UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

GENIUS PRODUCTS, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) or 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or the Form or Schedule and date of filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or Registration Statement No.: |

GENIUS PRODUCTS, INC.

740 Lomas Santa Fe, Suite 210

Solana Beach, California 92075

(858) 793-8840

December 12, 2005

Dear Stockholder of Genius Products, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Genius Products, Inc. to be held at the Del Mar Hilton Hotel, 15575 Jimmy Durante Boulevard, Del Mar, California at 8:30 a.m. local time on Thursday, December 29, 2005.

We have provided details of the business to be conducted at the Annual Meeting in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

In order for us to have an efficient meeting, please sign, date and return the enclosed proxy promptly in the accompanying reply envelope. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the Annual Meeting.

We look forward to seeing you at the Annual Meeting.

|

Sincerely, |

|

| /s/ Trevor Drinkwater |

Trevor Drinkwater |

Member of the Board, President and Chief Executive Officer |

Solana Beach, California

YOUR VOTE IS IMPORTANT

In order to assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelope. You do not need to add postage if mailed in the United States. Voting instructions are included with your proxy card.

GENIUS PRODUCTS, INC.

740 Lomas Santa Fe, Suite 210

Solana Beach, California 92075

(858) 793-8840

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting (the “Annual Meeting”) of the Stockholders of Genius Products, Inc. (the “Company”) will be held at the Del Mar Hilton Hotel, 15575 Jimmy Durante Boulevard, Del Mar, California at 8:30 a.m. local time on Thursday, December 29, 2005, for the following purposes:

| | 1. | To elect four directors to our board of directors to serve during the ensuing year or until their successors are duly elected and qualified. |

| | 2. | To transact such other business as may properly be brought before the Annual Meeting or any adjournments thereof. |

Only stockholders of record at the close of business on December 2, 2005 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON.

WHETHER OR NOT YOU PLAN TO ATTEND IN PERSON, YOU ARE URGED TO FILL IN THE ENCLOSED PROXY AND TO SIGN AND FORWARD IT IN THE ENCLOSED BUSINESS REPLY ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. ANY STOCKHOLDER WHO SIGNS AND SENDS IN A PROXY MAY REVOKE IT BY EXECUTING A NEW PROXY WITH A LATER DATE, BY WRITTEN NOTICE OF REVOCATION TO THE SECRETARY OF THE COMPANY AT ANY TIME BEFORE IT IS VOTED, OR BY ATTENDING THE ANNUAL MEETING AND VOTING IN PERSON.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES OF STOCK THAT YOU HOLD. YOUR COOPERATION IN PROMPTLY RETURNING YOUR PROXY WILL HELP LIMIT EXPENSES INCIDENT TO PROXY SOLICITATION.

| | | | |

| | | | | By Order of the Board of Directors |

| | |

| | | | | /s/ Trevor Drinkwater |

Solana Beach, California | | | | Trevor Drinkwater |

December 12, 2005 | | | | Member of the Board, President and Chief Executive Officer |

GENIUS PRODUCTS, INC.

740 Lomas Santa Fe, Suite 210

Solana Beach, California 92075

(858) 793-8840

PROXY STATEMENT

Solicitation of Proxies

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of Genius Products, Inc., a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held at the Del Mar Hilton Hotel, 15575 Jimmy Durante Boulevard, Del Mar, California on Thursday, December 29, 2005, at 8:30 a.m. local time and at any and all adjournments thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Accompanying this Proxy Statement is the board of directors’ proxy for the Annual Meeting, which you may use to indicate your vote as to the proposals described in this Proxy Statement. In addition to solicitation by use of the mail, certain of our officers and employees may, without receiving additional compensation therefore, solicit the return of proxies by telephone, telegram or personal interview. We have requested that brokerage houses and custodians, nominees and fiduciaries forward soliciting materials to their principals, the beneficial owners of common stock, and have agreed to reimburse them for reasonable out-of-pocket expenses in connection therewith.

Revocation of Proxies

All Proxies which are properly completed, signed and returned to us prior to the Annual Meeting, and which have not been revoked, will be voted in favor of the proposals described in this Proxy Statement unless otherwise directed. A stockholder may revoke his or her proxy at any time before it is voted either by filing with the Secretary of the Company, at its principal executive offices, a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and expressing a desire to vote his or her shares in person.

Record Date and Voting

The close of business on December 2, 2005 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment of the Annual Meeting. As of the record date, we had outstanding 44,136,839 shares of common stock, par value $.001 per share.

Each stockholder of record is entitled to one vote for each share held on all matters to come before the Annual Meeting, except that stockholders may have cumulative voting rights with respect to the election of directors. All proxies which are returned will be counted by the Inspector of Elections in determining the presence of a quorum and on each issue to be voted on for which a vote was cast. An abstention from voting or a broker non-vote will not be counted in the voting process.

Stockholders may revoke any proxy before it is voted by attendance at the Annual Meeting and voting in person, by executing a new proxy with a later date, or by giving written notice of revocation to the Secretary of the Company.

The shares represented by proxies that are returned properly signed will be voted in accordance with each stockholder’s directions. If the proxy card is signed and returned without direction as to how they are to be voted, the shares will be voted as recommended by our board of directors.

1

Mailing of Proxy Statement and Proxy Card

We will pay the cost for preparing, printing, assembling and mailing this Proxy Statement and the proxy card and all of the costs of the solicitation of the proxies.

Our principal executive offices are located at 740 Lomas Santa Fe, Suite 210, Solana Beach, California 92075. This Proxy Statement and the accompanying proxy card are first being mailed to stockholders on or about December 12, 2005.

2

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What proposals will stockholders be voting on at the Annual Meeting?

The following matter is scheduled to be voted on at the Annual Meeting:

| | • | | Proposal 1: Election of four directors to our board of directors to serve during the ensuing year or until their successors are duly elected and qualified. |

If any other matter is properly presented for approval at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares in his or her discretion.

How many votes are need to approve each proposal?

The votes required to approve each proposal are as follows:

| | • | | Proposal 1: Directors will be elected by plurality vote, and votes that are withheld will be excluded entirely from the vote and will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. Under our bylaws, a quorum will be present if at least a majority of the outstanding shares of common stock are represented by votes at the Annual Meeting or by proxy. On the record date, there were 44,136,839 shares of common stock outstanding. Thus, 22,068,420 shares must be represented in person or by proxy at the Annual Meeting to have a quorum.

Your shares will be counted toward the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the Annual Meeting or a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another date.

Who is soliciting my proxy?

The Company’s board of directors.

How does the Company’s board of directors recommend that I vote?

The Company’s board of directors recommends that stockholders vote “FOR” each of the four nominees identified herein.

Who is entitled to vote at the Annual Meeting?

Only holders of record of common stock as of the close of business on December 2, 2005 will be entitled to notice of the Annual Meeting and will be entitled to vote at the Annual Meeting.

Where and when is the Annual Meeting?

The Annual Meeting will be held at the Del Mar Hilton Hotel, 15575 Jimmy Durante Boulevard, Del Mar, California at 8:30 a.m. local time on Thursday, December 29, 2005.

Where can I vote my shares?

You can vote your shares where indicated by the instructions set forth on the proxy card, or you can attend and vote your shares in person at the Annual Meeting.

3

May I change my vote after I have mailed my signed proxy card?

Yes. Just send in a written revocation or a later dated, signed proxy card before the Annual Meeting or attend the Annual Meeting and vote in person. Simply attending the Annual Meeting, however, will not revoke your proxy – you would have to vote at the Annual Meeting in order to revoke your proxy.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

What do I need to do now?

Please vote your shares as soon as possible, so that your shares may be represented at the Annual Meeting. You may vote by signing and dating your proxy card and mailing it in the enclosed return envelope, or you may vote in person at the Annual Meeting.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We also may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Whom should I call if I have questions?

If you have any questions about any of the proposals on which you are voting, you may call or write to:

Genius Products, Inc.

