onsemi to Acquire GT Advanced Technologies (“GTAT”) August 25, 2021 Exhibit 99.2

Certain statements in this presentation, including, among others, the expected closing of the transactions and the potential effects thereof, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “should,” or “anticipates,” and similar expressions. All forward-looking statements in this presentation are made based on onsemi’s current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. Among these, such risks and uncertainties include, but are not limited to, the risk that one or more closing conditions to the transaction may not be satisfied or waived, on a timely basis or otherwise, and the risk that the transaction does not close when anticipated, or at all, including the risk that the requisite regulatory approvals may not be obtained. Additional factors that could cause results to differ materially from those projected in the forward-looking statements are contained in onsemi’s 2020 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other of onsemi’s filings with the SEC. onsemi assumes no obligation to update such information, except as may be required by law. Safe Harbor Statement 6/17/21

GTAT Overview Outstanding Silicon Carbide (SiC) crystal growth technology Key material for next-generation semiconductors that significantly improve efficiency in electric vehicles (EVs), EV charging and energy infrastructure Business model based on supplying SiC crystal to downstream partners specializing in wafering, polishing and subsequent fabrication Since March 2020, onsemi has been partnered with GTAT for the supply of SiC boules Founded in 1994 and headquartered in Hudson, New Hampshire Additional offices in Missoula, MT, Salem, MA and Shanghai, China Approximately 119 employees globally SiC boule Advanced automated SiC crystal growth systems

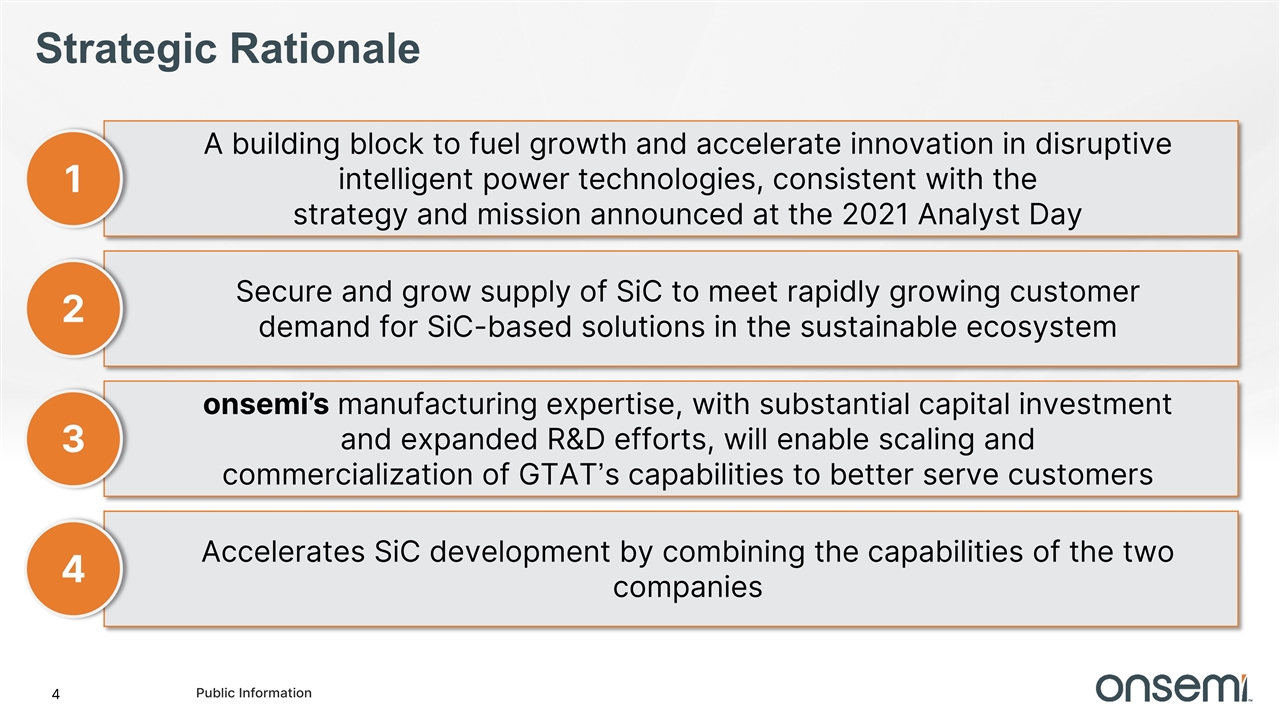

Strategic Rationale A building block to fuel growth and accelerate innovation in disruptive intelligent power technologies, consistent with the strategy and mission announced at the 2021 Analyst Day 1 Accelerates SiC development by combining the capabilities of the two companies Secure and grow supply of SiC to meet rapidly growing customer demand for SiC-based solutions in the sustainable ecosystem onsemi’s manufacturing expertise, with substantial capital investment and expanded R&D efforts, will enable scaling and commercialization of GTAT’s capabilities to better serve customers 3 2 4

