QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A/A

(Amendment No. 6)

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

|

|

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material pursuant to Rule 240.14a-12

|

724 Solutions Inc. |

| (Name of Registrant as Specified In Its Charter) |

Not Applicable |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

ý |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)1 and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

Common Shares

|

| | | (2) | | Aggregate number of securities to which transaction applies:

5,526,849 outstanding Common Shares, and options to purchase an estimated 150,422 additional Common Shares

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

$3.34 per share consideration, plus an additional estimated cash payment of $41,875 with respect to certain outstanding options to purchase Common Shares of the Registrant.

|

| | | (4) | | Proposed maximum aggregate value of transaction:

$18,501,550

|

| | | (5) | | Total fee paid:

$1,979.73

|

ý |

|

Fee paid previously with preliminary materials:

|

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF ANNUAL AND SPECIAL MEETING

OF SECURITYHOLDERS

TO BE HELD ON AUGUST 8, 2006

AND

MANAGEMENT INFORMATION CIRCULAR

AND PROXY STATEMENT

ARRANGEMENT INVOLVING

724 SOLUTIONS INC.

AND

724 HOLDINGS, INC.

JULY 11, 2006

THE ARRANGEMENT AND THE ARRANGEMENT AGREEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION OR BY ANY U.S. STATE SECURITIES COMMISSION, NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION OR ANY U.S. STATE SECURITIES COMMISSION PASSED UPON THE MERITS OR FAIRNESS OF THE ARRANGEMENT OR THE ARRANGEMENT AGREEMENT OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

July 11, 2006

Dear Securityholders:

724 Solutions Inc. has entered into an arrangement agreement with Austin Ventures VIII, L.P. and an affiliated entity, 724 Holdings, Inc. Under the agreement, 724 Holdings, Inc. would acquire all of our outstanding common shares not owned by Austin Ventures and Mr. John J. Sims, our chief executive officer. The proposed transaction is to be carried out by way of a court approved plan of arrangement. Under the plan of arrangement, shareholders would receive US$3.34 per common share and holders of options having an exercise price less than US$3.34 would receive cash consideration in an amount per share equal to the difference between US$3.34 and the exercise price. All outstanding options will be terminated.

Our board of directors approved the arrangement following the report and favourable recommendation of a special committee of directors independent of management and independent of Austin Ventures.

In reaching its recommendation, the special committee considered, among other things, a fairness opinion from its financial advisor, Thomas Weisel Partners LLC, and a valuation report from its independent valuator, Paradigm Capital Inc. The fairness opinion states that, as of the date of the opinion, and based upon and subject to the various factors, assumptions and limitations set out in the opinion, the consideration to be received by our shareholders, other than Austin Ventures, pursuant to the arrangement is fair, from a financial point of view, to those shareholders. The formal valuation states that, based upon and subject to the various factors, assumptions and limitations set out in the formal valuation, the fair market value of our common shares is between US$2.97 and US$3.50.

We have called an annual and special meeting of holders of our common shares and holders of certain stock options to consider the arrangement and related matters and the annual business of our company.Our board of directors has concluded that the arrangement is fair to the unaffiliated shareholders and in the best interests of our company and recommends that shareholders vote FOR the arrangement and the related proposals. The accompanying management information circular and proxy statement provides information concerning these matters to assist you in determining how to vote. You are urged to read this information carefully.

Your vote is very important. Whether or not you are able to attend the meeting in person, please complete and return the enclosed form of proxy to ensure your vote is counted at the meeting. We also encourage shareholders to complete and return the enclosed letter of transmittal in accordance with its instructions so that, if the arrangement is consummated, payment for your common shares can be sent to you promptly following the effectiveness of the arrangement.

On behalf of the board of directors, I would like to take this opportunity to thank you for your support of our company.

Yours very truly,

J. Ian Giffen

Chairman of the Board of Directors

and of the Special Committee

724 SOLUTIONS INC.

1221 State Street, Suite 200

Santa Barbara, California

USA 93101

NOTICE OF ANNUAL AND SPECIAL MEETING

Notice is hereby given that the annual and special meeting of holders of common shares and the holders of options exercisable for common shares having an exercise price less than $3.34 per share, or the in-the-money options, will be held on August 8, 2006 at 9:00 a.m. (Pacific Daylight Time) at the Fess Parker's Double Tree Resort at 633 East Cabrillo Boulevard, Santa Barbara, California.Whether or not you will be present in person at the meeting, you should complete and return the enclosed form of proxy as soon as possible.

Our board of directors has approved an agreement providing for a court approved plan of arrangement, or the arrangement, under section 182 of theBusiness Corporations Act (Ontario), or the OBCA, involving us, our securityholders and 724 Holdings, Inc., or Holdings, an affiliate of Austin Ventures VIII, L.P., Austin Ventures VI, L.P. and Austin Ventures VI Affiliates Fund, L.P., or, collectively, Austin Ventures. Austin Ventures is, in the aggregate, our largest creditor and our largest shareholder. As a result of the arrangement, Holdings will acquire all of our outstanding common shares, other than common shares owned by Austin Ventures and Mr. John J. Sims, our chief executive officer, for $3.34 per common share. Mr. Sims is not a party to the arrangement agreement but in connection with the arrangement he is expected to exchange all of his common shares in our company for shares of Holdings' capital stock. Each in-the-money stock option will be cancelled by us in exchange for a cash payment in an amount equal to the difference between $3.34 and the exercise price for each share subject to the option (less any required withholding taxes). All other outstanding stock options will be terminated.

At the meeting, shareholders will convene for the following purposes:

- •

- to consider and, if determined advisable, to pass, a special resolution approving the arrangement under section 182 of the OBCA, or the Arrangement Resolution;

- •

- to consider and, if determined advisable, to pass, a special resolution continuing our company under the OBCA and discontinuing our company under theCanada Business Corporations Act, or the CBCA, or the Continuance Resolution;

- •

- to receive our annual report, including our financial statements, as, at and for the year ended December 31, 2005, and the report of the auditors on those financial statements (without any action by our shareholders being required or proposed to be taken);

- •

- to elect directors to hold office until the next annual meeting of shareholders or until their respective successors are elected or appointed;

- •

- to appoint KPMG LLP as our independent auditors for fiscal 2006;

- •

- to consider and, if determined advisable, to pass, a resolution, approving any adjournment of the meeting, if necessary, to solicit additional proxies in favour of the Arrangement Resolution and/or the Continuance Resolution or otherwise to complete the arrangement; and

- •

- to transact any other business as may properly be brought before the meeting.

In addition, holders of in-the-money options will convene with shareholders to consider and to vote together with shareholders, as a single class, on the Arrangement Resolution.

The full text of the Arrangement Resolution is set out in Appendix A to the accompanying management information circular and proxy statement, or Circular, and the full text of the Continuance Resolution is set out in Appendix B to the Circular. The full text of the arrangement agreement is attached as Appendix C to the Circular and the full text of the plan of arrangement is attached as Appendix D to the Circular. A copy of our annual report to shareholders, the Circular, a form of proxy and a letter of transmittal accompany this notice.

Under the interim order of the court dated July 10, 2006, or the Interim Order, registered shareholders have the right under the Interim Order to dissent with respect to the Arrangement Resolution. If the

Arrangement Resolution becomes effective, registered shareholders who properly exercise their dissent rights to the Arrangement Resolution will be entitled to be paid fair value for their common shares.

Under the CBCA, registered shareholders have the right to dissent with respect to the Continuance Resolution. If the Continuance Resolution becomes effective, registered shareholders who properly exercise their dissent rights to the Continuance Resolution will be entitled to be paid fair value for their common shares.

Failure to comply strictly with applicable dissent procedures may result in the loss or unavailability of any right of dissent. Please see "Dissent Rights of Shareholders" in the Circular and Appendix G to the Circular.

The record date for determining the holders entitled to vote is June 30, 2006. If shareholders acquire common shares subsequent to the record date, shareholders may be entitled to vote at the meeting, but we are not soliciting forms of proxy from such shareholders.

