3Q22 Supplemental Slides1 John McCallion Chief Financial Officer Exhibit 99.3 1 These slides highlight information in MetLife, Inc.'s earnings release, quarterly financial supplement and other prior public disclosures.

2 Table of contents Topic Page No. Net income (loss) to adjusted earnings 3 Actuarial assumption review & other insurance adjustments 4 Adjusted earnings, ex. total notable items, by segment 5 Variable investment income (VII) 6 Direct expense ratio 8 Value of new business (VNB) 9 Cash & capital 10 Appendix 11

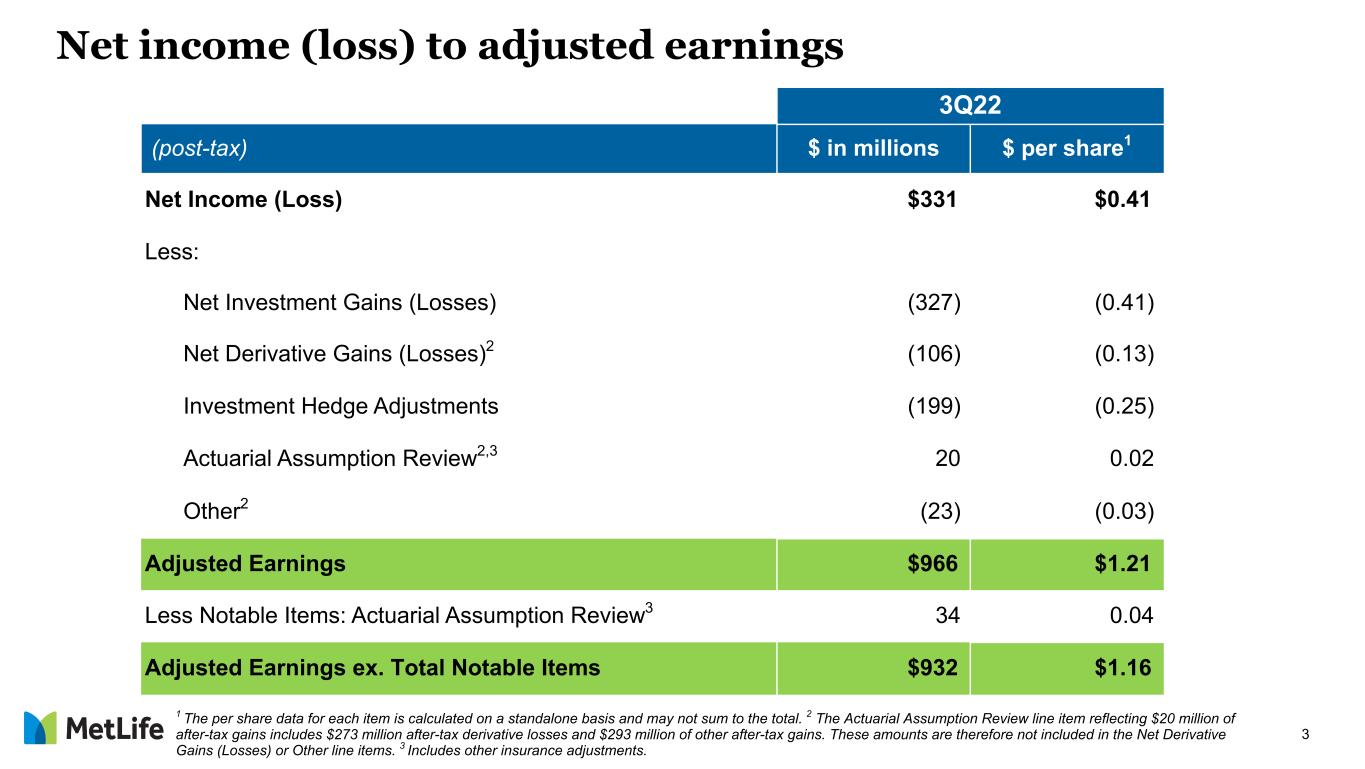

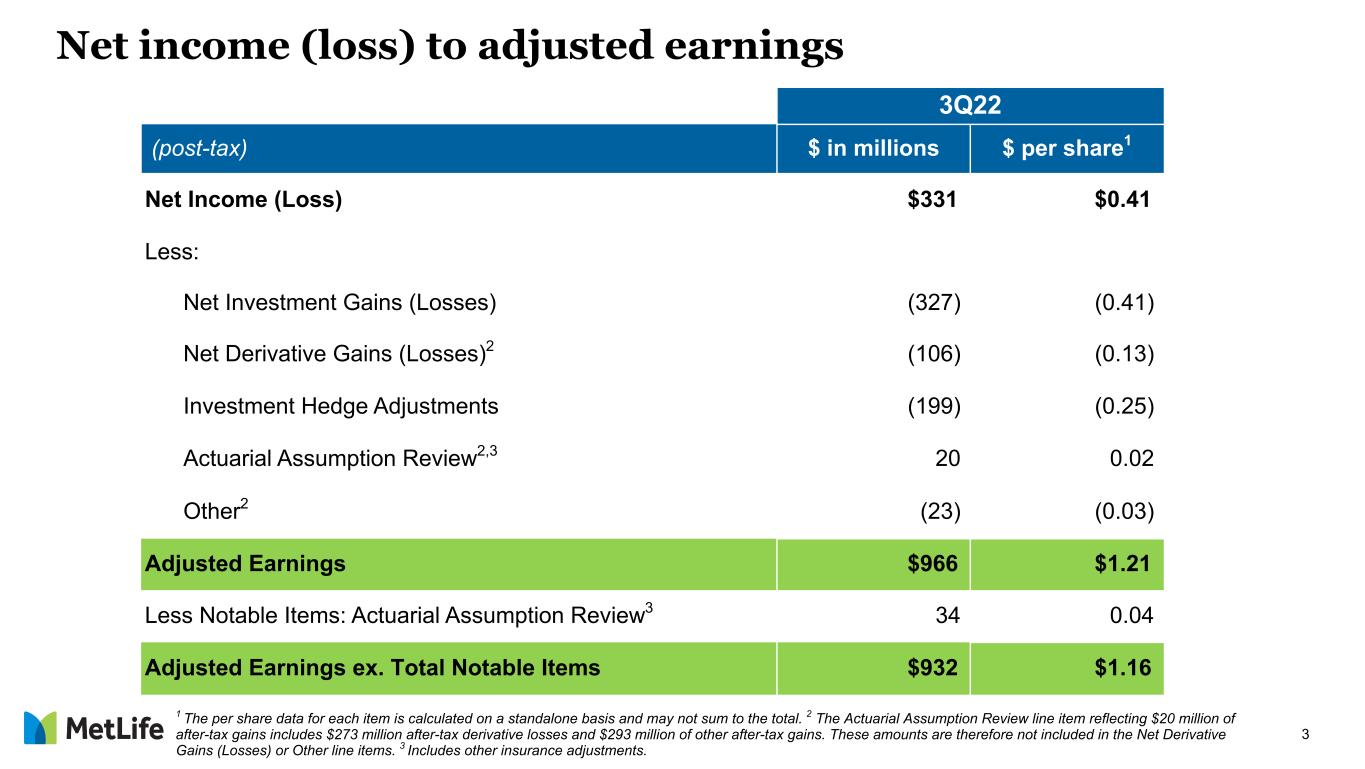

3 Net income (loss) to adjusted earnings 3Q22 (post-tax) $ in millions $ per share1 Net Income (Loss) $331 $0.41 Less: Net Investment Gains (Losses) (327) (0.41) Net Derivative Gains (Losses)2 (106) (0.13) Investment Hedge Adjustments (199) (0.25) Actuarial Assumption Review2,3 20 0.02 Other2 (23) (0.03) Adjusted Earnings $966 $1.21 Less Notable Items: Actuarial Assumption Review3 34 0.04 Adjusted Earnings ex. Total Notable Items $932 $1.16 1 The per share data for each item is calculated on a standalone basis and may not sum to the total. 2 The Actuarial Assumption Review line item reflecting $20 million of after-tax gains includes $273 million after-tax derivative losses and $293 million of other after-tax gains. These amounts are therefore not included in the Net Derivative Gains (Losses) or Other line items. 3 Includes other insurance adjustments.

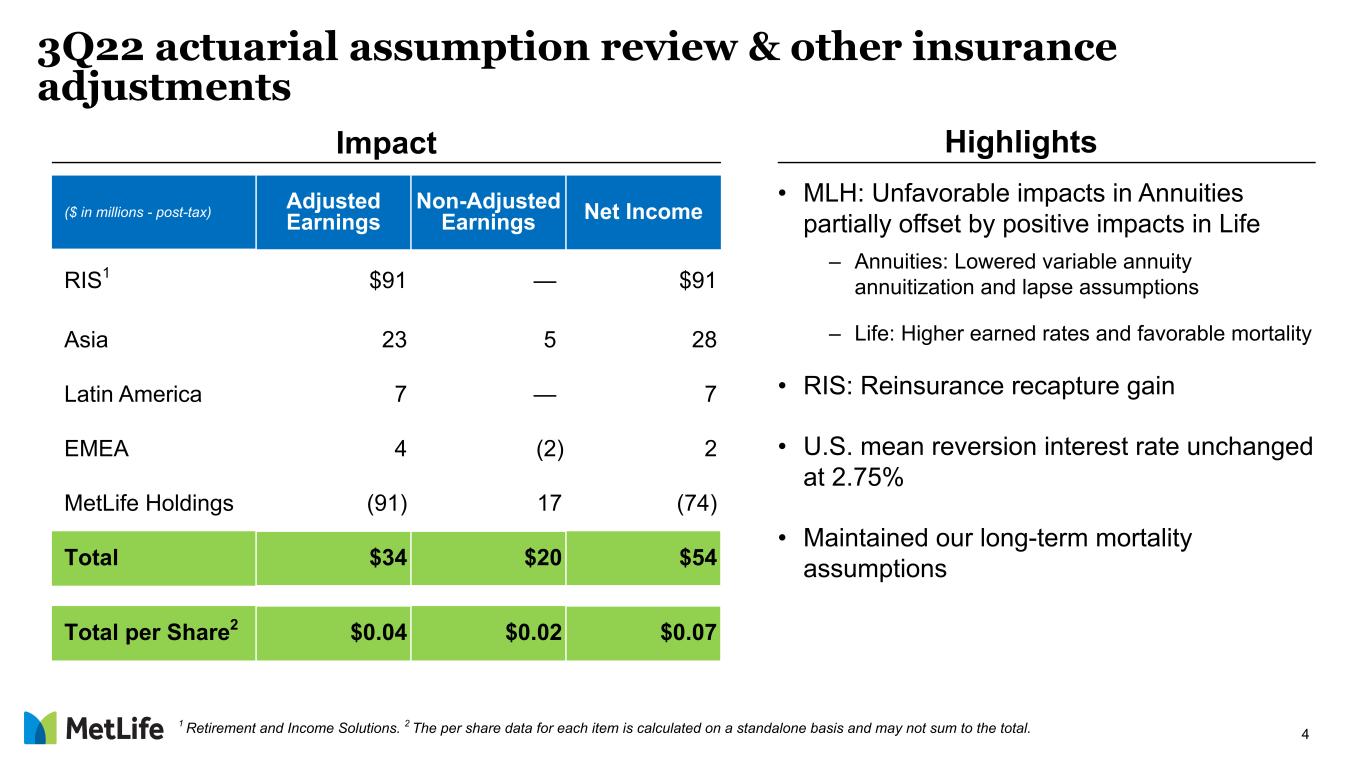

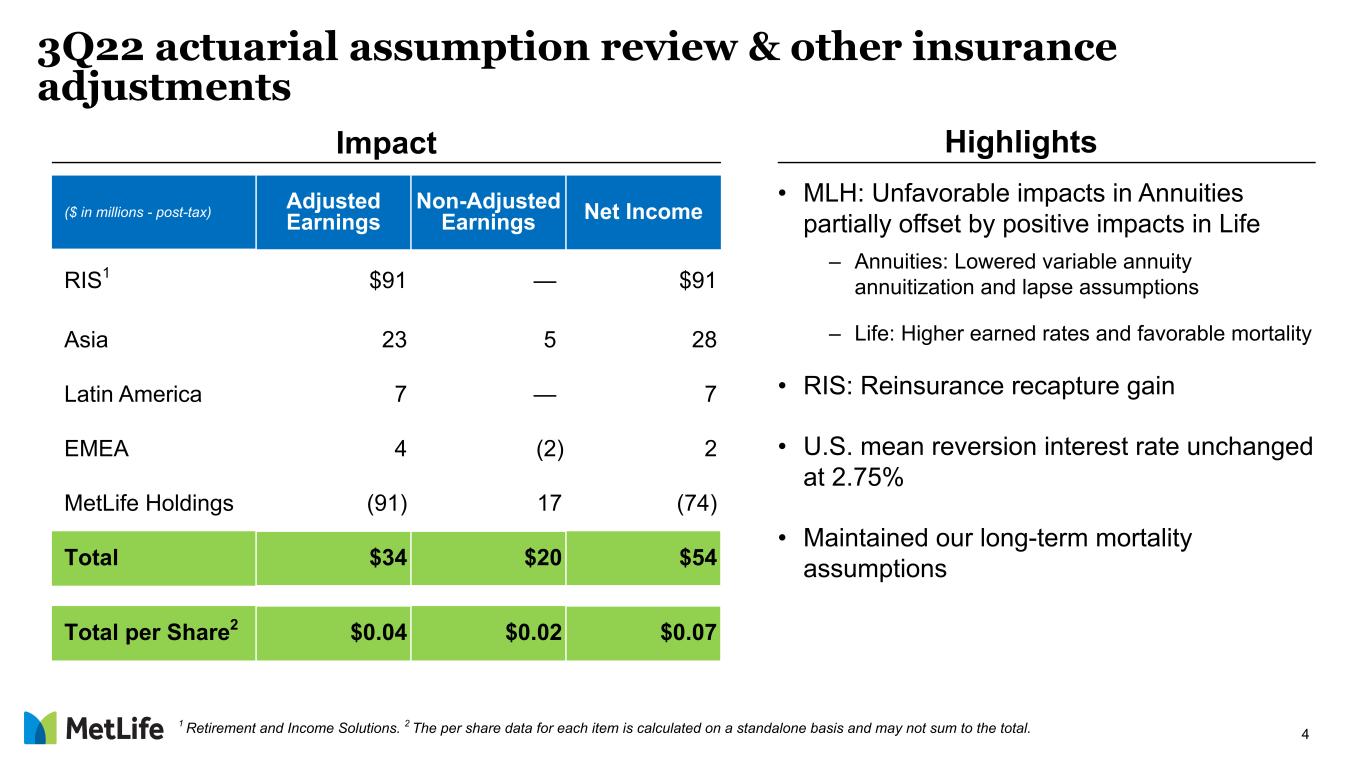

4 3Q22 actuarial assumption review & other insurance adjustments ($ in millions - post-tax) Adjusted Earnings Non-Adjusted Earnings Net Income RIS1 $91 — $91 Asia 23 5 28 Latin America 7 — 7 EMEA 4 (2) 2 MetLife Holdings (91) 17 (74) Total $34 $20 $54 Total per Share2 $0.04 $0.02 $0.07 Impact Highlights • MLH: Unfavorable impacts in Annuities partially offset by positive impacts in Life – Annuities: Lowered variable annuity annuitization and lapse assumptions – Life: Higher earned rates and favorable mortality • RIS: Reinsurance recapture gain • U.S. mean reversion interest rate unchanged at 2.75% • Maintained our long-term mortality assumptions 1 Retirement and Income Solutions. 2 The per share data for each item is calculated on a standalone basis and may not sum to the total.

