Use these links to rapidly review the document

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(3)

File No.: 333-88062

SUBJECT TO COMPLETION, DATED JUNE 6, 2002

The information in this prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and has been declared effective. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 5, 2002)

3,865,000 Shares

FARGO ELECTRONICS, INC.

Common Stock

We are selling 950,000 shares of our common stock. The selling stockholders named in this prospectus supplement are selling an additional 2,915,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling stockholders. Our common stock is quoted on the Nasdaq National Market under the symbol "FRGO."

On June 5, 2002, the last reported sale price of our common stock on the Nasdaq National Market was $9.44 per share.

You should consider the risks we have described in "Risk Factors" beginning on page S-8 of this prospectus supplement before buying shares of our common stock.

| | Per Share

| | Total

|

|---|

| Public offering price | | $ | | | $ | |

| Underwriting discount and commissions | | $ | | | $ | |

| Proceeds, before expenses, to us | | $ | | | $ | |

| Proceeds, before expenses, to the selling stockholders | | $ | | | $ | |

The underwriters may purchase up to an additional 572,500 shares from certain of the selling stockholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus supplement to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver shares to purchasers on or before , 2002.

| RAYMOND JAMES | | | | | | | | | |

|

ROBERT W. BAIRD & CO. |

|

|

|

|

|

|

NEEDHAM & COMPANY, INC. |

The date of this prospectus supplement is , 2002.

TABLE OF CONTENTS

You should rely only on the information contained in or incorporated by reference in this prospectus supplement or the accompanying prospectus. No one is authorized to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriters are making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. Do not assume that the information in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference is accurate as of any date other than their respective dates or such other date as may be specified within those documents for particular information. Our business, financial condition, results of operations and prospects may have changed since those dates.

S-1

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part, this prospectus supplement, describes the specific terms of this offering of common stock. The second part, the accompanying prospectus, gives more general information, some of which might not apply to this offering. Both this prospectus supplement and the accompanying prospectus include important information about us, our common stock being offered and other information you should know before investing. This prospectus supplement also adds, updates and changes information contained in the accompanying prospectus. You should read both this prospectus supplement and the accompanying prospectus as well as additional information described under "Documents Incorporated by Reference into This Prospectus" on page 11 of the accompanying prospectus before investing in our shares of common stock.

If the description of this offering varies between this prospectus supplement and the accompanying prospectus or any document incorporated by reference, you should rely on the information in this prospectus supplement.

This prospectus supplement and the accompanying prospectus do not constitute an offer or solicitation by anyone in any jurisdiction in which an offer or solicitation is not authorized or in which the person making an offer or solicitation is not qualified to do so, or to anyone to whom it is unlawful to make an offer or solicitation.

Unless the context otherwise requires, the terms "we," "our," "us," "the company," and "Fargo" in this prospectus supplement and the accompanying prospectus refer to Fargo Electronics, Inc., a Delaware corporation.

We own or have rights to certain trademarks that we use in connection with the sale of our products, including but not limited to, the following:Fargo®,Persona®,HDP®,UltraCard™, Pro-L™, Pro-LX™, DTC™, CardJet™, CardJet Printing Technology™ andHigh Definition Printing™. All other trademarks or trade names appearing elsewhere in this prospectus supplement and the accompanying prospectus are the property of their respective owners.

ABOUT FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus include or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. The words "anticipate," "believe," "estimate," "will," "may," "future," "plan," "intend" and "expect" and similar expressions generally identify forward-looking statements. Although we believe that our plans, intentions and expectations reflected in the forward-looking statements are reasonable, we cannot be sure that they will be achieved. Actual results may differ materially due to a number of factors. Important factors that could cause actual results to differ materially from our forward-looking statements are set forth in the section entitled "Risk Factors" on page S-8, under the heading "Cautionary Statement Regarding Future Results, Forward-Looking Information and Certain Important Factors" in our Annual Report on Form 10-K for the year ended December 31, 2001 (referred to hereinafter as our "2001 Annual Report") and in other documents either currently or that become incorporated by reference into this prospectus supplement and the accompanying prospectus. These factors are not intended to represent a complete list of the general or specific factors that may affect us. Other factors, including general economic factors and business strategies, may be significant, presently or in the future, and the factors set forth in those documents may affect us to a greater extent than indicated. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this prospectus supplement, the accompanying prospectus, our 2001 Annual Report and in other existing or future documents incorporated by reference into this prospectus supplement and the accompanying prospectus. Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

S-2

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus. Because it is a summary, it may not contain all of the information that is important to you. You should read carefully this entire prospectus supplement and the accompanying prospectus, especially the section entitled "Where You Can Find More Information" on page 12 of the accompanying prospectus, the section entitled "Risk Factors" beginning on page S-8 of this prospectus supplement as well as the other documents incorporated by reference in this prospectus supplement and in the accompanying prospectus, before making a decision to invest in our common stock.

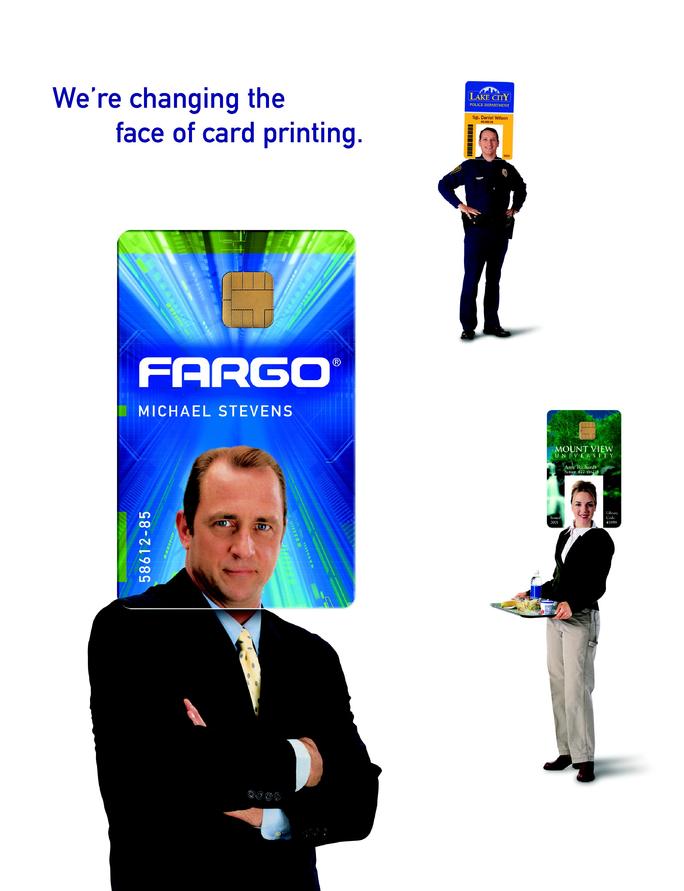

Our Business

We are a leading developer, manufacturer and supplier of printing systems and consumable supplies that personalize plastic identification cards by printing images and text onto the card. Our printing systems are capable of encoding data onto cards that incorporate bar code, magnetic stripe, smart card or proximity card technology. We believe that our engineering expertise and our ability to offer a broad range of printing systems using multiple printing technologies have led to a reputation for innovation in our industry. The consumable supplies used with our systems include dye sublimation ribbons, overlaminates, thermal resin ribbons, printheads and blank cards. The sale of these supplies provides us with a significant recurring revenue stream.

Concern for personal safety and property protection has led to the need for electronic and visual identification and access control. We believe the demand for our products will increase as governments and corporations worldwide address their security needs. We believe the development and implementation of new technologies that add security features to plastic cards should foster a growing market for our systems.

