QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Websense, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

10240 Sorrento Valley Road

San Diego, California 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 2, 2004

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Websense, Inc., a Delaware corporation (the "Company"). The meeting will be held on Wednesday, June 2, 2004 at 11:00 a.m. Pacific Daylight Time at 10240 Sorrento Valley Road, San Diego, California, for the following purposes:

- 1.

- To elect two directors to hold office until the 2007 Annual Meeting of Stockholders.

- 2.

- To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as independent auditors of the Company for its fiscal year ending December 31, 2004.

- 3.

- To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the annual meeting is April 5, 2004. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

|

By Order of the Board of Directors |

|

|

|

|

|

Douglas C. Wride,

Chief Financial Officer and Corporate Secretary |

San Diego, California

April 22, 2004 |

|

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the Internet as may be made available to you by your broker, bank or other agent, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

WEBSENSE, INC.

10240 Sorrento Valley Road

San Diego, California 92121

PROXY STATEMENT

FOR THE 2004 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 2, 2004

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Websense, Inc. (sometimes referred to as the "Company" or "Websense") is soliciting your proxy to vote at the 2004 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or if made available to you by your broker, bank or other agent, vote over the telephone or the Internet.

The Company intends to mail this proxy statement and accompanying proxy card on or about April 22, 2004 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 5, 2004 will be entitled to vote at the annual meeting. On this record date, there were 23,286,340 shares of common stock outstanding and entitled to vote. The stock transfer books of the Company will remain open between the record date and the date of the meeting. A list of stockholders entitled to vote at the annual meeting will be available for inspection at the executive offices of the Company.

If on April 5, 2004 your shares were registered directly in your name with Websense's transfer agent, U.S. Stock Transfer Corporation, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

If on April 5, 2004 your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

- •

- Election of two directors;

- •

- Ratification of Ernst & Young LLP as independent auditors of the Company for its fiscal year ending December 31, 2004.

1

How do I vote?

You may either vote "For" all the nominees to the Board of Directors or you may abstain from voting for any nominee you specify. For each of the other matters to be voted on, you may vote "For" or "Against" or abstain from voting. The procedures for voting are fairly simple:

If you are a stockholder of record, you may vote in person at the annual meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

- •

- To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

- •

- To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Websense. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank or other agent. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 5, 2004.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted "For" the election of both nominees for director, and "For" the ratification of the Company's independent auditors for the fiscal year ending December 31, 2004. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, our employees and U.S. Stock Transfer Corporation may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies, but U.S. Stock Transfer Corporation will be paid its customary fee of approximately $20,000 plus out-of-pocket expenses if it solicits proxies. U.S. Stock Transfer Corporation will mail a search notice to banks, brokers, nominees and street-name accounts to develop a listing of stockholders, distribute proxy materials to brokers and banks for subsequent distribution to beneficial holders of stock, and solicit proxy responses from holders of our common stock. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

2

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

- •

- You may submit another properly completed proxy card with a later date.

- •

- You may send a written notice that you are revoking your proxy to Websense's Corporate Secretary at 10240 Sorrento Valley Road, San Diego, California 92121.

- •

- You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

When are stockholder proposals due for next year's annual meeting?

To be considered for inclusion in next year's proxy materials, your proposal must be submitted in writing by December 22, 2004, to Websense's Corporate Secretary at 10240 Sorrento Valley Road, San Diego, California 92121. If you wish to bring a matter before the stockholders at next year's annual meeting and you do not notify Websense before March 17, 2005, the Company's management will have discretionary authority to vote all shares for which it has proxies in opposition to the matter. You are also advised to review the Company's bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count "For" and (with respect to proposals other than the election of directors) "Against" votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal and will have the same effect as "Against" votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in "street name"), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to "discretionary" items, but not with respect to "non-discretionary" items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

- •

- For the election of directors, the two nominees receiving the most "For" votes (among votes properly cast in person or by proxy) will be elected. Broker non-votes will have no effect.

- •

- To be approved, Proposal No. 2 (Ratification of the Company's auditors for the fiscal year ending December 31, 2004) must receive a "For" vote from the majority of shares present and entitled to vote either in person or by proxy. If you abstain from voting, it will have the same effect as an "Against" vote. Broker non-votes will have no effect.

3

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 23,286,340 outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in the Company's quarterly report on Form 10-Q for the second quarter of 2004.

Proposal 1

ELECTION OF DIRECTORS

Websense's Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class shall serve for the remainder of the full term of that class, and until the director's successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

The Board of Directors presently has six members. There are two directors in the class whose term of office expires in 2004. Each of the nominees listed below is currently a director of the Company who was previously elected by the stockholders. If elected at the annual meeting, each of these nominees would serve until the 2007 annual meeting and until his successor is elected and has qualified, or until the director's death, resignation or removal. It is the Company's policy to invite nominees for directors to attend the annual meeting. None of the nominees for election as a director at the 2003 Annual Meeting of Stockholders attended the 2003 Annual Meeting of Stockholders because only a very small number of stockholders attended that meeting.

The nominees for election have agreed to serve if elected, and management has no reason to believe that such nominees will be unavailable to serve. In the event the nominees are unable or decline to serve as directors at the time of the annual meeting, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy.

The following is a brief biography of each nominee and each director whose term will continue after the annual meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2007 ANNUAL MEETING

John B. Carrington

John B. Carrington, age 60, has served as the Company's Chief Executive Officer since May 1999 and has served as a Director and Chairman since June 1999. Mr. Carrington also served as the Company's President from May 1999 to January 2003. Prior to joining Websense, Mr. Carrington was Chairman, President and Chief Executive Officer of Artios, Inc., a provider of hardware and software design solutions to companies in the packaging industry, from August 1996 until it was acquired by BARCO n.a. in December 1998. He received his B.S. in Business Administration from the University of Texas.

