FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February 24th, 2005

Commission File Number: 000-28011

Terra Networks, S.A.

(Translation of registrant’s name into English)

Via de las Dos Castillas, 33

28224 Madrid

Spain

(34) 91-452-3900

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):N/A

Terra Networks, S.A.

TABLE OF CONTENTS

| | | | |

Item

| | | | Sequential Page Number

|

1 | | 4Q-2004 Earnings Release Financial Report | | 30 |

| 1. | Terra Networks Results Analysis |

| | • | | Consolidated Statement of Operations |

| | • | | Notes to Consolidated Statement of Operations |

| | • | | Consolidated Balance Sheet |

| | • | | Cash Flow and Change in Net Debt Position |

| | • | | Consolidated Statements of Operations |

| | • | | Notes to Consolidated Statements of Operations |

| | • | | Consolidated Balance Sheet |

| | • | | Description of main Consolidated Statement of Operations accounts and EBITDA |

| | • | | Main Fully and Equity Consolidated companies |

| | • | | Relevant Facts filed with the CNMV/SEC |

2

Terra Networks

2004 Results

Note: The rounding-off of figures has produced small differences in the partial totals shown and in the

percentage changes stated

3

Terra Networks Results

Key highlights:

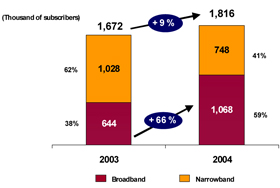

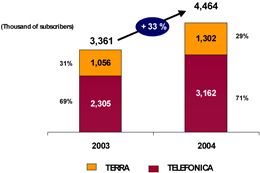

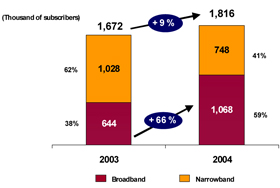

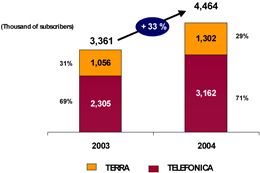

| | • | | Significant growth in paid access subscriber base as of December 2004: |

| | • | | 1.8 million paid Internet Access Subscribers (+9% in 2004) and |

| | • | | 4.5 million paid Subscribers to Added Value and Content services (+33% in 2004) |

| | • | | Y-o-Y growth of 66% in broadband subscribers in Spain and Latin America, to 1.1 million. |

| | • | | Terra is the largest Internet access service company in Latin America, with a total of 1.5 million paid subs, of which 879,000 are broadband subscribers. |

| | • | | Revenues amounted to 540 million euros. Stripping out the forex effect, and the impact of the sale of Lycos on the consolidation, revenues in constant euros would have increased by 9% |

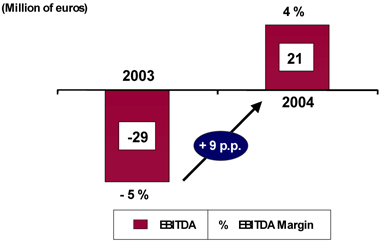

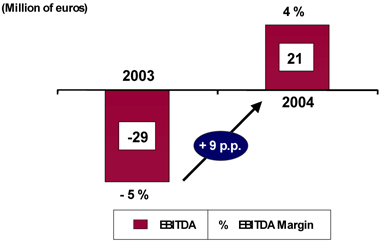

| | • | | Terra was EBITDA positive in all four quarters. 2004 EBITDA was 21 million euros, with a margin of 4% and an advance of 50 million euros or 9 percentage points compared to 2003. |

| | • | | The group reported net profit of164 million, compared with a loss of 173 million euros in 2003, reflecting 306 million euro tax credit deriving mostly from the sale of the Lycos, Inc shares. |

| | • | | The cash balance at the en d of December 2004 was 529 million euros, a decline of 1,066 million euros compared to December 2003, and due mainly to the payment of 1,136 million euros in dividends (2 euros per share) at the end of July 2004. |

4

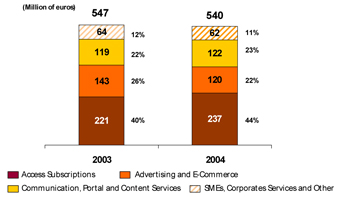

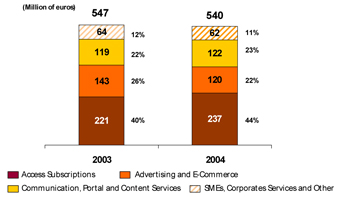

Revenue

Terra Networks reported revenues of 540 million euros in 2004, i.e. 1% less than in 2003. Note that the Y-o-Y comparison is affected by changes in the consolidation perimeter, most significantly the sale of Lycos, Inc. shares in early October 2004. Given that Lycos’ results were only consolidated from 1 January to 30 September, for comparisons, which exclude changes in the consolidation, Lycos’ contribution has been eliminated for the last three months of 2003. Stripping out this variation and the forex impact of currencies vs. the euro (currency in which the Terra Group consolidates its financial statements), revenues in 2004 were 8% higher than in 2003.

The alliance with Telefónica yielded revenues of 134 million euros in 2004, compared with 101 million euros in 2003.

Revenue by Business Line

I) Access revenues

Revenues from the access business stood at 237 million euros in 2004, the equivalent to 44% of total operating revenues and a 10% advance on 2003 in constant euros. The alliance with Telefónica contributed 13% of these revenues.

Terra Networks ended December 2004 with 1.8 million paid access subscribers, 9% more than a year ago. Broadband subscribers increased by 66%. The group had a total of 1.1 million ADSL subscribers at the end of the year, of which 68% were in Brazil, 18% in Spain and 12% in Chile.

We would highlight the increase and improvement of Broadband services – particularly the doubling of access speeds in both Spain and Latam.

Paid Access Subs

5

II) Advertising and e-commerce revenues

Advertising and E-commerce revenues were 120 million euros in 2004, a decline of 10% in constant euros versus 2003. These businesses accounted for 22% of total operating revenues. Around 10% of these revenues were generated from the alliance with Telefónica.

In 2004, this business was affected by:

| • | | Lower revenues from Lycos, culminating in the sale of shares in the company in October 2004, which contributed revenues of 35 million euros, and |

| • | | Lower revenues from One Travel, which has been earmarked for disposal, and which in 2004 contributed 26 million euros in revenues. |

The rest of advertising and e-commerce businesses recorded revenues growth of 23% in 2004 vs. 2003, excluding currency effects.

Terra has continued to focus on integrated marketing services that enable advertisers to access a more segmented public and enhance the efficiency of Internet as an advertising media.

In September 2004, Terra and Google signed an agreement to boost the quality of the Terra search engine in all its portals in Spain and Latam, providing Terra users with the most powerful search engine technology currently available. The agreement also envisages other lines of action to jointly market the service through Terra’s portals in all the countries where it operates, so enhancing revenues.