In order to be voted, proxies must be received by us, c/o our registrar and transfer agent, Computershare Investor Services Inc., by mail to P.O. Box 7021, 31 Adelaide Street East, Toronto, Ontario, Canada M5C 3H2, Attention: Corporate Actions, or by registered mail, hand or by courier to 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, Attention: Corporate Actions, by no later than 5:00 p.m. (Pacific Daylight Time) on August 4, 2006 or, in the case of any adjournment of the meeting, by no later than 5:00 p.m. (Pacific Daylight Time) on the business day immediately preceding the date of the resumed meeting.

By Order of the Board of Directors,

Stephen Morrison

Chief Financial Officer and Senior

Vice-President, Corporate Services

Toronto, Ontario, Canada

July 11, 2006

TABLE OF CONTENTS

| | Page

|

|---|

INFORMATION CONTAINED IN THIS MANAGEMENT INFORMATION CIRCULAR AND

PROXY STATEMENT | | v |

NOTICE TO UNITED STATES HOLDERS OF COMMON SHARES |

|

v |

SUMMARY TERM SHEET |

|

1 |

| | The Arrangement and Related Matters | | 1 |

| | Shareholder Voting and Related Matters | | 3 |

| | The Position of the Board and the Special Committee, the Austin Ventures Parties and the Chief Executive Officer | | 9 |

| | Interests of Our Directors and Executive Officers | | 11 |

| | Voting by Holders of Options and Related Matters | | 11 |

| | General Matters | | 13 |

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS |

|

14 |

SPECIAL FACTORS |

|

14 |

| | Background to the Arrangement Agreement | | 14 |

| | Position of the Board of Directors and the Special Committee as to Fairness | | 26 |

| | Position of the Austin Ventures Parties as to Fairness | | 29 |

| | Position of the Chief Executive Officer as to Fairness | | 31 |

| | Fairness Opinion | | 33 |

| | Formal Valuation | | 39 |

| | Financial Projections | | 40 |

| | Reasons for the Arrangement | | 42 |

| | Interests of Directors and Executive Officers | | 45 |

| | Effects of the Arrangement — Plans and Proposals | | 47 |

| | Canadian Federal Income Tax Considerations | | 47 |

| | United States Federal Tax Consequences of the Arrangement on the Corporation, the Austin Ventures Parties and the Chief Executive Officer | | 51 |

| | United States Federal Income Tax Considerations | | 51 |

PARTICULARS OF THE ARRANGEMENT |

|

53 |

| | Votes Required at the Meeting Relating to the Arrangement | | 53 |

| | Summary of the Arrangement | | 54 |

| | Options | | 54 |

| | Accounting Treatment | | 54 |

| | Sources of Funds for the Arrangement | | 54 |

| | Stock Exchange Listings and Reporting Obligations | | 55 |

| | Expenses | | 55 |

| | Court Approval and Completion of the Arrangement | | 55 |

THE ARRANGEMENT AGREEMENT |

|

56 |

| | Effective Date of the Arrangement | | 56 |

| | Covenants of the Corporation | | 57 |

| | Covenants of Holdings | | 59 |

| | Representations and Warranties | | 59 |

| | Conditions of Closing | | 60 |

| | Termination of Arrangement Agreement | | 62 |

| | Termination Payment and Expense Reimbursement | | 63 |

| | Amendment | | 63 |

| | Guarantee by Austin Ventures | | 64 |

DISSENT RIGHTS OF SHAREHOLDERS |

|

64 |

| | Dissenting to the Arrangement | | 64 |

| | Dissenting to the Continuance | | 67 |

| | | |

i

THE CONTINUANCE |

|

69 |

| | Reason for the Continuance | | 69 |

| | Summary Comparison of Shareholder Rights | | 70 |

| | Votes Required at the Meeting Relating to the Continuance | | 72 |

TERMINATION OF RIGHTS PLAN |

|

72 |

ADJOURNMENT OF MEETING |

|

72 |

INFORMATION CONCERNING THE AUSTIN VENTURES PARTIES |

|

72 |

INFORMATION CONCERNING THE CORPORATION |

|

73 |

| | General | | 73 |

| | Business | | 73 |

| | Acquisitions | | 74 |

| | Industry Overview | | 74 |

| | Business Strategy | | 75 |

| | Customer Benefits | | 75 |

| | Our Products | | 76 |

| | Support Services | | 78 |

| | Customers | | 78 |

| | Research and Development | | 79 |

| | Sales and Marketing | | 79 |

| | Strategic Relationships | | 79 |

| | Competition | | 80 |

| | Intellectual Property | | 80 |

| | Employees | | 81 |

| | Properties | | 81 |

| | Legal Proceedings | | 81 |

| | Financial Information | | 82 |

| | Selected Financial Data | | 82 |

| | Market for Securities | | 84 |

| | Exchange Rate Information | | 86 |

| | Dividend Policy | | 87 |

RISK FACTORS |

|

88 |

| | Risk Factors Related to the Arrangement | | 88 |

| | Risk Factors Related to Our Company | | 88 |

PROCEDURES FOR THE SURRENDER OF SHARE CERTIFICATES AND PAYMENT |

|

99 |

PURCHASES AND SALES OF COMMON SHARES |

|

100 |

APPOINTMENT AND REVOCATION OF PROXIES |

|

100 |

| | Non-Registered Holders | | 100 |

| | Revocation | | 101 |

FINANCIAL STATEMENTS AND AUDITORS' REPORT |

|

102 |

VOTING SECURITIES AND PRINCIPAL HOLDERS |

|

102 |

| | Principal Shareholders Table | | 103 |

| | Principal Holders of In-the-Money Options | | 104 |

ELECTION OF DIRECTORS |

|

105 |

| | Directors Table | | 106 |

| | Governance, Nomination, Human Resources and Compensation Committee Interlocks and Insider Participation | | 110 |

