Use these links to rapidly review the document

TABLE OF CONTENTS

Allos Therapeutics, Inc. Index to Financial Statements

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2008. |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to .

|

Commission File Number 00029815

Allos Therapeutics, Inc.

(Exact name of Registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 54-1655029

(I.R.S. Employer Identification No.) |

11080 CirclePoint Road, Suite 200

Westminster, Colorado 80020

(303) 426-6262

(Address, including zip code, and telephone number, including area code, of principal executive offices)

|

Securities registered pursuant to Section 12(b) of the Act:

| | |

Common Stock $.001 Par Value

| | NASDAQ Stock Market LLC

(NASDAQ Global Market)

|

|---|

| (Title of class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of common stock held by nonaffiliates of the registrant (based upon the closing sale price of such shares on the NASDAQ Global Market on June 30, 2008) was $293,509,927. Shares of the registrant's common stock held by each current executive officer and director and by each stockholder who is known by the registrant to own 10% or more of the outstanding common stock have been excluded from this computation in that such persons may be deemed to be affiliates of the registrant. Share ownership information of certain persons known by the registrant to own greater than 10% of the outstanding common stock for purposes of the preceding calculation is based solely on information on Schedules 13D and 13G, if any, filed with the Commission. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 26, 2009, there were 81,349,712 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for the 2009 Annual Meeting of Stockholders to be filed within 120 days after the end of the Registrant's fiscal year ended December 31, 2008 are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated therein.

Table of Contents

TABLE OF CONTENTS

| | | | |

| |

| | Page |

|---|

PART I | | | | |

ITEM 1. | | BUSINESS | |

3 |

ITEM 1A. | | RISK FACTORS | |

18 |

ITEM 1B. | | UNRESOLVED STAFF COMMENTS | |

37 |

ITEM 2. | | PROPERTIES | |

37 |

ITEM 3. | | LEGAL PROCEEDINGS | |

37 |

ITEM 4. | | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | |

38 |

PART II | | | | |

ITEM 5. | | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

39 |

ITEM 6. | | SELECTED FINANCIAL DATA | |

41 |

ITEM 7. | | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

42 |

ITEM 7A. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

57 |

ITEM 8. | | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

58 |

ITEM 9. | | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

58 |

ITEM 9A. | | CONTROLS AND PROCEDURES | |

58 |

ITEM 9B. | | OTHER INFORMATION | |

59 |

PART III | | | | |

ITEM 10. | | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

60 |

ITEM 11. | | EXECUTIVE COMPENSATION | |

60 |

ITEM 12. | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

61 |

ITEM 13. | | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

61 |

ITEM 14. | | PRINCIPAL ACCOUNTING FEES AND SERVICES | |

61 |

PART IV | | | | |

ITEM 15. | | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

62 |

| | SIGNATURES | |

66 |

2

Table of Contents

PART I

Allos Therapeutics, Inc., the Allos Therapeutics, Inc. logo and all other Allos names are trademarks of Allos Therapeutics, Inc. in the United States and in other selected countries. All other brand names or trademarks appearing in this report are the property of their respective holders. Unless the context requires otherwise, references in this report to "Allos," the "Company," "we," "us," and "our" refer to Allos Therapeutics, Inc.

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements concerning our projected timelines for the completion of enrollment and announcement of results from our ongoing clinical trials, the Company's intent and projected timeline to submit a New Drug Application for pralatrexate (PDX) as a treatment for patients with relapsed or refractory peripheral T-cell lymphoma, the potential for the results of our Phase 2 PROPEL trial to support marketing approval of pralatrexate; other statements regarding our future product development and regulatory strategies, including our intent to develop or seek regulatory approval for pralatrexate in specific indications; the ability of our third-party manufacturing parties to support our requirements for drug supply; any statements regarding our future financial performance, results of operations or sufficiency of capital resources to fund our operating requirements; and any other statements which are other than statements of historical fact. In some cases, these statements may be identified by terminology such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential" or "continue," or the negative of such terms and other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These statements involve known and unknown risks and uncertainties that may cause our, or our industry's results, levels of activity, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to such differences include, among other things, those discussed under the captions "Business," "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." All forward-looking statements included in this report are based on information available to us as of the date hereof and we undertake no obligation to revise any forward-looking statements in order to reflect any subsequent events or circumstances. Forward-looking statements not specifically described above also may be found in these and other sections of this report.

ITEM 1. BUSINESS

Overview

We are a biopharmaceutical company focused on developing and commercializing innovative small molecule drugs for the treatment of cancer. We strive to develop proprietary products that have the potential to improve the standard of care in cancer therapy. Our focus is on product opportunities for oncology that leverage our internal clinical development and regulatory expertise and address important markets with unmet medical need. We may also seek to grow our existing portfolio of product candidates through product acquisition and in-licensing efforts.

Our lead product candidate, pralatrexate, is a novel targeted antifolate designed to accumulate preferentially in cancer cells. Based on preclinical studies, we believe that pralatrexate selectively enters cells expressing RFC-1, a protein that is over expressed on cancer cells compared to normal cells. Once inside cancer cells, pralatrexate is efficiently polyglutamylated, which leads to high intracellular drug retention. Polyglutamylated pralatrexate essentially becomes "trapped" inside cancer cells, making it less susceptible to efflux-based drug resistance. Acting on the folate pathway, pralatrexate interferes with DNA synthesis and triggers cancer cell death. We believe pralatrexate has the potential to be delivered as a single agent or in combination therapy regimens.

