 | | 76,270 |

| Markus F. Herzig | | 6,905 | | 0.7 | | 6.00 | | — | | 03/01/2012 | | — | | 26,055 | | 66,029 |

| Douglas G. Johnson, Ph.D. | | 11,905

11,905 | | 1.2

1.2 | | 6.00

9.01 | | — | | 03/01/2012

07/08/2012 | | — | | 44,922

67,458 | | 113,841

170,951 |

- (1)

- Twenty-five percent (25%) of the options vest on the first anniversary of the grant date, and the remaining seventy-five percent (75%) of the options vest in equal monthly installments thereafter.

- (2)

- Based on options to purchase an aggregate of 977,644 shares of Common Stock granted to employees in 2002.

- (3)

- The potential realizable value is calculated based on the term of the option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to rules promulgated by the Securities and Exchange Commission and does not represent the Company's prediction of the Company's future stock price performance. In addition, the potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth certain information, as to each of the Named Executive Officers, concerning the number of shares subject to both exercisable and unexercisable stock options held as of December 31, 2002. Also reported are values for "in-the-money" options that represent the positive

20

spread between the respective exercise prices of outstanding stock options and the fair market value of the Company's Common Stock as of December 31, 2002.

| |

| |

| | Number of

Securities Underlying

Unexercised Options at

Fiscal Year End (#)

| |

| |

|

|---|

| | Shares

Acquired

On

Exercise

(#)

| |

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End ($)(1)

|

|---|

Name

| | Value

Realized

($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Stephen J. Hoffman, Ph.D., M.D. | | — | | $ | — | | 597,804 | | 29,167 | | $ | 3,445,824 | | $ | 44,428 |

| Michael E. Hart | | — | | | — | | 345,165 | | 345,085 | | | 2,060,921 | | | 761,599 |

| Pablo J. Cagnoni, M.D. | | — | | | — | | 26,562 | | 56,414 | | | 79,686 | | | 157,438 |

| Markus F. Herzig | | — | | | — | | 23,020 | | 48,885 | | | 66,528 | | | 131,818 |

| Douglas G. Johnson, Ph.D. | | — | | | — | | 58,899 | | 41,717 | | | 296,228 | | | 49,438 |

- (1)

- Calculated on the basis of the closing sale price per share of our Common Stock on December 31, 2002 (the last trading day of fiscal 2002) on the Nasdaq National Market of $7.52, minus the exercise price.

EMPLOYMENT, SEVERANCE AND CHANGE OF CONTROL AGREEMENTS

Dr. Hoffman

Effective as of February 28, 2003, the Company entered into a consulting agreement with Dr. Hoffman and terminated the employment agreement previously entered into with him in January 2001. Pursuant to the consulting agreement, Dr. Hoffman will serve the Company as non-executive Chairman of the Board and is required to provide consulting services as requested from time to time by the Company. The consulting agreement provides for an annual consulting fee of $150,000, paid monthly, so long as Dr. Hoffman provides consulting services in accordance with the agreement. The consulting agreement also provides for a minimum guaranteed incentive payment of $45,000 per year payable to Dr. Hoffman for each full year of consulting services provided under the agreement. The consulting agreement is for a term of two years commencing February 28, 2003, unless terminated earlier pursuant to its terms. The consulting agreement will terminate automatically upon Dr. Hoffman's failure to be re-elected to the Company's Board of Directors, just cause or consummation of a change in control.

The consulting agreement with Dr. Hoffman provides that the Company may terminate such agreement at its convenience and without just cause at any time upon ten days' notice. However, if the Company terminates the agreement without just cause or Dr. Hoffman is not re-elected to the Company's Board of Directors for any reason in 2003 or 2004, Dr. Hoffman will be entitled to receive (i) any consulting fees earned but unpaid prior to termination, (ii) reimbursement of any business expenses that were incurred but not reimbursed as of the date of termination, (iii) continuation of his annual consulting fee of $150,000, paid monthly, for a period of 12 months following the date of termination, and (iv) a performance incentive payment equal to $45,000. In the event that the Company consummates a change in control during the term of the agreement, Dr. Hoffman will be entitled to receive (i) any consulting fees earned but unpaid prior to termination, (ii) reimbursement of any business expenses that were incurred but not reimbursed as of the date of termination, (iii) continuation of his annual consulting fee of $150,000, paid monthly, for the remainder, if any, of the time period between the date of the closing of a change in control through the date 24 months following February 28, 2003, and (iv) a lump sum payment equal to $90,000 minus the amount of any performance incentive payments actually paid to Dr. Hoffman pursuant to the agreement. In addition, the vesting of any outstanding stock options held by Dr. Hoffman will be accelerated in full, and, if the surviving corporation or acquiring corporation assumes such stock options in connection with such

21

change in control, the time during which such options may be exercised will be extended to 24 months following the date of such change in control.

Mr. Hart

In December 2001, the Company entered into employment agreement with Mr. Hart, which superseded the employment agreement entered into with him in January 2001. The employment agreement provides for an annual base salary, which may be adjusted periodically in the sole discretion of the Board of Directors. Under the agreement, Mr. Hart may receive an annual discretionary bonus for up to a stated percentage of his annual base salary, which such bonus may be awarded or modified in the sole discretion of the Board of Directors. Mr. Hart's salary and bonus terms are further described in the section entitled "Report of the Compensation Committee of the Board of Directors on Executive Compensation—2002 CEO Compensation."