| | Share Ownership | | 111 |

EXECUTIVE OFFICERS |

|

111 |

| | | |

ii

EXECUTIVE COMPENSATION |

|

112 |

| | Summary Compensation Table | | 112 |

| | Option Grants During the Year Ended December 31, 2005 | | 113 |

| | Aggregated Option Exercises During the Year Ended December 31, 2005 and

Year-End Option Values | | 113 |

| | Stock Option Committee | | 114 |

| | Stock Option Plans | | 114 |

| | Summary Information Concerning Stock Option Plans | | 117 |

| | Indebtedness of Directors, Officers and Others | | 117 |

| | Employment Contracts | | 117 |

| | Report on Executive Compensation | | 119 |

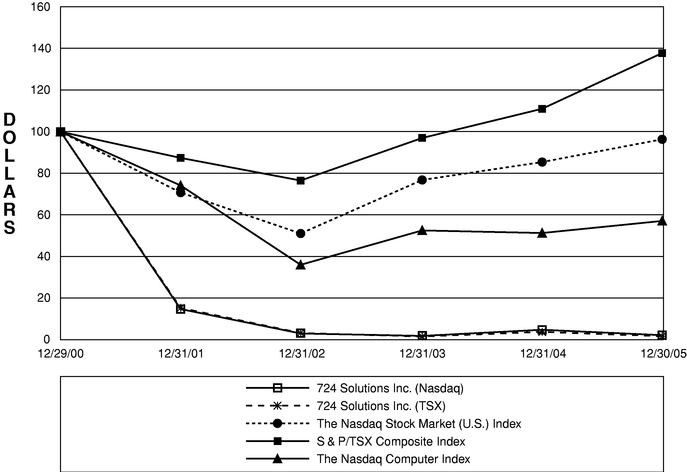

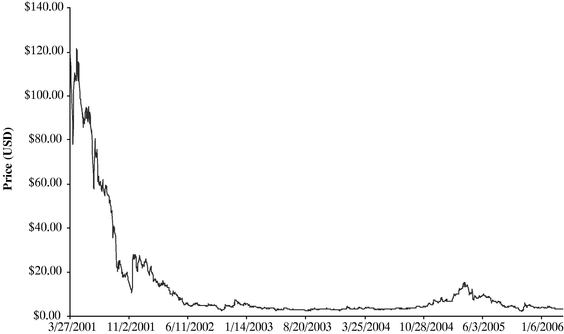

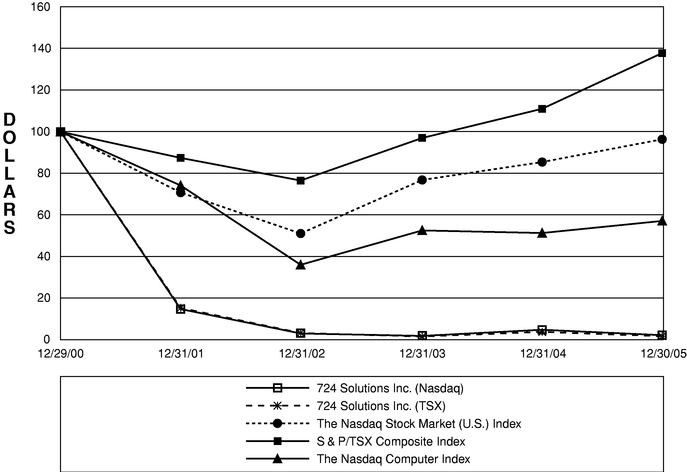

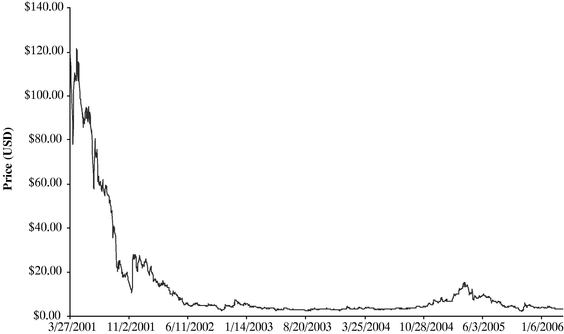

| | Stock Price Performance Graph | | 121 |

| | Cumulative Total Return | | 122 |

DIRECTORS AND OFFICERS INSURANCE |

|

123 |

COMPENSATION OF DIRECTORS |

|

123 |

COMPLIANCE WITH SECTION 16(A) OF THE U.S. EXCHANGE ACT |

|

124 |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

|

124 |

INTERESTS OF INSIDERS IN MATERIAL TRANSACTIONS |

|

131 |

| | Torys LLP | | 131 |

| | Austin Ventures | | 131 |

REPORT OF THE AUDIT COMMITTEE |

|

133 |

APPOINTMENT OF AUDITORS |

|

133 |

| | Audit Fees | | 133 |

| | Audit-Related Fees | | 134 |

| | Tax Fees | | 134 |

| | All Other Fees | | 134 |

SHAREHOLDER PROPOSALS |

|

134 |

ADDITIONAL INFORMATION |

|

134 |

APPROVAL BY BOARD OF DIRECTORS |

|

135 |

iii

TABLE OF APPENDICES

| | Page

|

|---|

Appendix A

Arrangement Resolution | | A-1 |

Appendix B

Continuance Resolution |

|

B-1 |

Appendix C

Arrangement Agreement |

|

C-1 |

Appendix D

Plan of Arrangement |

|

D-1 |

Appendix E

Interim Order |

|

E-1 |

Appendix F

Notice of Application for the Final Order |

|

F-1 |

Appendix G

Rights of Continuance Dissenting Shareholders and Arrangement Dissenting Shareholders |

|

G-1 |

Appendix H

Fairness Opinion |

|

H-1 |

Appendix I

Formal Valuation |

|

I-1 |

Appendix J

Audit Committee Charter |

|

J-1 |

Appendix K

Record Attendance by Directors |

|

K-1 |

Appendix L

Board of Directors Mandate |

|

L-1 |

Appendix M

Form 10-Q for the Three Month Period Ended March 31, 2006 |

|

M-1 |

iv

Please carefully read this Management Information Circular and Proxy Statement, including its Appendices. They contain detailed information relating to, among other things, the proposed arrangement. If you are in doubt as to how to deal with these materials or the matters they describe, please consult your financial or professional advisor.

INFORMATION CONTAINED IN THIS

MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT

Unless otherwise indicated, information contained in this management information circular and proxy statement, or this Circular, is given as of June 26, 2006. As of the date of this Circular, neither our board of directors, nor our management knows of any matters to come before the annual and special meeting on August 8, 2006, or the meeting, other than the matters referred to in the accompanying Notice of Annual and Special Meeting. References in this Circular to we, us, our or the Corporation are to 724 Solutions Inc. References in this Circular to Holdings are to 724 Holdings, Inc. References in this Circular to Austin Ventures are to Austin Ventures VIII, L.P., Austin Ventures VI, L.P. and Austin Ventures VI Affiliates Fund, L.P. References in this Circular to the Austin Ventures Parties are to Holdings, Austin Ventures, AV Partners VI, L.P., AV Partners VIII, L.P., Joseph C. Aragona, Kenneth P. Deangelis, Jeffery C. Garvey, Edward E. Olkkola, Christopher A. Pacitti, John D. Thornton, Blaine F. Wesner and Benjamin L. Scott, collectively. References in this Circular to $ are to U.S. dollars and references to C$ are to Canadian dollars. References in this Circular to unaffiliated shareholders means shareholders other than the Austin Ventures Parties, our directors and our executive officers. References in this Circular to shareholders mean holders of our common shares. References in this Circular to holders of in-the-money options mean holders of options exercisable for common shares having an exercise price less than $3.34 per share, or in-the-money options. References in this Circular to securityholders mean shareholders and holders of in-the-money options, collectively.

All information concerning the arrangement that specifically relates to the Austin Ventures Parties contained in this Circular has been provided to us by Austin Ventures. All information concerning the arrangement that specifically relates to Mr. John J. Sims, our chief executive officer, contained in this Circular has been provided to us by Mr. Sims. Our board of directors has relied upon this information without having made independent inquiries as to the accuracy or completeness of that information; however, it has no reason to believe such information is misleading or inaccurate. Except as provided under applicable law, neither we nor the board of directors assume any responsibility for the accuracy or completeness of the information concerning the arrangement, nor for any omission on the part of the Austin Ventures Parties or Mr. Sims to disclose facts or events which may affect the accuracy or completeness of any information concerning the arrangement nor for any omission on the part of any party other than ourselves provided to us for inclusion in this Circular concerning the arrangement.

No person has been authorized to give any information or to make representations on our behalf in connection with the subject matter of the meeting other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized. This Circular does not constitute the solicitation of an offer to acquire any securities or the solicitation of a proxy, in any jurisdiction in which such solicitation is not authorized or in which the person making that solicitation is not qualified to do so or to any person to whom it is unlawful to make that solicitation.

NOTICE TO UNITED STATES HOLDERS OF COMMON SHARES

Enforcement by shareholders of civil liabilities under the United States federal securities laws may be affected adversely by the fact that we and certain of our subsidiaries are organized under the laws of a jurisdiction other than the United States, that some of our respective officers and directors are residents of countries other than the United States, that certain experts named in this Circular are residents of countries other than the United States and that all or a substantial portion of our assets and those of our subsidiaries and such persons may be located outside the United States.

v

SUMMARY TERM SHEET

This summary term sheet highlights information contained in this Circular that we believe is important for you to consider in deciding how to vote. This summary is not intended to be complete and we have included cross references below to direct you to the sections in this Circular where more detailed information can be found about the corresponding topic. We encourage you to read the Circular in its entirety.Whether or not you are able to attend the meeting, we encourage you to complete and return the enclosed form of proxy to ensure that your vote is counted in accordance with your instructions.

The Arrangement and Related Matters

- Q:

- What is involved in the transaction?

- A:

- The transaction involves a court approved plan of arrangement, or arrangement, which follows the continuation of the Corporation from the jurisdiction of theCanada Business Corporations Act, as amended, or CBCA to the jurisdiction of theBusiness Corporations Act (Ontario), as amended, or OBCA, or the continuance. In order to give effect to the arrangement, each of the continuance and arrangement must be approved by the requisite vote at the meeting. If either of these resolutions are not approved at the meeting the transaction will not proceed and the arrangement will not be completed. See "Particulars of the Arrangement — Court Approval and Completion of the Arrangement."