III) Communication, Portal and Content Services

Communication, Portal and Content Services revenues amounted to 122 million euros in 2004 a 6% Y-o-Y increase in constant euros from 2003. This represents 23% of total revenues. Excluding the change in the consolidation sphere deriving from the sale of Lycos in October 2004 and the forex impact, growth in this line would have been 12% compared to 2003. 57% of revenues from this activity derive from the alliance with Telefónica.

CSPs/Portal Subs *

* Some subscribers may be contracting access and VAS at the same time

Revenues include services to residential and professional customers and SMEs, either directly or via corporations, mainly the Telefónica Group.

This business line was boosted by the launch of new Communication and Content products and services. We highlight the following:

6

| | • | | Terra secure connection: selection of services related to PC security and protection |

| | • | | Terra Antivirus: products focused on detecting and blocking viruses in PCs |

| | • | | Terra Mail Plus Kit: package offering e-mail with added functions: larger capacity, tighter security and more flexibility in access |

| | • | | Terra Fútbol, with Real Madrid and Barcelona football teams: a premium area with exclusive content for Spain’s two most popular football teams; news alerts via SMS/MMS Real Madrid: mobile phone service offering the latest club news and live coverage of matches and goals |

| | • | | Terra Música Premium: the first platform for listening to and downloading digital music via the Internet in Spain |

| | • | | Fotologs: virtual web-based photo album for sharing pics. |

IV) SMEs, Corporate Services and Other

Revenues from SMEs, Corporate Services and Others totalled 62 million euros in 2004, 2% more in constant euros than in 2003. This accounted for 11% of total revenues. 33% derived from the Telefonica alliance and correspond to e-learning and various Internet and technology consultancy services.

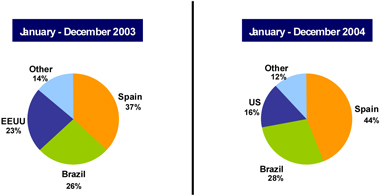

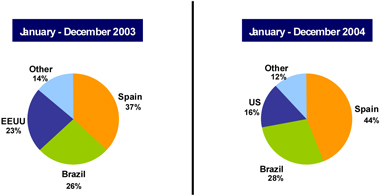

Revenue by Country *

* Not by legal entity

By area, Spain topped the list with 44% (37% in 2003), followed by Brazil with 28% (26% in 2003) and the USA with 16% (23% in 2003). The rest of company revenues accounted for 12%, with contributions from Mexico (6%) and Chile (5%) worthy of mention.

The business in Spain posted revenues of 240 million euros, with 18% Y-o-Y growth. This growth was due mainly to the increase in the number ADSL subscribers (+14%) and in communication, portal and content services subscriber numbers (+56%). At 31 December 2004, Terra Spain had 336,000 paid access customers: 147,000 narrow band subscribers and 189,000 ADSL subs. The group also had 2.1 million paid communication, portal and content service subscribers.

The last quarter of the year saw a significant number of migrations from ADSL Home to ADSL Plus services so increasing portfolio quality by moving clients to more added value products. Highlights of the added value and content services were the football and music product launches, plus a significant investment in media.

Brazil contributed revenues of 149 million euros, with Y-o-Y growth of 4% (+10% in local currency). Terra Brazil has reached 1.3 million paid access subscribers, 725,000 of which were broadband subs.

7

Terra Brasil has consolidated its position of leadership in the paid subs market, and is the undisputed leader of the ADSL market with a 50% share.

Launches made in recent quarters include new European championships on the sports channel and several packages (UEFA and European Championship) for mobiles and the Internet.

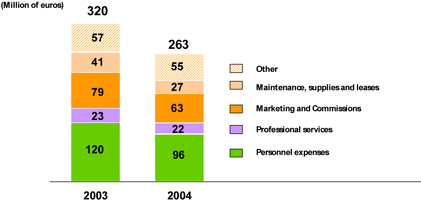

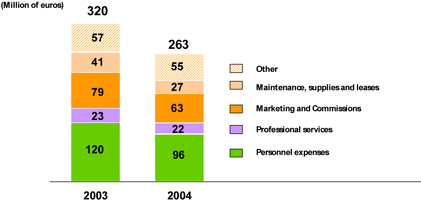

Operating Costs and Expenses

Gross profit was 284 million euros in 2004, or 53% of total revenues, an improvement of 2 percentage points on the figure of 52% reported in 2003.

Operating expensesdeclined significantly across the board. Total expenses amounted to 263 million euros, or 49% of sales in 2004, as compared to 320 million euros, or 59%, in 2003.

The largest savings were made inPersonnel costswhich stood at 96 million euros, or 20% lower than in 2003. This item accounted for 18% of total sales in 2004 vs. 22% in 2003, due largely to the headcount restructuring program implemented in the US in the first half of the year and in the Corporate division, Spain and Latam in the third quarter. In the fourth quarter, the group restructured and downsized its business in Mexico to focus on Value Added services, portals and companies, and this should have a greater impact in 2005.

Revenues from Professional Servicesstood at 22 million euros, in line with the previous year in absolute terms and once again accounting for 4% of total revenues.

Marketing Expenses and Commissions from salestotalled 63 million euros, 21% lower than in 2003, and representing 12% of total sales in the year, vs. 14% in 2003. This decrease was due mainly to lower marketing expenses incurred in the US during the sale of Lycos which was completed on October 5, 2004.

Maintenance, Supplies and Rentalsamounted to 27 million euros, 34% lower than in 2003. These items represented 5% of total sales in 2004 vs. 8% in 2003.

Other Expenseswhich include working capital provisions, taxes (other than income tax), travel and insurance expense among others stood at 56 million euros in 2004 in line with the figure of 57 million euros recorded in 2003.

EBITDA

8

EBITDA improved steadily throughout 2004 with a positive figure in all four quarters. The group reportedEBITDA of 21 million euros for the full year, and the EBITDA/sales margin was 4%. This compares to EBITDA of –29 million euros in 2003, and a margin over sales of -5%.

EBITDA Margin

In 2004 the company implemented significant headcount reductions, in Spain, the US, Mexico and its Corporate division, substantially scaling back in personnel costs and cutting its average workforce from 2,300 in 2003 to 2,018 employees in 2004. At the end of 2004, Terra had a workforce of 1,606 vs. 2,255 in 2003.

The strategic Alliancewith Telefónica generated 79.7 million euros in 2004, the equivalent to 101% coverage of the minimum annual pledged value.

Below the EBITDA line, depreciation and amortization stood at 79.5 million euros, in line with the figure of 78.7 million euros reported in 2003.