Attn: Corporate Secretary

740 Lomas Santa Fe, Suite 210

Solana Beach, California 92075

Telephone: (858) 793-8840

Facsimile: (858) 436-4430

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our annual report on Form 10-K for the year ending December 31, 2005.

4

PROPOSAL 1

ELECTION OF DIRECTORS

In accordance with our certificate of incorporation and bylaws, the board of directors consists of not less than one nor more than eight members, with the exact number to be determined by the board of directors. At each annual meeting of stockholders, directors are elected for the ensuing year or until their successors are elected or appointed. Our bylaws provide for the election of directors at the annual meeting of the stockholders. The board of directors proposes the election of the nominees named below.

Unless marked otherwise, proxies received will be voted FOR the election of each of the nominees named below, unless authority is withheld. If any such person is unable or unwilling to serve as a nominee for the office of director at the date of the Annual Meeting or any postponement or adjournment thereof, the proxies may be voted for a substitute nominee, designated by the proxy holders or by the present board of directors to fill such vacancy. The board of directors has no reason to believe that any such nominee will be unwilling or unable to serve if elected a director.

The board of directors proposes the election of the following nominees as members of the board of directors:

| | | | | | |

| Stephen K. Bannon | | Trevor Drinkwater | | James G. Ellis | | Herbert Hardt |

If elected, the nominees are expected to serve for the ensuring year or until their successors are elected or appointed.

Effect of Proposed Transaction with The Weinstein Company

On December 5, 2005, we announced the signing of definitive agreements to form a new venture to exploit the exclusive U.S. home video distribution rights to all feature film and direct-to-video releases owned or controlled by The Weinstein Company LLC (“TWC”). We expect to hold a Special Meeting of our stockholders in early 2006 at which the stockholders will be asked to approve the transaction with TWC and other matters. If our stockholders approve the transaction with TWC and the transaction closes, then we expect that, following the closing, our board of directors will be reconstituted to consist of seven directors, of which TWC will have the right to elect five directors (three of whom at the time of their election must be independent directors) and the holders of our common stock will have the right to elect the remaining two directors. If the transaction closes, then we expect that one or more of the directors elected by our stockholders at the Annual Meeting may resign from our board of directors. As of the date of this Proxy Statement, we do not know which directors may remain on our board following the closing of the transaction and which directors may resign.

We plan to file with the Securities and Exchange Commission, or SEC, and mail to our stockholders a proxy statement in connection with the transaction with TWC. Investors are urged to read the proxy statement and any other relevant documents when they become available because they will contain important information. Investors will be able to obtain free copies of the proxy statement and other documents that we file with the SEC through the Web site maintained by the SEC atwww.sec.gov. In addition, investors will be able to obtain copies of the proxy statement free of charge from us, by contacting our proxy solicitor: The Altman Group, 1200 Wall Street West, Third Floor, Lyndhurst, NJ, 07071 or 800-820-2416.

Our directors, executive officers and certain other members of management may be deemed to be soliciting proxies in favor of the proposed transaction from our stockholders. For information about these directors, executive officers and members of management, please see below in this Proxy Statement and please refer to our Annual Report on Form 10-KSB (as amended) for the fiscal year ended December 31, 2004 and our other filings with the SEC, which are available at the SEC’S website (www.sec.gov) and from us at the address provided in the preceding paragraph.

5

Directors and Nominees

Information is set forth below concerning the current members of our board of directors as of November 30, 2005. All of these directors have been nominated for reelection to our board of directors, except for Alexander L. Cappello, who has decided not to stand for reelection at the Annual Meeting. Information regarding each director’s beneficial ownership of our common stock as of October 31, 2005 is set forth below under “Security Ownership of Beneficial Owners and Management.” Each nominee has consented to being named in this Proxy Statement as a nominee for director and has agreed to serve as a director if elected.

| | | | |

NAME

| | AGE

| | POSITION

|

Stephen K. Bannon (1)(2) | | 52 | | Director, Chairman and Nominee |

Trevor Drinkwater | | 39 | | President, Chief Executive Officer, Director and Nominee |

James G. Ellis (1)(2) | | 58 | | Director and Nominee |

Herbert Hardt (1) | | 62 | | Director and Nominee |

Alexander L. Cappello (2) | | 50 | | Director |

| (1) | Member of Audit Committee. |

| (2) | Member of Compensation Committee. |

STEPHEN K. BANNON was appointed as a director of our company in March 2005 in connection with our acquisition of American Vantage Media Corporation (AVMC). Mr. Bannon served as the Chief Executive Officer of AVMC since May 2004. From January 2004 to April 2004, he provided executive and management services to AVMC as a consultant. From April 2002 to December 2003, Mr. Bannon served as Head, Strategic Advisory Services for The Firm, a leading talent management company in the entertainment and media industries. Mr. Bannon served as a managing director and head of media and entertainment investment banking at Jefferies & Company, Inc., an institutional brokerage and investment bank for middle market growth companies, from July 2000 to April 2002. He served as the Chief Executive Officer of Bannon & Co., Inc., an investment banking firm specializing in the entertainment, media and communications industries, from April 1990 to July 1998. Mr. Bannon served as Vice-Chairman of the Board of Directors and Chairman of the Executive Committee of First Look Media, Inc. from October 1996 to June 2000 and a director and a member of the Executive Committee of First Look Media, Inc. from December 1993 to February 2004. First Look Media, Inc. specializes in the acquisition and direct distribution of, and worldwide license and sale of distribution rights to, independently produced feature films in a wide variety of genres.

TREVOR DRINKWATER has served as our Chief Executive Officer since February 2005, as a member of the board since July 2005 and as our President since August 2005. From July 2004 to February 2005, Mr. Drinkwater served as our Executive Vice President of DVD Sales. Prior to that, he served as Chief Operating Officer of Take-Two Interactive Software, Inc. from 2003-2004, and Senior Vice President of Sales at Warner Home Video from 1999-2003.

JAMES G. ELLIS has served as a director since February 2005. Mr. Ellis has served as the Vice Dean of External Relations at The Marshall School of Business at the University of Southern California since July 2004. Prior to that, he was the Associate Dean of the Undergraduate Business Program. In addition, he is Professor of Marketing, a position he has held since 1997. Prior to joining academia, Mr. Ellis has held various positions in established companies as well as in entrepreneurial ventures. He is a founding director of Professional Business Bank in Pasadena, California, and currently serves on a number of corporate and non-profit boards. He is also a member of the Chief Executives Organization and World Presidents Organization, and is a graduate of the University of New Mexico and The Harvard University Graduate School of Business Administration.

HERBERT HARDT has served as a director since October 2005. Mr. Hardt has been a principal of Monness, Crespi, Hardt & Co., Inc since 1980. From 1976 to 1979, he served as Vice President of Fidelity Management and Research (Bermuda). Mr. Hardt worked at Fidelity Management and Research in Boston, first as an analyst and then as fund manager of Essex Fund and Trend Fund from 1971-1976. Mr. Hardt received his Bachelor of Arts with a Concentration in Engineering and Applied Physics from Harvard College in 1965 and his Master of Business Administration from Harvard University in 1971. He also attended graduate school in applied mathematics at the

6

University of Bern in Bern, Switzerland. From 1966-1969 Mr. Hardt served in the military with the 82nd Airborne Division.

ALEXANDER L. CAPPELLO has served as a director since September 2004. Mr. Cappello is Chairman and Chief Executive Officer of Cappello Group, Inc., a merchant banking firm specializing in principal transactions, corporate finance, institutional equity placements for public companies, project finance and merger and acquisitions services. Mr. Cappello has managed Cappello Group, Inc. and its predecessor firms since 1975. He is a Managing Director of Cappello Capital Corp. He also served as Chairman of the International Board of the Young Presidents’ Organization for 2003-2004. Currently, he is a member of the Board of Directors of the following entities: Cappello Group, Inc., RAND Corporation (Center for Middle East Public Policy), Advanced Biotherapy Inc. (OTCBB), CytRx Corporation (NASDAQ), Independent Colleges of Southern California (ICSC), USC Marshall School of Business, Greif Center for Entrepreneurial Studies, USC Advancement Council, Trustee Friends of Florence (Florence, Italy), and Chairman Emeritus of Catholic Big Brothers of Los Angeles.