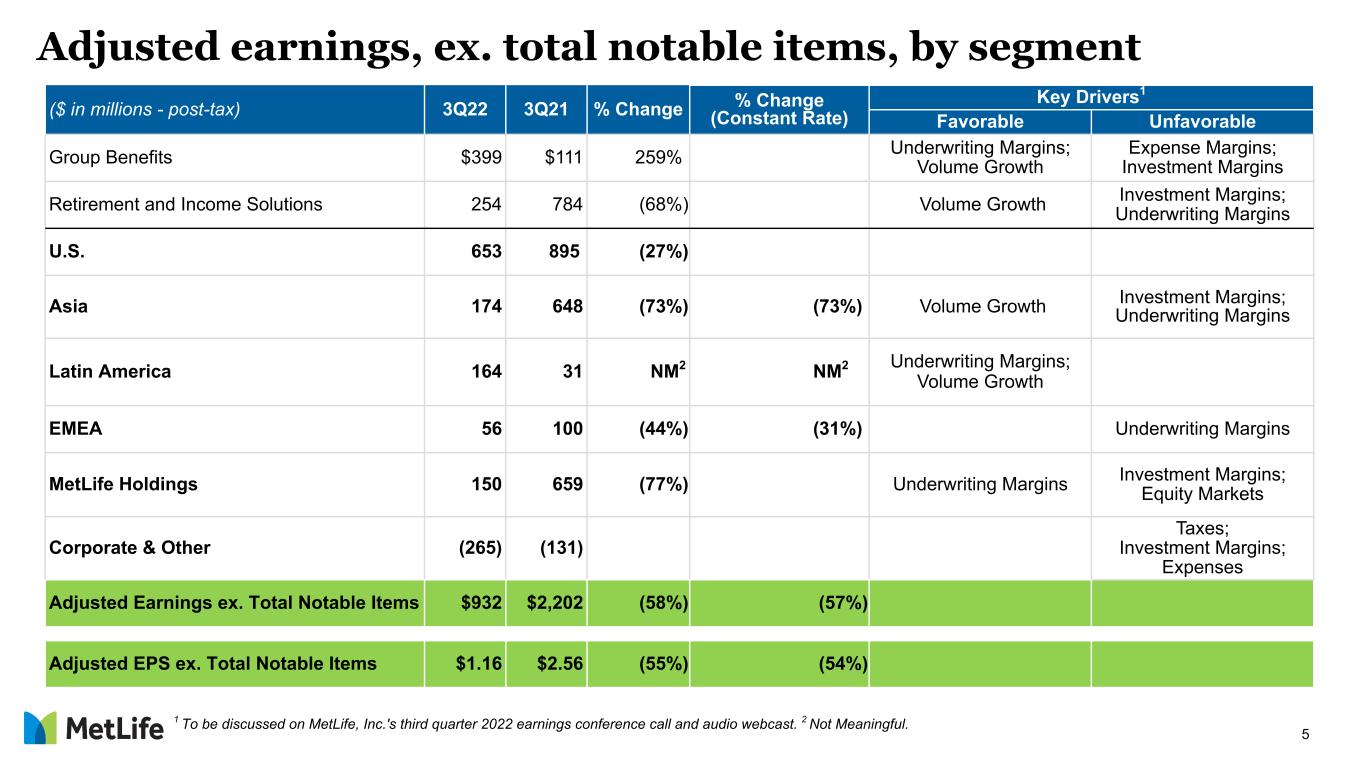

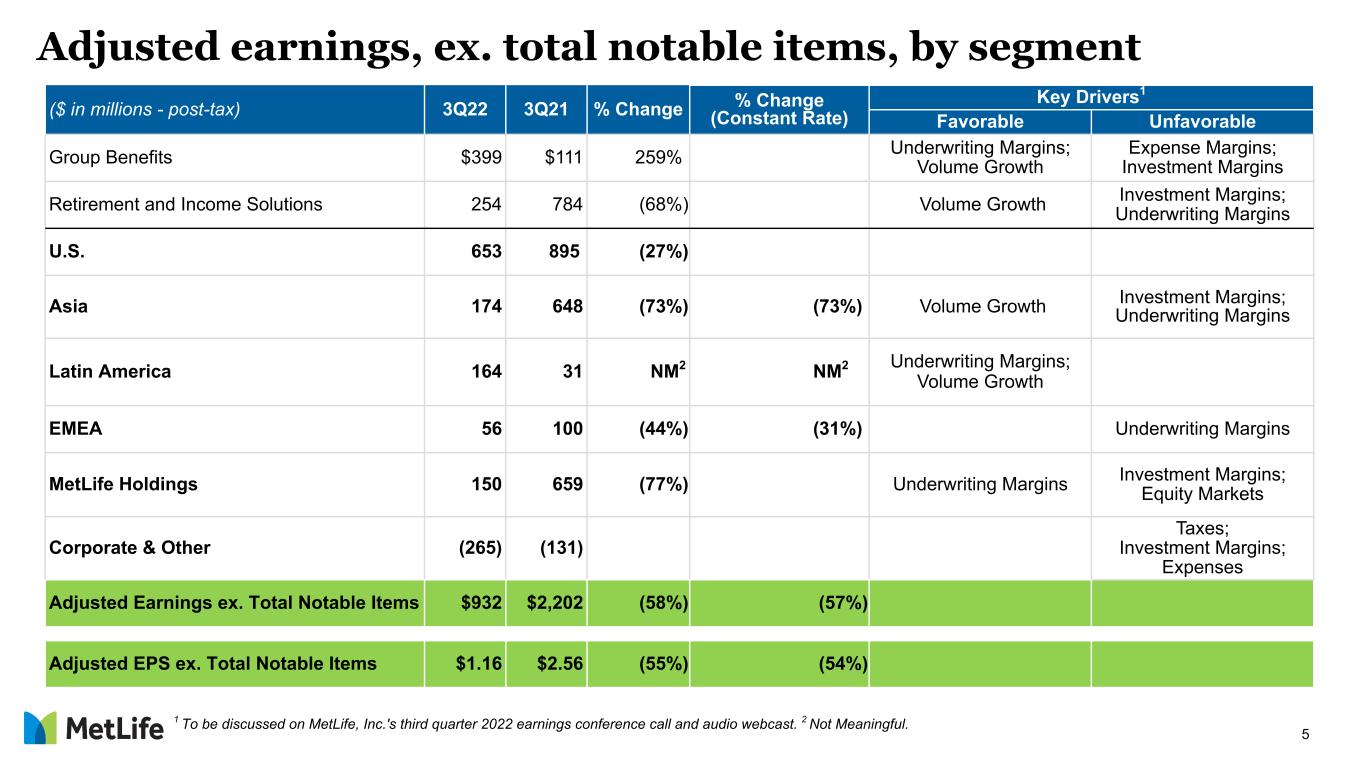

5 ($ in millions - post-tax) 3Q22 3Q21 % Change % Change (Constant Rate) Key Drivers1 Favorable Unfavorable Group Benefits $399 $111 259% Underwriting Margins; Volume Growth Expense Margins; Investment Margins Retirement and Income Solutions 254 784 (68%) Volume Growth Investment Margins; Underwriting Margins U.S. 653 895 (27%) Asia 174 648 (73%) (73%) Volume Growth Investment Margins; Underwriting Margins Latin America 164 31 NM2 NM2 Underwriting Margins; Volume Growth EMEA 56 100 (44%) (31%) Underwriting Margins MetLife Holdings 150 659 (77%) Underwriting Margins Investment Margins; Equity Markets Corporate & Other (265) (131) Taxes; Investment Margins; Expenses Adjusted Earnings ex. Total Notable Items $932 $2,202 (58%) (57%) Adjusted EPS ex. Total Notable Items $1.16 $2.56 (55%) (54%) Adjusted earnings, ex. total notable items, by segment 1 To be discussed on MetLife, Inc.'s third quarter 2022 earnings conference call and audio webcast. 2 Not Meaningful.