We market and sell our products exclusively through a distribution channel of independent distributors and resellers in more than 80 countries worldwide. We estimate that as of March 31, 2002, we have manufactured and sold more than 60,000 of our printing systems.

End-users of our printing systems create personalized cards for a wide variety of applications including:

- •

- corporate security and access;

- •

- driver's licenses, government and military identification;

- •

- student identification and access;

- •

- public transportation access; and

- •

- recreation and gaming.

We provide a diverse array of card printing systems that allow us to meet the needs of end-users ranging from those who desire a premium system to address complex applications to those focused on lower priced systems with fewer features.

Fargo is a Delaware corporation. Our principal executive offices are located at 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344, and our telephone number is (952) 941-9470. Our website address is www.fargo.com.

Recent Developments

On July 31, 2001, we signed an agreement to be acquired by Zebra Technologies Corporation through a cash tender offer for all of our outstanding shares at a price of $7.25 per share. The tender offer was conditioned upon successful termination of the Federal Trade Commission's Hart-Scott-Rodino antitrust review. Based on discussions with representatives of the FTC, we concluded with Zebra that the FTC would not approve the acquisition. On March 27, 2002, we agreed with Zebra to terminate the acquisition agreement. The termination agreement provided for the immediate

S-3

termination of the tender offer and included a mutual release. Shares tendered in the tender offer were returned to our stockholders.

We continued our product development activities throughout the now terminated transaction with Zebra. In 2002, we have introduced six new products, including the CardJet 410, the industry's first inkjet identification card printer and data encoder that we developed in cooperation with Hewlett-Packard Company with input from PPG Industries, Inc. We believe that this printer, targeted to the value-priced segment of the identification card market, will open new channels for us and give us new opportunities for growth.

Competitive Strengths

Our competitive strengths include:

Broad product line. We believe we are the only company that manufactures plastic card personalization and data encoding systems for both the high definition and direct-to-card dye sublimation markets. When we begin shipping our new inkjet line of printers, we believe we will be the only company in the identification card market manufacturing products that incorporate each of these three technologies. Because we offer multiple technology platforms, our distributors and resellers are able to reach more end-users and offer them compelling, cost-effective solutions at a variety of price points.

Commitment to innovation. We have consistently been successful identifying and incorporating innovative technologies, developed by us and others, to create integrated, precise solutions. We believe we were the first company to introduce a digital color desktop card printing system to the market for under $10,000 and the first to offer dual sided printing and built-in card lamination capabilities. In addition, we believe we were the first company to introduce a high definition card printing system for under $15,000. Continuing our history of innovation, in April 2002, we introduced a card printing system using inkjet technology. As new personalization technologies emerge, such as biometrics, we plan to explore applications for those technologies in our card printing systems.

Highly functional and integrated systems. One of the challenges our industry faces is constructing a single, compact system that can effectively manage the electrical, mechanical, digital and chemical processes required to print, laminate and encode a card quickly and accurately. Our systems integrate these functions in a single unit, creating complete card solutions in a single-step process that is easy to use.

Recurring revenue from supplies. Our consumable supplies business provides us with recurring revenues because most of our supplies contain proprietary elements that are unique to our systems. We engineer these supplies in cooperation with the manufacturers of these materials. These supplies are designed and manufactured to produce cards with high-quality images and minimize operator errors. Both the ribbons and the overlaminates used with our systems include proprietary technology owned by their respective manufacturers and, in some cases, technology owned by us.

Well-established distribution channel. We believe that our relationships with distributors and resellers are strong and provide us with a competitive advantage. Our reputation for quality, technological innovation and rapid delivery contribute to the popularity of our products among resellers. We provide technical support and training, marketing support and business consulting services to resellers to help them better serve their customers.

Highly skilled and experienced management team. We believe that our management team is the most experienced in our industry. Most members of our senior management have been with us for many years and have significant industry experience, which provides us with deep industry knowledge, stability and continuity.

S-4

Our Growth Strategy

Key elements of our strategy include:

Capitalize on increasing demand for security. Recent events have led to increased emphasis worldwide on security, identification and access control. We believe that we are well positioned to capitalize on our market leading position as a developer of card printing systems, and market our systems as an important component of any identification/access control system.

Penetrate existing and new markets. We believe that we have an opportunity to move into several vertical markets in which we currently have limited or no exposure. For example, end-users that traditionally have personalized cards through a central issue system, such as credit and debit cards, could benefit from an instant issue process. Similarly, our inkjet printing systems could allow us to transition the analog "cut and paste" market to a digital solution. We intend to selectively pursue these opportunities and others jointly through our distribution partners.

Further leverage our distribution channel. Distributors and resellers have significant influence on end-users' purchasing decisions. We believe that our distribution network is the largest and most dedicated in our industry. We intend to maintain and enhance our strong relationships with distributors and resellers, thereby penetrating their customer bases more fully. We believe that the continued strength of these relationships will facilitate our timely delivery of new products and customized solutions to end-users, thus enhancing our revenues.

Pursue new innovative technologies. We believe that we have a reputation for technological leadership in our industry as demonstrated by our introduction of new products and technologies to the market. As new personalization technologies emerge, such as biometrics, we plan to explore applications for those technologies in our card printing systems.

Selectively pursue acquisitions. In addition to our internal development, we may selectively pursue strategic acquisitions that we believe will broaden or complement our current technology base and allow us to serve additional end-users and their evolving needs.

The Offering

| Common stock offered by us | | 950,000 shares |

| Common stock offered by our selling stockholders | | 2,915,000 shares(1) |

| Common stock outstanding after the offering | | 12,753,014 shares(2) |

| Use of proceeds | | We intend to use the net proceeds received by us in this offering for repayment of debt and general corporate purposes. We will not receive any of the proceeds from the sale of shares by the selling stockholders. |

| Nasdaq National Market symbol | | FRGO |

- (1)

- Assumes that the underwriters' over-allotment option to purchase up to 572,500 additional shares of common stock from certain of our selling stockholders is not exercised.

- (2)

- Based on 11,803,014 shares outstanding as of May 31, 2002, excluding 763,163 shares of our authorized but unissued common stock subject to outstanding options under our stock option plan.

S-5

Summary Financial and Operating Data

The following summary financial data as of and for the years ended December 31, 1998 through December 31, 2001 are derived from our audited financial statements. The summary financial data as of and for the three months ended March 31, 2001 and 2002 are derived from our unaudited interim financial statements. Such unaudited interim financial statements have been prepared by us on a basis consistent with our annual audited financial statements and, in the opinion of our management, contain all normal recurring adjustments necessary for a fair presentation of the financial position and results of operations for the applicable periods. This information is only a summary and does not provide all of the information contained in our financial statements and related notes. You should read the "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page S-20 of this prospectus supplement and our financial statements.

| | Year Ended December 31,

| | Three Months Ended

March 31,

|

|---|

Statements of Operations Data:

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

|

|---|

| | (in thousands, except per share data)

|

|---|

| |

| |

| |

| |

| | (unaudited)

|

|---|

| Net sales | | $ | 47,647 | | $ | 54,107 | | $ | 57,845 | | $ | 60,963 | | $ | 13,172 | | $ | 15,021 |

