| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | November 30, 2005 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .5.0 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09675 |

|

Boston Advisors Trust |

(Exact name of registrant as specified in charter) |

|

One Federal Street, Boston, MA | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Michael J. Vogelzang, Chief Executive Officer

One Federal Street, Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 800-523-5903 | |

|

Date of fiscal year end: | 04/30/2005 | |

|

Date of reporting period: | 05/01/04 – 04/30/05 | |

| | | | | | | | |

Item 1 Report to Shareholders.

Boston Advisors Money Market Funds

April 30, 2005

Annual Report

Michael J. Vogelzang, CFA, President

Todd Finkelstein, CFA, Director of Fixed Income

Since the inception of the Boston Advisors Trust family of money market mutual funds, each of the constituent funds has provided liquidity and preserved capital consistent with seeking maximum current income for shareholders. As the adviser for the funds throughout their existence, and manager for most if not all of this time depending on the fund, Boston Advisors has stewarded your assets with great pride and care. With the transfer of your assets to comparable Federated funds only months away, we wish to underscore our appreciation of our stable and loyal shareholders during the years. It has been our pleasure to serve you.

Economic and Investing Environments:

During the period since our last shareholder report the economy has continued to grow at a solid pace. Quarterly real GDP remains in the 3.5 to 4.0% range at an annualized rate, sufficiently robust to keep the Federal Reserve raising short-term rates during the period. Over the six months ending 4/30/05, the Federal Funds rate has been raised on four separate occasions by 25 basis points each. As of this writing another similar increase has taken place with the current target level for Fed Funds residing at 3.00%. Each of the money market funds in the Boston Advisors Trust has benefited from these increases with rates now well above their lows just one year ago.

The daily release of important macro-economic statistics continue to paint the same picture as recent quarters — steady growth. This can be seen in the trends of retail sales, employment growth, capacity utilization rates and more. We believe the Fed remains quite conscious of the prospects for a pick-up in consumer inflation as commodity and producer prices have been manifesting increases for some time already. As a result, we expect the Fed to continue the tightening campaign in monetary policy begun June 30th of 2004, with 50 to 100 basis points increases in short-term interest rates still ahead of us this year.

Should the Fed continue its measured pace of rate increases and successfully reduce the prospect for inflation, we could see several more years of moderate but steady growth ahead. The result: higher investment yields on your money market funds would be part of the fallout as this scenario unfolds.

1

Boston Advisors Trust

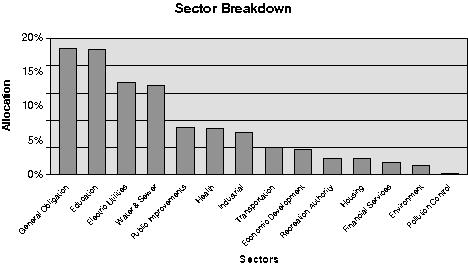

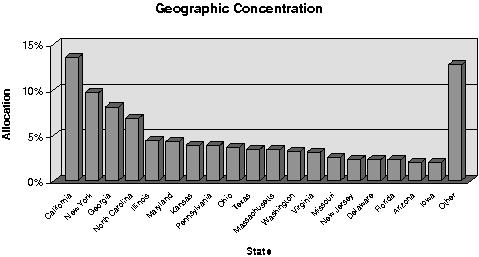

As of 4/30/2005

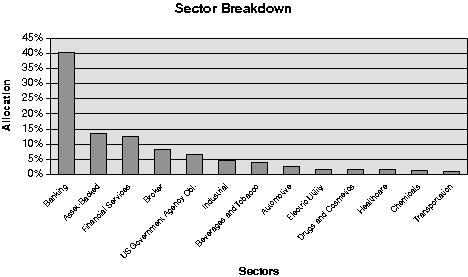

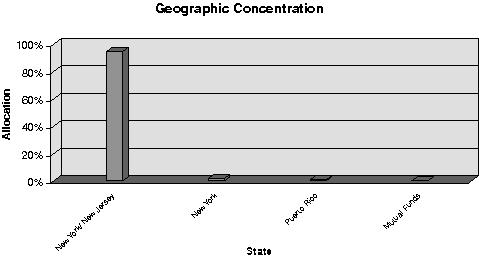

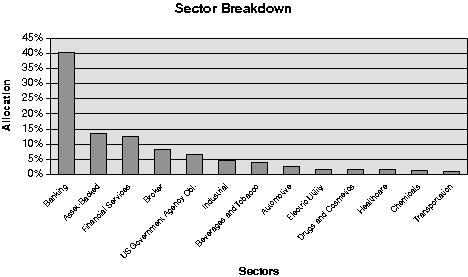

Boston Advisors Cash Reserves Fund

2

Boston Advisors Trust

As of 4/30/2005

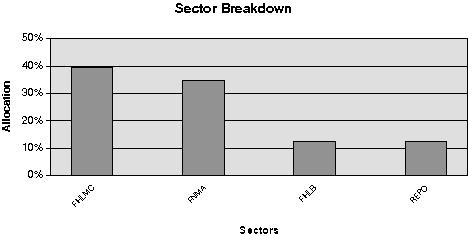

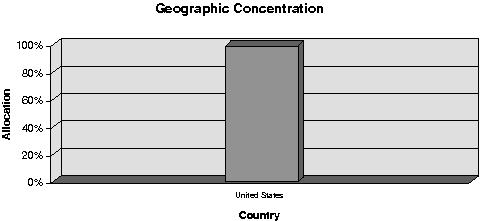

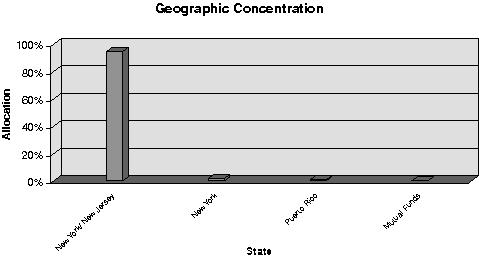

Boston Advisors U.S. Government Money Market Fund

3

Boston Advisors Trust

As of 4/30/2005

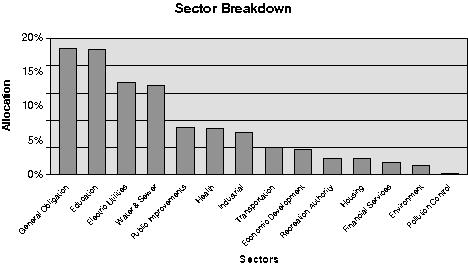

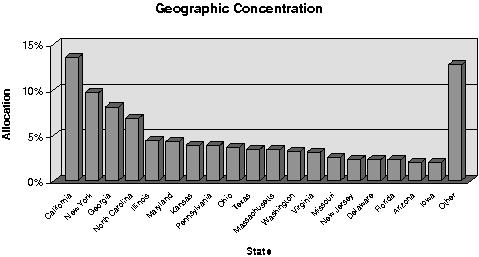

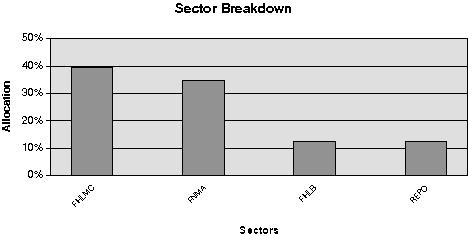

Boston Advisors Tax Free Fund

4

Boston Advisors Trust

As of 4/30/2005

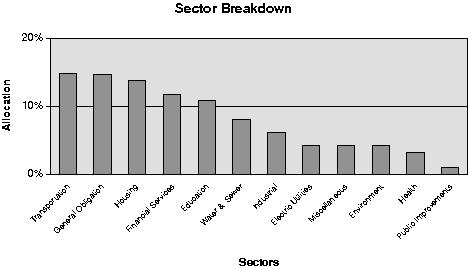

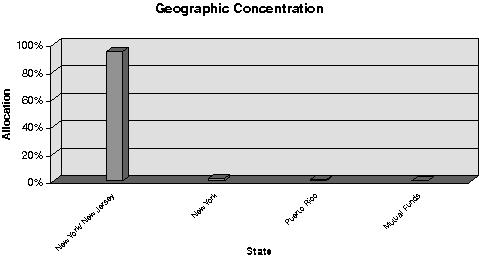

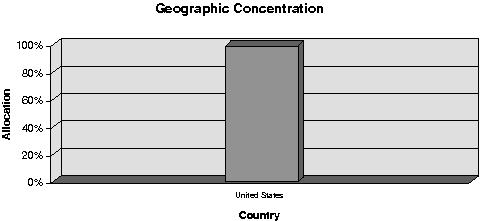

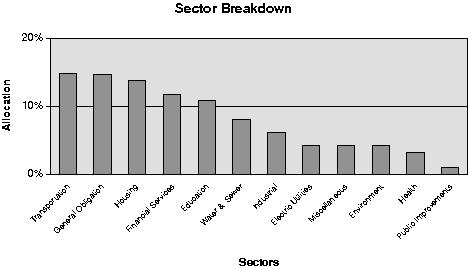

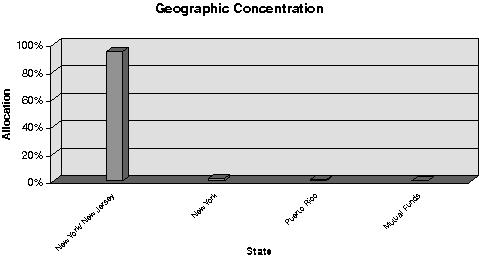

Boston Advisors New York Fund

5

Cash Reserves Fund

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Asset-Backed Commercial Paper — 13.6% | | | | | | | | | |

Banking — 13.6% | | | | | | | | | |

Golden Funding Corp. | | 2.690 | % | 05/03/2005 | | $ | 20,251,000 | | $ | 20,247,974 | |

Lockhart Funding LLC | | 2.920 | % | 05/13/2005 | | 30,000,000 | | 29,970,800 | |

Starbird Funding Corp. | | 2.820 | % | 05/04/2005 | | 30,000,000 | | 29,992,950 | |

Three Pillars Funding Corp. | | 2.820 | % | 05/05/2005 | | 30,000,000 | | 29,990,600 | |

Thunder Bay Funding, Inc. | | 2.900 | % | 05/16/2005 | | 35,000,000 | | 34,957,708 | |

