QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| ý | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

VIA NET.WORKS, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Dear Fellow Shareholder:

I would like to invite you to attend our annual meeting of shareholders to be held on Thursday May 22, 2003 at the Company's offices located in Reading, United Kingdom. We will have the opportunity this year to talk about the progress the Company made in 2002 and its prospects going forward.

As noted in the accompanying notice and proxy statement, at the annual meeting our shareholders will have the opportunity to cast their vote with respect to the election of certain directors on our board of directors and to authorize our board of directors to amend, at its discretion, our certificate of incorporation to effect a reverse split of our outstanding common stock, without further approval of shareholders, upon a determination by our board that a reverse stock split is in the best interests of our Company and the shareholders. Included with these soliciting materials is a proxy card for voting, a postage prepaid envelope to return your proxy, instructions for voting by telephone and a copy of our Annual Report to Shareholders.

It is important that your shares be represented at the meeting, even if you cannot attend the meeting to vote your shares in person. We urge you to vote your shares. Please give careful consideration to the items to be voted upon, complete and sign the proxy card and return it in the envelope provided or vote by telephone as instructed. If you return a proxy card or vote by telephone and later decide to attend the meeting, you may revoke your proxy at the meeting and vote your shares in person.

We look forward to receiving your vote and seeing you at the annual meeting.

| | Sincerely, |

|

|

|

Michael McTighe

Chairman of the Board of Directors |

Reading, United Kingdom

April 25, 2003

St. Giles House • 25 Kings Road • Reading RG1 3AR • United Kingdom

Notice of Annual Meeting of Shareholders

to be held on May 22, 2003

We will hold the annual meeting of the shareholders of VIA NET.WORKS, Inc. at the Company's offices located at St. Giles House, 25 Kings Road in Reading, United Kingdom on May 22, 2003, beginning at 10:00 a.m. GMT. At the meeting, holders of VIA's outstanding voting common stock will consider and vote on the following matters, as more fully described in the proxy statement:

- 1.

- The election of two Class III directors to serve for a three-year term,

- 2.

- Authorization for our board of directors to amend, at its discretion, our certificate of incorporation by adopting one of three proposed amendments to effect a reverse stock split, ranging from a one-for-five reverse stock split to a one-for-ten reverse stock split, of all the issued and outstanding shares of our common stock, par value $0.001 per share, without further approval of our shareholders, upon a determination by our board that a reverse stock split is in the best interests of our Company and our shareholders, and

- 3.

- Any other matters that may properly come before the meeting, or any postponements or adjournments of the meeting.

Shareholders of record at the close of business on April 4, 2003 are eligible to vote at the meeting or any postponements or adjournments of the meeting. A complete list of shareholders entitled to vote will be available for inspection at VIA NET.WORKS, Inc.'s offices at St. Giles House, 25 Kings Road, Reading RG1 3AR, United Kingdom for a period of ten days prior to the meeting.

Whether or not you plan to attend the meeting in person, please complete, sign and return the enclosed proxy promptly in the accompanying reply envelope. If you vote your proxy by telephone, please follow the instructions on your proxy card. By doing so, you will help us ensure the presence of a quorum at the meeting and save VIA the expense and time required to solicit proxies. If you send your proxy, you will still be able to change your vote or otherwise vote your shares in person at the meeting if you wish.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

| | | | Matt S. Nydell

Senior Vice President,

General Counsel and Secretary |

Reading, United Kingdom

April 25, 2003

St. Giles House • 25 Kings Road • Reading RG1 3AR • United Kingdom

TABLE OF CONTENTS

| Purpose of the Meeting | | 1 |

Proxies and Voting Procedures |

|

1 |

Election of Directors—Proposal 1 |

|

2 |

Audit Committee Report |

|

7 |

Report of the Compensation Committee |

|

8 |

Compensation Committee Interlocks and Insider Participation |

|

10 |

Stock Performance Graph |

|

11 |

Executive Officers |

|

12 |

Executive Compensation |

|

14 |

Ownership of Securities |

|

19 |

Reporting Compliance Section 16(a) Beneficial Ownership Reporting Compliance |

|

21 |

Approval of Amendments to Certificate of Incorporation to Effect a Reverse Stock Split |

|

21 |

Independent Accountants and Fees Paid |

|

30 |

Shareholder Proposals for the 2004 Proxy Statement |

|

31 |

Other Matters |

|

31 |

VIA NET.WORKS, INC.

PROXY STATEMENT

FOR

2003 ANNUAL MEETING OF SHAREHOLDERS

This proxy statement contains information relating to the solicitation of proxies by the board of directors of VIA NET.WORKS, Inc. (VIA, the Company, or we) to be voted upon at the annual meeting of the shareholders of the Company to be held on Thursday May 22 2003 at the Company's offices located at St. Giles House, 25 Kings Road in Reading, United Kingdom beginning at 10:00 a.m. GMT. and at any postponements or adjournments of the meeting. These materials were first mailed on or about April 25, 2003 to all shareholders entitled to vote at the annual meeting.

PURPOSE OF THE MEETING

At the annual meeting, the holders of our voting common stock shall consider and vote on the election of two Class III directors, authorization of three possible amendments to our certificate of incorporation to effect a reverse stock split and any other matters as may properly come before the shareholders. Our management will also provide a report on VIA's performance during fiscal year 2002 and answer questions posed by shareholders.

PROXIES AND VOTING PROCEDURES

Only holders of our voting common stock of record as of the close of business on April 4, 2003, the record date for the annual meeting, are entitled to notice of, and to vote at, the annual meeting or any postponements or adjournments of the meeting. We have two separate classes of common stock outstanding, voting and non-voting. If you were a shareholder of the voting common stock as of the close of business on April 4, 2003 you will be entitled to one vote for each share of voting common stock you held as of the record date. Our common stock is listed on the Nasdaq SmallCap Market® and the Euronext Amsterdam Exchange under the symbol "VNWI." As of the record date, there were 55,097,704 shares of voting common stock issued and outstanding.

Solicitation of Proxies

In addition to this solicitation, which we are conducting by mail, VIA and its directors, officers and employees (who will receive no additional compensation) may also solicit proxies in person, by telephone, email, facsimile and other methods. VIA will pay all costs of the annual meeting and of soliciting, printing and mailing proxies.

Revocability Of Proxies

If you are unable to attend the annual meeting, we urge you to vote your proxy. You may revoke your proxy at any time before the annual meeting or by attending the annual meeting and voting in person. If you wish to revoke your proxy, please send a written statement to the Secretary of the Company or send another properly executed proxy dated as of a later date to be delivered at or prior to the annual meeting. All revocations or new proxies must be delivered no later than May 20, 2003 to the Company's U.K. corporate office located at St. Giles House, 25 Kings Road, Reading, United Kingdom attn: Matt S. Nydell, VIA NET.WORKS, Inc. Annual Meeting.

Required Vote

At the annual meeting, shareholders will be voting on four proposals: to elect two Class III directors to VIA's board of directors and to authorize three amendments to our certificate of incorporation, one of which our board of directors at its discretion, may implement to effect a reverse stock split. With respect to the election of directors, the two nominees who receive the most affirmative

votes will be elected as Class III directors. The proposals to authorize the amendments to our certificate of incorporation require the affirmative vote of the holders of a majority of the votes entitled to be cast by the shares of common stock outstanding and entitled to vote at the annual meeting. Under our bylaws and the Delaware General Corporation Law, shares represented by proxies that reflect abstentions will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Accordingly, abstentions from the election of directors will not affect the election of the candidates receiving the most votes. With respect to the proposals to authorize the amendments to our certificate of incorporation to effect a reverse stock split and all other proposals to come before the meeting, abstentions will have the same effect as votes against such proposals. Shares represented by brokers who are prohibited from exercising discretionary authority because the beneficial owners of such shares have not provided voting instructions (commonly referred to as "broker non-votes") will be counted as present for determining the presence of a quorum, will not affect the election of candidates receiving the most votes for director, but will count as votes against the proposals to authorize the amendments to our certificate of incorporation.