Gross profit |

|

|

24,452 |

|

|

25,179 |

|

|

23,124 |

|

|

23,466 |

|

|

4,925 |

|

|

5,801 |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Research and development | | | 1,586 | | | 4,011 | | | 4,934 | | | 4,053 | | | 1,032 | | | 1,256 |

| | Selling, general and administrative | | | 8,307 | | | 8,525 | | | 10,027 | | | 10,341 | | | 2,831 | | | 2,834 |

| | Recapitalization costs(1) | | | 8,386 | | | — | | | — | | | — | | | — | | | — |

| | Acquisition-related costs(2) | | | — | | | — | | | — | | | 1,434 | | | 62 | | | 538 |

| | |

| |

| |

| |

| |

| |

|

Total operating expenses |

|

|

18,279 |

|

|

12,536 |

|

|

14,961 |

|

|

15,828 |

|

|

3,925 |

|

|

4,628 |

| | |

| |

| |

| |

| |

| |

|

Operating income |

|

|

6,173 |

|

|

12,643 |

|

|

8,163 |

|

|

7,638 |

|

|

1,000 |

|

|

1,173 |

Net income (loss) |

|

|

(2,089 |

) |

|

4,484 |

|

|

3,057 |

|

|

4,076 |

|

|

312 |

|

|

714 |

Accrued dividends on redeemable preferred stock |

|

|

(2,113 |

) |

|

(2,620 |

) |

|

(350 |

) |

|

— |

|

|

— |

|

|

— |

Accretion of convertible participating preferred stock(3) |

|

|

— |

|

|

(67,000 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

| | |

| |

| |

| |

| |

| |

|

Net income (loss) available to common stockholders |

|

$ |

(4,202 |

) |

$ |

(65,136 |

) |

$ |

2,707 |

|

$ |

4,076 |

|

$ |

312 |

|

$ |

714 |

| | |

| |

| |

| |

| |

| |

|

| Net income (loss) per common share: | | | | | | | | | | | | | | | | | | |

| | Basic earnings: | | $ | (0.98 | ) | $ | (37.56 | ) | $ | 0.25 | | $ | 0.35 | | $ | 0.03 | | $ | 0.06 |

| | |

| |

| |

| |

| |

| |

|

| | Diluted earnings: | | $ | (0.98 | ) | $ | (37.56 | ) | $ | 0.24 | | $ | 0.34 | | $ | 0.03 | | $ | 0.06 |

| | |

| |

| |

| |

| |

| |

|

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | | | |

| | Basic shares outstanding | | | 4,307 | | | 1,734 | | | 10,637 | | | 11,760 | | | 11,748 | | | 11,785 |

| | Diluted shares outstanding | | | 4,307 | | | 1,734 | | | 11,413 | | | 11,958 | | | 11,863 | | | 12,013 |

| | As of March 31, 2002

|

|---|

Balance Sheet Data:

| | Actual

| | As Adjusted(4)

|

|---|

| | (in thousands)

|

|---|

| | (unaudited)

|

|---|

| Cash and cash equivalents | | $ | 2,839 | | |

| Working capital | | | 8,509 | | |

| Total assets | | | 46,172 | | |

Total bank debt |

|

|

12,500 |

|

|

| Stockholders' equity | | | 26,379 | | |

- (1)

- Reflects expenses consisting primarily of employee compensation, legal and professional fees incurred by us in connection with our leveraged recapitalization in February 1998. The impact of the recapitalization costs and the fact that we were not a C Corporation for the entire year resulted in a reduction of net income available to common stockholders of $7,911,000 and resulted in a reduction of basic net income per share of $1.84 and diluted net income per share of $1.41.

S-6

- (2)

- The impact of these acquisition-related costs resulted in a reduction of net income available to common stockholders by $926,000 for the year ended December 31, 2001 and $342,000 for the quarter ended March 31, 2002. The impact of these acquisition-related costs resulted in a reduction in basic and diluted net income per common share of $0.08 per share for the year ended December 31, 2001 and $.03 per share for the quarter ended March 31, 2002.

- (3)

- Reflects the accretion of convertible participating preferred stock originally issued at $1.00 per share in our February 1998 recapitalization. Such stock was automatically converted to common stock on a 625-for-1 basis upon the closing of our initial public offering in February 2000. As of September 30, 1999, such preferred stock was recorded at the expected fair market value of the common stock ($15.00 per share), which resulted in a $67,000,000 reduction in net income available to common stockholders.

- (4)

- The as adjusted information reflects the application of the net proceeds from the sale of 950,000 shares of our common stock in this offering at a public offering, price of $ per share, after deducting underwriter discounts and estimated offering expenses payable by us, and the repayment of $ in outstanding debt as described in the "Use of Proceeds" section of this prospectus supplement.

S-7

RISK FACTORS

This offering involves a high degree of risk. In addition to the other information set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, the following risk factors should be considered carefully in evaluating us and our business before purchasing any of the common stock offered hereby.

Risks Related to our Business

The delay and uncertainty caused by the Federal Trade Commission's review of our proposed acquisition by Zebra, and the termination of the proposed transaction due to failure to obtain regulatory approval, has inhibited our growth and negatively impacted our distribution relationships.

We believe that the announcement in August 2001 of our proposed acquisition by Zebra and the nearly eight-month delay due to the Hart-Scott-Rodino antitrust review prior to termination of the transaction in March 2002 has had, and will likely continue to have, an adverse effect on our relationships with some of our distributors and resellers and, consequently, our sales. All of our revenue is derived from sales through our distributor and reseller network and we do not sell our products directly to end-users. Although certain of our distributors and resellers have made contractual commitments to us, they are independent businesses that we do not control. Because we are dependent upon the continued viability and financial stability of these distributors and resellers, our sales may decline if they are unable or choose not to purchase products from us. We believe that the announcement of our proposed acquisition by Zebra and the delay due to the regulatory review process caused some members of our distribution network to take actions to protect their business interests against the uncertainty inherent in the transaction. Since August 2001, some members have taken on competing product lines, devoted efforts to other products in different markets, reduced or discontinued sales of our products or failed to devote the resources necessary to provide effective sales and marketing support of our products. We believe that these actions have inhibited our growth and negatively impacted our business. The continuation of these actions, even though the proposed transaction with Zebra has now been terminated, could have a continuing material adverse effect on our financial condition and results of operations.

If we cannot or do not adequately protect or enforce our domestic or international intellectual property rights, others may offer products similar to ours which could depress our prices and gross margins or result in loss of market share.

We believe that protecting our proprietary technology is important to our success and competitive positioning. In addition to common law intellectual property rights, we currently rely on a combination of patents, trademarks, license agreements and contractual provisions to establish and protect our intellectual property rights. Our failure to protect or enforce our intellectual property rights could have a material adverse effect on our business, results of operations and financial condition. We cannot be certain that the steps we take to protect our intellectual property will adequately protect our proprietary rights, that others will not independently develop or otherwise acquire equivalent or superior technology or that we can maintain any of our technology as trade secrets. The laws of some of the countries in which our systems are or may be sold may not protect our systems and intellectual property to the same extent as the United States or at all.

In April 2002, Sony Chemical Corporation, a subsidiary of Sony Corporation, introduced a dye sublimation ribbon product that competes with our most important supply item. Based on a preliminary review of the Sony product, we believe the product introduced infringes upon one or more of our patents. We are taking legal steps to resolve this possible infringement, including the commencement of a lawsuit on April 24, 2002. Such suits, however, can be expensive, time-consuming, require a significant expenditure of resources and ultimately may not be successful. We have seen an increase in similar ribbon products from other manufacturers that also, we believe, violate our patents. Some of these

S-8

violations have occurred in countries where intellectual property protections, such as those afforded in the United States, either do not exist or have not been developed to the same level of sophistication. If Sony or others succeed in penetrating the market, our revenues would be adversely affected. See "Business—Legal Proceedings" on page S-38.