onsemi’s Platform Provides a Launchpad for Growth GTAT Capabilities Leading crystal development R&D capabilities Outstanding SiC technology that is scalable with substantial investment and manufacturing expertise Relationships with key customers in SiC ecosystem onsemi Platform Benefits Complementary R&D capabilities with expertise in key markets will accelerate GTAT’s development efforts Resources and capital to invest in growth and strong manufacturing expertise to scale the business Deep domain expertise and established relationships in existing end-markets and channels

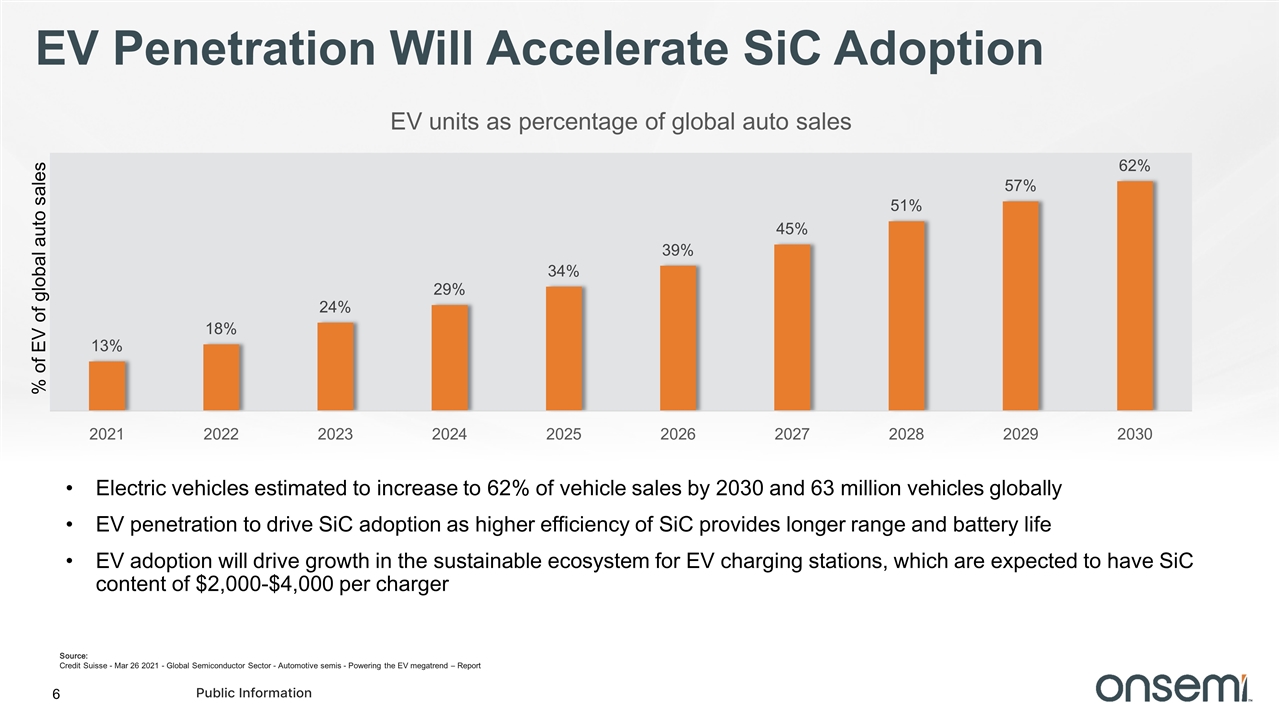