3

Table of Contents

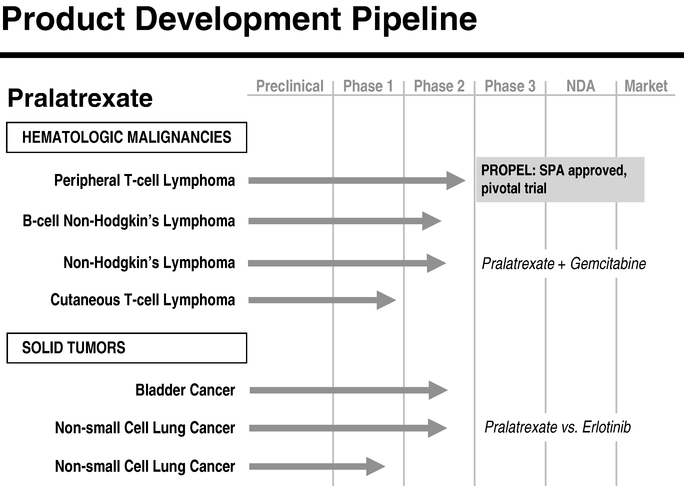

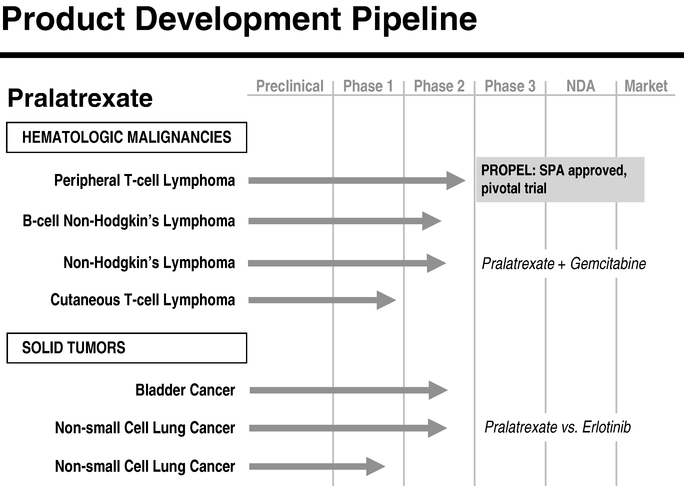

In February 2009, we announced the final results from PROPEL, our pivotal Phase 2 trial of pralatrexate in patients with relapsed or refractory peripheral T-cell lymphoma, or PTCL. Based on the results of this trial, we intend to submit a New Drug Application, or NDA, to the U.S. Food and Drug Administration, or FDA, for pralatrexate for the treatment of patients with relapsed or refractory PTCL in the first half of 2009. This trial was conducted under an agreement reached with the FDA under its special protocol assessment, or SPA process, which provides an agreement that the study design, including trial size, clinical endpoints and/or data analyses are acceptable to the FDA. The SPA agreement is not a guarantee of approval, and we cannot assure you that the design of, or data collected from, the PROPEL trial will be adequate to demonstrate the safety and efficacy of pralatrexate for the treatment of patients with relapsed or refractory PTCL, or otherwise be sufficient to support FDA or any foreign regulatory approval. In addition to the PROPEL trial, we are committed to evaluating pralatrexate for oncology use as a single agent and in combination with other therapies. We currently have seven ongoing clinical trials involving pralatrexate, including the PROPEL trial, and plan to initiate additional trials to evaluate pralatrexate's potential clinical utility in other hematologic malignancies and solid tumor indications.

Our Strategy

Our goal is to build a profitable company by generating income from products we develop and commercialize, either alone or with one or more potential strategic partners. The key elements of our strategy are to:

- •

- Focus on the oncology market. We intend to continue to focus our drug development efforts on the oncology market. We believe the oncology market is attractive due to its size, demand for safer and more effective cancer treatments, relatively small physician population that can be addressed with a targeted sales force, and potential for expedited regulatory review.

- •

- Obtain regulatory approval to market pralatrexate. We are currently focused on obtaining regulatory approval in the United States to market pralatrexate for the treatment of patients with relapsed or refractory PTCL. We recently announced the results of our pivotal Phase 2 PROPEL trial and intend to submit an NDA to the FDA for pralatrexate for the treatment of patients with relapsed or refractory PTCL in the first half of 2009.

- •

- Advance our pralatrexate development program. In addition to the PROPEL trial, we are committed to evaluating pralatrexate for oncology use as a single agent and in combination with other therapies. We currently have seven ongoing clinical trials involving pralatrexate, including the PROPEL trial, and plan to initiate additional trials in the future to evaluate pralatrexate's potential clinical utility in other hematologic malignancies and solid tumor indications.

- •

- Develop sales and marketing capabilities to commercialize pralatrexate. We currently retain exclusive worldwide commercial rights to pralatrexate for all indications. We intend to commercialize pralatrexate, if it is approved for marketing, by building an oncology focused U.S.-based sales and marketing organization which may be complemented by co-promotion arrangements with pharmaceutical or biotechnology partners, where appropriate. We intend to enter into co-promotion or out-licensing arrangements with other pharmaceutical or biotechnology firms, where necessary, to reach foreign market segments that are not reachable by a U.S.-based sales force or when deemed strategically and economically advisable.

- •

- Expand our product candidate portfolio. We may pursue opportunities from time to time to expand our product candidate portfolio by identifying and evaluating new compounds that have demonstrated potential in preclinical or clinical studies and are strategically aligned with our existing oncology portfolio. Our intent is to build a portfolio of proprietary product candidates that have the potential to improve the standard of care in cancer therapy and provide commercial, regulatory or geographic exclusivity.

4

Table of Contents

Our Product Candidates

The following table summarizes the target indications and clinical development status of our lead product candidate, pralatrexate:

Pralatrexate (PDX)

Pralatrexate is a novel targeted antifolate designed to accumulate preferentially in cancer cells. Based on preclinical studies, we believe that pralatrexate selectively enters cells expressing RFC-1, a protein that is over expressed on cancer cells compared to normal cells. Once inside cancer cells, pralatrexate is efficiently polyglutamylated, which leads to high intracellular drug retention. Polyglutamylated pralatrexate essentially becomes "trapped" inside cancer cells, making it less susceptible to efflux-based drug resistance. Acting on the folate pathway, pralatrexate interferes with DNA synthesis and triggers cancer cell death. We believe pralatrexate has the potential to be delivered as a single agent or in combination therapy regimens.

Scientific Rationale

The antimetabolites are a group of low-molecular weight compounds that exert their effect by virtue of their structural or functional similarity to naturally occurring molecules involved in DNA synthesis. Because the cell mistakes them for a normal metabolite, the antimetabolites either inhibit critical enzymes involved in DNA synthesis or become incorporated into the nucleic acid, producing incorrect codes. Both mechanisms result in inhibition of DNA synthesis and ultimately, cell death. Because of their primary effect on DNA synthesis, the antimetabolites are most effective against

5

Table of Contents

actively dividing cells and are largely cell-cycle phase specific. There are three classes of antimetabolites; purine analogs, pyrimidine analogs and folic acid analogs, also termed antifolates. Pralatrexate is a folic acid analog.

The selectivity of antifolates for tumor cells involves their conversion to a polyglutamated form by the enzyme folypolyglutamyl synthetase. Polyglutamation is a time- and concentration-dependent process that occurs in tumor cells, and to a lesser extent, normal tissue. The selective activity of the folic acid analogs in malignant cells versus normal cells likely is due to the relative difference in polyglutamate formation. Polyglutamated metabolites have prolonged intracellular half-life, increased duration of drug action and are potent inhibitors of several folate- dependent enzymes, including dihydrofolate reductase, or DHFR.

We believe that the resistance of malignant cells to the effects of the folic acid analogs may, in part, be due to impaired polyglutamation. We believe the improved antitumor effects of pralatrexate in comparison to methotrexate, as observed in preclinical studies, is likely due to the more effective uptake and transport of pralatrexate into the cell followed by the greater accumulation of pralatrexate and its metabolites within the tumor cell through the formation of the polyglutamated derivatives.

Pralatrexate in the treatment of peripheral T-cell lymphoma

Peripheral T-cell lymphomas, or PTCL, comprise a biologically diverse group of blood cancers that account for approximately 10 to 15 percent of all cases of non-Hodgkin's lymphoma, or NHL, in the United States. According to the American Cancer Society, an estimated 66,000 new cases of NHL were expected to be diagnosed in the United States in 2008. We estimate the current annual prevalence of PTCL in the United States to be approximately 9,500 patients. There are currently no pharmaceutical agents approved for use in the treatment of either first-line or relapsed or refractory PTCL. In addition to those PTCL patients who do not respond to first-line treatment, a significant number of first-line multi-agent chemotherapy responders relapse or become refractory after treatment. According to the clinical literature, patients with aggressive PTCL have an overall five-year survival rate of approximately 25% after first-line therapy.

In February 2009, we announced the final results from PROPEL, our pivotal Phase 2, international, multi-center, open-label, single-arm trial of pralatrexate in patients with relapsed or refractory PTCL. Based on the results of this trial, we intend to submit an NDA to the FDA for pralatrexate for the treatment of patients with relapsed or refractory PTCL in the first half of 2009.