Voting

You may attend the annual meeting and vote in person or, as a registered shareholder as of the record date, you may vote your shares by proxy, by mail or by telephone. To vote by mail, simply mark, sign and date your proxy card and return it in the postage-paid envelope provided. Please allow sufficient time for your proxy to be delivered before the close of business on May 20, 2003. You may vote by telephone 24 hours a day, 7 days a week until 12:00 midnight on May 20, 2003 by calling and using the procedure noted on the proxy card. These procedures are also available to shareholders who hold their shares through a broker, nominee, fiduciary or other custodian.

You will need proof of ownership of VIA shares as of the record date to be admitted into the annual meeting. If you bring a proxy card, a recent statement from a securities broker indicating your shareholding in VIA or a proxy from a securities broker if you hold your VIA shares through a broker, you will be admitted to the annual meeting.

Shares represented by proxies in the form enclosed, if such proxies are properly signed and returned and not revoked, and shares properly voted by telephone, will be voted as specified. If you sign, date and return the proxy card without specifying your vote, your shares will be voted FOR the election of all nominees for director and FOR the authorization of the three proposed amendments to our certificate of incorporation effecting a reverse stock split of all the issued and outstanding shares of our common stock, par value $0.001 per share, without further approval of our shareholders.

We know of no business other than the items described in this proxy statement to be transacted at the meeting. If other matters requiring a vote do arise, the persons named in the proxy will vote in accordance with their judgment on such matters. To be voted, proxies must be delivered to VIA's Secretary prior to the time of voting.

ELECTION OF DIRECTORS—PROPOSAL 1

Board of Directors

VIA's bylaws provide that the number of directors constituting the board of directors will not be less than three nor more than fifteen, as fixed from time to time by the board of directors. In 2000, the board of directors fixed the number of directors at ten. Since then, the board has determined that it is in the best interests of VIA to gradually reduce the number of members on our board of directors. In March 2003, consistent with its objective, the board of directors reduced the number of directors to seven. Currently, there is one vacancy on our board of directors.

Our board of directors is divided into three classes that have terms that expire in successive years. At each annual meeting of shareholders, directors will be elected for terms of three years each. The

2

Class III directors whose terms expire at the 2003 annual meeting are Steven C. Halstedt and John C. Steele. Our third Class III director, Gabriel A. Battista, resigned in January 2003. The board of directors has since reduced the size of the board to seven members, eliminating the seat held by Mr. Battista. The board of directors proposes that Messrs. Halstedt and Steele be re-elected as our Class III directors for a full term of three years and until their successors are duly elected and qualified. Each of the nominees has consented to serve another term as a Class III director.

Information about our Nominees and Directors

Steven C. Halstedt, 57, served as chairman of VIA's board of directors from January 2002 to October 2002. Mr. Halstedt also served as a director of VIA from June 1997 to November 1999. Mr. Halstedt is a managing director of Centennial Ventures, which he co-founded in 1981. Mr. Halstedt is also a general partner of Centennial Holdings V, L.P. and a managing principal of Centennial Holdings VI, LLC. Mr. Halstedt is a member of the board of directors of Raindance Communications, Inc., a publicly traded company listed on the Nasdaq National Market, and of Panasas, Inc, a privately held company. Mr. Halstedt received a B.S. with Distinction in Management Engineering from Worcester Polytechnical Institute. He also received an M.B.A. from The Amos Tuck School of Dartmouth College, where he was an Edward Tuck Scholar. Mr. Halstedt is a member of the Board of Trustees of Worcester Polytechnical Institute and serves on the Board of the National Venture Capital Association.

John C. Steele, 60, serves as chairman of the advisory board of Accenture HR Services a publicly traded company and as chairman of the board of Internet Designers Limited, a privately held systems integration and e-gaming solutions company. Mr. Steele is also a council member of the Arbitration and Conciliation Service in the United Kingdom. Mr. Steele worked with British Telecommunications Plc from 1989 through 2002 where he served as group personnel director and a member of the company's executive committee.

The board of directors recommends that shareholders vote "FOR" the election of Messrs. Halstedt and Steele as Class III Directors.

Stephen J. Eley, 43, has served as a director of VIA since April 1999. Mr. Eley has been a general partner since January 1990 of each of BCI Growth III, IV and V, private equity funds focused on providing growth capital to private and public companies. Prior to joining BCI, Mr. Eley was employed by AMEV Holdings/Venture Management, a venture capital firm, in New York from 1986 to 1989 and by Peat Marwick Mitchell & Co., an accounting and consultant firm, from 1983 to 1986. Mr. Eley serves on the board of directors of Piedmont Television Holdings, LLC, BullsEye Telecom, Inc., Catamount Holdings, LLC and as the chairman of the board of Asset Management Outsourcing, Inc., all of which are privately-held companies. Mr. Eley received a B.S. in accounting from the University of Rhode Island.

Michael McTighe, 49, joined VIA in June 2002 and was elected as chairman in October 2002. Prior to joining VIA, Mr. McTighe was chief executive officer of Carrier1. Before Carrier1, Mr. McTighe served as executive director and chief executive, Global Operations for Cable & Wireless plc. He has also served as president and chief executive officer of Philips Consumer Communications LLP, spent five years with Motorola with responsibilities for Europe and Asia and worked for 10 years with GE in various European markets. Mr. McTighe serves on the board of directors of Alliance & Leicester, plc and Pace Micro Technology plc, both of which are publicly traded companies. Mr. McTighe also serves on the board of directors for London Metals Exchange Holdings Ltd., Red M

3

Communications Ltd. and Eniton S.A. all of which are privately-held companies. Mr. McTighe holds a B.S. in Electronic Engineering from University College in London.

Rhett Williams, 46, joined VIA in November 2002 as chief executive officer and a director of the board. Prior to joining VIA, Mr. Williams was executive vice president and chief marketing officer of KPNQwest from April 1999 to June 2002. Before KPNQwest from November 1993 to March 1999, Mr. Williams was senior vice president for Corporate Accounts at KPN Telecom. Previously, he held several key senior management positions with AT&T in the U.S. and Europe, including AT&T's joint venture AT&T-Unisource Communication Services, as its managing director, Multinational Accounts. Mr. Williams holds degrees in Business Administration, Economics and International Affairs, earned in Switzerland and the U.S. He is fluent in English, French and Dutch.

Erik M. Torgerson, 37, has served as a director of VIA since May 1999 and as chairman of its audit committee since October 1999. Since 1993, he has been a general partner of Norwest Equity Partners, a venture capital firm. Prior to joining Norwest Equity Partners in 1993, Mr. Torgerson was employed by Arthur Andersen & Co., an accounting and consulting firm, in the financial consulting and audit practice. Mr. Torgerson currently serves on the board of directors at Butlernetworks A/S, Diveo Broadband Networks, Inc., and Peoplenet Communications, all of which are privately-held companies. Mr. Torgerson is a C.P.A. (inactive). He received his B.S. degree from the University of Minnesota and his M.B.A. from the University of Iowa.

Some of our directors became directors as a result of board designation rights we granted to some of our shareholders prior to our initial public offering. Specifically:

- (1)

- Mr. Eley was the director designee of BCI Growth V, LLC

- (2)

- Mr. Halstedt was the director designee of Centennial Fund VI, L.P.

- (3)

- Mr. Torgerson was the director designee of Norwest Equity Partners, LLC

These board designation rights terminated as of our initial public offering. There are no family relationships among any of our directors or executive officers.