- Q:

- What are the principal terms of the arrangement?

- A:

- On April 6, 2006, we entered into an arrangement agreement with Holdings and Austin Ventures VIII, L.P. Subject to the terms and conditions of the agreement, Holdings will acquire all of our outstanding common shares not owned by Austin Ventures and Mr. John J. Sims, our chief executive officer, for $3.34 per common share. In addition, holders of in-the-money options will receive the difference between $3.34 and the exercise price for each share subject to the option. The transaction is conditioned upon court and shareholder approval, and we have called a meeting to allow shareholders to vote on the arrangement and other matters contained in this Circular. Holders of in-the-money options also will consider and vote together with the shareholders as a single class on the arrangement. See "The Arrangement Agreement".

- Q:

- Who are the parties to the arrangement?

- A:

- In addition to us, the other parties to the arrangement agreement are Holdings and Austin Ventures VIII, L.P.

Holdings is a holding company affiliated with Austin Ventures. It was incorporated in the State of Delaware in March 2006. See "Information Concerning The Austin Ventures Parties".

Austin Ventures is, in the aggregate, our largest creditor and our largest shareholder. Austin Ventures is a provider of startup and growth capital to emerging companies and has been doing so for over twenty years. Austin Ventures partners with talented entrepreneurs and operating executives to build valuable businesses in a variety of technology and service industries. Austin Ventures invests nationally but maintains a particular focus on Texas and the Southwest U.S., where Austin Ventures is the region's most active investor. Austin Ventures' team of investment professionals works with companies at every stage of the funding lifecycle, from initial seed investments, through startup and growth capital, to buyouts and recapitalizations. Austin Ventures brings a long-term investment perspective, broad experience in building high-growth companies, and access to a substantial network of entrepreneurs and executives. See "Information Concerning The Austin Ventures Parties" and "Voting Securities and Principal Holders — Principal Shareholders Table".

1

AV Partners VIII, L.P. is the general partner of Austin Ventures VIII, L.P. The general partners of AV Partners VIII, L.P. are Joseph C. Aragona, Kenneth P. DeAngelis, Edward E. Olkkola, Christopher A. Pacitti, John D. Thornton and Blaine F. Wesner.

AV Partners VI, L.P. is the general partner of Austin Ventures VI, L.P. and Austin Ventures VI Affiliates Fund, L.P. The general partners of AV Partners VI, L.P. are Joseph C. Aragona, Kenneth P. DeAngelis, Jeffery C. Garvey, Edward E. Olkkola, John D. Thornton and Blaine F. Wesner.

Mr. Benjamin L. Scott, one of our directors, is associated with Austin Ventures as a venture partner of the management company of Austin Ventures. Mr Scott serves on our board of directors as a designee of Austin Ventures. Mr. Scott has no personal financial interest in the arrangement.

Mr. John J. Sims is our chief executive officer and is expected to continue in that position after completion of the transaction. Mr. Sims is not a party to the arrangement, but was offered the opportunity to purchase up to $1,000,000 of Holdings' capital stock which stock in the resulting company would be contingent on his remaining as chief executive officer for some period of time. Mr. Sims and Holdings have entered into an agreement that provides for Mr. Sims' contribution of our common shares held by him in exchange for shares of convertible preferred stock of Holdings. Mr. Sims has indicated that he does not intend to invest any additional amounts in Holdings at this time. See "Special Factors — Interests of Directors and Executive Officers."

- Q:

- Are there any conditions to the completion of the arrangement?

- A:

- The completion of the arrangement is subject to a number of conditions, in addition to securityholder and court approval, which are described under "The Arrangement Agreement — Conditions of Closing".

- Q:

- What will happen if the resolutions regarding the arrangement and continuance are not approved or the court order is not obtained?

- A:

- We will terminate the arrangement agreement and continue to carry on our business as a company organized under the CBCA should the resolutions not receive the required approval and/or the court order is not obtained. Given the factors regarding our business and our industry that our board of directors and special committee considered to recommend the arrangement, we may likewise determine it favourable to consider other strategic transactions that may become available to us. If we fail to complete the arrangement, in certain circumstances, we may be required to pay a termination payment and expense reimbursement to Holdings. See "The Arrangement Agreement — Termination of Arrangement Agreement" and " — Termination Payment and Expense Reimbursement" and "Risk Factors".

- Q:

- When will the arrangement be completed?

- A:

- We and Austin Ventures are working to complete the arrangement as quickly as possible. Subject to necessary approvals, we hope to complete the arrangement by August 15, 2006.

- Q:

- What will be the Canadian federal income tax consequences of the arrangement?

- A:

- A shareholder who is resident in Canada and who holds common shares as capital property will generally recognize a capital gain (or capital loss) for Canadian federal income tax purposes equal to the amount by which the amount of cash received for such common shares from Holdings under the arrangement, net of any reasonable costs of disposition, exceeds (or is less than) the holder's adjusted cost base of the common shares. Any capital gain realized by a shareholder who is a non-resident of Canada upon the holder's disposition of common shares to Holdings under the arrangement generally will not be subject to Canadian federal income taxation unless the common shares represent taxable Canadian property to the non-resident holder and do not constitute treaty protected property. See "Special Factors — Canadian Federal Income Tax Considerations".

2

- Q:

- What will be the U.S. federal income tax consequences of the arrangement?

- A:

- For United States federal income tax purposes, the arrangement will generally be treated as a taxable sale or exchange of common shares for cash by each shareholder. Unless certain rules applicable to "passive foreign investment companies" apply, a shareholder who is a U.S. person for tax purposes and who, on the date on which the arrangement is completed, holds common shares as a capital asset will generally recognize capital gain or loss by reason of the disposition of common shares under the arrangement in an amount equal to the difference between the amount of cash received by the shareholder and the shareholder's tax basis in its common shares. See "Special Factors — United States Federal Income Tax Considerations".

Shareholder Voting and Related Matters

- Q:

- Why am I receiving these materials?

- A:

- We are holding an annual and special meeting of securityholders. Shareholders will have a right to vote on all of the proposals to be considered at the meeting and are receiving this Circular, a form of proxy and a letter of transmittal. Holders of in-the-money options, have a right to vote on the Arrangement Resolution at the meeting and are receiving this Circular and a form of proxy.

- Q:

- What am I, as a shareholder, voting on?

- A:

- At the meeting, shareholders will:

- •

- be asked to consider a special resolution approving an arrangement under section 182 of the OBCA, or the Arrangement Resolution;

- •

- be asked to consider a special resolution continuing the Corporation under the OBCA and discontinuing the Corporation under the CBCA, or the Continuance Resolution;

- •

- receive the annual report of our company, including our financial statements as, at and for the year ended December 31, 2005, and the report of the auditors on those financial statements (without any action by our shareholders being required or proposed to be taken);

- •

- be asked to elect directors to hold office until the next annual meeting of shareholders or until their respective successors are elected or appointed;

- •

- be asked to appoint KPMG LLP as our independent auditors for fiscal 2006;

- •

- be asked to consider a resolution approving any adjournment of the meeting, if necessary to solicit additional proxies in favour of the Arrangement Resolution and/or the Continuance Resolution or otherwise to complete the arrangement, or the Adjournment Resolution; and

- •

- be asked to transact any other business as may properly be brought before the meeting.

In addition, holders of in-the-money options will convene with shareholders to consider and to vote with shareholders as a single class on the Arrangement Resolution.

The board of directors recommends that you vote FOR the Arrangement Resolution and the Continuance Resolution and FOR the election of directors nominated by management and the appointment of KPMG as our independent auditor.

The continuance and the arrangement will not proceed if the Continuance Resolution and the Arrangement Resolution are not approved at the meeting by the requisite vote. If the Continuance Resolution is approved by the requisite vote but the Arrangement Resolution is not approved by the requisite vote, we will not proceed with the continuance.