The PROPEL trial enrolled a total of 115 patients with relapsed or refractory PTCL, 109 of whom were considered evaluable for response according to the trial protocol. We believe the PROPEL trial is the largest prospectively designed single-agent trial conducted to date in patients with relapsed or refractory PTCL. To be eligible for the trial, a patient's disease must have progressed after at least one prior treatment. Patients were considered evaluable if they received at least one dose of pralatrexate and their diagnosis of PTCL was confirmed by independent pathology review. Patients received 30 mg/m2 of pralatrexate intravenously once every week for six weeks followed by one week of rest per cycle of treatment. Patients also received vitamin B12 and folic acid supplementation. The primary endpoint of the trial is objective response rate, as assessed by central independent oncology review using International Workshop Criteria. Duration of response is the key secondary endpoint. Other secondary endpoints include progression-free survival, overall survival and safety and tolerability.

The results of the trial demonstrated that 29 of 109 evaluable patients, or 27%, achieved a response as assessed by central independent oncology review. Of the 29 patients who achieved a response according to central independent oncology review, seven patients had a complete response, or CR, two patients had a complete response unconfirmed, or CRu, and 20 patients had a partial response, or PR. The Kaplan-Meier estimate for the median duration of response was 287 days, or 9.4 months. The most common grade 3/4 adverse events were thrombocytopenia, which was observed in

6

Table of Contents

32% of patients; mucosal inflammation in 21% of patients; neutropenia in 20% of patients; and anemia in 17% of patients.

According to the PROPEL investigators, 42 of 109 evaluable patients, or 39%, achieved a response. Of these, 15 patients had a CR, four patients had a CRu and 23 patients had a PR. PROPEL patients received a median of three prior systemic treatment regimens (range of 1-12), including 18 patients, or 16%, who had previously undergone an autologous stem cell transplant. In the trial, 66% of the patients who responded did so after cycle one of therapy. Patients will continue to be followed for long-term survival.

In accordance with the PROPEL trial protocol, three pre-planned interim analyses of safety data were previously conducted. In January, September and December 2007, we announced that an independent data monitoring committee, or DMC, completed interim analyses of safety data from the first 10, 35 and 65 evaluable patients who completed at least one cycle of treatment with pralatrexate, respectively, and recommended that the trial continue per the protocol at each analysis. No major safety concerns were identified by the DMC that affected the continuation of the trial.

The PROPEL trial was conducted under an agreement reached with the FDA under its SPA process. The SPA process allows for FDA evaluation of a clinical trial protocol intended to form the primary basis of an efficacy claim in support of an NDA, and provides an agreement that the study design, including trial size, clinical endpoints and/or data analyses are acceptable to the FDA. However, the SPA agreement is not a guarantee of approval, and we cannot assure you that the design of, or data collected from, the PROPEL trial will be adequate to demonstrate the safety and efficacy of pralatrexate for the treatment of patients with relapsed or refractory PTCL, or otherwise be sufficient to support FDA or any foreign regulatory approval. For example, the response rate, duration of response and safety profile required to support FDA approval are not specified in the PROPEL trial protocol and will be subject to FDA review. In addition, the median duration of response reported above is a Kaplan-Meier estimate based on the length of follow up for all responders at the time the PROPEL trial database was locked. As a result, the median duration of response may change based on continued patient follow up.

Pralatrexate has orphan drug designation and fast track designation in the United States for the treatment of patients with T-cell lymphoma and orphan medicinal product designation in Europe for the treatment of PTCL. Under the U.S. Orphan Drug Act, if we are the first company to receive FDA approval for pralatrexate for this orphan drug indication, we will obtain seven years of marketing exclusivity during which the FDA may not approve another company's application for the same drug for the same orphan indication. The FDA's fast track program is designed to facilitate the development and expedite the review of new drugs that are intended to treat serious or life-threatening conditions and that demonstrate the potential to address unmet medical needs. In Europe, orphan medicinal product designation, or OMPD, is intended to promote the development of drugs that may provide significant benefit to patients suffering from rare diseases identified as life-threatening or very serious. Under the guidelines of the European Medicines Agency, OMPD provides ten years of potential market exclusivity once the product candidate is approved for marketing for the designated indication in the European Union.

Pralatrexate in the treatment of non-Hodgkin's Lymphoma and Hodgkin's disease

Approximately 66,000 patients were expected to be diagnosed with non-Hodgkin's Lymphoma, or NHL, in the United States in 2008 and approximately 85% of NHL patients represent patients with B-cell lymphoma. The incidence of NHL has increased significantly since the 1970's and is currently growing at approximately 1% to 2% per year. Patients with indolent or low-grade NHL may have survival rates as long as 10 years, yet the disease is frequently incurable. Aggressive lymphomas generally result in shorter median survival times although patients with these malignancies can be cured

7

Table of Contents

in 30% to 60% of cases. Standard chemotherapy for NHL involves an initial combination of cyclophosphamide, doxorubicin, vincristine and prednisone, also known as CHOP. The addition of rituximab in one study increased response rates to nearly 100%. However, a significant number of patients treated with CHOP or rituximab eventually relapse and may be candidates for salvage chemotherapy, or chemotherapy given after recurrence of a tumor.

We are currently evaluating pralatrexate in an ongoing Phase 1/2, open-label, single-center study in patients with relapsed or refractory NHL and Hodgkin's disease. Interim data from this trial, which was most recently presented at the AACR-NCI-EORTC conference in October 2007, showed that responses were observed in 2 of 20, or 10% of, evaluable patients with B-cell lymphoma. This study is currently focused on exploring alternate dosing and administration schedules in patients with B-cell lymphoma to further evaluate pralatrexate's potential clinical utility in this setting.

In May 2007, we initiated patient enrollment in a Phase 1/2a, open-label, multi-center study of pralatrexate and gemcitabine with vitamin B12 and folic acid supplementation in patients with relapsed or refractory NHL or Hodgkin's disease. In the Phase 1 portion of this study, patients with either relapsed or refractory NHL (diffuse large B- or T-cell lymphoma, mantle cell lymphoma, transformed large cell lymphomas) or Hodgkin's disease receive pralatrexate either concurrently on the same day with or followed the next day by gemcitabine as part of a weekly schedule for three or four weeks with concurrent vitamin B12 and folic acid supplementation. We plan to enroll up to 54 evaluable patients in the Phase 1 portion of the study with the objective of determining the maximum tolerated dose, or MTD, safety, tolerability, and pharmacokinetic profile of escalating doses of sequential pralatrexate and gemcitabine. If the Phase 1 portion of the study is successful, we plan to enroll up to 45 additional patients with relapsed or refractory PTCL in the Phase 2a portion of the trial at the established MTD to assess preliminary efficacy of pralatrexate and gemcitabine.

In December 2008, interim data from this study were presented at the 50th Annual Meeting of the American Society of Hematology. Data were presented on 27 patients, 22 of whom were evaluable for response. Patients were enrolled in eight cohorts with different doses and schedules. Partial responses were observed in 6 of 22 evaluable patients, including five patients on a sequential dosing schedule and one patient on a same-day dosing schedule. Patients received a median of three prior systemic regimens. The most common adverse event was thrombocytopenia, with Grade 3 observed in four patients and Grade 4 observed in seven patients. The MTD for the sequential dosing schedule was established as 10 mg/m2 of pralatrexate followed by 400 mg/m2 of gemcitabine, once every two weeks. Enrollment in the trial is ongoing to determine the MTD for the same-day dosing schedule.