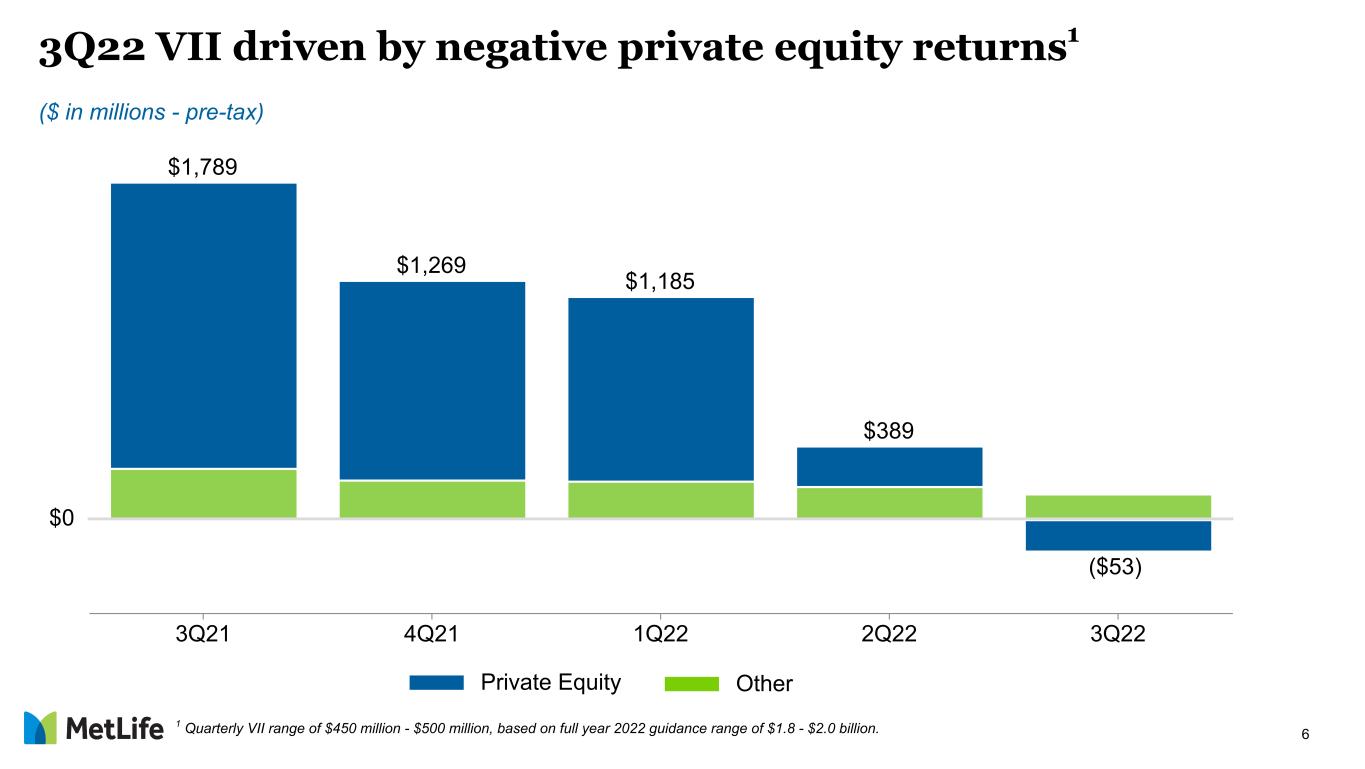

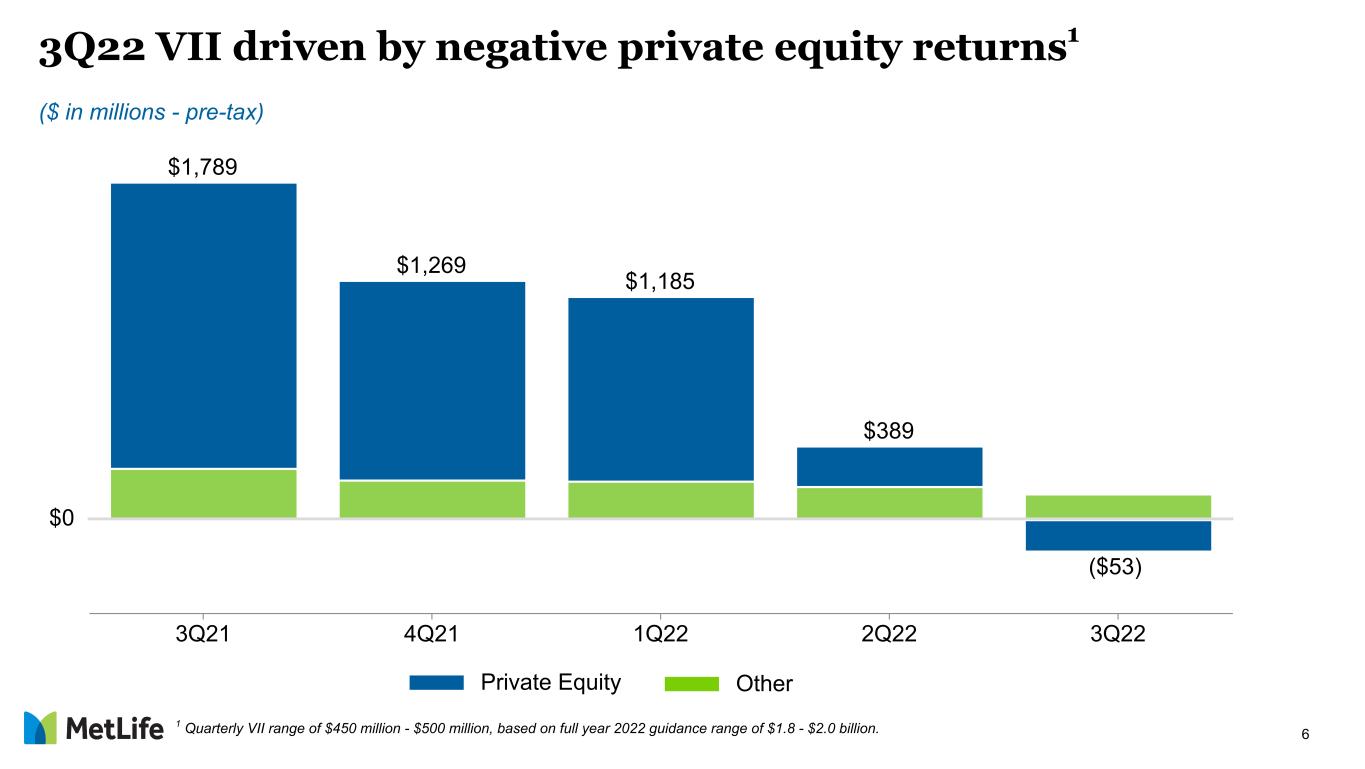

6 $1,789 $1,269 $1,185 $389 ($53) 3Q21 4Q21 1Q22 2Q22 3Q22 3Q22 VII driven by negative private equity returns1 ($ in millions - pre-tax) Private Equity Other 1 Quarterly VII range of $450 million - $500 million, based on full year 2022 guidance range of $1.8 - $2.0 billion. ($53) $0

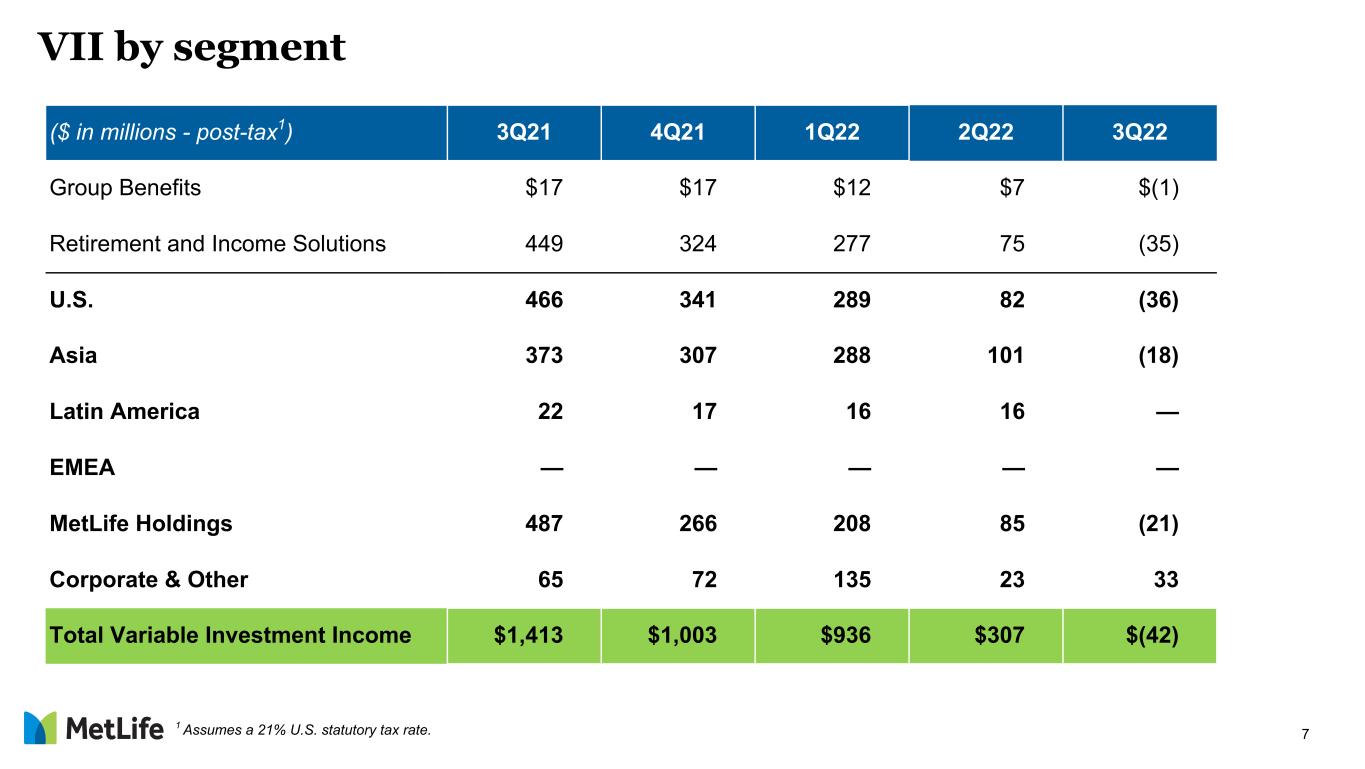

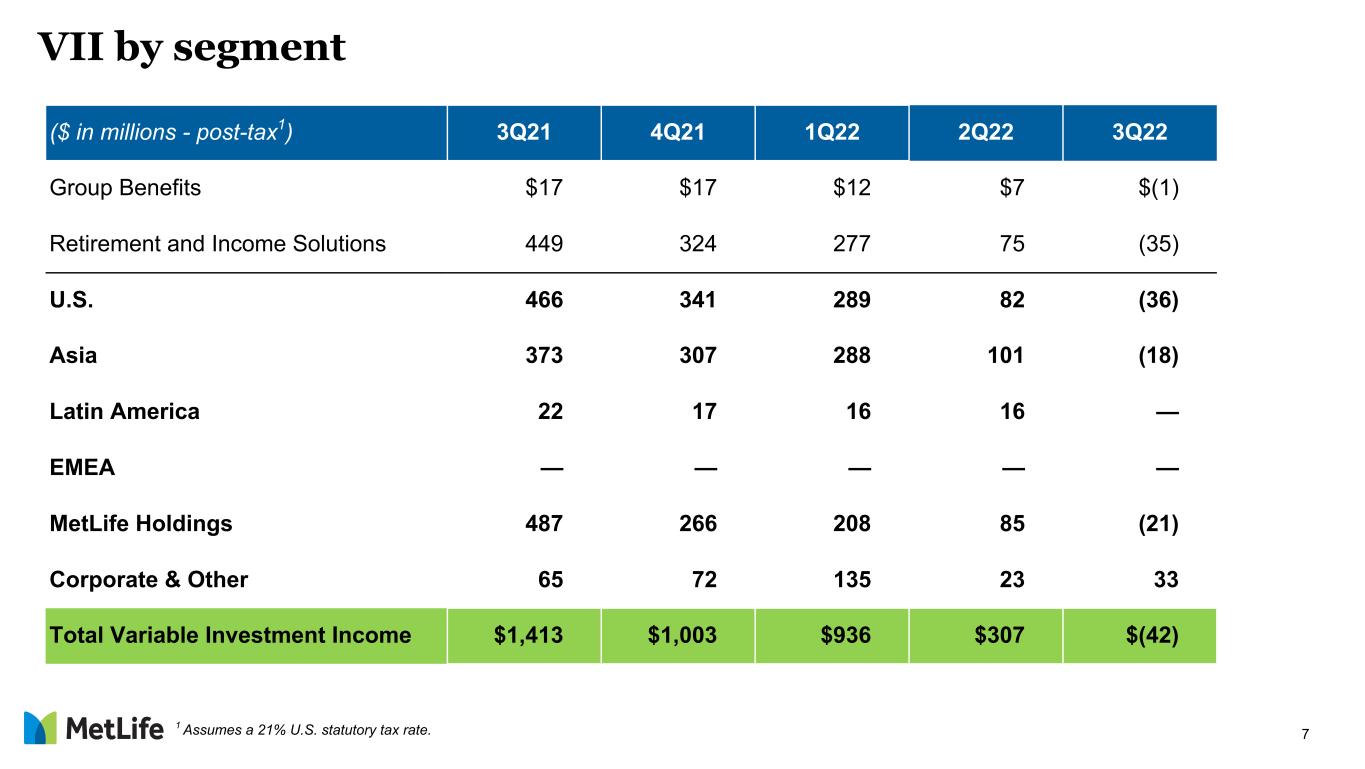

7 ($ in millions - post-tax1) 3Q21 4Q21 1Q22 2Q22 3Q22 Group Benefits $17 $17 $12 $7 $(1) Retirement and Income Solutions 449 324 277 75 (35) U.S. 466 341 289 82 (36) Asia 373 307 288 101 (18) Latin America 22 17 16 16 — EMEA — — — — — MetLife Holdings 487 266 208 85 (21) Corporate & Other 65 72 135 23 33 Total Variable Investment Income $1,413 $1,003 $936 $307 $(42) 1 Assumes a 21% U.S. statutory tax rate. VII by segment