Directors’ Meetings and Committees

The board of directors has an Audit Committee and a Compensation Committee. During fiscal year 2004, the board of directors held four meetings. During 2004, each incumbent director attended or participated in at least 75% of the aggregate of: (i) the total number of meetings of the board of directors (during the period for which such director served as a director); and (ii) the total number of meetings held by all committees of the board of directors on which such director served (during the period for which such director served on such committees).

The Audit Committee acts pursuant to a written charter, a copy of which was attached as Appendix A to our proxy statement for our annual meeting of stockholders in 2004. The Audit Committee currently consists of Messrs. Hardt, Bannon and Ellis. Our board of directors has determined that Mr. Hardt is an audit committee financial expert as defined under applicable rules of the Securities and Exchange Commission. Our board of directors also has determined that all members of the Audit Committee are “independent,” as defined in the Nasdaq listing standards. The Audit Committee, among other things, reviews the scope and results of the annual audit and other services provided by our independent auditors and reviews and evaluates our accounting policies and systems of internal accounting controls. The Audit Committee held four meetings in 2004.

The Compensation Committee currently consists of Messrs. Bannon, Ellis and Cappello. Our board of directors also has determined that all members of the Compensation Committee are “independent,” as defined in the Nasdaq listing standards, except for Mr. Cappello, who is not deemed to be “independent” because of our relationship with Cappello Capital Corp., as described below under “Related Party Transactions.” The Compensation Committee, among other things, reviews and approves the salaries, bonuses and other compensation payable to our executive officers and administers and makes recommendations concerning our employee benefit plans. The Compensation Committee held one meeting in fiscal year 2004.

A Nominating Committee has not been established due to the small size of the Company and our board. Until a Nominating Committee is established the nominating decisions are made by the full board and each director participates in the consideration of nominees.

It is our board’s policy to consider candidates recommended by stockholders. If a stockholder wishes to submit a candidate for nomination to our board of directors, the stockholder should send a written notice to our Secretary, at 740 Lomas Santa Fe, Suite 210, Solana Beach, California 92075, Attn: Corporate Secretary.

It is our board’s policy to evaluate candidates proposed by stockholders using the same criteria as for other candidates. The following are among the qualifications that our board considers when evaluating and selecting candidates for nomination to the board of directors:

| | • | | experience in business, finance or administration; |

| | • | | familiarity with our industry; |

| | • | | prominence and reputation; and |

| | • | | whether the individual has sufficient time available to devote to the work of the board of directors and one or more of its committees. |

7

In addition, our board of directors expects nominees to possess certain core competencies, some of which may include broad experience in business, finance or administration, familiarity with national and international business matters, and familiarity with our industry. In addition to having one or more of these core competencies, board member nominees are identified and considered on the basis of knowledge, experience, integrity, diversity, leadership, reputation, and ability to understand our business.

Policy Regarding Director Attendance at Annual Meeting of Stockholders

We believe that the annual meeting of stockholders is a good opportunity for the stockholders to meet and, if appropriate, ask questions of the board of directors. It is also a good opportunity for the members of the board of directors to hear any feedback the stockholders may share with the Company at the meeting. It is our policy that our directors are invited and strongly encouraged to attend the Company’s annual meeting of stockholders. We will reimburse all reasonable out of pocket traveling expenses incurred by the directors in attending the annual meeting. At the time of our 2004 Annual Meeting of Stockholders, we had five directors, all of whom was in attendance at our 2004 Annual Meeting of Stockholders.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee was at any time during fiscal year 2004 or at any other time our officer or employee. There are no compensation committee interlocks between us and other entities involving our executive officers and board members who serve as executive officers or board members of such other entities.

Code of Ethics

We have adopted a financial code of ethics that applies to our principal executive officer, principal financial officer and controller or principal accounting officer, or persons performing similar functions. This financial code of ethics constitutes a “code of ethics,” as defined in Securities and Exchange Regulation S-K Item 406(b). A copy of our financial code of ethics is available on our website athttp://www.geniusproducts.com/dyncontent.aspx?pagename=code_of_ethics. If we make any amendments to our financial code of ethics, other than technical, administrative or other non-substantive amendments, or grant any waivers, including implicit waivers, from a provision of our financial code of ethics to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, then we will disclose the nature of the amendment or waiver, its effective date and to whom it applies on our website athttp://www.geniusproducts.com/dyncontent.aspx?pagename=code_of_ethics or in a report on Form 8-K filed with the Securities and Exchange Commission.

Communications between Stockholders and the Board of Directors

Stockholders may communicate with our board of directors by writing to: Board of Directors, Genius Products, Inc., 740 Lomas Santa Fe, Suite 210, Solana Beach, California 92075. Communications to individual directors may be sent to the same address.

Audit Committee Approvals

Effective May 6, 2003, the Securities and Exchange Commission adopted rules that require that before our auditor is engaged by us to render any auditing or permitted non-audit related services, the engagement must be approved by our Audit Committee or entered into pursuant to pre-approval policies and procedures established by the Audit Committee, provided the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service, and such policies and procedures do not include delegation of the Audit Committee’s responsibilities to management.

Our Audit Committee requires advance approval of all audit, audit- related, tax and other services performed by the independent auditor. Unless the specific service has been previously pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent auditor is engaged to perform it.

8

Audit Committee Financial Expert

The board of directors has determined that at least one of the members of the Audit Committee, Herbert Hardt, qualifies as an “audit committee financial expert” as defined in Securities and Exchange Commission Regulation S-K Item 401(h)(2).

Director Compensation

Before September 2004, directors did not receive cash compensation for their services as directors but were reimbursed for expenses actually incurred in connection with attending meetings of the board of directors. Beginning in September 2004, each non-employee director receives a fee of $200 for each committee meeting attended. The chair of the committee receives a fee of $300 for each committee meeting attended. Directors are reimbursed for expenses actually incurred in connection with attending meetings of the board of directors and/or committee meetings.

During 2004, the board of directors granted options for board service to directors as follows:

| | |

Name

| | Option Grants (shares)

|

Alexander L. Cappello | | 429,520 |

Michael J. Koss* | | 429,520 |

Charles Rivkin* | | 429,520 |

Peter J. Schlessel* | | 429,520 |

| * | Represents grant to a former director; only a portion of which vested prior to his resignation. |

On October 31, 2003, the Compensation Committee authorized the grant of options for board service to Klaus Moeller. Klaus Moeller received an option to purchase 25,685 shares of our common stock. The exercise price for each option was $1.50 per share. The closing price of our common stock on October 31, 2003, the date of the grant, was $1.36.

In connection with his appointment as a director in March 2005, we granted to Stephen K. Bannon an option to acquire 429,520 shares of our common stock, at an exercise price equal to $1.63 per share.

In connection with his appointment as a director in February 2005, we granted to James G. Ellis an option to acquire 429,520 shares of our common stock, at an exercise price equal to $1.63 per share.

In connection with his appointment as a director in October 2005, we granted to Herbert Hardt an option to acquire 143,173 shares of our common stock, at an exercise price equal to $1.59 per share.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF

THE FOUR NOMINEES LISTED HEREIN.

OTHER MATTERS

The directors of the Company know of no other matters to be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, including any adjournment or adjournments thereof, it is intended that proxies received in response to this solicitation will be voted on such matters in the discretion of the person or persons named in the accompanying proxy form.