In October 2008, the FDA granted orphan drug designation to pralatrexate for the treatment of patients with follicular lymphoma and for the treatment of patients with diffuse large B-cell lymphoma.

Pralatrexate in the treatment of cutaneous T-cell lymphoma

Cutaneous T-cell lymphomas, or CTCL, are comprised of a number of non-Hodgkin's T-cell lymphomas, including mycosis fungoides and Sezary syndrome, which have their primary manifestations in the skin. According to the Lymphoma Research Foundation, CTCL accounts for approximately 2% to 3% of the estimated 66,000 new cases of NHL diagnosed each year in the United States.

In August 2007, we initiated patient enrollment in a Phase 1, open-label, multi-center study of pralatrexate with vitamin B12 and folic acid supplementation in patients with relapsed or refractory CTCL. In this study, patients with either relapsed or refractory CTCL receive pralatrexate as part of a weekly schedule for two or three weeks followed by one week of rest. Patients receive starting doses of pralatrexate at 30 mg/m2, with dose reduction in subsequent cohorts based on toxicity.

In December 2008, interim data from this study were presented at the 50th Annual Meeting of the American Society of Hematology. Data were presented on 24 patients, including 22 evaluable patients

8

Table of Contents

who completed at least one cycle of treatment at doses ranging from 10-30 mg/m2 as part of a weekly schedule for two or three weeks followed by one week of rest. Responses were observed in 12 of 22 evaluable patients, or 55%, including one complete response and 11 partial responses. Patients received a median of four prior systemic therapies. The most common adverse event was mucosal inflammation, with Grade 1/2 mucosal inflammation observed in 11 of 24 patients and Grade 3 mucosal inflammation observed in 4 of 24 patients. There was no Grade 4 mucosal inflammation and no thrombocytopenia above Grade 1.

We plan to enroll up to 56 evaluable patients in the study with the objective of determining the optimal dose and safety profile of pralatrexate in this population. We plan to enroll at least 20 of these patients at what we believe to be the optimal dose and schedule.

Pralatrexate in the treatment of non-small cell lung cancer

Lung cancer is the most common cause of cancer death in the United States. According to the American Cancer Society, an estimated 215,020 new cases of lung cancer were expected to be diagnosed in the United States in 2008. Non-small cell lung cancer, or NSCLC, is the most common type of lung cancer, accounting for approximately 87% of lung cancer cases, according to the American Cancer Society. More people die of lung cancer than of breast, prostate and colorectal cancers combined. Over the last decade, oncologists have begun treating advanced NSCLC patients more aggressively, typically administering a potent combination of paclitaxel and carboplatin. Other drugs used in this setting include gemcitabine, vinorelbine, docetaxel and cisplatin. Despite aggressive therapy using gemcitabine and vinorelbine, one study found that the one-year survival rate for patients with Stage IIIB or IV NSCLC was approximately 40%.

In January 2008, we initiated patient enrollment in a Phase 2b, randomized, multi-center study comparing pralatrexate and Tarceva (erlotinib), both with vitamin B12 and folic acid supplementation, in patients with Stage IIIB/IV NSCLC who are, or have been, cigarette smokers who have failed treatment with at least one prior platinum-based chemotherapy regimen. The objective of this study is to compare the efficacy of pralatrexate to that of Tarceva in patients with Stage IIIB/IV NSCLC. The primary endpoint of the study is overall survival. Secondary endpoints include response rate and progression-free survival, both compared to Tarceva, and the safety and tolerability of pralatrexate. The study will seek to enroll approximately 160 patients in up to 50 investigative sites worldwide. Patients will be randomized 1:1 to either the pralatrexate arm or the Tarceva arm. Patients randomized to the pralatrexate arm will receive pralatrexate as an intravenous, or IV, push administered on days 1 and 15 of a 4-week/28 day cycle. The initial dose of pralatrexate will be 190 mg/m2, which, based on defined criteria, may be increased to 230 mg/m2 or reduced in 40 mg/m2 decrements. Patients randomized to the Tarceva arm will receive Tarceva 150 mg/day orally daily for the 4-week/28 day cycle. Patients in both arms will receive concurrent vitamin therapy of B12 and folic acid. Based on current enrollment rates, we expect to complete patient enrollment in this study in the third quarter of 2009.

Our decision to begin this study was based, in part, upon data from a Phase 2 open-label, single-agent study of pralatrexate in patients with relapsed or refractory Stage IIIB or IV NSCLC completed in 2001 by Memorial Sloan-Kettering Cancer Center one of the institutions from which we licensed pralatrexate. This study demonstrated a response rate of 11%, a median time to progression of three months and a median survival time of 13.5 months. However, 21% of the patients suffered grade 3 or 4 stomatitis, or mouth ulcers. As a result of subsequent research that suggested supplementation of pralatrexate with folic acid and vitamin B12 may reduce the incidence of clinically significant stomatitis, in January 2005 we initiated a Phase 1 dose escalation study of pralatrexate with vitamin B12 and folic acid supplementation in patients with previously treated Stage IIIB/IV advanced NSCLC.

In October 2007, data from this ongoing Phase 1 study were presented at the AACR-NCI-EORTC conference. In the study, a total of 22 patients with relapsed or refractory NSCLC were treated at

9

Table of Contents

doses of 150 to 325 mg/m2 of pralatrexate. The MTD was determined to be 270 mg/m2, which is nearly twice the dose used in the previous Phase 2 study discussed above in which pralatrexate was administered without vitamin supplementation, and what we believe to be clinically significant radiologic responses were observed. Greater than 50% of patients, or 13 of 22, received two or more prior treatment regimens. This study was used to establish the dosing regimen for our current Phase 2b study in patients with Stage IIIB/IV NSCLC.

Pralatrexate in the treatment of bladder cancer

Bladder cancer is the ninth most common type of cancer. According to the American Cancer Society, an estimated 68,810 new cases of bladder cancer were expected to be diagnosed in the United States in 2008. Transitional cell carcinoma, or TCC, is the most common form of bladder cancer, accounting for more than 90% of all bladder cancers. There are no approved agents for the treatment of advanced or metastatic relapsed TCC of the urinary bladder.

In July 2008, we initiated patient enrollment in a Phase 2, open-label, single-arm, multi-center study of pralatrexate in patients with advanced or metastatic relapsed TCC of the urinary bladder. The primary endpoint of the study is objective response rate (complete and partial response). Secondary endpoints include duration of response, clinical benefit rate, progression-free survival overall survival and the safety and tolerability of pralatrexate. The study will seek to enroll approximately 41 patients in up to 20 investigative sites worldwide. Patients receive pralatrexate as an IV push administered on days 1 and 15 of a 4-week/28 day cycle. The initial dose of pralatrexate is 190 mg/m2, which may be adjusted based on criteria defined in the protocol. Patients will receive concurrent vitamin therapy of B12 and folic acid.

Pralatrexate in the treatment of other solid tumor indications

In addition to our ongoing NSCLC and bladder cancer studies, we are evaluating the potential future development of pralatrexate for other solid tumor indications, including Stage III/IV head and neck cancer and Stage III/IV breast cancer, among others. There can be no assurances that we will pursue the development of pralatrexate for one or more of these indications or that such development efforts will be ultimately successful.

