Safe Harbor Statement and Non-GAAP Measures

2

Safe Harbor Statement: Except for historical matters contained herein, the matters discussed in this presentation are forward-looking statements. The forward-

looking statements reflect assumptions and involve risks and uncertainties that may affect Genius Products’ business, forecasts, projections and prospects, and cause

actual results to differ materially from those in these forward-looking statements. These forward-looking statements include, but are not limited to, statements

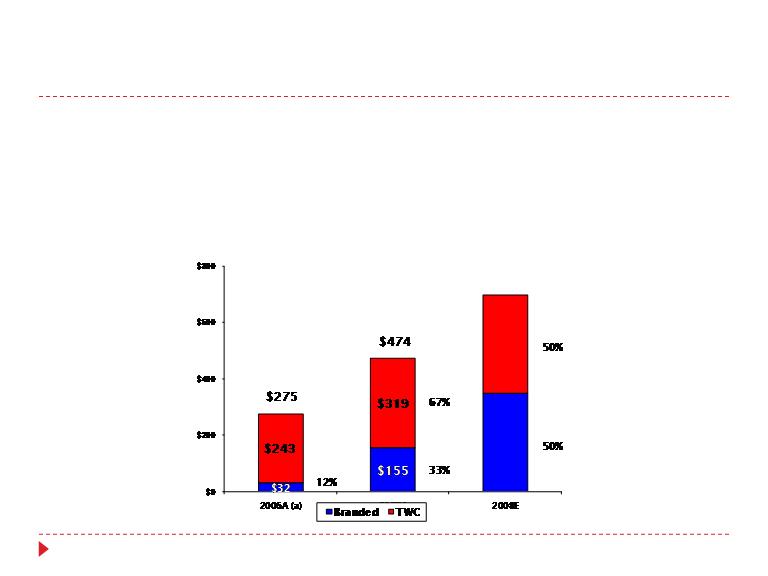

regarding our revenue, net income and profitability in 2007 and beyond, the period during which Genius Products will achieve profitability, our projected revenue from

TWC and non-TWC content in 2007 and beyond, increases in sales volume, our anticipated growth in revenue and content, our ability to forecast returns, our ability to

successfully position ourselves as a leading home entertainment distributor, the number of anticipated releases per year under our agreements with our content

partners, the anticipated timing and performance of new releases, our anticipated co-productions with our co-producing partners and our anticipated expansion into

new lines of business and/or new territories. Actual results could vary for many reasons, including but not limited to, our ability to acquire and keep valuable content

and expand our distribution and co-production partnerships, the unpredictability of audience demand, the success of The Weinstein Company titles at the box office

and the popularity of our titles on DVD, our ability to perform under the terms of our agreement with our content providers, our ability to comply with the terms of our

credit facility with Société Générale, our ability to continue to manage our significant growth, our ability to continue to attract and keep experienced management, the

effect of technological change, the availability of alternative forms of entertainment and our ability to maximize our operating leverage. Other such risks and

uncertainties include the matters described in Genius Products’ filings with the Securities and Exchange Commission. Genius Products assumes no obligation to

update any forward-looking statements to reflect events or circumstances after the date of this presentation.

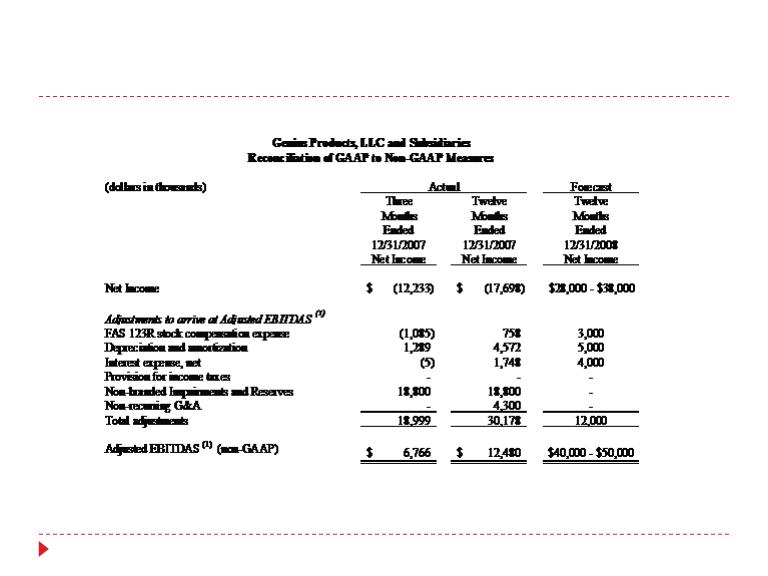

Use of Non-GAAP Financial Information. Adjusted earnings before interest, taxes, depreciation, amortization and non-cash compensation (“Adjusted EBITDAS”) as

presented in this presentation is a non-GAAP financial measure that represents GAAP net income excluding the effects of a variety of charges and credits that are

required to be included in a GAAP presentation, including non-cash compensation expense related to FAS 123(R), depreciation, amortization, taxes, interest income,

interest expense and non-recurring charges consisting of extraordinary consulting fees and accounting costs associated with audit costs and Sarbanes Oxley

implementation, non-branded business obsolescence and impairment charges and non-recurring G&A. Adjusted EBITDAS may differ from non-GAAP measures used by

other companies and is not a measurement under GAAP. Management believes the Adjusted EBITDAS presentation enhances an overall understanding of Genius

Products’ financial performance from operations, and it is used by management for that purpose. The Company believes Adjusted EBITDAS provides useful information

to investors about the Company’s financial performance because it eliminates the effects of period to period changes in non-cash compensation expenses,

depreciation, amortization, interest income, interest expense and taxes, and non-recurring charges consisting of extraordinary consulting fees and accounting costs

associated with audit costs and Sarbanes Oxley implementation, non-branded business obsolescence and impairment charges and non-recurring G&A , all of which the

Company believes are not reflective of the underlying performance of its ongoing operations. Measures similar to Adjusted EBITDAS are also widely used by the

Company and other companies in the industry to evaluate and price potential acquisition candidates. In addition, the Company presents these measures because the

Company believes they are frequently used by analysts, investors and other interested parties in evaluating companies such as Genius Products. Since Genius Products

has historically reported non-GAAP results to the investment community, management believes the inclusion of this non-GAAP financial measure provides consistency

in its financial reporting. There are limitations inherent in non-GAAP financial measures such as Adjusted EBITDAS in that they exclude a variety of charges and credits

that are required to be included in a GAAP presentation, and do not therefore present the full measure of Genius Products recorded costs against its revenue.

Management compensates for these limitations in non-GAAP measures by also evaluating performance based on traditional GAAP financial measures. Accordingly,

investors should consider these non-GAAP results together with GAAP results, rather than as an alternative to GAAP basis financial measures.