3

See "Particulars of the Arrangement — Votes Required at the Meeting Relating to the Arrangement", "Election of Directors", "Appointment of Auditors" and "The Continuance — Votes Required at the Meeting Relating to the Continuance".

- Q:

- What do I need to do now?

- A:

- We urge you to read this Circular carefully to understand the matters being voted on.To ensure your vote is counted, complete and return the enclosed form of proxy as soon as possible even if you attend the meeting in person. See "Appointment and Revocation of Proxies".

- Q:

- Can I change my vote after I have voted by proxy?

- A:

- Yes. If you are a registered shareholder and wish to change your vote before 5:00 p.m. (Pacific Daylight Time) on August 4, 2006 you may do so by re-voting. After that date you may change your vote by delivering a written statement, signed by you or your authorized attorney to:

- •

- the Corporate Secretary c/o 724 Solutions Inc., 20 York Mills Road, Suite 201, Toronto, Ontario, Canada, M2P 2C2 at any time up to and including August 4, 2006, or the business day preceding the day to which the meeting is adjourned; or

- •

- the Chairman of the meeting prior to the commencement of the meeting on the day of the meeting or the day to which the meeting is adjourned.

If you are a shareholder whose common shares are registered in the name of a broker, investment dealer, trust company or other intermediary you may revoke a voting instruction form or waiver of the right to receive meeting materials and to vote at any time by written notice to the intermediary, except that an intermediary is not required to act on a revocation that is not received by the intermediary at least seven days prior to the meeting.

See "Appointment and Revocation of Proxies".

- Q:

- If I am a shareholder, what will I be entitled to receive for my common shares in the arrangement?

- A:

- Each shareholder will be entitled to receive a cash payment from Holdings in the amount of $3.34 per common share. The cash will be paid in U.S. dollars to all recipients. See "Particulars of the Arrangement — Summary of the Arrangement".

- Q:

- How do shareholders receive their payment?

- A:

- If the Arrangement Resolution and the Continuance Resolution are approved by the requisite vote at the meeting, and the arrangement is consummated, shareholders who complete and return a letter of transmittal to Computershare Investor Services Inc. by mail to P.O. Box 7021, 31 Adelaide Street East, Toronto, Ontario M5C 3H2, Attention: Corporate Actions, or by registered mail, hand or by courier to 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, Attention: Corporate Actions, will receive a cash payment for their common shares.

Shareholders whose common shares are registered in the name of a broker, investment dealer, bank, trust company or other intermediary should contact that intermediary for instructions and assistance in delivering share certificates representing those common shares. See "Procedures for the Surrender of Share Certificates and Payment".

- Q:

- Which shareholders are entitled to vote?

- A:

- Each person who is a shareholder of record at the close of business on June 30, 2006, or the record date, for the meeting, as established under the provisions of the CBCA and the interim order of the court dated July 10, 2006, or the Interim Order, will be entitled to attend the meeting and vote in person or appoint a proxy nominee to attend the meeting and vote.

4

Under the Interim Order, in the event that a holder, or transferee, acquires common shares after June 30, 2006 and establishes ownership of the common shares and demands not later than 5:00 p.m. (Pacific Daylight Time) on July 28, 2006, to be included on the list of shareholders entitled to vote at the meeting, the transferee will be entitled to vote those common shares at the meeting. Although transferees who acquire their common shares after the record date for the meeting may attend the meeting and vote in person or by proxy, we are not soliciting proxies from those holders.

- Q:

- What constitutes a quorum at the meeting?

- A:

- The quorum required at the meeting is that number of persons present in person or represented by proxy holding not less than 331/3% of our outstanding common shares.

- Q:

- What votes are required at the meeting on the annual business matters?

- A:

- In the election of directors, the six nominees receiving the highest number of affirmative votes cast at the meeting by shareholders who vote in respect of the election of directors (present in person or represented by proxy) shall be elected as directors.The board of directors unanimously recommends that shareholders vote FOR the election of the directors nominated by management of our company.

The appointment of KPMG LLP as our independent auditors for fiscal 2006 must be approved by at least a majority of the votes cast at the meeting by shareholders who vote in respect of the appointment of the auditors (present in person or represented by proxy).The board of directors unanimously recommends that shareholders vote FOR the appointment of KPMG as our independent auditor. See "Election of Directors" and "Appointment of Auditors".

- Q:

- As a shareholder how do I vote?

- A:

- There are two ways that shareholders can vote. You may vote in person at the meeting or you may vote by mail, telephone or the internet in accordance with the instructions contained in the enclosed form of proxy.Whether or not you are able to attend the meeting, we encourage you to complete and return the enclosed form of proxy to ensure that your vote is counted in accordance with your instructions. The persons named in the form of proxy or some other person you choose, who need not be a shareholder, may be appointed by you to represent you as proxyholder and vote on your behalf at the meeting. If your common shares are held in the name of an intermediary, please see the voting instructions and the information under "Appointment and Revocation of Proxies — Non-Registered Holders".

- Q:

- What if I plan to attend the meeting and vote in person?

- A:

- Even if you plan to attend the meeting and vote in person, we recommend that you vote in accordance with the procedures outlined in the form of proxy to ensure your vote is counted. Even if you return a form of proxy, you can attend the meeting and your vote can be taken and counted at the meeting. Please register with Computershare Investor Services Inc., or the Transfer Agent, upon arrival at the meeting. If your common shares are held in the name of an intermediary, please see the information under "Appointment and Revocation of Proxies — Non-Registered Holders".

- Q:

- Who is soliciting my proxy?

- A:

- This Circular is furnished in connection with the solicitation by management of our company of proxies to be used at the meeting for the purposes set out in the notice of annual and special meeting accompanying this Circular and at any resumed meeting following any adjournment or adjournments of the meeting. The costs of the solicitation will be borne by us. It is expected that the solicitation will be made primarily by mail. Proxies may also be solicited by telephone, in writing or in person by our directors, officers or employees. We are not soliciting proxies from transferees who acquire common shares after June 30, 2006. We have also retained Georgeson Shareholder Communications Canada Inc., or Georgeson, to act as our proxy solicitation agent, for which it will be paid a fee of up to $45,000 and out-of-pocket expenses. This Circular, as applicable, and the accompanying proxy forms, letter of

5

transmittal and annual report to shareholders are expected to be first mailed to securityholders on or about July 17, 2006.

- Q:

- What happens if I abstain from voting on the proposals?

- A:

- If you return the form of proxy with instructions to abstain from voting on the proposals, your common shares will be counted for determining whether a quorum is present at the meeting. An abstention with respect to the proposals has the legal effect of a vote AGAINST the proposals and it will not be counted towards determining if the resolutions are approved.

- Q:

- What happens if I do not return the form of proxy or otherwise do not vote?

- A:

- Your failure to return the form of proxy or otherwise vote will mean that your common shares will not be counted toward determining whether a quorum is present at the meeting and whether the proposals are approved.

- Q:

- Can I appoint someone other than these directors to vote on my behalf at the meeting?

- A:

- Yes. Write the name of this person, who need not be a securityholder, in the blank space provided in the form of proxy.

It is important to ensure that any other person you appoint is attending the meeting and is aware that he or she has been appointed to vote your common shares or in-the-money options, as applicable. Proxyholders should, upon arrival at the meeting, present themselves to a representative of the Transfer Agent.

- Q:

- What do I do with a completed form of proxy if I am voting by mail?

- A:

- Return your dated and signed form of proxy in the postage prepaid envelope provided so that it arrives not later than 5:00 p.m. (Pacific Daylight Time) on August 4, 2006. This will ensure that your vote is recorded.

- Q:

- When are proxies due if I am voting by telephone or the Internet?

- A:

- Proxies are due at the same time as those that are sent by fax or by mail, by 5:00 p.m. (Pacific Daylight Time) on August 4, 2006.

- Q:

- How will my common shares be voted if I give a proxy?