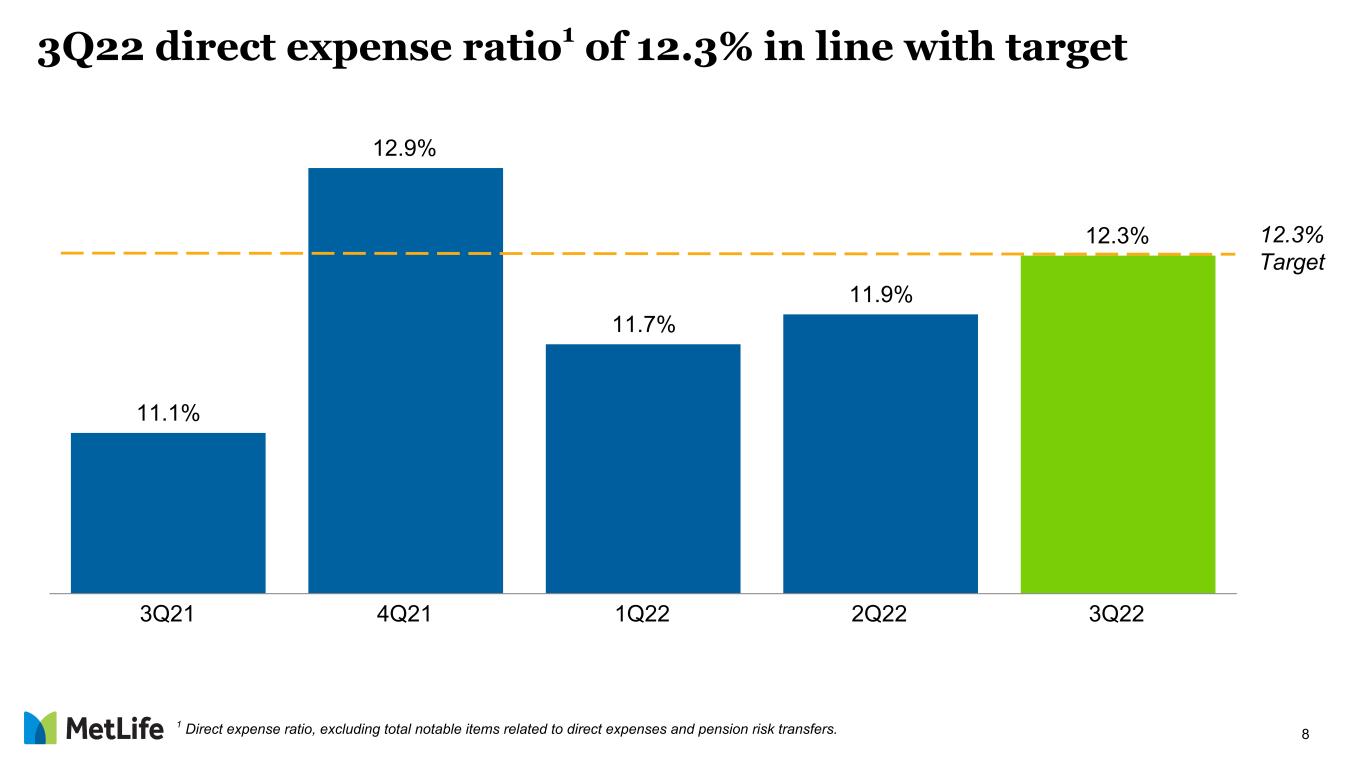

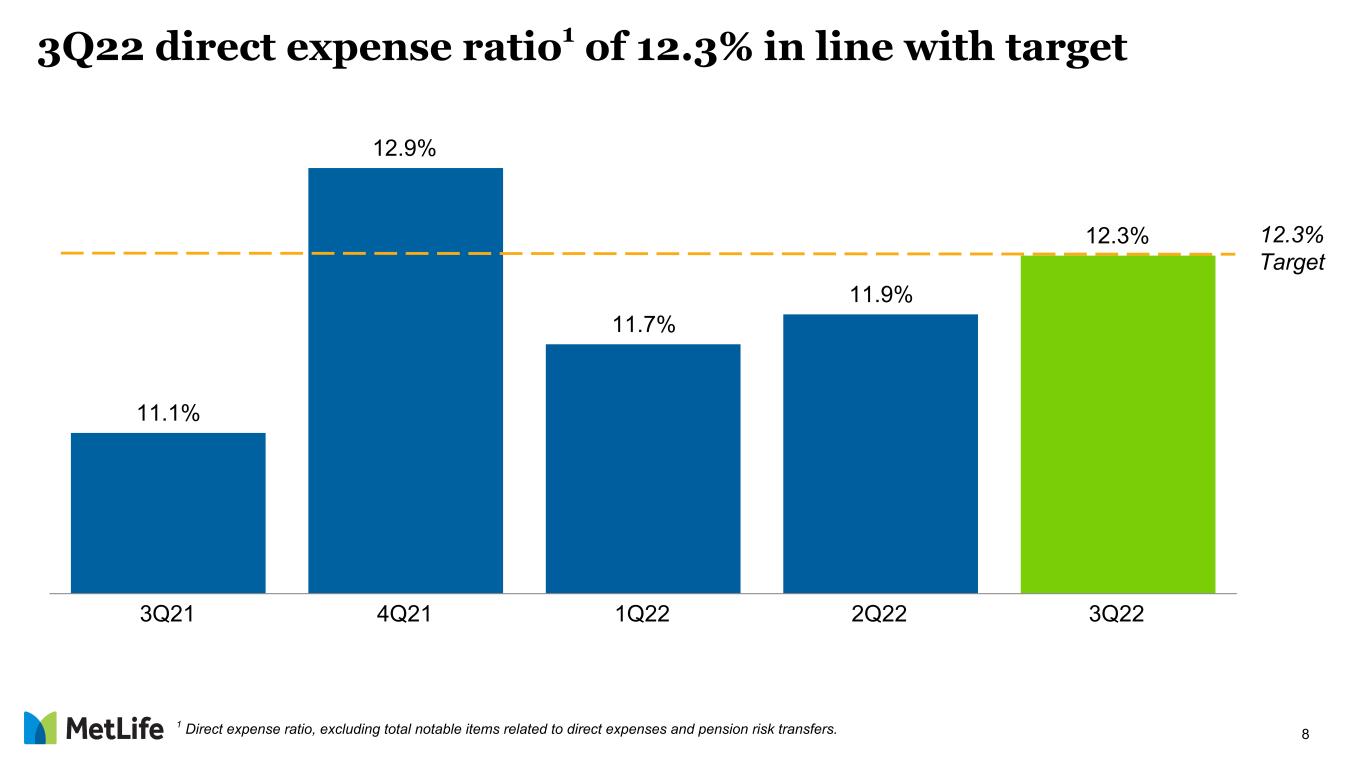

8 11.1% 12.9% 11.7% 11.9% 12.3% 3Q21 4Q21 1Q22 2Q22 3Q22 1 Direct expense ratio, excluding total notable items related to direct expenses and pension risk transfers. 12.3% Target 3Q22 direct expense ratio1 of 12.3% in line with target

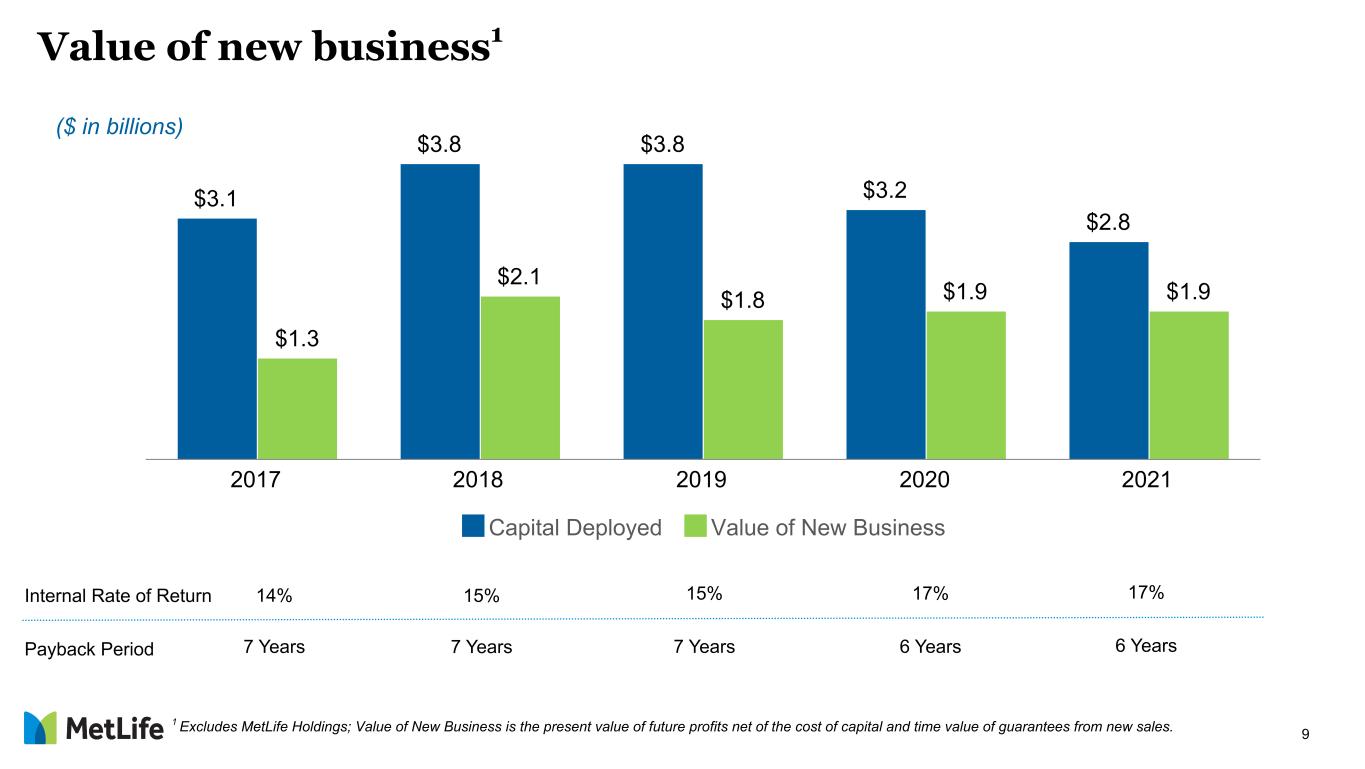

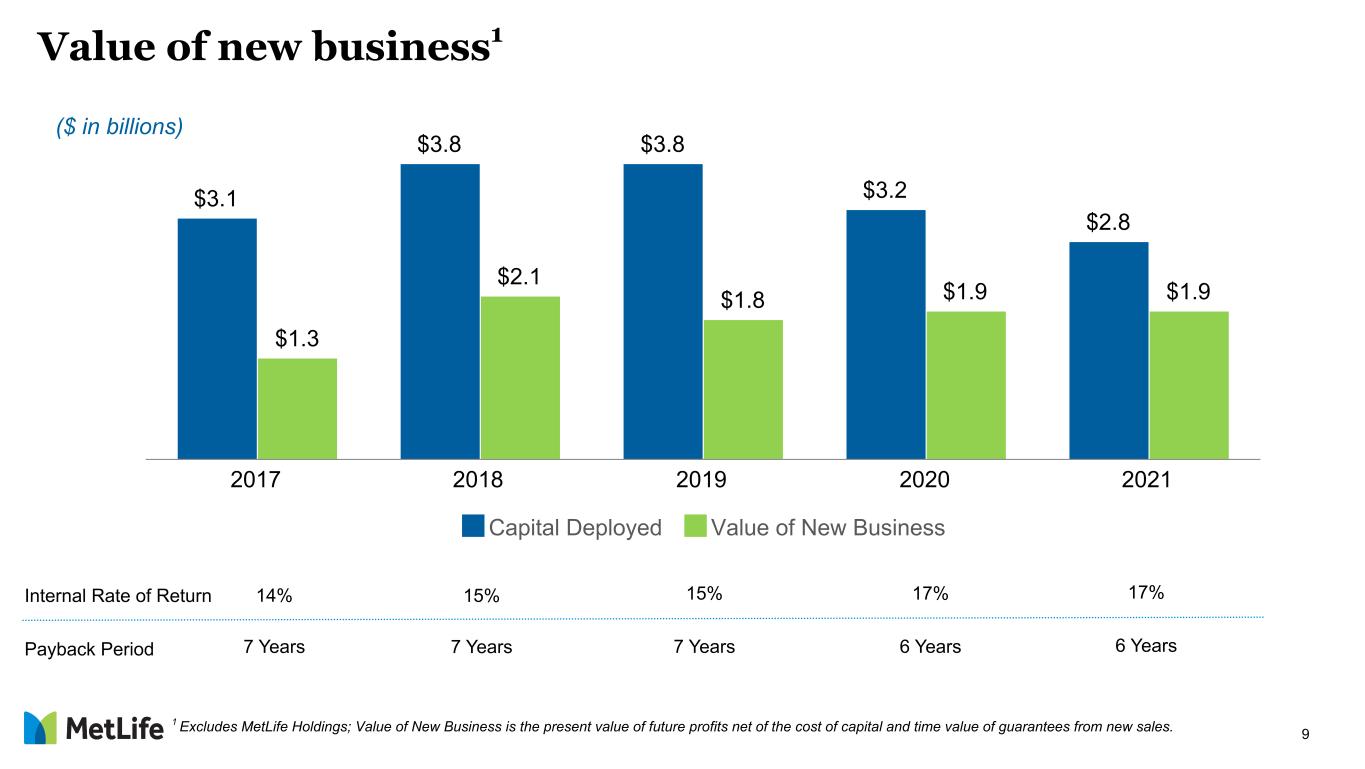

9 Value of new business1 $3.1 $3.8 $3.8 $3.2 $2.8 $1.3 $2.1 $1.8 $1.9 $1.9 Capital Deployed Value of New Business 2017 2018 2019 2020 2021 ($ in billions) Internal Rate of Return Payback Period 15% 7 Years 15% 7 Years 17% 6 Years 14% 7 Years 1 Excludes MetLife Holdings; Value of New Business is the present value of future profits net of the cost of capital and time value of guarantees from new sales. 17% 6 Years

