Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Fixed Income SHares (the ‘‘Trust’’), was organized as a Massachusetts business trust on November 3, 1999. The Trust is comprised of Series C, Series H, Series M, Series R (the ‘‘Portfolios’’), and the Allianz Dresdner Daily Asset Fund. These financial statements relate to Series C, Series H, Series M and Series R. The financial statements for Allianz Dresdner Daily Asset Fund are provided separately. Allianz Global Investors Fund Management LLC (the ‘‘Investment Manager’’) serves as the Portfolios’ Investment Manager and is an indirect, wholly-owned subsidiary of Allianz Global Investors of America L.P. (‘‘Allianz Global’’). Allianz Global is an indirect, majority-owned subsidiary of Allianz SE. The Portfolios are authorized to issue an unlimited number of shares of beneficial interest at $0.001 par value.

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

In July 2006, the Financial Accounting Standards Board issued Interpretation No. 48, ‘‘Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109’’ (the ‘‘Interpretation’’). The Interpretation establishes for all entities, including pass-through entities such as the Portfolios, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. The Interpretation is effective for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the date of effectiveness. The Portfolios’ management has begun to evaluate the application of the Interpretation, and is not in a position at this time to estimate the significance of its impact, if any, on the Portfolios’ financial statements. On December 22, 2006, the Securities & Exchange Commission announced that it would not object if a Portfolio implements Interpretation 48 in its NAV calculation as late as its last NAV calculation in the first required financial statement reporting period for its fiscal year beginning after December 15, 2006. Consequently, the Portfolios will be required to comply with the Interpretation by April 30, 2008.

In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards (‘‘SFAS’’) 157, Fair Value Measurements, which clarifies the definition of fair value and requires companies to expand their disclosure about the use of fair value to measure assets and liabilities in interim and annual periods subsequent to initial recognition. Adoption of SFAS 157 requires the use of the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. At this time, the Portfolios are in the process of reviewing the Standard against their current valuation policies to determine future applicability.

In the normal course of business, the Portfolios enter into contracts that contain a variety of representations which provide general indemnifications. The Portfolios’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolios based upon events that have not yet been asserted. However, the Portfolios expect the risk of any loss to be remote.

The following is a summary of significant accounting policies followed by the Portfolios:

(a) Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Portfolio securities and other financial instruments for which market quotations are not readily available or if a development/event occurs that may significantly impact the value of a security, are fair-valued, in good faith, pursuant to guidelines established by the Board of Trustees, including certain fixed income securities which may be valued with reference to securities whose prices are more readily available. The Portfolios’ investments, including over-the-counter options, are valued daily using prices supplied by an independent pricing service or dealer quotations, or by using the last sale price on the exchange that is the primary market for such securities, or the last quoted mean price for those securities for which the over-the-counter market is the primary market or for listed securities in which there were no sales. Independent pricing services use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. The Portfolios’ investments in senior floating rate loans (‘‘Senior Loans’’) for which a secondary market exists will be valued at the mean of the last available bid and asked prices in the market for such Senior Loans, as provided by an independent pricing service. Other Senior Loans are valued at fair value pursuant to procedures approved by the Board of Trustees, which include consideration and evaluation of: (1) the creditworthiness of the borrower and any intermediate participants; (2) the term of the Senior Loan; (3) recent prices in the market for similar loans, if any; (4) recent prices in the market for loans of similar quality, coupon rate, and period until next interest rate reset and maturity; and (5) general economic and market conditions affecting the fair value of the Senior Loan. At April 30, 2007,

52 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

1. Organization and Significant Accounting Policies (continued)

no Senior Loans were fair valued. Exchange traded options, futures and options on futures are valued at the settlement price determined by the relevant exchange. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily until settlement at the forward settlement value. Short-term securities maturing in 60 days or less are valued at amortized cost, if their original term to maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if the original term to maturity exceeded 60 days. The prices used by the Portfolios to value securities may differ from the value that would be realized if the securities were sold and the differences could be material to the financial statements. The Portfolios’ net asset values are determined daily as of the close of regular trading (normally, 4:00 p.m. Eastern time) on the New York Stock Exchange (‘‘NYSE’’) on each day the NYSE is open for business.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Securities purchased and sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income adjusted for the accretion of discounts and amortization of premiums, is recorded on an accrual basis. Discounts or premiums on debt securities purchased are accreted or amortized to interest income over the lives of the respective securities using the effective interest method. Paydown gains and losses on mortgage- and asset-backed securities are recorded as adjustments to interest income in the Statements of Operations.

(c) Federal Income Taxes

The Portfolios intend to distribute all of their taxable income and to comply with the other requirements of the U.S. Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required.

(d) Dividends and Distributions

Dividends from net investment income are declared daily and paid monthly. Distributions of net realized capital gains, if any, are declared and paid at least annually. The Portfolios record dividends and distributions to shareholders on the ex-dividend date. The amount of dividends and distributions are determined in accordance with federal income tax regulations, which may differ from generally accepted accounting principles in the United States of America. These ‘‘book-tax’’ differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal income tax treatment; temporary differences do not require reclassification. To the extent dividends and/or distributions exceed current and accumulated earnings and profits for federal income tax purposes, they are reported as dividends and/or distributions of paid-in capital in excess of par.

(e) Foreign Currency Translation

The Portfolios’ accounting records are maintained in U.S. dollars as follows: (1) the foreign currency market value of investments and other assets and liabilities denominated in foreign currency are translated at the prevailing exchange rate at the end of the period; and (2) purchases and sales, income and expenses are translated at the prevailing exchange rate on the respective dates of such transactions. The resulting net foreign currency gain or loss is included in the Statements of Operations.

The Portfolios do not generally isolate that portion of the results of operations arising as a result of changes in the foreign currency exchange rates from the fluctuations arising from changes in the market prices of securities. Accordingly, such foreign currency gain (loss) is included in net realized and unrealized gain (loss) on investments. However, the Portfolios do isolate the effect of fluctuations in foreign currency exchange rates when determining the gain or loss upon the sale or maturity of foreign currency denominated debt obligations pursuant to U.S. federal income tax regulations; such amount is categorized as foreign currency gain or loss for both financial reporting and income tax reporting purposes.

(f) Option Transactions

The Portfolios may purchase and write (sell) put and call options for hedging purposes, risk management purposes or as a part of their investment strategy. The risk associated with purchasing an option is that the Portfolios pay a premium whether or not the option is exercised. Additionally, the Portfolios bear the risk of loss of premium and change in market value should the counterparty not perform under the contract. Put and call options purchased are accounted for in the same manner as portfolio securities. The cost of securities acquired through the exercise of call options is increased by the premiums paid. The proceeds from securities sold through the exercise of put options is decreased by the premiums paid.

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 53

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

1. Organization and Significant Accounting Policies (continued)

When an option is written, the premium received is recorded as an asset with an equal liability and is subsequently marked to market to reflect the current market value of the option written. These liabilities are reflected as options written in the Statements of Assets and Liabilities. Premiums received from writing options which expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss. If a put option is exercised, the premium reduces the cost basis of the security. In writing an option, the Portfolios bear the market risk of an unfavorable change in the price of the security underlying the written option. Exercise of a written option could result in the Portfolios purchasing a security at a price different from the current market.

(g) Credit Default/Interest Rate Swaps

The Portfolios may enter into interest rate and credit default swap contracts (‘‘swaps’’) for investment purposes, to manage their interest rate and credit risk or to add leverage.

As a seller in the credit default swap contract, the Portfolios would be required to pay the notional amount or other agreed-upon value of a referenced debt obligation to the counterparty in the event of a default by a third party, such as a U.S. or foreign corporate issuer, on the referenced debt obligation. In return, the Portfolios would receive from the counterparty a periodic stream of payments over the term of the contract provided that no event of default has occurred. If no default occurs, the Portfolios would keep the stream of payments and would have no payment obligations. Such periodic payments are accrued daily and recorded as realized gain (loss).

The Portfolios may also purchase credit default swap contracts in order to hedge against the risk of default of debt securities held, in which case the Portfolios would function as the counterparty referenced in the preceding paragraph. As a purchaser of a credit default swap contract, the Portfolios would receive the notional amount or other agreed upon value of a referenced debt obligation from the counterparty in the event of default by a third party, such as a U.S. or foreign corporate issuer on the referenced obligation. In return, the Portfolios would make periodic payments to the counterparty over the term of the contract provided no event of default has occurred. Such periodic payments are accrued daily and recorded as realized gain (loss).

Interest rate swap agreements involve the exchange by the Portfolios with a counterparty of their respective commitments to pay or receive interest, e.g., an exchange of floating rate payments for fixed rate payments with respect to a notional amount of principal. Net periodic payments received by the Portfolios are included as part of realized gain (loss) and or change in unrealized appreciation/depreciation in the Statements of Operations.

