Exhibit 99.1

Exhibit 99.1

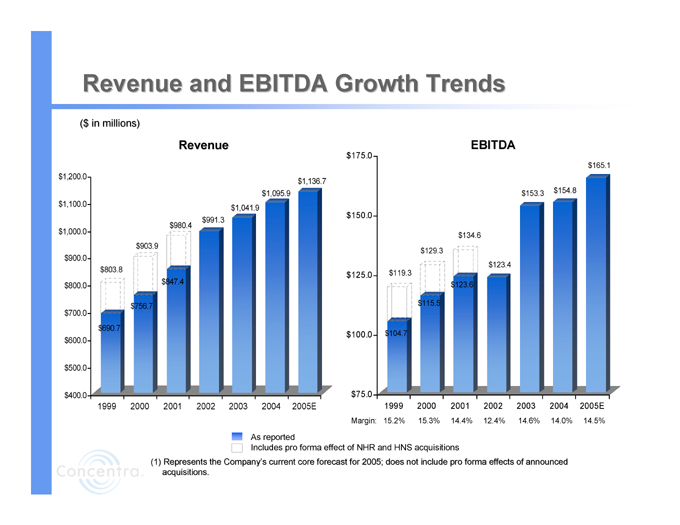

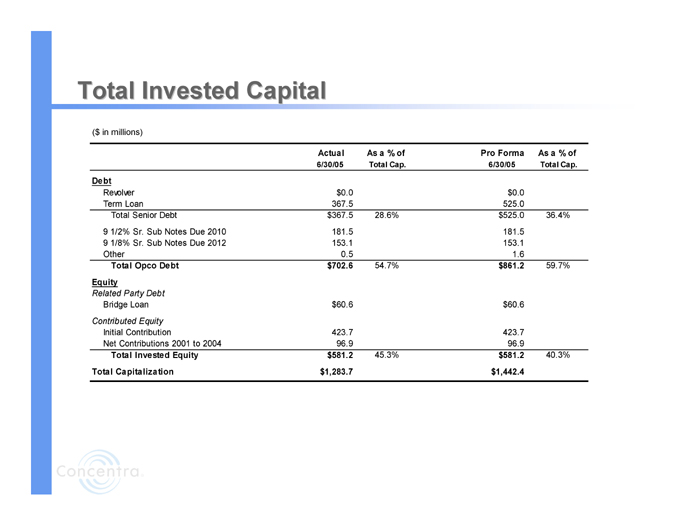

Revenue and EBITDA Growth Trends

($ in millions)

Revenue

$1,200.0

$1,100.0

$1,000.0

$900.0

$800.0

$700.0

$600.0

$500.0

$400.0

$803.8

$690.7

1999 $903.9

$756.7

2000 $980.4

$847.4

2001 $991.3

2002 $1,041.9

2003 $1,095.9

2004 $1,136.7

2005E

EBITDA

$175.0 $150.0 $125.0 $100.0 $75.0 $119.3

$104.7

1999 $129.3

$115.5

2000 $134.6

$123.6

2001 $123.4

2002 $153.3

2003 $154.8

2004 $165.1

2005E

Margin: 15.2% 15.3% 14.4% 12.4% 14.6% 14.0% 14.5%

As reported

Includes pro forma effect of NHR and HNS acquisitions

(1) Represents the Company’s current core forecast for 2005; does not include pro forma effects of announced acquisitions.