Since VIA's 2002 annual meeting of shareholders five directors have resigned from VIA's board of directors. Mr. William Johnston resigned as a Class I director effective September 18, 2002, Mr. Adam Goldman resigned as a Class II director effective September 23, 2002 and Mr. John Puente resigned as a Class III director effective September 18, 2002. Mr. Gabriel Battista resigned as a Class III director effective January 13, 2003. Mr. Karl Maier resigned as a Class II director effective March 31, 2003 in connection with his departure from the management of the Company.

Compensation of Directors

Prior to January 2003, each of our independent directors, who was not an employee of VIA or was not, prior to our initial public offering, a board designee of one of our shareholders, received an annual fee of $5,000 for serving on our board plus $1,000 for each regularly scheduled meeting attended and $500 for each special meeting and each committee meeting attended. In addition, each of these directors, upon joining our board, received an option to purchase up to 100,000 shares of our common stock at an exercise price equal to the fair market value of the stock on the date of grant. These options typically vested over three years. In addition, prior to our initial public offering, independent directors received the right, granted under the earlier version of our Key Employee Equity Plan described below, to purchase up to 50,000 shares of our common stock at an exercise price equal to the fair market value of the stock on the date of grant. In 2002, Messrs. Battista and Puente, both of whom have since left the board of directors, and Mr. McTighe, through September 1, 2002, were the only directors who received compensation in accordance with this policy. All of our directors, including those who did not otherwise receive compensation for serving on our board of directors, were reimbursed for travel and other expenses relating to attendance at meetings of the board of directors or committees of the board of directors.

4

On September 26, 2002, the board of directors adopted a new compensation policy for members of our board of directors. Except as noted below, beginning in 2003, each non-executive director is entitled to an annual retainer of $12,000 and a fee of $1,000 for each committee meeting in excess of the first six meetings attended by a director during the year. The policy provides that all directors who are employees or partners of shareholders whose beneficial ownership in VIA exceeds 5% of the total number of outstanding shares of VIA common stock shall receive all cash compensation in shares of VIA common stock, valued as of January 1st of the relevant year. This currently applies to Messrs. Halstedt and Torgerson. The annual retainer is payable only if the director attends at least 50% of all board meetings during a calendar year. Upon joining the board, each non-executive director receives a one-time grant of options to purchase up to 100,000 shares of our common stock at an exercise price equal to the fair market value of the stock on the date of grant and annual grants of options to purchase up to 25,000 shares of our common stock. Under the policy, these options will vest over three years; however, in recognition of their past service, the options granted to Messrs. Battista, Torgerson and Eley provided for accelerated vesting, one-half of the shares subject to the option vested immediately, with the balance of the shares subject to the option vesting over three years.

Under the new policy, the chairman of the board receives an annual fee of $10,000 and the chairman of the audit committee receives a supplemental annual fee of $5,000. Audit committee members also receive additional annual grants of options to purchase 5,000 shares of our common stock at an exercise price equal to the fair market value of the stock on the date of grant.

Mr. Steele joined our board of directors in October 2002, at which time he began receiving benefits under our new compensation policy.

In September 2002, prior to the adoption of the new policy, the board of directors approved and authorized the Company to enter into an agreement with Mr. McTighe, who agreed to serve as Chairman of VIA's board of directors and to devote one day per week to support VIA's management team, in addition to his services as Chairman. Under this agreement, VIA agreed to pay Mr. McTighe total compensation in the amount of £60,000 per annum, of which £42,552.50 relates to his consulting services and the balance for his service as chairman and on the board of directors. In connection with his dual role, Mr. McTighe also received an option grant to purchase up to 250,000 shares of VIA common stock. Further details of this agreement are described under the section entitled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements." In 2002, Mr. McTighe did not receive any further compensation outside of that which he received under the agreement and under the former compensation policy.

Our Confidentiality Policy and our Directors

Because in the past certain of our directors have served as executive officers or directors of companies that may compete with us, we adopted a policy on confidentiality to protect our confidential information and prevent our directors from facing conflicts of interest that they may not be able to resolve. Under this policy, our directors are not required to bring to our attention any information about potential acquisitions of Internet services providers and other related services providers of which they become aware exclusively through their affiliations with, or membership on the boards of directors of, other specified companies, and we do not consider this type of opportunity to constitute a corporate opportunity of ours. In addition, under this policy, our directors are required to maintain the confidentially of our financial and operating information.

Board Committees and Meetings

During the fiscal year ended December 31, 2002, our board of directors held eleven regularly scheduled meetings and three special meetings. All incumbent directors attended or participated in more than 75% of the aggregate number of the meetings of the board of directors and committees on which they served. In 2002, the board had standing audit, compensation, executive, finance, and nominating and corporate governance committees. The executive committee was dissolved in August 2002. The current membership of each committee of the board is noted in the chart below.

5

Board of Directors Committee Membership

Board Member

| | Term Expiring

| | Audit

| | Compensation

| | Finance

| | Nominating/

Corporate

Governance

|

|---|

| Stephen Eley | | 2004 | | M | | M | | | | |

| Steven Halstedt | | 2003 | | | | M | | C | | |

| Michael McTighe | | 2004 | | M | | | | M | | M |

| John Steele | | 2003 | | | | C | | | | C |

| Erik Torgerson | | 2005 | | C | | | | | | M |

| Rhett Williams | | 2004 | | | | | | M | | |

C = Chair

M = Member

Audit Committee. The audit committee recommends independent auditors for approval and appointment by our board of directors and monitors the independence and performance of the independent auditors. The audit committee also assists the board by monitoring the integrity of our financial statements and reviewing our compliance with legal and regulatory requirements and overseeing our internal control practices. The audit committee met on twenty-seven occasions during 2002.

Compensation Committee. The compensation committee oversees compensation policies of VIA and its subsidiaries. The oversight responsibilities of the committee include: consulting with the chief executive officer to establish guidelines and policies for all executive compensation plans, annual review and determination of the material elements of the chief executive officer's compensation, review of the material elements of all other senior executive officers' compensation, review and approval of senior management base salaries that exceed $200,000, review and approval of yearly corporate goals and administration of our employee stock option plans. The compensation committee held nine meetings during 2002.

Executive Committee. Prior to its dissolution in August 2002, the executive committee was responsible for consulting, advising and aiding the officers of the Company with the management, strategic direction and other important matters of the Company and generally acting in the stead of the board of directors between regularly scheduled board meetings. The executive committee was established in January 2002 and met on fourteen occasions during 2002.

Finance Committee. The finance committee provides direction and advice to the officers of the Company with respect to strategic business combinations, merger and acquisition opportunities and financial policies of the Company. The finance committee also undertakes other specific activities as expressly delegated by the board of directors. The finance committee met on six occasions during 2002.

Nominating and Corporate Governance Committee. In September 2002, the board of directors reconstituted its nominating committee into a nominating and corporate governance committee to specifically consider and oversee corporate governance matters. The nominating and corporate governance committee is responsible for providing oversight and direction on matters relating to the composition and operation of the board of directors (including board member qualification standards), the committees of the board of directors, and the establishment of a set of corporate governance principles and codes of ethical conduct. The committee also provides assistance to the board of directors and the chairman in other areas of corporate governance issues, including committee selection and rotation practices, evaluation of the overall effectiveness of the board of directors and management (including the chief executive officer position) and oversight of senior management searches. The nominating and corporate governance committee also will consider as nominees for director persons recommended by the shareholders of the Company. Such recommendations should be sent to the Company in accordance with the instructions found below under "Shareholder Proposals for the 2004 Proxy Statement." The nominating and corporate governance committee met once during 2002.