- A:

- Signing an enclosed form of proxy gives authority to Ian Giffen, James Dixon or Barry Reiter, each of whom is a director of our company, or to another person you have appointed, to vote your common shares at the meeting. The persons named on a form of proxy must vote your common shares for or against the various matters, or abstain from voting your common shares, in accordance with your directions.In the absence of such directions, however, if you appoint the above management representatives as your proxy, your common shares will be voted:

- •

- FOR the Arrangement Resolution;

- •

- FOR the Continuance Resolution;

- •

- FOR the Adjournment Resolution;

- •

- FOR the election of the directors nominated by management of our company; and

- •

- FOR the appointment of KPMG LLP as our independent auditor.

6

- Q:

- What if amendments are made to these matters or if other matters are brought before the meeting?

- A:

- The persons named in the form of proxy will have discretionary authority with respect to amendments or variations to matters identified in the notice of annual and special meeting and with respect to other matters that may properly come before the meeting, to the extent permitted by applicable law.

As of the date of this Circular neither our board of directors nor our management knows of any such amendment, variation or other matter expected to come before the meeting. If any other matters properly come before the meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment.

- Q:

- How many common shares are shareholders entitled to vote?

- A:

- As of June 26, 2006, there were 6,074,703 outstanding common shares. Each shareholder has one vote for each common share held at the close of business on the record date. To the knowledge of the directors and management of our company, no one person owns or exercises control or direction over more than 5% of our outstanding common shares other than the Austin Ventures Parties who, as of June 26, 2006, beneficially owned a total of 566,766 common shares (including 5,162 common shares held by affiliates of Austin Ventures), representing 9.3% of the outstanding common shares, and held $8,000,000 in secured convertible notes, or the Notes, plus approximately $1,199,573 in accrued interest on the Notes at that date (the principal and accrued interest are convertible into 2,996,599 common shares).

As of June 26, 2006, the directors and executive officers of our company, as a group, beneficially owned 81,722 common shares, representing 1.3% of the outstanding common shares, and in-the-money options, to purchase up to 107,100 common shares representing 71.2% of the total common shares subject to all in-the-money options. See "Voting Securities and Principal Holders".

- Q:

- If my common shares are held in street name by my broker or other intermediary, will my broker or other intermediary vote my shares for me?

- A:

- A broker or other intermediary will vote the common shares held by you only if you provide instructions to them on how to vote. Without instructions, your common shares will not be voted. Shareholders should instruct their broker or other intermediary to vote their common shares by following the directions that they provide.

- Q:

- Who counts the votes?

- A:

- The Transfer Agent counts and tabulates the proxies. This is done independently of us to preserve the confidentiality of individual securityholder votes. Proxies are referred to us only in cases where a securityholder clearly intends to communicate with management or when it is necessary to do so to meet the requirements of applicable law.

- Q:

- Should I send in my letter of transmittal and share certificates now?

- A:

- A letter of transmittal is enclosed. You may send in the letter of transmittal and your share certificates, now to Computershare Investor Services Inc., or the Depositary, or at any time until five years after the completion of the arrangement. You will not receive any amounts due to you under the arrangement until your letter of transmittal and share certificates are sent to the Depositary.

Shareholders whose common shares are registered in the name of a broker, investment dealer, bank, trust company or other intermediary should contact that intermediary for instructions and assistance in delivering share certificates representing those common shares.

See "Procedures for the Surrender of Share Certificates and Payment".

7

- Q:

- What happens if I send in my share certificates and the arrangement is not approved?

- A:

- If the required resolutions are not approved or if the arrangement does not otherwise proceed, your share certificates will be returned by the Depositary.

- Q:

- What votes are required at the meeting to approve the proposals related to the arrangement?

- A:

- The Arrangement Resolution must be approved by at least 662/3% of the votes cast at the meeting by shareholders and holders of in-the-money options entitled to vote at the meeting (present in person or represented by proxy), voting together as one class. In addition, the Arrangement Resolution must be approved by a majority of the votes cast at the meeting by shareholders entitled to vote at the meeting (present in person or represented by proxy) excluding votes in respect of common shares held by Austin Ventures, Mr. Aragona and Mr. Sims, or the Interested Persons.The board of directors (with Messrs. Aragona, Scott and Sims abstaining) unanimously recommends that securityholders vote FOR the Arrangement Resolution.

The Continuance Resolution must be approved by at least 662/3% of the votes cast at the meeting by shareholders entitled to vote at the meeting (present in person or represented by proxy).The board of directors (with Messrs. Aragona, Scott and Sims abstaining) unanimously recommends that shareholders vote FOR the Continuance Resolution.

The arrangement will not proceed if the Arrangement Resolution or the Continuance Resolution is not approved at the meeting by the requisite vote. See "Particulars of the Arrangement — Votes Required at the Meeting Relating to the Arrangement" and "The Continuance — Votes Required at the Meeting Relating to the Continuance".

- Q:

- In addition to approval by securityholders, are there any other approvals required for the arrangement?

- A:

- The arrangement requires the approval of the court under the final order of the court, or Final Order, as the order may be amended or varied by the court at any time prior to 12:01 a.m. on the date shown on the certificate of arrangement, or the Effective Time or, if appealed, then (unless such appeal is withdrawn or denied) as affirmed on appeal prior to the Effective Time. The notice of application for the final order of the court, or the Final Order, is attached as Appendix F to this Circular.

Prior to the mailing of this Circular, we obtained the Interim Order authorizing and directing us to call, hold and conduct the meeting and to submit the Arrangement Resolution to securityholders for approval. A copy of the Interim Order is attached as Appendix E to this Circular.

Subject to the approval of the Arrangement Resolution by the requisite vote of securityholders and of the Continuance Resolution by the requisite vote of shareholders, the hearing in respect of the Final Order is expected to take place on August 14, 2006. Court approval of the Final Order will be granted if the court determines that the arrangement meets the requirements of the OBCA and the Interim Order granted by the court; nothing has been done or purported to be done that is not authorized by the OBCA; and the arrangement is fair and reasonable. Whether an arrangement is fair and reasonable depends on procedural and substantive considerations. See "Particulars of the Arrangement — Court Approval and Completion of the Arrangement".

- Q:

- Are shareholders entitled to dissent rights?

- A:

- Yes. Registered shareholders have the right to dissent from the Continuance Resolution upon strict compliance with section 190 of the CBCA and under the Interim Order and the right to dissent from the Arrangement Resolution upon strict compliance with section 185 of the OBCA as modified by the Interim Order. Persons who are beneficial holders of common shares, for example, shareholders who hold their shares in "street name", and persons who are holders of in-the-money options, should be aware that only registered holders of common shares are entitled to exercise these rights of dissent. See "Dissent Rights of Shareholders" and Appendix G to this Circular. It is a condition to the completion

8

of the arrangement that dissent rights in connection with the Arrangement Resolution shall not have been exercised by shareholders holding more than 10% of the outstanding common shares.

- Q:

- What happens if I acquire common shares after the record date?

- A:

- If you acquire your shares after the record date, you may be able to vote the shares at the meeting either personally or by proxy, but management is not soliciting your proxy.

The Position of the Board and the Special Committee, the Austin Ventures Parties

and the Chief Executive Officer

- Q:

- Does the board of directors support the arrangement and related transactions?

- A:

- Yes. Our board of directors (with Messrs. Aragona, Scott and Sims abstaining) approved the arrangement agreement following the report and favourable recommendation of its special committee of directors independent of management of our company and independent of Austin Ventures who reviewed and considered the arrangement. In doing so, our board of directors (with Messrs. Aragona, Scott and Sims abstaining) determined that the arrangement is in the best interests of our company and fair to our unaffiliated shareholders, and authorized the submission of the arrangement and related matters to securityholders for approval. See "Special Factors — Position of the Board of Directors and the Special Committee as to Fairness".The board of directors (with Messrs. Aragona, Scott and Sims abstaining) unanimously recommends that securityholders vote FOR the Arrangement Resolution.

- Q:

- How did the board of directors and the special committee reach that conclusion?