Swaps are marked to market daily based upon quotations from brokers or market makers and the change in value, if any, is recorded as unrealized appreciation or depreciation in the Portfolio’s Statement of Operations. For a credit default swap sold by the Portfolios, payment of the agreed upon amount made by the Portfolios in the event of default of the referenced debt obligation is recorded as the cost of the referenced debt obligation purchased/received. For a credit default swap purchased by the Portfolios, the agreed upon amount received by the Portfolios in the event of default of the referenced debt obligation is recorded as proceeds from sale/delivery of the referenced debt obligation and the resulting gain or loss realized on the referenced debt obligation is recorded as such by the Portfolios.

Entering into swaps involves, to varying degrees, elements of credit, market and documentation risk in excess of the amounts recognized on the Statements of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreements may default on its obligation to perform or disagree as to the meaning of the contractual terms in the agreements, and that there may be unfavorable changes in net interest rates.

(h) Futures Contracts

A futures contract is an agreement between two parties to buy and sell a financial instrument at a set price on a future date. Upon entering into such a contract, the Portfolios are required to pledge to the broker an amount of cash or securities equal to the minimum ‘‘initial margin’’ requirements of the exchange. Pursuant to the contracts, the Portfolios agree to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contracts. Such receipts or payments are known as ‘‘variation margin’’ and are recorded by the Portfolios as unrealized appreciation or depreciation. When the contracts are closed, the Portfolios record a realized gain or loss

54 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

1. Organization and Significant Accounting Policies (continued)

equal to the difference between the value of the contracts at the time they were opened and the value at the time they were closed. Any unrealized appreciation or depreciation recorded is simultaneously reversed. The use of futures transactions involves the risk of an imperfect correlation in the movements in the price of futures contracts, interest rates and the underlying hedged assets, and the possible inability of counterparties to meet the terms of their contracts.

(i) Forward Foreign Currency Contracts—Series C, Series M, Series R

A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set exchange rate on a future date. Series C, Series M and Series R may enter into forward foreign currency contracts for the purpose of hedging against foreign currency risk arising from the investment or anticipated investment in securities denominated in foreign currencies. These Portfolios may also enter into these contracts for purposes of increasing exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one country to another. The market value of a forward foreign currency contract fluctuates with changes in forward currency exchange rates. All commitments are marked to market daily at the applicable exchange rates and any resulting unrealized appreciation or depreciation is recorded. Realized gains or losses are recorded at the time the forward contract matures or by delivery of the currency. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

(j) Inflation-Indexed Bonds

Inflation-indexed bonds are fixed income securities whose principal value is periodically adjusted to the rate of inflation. The interest rate on these bonds is generally fixed at issuance at a rate lower than typical bonds. Over the life of an inflation-indexed bond, however, interest will be paid based on a principal value, which is adjusted for inflation. Any increase in the principal amount of an inflation-indexed bond will be considered interest income in the Statements of Operations, even though investors do not receive principal until maturity.

(k) Repurchase Agreements

The Portfolios enter into transactions with their custodian bank or securities brokerage firms whereby they purchase securities under agreements to resell at an agreed upon price and date (‘‘repurchase agreements’’). Such agreements are carried at the contract amount in the financial statements. Collateral pledged (the securities received), which consists primarily of U.S. government obligations and asset-backed securities, are held by the custodian bank until maturity of the repurchase agreement. Provisions of the repurchase agreements and the procedures adopted by the Portfolios require that the market value of the collateral, including accrued interest thereon, is sufficient in the event of default by the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Portfolios may be delayed or limited.

(l) Reverse Repurchase Agreements

The Portfolios may enter into reverse repurchase agreements. In a reverse repurchase agreement, the Portfolios sell securities to a bank or broker-dealer and agree to repurchase the securities at a mutually agreed upon date and price. Generally, the effect of such a transaction is that the Portfolios can recover and reinvest all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement and still be entitled to the returns associated with those portfolio securities. Such transactions are advantageous if the interest cost to the Portfolios of the reverse repurchase transaction is less than the returns they obtain on investments purchased with the cash. Unless the Portfolios cover their positions in reverse repurchase agreements (by segregating liquid assets at least equal in amount to the forward purchase commitment), their obligations under the agreements will be subject to the Portfolios’ limitations on borrowings. Reverse repurchase agreements involve leverage risk and also the risk that the market value of the securities that the Portfolios are obligated to repurchase under the agreement may decline below the repurchase price. In the event the buyer of securities under a reverse repurchase agreement files for bankruptcy or becomes insolvent, the Portfolios’ use of the proceeds of the agreement may be restricted pending determination by the other party, or its trustee or receiver, whether to enforce the Portfolios’ obligation to repurchase the securities. At April 30, 2007, the Portfolios had no reverse repurchase agreements outstanding.

(m) When-Issued/Delayed-Delivery Transactions

The Portfolios may purchase or sell securities on a when-issued or delayed-delivery basis. The transactions involve a commitment to purchase or sell securities for a predetermined price or yield, with payment and delivery taking place beyond the customary settlement period. When delayed-delivery purchases are outstanding, the Portfolios will set

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 55

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

1. Organization and Significant Accounting Policies (continued)

aside and maintain until the settlement date in a designated account, liquid assets in an amount sufficient to meet the purchase price. When purchasing a security on a delayed-delivery basis, the Portfolios assume the rights and risks of ownership of the security, including the risk of price and yield fluctuations, and takes such fluctuations into account when determining their net asset values. The Portfolios may dispose of or renegotiate a delayed-delivery transaction after it is entered into, and may sell when-issued securities before they are delivered, which may result in a realized gain or loss. When a security on a delayed-delivery basis is sold, the Portfolios do not participate in future gains and losses with respect to the security.

(n) Stripped Mortgage Backed Securities (‘‘SMBS’’)

SMBS represent a participation in, or are secured by and payable from, mortgage loans on real property, and may be structured in classes with rights to receive varying proportions of principal and interest. SMBS include interest-only securities (IOs), which receive all of the interest, and principal-only securities (POs), which receive all of the principal. If the underlying mortgage assets experience greater than anticipated payments of principal, the Portfolio may fail to recoup some or all of its initial investment in these securities. The market value of these securities is highly sensitive to changes in interest rates.

(o) Restricted Securities

The Portfolios are permitted to invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expenses, and prompt sale at an acceptable price may be difficult.

(p) Short Sales

A short sale is a transaction in which a Portfolio sells securities it does not own in anticipation of a decline in the market price of the securities. The Portfolio is obligated to deliver securities at the market price at the time the short position is closed. Possible losses from short sales may be unlimited, whereas losses from purchases cannot exceed the total amount invested.

(q) Senior Loans

The Portfolios purchase assignments of Senior Loans originated, negotiated and structured by a U.S. or foreign commercial bank, insurance company, finance company or other financial institution (the ‘‘Agent’’) for a lending syndicate of financial institutions (the ‘‘Lender’’). When purchasing an assignment, the Portfolios succeed all the rights and obligations under the loan agreement with the same rights and obligations as the assigning Lender. Assignments may, however, be arranged through private negotiations between potential assignees and potential assignors, and the rights and obligations acquired by the purchaser of an assignment may differ from, and be more limited than, those held by the assigning Lender.

2. Investment Manager/Sub-Adviser/Administrator/Distributor

The Investment Manager serves in its capacity pursuant to an Investment Management Agreement with the Trust. Pursuant to a Portfolio Management Agreement, the Investment Manager employs the Sub-Adviser, an affiliate of the Investment Manager, to serve as sub-adviser and provide investment advisory services to the Portfolios. The Investment Manager receives no investment management or other fees from the Portfolios and at its own expense pays the fees of the Sub-Adviser. The financial statements reflect the fact that no fees or expenses are incurred by the Portfolios. It should be understood, however, that the Portfolios are an integral part of ‘‘wrap-fee’’ programs sponsored by investment advisers unaffiliated with the Portfolios, the Investment Manager or the Sub-Adviser.

Typically, participants in these programs pay a ‘‘wrap fee’’ to their investment adviser. Although the Portfolios do not compensate the Investment Manager or Sub-Adviser directly for their services under the Investment Management Agreement or Portfolio Management Agreement, respectively, the Investment Manager and Sub-Adviser may benefit from their relationship with the sponsors of wrap fee programs for which the Trust is an investment option.

The Investment Manager also serves as administrator to the Portfolios pursuant to an administration agreement (‘‘Administration Agreement’’) with the Trust. The administrator’s responsibilities include providing or procuring certain administrative services to the Portfolios as well as arranging at its own expense for the provision of legal, audit, custody, transfer agency and other services required for the ordinary operation of the Portfolios, and is responsible for printing, trustees’ fees, and other costs of the Portfolios. Under the Administration Agreement, the Investment Manager has agreed to provide or procure these services, and to bear these expenses at no charge to the Portfolios.

56 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

2. Investment Manager/Sub-Adviser/Administrator/Distributor (continued)

Allianz Global Investors Distributors LLC (‘‘the Distributor’’), an affiliate of the Investment Manager, serves as the distributor of the Trust’s shares. Pursuant to a distribution agreement with the Trust, the Investment Manager on behalf of the Portfolios pays the Distributor.