6

AUDIT COMMITTEE REPORT

The audit committee of the board of directors is composed entirely of non-employee directors: Messrs. Torgerson, McTighe and Eley. The board of directors has determined that Messrs. Torgerson and Eley are independent, as defined in Rule 4200 of the Nasdaq Stock Market listing standards. Because of Mr. McTighe's consultancy agreement with the Company, the board has determined that he is not independent within the meaning of Nasdaq's rules. However, the board has determined that Mr. McTighe's current membership on the audit committee is required in the best interests of the Company and its shareholders, given Mr. McTighe's business experience and in-depth understanding of the Company's business, and Nasdaq's requirement that the audit committee consist of at least three members. In compliance with new Securities and Exchange Commission Rules required by the Sarbanes-Oxley Act, Nasdaq has proposed rules to go into effect in 2004 that would prohibit Mr. McTighe from serving on the Company's audit committee as a result of his consultancy agreement with the Company. The Company is actively engaged in a search for an additional board and audit committee member who would be independent within the meaning of Nasdaq's rules. The audit committee's responsibilities are described under the caption "Board Committees and Meetings" under "Election of Directors—Proposal I" above in this proxy statement. Further detail on the audit committee's responsibilities is set forth in the audit committee charter adopted by the board of directors in November 2000, a copy of which was included in VIA's proxy statement for the 2001 annual meeting.

The audit committee, with the full authority of the board of directors, participated in and approved the decision to change independent accountants in 2002. Effective as of September 26, 2002, the audit committee engaged Deloitte & Touche to serve as the Company's independent public accountants for the remainder of 2002 and to conduct the audit of its consolidated financial statements for the year ending December 31, 2002.

The audit committee has reviewed and discussed with VIA's management and independent auditors the audited financial statements contained in the 2002 annual report on Form 10-K filed with the Securities and Exchange Commission. The Company's management is responsible for the financial statements and the reporting process, including the system of internal controls. The independent auditors are responsible for opining on the conformity of those audited financial statements with generally accepted accounting principles in the United States.

The audit committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended. In addition, the audit committee received the written disclosures and letter required by Independence Standards Board Standard No. 1,Independence Discussion with Audit Committees, has discussed with the independent auditors the auditors' independence from the Company and its management and has considered the compatibility of non-audit services with the auditor's independence. The audit committee also discussed and approved the Company's critical accounting policies.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the board of directors that the audited financial statements be included in the Company's annual report on Form 10-K for the fiscal year ended December 31, 2002 for filing with the Securities and Exchange Commission. The audit committee also made its recommendation to the board of directors on the selection of VIA's independent auditors.

| | Submitted by the Audit Committee |

|

Erik Torgerson, Chairman

Stephen Eley

Michael McTighe |

7

REPORT OF THE COMPENSATION COMMITTEE

The compensation committee of the board of directors has provided the following report on executive compensation for fiscal year 2002. The compensation committee members are Messrs. Steele, Eley and Halstedt, all of whom are non-employee directors.

Compensation Philosophy

The compensation committee is responsible for administering our stock option plans, including our 1998 Option Plan and our amended KEEP, establishing overall compensation for our chief executive officer and reviewing compensation policies for our senior executive officers, including our named executive officers.

VIA's compensation policies are intended to create appropriate incentives to motivate our employees to achieve corporate goals and to ensure our future success. The compensation committee supports these policies by ensuring that our executive officers receive competitive compensation packages that recognize the contributions each executive makes to VIA's performance.

VIA has structured its compensation packages for executive officers to include three main components: base salary, performance bonus and stock option grants. The compensation committee believes these three components are necessary and will enable the Company to attract and retain highly qualified executive officers in the competitive technology industry.

Base salary. The initial base salary for each executive officer is based on negotiations with the individual taking into account market conditions, salary history and compensation levels of other executive officers having equivalent responsibility within the Company. The base salary of each executive officer is reviewed at his or her anniversary hire date for merit increases up to a certain percentage of the base salary and for market adjustments. Merit increases are determined primarily based upon each executive's contributions toward the Company's success and his or her achievements within the executive's functional area during the prior twelve month period. The compensation committee reviews and approves recommendations for merit and market adjustment increases made by VIA's chief executive officer.

Performance Bonus. For 2002 and prior years, all executive officers were eligible for an annual performance bonus, up to a specified percentage of their base salary. The determination of performance bonuses for each executive officer, other than the chief executive officer, generally was based partly on achievement of personal goals agreed upon between the executive and his or her supervisor, taking into account the executive's functional responsibilities within the Company, and partly on VIA's achievement of corporate goals. The corporate goals component of the performance bonus was based on the financial and business goals for VIA as a whole, established during the first quarter of the fiscal year. After the conclusion of the fiscal year, the compensation committee reviewed and reported to the full board of directors the extent to which the corporate goals had been met. The compensation committee also approved performance bonuses to be paid to VIA's senior executive officers based on recommendations of VIA's chief executive officer, other than with respect to his own bonus, which take into account the Company's success in meeting corporate goals and his assessment of each senior executive's success in meeting personal goals. The bonus for the chief executive officer is based entirely on VIA's performance with respect to the corporate goals.

In the first quarter of 2003, the board of directors, upon the recommendation of the compensation committee, approved a new bonus policy for all employees, including executive officers. Under the policy, personal and corporate performance will now be reviewed and bonuses will now be paid on a semi-annual basis rather than annually. In addition, the new policy modified the allocable percentage of bonus eligibility weighting between achievement of personal goals and corporate goals, directing a higher percentage weighting toward the achievement of corporate goals for senior executives.

8

During 2002, each of Mr. Williams and our other executive officers listed in our Summary Compensation Table below, whom we refer to as our named executive officers, were eligible for a bonus of up to a specific percentage of their base salaries. The compensation committee met on March 19, 2003 and determined that VIA had achieved, and approved a determination of performance for the corporate goals of, approximately 100% of the agreed targets. Subsequent to the end of 2002, Mr. Maier left the Company. Prior to his departure, VIA entered into an Employment Separation Agreement and Release with Mr. Maier. Under the agreement Mr. Maier received a bonus for 2002 in accordance with the terms of his Employment Agreement dated as of June 24, 2002 ("Employment Agreement") and VIA's bonus policy in effect for 2002. Mr. Maier also received a bonus payment for the first three months of 2003. Further information about this Employment Separation Agreement can be found under the section entitled "Employment Agreements and Terminations of Employment and Change in Control Arrangements" below in this proxy statement. The performance bonus amounts for fiscal years 2002, 2001 and 2000 for Messrs. Williams, Maier and D'Ottavio and each of our other named executive officers are set forth in the Summary Compensation Table in this proxy statement.

Stock option grants. The compensation committee receives the recommendation of the chief executive officer for initial stock option grants for all executive officers in connection with commencement of their employment. Executive officers are typically eligible for additional grants of options in recognition of extraordinary individual performance, promotion, and in connection with a broad based general distribution of options to employees in recognition of superior performance of the Company. The compensation committee is responsible for approving all such subsequent grants based on the recommendation of the chief executive officer.

Income Tax Considerations. Under Section 162(m) of the Internal Revenue Code of 1986 and applicable Treasury regulations, no tax deduction is allowed for annual compensation in excess of $1 million paid to any of the Company's five most highly compensated executive officers. However, certain performance-based compensation, including stock option grants, is excluded from the $1 million limit if the requirements of Section 162(m) are met. Stock option grants awarded to the Named Executive Officers is intended to be deductible under Section 162(m). The Compensation Committee intends to structure performance-based compensation in the form of stock option grants to executive officers who may be subject to Section 162(m) in a manner that satisfies the requirements of Section 162(m) so long as doing so is compatible with its determinations as to the most appropriate methods and approaches for the design and delivery of compensation to executive officers of the Company.