RH1

Our other product candidate, RH1, is a small molecule chemotherapeutic agent that we believe is bioactivated by the enzyme DT-diaphorase, or DTD, also known as NAD(P)H quinone oxidoreductase, or NQ01. We believe DTD is over-expressed in many tumors, relative to normal tissue, including lung, colon, breast and liver tumors. We believe that because RH1 is bioactivated in the presence of DTD, it may have the potential to provide targeted drug delivery to these tumor types while limiting the amount of toxicity to normal tissue.

In November 2007, we initiated patient enrollment in a Phase 1, open-label, multi-center dose escalation study of RH1 in patients with advanced solid tumors or NHL. We are in the process of closing this study and determining our future development plans, if any, for RH1.

Manufacturing

The production of pralatrexate and RH1 employ small molecule organic chemistry procedures standard for the pharmaceutical industry. We plan to continue to outsource manufacturing responsibilities for these and any additional future products, and we intend to select and rely, at least initially, on single source suppliers to manufacture each of our product candidates. We believe this manufacturing strategy allows us to direct our financial and managerial resources to the development and commercialization of products rather than to the establishment of a manufacturing infrastructure.

10

Table of Contents

We believe it also enables us to minimize fixed costs and capital expenditures, while gaining access to advanced manufacturing process capabilities and expertise. However, if our third party suppliers become unable or unwilling to provide sufficient future drug supply or meet regulatory requirements relating to the manufacture of pharmaceutical agents, we would be forced to incur additional expenses to secure alternative third party manufacturing arrangements and may suffer delays in our ability to conduct clinical trials or commercialize these products.

Pralatrexate

We have entered into arrangements with one third-party manufacturer to produce pralatrexate bulk drug substance and another third-party manufacturer to produce pralatrexate formulated drug product for use in our clinical development programs. We believe these third-party manufacturers have the capability to meet our requirements for all future clinical trial requirements. As we pursue FDA approval to market pralatrexate for the treatment of patients with relapsed or refractory PTCL, we will seek to establish appropriate commercial supply arrangements for the production of pralatrexate bulk drug substance and formulated drug product.

RH1

We have entered into arrangements with one third party manufacturer to produce RH1 bulk drug substance and another third party manufacturer to produce RH1 formulated drug product for use in our clinical development programs. We believe these third party manufacturers have the capability to meet our requirements for any future clinical trials, if any, involving RH1.

Sales and Marketing

We currently retain exclusive worldwide commercial rights to pralatrexate and RH1 for all target indications. If we obtain FDA approval to market pralatrexate, we intend to commercialize pralatrexate in the United States by building a focused sales and marketing organization that may be complemented by co-promotion or other partnering arrangements with pharmaceutical or biotechnology partners, where appropriate. Our sales and marketing strategy is to:

- •

- Build a U.S. sales force. We believe that a moderate-sized sales force could effectively reach targeted physicians and medical institutions that treat the majority of patients with PTCL in the United States. We intend to build and manage this sales force internally.

- •

- Build a marketing organization. We also plan to build an internal marketing and sales operations organization to develop and implement product plans, and support our sales force and marketing partners.

- •

- Establish co-promotion alliances. We intend to enter into co-promotion or out-licensing arrangements with other pharmaceutical or biotechnology firms, where necessary, to reach foreign market segments that are not reachable by a U.S.-based sales force or when deemed strategically and economically advisable.

Intellectual Property

We believe that patent protection and trade secret protection are important to our business and that our future success will depend, in part, on our ability to maintain our technology licenses, maintain trade secret protection, obtain and maintain patents and operate without infringing the proprietary rights of others both in the United States and abroad. We believe that obtaining identical patents and protection periods for a given technology throughout all markets of the world will be difficult because of differences in patent laws. In addition, the protection provided by non-U.S. patents, if any, may be weaker than that provided by U.S. patents.

11

Table of Contents

In order to protect the confidentiality of our technology, including trade secrets and know-how and other proprietary technical and business information, we require all of our employees, consultants, advisors and collaborators to enter into confidentiality agreements that prohibit the use or disclosure of confidential information. The agreements also oblige our employees, consultants, advisors and collaborators to assign or license to us ideas, developments, discoveries and inventions made by such persons in connection with their work with us. We cannot be sure that these agreements will maintain confidentiality, will prevent disclosure, or will protect our proprietary information or intellectual property, or that others will not independently develop substantially equivalent proprietary information or intellectual property.

The pharmaceutical industry is highly competitive and patents have been applied for by, and issued to, other parties relating to products or new technologies that may be competitive with those being developed by us. Therefore, our product candidates may give rise to claims that they infringe the patents or proprietary rights of other parties now or in the future. Furthermore, to the extent that we, our consultants, or manufacturing and research collaborators, use intellectual property owned by others in work performed for us, disputes may also arise as to the rights to such intellectual property or in related or resulting know-how and inventions. An adverse claim could subject us to significant liabilities to such other parties and/or require disputed rights to be licensed from such other parties. A license required under any such patents or proprietary rights may not be available to us, or may not be available on acceptable terms. If we do not obtain such licenses, we may encounter delays in product market introductions, or may find that we are prevented from the development, manufacture or sale of products requiring such licenses. In addition, we could incur substantial costs in defending ourselves in legal proceedings instituted before patent and trademark offices in the United States, the European Union, or other ex-U.S. territories, or in a suit brought against us by a private party based on such patents or proprietary rights, or in a suit by us asserting our patent or proprietary rights against another party, even if the outcome is not adverse to us.

Pralatrexate

In December 2002, we entered into a license agreement with Memorial Sloan-Kettering Cancer Center, SRI International and Southern Research Institute, as amended, under which we obtained exclusive worldwide rights to a portfolio of patents and patent applications related to pralatrexate and its uses. The portfolio currently consists of two issued patents in the United States, two granted patents in Europe, and pending patent applications in the United States, Canada, Europe, Australia, Japan, China, Brazil, Indonesia, India, South Korea, Mexico, Norway, New Zealand, the Philippines, Singapore and South Africa. The licensed patents and applications, which expire at various times between July 2017 and May 2025, contain claims covering pralatrexate substantially free of 10-deazaaminopterin, methods to treat tumors with pralatrexate substantially free of 10-deazaaminopterin, treatment of breast, lung, and prostate cancer and leukemia with a combination of pralatrexate and a taxane, treatment of T-cell lymphoma with pralatrexate, treatment of lymphoma with a combination of pralatrexate and gemcitabine, methods of assessing sensitivity of a tumor to pralatrexate, and other methods and compositions.