3. Investment in Securities

Purchases and sales of securities (excluding short-term investments) for the six months ended April 30, 2007, were:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | U.S. Government Agency |  | All Other |

| |  | Purchases |  | Sales |  | Purchases |  | Sales |

| Series C: |  | $ | 2,531,691,122 | |  | $ | 2,689,763,832 | |  | $ | 470,374,362 | |  | $ | 195,496,867 | |

| Series H: |  | | — | |  | | — | |  | | 3,160,660 | |  | | 154,704 | |

| Series M: |  | | 20,691,348,670 | |  | | 21,281,911,579 | |  | | 49,142,060 | |  | | 183,683,622 | |

| Series R: |  | | 896,005,748 | |  | | 948,007,863 | |  | | 4,134,345 | |  | | 523,090 | |

|

(a) Futures contracts outstanding at April 30, 2007:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series C: |  | Contracts |  | Market Value

(000) |  | Expiration

Date |  | Unrealized

Appreciation

(Depreciation) |

| Long: Financial Future Euro–90 day |  | | 11,601 | |  | $ | 2,749,437 | |  | | 9/17/07 | |  | $ | (6,436,747 | ) |

| Financial Future Euro–90 day |  | | 8,843 | |  | | 2,099,991 | |  | | 12/17/07 | |  | | (670,453 | ) |

| Financial Future Euro–90 day |  | | 3,046 | |  | | 724,834 | |  | | 3/17/08 | |  | | 792,674 | |

| Financial Future Euro–90 day |  | | 236 | |  | | 56,274 | |  | | 12/15/08 | |  | | 105,190 | |

| Financial Future Euro–90 day |  | | 2,020 | |  | | 481,316 | |  | | 6/15/09 | |  | | 133,886 | |

| U.S. Treasury Bond Futures |  | | 61 | |  | | 6,817 | |  | | 6/30/07 | |  | | (88,164 | ) |

| Short: Financial Future Euro–90 day |  | | (454 | ) |  | | (108,188 | ) |  | | 6/16/08 | |  | | (43,997 | ) |

| Financial Future Euro–90 day |  | | (454 | ) |  | | (108,251 | ) |  | | 9/15/08 | |  | | (86,664 | ) |

| U.S. Treasury Notes 10 yr. Futures |  | | (13 | ) |  | | (1,408 | ) |  | | 6/20/07 | |  | | 3,047 | |

| |  | | | |  | | | |  | | | |  | $ | (6,291,228 | ) |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series M: |  | Contracts |  | Market Value

(000) |  | Expiration

Date |  | Unrealized

Appreciation

(Depreciation) |

| Long: Financial Future Euro–90 day |  | | 12,411 | |  | $ | 2,941,407 | |  | | 9/17/07 | |  | $ | (5,574,724 | ) |

| Financial Future Euro–90 day |  | | 3,400 | |  | | 807,415 | |  | | 12/17/07 | |  | | (1,034,456 | ) |

| U.S. Treasury Bond Futures |  | | 492 | |  | | 54,981 | |  | | 6/30/07 | |  | | (534,812 | ) |

| U.S. Treasury Notes 10 yr. Futures |  | | 159 | |  | | 17,224 | |  | | 6/20/07 | |  | | 59,625 | |

| Short: U.S. Treasury Notes 5 yr. Futures |  | | (1,345 | ) |  | | (142,339 | ) |  | | 6/29/07 | |  | | (493,866 | ) |

| |  | | | |  | | | |  | | | |  | $ | (7,578,233 | ) |

|

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 57

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series R: |  | Contracts |  | Market Value

(000) |  | Expiration

Date |  | Unrealized

Appreciation

(Depreciation) |

| Long: U.S. Treasury Notes 5 yr. Futures |  | | 135 | |  | $ | 14,287 | |  | | 6/29/07 | |  | $ | 76,211 | |

| U.S. Treasury Notes 10 yr. Futures |  | | 484 | |  | | 52,431 | |  | | 6/20/07 | |  | | (42,124 | ) |

| Euro Bund 10 yr. Futures |  | | 1 | |  | | 156 | |  | | 6/30/07 | |  | | (2,216 | ) |

| Japanese Government Bond 10 yr. Futures |  | | 4 | |  | | 5,622 | |  | | 6/11/07 | |  | | 1,771 | |

| Financial Future British Pound–90 day |  | | 70 | |  | | 16,477 | |  | | 3/19/08 | |  | | (40,461 | ) |

| Financial Future British Pound–90 day |  | | 129 | |  | | 30,380 | |  | | 6/18/08 | |  | | (45,645 | ) |

| Short: Financial Future Euro–90 day |  | | (29 | ) |  | | (6,887 | ) |  | | 12/17/07 | |  | | 36,250 | |

| Financial Future Euro–90 day |  | | (29 | ) |  | | (6,901 | ) |  | | 3/17/08 | |  | | 26,100 | |

| Financial Future Euro–90 day |  | | (59 | ) |  | | (14,060 | ) |  | | 6/16/08 | |  | | 4,950 | |

| Financial Future Euro–90 day |  | | (59 | ) |  | | (14,068 | ) |  | | 9/15/08 | |  | | (900 | ) |

| Financial Future Euro–90 day |  | | (30 | ) |  | | (7,154 | ) |  | | 12/15/08 | |  | | (15,375 | ) |

| Financial Future Euro–90 day |  | | (30 | ) |  | | (7,152 | ) |  | | 3/16/09 | |  | | (15,938 | ) |

| U.S. Treasury Bond Future |  | | (135 | ) |  | | (15,086 | ) |  | | 6/30/07 | |  | | 159,703 | |

| |  | | | |  | | | |  | | | |  | $ | 140,326 | |

|

(b) Transactions in options written for the six months ended April 30, 2007:

|  |  |  |  |  |  |  |  |  |  |

| Series C: |  | Contracts/Notional |  | Premiums |

| Options outstanding, October 31, 2006 |  | | 64,001,880 | |  | $ | 1,250,688 | |

| Options written |  | | 396,000,000 | |  | | 5,538,714 | |

| Options terminated in closing transactions |  | | (100,001,880 | ) |  | | (611,859 | ) |

| Options outstanding, April 30, 2007 |  | | 360,000,000 | |  | $ | 6,177,543 | |

|

|  |  |  |  |  |  |  |  |  |  |

| Series M: |  | Contracts/Notional |  | Premiums |

| Options outstanding, October 31, 2006 |  | | — | |  | $ | 0 | |

| Options written |  | | 171,000,000 | |  | | 554,414 | |

| Options terminated in closing transactions |  | | (171,000,000 | ) |  | | (554,414 | ) |

| Options outstanding, April 30, 2007 |  | | — | |  | $ | 0 | |

|

|  |  |  |  |  |  |  |  |  |  |

| Series R: |  | Contracts/Notional |  | Premiums |

| Options outstanding, October 31, 2006 |  | | 62 | |  | $ | 29,714 | |

| Options written |  | | 24 | |  | | 11,086 | |

| Options exercised |  | | (82 | ) |  | | (43,243 | ) |

| Options expired |  | | 41 | |  | | 21,622 | |

| Options terminated in closing transactions |  | | (45 | ) |  | | (19,179 | ) |

| Options outstanding, April 30, 2007 |  | | — | |  | $ | 0 | |

|

58 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

(c) Credit default swaps contracts outstanding at April 30, 2007:

Series C:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Swap Counterparty/

Referenced Debt Issuer |  | Notional Amount

Payable on

Default (000) |  | Termination

Date |  | Payments

Received (Paid)

by Portfolio |  | Unrealized

Appreciation

(Depreciation) |

| Goldman Sachs |  | | | |  | | | |  | | | |  | | | |

| Anadarko Petroleum |  | $ | 3,700 | |  | | 3/20/08 | |  | | 0.15 | % |  | $ | 1,850 | |

| AutoZone |  | | 2,400 | |  | | 6/20/12 | |  | | (0.34 | )% |  | | (4,972 | ) |

| Centex |  | | 2,300 | |  | | 3/20/17 | |  | | (0.849 | )% |  | | 153,568 | |

| Chesapeake Energy |  | | 1,500 | |  | | 3/20/14 | |  | | 1.32 | % |  | | (1,464 | ) |

| ConAgra Foods |  | | 1,500 | |  | | 6/20/12 | |  | | (0.299 | )% |  | | (2,312 | ) |

| CSC Holdings |  | | 5,000 | |  | | 12/20/07 | |  | | (0.55 | )% |  | | (12,332 | ) |

| Dow Jones CDX |  | | 37,800 | |  | | 6/20/12 | |  | | 0.35 | % |  | | (3,695 | ) |

| Federated BP |  | | 300 | |  | | 6/20/12 | |  | | (0.53 | )% |  | | (525 | ) |

| Ford Motor Credit |  | | 5,000 | |  | | 6/20/07 | |  | | 4.65 | % |  | | 56,371 | |

| Ford Motor Credit |  | | 10,000 | |  | | 6/20/07 | |  | | 4.65 | % |  | | 112,742 | |

| Ford Motor Credit |  | | 15,000 | |  | | 12/20/07 | |  | | 0.81 | % |  | | 12,936 | |

| Ford Motor Credit |  | | 10,000 | |  | | 3/20/08 | |  | | 1.30 | % |  | | 40,580 | |