Chief Executive Officer Compensation

In January 2002, Mr. David D'Ottavio left the Company. After consultation with outside counsel and executive search professionals, the compensation committee approved the final terms of the Employment Separation Agreement with Mr. D'Ottavio, which included a severance payment, modified treatment of the option grants previously awarded to Mr. D'Ottavio, and other compensatory items. In January of 2002, the board of directors appointed Mr. Karl Maier as acting chief executive officer of the Company. Mr. Maier's compensation, which was based on a six-month contract, was adopted and approved by the compensation committee. In negotiating the agreement with Mr. Maier, the committee considered the requirements and circumstances of the Company, the experience and track record of Mr. Maier, the temporary nature of his appointment and market conditions. In June 2002, after Mr. Maier introduced a strategic turnaround plan and began implementation of the plan, the board of directors engaged in discussions with Mr. Maier to continue to serve with the Company in the role as acting chief executive officer. As a result of these discussions, VIA entered into a new employment agreement with Mr. Maier, which provided for a new compensation package. In determining the appropriate compensation under this new agreement, the compensation committee considered the achievements of Mr. Maier, the financial situation and operating requirements of the Company and

9

market conditions. Subsequent to the end of 2002, in February of 2003, the compensation committee approved the final terms of the Employment Separation Agreement negotiated with Mr. Maier as described above.

Further information relating to the Employment Agreement and Employment Separation Agreement between VIA and Mr. Maier can be found under the section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements" below in this proxy statement.

Mr. Rhett Williams joined the Company in November 2002 as chief executive officer. Mr. Williams may also from time to time serve as a director, officer or employee of any subsidiary of the Company. The compensation committee considered Mr. Williams' background and experience, met with him prior to his joining VIA and reviewed his expressed salary requirements. Having reviewed current market and peer comparables and other factors, the committee has determined that Mr. Williams' salary and other material elements of his compensation package are appropriate for the industry and acceptable to the Company for fiscal year 2003. As noted below, a substantial portion of Mr. William's total compensation is based upon the achievement of the Company's financial and non-quantitative corporate objectives.

As part of his compensation package, Mr. Williams is eligible for an annual bonus up to a maximum of 50% of his base salary. In addition, if Mr. Williams substantially exceeds his bonus targets, he will be eligible for a supplemental bonus, in the discretion of the board of directors, up to a maximum of an additional 25% of his salary. Determination of Mr. Williams' annual bonus is based solely on the Company's achievement of the corporate goals established by the compensation committee for each fiscal year to ensure that Mr. Williams' compensation is aligned with achievement of the Company's goals. The prorated bonus awarded to Mr. Williams for 2002 is noted in the Summary Compensation Table in this proxy statement. The compensation committee also awarded him stock options in October 2002 and March 2003 pursuant to certain terms of a Service Agreement between the Company and Mr. Williams, dated October 30, 2002.

Further information relating to the Service Agreement between VIA and Mr. Williams can be found under the section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements" below in this proxy statement.

| | Submitted by the Compensation Committee |

|

John Steele, Chair

Stephen Eley

Steven Halstedt |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of our compensation committee has been employed by or served as an officer of VIA or our subsidiaries, or has had any relationship requiring disclosure in "Related Transactions."

10

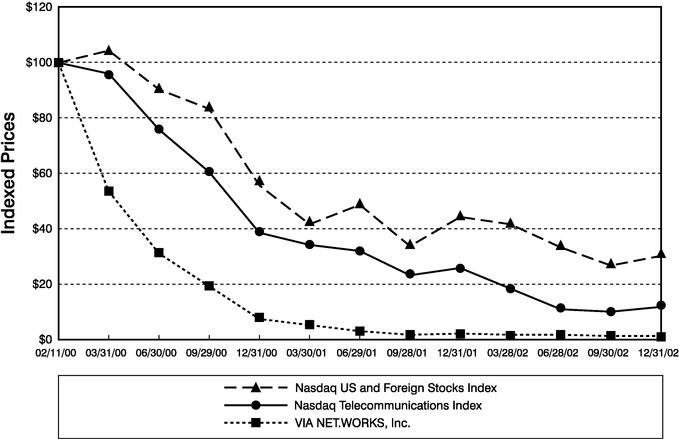

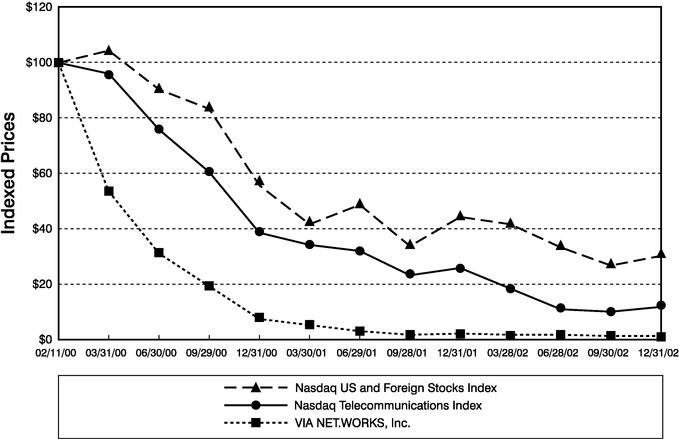

STOCK PERFORMANCE GRAPH

The graph below shows the performance of the Company's common stock assuming $100 invested on February 11, 2000 together with the performance of the Nasdaq U.S. and Foreign Stock Index and the Nasdaq Telecommunications Index® over the period beginning on the date of our initial public offering on February 11, 2000 through the end of fiscal year 2002.

Comparison of Total Return from Date of Initial Public Offering through December 31, 2002

11

EXECUTIVE OFFICERS

The following table shows information about each of our executive officers as of April 15, 2003.

Name

| | Age

| | Position

|

|---|

| Rhett Williams | | 46 | | Chief Executive Officer |

| Michael Magluilo. | | 31 | | Vice President, Corporate Development |

| Rebecca Markovits | | 39 | | Vice President, Human Resources |

| Matt Nydell | | 43 | | Senior Vice President, General Counsel and Secretary |

| Fraser Park | | 39 | | Vice President, Chief Financial Officer and Treasurer |

| Dick Theunissen | | 33 | | Vice President, Product Marketing and Management |

| Raymond Walsh | | 37 | | Senior Vice President, Technology and Operations |

| Keith Westcott | | 46 | | Vice President, Indirect Sales |

Rhett Williams(please see biographical information under Proposal 1 above).

Michael Magluilo joined VIA in April 2002 as Vice President, Corporate Development. Prior to joining VIA, Mr. Magluilo served as Director, Corporate Development from May 2001 through December 2001 with HRZ Communications where he was responsible for business plan development and implementation of the Company's acquisition strategy. From January 2000 through February 2001, Mr. Magluilo was with Level 3 Communications where he served as Vice President of Corporate Development for North America responsible for the Company's strategic planning, strategic investment and capital allocation processes. Previously from June 1997 through January 2000, Mr. Magluilo served as Vice President, Investment Banking for Daniels & Associates, L.P. Mr. Magluilo holds a B.S. in Finance from the University of Illinois at Urbana-Champaign.

Rebecca Markovits joined VIA in June 2002 as Vice President, Human Resources. Prior to joining VIA, Ms. Markovits headed up the global human resources group at KPNQwest from February 1998 through May 2002. Previously Ms. Markovits served in Human Resource management positions at ITT World Directories.

Matt Nydell has been with VIA since August 1998. He has served as VIA's Senior Vice President, General Counsel and Secretary since April 2002. From August 1998 to April 2002, he served as VIA's Vice President, General Counsel and Secretary. From November 1996 to August 1998, he was Director, Ventures and Alliances for MCI Communications Corporation, a telecommunications company, where he oversaw MCI's interest in Concert Communications Company, an international telecommunications joint venture with British Telecommunications. From June 1994 to November 1996, he was Senior Counsel in MCI's Mass Market's legal group. Prior to joining MCI, Mr. Nydell was an attorney with the Washington office of law firm Donovan Leisure Newton and Irvine. Mr. Nydell received a J.D./M.A., foreign affairs, from the University of Virginia, and a B.A., with honors, in Philosophy from Bucknell University.