4

Gary E. Sutton

Gary E. Sutton, age 61, has served as a Director since June 1999. Mr. Sutton retired in August 2000 from Skydesk, Inc., a provider of online data protection services, after serving as its President, Chief Executive Officer and Chairman since January 1996. From 1990 to 1995, Mr. Sutton was chairman of Knight Protective Industries, a security systems provider. Mr. Sutton is also a co-founder of Teledesic, Inc., a low-earth orbit telecommunications service. Mr. Sutton authored the bookProfit Secrets of a No-Nonsense CEO and several other titles. He received his B.S. from Iowa State University.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2005 ANNUAL MEETING

Mark S. St.Clare

Mark S. St.Clare, age 57, has served as a Director since October 2002. From November 2000 to October 2002, Mr. St.Clare served as Chief Financial Officer of Access360, a provider of identity management software, until that company's acquisition by IBM. Mr. St.Clare previously served as Chief Financial Officer of Nexgenix, Inc., a supplier of Internet professional services, from February 2000 to November 2000. From January 1985 to February 2000, Mr. St.Clare served as Senior Vice President and Chief Financial Officer of FileNET Corporation, a publicly held software company. Mr. St.Clare also served as Secretary of FileNET from June 1993 to February 1999. He received a B.S. in Business Administration from the University of Denver.

Peter C. Waller

Peter C. Waller, age 49, has served as a Director since March 2001. Since March 2001, Mr. Waller has served as Chief Executive Officer of ThreeSixty Sourcing, a provider of imported consumer goods. From June 1997 to February 2001, Mr. Waller served as the President of Taco Bell Corp., an international food service chain that became a subsidiary of Tricon Global Restaurants after it was spun off from Pepsico in 1997. Mr. Waller previously served as Chief Marketing Officer of Taco Bell Corp. from January 1996 to May 1997. From 1990 to 1995, Mr. Waller held senior marketing positions with KFC, an international food service chain, in Western Europe, Australia and for the last two of those years, as Chief Marketing Officer of the USA operations. During the previous fifteen years, Mr. Waller held various marketing and brand manager responsibilities with Procter and Gamble, an international consumer goods manufacturer, Braun GmbH, an international subsidiary of Gillette Inc. which manufactures small electrical appliances, and Nabisco, an international manufacturer of biscuits, snacks and grocery products, in England, Germany, Canada and the USA. Mr. Waller received his M.A. from Oxford University, England.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2006 ANNUAL MEETING

Bruce T. Coleman

Bruce T. Coleman, age 65, served as our interim Chief Executive Officer from November 1998 to May 1999, and continues to be a Director, a position he has held since November 1998. Mr. Coleman has served as the Chief Executive Officer of El Salto Advisors, an interim executive firm, since November 1991. Mr. Coleman also has served as Chief Executive Officer of Vernier Networks, Inc., a provider of security solutions for mobile users, since January 2004. From October 2000 to August 2001, he served as Chief Executive Officer of Stamps.com, a provider of Internet mailing and shipping services. From October 1999 to May 2000, Mr. Coleman served as Chief Executive Officer of Rogue Wave Software, an enterprise systems software provider. From July 1997 to June 1998, Mr. Coleman served as Chief Executive Officer of Open Horizon, Inc., a provider of Java-based software, and from December 1995 to July 1996, he served as Chief Executive Officer of Computer Network Technology, Inc., a provider of networking hardware and software. Mr. Coleman also serves as a director of Printronix, Inc., a publicly

5

traded provider of printing solutions, supplies and services. He received a B.A. in Economics from Trinity College and an M.B.A. from Harvard Business School.

John F. Schaefer

John F. Schaefer, age 61, has served as a Director since May 2001. Since November 1994, Mr. Schaefer has served as Chairman and Chief Executive Officer of Phase Metrics, which was a publicly traded producer of technically advanced process and production test equipment for the data storage industry until substantially all of its assets were purchased by KLA-Tencor Corporation in April 2001. Since that time, Mr. Schaefer's responsibilities for Phase Metrics have principally related to oversight of certain post-acquisition matters. From 1992 to 1994, Mr. Schaefer was President, Chief Operating Officer and a director of McGaw, Incorporated, a producer of intravenous products and devices. From 1989 to 1991, Mr. Schaefer was President, Chief Executive Officer and a director of Levolor Corporation, a manufacturer of custom window treatment systems. Between 1974 and 1988, Mr. Schaefer was a Corporate Officer and director of Baker Hughes, Inc., a provider of services and equipment for the oilfield and process industries. Mr. Schaefer served as a Staff Assistant to the President of the United States between 1971 and 1974. He received a B.S. in Engineering from the United States Naval Academy and an M.B.A. from Harvard Business School.

INDEPENDENCE OF THE BOARD OF DIRECTORS

The Nasdaq Stock Market ("Nasdaq") listing standards require that a majority of the members of a listed company's board of directors qualify as "independent," as affirmatively determined by the board of directors. Our Board consults with the Company's legal counsel to ensure that the Board's determinations are consistent with all relevant securities and other laws and regulations regarding the definition of "independent," including those set forth in pertinent listing standards of the Nasdaq, as in effect time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that all of the Company's directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Mr. Carrington, the CEO of the Company.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors has documented the governance practices followed by the Company by adopting Corporate Governance Guidelines to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company's business operations as needed and to make decisions that are independent of the Company's management. The guidelines are also intended to align the interests of directors and management with those of the Company's stockholders. The Corporate Governance Guidelines set forth the practices the Board will follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning, and board committees and compensation. The Corporate Governance Guidelines were adopted by the Board to, among other things, reflect changes to the Nasdaq listing standards and Securities and Exchange Commission rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002. The Corporate Governance Guidelines, as well as the charter for each committee of the Board, may be viewed athttp://www.websense.com/investors/governance/.