Net financial incomewas 18.3 million euros, reflecting interest received on cash balances minus variations in portfolio provisions and other financial expenses. This figure is lower than in 2003, due, among other reasons, to the payment of 2 euro per share dividend on July 30 which required a cash outlay of 1,136 million euros.

Goodwill amortization65 million euros in 2004, 21% lower than in 2003 due mainly to the reclassification of the goodwill associated with the alliance with Telefónica as intangible fixed assets at the start of 4Q04.

Equity-accountedlosses were 14.6 million euros, due largely to the loss of Lycos Europe.

Extraordinary resultsstood at -25.8 million euros. On this line, extraordinary expenses, which totalled 67 million euros, were largely the result of severance payments and provisions for the restructuring of Lycos, to expenses associated with the redundancy program for the Corporate activity and Latam, the voluntary retirement plan in Spain, the cancellation of leasing contracts in Spain, expenses linked to write-downs in the valuation of One Travel and restructuring at Terra Mexico. In contrast, extraordinary incomes amounted to 41.3 million euros, of which 26 million euros came from the sale of Lycos, Inc, and 11 million euros from the sale of Tecnología SVA in Mexico.

Corporate Income Taxeswere 306 million euros due the recognition of a tax credit based the inclusion of Terra in the Telefonica Consolidated Tax Group. The tax credit was mostly generated on the sale of Lycos, Inc.

9

Minority intereststotalled 3.1 million euros and correspond mainly to One Travel.

Net Income

Net incomein 2004 totalled 164 million euros, compared with a loss of 173 million euros in 2003.

Cash and Capex

The cash balance at the end close of December 2004 amounted to 529 million euros. The balance fell by €1,066 million euros compared to December 2003, due mainly to the payout of 1,136 million euros in dividends (2 euros per share) at the end of July 2004.

Cash flow from operating activities, which amounted to -3 million euros, was penalised by the extraordinary payments for restructuring operations and personnel and the cancellation of contracts in Spain, Mexico and the United States, totalling approximately 44 million euros. On the other hand, tax refunds worth 14 million euros were also received.

Cash flow from investments (50 million euros) derived from the sale of Lycos and other financial assets worth 99 million euros. The company reported Capex of 49 million euros, 3 million euros in consolidated companies and paid 15 million euros to acquire 7,000,000 shares in July 2004 to cover the company’s stock option program.

Cash flow from financing activities, excluding the dividend payment, stood at 24 million euros corresponding to the interest received on cash balances.

Events subsequent to closure

a) Sale of One Travel.com, Inc

On 11 February 2005, Terra Networks, S.A. agreed to sell its stake in One Travel.com, Inc, namely 54.15% of the shareholders’ capital, within the framework of a series of agreements with One Travel.com, Inc, and the US operator RCG Companies, aimed at a merger between the two players. The total amount of the transaction comes to US$25.5 million.

b) Merger with, Telefónica S.A.

On 9 February 2005, Terra Networks, S.A. received an invitation from Telefónica, S.A. to perform a merger between the two companies.

The Board of Directors at Terra, in an extraordinary meeting held on 10 February 2005, was notified of the invitation from Telefónica. The Board resolved to open a study and negotiation phase to determine whether a possible merger would benefit the interests of Terra and to examine the terms of said merger.

The invitation received by Terra outlines the main financial terms of the merger and, specifically, sets out a proposed share swap equation of 2 Telefónica shares, each with a par value of one euro, for every 9 Terra shares, each with a par value of two euros.

On 23rd February 2004 Terra Board of Directors approved Telefonica´s merger proposal which is now subjecto to the corresponding approval by shareholders at the Ordinary General Shareholders’ Meeting of both companies.

10

On the same meeting Terra´s Board of Directors also approved the proposal to pay a dividend in the amount of 0.60 Euros per share, with a charge against the “Reserve for Shares Issuance Premium” account. The effectiveness of the distribution is subject to the corresponding approval by the shareholders at the Ordinary General Shareholders’ Meeting of Terra. Payment is expected to be made during the days following the meeting and, in any event, before the merger of Telefónica and Terra is recorded with the Commercial Registry.

11

Financial Statements

Note: The rounding-off of figures has produced small differences in the partial totals shown and in the percentage

changes stated

12

Consolidated Statement of Operations

(in thousand of Euros - Spanish GAAP)

audited

| | | | | | |

| | | Twelve months Dec-31

| |

| | | 2004

| | | 2003 (1)

| |

Revenues: | | | | | | |

Access | | 236,501 | | | 221,034 | |

Advertising and e-commerce | | 119,661 | | | 143,021 | |

Communication, portal and content services | | 122,304 | | | 119,023 | |

Corporate & SMEs Services and Other | | 62,012 | | | 63,550 | |

Total revenues | | 540,478 | | | 546,627 | |

| | |

Goods purchased | | (256,307 | ) | | (265,836 | ) |

| | |

Gross profit | | 284,171 | | | 280,791 | |

| | |

Personnel expenses | | (95,785 | ) | | (119,653 | ) |

Professional services | | (21,912 | ) | | (23,191 | ) |

Depreciation and amortization | | (79,513 | ) | | (78,742 | ) |

Marketing and Commissions | | (62,611 | ) | | (79,104 | ) |

Maintenance, supplies and leases | | (27,284 | ) | | (41,306 | ) |

Other expenses | | (55,713 | ) | | (57,021 | ) |

Total other operating expenses | | (342,818 | ) | | (399,017 | ) |

| | |

Operating loss | | (58,647 | ) | | (118,226 | ) |

| | |

Financial income (expense) | | 18,277 | | | 57,743 | |

Amortization of goodwill | | (64,848 | ) | | (82,297 | ) |

Equity share in affiliate losses, net | | (14,559 | ) | | (34,734 | ) |

Extraordinary income (expense) and other | | (25,773 | ) | | 4,534 | |

| | |

Income (loss) before taxes | | (145,550 | ) | | (172,980 | ) |

| | |

Corporate income tax | | 306,456 | | | (266 | ) |

Minority interest | | 3,066 | | | 536 | |

| | |

Net Loss (Spanish GAAP) | | 163,972 | | | (172,710 | ) |

| | |

Shares excluding Stock Options Plan (‘000) | | 561,062 | | | 560,997 | |

| (1) | Revenue by business line and some operating expenses show slight variations from previously reported figures due to reclassifications |