Windmill Funding I Corp. | | 2.850 | % | 05/12/2005 | | 28,000,000 | | 27,975,617 | |

Total Asset-Backed Commercial Paper | | | | | | | | 173,135,649 | |

Certificates Of Deposit — 4.1% | | | | | | | | | |

Banking — 4.1% | | | | | | | | | |

Wells Fargo Bank NA | | 2.860 | % | 05/16/2005 | | 35,000,000 | | 35,000,000 | |

Wilmington Trust Corp. | | 2.790 | % | 05/04/2005 | | 17,000,000 | | 16,999,898 | |

Total Certificates Of Deposit | | | | | | | | 51,999,898 | |

Commercial Paper — 72.1% | | | | | | | | | |

Automotive — 2.7% | | | | | | | | | |

Toyota Motor Credit Corp. | | 2.830 | % | 05/16/2005 | | 35,000,000 | | 34,958,729 | |

Banking — 32.6% | | | | | | | | | |

Abbey National North America | | 2.800 | % | 05/05/2005 | | 30,000,000 | | 29,990,667 | |

Canadian Imperial Bank of Commerce | | 2.875 | % | 05/17/2005 | | 35,000,000 | | 34,955,278 | |

Citicorp | | 2.780 | % | 05/16/2005 | | 25,000,000 | | 24,971,042 | |

Deutsche Bank Financial LLC | | 2.850 | % | 05/05/2005 | | 25,000,000 | | 24,992,083 | |

Dexia Delaware LLC | | 2.810 | % | 05/13/2005 | | 13,250,000 | | 13,237,589 | |

Dresdner U.S. Finance, Inc. | | 2.975 | % | 06/07/2005 | | 25,000,000 | | 24,923,559 | |

ING (US) Funding LLC | | 2.780 | % | 05/02/2005 | | 25,000,000 | | 24,998,069 | |

Marshall & Ilsley Corp. | | 2.980 | % | 06/17/2005 | | 40,000,000 | | 39,844,378 | |

Rabobank USA Finance Corp. | | 2.780 | % | 05/03/2005 | | 50,000,000 | | 49,992,278 | |

Royal Bank of Scotland | | 2.760 | % | 05/02/2005 | | 44,530,000 | | 44,526,586 | |

Societe Generale North America, Inc. | | 2.790 | % | 05/04/2005 | | 25,000,000 | | 24,994,188 | |

Toronto-Dominion Holdings USA, Inc. | | 2.870 | % | 05/16/2005 | | 25,000,000 | | 24,970,104 | |

UBS Finance Delaware LLC | | 2.865 | % | 05/09/2005 | | 27,200,000 | | 27,182,683 | |

Westdeutsche Landesbank | | 2.955 | % | 06/06/2005 | | 25,408,000 | | 25,332,919 | |

| | | | | | | | 414,911,423 | |

Beverages, Food & Tobacco — 3.9% | | | | | | | | | |

Coca-Cola Co. (The) | | 2.830 | % | 05/09/2005 | | 20,000,000 | | 19,987,422 | |

Coca-Cola Enterprises, Inc. | | 2.880 | % | 05/06/2005 | | 29,000,000 | | 28,988,400 | |

| | | | | | | | 48,975,822 | |

| | | | | | | | | | | |

6

Cash Reserves Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Brokers — 8.5% | | | | | | | | | |

Credit Suisse First Boston NY | | 2.860 | % | 05/12/2005 | | $ | 25,000,000 | | $ | 24,978,153 | |

Goldman Sachs Group, Inc. | | 2.900 | % | 05/04/2005 | | 25,000,000 | | 24,993,958 | |

Merrill Lynch & Co., Inc. | | 2.930 | % | 05/03/2005 | | 27,000,000 | | 26,995,605 | |

Morgan Stanley | | 2.850 | % | 05/09/2005 | | 31,647,000 | | 31,626,957 | |

| | | | | | | | 108,594,673 | |

Chemicals — 1.4% | | | | | | | | | |

Dupont EI de Nemours Co. | | 2.750 | % | 05/03/2005 | | 17,784,000 | | 17,781,283 | |

Commercial Services — 1.6% | | | | | | | | | |

NetJets, Inc. | | 2.980 | % | 06/15/2005 | | 20,000,000 | | 19,925,500 | |

Electric Utilities — 1.6% | | | | | | | | | |

Florida Power & Light Co. | | 2.880 | % | 05/12/2005 | | 20,496,000 | | 20,477,964 | |

Financial Services — 10.8% | | | | | | | | | |

American General Finance Corp. | | 2.780 | % | 05/03/2005 | | 25,000,000 | | 24,996,139 | |

CIT Group, Inc. | | 2.670 | % | 06/17/2005 | | 19,485,000 | | 19,417,079 | |

CIT Group, Inc. | | 2.970 | % | 05/31/2005 | | 13,500,000 | | 13,466,588 | |

Household Finance Corp. | | 2.790 | % | 05/06/2005 | | 25,000,000 | | 24,990,313 | |

Household Finance Corp. | | 2.830 | % | 05/04/2005 | | 20,000,000 | | 19,995,283 | |

National Rural Utilities Cooperative Finance | | 2.830 | % | 05/06/2005 | | 35,000,000 | | 34,986,243 | |

| | | | | | | | 137,851,645 | |

Industrial – Diversified — 3.1% | | | | | | | | | |

General Electric Capital Corp. | | 2.970 | % | 06/06/2005 | | 40,000,000 | | 39,881,200 | |

Industrial Equipment — 1.6% | | | | | | | | | |

Caterpillar Financial Services Corp. | | 3.030 | % | 05/27/2005 | | 20,000,000 | | 19,956,233 | |

Insurance — 1.6% | | | | | | | | | |

United Healthcare Corp. | | 2.810 | % | 05/04/2005 | | 20,000,000 | | 19,995,317 | |

Pharmaceuticals — 1.6% | | | | | | | | | |

Abbott Laboratories | | 3.000 | % | 05/19/2005 | | 20,000,000 | | 19,970,000 | |

Transportation — 1.1% | | | | | | | | | |

Paccar Financial Corp. | | 2.810 | % | 05/02/2005 | | 13,885,000 | | 13,883,916 | |

Total Commercial Paper | | | | | | | | 917,163,705 | |

| | | | | | | | | | | |

7

Cash Reserves Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Fixed Rate U.S. Government Agency Obligations — 2.1% | | | | | |

Federal Home Loan Bank | | 1.660 | % | 05/16/2005 | | $ | 26,800,000 | | $ | 26,800,000 | |

Variable Rate U.S. Government Agency Obligations — 1.7% | | | | | |

U.S. Government Agency Obligations — 1.7% | | | | | | | | | |

Federal National Mortgage Association(1) | | 2.870 | % | 06/09/2005 | | 21,250,000 | | 21,249,352 | |

Total Variable Rate U.S. Government Agency Obligations | | | | | | 21,249,352 | |

Variable Rate Notes — 3.7% | | | | | | | | | |

Banking — 1.8% | | | | | | | | | |

Banque Nationale de Paris/New York(1) | | 2.875 | % | 06/09/2005 | | 23,250,000 | | 23,248,248 | |

Financial Services — 1.9% | | | | | | | | | |

Goldman Sachs Group, Inc.(1) | | 3.000 | % | 05/16/2005 | | 24,000,000 | | 24,000,000 | |

Total Variable Rate Notes | | | | | | | | 47,248,248 | |

Repurchase Agreement — 2.8% | | | | | | | | | |

UBS Paine Webber Warburg Repurchase Agreement, collateralized by Federal Home Loan Banks and Fannie Mae Discount Notes, with interest rates ranging from 0.000% to 7.248%, maturity dates ranging from 9/08/05 - 2/15/21 and an aggregate market value of $37,218,397. | | 2.900 | % | 05/02/2005 | | 36,487,000 | | 36,487,000 | |

Total Investments — 100.1% (Cost $1,274,083,852) | | | | | | | | $ | 1,274,083,852 | |

Net Other Assets — (0.1%) | | | | | | | | (1,531,340 | ) |

Net Assets — 100.0% | | | | | | | | $ | 1,272,552,512 | |

Total cost for income tax purposes | | | | | | | | $ | 1,274,083,852 | |

| | | | | | | | | | | |

Notes to Schedule of Investments:

(1) The maturity date shown for security is next interest rate reset date.

The accompanying notes are an integral part of the financial statements.

8

U.S. Government Money Market Fund

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Fixed Rate U.S. Government Agency Obligations — 85.8% | | | | | | | |

Federal Home Loan Bank | | 1.660 | % | 05/16/2005 | | $ | 3,800,000 | | $ | 3,800,000 | |

Federal Home Loan Bank | | 2.740 | % | 05/04/2005 | | 3,425,000 | | 3,424,218 | |

Federal Home Loan Bank | | 2.850 | % | 05/20/2005 | | 5,000,000 | | 4,992,479 | |

Federal Home Loan Bank | | 2.880 | % | 06/10/2005 | | 1,875,000 | | 1,869,000 | |

Federal Home Loan Bank | | 2.886 | % | 06/15/2005 | | 7,500,000 | | 7,472,944 | |

Federal Home Loan Mortgage Corporation | | 2.660 | % | 05/10/2005 | | 7,263,000 | | 7,258,170 | |

Federal Home Loan Mortgage Corporation | | 2.686 | % | 05/03/2005 | | 4,033,000 | | 4,032,398 | |

Federal Home Loan Mortgage Corporation | | 2.700 | % | 05/02/2005 | | 7,500,000 | | 7,499,437 | |

Federal Home Loan Mortgage Corporation | | 2.760 | % | 05/03/2005 | | 3,673,000 | | 3,672,437 | |

Federal Home Loan Mortgage Corporation | | 2.860 | % | 06/03/2005 | | 4,710,000 | | 4,697,652 | |

Federal Home Loan Mortgage Corporation | | 2.870 | % | 06/15/2005 | | 10,297,000 | | 10,260,060 | |

Federal Home Loan Mortgage Corporation | | 2.880 | % | 06/07/2005 | | 8,600,000 | | 8,574,544 | |

Federal Home Loan Mortgage Corporation | | 2.880 | % | 06/14/2005 | | 10,074,000 | | 10,038,540 | |

Federal Home Loan Mortgage Corporation | | 2.890 | % | 06/15/2005 | | 3,500,000 | | 3,487,356 | |