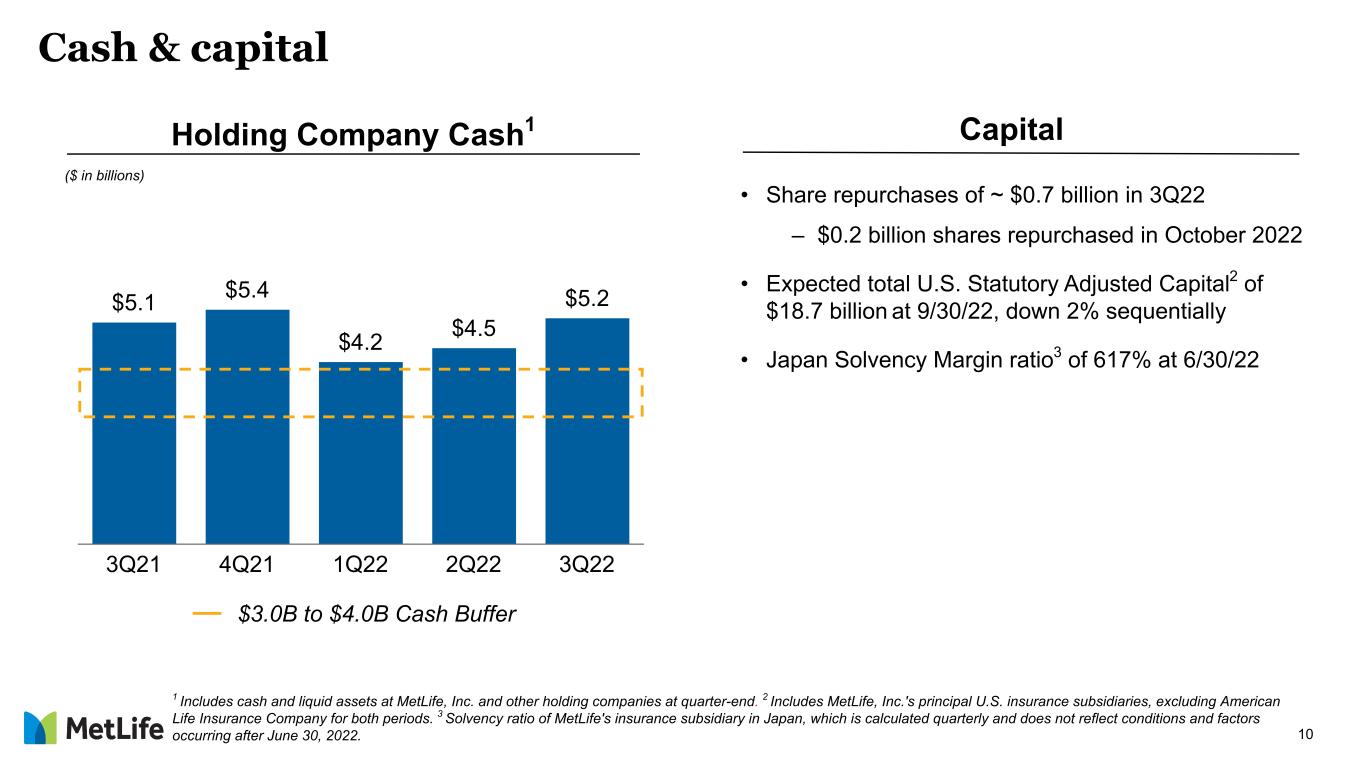

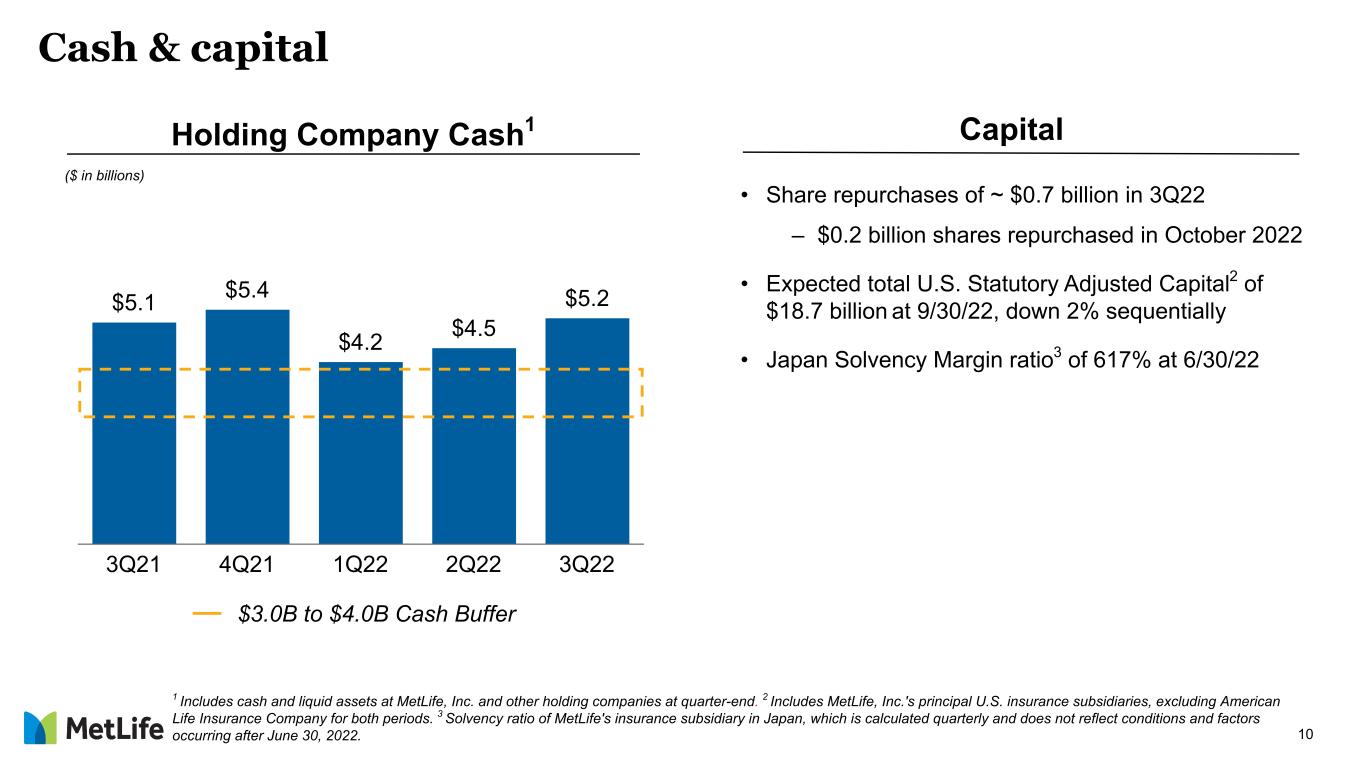

10 Holding Company Cash1 $5.1 $5.4 $4.2 $4.5 $5.2 3Q21 4Q21 1Q22 2Q22 3Q22 Cash & capital 1 Includes cash and liquid assets at MetLife, Inc. and other holding companies at quarter-end. 2 Includes MetLife, Inc.'s principal U.S. insurance subsidiaries, excluding American Life Insurance Company for both periods. 3 Solvency ratio of MetLife's insurance subsidiary in Japan, which is calculated quarterly and does not reflect conditions and factors occurring after June 30, 2022. $3.0B to $4.0B Cash Buffer Capital • Share repurchases of ~ $0.7 billion in 3Q22 – $0.2 billion shares repurchased in October 2022 • Expected total U.S. Statutory Adjusted Capital2 of $18.7 billion at 9/30/22, down 2% sequentially • Japan Solvency Margin ratio3 of 617% at 6/30/22 ($ in billions)

Appendix

12 Group Benefits underwriting impacted by COVID-19 mortality 1 Results are derived from insurance and non-administrative services-only contracts. 2 Excludes certain experience-rated contracts and includes accidental death and dismemberment. 3 COVID-19 reported deaths. 4 Includes an IBNR release related to COVID-19 claims of roughly 1.5 points benefit to the mortality ratio or approximately $25 million benefit to adjusted earnings for each of 1Q22 and 2Q22. Group Benefits Adjusted Earnings 106.2% 106.3% 103.8% 85.8% 86.0% Ratio (as reported) Ratio ex. COVID-19 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 85.0% 90.0% 95.0% 100.0% 105.0% 110.0% Group Life Mortality Ratio1,2 3Q22 Highlights COVID-19 Impact to Adjusted Earnings (~$290M) (~$300M) $111M $20M COVID-19 Impact on Ratio3 85-90% target range • COVID-19 life claims remain low • Minimal non-COVID-19 excess mortality ~18 pts ~18 pts $112M (~$230M) ~14 pts $400M (~$10M)4 ~1 pt4 $399M (~$10M)4 ~1 pt4

13 Cautionary Statement on Forward-Looking Statements The forward-looking statements in this presentation, using words such as “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “if,” “intend,” “likely,” “may,” “plan,” “potential,” “project,” “should,” “will,” and “would,” are based on assumptions and expectations that involve risks and uncertainties, including the “Risk Factors” MetLife, Inc. describes in its U.S. Securities and Exchange Commission filings. MetLife’s future results could differ, and it does not undertake any obligation to publicly correct or update any of these statements.

14 Explanatory Note on Non-GAAP and Other Financial Information Any references in this presentation (except in this Explanatory Note on Non-GAAP Financial Information and Reconciliations) to: Should be read as, respectively: (i) net income (loss); (i) net income (loss) available to MetLife, Inc.’s common shareholders; (ii) net income (loss) per share; (ii) net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; (iii) adjusted earnings; (iii) adjusted earnings available to common shareholders; (iv) adjusted earnings per share; (iv) adjusted earnings available to common shareholders per diluted common share; (v) book value per share; and (v) book value per common share; and (vi) book value per share, excluding AOCI other than FCTA. (vi) book value per common share, excluding AOCI other than FCTA. In this presentation, MetLife presents certain measures of its performance on a consolidated and segment basis that are not calculated in accordance with accounting principles generally accepted in the United States of America (GAAP). MetLife believes that these non-GAAP financial measures enhance the understanding for MetLife and its investors of MetLife's performance by highlighting the results of operations and the underlying profitability drivers of the business. Segment-specific financial measures are calculated using only the portion of consolidated results attributable to that specific segment.

15 Explanatory Note on Non-GAAP and Other Financial Information (Continued) The following non-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with GAAP: Non-GAAP financial measures: Comparable GAAP financial measures: (i) adjusted premiums, fees and other revenues; (i) premiums, fees and other revenues; (ii) adjusted premiums, fees and other revenues, excluding pension risk transfers (PRT); (ii) premiums, fees and other revenues; (iii) adjusted capitalization of deferred policy acquisition costs (DAC); (iii) capitalization of DAC; (iv) adjusted earnings available to common shareholders; (iv) net income (loss) available to MetLife, Inc.’s common shareholders; (v) adjusted earnings available to common shareholders, excluding total notable items; (v) net income (loss) available to MetLife, Inc.’s common shareholders; (vi) adjusted earnings available to common shareholders per diluted common share; (vi) net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; (vii) adjusted earnings available to common shareholders, excluding total notable items, per diluted common share; (vii) net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share; (viii) total MetLife, Inc.’s common stockholders’ equity, excluding AOCI other than FCTA; (viii) total MetLife, Inc.’s stockholders’ equity; (ix) book value per common share, excluding AOCI other than FCTA; (ix) book value per common share; (x) adjusted other expenses; (x) other expenses; (xi) adjusted other expenses, net of adjusted capitalization of DAC; (xi) other expenses, net of capitalization of DAC; (xii) adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses; (xii) other expenses, net of capitalization of DAC; (xiii) adjusted expense ratio; (xiii) expense ratio; (xiv) adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT; (xiv) expense ratio; (xv) direct expenses; (xv) other expenses; (xvi) direct expenses, excluding total notable items related to direct expenses; (xvi) other expenses; (xvii) direct expense ratio; and (xvii) expense ratio; and (xviii) direct expense ratio, excluding total notable items related to direct expenses and PRT. (xviii) expense ratio.

16 Any of these financial measures shown on a constant currency basis reflect the impact of changes in foreign currency exchange rates and are calculated using the average foreign currency exchange rates for the most recent period and applied to the comparable prior period. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in this presentation and in this period’s quarterly financial supplement and earnings news release, which are available at www.metlife.com. Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are not accessible on a forward-looking basis because we believe it is not possible without unreasonable effort to provide other than a range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or outside the range and from period to period and may have a material impact on net income. MetLife’s definitions of non-GAAP and other financial measures discussed in this presentation may differ from those used by other companies: Adjusted earnings and related measures • adjusted earnings; • adjusted earnings available to common shareholders; • adjusted earnings available to common shareholders on a constant currency basis; • adjusted earnings available to common shareholders, excluding total notable items; • adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis; • adjusted earnings available to common shareholders per diluted common share; • adjusted earnings available to common shareholders on a constant currency basis per diluted common share; • adjusted earnings available to common shareholders, excluding total notable items per diluted common share; and • adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis per diluted common share. These measures are used by management to evaluate performance and allocate resources. Consistent with GAAP guidance for segment reporting, adjusted earnings and components of, or other financial measures based on, adjusted earnings are also MetLife’s GAAP measures of segment performance. Adjusted earnings and other financial measures based on adjusted earnings are also the measures by which MetLife senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans. Adjusted earnings and other financial measures based on adjusted earnings allow analysis of MetLife's performance relative to its business plan and facilitate comparisons to industry results. Adjusted earnings is defined as adjusted revenues less adjusted expenses, net of income tax. Adjusted loss is defined as negative adjusted earnings. Adjusted earnings available to common shareholders is defined as adjusted earnings less preferred stock dividends. Adjusted revenues and adjusted expenses These financial measures, along with the related adjusted premiums, fees and other revenues, focus on our primary businesses principally by excluding the impact of market volatility, which could distort trends, and revenues and costs related to non- core products and certain entities required to be consolidated under GAAP. Also, these measures exclude results of discontinued operations under GAAP and other businesses that have been or will be sold or exited by MetLife but do not meet the discontinued operations criteria under GAAP (Divested businesses). Divested businesses also include the net impact of transactions with exited businesses that have been eliminated in consolidation under GAAP and costs relating to businesses that have been or will be sold or exited by MetLife that do not meet the criteria to be included in results of discontinued operations under GAAP. Adjusted revenues also excludes net investment gains (losses) (NIGL) and net derivative gains (losses) (NDGL). Adjusted expenses also excludes goodwill impairments. Explanatory Note on Non-GAAP and Other Financial Information (Continued)