The Company's independent directors meet in regularly scheduled executive sessions at which only independent directors are present. Persons interested in communicating with the independent directors with their concerns or issues may address correspondence to a particular director, or to the independent directors generally, in care of Websense at 10240 Sorrento Valley Road, San Diego, California 92121. If no

6

particular director is named, letters will be forwarded, depending on the subject matter, to the Chair of the Audit, Compensation, or Nominating and Corporate Governance Committee.

The Board has three committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for 2003 for each of the Board committees:

Name

| | Audit

| | Compensation

| | Nominating and

Corporate

Governance

| |

|---|

| John Carrington | | | | | | | |

| Bruce Coleman | | | | X | * | | |

| John Schaefer | | X | | | | X | * |

| Mark St.Clare | | X | * | | | X | |

| Gary Sutton | | X | | X | | X | |

| Peter Waller | | | | X | | | |

Total meetings in fiscal year 2003 |

|

12 |

|

6 |

|

1 |

** |

- *

- Committee Chairperson

- **

- The Nominating and Corporate Governance Committee was formed during 2003.

Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding "independence" and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities.

AUDIT COMMITTEE

The Audit Committee of the Board of Directors oversees the Company's corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on the Company's audit engagement team as required by law; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in the Company's Annual Report on Form 10-K; and discusses with management and the independent auditors the results of the annual audit and the results of the Company's quarterly financial statements. The Audit Committee has adopted a written Audit Committee Charter that is attached as Appendix A to these proxy materials.

The Board of Directors annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of the Company's Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards). The Board of Directors has determined that Mark St.Clare qualifies as an "audit committee financial expert," as defined in applicable SEC rules. The Board made a qualitative assessment of

7

Mr. St.Clare's level of knowledge and experience based on a number of factors, including his formal education and experience as a chief financial officer for public reporting companies.

COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors reviews and approves the overall compensation strategy and policies for the Company. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of the Company's executive officers and other senior management; reviews and approves the compensation and other terms of employment of the Company's Chief Executive Officer; reviews and approves the compensation and other terms of employment of the other executive officers; and administers the Company's stock option and purchase plans, pension and profit sharing plans, stock bonus plans, deferred compensation plans and other similar programs. Our Compensation Committee charter can be found on our corporate website athttp://www.websense.com/investors/governance/. All members of the Company's Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, selecting candidates for election to the Board of Directors, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board, and developing a set of corporate governance principles for the Company. Our Nominating and Corporate Governance Committee charter can be found on our corporate website athttp://www.websense.com/investors/governance/. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards).

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrating excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company's stockholders. However, the Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors' overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors' independence. In the case of new director candidates, the Committee also determines whether the nominee must be independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The committee then uses the Board's and management's network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Committee meets to discuss and consider such candidates' qualifications and then selects a nominee by majority vote. The Nominating and Corporate Governance Committee was formed in 2003. To date, the Committee has nominated two incumbent director candidates for the 2004 Annual

8

Meeting of Stockholders, has not needed to identify or evaluate any new director candidates, and therefore has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates. To date, the Nominating and Corporate Governance Committee has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of our voting stock.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder or not. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 10240 Sorrento Valley Road, San Diego, California 92121, not less than six months prior to any meeting at which directors are to be elected. Submissions must include the full name of the proposed nominee, a description of the proposed nominee's business experience for at least the previous five years, complete biographical information, a description of the proposed nominee's qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of the Company's stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors met 7 times during the last fiscal year. Each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member, respectively.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Company has a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Corporate Secretary of Websense at 10240 Sorrento Valley Road, San Diego, California 92121. All communications will be compiled by the Corporate Secretary of the Company and submitted to the Board or the individual Directors on a periodic basis. These communications will be reviewed by one or more employees of the Company designated by the Board, who will determine whether they should be presented to the Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications (such as advertisements, solicitations and hostile communications). All communications directed to the Audit Committee in accordance with the Company's Code of Business Conduct that relate to questionable accounting or auditing matters involving the Company will be promptly and directly forwarded to the Audit Committee.

CODE OF ETHICS

The Company has adopted a Code of Business Conduct which, together with the policies referred to therein, is applicable to all directors, officers and employees of the Company. In addition, the Company has adopted a Code of Ethics for the Chief Executive Officer, Senior Financial Officers and All Finance and Accounting Department Personnel ("Code of Ethics"). The Code of Business Conduct and the Code of Ethics cover all areas of professional conduct, including conflicts of interest, disclosure obligations, insider trading and confidential information, as well as compliance with all laws, rules and regulations applicable to our business. The Company encourages all employee, officers and directors to promptly report any violations of any of the company's policies. In the event that an amendment to, or a waiver from, a provision of the Code of Business Conduct or Code of Ethics that applies to any of our directors or executive officers is necessary, the Company intends to post such information on its website. Copies of our Code of Business Conduct and our Code of Ethics can be obtained from our website atwww.websense.com/investors/governance/.