13

Notes to Consolidated Statement of Operations

(in thousands of Euros –Spanish GAAP)

unaudited

Revenues by Country (1)

| | | | | | | | | | | | | |

| | | Dec-31

| | Dec-31

| | | | |

| | | 2004

| | 2003

| | 2004

| | | 2003

| | | | |

| | | Current Euros

| | Local Currency

| | | %

| |

Spain | | 239,703 | | 203,257 | | 239,703 | | | 203,257 | | | 18 | % |

Brazil | | 148,845 | | 142,599 | | 540,588 | | | 492,527 | | | 10 | % |

US | | 87,784 | | 126,026 | | 109,042 | | | 142,235 | | | -23 | % |

Other | | 64,146 | | 74,746 | | 69,069 | (2) | | 74,746 | (3) | | -8 | % |

Total revenues | | 540,478 | | 546,627 | | | | | | | | | |

| (2) | In Euros at 12m’03 average exchange rates |

EBITDA Reconciliation – Current Euros

| | | | | | | | | |

| | | Dec-31

| | | | |

| | | 2004

| | | 2003

| | | %

| |

Operating loss | | (58,647 | ) | | (118,226 | ) | | 50 | % |

Depreciation and amortization | | 79,513 | | | 78,742 | | | -1 | % |

Leases (1) | | 0 | | | 10,133 | | | 100 | % |

| | | |

EBITDA (2) | | 20,866 | | | (29,353 | ) | | 171 | % |

EBITDA Margin | | 4 | % | | -5 | % | | 9 | b.p. |

| (1) | In all prior periods reported and for EBITDA guidance calculation purposes, expenses related to equipment leases recorded in Lycos are deemed to be depreciation costs |

| (2) | See EBITDA description in the Other Information section |

14

Figures at Constant Euros

(in thousands)

| | | | | | | | | |

| | | Dec-31

| | | | |

| | | 2004 (1)

| | | 2003

| | | %

| |

Revenue by business: | | | | | | | | | |

Access | | 242,770 | | | 221,034 | | | 10 | % |

Advertising and e-commerce | | 128,403 | | | 143,021 | | | -10 | % |

Communication, portal and content services | | 125,753 | | | 119,023 | | | 6 | % |

Corporate & SMEs Services and Other | | 64,974 | | | 63,550 | | | 2 | % |

Total revenues | | 561,900 | | | 546,627 | | | 3 | % |

| | | |

Revenue by country: | | | | | | | | | |

Spain | | 239,703 | | | 203,257 | | | 18 | % |

Brazil | | 156,514 | | | 142,599 | | | 10 | % |

US | | 96,615 | | | 126,026 | | | -23 | % |

Other | | 69,069 | | | 74,746 | | | -8 | % |

Total revenues | | 561,901 | | | 546,627 | | | 3 | % |

| | | |

EBITDA (2) | | 20,130 | | | (29,353 | ) | | 169 | % |

EBITDA Margin | | 4 | % | | -5 | % | | 9 | b.p. |

| (1) | 12M 2003 average exchange rates |

| (2) | See EBITDA description in the Other Information section |

15

Consolidated Balance Sheet

(in million of Euros – Spanish GAAP)

audited

| | | | |

| | | Dec-31

|

| | | 2004

| | 2003

|

ASSETS | | | | |

Fixed and Other Noncurrent Assets: | | | | |

Intangible assets | | 224 | | 80 |

Property and equipment | | 12 | | 38 |

Long-term investments | | 506 | | 547 |

Treasury Stock | | 15 | | 126 |

Other fixed and noncurrent assets | | 1 | | 1 |

Total fixed an other noncurrent assets | | 758 | | 792 |

| | |

Goodwill in consolidation | | 97 | | 422 |

| | |

Long-Term deferred expenses | | 11 | | 6 |

| | |

Current Assets: | | | | |

Cash and Short-term investments | | 854 | | 1,599 |

Other current assets | | 132 | | 168 |

Total current Assets | | 986 | | 1,767 |

| | |

TOTAL ASSETS | | 1,852 | | 2,987 |

| | |

SHAREHOLDERS’ EQUITY AND LIABILITIES | | | | |

Shareholders’ equity | | 1,635 | | 2,721 |

Minority interests | | 0 | | 3 |

Long-term liabilities | | 69 | | 60 |

Current liabilities | | 148 | | 203 |

| | |

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES | | 1,852 | | 2,987 |

16

Cash Flow Statement

(in million of Euros – Spanish GAAP)

unaudited

| | |

| | | Dec-31 2004

|

Initial Balance (1) | | 1,595 |

Cash flows from operating activities | | -3 |

Cash flows from investing activities | | 50 |

Cash flows from financing activities | | -1,112 |

Conversion rates changes | | 11 |

Ending Balance, preliminary | | 541 |

Changes in consolidation (2) | | -12 |

Ending Balance, final (3) | | 529 |

| (1) | Initial Balance expressed in Euros at Dec 2003 closing exchange rates. There is a €2 million difference with the 12M03 reported final balance due to a change in the consolidation perimeter |

| (2) | Sale of Lycos in October |

| (3) | Ending Balance expressed in Euros at Dec 2004 closing exchange rates |

Change in Net Debt

(in million of Euros – Spanish GAAP)

unaudited

| | | | | | |

| | | | | | | Dec-31 2004

|

| | | I | | Cash flow from operations | | -2.6 |

| | | II | | Other payment related to operating activities | | -0.1 |

| | | III | | Net interest payment | | 21.4 |

| | | IV | | Payment for income tax | | 0.0 |

| | | |

A=I+II+III+IV | | | | Net cash provided by operating activities | | 18.7 |

| | | |

| | | V | | Net payment for investment in fixed and intangible assets | | -48.7 |

| | | VI | | Net payment for financial investment | | 98.9 |

| | | |

B=V+VI | | | | Net cash used in investing activities | | 50.2 |

| | | |

C | | | | Dividends paid | | -1,135.9 |

| | | |

D=A+B+C | | | | Free cash flow after dividends | | -1,067.0 |

| | | |

E | | | | Capital increases | | 0.2 |

F | | | | Financing increases | | 2.5 |

G | | | | Effects of conversion rate changes on net debt | | 10.9 |

| | | |

H=I+J | | | | Net debt at beginning of period | | -1,595.2 |

I | | | | Cash and cash equivalent | | -1,595.2 |

J | | | | Other short term financial investment | | 0.0 |

| | | |

K=L+M | | | | Net debt at end of period | | -853.5 |

L=L’-L” | | | | Cash and cash equivalent, final | | -529.5 |

L’=I-G-F-E-D | | | | Cash and cash equivalent, preliminary | | -541.7 |

L” | | | | Changes in consolidation | | 12.2 |

M | | | | Other short term financial investment | | -324.0 |

17

Operating Data

(in thousands)

| | | | | | | |

| | | Dec-31

| | | |

| | | 2004

| | 2003

| | %

| |

Total Paid Subscribers (1) | | 6,280 | | 5,033 | | 25 | % |

| | | |

Access: | | | | | | | |

Narrowband | | 748 | | 1,028 | | -27 | % |

Broadband | | 1,068 | | 644 | | 66 | % |

Total | | 1,816 | | 1,672 | | 9 | % |

| | | |

VAS (CSP/Portal): | | 4,464 | | 3,361 | | 33 | % |

| | | |

Broadband Access Subscribers: | | | | | | | |

Spain | | 189 | | 166 | | 14 | % |

Latam | | 879 | | 478 | | 84 | % |

Total | | 1,068 | | 644 | | 66 | % |

| (1) | Based on number of services delivered. Some subscribers may be contracting access and Value Added Services at the same time |