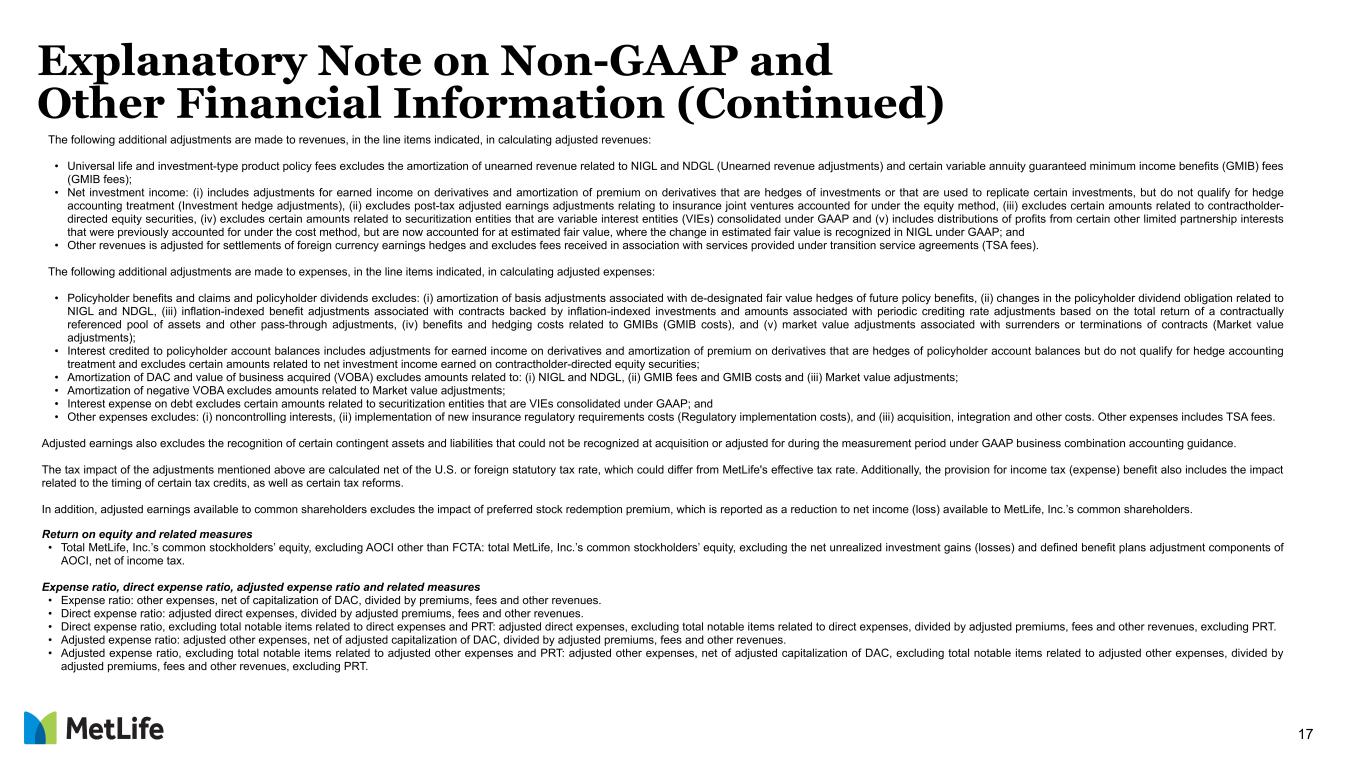

17 Explanatory Note on Non-GAAP and Other Financial Information (Continued) The following additional adjustments are made to revenues, in the line items indicated, in calculating adjusted revenues: • Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to NIGL and NDGL (Unearned revenue adjustments) and certain variable annuity guaranteed minimum income benefits (GMIB) fees (GMIB fees); • Net investment income: (i) includes adjustments for earned income on derivatives and amortization of premium on derivatives that are hedges of investments or that are used to replicate certain investments, but do not qualify for hedge accounting treatment (Investment hedge adjustments), (ii) excludes post-tax adjusted earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iii) excludes certain amounts related to contractholder- directed equity securities, (iv) excludes certain amounts related to securitization entities that are variable interest entities (VIEs) consolidated under GAAP and (v) includes distributions of profits from certain other limited partnership interests that were previously accounted for under the cost method, but are now accounted for at estimated fair value, where the change in estimated fair value is recognized in NIGL under GAAP; and • Other revenues is adjusted for settlements of foreign currency earnings hedges and excludes fees received in association with services provided under transition service agreements (TSA fees). The following additional adjustments are made to expenses, in the line items indicated, in calculating adjusted expenses: • Policyholder benefits and claims and policyholder dividends excludes: (i) amortization of basis adjustments associated with de-designated fair value hedges of future policy benefits, (ii) changes in the policyholder dividend obligation related to NIGL and NDGL, (iii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets and other pass-through adjustments, (iv) benefits and hedging costs related to GMIBs (GMIB costs), and (v) market value adjustments associated with surrenders or terminations of contracts (Market value adjustments); • Interest credited to policyholder account balances includes adjustments for earned income on derivatives and amortization of premium on derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes certain amounts related to net investment income earned on contractholder-directed equity securities; • Amortization of DAC and value of business acquired (VOBA) excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB fees and GMIB costs and (iii) Market value adjustments; • Amortization of negative VOBA excludes amounts related to Market value adjustments; • Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and • Other expenses excludes: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements costs (Regulatory implementation costs), and (iii) acquisition, integration and other costs. Other expenses includes TSA fees. Adjusted earnings also excludes the recognition of certain contingent assets and liabilities that could not be recognized at acquisition or adjusted for during the measurement period under GAAP business combination accounting guidance. The tax impact of the adjustments mentioned above are calculated net of the U.S. or foreign statutory tax rate, which could differ from MetLife's effective tax rate. Additionally, the provision for income tax (expense) benefit also includes the impact related to the timing of certain tax credits, as well as certain tax reforms. In addition, adjusted earnings available to common shareholders excludes the impact of preferred stock redemption premium, which is reported as a reduction to net income (loss) available to MetLife, Inc.’s common shareholders. Return on equity and related measures • Total MetLife, Inc.’s common stockholders’ equity, excluding AOCI other than FCTA: total MetLife, Inc.’s common stockholders’ equity, excluding the net unrealized investment gains (losses) and defined benefit plans adjustment components of AOCI, net of income tax. Expense ratio, direct expense ratio, adjusted expense ratio and related measures • Expense ratio: other expenses, net of capitalization of DAC, divided by premiums, fees and other revenues. • Direct expense ratio: adjusted direct expenses, divided by adjusted premiums, fees and other revenues. • Direct expense ratio, excluding total notable items related to direct expenses and PRT: adjusted direct expenses, excluding total notable items related to direct expenses, divided by adjusted premiums, fees and other revenues, excluding PRT. • Adjusted expense ratio: adjusted other expenses, net of adjusted capitalization of DAC, divided by adjusted premiums, fees and other revenues. • Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT: adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses, divided by adjusted premiums, fees and other revenues, excluding PRT.

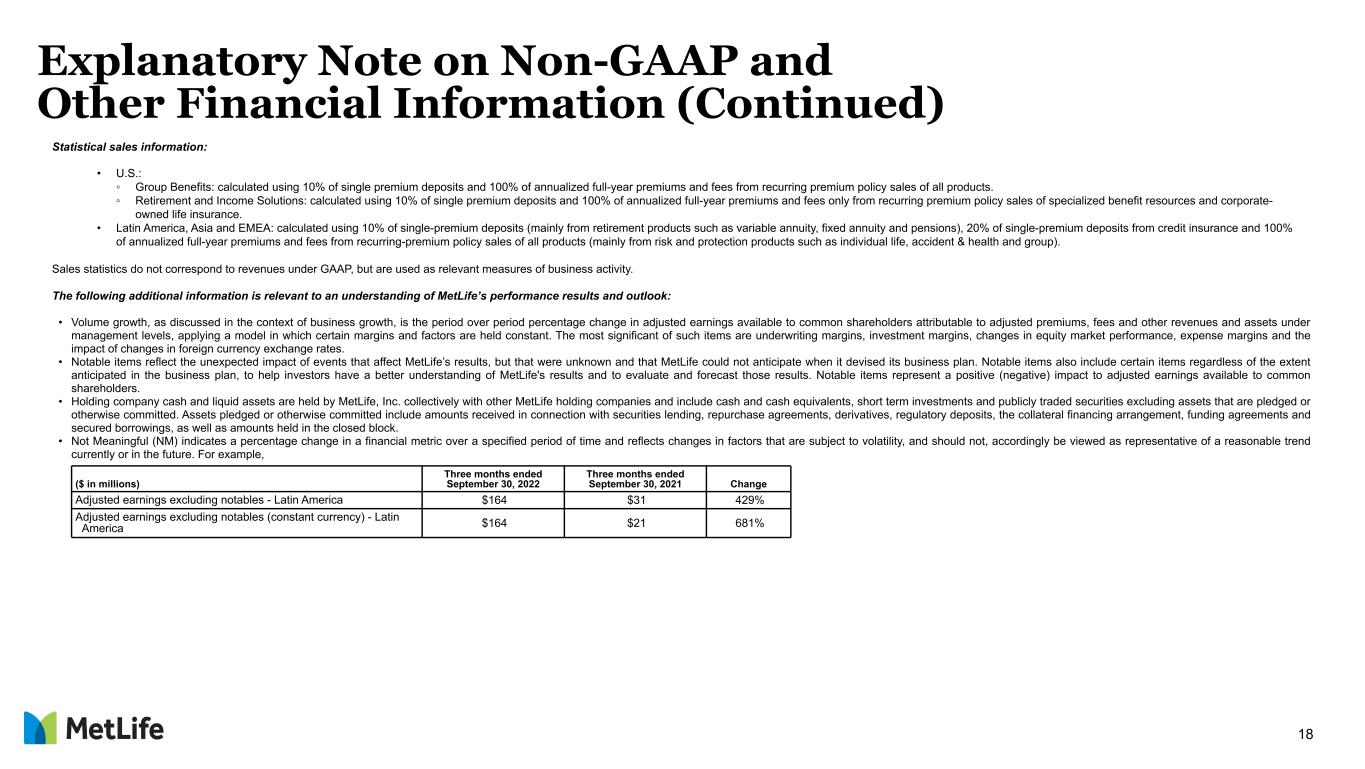

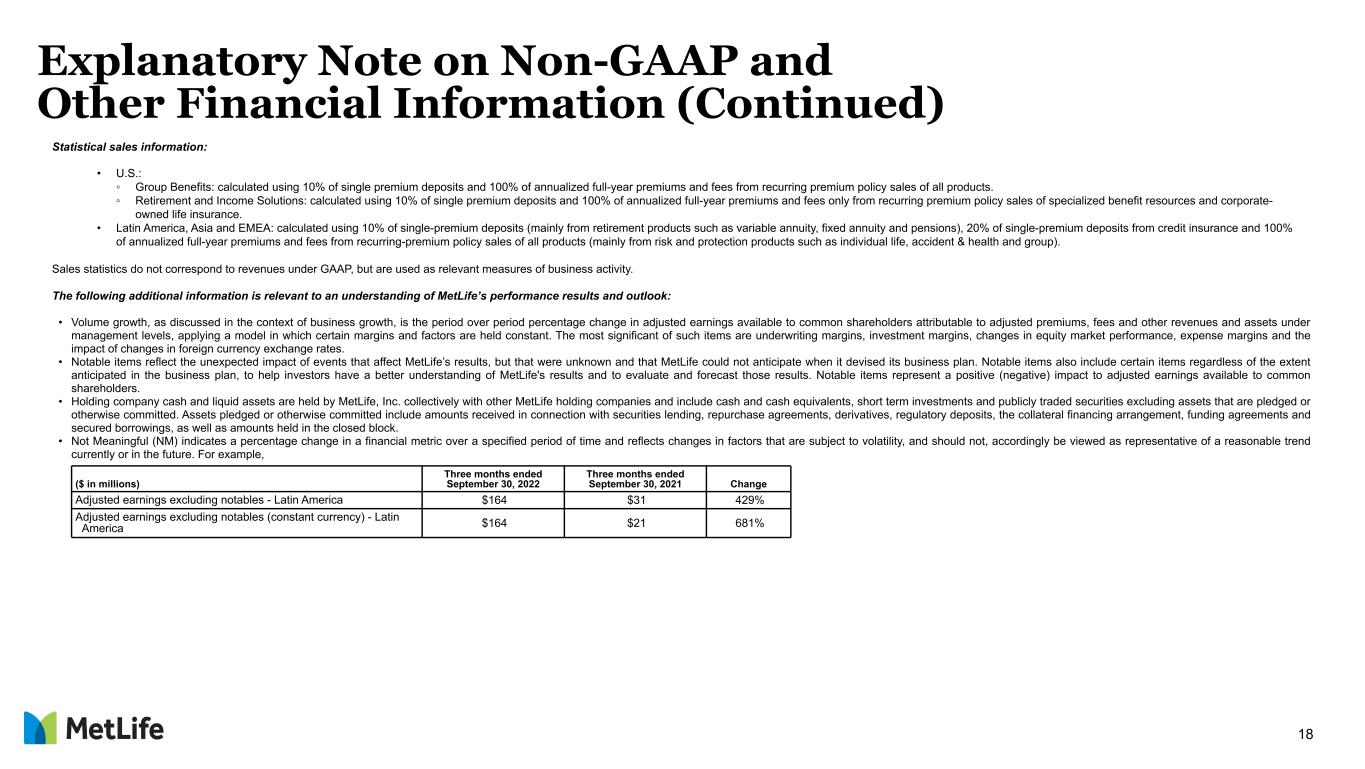

18 Explanatory Note on Non-GAAP and Other Financial Information (Continued) Statistical sales information: • U.S.: ◦ Group Benefits: calculated using 10% of single premium deposits and 100% of annualized full-year premiums and fees from recurring premium policy sales of all products. ◦ Retirement and Income Solutions: calculated using 10% of single premium deposits and 100% of annualized full-year premiums and fees only from recurring premium policy sales of specialized benefit resources and corporate- owned life insurance. • Latin America, Asia and EMEA: calculated using 10% of single-premium deposits (mainly from retirement products such as variable annuity, fixed annuity and pensions), 20% of single-premium deposits from credit insurance and 100% of annualized full-year premiums and fees from recurring-premium policy sales of all products (mainly from risk and protection products such as individual life, accident & health and group). Sales statistics do not correspond to revenues under GAAP, but are used as relevant measures of business activity. The following additional information is relevant to an understanding of MetLife’s performance results and outlook: • Volume growth, as discussed in the context of business growth, is the period over period percentage change in adjusted earnings available to common shareholders attributable to adjusted premiums, fees and other revenues and assets under management levels, applying a model in which certain margins and factors are held constant. The most significant of such items are underwriting margins, investment margins, changes in equity market performance, expense margins and the impact of changes in foreign currency exchange rates. • Notable items reflect the unexpected impact of events that affect MetLife’s results, but that were unknown and that MetLife could not anticipate when it devised its business plan. Notable items also include certain items regardless of the extent anticipated in the business plan, to help investors have a better understanding of MetLife's results and to evaluate and forecast those results. Notable items represent a positive (negative) impact to adjusted earnings available to common shareholders. • Holding company cash and liquid assets are held by MetLife, Inc. collectively with other MetLife holding companies and include cash and cash equivalents, short term investments and publicly traded securities excluding assets that are pledged or otherwise committed. Assets pledged or otherwise committed include amounts received in connection with securities lending, repurchase agreements, derivatives, regulatory deposits, the collateral financing arrangement, funding agreements and secured borrowings, as well as amounts held in the closed block. • Not Meaningful (NM) indicates a percentage change in a financial metric over a specified period of time and reflects changes in factors that are subject to volatility, and should not, accordingly be viewed as representative of a reasonable trend currently or in the future. For example, ($ in millions) Three months ended September 30, 2022 Three months ended September 30, 2021 Change Adjusted earnings excluding notables - Latin America $164 $31 429% Adjusted earnings excluding notables (constant currency) - Latin America $164 $21 681%