Our markets are highly competitive and many of our competitors have substantial resources. Competition may result in price reductions, lower gross profits and loss of market share.

We face significant competition in developing and selling our systems. Our principal competitors have substantial marketing, financial, development and personnel resources. To remain competitive, we believe that we must continue to provide:

- •

- technologically advanced systems that satisfy the demands of end-users;

- •

- a dependable and efficient distribution and reseller network;

- •

- superior customer service; and

- •

- high levels of quality and reliability.

We cannot assure you that we will be able to compete successfully against our current or future competitors. Zebra, which sells competing products under the Eltron brand name, has been a significant competitor of ours in the past, and may be a more vigorous competitor in the future after the termination of their agreement to acquire us. Increased competition from manufacturers of systems or consumable supplies may result in price reductions, lower gross margins and loss of market share and could require increased spending by us on research and development, sales and marketing and customer support. Some of our competitors may make strategic acquisitions or establish cooperative relationships with suppliers or companies that produce complementary products such as cameras, computer equipment, software or biometric applications. If any technology that is competing with ours becomes more reliable, higher performing, less expensive or has other advantages over our technology, then the demand for our products could decrease.

We rely on sole and single-source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders, all of which could materially harm our business.

We rely on outside vendors to manufacture or develop products and consumable supplies that are used in our systems. We purchase critical components for our systems, including printheads, dye sublimation printer ribbons and microprocessors from separate single-source suppliers. Our inability to obtain adequate deliveries or alternative sources of supply could cause delays, loss of sales, increases in costs and lower gross profit margins. Currently, our sole supplier of printheads for dye sublimation printers is Kyocera, based in Japan, our sole supplier of dye sublimation ribbons is Dai Nippon, also based in Japan, and our supplier of most of the microprocessors that run our printers is Motorola. If any of these suppliers is unable to ship critical components, we, together with others in our industry, would be unable to manufacture and ship products to our customers. If the price of printheads, ribbons or microprocessors increases for any reason, or if these suppliers are unable or unwilling to deliver, we may have to find another source, which could result in interruptions, increased costs, delays, loss of sales and quality control problems. War, natural disaster, trade embargoes or economic hardship in Japan could also result in a disruption in shipments from our Japanese suppliers, which could require us and our competitors to develop new sources of these supplies or else cause us to be unable to complete and ship orders to our customers.

Our products incorporate technologies that we do not own and we could lose revenue if we are unable to obtain these technologies in the future.

Our products incorporate technologies over which we have no control, including thermal printhead technology, dye sublimation technology, software, microprocessors and, upon the shipment of our

S-9

CardJet printers, inkjet technology and the chemistry of the cards. The owners of these technologies are free to sell or license these technologies to our competitors, agree to supply these technologies exclusively to a third party or enter the market for our systems as our competitor. If any of these events occurs, the owners of these technologies could choose not to continue to supply us with vital system components, which would result in the diversion of our research and development resources and could result in lost revenue, inability to ship products and harm to our reputation. Some of these technologies are incorporated into new systems and if these systems are not shipped, we will see a material adverse impact to our revenues in the foreseeable future.

The complex design of our systems could result in manufacturing delays and other problems that cause us to fail to meet the demand for our systems on a timely basis, increase the cost of our systems, or both.

We have experienced manufacturing problems with some of our systems in the past. Similar problems in the future could lead to production delays that could cause our distribution network to choose to sell competing systems. In addition, manufacturing problems could result in higher material, labor and other costs which could increase the total cost of our systems and could decrease our profit margins.

Our systems may have manufacturing or design defects that we discover after shipment, which could negatively affect our revenues, increase our costs and harm our reputation.

Our systems are complex and may contain undetected and unexpected defects, errors or failures. If these product defects are substantial, the result could be product recalls, an increased amount of product returns, loss of market acceptance and damage to our reputation, all of which could increase our costs and cause us to lose sales. We carry general commercial liability insurance, including product liability, with a coverage limit of $2 million per occurrence plus an umbrella policy with a $5 million limit. Our insurance may be insufficient to protect us against losses caused by severe defects in our products.

We do not maintain significant inventories of component parts or finished goods and our failure to adequately forecast demand could result in shortages and damage our business.

Because most of our systems are built upon order, we do not maintain a significant inventory of completed systems. We maintain only limited inventories of component parts and consumable supplies, although we enter into purchase agreements with certain suppliers that require us to purchase minimum amounts. We endeavor to produce systems as they are ordered, which causes us to forecast production based on past sales and our estimates of future demand. In the event that we significantly underestimate our needs or encounter an unexpectedly high level of demand for our systems or our suppliers are unable to deliver our orders of components in a timely manner, we may be unable to fill our product orders on time which could harm our reputation and result in reduced sales.

Our business success depends wholly on the continued demand for card printing systems and related supplies.

Because we sell only card printing systems and related consumable supplies, our business depends on the continued demand for cards for identification, access control and other purposes. Demand for our products could decline if businesses and organizations use alternative technologies, such as biometric technologies that use physical characteristics of a person such as voice, fingerprints or eyes as a means of identification, or otherwise reduce their dependence on identification or access cards. These changes in the business environment or competition from current and potential competitors could significantly erode the demand for our systems and cause our business to suffer.

S-10

Technology in our industry evolves rapidly, potentially causing our products to become obsolete, and we must continue to enhance existing systems and develop new systems or we will lose sales.

Rapid technological advances, rapidly changing customer requirements and fluctuations in demand characterize the current market for our products. Our existing and development-stage products may become obsolete if our competitors introduce newer or more appealing technologies. If these technologies are patented or proprietary to our competitors, we may not be able to access these technologies. To be successful, we must constantly enhance our existing systems and develop and introduce new systems. If we fail to anticipate or respond to technological developments or customer requirements, or if we are significantly delayed in developing and introducing products, our business will suffer lost sales.

All of our sales are made through independent distributors and resellers, over whom we have limited control, and if they do not effectively market or sell our products, our sales will decline.

All of our revenue comes from sales through our distributor and reseller network, and we do not sell our products directly to end-users. Although certain distributors and resellers have made some contractual commitments to us, they are independent businesses that we do not control. We cannot be certain that they will continue to market or sell our systems effectively. In particular, our agreements with distributors and resellers of our Persona Series line of systems are typically non-exclusive, so distributors and resellers could carry competing product lines, devote their efforts to other products in different markets, reduce or discontinue sales of our products or fail to devote the resources necessary to provide effective sales and marketing support of our products, which could have a material adverse effect on our financial condition and results of operations. In addition, we have moved to a more exclusive distribution strategy for our Professional Series line of systems, so we rely on fewer distributors and resellers to sell our premium products. The failure of any one or more of the distributors or resellers of our Professional Series systems to effectively market and sell these products could impede this distribution strategy and negatively affect our sales. If distributors and resellers carry excess inventories of our systems or supplies, our sales could be negatively affected. We are dependent upon the continued viability and financial stability of these distributors and resellers, many of which are small organizations with limited capital. We believe that our future growth and success will continue to depend in large part upon the success of our distributors in operating their own businesses.

We sell a significant portion of our products internationally and purchase important components from foreign suppliers, which exposes us to currency fluctuations and other risks.