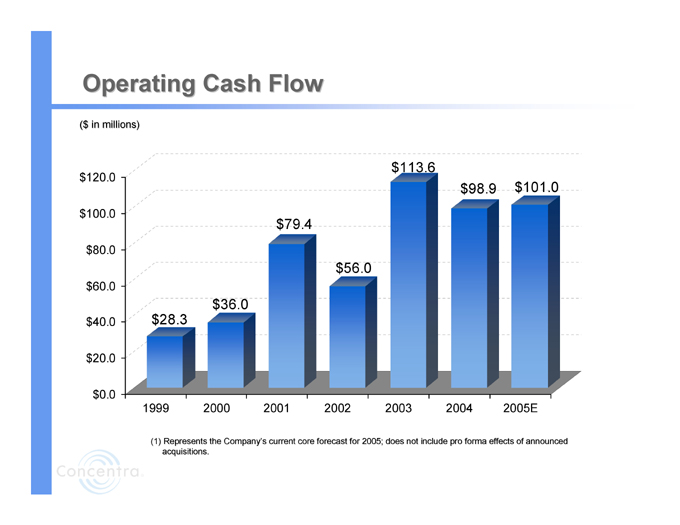

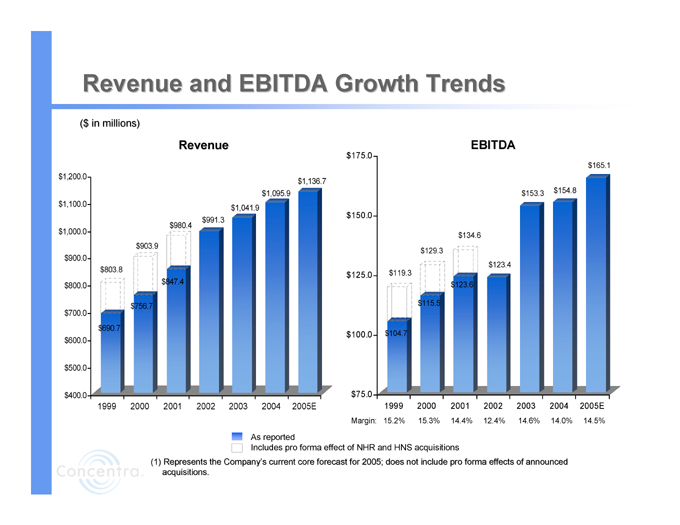

Operating Cash Flow

($ in millions)

$120.0

$100.0

$80.0

$60.0

$40.0

$20.0

$0.0

$28.3

1999 $36.0

2000 $79.4

2001 $56.0

2002 $113.6

2003 $98.9

2004 $101.0

2005E

(1) Represents the Company’s current core forecast for 2005; does not include pro forma effects of announced acquisitions.