- A:

- In reaching its conclusion that the arrangement is substantively and procedurally fair to unaffiliated shareholders, and that the arrangement is in the best interests of our company, our special committee considered and relied upon a number of factors, including the following:

- •

- its understanding of our industry and its assessment of our future prospects, including the fact that no developments in our industry or unique to our company were expected to occur in the near future that would substantially raise the value of our common shares, as well as the factors set forth in the section "Special Factors — Reasons for the Arrangement — From the Corporation's Perspective";

- •

- the absence of a superior proposal despite significant efforts by our special committee and financial advisor;

- •

- the Fairness Opinion, as described in "Special Factors — Fairness Opinion";

- •

- the Formal Valuation, as described in "Special Factors — Formal Valuation";

- •

- the fact that the special committee had been successful in obtaining an increase of $0.27, or 8.8%, per common share, in the price per common share offered by Austin Ventures from the price initially proposed;

- •

- the fact that the trading volume of our common shares is low and as such the quoted market price of our common shares, even if more than $3.34 per share, may not be a fair indicator of the price at which a third party would acquire or make a substantial investment in our company, as transactions involving a relatively small number of shares could disproportionately increase or decrease the market price of our common shares;

- •

- the current and historical market prices for our common shares, including those set forth in the table in the section "Information Concerning the Corporation — Market for Securities," which had at certain times traded below the price of $3.34 per share, and could possibly trade in the near future for less than $3.34 per share in the absence of any positive business developments;

- •

- the fact that the consideration under the arrangement will be paid entirely in cash, which provides an objective degree of value;

9

- •

- procedurally, the arrangement is conditional upon the approval of the Arrangement Resolution by at least 662/3% of the votes cast at the meeting by shareholders and holders of in-the-money options entitled to vote at the meeting (present in person or represented by proxy), voting together as one class and the approval of a majority of the votes cast at the meeting by shareholders entitled to vote at the meeting (present in person or represented by proxy), excluding votes in respect of common shares held by Interested Persons;

- •

- completion of the arrangement will be subject to a determination as to its fairness by the court;

- •

- the ability of registered shareholders who do not vote in favour of the Arrangement Resolution to require a judicial appraisal of their common shares and to obtain "fair value" under the arrangement dissent procedures, as described below;

- •

- the failure of other parties to come forward with superior proposals despite the opportunities to do so after the announcement of the Austin Ventures' proposal and prior to the execution of the arrangement agreement; and

- •

- the ability of our board of directors, in certain circumstances, to consider and recommend approval of any superior proposal, as described below.

In adopting the special committee's recommendations and concluding that the arrangement is substantively and procedurally fair to the unaffiliated shareholders and that the arrangement is in the best interests of our company, our board of directors considered and relied upon the same factors and considerations that the special committee relied upon, as described above. See "Special Factors — Position of the Board of Directors and the Special Committee as to Fairness".

- Q:

- What is the position of the Austin Ventures Parties as to Fairness?

- A:

- The Austin Ventures Parties believe that the arrangement is substantively and procedurally fair to the unaffiliated shareholders of our company. However, Austin Ventures attempted to negotiate the transaction that would be most favourable to it, and not to the shareholders of our company, and accordingly did not negotiate the arrangement agreement with a goal of obtaining terms that were fair to such unaffiliated shareholders. The Austin Ventures Parties have noted that the unaffiliated shareholders were, as described elsewhere in this Circular, represented by the special committee of non-employee directors independent of Austin Ventures that negotiated with Austin Ventures on behalf of those shareholders, with the assistance of a financial advisor and a legal advisor. The Austin Ventures Parties have also noted that the arrangement was approved by a majority of the non-employee directors independent of Austin Ventures and must be approved by a majority of the shareholders other than the Interested Persons. However, no Austin Ventures Party has undertaken any formal valuation of the fairness of the arrangement to the unaffiliated shareholders or engaged a financial advisor for that purpose. Moreover, no Austin Ventures Party participated in the deliberations of the special committee or received advice from the special committee's financial advisor or legal advisor. See the factors set forth in "Special Factors — Position of the Austin Ventures Parties as to Fairness."

- Q:

- What is the position of the Chief Executive Officer as to Fairness?

- A:

- Mr. Sims believes that the arrangement is substantively and procedurally fair to the unaffiliated shareholders of our company. Mr. Sims has noted that our unaffiliated shareholders were, as described elsewhere in this Circular, represented by the special committee of non-employee directors that negotiated with Austin Ventures on their behalf, with the assistance of a financial advisor and a legal advisor. Mr. Sims has also noted that the arrangement was approved by a majority of the non-employee directors and must be approved by a majority of the shareholders other than the Interested Persons. However, Mr. Sims has not undertaken any formal valuation of the fairness of the arrangement to those shareholders or engaged a financial advisor for that purpose. Moreover, although Mr. Sims was invited as an officer of the company to attend portions of the meetings of the special committee Mr. Sims has not participated in the deliberations of the special committee or received advice from the special

10

committee's financial advisor or legal advisor. See the factors set forth in "Special Factors — Position of the Chief Executive Officer as to Fairness."

Interests of Our Directors and Executive Officers

- Q:

- Do any of our directors or executive officers have an interest in the matters to be acted upon at the meeting?

- A:

- Mr. Aragona, one of our directors, and Mr. Sims, our chief executive officer, each have an interest in the matters acted upon at the meeting.

Mr. Aragona is a general partner of the general partners of Austin Ventures. Mr. Aragona serves on our board of directors as a designee of Austin Ventures.

Mr. John J. Sims is our chief executive officer and is expected to continue in that position after completion of the transaction. Mr. Sims is not a party to the arrangement, but was offered the opportunity to purchase up to $1,000,000 of Holdings' capital stock which stock in the resulting company would be contingent on his remaining as chief executive officer for some period of time. Mr. Sims and Holdings have entered into an agreement that provides for Mr. Sims' contribution of our common shares held by him in exchange for shares of convertible preferred stock of Holdings. Mr. Sims has indicated that he does not intend to invest any additional amounts in Holdings at this time. See "Special Factors — Interests of Directors and Executive Officers."

Mr. Benjamin L. Scott, one of our directors, is associated with Austin Ventures as a venture partner of the management company of Austin Ventures. Mr Scott serves on our board of directors as a designee of Austin Ventures. Mr. Scott has no personal financial interest in the arrangement.

Under the arrangement, all holders of in-the-money options, including certain of our directors and executive officers, will receive cash consideration in an amount per share equal to the difference between $3.34 and the exercise price.

Under the arrangement agreement, we and Holdings have agreed to maintain the indemnification agreements currently in place with our directors, officers and employees, as well as our current directors' and officers' liability insurance and fiduciary liability insurance maintained by us and our subsidiaries, for a period of six years following the Effective Date.

See "Special Factors — Interests of Directors and Executive Officers".

Voting by Holders of Options and Related Matters

- Q:

- Which holders of options are entitled to vote?

- A:

- Each person who is a holder of in-the-money options at the close of business on the record date for the meeting will be entitled to attend the meeting in person or appoint a proxy nominee to attend the meeting. At the meeting, holders of in-the-money options will be asked to consider the Arrangement Resolution.

Under the Interim Order, in the event that any holder of options to purchase common shares is issued common shares upon exercise of options after the record date and the holder establishes ownership of the common shares and demands not later than 5:00 p.m. (Pacific Daylight Time) on July 28, 2006 to be included on the list of shareholders entitled to vote at the meeting, the shareholder will be entitled to vote these common shares at the meeting. As of June 26, 2006 there were outstanding in-the-money options entitling holders thereof to purchase up to 150,422 common shares. Each holder of in-the-money options has one vote for each common share underlying the holder's in-the-money option. As of June 26, 2006, the common shares underlying the in-the-money options represented approximately 2.4% of the combined class of holders of common shares and in-the-money options.

11

- Q:

- As a holder of in-the-money options how do I vote?

- A:

- There are two ways that holders of in-the-money options can vote. You may vote in person at the meeting or you may vote by mail, telephone or the Internet in accordance with the instructions contained in the enclosed form of proxy.Whether or not you are able to attend the meeting, we encourage you to complete and return the enclosed form of proxy to ensure that your vote is counted in accordance with your instructions. The persons named in the form of proxy or some other persons you choose, who need not be a securityholder, may be appointed by you to represent you as proxyholder and vote on your behalf at the meeting. See "Appointment and Revocation of Proxies".