Fraser Park joined VIA as its Vice President, Chief Financial Officer and Treasurer in January 2003. Mr. Park served from November 2001 through August 2002 as chief financial officer of RiverSoft plc, a publicly-listed software company where he led the reorganization of the business and its subsequent sale to a trade competitor. Previously, from August 1999 through June 2001 he served as chief financial officer at Nettec plc where he led the company's successful IPO on the London Stock Exchange in April 2000. From 1996 to 1999, Mr. Park worked for the strategic management consultancy, McKinsey, as an engagement manager, before which he held senior financial roles at The

12

Stanley Works on both a national UK and European level. Mr. Park holds a BA (Hons) in Accountancy and Finance from Strathclyde University, Scotland, and qualified as a chartered accountant in 1988.

Dick Theunissen joined VIA in December 2002 as its Vice President, Product Marketing and Management. Prior to joining VIA, Mr. Theunissen served as Vice President Product Management at KPNQwest from 1999 to 2002. Previously. Mr. Theunissen held several positions with KPN. Mr. Theunissen holds a Master of Science degree in Economics for the Erasmus University Rotterdam, The Netherlands.

Raymond Walsh has served as VIA's Senior Vice President, Technology and Operations since June 2002. Prior to joining VIA, Mr. Walsh served as Senior Vice President of Operations and CIO at KPNQwest from February 1999 to June 2002. In addition, Mr. Walsh served in various technology and operational management positions at Qwest, LCI International and WilTel. Mr. Walsh holds a B.S. in Management Science and Computer Systems from Oklahoma State University.

Keith Westcott joined VIA in December 2002 as Vice President, Indirect Sales. From May 2002 through December 2002, Mr. Westcott was a management consultant for various small to mid sized enterprises in the United Kingdom. Mr. Westcott served from March 1999 through May 2002 as Managing Director for KPNQwest UK & Ireland. Prior to this position, from February 1998 through March 1999, he was Marketing Director of Guardian IT, Plc, a business continuity and disaster recovery company listed on the London Stock Exchange. He also served as Group Marketing Director for ICL, a wholly owned subsidiary of Fujistu Ltd for a period of one year. Previously Mr. Westcott held pan-European sales and marketing roles in the information technology, telecommunications and Internet sectors, including positions with AT&T, Olivetti and Data General. Mr. Westcott earned a diploma in Industrial Design from Exeter College of Art.

13

EXECUTIVE COMPENSATION

The following table presents a summary of compensation paid with respect to the past three fiscal years to each of our chief executive officers during 2002 and the four executives most highly compensated during 2002, all of whom we refer to as our named executive officers.

Summary Compensation Table

| |

| |

| |

| | Long Term

Compensation

| |

| |

|---|

| |

| | Annual Compensation

| |

| |

|---|

Name and Principal Position

| |

| | Securities

Underlying

Options

| | All Other

Compensation

| |

|---|

| | Year

| | Salary

| | Bonus

| |

|---|

Rhett Williams(1)

Chief Executive Officer | | 2002 | | $ | 72,333 | | $ | 109,688 | | | 1,000,000 | | $ | 31,094 | (2) |

David M. D'Ottavio(3)

Chief Executive Officer |

|

2000

2001

2002 |

|

$

|

331,242

349,999

21,875 |

|

$

|

175,000

87,500

— |

|

$

|

—

200,000

— |

|

|

328,125 |

(4) |

Karl A. Maier(5)

Acting Chief Executive Officer, Chief Operating Officer and President |

|

2002 |

|

$ |

310,384 |

|

$ |

210,000 |

|

|

370,000 |

|

$ |

53,832 |

(6) |

Matt S. Nydell

Senior Vice President, General Counsel and Secretary |

|

2000

2001

2002 |

|

$

|

165,000

203,583

218,151 |

|

$

|

98,300

58,785

109,688 |

|

|

56,250

110,000

150,000 |

|

$ |

3,902 |

(7) |

Raymond Walsh(8)

Senior Vice President, Technology and Operations |

|

2002 |

|

$ |

113,788 |

|

$ |

63,984 |

|

|

250,000 |

|

$ |

51,458 |

(9) |

Michael Magluilo(10)

Vice President, Corporate Development |

|

2002 |

|

$ |

121,042 |

|

$ |

56,875 |

|

|

150,000 |

|

$ |

17,216 |

(11) |

Rebecca Markovits(12)

Vice President, Human Resources |

|

2002 |

|

$ |

85,088 |

|

$ |

41,055 |

|

|

150,000 |

|

$ |

9,572 |

(13) |

E. Benjamin Buttolph(14)

Vice President, Chief Financial Officer and Treasurer |

|

2002 |

|

$ |

154,583 |

|

$ |

96,062 |

|

|

105,000 |

|

|

— |

|

- (1)

- Mr. Williams joined VIA on November 1, 2002. See section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements" for further information.

- (2)

- This amount represents payments of $94 made on behalf of Mr. Williams for life insurance and $3100 for car allowance.

- (3)

- Mr. D'Ottavio left VIA in January 2002.

- (4)

- This amount represents payments paid to Mr. D'Ottavio upon his separation from VIA in January 2002.

- (5)

- Mr. Maier joined VIA on January 21, 2002 and left VIA in March 2003. See section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements" for further information.

- (6)

- This amount represents payments of $909 made on behalf of Mr. Maier for life insurance, $50,736 for expatriate compensation under the Company's foreign assignment policy and $2,187 Company matching funds in the 401(k) plan.

- (7)

- This amount represents payments of $698 made on behalf of Mr. Nydell for life insurance and $3,204 Company matching funds in the 401(k) plan.

- (8)

- Mr. Walsh joined VIA on June 10, 2002.

14

- (9)

- This amount represents payments made on behalf of Mr. Walsh for expatriate compensation under the Company's foreign assignment policy.

- (10)

- Mr. Magluilo joined VIA on April 1, 2002.

- (11)

- This amount represents payments of $304 made on behalf of Mr. Magluilo for life insurance and $16,912 for expatriate compensation under the Company's foreign assignment policy.

- (12)

- Ms. Markovits joined VIA on June 10, 2002.

- (13)

- This amount represents payments of $9,572 made on behalf of Ms. Markovits for car allowance.

- (14)

- Mr. Buttolph left VIA in October 2002. See section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements" for further information.

1998 Stock Option and Restricted Stock Plan. In 1998 we adopted the Amended and Restated 1998 Stock Option and Restricted Stock Plan (the "1998 Option Plan"), which allows us to issue restricted shares of our common stock or options to purchase shares of our common stock. The total number of shares of our common stock available for issuance under the 1998 Option Plan is 9,200,000, no more than 125,000 of which may be issued in the form of restricted common stock. No person may be granted more than 125,000 shares of restricted stock or options to purchase more than 1,000,000 shares of stock in any calendar year.

The 1998 Option Plan is administered by the compensation committee. Except as described in the plan, our compensation committee determines the grantees, the type of grant, number of shares subject to each grant, and the term, exercise price, and vesting schedules for each grant. All of our employees are eligible to participate under the 1998 Option Plan. The maximum term of options granted under the 1998 Option Plan is ten years plus one month.

Options to purchase 7,273,546 shares of common stock were issued and outstanding under the 1998 Option Plan as of April 1, 2003. All of these options are subject to vesting requirements based on continued employment, typically vesting over four years. Option agreements governing options granted to VIA employees generally provide for the acceleration of the vesting period if there is a change of control of VIA in which we are not the surviving company, except if the surviving company assumes the obligations under existing option grants, an equivalent and substitute option in stock in the surviving company is provided, or VIA's board of directors determines that the change of control will not trigger accelerations of the options. Options granted prior to our initial public offering on February 11, 2000 have an exercise price equal to what the board of directors determined the fair market value of the common stock to be on the date of the grant. Options granted after the date of our initial public offering have an exercise price equal to the closing price for our stock on the Nasdaq SmallCap Market® on the last trading day immediately prior to the date of grant.