| International Paper |  | | 3,000 | |  | | 6/20/10 | |  | | 0.78 | % |  | | 53,632 | |

| Kohls |  | | 2,400 | |  | | 6/20/12 | |  | | (0.22 | )% |  | | (2,580 | ) |

| Nordstrom |  | | 2,200 | |  | | 6/20/11 | |  | | (0.18 | )% |  | | (3,781 | ) |

| Pulte Homes |  | | 2,300 | |  | | 3/20/17 | |  | | (0.859 | )% |  | | 153,437 | |

| Southwest Airlines |  | | 2,000 | |  | | 6/20/11 | |  | | (0.29 | )% |  | | 813 | |

| V.F. Corp. |  | | 2,400 | |  | | 6/20/12 | |  | | (0.22 | )% |  | | (1,487 | ) |

| Weyerhaeuser |  | | 2,300 | |  | | 3/20/17 | |  | | (1.018 | )% |  | | (15,156 | ) |

| Whirlpool |  | | 700 | |  | | 6/20/12 | |  | | (0.63 | )% |  | | (5,723 | ) |

| Lehman Brothers |  | | | |  | | | |  | | | |  | | | |

| Chesapeake Energy |  | | 2,300 | |  | | 3/20/14 | |  | | 1.16 | % |  | | (23,396 | ) |

| DR Horton |  | | 4,400 | |  | | 3/20/12 | |  | | (0.705 | )% |  | | 108,002 | |

| Federative Republic of Brazil |  | | 4,400 | |  | | 7/20/13 | |  | | 2.02 | % |  | | 291,353 | |

| Ford Motor Credit |  | | 20,000 | |  | | 3/20/08 | |  | | 0.75 | % |  | | (35,936 | ) |

| GMAC |  | | 15,000 | |  | | 3/20/08 | |  | | 0.75 | % |  | | (19,298 | ) |

| GMAC |  | | 10,000 | |  | | 3/20/08 | |  | | 1.05 | % |  | | 16,196 | |

| GMAC |  | | 2,500 | |  | | 3/20/08 | |  | | 1.55 | % |  | | 16,873 | |

| International Paper |  | | 1,000 | |  | | 6/20/12 | |  | | (0.45 | )% |  | | (3,205 | ) |

| MeadWestvaco |  | | 1,000 | |  | | 6/20/12 | |  | | (0.51 | )% |  | | 4,866 | |

| Nordstrom |  | | 600 | |  | | 6/20/12 | |  | | (0.179 | )% |  | | (53 | ) |

| Pemex |  | | 8,000 | |  | | 3/20/09 | |  | | 0.34 | % |  | | 3,384 | |

| Proctor & Gamble |  | | 40,200 | |  | | 9/20/08 | |  | | 0.07 | % |  | | 26,366 | |

| Reynolds American |  | | 1,800 | |  | | 6/20/12 | |  | | 1.00 | % |  | | (3,075 | ) |

Starwood Hotels & Resorts

Worldwide |  | | 2,700 | |  | | 9/20/11 | |  | | 1.01 | % |  | | 4,388 | |

| Toll Brothers |  | | 2,300 | |  | | 3/20/17 | |  | | (1.20 | )% |  | | 76,115 | |

| United Mexican States |  | | 7,500 | |  | | 3/20/09 | |  | | 0.24 | % |  | | 6,994 | |

| United Mexican States |  | | 1,000 | |  | | 1/20/17 | |  | | 0.67 | % |  | | 13,049 | |

| Weyerhaeuser |  | | 700 | |  | | 6/20/12 | |  | | (0.45 | )% |  | | 1,876 | |

|

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 59

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Swap Counterparty/

Referenced Debt Issuer |  | Notional Amount

Payable on

Default (000) |  | Termination

Date |  | Payments

Received (Paid)

by Portfolio |  | Unrealized

Appreciation

(Depreciation) |

| Merrill Lynch |  | | | |  | | | |  | | | |  | | | |

| Apache |  | $ | 4,500 | |  | | 6/20/10 | |  | | 0.39 | % |  | $ | 38,302 | |

| Canadian Natural Resources |  | | 1,800 | |  | | 3/20/10 | |  | | 0.32 | % |  | | 9,714 | |

| Centex |  | | 4,500 | |  | | 3/20/12 | |  | | (0.45 | )% |  | | 162,727 | |

| Ford Motor Credit |  | | 1,100 | |  | | 9/20/10 | |  | | 3.80 | % |  | | 45,367 | |

| General Electric Credit |  | | 1,800 | |  | | 6/20/10 | |  | | 0.30 | % |  | | 11,178 | |

| Lennar |  | | 4,700 | |  | | 3/20/12 | |  | | (0.58 | )% |  | | 105,334 | |

| Pulte Homes |  | | 4,500 | |  | | 3/20/12 | |  | | (0.45 | )% |  | | 164,622 | |

| Toll Brothers |  | | 3,900 | |  | | 3/20/12 | |  | | (0.89 | )% |  | | 36,892 | |

| XTO Energy |  | | 1,300 | |  | | 3/20/10 | |  | | 0.38 | % |  | | 9,733 | |

| Morgan Stanley |  | | | |  | | | |  | | | |  | | | |

| Altira Group |  | | 2,500 | |  | | 12/20/10 | |  | | 0.95 | % |  | | 64,342 | |

| ConocoPhillips |  | | 4,700 | |  | | 3/20/11 | |  | | 0.23 | % |  | | 26,124 | |

| Darden Restaurants |  | | 2,500 | |  | | 6/20/12 | |  | | (0.49 | )% |  | | 20,425 | |

| Dow Jones CDX |  | | 25,200 | |  | | 12/20/16 | |  | | (0.65 | )% |  | | 62,824 | |

| Glitnir banki hf |  | | 20,000 | |  | | 6/20/12 | |  | | (0.29 | )% |  | | (39,028 | ) |

| GMAC |  | | 3,000 | |  | | 3/20/08 | |  | | 0.60 | % |  | | (9,475 | ) |

| Inco Ltd. |  | | 9,000 | |  | | 12/20/11 | |  | | (0.50 | )% |  | | (104,991 | ) |

| Liz Claiborne |  | | 3,300 | |  | | 6/20/12 | |  | | (0.48 | )% |  | | (2,673 | ) |

| Office Depot |  | | 2,400 | |  | | 6/20/12 | |  | | (0.45 | )% |  | | 4,623 | |

| Republic of Indonesia |  | | 7,700 | |  | | 3/20/09 | |  | | 0.46 | % |  | | 11,741 | |

| Republic of Peru |  | | 7,700 | |  | | 3/20/09 | |  | | 0.32 | % |  | | 353 | |

| Russian Federation |  | | 8,000 | |  | | 3/20/09 | |  | | 0.31 | % |  | | 6,228 | |

| Time Warner |  | | 5,000 | |  | | 9/20/10 | |  | | 0.58 | % |  | | 64,388 | |

| Ukraine |  | | 7,700 | |  | | 3/20/09 | |  | | 0.66 | % |  | | 13,789 | |

| Vale Overseas Ltd. |  | | 9,000 | |  | | 12/20/11 | |  | | 0.70 | % |  | | 93,465 | |

| Walt Disney |  | | 1,400 | |  | | 6/20/11 | |  | | (0.18 | )% |  | | (3,989 | ) |

| Whirlpool |  | | 2,300 | |  | | 3/20/17 | |  | | (0.78 | )% |  | | 26,363 | |

| |  | | | |  | | | |  | | | |  | $ | 1,834,779 | |

|

Series M:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Swap Counterparty/

Referenced Debt Issuer |  | Notional Amount

Payable on

Default (000) |  | Termination

Date |  | Payments

(Paid) by Portfolio |  | Unrealized

Appreciation

(Depreciation) |

| Goldman Sachs |  | | | |  | | | |  | | | |  | | | |

| MeadWestvaco |  | $ | 2,900 | |  | | 6/20/12 | |  | | (0.519 | )% |  | $ | 12,822 | |

| Lehman Brothers |  | | | |  | | | |  | | | |  | | | |

| International Paper |  | | 3,400 | |  | | 6/20/12 | |  | | (0.46 | )% |  | | (12,606 | ) |

| Weyerhaeuser Co. |  | | 3,400 | |  | | 6/20/12 | |  | | (0.47 | )% |  | | 5,879 | |

| |  | | | |  | | | |  | | | |  | $ | 6,095 | |

|

60 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

Series R:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Swap Counterparty/

Referenced Debt Issuer |  | Notional Amount

Payable on

Default (000) |  | Termination

Date |  | Payments Received

by Portfolio |  | Unrealized

Appreciation |

| Goldman Sachs |  | | | |  | | | |  | |  | | | |

| Ford Motor Credit |  | $ | 500 | |  | | 9/20/07 | |  | 2.30% |  | $ | 4,500 | |

| GMAC |  | | 300 | |  | | 6/20/11 | |  | 3.40% |  | | 19,866 | |

| Morgan Stanley |  | | | |  | | | |  | |  | | | |

| Russian Federation |  | | 1,000 | |  | | 12/20/07 | |  | 0.26% |  | | 1,165 | |

| |  | | | |  | | | |  | |  | $ | 25,531 | |

|

(d) Interest rate swap agreements outstanding at April 30, 2007:

Series C:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | |  | |  | Rate Type |  | |

| Swap Counterparty |  | Notional

Amount

(000) |  | Termination

Date |  | Payments

Made by

Fund |  | Payments

Received by

Fund |  | Unrealized

Appreciation

(Depreciation) |

| Goldman Sachs |  | ¥97,200,000 |  | | 3/18/09 | |  | 6-Month JPY-LIBOR |  | 1.00% |  | $ | (386,638 | ) |

| Goldman Sachs |  | $160,000 |  | | 6/20/09 | |  | 3-Month USD-LIBOR |  | 5.00% |  | | 877,840 | |

| Goldman Sachs |  | ¥49,200,000 |  | | 3/20/11 | |  | 1.50% |  | 6-Month JPY-LIBOR |  | | 377,157 | |

| Goldman Sachs |  | €5,900 |  | | 3/30/12 | |  | 5-Year French CPI Ex

Tobacco Daily

Reference Index |  | 1.96% |  | | 6,710 | |

| Goldman Sachs |  | $67,200 |  | | 6/20/12 | |  | 3-Month USD-LIBOR |  | 5.00% |  | | 270,211 | |

| Goldman Sachs |  | £6,400 |  | | 12/15/35 | |  | 4.00% |  | 6-Month GBP-LIBOR |  | | 398,399 | |

| Lehman Brothers |  | $700,000 |  | | 6/21/07 | |  | 3-Month USD-LIBOR |  | 4.00% |  | | (1,429,284 | ) |

| Lehman Brothers |  | 182,000 |  | | 6/20/12 | |  | 3-Month USD-LIBOR |  | 5.00% |  | | 1,369,822 | |

| Lehman Brothers |  | 121,200 |  | | 6/20/14 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 666,370 | |

| Lehman Brothers |  | 1,600 |  | | 6/20/17 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 35,031 | |

| Lehman Brothers |  | £118,000 |  | | 12/15/35 | |  | 4.00% |  | 6-Month GBP-LIBOR |  | | 7,735,426 | |

| Merrill Lynch |  | BRL 151,000 |  | | 1/4/10 | |  | BRL-CDI-Compounded |  | 12.948% |  | | 2,685,213 | |

| Merrill Lynch |  | MXN 750,000 |  | | 11/4/16 | |  | 28-Day Mexico TIIE Banxico |  | 8.17% |  | | (195,890 | ) |

| Merrill Lynch |  | $700 |  | | 12/15/24 | |  | 6.00% |  | 3-Month USD-LIBOR |  | | (16,721 | ) |

| Merrill Lynch |  | CAD 9,200 |  | | 6/15/27 | |  | 3-Month Canadian

Bank Bill |  | 4.50% |  | | (258,887 | ) |

| Morgan Stanley |  | ¥214,400,000 |  | | 3/18/09 | |  | 6-Month JPY-LIBOR |  | 1.00% |  | | (958,355 | ) |

| Morgan Stanley |  | NZD 110,345 |  | | 6/15/09 | |  | 3-Month New

Zealand Bank Bill |  | 7.25% |  | | (492,655 | ) |

| Morgan Stanley |  | $283,100 |  | | 6/20/09 | |  | 3-Month USD-LIBOR |  | 5.00% |  | | (527,557 | ) |

| Morgan Stanley |  | BRL 138,000 |  | | 1/4/10 | |  | BRL-CDI-Compounded |  | 12.78% |  | | 2,448,625 | |

| Morgan Stanley |  | AUD 112,000 |  | | 1/15/10 | |  | 6-Month Australian Bank Bill |  | 6.50% |  | | 31,160 | |

| Morgan Stanley |  | 83,500 |  | | 1/15/10 | |  | 6-Month Australian Bank Bill |  | 6.50% |  | | (1,184 | ) |

| Morgan Stanley |  | ¥107,800,000 |  | | 3/20/11 | |  | 1.50% |  | 6-Month JPY-LIBOR |  | | 1,051,130 | |

| Morgan Stanley |  | $55,300 |  | | 6/20/14 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | (562,395 | ) |

| Morgan Stanley |  | MXN 109,000 |  | | 11/4/16 | |  | 28-Day Mexico TIIE Banxico |  | 8.17% |  | | (47,970 | ) |

| Morgan Stanley |  | $ | 38,500 | |  | | 6/20/17 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 56,706 | |

| Morgan Stanley |  | | ¥15,500,000 | |  | | 12/15/35 | |  | 6-Month JPY-LIBOR |  | 3.00% |  | | (253,239 | ) |

| |  | | | |  | | | |  | |  | |  | $ | 12,879,025 | |

|

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 61

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

Series M:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | |  | |  | Rate Type |  | |

| Swap Counterparty |  | Notional

Amount

(000) |  | Termination

Date |  | Payments

Made by

Fund |  | Payments

Received by

Fund |  | Unrealized

Appreciation

(Depreciation) |

| Goldman Sachs |  | $ | 149,500 | |  | 6/20/12 |  | 3-Month USD-LIBOR |  | 5.00% |  | $ | 601,140 | |

| Goldman Sachs |  | | 1,184,100 | |  | 12/21/16 |  | 5.00% |  | 3-Month USD-LIBOR |  | | 8,188,179 | |

| Goldman Sachs |  | | 394,500 | |  | 6/20/17 |  | 5.00% |  | 3-Month USD-LIBOR |  | | (3,150,324 | ) |

| Goldman Sachs |  | | 90,000 | |  | 12/15/35 |  | 3-Month USD-LIBOR |  | 5.00% |  | | (1,679,688 | ) |

| Goldman Sachs |  | | 15,600 | |  | 6/20/37 |  | 3-Month USD-LIBOR |  | 5.00% |  | | (476,320 | ) |

| Lehman Brothers |  | | 939,000 | |  | 6/20/12 |  | 3-Month USD-LIBOR |  | 5.00% |  | | 7,956,223 | |

| Lehman Brothers |  | | 33,000 | |  | 6/20/14 |  | 5.00% |  | 3-Month USD-LIBOR |  | | 181,437 | |

| Morgan Stanley |  | | 75,000 | |  | 6/20/09 |  | 5.00% |  | 3-Month USD-LIBOR |  | | (166,237 | ) |

| Morgan Stanley |  | | 32,000 | |  | 6/20/14 |  | 5.00% |  | 3-Month USD-LIBOR |  | | (325,437 | ) |

| Morgan Stanley |  | | 42,800 | |  | 12/21/16 |  | 5.00% |  | 3-Month USD-LIBOR |  | | 305,078 | |

| Morgan Stanley |  | | 226,100 | |  | 6/20/37 |  | 3-Month USD-LIBOR |  | 5.00% |  | | (6,878,381 | ) |

| |  | | | |  | |  | |  | |  | $ | 4,555,670 | |

|

Series R:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | |  | |  | Rate Type |  | |

| Swap Counterparty |  | Notional

Amount

(000) |  | Termination

Date |  | Payments

Made by

Fund |  | Payments

Received by

Fund |  | Unrealized

Appreciation

(Depreciation) |

| Goldman Sachs |  | $ | 6,200 | |  | | 6/20/09 | |  | 3-Month USD-LIBOR |  | 5.00% |  | $ | (11,554 | ) |

| Goldman Sachs |  | €2,300 |  | | 12/15/11 | |  | 5-Year French CPI Ex

Tobacco Daily Reference Index |  | 1.976% |  | | 15,216 | |

| Goldman Sachs |  | €2,400 |  | | 3/15/12 | |  | 5-Year French CPI Ex

Tobacco Daily Reference Index |  | 1.995% |  | | 11,010 | |

| Goldman Sachs |  | €6,600 |  | | 3/30/12 | |  | 5-Year French CPI Ex

Tobacco Daily Reference Index |  | 1.96% |  | | 7,506 | |

| Goldman Sachs |  | €500 |  | | 6/17/15 | |  | 4.50% |  | 6-month EUR-LIBOR |  | | 42,388 | |

| Goldman Sachs |  | | £2,500 | |  | | 9/15/15 | |  | 5.00% |  | 6-Month GBP-LIBOR |  | | 78,539 | |

| Lehman Brothers |  | $ | 1,000 | |  | | 6/20/12 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 6,929 | |

| Lehman Brothers |  | | 800 | |  | | 6/20/14 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 4,399 | |

| Lehman Brothers |  | | 100 | |  | | 6/20/17 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 2,189 | |

| Merrill Lynch |  | CAD 800 |  | | 6/15/35 | |  | 3-Month Canadian

Bank Bill |  | 5.50% |  | | (25,851 | ) |

| Morgan Stanley |  | $ | 500 | |  | | 6/20/09 | |  | 3-Month USD-LIBOR |  | 5.00% |  | | (932 | ) |

| Morgan Stanley |  | €100 |  | | 6/15/17 | |  | 4.00% |  | 6-Month EUR-LIBOR |  | | 4,513 | |

| Morgan Stanley |  | $ | 3,900 | |  | | 6/20/17 | |  | 5.00% |  | 3-Month USD-LIBOR |  | | 5,744 | |

| |  | | | |  | | | |  | |  | |  | $ | 140,096 | |

|

62 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

AUD–Australian Dollar

BRL–Brazilian Real

CAD–Canadian Dollar

CDI–Inter-bank Deposit Certificate

CPI–Consumer Price Index

€–Euros

EUR–Euros

£–British Pound

GBP–British Pound

¥–Japanese Yen

JPY–Japanese Yen

LIBOR–London Inter-bank Offered Rate

MXN–Mexican Peso

NZD–New Zealand Dollar

TIIE–Inter-bank Equilibrium Interest Rate

Series C and Series M received $10,750,000 and $18,500,000 par value, respectively, in U.S. Treasury Bills as collateral for swap contracts.