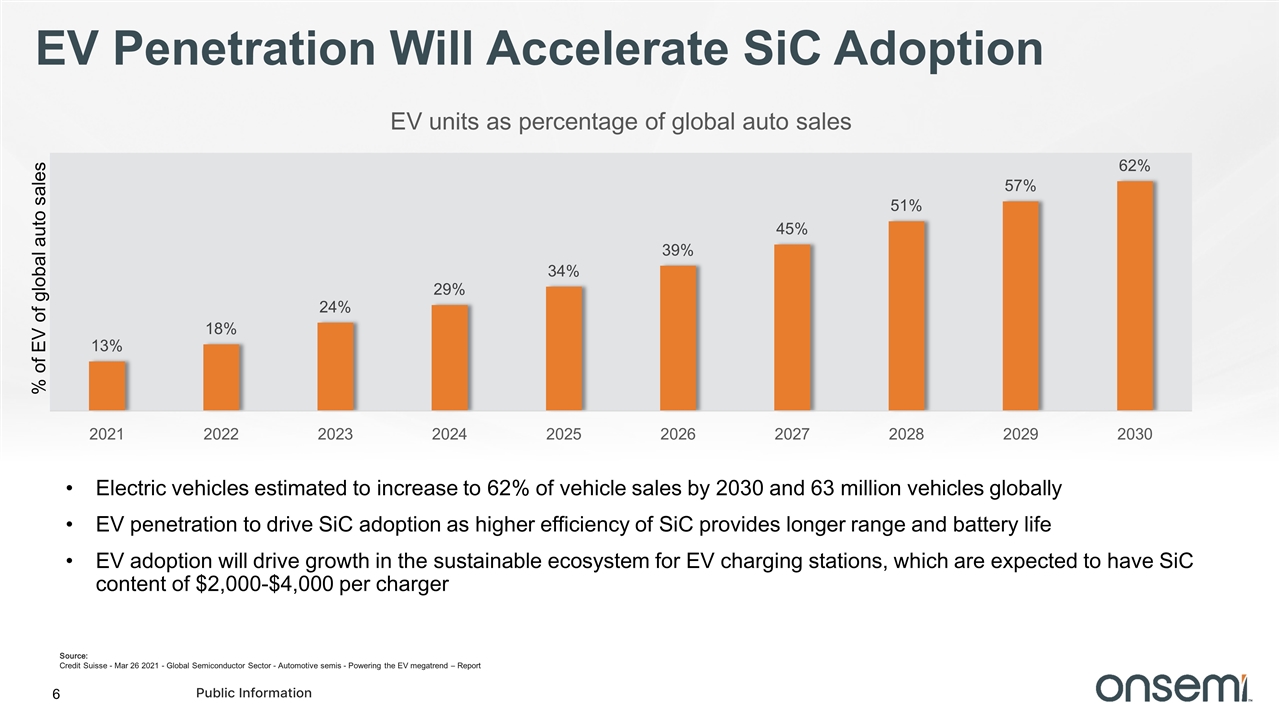

EV Penetration Will Accelerate SiC Adoption 6 Electric vehicles estimated to increase to 62% of vehicle sales by 2030 and 63 million vehicles globally EV penetration to drive SiC adoption as higher efficiency of SiC provides longer range and battery life EV adoption will drive growth in the sustainable ecosystem for EV charging stations, which are expected to have SiC content of $2,000-$4,000 per charger Source: Credit Suisse - Mar 26 2021 - Global Semiconductor Sector - Automotive semis - Powering the EV megatrend – Report % of EV of global auto sales

