September 18, 2012

Mr. Daniel E. Klimas and the Board of Directors

LNB Bancorp, Inc.

457 Broadway

Lorain, Ohio 44052

Dear Dan and Members of the Board of Directors,

I have been a vocal supporter of LNB, but have not hesitated to encourage management to take the steps necessary to allow LNB to control its own destiny and flourish as a healthy community bank. I have been particularly vocal about management’s plan to retire the bank’s TARP obligations. Mr. Klimas seems to believe that TARP is no longer an issue, but I respectfully disagree.

As you know, in 2008, LNB borrowed $25.2 million under the Federal government’s Troubled Asset Relief Program. I have repeatedly questioned you about your plans to replace the TARP funds because of the onerous interest provisions. If LNB fails to replace TARP by the end of 2013, the dividend payments on the TARP funds will increase by 80%, from 5% ($1.26 million annually) to 9% ($2.27 million annually). The $2.27 million dividend payment represents an incredible 61% of LNB’s 2011 net income available to common shareholders, which would leave very little left over for the bank’s owners. I previously reached out to you to discuss options for retiring the TARP funds in a way that would not be significantly dilutive to LNB’s shareholders, but my efforts were rebuffed.

Although most banks nationally have paid back their TARP obligations, LNB has not. Instead, in June the Federal government auctioned off LNB’s debt to private investors at a discount — the government received only $21.6 million for the $25.2 million face value of the debt. It’s unfortunate that LNB didn’t capture any of this savings, because it won’t reduce the interest payments LNB owes to the new TARP owners by a single cent. Because I believe in the future promise of LNB, I myself purchased some of LNB’s TARP debt, and while as a debt holder I would be delighted by an increase in the interest rate, as a shareholder I would prefer, as I have been suggesting for years, that LNB retire its TARP debt before the interest rate nearly doubles. And yet, with little more than a year before the increase, in a marketplace where LNB will have more and more competition looking to replace TARP capital, Mr. Klimas appears to feel no urgency to address the TARP dilemma. In an interview with the Plain Dealer, Mr. Klimas stated that although management would “prefer [the interest rate] didn’t increase” they didn’t “feel there’s a need to buy [the TARP] shares back immediately.” When will you feel a sense of urgency? And will it be too late for the shareholders of LNB?

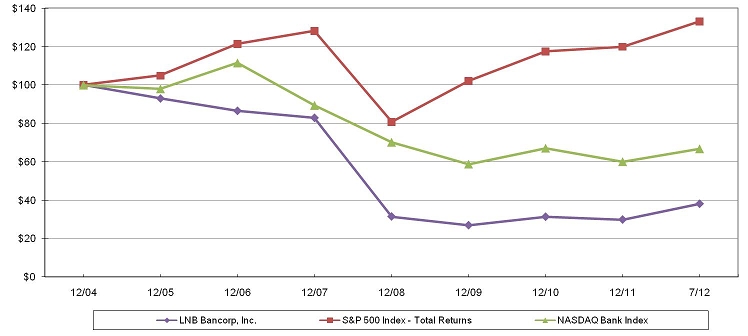

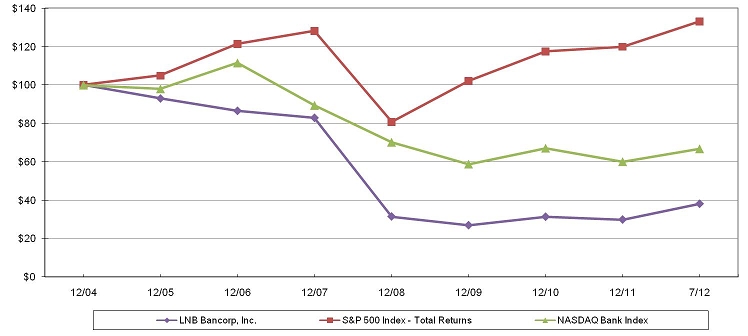

Mr. Klimas became LNB’s president and CEO on February 7, 2005. LNB’s board appointed James Herrick chairman on December 31, 2004. The following graph compares the performance of LNB’s stock to that of the S&P 500 Index and the NASDAQ Bank Index, the two indices that LNB uses for comparative purposes in its proxy, assuming the investment of $100 on December 31, 2004, when Messrs. Klimas and Herrick assumed leadership of the bank, and the reinvestment of dividends paid. By the end of this July, the $100 invested in LNB had plummeted to $38.11!

The graph shown above is based on the following data points:

| | | 12/04 | | | 12/05 | | | 12/06 | | | 12/07 | | | 12/08 | | | 12/09 | | | 12/10 | | | 12/11 | | | 7/12 | |

| LNB Bancorp, Inc. | | $ | 100.00 | | | $ | 92.96 | | | $ | 86.52 | | | $ | 82.88 | | | $ | 31.49 | | | $ | 26.97 | | | $ | 31.36 | | | $ | 29.90 | | | $ | 38.11 | |

| S&P 500 Index | | | 100.00 | | | | 104.91 | | | | 121.48 | | | | 128.16 | | | | 80.74 | | | | 102.11 | | | | 117.49 | | | | 119.97 | | | | 133.18 | |

| NASDAQ Bank Index | | | 100.00 | | | | 98.07 | | | | 111.62 | | | | 89.40 | | | | 70.14 | | | | 58.71 | | | | 67.02 | | | | 59.98 | | | | 66.69 | |

Despite my concerns, I continue to believe in LNB’s future under the right leadership. Management and the board must make creating shareholder value the number one priority. How should you do this? I believe that LNB’s leadership must:

| · | Develop immediately (although already tardy) a plan to repay the TARP debt without significantly diluting LNB’s shareholders and communicate that plan to the shareholders. |

| · | Continue to reduce the size of the board and insure that the directors are invested in the company to align their interests with those of the shareholders. |

| · | Appoint an executive chairman to help develop a plan for improvement and create a real sense of urgency to implement that plan to benefit all shareholders. |

| · | To do so management must improve LNB’s internal performance dramatically. That means addressing credit problems and significantly, substantially and sustainably decreasing costs while improving revenues. |

By implementing these steps I believe LNB could take advantage of the current low valuation of small commercial banks and make strategic or tuck-in acquisitions. If management is unable or unwilling to make LNB a high performance bank, the board will have to consider strategic alternatives to create shareholder value. I do not believe continuing as the bank has — with a low stock price, thin capital, no dividend and mediocre performance — is an acceptable option.

I look forward to the opportunity to discuss these ideas with you. Thank you for your time, interest and consideration.

Regards,

/s/ Umberto P. Fedeli