9

Proposal 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2004 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the annual meeting. Ernst & Young LLP has audited the Company's financial statements since the Company's initial public offering in March 2000. Representatives of Ernst & Young LLP are expected to be present at the annual meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company's bylaws nor other governing documents or law require stockholder ratification of the selection of Ernst & Young LLP as the Company's independent auditors. However, the Board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

INDEPENDENT AUDITORS' FEES

The following table shows aggregate fees to the Company for fiscal years ended December 31, 2003 and December 31, 2002, by Ernst & Young LLP, the Company's principal accountant. Certain amounts from fiscal 2002 have been reclassified to conform to new presentation requirements.

| | Fiscal Year Ended

|

|---|

| | 2003

| | 2002

|

|---|

| | (in thousands)

|

|---|

| Audit Fees (for annual audit, reviews of the Company's quarterly reports on Form 10-Q, review of the annual proxy statement, comfort letters and consents for Company filings on Form S-8, and statutory and group audits required internationally)(1) | | $ | 210 | | $ | 203 |

| Audit-Related Fees (for documentation of internal controls and consultation regarding financial accounting and reporting standards)(2) | | | 61 | | | 18 |

| Tax Fees (for U.S. and international income tax compliance, advice and planning)(2) | | | 159 | | | 374 |

| All Other Fees (for annual license fees to auditor's online informational resources)(2) | | | — | | | 2 |

| | |

| |

|

| Total Fees | | | 430 | | | 597 |

| | |

| |

|

- (1)

- Includes fees and out-of-pocket expenses, whether or not yet billed.

- (2)

- Includes amounts billed and related out-of-pocket expenses for services rendered during the year.

All fees for 2003 described above were approved by the Audit Committee.

10

PRE-APPROVAL POLICIES AND PROCEDURES.

The Audit Committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by our independent auditor, Ernst & Young LLP. The Audit Committee generally pre-approves specified services in the defined categories of audit services, audit-related services, and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee's approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee's members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

The Audit Committee has determined that the rendering of the services other than audit services by Ernst & Young LLP is compatible with maintaining the principal accountant's independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Company's management is responsible for the preparation, presentation, and integrity of the Company's financial statements, accounting and financial reporting principles, internal controls, and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. The Company's independent auditors, Ernst & Young LLP, are responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles. The following is the report of the Audit Committee with respect to the Company's audited financial statements for the fiscal year ended December 31, 2003, included in the Company's Annual Report on Form 10-K for that year.

The Audit Committee has reviewed and discussed these audited financial statements with the Company's management. The Audit Committee has also discussed with the Company's independent auditors, Ernst & Young LLP, the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380) as amended, which includes, among other items, matters related to the conduct of the audit of the Company's financial statements. Further, the Audit Committee has received the written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board Standard No. 1 ("Independence Discussions with Audit Committees") as amended, and has discussed with Ernst & Young LLP the independence of Ernst & Young LLP from the Company.

Based on these reviews and discussions, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the Securities and Exchange Commission.

|

|

Submitted by the Audit Committee of the Board of Directors, |

|

|

Mark S. St.Clare

John F. Schaefer

Gary E. Sutton |

OTHER MATTERS

The Company knows of no other matters that will be presented for consideration at the annual meeting. If any other matters properly come before the annual meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board of Directors may recommend. By execution of the enclosed proxy, you grant discretionary authority with respect to such other matters.

11

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us regarding the beneficial ownership of our common stock as of February 29, 2004, by:

- •

- each person or group of affiliated persons known by us to own beneficially more than 5% of our outstanding common stock;

- •

- each current director and nominee for director;

- •

- each of our executive officers named in the Summary Compensation Table of the Compensation of Executive Officers section of this Proxy Statement; and

- •

- all current directors and executive officers as a group.

Except as otherwise noted, the address of each person listed in the table is c/o Websense, Inc., 10240 Sorrento Valley Road, San Diego, California 92121. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to shares. To our knowledge, except under applicable community property laws or as otherwise indicated, the persons named in the table have sole voting and sole investment control with respect to all shares shown as beneficially owned. The applicable percentage of ownership for each stockholder is based on 22,841,938 shares of common stock outstanding as of February 29, 2004, together with applicable options for that stockholder. Shares of common stock issuable upon exercise of options and other rights beneficially owned that are exercisable on or before April 29, 2004 are deemed outstanding for the purpose of computing the percentage ownership of the person holding those options and other rights but are not deemed outstanding for computing the percentage ownership of any other person.

Name and Address

| | Number of Shares

Beneficially Owned

| | Percent

(%)

| |

|---|

| Named Executive Officers, Directors and Nominees for Directors: | | | | | |

| |

John B. Carrington(1) |

|

360,483 |

|

1.55 |

% |

| | Harold Kester(2) | | 87,898 | | * | |

| | Douglas C. Wride(3) | | 98,693 | | * | |

| | Curt Staker(4) | | 140,207 | | * | |

| | Kian Saneii(5) | | 82,000 | | * | |

| | Bruce T. Coleman(6) | | 122,500 | | * | |

| | John F. Schaefer(7) | | 59,000 | | * | |

| | Gary E. Sutton(8) | | 32,500 | | * | |

| | Peter C. Waller(9) | | 55,000 | | * | |

| | Mark St. Clare(10) | | 53,500 | | * | |

5% Stockholders |

|

|

|

|

|

| |

T. Rowe Price Associates, Inc.(11)

100 East Pratt Street

Baltimore, Maryland 21202-1009 |

|

2,293,600

|

|

10.04

|

|

| |

FMR Corp.(12)

1 Federal Street

Boston, MA 02110-2003 |

|

2,721,429

|

|

11.91

|

|

All of our officers and directors as a group (12 persons)(13) |

|

1,201,382 |

|

5.02 |

|

- *

- Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

- (1)

- Consists of 360,483 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004.

12

- (2)

- Includes 84,125 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004.

- (3)

- Includes 94,443 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004.

- (4)

- Consists of 140,207 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004.

- (5)

- Consists of 82,000 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004.

- (6)

- Includes 47,500 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004, of which 2,500 shares remain unvested and therefore subject to certain rights of repurchase by the Company.