18

Historic Data

Note: The rounding-off of figures has produced small differences in the partial totals shown and in the percentage

changes stated

19

Consolidated Statement of Operations

(in thousand of Euros – Spanish GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003 (1)

| | | 2004

| |

| | | 3m

| | | 6m

| | | 9m

| | | 12m

| | | 3m

| | | 6m

| | | 9m

| | | 12m

| |

| | | Unaudited | | | Unaudited | | | Unaudited | | | Audited | | | Unaudited | | | Unaudited | | | Unaudited | | | Audited | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

Access | | 50,566 | | | 104,409 | | | 161,392 | | | 221,034 | | | 56,959 | | | 116,833 | | | 176,366 | | | 236,501 | |

Advertising and e-commerce | | 20,285 | | | 59,933 | | | 99,558 | | | 143,021 | | | 34,214 | | | 68,667 | | | 96,204 | | | 119,661 | |

Communication, portal and content services | | 31,452 | | | 62,333 | | | 88,766 | | | 119,023 | | | 29,135 | | | 61,692 | | | 92,750 | | | 122,304 | |

Corporate & SMEs Services and Other | | 12,523 | | | 27,061 | | | 41,523 | | | 63,550 | | | 13,928 | | | 27,709 | | | 42,147 | | | 62,012 | |

Total revenues | | 114,827 | | | 253,736 | | | 391,239 | | | 546,627 | | | 134,236 | | | 274,901 | | | 407,466 | | | 540,478 | |

| | | | | | | | |

Goods purchased | | (57,857 | ) | | (129,529 | ) | | (199,561 | ) | | (265,836 | ) | | (63,881 | ) | | (131,600 | ) | | (196,425 | ) | | (256,307 | ) |

Gross profit | | 56,970 | | | 124,207 | | | 191,678 | | | 280,791 | | | 70,355 | | | 143,301 | | | 211,041 | | | 284,171 | |

| | | | | | | | |

Personnel expenses | | (31,831 | ) | | (62,712 | ) | | (93,126 | ) | | (119,653 | ) | | (27,187 | ) | | (54,003 | ) | | (78,484 | ) | | (95,785 | ) |

Professional services | | (5,118 | ) | | (11,430 | ) | | (16,374 | ) | | (23,191 | ) | | (5,048 | ) | | (10,858 | ) | | (17,170 | ) | | (21,912 | ) |

Depreciation and amortization | | (19,461 | ) | | (37,492 | ) | | (57,158 | ) | | (78,742 | ) | | (21,848 | ) | | (38,714 | ) | | (48,228 | ) | | (79,513 | ) |

Marketing and Commissions | | (15,592 | ) | | (35,398 | ) | | (54,395 | ) | | (79,104 | ) | | (15,204 | ) | | (33,347 | ) | | (46,576 | ) | | (62,611 | ) |

Maintenance, supplies and leases | | (12,176 | ) | | (23,905 | ) | | (33,333 | ) | | (41,306 | ) | | (7,726 | ) | | (15,128 | ) | | (22,258 | ) | | (27,284 | ) |

Other expenses | | (11,814 | ) | | (27,385 | ) | | (41,553 | ) | | (57,021 | ) | | (14,526 | ) | | (27,606 | ) | | (42,215 | ) | | (55,713 | ) |

Total other operating expenses | | (95,992 | ) | | (198,322 | ) | | (295,939 | ) | | (399,017 | ) | | (91,539 | ) | | (179,656 | ) | | (254,931 | ) | | (342,818 | ) |

| | | | | | | | |

Operating loss | | (39,022 | ) | | (74,115 | ) | | (104,261 | ) | | (118,226 | ) | | (21,184 | ) | | (36,355 | ) | | (43,890 | ) | | (58,647 | ) |

| | | | | | | | |

Financial income (expense) | | 12,270 | | | 21,416 | | | 27,059 | | | 57,743 | | | 11,988 | | | 17,410 | | | 16,335 | | | 18,277 | |

Amortization of goodwill | | (20,129 | ) | | (42,173 | ) | | (62,385 | ) | | (82,297 | ) | | (19,675 | ) | | (39,388 | ) | | (58,997 | ) | | (64,848 | ) |

Equity share in affiliate losses, net | | (11,187 | ) | | (8,608 | ) | | (15,014 | ) | | (34,734 | ) | | (4,609 | ) | | (8,050 | ) | | (12,856 | ) | | (14,559 | ) |

Extraordinary income (expense) and other | | 2,518 | | | 5,773 | | | 17,401 | | | 4,534 | | | (19,607 | ) | | (24,400 | ) | | (29,725 | ) | | (25,773 | ) |

| | | | | | | | |

Income (loss) before taxes | | (55,550 | ) | | (97,707 | ) | | (137,200 | ) | | (172,980 | ) | | (53,087 | ) | | (90,783 | ) | | (129,133 | ) | | (145,550 | ) |

| | | | | | | | |

Corporate income tax | | (164 | ) | | (168 | ) | | (226 | ) | | (266 | ) | | 10,573 | | | 19,008 | | | 29,348 | | | 306,456 | |

Minority interest | | 26 | | | 24 | | | 447 | | | 536 | | | 2,121 | | | 2,498 | | | 2,927 | | | 3,066 | |

| | | | | | | | |

Net Loss (Spanish GAAP) | | (55,688 | ) | | (97,851 | ) | | (136,979 | ) | | (172,710 | ) | | (40,393 | ) | | (69,277 | ) | | (96,858 | ) | | 163,972 | |

| | | | | | | | |

Shares excluding Stock Options Plan (‘000) | | 559,848 | | | 560,835 | | | 560,973 | | | 560,997 | | | 561,012 | | | 561,070 | | | 561,059 | | | 561,062 | |

| (1) | Revenue by business line and some operating expenses show slight variations from previously reported figures due to reclassifications |

20

Notes to Consolidated Statement of Operations

(in thousand of Euros – Spanish GAAP)

unaudited

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| |

| | | 3m

| | | 6m

| | | 9m

| | | 12m

| | | 3m

| | | 6m

| | | 9m

| | | 12m

| |

Revenues by Country: (1) | | | | | | | | | | | | | | | | | | | | | | | | |

Spain | | 42,051 | | | 89,635 | | | 139,948 | | | 203,257 | | | 55,427 | | | 115,530 | | | 173,470 | | | 239,703 | |