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 63

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

(e) Forward foreign currency contracts outstanding at April 30, 2007:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series C: |  | U.S.$ Value

Origination

Date |  | U.S.$ Value

April 30, 2007 |  | Unrealized

Appreciation

(Depreciation) |

| Purchased: |  | | | |  | | | |  | | | |

| 9,539,180 Brazilian Real settling 5/3/07 |  | $ | 4,335,762 | |  | $ | 4,691,023 | |  | $ | 355,261 | |

| 13,045,930 Brazilian Real settling 3/4/08 |  | | 6,076,287 | |  | | 6,151,033 | |  | | 74,745 | |

| 111,000,000 Chilean Peso settling 5/8/07 |  | | 210,918 | |  | | 211,333 | |  | | 415 | |

| 400,455,000 Chilean Peso settling 6/19/07 |  | | 759,473 | |  | | 762,573 | |  | | 3,100 | |

| 111,000,000 Chilean Peso settling 3/13/08 |  | | 210,686 | |  | | 211,461 | |  | | 775 | |

| £ 20,000,000 settling 5/17/07 |  | | 39,473,400 | |  | | 39,993,670 | |  | | 520,270 | |

| 25,496,000 Indian Rupee settling 5/29/07 |  | | 572,429 | |  | | 615,282 | |  | | 42,853 | |

| 8,190,000 Indian Rupee settling 6/20/07 |  | | 183,797 | |  | | 196,812 | |  | | 13,015 | |

| ¥ 1,184,291,000 settling 5/15/07 |  | | 10,000,000 | |  | | 9,930,456 | |  | | (69,544 | ) |

| 108,905,000 South Korean Won settling 5/25/07 |  | | 116,352 | |  | | 117,090 | |  | | 738 | |

| 197,700,000 South Korean Won settling 6/26/07 |  | | 209,844 | |  | | 212,700 | |  | | 2,856 | |

| 3,075,980,000 South Korean Won settling 7/18/07 |  | | 3,306,083 | |  | | 3,311,192 | |  | | 5,109 | |

| 3,108,165,500 South Korean Won settling 9/21/07 |  | | 3,349,975 | |  | | 3,350,847 | |  | | 873 | |

| 66,430,056 Mexican Peso settling 3/13/08 |  | | 5,911,889 | |  | | 5,959,002 | |  | | 47,113 | |

| 25,061,000 Norwegian Krone settling 6/7/07 |  | | 4,111,798 | |  | | 4,218,676 | |  | | 106,878 | |

| 1,588,818 New Zealand Dollar settling 5/24/07 |  | | 1,181,397 | |  | | 1,178,209 | |  | | (3,188 | ) |

| 6,232,288 Polish Zloty settling 9/28/07 |  | | 2,250,000 | |  | | 2,254,938 | |  | | 4,938 | |

| 12,499,066 Polish Zloty settling 3/13/08 |  | | 4,325,834 | |  | | 4,531,608 | |  | | 205,774 | |

| 67,489,042 Russian Ruble settling 9/19/07 |  | | 2,570,761 | |  | | 2,630,494 | |  | | 59,734 | |

| 3,376,458 Russian Ruble settling 11/2/07 |  | | 127,174 | |  | | 131,606 | |  | | 4,432 | |

| 170,468,800 Russian Ruble settling 12/10/07 |  | | 6,551,784 | |  | | 6,643,514 | |  | | 91,730 | |

| 5,094,241 Singapore Dollar settling 7/18/07 |  | | 3,370,322 | |  | | 3,371,343 | |  | | 1,022 | |

| 1,245,000 Singapore Dollar settling 8/7/07 |  | | 830,138 | |  | | 825,095 | |  | | (5,043 | ) |

| 4,572,758 Singapore Dollar settling 9/21/07 |  | | 3,059,256 | |  | | 3,040,644 | |  | | (18,612 | ) |

| 6,101,113,000 Taiwan Dollar settling 5/2/07 |  | | 184,615 | |  | | 183,138 | |  | | (1,477 | ) |

| 2,596,750 South African Rand settling 5/16/07 |  | | 339,420 | |  | | 368,382 | |  | | 28,962 | |

| Sold: |  | | | |  | | | |  | | | |

| 642,000 Australian Dollar settling 5/17/07 |  | | 533,529 | |  | | 534,126 | |  | | (597 | ) |

| 9,539,180 Brazilian Real settling 5/3/07 |  | | 4,610,527 | |  | | 4,691,023 | |  | | (80,496 | ) |

| 1,200,000 Canadian Dollar settling 5/17/07 |  | | 1,037,231 | |  | | 1,086,375 | |  | | (49,144 | ) |

| 111,000,000 Chilean Peso settling 5/8/07 |  | | 210,506 | |  | | 211,333 | |  | | (827 | ) |

| € 43,561,000 settling 5/24/07 |  | | 59,222,269 | |  | | 59,509,207 | |  | | (286,939 | ) |

| £ 20,812,000 settling 5/17/07 |  | | 120,117,207 | |  | | 121,604,752 | |  | | (1,487,545 | ) |

| ¥ 684,297,000 settling 5/15/07 |  | | 5,731,272 | |  | | 5,737,932 | |  | | (6,660 | ) |

| 877,000 New Zealand Dollar settling 5/17/07 |  | | 647,204 | |  | | 650,705 | |  | | (3,501 | ) |

| 6,101,113 Taiwan Dollar settling 6/4/07 |  | | 183,935 | |  | | 183,278 | |  | | (658 | ) |

| |  | | | |  | | | |  | $ | (443,638 | ) |

|

64 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

3. Investment in Securities (continued)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series M: |  | U.S.$ Value

Origination

Date |  | U.S.$ Value

April 30, 2007 |  | Unrealized

Appreciation

(Depreciation) |

| Purchased: |  | | | |  | | | |  | | | |

| ¥ 26,600,000 settling 5/15/07 |  | $ | 223,012 | |  | $ | 223,045 | |  | $ | 33 | |

| ¥ 120,000,000 settling 5/15/07 |  | | 1,005,969 | |  | | 1,006,218 | |  | | 249 | |

| ¥ 156,200,000 settling 5/15/07 |  | | 1,332,810 | |  | | 1,309,760 | |  | | (23,050 | ) |

| ¥ 214,028,000 settling 5/15/07 |  | | 1,826,142 | |  | | 1,794,657 | |  | | (31,485 | ) |

| Sold: |  | | | |  | | | |  | | | |

| ¥ 29,387,000 settling 5/15/07 |  | | 247,879 | |  | | 246,414 | |  | | 1,464 | |

| ¥ 59,739,000 settling 5/15/07 |  | | 504,309 | |  | | 500,920 | |  | | 3,389 | |

| |  | | | |  | | | |  | $ | (49,400 | ) |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series R: |  | U.S.$ Value

Origination

Date |  | U.S.$ Value

April 30, 2007 |  | Unrealized

Appreciation

(Depreciation) |

| Purchased: |  | | | |  | | | |  | | | |

| 11,851,272 Yuan Renminbi settling 1/10/08 |  | $ | 1,558,000 | |  | $ | 1,597,741 | |  | $ | 9,741 | |

| 4,576,190 Yuan Renminbi settling 3/7/08 |  | | 624,000 | |  | | 623,008 | |  | | (992 | ) |

| 7,534,071 Yuan Renminbi settling 3/2/09 |  | | 1,064,500 | |  | | 1,077,891 | |  | | 13,391 | |

| ¥ 29,291,000 settling 5/15/07 |  | | 243,406 | |  | | 245,609 | |  | | 2,203 | |

| Sold: |  | | | |  | | | |  | | | |

| 132,000 Canadian Dollar settling 5/17/07 |  | | 114,095 | |  | | 119,501 | |  | | (5,406 | ) |

| € 7,785,000 settling 5/24/07 |  | | 10,583,902 | |  | | 10,635,182 | |  | | (51,280 | ) |

| £ 622,000 settling 5/17/07 |  | | 1,230,316 | |  | | 1,243,803 | |  | | (13,487 | ) |

| ¥ 45,887,152 settling 5/15/07 |  | | 393,000 | |  | | 384,771 | |  | | 8,229 | |