Amended and Restated Key Employee Equity Plan. During 1998, the Company adopted the V-I-A Internet Inc. Key Employee Equity Plan (the "KEEP"), an incentive plan to attract and retain qualified officers, key employees, directors and other persons at VIA and our operating companies. The KEEP provides for the granting of stock options to key employees of VIA. Rights are granted with an exercise price as determined by the Company's board of directors. As of December 31, 2000, the Company had reserved 800,000 common shares for issuance under the KEEP. On August 9, 2001, VIA amended the KEEP to permit, among other things, grants of non-incentive stock options to employees, consultants or advisors, other than to directors and officers, of VIA. Options granted under the amended KEEP will vest over such periods as may be determined by the board of directors and will generally have an exercise price equal to the closing price for our stock on the Nasdaq SmallCap Market® on the last trading day immediately prior to the date of grant. As of December 31, 2002, the Company had reserved 214,517 common shares for issuance under the amended KEEP. No options awards were made under the amended KEEP in 2002.

15

Our compensation committee, which administers the amended KEEP, has full power and final authority to designate the grantees, to determine the number of purchase options awarded and to determine the terms and conditions relating to the vesting, exercise, transfer or forfeiture of the grant, including the exercise price.

Option Grants in Last Fiscal Year

The following table provides information relating to options to purchase common stock we granted our named executive officers during the year ended December 31, 2002. The percentages in the table below are based on the options to purchase shares of our common stock we granted under our 1998 Option Plan in the year ended December 31, 2002. Except as noted, the options described in the table below become exercisable over periods of from one to four years and have a term of ten years. The three separate options to purchase up to 10,000 shares granted to Mr. Buttolph and the option to purchase up to 10,000 shares granted to Mr. Maier vested immediately and have a term of three years from the date of grant. The option to purchase up to 100,000 shares granted to Mr. Maier has a term of three years and vested in three equal installments on the 30th 60th and 90th day after the date of the grant. The option to purchase up to 75,000 shares granted to Mr. Buttolph has a term of three years and vested ninety days after the date of grant. The option to purchase up to 150,000 shares granted to Mr. Nydell vested immediately and has a term of ten years. Potential realizable values are net of exercise price before taxes and are based on the assumption that our common stock appreciates at the annual rates shown, compounded annually, from the date of grant until the expiration of the relevant term. These numbers are calculated based on the requirements of the Securities and Exchange Commission and do not reflect our estimates of future stock price growth.

Option Grants in Last Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at Assumed Annual Rates of Share Price Appreciation for Option Term

|

|---|

| |

| | Percent of

Total

Options

Granted to

Employees

in Fiscal

Year

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| |

| |

|

|---|

Name

| | Exercise

Price

Per Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Rhett Williams | | 1,000,000 | | 29.90 | % | 0.54 | | 10/31/12 | | 297,717 | | 733,292 |

| Karl Maier | | 100,000

10,000

240,000 | |

10.46 |

% | 0.99

0.63

0.83 | | 01/21/05

05/21/05

07/01/05 | | 10,148

646

20,418 | | 20,790

1,323

41,832 |

| David D'Ottavio | | — | | — | | — | | — | | — | | — |

| Matt Nydell | | 150,000 | | 4.48 | % | 0.56 | | 10/30/12 | | 46,312 | | 114,068 |

| Raymond Walsh | | 250,000 | | 7.47 | % | 0.63 | | 06/09/12 | | 86,834 | | 213,877 |

| Michael Magluilo | | 150,000 | | 4.48 | % | 0.66 | | 05/10/12 | | 54,581 | | 134,437 |

| Rebecca Markovits | | 100,000

75,000

10,000

10,000 | | 2.99 | % | 0.78

0.78

0.71

0.65 | | 6/16/12

04/14/05

08/14/05

09/14/05 | | 43,004

5,996

728

666 | | 105,920

12,285

1,491

1,365 |

| E. Benjamin Buttolph | | 10,000 | | 3.14 | % | 0.59 | | 10/14/05 | | 605 | | 1,239 |

Option Exercises and Fiscal Year-End Option Values

None of our named executive officers exercised any stock options during 2002. The following table presents summary information with respect to stock options owned by our named executive officers at December 31, 2002. We have calculated the value of unexercised in-the-money options based on the closing price of the stock on the Nasdaq SmallCap Market® on December 31, 2002 of $0.68 per share. The actual value of the stock options will depend upon the market value of the shares that can be purchased under the option at a future date.

16

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| |

| |

| | Number of securities underlying unexercised options at December 31, 2002

| | Value of unexercised

in-the-money options at December 31, 2002

|

|---|

| | Number of

shares

acquired on

exercise

| |

|

|---|

Name

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Rhett Williams | | — | | — | | 0 | | 1,000,000 | | — | | 140,000 |

| Karl Maier | | — | | — | | 220,000 | | 130,000 | | 500 | | — |

| David D'Ottavio | | — | | — | | 500,000 | | 0 | | — | | — |

| Matt Nydell | | — | | — | | 543,742 | | 108,568 | | 18,000 | | — |

| Raymond Walsh | | — | | — | | — | | 250,000 | | — | | 12,500 |

| Michael Magluilo | | — | | — | | — | | 150,000 | | — | | 3,000 |

| Rebecca Markovits | | — | | — | | — | | 100,000 | | — | | — |

| E. Benjamin Buttolph | | — | | — | | — | | — | | — | | — |

Employment Agreements and Terminations of Employment and Change-in-Control Arrangements

In October 2002 VIA negotiated a service agreement with Mr. Williams in connection with his employment as chief executive officer beginning November 18, 2002. The agreement provides for Mr. Williams to receive an annual base salary of not less than £280,000. He is also eligible to receive an annual bonus of up to 50% of his base salary which may be increased up to a maximum of 75% of his base salary at the discretion of the board of directors, if Mr. Williams significantly exceeds the corporate goals as set by the compensation committee. Mr. Williams is entitled to receive retirement benefits under VIA's 401(k) plan, or, if the Company's 401(k) plan does not permit Mr. William's participation due to his location outside of the United States or the nature of the plan, then he may receive retirement benefits through a private pension with a maximum contribution by VIA of 6% of his base salary. Under the service agreement, Mr. Williams is entitled to receive grants of options to purchase an aggregate of 1,200,000 shares of the Company's common stock. The agreement may be terminated by either VIA or Mr. Williams by giving six-months written notice. If VIA terminates the agreement, Mr. Williams will receive a severance payment in an amount equal to one-year's base salary and reimbursement of reasonable relocation expenses or a lump sum equivalency.

From January 2002 through June 2002 Mr. Maier was employed as VIA's acting chief executive officer under the terms of a six-month agreement as discussed in the Company's 2002 proxy statement under the section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements." In June 2002 VIA negotiated a new employment contract with Mr. Maier extending his employment with VIA. The agreement provided for Mr. Maier to serve in the senior executive positions of president and chief operating officer for a three-year period from June 24, 2003 and to continue in the position of acting chief executive officer until such time as the position was filled. Under the agreement, Mr. Maier was entitled to an annual base salary of not less than US$350,000. The agreement provided that Mr. Maier would be eligible to receive an annual bonus of up to 50% of his base salary which may be increased up to a maximum of 70% of his base salary at the discretion of the board of directors, if Mr. Maier significantly exceeded the goals as set by the compensation committee. The agreement further provided that, in connection with the Company's relocation of its corporate offices to Europe, Mr. Maier would relocate to the Company's corporate offices in the United Kingdom. In this regard, the agreement provided that Mr. Maier would receive expatriate benefits in accordance with the terms of VIA's Foreign Service Assignment policy. Under the agreement, VIA was entitled to terminate Mr. Maier's employment at any time after January 1, 2003 for any reason without cause, and with or without notice, upon payment of specified severance benefits.