We sell a significant amount of our products to customers outside the United States, particularly in Europe and Asia. International sales accounted for 37%, 38%, and 36% of our net sales in 2001, 2000, and 1999, respectively. We expect that shipments to international customers, including customers in Europe and Asia, will continue to account for a significant portion of our net sales. Sales outside the United States involve the following risks, among others:

- •

- foreign governments may impose tariffs, quotas and taxes;

- •

- political and economic instability may reduce demand for our products;

- •

- restrictions on the export or import of technology may reduce or eliminate our ability to sell in certain markets;

- •

- potentially limited intellectual property protection in certain countries may limit our recourse against infringing products or cause us to refrain from selling in certain markets;

- •

- we may face difficulties in managing international operations;

- •

- our contracts with foreign distributors and resellers do not fully protect us against political and economic instability;

S-11

- •

- we may face difficulties in collecting receivables; and

- •

- we may not be able to control our international distributors' efforts on our behalf.

We do not hedge against foreign currency fluctuations and, because we denominate our international sales in U.S. dollars, currency fluctuations could also cause our products to become less affordable or less price competitive than those of foreign manufacturers. These factors may have a material adverse effect on our international sales.

In addition, we purchase components from a number of foreign suppliers and outsource certain manufacturing tasks to foreign manufacturers. In February 2001, we entered into a new agreement with our supplier of dye sublimation ribbons to make our purchases in dollars rather than yen. Although this agreement will reduce the risks of increased purchasing costs if the value of the dollar declines relative to the yen, we will not be able to benefit from the full potential cost savings if the value of the dollar increases relative to the yen.

If our systems fail to comply with domestic and international government regulations, or if these regulations result in a barrier to our business, we could lose sales.

Our systems must comply with various domestic and international laws, regulations and standards. In the event that we are unable or unwilling to comply with any such laws, regulations or standards, we may decide not to conduct business in certain markets. Particularly in international markets, we may experience difficulty in securing required licenses or permits on commercially reasonable terms, or at all. Failure to comply with existing or evolving laws or regulations, including export and import restrictions and barriers, or to obtain timely domestic or foreign regulatory approvals or certificates could result in lost sales.

On May 15, 2002, the European Union Competition Commission stated that it is reviewing the pricing of printer ink cartridges. Although this investigation is primarily focused on large inkjet printer manufacturers, if these companies are found to be in violation of European Union antitrust laws or other similar laws, it is possible that the same laws may apply to us, which may negatively impact our sales.

Our quarterly operating results have been volatile as a result of many factors and continued volatility may cause our stock price to fluctuate.

We have experienced fluctuations in our quarterly operating results and we expect those fluctuations to continue due to a variety of factors. Some of the factors that influence our quarterly operating results include:

- •

- the number and mix of products sold in the quarter;

- •

- the availability and cost of components and materials;

- •

- timing, costs and benefits of new product introductions;

- •

- customer order size and shipment timing; and

- •

- seasonal factors affecting timing of purchase orders.

Because of these factors, our quarterly operating results are difficult to predict and are likely to vary in the future. If our earnings are below financial analysts' expectations in any quarter, our stock price is likely to drop.

We may not be able to adequately protect ourselves against infringement claims of others, which if successfully brought could require us to redesign or cease marketing our products.

We cannot be certain that we have not infringed the proprietary rights of others. Any such infringement could cause third parties to bring claims against us, resulting in significant costs, possible

S-12

damages and substantial uncertainty. We could also be forced to develop a non-infringing alternative, which could be costly and time-consuming.

If we fail to attract and retain highly skilled managerial and technical personnel, we may fail to remain competitive.

Our future success depends, in significant part, upon the continued service and performance of our senior management and other key personnel, in particular Gary R. Holland, our Chief Executive Officer. Although we have "key man" insurance on Mr. Holland with a death benefit of $3 million, losing the services of Mr. Holland could impair our ability to effectively manage our company and to carry out our business plan. In addition, competition for skilled technical employees in our industry is intense. If we cannot attract and retain sufficient qualified technical employees, we may not be able to effectively develop and deliver competitive products to the market.

We may need to raise additional capital to fund our future operations, and any failure to obtain additional capital when needed or on satisfactory terms could damage our business.

We may need to raise or borrow additional capital in the future to fund our ongoing operations. Any equity or debt financing, if available at all, may be on terms that are not favorable to us and, in the case of equity offerings, may result in dilution to our stockholders. Any difficulty in obtaining additional financial resources, including the inability to borrow on satisfactory financial terms, could force us to curtail our operations or prevent us from pursuing our growth strategy or otherwise cause us financial harm.

In addition, as of March 31, 2002, we had $12.5 million of debt outstanding under our credit facility agreement. This credit facility imposes several restrictive conditions on our ability to incur additional indebtedness and pay dividends. This credit facility, and other future credit facilities, may prevent us from taking steps necessary to further our growth. This credit facility matures in April 2003. Our current lenders and other potential lenders may not extend us credit in the future.

Risks Related to this Offering

The market price of our common stock has fluctuated substantially in the past and is likely to fluctuate in the future as a result of a number of factors.

The market price of our common stock and the number of shares traded each day have varied greatly. Such fluctuations may continue because of numerous factors, including:

- •

- actual or anticipated fluctuations in our operating results and those of our competitors;

- •

- our announcements or our competitors' announcements of technological innovations or new products;

- •

- developments regarding patents or proprietary rights;

- •

- changes in financial analysts' estimates of our future performance and the future performance of our competitors or the technology industry generally;

- •

- sales of a high volume of shares of our common stock by our large stockholders;

- •

- general conditions in the industries in which we operate; and

- •

- general economic conditions.

In addition, in recent years the stock market has experienced extreme price and volume fluctuations. This volatility has had a significant effect on the market prices of securities issued by many companies for reasons unrelated to their operating performance. These broad market fluctuations may materially and adversely affect our stock price, regardless of our operating results.

S-13

Investors in our common stock may be diluted.

Investors ownership in our common stock will be subject to the risk that their equity interests in us may be diluted through the issuance of additional equity securities. We have the right to issue, at the discretion of our board of directors, shares other than those to be issued in this offering, upon such terms and conditions and at such prices as our board of directors may establish. In addition, we may in the future issue preferred stock that might have priority over our common stock as to distributions and liquidation proceeds.

The stockholder rights plan and other anti-takeover provisions adopted by us may have the effect of discouraging, delaying or preventing a change of control of Fargo.

The provisions of Delaware law and our certificate of incorporation and bylaws could make it difficult for a third party to acquire us, even though an acquisition might be beneficial to our stockholders. Our certificate of incorporation provides our board of directors the authority, without stockholder action, to issue up to 10,000,000 shares of undesignated stock, including preferred stock in one or more series. In February 2000, a committee of our board of directors authorized the designation of up to 300,000 shares of Series C preferred stock in connection with the adoption of our stockholders rights agreement. Our board has the authority, without stockholder approval, to establish from the undesignated stock, one or more classes or series of company shares, including preferred stock, and to fix the rights, preferences and privileges (including voting rights) of any such class or series of company shares. We do not presently intend to designate or issue any additional company shares from the undesignated stock. However, your rights as a holder of common stock will be subject to, and may be adversely affected by, the rights of holders of any future shares we designate and issue from the undesignated stock. The designation and issuance of company shares from the undesignated stock may also cause significant dilution in your interests as a stockholder. By issuing any such shares, we could also make it more difficult for a third party to acquire us.

Our certificate of incorporation does not allow our stockholders to cumulate their votes to elect directors, and it provides for a classified board, with each board member serving a staggered three-year term. In addition, our bylaws establish an advance notice procedure for stockholder proposals and for nominating candidates for election as directors. In addition, we are subject to the anti-takeover provisions of Section 203 of the Delaware General Corporation Law. These provisions, along with the ability of our board of directors to designate and issue shares from the undesignated stock, could prevent or delay a change of control of Fargo. In turn, this could adversely affect common stock market prices. See "Description of Capital Stock" beginning on page S-44.