- (7)

- Includes 55,000 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004, of which 27,500 shares remain unvested and therefore subject to certain rights of repurchase by the Company. Also includes 1,000 shares jointly owned by Mr. Schaefer and his wife.

- (8)

- Consists of 32,500 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004, of which 2,500 shares remain unvested and therefore subject to certain rights of repurchase by the Company.

- (9)

- Consists of 55,000 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004, of which 15,000 shares remain unvested and therefore subject to certain rights of repurchase by the Company.

- (10)

- Includes 52,500 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004, of which 40,000 shares remain unvested and therefore subject to certain rights of repurchase by the Company.

- (11)

- Pursuant to a Form 13G filed with the SEC on February 11, 2004, these shares are owned by various individual and institutional investors for which T. Rowe Price Associates, Inc. ("Price Associates") serves as investment advisor, with power to direct investments for all 2,293,600 of the shares and sole power to vote 764,100 of the shares. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such shares; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of these shares.

- (12)

- Pursuant to a Form 13G/A filed with the SEC on March 10, 2004, FMR Corp. has reported that as of December 31, 2003 it had sole investment discretion over all 2,721,429 shares and sole voting authority over 492,900 of such shares.

- (13)

- Includes 1,110,586 shares of common stock issuable upon exercise of stock options exercisable within 60 days of February 29, 2004, of which 87,500 shares remain unvested and therefore subject to certain rights of repurchase by the Company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the "1934 Act") requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

13

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2003, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

COMPENSATION OF DIRECTORS

Non-employee directors are compensated at the rate of $1,500 per meeting of the Board attended in person and $750 per such meeting attended by telephone, and $1,000 per meeting of the Audit Committee attended in person or by telephone. The chairman of the Audit Committee is compensated an additional $1,000 per meeting of the Audit Committee attended in person and an additional $500 per such meeting attended by telephone. The chairman of the Compensation Committee is compensated an additional $500 per meeting of the Compensation Committee attended in person or by telephone. Beginning in 2004, non-employee directors will also be compensated at the rate of $500 per meeting of the Compensation Committee attended in person or by telephone, and the chairman of the Nominating and Corporate Governance Committee will be compensated an additional $500 per meeting of the Nominating and Corporate Governance Committee attended in person or by telephone. All Board compensation based on attendance at meetings is paid quarterly in arrears. In the fiscal year ended December 31, 2003, the total compensation earned by non-employee directors was $110,000. Non-employee directors are also reimbursed for their reasonable expenses incurred in attending meetings of the Board of Directors and its committees. Additional fees may be paid to directors based on performance of special projects, but no such payments were made in 2003 and none are presently anticipated for 2004.

Under the Automatic Option Grant Program in effect under the Company's 2000 Stock Incentive Plan (the "2000 Plan"), each individual who first joins the Board of Directors as a non-employee Board Member anytime after March 28, 2000 will receive, on the date of such initial election or appointment, an automatic option grant to purchase 50,000 shares of the Company's common stock, provided that such person has not previously been in the employ of the Company. In addition, on the date of each Annual Stockholders meeting held after March 28, 2000, each individual who continues to serve as a non-employee Board Member will automatically be granted an option to purchase 2,500 shares of the Company's common stock, provided such individual has served as a non-employee Board Member for at least six months prior to such meeting. Each grant under the Automatic Option Grant Program is immediately exercisable and will have an exercise price per share equal to the fair market value per share of the Company's common stock at the Nasdaq close on the option grant date, and will have a maximum term of 10 years, subject to earlier termination or repurchase should the director cease to serve as a Board Member. The shares subject to each initial 50,000-share automatic option grant will vest in a series of four successive equal annual installments upon the optionee's completion of each year of Board Service over the four-year period measured from the grant date. The shares subject to each annual 2,500-share automatic option grant will vest upon the optionee's completion of one year of Board Service measured from the grant date. However, the shares will immediately vest in full upon changes in control or ownership or upon the optionee's death or disability.

During the last fiscal year, the Company granted options covering 2,500 shares to each non-employee director of the Company, at an exercise price per share of $17.30. The fair market value of such common stock on the date of grant was $17.30 per share (based on the closing sales price reported on the Nasdaq National Market for the date of grant).

14

COMPENSATION OF EXECUTIVE OFFICERS

SUMMARY OF COMPENSATION

The following table shows for the fiscal years ended December 31, 2003, 2002 and 2001, compensation earned by the Company's Chief Executive Officer and its other four most highly compensated executive officers at December 31, 2003 (the "Named Executive Officers"):

SUMMARY COMPENSATION TABLE

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| | Fiscal

Year

| | Securities

Underlying Stock

Options Granted

| | All Other

Compensation

|

|---|

| | Salary

| | Bonus

|

|---|

John B. Carrington(1)

Chairman and Chief Executive Officer | | 2003

2002

2001 | | $

| 403,269

360,577

287,076 | | $

| 196,358

209,571

214,878 | | 40,000

80,000

60,000 | | $

| 2,209

1,022

1,022 |

Curt Staker(2)

President |

|

2003

2002

2001 |

|

|

248,923

210,000

178,500 |

|

|

278,808

171,135

212,666 |

|

100,000

50,000

250,000 |

|

|

1,691

991

97,027 |

Douglas C. Wride(1)

Vice President and Chief Financial Officer |

|

2003

2002

2001 |

|

|

270,192

240,385

194,615 |

|

|

80,757

69,212

64,078 |

|

40,000

80,000

60,000 |

|

|

735

767 767 |

Kian Saneii(3)

Vice President of Marketing and Business Development |

|

2003

2002

2001 |

|

|

237,115

218,269

70,154 |

|

|

58,627

32,353

15,698 |

|

15,000

10,000

150,000 |

|

|

1,152

896

8,674 |

Harold M. Kester(1)

Chief Technology Officer |

|

2003

2002

2001 |

|

|

207,500

182,404

166,269 |

|

|

38,123

24,679

22,887 |

|

15,000

30,000

30,000 |

|

|

1,713

767

767 |

- (1)

- All other compensation represents a Company-paid premium for executive long term disability.