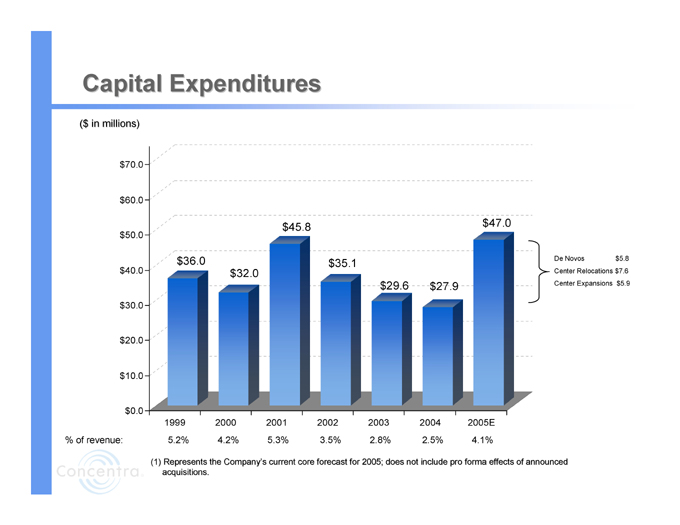

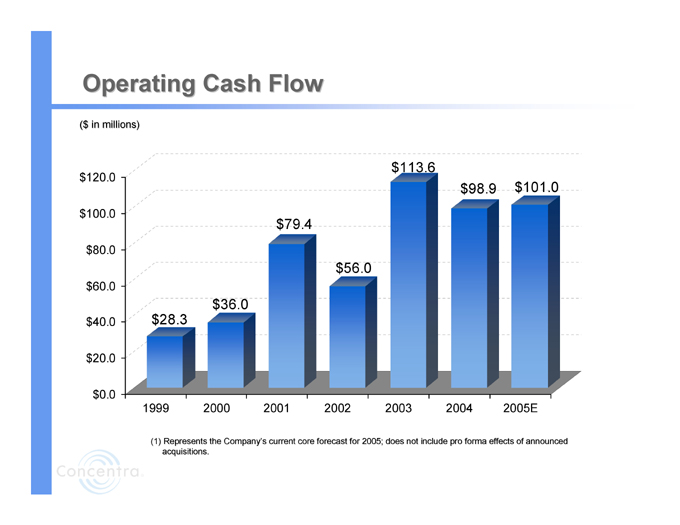

Capital Expenditures

($ in millions)

$70.0

$60.0

$50.0

$40.0

$30.0

$20.0

$10.0

$0.0

$36.0

1999 $32.0

2000 $45.8

2001 $35.1

2002 $29.6

2003 $27.9

2004 $47.0

2005E

De Novos $5.8

Center Relocations $7.6

Center Expansions $5.9

% of revenue: 5.2% 4.2% 5.3% 3.5% 2.8% 2.5% 4.1%

(1) Represents the Company’s current core forecast for 2005; does not include pro forma effects of announced acquisitions.

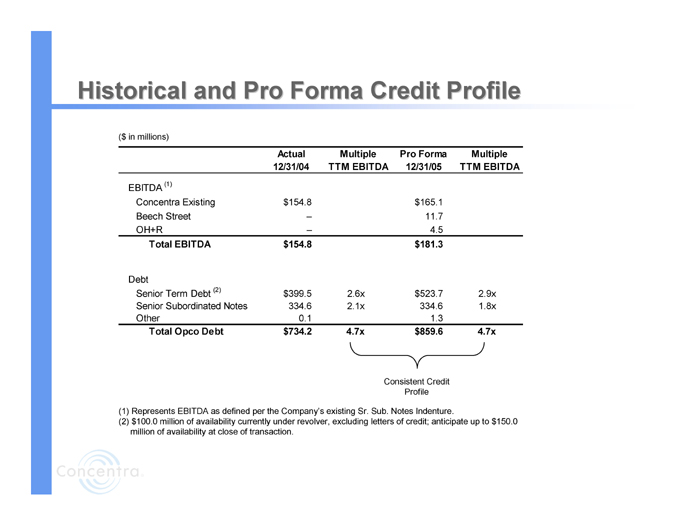

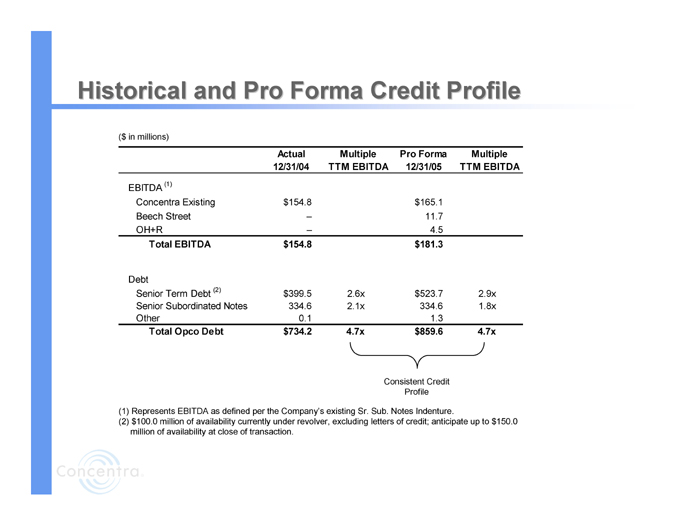

Historical and Pro Forma Credit Profile

($ in millions)

Actual 12/31/04 Multiple TTM EBITDA Pro Forma 12/31/05 Multiple TTM EBITDA

EBITDA (1)

Concentra Existing $154.8 $165.1

Beech Street – 11.7

OH+R – 4.5

Total EBITDA $154.8 $181.3

Debt

Senior Term Debt (2) $399.5 2.6x $523.7 2.9x

Senior Subordinated Notes 334.6 2.1x 334.6 1.8x

Other 0.1 1.3

Total Opco Debt $734.2 4.7x $859.6 4.7x

Consistent Credit Profile

(1) Represents EBITDA as defined per the Company’s existing Sr. Sub. Notes Indenture.