Federal Home Loan Mortgage Corporation | | 2.900 | % | 06/14/2005 | | 3,400,000 | | 3,387,949 | |

Federal Home Loan Mortgage Corporation | | 2.930 | % | 06/07/2005 | | 4,684,000 | | 4,669,895 | |

Federal National Mortgage Association | | 2.700 | % | 05/03/2005 | | 5,650,000 | | 5,649,152 | |

Federal National Mortgage Association | | 2.730 | % | 05/11/2005 | | 5,900,000 | | 5,895,526 | |

Federal National Mortgage Association | | 2.760 | % | 05/11/2005 | | 10,000,000 | | 9,992,333 | |

Federal National Mortgage Association | | 2.780 | % | 05/11/2005 | | 7,500,000 | | 7,494,208 | |

Federal National Mortgage Association | | 2.800 | % | 05/23/2005 | | 3,325,000 | | 3,319,311 | |

Federal National Mortgage Association | | 2.820 | % | 05/11/2005 | | 6,164,000 | | 6,159,172 | |

Federal National Mortgage Association | | 2.880 | % | 06/01/2005 | | 8,459,000 | | 8,438,022 | |

Federal National Mortgage Association | | 2.880 | % | 06/14/2005 | | 2,400,000 | | 2,391,552 | |

Federal National Mortgage Association | | 2.890 | % | 06/15/2005 | | 5,385,000 | | 5,365,547 | |

Federal National Mortgage Association | | 2.900 | % | 05/25/2005 | | 1,600,000 | | 1,596,907 | |

Total Fixed Rate U.S. Government Agency Obligations | | | | | | | | 145,438,809 | |

| | | | | | | | | | | |

9

U.S. Government Money Market Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Variable Rate U.S. Government Agency Obligations — 1.7% | | | | | | |

Federal National Mortgage Association(1) | | 2.870 | % | 06/09/2005 | | $ | 3,000,000 | | $ | 2,999,908 | |

Repurchase Agreement — 12.6% | | | | | | | | | |

UBS Paine Webber Warburg Repurchase Agreement, collateralized by Federal Home Loan Banks and Fannie Mae Discount Notes, with interest rates ranging from 0.000% to 5.875%, maturity dates ranging from 6/10/05 - 4/08/22 and an aggregate market value of $21,770,980. | | 2.900 | % | 05/02/2005 | | 21,344,000 | | 21,344,000 | |

Total Investments — 100.1% (Cost $169,782,717) | | | | | | | | $ | 169,782,717 | |

Net Other Assets — (0.1%) | | | | | | | | (224,746 | ) |

Net Assets — 100.0% | | | | | | | | $ | 169,557,971 | |

Total cost for income tax purposes | | | | | | | | $ | 169,782,717 | |

| | | | | | | | | | | |

Notes to Schedule of Investments:

(1) The maturity date shown for security is next interest rate reset date.

The accompanying notes are an integral part of the financial statements.

10

Tax Free Money Market Fund

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amorized cost | |

| | | | | | | | | |

Municipal Interest Bearing Commercial Paper — 12.0% | | | | | | | |

Austin, TX, Combined Utility System | | 2.600 | % | 06/17/2005 | | $ | 1,650,000 | | $ | 1,650,000 | |

Municipal Electricity Authority of Georgia | | 2.250 | % | 05/11/2005 | | 2,500,000 | | 2,500,000 | |

New York State, Environmental Quality | | 2.030 | % | 05/16/2005 | | 1,000,000 | | 1,000,000 | |

Ohio State University Improvements | | 2.050 | % | 06/01/2005 | | 2,500,000 | | 2,498,500 | |

Palm Beach County, FL, School District | | 1.970 | % | 05/05/2005 | | 700,000 | | 700,000 | |

Total Municipal Interest Bearing Commercial Paper | | | | | | | | 8,348,500 | |

Fixed Rate Municipal Obligations — 9.1% | | | | | | | | | |

Box Elder County, UT, School District | | 5.000 | % | 06/15/2005 | | 730,000 | | 732,681 | |

Des Moines, IA, Metropolitan Wastewater Reclamation Authority | | 3.000 | % | 06/01/2005 | | 1,000,000 | | 1,001,013 | |

New York, NY, City Municipal Water Finance Authority | | 6.000 | % | 06/15/2005 | | 1,500,000 | | 1,522,456 | |

Newtown, CT, School Improvements | | 4.000 | % | 06/01/2005 | | 500,000 | | 500,860 | |

Polk County, IA, Public Improvements | | 4.000 | % | 06/01/2005 | | 500,000 | | 500,842 | |

Rutherford County, TN, School Improvements | | 6.250 | % | 05/02/2005 | | 500,000 | | 500,000 | |

Spencerport, NY, Central School District | | 3.500 | % | 06/15/2005 | | 600,000 | | 601,099 | |

Utica, MI, Community Schools | | 2.000 | % | 05/02/2005 | | 1,000,000 | | 1,000,000 | |

Total Fixed Rate Municipal Obligations | | | | | | | | 6,358,951 | |

Daily Variable Rate Municipal Obligations — 33.0% | | | | | | | | | |

Jacksonville Electric Authority, FL(1) | | 3.050 | % | 05/02/2005 | | 1,900,000 | | 1,900,000 | |

Long Island Power Authority, NY(1) | | 3.050 | % | 05/02/2005 | | 1,260,000 | | 1,260,000 | |

Metropolitan Water District of Southern California(1) | | 3.020 | % | 05/02/2005 | | 2,200,000 | | 2,200,000 | |

Missouri State Health Educational Facilities Authority, (Lester E. Cox Medical Center)(1) | | 3.120 | % | 05/02/2005 | | 1,900,000 | | 1,900,000 | |

Missouri State Health & Educational Facilities Authority, (Washington University of St. Louis)(1) | | 3.020 | % | 05/02/2005 | | 1,600,000 | | 1,600,000 | |

Mount Vernon, IN, (General Electric Co.)(1) | | 3.000 | % | 05/02/2005 | | 1,900,000 | | 1,900,000 | |

New York, NY, City Municipal Water Finance Authority(1) | | 3.000 | % | 05/02/2005 | | 50,000 | | 50,000 | |

New York, NY, City Municipal Water Finance Authority(1) | | 3.020 | % | 05/02/2005 | | 1,700,000 | | 1,700,000 | |

New York, NY, City Transitional Finance Authority, (NYC Recovery)(1) | | 3.050 | % | 05/02/2005 | | 600,000 | | 600,000 | |

New York, NY, City Transitional Finance Authority, (NYC Recovery)(1) | | 3.120 | % | 05/02/2005 | | 1,350,000 | | 1,350,000 | |

New York, NY, Public Improvements(1) | | 2.960 | % | 05/02/2005 | | 1,700,000 | | 1,700,000 | |

Orange County Sanitation District(1) | | 3.010 | % | 05/02/2005 | | 1,100,000 | | 1,100,000 | |

Roanoke, VA, Industrial Development Authority, (Carion Medical Center)(1) | | 3.050 | % | 05/02/2005 | | 900,000 | | 900,000 | |

| | | | | | | | | | | |

11

Tax Free Money Market Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amorized cost | |

| | | | | | | | | |

Daily Variable Rate Municipal Obligations (Continued) | | | | | |

Turlock, CA, Irrigation District(1) | | 3.040 | % | 05/02/2005 | | $ | 2,400,000 | | $ | 2,400,000 | |

Valdez, AK, (Exxon Pipeline Co./Exxon Mobil Co.)(1) | | 2.940 | % | 05/02/2005 | | 2,500,000 | | 2,500,000 | |

Total Daily Variable Rate Municipal Obligations | | | | | | | | 23,060,000 | |

Weekly Variable Rate Municipal Obligations — 42.0% | | | | | | | |

Baltimore, MD, Industrial Development Authority, (Baltimore Capital Acquisition)(1) | | 3.000 | % | 05/04/2005 | | 1,700,000 | | 1,700,000 | |

California Economic Development Financing Authority, (KQED, Inc.)(1) | | 2.930 | % | 05/04/2005 | | 800,000 | | 800,000 | |

Collier County, FL, Industrial Development Authority, (Redlands Christian Migrant Association, Inc.)(1) | | 3.050 | % | 05/05/2005 | | 1,000,000 | | 1,000,000 | |

Delaware Valley, PA, Regional Financial Authority(1) | | 3.000 | % | 05/04/2005 | | 1,000,000 | | 1,000,000 | |

Elmhurst, IL, (Joint Commission on Accredation of Healthcare Organizations)(1) | | 3.000 | % | 05/05/2005 | | 1,090,000 | | 1,090,000 | |

Fairfax County, VA, Economic Development Authority, (The Smithsonian Institution)(1) | | 2.900 | % | 05/05/2005 | | 1,000,000 | | 1,000,000 | |

Guinnett County, GA, Water & Sewer Authority(1) | | 2.980 | % | 05/04/2005 | | 1,500,000 | | 1,500,000 | |

Harris County, TX, Health Facilities Development Authority, (Gulf Coast Regional Blood Center)(1) | | 3.050 | % | 05/05/2005 | | 500,000 | | 500,000 | |

Illinois Educational Facilities Authority, (Columbia College)(1) | | 3.000 | % | 05/04/2005 | | 1,500,000 | | 1,500,000 | |

Illinois Finance Authority, (Northwestern University)(1) | | 2.970 | % | 05/04/2005 | | 2,500,000 | | 2,500,000 | |

Indiana Municipal Power Agency(1) | | 3.000 | % | 05/04/2005 | | 1,200,000 | | 1,200,000 | |

King County, WA, Sewer(1) | | 3.040 | % | 05/04/2005 | | 1,500,000 | | 1,500,000 | |

Lehigh County, PA, Industrial Development Authority, (Allegheny Electric Co-op, Inc.)(1) | | 3.100 | % | 05/04/2005 | | 110,000 | | 110,000 | |

Maryland State Health & Higher Educational Facilities Authority, (Johns Hopkins University)(1) | | 3.000 | % | 05/05/2005 | | 1,500,000 | | 1,500,000 | |

New Hampshire Health & Education Facilities Authority, (Dartmouth College)(1) | | 2.990 | % | 05/04/2005 | | 630,000 | | 630,000 | |