- (2)

- In 2003 and 2002, all other compensation represents a Company-paid premium for executive long term disability. In 2001, all other compensation represents payments made on Mr. Staker's behalf relating to his relocation in the amount of $96,284 as well as a Company-paid premium for executive long term disability.

- (3)

- In 2003 and 2002, all other compensation represents a Company-paid premium for executive long term disability. In 2001, all other compensation represents consulting fees of $8,375 as well as a Company-paid premium of $299 for executive long term disability.

15

STOCK OPTION GRANTS AND EXERCISES

Stock Option Grants

The following table contains information concerning the stock options granted to the Named Executive Officers in the fiscal year ended December 31, 2003. We have not granted any stock appreciation rights.

Option Grants in Last Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term(1)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(2)

| |

| |

| |

|

|---|

| | % of Total

Options

Granted to

Employees

| |

| |

|

|---|

Name(2)

| | Exercise

Price per

Share(3)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| John B. Carrington | | 40,000 | | 4.1 | % | $ | 14.98 | | 01/22/12 | | $ | 376,834 | | $ | 954,970 |

| Curt Staker | | 100,000 | | 10.3 | | | 14.98 | | 01/22/12 | | | 942,084 | | | 2,387,426 |

| Douglas C. Wride | | 40,000 | | 4.1 | | | 14.98 | | 01/22/12 | | | 376,834 | | | 954,970 |

| Kian Saneii | | 15,000 | | 1.5 | | | 14.98 | | 01/22/12 | | | 141,313 | | | 358,114 |

| Harold M. Kester | | 15,000 | | 1.5 | | | 14.98 | | 01/22/12 | | | 141,313 | | | 358,114 |

- (1)

- There is no assurance provided to any executive officer or any other holder of the Company's securities that the actual stock price appreciation over the ten year option term will be at the assumed 5% or 10% annual rates of compounded stock price appreciation or at any other defined level. Unless the market price of the common stock appreciates over the option term, no value will be realized from the option grants made to the Named Executive Officers.

- (2)

- Each of the options granted have a maximum term of ten years measured from the applicable grant date, subject to earlier termination in the event of the optionee's cessation of service with the Company. Each of the options granted will become exercisable for 25% of the shares upon the completion of one year of service measured from the applicable grant date and will become exercisable for the remaining shares in equal monthly installments over the next 36 months of service thereafter. However, each of the options will immediately become exercisable for all of the option shares in the event the Company is acquired by a merger or asset sale, unless the options are assumed by the acquiring entity, or if the optionee's service with the Company is involuntarily terminated within 18 months following such merger or asset sale or within 18 months following a hostile change in control or ownership of the Company. The grant dates for the options set forth in the table are January 22, 2003.

- (3)

- The exercise price may be paid in cash or in shares of common stock valued at fair market value on the exercise date or may be paid with the proceeds from a same-day sale of the purchased shares.

Option Exercises and Holdings

The following table provides information with respect to the Named Executive Officers, concerning their exercise of options during the year ended December 31, 2003 and unexercised options held by them as of the end of such fiscal year. No stock appreciation rights were exercised during the fiscal year, and no stock appreciation rights were outstanding at the end of the fiscal year.

16

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-end Option Values

| |

| |

| | Number of Securities Underlying Unexercised Options at December 31, 2003

| |

| |

|

|---|

| |

| |

| | Value of Unexercised In-the-Money Options at December 31, 2003(2)

|

|---|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| John B. Carrington | | 321,021 | | $ | 6,207,261 | | 385,606 | | 97,917 | | $ | 9,574,781 | | $ | 923,175 |

| Curt Staker | | 56,000 | | | 529,465 | | 102,041 | | 198,959 | | | 1,235,478 | | | 2,587,912 |

| Douglas C. Wride | | 88,000 | | | 1,433,614 | | 71,110 | | 97,917 | | | 655,475 | | | 923,175 |

| Kian Saneii | | 12,000 | | | 109,160 | | 72,291 | | 82,709 | | | 880,880 | | | 1,031,070 |

| Harold M. Kester | | 20,000 | | | 410,274 | | 80,750 | | 38,750 | | | 1,683,596 | | | 382,794 |

- (1)

- Amount based on the difference between the fair market value of our common stock on the date of exercise and the exercise price of the option.

- (2)

- Based upon the market price of $29.27 per share, which was the closing selling price per share of common stock on the Nasdaq National Market on December 31, 2003, minus the per-share exercise price of the option.

EMPLOYMENT, SEVERANCE AND CHANGE OF CONTROL AGREEMENTS

Employment Agreement of John B. Carrington. Upon his initial employment with the Company in May 1999, the Company entered into an employment agreement with Mr. Carrington to serve as President and Chief Executive Officer. This agreement provides for an initial term of two years which term shall be automatically extended for successive one-year periods unless terminated by the Company prior to April 22 of any year. The agreement has not been terminated by the Company. The agreement provides that Mr. Carrington's salary and bonus shall be determined by the Company's Board of Directors but shall not be less than $200,000 per year. Under his employment agreement, Mr. Carrington was granted an option to purchase 975,000 shares of the Company's common stock, which vests over a four-year period, 25% of which vested upon the completion of one year of service and the remainder vesting in equal monthly installments over the next 36 months of service. Upon a change in control, all of Mr. Carrington's option shares that remain unvested will vest in full. Mr. Carrington was also granted an option to purchase 325,000 shares of the Company's common stock, which he exercised in May 1999 and which is now fully vested.