9

INDEPENDENT PUBLIC ACCOUNTANTS

Fees of Independent Public Accountants

Audit Fees. The aggregate audit fees billed for our fiscal year ended December 31, 2004 by Singer Lewak Greenbaum & Goldstein LLP (“Singer Lewak”) and by Cacciamatta Accountancy Corporation (“Cacciamatta”) were $152,651 and $58,325, respectively. The aggregate audit fees billed for our fiscal year ended December 31, 2003 by Cacciamatta were $57,595. Singer Lewak did not bill us for any audit fees for our fiscal year ended December 31, 2003. Audit fees consisted of fees for the audit of our financial statements for these years and review of our financial statements included in our Quarterly Reports on Form 10-QSB during these years.

Audit-Related Fees. Fees billed by Singer Lewak for assurance and related services during our fiscal year ended December 31, 2004 were $35,725. Fees billed by Cacciamatta for assurance and related services during our fiscal year ended December 31, 2004 were $10,000. Neither Singer Lewak nor Cacciamatta billed us for any audit-related fees during our fiscal year ended December 31, 2003.

Tax Fees. Singer Lewak and Cacciamatta did not bill us any fees for tax compliance, tax advice and tax planning during our fiscal years ended December 31, 2004 and 2003.

All Other Fees. Singer Lewak and Cacciamatta did not bill us for any services or products other than as reported above during our fiscal years ended December 31, 2004 and 2003.

Dismissal of Cacciamatta Accountancy Corporation

Effective October 25, 2004, we dismissed Cacciamatta, who had previously served as our independent accountants, and engaged Singer Lewak as our new independent accountants. Our Audit Committee recommended that we change audit firms, directed the process of review of candidate firms to replace Cacciamatta and made the final decision to engage Singer Lewak.

The reports of Cacciamatta on the financial statements of the Company for the two fiscal years ended December 31, 2003 and 2002 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle.

In connection with its audits of the Company for the two fiscal years ended December 31, 2003 and 2002, and through the date of this report, there were no disagreements with Cacciamatta on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Cacciamatta, would have caused Cacciamatta to make reference thereto in their report on the financial statements for such years.

During the two most recent fiscal years and through the date of this Proxy Statement, the Company has not consulted with Singer Lewak on any matter that: (i) involved the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, in each case where a written report was provided or oral advice was provided that was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) was either the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a reportable event under Item 304(a)(1)(v) of Regulation S-K.

10

SECURITY OWNERSHIP OF BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to us with respect to the beneficial ownership of common stock as of October 31, 2005, by (i) each person who is known by us to own beneficially more than 5% of our common stock, (ii) each of our directors and Named Executive Officers and (iii) all of our executive officers and directors as a group. Except as otherwise listed below, the address of each person is c/o Genius Products, Inc., 740 Lomas Santa Fe, Suite 210, Solana Beach, California 92075. As of October 31, 2005, there were outstanding 43,208,974 shares of our common stock.

| | | | | | |

| | | Shares Beneficially Owned (1)

| |

Name of Owner

| | Number

| | | Percent

| |

Stephen K. Bannon | | 1,829,520 | (2) | | 1.16 | % |

Trevor Drinkwater | | 3,100,000 | (3) | | 3.17 | % |

James G. Ellis | | 429,520 | (4) | | * | |

Herbert Hardt | | 323,223 | (5) | | * | |

Alexander L. Cappello | | 1,571,767 | (6) | | 2.50 | % |

Klaus Moeller | | 2,761,918 | (7) | | 6.10 | % |

Michael Meader | | 2,382,733 | (8) | | 5.30 | % |

Larry Balaban | | 1,733,731 | (9) | | 3.91 | % |

Howard Balaban | | 1,921,190 | (10) | | 4.33 | % |

Julie Ekelund | | 1,562,875 | (11) | | 3.51 | % |

All directors and officers as a group (11 persons) | | 9,934,030 | (12) | | 21.44 | % |

American Vantage Companies | | 2,325,000 | (13) | | 5.27 | % |

Persons affiliated with JLF Asset Management, LLC | | 3,829,968 | (14) | | 8.86 | % |

Bonanza Master Fund, Ltd. | | 3,037,974 | (15) | | 6.95 | % |

Persons affiliated with Gruber & McBaine Capital Management | | 2,022,900 | (16) | | 4.65 | % |

| * | Represents less than 1% of our common stock. |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options and warrants currently exercisable or convertible, or exercisable or convertible within 60 days of October 31, 2005, are deemed outstanding for computing the percentage of the person holding such option or warrant but are not deemed outstanding for computing the percentage of any other person. Except as pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned. |

| (2) | Includes options to purchase 107,379 shares exercisable within 60 days of October 31, 2005. Also includes options to purchase 400,000 shares exercisable as follows: 75,000 shares if the fair market value (“FMV”) of our common stock is at $4.00 per share; 125,000 shares if the FMV of our common stock is at $6.00 per share; 200,000 shares if the FMV of our common stock is at $8.00 per share. |

| (3) | Includes options to purchase 1,012,500 shares exercisable within 60 days of October 31, 2005. Also includes options to purchase 400,000 shares exercisable as follows: 75,000 shares if the FMV of our common stock is at $4.00 per share; 125,000 shares if the FMV of our common stock is at $6.00 per share; 200,000 shares if the FMV of our common stock is at $8.00 per share. |

| (4) | Includes options to purchase 119,311 shares exercisable within 60 days of October 31, 2005. |

| (5) | Includes options to purchase 23,862 shares exercisable within 60 days of October 31, 2005. |

11

| (6) | Includes (i) options to purchase 178,965 shares exercisable within 60 days of October 31, 2005, and (ii) warrants to purchase 928,584 shares exercisable within 60 days of October 31, 2005. |

| (7) | Includes 667,343 shares held by or for the benefit of family members of Mr. Moeller, as to which Mr. Moeller disclaims all beneficial interest. Also includes (i) options to purchase 2,058,685 shares exercisable within 60 days of October 31, 2005 and (ii) warrants to purchase 28,572 shares exercisable within 60 days of October 31, 2005. |

| (8) | Includes options to purchase 1,702,000 shares exercisable within 60 days of October 31, 2005. Also includes a warrant to purchase 28,572 shares exercisable within 60 days of October 31, 2005. |

| (9) | Includes options to purchase 1,114,000 shares exercisable within 60 days of October 31, 2005. Also includes a warrant to purchase 28,572 shares exercisable within 60 days of October 31, 2005. |

| (10) | Includes options to purchase 1,114,000 shares exercisable within 60 days of October 31, 2005. Also includes a warrant to purchase 28,572 shares exercisable within 60 days of October 31, 2005. |

| (11) | Includes options to purchase 1,077,500 shares exercisable within 60 days of October 31, 2005. Also includes warrants to purchase 190,572 shares exercisable within 60 days of October 31, 2005. |

| (12) | Includes outstanding options to purchase 2,197,017 shares exercisable within 60 days of October 31, 2005. Also includes warrants to purchase 928,584 shares exercisable within 60 days of October 31, 2005. |

| (13) | The amount of shares indicated includes warrants to purchase 950,000 shares of common stock. The mailing address for AVC is 4735 South Durango Drive, Suite 105, Las Vegas, Nevada 89147. The foregoing information has been derived from an Amendment No. 2 to Schedule 13G filed with the Securities and Exchange Commission on August 19, 2005. |

| (14) | The securities reported herein are held in various denominations by (i) a separately managed account managed by Jeffrey L. Feinberg and (ii) JLF Partners I, L.P., JLF Partners II, L.P., and JLF Offshore Fund, Ltd., to which JLF Asset Management, L.L.C. serves as the management company and/or investment manager. The amount of shares indicated does not include warrants to purchase 667,584 shares of common stock, because such warrants may only be exercised if by so doing the stock holdings of the warrantholder and its affiliates would not equal or exceed 10% of our outstanding shares and the warrantholder has provided us with at least 61 days prior notice. Jeffrey L. Feinberg is the managing member of JLF Asset Management, L.L.C. As the investment manager of such accounts and funds, JLF Asset Management, L.L.C. has the power to vote and/or dispose of those shares of common stock held by such persons and, accordingly, may be deemed to be the beneficial owner of such shares. The foregoing does not necessarily imply the existence of a group for purposes of Section 13(d)(3) of the Exchange Act or any other purpose. The mailing address for JLF Asset Management, L.L.C. is 2775 Via de la Valle, Del Mar, CA 92014. The foregoing information has been derived from a Schedule 13G filed with the Securities and Exchange Commission on March 28, 2005. |