New York, NY(1) | | 2.980 | % | 05/04/2005 | | 1,000,000 | | 1,000,000 | |

North Carolina State University, NC, Raleigh(1) | | 2.990 | % | 05/04/2005 | | 850,000 | | 850,000 | |

Northeastern Pennsylvania Hospital & Education Authority(1) | | 3.000 | % | 05/05/2005 | | 1,440,000 | | 1,440,000 | |

Ohio State Public Improvements(1) | | 2.980 | % | 05/04/2005 | | 2,300,000 | | 2,300,000 | |

Ohio State Refunding Bonds(1) | | 2.940 | % | 05/04/2005 | | 400,000 | | 400,000 | |

Ohio State Water Development Authority(1) | | 2.980 | % | 05/04/2005 | | 1,650,000 | | 1,650,000 | |

| | | | | | | | | | | |

12

Tax Free Money Market Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amorized cost | |

| | | | | | | | | |

Weekly Variable Rate Municipal Obligations (Continued) | | | | | |

Pima County, AZ, Industrial Development Authority, (Tucson Power Co.)(1) | | 2.960 | % | 05/04/2005 | | $ | 1,500,000 | | $ | 1,500,000 | |

South Louisiana Port Commission, (Occidental Petroleum Corp.)(1) | | 2.960 | % | 05/04/2005 | | 1,325,000 | | 1,325,000 | |

St. Paul, MN, Housing & Redevelopment Authority, (District Energy of St. Paul)(1) | | 3.000 | % | 05/04/2005 | | 1,350,000 | | 1,350,000 | |

Total Weekly Variable Rate Municipal Obligations | | | | | | | | 29,345,000 | |

Total Investments — 96.1% (Cost $67,112,451) | | | | | | | | $ | 67,112,451 | |

Net Other Assets — 3.9% | | | | | | | | 2,723,006 | |

Net Assets — 100.0% | | | | | | | | $ | 69,835,457 | |

Total cost for income tax purposes | | | | | | | | $ | 67,112,451 | |

| | | | | | | | | | | |

Notes to Schedule of Investments:

(1) The maturity date shown for security is next interest rate reset date.

The accompanying notes are an integral part of the financial statements.

13

Boston Advisors Trust State Table

Tax Free Money Market Fund

(In Liquidation)

Schedule of Investments - April 30, 2005 (unaudited)

State (as a % of market value of investments) | | Percentage | |

| | | |

New York | | | 16.1% | | |

Ohio | | | 10.2% | | |

California | | | 9.7% | | |

Illinois | | | 7.6% | | |

Georgia | | | 6.0% | | |

Florida | | | 5.4% | | |

Missouri | | | 5.2% | | |

Maryland | | | 4.8% | | |

Indiana | | | 4.6% | | |

Pennsylvania | | | 3.8% | | |

Alaska | | | 3.7% | | |

Texas | | | 3.2% | | |

Virginia | | | 2.8% | | |

Iowa | | | 2.2% | | |

Washington | | | 2.2% | | |

Arizona | | | 2.2% | | |

Minnesota | | | 2.0% | | |

Louisiana | | | 2.0% | | |

Michigan | | | 1.5% | | |

North Carolina | | | 1.3% | | |

Utah | | | 1.1% | | |

New Hampshire | | | 0.9% | | |

Connecticut | | | 0.8% | | |

Tennessee | | | 0.7% | | |

14

New York Municipal Money Market Fund

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Municipal Interest Bearing Commercial Paper — 10.4% | | | | | | | |

Metropolitan Transportation Authority, NY | | 1.980 | % | 05/05/2005 | | $ | 2,000,000 | | $ | 2,000,000 | |

Metropolitan Transportation Authority, NY | | 2.300 | % | 05/04/2005 | | 4,000,000 | | 4,000,000 | |

New York State | | 2.280 | % | 05/17/2005 | | 5,000,000 | | 5,000,000 | |

New York State Dormitory Authority, (Mount Sinai School of Medicine) | | 2.130 | % | 05/03/2005 | | 3,100,000 | | 3,100,000 | |

New York State, Environmental Quality | | 2.030 | % | 05/16/2005 | | 2,000,000 | | 2,000,000 | |

Total Municipal Interest Bearing Commercial Paper | | | | | | | | 16,100,000 | |

Fixed Rate Municipal Obligations — 3.9% | | | | | | | | | |

Elmira City, NY, School District | | 3.250 | % | 06/15/2005 | | 1,890,000 | | 1,893,006 | |

New York, NY, City Municipal Water Finance Authority | | 6.000 | % | 06/15/2005 | | 1,000,000 | | 1,001,411 | |

Niagara Falls, NY, City School District | | 3.000 | % | 06/15/2005 | | 2,225,000 | | 2,226,624 | |

North Hempstead, NY | | 5.000 | % | 05/16/2005 | | 1,000,000 | | 1,015,415 | |

Total Fixed Rate Municipal Obligations | | | | | | | | 6,136,456 | |

Daily Variable Rate Municipal Obligations — 27.9% | | | | | | | | | |

Jay Street Development Corp., NY, (Jay Street)(1) | | 2.940 | % | 05/02/2005 | | 1,700,000 | | 1,700,000 | |

Long Island Power Authority, NY(1) | | 3.000 | % | 05/02/2005 | | 2,700,000 | | 2,700,000 | |

Long Island Power Authority, NY(1) | | 3.020 | % | 05/02/2005 | | 3,500,000 | | 3,500,000 | |

Long Island Power Authority, NY(1) | | 3.050 | % | 05/02/2005 | | 1,000,000 | | 1,000,000 | |

Nassau County, NY, Industrial Development Agency, (Cold Spring Harbor Lab)(1) | | 3.050 | % | 05/02/2005 | | 7,105,000 | | 7,105,000 | |

New York State Dormitory Authority, (Cornell University)(1) | | 3.050 | % | 05/02/2005 | | 2,600,000 | | 2,600,000 | |

New York State Environmental Facilities Corp., (General Electric Co.)(1) | | 3.010 | % | 05/02/2005 | | 6,700,000 | | 6,700,000 | |

New York, NY, City Municipal Water Finance Authority(1) | | 3.000 | % | 05/02/2005 | | 300,000 | | 300,000 | |

New York, NY, City Municipal Water Finance Authority(1) | | 3.000 | % | 05/02/2005 | | 800,000 | | 800,000 | |

New York, NY, City Municipal Water Finance Authority(1) | | 3.020 | % | 05/02/2005 | | 2,260,000 | | 2,260,000 | |

New York, NY, City Transitional Finance Authority(1) | | 3.020 | % | 05/02/2005 | | 1,600,000 | | 1,600,000 | |

New York, NY, City Transitional Finance Authority(1) | | 3.040 | % | 05/02/2005 | | 500,000 | | 500,000 | |

New York, NY, City Transitional Finance Authority, (NYC Recovery)(1) | | 3.050 | % | 05/02/2005 | | 370,000 | | 370,000 | |

New York, NY, Industrial Development Agency, (Lycee Francais de New York)(1) | | 3.040 | % | 05/02/2005 | | 2,400,000 | | 2,400,000 | |

| | | | | | | | | | | |

15

New York Municipal Money Market Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Daily Variable Rate Municipal Obligations (Continued) | | | | | |

New York, NY, Public Improvements(1) | | 2.960 | % | 05/02/2005 | | $ | 1,300,000 | | $ | 1,300,000 | |

New York, NY, Public Improvements(1) | | 3.000 | % | 05/02/2005 | | 1,200,000 | | 1,200,000 | |

New York, NY, Public Improvements(1) | | 3.000 | % | 05/02/2005 | | 1,160,000 | | 1,160,000 | |

Port Authority, NY/NJ(1) | | 3.000 | % | 05/02/2005 | | 1,100,000 | | 1,100,000 | |

Port Authority, NY/NJ, (Versatile Structure Obligation)(1) | | 3.010 | % | 05/02/2005 | | 5,000,000 | | 5,000,000 | |

Total Daily Variable Rate Municipal Obligations | | | | | | | | 43,295,000 | |

Weekly Variable Rate Municipal Obligations — 54.9% | | | | | | | |

Franklin County, NY, Industrial Development Agency, (Trudeau Institute, Inc.)(1) | | 2.980 | % | 05/04/2005 | | 1,870,000 | | 1,870,000 | |

Great Neck North, NY, Water Authority(1) | | 3.040 | % | 05/04/2005 | | 1,970,000 | | 1,970,000 | |

Nassau County, NY, Interim Finance Authority(1) | | 3.000 | % | 05/04/2005 | | 6,000,000 | | 6,000,000 | |

New York State Dormitory Authority(1) | | 3.040 | % | 05/05/2005 | | 5,750,000 | | 5,750,000 | |

New York State Dormitory Authority (Cornell University)(1) | | 2.920 | % | 05/05/2005 | | 5,000,000 | | 5,000,000 | |

New York State Dormitory Authority, (Mental Health Services)(1) | | 2.980 | % | 05/05/2005 | | 5,300,000 | | 5,300,000 | |

New York State Dormitory Authority, (New York Public Library)(1) | | 3.000 | % | 05/04/2005 | | 1,100,000 | | 1,100,000 | |

New York State Housing Finance Agency(1) | | 3.000 | % | 05/04/2005 | | 5,000,000 | | 5,000,000 | |

New York State Housing Finance Agency(1) | | 3.000 | % | 05/04/2005 | | 1,500,000 | | 1,500,000 | |

New York State Housing Finance Agency, (Normandie CT I)(1) | | 2.970 | % | 05/04/2005 | | 3,320,000 | | 3,320,000 | |

New York State Local Government Assistance Corp.(1) | | 2.890 | % | 05/04/2005 | | 4,270,000 | | 4,270,000 | |

New York State Local Government Assistance Corp.(1) | | 2.950 | % | 05/04/2005 | | 3,000,000 | | 3,000,000 | |

New York, NY, City Housing Development Corp., (63 Wall Street/RBNB Wall Street Owner)(1) | | 3.000 | % | 05/04/2005 | | 7,000,000 | | 7,000,000 | |

New York, NY, City Housing Development Corp., (BCRE-90 West Street LLC)(1) | | 3.000 | % | 05/04/2005 | | 5,700,000 | | 5,700,000 | |

New York, NY, City Industrial Development Agency, (Planned Parenthood)(1) | | 2.980 | % | 05/05/2005 | | 4,800,000 | | 4,800,000 | |