(2) $100.0 million of availability currently under revolver, excluding letters of credit; anticipate up to $150.0 million of availability at close of transaction.

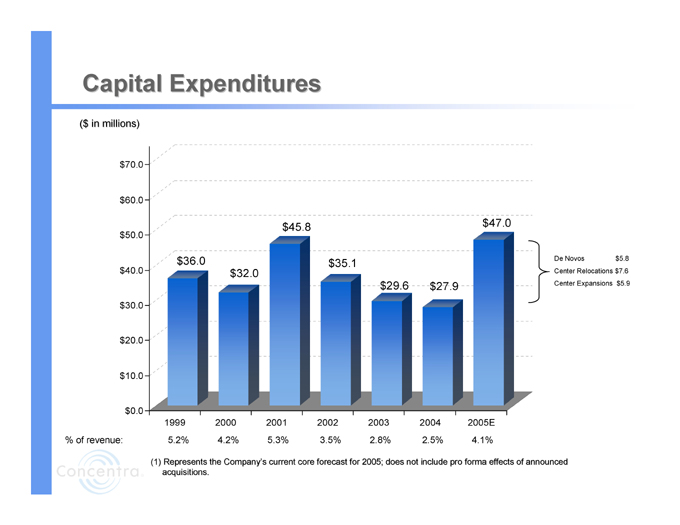

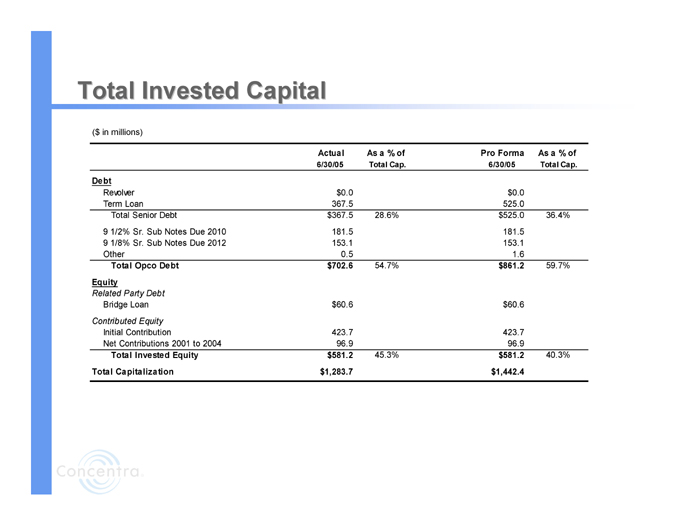

Total Invested Capital

($ in millions)

Actual 6/30/05 As a % of Total Cap. Pro Forma 6/30/05 As a % of Total Cap.

Debt

Revolver $0.0 $0.0

Term Loan 367.5 525.0

Total Senior Debt $367.5 28.6% $525.0 36.4%

9 1/2% Sr. Sub Notes Due 2010 181.5 181.5

9 1/8% Sr. Sub Notes Due 2012 153.1 153.1

Other 0.5 1.6

Total Opco Debt $702.6 54.7% $861.2 59.7%

Equity

Related Party Debt

Bridge Loan $60.6 $60.6

Contributed Equity

Initial Contribution 423.7 423.7

Net Contributions 2001 to 2004 96.9 96.9

Total Invested Equity $581.2 45.3% $581.2 40.3%

Total Capitalization $1,283.7 $1,442.4