| (15) | Bonanza Master Fund, Ltd. is managed by Bonanza Capital, Ltd., which is managed by Bonanza Fund Management, Inc. The amount of shares indicated includes warrants to purchase 506,329 shares of common stock. The mailing address for Bonanza Master Fund, Ltd. is 300 Crescent Court, Suite 1740, Dallas, Texas 75201. The foregoing information has been derived from a Schedule 13G filed with the Securities and Exchange Commission on March 31, 2005. |

| (16) | The securities reported herein are held in various denominations by Firefly Partners, LP, Lagunitas Partners LP, Jon D. Gruber, J. Patterson McBaine, Eric Swergold, J. Lynn Rose, and in various client accounts managed by Gruber & McBaine Capital Management. Gruber & McBaine Capital Management is the investment advisor for Firefly Partners, LP, Lagunitas Partners LP, and these client accounts. The amount of shares includes warrants to purchase 252,274 shares of common stock. The mailing address for Gruber & McBaine Capital Investment is 50 Osgood Place, San Francisco, CA 94133. The foregoing information has been derived from a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2005. |

12

EXECUTIVE OFFICERS

The following table sets forth certain information with respect to each executive officer of the Company as of November 30, 2005.

| | | | |

NAME

| | AGE

| | POSITION

|

Trevor Drinkwater | | 39 | | President, Chief Executive Officer and Director |

Shawn Howie | | 50 | | Chief Financial Officer |

Rodney Satterwhite | | 41 | | Executive Vice President and Chief Operating Officer |

Michel Urich | | 39 | | Executive Vice President and General Counsel |

Christine Martinez | | 39 | | Executive Vice President and General Manager of Genius Products Division |

Michael Radiloff | | 42 | | Executive Vice President of Marketing |

David Snyder | | 48 | | Executive Vice President, Content Development and Acquisition |

TREVOR DRINKWATER has served as our Chief Executive Officer since February 2005, as a member of the board since July 2005 and as our President since August 2005. For additional information regarding Mr. Drinkwater, see above under “Directors and Nominees.”

SHAWN HOWIE has served as our Executive Vice President and Chief Financial Officer since June 2005. Prior to his employment with the Company, Mr. Howie served as the Chief Financial Officer of Movielink, LLC from April 2002 to June 2005, of Wolfgang Puck Worldwide from 2001-2002 and of Direct Marketing Connections from 2000-2001. Prior to that, he served as Vice President, Corporate Finance at KB Home and Vice President, Controller and Chief Financial Officer of Irvine Apartment Communities, and served over 12 years as a Certified Public Accountant with Ernst & Young. He also serves on the Board of Regents at California Lutheran University and is a member of its audit committee.

RODNEY SATTERWHITE became our Executive Vice President and Chief Operating Officer in November 2005, after serving as our Executive Vice President of Operations from April 2005 to November 2005 and our Vice President, Sales Services from July 2004 to April 2005. Mr. Satterwhite, who holds an MBA in finance, has over 19 years experience in retail and entertainment, ranging from sourcing and logistics to retail strategy and merchandising. While at Giant Food Inc. from October 1986 to May 1998 he gained management experience in the areas of manufacturing, sourcing, distribution, cost accounting, finance, merchandising and category management. As a Warner Brothers executive from May 1998 to February 2004, he was responsible for developing supply, logistics, and retail business development strategies for both sell-through and rental markets. From February to July 2004, before joining the Company, he was responsible for revamping trade marketing, sales planning and analysis, inventory/supply and customer service as Take Two Interactive’s Vice President of North American Sales Services.

MICHEL URICH became our Executive Vice President and General Counsel in November 2005, after serving as General Counsel since July 25, 2005. Prior to joining us, from August 2001 to June 2005 Mr. Urich served as Senior Vice President and Director of Legal Affairs at Nara Bancorp, Inc., as well as Nara Bank. Mr. Urich obtained two law degrees from the University of London as well as an MBA from the University of San Francisco.

CHRISTINE MARTINEZ became our Executive Vice President and General Manager in September 2005. Prior to joining the Company, Ms. Martinez was a Sales and Marketing Executive at Warner Home Video from April 1996 to May 2005. Her last executive appointment with Warner Home Video was as Vice President, Marketing – Non Theatrical, from November 2003 until her departure from the company. Ms. Martinez also had a three year tenure in sales, from March 1993 to April 1996, with WEA Corp., a former Time Warner division.

MICHAEL RADILOFF became our Executive Vice President of Marketing in October 2005. Mr. Radiloff is a senior marketing executive with 15 years of entertainment and packaged goods marketing experience with industry-leading companies. He was most recently at Warner Home Video as Vice President of Theatrical Catalog Marketing from May 2001 to September 2005 and as Director of DVD Marketing from March 2000 to April 2001. As the person responsible for releasing Warner’s vast film library onto DVD, Mr. Radiloff launched over 100 new DVD releases annually. Prior to that, he worked as a Brand Marketing Manager at Disney Interactive and Activision. Mr. Radiloff holds an MBA from Stanford Graduate School of Business.

13

DAVID SNYDER joined the Company as Executive Vice President, Content in April of 2005. Prior to his employment with the Company, Mr. Snyder was executive producer of a number of animated and live action properties includingHarry and His Bucket Full of Dinosaurs on The Cartoon Network. From August 2000-September 2002 he served as Senior Vice President, Entertainment for Gullane Entertainment where he was responsible for 78 episodes of Thomas the Tank Engine and Friends, over 2,400 episodes of the Award winning international hit,Art Attackand the Cartoon Network’sYoko, Jakamoko and Toto.From April 1988-July 2000, Mr. Snyder was with the Walt Disney Company ending his career there as Senior Vice President of Walt Disney Television International, responsible for creative content for the international Disney Channels as well as all brand building initiatives of Disney’s International television Business.

14

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table sets forth summary information regarding the compensation earned by our chief executive officer and each of our other most highly compensated executive officers employed by us as of December 31, 2004 and whose salary and bonus for the fiscal year ended December 31, 2004 was in excess of $100,000 for their services rendered in all capacities to us. No executive officers who would have otherwise been included in this table on the basis of salary and bonus earned for the fiscal year 2004 year have been excluded by reason of his or her termination of employment or change in executive status during that year. The listed individuals are hereinafter referred to as the “Named Executive Officers.”