If Mr. Carrington's employment is terminated by the Company other than for cause, or is terminated by Mr. Carrington upon breach of his employment agreement by the Company, he is entitled to receive, as severance, a lump sum payment equal to 50% of his base salary and 50% of his average annual bonus earned under this agreement. Notwithstanding the foregoing, if within two years following a change of control, Mr. Carrington's employment is terminated by the Company other than for cause, is terminated by Mr. Carrington upon breach of his employment agreement by the Company, or is constructively terminated, he is entitled to receive, as severance, a lump sum payment equal to 150% of his base salary and 150% of his average annual bonus earned under this agreement.

Employment Agreement of Douglas C. Wride. In June 1999, the Company entered into an employment agreement with Mr. Wride to serve as Chief Financial Officer. This agreement provides that Mr. Wride will be employed "at will" and paid an annual base salary of at least $150,000. In addition, Mr. Wride will be eligible to receive a bonus of up to 20% of his annual base salary. The Company's Board of Directors retains discretion to grant Mr. Wride additional compensation. Under his employment agreement, Mr. Wride was granted an option to purchase 300,000 shares of the Company's common stock, which vest in equal monthly installments over a four-year period.

17

If Mr. Wride's employment is terminated by the Company other than for cause, he is entitled to receive, as severance, six months of continuation of his base salary and he will also be entitled to vest in the number of shares of the Company's common stock that would have become vested under his options if his employment had continued for an additional six months. Notwithstanding the foregoing, if within one year following a change of control, Mr. Wride is terminated other than for cause, he is entitled to receive, as severance, one year of continuation of his base salary and he will also be immediately vested in all of his option shares.

No employment contract exists with any of the other Named Executive Officers of the Company.

In the event that we are acquired by merger or asset sale, each outstanding option held by our Named Executive Officers which is not assumed by the successor corporation will immediately vest in full, except to the extent our repurchase rights with respect to those shares are assigned to the successor corporation. Such options will also immediately vest in full in the event those options are assumed in the acquisition but the officer's employment with us or the acquiring entity is subsequently involuntarily terminated within 18 months following the acquisition. In addition, such options will immediately vest in full if such officer's employment with us is involuntarily terminated within 18 months following a successful tender offer for more than 50% of our outstanding voting stock or a change in the majority of our board through one or more contested elections for board membership. In addition, certain of the option grants made to our Named Executive Officers and all options granted to our non-employee board members include limited stock appreciation rights. Options with this feature may be surrendered to us (whether or not then vested or exercisable) upon the successful completion of a hostile tender offer for more than 50% of our outstanding voting stock. In return for the surrendered option, the optionee is entitled to a cash distribution from us in an amount per surrendered option share based upon the highest price per share of our common stock paid in that tender offer. All options held by our non-employee directors will immediately vest in full upon changes in control or ownership.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

Overview and Philosophy. The Compensation Committee of the Board of Directors (the "Committee") is responsible for developing and making recommendations to the Board with respect to the Company's executive compensation policies. In addition, the Committee, pursuant to authority delegated by the Board, determines on an annual basis the compensation to be paid to the Company's Chief Executive Officer and each of the other executive officers of the Company.

The Committee has adopted the following objectives as guidelines for its compensation decisions:

- •

- Provide competitive total compensation packages that enable the Company to attract and retain key executives.

- •

- Integrate all compensation programs with the Company's short-term and long-term business objectives and strategic goals.

- •

- Ensure that compensation is meaningfully related to the value created for stockholders.

Executive Officer Compensation Program Components. The Committee reviews the Company's compensation program to ensure that salary levels and incentive opportunities are competitive and reflect the performance of the Company. The Company's compensation program for the Chief Executive and other executive officers consists of base salary, annual cash incentive compensation and long-term compensation in the form of stock options.

Base Salary. Base salary levels for the Chief Executive and the other executive officers are determined, in part, through comparisons with companies in the local software industry and other companies with which the Company competes for personnel. In addition, the Committee evaluates individual experience and performance and specific issues particular to the Company, such as creation of

18

stockholder value and achievement of specific Company milestones. The Committee reviews each executive's salary once a year and may increase each executive's salary at that time based on: (i) the individual's increased contribution to the Company over the prior 12 months; (ii) the individual's increased responsibilities over the prior 12 months; and (iii) any increase in median competitive pay levels.

Annual Incentive Compensation. The Chief Executive and other executive officers are also eligible to receive cash incentive compensation. For executive officers other than the CEO, this compensation is intended to provide a direct financial incentive in the form of quarterly and annual cash bonuses based on the achievement during the fiscal year of specifically defined individual and corporate performance goals. Generally, twenty percent of the total possible incentive compensation is based on the achievement of individual accomplishments. The remaining 80% is based on the Company's achievement of total billings and operating profitability goals, measured both quarterly and annually. The Chief Executive Officer's bonus is paid annually and is based solely upon the Company's achievement of annual billings and operating profitability goals. Bonus awards are set at a level competitive within the local software and high technology industries as well as among a broader group of technology companies of comparable size and complexity. Such companies are not necessarily included in the indices used to compare stockholder returns in the stock Performance Measurement Comparison.

Long-Term Incentive Compensation. The 2000 Stock Incentive Plan is the Company's long-term incentive plan for executive officers and, to a lesser degree, all other employees. The Committee strongly believes that by providing those persons who have substantial responsibility for the management and growth of the Company with an opportunity to increase their ownership of Company stock, the best interests of stockholders and executives will be more closely aligned. Executive officers are typically granted new stock options each year, which have exercise prices equal to the prevailing market value of the Company's common stock on the date of grant, and generally have 10-year terms and vesting periods of four years. Awards are made at a level calculated to be competitive within both the local software industry and a broader group of technology companies of comparable size and complexity.