Brazil | | 33,270 | | | 71,934 | | | 105,990 | | | 142,599 | | | 33,651 | | | 70,228 | | | 105,426 | | | 148,845 | |

US | | 21,317 | | | 57,262 | | | 93,812 | | | 126,026 | | | 30,041 | | | 58,113 | | | 79,937 | | | 87,784 | |

Other | | 18,189 | | | 34,905 | | | 51,489 | | | 74,746 | | | 15,116 | | | 31,030 | | | 48,633 | | | 64,146 | |

Total revenues | | 114,827 | | | 253,736 | | | 391,239 | | | 546,627 | | | 134,236 | | | 274,901 | | | 407,466 | | | 540,478 | |

| | | | | | | | |

EBITDA reconciliation: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Operating loss | | (39,022 | ) | | (74,115 | ) | | (104,261 | ) | | (118,226 | ) | | (21,184 | ) | | (36,355 | ) | | (43,890 | ) | | (58,647 | ) |

Depreciation and amortization | | 19,461 | | | 37,492 | | | 57,158 | | | 78,742 | | | 21,848 | | | 38,714 | | | 48,228 | | | 79,513 | |

Lease expense on fixed assets (2) | | 4,359 | | | 8,404 | | | 9,875 | | | 10,133 | | | 0 | | | 0 | | | 0 | | | 0 | |

EBITDA (3) | | (15,202 | ) | | (28,219 | ) | | (37,228 | ) | | (29,353 | ) | | 664 | | | 2,359 | | | 4,338 | | | 20,866 | |

EBITDA Margin | | -13 | % | | -11 | % | | -10 | % | | -5 | % | | 0 | % | | 1 | % | | 1 | % | | 4 | % |

| (2) | In all prior periods reported and for EBITDA guidance calculation purposes, expenses related to equipment leases recorded in Lycos are deemed to be depreciation costs |

| (3) | See EBITDA description in the Other Information section |

21

Consolidated Balance Sheet

(in million of Euros – Spanish GAAP)

| | | | | | | | | | | | | | | | |

| | | 2003

| | 2004

|

| | | Mar-31

| | Jun-30

| | Sep-30

| | Dec-31

| | Mar-31

Audited

| | Jun-30

| | Sep-30

| | Dec-31

Audited

|

ASSETS | | | | | | | | | | | | | | | | |

| | | | | | | | |

Due from Shareholders for Uncalled Capital | | 254 | | 229 | | 224 | | 0 | | 0 | | 0 | | 0 | | 0 |

| | | | | | | | |

Fixed and Other Noncurrent Assets: | | | | | | | | | | | | | | | | |

Intangible assets | | 72 | | 69 | | 78 | | 80 | | 75 | | 69 | | 62 | | 224 |

Property and equipment | | 46 | | 43 | | 39 | | 38 | | 34 | | 29 | | 27 | | 12 |

Long-term investments | | 559 | | 615 | | 619 | | 547 | | 561 | | 553 | | 537 | | 506 |

Treasury Stock | | 2 | | 2 | | 0 | | 126 | | 125 | | 0 | | 15 | | 15 |

Other fixed and noncurrent assets | | 1 | | 1 | | 1 | | 1 | | 1 | | 1 | | 1 | | 1 |

Total fixed and other noncurrent assets | | 679 | | 730 | | 737 | | 792 | | 796 | | 652 | | 642 | | 758 |

Goodwill in consolidation | | 606 | | 471 | | 451 | | 422 | | 403 | | 383 | | 363 | | 97 |

Long-Term deferred expenses | | 7 | | 7 | | 7 | | 6 | | 6 | | 6 | | 14 | | 11 |

Current Assets: | | | | | | | | | | | | | | | | |

Cash and Short-term investments | | 1,744 | | 1,650 | | 1,622 | | 1,599 | | 1,608 | | 1,616 | | 485 | | 854 |

Other current assets | | 147 | | 169 | | 176 | | 168 | | 139 | | 138 | | 134 | | 132 |

Total current Assets | | 1,891 | | 1,819 | | 1,798 | | 1,767 | | 1,747 | | 1,754 | | 619 | | 986 |

| | | | | | | | |

TOTAL ASSETS | | 3,437 | | 3,256 | | 3,217 | | 2,987 | | 2,952 | | 2,795 | | 1,638 | | 1,852 |

| | | | | | | | |

SHAREHOLDERS’ EQUITY AND LIABILITIES | | | | | | | | | | | | | | | | |

Shareholders’ equity | | 3,112 | | 2,987 | | 2,939 | | 2,721 | | 2,685 | | 2,533 | | 1,382 | | 1,635 |

Minority interests | | 0 | | 4 | | 3 | | 3 | | 1 | | 1 | | 0 | | 0 |

Long-term liabilities | | 60 | | 62 | | 73 | | 60 | | 69 | | 70 | | 76 | | 69 |

Current liabilities | | 266 | | 203 | | 202 | | 203 | | 197 | | 191 | | 180 | | 148 |

| | | | | | | | |

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES | | 3,437 | | 3,256 | | 3,217 | | 2,987 | | 2,952 | | 2,795 | | 1,638 | | 1,852 |

22

Operating Data

(in thousands)

| | | | | | | | | | | | | | | | |

| | | 2003

| | 2004

|

| | | 3m

| | 6m

| | 9m

| | 12m

| | 3m

| | 6m

| | 9m

| | 12m

|

Total Paid Subscribers (1) | | 3,260 | | 3,610 | | 4,602 | | 5,033 | | 5,273 | | 5,726 | | 6,110 | | 6,280 |

| | | | | | | | |

Access: | | | | | | | | | | | | | | | | |

Narrowband | | 1,031 | | 1,045 | | 1,035 | | 1,028 | | 1,020 | | 992 | | 884 | | 748 |

Broadband | | 419 | | 477 | | 543 | | 644 | | 726 | | 842 | | 965 | | 1,068 |

Total | | 1,450 | | 1,522 | | 1,578 | | 1,672 | | 1,746 | | 1,833 | | 1,850 | | 1,816 |

| | | | | | | | |

VAS (CSP/Portal): | | 1,810 | | 2,088 | | 3,024 | | 3,361 | | 3,528 | | 3,893 | | 4,260 | | 4,464 |

| | | | | | | | |

Broadband Access Subscribers: | | | | | | | | | | | | | | | | |

Spain | | 122 | | 135 | | 143 | | 166 | | 184 | | 192 | | 191 | | 189 |

Latam | | 297 | | 342 | | 400 | | 478 | | 542 | | 650 | | 775 | | 879 |

Total | | 419 | | 477 | | 543 | | 644 | | 726 | | 842 | | 965 | | 1,068 |

| (1) | Based on number of services delivered. Some subscribers may be contracting access and Value Added Services at the same time |

23

Other Information

24

Description of main Consolidated Statement of Operations accounts and EBITDA

Revenues

Access: subscriptions, traffic-inducement fees and call center revenues from residential clients.