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | Annual Compensation

| | Long-Term Compensation

| | All Other

Compensation

$ (Car Allowance)

|

| | | | | | | | | Awards

| | | Payouts

| |

Name and Position

| | Year

| | Salary

$

| | | Bonus

$

| | Other Annual

Compensation

$

| | Restricted

Stock

Awards

$

| | | Securities

Underlying

Option/SARs

and Warrants

| | | LTIP

Payouts

$

| |

Klaus Moeller Former CEO and Interim

CFO | | 2004 | | 225,000 | | | 125,000 | | 0 | | 0 | | | 750,000 | | | 0 | | 9,000 |

| | 2003 | | 150,000 | (1) | | 45,000 | | 0 | | 28,572 | (1) | | 572,000 | (1) | | 0 | | 9,000 |

| | 2002 | | 150,000 | (1) | | 0 | | 0 | | 47,619 | (1) | | 450,000 | | | 0 | | 9,000 |

| | | | | | | | |

Michael Meader Former President | | 2004 | | 197,500 | | | 85,000 | | 0 | | 0 | | | 575,000 | | | 0 | | 9,000 |

| | 2003 | | 150,000 | (2) | | 15,000 | | 0 | | 28,572 | (2) | | 468,000 | (2) | | 0 | | 9,000 |

| | 2002 | | 150,000 | (2) | | 0 | | 0 | | 47,619 | (2) | | 450,000 | | | 0 | | 9,000 |

| | | | | | | | |

Larry Balaban Executive VP of Marketing and Production | | 2004 | | 172,500 | | | 55,000 | | 0 | | 0 | | | 350,000 | | | 0 | | 9,000 |

| | 2003 | | 150,000 | (3) | | 15,000 | | 0 | | 28,572 | (3) | | 427,500 | (3) | | 0 | | 9,000 |

| | 2002 | | 150,000 | (3) | | 0 | | 0 | | 47,619 | (3)(4) | | 450,000 | | | 0 | | 9,000 |

| | | | | | | | |

Howard Balaban Executive VP of New Business Development | | 2004 | | 172,500 | | | 60,000 | | 0 | | 0 | | | 350,000 | | | 0 | | 9,000 |

| | 2003 | | 150,000 | (3) | | 15,000 | | 0 | | 28,572 | (3) | | 427,500 | (3) | | 0 | | 9,000 |

| | 2002 | | 150,000 | (3) | | 0 | | 0 | | 47,619 | (3) | | 450,000 | | | 0 | | 9,000 |

| | | | | | | | |

Julie Ekelund Executive VP of Sales | | 2004 | | 172,500 | | | 0 | | 0 | | 0 | | | 350,000 | | | 0 | | 9,000 |

| | 2003 | | 150,000 | (4) | | 15,000 | | 0 | | 28,572 | (4) | | 427,500 | (4) | | 0 | | 9,000 |

| | 2002 | | 150,000 | (4) | | 0 | | 0 | | 20,000 | (4) | | 450,000 | | | 0 | | 9,000 |

| (1) | Mr. Moeller resigned as our Chief Executive Officer in February 2005. During 2003, in response to our company’s limited cash flow, Mr. Moeller accepted $20,000 of his 2003 salary in the form of 28,572 shares of common stock valued at $0.70 per share and a five-year warrant to purchase 28,572 shares of common stock at an exercise price of $1.40. These issuances were made as of June 2, 2003, at the same price as a private placement at that time. |

| (2) | Mr. Meader resigned as our President in July 2005. During 2003, in response to our company’s limited cash flow, Mr. Meader accepted $20,000 of his 2003 salary in the form of 28,572 shares of common stock valued at $0.70 per share and a five-year warrant to purchase 28,572 shares of common stock at an exercise price of $1.40. These issuances were made as of June 2, 2003, at the same price of a private placement at that time. |

| (3) | During 2003, in response to our company’s limited cash flow, Mr. Larry Balaban and Mr. Howard Balaban each accepted $20,000 of 2003 salary in the form of 28,572 shares of common stock valued at $0.70 per share and a five-year warrant to purchase 28,572 shares of common stock at an exercise price of $1.40. These issuances were made as of June 2, 2003, at the same price of a private placement at that time. |

| (4) | Ms. Ekelund was issued 20,000 shares of common stock as a signing bonus for entering into a three-year employment agreement as of April 1, 2002, with a $30,000 reduction of 2002 salary. This issuance was made as of April 1, 2002. During 2003, in response to our company’s limited cash flow, Ms. Ekelund accepted $20,000 of her 2003 salary in the form of 28,572 shares of common stock valued at $0.70 per share and a five-year warrant to purchase 28,572 shares of common stock at an exercise price of $1.40. These issuances were made as of June 2, 2003, at the same price of a private placement at that time. |

15

The following table sets forth the options granted, if any, to the Named Executive Officers during the fiscal year ended December 31, 2004.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

INDIVIDUAL GRANTS

| | | | | | | | | |

Name

| | Number of Securities

Underlying

Options/SARs Granted

(#)

| | Percent of Total

Options/SARs Granted

to Employees in Fiscal

Year (%)

| | | Exercise or Base Price

($/SH)

| | Expiration Date

|

Klaus Moeller | | 750,000 | | 13 | % | | $2.00-$4.00 | | September 30, 2015 |

Michael Meader | | 575,000 | | 10 | % | | $2.00-$4.00 | | September 30, 2015 |

Larry Balaban | | 350,000 | | 6 | % | | $2.00-$4.00 | | September 30, 2015 |

Howard Balaban | | 350,000 | | 6 | % | | $2.00-$4.00 | | September 30, 2015 |

Julie Ekelund | | 350,000 | | 6 | % | | $2.00-$4.00 | | September 30, 2015 |

The following table sets forth information concerning the exercise of stock options by the Named Executive Officers during our fiscal year ended December 31, 2004, and the value of all exercisable and unexercisable options at December 31, 2004. This table does not include warrants.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

| | | | | | | | | | |

| | | Number of Securities Underlying Unexercised

Options at FY-End (#)

| | Value of Unexercised In-The-Money Options

at FY-End ($) (1)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Klaus Moeller | | 1,222,685 | | 575,000 | | $ | 510,176 | | $ | 28,000 |

Michael Meader | | 1,005,500 | | 487,500 | | $ | 492,020 | | $ | 28,000 |

Larry Balaban | | 852,500 | | 375,000 | | $ | 486,350 | | $ | 28,000 |

Howard Balaban | | 852,500 | | 375,000 | | $ | 486,350 | | $ | 28,000 |

Julie Ekelund | | 780,000 | | 375,000 | | $ | 476,200 | | $ | 28,000 |

| (1) | Based on the closing price for our common stock at the close of market on December 31, 2004. On December 31, 2004, the price of our common stock was $1.64 per share. The lowest exercise price of any outstanding option at December 31, 2004 was $0.63 per share. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements with Named Executive Officers

Employment Agreements with Named Executive Officers

Effective January 3, 2002, we entered into three-year employment agreements with Klaus Moeller, Michael Meader, Larry Balaban and Howard Balaban. Effective April 1, 2002, we entered into a three-year employment agreement with Julie Ekelund, our Executive Vice President. Under each employment agreement, the executive is entitled to an annual salary of $150,000 and was granted an option to purchase 450,000 shares of common stock which vest one-third each year beginning on December 31, 2002. The options granted are exercisable for a period of 10 years from the date of grant at an exercise price of $0.63 per share, the market price on the date of grant. Under these employment agreements, if the senior executive died or was terminated without cause (as defined in the employment agreement) during the first year of the employment agreement, the senior executive would have received 24 months of salary as severance pay. If the senior executive died or was terminated without cause during the second year of the employment agreement, the senior executive would have received 18 months of salary as severance pay. If the senior executive dies or is terminated without cause during the third year of the employment agreement, the senior executive will receive 12 months of salary as severance pay. Severance pay under these employment agreements is due and payable in full immediately upon death or termination of the senior executive. If we were required to make payments under the severance pay provisions contained in one or more of these employment agreements, this could have a material adverse effect upon our liquidity and results of operations.

16

Effective October 31, 2003, the above employment agreements were amended to (i) extend the expiration date until January 2, 2006, (ii) to increase annual salaries according to the table below, and (iii) to grant to each senior executive a ten-year stock option to purchase 250,000 shares of our common stock at an exercise price of $1.50 per share, of which 50,000 shares will vest on December 31, 2004, and 200,000 shares will vest on December 31, 2005.

| | | | | | |

| | | 2004 Salary

| | 2005 Salary

|

Klaus Moeller | | $ | 222,500 | | $ | 244,750 |

Mike Meader | | $ | 197,500 | | $ | 217,250 |

Howard Balaban | | $ | 172,500 | | $ | 189,750 |

Larry Balaban | | $ | 172,500 | | $ | 189,750 |

Julie Ekelund | | $ | 172,500 | | $ | 189,750 |

Severance Agreements with Messrs. Meader and Moeller

On July 27, 2005, we announced a reorganization of our management team and announced that Michael Meader would resign as our president and become a consultant to the Company and Klaus Moeller would resign as an executive of the Company, but would remain a director and consult for the Company. On July 29, 2005, we entered into severance and consulting arrangements with Messrs. Meader and Moeller, upon the terms described below. Mr. Moeller subsequently resigned as a director, effective September 9, 2005.