Summary

After its review of all existing programs, the Committee continues to believe that the Company's compensation program for its Chief Executive and other executive officers is competitive with the compensation programs provided by other companies with which the Company competes. The Committee intends that any amounts to be paid under the annual incentive plan will be appropriately related to corporate and individual performance, yielding awards that are directly linked to the achievement of Company goals and annual financial and operational results.

|

|

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS, |

|

|

Bruce T. Coleman

Gary E. Sutton

Peter C. Waller |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Mr. Coleman, Mr. Sutton and Mr. Waller served as members of the Company's Compensation Committee in the year ended December 31, 2003. Mr. Coleman served as the Company's interim Chief Executive Officer for 6 months from November 1998 to May 1999. No other member of the Compensation Committee has been a contractor, officer or employee of the Company at any time. None of the Company's executive officers serves as a member of the Board of Directors or Compensation Committee of any other company that has one or more executive officers serving as a member of the Company's Board of Directors or Compensation Committee.

19

PERFORMANCE MEASUREMENT COMPARISON

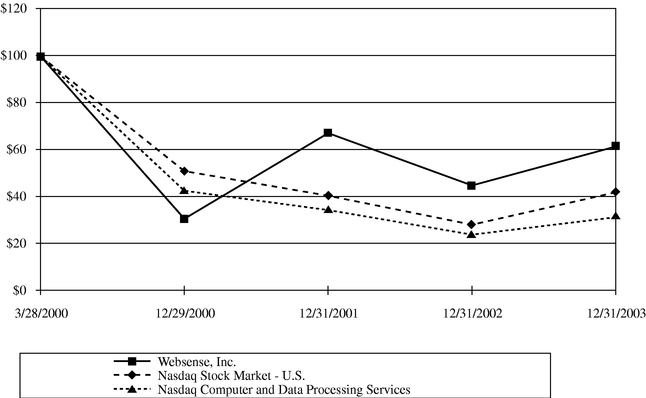

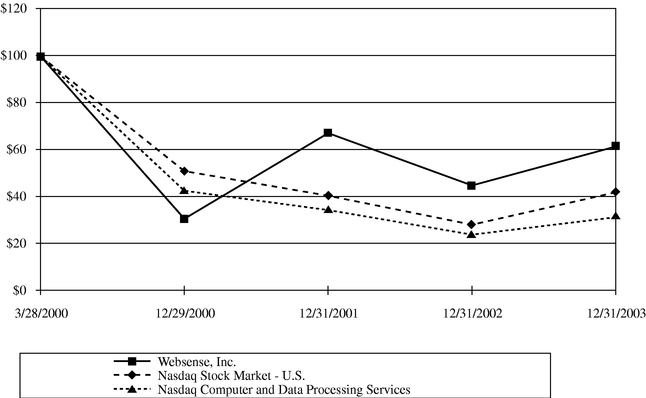

The following graph compares the cumulative total return of the Company's common stock to the weighted average return of stocks of companies included in the Nasdaq Stock Market—U.S. and a Nasdaq peer group index consisting of Computer and Data Processing Services companies from March 28, 2000 (the date the Company's common stock began to trade publicly) through December 31, 2003. The Company's fiscal year ends on December 31. The graph assumes $100 was invested at the close of trading on March 28, 2000 in the Company's common stock and in each index. The total return for each of the Company's common stock, the Nasdaq Stock Market—U.S. and the Nasdaq Computer and Data Processing Services Index assumes the reinvestment of dividends, although dividends have not been declared on the Company's common stock. The Nasdaq Stock Market—U.S. tracks the aggregate price performance of equity securities of companies traded on the Nasdaq Stock Market. The Nasdaq Computer and Data Processing Services Index consists of companies with a Standard Industrial Classification Code identifying them as Computer and Data Processing Services companies. The stockholder return shown on the graph below should not be considered indicative of future stockholder returns and the Company will not make or endorse any predictions as to future stockholder returns.

| | 3/28/2000

| | 12/29/2000

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

|

|---|

| Websense, Inc. | | $ | 100.00 | | $ | 30.37 | | $ | 67.16 | | $ | 44.74 | | $ | 61.30 |

| Nasdaq Stock Market—U.S. | | $ | 100.00 | | $ | 50.77 | | $ | 40.28 | | $ | 27.84 | | $ | 41.72 |

| Nasdaq Computer and Data Processing Services | | $ | 100.00 | | $ | 42.48 | | $ | 34.20 | | $ | 23.58 | | $ | 31.08 |

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings made by the Company under those statutes, the Compensation Committee Report, the Audit Committee Report, Audit Committee Charter, reference to the independence of the Audit Committee members and stock Performance Measurement Comparison are not "soliciting material," are not deemed filed with the Securities and Exchange Commission, and shall not be deemed incorporated by reference into any of those prior filings or into any future filings made by the

20

Company under those statutes irrespective of any general incorporation language contained in any such filing.

CERTAIN TRANSACTIONS

Stock option grants to the Company's directors are described under the caption "Director Compensation."

The Company has entered into indemnification agreements with each of its directors and officers. These agreements require the Company, among other things, to indemnify each director or officer against certain expenses, including attorneys' fees, judgments, fines and settlements paid by such individual in connection with any action, suit or proceeding arising out of such individual's status or service as a director or officer. These agreements also require the Company to advance expenses incurred by the individual in connection with any proceeding against him or her with respect to which such individual may be entitled to indemnification by the Company.

Some of the Company's stockholders are entitled to have their shares registered by the Company for resale.

HOUSEHOLDING OF PROXY MATERIALS