Niagara Falls, NY, Bridge Commission(1) | | 2.980 | % | 05/04/2005 | | 5,900,000 | | 5,900,000 | |

Oneida County, NY, Industrial Development Agency(1) | | 3.040 | % | 05/04/2005 | | 4,630,000 | | 4,630,000 | |

Puerto Rico Highway & Transportation Authority(1) | | 3.000 | % | 05/04/2005 | | 1,100,000 | | 1,100,000 | |

Suffolk County, NY, Water Authority(1) | | 2.980 | % | 05/04/2005 | | 4,900,000 | | 4,900,000 | |

| | | | | | | | | | | |

16

New York Municipal Money Market Fund (Continued)

(In Liquidation)

Schedule of Investments - April 30, 2005

Security Description | | Rate | | Maturity | | Principal | | Amortized cost | |

| | | | | | | | | |

Weekly Variable Rate Municipal Obligations (Continued) | | | | | |

Triborough Bridge & Tunnel Authority(1) | | 3.000 | % | 05/05/2005 | | $ | 3,800,000 | | $ | 3,800,000 | |

Triborough Bridge & Tunnel Authority(1) | | 3.000 | % | 05/05/2005 | | 3,300,000 | | 3,300,000 | |

Total Weekly Variable Rate Municipal Obligations | | | | | | | | 85,210,000 | |

Money Market Fund — 0.0% | | | | | | | | | |

Dreyfus New York Municipal Cash Management Institutional Money Market Fund | | 2.090 | % | 05/02/2005 | | 516 | | 516 | |

Total Investments — 97.1% (Cost $150,741,972) | | | | | | | | $ | 150,741,972 | |

Net Other Assets — 2.9% | | | | | | | | 4,466,214 | |

Net Assets — 100.0% | | | | | | | | $ | 155,208,186 | |

Total cost for income tax purposes | | | | | | | | $ | 150,741,972 | |

| | | | | | | | | | | |

Notes to Schedule of Investments:

(1) The maturity date shown for security is next interest rate reset date.

The accompanying notes are an integral part of the financial statements.

17

Statements of Assets and Liabilities (In Liquidation)

| | Boston Advisors | | Boston Advisors | | Boston Advisors | | Boston Advisors | |

| | Cash | | U.S. Government | | Tax Free | | New York Municipal | |

| | Reserves Fund | | Money Market Fund | | Money Market Fund | | Money Market Fund | |

Assets | | | | | | | | | | | | | | | |

Investments in securities, at value (Cost $1,237,596,852, $148,438,717, $67,112,451 and $150,741,972, respectively) | | $ | 1,237,596,852 | | | $ | 148,438,717 | | | | $ | 67,112,451 | | | | $ | 150,741,972 | | |

Repurchase agreements, at value (Cost $36,487,000, $21,344,000, $0 and $0, respectively) | | 36,487,000 | | | 21,344,000 | | | | — | | | | — | | |

Cash | | 177 | | | 372 | | | | 42,330 | | | | 19,266 | | |

Receivable for investments sold | | — | | | — | | | | 2,500,000 | | | | 6,500,000 | | |

Interest receivable | | 365,777 | | | 17,869 | | | | 274,244 | | | | 402,022 | | |

Prepaid expenses | | 15,864 | | | 6,715 | | | | 5,547 | | | | 990 | | |

Total assets | | 1,274,465,670 | | | 169,807,673 | | | | 69,934,572 | | | | 157,664,250 | | |

Liabilities | | | | | | | | | | | | | | | |

Payable for investments purchased | | — | | | — | | | | — | | | | 2,226,624 | | |

Dividends payable | | 883,086 | | | 115,762 | | | | 42,397 | | | | 113,220 | | |

Payable to the Investment Adviser | | 491,537 | | | 42,175 | | | | 5,119 | | | | 22,742 | | |

Payable to affiliate for Trustees’ fees | | 4,875 | | | 4,875 | | | | 4,875 | | | | 4,875 | | |

Payable to Distributor | | 256,486 | | | 34,273 | | | | 13,684 | | | | 33,533 | | |

Payable to Transfer Agent | | 122,598 | | | 15,132 | | | | 2,731 | | | | 9,989 | | |

Accrued expense and other payables | | 154,576 | | | 37,485 | | | | 30,309 | | | | 45,081 | | |

Total liabilities | | 1,913,158 | | | 249,702 | | | | 99,115 | | | | 2,456,064 | | |

Net Assets | | $ | 1,272,552,512 | | | $ | 169,557,971 | | | | $ | 69,835,457 | | | | $ | 155,208,186 | | |

Net Assets consist of: | | | | | | | | | | | | | | | |

Paid-in capital | | 1,272,643,598 | | | 169,561,897 | | | | 69,843,343 | | | | 155,234,030 | | |

Accumulated net investment income | | 34,136 | | | 1,460 | | | | 3,033 | | | | 9,709 | | |

Accumulated net realized losses on investment transactions | | (125,222 | ) | | (5,386 | ) | | | (10,919 | ) | | | (35,553 | ) | |

Total Net Assets | | $ | 1,272,552,512 | | | $ | 169,557,971 | | | | $ | 69,835,457 | | | | $ | 155,208,186 | | |

Net Assets | | | | | | | | | | | | | | | |

Class 1 | | 1,251,434,513 | | | 169,557,971 | | | | 69,835,457 | | | | 155,208,186 | | |

Class 2 | | 21,117,999 | | | — | | | | — | | | | — | | |

Total | | $ | 1,272,552,512 | | | $ | 169,557,971 | | | | $ | 69,835,457 | | | | $ | 155,208,186 | | |

Shares outstanding | | | | | | | | | | | | | | | |

Class 1 | | 1,251,524,156 | | | 169,561,897 | | | | 69,843,343 | | | | 155,234,030 | | |

Class 2 | | 21,119,442 | | | — | | | | — | | | | — | | |

Total | | 1,272,643,598 | | | 169,561,897 | | | | 69,843,343 | | | | 155,234,030 | | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | | | | | | | | | | | | |

Class 1 | | $1.00 | | | $1.00 | | | | $1.00 | | | | $1.00 | | |

Class 2 | | 1.00 | | | — | | | | — | | | | — | | |

See Notes to Financial Statements

18

Statement of Operations (In Liquidation)

| | Boston Advisors | �� | Boston Advisors | | Boston Advisors | | Boston Advisors | |

| | Cash | | U.S. Government | | Tax Free | | New York Municipal | |

| | Reserves Fund | | Money Market Fund | | Money Market Fund | | Money Market Fund | |

| | | | | | | | | |

Investment Income | | | | | | | | | | | | | | | | | |

Interest | | | $ | 23,949,049 | | | | $ | 3,242,790 | | | | $ | 1,168,758 | | | | $ | 2,404,635 | | |

Total investment income | | | 23,949,049 | | | | 3,242,790 | | | | 1,168,758 | | | | 2,404,635 | | |

Expenses | | | | | | | | | | | | | | | | | |

Investment adviser fee | | | 6,981,539 | | | | 972,256 | | | | 422,425 | | | | 867,447 | | |

Distribution and service fees | | | | | | | | | | | | | | | | | |

Class 1 | | | 3,119,013 | | | | 441,934 | | | | 192,011 | | | | 394,294 | | |

Legal fees | | | 34,096 | | | | 34,096 | | | | 34,096 | | | | 39,326 | | |

Printing | | | 115,213 | | | | 16,349 | | | | 7,284 | | | | 12,594 | | |

Audit fees | | | 24,755 | | | | 24,755 | | | | 24,755 | | | | 24,755 | | |

Custodian and fund accounting expense | | | 441,422 | | | | 69,468 | | | | 36,161 | | | | 102,752 | | |

Transfer agency expense | | | 1,441,189 | | | | 179,739 | | | | 33,301 | | | | 117,434 | | |

Registration expense | | | — | | | | 23,905 | | | | 25,583 | | | | — | | |

Trustees fees and expenses | | | 26,172 | | | | 26,172 | | | | 26,172 | | | | 26,172 | | |

Insurance expense | | | 66,127 | | | | 13,679 | | | | 4,029 | | | | 7,985 | | |

Miscellaneous | | | 20 | | | | 17 | | | | 19 | | | | 464 | | |

Total expenses | | | 12,249,546 | | | | 1,802,370 | | | | 805,836 | | | | 1,593,223 | | |

Reduction of investment adviser expense | | | (1,512,391 | ) | | | (211,405 | ) | | | (114,591 | ) | | | (568,053 | ) | |

Net expenses | | | 10,737,155 | | | | 1,590,965 | | | | 691,245 | | | | 1,025,170 | | |

Net investment income | | | 13,211,894 | | | | 1,651,825 | | | | 477,513 | | | | 1,379,465 | | |

Net Realized Gains/Losses on Investments | | | | | | | | | | | | | | | | | |

Net realized gains/losses on investment transactions | | | (124,908 | ) | | | (5,386 | ) | | | (10,919 | ) | | | (35,553 | ) | |

Net increase in net assets from operations | | | $ | 13,086,986 | | | | $ | 1,646,439 | | | | $ | 466,594 | | | | $ | 1,343,912 | | |

See Notes to Financial Statements

19

Statement of Changes in Net Assets (In Liquidation)

| | Boston Advisors | | Boston Advisors | |

| | Cash | | U.S. Government | |

| | Reserves Fund | | Money Market Fund | |

| | | | | |

| | Year Ended | | Year Ended | | Year Ended | | Year Ended | |

| | April 30, 2005 | | April 30, 2004 | | April 30, 2005 | | April 30, 2004 | |

| | | | | | | | | |

Increase (Decrease) in Net Assets From Operations | | | | | | | | | |

Net investment income | | $ | 13,211,894 | | $ | 4,528,148 | | $ | 1,651,825 | | $ | 446,369 | |

Net realized loss | | (124,908 | ) | — | | (5,386 | ) | — | |

Net increase in net assets resulting from operations | | 13,086,986 | | 4,528,148 | | 1,646,439 | | 446,369 | |

Distributions to Shareholders | | | | | | | | | |

From net investment income | | | | | | | | | |

Class 1 | | (12,918,940 | ) | (4,378,990 | ) | (1,650,365 | ) | (446,369 | ) |

Class 2 | | (259,132 | ) | (149,158 | ) | — | | — | |

Total distributions to shareholders | | (13,178,072 | ) | (4,528,148 | ) | (1,650,365 | ) | (446,369 | ) |

