SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May, 2003

Commission File Number: 000-28011

Terra Networks, S.A.

(Translation of registrant’s name into English)

Paseo de la Castellana, 92

28.046 Madrid

Spain

(34) 91-452-3900

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Terra Networks, S.A.

TABLE OF CONTENTS

Item

| | | | Sequential Page Number

|

|

1 | | Press Release dated May 7 | | 1 to 11 |

In the first three months of 2003, net income improved by 57% compared to the same period in 2002

TERRA LYCOS IMPROVES EBITDA BY 63% OVER THE FIRST THREE MONTHS OF LAST YEAR AND 26% OVER THE PREVIOUS QUARTER

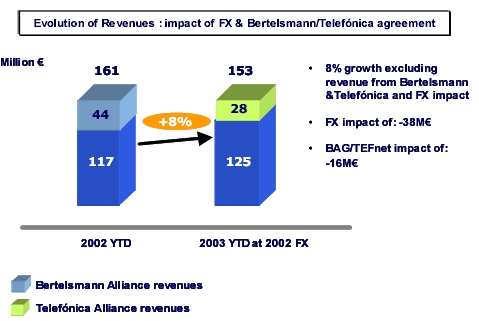

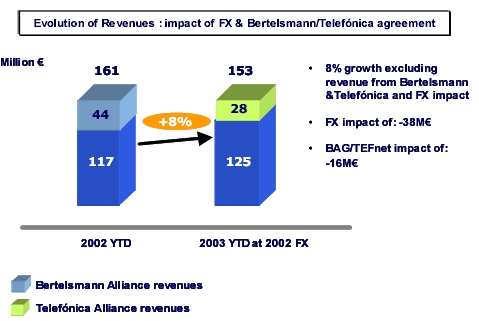

| | · | | Revenue grew 8% over same period last year excluding the foreign exchange rate’s adverse effect and the impact of the Bertelsmann and Telefonica Strategic Alliances. Compared to the previous agreement, the new long-term strategic alliance with Telefónica, signed in February 2003, means lower revenue in the near term in exchange for profitability, stability and higher revenue in the long term. |

| | · | | Revenue for the January-March period was 153 million constant first-quarter-2002 euros, excluding the foreign exchange rate impact. Compared with the same period of the previous year, the foreign exchange rate effect in the first quarter of all currencies where transactions are conducted outside the euro zone yielded a negative accounting impact of 38 million euros for the first three months of the year. In current euros, revenue for the period was 115 million euros. |

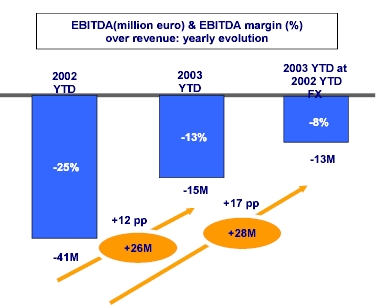

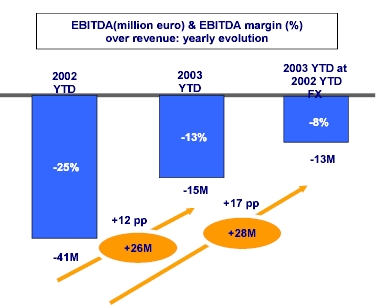

| | · | | EBITDA in current euros (See attachment II & IV) was -15 million euros, an improvement of 63%, or 26 million euros, compared to the same period last year, and a 26% improvement compared to the previous quarter. The EBITDA margin in current euros for the first three months of the year was -13%, an improvement of 12 percentage points compared to the same period of last year. |

| | · | | Excluding the foreign exchange rate impact, EBITDA (See attachment II & IV) improved to -13 million euros and the EBITDA margin improved to -8%, an improvement of 69% and 17 percentage points respectively over the first quarter of 2002. |

| | · | | In the first three months of the year, net income improved by 57%, or 74 million euros, compared to same period last year, to reach -56 million euros. |

| | · | | Terra Lycos ended March 2003 with a total of 3.3 million paying customers in access, communication and portal services, a 78% increase compared to the same period in 2002. |

| | · | | The Company ended the quarter with 419,000 ADSL customers, an increase of 54% compared to the same period in 2002, and an increase of 11% compared to the previous quarter. |

1

Madrid, May 7, 2003. —Terra Lycos (MC: TRR; NASDAQ: TRLY), the largest global Internet network, today released its financial results for the first quarter of 2003.