The employment agreement with Mr. Hart provides that his employment with the Company is at-will and may be altered or terminated by either Mr. Hart or the Company at any time. However, if the Company terminates Mr. Hart's employment without just cause or if he resigns for good reason, other than pursuant to a change in control, Mr. Hart will be entitled to receive: (a) his base salary for twelve months following the date of termination, (b) payment of any accrued but unused vacation and sick leave, (c) reimbursement for premiums of Mr. Hart's supplemental disability plan and supplemental life insurance plan for 24 months following the date of termination, and (d) payment of premiums for Mr. Hart's group health insurance COBRA continuation coverage for up to 12 months after the date of termination.

The employment agreement with Mr. Hart also provides that if the Company terminates his employment without just cause or if he resigns for good reason within one month prior to or 13 months following the effective date of a change in control, Mr. Hart will be entitled to receive: (a) his base salary for two years following the date of termination, (b) payment of any accrued but unused vacation and sick leave, (c) reimbursement for premiums of Mr. Hart's supplemental disability plan and supplemental life insurance plan for 24 months following the date of termination, (d) a bonus in an amount equal to the bonus paid in the year immediately preceding the change in control, and (e) payment of premiums for Mr. Hart's group health insurance COBRA continuation coverage for up to 18 months after the date of termination. In addition, the vesting of any outstanding stock options issued to Mr. Hart will be accelerated in full and the time during which such options may be exercised will be extended to 24 months following the date of such change in control.

Severance Arrangements

The Company has established a Severance Benefit Plan to provide for the payment of severance benefits to all full-time employees, including the Named Executive Officers who do not otherwise have separate employment agreements with the Company, whose employment is involuntarily terminated due to a change of control event. The Severance Benefit Plan provides that if the Company terminates the eligible employee without just cause or if the eligible employee resigns for good reason, within two months prior to or 13 months following the effective date of a change in control, the eligible employee will be entitled to receive upon signing a release: (a) two weeks of base salary for each 12 months of employment with the Company and, upon signing a release, an additional three weeks of base salary per $10,000 of annualized current base salary, with a maximum total benefit of 52 weeks base salary, (b) payment of premiums for the eligible employee's group health insurance COBRA continuation coverage after the date of termination for the same benefit period as the salary component of the Severance Benefit Plan, and (c) upon signing a release, full acceleration of vesting of any outstanding stock options issued to the eligible employee.

22

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION(2)

The Compensation Committee of the Board of Directors (the "Committee") is composed of Dr. Jaffe and Mr. Edwards, neither of whom are currently officers or employees of the Company. The Committee is responsible for approving the overall compensation strategy of the Company including the Company's compensation policies, plans and programs related to salary, long-term incentives, bonuses, perquisites, equity incentives, severance arrangements and other related benefits and benefit plans for all directors and officers of the Company. For the Chief Executive Officer, the Committee evaluates performance in light of relevant corporate performance goals and objectives and approves the compensation and other terms of employment.

- (2)

- The material in this report is not "soliciting material," is not deemed "filed" with the SEC, and is not to be incorporated by reference into any filing of the Company under the 1933 Act or 1934 Act, whether made before or after the date hereof and irrespective of any general incorporation contained in such filing.

Compensation Philosophy

The goals of the compensation program are to align compensation with business objectives and performance and to enable the Company to attract, retain and reward executive officers and other key employees who contribute to the long-term success of the Company and to motivate them to enhance long-term stockholder value. Key elements of this philosophy are:

- •

- The Company pays competitively with leading biotechnology companies with which the Company competes for talent.

- •

- The Company maintains annual incentive opportunities sufficient to provide motivation to achieve specific operational goals and to generate rewards that bring total compensation to competitive levels.

- •

- The Company provides equity-based incentives for all employees to ensure that they are motivated over the long-term to respond to the Company's business challenges and opportunities as owners and not just as employees.

2002 Executive Compensation

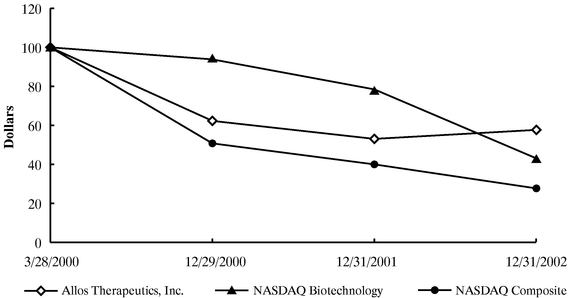

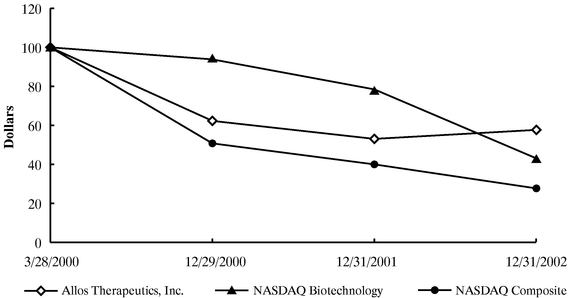

Compensation Program. The Committee is responsible for reviewing and approving the compensation for all executives of the Company and establishes and reviews general polices related to compensation and benefits of employees of the Company. There are three major components to the Company's executive compensation: base compensation, potential annual cash bonus and potential long-term compensation in the form of equity incentives.