| |  | | | |  | | | |  | $ | (37,601 | ) |

|

(f) Short sales outstanding at April 30, 2007:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Series C: |  | Coupon |  | Maturity |  | Par |  | Proceeds |  | Value |

| Government National Mortgage Association, MBS |  | | 5.50 | % |  | | 5/1/37 | |  | | 3,100,000 | |  | $ | 3,078,688 | |  | $ | 3,083,532 | |

| Series M: |  | | | |  | | | |  | | | |  | | | |  | | | |

| Fannie Mae |  | | 5.00 | % |  | | 5/31/37 | |  | | 23,000,000 | |  | $ | 22,292,031 | |  | $ | 22,223,750 | |

| Series R: |  | | | |  | | | |  | | | |  | | | |  | | | |

| U.S. Treasury Notes |  | | 4.875 | % |  | | 8/15/16 | |  | | 800,000 | |  | $ | 806,863 | |  | $ | 814,938 | |

| U.S. Treasury Inflation Indexed Bonds & Notes |  | | 2.375 | % |  | | 1/15/17 | |  | | 203,182 | |  | | 205,397 | |  | | 205,397 | |

| U.S. Treasury Inflation Indexed Notes |  | | 3.00 | % |  | | 7/15/12 | |  | | 32,246,435 | |  | | 33,659,653 | |  | | 33,659,653 | |

| |  | | | |  | | | |  | | | |  | | | |  | $ | 34,679,988 | |

|

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 65

Fixed Income SHares—Series C, H, M, R

Notes to Financial Statements

4. Income Tax Information

The cost of investments for federal income tax purposes and gross unrealized appreciation and gross unrealized depreciation of investments at April 30, 2007 were:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Cost of Investments |  | Gross

Unrealized

Appreciation |  | Gross

Unrealized

Depreciation |  | Net Unrealized

Appreciation

(Depreciation) |

| Series C |  | $ | 1,616,720,558 | |  | $ | 23,124,617 | |  | $ | 11,925,248 | |  | $ | 11,199,369 | |

| Series H |  | | 3,793,635 | |  | | 11,555 | |  | | — | |  | | 11,555 | |

| Series M |  | | 2,983,076,674 | |  | | 11,119,764 | |  | | 7,013,771 | |  | | 4,105,993 | |

| Series R |  | | 224,711,855 | |  | | 1,181,993 | |  | | 2,191,177 | |  | | (1,009,184 | ) |

|

5. Legal Proceedings

In June and September 2004, the Investment Manager, certain of its affiliates (including Allianz Global Investors Distributors LLC and PEA Capital LLC) and Allianz Global, agreed to settle, without admitting or denying the allegations, claims brought by the Securities and Exchange Commission (the ‘‘Commission’’), the New Jersey Attorney General and the California Attorney General alleging violations of federal and state securities laws with respect to certain open-end funds for which the Investment Manager serves as investment adviser. Two settlements (with the Commission and New Jersey) related to an alleged ‘‘market timing’’ arrangement in certain open-end funds sub-advised by PEA Capital LLC. Two settlements (with the Commission and California) related to the alleged use of cash and fund portfolio commissions to finance ‘‘shelf-space’’ arrangements with broker-dealers for open-end funds. The Investment Manager and its affiliates agreed to pay a total of $68 million to settle the claims related to market timing and $20.6 million to settle the claims related to shelf space. In addition to monetary payments, the settling parties agreed to undertake certain corporate governance, compliance and disclosure reforms related to market timing, brokerage commissions, revenue sharing and shelf space arrangements, and consented to cease and desist orders and censures. The settling parties did not admit or deny the findings in these settlements. None of the settlements allege that any inappropriate activity took place with respect to the Fund.

Since February 2004, the Investment Manager and certain of its affiliates and their employees have been named as defendants in fifteen lawsuits filed in various jurisdictions. Eleven of those lawsuits concern market timing and have been transferred to and consolidated for pre-trial proceedings in a multi-district litigation proceeding in the U.S. District Court for the District of Maryland; the other four lawsuits concern revenue sharing and have been consolidated into a single action in the U.S. District Court for the District of Connecticut. The lawsuits generally relate to the same allegations that are the subject of the regulatory proceedings discussed above. The lawsuits seek, among other things, unspecified compensatory damages plus interest and, in some cases, punitive damages, the rescission of investment advisory contracts, the return of fees paid under those contracts, restitution, and waiver of or return of certain sales charges paid by open-end fund shareholders.

The Investment Manager and the Sub-Adviser believe that these matters are not likely to have a material adverse effect on the Fund or on their ability to perform their respective investment advisory activities relating to the Fund. The foregoing speaks only as of the date hereof.

6. Corporate Changes:

On September 12, 2006, the Fund’s Board of Trustees appointed William B. Ogden, IV as a Trustee. On October 10, 2006, David C. Flattum, an interested Trustee, resigned.

On December 12, 2006, the Fund’s Board of Trustees appointed John C. Maney as an (interested) Trustee and appointed Hans W. Kertess as Chairman of the Board of Trustees, effective January 1, 2007.

66 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Fixed Income SHares—Series H

Matters Relating to the Trustees

Consideration of the Investment

Management and Portfolio Management

Agreements

The Investment Company Act of 1940 requires that both the full Board of Trustees (the ‘‘Trustees’’) and a majority of the non-interested (‘‘independent’’) Trustees, voting separately, approve the Trust’s Investment Advisory Agreement (the ‘‘Advisory Agreement’’) with the Investment Manager and a Portfolio Management Agreement (the ‘‘Sub-Advisory Agreement’’ and together with the Advisory Agreement the ‘‘Agreements’’) with the Sub-Adviser, as it pertains to Series H (the ‘‘Portfolio’’) of the Trust. The Trustees met on February 20, 2007 (the ‘‘contract review meeting&rs quo;’) for the specific purpose of considering whether to approve the Advisory Agreement and the Sub-Advisory Agreement. The independent Trustees were assisted in their evaluation of the Agreements by independent legal counsel, from whom they received separate legal advice and with whom they met separately from Fund management during the contract review meeting.

Based on their evaluation of factors that they deemed to be material, including those factors described below, the Board of Trustees, including a majority of the independent Trustees, concluded that the Trust’s Advisory Agreement and the Sub-Advisory Agreement should be approved for an initial two-year period commencing April 1, 2007.

In connection with their deliberations regarding the approval of the Agreements, the Trustees, including the independent Trustees, considered such information and factors as they believed, in light of the legal advice furnished to them and their own business judgment, to be relevant. As described below, the Trustees considered the nature, quality, and extent of the investment management, administrative and other services performed by the Investment Manager and the Sub-Adviser under these Agreements.

In connection with their contract review meeting, the Trustees received and relied upon materials provided by the Investment Manager which included, among other items: (i) information regarding the investment performance and management fees of comparable portfolios of other clients of the Sub-Adviser, (ii) an estimate of the profitability to the Investment Manager and its affiliates from its relationship with the Portfolio, (iii) descriptions of various functions performed by the Investment Manager and the Sub-Adviser for the Portfolio, such as compliance monitoring and portfolio trading practices, and (iv) information regarding the overall organization of the Investment Manager and the Sub-Adviser, including information regardi ng senior management, portfolio managers and other personnel providing investment management, administrative and other services to the Portfolio.

The Trustees conclusions as to the continuation of the Agreements were based on a comprehensive consideration of all information provided to the Trustees and not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations are described below, although individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors.

In determining to approve the Agreements, the Trustees met with the relevant investment advisory personnel from the Investment Manager and the Sub-Adviser and considered information relating to personnel providing services under the applicable agreement. The information considered included the education and experience of the personnel providing services, including the education and experience of the investment professional expected to be managing the assets of the Portfolio. The Trustees also took into account the time and attention that had been devoted by senior management to the Trust and the other funds in the complex. The Trustees evaluated the level of skill required to manage the Trust and concluded that the human resourc es devoted by the Investment Manager and the Sub-Adviser to the Portfolio were appropriate to fulfill effectively the duties of the Investment Manager and Sub-Adviser under the applicable agreement. The Trustees also considered the business reputation of the Investment Manager and Sub-Adviser since their inception, their significant financial resources, the Investment Manager’s and Sub-Adviser’s experience in managing the Trust, including their professional liability insurance coverage and the Investment Manager’s assets under management and concluded that they would be able to meet any reasonably foreseeable obligations under the applicable agreements.

The Trustees received information concerning the investment philosophy and investment process applied by the Investment Manager and Sub-Adviser in managing the Portfolio, as described in the Prospectuses. In this connection, the Trustees considered the Investment Manager’s and Sub-Adviser’s in-house research capabilities, including their ongoing forecasting of industry, sector and overall market movements, interest rates and the development of their ongoing outlook on the global economy, as well as other resources available to the Investment Manager’s and Sub-Adviser’s personnel, including research services available to the Investment Manager and Sub-Adviser as a result of securities transactions effected for the Trust and other investment advisory clients. The Trustees concluded that the Investment Manager’s and Sub-Adviser’s investment processes, research capabilities and philosophy were well suited to the Trust, given each Portfolio’s investment objectives and policies.