In February 2003 VIA negotiated a separation agreement with Mr. Maier. Under the terms of the separation agreement, Mr. Maier would be released from all his duties and responsibilities as president

17

and chief operating officer by March 31, 2003, although he will remain an employee of VIA until June 30, 2003. The agreement provides that Mr. Maier will continue to receive his base salary and foreign service assistance payments until June 30, 2003. In addition, Mr. Maier is eligible to receive a bonus for achievement of certain goals established for him with respect to the first three months of 2003. Under the agreement, Mr. Maier will receive a severance amount of six-months' base salary and other continuing benefits under VIA's Foreign Service Assignment policy.

In January 2002, Mr. D'Ottavio, entered into a separation agreement with VIA under the terms of an agreement which was described in the Company's 2002 proxy statement under the section titled "Employment Agreements and Terminations of Employment and Change-in-Control Arrangements."

In connection with his continued employment with VIA as Senior Vice President, General Counsel and Secretary, VIA entered into an employment agreement with Mr. Nydell effective as of April 24, 2002. Under terms of the agreement, Mr. Nydell is entitled to an annual base salary of not less than $225,000 and he is eligible to participate in all bonus programs applicable to senior executives of the Company. The agreement provides that if Mr. Nydell is terminated without cause or if, after October 31, 2002, Mr. Nydell terminates his employment with VIA, he will be entitled to severance benefits consisting of: (a) one-year of his base salary, (b) continuation of health, dental, life accidental death and disability, and long- and short-term disability insurance for one-year or a lump sum payment in lieu of the coverage, and (c) a pro-rated bonus applicable to the calendar year when he is terminated. In addition, should Mr. Nydell be terminated by VIA without cause or should he terminate his employment with good reason, all stock options previously granted to Mr. Nydell shall be deemed fully vested on his termination date and the exercise period shall be extended to one year from the termination date.

In connection with his appointment as chief financial officer, VIA entered into an employment agreement with Mr. Buttolph effective as of April 15, 2002. The agreement provided that Mr. Buttolph would serve as chief financial officer for a minimum period of six months. The agreement provided that after six months, Mr. Buttolph would either continue on as chief financial officer of VIA on a permanent basis on terms to be negotiated, the employment relationship arrangement would terminate, or VIA would renegotiate the terms under which he would continue his employment on a temporary basis. Under the agreement, Mr. Buttolph was entitled to a salary at an annualized rate of $265,000 and a one-time grant of stock options to purchase up to 75,000 shares of VIA's common stock. These options vested at the end of the 90th day of his employment and permitted Mr. Buttolph to exercise all vested options for a period of 36 months from the date of grant. Under his employment agreement, Mr. Buttolph was entitled to receive additional stock options to purchase up to 10,000 shares of stock, fully vested, for each one-month anniversary he remained employed as chief financial officer for VIA for longer than three months. Mr. Buttolph's employment agreement provided that he would be eligible to receive a bonus of up to 30% of his base salary, awarded upon achievement of certain performance objectives. In October 2002, Mr. Buttolph's employment agreement was extended on a month-to-month basis. The Company and Mr. Buttolph mutually agreed to terminate the relationship in November 2002.

Consistent with prior practice for specified senior officers, all option agreements governing options granted to the chief executive officer and to each vice president reporting to the chief executive officer provide for the acceleration of the vesting period of the options if there is a "change of control" (as defined in the agreements) in which VIA is not the surviving company. However, the option agreements further provide that no acceleration of vesting will occur if the optionee continues with the surviving company in an equivalent position or role for a period of not less than one year.

18

OWNERSHIP OF SECURITIES

The following table shows the number and percentage of outstanding shares of our common stock that were owned as of April 1, 2003 by:

- •

- each person who we know to be the beneficial owner of more than 5% of our outstanding common stock

- •

- each of our directors and named executive officers, and

- •

- all of our directors and executive officers as a group.

As of April 1, 2003, there were 55,097,704 shares of voting common stock and 5,050,000 shares of non-voting common stock outstanding.

The total number of shares of common stock outstanding used in calculating the percentage owned by each person includes the shares of common stock issuable upon conversion of our non-voting common stock or upon the exercise of options held by that person that are exercisable as of June 1, 2003.

Unless indicated otherwise below, the address for our directors and officers is c/o VIA NET.WORKS, Inc., St. Giles House, 25 Kings Road, Reading, RG1 3AR United Kingdom. Except as indicated below, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them.

Name

| | Number of Shares

Beneficially Owned

| | Percentage of Shares

Beneficially Owned

| |

|---|

| Centennial Ventures(1) | | 8,445,589 | | 15.3 | % |

| Norwest Equity Capital, LLC and related entity (2). | | 7,184,679 | | 11.9 | |

| John E. Lindahl, George J. Still, Jr. and John P. Whaley (2) | | 7,184,679 | | 11.9 | |

| Telecom Partners II, L.P., William J. Elsner and Stephen W. Schovee (3) | | 4,175,262 | | 6.9 | |

| HarbourVest International Private Equity Partners III-Direct Fund L.P.(4) | | 3,833,334 | | 6.4 | |

| Edward Kane and Brooks Zug (4) | | 3,833,334 | | 6.4 | |

| Providence Equity Partners L.P. and affiliated entity (5) | | 3,433,333 | | 5.7 | |

| David D'Ottavio | | 500,000 | | * | |

| Karl A. Maier (6) | | 360,000 | | * | |

| Matt S. Nydell (7) | | 645,826 | | * | |

| Michael Magluilo (8) | | 40,625 | | * | |

| Rebecca Markovits (9) | | 25,000 | | * | |

| Ray Walsh (10) | | 62,500 | | * | |

| Stephen J. Eley(11) | | 2,166,878 | | 3.5 | |

| Steven Halstedt(1) | | 10,000 | | * | |

| Erik M. Torgerson(12) | | 61,111 | | * | |

| All directors and executive officers as a group (13 persons)(13) | | 898,183 | | * | |

- *

- Less than 1%.

- (1)

- Includes 4,105,806 shares held by Centennial Fund V, L.P., 3,626,542 shares held by Centennial Fund VI, L.P., 90,995 shares held by Centennial Entrepreneurs Fund VI, L.P., 172,000 shares held by Centennial Strategic Partners VI, L.P., 225,972 shares held by Centennial Holdings I, LLC, and 124,274 shares held by Centennial Entrepreneurs Fund V, L.P. Centennial Holdings V, L.P. is the sole general partner of Centennial Fund V and of Centennial Entrepreneurs Fund V and, accordingly, may be deemed to be the indirect beneficial owner of the shares of common stock they hold by virtue of its authority to make decisions regarding the voting and disposition of such

19

shares. Centennial Holdings VI, L.P. is the sole general partner of Centennial Fund VI and of Centennial Entrepreneurs Fund VI and is the managing member of CSP VI Management LLC, the general partner of Centennial Strategic Partners VI, and accordingly, may be deemed to be the indirect beneficial owner of the shares of common stock they hold by virtue of its authority to make decisions regarding the voting and disposition of such shares. Except as provided above with respect to Centennial Holdings VI, LLC and Centennial Holdings V, L.P., none of the Centennial entities listed above has voting or investment power over the shares held by any other Centennial entity, and accordingly each entity disclaims beneficial ownership of such shares. Also includes 100,000 shares of common stock issuable upon the exercise of a warrant held by Steven Halstedt that is exercisable within 60 days. While this warrant is held in Mr. Halstedt's name, it is held for the benefit of certain Centennial entities that may be deemed the beneficial owner of this warrant. Mr. Halstedt disclaims beneficial ownership of the shares underlying the warrant. Mr. Halstedt is one of three general partners of Centennial Holdings V and one of the four managing principals of managing principals of Centennial Holdings VI. Acting alone, Mr. Halstedt does not have voting or investment power over any of these shares and, as a result, Mr. Halstedt disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in them. The address for each of the Centennial entities and Mr. Halstedt is 1428 Fifteenth Street, Denver, Colorado 80202.

- (2)