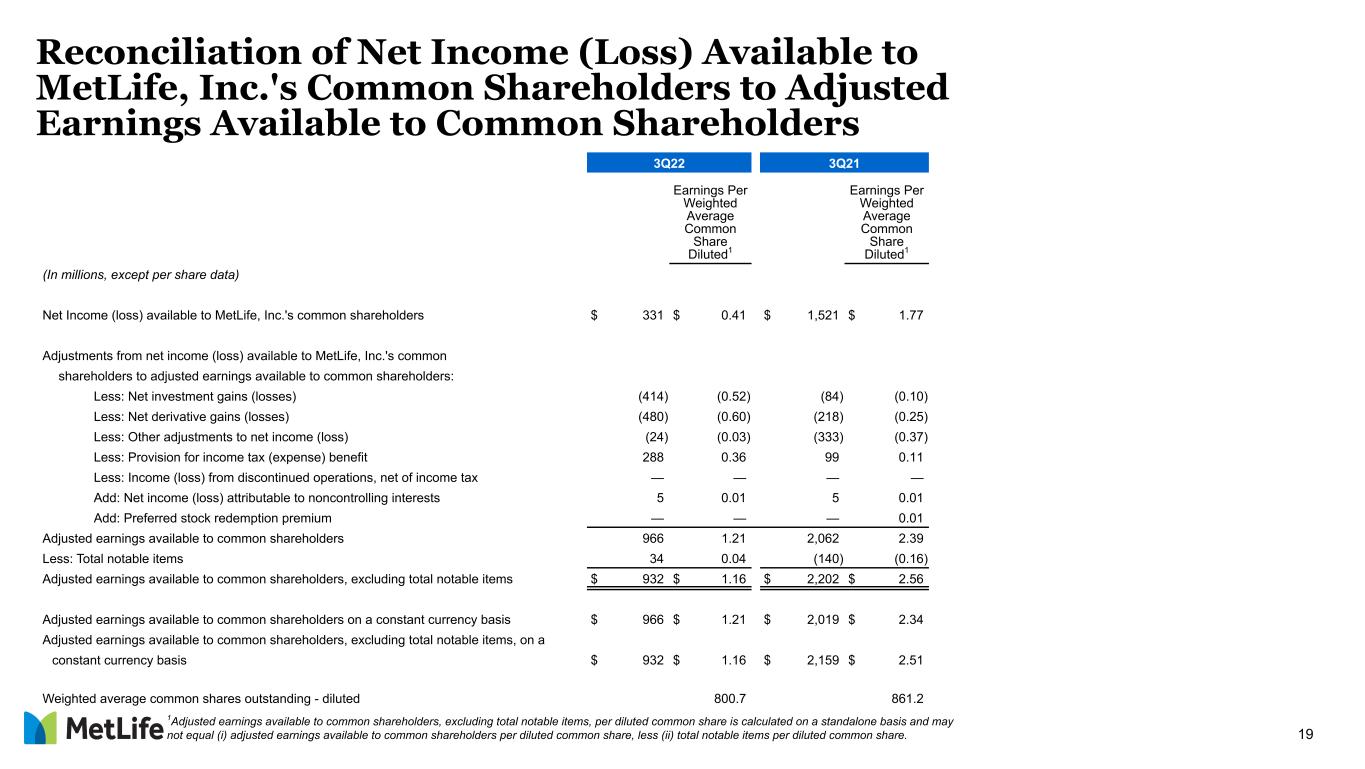

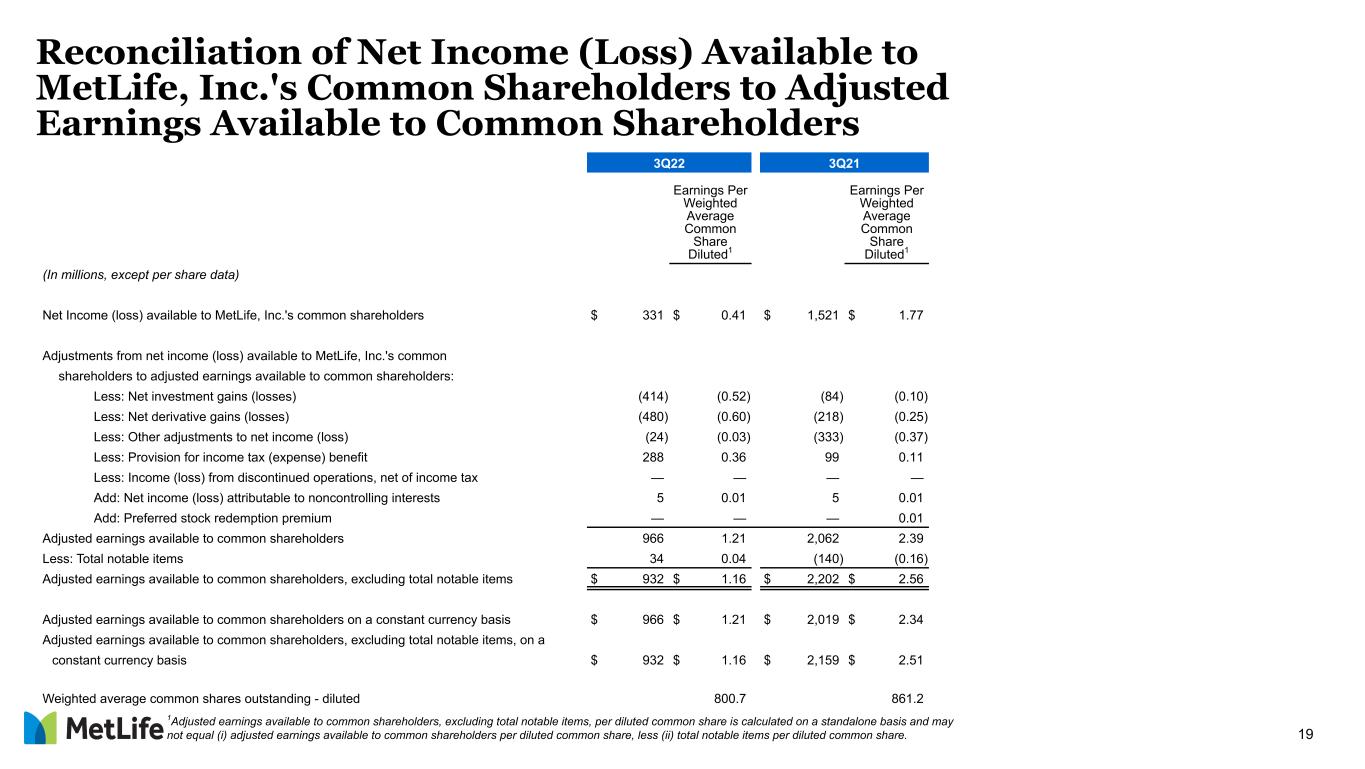

19 Reconciliation of Net Income (Loss) Available to MetLife, Inc.'s Common Shareholders to Adjusted Earnings Available to Common Shareholders 3Q22 3Q21 Earnings Per Weighted Average Common Share Diluted1 Earnings Per Weighted Average Common Share Diluted1 (In millions, except per share data) Net Income (loss) available to MetLife, Inc.'s common shareholders $ 331 $ 0.41 $ 1,521 $ 1.77 Adjustments from net income (loss) available to MetLife, Inc.'s common shareholders to adjusted earnings available to common shareholders: Less: Net investment gains (losses) (414) (0.52) (84) (0.10) Less: Net derivative gains (losses) (480) (0.60) (218) (0.25) Less: Other adjustments to net income (loss) (24) (0.03) (333) (0.37) Less: Provision for income tax (expense) benefit 288 0.36 99 0.11 Less: Income (loss) from discontinued operations, net of income tax — — — — Add: Net income (loss) attributable to noncontrolling interests 5 0.01 5 0.01 Add: Preferred stock redemption premium — — — 0.01 Adjusted earnings available to common shareholders 966 1.21 2,062 2.39 Less: Total notable items 34 0.04 (140) (0.16) Adjusted earnings available to common shareholders, excluding total notable items $ 932 $ 1.16 $ 2,202 $ 2.56 Adjusted earnings available to common shareholders on a constant currency basis $ 966 $ 1.21 $ 2,019 $ 2.34 Adjusted earnings available to common shareholders, excluding total notable items, on a $ 932 $ 1.16 $ 2,159 $ 2.51 constant currency basis Weighted average common shares outstanding - diluted 800.7 861.2 1Adjusted earnings available to common shareholders, excluding total notable items, per diluted common share is calculated on a standalone basis and may not equal (i) adjusted earnings available to common shareholders per diluted common share, less (ii) total notable items per diluted common share.

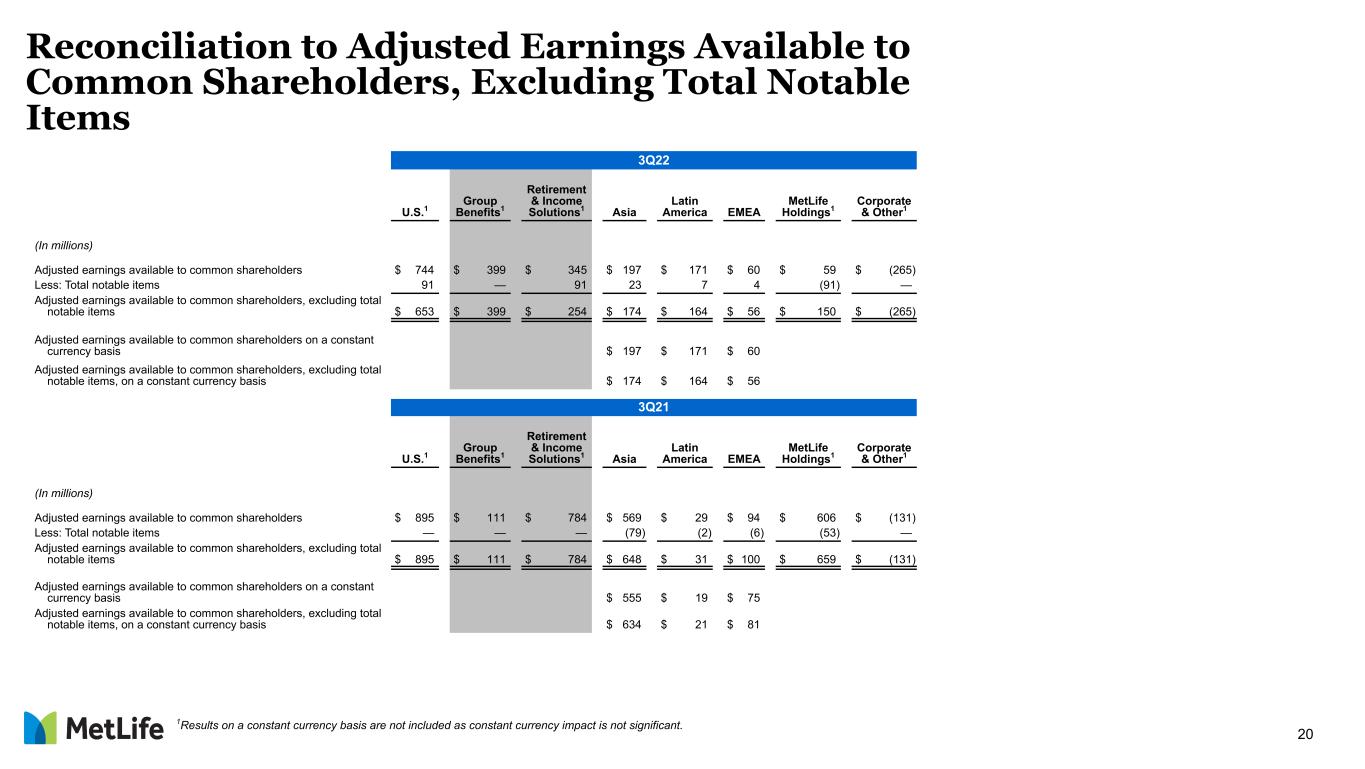

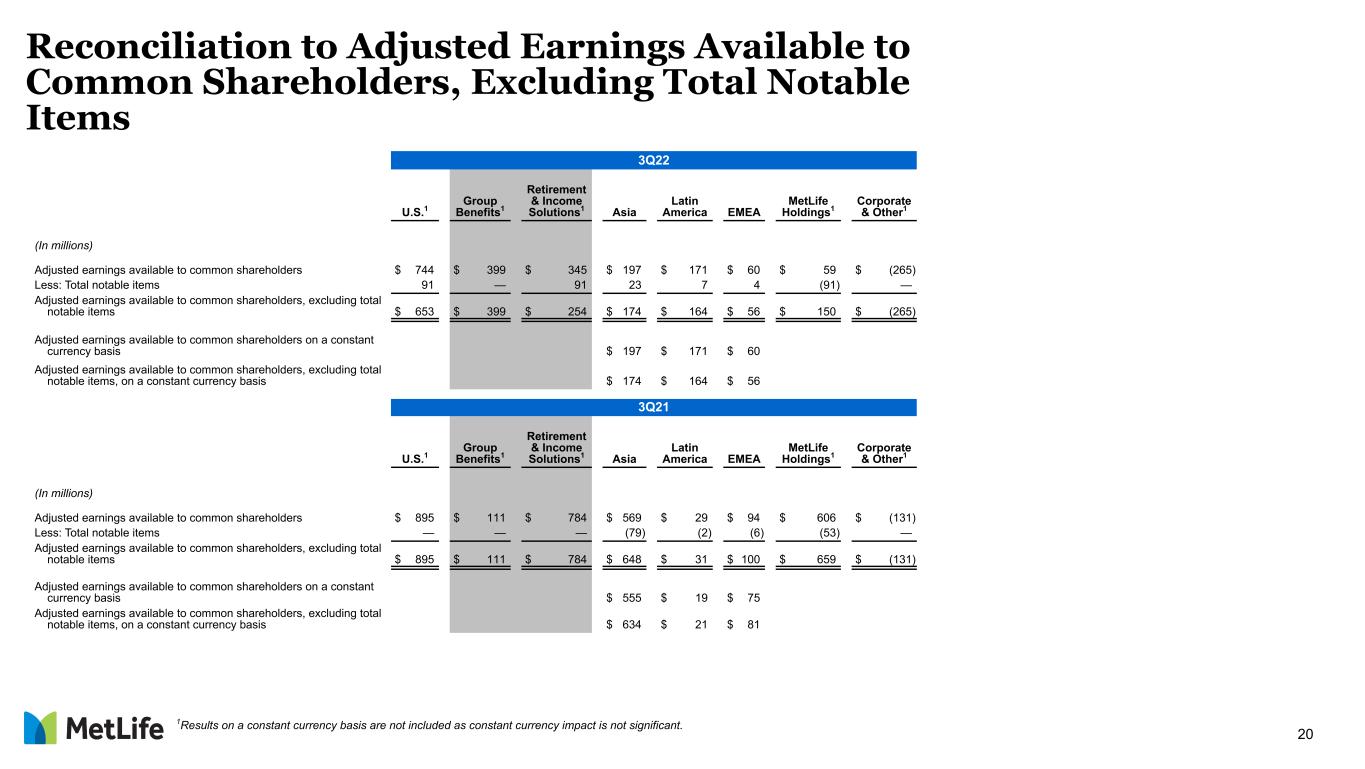

20 Reconciliation to Adjusted Earnings Available to Common Shareholders, Excluding Total Notable Items 3Q22 U.S.1 Group Benefits1 Retirement & Income Solutions1 Asia Latin America EMEA MetLife Holdings1 Corporate & Other1 (In millions) Adjusted earnings available to common shareholders $ 744 $ 399 $ 345 $ 197 $ 171 $ 60 $ 59 $ (265) Less: Total notable items 91 — 91 23 7 4 (91) — Adjusted earnings available to common shareholders, excluding total notable items $ 653 $ 399 $ 254 $ 174 $ 164 $ 56 $ 150 $ (265) Adjusted earnings available to common shareholders on a constant currency basis $ 197 $ 171 $ 60 Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis $ 174 $ 164 $ 56 3Q21 U.S.1 Group Benefits1 Retirement & Income Solutions1 Asia Latin America EMEA MetLife Holdings1 Corporate & Other1 (In millions) Adjusted earnings available to common shareholders $ 895 $ 111 $ 784 $ 569 $ 29 $ 94 $ 606 $ (131) Less: Total notable items — — — (79) (2) (6) (53) — Adjusted earnings available to common shareholders, excluding total notable items $ 895 $ 111 $ 784 $ 648 $ 31 $ 100 $ 659 $ (131) Adjusted earnings available to common shareholders on a constant currency basis $ 555 $ 19 $ 75 Adjusted earnings available to common shareholders, excluding total notable items, on a constant currency basis $ 634 $ 21 $ 81 1Results on a constant currency basis are not included as constant currency impact is not significant.