Under the terms of a Confidential Settlement Agreement and Mutual Release of Claims with Mr. Meader (the “Meader Severance Agreement”), we agreed to the following:

| | • | | Mr. Meader resigned effective July 28, 2005 (the “Meader Resignation Date”); |

| | • | | The Company agreed to pay Mr. Meader severance for 12 months totaling $217,250, subject to standard payroll deductions and withholdings and payable in accordance with the regular company payroll practice; |

| | • | | The Company agreed to issue to Mr. Meader 209,000 additional vested stock options at fair market value on date of grant, pursuant to our 2004 Stock Incentive Plan, exercisable over a period of 5 years; |

| | • | | Mr. Meader retains any award of stock options previously vested and unvested as of the Meader Resignation Date. Unvested options shall vest as of the Meader Resignation Date; |

| | • | | The Company agreed to pay Mr. Meader’s health insurance premiums for 12 months beginning at the conclusion of the Separation and Retention Agreement (the “Meader Consulting Agreement”); |

| | • | | The Company agreed to reimburse Mr. Meader for reasonable legal expenses in connection with the negotiation and execution of the Meader Severance Agreement in an amount not to exceed $3,000; and |

| | • | | The parties agree to release each other of all claims. |

Under the Meader Consulting Agreement, Mr. Meader agreed to provide retention services to us as an employee in matters related only to our music and/or catalog business for a period of 60 days starting on July 28, 2005 (the “Retention Period”), which has since expired. During the Retention Period, we could terminate the Retention Period early for “cause” as defined in the Meader Consulting Agreement. Under the terms of the agreement, we agreed to pay Mr. Meader $18,104.16 per month in consulting fees for work performed during the Retention Period, payable in accordance with our regular payroll practice. In addition, we agreed to pay Mr. Meader as additional compensation, a commission of 2% of all sales of music by us during the third quarter of 2005.

Under the terms of a Confidential Settlement Agreement and Mutual Release of Claims with Mr. Moeller (the “Moeller Severance Agreement”), we agreed to the following:

| | • | | Mr. Moeller resigned effective July 28, 2005 (the “Moeller Resignation Date”); |

17

| | • | | The Company agreed to pay Mr. Moeller severance for 12 months totaling $244,750, subject to standard payroll deductions and withholdings and payable in accordance with the regular company payroll practice; |

| | • | | The Company agreed to issue to Mr. Moeller 261,000 additional vested stock options at fair market value on date of grant, pursuant to our 2004 Stock Incentive Plan, exercisable over a period of 5 years; |

| | • | | Mr. Moeller retains any award of stock options previously vested and unvested as of the Moeller Resignation Date. Unvested options shall vest as of the Moeller Resignation Date; |

| | • | | The Company agreed to pay Mr. Moeller’s health insurance premiums for 12 months beginning at the conclusion of the Separation and Retention Agreement (the “Moeller Consulting Agreement”); |

| | • | | The Company agreed to reimburse Mr. Moeller for reasonable legal expenses in connection with the negotiation and execution of the Moeller Severance Agreement in an amount not to exceed $3,000; and |

| | • | | The parties agree to release each other of all claims. |

Under the Moeller Consulting Agreement, Mr. Moeller agreed to provide consulting services to us, as an independent contractor, in any area for which he is qualified by virtue of his education, experience and training upon request by a duly authorized officer. The consulting relationship began on July 29, 2005, and was to continue for a minimum of four months, and thereafter terminable by either party on 60 days written notice (the “Consulting Period”). Our obligation to pay Mr. Moeller any further consulting fees was to cease upon termination of the Consulting Period.

During the Consulting Period, Mr. Moeller was to receive $8,500 per month in consulting fees, which shall be paid every six months. In addition, Mr. Moeller was to receive a fully vested stock option grant for 150,000 shares at fair market value on date of grant, pursuant to our 2004 Stock Incentive Plan.

On September 1, 2005, the Company and Mr. Moeller mutually agreed to terminate the Moeller Consulting Agreement and the Company paid Mr. Moeller for services performed under the Moeller Consulting Agreement through September 1, 2005.

For a description of agreements with persons who currently serve as executive officers but are not included above as Named Executive Officers, see below under “Related Party Transactions.”

18

The following reports of the Compensation Committee and the Audit Committee, references to the independence of the Audit Committee members, Audit Committee Charter and Stock Performance Graph should not be considered to be part of this Proxy Statement. Any current or future cross-references to this Proxy Statement in filings with the Securities and Exchange Commission under either the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, will not include the reports or graph reproduced below or the Audit Committee Charter.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Our Compensation Committee, which is comprised of three directors, is responsible for considering and approving compensation arrangements for our senior management, including our chief executive officer and the other executive officers. Our board of directors also has determined that all members of the Compensation Committee are “independent,” as defined in the Nasdaq listing standards, except for Mr. Cappello, who is not deemed to be “independent” because of our relationship with Cappello Capital Corp., as described below under “Related Party Transactions.”

Our executive compensation policy is to: (i) attract and retain key executives who are important to our continued success; and (ii) provide effective financial incentives, at a reasonable cost to the stockholders, for senior management to enhance the value of the stockholders’ investment. The Compensation Committee attempts to achieve these goals by integrating competitive annual base salaries and incentive bonuses with stock options. In support of this philosophy, a meaningful portion of executive compensation is placed at-risk and linked to our financial performance. The Compensation Committee believes that cash compensation in the form of salary and incentive bonuses provides our executives with short-term rewards for success in operations, and that long-term compensation through the award of stock options encourages growth in management stock ownership, which leads to expansion of management’s stake in our long-term performance and success. The Compensation Committee considers all elements of compensation and the compensation policy when determining individual components of pay. The Compensation Committee is responsible to the board of directors for ensuring that our executive officers are compensated in a manner that furthers our business strategies and aligns their interests with those of our stockholders.

The primary components of our executive compensation program are (i) base salaries, (ii) incentive bonuses and (iii) stock options.

Base Salaries and Incentive Bonuses

Executive officers’ base salaries are reviewed periodically by the Compensation Committee, based on level of responsibility and individual performance, subject to the terms of our employment agreements with executive officers. For fiscal year 2004, the Compensation Committee approved the base salaries of the executive officers based on salaries paid to executive officers with comparable responsibilities employed by similar companies. The executive officer incentive bonuses are designed to reward executives for individual and corporate performance and contributions to our success and overall growth and progress. Incentive bonus amounts are determined through consideration of the executive officers’ respective responsibilities and positions in conjunction with progress in the achievement of individual and corporate objectives during the fiscal year. In reviewing executive officer salaries and incentive bonuses, the Compensation Committee exercises its judgment based on all the factors described above.

Stock Options

We believe that stock options encourage and reward effective management, which results in long-term corporate financial success, as measured by stock price appreciation. During 2004, stock options to purchase 2,375,000 shares of Common Stock were granted to the Named Executive Officers and stock options to purchase 1,652,000 shares were granted to 17 other employees (excluding grants to directors). The number of options that each executive officer or employee was granted was based primarily on the Compensation Committee’s assessment of the executive’s or employee’s ability to enhance our long-term growth and profitability. The vesting provisions of options are designed to encourage longevity of employment.

19

2004 Compensation of the Chief Executive Officer

The compensation awarded to Mr. Moeller in 2004 reflects the basic philosophy generally discussed above that compensation be based on individual and corporate performance. Elements of corporate performance considered include our financial results, stock price appreciation and business development accomplishments.