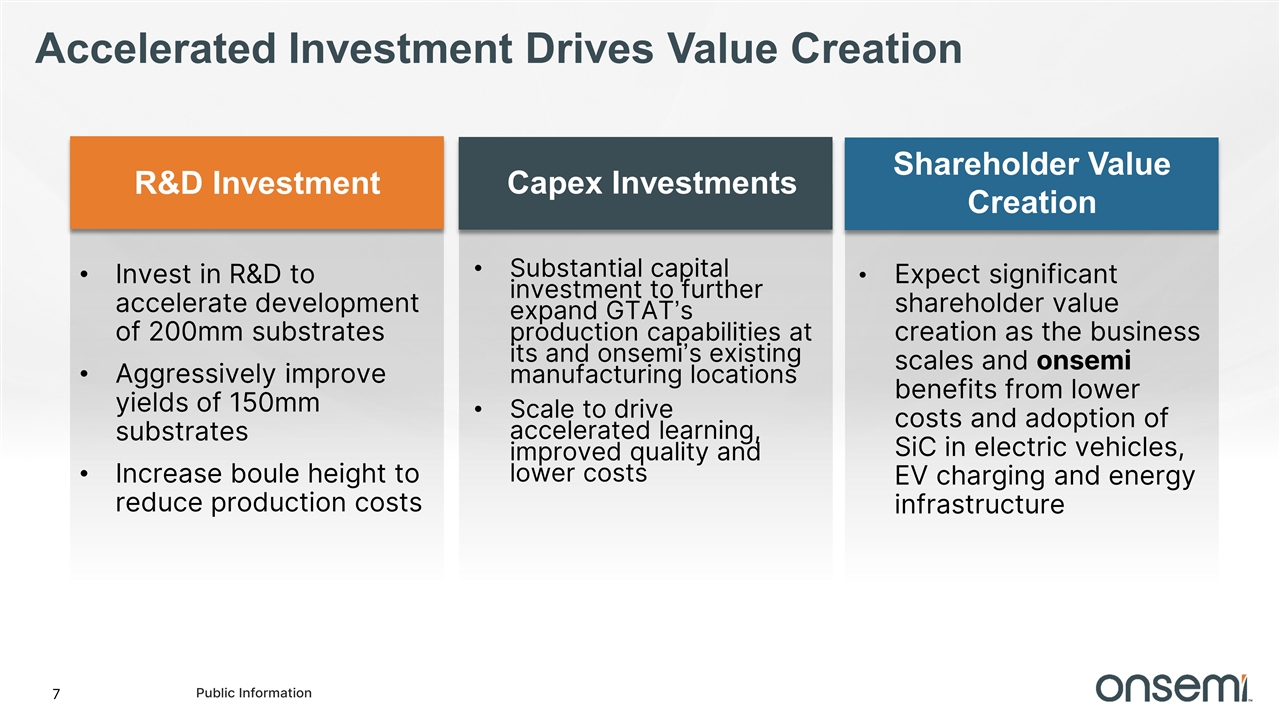

Accelerated Investment Drives Value Creation R&D Investment Capex Investments Shareholder Value Creation Invest in R&D to accelerate development of 200mm substrates Aggressively improve yields of 150mm substrates Increase boule height to reduce production costs Substantial capital investment to further expand GTAT’s production capabilities at its and onsemi’s existing manufacturing locations Scale to drive accelerated learning, improved quality and lower costs Expect significant shareholder value creation as the business scales and onsemi benefits from lower costs and adoption of SiC in electric vehicles, EV charging and energy infrastructure

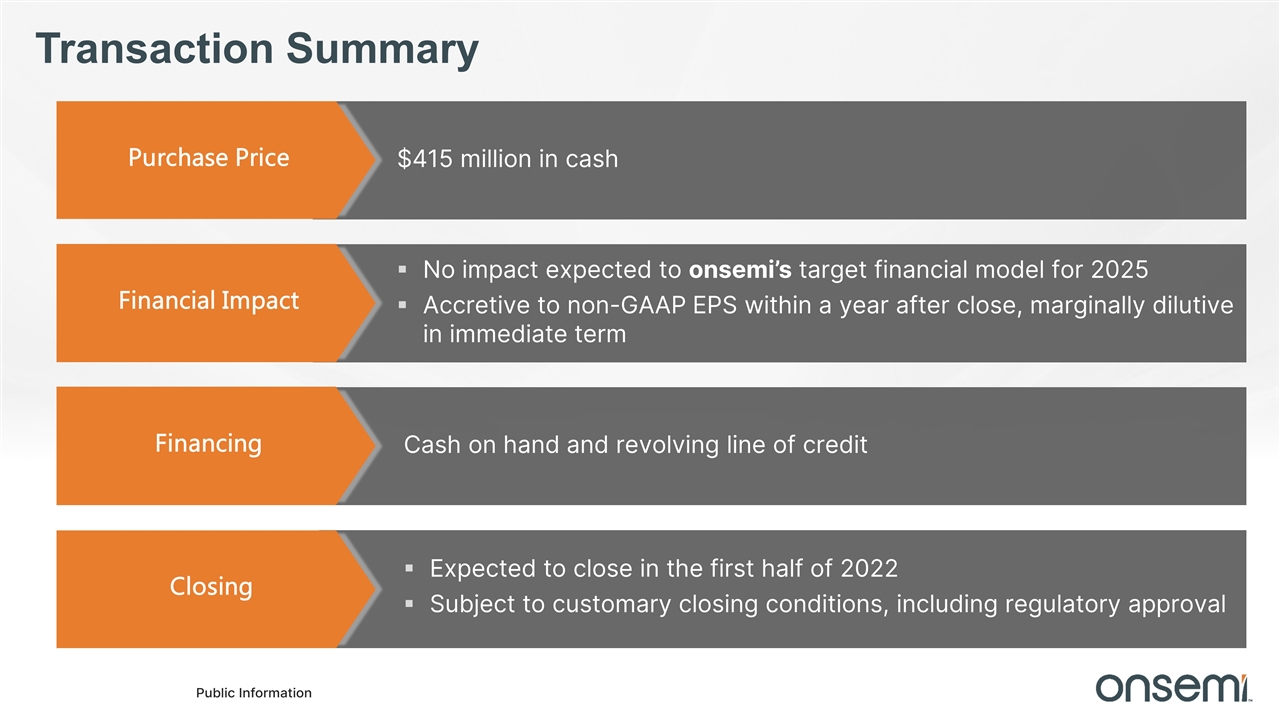

Transaction Summary $415 million in cash Purchase Price No impact expected to onsemi’s target financial model for 2025 Accretive to non-GAAP EPS within a year after close, marginally dilutive in immediate term Financial Impact Cash on hand and revolving line of credit Financing Expected to close in the first half of 2022 Subject to customary closing conditions, including regulatory approval Closing