Under the terms of the agreement, we paid an up-front license fee of $2.0 million upon execution of the agreement and are also required to make certain additional cash payments based upon the achievement of certain clinical development or regulatory milestones or the passage of certain time periods. To date, we have made aggregate milestone payments of $2.5 million based on the passage of time. In the future, we could make an aggregate milestone payment of $500,000 upon the earlier of achievement of a clinical development milestone or the passage of certain time periods, or the Clinical Milestone, and up to $10.3 million upon achievement of certain regulatory milestones, or the Regulatory Milestones, including regulatory approval to market pralatrexate in the United States or Europe. The last scheduled payment towards the Clinical Milestone of $500,000 is currently due on

12

Table of Contents

December 23, 2009. We intend to submit an NDA for pralatrexate for the treatment of patients with relapsed or refractory PTCL in the first half of 2009. If the FDA accepts our NDA for review and if we obtain FDA approval to market pralatrexate, we will be obligated to make payments of $1,500,000 and $5,300,000, respectively, which represent a portion of the Regulatory Milestones. The up-front license fee and all milestone payments under the agreement have been or will be recorded to research and development expense when incurred. Under the terms of the agreement, we are required to fund all development programs and will have sole responsibility for all commercialization activities. In addition, we will pay the licensors a royalty based on a percentage of net revenues arising from sales of the product or sublicense revenues arising from sublicensing the product, if and when such sales or sublicenses occur.

RH1

In December 2004, we entered into an agreement with the University of Colorado Health Sciences Center, the University of Salford and Cancer Research Technology, or CRT, under which we obtained exclusive worldwide rights to certain intellectual property surrounding a proprietary molecule known as RH1. Under the terms of the agreement, we paid an up-front license fee of $190,500 upon execution of the agreement and are also required to make certain additional cash payments based upon the achievement of certain clinical development, regulatory and commercialization milestones. We could make aggregate milestone payments of up to $9.2 million upon the achievement of the clinical development, regulatory and commercialization milestones set forth in the agreement. The up-front license fee and all milestone payments under the agreement, as well as the one-time data option fee discussed below, have been recorded to research and development expense. Under the terms of the agreement and related data option agreement, we paid the licensors a one-time data option fee of $360,000 in 2007 for an exclusive license to the results of a Phase 1 study sponsored by Cancer Research UK, CRT's parent institution. This Phase 1 study was completed in 2007 and, under the terms of the agreement, we have since assumed responsibility for all future development costs and activities and have sole responsibility for all commercialization activities. In addition, we will pay the licensors a royalty based on a percentage of net revenues arising from sales of the product or sublicense revenues arising from sublicensing the product, if and when such sales or sublicenses occur. We are in the process of closing our Phase 1 study of RH1 in patients with advanced solid tumors or NHL and determining our future development plans, if any, for RH1.

Competition

The pharmaceutical industry is characterized by rapidly evolving technology and intense competition. Many companies of all sizes, including a number of large pharmaceutical companies and several biotechnology companies, are developing cancer therapies similar to ours. There are products and technologies currently on the market that will compete directly with the products that we are developing. In addition, colleges, universities, governmental agencies and other public and private research institutions will continue to conduct research and are becoming more active in seeking patent protection and licensing arrangements to collect license fees, milestone payments and royalties in exchange for license rights to technologies that they have developed, some of which may directly compete with our technologies. These companies and institutions also compete with us in recruiting qualified scientific personnel. Many of our competitors have substantially greater financial, research and development, human and other resources than do we. Furthermore, large pharmaceutical companies may have significantly more experience than we do in preclinical testing, human clinical trials, manufacturing, regulatory approval and commercialization procedures. Our competitors may:

- •

- develop or acquire safer and/or more effective products;

- •

- obtain patent protection or intellectual property rights that limit our ability to commercialize products; and/or

13

Table of Contents

- •

- commercialize products earlier or more effectively than us.

We expect technology developments in our industry to continue to occur at a rapid pace. Commercial developments by our competitors may render some or all of our potential products obsolete or non-competitive, which would have a material adverse effect on our business and financial condition.

While there are currently no FDA-approved agents in the United States indicated for the treatment of PTCL, we are aware of multiple investigational agents that are currently being studied in clinical trials. There are also several agents and regimens, such as CHOP, that are currently used by physicians without an FDA label in PTCL that could potentially represent competition for pralatrexate.

Government Regulation

FDA Regulation and Product Approval

The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture and marketing of pharmaceutical products. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion of our product candidates.

The process required by the FDA before our product candidates may be marketed in the United States generally involves the following:

- •

- preclinical laboratory and animal tests;

- •

- submission to the FDA of an Investigational New Drug, or IND, application, which must become effective before clinical trials may begin;

- •

- adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed pharmaceutical in our intended use;

- •

- pre-approval inspection of manufacturing facilities and selected clinical investigators; and

- •

- submission to the FDA of an NDA that must be approved.

The testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for our product candidates will be granted on a timely basis, if at all.

Preclinical tests include laboratory evaluation of the product candidate, its chemistry, formulation and stability, as well as animal studies to assess its potential safety and efficacy. We then submit the results of the preclinical tests, together with manufacturing information and analytical data, to the FDA as part of an IND application, which must become effective before we may begin human clinical trials. The IND automatically becomes effective 30 days after the FDA acknowledges that the filing is complete, unless the FDA, within the 30-day time period, raises concerns or questions about the conduct of the trials as outlined in the IND. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. Further, an independent Institutional Review Board at each medical center proposing to conduct the clinical trials must review and approve any clinical study.

Human clinical trials are typically conducted in three sequential phases, which may overlap:

- •

- Phase 1: The drug is initially administered into healthy human subjects or patients and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion.

14

Table of Contents

- •

- Phase 2: The drug is administered to a limited patient population to identify possible adverse effects and safety risks, to determine the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

- •

- Phase 3: When Phase 2 evaluations demonstrate that a dosage range of the drug is effective and has an acceptable safety profile, Phase 3 trials are undertaken to further evaluate dosage and clinical efficacy, and to further test for safety, in each case, in an expanded patient population at geographically dispersed clinical study sites.

In the case of product candidates for severe or life-threatening diseases such as cancer, the initial human testing is often conducted in patients rather than in healthy volunteers. Since these patients already have the target disease, these studies may provide initial evidence of efficacy traditionally obtained in Phase 2 trials and thus these trials are frequently referred to as Phase 1b trials. Additionally, when product candidates can do damage to normal cells, it is not ethical to administer such drugs to healthy patients in a Phase 1 trial.

We cannot be certain that we will successfully complete Phase 1, Phase 2 or Phase 3 testing of our product candidates within any specific time period, if at all. Furthermore, the FDA, the Institutional Review Boards or the sponsor may suspend clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk.

The results of product development, preclinical studies and clinical studies are submitted to the FDA as part of an NDA for approval of the marketing and commercial shipment of the product candidate. The FDA may deny an NDA if the applicable regulatory criteria are not satisfied or may require additional clinical data. Even if such data is submitted, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval. Once issued, the FDA may withdraw product approval if compliance with regulatory standards is not maintained or if problems occur after the product reaches the market. In addition, the FDA may require testing and surveillance programs to monitor the effect of approved products that have been commercialized, and the agency has the power to prevent or limit further marketing of a product based on the results of these post-marketing programs.

Satisfaction of the above FDA requirements or similar requirements of state, local and foreign regulatory agencies typically takes several years and the actual time required may vary substantially, based upon the type, complexity and novelty of the pharmaceutical product candidate. Government regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures upon our activities.

We cannot be certain that the FDA or any other regulatory agency will grant approval for any of our product candidates on a timely basis, if at all. Success in preclinical or early stage clinical trials does not assure success in later stage clinical trials. Data obtained from preclinical and clinical activities is not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. Even if a product candidate receives regulatory approval, the approval may be significantly limited to specific indications. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market. Delays in obtaining, or failures to obtain regulatory approvals for pralatrexate would have a material adverse effect on our business. Marketing our product candidates abroad will require similar regulatory approvals and is subject to similar risks. In addition, we cannot predict what adverse governmental regulations may arise from future U.S. or foreign governmental action.