Revenue

Revenue grew 8% over the same period last year excluding the foreign exchange rate’s adverse effect, revenues provided by the Bertelsmann Agreement in the first quarter of 2002 and revenues this quarter from the new Telefonica Alliance.

Terra Lycos revenue was 153 million euros in constant first-quarter-2002 euros, excluding the impact of the foreign exchange rate. After local currencies were consolidated (63% of Terra Lycos revenue comes from non-euro currencies), revenue was adversely affected by 38 million euros by the foreign exchange rate due to the revaluation of the euro. In more detail, the exchange rate impacted revenues in Brazil by -26 million euros, -5 million euros in Mexico, -5 million euros in the US and -2 million euros in Chile. The equivalent revenue figure in current euros, accounting for the impact of the current foreign exchange rate, was 115 million euros.

The lower revenue in this quarter was also a result of the new long-term strategic alliance with Telefónica, which replaced the agreement with Bertelsmann, and which makes Terra Lycos the portal and exclusive provider and aggregator of Internet content and services for Telefonica for the next six years. The transition from the Bertelsmann agreement to the Telefonica alliance has yielded a negative revenue impact of 16 million constant euros in the quarter, however it is important to highlight that revenue from the alliance in this first quarter was 19 million euros, out of the 118 million euros estimated for 2003.

2

The previous agreement produced revenue of 180 million euros from Bertelsmann and Telefónica in 2002, versus 118 million euros estimated for this year under the new extendable six-year alliance. This lower revenue will have an impact on the revenue reported for 2003.

Although the alliance means less revenue in the short term, it guarantees profitability and stability for the Terra Lycos business model in the medium and long term (a minimum of six years vs 3 years) by assuring a minimum annual positive impact of 78.5 million euros on EBITDA and moving toward greater geographic and product diversification.

From January to March, 43% of revenues resulted from access business; 27% from content, portal and communication services; 18% from advertising and e-commerce; 12% from corporate & SMEs services and other income.

This positive trend in the diversification of Terra Lycos’ revenues began in the fourth quarter of last year as a result of the transition in the Company’s business model. Particularly noteworthy is the spectacular growth in revenue generated by communication, portal and content services, which now account for 27% of total revenue, versus 6% in the first quarter of 2002.

The Company’s positive move toward charging for content and communication services through the “O.B.P” (Open, Basic, Premium) model has meant that, during the first three months of the year, revenue from subscriptions to value added services, excluding access, accounted for 29% of total revenue. Examples of O.B.P. include communication and portal services exclusively provided to Telefónica in Spain, Telefónica.net and ADSL Solutions. Also, the Tripod and Angelfire premium personal Web publication services are being very well received, with a 225% increase to the number of subscribers compared to the same period last year.

During the quarter, Terra Lycos signed alliances with leading companies in other sectors, including an agreement with MotorPress to create Autopista On-line, an innovative portal that seeks to seize business opportunities in the automotive sector over the Internet by offering a broad range of value-added services and content. In Spain, Brazil and the United States, Terra Lycos has launched the new version of Terra Messenger, an instant-messaging service that inaugurates a new strategy for the Company in real-time communications.

March 2003 marked the introduction of the Terra Programming Grid, in an event patterned after the method television networks traditionally use to introduce their new programs each season. The aim was to make marketing and advertising professionals aware of the most complete Internet content programming: “Terra’s Continents.”