- Q:

- As a holder of in-the-money options, what if I plan to attend the meeting and vote in person?

- A:

- Even if you plan to attend the meeting and vote in person we recommend that you vote in accordance with the procedures outlined in the form of proxy to ensure you vote is counted. Even if you return a form of proxy, you can attend the meeting and your vote can be taken and counted at the meeting. Please register upon arrival at the meeting.

- Q:

- If I am a holder of in-the-money options, what will I receive?

- A:

- Each in-the-money option will be cancelled by us in exchange for a cash payment by us in an amount equal, for each option, to the difference between $3.34 and the exercise price of that in-the-money option (less any required withholding taxes). The cash will be paid in U.S. dollars to all recipients. As of June 26, 2006 there were outstanding in-the-money options to purchase up to 150,422 common shares and we estimate that approximately $41,875 will be paid to the holders of the in-the-money options under the arrangement. See "Particulars of the Arrangement — Options".

- Q:

- What will happen to options that are not in-the-money options?

- A:

- Each option outstanding immediately prior to the Effective Time, other than an in-the-money option, will be terminated.

- Q:

- How will my in-the-money options be voted if I give a proxy?

- A:

- Signing an enclosed form of proxy gives authority to Ian Giffen, James Dixon or Barry Reiter, each of whom is a director of our company, or to another person you have appointed, to vote your options at the meeting. The persons named on the form of proxy must vote your in-the-money options for or against the various matters, or abstain from voting your options in accordance with your directions.In the absence of such directions however, if you appoint the above directors, as your proxy, your in-the-money options will be voted FOR the Arrangement Resolution.

12

General Matters

- Q:

- Who do I call if I have questions about the Circular or the form of proxy?

- A:

- If you are a shareholder, and have any questions about the Circular or the form of proxy please contact Georgeson,

| by mail at: | | or by telephone: |

Georgeson Shareholder Communications Canada Inc.

100 University Avenue

11th Floor, South Tower

Toronto, Ontario

M5J 2Y1 |

|

North American toll-free number at

1-866-606-0404 |

If you are a holder of in-the-money options, and have any questions about the Circular or the form of proxy please contact Stephen Morrison, our Chief Financial Officer and Senior Vice-President, Corporate Services,

| by mail at: | | or by telephone: |

724 Solutions Inc.

1221 State Street, Suite 200

Santa Barbara, California

USA 93101 |

|

1-805-884-8308 |

- Q:

- Who do I call if I have questions about the letter of transmittal?

- A:

- If you are a shareholder, and have questions about the letter of transmittal, please contact the Depositary,

| by mail at: | | or by telephone: |

Computershare Investor Services Inc.

P.O. Box 7021, 31 Adelaide St. E.

Toronto, Ontario

M5C 3M2 |

|

Toll Free: 1-800-564-6253

Collect: 1-514-982-7555 |

13

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Circular contains information about the timetable for the arrangement, our future business prospects and potential effects of the arrangement that constitute "forward-looking statements". These statements may include statements regarding the period following the completion of the arrangement, the expected timetable for completing the arrangement, the benefits of the proposed arrangement and any other statements about future expectations, benefits, goals, plans or prospects.

Words such as "may," "could," "anticipates," "estimates," "expects," "projects," "intends," "plans," "believes" and words and terms of similar substance used in connection with any discussion identify forward-looking statements. All forward-looking statements are based on present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These factors include:

- •

- the possibility that the arrangement may not be completed in a timely manner if at all, which may adversely affect our business;

- •

- the possibility that the Arrangement Resolution and/or the Continuance Resolution may not be approved at the meeting;

- •

- the timing of, and judicial, legal, regulatory and other conditions associated with, the completion of the arrangement;

- •

- the possibility that the arrangement may adversely affect our results of operations, whether or not we complete the arrangement; and

- •

- the potential loss of key customers, suppliers, strategic partners or employees as a result of our announcement of the arrangement.

Whether or not the arrangement is completed, our business is subject to the risks and uncertainties described in the section "Risk Factors" in this Circular. These risks include, among other things, our history of losses, our limited customer base, and our significant competition in our target markets.

Securityholders are cautioned not to place undue reliance on the forward-looking statements. These statements speak only as of the date of this Circular. We assume no obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

SPECIAL FACTORS

Background to the Arrangement Agreement

We were formed in July 1997 and introduced our initial products in 1999. Initially, we focused on creating wireless software products that assisted financial services companies in making their traditional services available to their customers wirelessly from mobile phones and other handheld computing devices.

Our common shares began trading on Nasdaq and the TSX in January 2000. Since our common shares began trading, our board of directors has implemented various measures in an effort to enhance shareholder value, including acquisitions, restructurings, and financings.

We have completed four acquisitions, of which the most significant is our January 2001 acquisition of Tantau Software, Inc., or Tantau. As part of the transaction, we issued to Tantau's equity holders 1.9 million shares, and outstanding options to purchase shares of Tantau were converted into options to purchase an aggregate of 180,000 of our shares (all adjusted for the 10 for 1 reverse share split undertaken in April 2003). After the completion of the transaction, our shareholders owned approximately 68% of the combined company and Tantau's shareholders owned approximately 32% of the combined company, on a fully diluted basis. Austin Ventures acquired its initial common share interest in our company through the Tantau transaction.

14

The purpose of the Tantau acquisition was to create a global provider of mobile data software primarily for the global mobile data services marketplace. Our combined company was intended to have an expanded geographic presence and set of customers, strong infrastructure and application technology, an experienced management team, and a greater ability to address a broader market, including the mobile network operator market. Our X-treme Mobility Gateway and several of our other products that we sell to mobile network operators incorporate technology that we acquired through our purchase of Tantau. Following the completion of the Tantau transaction, John J. Sims, Tantau's president and chief executive officer, assumed the role of chief executive officer of our company.

During 2002, we concluded that the adoption of wireless technologies by the financial services industry had slowed considerably. At the same time, we judged that the market for mobile data services in the mobile network operator sector was potentially larger and likely to develop sooner. As a consequence, we began a process to restructure our company to focus on business opportunities in the mobile network operator marketplace. During 2004, we completed this process and are now focused on selling our software products to mobile network operators.

In early 2003, our common shares were trading below the $1.00 per share minimum trading price set out by Nasdaq's listing requirements. We were advised by Nasdaq that we must cure our minimum trading price issue by June 9, 2003 in order to maintain our Nasdaq listing. In April 2003, we sought and obtained our shareholders' approval to consolidate our outstanding common shares on a ten old common shares for one new common share basis. This reverse share split was effected to assist us in maintaining our Nasdaq listing, and to potentially increase the attractiveness of our common shares as an investment.

In order to help ensure that we would have sufficient capital to take advantage of our core business opportunities, we have taken significant actions to reduce our operating expenses and in May and June 2004 we raised $8,000,000 in two tranches through the sale of Notes to Austin Ventures. The second tranche of the financing was completed after we received shareholder approval. The interest on the Notes and all interest owing are convertible at the option of the holder into common shares at the conversion price of the Notes, currently $3.07 per share. The interest payable quarterly is payable in cash or, in common shares at the conversion price provided our common shares are trading at or above that price at the time of the interest payment. Austin Ventures is our largest beneficial shareholder. Assuming that all amounts outstanding under the Notes as of June 26, 2006 are converted into common shares at the conversion price of $3.07 and that no additional common shares are issued, Austin Ventures would be deemed to beneficially own 39.1% of our issued and outstanding common shares. See "Interests of Insiders in Material Transactions — Austin Ventures".

In connection with our quarterly payment of interest due under the Notes we made quarterly interest payments to Austin Ventures in common shares of 33,549 common shares on January 4, 2005 and 35,259 common shares on January 3, 2006.

On April 27, 2005, our senior management, as part of a routine strategy update at a regularly scheduled board meeting, discussed with our board of directors a number of matters related to our current and future operations, including our company's then current growth rate, market conditions in the mobile data market, risks to our business, the status and activities of our primary competitors and the changing environment in which public companies operate.