Our stockholder rights agreement entitles certain of our stockholders to purchase our Series C preferred stock or equivalent upon certain triggering events. These rights will not be exercisable until the acquisition by a person or affiliated group of 15% or more of the outstanding shares of our common stock, or the commencement or announcement of a tender offer or exchange offer which would result in the acquisition of 15% or more of our outstanding shares. The stockholder rights agreement may have the effect of discouraging, delaying or preventing a change of control of Fargo.

S-14

USE OF PROCEEDS

We estimate the net proceeds from the sale of newly-issued shares of our common stock in this offering will be approximately $ , after deducting underwriting discounts and commissions and our and the selling stockholders' estimated offering expenses, all of which are payable by us.

We intend to use the net proceeds of this offering for general corporate purposes, including the repayment of indebtedness of up to $12.5 million of outstanding principal as of March 31, 2002, plus accrued interest, under our credit facility with LaSalle Bank and Harris Bank. The credit facility matures in April 2003. The interest rates charged on the balance outstanding under the credit facility may vary from the prime rate of interest plus 0.25% to 0.50% or LIBOR plus 1.75% to 2.00%, depending upon certain financial coverage ratios. Our credit agreement requires us to use at least 25% of the net proceeds received by us in any offering of our equity securities to repay outstanding principal.

We will not receive any of the proceeds from sales of common stock by any selling stockholder. Pursuant to an agreement with the selling stockholders, we have agreed to pay all expenses of effecting the registration of shares of common stock offered by any selling stockholder, including reasonable fees and disbursements of counsel for the selling stockholders. We will not pay any underwriting discounts and commissions, fees and disbursements of any additional counsel for any selling stockholder, or transfer taxes attributable to the sale of the offered shares, which will be paid by any selling stockholder.

DIVIDEND POLICY

Since the completion of our public offering, we have not declared or paid any cash dividends on our common stock or other securities and we do not anticipate paying cash dividends in the foreseeable future. We currently intend to retain our earnings, if any, for future growth. Future dividends on our common stock or other securities, if any, will be at the discretion of our board of directors and will depend on, among other things, our operations, capital requirements and surplus, general financial condition, contractual restrictions and such other factors as our board of directors may deem relevant. In addition, our ability to declare and pay dividends is restricted by the terms of our credit facility.

S-15

PRICE RANGE OF OUR COMMON STOCK

Our common stock is currently traded on the Nasdaq National Market under the symbol "FRGO." The following table sets forth the high and low closing sales prices per share as reported by the Nasdaq National Market for each quarter since our initial public offering of common stock in February 2000.

| | Common Stock Price

|

|---|

| | High

| | Low

|

|---|

| Fiscal Year Ending December 31, 2002: | | | | | | |

| | First Quarter | | $ | 7.52 | | $ | 5.64 |

| | Second Quarter (through May 31, 2002) | | | 12.47 | | | 7.25 |

Fiscal Year Ended December 31, 2001: |

|

|

|

|

|

|

| | First Quarter | | $ | 5.25 | | $ | 2.06 |

| | Second Quarter | | | 4.99 | | | 2.03 |

| | Third Quarter | | | 7.22 | | | 4.10 |

| | Fourth Quarter | | | 7.19 | | | 6.59 |

Fiscal Year Ended December 31, 2000: |

|

|

|

|

|

|

| | First Quarter | | $ | 17.75 | | $ | 10.75 |

| | Second Quarter | | | 12.13 | | | 2.50 |

| | Third Quarter | | | 9.50 | | | 3.50 |

| | Fourth Quarter | | | 6.31 | | | 1.47 |

S-16

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2002 on:

- •

- an actual basis; and

- •

- an adjusted basis, which gives effect to:

- •

- the receipt of the estimated net proceeds from the issuance of 950,000 shares of our common stock at the assumed offering price of$ per share; and

- •

- the repayment of approximately $ of our indebtedness under our credit facility with the net proceeds from this offering.

You should read this table in conjunction with our unaudited interim financial statements and the related notes included elsewhere in this prospectus supplement.

| | As of March 31, 2002

|

|---|

| | Actual

| | As Adjusted

|

|---|

| | ($ in thousands)

|

|---|

| Cash and cash equivalents | | $ | 2,839 | | |

| | |

| | |

Total bank debt, including current portion (matures on April 1, 2003) |

|

|

12,500 |

|

|

Stockholders' equity: |

|

|

|

|

|

| | Common stock, $.01 par value; 50,000,000 shares authorized, 11,785,900 issued and outstanding; shares issued as adjusted | | | 118 | | |

| Additional paid-in capital | | | 145,249 | | |

| Accumulated deficit | | | (118,326 | ) | |

| Deferred compensation | | | (37 | ) | |

| Stock subscription receivable | | | (625 | ) | |

| | |

| | |

| | | Total stockholders' equity | | | 26,379 | | |

| | |

| | |

| | Total capitalization, including bank debt | | $ | 38,879 | | |

| | |

| | |

The outstanding share information in the table above is based on the number of shares outstanding as of March 31, 2002 and excludes:

- •

- 244,182 shares of common stock issuable upon exercise of outstanding options at a weighted average exercise price of $5.97 per share; and

- •

- 522,333 shares available for future issuance under our Amended and Restated 1998 Stock Option and Grant Plan and 2001 Employee Stock Purchase Plan.

S-17

SELECTED FINANCIAL INFORMATION

The following selected financial information as of and for the years ended December 31, 1998 through December 31, 2001 are derived from our audited financial statements. The selected financial information as of and for the three months ended March 31, 2001 and 2002 are derived from our unaudited interim financial statements. Such unaudited interim financial statements have been prepared by us on a basis consistent with our annual audited financial statements and, in the opinion of our management, contain all normal recurring adjustments necessary for a fair presentation of the financial position and results of operations for the applicable periods. This information is only a summary and does not provide all of the information contained in our financial statements and related notes. You should read the "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page S-20 of this prospectus supplement and our financial statements.

| | Year Ended December 31,

| | Three Months Ended

March 31,

| |

|---|

Statements of Operations Data:

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| | (in thousands, except per share data)

| |

|---|

| |

| |

| |

| |

| | (unaudited)

| |

|---|

| Net sales | | $ | 47,647 | | $ | 54,107 | | $ | 57,845 | | $ | 60,963 | | $ | 13,172 | | $ | 15,021 | |

| Cost of sales | | | 23,195 | | | 28,928 | | | 34,721 | | | 37,497 | | | 8,247 | | | 9,220 | |

| | |

| |

| |

| |

| |

| |

| |

| | Gross profit | | | 24,452 | | | 25,179 | | | 23,124 | | | 23,466 | | | 4,925 | | | 5,801 | |

| | |

| |

| |

| |

| |

| |

| |

| Operating expenses: | | | | | | | | | | | | | | | | | | | |

| | Research and development | | | 1,586 | | | 4,011 | | | 4,934 | | | 4,053 | | | 1,032 | | | 1,256 | |

| | Selling, general and administrative | | | 8,307 | | | 8,525 | | | 10,027 | | | 10,341 | | | 2,831 | | | 2,834 | |

| | Recapitalization costs(1) | | | 8,386 | | | — | | | — | | | — | | | — | | | — | |

| | Acquisition-related costs(2) | | | — | | | — | | | — | | | 1,434 | | | 62 | | | 538 | |

| | |

| |

| |

| |

| |

| |

| |

| Total operating expenses | | | 18,279 | | | 12,536 | | | 14,961 | | | 15,828 | | | 3,925 | | | 4,628 | |

| | |

| |

| |

| |

| |

| |

| |

| Operating income | | | 6,173 | | | 12,643 | | | 8,163 | | | 7,638 | | | 1,000 | | | 1,173 | |

| | |

| |

| |

| |

| |

| |

| |

| Other income (expense): | | | | | | | | | | | | | | | | | | | |

| | Interest expense | | | (5,298 | ) | | (5,956 | ) | | (2,830 | ) | | (1,379 | ) | | (480 | ) | | (150 | ) |

| | Interest income | | | 109 | | | 102 | | | 81 | | | 79 | | | — | | | — | |

| | Other, net | | | (273 | ) | | 270 | | | 7 | | | (33 | ) | | (25 | ) | | 8 | |

| | |

| |

| |

| |

| |

| |

| |

| Total other expense | | | (5,462 | ) | | (5,584 | ) | | (2,742 | ) | | (1,333 | ) | | (505 | ) | | (142 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Income before provision for income taxes and extraordinary loss | | | 711 | | | 7,059 | | | 5,421 | | | 6,305 | | | 495 | | | 1,031 | |

| Provision for income taxes | | | 2,800 | | | 2,575 | | | 1,979 | | | 2,229 | | | 183 | | | 317 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income (loss) before extraordinary loss | | | (2,089 | ) | | 4,484 | | | 3,442 | | | 4,076 | | | 312 | | | 714 | |

| Extraordinary loss, net of applicable income taxes | | | — | | | — | | | (385 | ) | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | | (2,089 | ) | | 4,484 | | | 3,057 | | | 4,076 | | | 312 | | | 714 | |

| Accrued dividends on redeemable preferred stock | | | (2,113 | ) | | (2,620 | ) | | (350 | ) | | — | | | — | | | — | |

| Accretion of convertible participating preferred stock(3) | | | — | | | (67,000 | ) | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| Net income (loss) available to common stockholders | | $ | (4,202 | ) | $ | (65,136 | ) | $ | 2,707 | | $ | 4,076 | | $ | 312 | | $ | 714 | |

| | |

| |

| |

| |

| |

| |

| |

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Basic earnings: | | | | | | | | | | | | | | | | | | | |

| | | Income (loss) before extraordinary loss | | $ | (0.98 | ) | $ | (37.56 | ) | $ | 0.29 | | $ | 0.35 | | $ | 0.03 | | $ | 0.06 | |

| | | Extraordinary loss | | | — | | | — | | | (0.04 | ) | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | Net income (loss) | | $ | (0.98 | ) | $ | (37.56 | ) | $ | 0.25 | | $ | 0.35 | | $ | 0.03 | | $ | 0.06 | |

| | |

| |

| |

| |

| |

| |

| |

| | Diluted earnings: | | | | | | | | | | | | | | | | | | | |

| | | Income (loss) before extraordinary loss | | $ | (0.98 | ) | $ | (37.56 | ) | $ | 0.27 | | $ | 0.34 | | $ | 0.03 | | $ | 0.06 | |

| | | Extraordinary loss | | | — | | | — | | | (0.03 | ) | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | Net income (loss) | | $ | (0.98 | ) | $ | (37.56 | ) | $ | 0.24 | | $ | 0.34 | | $ | 0.03 | | $ | 0.06 | |

| | |

| |

| |

| |

| |

| |

| |

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | Basic shares outstanding | | | 4,307 | | | 1,734 | | | 10,637 | | | 11,760 | | | 11,748 | | | 11,785 | |

| | | Diluted shares outstanding | | | 4,307 | | | 1,734 | | | 11,413 | | | 11,958 | | | 11,863 | | | 12,013 | |

- (1)

- Reflects expenses consisting primarily of employee compensation, legal and professional fees incurred by us in connection with our leveraged recapitalization in February 1998. The impact of the recapitalization costs and the fact that we were not a C Corporation for the entire year resulted in a reduction of net income available to common stockholders of $7,911,000 and resulted in a reduction of basic net income per share of $1.84 and diluted net income per share of $1.41.

S-18

- (2)

- The impact of these acquisition-related costs resulted in a reduction of net income available to common stockholders by $926,000 for the year ended December 31, 2001 and $342,000 for the quarter ended March 31, 2002. The impact of these acquisition-related costs resulted in a reduction in basic and diluted net income per common share of $0.08 per share for the year ended December 31, 2001 and $0.03 per share for the quarter ended March 31, 2002.

- (3)

- Reflects the accretion of convertible participating preferred stock originally issued at $1.00 per share in our February 1998 recapitalization. Such stock was automatically converted to common stock on a 625-for-1 basis upon the closing of our initial public offering in February 2000. As of September 30, 1999, such preferred stock was recorded at the expected fair market value of the common stock ($15.00 per share), which resulted in a $67,000,000 reduction in net income available to common stockholders.

| | As of December 31,

| | As of March 31,

|

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

|

|---|

| | (in thousands)

|

|---|

| |

| |

| |

| |

| | (unaudited)

|

|---|

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents |

|

$ |

1,103 |

|

$ |

1,509 |

|

$ |

1,223 |

|

$ |

3,586 |

|

$ |

2,244 |

|

$ |

2,839 |

| Working capital | | | 5,184 | | | 7,569 | | | 14,850 | | | 9,190 | | | 11,518 | | | 8,509 |

| Total assets | | | 46,628 | | | 49,094 | | | 48,815 | | | 46,213 | | | 49,331 | | | 46,172 |

Note payable, stockholder |

|

|

10,000 |

|

|

10,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| Total bank debt | | | 53,500 | | | 50,100 | | | 22,900 | | | 14,000 | | | 22,900 | | | 12,500 |

| Redeemable preferred stock | | | 32,113 | | | 34,733 | | | — | | | — | | | — | | | — |

| Convertible participating preferred stock | | | 8,000 | | | 75,000 | | | — | | | — | | | — | | | — |

| Stockholders' equity (deficiency) | | | (59,825 | ) | | (124,948 | ) | | 21,359 | | | 25,638 | | | 21,684 | | | 26,379 |

In February 2000, we completed our initial public offering of 5,000,000 shares of our common stock, resulting in proceeds to us of $69,750,000 before offering expenses. We used the proceeds of the offering to repay debt and redeem our redeemable preferred stock.

S-19

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Background

We are a leading developer, manufacturer and supplier of printing systems and consumable supplies that personalize plastic identification cards by printing images and text onto the card. Our printing systems are capable of encoding data onto cards that incorporate bar code, magnetic stripe, smart card or proximity card technology. We believe that our engineering expertise and our ability to offer a broad range of printing systems using multiple printing technologies have led to a reputation for innovation in our industry. The consumable supplies used with our systems include dye sublimation ribbons, overlaminates, thermal resin ribbons, printheads and blank cards. The sale of these supplies provides us with a significant recurring revenue stream.

Concern for personal safety and property protection has led to the need for electronic and visual identification and access control. We believe the demand for our products will increase as governments and corporations worldwide address their security needs. We believe the development and implementation of new technologies that add security features to plastic cards should foster a growing market for our systems.

We market and sell our products exclusively through a distribution channel of independent distributors and resellers in more than 80 countries worldwide. We estimate that as of March 31, 2002, we have manufactured and sold more than 60,000 of our printing systems.

Results of Operations

The following table sets forth, for the periods indicated, certain selected financial data expressed as a percentage of net sales:

| | Year Ended December 31,

| | Three Months Ended

March 31,

| |

|---|

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| |

| |

| |

| | (unaudited)

| |

|---|

| Net sales | | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

| Cost of sales | | 53.5 | | 60.0 | | 61.5 | | 62.6 | | 61.4 | |

| | |

| |

| |

| |

| |

| |

Gross profit |

|

46.5 |

|

40.0 |

|

38.5 |

|

37.4 |

|

38.6 |

|

| | |

| |

| |

| |

| |

| |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| | Research and development | | 7.4 | | 8.5 | | 6.6 | | 7.8 | | 8.4 | |

| | Selling, general and administrative | | 15.8 | | 17.3 | | 17.0 | | 21.5 | | 18.8 | |

| | Acquisition-related costs | | — | | — | | 2.4 | | 0.5 | | 3.6 | |

| | |

| |

| |

| |

| |

| |

| | | Total operating expenses | | 23.2 | | 25.8 | | 26.0 | | 29.8 | | 30.8 | |

| | |

| |

| |

| |

| |

| |

Operating income |

|

23.3 |

% |

14.2 |

% |

12.5 |

% |

7.6 |

% |

7.8 |

% |

| | |

| |

| |

| |

| |

| |

Comparison of Three Months Ended March 31, 2002 and 2001

Net sales. Net sales increased 14.0% to $15.0 million for the three-month period ended March 31, 2002, from $13.2 million in the same period of 2001. Of the $15.0 million in sales in the first quarter of 2002, sales of equipment increased 1.9% to $6.6 million from $6.5 million in the first quarter of 2001, and sales of supplies increased 25.9% to $8.4 million from $6.7 million in the first quarter of 2001. The increase in sales of supplies was the result of increased unit volume of ribbons.

S-20

Our now terminated agreement to be acquired by Zebra Technologies Corporation was announced on August 1, 2001. We believe that the announcement of the acquisition and the delay in the consummation of the transaction has had, and will likely continue to have, an adverse effect on our distributorship and reseller arrangements and, consequently, our sales.

International sales increased 10.7% to $5.8 million in the first quarter of 2002 from $5.2 million in the same period of 2001 and accounted for 38.5% of net sales for the three months ended March 31, 2002, compared to 39.7% of net sales in the same period of 2001. The increase in international sales was principally attributable to increased sales of equipment and supplies in Canada and Mexico in the first quarter of 2002.

Gross profit. Gross profit as a percentage of net sales increased to 38.6% for the three months ended March 31, 2002, from 37.4% in the same period of 2001. Gross profit is highly dependent on the level of net sales compared to the fixed component of cost of sales and the related realization of manufacturing efficiencies. Gross profit for the three months ended March 31, 2002, was positively impacted by a greater increase in net sales relative to the increase in cost of sales, compared to the same period of 2001. This was partially offset by increased discounts and increased sales of lower margin printers for the three-month period ended March 31, 2002.

Research and development. Research and development expenses increased 21.7% to $1.3 million for the three months ended March 31, 2002, from $1.0 million in the same period of 2001. Research and development expenses as a percentage of net sales were 8.4% for the first quarter of 2002, compared to 7.8% for the same period of 2001. The increase in the first quarter of 2002 was primarily due to higher salary expense as a result of higher staffing levels and higher costs on prototype parts related to activities in the research and development of new products.

Selling, general and administrative. Selling, general and administrative expenses remained steady at approximately $2.8 million for the three months ended March 31, 2002, nearly the same amount incurred during the same period of 2001. As a percentage of net sales, selling, general and administrative expenses were 18.8% in the first quarter of 2002, compared to 21.5% for the same period of 2001. Increased advertising and tradeshow expenses were offset by lower legal and professional fees for the quarter ended March 31, 2002. We experienced higher legal and professional fees in the first quarter of 2001 due to fees paid to outside consultants to improve our manufacturing processes. The decrease in selling, general and administrative expenses as a percent of total sales was principally due to higher net sales in the first quarter of 2002.

Acquisition-related costs. In connection with our now-terminated acquisition by Zebra, we incurred legal and professional expenses of $538,000 for the three-month period ended March 31, 2002, and $62,000 for the same period of 2001. As a percentage of net sales, acquisition-related costs were 3.6% in the first quarter of 2002, compared to 0.5% in the same period of 2001. As a result of the termination of this transaction in March 2002, we may incur additional costs to rebuild our distribution channel, which may have a negative impact on our sales, gross profit and operating income in future periods.

Operating income. Operating income increased 17.3% to $1.2 million for the quarter ended March 31, 2002, from $1.0 million during the same period of 2001. As a percentage of net sales, operating income was 7.8% in the first quarter of 2002 compared to 7.6% in the same period of 2001. Excluding acquisition-related costs, operating income would have been $1.7 million or 11.4% of net sales for the three-month period ended March 31, 2002 compared to $1.1 million or 8.1% of net sales for the three-month period ended March 31, 2001.

Interest expense. Interest expense totaled $150,000 for the three months ended March 31, 2002, compared to $480,000 for the comparable period in 2001. The reduction in our outstanding debt

S-21

combined with reduced interest rates led to the lower interest expense. The weighted average interest rate on our outstanding debt for the three months ended March 31, 2002 was 3.7% as compared to 7.7% in the same period of 2001.

Income tax expense. Income tax expense was $317,000 for the three months ended March 31, 2002, which results in an effective tax rate of 30.7%, compared to income tax expense of $183,000 and an effective tax rate of 36.9% for the same period of 2001. The decrease in the effective tax rate for the three-month period ended March 31, 2002, relates to research and experimentation credits we utilized in the first quarter of 2002.

Comparison of Years Ended December 31, 2001 and 2000

Net sales. Net sales increased 5.4% to $61.0 million in 2001 from $57.8 million in 2000. The mix of net sales continued to change with sales of plastic card personalization products increasing 5.9% to $60.6 million in 2001 from $57.2 million in 2000. Sales of equipment increased 9.4% to $27.0 million from $24.7 million in 2000, and sales of supplies increased 3.3% to $33.6 million from $32.5 million in 2000. The increase in sales of equipment is largely attributable to the shipment of printers for the Department of Defense "Common Access" Identification Card Project. The increase in sales of supplies was the result of increased unit volume of ribbons.

International sales increased 0.4% to $22.3 million in 2001 from $22.2 million in 2000 and accounted for 36.6% of net sales in 2001 compared to 38.4% of net sales in 2000. The decrease in international sales as a percent of total sales was principally due to the increase in sales in the United States from the shipment of printers to the Department of Defense for the year ended December 31, 2001. We experienced increased international sales in Canada, primarily the result of increased sales of equipment. This increase in international sales was partially offset by decreased sales in Asia Pacific. Asia Pacific sales were lower mainly due a decrease in sales of equipment.

Gross profit. Gross profit increased 1.6% to $23.5 million for 2001 from $23.1 million in 2000. Several factors, however, led to a decline in the gross profit margin percent to 38.5% in 2001 from 40.0% in 2000, notably, increases in manufacturing start-up costs associated with our new products, increased discounts and increased sales of lower margin printers in 2001. Lower material costs on supplies partially offset these negative factors.

Research and development. Research and development expenses decreased 17.9% to $4.1 million in 2001 from $4.9 million in 2000. Research and development expenses as a percentage of net sales were 6.6% for 2001 compared to 8.5% for 2000. Lower salary expense as a result of lower staffing levels and tighter controls on expenditures for prototype parts contributed to the decrease in research and development expenses.