Operating Expenses

During the first three months of the year, through efficient management supported by steady improvement in processes, Terra Lycos was able to continue the gradual reduction in operating expenses. During the period, the Company cut its costs by 39% compared to the same period last year. An important part of these reductions in operating expenses is the new organizational model focused on the new Global Operations Unit whose mission is to generate growth with thelaunch of new global products and to provide savings through cost efficiency in product development and implementation.

3

Operating Margin—EBITDA

EBITDA (See attachment II&IV) for January-March 2003 improved by 26 million euros over the same period last year, reaching -15 million euros, which is in line with the steady positive trend in EBITDA over the last ten quarters. EBITDA margin in current euros was -13%, an improvement of 12 percentage points compared to the same period last year.

Excluding the impact of the foreign exchange rate, EBITDA for the first three months of the year in constant first-quarter-2002 euros was - -13 million euros, and the EBITDA margin was -8%. This represents an improvement of 69% and 17 percentage points over the first three months of 2002.

Net Income

Net income in the first three months of 2003 was -56 million euros, an improvement of 57%, or 74 million euros, compared to the first quarter of last year.

The improvement in net income is due to EBITDA improvement, efficient management during the quarter and the write-down of assets of 1.4 billion euros that Terra Lycos made at the close of 2002 in a show of transparency and use of conservative accounting practices, adapting the book value of investments made in the past to the current condition of the market.

Cash

Terra Lycos has one of the strongest cash positions in the sector allowing it to finance its operations and seize business opportunities to continue growing profitably. Efficient cash management enabled the Company to end the first quarter with 1.73 billion euros.

4

Operating Results

Terra Lycos ended March 2003 with a total of 3.3 million paying customers for content, portal, communication services and access, an increase of 78% compared to the first quarter of last year. As of March 31, the number of ADSL customers was 419,000, a 54% increase compared to the first quarter of 2002, and 11% compared to the previous quarter.

Joaquim Agut, executive chairman of Terra Lycos, said “the results reflect our positive trend in recent quarters toward achieving profitability.” Mr. Agut added that “efficient management through steady improvement in processes has been accompanied by diversification of revenue sources, focusing on profitable business segments.” Mr. Agut said that “this change in our business model has definitely been supported by the strategic alliance with Telefónica, which guarantees us long-term stability, not to mention alliances with other leading companies and our commitment to launching global value-added products.”

About Terra Lycos

Terra Lycos is the global Internet group with a presence in 42 countries and 19 languages. The group, which resulted from the Terra Networks, S.A. acquisition of Lycos, Inc. in October 2000, is one of the most popular websites in the United States, Europe, Asia and Latin America, and it is the foremost access provider in Spain and Latin America.

The Terra Lycos network of sites includes Terra in 17 countries, Lycos in 25 countries, Angelfire.com, Atrea.com, Azeler.es, Direcciona.es, Educaterra.com, Emplaza.com, Gamesville.com, HotBot.com, Ifigenia.com, Invertia.com, Lycos Zone, Maptel.com, Matchmaker.com, Quote.com, RagingBull.com, Rumbo.com, Tripod.com, Uno-e.com and Wired News (Wired.com), among others.

Terra Lycos is headquartered in Barcelona and has operating centers in Madrid and Boston, among other locations. It is listed on the Madrid Stock Exchange (TRR) and the Nasdaq (TRLY).