Any products manufactured or distributed by us pursuant to FDA clearances or approvals are subject to pervasive and continuing regulation by the FDA, including record-keeping requirements and reporting of adverse experiences with the drug. Our third-party drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies,

15

Table of Contents

and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with current Good Manufacturing Practices, which impose certain procedural and documentation requirements upon us and our third-party manufacturers. We cannot be certain that we or our present or future suppliers will be able to comply with the current Good Manufacturing Practices and other FDA regulatory requirements.

The FDA regulates drug labeling and promotion activities. The FDA has actively enforced regulations prohibiting the marketing of products for unapproved uses.

Our product candidates are also subject to a variety of state laws and regulations in those states or localities where such product candidates may be marketed. Any applicable state or local regulations may hinder our ability to market our product candidates in those states or localities.

The FDA's policies may change and additional government regulations may be enacted in the future that could prevent or delay regulatory approval of our potential products. Moreover, increased attention to the containment of health care costs in the United States and in foreign markets could result in new government regulations, which could have a material adverse effect on our business. We cannot predict the likelihood, nature or extent of adverse governmental regulation, which might arise from future legislative or administrative action, either in the United States or abroad.

Foreign Regulation and Product Approval

Outside the United States, our ability to market a product candidate is contingent upon receiving marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical trials, marketing authorization, pricing and reimbursement vary widely from country to country. At present, foreign marketing authorizations are applied for at a national level, although within the European Union, or EU, centralized registration procedures are available to companies wishing to market a product in more than one EU member state. If the regulatory authority is satisfied that adequate evidence of safety, quality and efficacy has been presented, a marketing authorization will be granted. In some countries in the EU, pricing of prescription drugs is subject to government control and agreements must be reached on a national level before marketing may begin in that country. If we are unable to reach agreement on an acceptable price for our products, we may choose not to pursue marketing of our drugs in that country. The foreign regulatory approval process involves all of the risks associated with FDA approval discussed above.

Other Regulations

We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. We may incur significant costs to comply with such laws and regulations now or in the future.

Results of Operations

We are a development stage company. Since our inception in 1992, we have not generated any revenue from product sales and have experienced significant net losses and negative cash flows from operations. We have incurred these losses principally from costs incurred in our research and development programs, clinical manufacturing and from our marketing, general and administrative expenses. Our primary business activities have been focused on the development of pralatrexate, RH1 and EFAPROXYN (a program which we discontinued in mid-2007). For the years ended December 31, 2008, 2007 and 2006, we had net losses attributable to common stockholders of $51.7 million, $39.4 million, and $30.2 million, respectively. Research and development expenses for the years ended December 31, 2008, 2007 and 2006 were $23.8 million, $17.4 million and $14.3 million, respectively. As of December 31, 2008, we had accumulated a deficit during our development stage of $299.7 million.

16

Table of Contents

Our ability to generate revenue and achieve profitability is dependent on our ability, alone or with partners, to successfully complete the development of pralatrexate, conduct clinical trials, obtain the necessary regulatory approvals, and manufacture and market pralatrexate. The timing and costs to complete the successful development of pralatrexate is highly uncertain, and therefore difficult to estimate. The lengthy process of seeking regulatory approvals for pralatrexate, and the subsequent compliance with applicable regulations, require the expenditure of substantial resources. For a more complete discussion of the regulatory approval process, please refer to the "Government Regulation" section above. Clinical development timelines, likelihood of success and total costs vary widely and are impacted by a variety of risks and uncertainties, including those discussed in the "Risk Factors" section of Item 1A below. Because of these risks and uncertainties, we cannot predict when or whether we will successfully complete the development of pralatrexate or the ultimate costs of such efforts. Due to these same factors, we cannot be certain when, or if, we will generate any revenue or net cash inflow from pralatrexate.

Even if our clinical trials demonstrate the safety and effectiveness of pralatrexate in its target indications, we do not expect to be able to generate commercial sales of pralatrexate until the second half of 2009, at the earliest. We expect to continue incurring net losses and negative cash flows for the foreseeable future. Although the size and timing of our future net losses are subject to significant uncertainty, we expect them to increase over the next several years as we continue to fund our research and development programs and prepare for the potential commercial launch of pralatrexate.

We anticipate continuing our current development programs and/or beginning other long-term development projects involving pralatrexate. These projects may require many years and substantial expenditures to complete and may ultimately be unsuccessful. In addition, we intend to submit an NDA for pralatrexate for the treatment of patients with relapsed or refractory PTCL in the first half of 2009. We expect to incur significant costs relating to preparations for the potential commercial launch of pralatrexate, including pre-commercial scale up of manufacturing and development of sales and marketing capabilities, prior to the receipt of regulatory approval to market pralatrexate. Therefore, we will need to raise additional capital to support our future operations, including the potential commercialization of pralatrexate if approved for marketing. Our actual capital requirements will depend on many factors, including those discussed under the "Liquidity and Capital Resources" section below.

We may seek to obtain this additional capital through equity or debt financings, arrangements with corporate partners, or from other sources. Such arrangements, if successfully consummated, may be dilutive to our existing stockholders. However, there is no assurance that additional financing will be available when needed, or that, if available, we will obtain such financing on terms that are favorable to our stockholders or us. In particular, the current instability in the global financial markets and lack of liquidity in the credit and capital markets may adversely affect our ability to secure adequate capital to support our future operations. In the event that additional funds are obtained through arrangements with collaborative partners or other sources, such arrangements may require us to relinquish rights to some of our technologies, product candidates or products under development, which we would otherwise seek to develop or commercialize ourselves on terms that are less favorable than might otherwise be available. If we are unable to generate meaningful amounts of revenue from future product sales, if any, or cannot otherwise raise sufficient additional funds to support our operations, we may be required to delay, reduce the scope of or eliminate one or more of our development programs and our business and future prospects for revenue and profitability may be harmed.

We incorporated in the Commonwealth of Virginia on September 1, 1992 as HemoTech Sciences, Inc. and filed amended Articles of Incorporation to change our name to Allos Therapeutics, Inc. on October 19, 1994. We reincorporated in Delaware on October 28, 1996. We operate as a single business segment.

17

Table of Contents

Employees

As of February 26, 2009, we had a total of 81 full-time employees. Of those, 50 are engaged in clinical development, regulatory affairs, biostatistics, manufacturing and preclinical development. The remaining 31 are involved in marketing, corporate development, finance, administration and operations.

Available Information

We are located in Westminster, Colorado, a suburb of Denver. Our mailing address is 11080 CirclePoint Road, Suite 200, Westminster, Colorado 80020. Our website address iswww.allos.com; however, information found on our website is not incorporated by reference into this report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our website as soon as reasonably practicable after we file them with, or furnish them to, the Securities and Exchange Commission, or SEC. Once atwww.allos.com, go to Investors/Media and then to SEC Filings to locate copies of such reports. You may also read and copy materials that we file with SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website atwww.sec.gov that contains reports, proxy and information statements and other information regarding us and other issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

Our business faces significant risks. These risks include those described below and may include additional risks of which we are not currently aware or that we currently do not believe are material. If any of the events or circumstances described in the following risk factors actually occurs, they may materially harm our business, financial condition, operating results and cash flow. As a result, the market price of our common stock could decline. Additional risks and uncertainties that are not yet identified or that we think are immaterial may also materially harm our business, operating results and financial condition. The following risks should be read in conjunction with the other information set forth in this report.