Transactions in shares of beneficial interest | | | | | | | | | |

Proceeds from sale of shares | | | | | | | | | |

Class 1 | | 4,761,896,170 | | 4,833,027,671 | | 687,002,133 | | 713,467,996 | |

Class 2 | | 36,140,912 | | 47,662,853 | | — | | — | |

Net Asset Value of shares issued to shareholders in payment of distributions declared | | | | | | | | | |

Class 1 | | 11,854,548 | | 4,369,618 | | 1,507,436 | | 457,672 | |

Class 2 | | 247,296 | | 150,286 | | — | | — | |

Cost of shares redeemed | | | | | | | | | |

Class 1 | | (4,779,347,293 | ) | (4,843,412,819 | ) | (699,441,809 | ) | (723,683,825 | ) |

Class 2 | | (43,843,149 | ) | (46,269,166 | ) | — | | — | |

Net decrease in net assets from Fund share transactions | | (13,051,516 | ) | (4,471,557 | ) | (10,932,240 | ) | (9,758,157 | ) |

Net decrease in net assets | | (13,142,602 | ) | (4,471,557 | ) | (10,936,166 | ) | (9,758,157 | ) |

Net Assets | | | | | | | | | |

At beginning of year | | 1,285,695,114 | | 1,290,166,671 | | 180,494,137 | | 190,252,294 | |

At end of year | | $ | 1,272,552,512 | | $ | 1,285,695,114 | | $ | 169,557,971 | | $ | 180,494,137 | |

Accumulated undistributed net investment income included in net assets | | $ | 34,136 | | $ | 314 | | $ | 1,460 | | $ | 20,263 | |

See Notes to Financial Statements

20

Statement of Changes in Net Assets (In Liquidation) (Continued)

| | Boston Advisors | | Boston Advisors | |

| | Tax Free | | New York Municipal | |

| | Money Market Fund | | Money Market Fund | |

| | | | | |

| | Year Ended | | Year Ended | | Year Ended | | Year Ended | |

| | April 30, 2005 | | April 30, 2004 | | April 30, 2005 | | April 30, 2004 | |

| | | | | | | | | |

Increase (Decrease) in Net Assets From Operations | | | | | | | | | |

Net investment income | | $ | 477,513 | | $ | 121,018 | | $ | 1,379,465 | | $ | 460,358 | |

Net realized loss | | (10,919 | ) | — | | (35,553 | ) | — | |

Net increase in net assets resulting from operations | | 466,594 | | 121,018 | | 1,343,912 | | 460,358 | |

Distributions to Shareholders | | | | | | | | | |

From net investment income | | | | | | | | | |

Class 1 | | (474,480 | ) | (121,018 | ) | (1,369,756 | ) | (460,358 | ) |

Total distributions to shareholders | | (474,480 | ) | (121,018 | ) | (1,369,756 | ) | (460,358 | ) |

Transactions in shares of beneficial interest | | | | | | | | | |

Proceeds from sale of shares | | | | | | | | | |

Class 1 | | 238,042,120 | | 237,899,013 | | 587,831,962 | | 514,722,265 | |

Net Asset Value of shares issued to shareholders in payment of distributions declared | | | | | | | | | |

Class 1 | | 424,594 | | 125,701 | | 1,240,524 | | 458,005 | |

Cost of shares redeemed | | | | | | | | | |

Class 1 | | (249,098,786 | ) | (237,808,912 | ) | (571,896,395 | ) | (508,146,781 | ) |

Net increase (decrease) in net assets from Fund share transactions | | (10,632,072 | ) | 215,802 | | 17,176,091 | | 7,033,489 | |

Net increase (decrease) in net assets | | (10,639,958 | ) | 215,802 | | 17,150,247 | | 7,033,489 | |

Net Assets | | | | | | | | | |

At beginning of year | | 80,475,415 | | 80,259,613 | | 138,057,939 | | 131,024,450 | |

At end of year | | $ | 69,835,457 | | $ | 80,475,415 | | $ | 155,208,186 | | $ | 138,057,939 | |

Accumulated undistributed net investment income included in net assets | | $ | 3,033 | | $ | — | | $ | 9,709 | | $ | — | |

See Notes to Financial Statements

21

Financial Highlights - Class 1

(In Liquidation)

| | Boston Advisors

Cash Reserves Fund | |

| | | |

| | For

the Year

Ended

April 30, 2005 | | For

the Year

Ended

April 30, 2004 | | For

the Year

Ended

April 30, 2003 | | For

the Year

Ended

April 30, 2002 | | For

the Period

Ended

April 30, 2001(1) | |

| | | | | | | | | | | |

Net asset value, beginning of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Increase in Net Assets from Operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.010 | | | | 0.003 | | | | 0.008 | | | | 0.022 | | | | 0.050 | | |

Net increase from investment operations | | | 0.010 | | | | 0.003 | | | | 0.008 | | | | 0.022 | | | | 0.050 | | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.010 | ) | | | (0.003 | ) | | | (0.008 | ) | | | (0.022 | ) | | | (0.050 | ) | |

Total distributions | | | (0.010 | ) | | | (0.003 | ) | | | (0.008 | ) | | | (0.022 | ) | | | (0.050 | ) | |

Net asset value, end of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Total Return | | | 1.04 | % | | | 0.35 | % | | | 0.81 | % | | | 2.25 | % | | | 5.07 | %(2) | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | | $ | 1,251,435 | | | | $ | 1,257,121 | | | | $ | 1,263,136 | | | | $ | 1,346,260 | | | | $ | 1,146,333 | | |

Ratio of net operating expenses to average net assets | | | 0.85 | % | | | 0.83 | % | | | 0.85 | % | | | 0.90 | % | | | 0.90 | %(3) | |

Ratio of net investment income to average net assets | | | 1.04 | % | | | 0.35 | % | | | 0.81 | % | | | 2.17 | % | | | 5.42 | %(3) | |

Ratio of expense to average net assets prior to waived fees and reimbursed expenses | | | 0.97 | % | | | 0.97 | % | | | 0.99 | % | | | 0.99 | % | | | 1.03 | %(3) | |

Ratio of net investment income to average net assets prior to waived fees and reimbursed expenses | | | 0.92 | % | | | 0.21 | % | | | 0.67 | % | | | 2.08 | % | | | 5.29 | %(3) | |

(1) For the period from commencement of offering of Class 1 shares, June 5, 2000 to April 30, 2001.

(2) Not Annualized.

(3) Annualized.

See Notes to Financial Statements

22

Financial Highlights - Class 2

(In Liquidation)

| | Boston Advisors

Cash Reserves Fund | |

| | | |

| | For

the Year

Ended

April 30, 2005 | | For

the Year

Ended

April 30, 2004 | | For

the Year

Ended

April 30, 2003 | | For

the Year

Ended

April 30, 2002 | | For

the Year

Ended

April 30, 2001(1) | |

| | | | | | | | | | | |

Net asset value, beginning of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Increase in Net Assets from Operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.012 | | | | 0.005 | | | | 0.010 | | | | 0.025 | | | | 0.020 | | |

Net increase from investment operations | | | 0.012 | | | | 0.005 | | | | 0.010 | | | | 0.025 | | | | 0.020 | | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.012 | ) | | | (0.005 | ) | | | (0.010 | ) | | | (0.025 | ) | | | (0.020 | ) | |

Total distributions | | | (0.012 | ) | | | (0.005 | ) | | | (0.010 | ) | | | (0.025 | ) | | | (0.020 | ) | |

Net asset value, end of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Total Return | | | 1.24 | % | | | 0.53 | %(4) | | | 1.02 | % | | | 2.50 | % | | | 2.01 | %(2) | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | | $ | 21,118 | | | | $ | 28,574 | | | | $ | 27,030 | | | | $ | 19,898 | | | | $ | 19,003 | | |

Ratio of net operating expenses to average net assets | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.66 | %(3) | |

Ratio of net investment income to average net assets | | | 1.19 | % | | | 0.53 | % | | | 0.99 | % | | | 2.44 | % | | | 5.22 | %(3) | |

Ratio of expense to average net assets | | | | | | | | | | | | | | | | | | | | | |

prior to waived fees and reimbursed expenses | | | 0.72 | % | | | 0.72 | % | | | 0.75 | % | | | 0.74 | % | | | 0.83 | %(3) | |

Ratio of net investment income to average net assets prior to waived fees and reimbursed expenses | | | 1.12 | % | | | 0.46 | % | | | 0.89 | % | | | 2.35 | % | | | 5.05 | %(3) | |

(1) For the period from commencement of offering of Class 2 shares, December 13, 2000 to April 30, 2001.

(2) Not Annualized.

(3) Annualized.

(4) The effect of losses resulting from compliance violations and the subadviser reimbursement of such losses were less than 0.01%.

See Notes to Financial Statements

23

Financial Highlights - Class 1

(In Liquidation)

| | Boston Advisors

U.S. Government Money Market Fund | |

| | | |

| | For

the Year

Ended

April 30, 2005 | | For

the Year

Ended

April 30, 2004 | | For

the Year

Ended

April 30, 2003 | | For

the Year

Ended

April 30, 2002 | | For

the Period

Ended

April 30, 2001(1) | |

| | | | | | | | | | | |

Net asset value, beginning of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Increase in Net Assets from Operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.009 | | | | 0.002 | | | | 0.007 | | | | 0.022 | | | | 0.049 | | |

Net increase from investment operations | | | 0.009 | | | | 0.002 | | | | 0.007 | | | | 0.022 | | | | 0.049 | | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.009 | ) | | | (0.002 | ) | | | (0.007 | ) | | | (0.022 | ) | | | (0.049 | ) | |

Total distributions | | | (0.009 | ) | | | (0.002 | ) | | | (0.007 | ) | | | (0.022 | ) | | | (0.049 | ) | |

Net asset value, end of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Total Return | | | 0.95 | % | | | 0.23 | % | | | 0.71 | % | | | 2.20 | % | | | 4.98 | %(2) | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | | $ | 169,558 | | | | $ | 180,494 | | | | $ | 190,252 | | | | $ | 194,813 | | | | $ | 112,373 | | |

Ratio of net operating expenses to average net assets | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | %(3) | |

Ratio of net investment income to average net assets | | | 0.93 | % | | | 0.23 | % | | | 0.72 | % | | | 2.10 | % | | | 5.34 | %(3) | |

Ratio of expense to average net assets prior to waived fees and reimbursed expenses | | | 1.02 | % | | | 0.98 | % | | | 0.98 | % | | | 1.01 | % | | | 1.07 | %(3) | |

Ratio of net investment income to average net assets prior to waived fees and reimbursed expenses | | | 0.81 | % | | | 0.15 | % | | | 0.64 | % | | | 1.99 | % | | | 5.17 | %(3) | |

(1) For the period from commencement of offering of Class 1 shares, June 5, 2000 to April 30, 2001.