Telephone Numbers: |

· Public Relations

Miguel Angel Garzón

+34-91-452-3921 | | | | Kirsten Murawski (U.S.) +1-781-370-2691 |

miguel.garzon@corp.terralycos.com | | | | kirsten.murawski@corp.terralycos.com |

|

· Investor Relations Miguel von Bernard +34-91-452-3278 | | | | |

relaciones.inversores@corp.terralycos.com | | | | |

5

Annex I

TERRA LYCOS

Consolidated Statement of Operations

In thousand of euros—Spanish GAAP

Unaudited

| | | Three Months Ended | |

| | | mar-31

| |

| | | 2003

| | | 2002

| |

|

Revenues: | | | | | | |

Access | | 49.722 | | | 60.896 | |

Advertising and e-commerce | | 20.753 | | | 75.138 | |

Communication, portal and content services | | 30.593 | | | 9.396 | |

Corporate & SMEs Services and Other | | 13.759 | | | 15.166 | |

Total revenues | | 114.827 | | | 160.596 | |

|

Operating expenses: | | | | | | |

Goods purchased | | (57.857 | ) | | (83.218 | ) |

Personnel expenses | | (31.831 | ) | | (47.788 | ) |

Professional services | | (6.088 | ) | | (11.973 | ) |

Depreciation and amortization | | (19.461 | ) | | (40.369 | ) |

Marketing and Commisions | | (15.592 | ) | | (28.266 | ) |

Maintenance, supplies and leases | | (12.176 | ) | | (17.020 | ) |

Other operating expenses | | (10.844 | ) | | (19.179 | ) |

Total operating expenses | | (153.849 | ) | | (247.813 | ) |

|

Operating loss | | (39.022 | ) | | (87.217 | ) |

|

Financial income (expense) | | 12.270 | | | 14.445 | |

Amortization of goodwill | | (20.129 | ) | | (65.661 | ) |

Equity share in affiliate losses, net | | (11.187 | ) | | (21.012 | ) |

Extraordinary income (expense) and other | | 2.518 | | | (1.352 | ) |

|

Income (loss) before taxes | | (55.550 | ) | | (160.797 | ) |

|

Corporate income tax credit | | (164 | ) | | 30.046 | |

Minority interest | | 26 | | | 586 | |

|

Net Loss (Spanish GAAP) | | (55.688 | ) | | (130.165 | ) |

|

Shares excluding Stock Options Plan (’000) | | 559.848 | | | 560.600 | |

6

Annex II

Notes to P&L (I)

EBITDAReconciliation

(in thousands—Spanish GAAP) | | Three Months Ended | | | |

Unaudited | | mar-31

| | | |

| | | 2003

| | | 2002

| | | +%

|

|

Operating loss | | (39.022 | ) | | (87.217 | ) | | 55% F |

Depreciation and amortization | | 19.461 | | | 40.369 | | | 52% F |

Lease expense on fixed assets(1) | | 4.359 | | | 6.009 | | | 27% F |

EBITDA(2) | | (15.202 | ) | | (40.839 | ) | | 63% F |

EBITDA Margin | | -13 | % | | -25 | % | | 12 p.p. |

| | (1) | | In all prior periods reported and for EBITDA guidance calculation purposes, expenses related to equipment leases recorded in Lycos are deemed to be depreciation costs. |

| | (2) | | See EBITDA description in the Other Information section F: Favorable evolution |

Figures at Constant 3m’02 Exchange Rates

(in thousands—Spanish GAAP) | | Three Months Ended | | | |

Unaudited | | mar-31

| | | |

| | | 2003

| | | 2002

| | | +%

|

| | | Constant €(1) | | | | | | |

|

Revenue by business: | | | | | | | | |

Access | | 66.020 | | | 60.896 | | | 8% |

Advertising and e-commerce | | 26.885 | | | 75.138 | | | -64% |

Communication, portal and content services | | 40.753 | | | 9.396 | | | 334% |

Corporate & SMEs Services and Other | | 19.605 | | | 15.166 | | | 29% |

Total revenues | | 153.263 | | | 160.596 | | | -5% |

|

Revenue by country: | | | | | | | | |

Spain | | 42.051 | | | 35.458 | | | 19% |

Brazil | | 59.614 | | | 31.853 | | | 87% |

US | | 26.098 | | | 67.455 | | | -61% |

Other | | 25.500 | | | 25.830 | | | -1% |

Total revenues | | 153.263 | | | 160.596 | | | -5% |

|

EBITDA(2) | | (12.540 | ) | | (40.839 | ) | | 69% |

EBITDA Margin | | -8 | % | | -25 | % | | 17 p.p. |

| | (1) | | 3m’02 average exchange rates |

| | (2) | | DDSee EBITDA description in the Other Information section |

7

Annex II

Notes to P&L (II)