4.30.07 | Fixed Income SHares—Series C, H, M, R Semi-Annual Report 67

Fixed Income SHares—Series H

Matters Relating to the Trustees

Consideration of the Investment

Management and Portfolio Management

Agreements

The Trustees considered the scope of the services provided by the Investment Manager and Sub-Adviser to the Trust under the Agreements relative to services provided by third parties to other mutual funds and relative to services provided by the Investment Manager and Sub-Adviser to their other advisory clients. The Trustees noted that the Investment Manager’s and Sub-Adviser’s required standard of care was comparable to that found in most mutual fund investment advisory agreements. The Trustees also considered the tools and procedures used to assure the Trust’s compliance with applicable regulations and policies including the appointment of a Chief Compliance Officer and the adoption of enhanced compliance pol icies and procedures. The Trustees apprised themselves and took account of past claims made by regulators and others against affiliates of the Investment Manager and the steps taken to address those claims. The Trustees concluded that the scope of the Investment Manager’s and Sub-Adviser’s services to the Trust, as described above, was consistent with the Trust’s operational requirements, including, in addition to the applicable investment objectives, compliance with the Trust’s investment restrictions, tax and reporting requirements and related shareholder services.

The Trustees also evaluated the procedures of the Investment Manager and Sub-Adviser designed to fulfill their fiduciary duty to the Trust with respect to possible conflicts of interest, including their codes of ethics, the procedures by which the Investment Manager and Sub-Adviser allocate trades among their various investment advisory clients, the integrity of the systems in place to ensure compliance with the foregoing and the record of the Investment Manager and Sub-Adviser in these matters. The Trustees also confirmed information concerning standards of the Investment Manager and Sub-Adviser with respect to the execution of the Portfolio’s transactions. The information considered by the Trustees included information r egarding the Investment Manager and the Sub-Adviser, their personnel, policies and practices included in each of their respective Forms ADV.

In the course of their deliberations, the Trustees took into account information provided by the Investment Manager in connection with the contract review meeting, as well as information previously provided to the Trustees at the June 2006 meeting, where the Agreements were reapproved with respect to the other Portfolios of the Trust. After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that they were satisfied with the Investment Manager’s and Sub-Adviser’s responses.

In approving the Agreements, the Trustees also gave substantial consideration to the fact that, with respect to the Portfolio, no fees are payable under either the Advisory Agreement with the Investment Manager or the Portfolio Management Agreement between the Investment Manager and the Sub-Adviser. The Trustees did consider, however, the amounts paid to the Investment Manager and the Sub-Adviser from the ‘‘wrap fee’’ paid by the sponsors of the wrap programs to the Investment Manager’s affiliate, AGI Managed Accounts LLC, as well as the fees ‘‘imputed’’ to the Investment Manager and the Sub-Adviser, as disclosed in the Portfolio’s Prospectus. Because the Portfolio woul d not pay fees, the Trustees did not consider the extent to which economies of scale would be realized due to the Portfolio’s anticipated growth of assets, whether fee levels reflect economies of scale for the Portfolio’s shareholders or comparisons of fees paid by the Portfolio with fees paid to other investment advisers or by other clients of the Investment Manager or the Sub-Adviser.

The Trustees also considered the expected profitability to the Investment Manager and its affiliates of the relationship of the Investment Manager and its affiliates to the Portfolio, and determined that such profitability was not excessive. The Trustees considered the costs of the services provided under the Agreements, as well as the fees and profits, if any, expected to be realized by the Investment Manager, the Sub-Adviser and their affiliates from their relationship with the Portfolio.

The Trustees considered the fact that the Investment Manager and the Sub-Adviser may benefit from their relationship with the sponsors of wrap programs for which the Portfolio will be an investment options. Such benefits include the receipt by their affiliates of fees paid by the sponsor of the wrap program based on assets under management of the wrap program. The Trustees also took into account so-called ‘‘fallout benefits’’ to the Investment Manager and the Sub-Adviser, such as reputational value derived from serving as investment adviser and the fact that the Investment Manager and the Sub-Adviser will receive services from brokers who execute portfolio transactions for the Portfolio.

Based on the foregoing, the Trustees decided to approve the engagement of the Investment Manager and Sub-Adviser to serve as investment advisors for the Portfolio.

68 Fixed Income SHares—Series C, H, M, R Semi-Annual Report | 4.30.07

Trustees and Principal Officers

Hans W. Kertess

Trustee, Chairman of the Board of Trustees

Paul Belica

Trustee

Robert E. Connor

Trustee

John J. Dalessandro II

Trustee

John C. Maney

Trustee

William B. Ogden, IV

Trustee

R. Peter Sullivan III

Trustee

Brian S. Shlissel

President & Chief Executive Officer

Lawrence G. Altadonna

Treasurer, Principal Financial & Accounting Officer

Thomas J. Fuccillo

Vice President, Secretary & Chief Legal Officer

Scott Whisten

Assistant Treasurer

Youse E. Guia

Chief Compliance Officer

Kathleen A. Chapman

Assistant Secretary

William V. Healey

Assistant Secretary

Richard H. Kirk

Assistant Secretary

Lagan Srivastava

Assistant Secretary

Investment Manager/Administrator

Allianz Global Investors Fund Management LLC

1345 Avenue of the Americas

New York, NY 10105

Sub-Adviser

Pacific Investment Management Company LLC

840 Newport Center Drive

Newport Beach, CA 92660

Distributor

Allianz Global Investors Distributors LLC

2187 Atlantic Street

Stamford, CT 06902

Custodian & Accounting Agent

State Street Bank & Trust Co.

801 Pennsylvania

Kansas City, MO 64105-1307

Transfer Agent, Dividend Paying Agent and Registrar

Boston Financial Data Services

330 West 9th Street

Kansas City, MO 64105

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

1055 Broadway

Kansas City, MO 64105

Legal Counsel

Ropes & Gray LLP

One International Place

Boston, MA 02210-2624

This report, including the financial information herein, is transmitted to the shareholders of Fixed Income Shares-Series C, M, H, R for their information. It is not a prospectus, circular or representation intended for use in the purchase of shares of the Trust or any securities mentioned in this report.

The financial information included herein is taken from the records of the Trust without examintation by an independent registered public accounting firm, who did not express an opinion hereon

The Trust files its complete schedules of portfolio holdings with the Securities and Exchange Commission (‘‘SEC’’) for the first and third quarter of its fiscal year on Form N-Q. The Trust’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Allianz Dresdner Daily Asset Fund

Semi-Annual Report

April 30, 2007

This material is authorized for use only when preceded or accompanied by the current Fund’s prospectus.

This report, including the financial information herein, is transmitted to the shareholders of Allianz Dresdner Daily Asset Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

Allianz Dresdner Daily Asset Fund – Letter to Shareholders

June 13, 2007

Dear Shareholder:

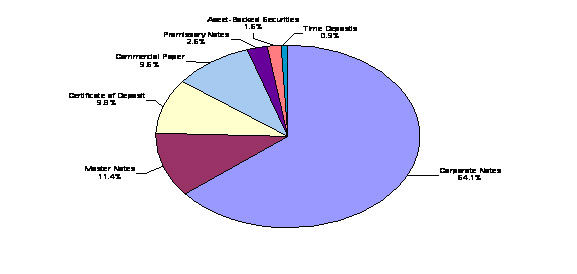

During six months ended April 30, 2007, the Allianz Dresdner Daily Asset Fund (the “Fund”) experienced significant growth. The Fund’s net assets were $2,059,106,592 at October 31, 2006 and stood at $2,883,728,106 on April 30, 2007.

At the beginning of 2007 we evaluated some of the risks that we felt would come to a head in 2007. The first issue was the direction of interest rates. The majority of economists believed the Federal Reserve (the “Fed”) would hold rates steady for at least the first six months of the year. Some believed the Fed would lower rates by as much as 50 basis points. The market had priced in a roughly 50% chance of a fed funds reduction in rates of 25 basis points. Others thought the Fed would raise rates by 50 basis points.

Since there is no real consensus on interest rates, the market is very susceptible to moves in either direction. We have a good portion of our investments in floating rate securities. At the end of April in excess of 95% of the Fund was invested in floating rate securities based on the following indexes: LIBOR (both one and three month LIBOR), and Fed Funds. Our strategy has been to maintain a very short duration through the use of floating rate securities and especially fed funds floaters which comprise over 54% of the floaters in the Fund’s portfolio. In an uncertain rate environment a short duration can potentially reduce interest rate risk. The Fund yielded approximately fed funds flat plus 1, after fees, which is a key securities lending rebate rate barometer.

The credit quality of the fund is well within the AAA rating parameters.

Charles H. Dedekind, Portfolio Manager

Dresdner Advisors LLC

John Bilello, Portfolio Manager

Dresdner Advisors LLC

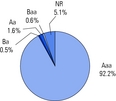

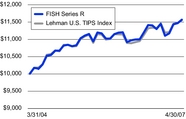

Allianz Dresdner Daily Asset Fund Performance & Statistics

April 30, 2007 (unaudited)