Advertising and e-commerce: advertising, slotting fees and transaction commissions.

Communication, Portal and Content Services: value-added service fees related to communication, portal and content services and software package licenses paid to us by the final user or the companies through which we distribute them to the final user.

Corporate & SMEs Services and Other: primarily services to corporations and SMEs both access and media related. It excludes fees paid to us by the companies that distribute our value-added services, which are included under the Communication, Portal and Content Services line.

Goods Purchased

Include telecommunication expenses, technical help desk expenses, purchase of customer connection kits and modems, cost of e-commerce products sold, ad-serving costs, purchase of content, operating outsourcing and any other purchase.

Personnel Expenses

Include salaries, associated expenses and other employee benefits, regardless of the job classification of the employee.

Professional Services

Include consulting, legal advisors’ and auditors’ fees, among others.

Depreciation and Amortization Expenses

Include depreciation charges relating to tangible assets and amortization charges relating to intangible assets (not including goodwill), intangible rights and start-up costs.

Marketing and Commissions

Include expenses related to advertising and marketing.

Maintenance, Supplies and Leases

Include rental expenses, equipment leases, repairs and maintenance expenses, as well as expenses related to internal communications and other office expenses.

Other Expenses

These expenses include bad debt, tax (other than income tax), travel and insurance expenses and other operating expenses.

EBITDA

EBITDA is defined as operating income (loss) before depreciation on fixed assets, lease expense on fixed assets and amortization on intangible assets.

Other below the line items that are not included in EBITDA represent costs that are either not directly related to our core business or are non-recurring in nature including our share of gains and losses on equity method investments, goodwill amortization and other one time charges we believe to be outside the normal course of business and which may change from period to period, as well as income taxes.

25

Main Fully and Equity Consolidated Companies

| | | | | |

MAIN FULLY CONSOLIDATED COMPANIES

| | % Part.

| |

ARGENTINE | | TERRA NETWORKS ARGENTINA | | 99,99 | % |

BRAZIL | | TELEFONICA INTERACTIVA BRASIL, LTDA. (GRUPO) | | 99,99 | % |

CHILE | | TERRA NETWORKS CHILE HOLDING LIMITADA, S.A. (GRUPO) | | 99,99 | % |

COLOMBIA | | TERRA NETWORKS COLOMBIA HOLDING, S.A. (GRUPO) | | 99,99 | % |

GUATEMALA | | TERRA NETWORKS GUATEMALA, S.A. (GRUPO) | | 100,00 | % |

MEXICO | | TERRA NETWORKS MEXICO HOLDING, S.A. DE C.V. (GRUPO) | | 100,00 | % |

PERU | | TERRA NETWORKS PERU, S.A. | | 99,99 | % |

SPAIN | | EDUCATERRA | | 100,00 | % |

SPAIN | | MAPTEL NETWORKS, S.A.U. | | 100,00 | % |

SPAIN | | TERRA NETWORKS ESPAÑA, S.A.U. | | 100,00 | % |

USA | | TERRA NETWORKS USA, INC | | 100,00 | % |

USA | | ONE TRAVEL.COM, INC. | | 54,15 | % |

VENEZUELA | | TERRA NETWORKS VENEZUELA S.A. | | 100,00 | % |

| |

MAIN EQUITY CONSOLIDATED COMPANIES

| | % Part.

| |

HOLLAND | | LYCOS EUROPE | | 32,10 | % |

SPAIN | | AZELER AUTOMOCION, S.A. | | 50,00 | % |

SPAIN | | ATREA, S.A. | | 50,00 | % |

SPAIN | | RED UNIVERSAL DE MARKETING Y BOOKINGS ON-LINE, S.A. | | 50,00 | % |

26

Relevant Facts filed with the SEC/CNMV

| | • | | 23rd February 2004: On 23rd February 2005, Terra Networks S.A:’s Board of Directors approved Telefonica´s merger proposal which is now subjecto to the corresponding approval by shareholders at the Ordinary General Shareholders’ Meeting of both companies. On the same meeting Terra´s Board of Directors also approved the proposal to pay a dividend in the amount of 0.60 Euros per share, with a charge against the “Reserve for Shares Issuance Premium” account.. The effectiveness of the distribution is subject to the corresponding approval by the shareholders at the Ordinary General Shareholders’ Meeting of Terra. Payment is expected to be made during the days following the meeting and, in any event, before the merger of Telefónica and Terra is recorded with the Commercial Registry. |

| | • | | 14 February 2005:On 9 February 2005, Terra Networks, S.A. received an invitation from Telefónica, S.A. to perform a merger between the two companies. The Board of Directors at Terra Networks, S.A., in an extraordinary meeting held on 10 February 2005, was notified of the invitation from Telefónica S.A., and resolved to open a study and negotiation phase to determine whether a possible merger would benefit the interests of Terra Networks, S.A. and to examine the terms of said merger. |

| | • | | 11 February 2005: On 11 February 2005, Terra Networks, S.A. agreed to sell its stake in One Travel.com, Inc, namely 54.1% of the shareholders’ capital, within the framework of a series of agreements with One Travel.com, Inc, and the US company RCG Companies, aimed at the merger between the two companies. The total amount of the transaction is US$25.5 million, of which US$2.5 million becomes payable on signing the agreement, US$10.5 million on completing the merger and US$12.5 million between six months’ and one year’s time. |

| | • | | 11 February 2005:The Board of Directors at Terra Networks, S.A., in a meeting held on 10 February 2005, noted the resignation of Board members, Mr. Angel Vilá Boix and Telefónica Data Corp. Furthermore, shareholders Mr. Alfonso Merry del Val Gracie and Mr. Fernando Labad Sasiaín were co-opted as new members to cover the aforementioned vacancies. |

| | • | | October 6th, 2004: on October 5th 2004, TERRA NETWORKS, S.A. and the Korean group DAUM COMMUNICATIONS Corp. executed a sales agreement by which the former acquired the latter’s shares in the TERRA subsidiary LYCOS, Inc. after obtaining the relevant authorization from the anti-trust authorities. |

| | • | | August 2nd, 2004: On July 31st TERRA NETWORKS, S.A. and the Korean group DAUM COMMUNICATIONS Corp. announced an agreement by which the former will sell the latter all of its shares in TERRA subsidiary LYCOS, Inc., thereby executing the agreements made between the governing bodies of the two companies and having completed the tender brought about at the behest of TERRA and led by the investment bank Lehman Brothers, which acted as TERRA’s financial advisor. |

| | • | | July 28th , 2004: Pursuant to the strategy announced to the market in the relevant fact filed on April 29th 2004, Terra Networks, S.A. initiated a tender to find a purchaser for its US subsidiary, Lycos, Inc. |

| | • | | July 15, 2004: Terra Networks, S.A. announces that on July 15, 2004 Barclays Bank sold 7,000,000 Terra Network shares off the market at a price of 2.16 euros per share. |