The previous members of the Committee determined Mr. Moeller’s base salary for fiscal year 2004 based on the review described above. With respect to incentive bonuses and option grants, Mr. Moeller’s awards for fiscal year 2004 were determined in the same manner as for all other participants in these plans.

|

COMPENSATION COMMITTEE: |

James G. Ellis, Chairman |

Stephen K. Bannon |

Alexander L. Cappello |

REPORT OF THE AUDIT COMMITTEE

The following is the report delivered by the Audit Committee of our board of directors with respect to the principal factors considered by such Committee in its oversight of our accounting, auditing and financial reporting practices for fiscal year 2004.

In accordance with its written charter adopted by the board of directors, the Audit Committee assists our board of directors in fulfilling its responsibility for oversight of the quality and integrity of our accounting, auditing and financial reporting practices. Our independent auditors are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principals.

In discharging their oversight responsibility as to the audit process, the prior members of our Audit Committee received from our independent auditors, Singer Lewak Greenbaum & Goldstein LLP, the written disclosures and the letter describing all relationships between the auditors and us that might bear on the auditor’s independence, consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the prior members of our Audit Committee discussed with the auditors any relationships that may impact their objectivity and independence and satisfied themselves as to the auditor’s independence.

The prior members of our Audit Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees.”

The prior members of our Audit Committee reviewed and discussed our audited financial statements as of and for the fiscal year ended December 31, 2004 with management and the independent auditors.

Based on the review and discussions referred to above, the prior members of our Audit Committee recommended to our board of directors that our audited financial statements be included in our Annual Report on Form 10-KSB for the fiscal year ended December 31, 2004, for filing with the Securities and Exchange Commission.

|

AUDIT COMMITTEE: |

Herbert Hardt, Chairman |

Stephen K. Bannon |

James G. Ellis |

20

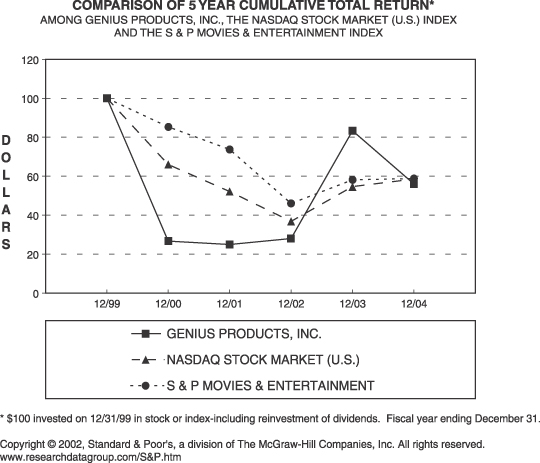

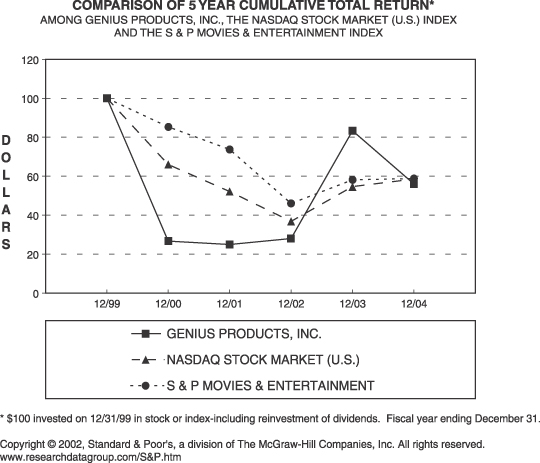

STOCK PERFORMANCE GRAPH

The following graph compares the performance of our common stock over the five preceding fiscal years to the weighted average performance over the same period of the stock of companies included in The Nasdaq Stock Market U.S. Index and the S&P Movies & Entertainment Index. The graph assumes $100 was invested at the close of trading on December 31, 1999 in our common stock and in each of the indices and that all dividends were reinvested. The Nasdaq Stock Market U.S. Index tracks the aggregate price performance of equity securities of companies traded on The Nasdaq National Market. The S&P Movies & Entertainment Index is a published industry index that currently includes Walt Disney Company, News Corp., Time Warner Inc. and Viacom Inc. The stockholder return shown on the graph below should not be considered indicative of future stockholder returns, and we will not make or endorse any predictions to future stockholder returns.

| | | | | | | | | | | | |

| | | Cumulative Total Return

|

| | | 12/99

| | 12/00

| | 12/01

| | 12/02

| | 12/03

| | 12/04

|

GENIUS PRODUCTS, INC. | | 100.00 | | 26.67 | | 25.00 | | 28.00 | | 83.33 | | 56.00 |

NASDAQ STOCK MARKET (U.S.) | | 100.00 | | 65.98 | | 52.19 | | 36.78 | | 54.64 | | 58.51 |

S & P MOVIES & ENTERTAINMENT | | 100.00 | | 85.33 | | 73.72 | | 46.01 | | 58.19 | | 58.82 |

21

RELATED PARTY TRANSACTIONS

Employment, Stock Option and Other Agreements with Executive Officers

As described above under “Executive Compensation and Other Information,” we have entered into certain employment, stock option and other agreements with the Named Executive Officers. In addition, we have entered into the following employment, stock option and other agreements with persons now serving as our executive officers:

Agreements with Trevor Drinkwater

On August 3, 2005, we entered into an employment agreement with Trevor Drinkwater, pursuant to which Mr. Drinkwater agreed to serve as our chief executive officer. The employment agreement provides that:

| | • | | Mr. Drinkwater is employed on an at-will basis and his employment may be terminated by us at any time; |

| | • | | Mr. Drinkwater’s annual salary would be $275,000; |

| | • | | Mr. Drinkwater would be provided an $800 monthly auto allowance and three weeks annual paid vacation; |

| | • | | We would grant to Mr. Drinkwater options to purchase 1,200,000 shares of our common stock priced at fair market value of our common stock on the date of grant. The options vest over a three-year period, with 600,000 vesting upon the date of grant and the remaining 600,000 vesting in equal installments on each of the second and third anniversaries of the date of grant; |

| | • | | We would pay to Mr. Drinkwater, at our sole discretion, an incentive bonus based upon achievement of “operating profit results” as defined in Exhibit A of the employment agreement. Mr. Drinkwater also would receive accelerated vesting of all stock options if the targeted Operating Profit Results are achieved; and |

| | • | | If we terminate Mr. Drinkwater’s employment without cause (as defined in the employment agreement), Mr. Drinkwater would be entitled to receive a severance payment equal to his compensation for a twelve month period plus all accrued but unpaid salary and vacation time. |

Effective December 5, 2005, the Company entered into an amendment to the employment agreement with Trevor Drinkwater, pursuant to which the following changes were made to Mr. Drinkwater’s employment agreement:

| | • | | Three-year term, with up to two one-year extensions at the option of the Company; |

| | • | | Base compensation of $425,000 in year one, $475,000 in year two, $525,000 in year three, $625,000 in year four (if applicable), and $675,000 in year five (if applicable), plus annual bonuses in each year of up to 50% of base salary based on performance factors to be determined by the Company’s Board of Directors; and |

| | • | | Additional stock options to acquire 1,000,000 shares, vesting in equal installments over five years. |

The amendment provides that it will become effective upon the closing of the transaction with TWC described above on page 5 of this Proxy Statement and that the amendment will be null and void in the event that the closing does not occur.

Agreement with Shawn Howie

On June 23, 2005, we entered into an employment agreement with Shawn Howie, pursuant to which Mr. Howie agreed to serve as an executive vice president and our chief financial officer. The employment agreement provides that:

| | • | | Mr. Howie is employed on an at-will basis and his employment may be terminated by us at any time; |

22

| | • | | Mr. Howie’s annual salary would be $225,000; |

| | • | | We would pay to Mr. Howie, at our sole discretion, a year-end performance bonus consistent with the bonus plan of our chief executive officer; and |

| | • | | If we terminate Mr. Howie’s employment without cause (as defined in the employment agreement), Mr. Howie is entitled to receive a severance payment equal to his compensation for a six month period plus all accrued but unpaid salary and vacation time. |