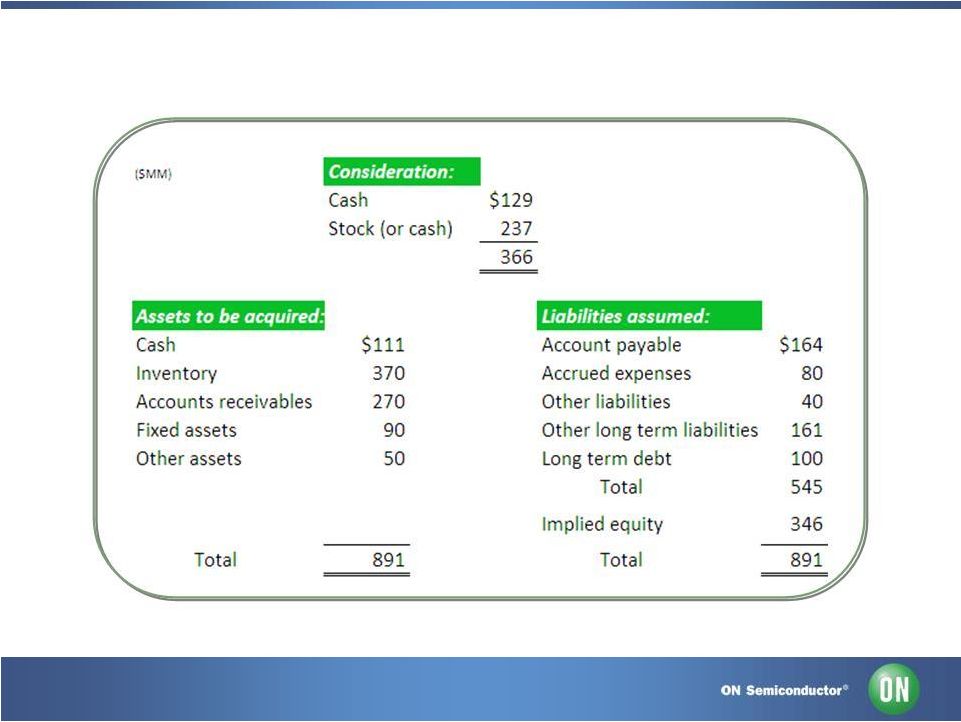

23 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements related to the proposed transaction between ON Semiconductor and SANYO Electric, including the actual amount of consideration to be received by SANYO Electric in the transaction; the closing and the anticipated timing of the closing and the effects of the proposed transaction on ON Semiconductor. Forward-looking statements also include statements regarding the potential benefits of the transaction, including the combined businesses’ projected and pro forma revenue, gross margin, cash flow and other financial results; expected cost savings, economies of scale, cross selling opportunities and expansion of addressable market; the goal to deliver in excess of $30 million in pre-tax income on a quarterly basis approximately six quarters after closing; expected rates of post-manufacturing integration; the expectation that the transaction will be accretive to ON Semiconductor approximately twelve months after the closing; the expected recovery of the Japan semiconductor market and increases to the region’s capital spending; the combined businesses’ integration plans and ON Semiconductor’s positioning to realize greater scale, diversity and growth opportunities and significant long term stock price appreciation potential. These forward-looking statements are based on information available to ON Semiconductor as of the date of this presentation. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. Such risks and uncertainties include a variety of factors, some of which are beyond ON Semiconductor’s control. In particular, such risks and uncertainties include difficulties encountered in integrating acquired businesses; the risk that the transaction does not close when anticipated, or at all; pricing and demand for semiconductor products; dependence on each company’s ability to successfully manufacture in increasing volumes on a cost- effective basis and with acceptable quality for its current products; the adverse impact of increased competition; changes in overall economic conditions and markets, including the current credit markets; changes in demand for ON Semiconductor 's or SANYO Semiconductor's products; changes in customers’ purchasing habits or procedures; technological and product development risks; availability of raw materials; changes in manufacturing yields; control of costs and expenses; significant litigation; risks associated with acquisitions and dispositions; risks associated with leverage and restrictive covenants in debt agreements; risks associated with international operations including foreign employment and labor matters associated with unions and collective bargaining agreements; the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally; and risks involving environmental or other governmental regulation. Information concerning additional factors that could cause results to differ materially from those projected in the forward-looking statements is contained in ON Semiconductor’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission (the “SEC”) on February 25, 2010, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other of ON Semiconductor’s SEC filings. These forward-looking statements should not be relied upon as representing ON Semiconductor’s views as of any subsequent date and neither undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made. |