(2) Not Annualized.

(3) Annualized.

See Notes to Financial Statements

24

Financial Highlights - Class 1

(In Liquidation)

| | Boston Advisors

Tax Free Money Market Fund | |

| | | |

| | For | | For | | For | | For | | For | |

| | the Year | | the Year | | the Year | | the Year | | the Period | |

| | Ended | | Ended | | Ended | | Ended | | Ended | |

| | April 30, 2005 | | April 30, 2004 | | April 30, 2003 | | April 30, 2002 | | April 30, 2001(1) | |

| | | | | | | | | | | |

Net asset value, beginning of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Increase in Net Assets from Operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.006 | | | | 0.001 | | | | 0.005 | | | | 0.013 | | | | 0.027 | | |

Net increase from investment operations | | | 0.006 | | | | 0.001 | | | | 0.005 | | | | 0.013 | | | | 0.027 | | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.006 | ) | | | (0.001 | ) | | | (0.005 | ) | | | (0.013 | ) | | | (0.027 | ) | |

Total distributions | | | (0.006 | ) | | | (0.001 | ) | | | (0.005 | ) | | | (0.013 | ) | | | (0.027 | ) | |

Net asset value, end of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Total Return | | | 0.63 | % | | | 0.15 | % | | | 0.48 | % | | | 1.30 | % | | | 2.77 | %(2) | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | | $ | 69,835 | | | | $ | 80,475 | | | | $ | 80,260 | | | | $ | 85,138 | | | | $ | 73,525 | | |

Ratio of net operating expenses to average net assets | | | 0.90 | % | | | 0.86 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | %(3) | |

Ratio of net investment income to average net assets | | | 0.62 | % | | | 0.15 | % | | | 0.46 | % | | | 1.24 | % | | | 2.99 | %(3) | |

Ratio of expense to average net assets prior to waived fees and reimbursed expenses | | | 1.05 | % | | | 0.97 | % | | | 0.98 | % | | | 1.02 | % | | | 1.09 | %(3) | |

Ratio of net investment income to average net assets prior to waived fees and reimbursed expenses | | | 0.47 | % | | | 0.04 | % | | | 0.38 | % | | | 1.12 | % | | | 2.80 | %(3) | |

(1) For the period from commencement of offering of Class 1 shares, June 5, 2000 to April 30, 2001.

(2) Not Annualized.

(3) Annualized.

See Notes to Financial Statements

25

Financial Highlights - Class 1

(In Liquidation)

| | Boston Advisors

New York Municipal Money Market Fund | |

| | | |

| | For

the Year

Ended

April 30, 2005 | | For

the Year

Ended

April 30, 2004 | | For

the Period

Ended

April 30, 2003(1) | |

| | | | | | | |

Net asset value, beginning of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Increase in Net Assets from Operations | | | | | | | | | | | | | |

Net investment income | | | 0.009 | | | | 0.003 | | | | 0.005 | | |

Net increase from investment operations | | | 0.009 | | | | 0.003 | | | | 0.005 | | |

Distributions to Shareholders from: | | | | | | | | | | | | | |

Net investment income | | | (0.009 | ) | | | (0.003 | ) | | | (0.005 | ) | |

Total distributions | | | (0.009 | ) | | | (0.003 | ) | | | (0.005 | ) | |

Net asset value, end of year | | | $ | 1.000 | | | | $ | 1.000 | | | | $ | 1.000 | | |

Total Return | | | 0.87 | % | | | 0.33 | % | | | 0.53 | %(2) | |

Ratios/Supplemental Data: | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ | 155,208 | | | | $ | 138,058 | | | | $ | 131,024 | | |

Ratio of net operating expenses to average net assets | | | 0.65 | % | | | 0.65 | % | | | 0.65 | %(3) | |

Ratio of net investment income to average net assets | | | 0.87 | % | | | 0.32 | % | | | 0.60 | %(3) | |

Ratio of expense to average net assets prior to waived fees and reimbursed expenses | | | 1.01 | % | | | 1.01 | % | | | 1.10 | %(3) | |

Ratio of net investment income (loss) to average net assets prior to waived fees and reimbursed expenses | | | 0.51 | % | | | (0.04 | )% | | | 0.15 | %(3) | |

(1) For the period from commencement of offering of Class 1 shares, June 11, 2002 to April 30, 2003.

(2) Not Annualized.

(3) Annualized.

See Notes to Financial Statements

26

Notes to Financial Statements

April 30, 2005 (In Liquidation)

1 — Significant Accounting Policies

Boston Advisors Trust (the “Trust”) is a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended. The Trust was established as a Massachusetts Business Trust on September 30, 1999. The Trust currently offers four Funds: Boston Advisors Cash Reserves Fund (the “Cash Reserves Fund”), Boston Advisors U.S. Government Money Market Fund (the “U.S. Government Money Market Fund”), Boston Advisors Tax Free Money Market Fund (the “Tax Free Money Market Fund”), and Boston Advisors New York Municipal Money Market Fund (the “New York Municipal Money Market Fund”), (each, a “Fund”). Each Fund’s investment objective is to seek to preserve capital and maintain liquidity, consistent with seeking maximum current income. Additionally the Tax Free Money Market Fund seeks to generate income that is substantially exempt from federal income taxes and the New York Municipal Money Market Fund seeks to generate income that is substantially exempt from federal income tax and personal income taxes imposed by New York State and New York municipalities. The Cash Reserves Fund issues two classes of shares (Class 1 and Class 2 shares). Class 1 shares have a 12b-1 distribution fee. There are no other class specific expenses for either share class. The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A. Security Valuation — Each Fund values investment securities utilizing the amortized cost valuation method permitted by Rule 2a-7 of the Investment Company Act of 1940, pursuant to which each Fund must comply with certain conditions. This pricing method involves initially valuing a fund security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

B. Income — Interest income is determined on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

C. Expenses — The Trust accounts separately for the assets, liabilities and operations of each Fund. Direct expenses of each Fund are charged to that Fund while general expenses are allocated among the Trust’s respective portfolios based on their respective net assets.

The investment income and expenses of each Fund (other than class specific expenses) and realized gains and losses on investments of each Fund are allocated to each class of shares based upon their relative net asset value on the date income is earned or expenses and realized gains or losses are incurred.

D. Repurchase Agreements — Each Fund’s custodian and other banks acting in a sub-custodian capacity take possession of the collateral pledged for investments in repurchase agreements. The underlying collateral is valued daily on a mark-to-market basis to determine that the value, including accrued interest, exceeds the repurchase price. In the event of the seller’s default of the obligation to repurchase, each Fund has a right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

27

Notes to Financial Statements (Continued)

April 30, 2005 (In Liquidation)

E. Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

F. Other — Investment transactions are accounted for on a trade-date basis. Gains and losses on securities are determined on the basis of identified cost.

2 — Taxes and Distributions to Shareholders

Each Fund’s policy is to comply with the provisions of the Internal Revenue Code 1986 (the “Code”) applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, including any net realized gain on investments. Accordingly, no provision for federal income or excise tax is necessary.

The net investment income of each Fund is declared as a dividend daily, and paid monthly, to shareholders of record at the close of business on record date. Net realized gains on portfolio securities, if any, are distributed at least annually. Distributions are paid in the form of additional shares of the same Fund or, at the election of the shareholder, in cash. For U.S. Government Money Market Fund and Tax Free Money Market Fund, certain distributions may be paid from net interest earned and designated as tax exempt interest. Such distributions are not includable by shareholders as income subject to federal and/or state taxes, but may be subject to federal alternative minimum tax.

Income dividends and capital gain distributions are determined in accordance with U.S. federal income tax regulations which may differ from accounting principles generally accepted in the United States of America. During the period ended April 30, 2005, the tax basis of distributions paid were as follows:

| | Ordinary Income | | Tax-Exempt Income | |

| | | | | |

Cash Reserves Fund | | | | | | | | | |

Class 1 | | | $ | 12,918,940 | | | | $ | — | | |

Class 2 | | | 259,132 | | | | — | | |

U.S. Government Money Market Fund | | | 1,650,365 | | | | — | | |

Tax Free Money Market Fund | | | — | | | | 474,480 | | |

New York Municipal Money Market Fund | | | — | | | | 1,369,756 | | |

| | | | | | | | | | | |

28

Notes to Financial Statements (Continued)

April 30, 2005 (In Liquidation)

During the year ended April 30, 2004, the tax basis of distributions paid were as follows:

| | Ordinary Income | | Tax-Exempt Income | |

| | | | | |

Cash Reserves Fund | | | | | | | | | |

Class 1 | | | $ | 4,468,044 | | | | $ | — | | |

Class 2 | | | 152,191 | | | | — | | |

U.S. Government Money Market Fund | | | 467,449 | | | | — | | |

Tax Free Money Market Fund | | | — | | | | 127,996 | | |

New York Municipal Money Market Fund | | | — | | | | 471,240 | | |

| | | | | | | | | | | |

As of April 30, 2005, the components of distributable earnings on a tax basis were as follows:

| | Cash Reserves

Fund | | U. S. Government

Money Market

Fund | | Tax Free

Money Market

Fund | | New York

Municipal

Money Market

Fund | |

| | | | | | | | | |

Undistributed Ordinary Income | | $ | 917,222 | | | $ | 117,222 | | | | $ | 45,430 | * | | | $ | 122,929 | * | |

Undistributed Long-Term Gain (Loss) | | (1,008,308 | ) | | (121,148 | ) | | | (53,316 | ) | | | (148,773 | ) | |

| | | | | | | | | | | | | | | | | | | |

* All of the dividends distributed by the Tax Free Money Market Fund and the New York Municipal Money Market Fund were derived from municipal securities which are exempt from State and Federal income taxes.