BAU Revenues (Business as Usual Revenues net of FX and Bertelsmann/TEF contracts)

(in thousands—Spanish GAAP) | | Three Months Ended |

Unaudited | | mar-31

|

| | | 2003

| | 2002

| | Ù%

|

|

Revenue at Current Euros | | 114.827 | | | | |

Effect of exchange rates on revenues(1) | | 38.436 | | | | |

Revenue at Constant Euros | | 153.263 | | 160.596 | | -5% |

|

Bertelsmann/Telefonica revenues | | 19.112 | | 44.353 | | |

Effect of FX on Bertelsmann/TEF revenues(1) | | 8.575 | | | | |

|

BAU Revenues | | 125.576 | | 116.243 | | 8% |

| | (1) | | 3m’02 average exchange rates |

8

Annex III

TERRA LYCOS

Operating Data

In thousand subscribers

| | | mar-31 2003

| | | mar-31 2002

| | Ù%

| |

|

Total Pay Subscribers(1) | | 3.260 | | | 1.830 | | 78 | % |

Access: | | | | | | | | |

Narrowband | | 1.031 | | | 1.038 | | -1 | % |

Broadband | | 419 | | | 272 | | 54 | % |

Total | | 1.450 | | | 1.310 | | 11 | % |

|

OBP (CSP/Portal): | | 1.810 | | | 520 | | 248 | % |

|

Broadband Access Subscribers: | | | | | | | | |

Spain | | 122 | (2) | | 122 | | 0 | % |

Latam | | 297 | | | 150 | | 98 | % |

Total | | 419 | | | 272 | | 54 | % |

| | (1) | | Based on number of services delivered. Some suscribers may be contracting access and OBP product/services at the same time. (2) Between 3m'02 and 3m'03 the company terminated 7,500 subscriber accounts, mainly due to bad-debt. |

9

Annex IV

Other Information

Revenues

Access: subscriptions, traffic-inducement fees and call center revenues from residential clients.

Advertising and e-commerce: advertising, slotting fees and transaction commissions.

Communication, Portal and Content Services: value-added service fees related to communication, portal and content services and software package licenses paid to us by the final user or the companies through which we distribute them to the final user.

Corporate Services & SMEs and Other: primarily services to corporations and SMEs both access and media related. It excludes fees paid to us by the companies that distribute our value-added services, which are included under the Communication, portal and Content Services line.

Goods Purchased

Include telecommunication expenses, technical help desk expenses, purchase of customer connection kits and modems, cost of e-commerce products sold, ad-serving costs, purchase of content, operating outsourcing and any other purchase.

Personnel Expenses

Include salaries, associated expenses and other employee benefits, regardless of the job classification of the employee.

Professional Services

Include, among others, consulting, legal advisors’, auditors’ fees and insurance policies.

Depreciation and Amortization Expenses

Include depreciation charges relating to tangible assets and amortization charges relating to intangible assets (not including goodwill), intangible rights and start-up costs.

Marketing and Commissions

Include expenses related to advertising and marketing.

Maintenance, Supplies and Leases

Include rental expenses, equipment leases, repairs and maintenance expenses, as well as expenses related to internal communications and other office expenses.

Other Operating Expenses

These expenses include bad debt, tax (other than income tax), travel expenses and other operating expenses.

EBITDA

EBITDA is defined as operating income (loss) before depreciation on fixed assets, lease expense on fixed assets and amortization on intangible assets.

Other below the line items that are not included in EBITDA represent costs that are either not directly related to our core business or are non-recurring in nature including our share of gains

10

and losses on equity method investments, goodwill amortization and other one time charges we believe to be outside the normal course of business and which may change from period to period, as well as income taxes.

11

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Terra Networks, S.A. |

|

By: | | /S/ ELÍAS RODRÍGUEZ-VIÑA CANCIO

|

| | | | | |

| | | Name: | | Elías Rodríguez-Viña Cancio |

| | | Title: | | Chief Financial Officer Terra Networks, S.A. |

Date: