Exhibit 99.1

Forward-Looking Statements, Confidentiality and Non-GAAP Financial Measures 2 SPECIAL NOTICE REGARDING PUBLICLY AVAILABLE INFORMATION: THE COMPANY (AS DEFINED BELOW) HAS REPRESENTED THAT THE INFORMATION CONTAINED IN THIS PRESENTATION IS EITHER PUBLICLY AVAILABLE OR DOES NOT CONSTITUTE MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES FOR PURPOSES OF UNITED STATES FEDERAL AND STATE SECURITIES LAWS. THE RECIPIENT (AS DEFINED BELOW) OF THIS PRESENTATION HAS STATED THAT IT DOES NOT WISH TO RECEIVE MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES AND ACKNOWLEDGES THAT OTHER LENDERS HAVE RECEIVED A PRESENTATION THAT CONTAINS ADDITIONAL INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES THAT MAY BE MATERIAL. NEITHER THE COMPANY NOR THE ARRANGERS (AS DEFINED BELOW) TAKE ANY RESPONSIBILITY FOR THE RECIPIENT'S DECISION TO LIMIT THE SCOPE OF THE INFORMATION IT HAS OBTAINED IN CONNECTION WITH ITS EVALUATION OF THE COMPANY AND THE FACILITIES (AS DEFINED BELOW). NOTWITHSTANDING THE RECIPIENT’S DESIRE TO ABSTAIN FROM RECEIVING MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES, THE RECIPIENT ACKNOWLEDGES THAT (1) ALL INDIVIDUALS LISTED AS CONTACTS IN THIS PRESENTATION MAY BE IN RECEIPT OF MATERIAL NON-PUBLIC INFORMATION OR OTHERWISE HAVE ACCESS TO INFORMATION THAT IS PROVIDED TO LENDERS OR POTENTIAL LENDERS WHO DESIRE TO RECEIVE MATERIAL NON-PUBLIC INFORMATION AND THAT IF THE RECIPIENT CHOOSES TO COMMUNICATE WITH ANY SUCH INDIVIDUALS, THE RECIPIENT ASSUMES THE RISK OF RECEIVING MATERIAL NON-PUBLIC INFORMATION CONCERNING THE COMPANY OR ITS SECURITIES, (2) INFORMATION OBTAINED AS A RESULT OF BECOMING A LENDER MAY INCLUDE MATERIAL NON-PUBLIC INFORMATION, AND (3) IT HAS DEVELOPED COMPLIANCE PROCEDURES REGARDING THE USE OF MATERIAL NON-PUBLIC INFORMATION AND IT WILL HANDLE SUCH INFORMATION IN ACCORDANCE WITH APPLICABLE LAW, INCLUDING FEDERAL AND STATE SECURITIES LAWS. THIS PRESENTATION HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES FROM INFORMATION SUPPLIED SOLELY BY OR ON BEHALF OF BEASLEY BROADCAST GROUP, INC. AND ITS SUBSIDIARIES (“BEASLEY” OR THE “COMPANY”) AND IS BEING FURNISHED BY GUGGENHEIM SECURITIES, LLC AND U.S. BANK NATIONAL ASSOCIATION (THE “ARRANGERS”) TO YOU IN YOUR CAPACITY AS A PROSPECTIVE LENDER (THE “RECIPIENT”) IN CONSIDERING THE PROPOSED FACILITIES DESCRIBED IN THIS PRESENTATION (THE “FACILITIES”). RECIPIENT’S ACCEPTANCE OF THIS PRESENTATION CONSTITUTES AN AGREEMENT BY IT TO BE BOUND BY THE TERMS OF THE “NOTICE TO AND UNDERTAKING BY RECIPIENTS” (THE “NOTICE AND UNDERTAKING”) APPEARING AT THE END OF THIS PRESENTATION AND THE SPECIAL NOTICE SET FORTH ABOVE (THE “SPECIAL NOTICE”). IF THE RECIPIENT IS NOT WILLING TO ACCEPT THIS PRESENTATION AND OTHER EVALUATION MATERIAL (AS DEFINED IN THE NOTICE AND UNDERTAKING) ON THE TERMS SET FORTH IN THE NOTICE AND UNDERTAKING AND THE SPECIAL NOTICE, IT MUST RETURN THIS PRESENTATION AND ANY OTHER EVALUATION MATERIAL TO THE ARRANGERS IMMEDIATELY WITHOUT MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE THEREOF, AND IMMEDIATELY TERMINATE ITS ACCESS TO THE RELATED DEBTDOMAIN SITE. THIS PRESENTATION IS NOT AN OFFER TO SELL OR PURCHASE NOR A SOLICITATION OF AN OFFER TO SELL OR PURCHASE ANY SECURITIES AND SHALL NOT CONSTITUTE AN OFFER, SOLICITATION OR SALE IN ANY STATE OR JURISDICTION IN WHICH, OR TO ANY PERSON TO WHOM, SUCH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL. This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to future events or future performance of the Company and include statements about the Company’s expectations or forecasts for future periods and events. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are not historical facts and are based on information available at the time this presentation was prepared and/or management’s good faith belief with respect to future events. Such forward-looking statements are subject to risks and uncertainties, some or all of which are not predictable or within the control of the Company, that could cause actual performance or results to differ materially from those expressed in the statements. In the event that the risks disclosed in the Company’s public filings cause results to differ materially from those expressed in its forward-looking statements, its business, financial condition, results of operations or liquidity could be materially adversely affected and investors in its securities could lose part or all of their investment. Accordingly, the Company’s investors are cautioned not to rely on these forward-looking statements because, although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. This presentation includes certain financial measures that have not been prepared in a manner that complies with generally accepted accounting principles in the United States (“GAAP”), including EBITDA, Pro Forma Adjusted EBITDA, Pro Forma Net Revenue, Free Cash Flow, Free Cash Flow Conversion, Pro Forma Station Operating Income and Pro Forma Capital Expenditures (collectively, the “non-GAAP financial measures”). In addition, this presentation includes certain calculations provided for under the financial maintenance covenants contained in the Company’s senior credit facility. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income from operations, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under GAAP. You should be aware that this presentation of these measures may not be comparable to similarly-titled measures used by other companies. See Appendix for a reconciliation of each of the non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP.

Management Presenters 3 Name Title Company Caroline Beasley Chief Executive Officer Marie Tedesco Chief Financial Officer Justin Chase Executive Vice President of Programming

Table of Contents Transaction Overview Beasley at a Glance Key Credit Highlights Historical Financial Overview

Section I Transaction Overview

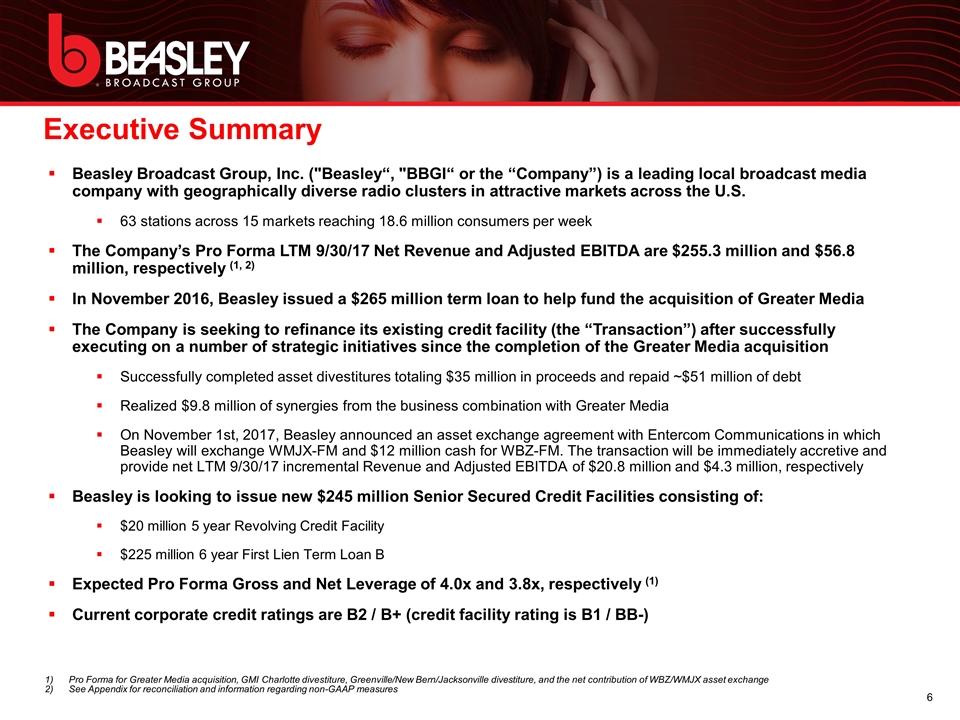

Executive Summary Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and the net contribution of WBZ/WMJX asset exchange See Appendix for reconciliation and information regarding non-GAAP measures Beasley Broadcast Group, Inc. ("Beasley“, "BBGI“ or the “Company”) is a leading local broadcast media company with geographically diverse radio clusters in attractive markets across the U.S. 63 stations across 15 markets reaching 18.6 million consumers per week The Company’s Pro Forma LTM 9/30/17 Net Revenue and Adjusted EBITDA are $255.3 million and $56.8 million, respectively (1, 2) In November 2016, Beasley issued a $265 million term loan to help fund the acquisition of Greater Media The Company is seeking to refinance its existing credit facility (the “Transaction”) after successfully executing on a number of strategic initiatives since the completion of the Greater Media acquisition Successfully completed asset divestitures totaling $35 million in proceeds and repaid ~$51 million of debt Realized $9.8 million of synergies from the business combination with Greater Media On November 1st, 2017, Beasley announced an asset exchange agreement with Entercom Communications in which Beasley will exchange WMJX-FM and $12 million cash for WBZ-FM. The transaction will be immediately accretive and provide net LTM 9/30/17 incremental Revenue and Adjusted EBITDA of $20.8 million and $4.3 million, respectively Beasley is looking to issue new $245 million Senior Secured Credit Facilities consisting of: $20 million 5 year Revolving Credit Facility $225 million 6 year First Lien Term Loan B Expected Pro Forma Gross and Net Leverage of 4.0x and 3.8x, respectively (1) Current corporate credit ratings are B2 / B+ (credit facility rating is B1 / BB-)

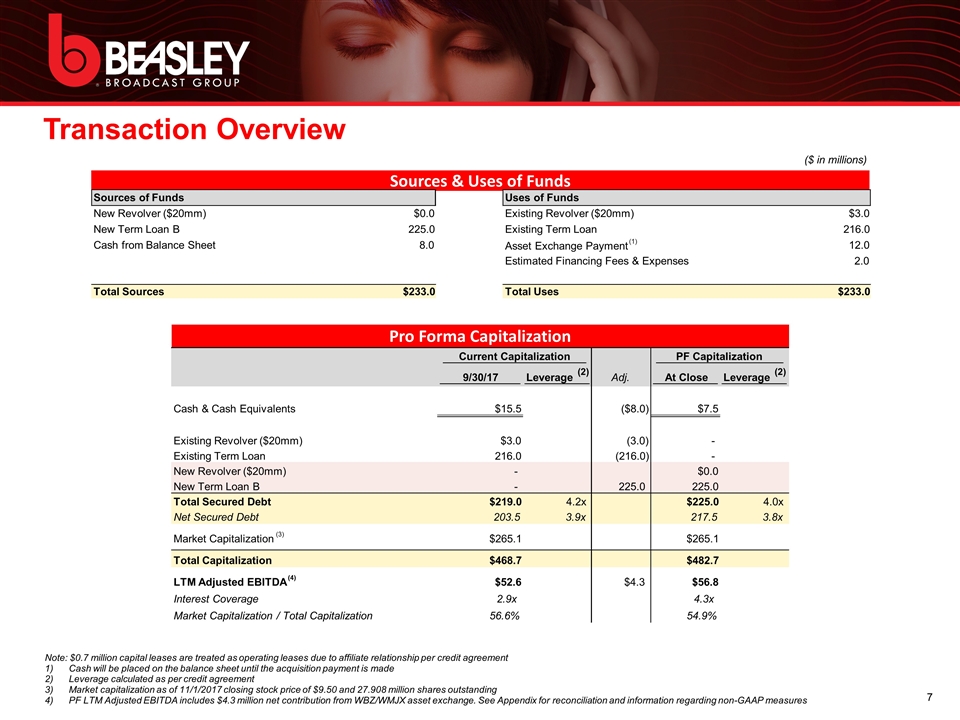

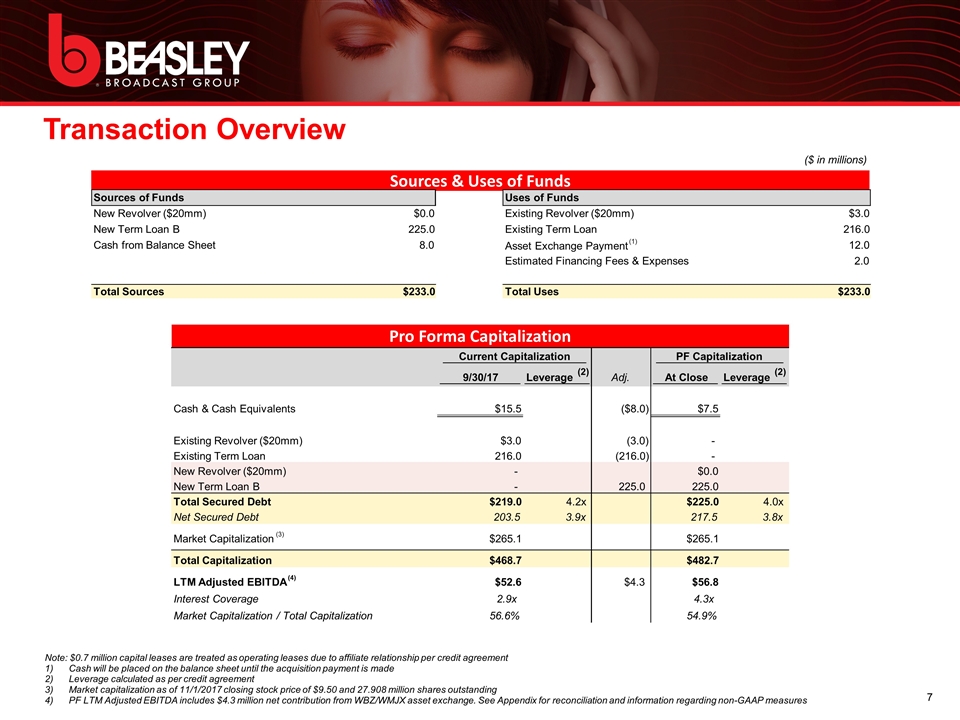

Transaction Overview Note: $0.7 million capital leases are treated as operating leases due to affiliate relationship per credit agreement Cash will be placed on the balance sheet until the acquisition payment is made Leverage calculated as per credit agreement Market capitalization as of 11/1/2017 closing stock price of $9.50 and 27.908 million shares outstanding PF LTM Adjusted EBITDA includes $4.3 million net contribution from WBZ/WMJX asset exchange. See Appendix for reconciliation and information regarding non-GAAP measures ($ in millions) Pro Forma Capitalization Sources & Uses of Funds Current Capitalization PF Capitalization 9/30/17 Leverage (2) Adj. At Close Leverage (2) Cash & Cash Equivalents $15.5 ($8.0) $7.5 Existing Revolver ($20mm) $3.0 (3.0) - Existing Term Loan 216.0 (216.0) - New Revolver ($20mm) - $0.0 New Term Loan B - 225.0 225.0 Total Secured Debt $219.0 4.2x $225.0 4.0x Net Secured Debt 203.5 3.9x 217.5 3.8x Market Capitalization (3) $265.1 $265.1 Total Capitalization $468.7 $482.7 LTM Adjusted EBITDA (4) $52.6 $4.3 $56.8 Interest Coverage 2.9x 4.3x Market Capitalization / Total Capitalization 56.6% 54.9% Sources of Funds Uses of Funds New Revolver ($20mm) $0.0 Existing Revolver ($20mm) $3.0 New Term Loan B 225.0 Existing Term Loan 216.0 Cash from Balance Sheet 8.0 Asset Exchange Payment (1) 12.0 Estimated Financing Fees & Expenses 2.0 Total Sources $233.0 Total Uses $233.0

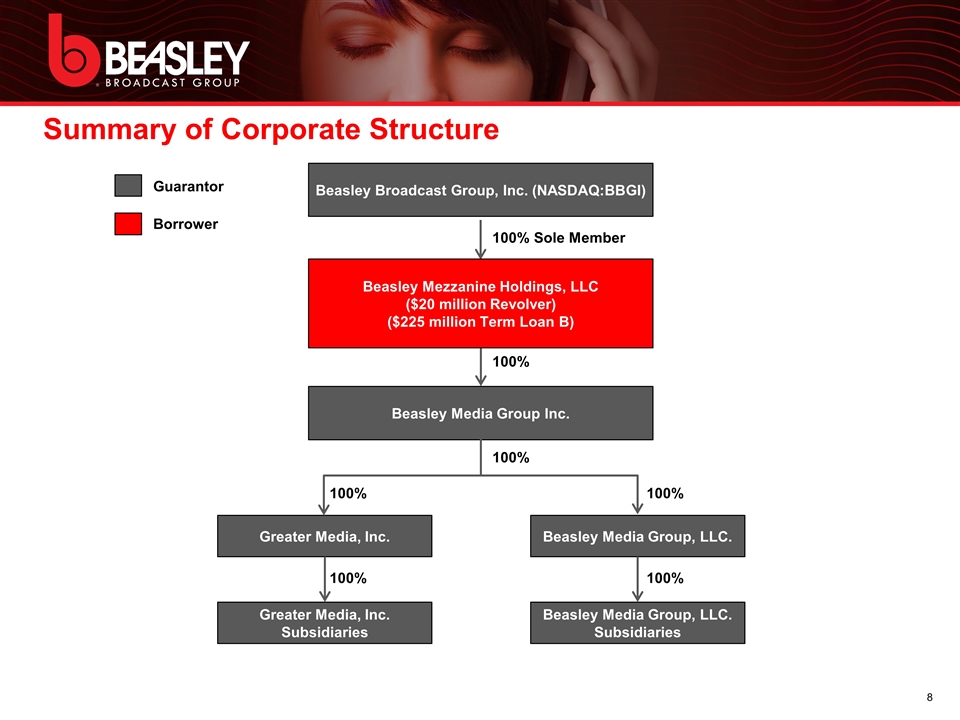

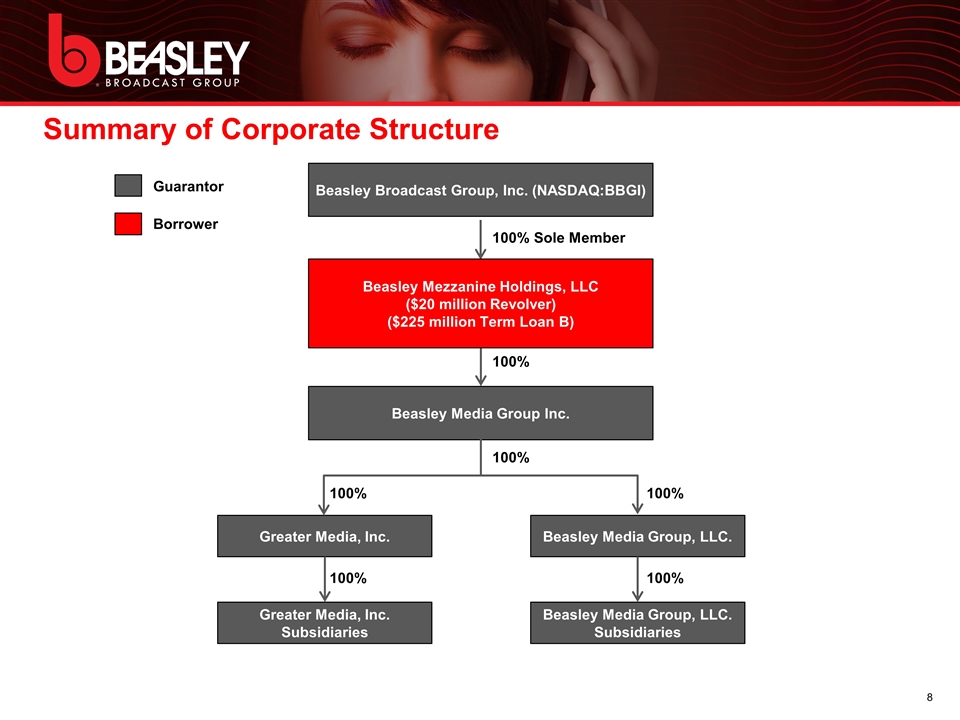

Summary of Corporate Structure Beasley Broadcast Group, Inc. (NASDAQ:BBGI) Greater Media, Inc. Beasley Media Group, LLC. Guarantor Borrower 100% Sole Member 100% 100% Beasley Media Group Inc. 100% Greater Media, Inc. Subsidiaries 100% Beasley Media Group, LLC. Subsidiaries 100% 100% Beasley Mezzanine Holdings, LLC ($20 million Revolver) ($225 million Term Loan B)

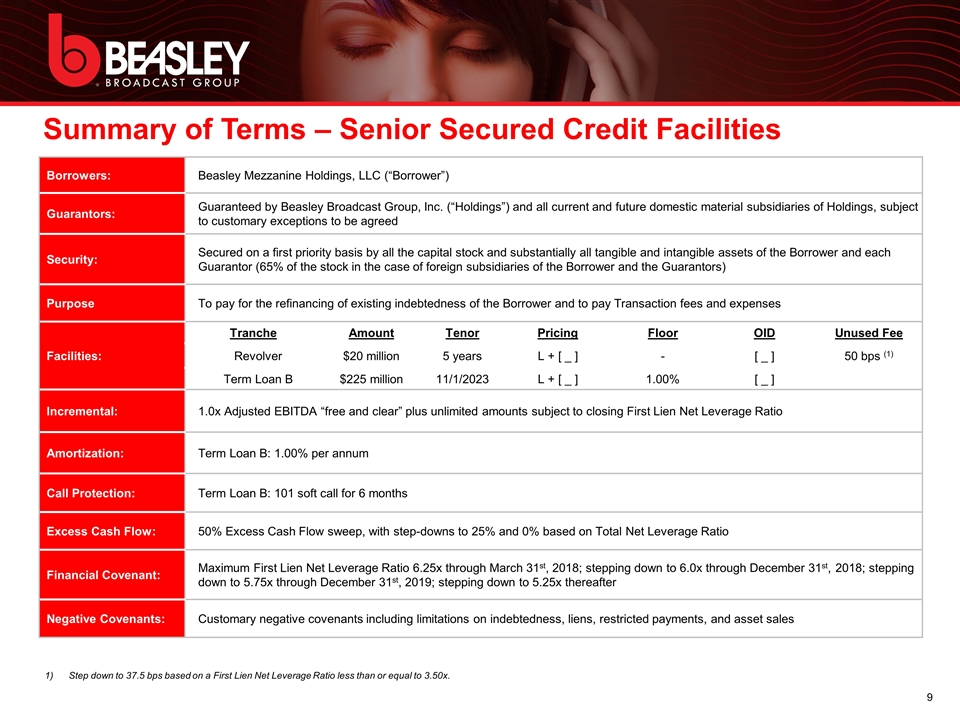

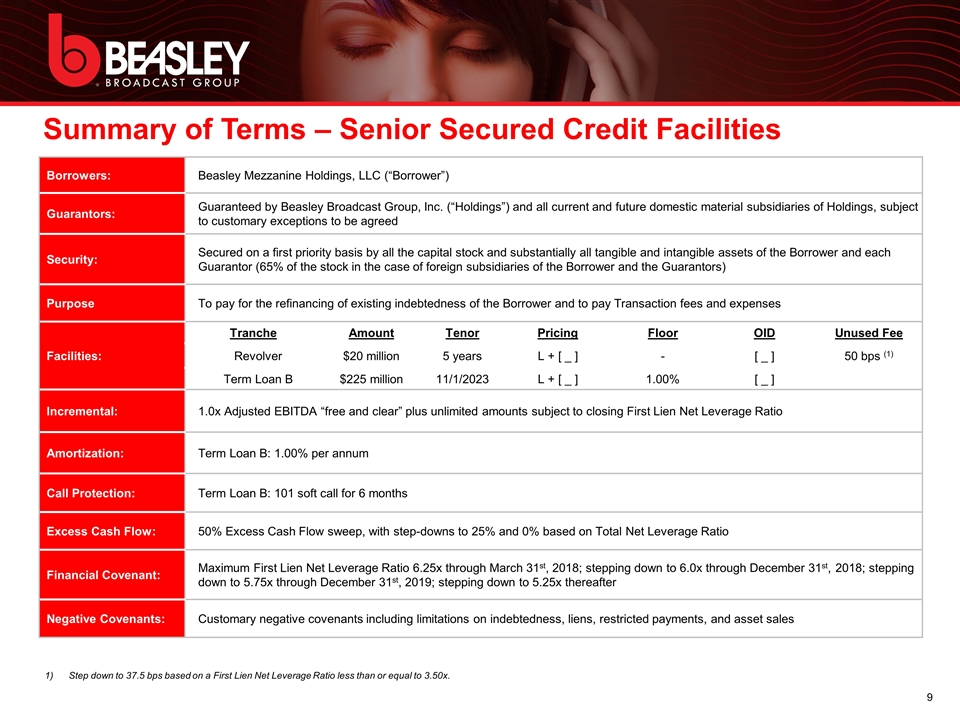

Summary of Terms – Senior Secured Credit Facilities Step down to 37.5 bps based on a First Lien Net Leverage Ratio less than or equal to 3.50x. Borrowers: Beasley Mezzanine Holdings, LLC (“Borrower”) Guarantors: Guaranteed by Beasley Broadcast Group, Inc. (“Holdings”) and all current and future domestic material subsidiaries of Holdings, subject to customary exceptions to be agreed Security: Secured on a first priority basis by all the capital stock and substantially all tangible and intangible assets of the Borrower and each Guarantor (65% of the stock in the case of foreign subsidiaries of the Borrower and the Guarantors) Purpose To pay for the refinancing of existing indebtedness of the Borrower and to pay Transaction fees and expenses Facilities: Tranche Amount Tenor Pricing Floor OID Unused Fee Revolver $20 million 5 years L + [ _ ] - [ _ ] 50 bps (1) Term Loan B $225 million 11/1/2023 L + [ _ ] 1.00% [ _ ] Incremental: 1.0x Adjusted EBITDA “free and clear” plus unlimited amounts subject to closing First Lien Net Leverage Ratio Amortization: Term Loan B: 1.00% per annum Call Protection: Term Loan B: 101 soft call for 6 months Excess Cash Flow: 50% Excess Cash Flow sweep, with step-downs to 25% and 0% based on Total Net Leverage Ratio Financial Covenant: Maximum First Lien Net Leverage Ratio 6.25x through March 31st, 2018; stepping down to 6.0x through December 31st, 2018; stepping down to 5.75x through December 31st, 2019; stepping down to 5.25x thereafter Negative Covenants: Customary negative covenants including limitations on indebtedness, liens, restricted payments, and asset sales

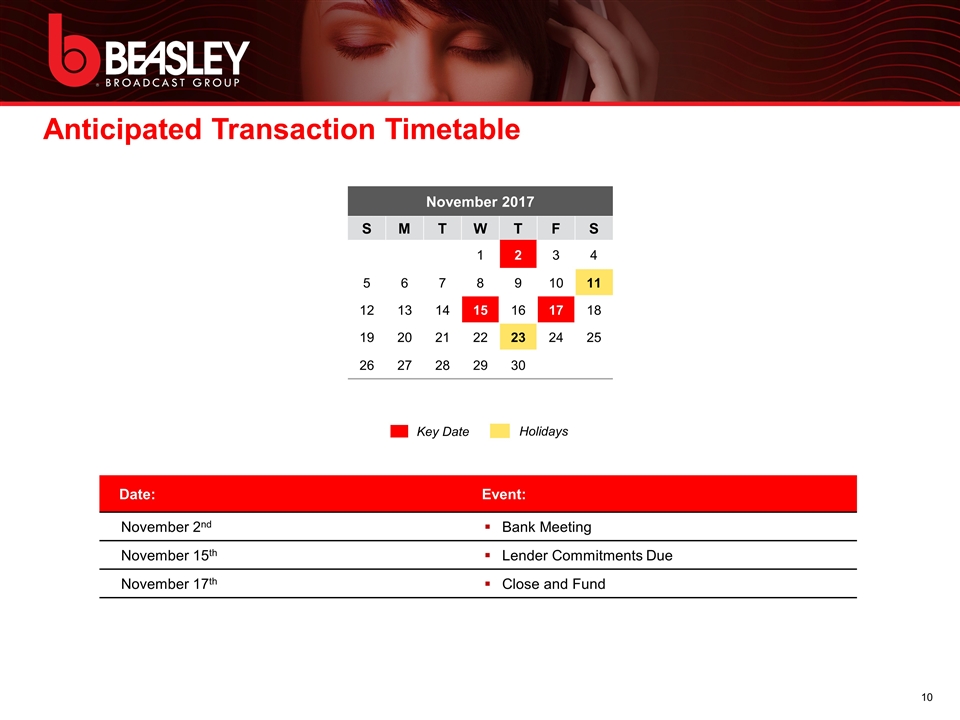

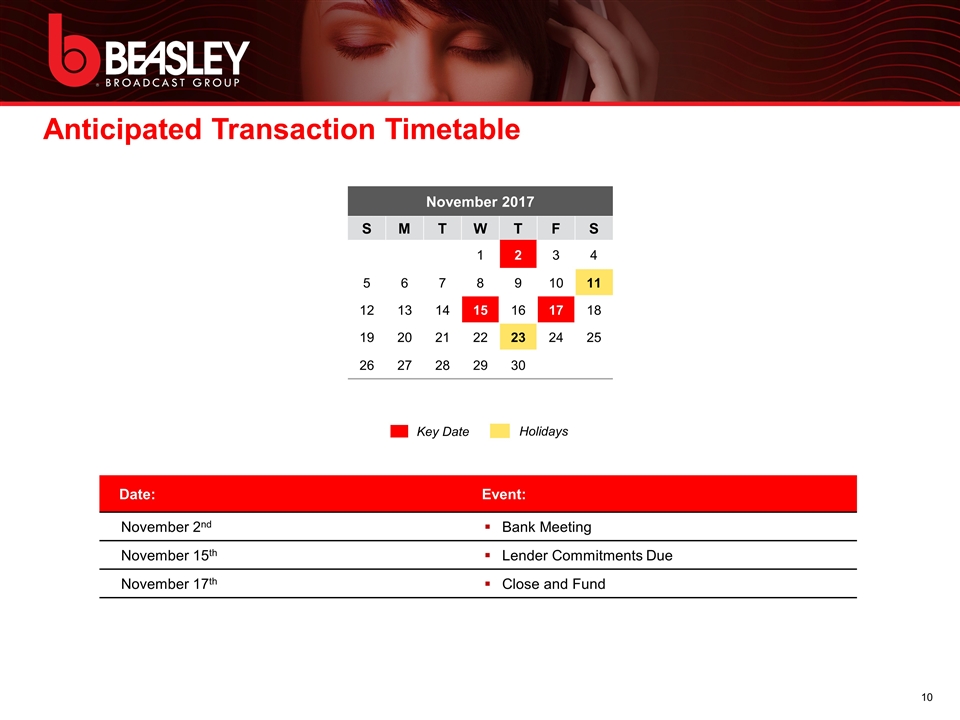

Anticipated Transaction Timetable Date: Event: November 2nd Bank Meeting November 15th Lender Commitments Due November 17th Close and Fund Key Date Holidays November 2017 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Section II Beasley at a Glance

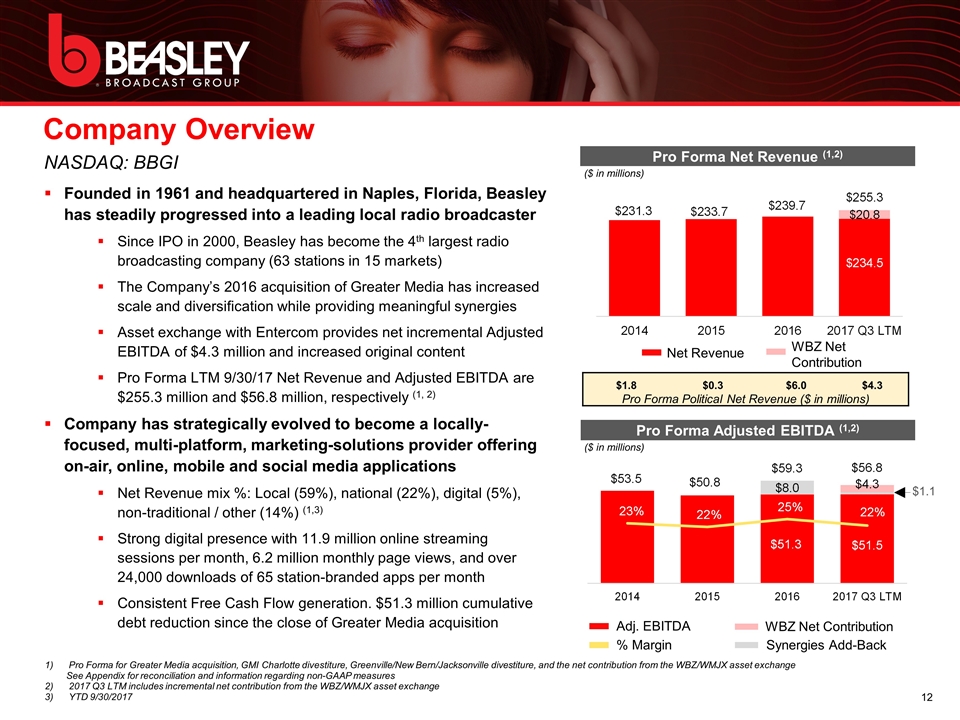

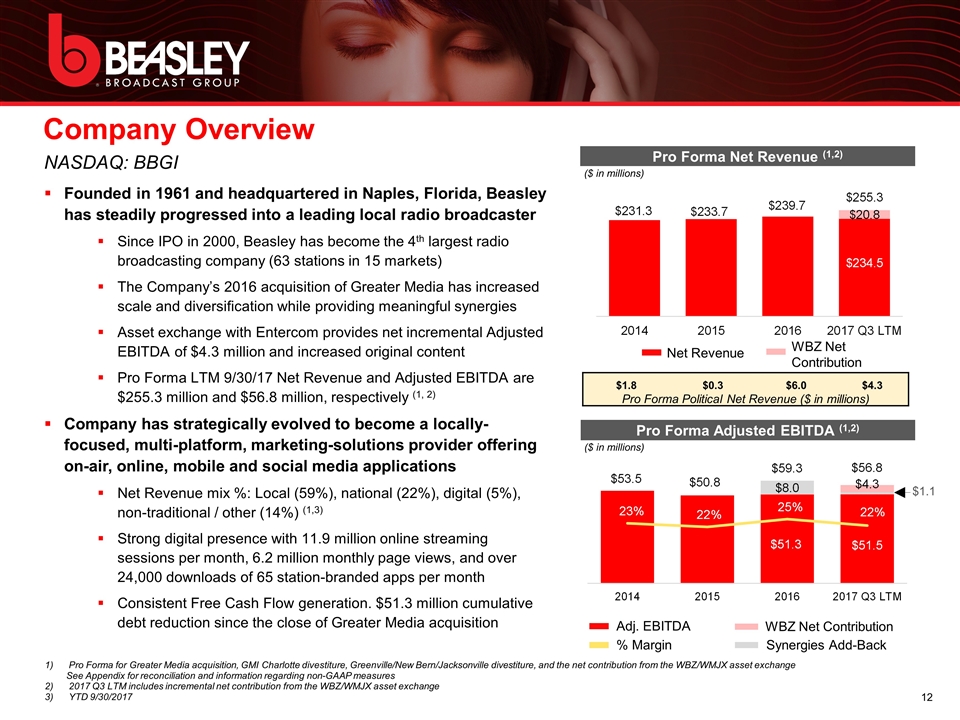

Company Overview NASDAQ: BBGI Founded in 1961 and headquartered in Naples, Florida, Beasley has steadily progressed into a leading local radio broadcaster Since IPO in 2000, Beasley has become the 4th largest radio broadcasting company (63 stations in 15 markets) The Company’s 2016 acquisition of Greater Media has increased scale and diversification while providing meaningful synergies Asset exchange with Entercom provides net incremental Adjusted EBITDA of $4.3 million and increased original content Pro Forma LTM 9/30/17 Net Revenue and Adjusted EBITDA are $255.3 million and $56.8 million, respectively (1, 2) Company has strategically evolved to become a locally-focused, multi-platform, marketing-solutions provider offering on-air, online, mobile and social media applications Net Revenue mix %: Local (59%), national (22%), digital (5%), non-traditional / other (14%) (1,3) Strong digital presence with 11.9 million online streaming sessions per month, 6.2 million monthly page views, and over 24,000 downloads of 65 station-branded apps per month Consistent Free Cash Flow generation. $51.3 million cumulative debt reduction since the close of Greater Media acquisition 12 Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and the net contribution from the WBZ/WMJX asset exchange See Appendix for reconciliation and information regarding non-GAAP measures 2017 Q3 LTM includes incremental net contribution from the WBZ/WMJX asset exchange YTD 9/30/2017 Pro Forma Net Revenue (1,2) ($ in millions) $1.8 $0.3 $6.0 $4.3 Pro Forma Political Net Revenue ($ in millions) WBZ Net Contribution Net Revenue WBZ Net Contribution Pro Forma Adjusted EBITDA (1,2) ($ in millions) Adj. EBITDA % Margin Synergies Add-Back $1.1

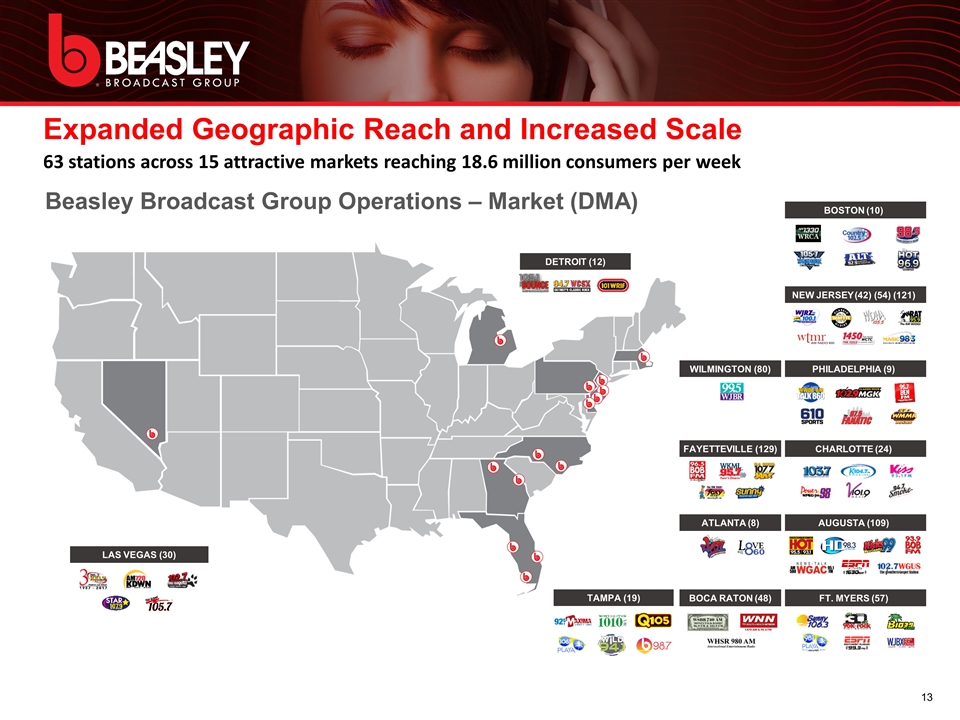

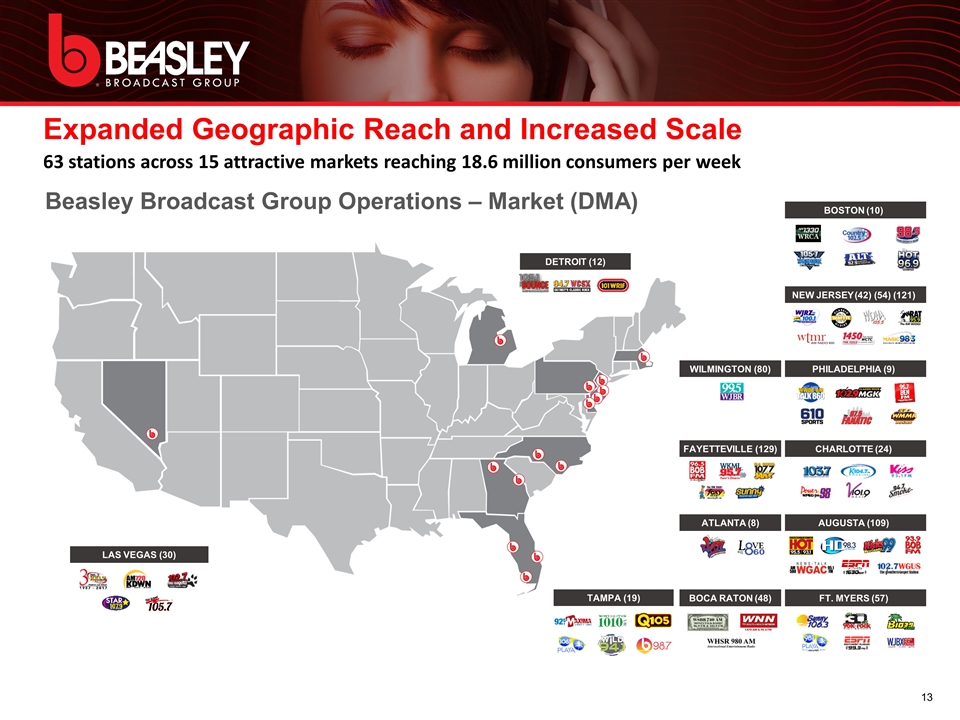

Beasley Broadcast Group Operations – Market (DMA) Expanded Geographic Reach and Increased Scale ATLANTA (8) AUGUSTA (109) BOCA RATON (48) BOSTON (10) CHARLOTTE (24) FAYETTEVILLE (129) DETROIT (12) FT. MYERS (57) LAS VEGAS (30) NEW JERSEY (42) (54) (121) WILMINGTON (80) PHILADELPHIA (9) TAMPA (19) 63 stations across 15 attractive markets reaching 18.6 million consumers per week 13

Beasley Strategic Objectives Maximize Cash Flow Margins Increase Aggregation and Monetization of Digital Audience Prudent Balance Sheet Management Opportunistic / Strategic / Deleveraging M&A Focus on Core Product and Content Offerings Strong hyper local brands Attractive and diverse programming formats Effective cross-platform advertising solutions Expand digital product offerings Adopt relevant new technology Enhance user experience Focus on achieving net leverage target <4.0x Achieve operating efficiencies, including at Greater Media and Beasley legacy stations Maintain strict expense management Disciplined approach to acquisitions Strategic / deleveraging acquisitions and divestitures

Section III Key Credit Highlights

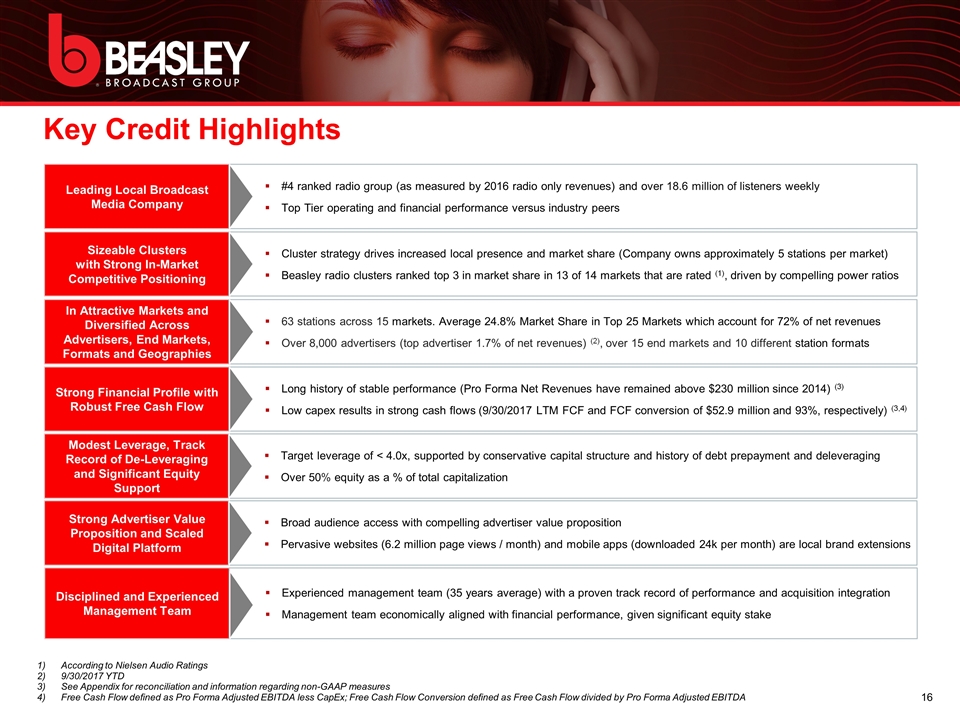

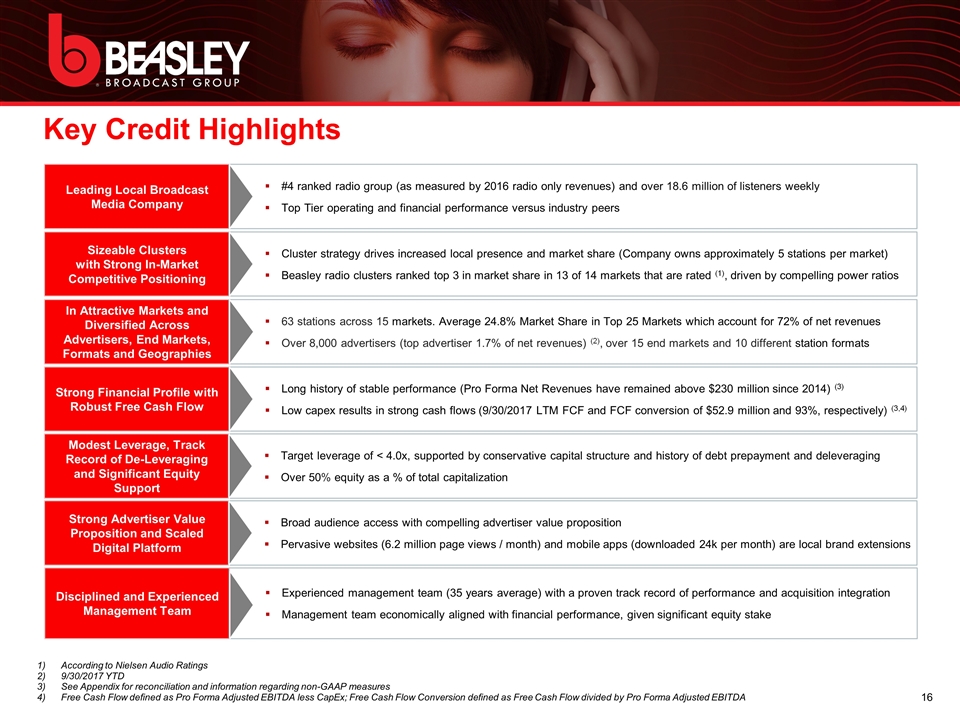

Key Credit Highlights According to Nielsen Audio Ratings 9/30/2017 YTD See Appendix for reconciliation and information regarding non-GAAP measures Free Cash Flow defined as Pro Forma Adjusted EBITDA less CapEx; Free Cash Flow Conversion defined as Free Cash Flow divided by Pro Forma Adjusted EBITDA Leading Local Broadcast Media Company #4 ranked radio group (as measured by 2016 radio only revenues) and over 18.6 million of listeners weekly Top Tier operating and financial performance versus industry peers In Attractive Markets and Diversified Across Advertisers, End Markets, Formats and Geographies 63 stations across 15 markets. Average 24.8% Market Share in Top 25 Markets which account for 72% of net revenues Over 8,000 advertisers (top advertiser 1.7% of net revenues) (2), over 15 end markets and 10 different station formats Sizeable Clusters with Strong In-Market Competitive Positioning Cluster strategy drives increased local presence and market share (Company owns approximately 5 stations per market) Beasley radio clusters ranked top 3 in market share in 13 of 14 markets that are rated (1), driven by compelling power ratios Strong Advertiser Value Proposition and Scaled Digital Platform Broad audience access with compelling advertiser value proposition Pervasive websites (6.2 million page views / month) and mobile apps (downloaded 24k per month) are local brand extensions Strong Financial Profile with Robust Free Cash Flow Long history of stable performance (Pro Forma Net Revenues have remained above $230 million since 2014) (3) Low capex results in strong cash flows (9/30/2017 LTM FCF and FCF conversion of $52.9 million and 93%, respectively) (3,4) Modest Leverage, Track Record of De-Leveraging and Significant Equity Support Target leverage of < 4.0x, supported by conservative capital structure and history of debt prepayment and deleveraging Over 50% equity as a % of total capitalization Disciplined and Experienced Management Team Experienced management team (35 years average) with a proven track record of performance and acquisition integration Management team economically aligned with financial performance, given significant equity stake 16

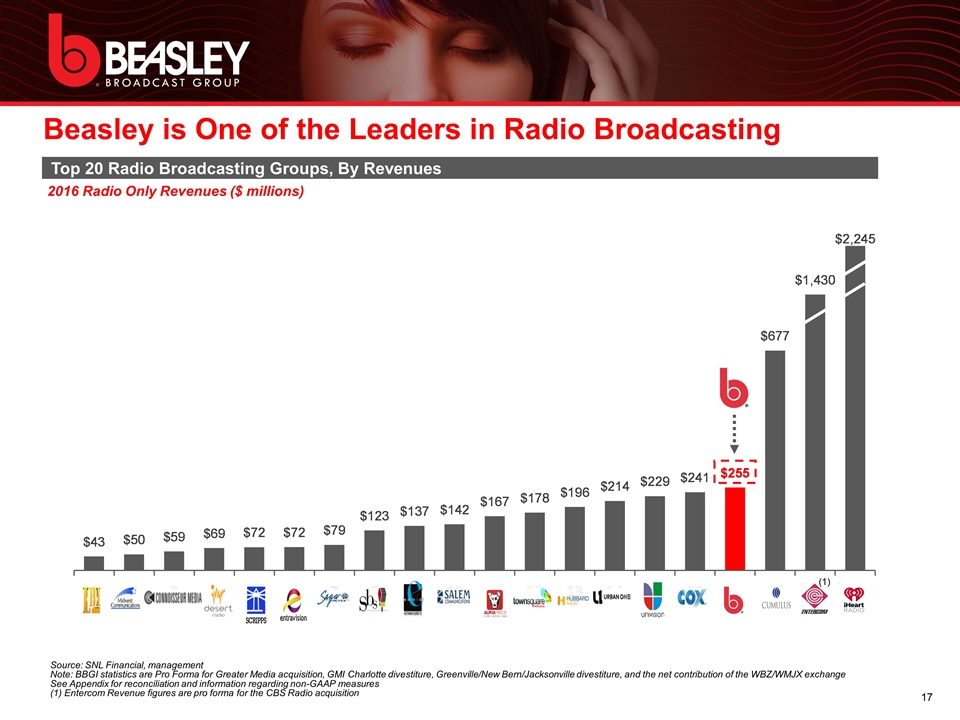

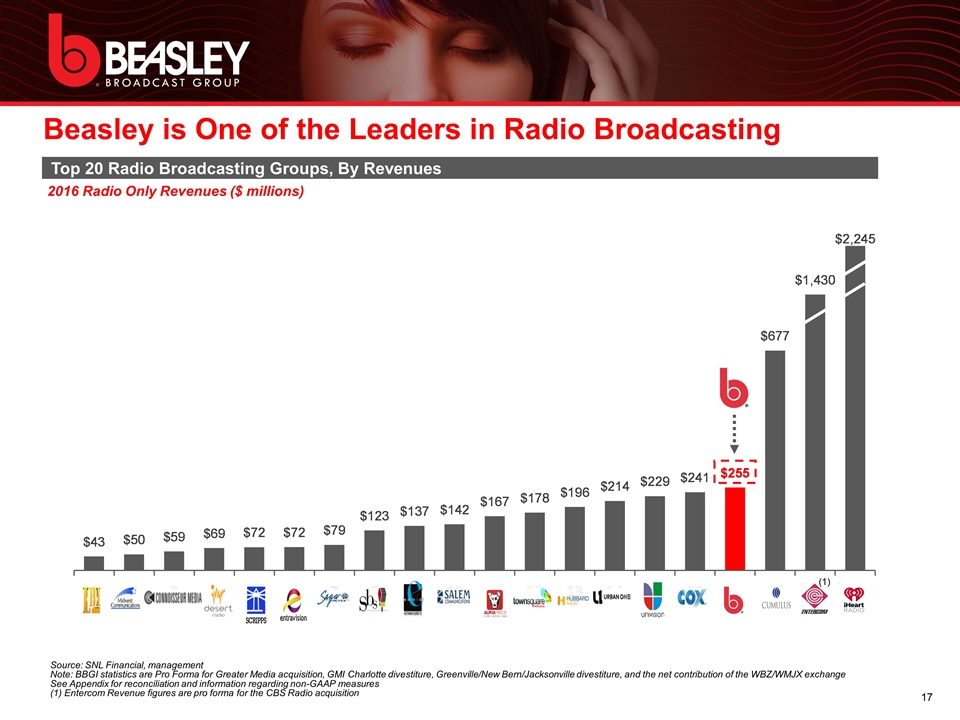

Beasley is One of the Leaders in Radio Broadcasting 17 Top 20 Radio Broadcasting Groups, By Revenues 2016 Radio Only Revenues ($ millions) Source: SNL Financial, management Note: BBGI statistics are Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and the net contribution of the WBZ/WMJX exchange See Appendix for reconciliation and information regarding non-GAAP measures (1) Entercom Revenue figures are pro forma for the CBS Radio acquisition (1)

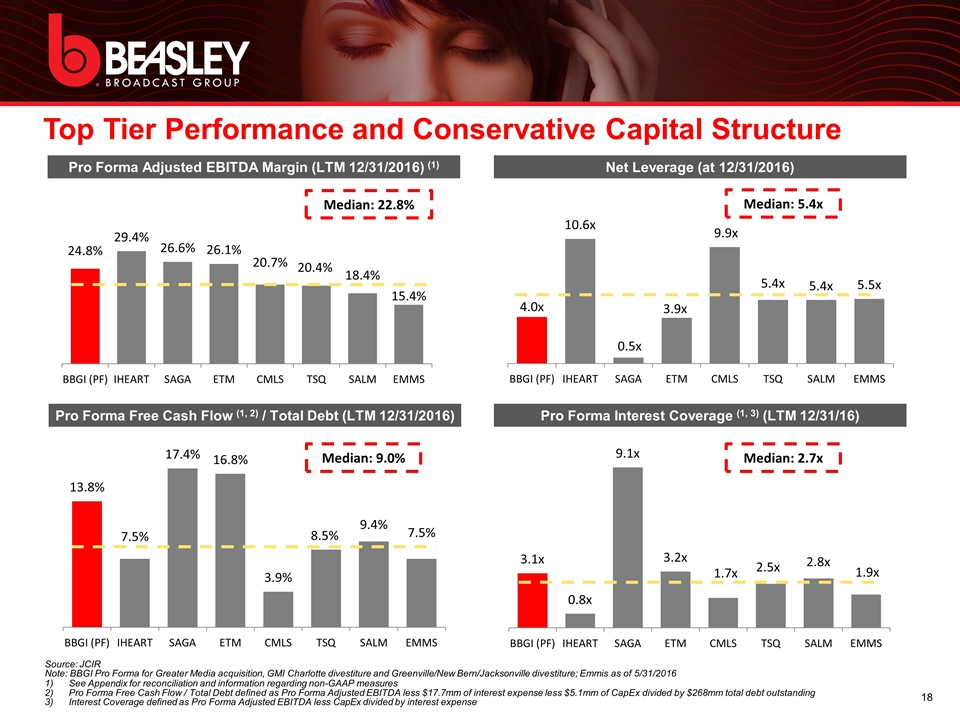

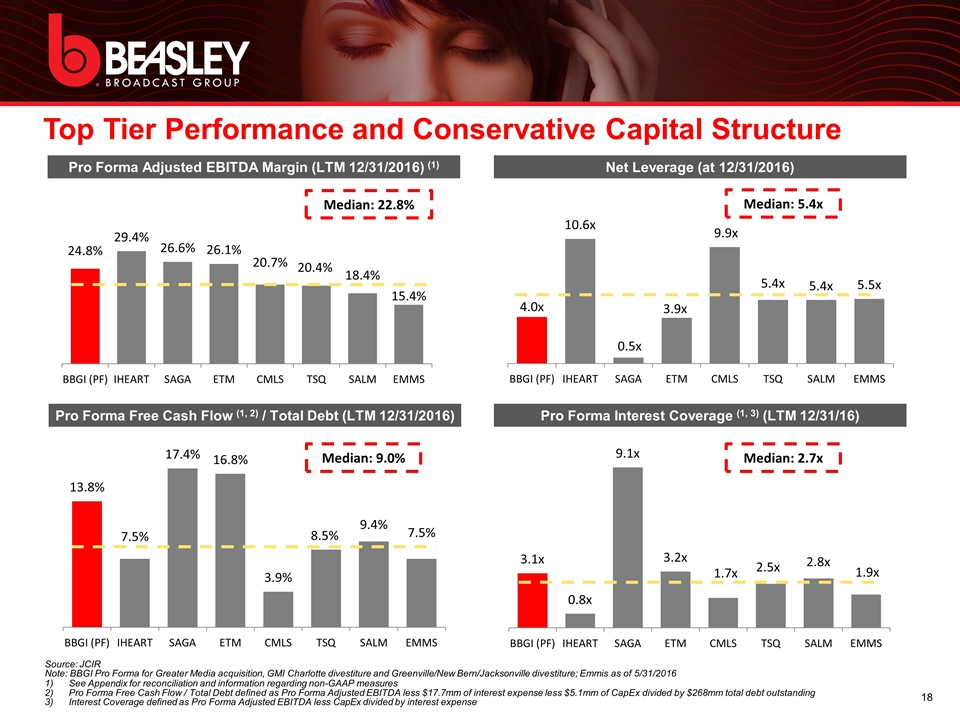

Top Tier Performance and Conservative Capital Structure 18 See Appendix for reconciliation and information regarding non-GAAP measures Pro Forma Free Cash Flow / Total Debt defined as Pro Forma Adjusted EBITDA less $17.7mm of interest expense less $5.1mm of CapEx divided by $268mm total debt outstanding Interest Coverage defined as Pro Forma Adjusted EBITDA less CapEx divided by interest expense Source: JCIR Note: BBGI Pro Forma for Greater Media acquisition, GMI Charlotte divestiture and Greenville/New Bern/Jacksonville divestiture; Emmis as of 5/31/2016 Median: 2.7x Pro Forma Interest Coverage (1, 3) (LTM 12/31/16) Pro Forma Adjusted EBITDA Margin (LTM 12/31/2016) (1) Median: 22.8% Median: 9.0% Pro Forma Free Cash Flow (1, 2) / Total Debt (LTM 12/31/2016) Net Leverage (at 12/31/2016) Median: 5.4x

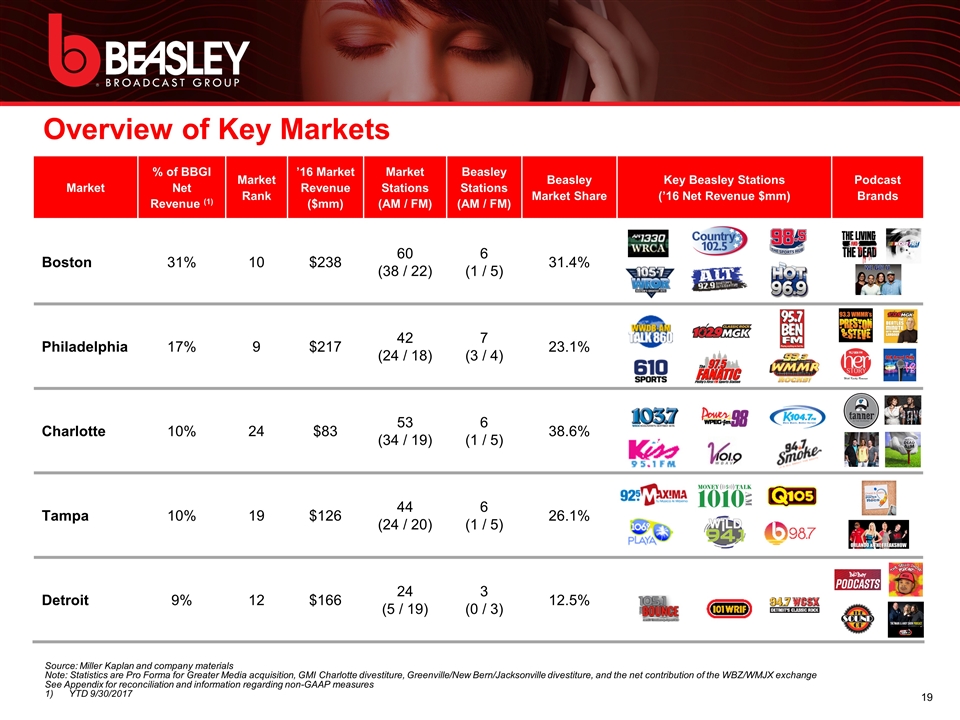

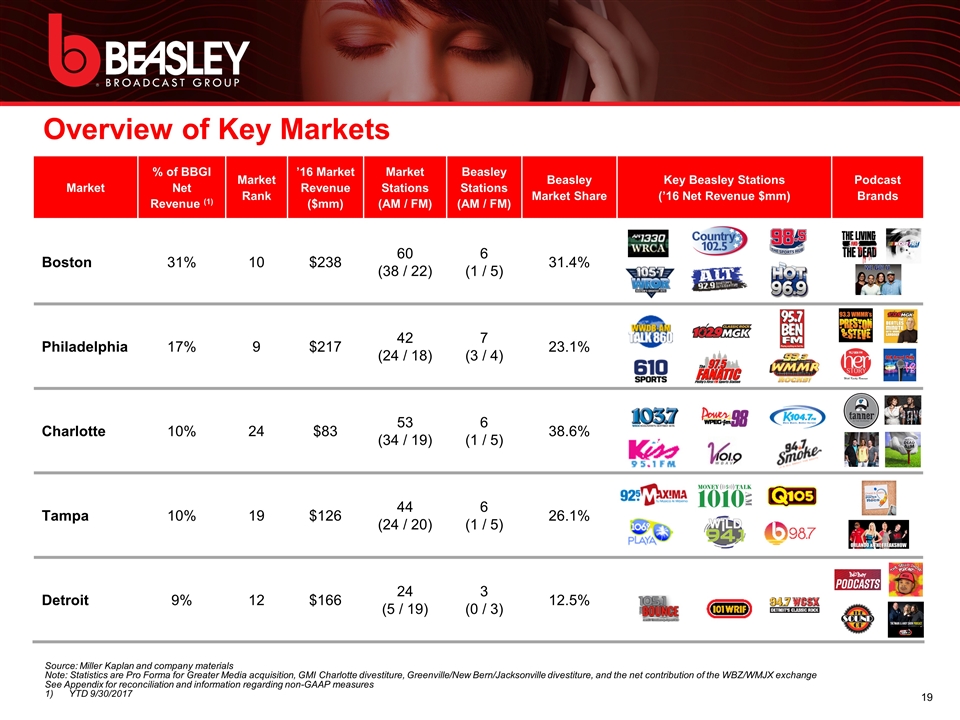

Overview of Key Markets 19 Source: Miller Kaplan and company materials Note: Statistics are Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and the net contribution of the WBZ/WMJX exchange See Appendix for reconciliation and information regarding non-GAAP measures YTD 9/30/2017 Market % of BBGI Net Revenue (1) Market Rank ’16 Market Revenue ($mm) Market Stations (AM / FM) Beasley Stations (AM / FM) Beasley Market Share Key Beasley Stations (’16 Net Revenue $mm) Podcast Brands Boston 31% 10 $238 60 (38 / 22) 6 (1 / 5) 31.4% Philadelphia 17% 9 $217 42 (24 / 18) 7 (3 / 4) 23.1% Charlotte 10% 24 $83 53 (34 / 19) 6 (1 / 5) 38.6% Tampa 10% 19 $126 44 (24 / 20) 6 (1 / 5) 26.1% Detroit 9% 12 $166 24 (5 / 19) 3 (0 / 3) 12.5%

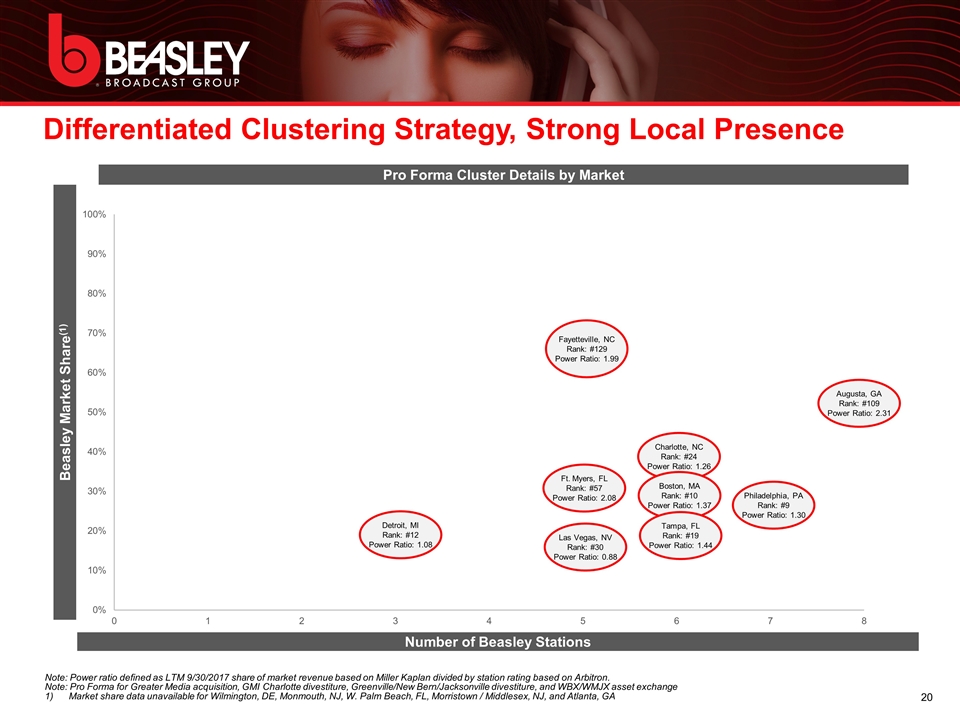

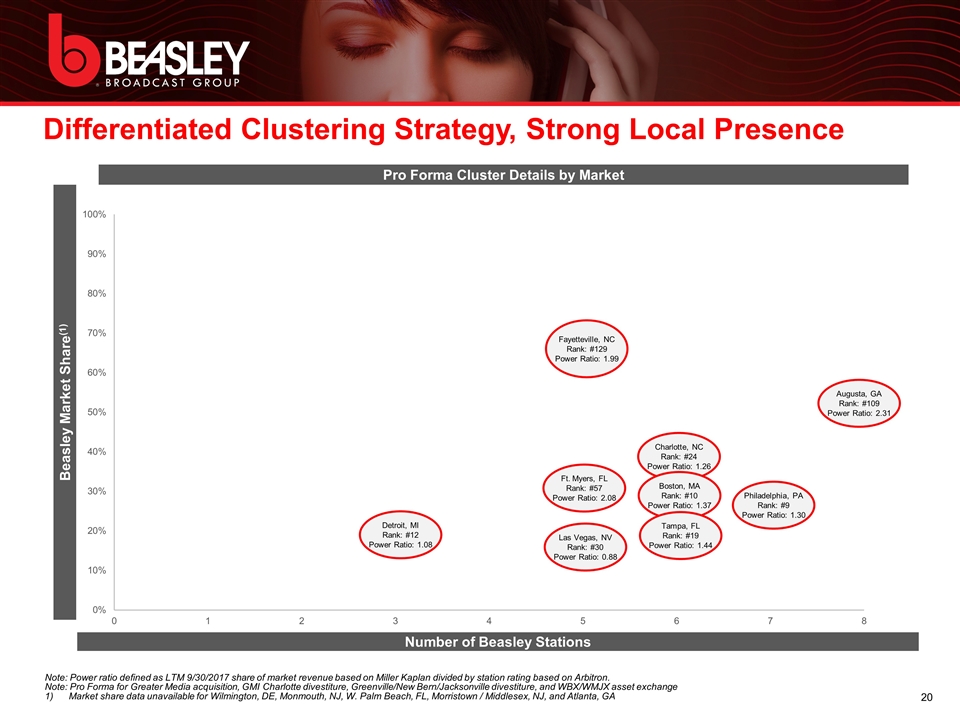

Differentiated Clustering Strategy, Strong Local Presence 20 Note: Power ratio defined as LTM 9/30/2017 share of market revenue based on Miller Kaplan divided by station rating based on Arbitron. Note: Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and WBX/WMJX asset exchange Market share data unavailable for Wilmington, DE, Monmouth, NJ, W. Palm Beach, FL, Morristown / Middlesex, NJ, and Atlanta, GA Pro Forma Cluster Details by Market Number of Beasley Stations Beasley Market Share(1) Fayetteville, NC Rank: #129 Power Ratio: 1.99 Augusta, GA Rank: #109 Power Ratio: 2.31 Charlotte, NC Rank: #24 Power Ratio: 1.26 Philadelphia, PA Rank: #9 Power Ratio: 1.30 Boston, MA Rank: #10 Power Ratio: 1.37 Las Vegas, NV Rank: #30 Power Ratio: 0.88 Detroit, MI Rank: #12 Power Ratio: 1.08 Ft. Myers, FL Rank: #57 Power Ratio: 2.08 Tampa, FL Rank: #19 Power Ratio: 1.44

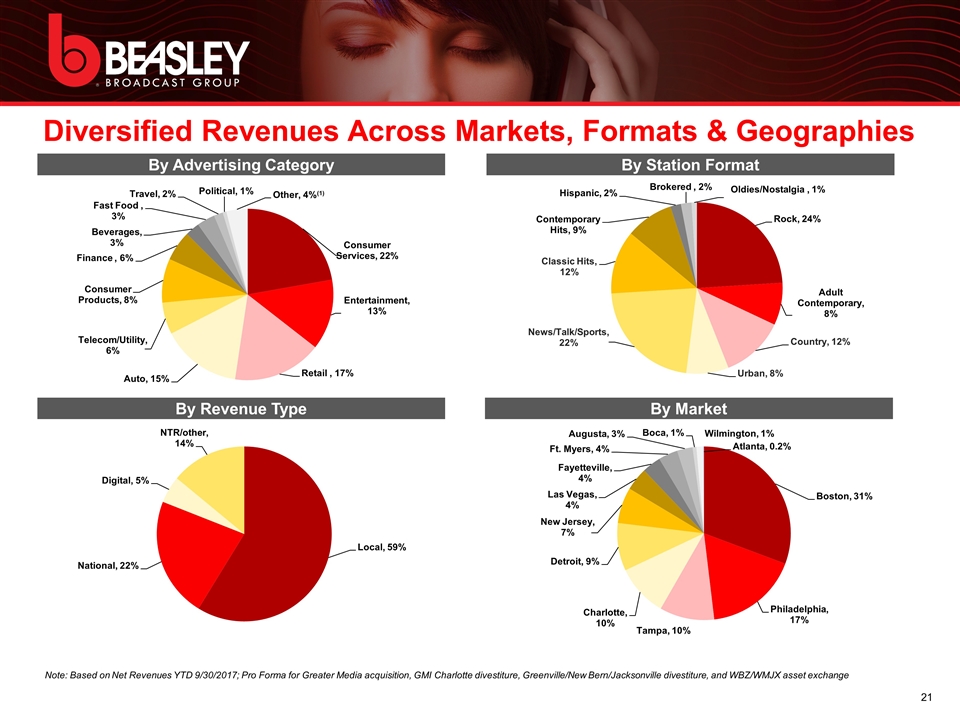

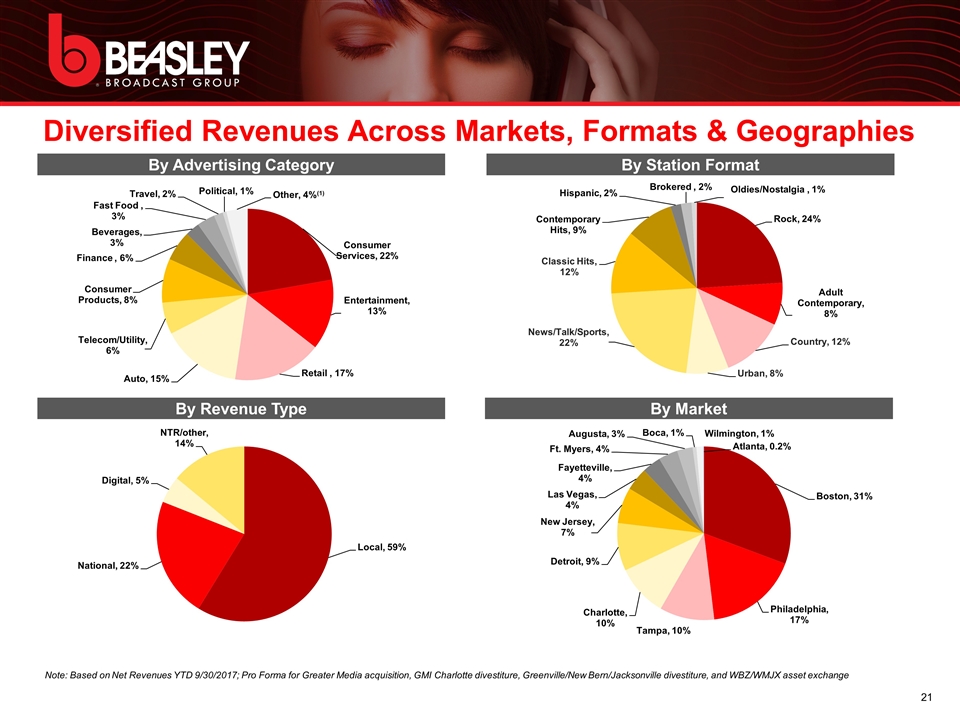

Diversified Revenues Across Markets, Formats & Geographies 21 Note: Based on Net Revenues YTD 9/30/2017; Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and WBZ/WMJX asset exchange By Advertising Category By Revenue Type By Market By Station Format

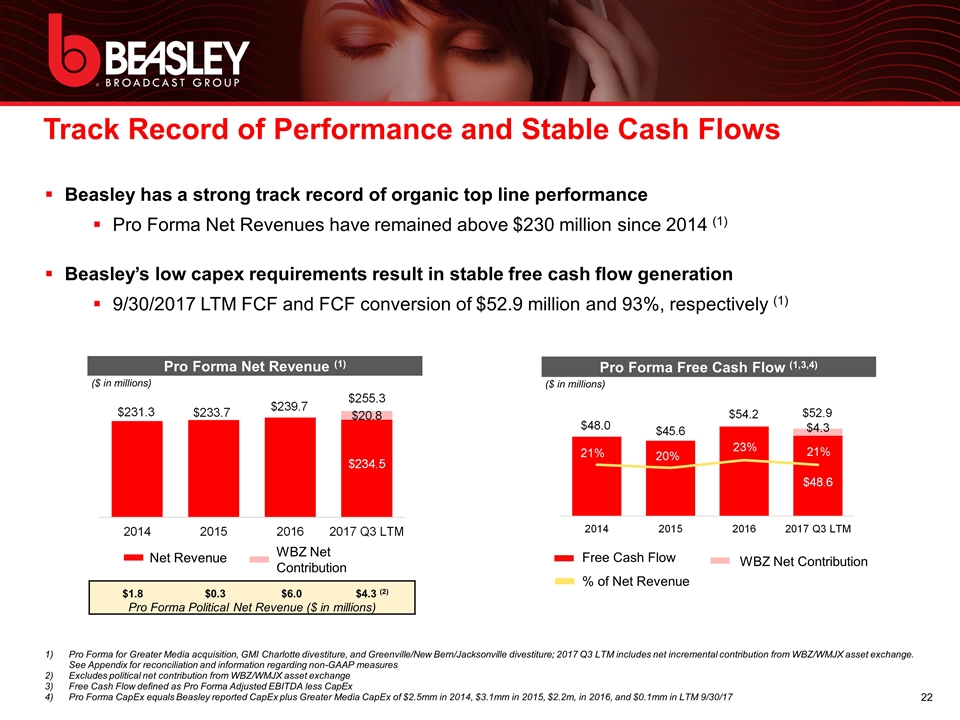

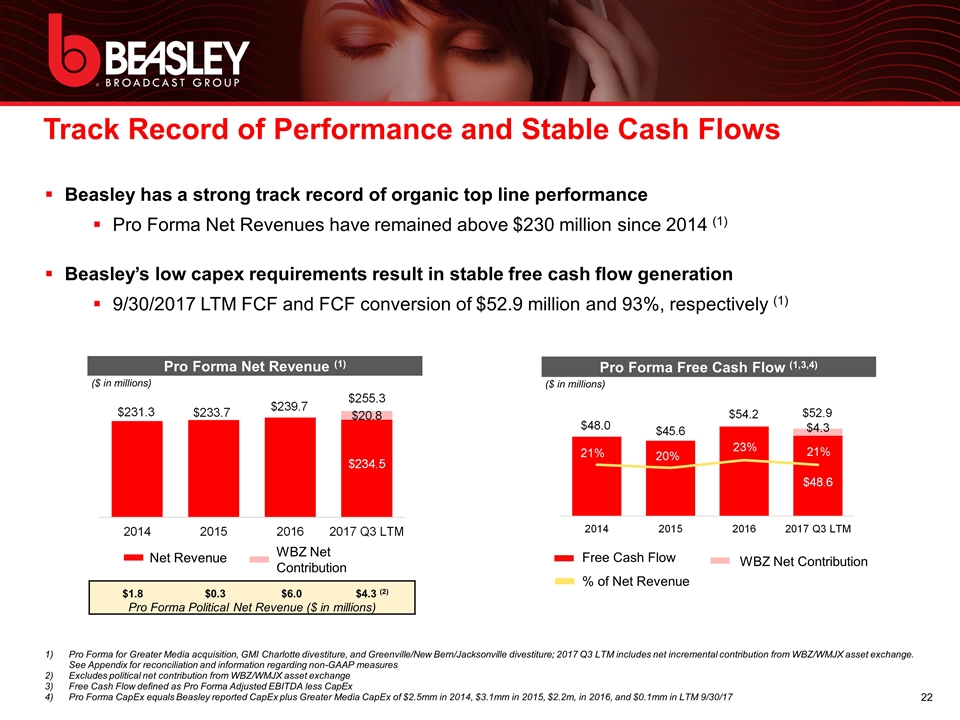

Track Record of Performance and Stable Cash Flows 22 Beasley has a strong track record of organic top line performance Pro Forma Net Revenues have remained above $230 million since 2014 (1) Beasley’s low capex requirements result in stable free cash flow generation 9/30/2017 LTM FCF and FCF conversion of $52.9 million and 93%, respectively (1) $1.8 $0.3 $6.0 $4.3 (2) Pro Forma Political Net Revenue ($ in millions) Pro Forma Net Revenue (1) ($ in millions) Pro Forma Free Cash Flow (1,3,4) ($ in millions) WBZ Net Contribution Net Revenue Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, and Greenville/New Bern/Jacksonville divestiture; 2017 Q3 LTM includes net incremental contribution from WBZ/WMJX asset exchange. See Appendix for reconciliation and information regarding non-GAAP measures Excludes political net contribution from WBZ/WMJX asset exchange Free Cash Flow defined as Pro Forma Adjusted EBITDA less CapEx Pro Forma CapEx equals Beasley reported CapEx plus Greater Media CapEx of $2.5mm in 2014, $3.1mm in 2015, $2.2m, in 2016, and $0.1mm in LTM 9/30/17 Free Cash Flow % of Net Revenue WBZ Net Contribution

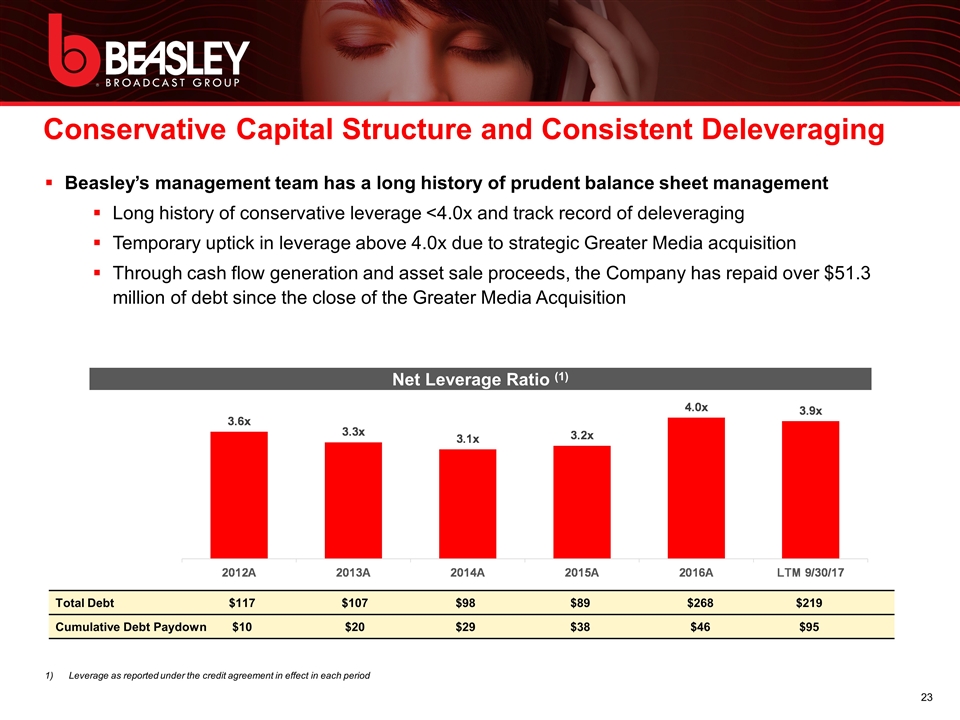

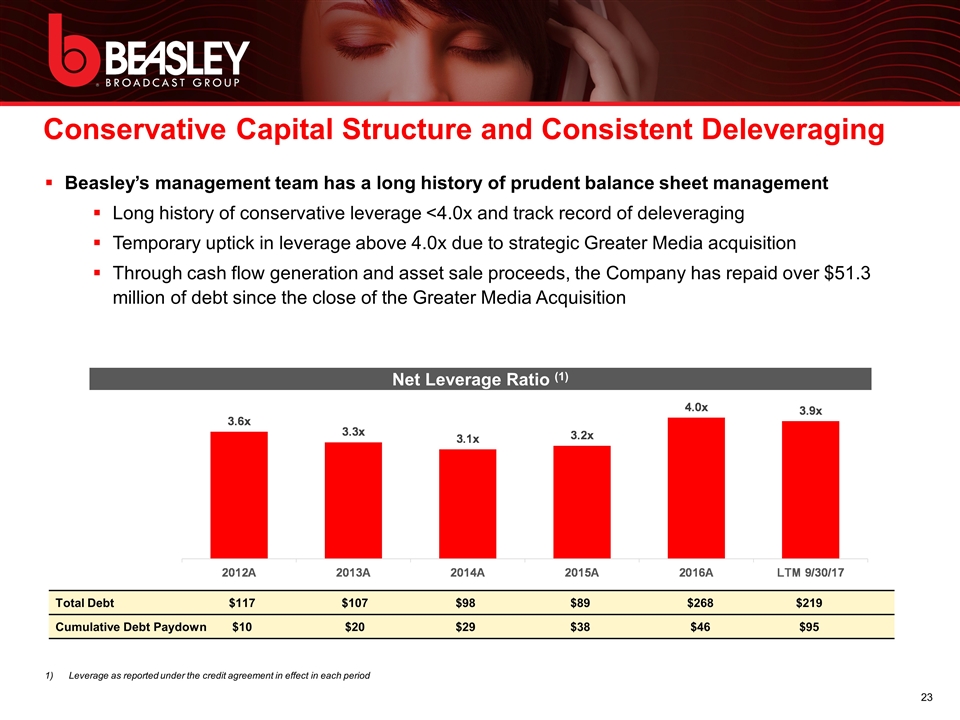

23 Leverage as reported under the credit agreement in effect in each period Conservative Capital Structure and Consistent Deleveraging Net Leverage Ratio (1) Total Debt $117 $107 $98 $89 $268 $219 Cumulative Debt Paydown $10 $20 $29 $38 $46 $95 Beasley’s management team has a long history of prudent balance sheet management Long history of conservative leverage <4.0x and track record of deleveraging Temporary uptick in leverage above 4.0x due to strategic Greater Media acquisition Through cash flow generation and asset sale proceeds, the Company has repaid over $51.3 million of debt since the close of the Greater Media Acquisition

Proven Ability to Capitalize on Shifting Industry Fundamentals 24 Radio remains an important medium for advertisers, both locally and nationally Engaged Audience / Greatest Reach Radio is the #1 reach medium in the U.S., reaching ~97% of American adults monthly (1) High-Impact Cross Platform Solutions Seamless cross platform media solutions on-air, online, onsite and on-demand Highest Audio Programming Share Broadcast radio’s 60% share of listening is the highest of all other audio options, including satellite radio (11.5%), digital (17.1%) and iPod/MP3 (4.9%) (2) Cost effective with Short Sales Cycles Low cost for high reach and real-time feedback remains an attractive value proposition for local advertisers in today’s fragmented media landscape Significant Source of Daily Media Exposure American adults listen to nearly 2.0 hours radio each day on average (1) Large Accessible/Captive Commuter Audience The avg. urban commuter spends ~42 hours per year stuck in traffic (vs.~16 hours in 1982) New car buyers avg. 18.9 hours per week of radio listening (vs. avg. 15.7 hours in 2011) ~95% of new car buyers listen to radio (3) Positive Impact on Advertisers Bottom Line Average payback per $1.00 investment is $8.00 across key advertising categories (4) Medium Closest To The Point Of Purchase Radio delivers the “last word” for advertisers reaching consumers immediately prior to shopping and remains the most mobile of all media, including mobile, as the majority of mobile radio consumption continues to occur in-home (5) Source: Nielsen Total Audience Report Q3 2016. Represents Adults P18+. Source: USA Touchpoints 2016 Source: J.D. Power 2016 U.S. Automotive Media and Marketing Report; Texas Transportation Institute 2015 Source: ROAs average of Nielsen’s ROA studies Source: Nielsen, Radio Advertising Bureau, Arbitron and USA TouchPoints

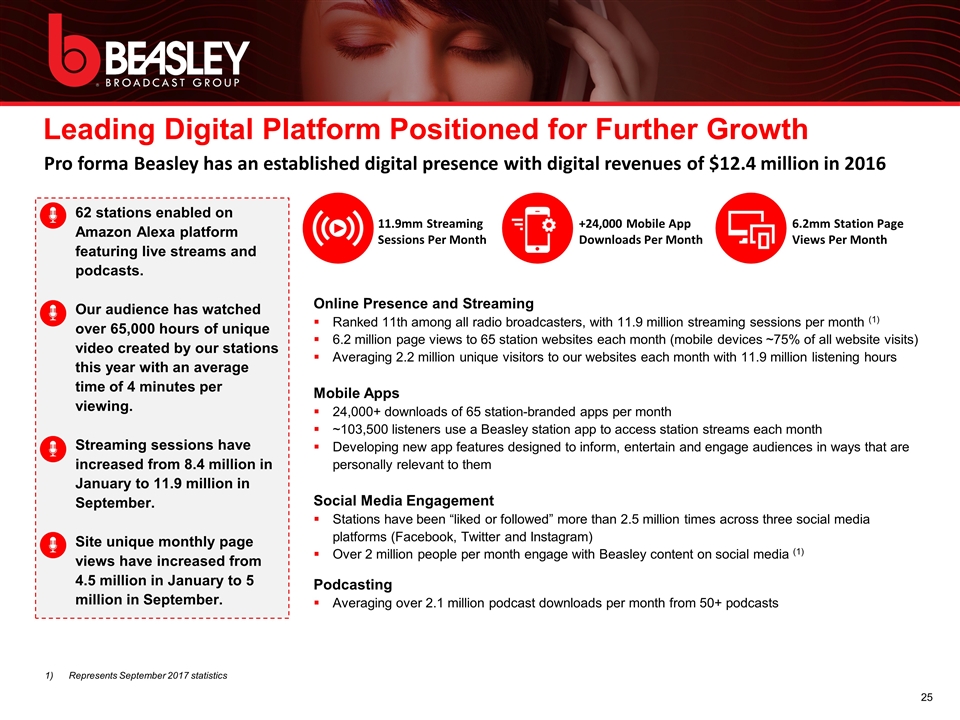

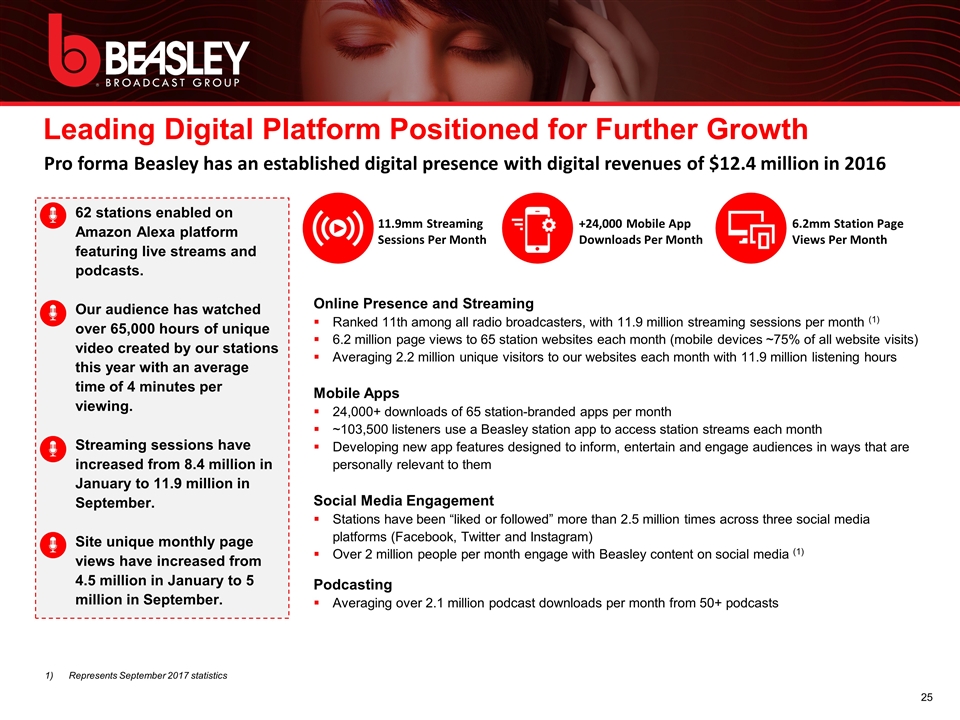

Leading Digital Platform Positioned for Further Growth 25 Represents September 2017 statistics Pro forma Beasley has an established digital presence with digital revenues of $12.4 million in 2016 11.9mm Streaming Sessions Per Month +24,000 Mobile App Downloads Per Month 6.2mm Station Page Views Per Month 62 stations enabled on Amazon Alexa platform featuring live streams and podcasts. Our audience has watched over 65,000 hours of unique video created by our stations this year with an average time of 4 minutes per viewing. Streaming sessions have increased from 8.4 million in January to 11.9 million in September. Site unique monthly page views have increased from 4.5 million in January to 5 million in September. Online Presence and Streaming Ranked 11th among all radio broadcasters, with 11.9 million streaming sessions per month (1) 6.2 million page views to 65 station websites each month (mobile devices ~75% of all website visits) Averaging 2.2 million unique visitors to our websites each month with 11.9 million listening hours Mobile Apps 24,000+ downloads of 65 station-branded apps per month ~103,500 listeners use a Beasley station app to access station streams each month Developing new app features designed to inform, entertain and engage audiences in ways that are personally relevant to them Social Media Engagement Stations have been “liked or followed” more than 2.5 million times across three social media platforms (Facebook, Twitter and Instagram) Over 2 million people per month engage with Beasley content on social media (1) Podcasting Averaging over 2.1 million podcast downloads per month from 50+ podcasts

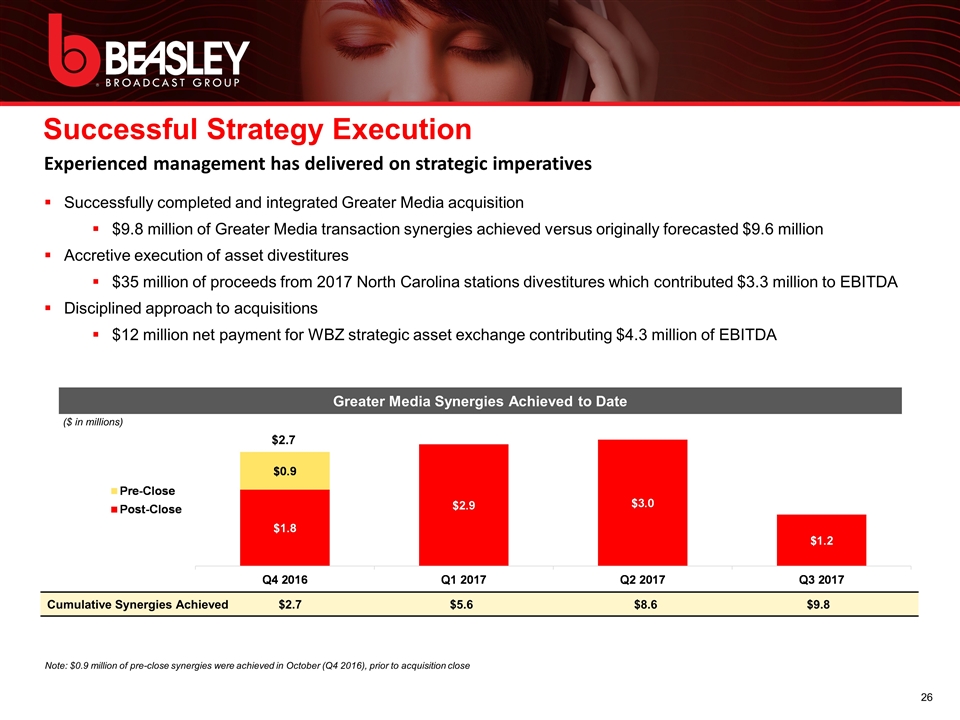

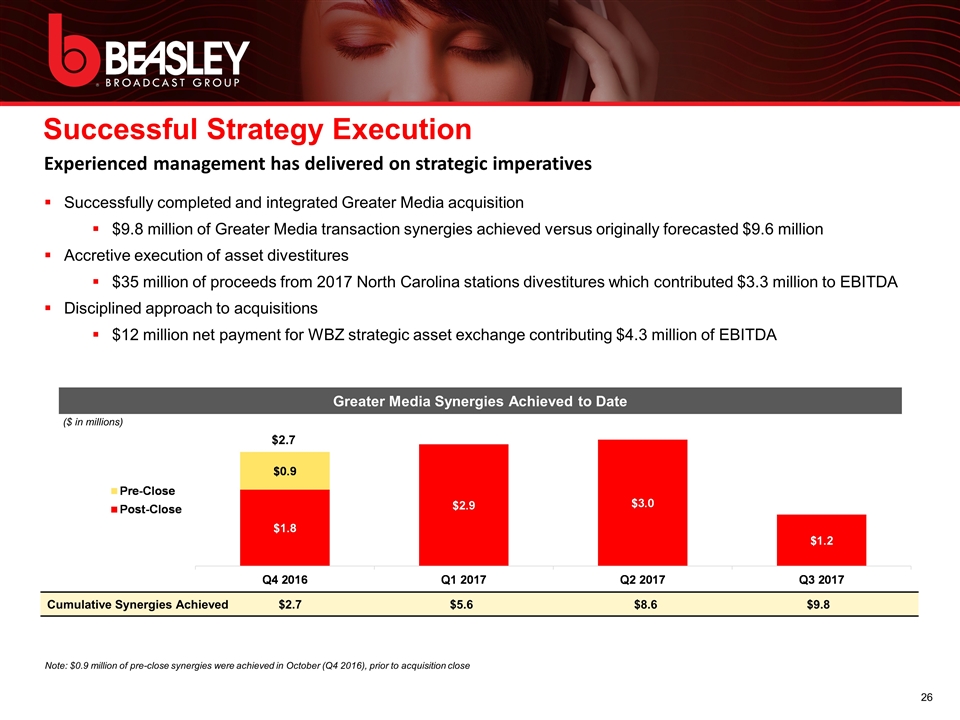

Successfully completed and integrated Greater Media acquisition $9.8 million of Greater Media transaction synergies achieved versus originally forecasted $9.6 million Accretive execution of asset divestitures $35 million of proceeds from 2017 North Carolina stations divestitures which contributed $3.3 million to EBITDA Disciplined approach to acquisitions $12 million net payment for WBZ strategic asset exchange contributing $4.3 million of EBITDA Successful Strategy Execution 26 Note: $0.9 million of pre-close synergies were achieved in October (Q4 2016), prior to acquisition close Experienced management has delivered on strategic imperatives Greater Media Synergies Achieved to Date Cumulative Synergies Achieved $2.7 $5.6 $8.6 $9.8 ($ in millions) $2.7

Section IV Historical Financial Overview

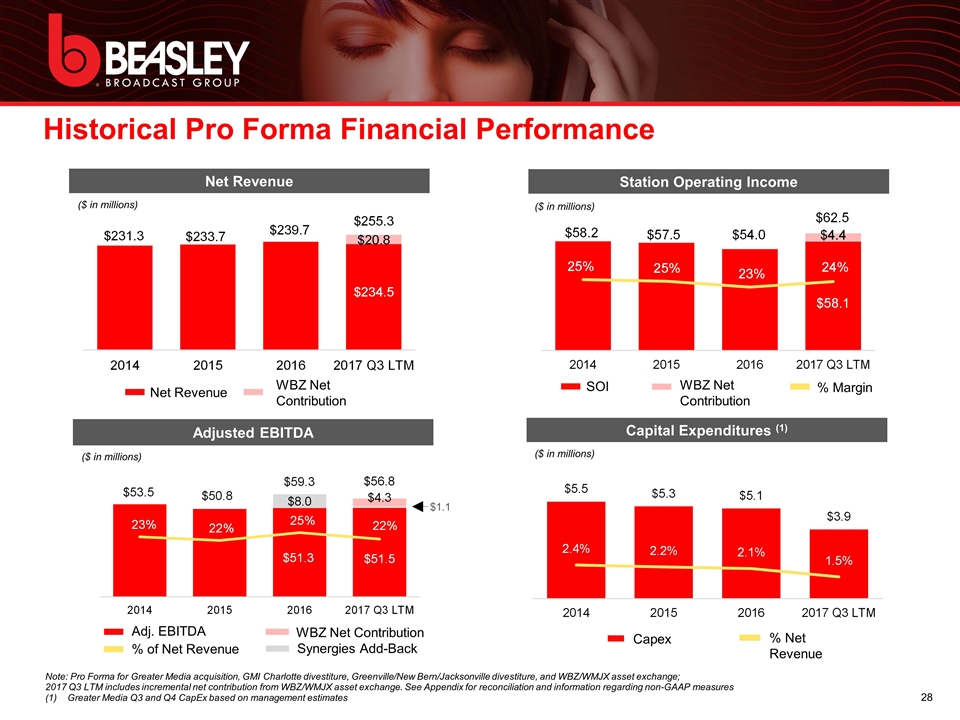

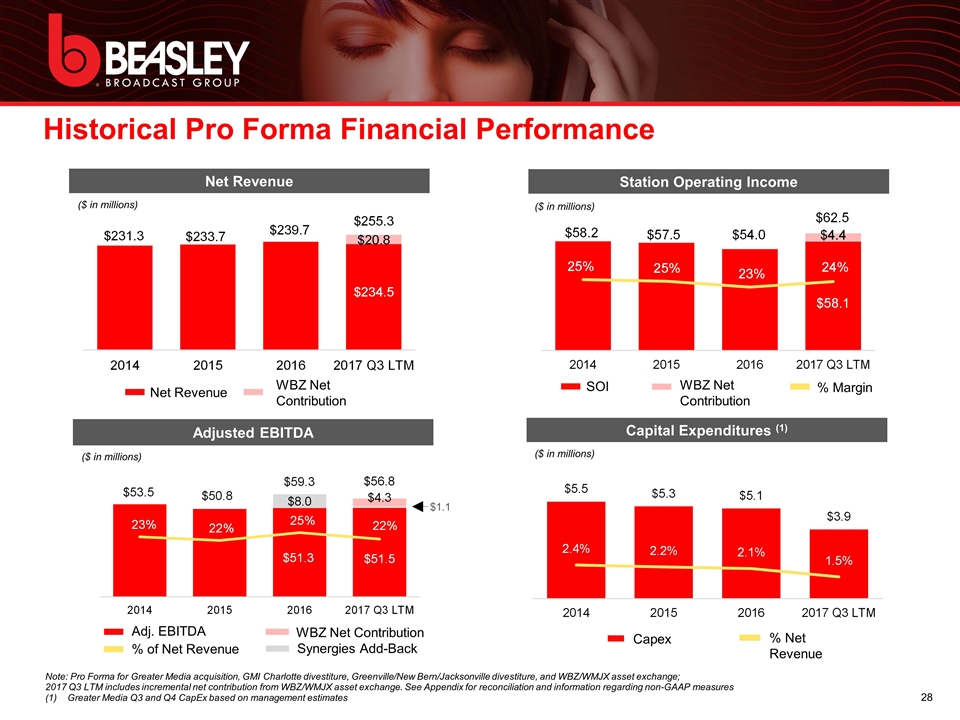

Historical Pro Forma Financial Performance 28 Net Revenue ($ in millions) Station Operating Income ($ in millions) Capital Expenditures (1) ($ in millions) Capex % Net Revenue WBZ Net Contribution SOI % Margin WBZ Net Contribution Net Revenue Note: Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, Greenville/New Bern/Jacksonville divestiture, and WBZ/WMJX asset exchange; 2017 Q3 LTM includes incremental net contribution from WBZ/WMJX asset exchange. See Appendix for reconciliation and information regarding non-GAAP measures (1) Greater Media Q3 and Q4 CapEx based on management estimates Adjusted EBITDA ($ in millions) WBZ Net Contribution Synergies Add-Back Adj. EBITDA % of Net Revenue $1.1 ($ in millions)

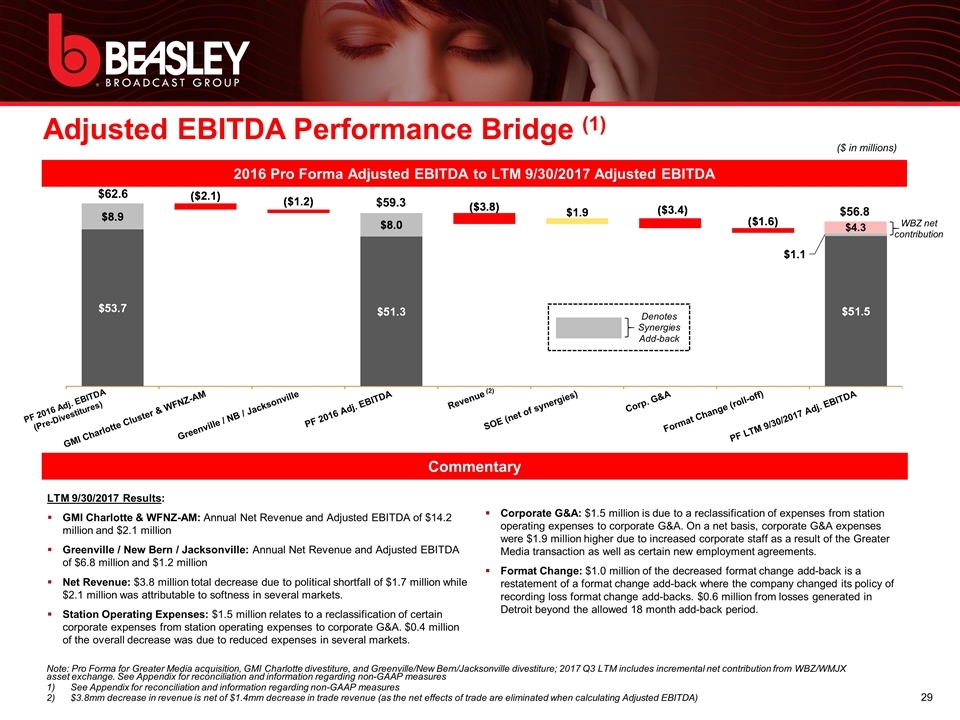

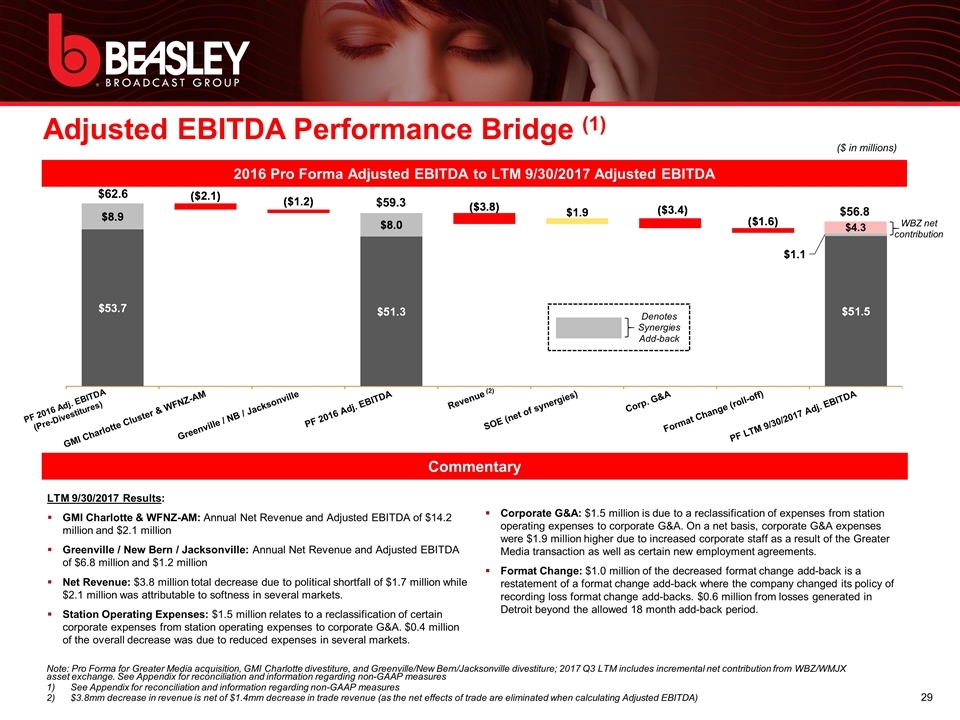

Adjusted EBITDA Performance Bridge (1) 29 Commentary LTM 9/30/2017 Results: GMI Charlotte & WFNZ-AM: Annual Net Revenue and Adjusted EBITDA of $14.2 million and $2.1 million Greenville / New Bern / Jacksonville: Annual Net Revenue and Adjusted EBITDA of $6.8 million and $1.2 million Net Revenue: $3.8 million total decrease due to political shortfall of $1.7 million while $2.1 million was attributable to softness in several markets. Station Operating Expenses: $1.5 million relates to a reclassification of certain corporate expenses from station operating expenses to corporate G&A. $0.4 million of the overall decrease was due to reduced expenses in several markets. 2016 Pro Forma Adjusted EBITDA to LTM 9/30/2017 Adjusted EBITDA Corporate G&A: $1.5 million is due to a reclassification of expenses from station operating expenses to corporate G&A. On a net basis, corporate G&A expenses were $1.9 million higher due to increased corporate staff as a result of the Greater Media transaction as well as certain new employment agreements. Format Change: $1.0 million of the decreased format change add-back is a restatement of a format change add-back where the company changed its policy of recording loss format change add-backs. $0.6 million from losses generated in Detroit beyond the allowed 18 month add-back period. Note: Pro Forma for Greater Media acquisition, GMI Charlotte divestiture, and Greenville/New Bern/Jacksonville divestiture; 2017 Q3 LTM includes incremental net contribution from WBZ/WMJX asset exchange. See Appendix for reconciliation and information regarding non-GAAP measures See Appendix for reconciliation and information regarding non-GAAP measures $3.8mm decrease in revenue is net of $1.4mm decrease in trade revenue (as the net effects of trade are eliminated when calculating Adjusted EBITDA) PF 2016 Adj. EBITDA (Pre-Divestitures) WBZ net contribution (2) $59.3 $62.6 Denotes Synergies Add-back $4.3 $56.8 ($ in millions)

Summary of Credit Highlights 30 Disciplined and Experienced Management Team 7 Leading Local Broadcast Media Company 1 Attractive Industry and Scaled Digital Platform 6 Diversified Format, Advertisers, and End Markets 3 Sizeable Clusters with Strong In-Market Competitive Positioning 2 Modest Leverage, Track Record of De-Leveraging and Significant Equity Support 5 Strong Financial Profile with Robust Free Cash Flow 4

Appendix

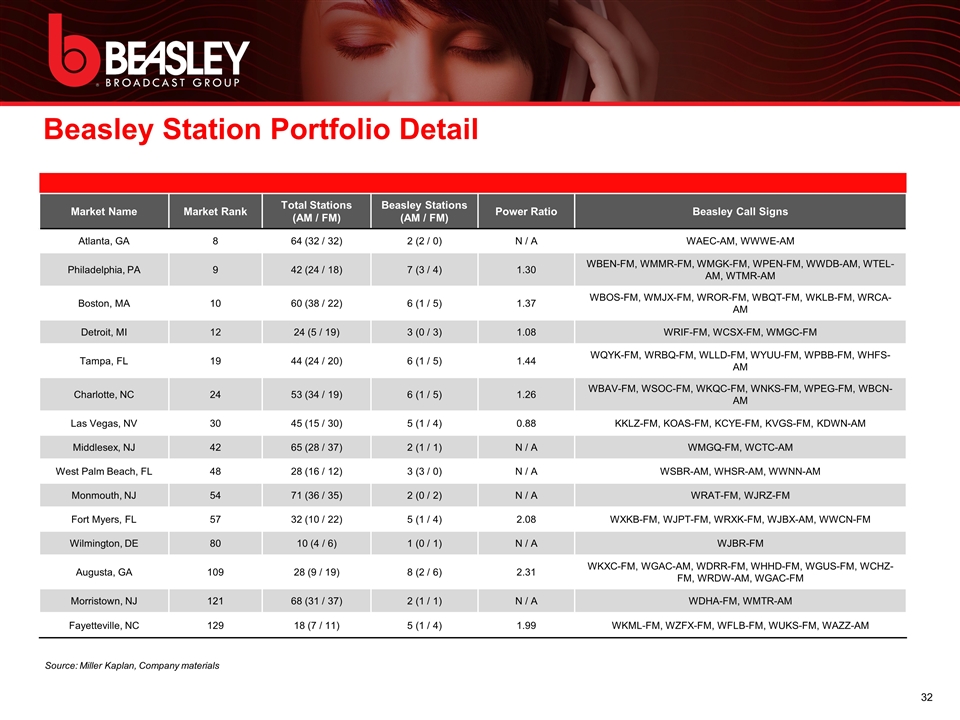

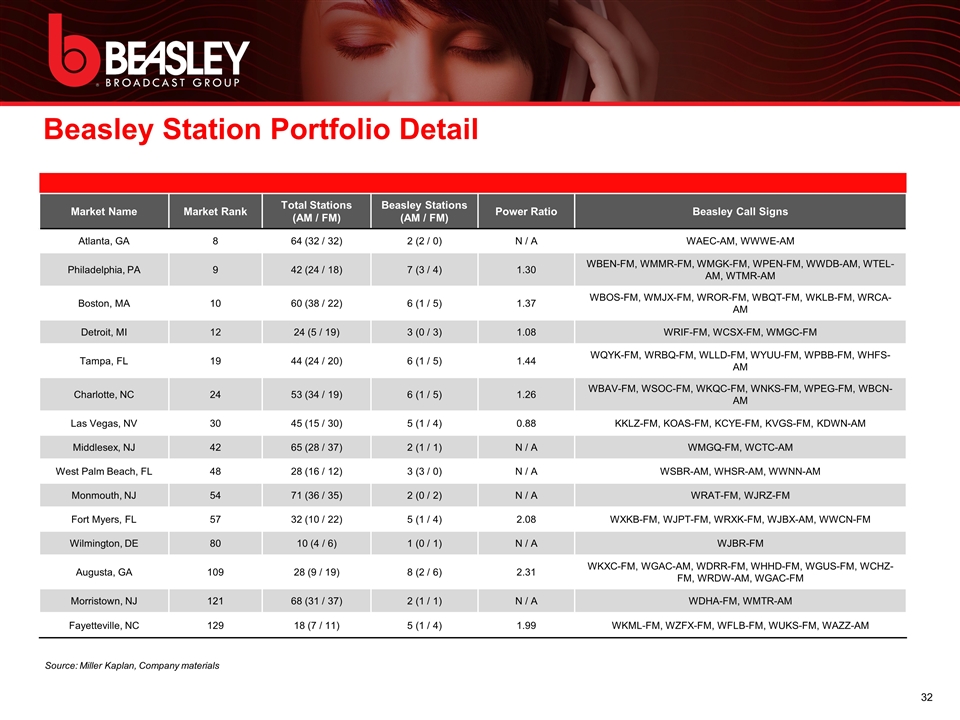

Beasley Station Portfolio Detail 32 Source: Miller Kaplan, Company materials Market Name Market Rank Total Stations (AM / FM) Beasley Stations (AM / FM) Power Ratio Beasley Call Signs Atlanta, GA 8 64 (32 / 32) 2 (2 / 0) N / A WAEC-AM, WWWE-AM Philadelphia, PA 9 42 (24 / 18) 7 (3 / 4) 1.30 WBEN-FM, WMMR-FM, WMGK-FM, WPEN-FM, WWDB-AM, WTEL-AM, WTMR-AM Boston, MA 10 60 (38 / 22) 6 (1 / 5) 1.37 WBOS-FM, WMJX-FM, WROR-FM, WBQT-FM, WKLB-FM, WRCA-AM Detroit, MI 12 24 (5 / 19) 3 (0 / 3) 1.08 WRIF-FM, WCSX-FM, WMGC-FM Tampa, FL 19 44 (24 / 20) 6 (1 / 5) 1.44 WQYK-FM, WRBQ-FM, WLLD-FM, WYUU-FM, WPBB-FM, WHFS-AM Charlotte, NC 24 53 (34 / 19) 6 (1 / 5) 1.26 WBAV-FM, WSOC-FM, WKQC-FM, WNKS-FM, WPEG-FM, WBCN-AM Las Vegas, NV 30 45 (15 / 30) 5 (1 / 4) 0.88 KKLZ-FM, KOAS-FM, KCYE-FM, KVGS-FM, KDWN-AM Middlesex, NJ 42 65 (28 / 37) 2 (1 / 1) N / A WMGQ-FM, WCTC-AM West Palm Beach, FL 48 28 (16 / 12) 3 (3 / 0) N / A WSBR-AM, WHSR-AM, WWNN-AM Monmouth, NJ 54 71 (36 / 35) 2 (0 / 2) N / A WRAT-FM, WJRZ-FM Fort Myers, FL 57 32 (10 / 22) 5 (1 / 4) 2.08 WXKB-FM, WJPT-FM, WRXK-FM, WJBX-AM, WWCN-FM Wilmington, DE 80 10 (4 / 6) 1 (0 / 1) N / A WJBR-FM Augusta, GA 109 28 (9 / 19) 8 (2 / 6) 2.31 WKXC-FM, WGAC-AM, WDRR-FM, WHHD-FM, WGUS-FM, WCHZ-FM, WRDW-AM, WGAC-FM Morristown, NJ 121 68 (31 / 37) 2 (1 / 1) N / A WDHA-FM, WMTR-AM Fayetteville, NC 129 18 (7 / 11) 5 (1 / 4) 1.99 WKML-FM, WZFX-FM, WFLB-FM, WUKS-FM, WAZZ-AM

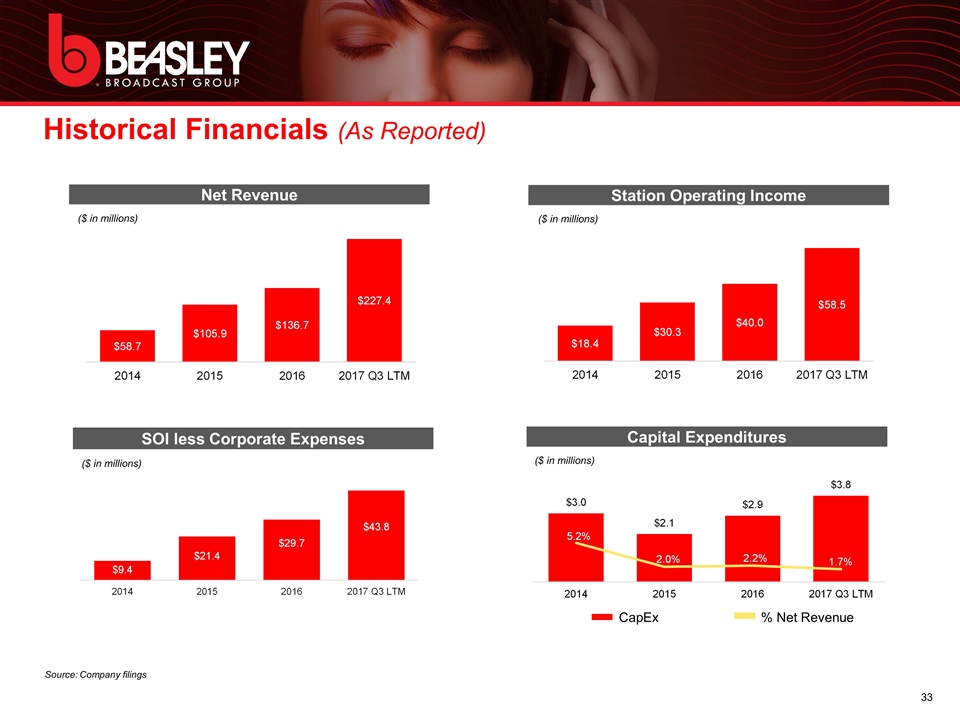

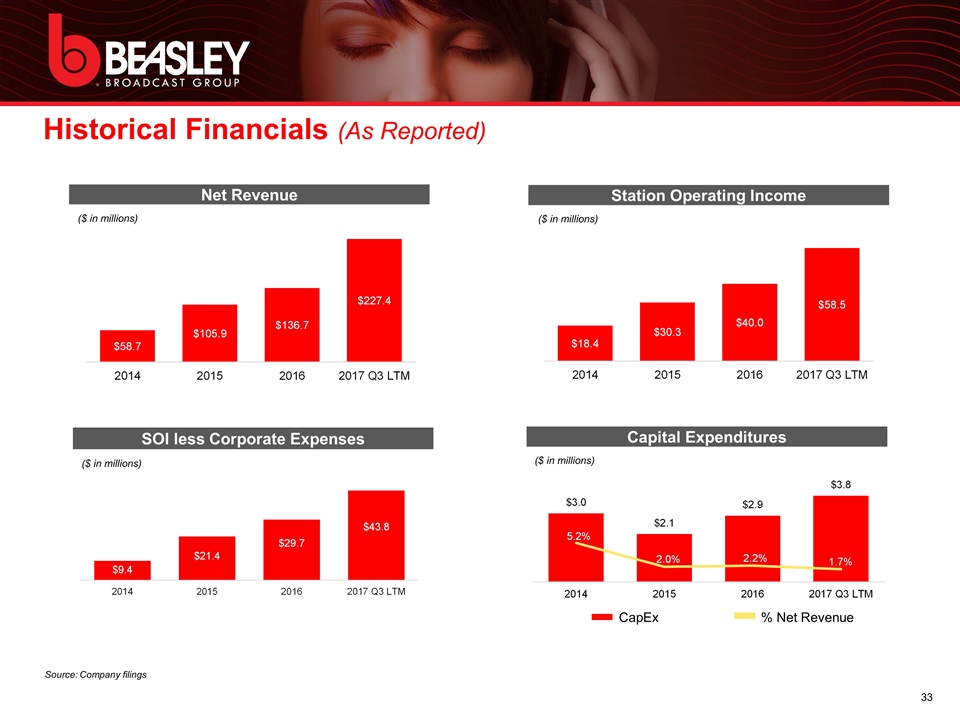

Historical Financials (As Reported) 33 Source: Company filings Net Revenue ($ in millions) Station Operating Income ($ in millions) 30.3% 30.6% 28.6% 29.3% 22.2% 22.6% SOI less Corporate Expenses ($ in millions) Capital Expenditures ($ in millions) CapEx % Net Revenue

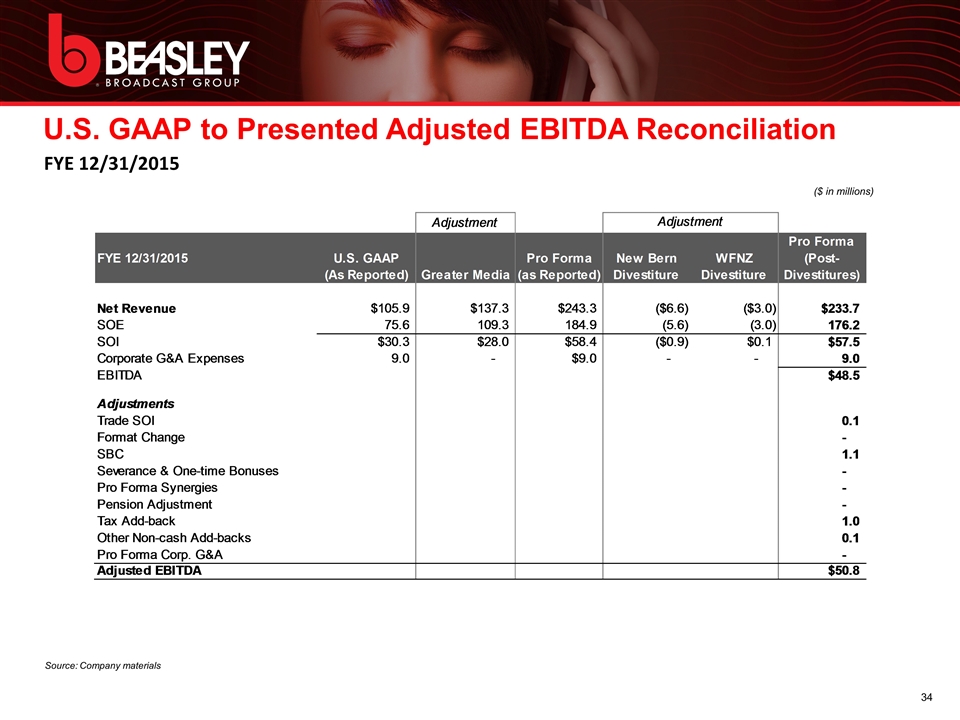

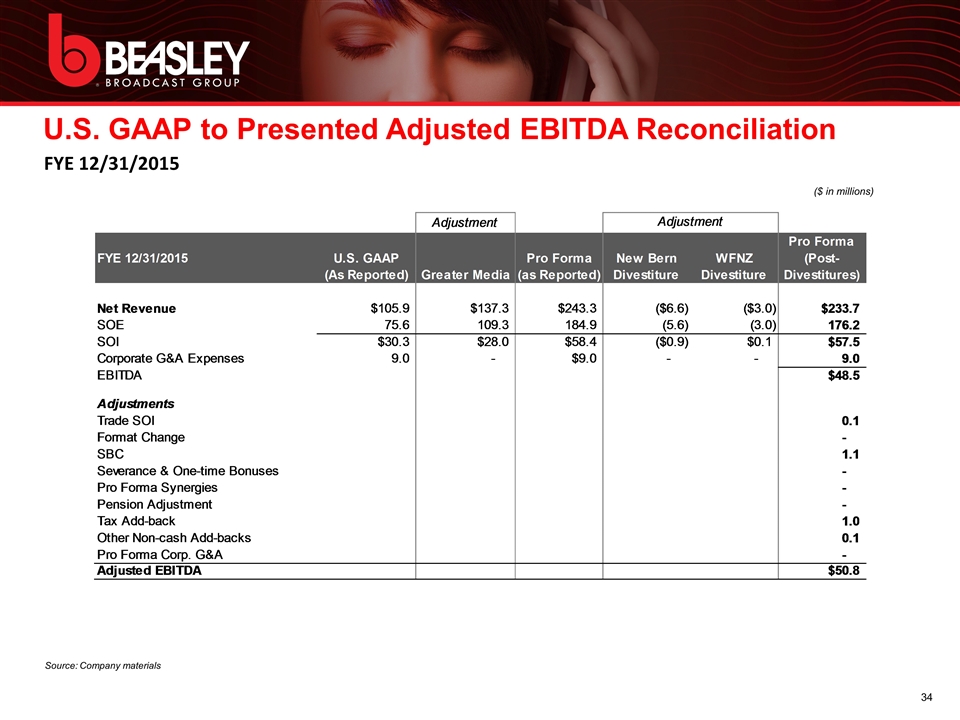

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 34 Source: Company materials FYE 12/31/2015 ($ in millions)

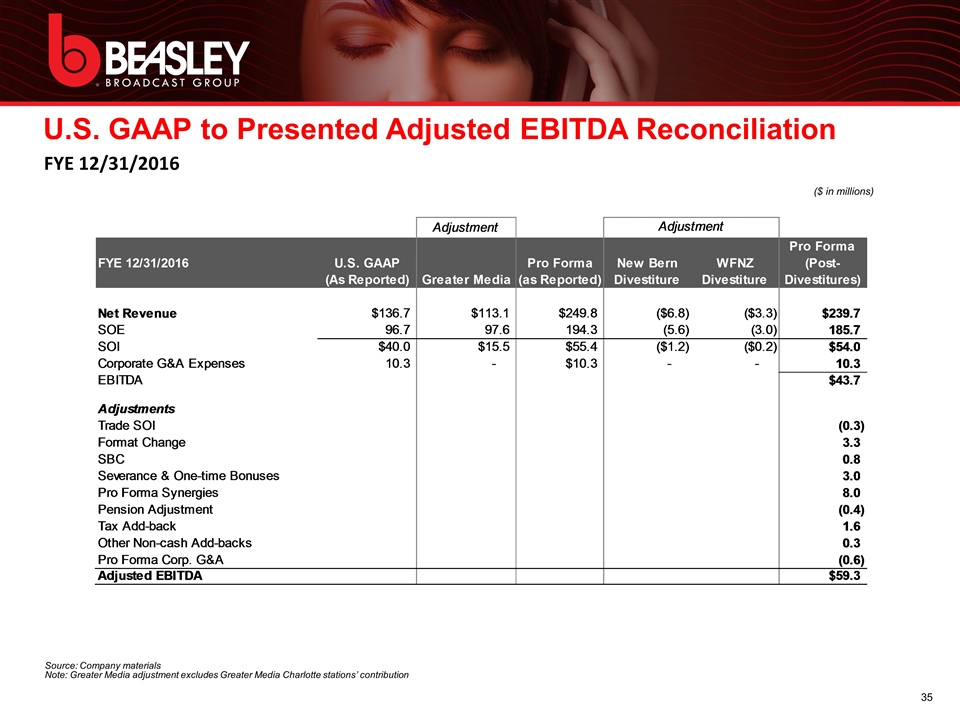

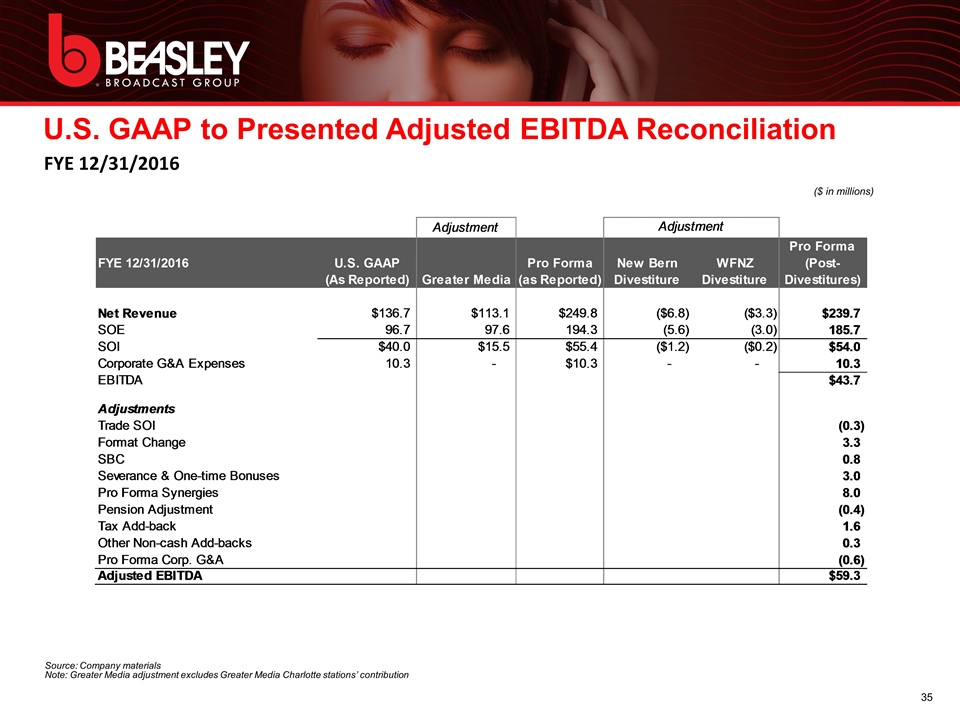

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 35 Source: Company materials Note: Greater Media adjustment excludes Greater Media Charlotte stations’ contribution FYE 12/31/2016 ($ in millions)

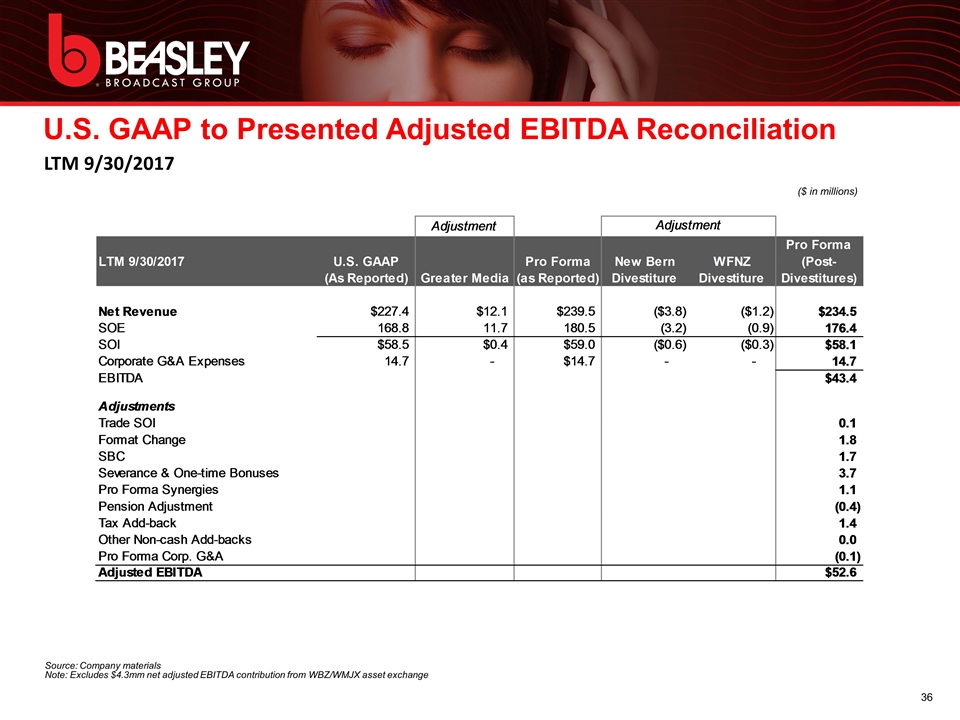

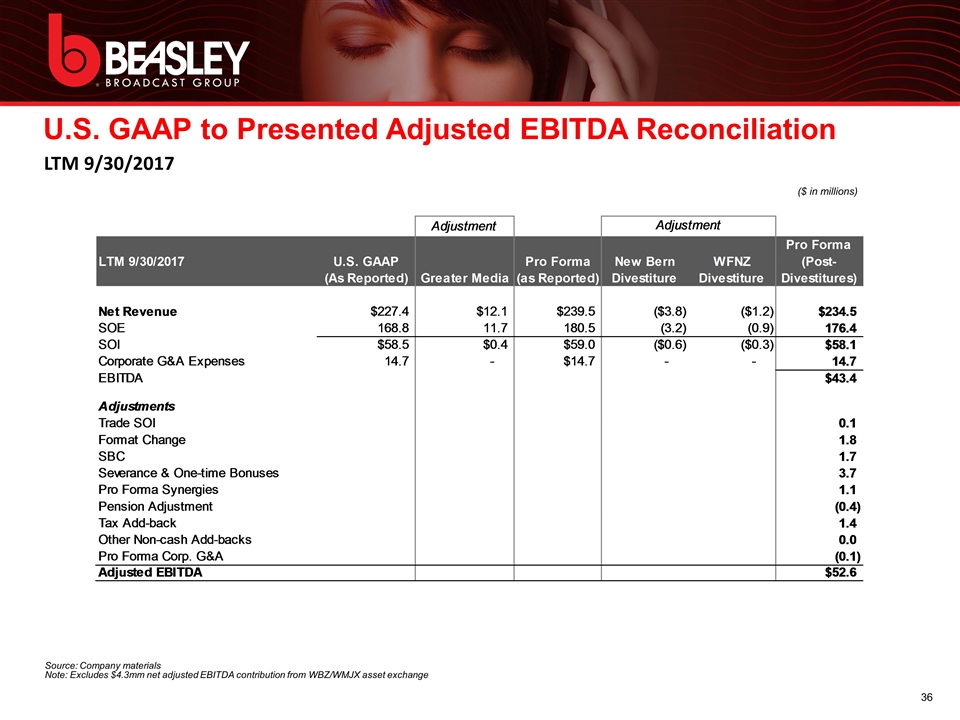

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 36 Source: Company materials Note: Excludes $4.3mm net adjusted EBITDA contribution from WBZ/WMJX asset exchange LTM 9/30/2017 ($ in millions)

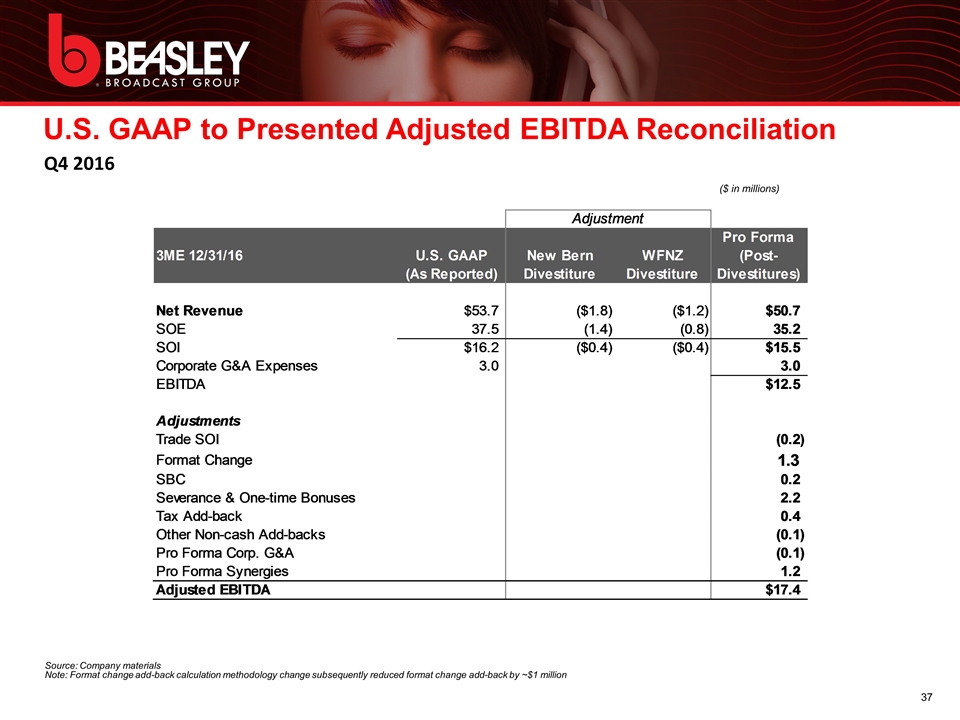

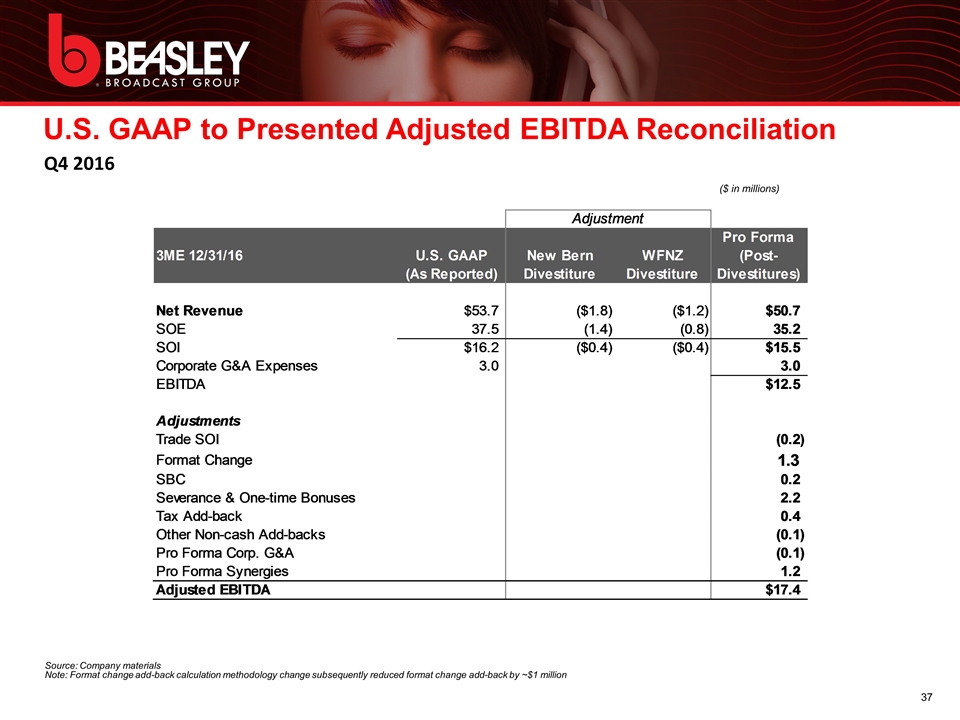

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 37 Source: Company materials Note: Format change add-back calculation methodology change subsequently reduced format change add-back by ~$1 million Q4 2016 ($ in millions)

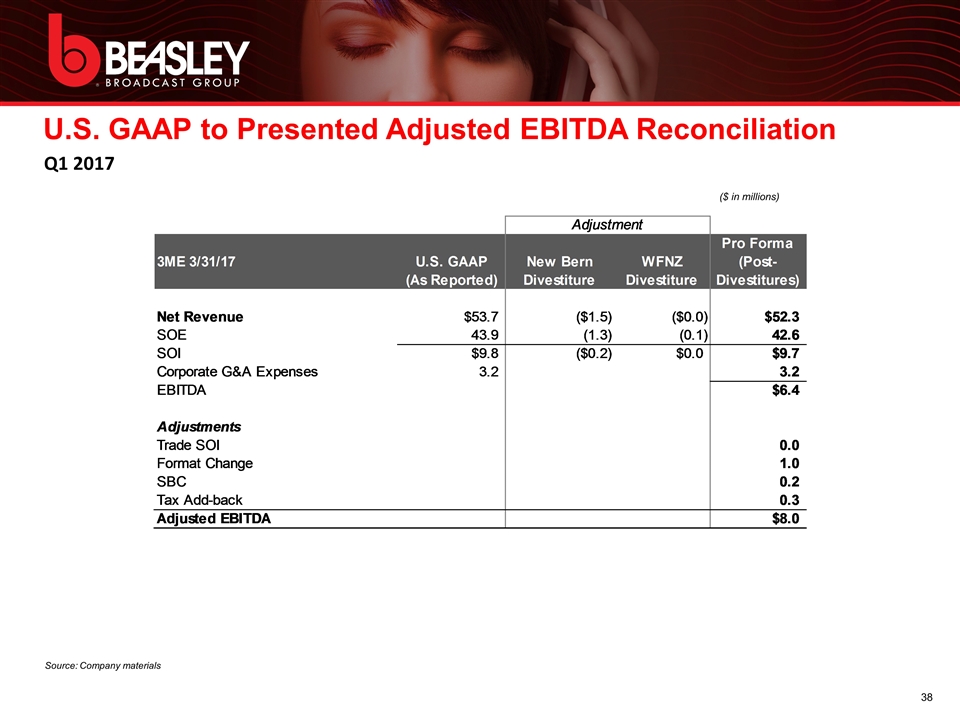

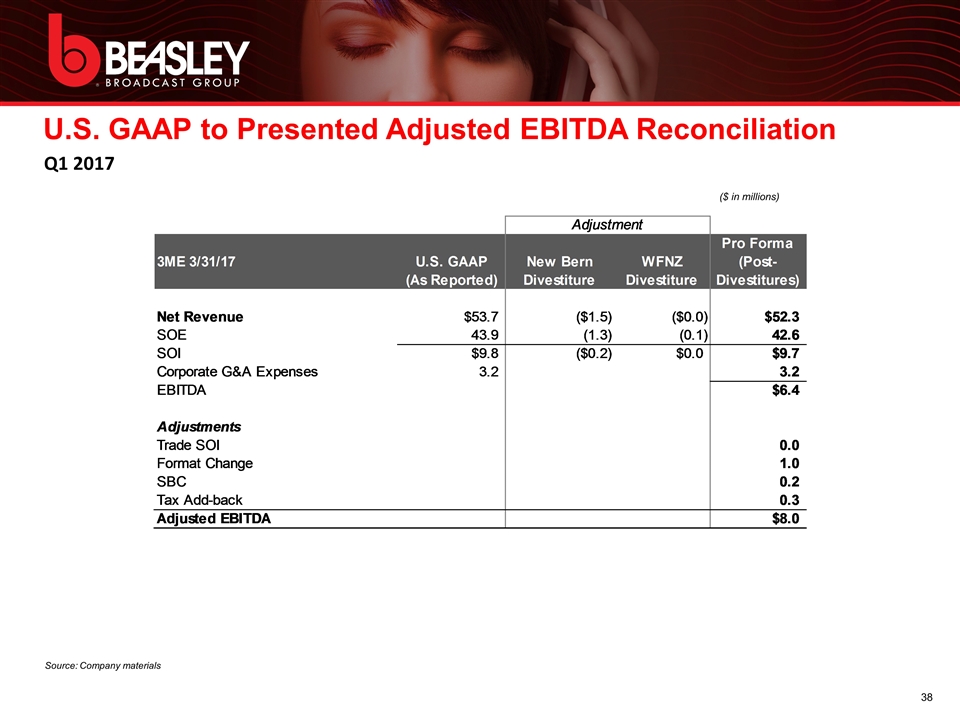

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 38 Source: Company materials Q1 2017 ($ in millions)

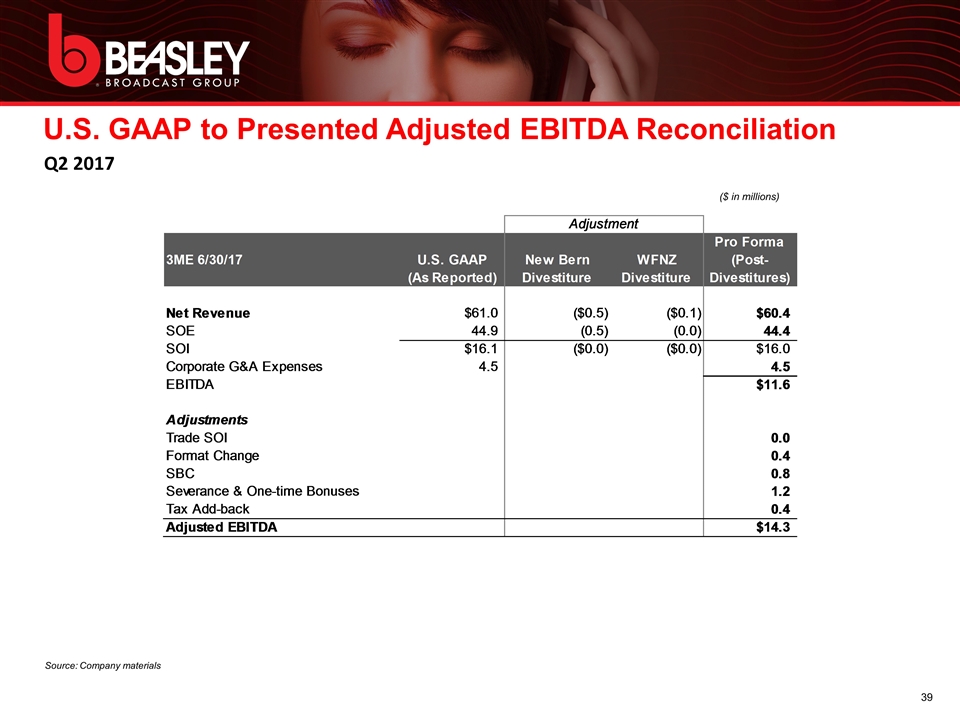

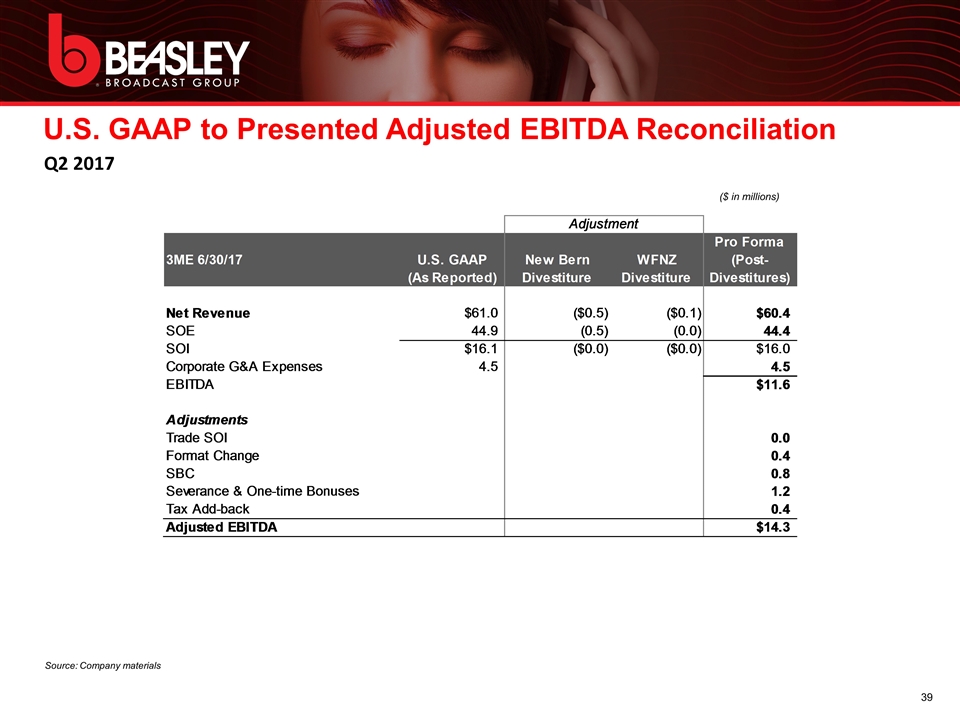

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 39 Source: Company materials Q2 2017 ($ in millions)

U.S. GAAP to Presented Adjusted EBITDA Reconciliation 40 Source: Company materials Q3 2017 ($ in millions)

Notice to and Undertaking by Recipients 41 Confidentiality As used herein: (a) "Evaluation Material" refers to this Presentation and any other information regarding the Company or the Facilities furnished or communicated to the Recipient by or on behalf of the Company in connection with the Facilities (whether prepared or communicated by the Arrangers or the Company, their respective advisors or otherwise), and including information and materials provided through access to the related Debtdomain site and (b) "Internal Evaluation Material" refers to all memoranda, notes, and other documents and analyses developed by the Recipient using any of the information specified under the definition of Evaluation Material. The Recipient acknowledges that the Company considers the Evaluation Material to include confidential, sensitive and proprietary information and agrees that it shall use reasonable precautions in accordance with its established procedures to keep the Evaluation Material confidential; provided however that (i) it may make any disclosure of such information to which the Company gives its prior written consent and (ii) any of such information may be disclosed to it, its affiliates and their respective partners, directors, officers, employees, agents, advisors and other representatives (collectively, "Representatives") who need to know such information for the purposes of evaluating the Facilities (it being understood that such Representatives shall be informed by the Recipient of the confidential nature of such information and shall be directed by the Recipient to treat such information in accordance with the terms of this Notice and Undertaking and the Special Notice). The Recipient agrees to be responsible for any breach of this Notice and Undertaking or the Special Notice that results from the actions or omissions of its Representatives. The Recipient shall be permitted to disclose the Evaluation Material in the event that it is required by law or regulation or requested by any governmental agency or other regulatory authority (including any self-regulatory organization having or claiming to have jurisdiction) or in connection with any legal proceedings if compelled by a court of competent jurisdiction. The Recipient agrees that it will notify the Arrangers as soon as practical in the event of any request made of the Recipient for such disclosure or any requirement of such disclosure (other than at the request of a regulatory authority), unless such notification shall be prohibited by applicable law or legal process and will use commercially reasonable efforts to ensure that any information so disclosed is afforded confidential treatment. The Recipient shall have no obligation hereunder with respect to any Evaluation Material to the extent that such information (i) is or becomes generally available to the public other than as a result of a disclosure by the Recipient or any of its Representatives in violation of this agreement or any other confidentiality obligation of the Recipient to the Company, (ii) was within the Recipient's possession prior to its being furnished pursuant hereto, provided that the source of such information was not known by you, after good faith inquiry, to be bound by a confidentiality agreement with or other contractual, legal or fiduciary obligation of confidentiality to the Company or any other party with respect to such information or (iii) is or becomes available to the Recipient on a non-confidential basis from a source other than the Company or its agents, provided that the source of such information was not known by the Recipient, after good faith inquiry, to be bound by a confidentiality agreement with or other contractual, legal or fiduciary obligation of confidentiality to the Company or any other party with respect to such information. In the event that the Recipient of the Evaluation Material decides not to participate in the transaction described herein, upon request of the Company or the Arrangers, such Recipient shall as soon as practicable terminate its access to the related Debtdomain site and return all Evaluation Material (other than Internal Evaluation Material) to the Company or the Arrangers or represent in writing to the Company or the Arrangers that the Recipient has destroyed all copies of the Evaluation Material (other than Internal Evaluation Material) unless the Recipient has advised the Arrangers and the Company that the Recipient is prohibited from doing so by the Recipient's internal policies and procedures. Notwithstanding the foregoing, any retained Evaluation Material or Internal Evaluation Material as contemplated by the prior sentence shall continue to be subject to this Notice and Undertaking. Information The Recipient acknowledges and agrees that (i) the Arrangers received the Evaluation Material from third party sources (including the Company) and it is provided to the Recipient solely for informational purposes, (ii) neither of the Arrangers nor any of their respective subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents shall bear any responsibility or liability for the accuracy or completeness (or lack thereof) of the Evaluation Material or any information contained therein, (iii) no representation, guaranty or warranty (express or implied) regarding the Evaluation Material (including with respect to forward looking statements or projections) is made by the Arrangers or any of their respective subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents, (iv) neither the Arrangers nor any of their subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents has made any independent verification as to the accuracy or completeness of the Evaluation Material (including with respect to forward looking statements or projections), (v) neither of the Arrangers nor any of their respective subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents shall have any obligation to update or supplement any Evaluation Material or otherwise provide additional information, and (vi) neither of the Arrangers nor any of their respective subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents shall have any liability related to the use of information contained in this Presentation or any related marketing materials by any Recipient. The Evaluation Material has been prepared to assist interested parties in making their own evaluation of the Company and the Facilities and does not purport to be all-inclusive or to contain all of the information that a prospective participant may consider material or desirable in making its decision to become a lender. The Evaluation Material is not intended to form the basis of any investment decision and does not attempt to present all the information that prospective investors may require for purposes of making an investment decision. Each Recipient of the information and data contained herein should take such steps as it deems necessary to assure that it has the information it considers material or desirable in making its decision to become a lender and should perform its own independent investigation and analysis of the Facilities or the transactions contemplated thereby and the creditworthiness of the Company. The Recipient represents that it is sophisticated and experienced in extending credit to entities similar to the Company and agrees to undertake and rely on its own independent investigation and analysis and consult with its own attorneys, accountants and other professional advisors regarding the Company and the merits and risks of entering into the Facilities, including all related legal, investment, tax and other matters. The information and data contained herein are not a substitute for the Recipient's independent evaluation and analysis and should not be considered as a recommendation by the Arrangers or any of their affiliates that any Recipient enter into the Facilities.

Notice to and Undertaking by Recipients 42 The Evaluation Material may include certain forward looking statements and projections provided by the Company. Any such statements and projections reflect various estimates and assumptions by the Company concerning anticipated results and may involve elements of subjective judgment and analysis. The forward looking statements and projections are not historical facts and are based on management’s analysis of information at the time this Presentation was prepared and/or management’s good faith belief with respect to future events. These forward looking statements involve uncertainty and risk. No representations or warranties are made by the Company or any of its affiliates as to the accuracy of any such statements or projections and such statements and projections should not be relied upon as a promise or representation as to the future. Whether or not any such forward looking statements or projections are in fact achieved will depend upon future events some of which are not within the control of the Company. Accordingly, actual results may vary from the projected results and such variations may be material. The Company assumes no obligation to update forward looking statements or projections contained herein to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information. Statements contained herein describing documents and agreements are summaries only and such summaries are qualified in their entirety by reference to such documents and agreements. General It is understood that (a) unless and until a definitive agreement regarding the Facilities between the parties thereto has been executed, the Recipient will be under no legal obligation of any kind whatsoever with respect to the Facilities by virtue of this Notice and Undertaking except for the matters specifically agreed to herein and in the Special Notice and (b) the Company or the Arrangers, as applicable, reserve the right, in its sole discretion and for any reason, to modify or amend the terms of the Facilities, to approve or disapprove any prospective lender or other investor, to accept or reject, in whole or in part, any request by an investor to participate as lender, participant or otherwise in the Facilities, to allocate to any investor a smaller portion of the Facilities than the amount sought by such investor and to withdraw from any further discussions, negotiations or transaction. None of the Company or the Arrangers will have any liability or obligation whatsoever to any prospective investor in the event of any of the foregoing. The Recipient agrees that money damages would not be a sufficient remedy for breach of this Notice and Undertaking or of the Special Notice, and that in addition to all other remedies available at law or in equity, the Company and the Arrangers shall be entitled to equitable relief, including injunction and specific performance, without proof of actual damages. This Notice and Undertaking and the Special Notice together embody the entire understanding and agreement between the Recipient, the Company and the Arrangers with respect to the Evaluation Material and the Internal Evaluation Material and supersede all prior understandings and agreements relating thereto. The terms and conditions of this Notice and Undertaking and the Special Notice relating to confidentiality shall apply until such time, if any, that the Recipient becomes a party to the definitive agreements regarding the Facilities, and thereafter the provisions of such definitive agreements relating to confidentiality shall govern. If you do not enter into the Facilities, the application of this Notice and Undertaking and the Special Notice shall terminate with respect to all Evaluation Material on the date falling one year after the date of this Presentation. This Notice and Undertaking and the Special Notice shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of law (except Section 5-1401 of the New York General Obligations Law to the extent that it mandates that the law of the State of New York govern).