At April 30, 2005, the Funds had capital loss carry forwards to offset future gains, if any, to the extent permitted by the Code, of the following:

| | Amount | | Expiration Date | |

| | | | | |

Cash Reserves Fund | | | $ | 314 | | | | 2009 | | |

| | | | | | | | | | |

3 — Investment Adviser Fee

Boston Advisors, Inc. (the “Adviser”), a wholly owned subsidiary of The Advest Group, Inc. (“Advest Group”), serves as the investment adviser to the Funds, providing management, investment advisory and other services. In exchange, the Funds have agreed to pay the Adviser a monthly advisory fee at an annual rate of 0.55% of each Fund’s average daily net assets. For each Fund, the Adviser has agreed to contractually waive its advisory fee and reimburse each Fund for its expenses through September 1, 2005, to the extent necessary that the total expenses of each Fund do not exceed the percentage of average daily net assets as follows:

Cash Reserves Fund | | | |

Class 1 | | 0.90 | % |

Class 2 | | 0.65 | % |

U.S. Government Money Market Fund | | 0.90 | % |

Tax Free Money Market Fund | | 0.90 | % |

New York Municipal Money Market Fund | | 0.90 | % |

29

Notes to Financial Statements (Continued)

April 30, 2005 (In Liquidation)

The Adviser reserves the right to reduce its fees from time to time on a voluntary basis. Such additional voluntary limitation may be discontinued at any time at the Adviser’s discretion. Any such voluntary expense limitation will have the effect of increasing a Fund’s return and yield. The Adviser also reserves the right to be reimbursed for management fees waived and fund expenses paid by it during the prior two years to the extent that a Fund’s expense ratio falls below any expense limitations.

4 — Distribution Plan

Advest, Inc. (“Advest”), a wholly owned subsidiary of The Advest Group, Inc. (“Advest Group”), serves as the distributor to the Funds. The Funds have adopted a Rule 12b-1 distribution plan (the “Plan”) authorizing each Fund’s Class 1 shares to pay service fees equal to 0.25% of the Class 1 average daily net assets. Advest may pay up to the entire fee under the Plan to its own representatives or to other dealers providing services in connection with the sale of each Fund’s shares. To the extent the fee is not paid to others, Advest may retain this fee as compensation for its services and expenses incurred in accordance with the Plan. For the period ended April 30, 2005, the distribution fees earned by Advest from the Cash Reserves Fund, the U.S. Government Money Market Fund, the Tax Free Money Market Fund and the New York Municipal Money Market Fund amounted to $3,119,013, $441,934, $192,011 and $394,294, respectively. Advest reimbursed the New York Municipal Money Market Fund the full amount of the Fund’s payment and retained the full amount of each Fund’s payment for the remaining funds.

5 — Transfer Agent Fee

Advest Transfer Services, Inc. (“ATS”), a subsidiary of the Advest Group, serves as the Funds’ shareholder servicing agent and transfer agent. ATS receives account fees and asset-based fees that vary according to account size and type of account.

6 — Administration, Custodian and Fund Accounting Fee

Investors Bank & Trust Company (“Investors Bank”) serves as the Trust’s administrator, custodian and fund accounting agent. As compensation for its services, Investors Bank receives out-of-pocket costs, transaction fees, and asset based fees, which are accrued daily and paid monthly. Fees for such services paid to Investors Bank by the Funds are reflected as custodian and fund accounting expense in the statement of operations.

7 — Investment Sub-Advisory Fee

MONY Capital Management, Inc. (the “Subadviser”) serves as the subadviser for the Cash Reserves Fund and the U.S. Government Money Market Fund. The Adviser and Subadviser are both wholly-owned subsidiaries of The MONY Group Inc., a diversified financial services company offering insurance, brokerage, asset management and other financial services. The subadvisory relationship with the Funds commenced on December 2, 2002.

The Subadvisory Agreement provides that the Adviser will pay the Subadviser a fee equal to 0.03% of each Fund’s average daily net assets. The Funds will not pay any fee directly to the Subadviser.

30

Notes to Financial Statements (Continued)

April 30, 2005 (In Liquidation)

8 — Subsequent Event

The Board of Trustees of Boston Advisors Trust, a Massachusetts business trust (the “Trust”), and each of its series, Boston Advisors Cash Reserves Fund, Boston Advisors U.S. Government Money Market Fund, Boston Advisors Tax Free Money Market Fund and Boston Advisors New York Municipal Money Market Fund (each, a “Fund”), has approved a Plan of Liquidation (the “Plan”) as being advisable and in the best interests of each Fund. The Board of Trustees took this action in light of the anticipated termination of the Funds as investment options for cash management of brokerage accounts of Advest, Inc.

31

Report of Independent Registered Public Accounting Firm

To the Shareholders of Boston Advisors Cash Reserves Fund, Boston Advisors U.S. Government Money Market Fund, Boston Advisors Tax Free Money Market Fund, Boston Advisors New York Municipal Money Market Fund, and the Board of Trustees of Boston Advisors Trust:

In our opinion, the accompanying statements of assets and liabilities (In Liquidation), including the schedules of investments (In Liquidation), and the related statements of operations (In Liquidation) and of changes in net assets (In Liquidation) and the financial highlights (In Liquidation) present fairly, in all material respects, the financial position of Boston Advisors Cash Reserves Fund, Boston Advisors U.S. Government Money Market Fund, Boston Advisors Tax Free Money Market Fund, and Boston Advisors New York Municipal Money Market Fund (each a fund of Boston Advisors Trust, hereafter referred to as the “Fund”) at April 30, 2005, the results of each of their operations for the year then ended, and the changes in their net assets for each of the two years in the period then ended and the financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the Standards of the Public Company of Oversight Board (United States), which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at April 30, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

The accompanying financial statements have been prepared assuming that the Fund will continue as a going concern. As explained in Note 8, the Board of Trustees of the Fund approved liquidation plans for the Fund. The financial statements do not include any adjustments that might result from the outcome of liquidating the Fund.

PricewaterhouseCoopers LLP

Boston, Massachusetts

June 22, 2005

32

Additional Information

April 30, 2005 (In Liquidation)

1 — Board of Trustees — Considerations in Approving Investment Adviser Agreement

At a meeting held on March 8, 2005, the Board of Trustees of Boston Advisors Trust approved the continuation of the Investment Adviser Agreement for Cash Reserves Fund, U.S. Government Money Market Fund, Tax Free Money Market Fund and New York Municipal Money Market Fund (each, a “Fund”).

In determining whether to approve the Investment Adviser Agreement, the Board, including all of the Trustees who are not interested persons under the Investment Company Act of 1940 (the “Independent Trustees”), reviewed and considered the following information:

A — The nature, extent and quality of services provided by the Adviser.

The Trustees reviewed in detail the nature and extent of the services provided by Boston Advisors, Inc. (the “Adviser”) under the terms of the Funds’ Investment Adviser Agreement and the quality of those services over the past year. The Trustees noted that the services include: providing investment advice and recommendations to the Funds with respect to the Funds’ investments investment policies and the purchase and sale of securities; supervising and monitoring the investment program of the Funds and the composition of the Funds’ portfolios; arranging for the purchase and sale of securities and other investments of the Funds; providing reports on the foregoing to the Trust; and making its officers and employees available to the Trust to review the investment policies of the Funds and to consult with the Trust’s officers regarding the investment affairs of the Funds. The Trustees evaluated these factors based on their direct experience with the Adviser and in consultation with counsel to the independent directors and Fund counsel. The Trustees concluded that the nature and extent of the services provided under the Investment Adviser Agreement were reasonable and appropriate in relation to the advisory fees, that the level of services provided by the Adviser had not diminished over the past year and that the quality of services continues to be high. The Trustees reviewed the personnel responsible for providing advisory services to the Funds and concluded, based on their experience and interaction with the Adviser, that: (i) the Adviser was able to retain quality portfolio managers and other personnel; (ii) the Adviser exhibited a high level of diligence and attention to detail in carrying out its advisory responsibilities under the Investment Adviser Agreement; (iii) the Adviser was responsive to requests of the Trustees; and (iv) the Adviser had kept the Trustees apprised of developments relating to the Funds and the industry in general. The Trustees also focused on the Adviser’s reputation and long-standing relationship with the Funds and, in particular, the experience of the Adviser in advising money market funds.

B — The performance of the Funds and the Adviser.

The Trustees reviewed the investment performance of the Funds, both on an absolute basis and as compared to various peer group categories for the year ended January 2005. The peer group categories included: (i) the entire universe of first tier retail money market funds, government and agency retail money market funds, tax-free national money market funds and tax-free state specific money market funds for the Cash Reserves Fund, U.S. Government Money Market Fund, Tax Free Money Market Fund and New York Municipal Money Market Fund, respectively; (ii) a competitors class peer group for each of the Funds, representing other funds with similar investment policies that are considered to be competitors of the Funds with similar distribution channels (i.e., that are used as sweep vehicles) (the “competitors peer groups”); (iii) other funds with similar investment policies to the respective Funds that are advised or sub-advised by the Adviser, of which there were none; and (iv) other types of accounts, such as institutional and pension accounts, with similar investment policies to the re

33

Additional Information (Continued)

April 30, 2005 (In Liquidation)

spective Funds that are advised or sub-advised by the Adviser, of which there were none; each as reported by iMoney Net, Inc. (these peer groups are collectively referred to as the “Peer Groups”). The Trustees used each Fund’s performance against its respective Peer Groups to provide objective comparative benchmarks against which they could assess the Fund’s performance. The Trustees considered those comparisons as helpful in their assessment as to whether the Adviser was obtaining for the Funds’ shareholders the performance that was available in the marketplace given each Fund’s investment objectives, strategies, limitations and restrictions. In particular, the Board noted that the gross performance of each Fund was satisfactory.

In connection with its assessment of the performance of the Adviser, the Trustees considered the Adviser’s financial condition and whether it has the resources necessary to continue to carry out its obligations under the Investment Adviser Agreement. The Trustees concluded that the Adviser had the financial resources necessary to continue to perform its obligations under the Investment Adviser Agreement and to continue to provide the high quality services that it had provided to the Funds to date.

C — The cost of the advisory services and the profits to the Adviser and its affiliates from the relationship with the Funds.