27

| | • | | June 15, 2004:Terra Networks, S.A. announces that the Ordinary General Shareholders’ Meeting held on the evening of June 22, 2004 in Barcelona approved by a sufficient majority of votes all the resolutions proposed, including the reduction of share capital through the amortization of the group’s own shares and the payment of a dividend against the “Share issue premium reserve”. |

| | • | | 28 May 2004:Terra Networks, S.A. announces that the Board of Directors, at its meeting held on 27th May 2004, unanimously resolved to amend the Regulations governing the Company’s Board of Directors to adapt them to the terms of the said Act 26/2003. These regulations can be consulted on the websitewww.terralycos.com |

| | • | | 28 May 2004:Terra Networks, S.A. sends the Board of Directors Report in relation with the proposal to submit for the approval of the General Shareholders’ Meeting the share capital reduction to amortize own shares acquired by the Company and the consequent modification of articles 5 and 6 of the Company Bylaws. |

| | • | | 27 May 2004Terra Networks, S.A. announces the Agenda of the Ordinary General Shareholders’ Meeting to be held on June 22, 2004. |

| | • | | 20 May 2004:Terra Networks, S.A. describes the Stock Option Plans of the Terra Lycos Group in May 2004. There are 17.1 million live Stock Options, with 40.4 million shares to provide coverage. |

| | • | | April 29th. 2004:Terra Networks, S.A. is currently involved in a reviewing and analyzing process on some of its operating units. As part of this global process, different alternatives are being analyzed for Lycos US. No definitive decision has been adopted so far. |

| | • | | March 30th. 2004: To complete the restructuring process at Terra Lycos group, the Company believes it needs, amongst other things, to reduce personnel costs. Accordingly, it has submitted an application to make redundancies. For the time being, it does not know the precise scope of this action or the number of employees that will be affected. |

| | • | | March 24th. 2004: As part of the technical reorganization of its central operating units, Terra Networks, S.A. has created two new areas called, respectively, the Content and Innovation Unit, and the Technology and Development Unit. Luis Velo has been appointed to head the former and Alfonso Vicente the latter. |

| | • | | March 10th. 2004: Terra Lycos files the Corporate Governance Annual Report related to year 2003 once it has been approved by the Board of Directors of Terra Networks, S.A. with the favourable report from the Audit and Control Committee. The mentioned Report of Corporate Governance may be consult throughout Terra Networks, S.A. web page. (http://www.terralycos.com). |

| | • | | February 25th. 2004: The Board of Directors of Terra Lycos accepted the resignation submitted by Mr. Luis Ramón Arrieta Durana, as Member of the Board of Directors as well as Member of the Audit and Control Committee and Appointment and Remuneration Committee, after thanking Mr. Arrieta for his work and dedication during the term of his functions. |

| | • | | February 25th. 2004: The Board of Directors of Terra Lycos accepted the resignation submitted by Mr. Joaquim Agut Bonsfills, as Member of the Board of Directors, after thanking Mr. Agut for his work and dedication during the term of his functions, for both, Executive Chairman and Member of the Board of Directors. |

28

| | • | | January 27th. 2004:The Board of Directors of Terra Lycos accepted the resignation submitted by Mr. Edward M. Philip, as Member of the Board of Directors, after thanking Mr. Philip for his work and dedication during the term of his functions. |

29

Press Releases of the Quarter

| | • | | 11 January 2005: Alestra (ATT) and Terra announce a commercial deal whereby Alestra will manage the Internet access service provided by Terra in the Mexican market, while Terra will continue to manage and market the portal www.terra.com.mx, and to provide e-mail and value added services to the access client portfolio resulting from the deal. |

| | • | | 30 December 2004: Terra Spain reduces the monthly fee for all its 24-hour ADSL subscribers. These subscribers will also enjoy, at no additional cost, an integrated PC protection kit (valued at 5.95 euros) including antivirus and firewall. |

| | • | | 07 November 2004: Terra Networks, S.A. announces the launch of its Internet access offer ( telephone or dial-up) in Colombia, expanding its portfolio of services in this market. |

| | • | | 21 October 2004: Real Madrid C.F. and Terra Spain present “Real Madrid Zona Exclusiva”. This is a premium, exclusive product, developed jointly by the two companies, offering a range of multimedia services for the Internet and mobile phones to bring the club’s latest news to all its fans at home and abroad. |

| | • | | 18 October 2004: Terra Spain unveils its new broadband access product “Terra ADSL Ocio”. This product is outstanding for its speed, low price, flexibility of connection times and the quality parameters applied. |

30

Safe-Harbour

This document contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this document and include statements regarding the intent, belief or current expectations of the customer base, estimates regarding future growth in the different business lines and the global business, market share, financial results and other aspects of the activities and situation relating to the Company. This foward-looking statements in this document can be identified, in some instances, by the use of words such as “expects”, “anticipates”, “intends”, “believes” and similar language or the negative thereof or by the forward-looking nature of discussions of strategy, plans or intentions (Shearman.-May 2 2003). Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements as a result of various factors. Analysts and investors are cautioned not to place undue reliance on those forward looking statements, which speak only as of the date of this presentation. Terra Lycos undertakes no obligation to release publicly the results of any revisions to these forward looking statements which may be made to reflect events and circumstances after the date of this presentation, including, without limitation, changes in Terra Lycos business or acquisition strategy or to reflect the occurrence of unanticipated events. Analysts and investors are encouraged to consult the Company’s Annual Report on Form 20-F as well as periodic filings made on Form 6-K, which are on file with the United States Securities and Exchange Commission.

Contact Information

Terra Networks

Investor Relations

Vía de las Dos Castillas, 33 Ed. Atica 1

28224 Pozuelo de Alarcón, Madrid, Spain

E-mails:

relaciones.inversores@corp.terra.com

oficina.accionistas@corp.terra.com

| | |

| Miguel von Bernard | | Investor Relations Director |

Phone: | | 34.91. 452.3922 |

e-mail: | | miguel.vonbernard@corp.terra.com |

31

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | Terra Networks, S.A. |

| | |

Date: February 24, 2005 | | By: | | /s/ Elías J. Rodríguez-Viña

|

| | | Name: | | Elías Jesús Rodríguez-Viña |

| | | Title: | | Chief Financial Officer Terra Networks, S.A. |