We have a history of net losses and an accumulated deficit, and we may never generate revenue or achieve or maintain profitability in the future.

Since our inception in 1992, we have not generated any revenue from product sales and have experienced significant net losses and negative cash flows from operations. To date, we have financed our operations primarily through the public and private sale of securities. For the years ended December 31, 2008, 2007 and 2006, we had net losses attributable to common stockholders of $51.7 million, $39.4 million, and $30.2 million, respectively. As of December 31, 2008, we had accumulated a deficit during our development stage of $299.7 million. We have incurred these losses principally from costs incurred in our research and development programs, clinical manufacturing and from our marketing, general and administrative expenses. We expect to continue incurring net losses for the foreseeable future. Our ability to generate revenue and achieve profitability is dependent on our ability, alone or with partners, to successfully complete the development of pralatrexate (PDX), conduct clinical trials, obtain the necessary regulatory approvals, and manufacture and market pralatrexate. We may never generate revenue from product sales or become profitable. We expect to continue to spend substantial amounts on research and development, including amounts spent on conducting clinical trials for pralatrexate, and in preparing for the potential commercial launch of pralatrexate. We may not be able to continue as a going concern if we are unable to generate meaningful amounts of revenue to support our operations or cannot otherwise raise the necessary funds to support our operations.

18

Table of Contents

Our near-term prospects are substantially dependent on pralatrexate (PDX), our lead product candidate. If we are unable to successfully develop and obtain regulatory approval for pralatrexate for the treatment of patients with relapsed or refractory PTCL, our ability to generate revenue will be significantly delayed.

We currently have no products that are approved for commercial sale. Our product candidates are in various stages of development, and significant research and development, financial resources and personnel will be required to develop commercially viable products, obtain the necessary regulatory approvals therefor, and successfully commercialize them. Substantially all of our efforts and expenditures over the next few years will be devoted to pralatrexate as we are in the process of closing our current Phase 1 clinical study of RH1 in patients with advanced solid tumors or NHL and determining our future development plans, if any, for RH1. Accordingly, our future prospects are substantially dependent on the successful development, regulatory approval and commercialization of pralatrexate for the treatment of patients with relapsed or refractory PTCL. Even if we receive regulatory approval, pralatrexate is not expected to be commercially available for this or any other indication until at least the second half of 2009. Further, certain of the indications that we are pursuing for pralatrexate have relatively low incidence rates, which may make it difficult for us to enroll a sufficient number of patients in our clinical trials on a timely basis, or at all, and may limit the revenue potential of pralatrexate. If we are unable to successfully develop, obtain regulatory approval for and commercialize pralatrexate for the treatment of patients with relapsed or refractory PTCL, our ability to generate revenue from product sales will be significantly delayed and our stock price would likely decline.

We cannot predict when or if we will obtain regulatory approval to commercialize pralatrexate.

Pralatrexate is in the clinical stage of development and has not been approved for marketing in the United States or any other country. A pharmaceutical product cannot be marketed in the United States or most other countries until it has completed a rigorous and extensive regulatory review and approval process. If we fail to obtain regulatory approval to market pralatrexate, we will be unable to sell pralatrexate and generate revenue, which would jeopardize our ability to continue operating our business. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. Of particular significance are the requirements covering research and development, testing, manufacturing, quality control, labeling and promotion of drugs for human use. We may not obtain regulatory approval for pralatrexate, or we may not obtain regulatory review of pralatrexate in a timely manner.

While we have negotiated a special protocol assessment with the FDA relating to our PROPEL trial, this agreement does not guarantee any particular outcome from regulatory review of the trial or the product, including any regulatory approval.

The protocol for the PROPEL trial was reviewed by the FDA under its special protocol assessment, or SPA process, which allows for FDA evaluation of a clinical trial protocol intended to form the primary basis of an efficacy claim in support of a new drug application, and provides an agreement that the study design, including trial size, clinical endpoints and/or data analyses are acceptable to the FDA. However, the SPA agreement is not a guarantee of approval, and we cannot be certain that the design of, or data collected from, the PROPEL trial will be adequate to demonstrate the safety and efficacy of pralatrexate for the treatment of patients with relapsed or refractory PTCL, or otherwise be sufficient to support FDA or any foreign regulatory approval. In addition, the response rate, duration of response and safety profile required to support FDA approval are not specified in the PROPEL trial protocol and will be subject to FDA review. Further, the SPA agreement is not binding on the FDA if public health concerns unrecognized at the time the SPA agreement was entered into become evident, other new scientific concerns regarding product safety or efficacy arise, or if we fail to comply with the agreed upon trial protocols. In addition, the SPA agreement may be changed by us or

19

Table of Contents

the FDA on written agreement of both parties, and the FDA retains significant latitude and discretion in interpreting the terms of the SPA agreement and the data and results from the PROPEL trial. As a result, we do not know how the FDA will interpret the parties' respective commitments under the SPA agreement, how it will interpret the data and results from the PROPEL trial, or whether pralatrexate will receive any regulatory approvals as a result of the SPA agreement or the PROPEL trial. Therefore, despite the potential benefits of the SPA agreement, significant uncertainty remains regarding the clinical development and regulatory approval process for pralatrexate for the treatment of patients with relapsed or refractory PTCL.

Even if pralatrexate meets safety and efficacy endpoints in clinical trials, regulatory authorities may not approve pralatrexate, or we may face post-approval problems that require withdrawal of pralatrexate from the market.

The research, testing, manufacturing, labeling, approval, selling, marketing and distribution of drug products are subject to extensive regulation by the FDA and other regulatory authorities in the United States and other countries, which regulations differ from country to country. We will not be able to commercialize pralatrexate until we have obtained regulatory approval. We have limited experience in filing and pursuing applications necessary to gain regulatory approvals, which may place us at risk of delays, overspending and human resources inefficiencies.

Pralatrexate may not be approved even if it achieves its endpoints in clinical trials. Regulatory agencies, including the FDA, or their advisors, may disagree with our interpretations of data from preclinical studies and clinical trials. The FDA has substantial discretion in the approval process, and when or whether regulatory approval will be obtained for any drug we develop. For example, even though we established an SPA with the FDA for our PROPEL trial, there is no guarantee that the data generated from the PROPEL trial will be adequate to support FDA approval. Regulatory agencies also may approve a product candidate for fewer conditions than requested or may grant approval subject to the performance of post-marketing studies or risk evaluation and mitigation strategies (REMS) for a product candidate. In addition, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of pralatrexate.

Even if we receive regulatory approval, pralatrexate may later produce adverse events that limits or prevents its widespread use or that force us to withdraw pralatrexate from the market. In addition, a marketed product continues to be subject to strict regulation after approval and may be required to undergo post-approval studies. Any unforeseen problems with an approved product or any violation of regulations could result in restrictions on the product, including its withdrawal from the market. Any delay in or failure to receive or maintain regulatory approval for pralatrexate could harm our business and prevent us from ever generating meaningful revenues or achieving profitability.

Even if we receive regulatory approval for pralatrexate, we will be subject to ongoing regulatory obligations and review.