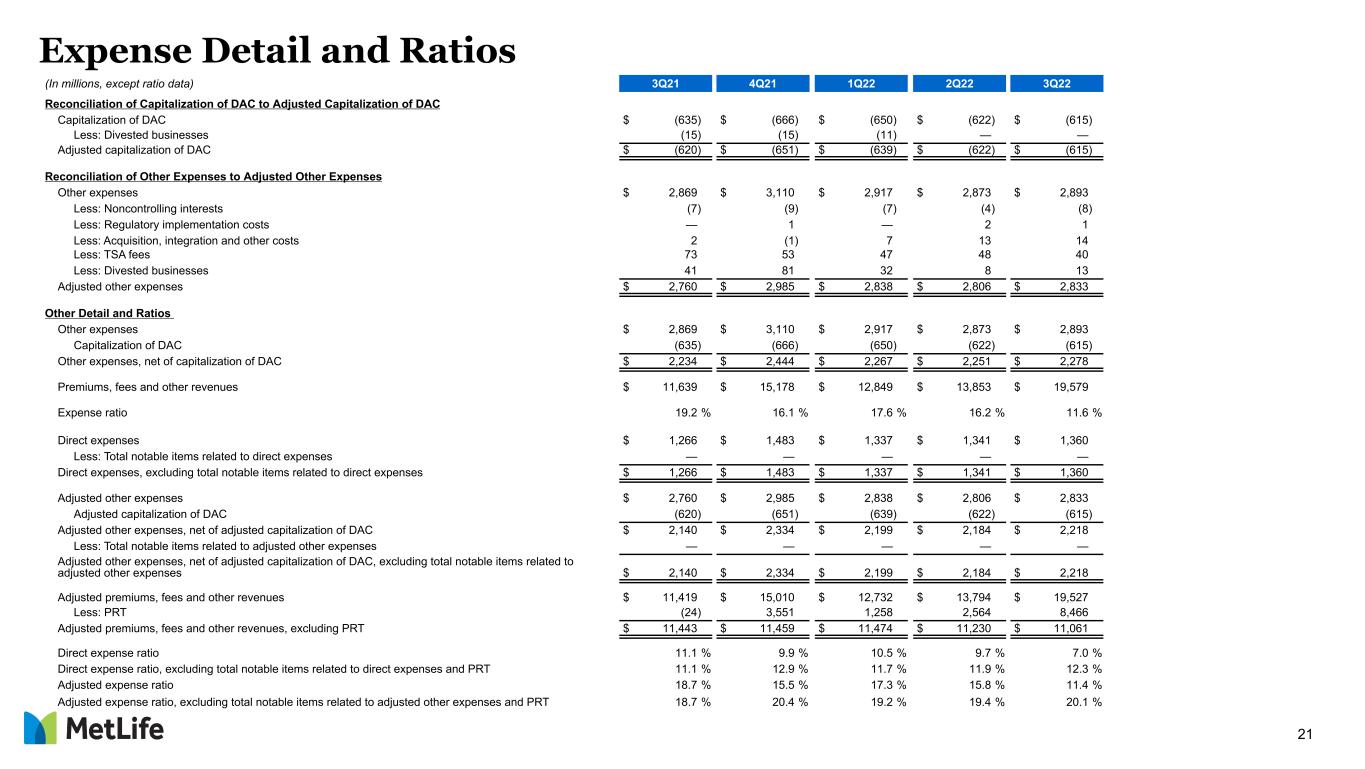

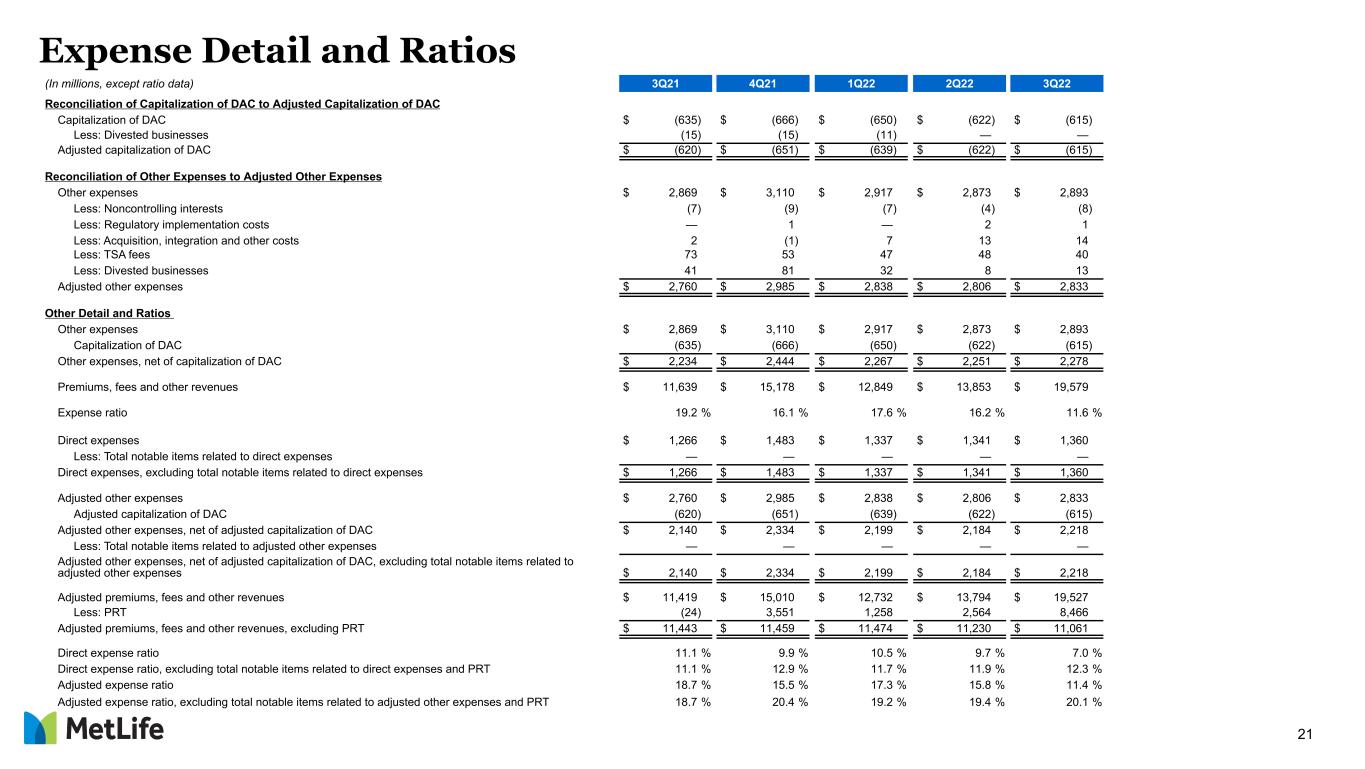

21 Expense Detail and Ratios (In millions, except ratio data) 3Q21 4Q21 1Q22 2Q22 3Q22 Reconciliation of Capitalization of DAC to Adjusted Capitalization of DAC Capitalization of DAC $ (635) $ (666) $ (650) $ (622) $ (615) Less: Divested businesses (15) (15) (11) — — Adjusted capitalization of DAC $ (620) $ (651) $ (639) $ (622) $ (615) Reconciliation of Other Expenses to Adjusted Other Expenses Other expenses $ 2,869 $ 3,110 $ 2,917 $ 2,873 $ 2,893 Less: Noncontrolling interests (7) (9) (7) (4) (8) Less: Regulatory implementation costs — 1 — 2 1 Less: Acquisition, integration and other costs 2 (1) 7 13 14 Less: TSA fees 73 53 47 48 40 Less: Divested businesses 41 81 32 8 13 Adjusted other expenses $ 2,760 $ 2,985 $ 2,838 $ 2,806 $ 2,833 Other Detail and Ratios Other expenses $ 2,869 $ 3,110 $ 2,917 $ 2,873 $ 2,893 Capitalization of DAC (635) (666) (650) (622) (615) Other expenses, net of capitalization of DAC $ 2,234 $ 2,444 $ 2,267 $ 2,251 $ 2,278 Premiums, fees and other revenues $ 11,639 $ 15,178 $ 12,849 $ 13,853 $ 19,579 Expense ratio 19.2 % 16.1 % 17.6 % 16.2 % 11.6 % Direct expenses $ 1,266 $ 1,483 $ 1,337 $ 1,341 $ 1,360 Less: Total notable items related to direct expenses — �� — — — Direct expenses, excluding total notable items related to direct expenses $ 1,266 $ 1,483 $ 1,337 $ 1,341 $ 1,360 Adjusted other expenses $ 2,760 $ 2,985 $ 2,838 $ 2,806 $ 2,833 Adjusted capitalization of DAC (620) (651) (639) (622) (615) Adjusted other expenses, net of adjusted capitalization of DAC $ 2,140 $ 2,334 $ 2,199 $ 2,184 $ 2,218 Less: Total notable items related to adjusted other expenses — — — — — Adjusted other expenses, net of adjusted capitalization of DAC, excluding total notable items related to adjusted other expenses $ 2,140 $ 2,334 $ 2,199 $ 2,184 $ 2,218 Adjusted premiums, fees and other revenues $ 11,419 $ 15,010 $ 12,732 $ 13,794 $ 19,527 Less: PRT (24) 3,551 1,258 2,564 8,466 Adjusted premiums, fees and other revenues, excluding PRT $ 11,443 $ 11,459 $ 11,474 $ 11,230 $ 11,061 Direct expense ratio 11.1 % 9.9 % 10.5 % 9.7 % 7.0 % Direct expense ratio, excluding total notable items related to direct expenses and PRT 11.1 % 12.9 % 11.7 % 11.9 % 12.3 % Adjusted expense ratio 18.7 % 15.5 % 17.3 % 15.8 % 11.4 % Adjusted expense ratio, excluding total notable items related to adjusted other expenses and PRT 18.7 % 20.4 % 19.2 % 19.4 % 20.1 %

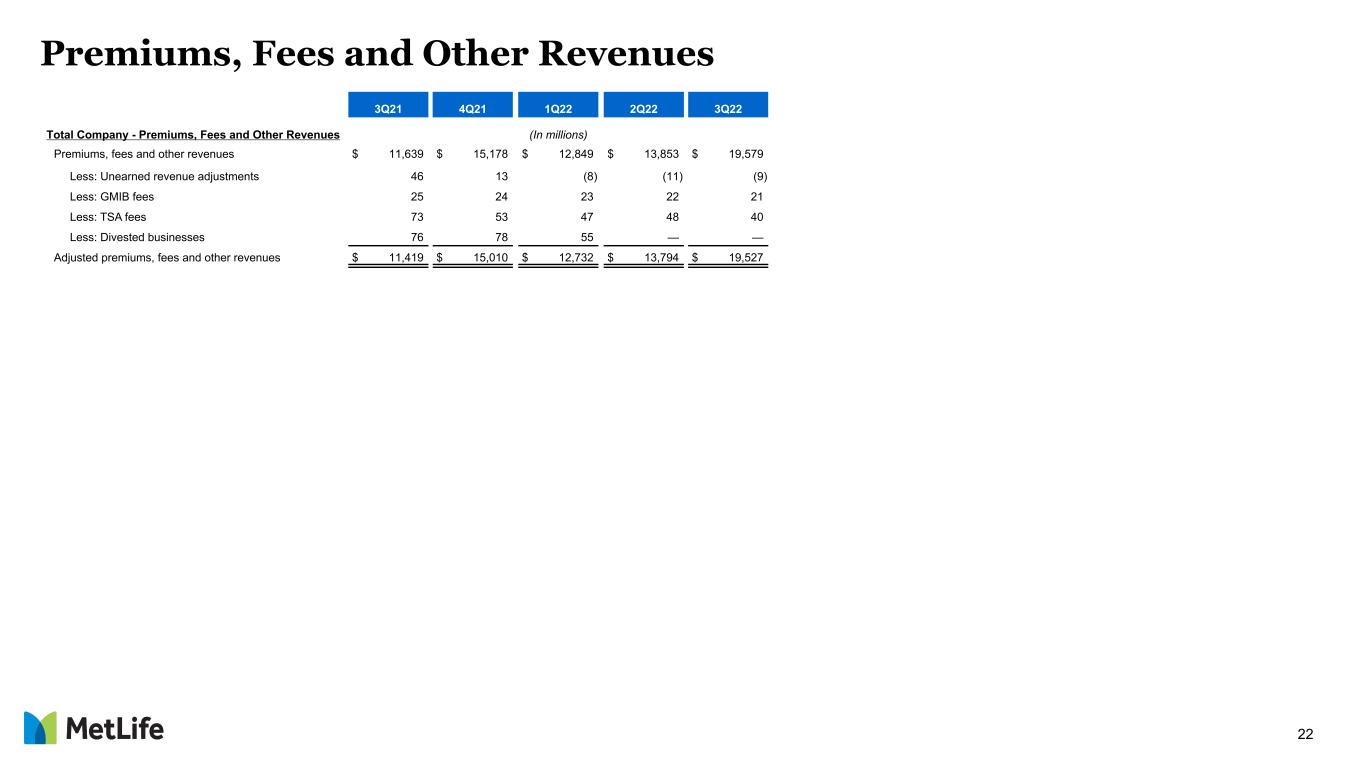

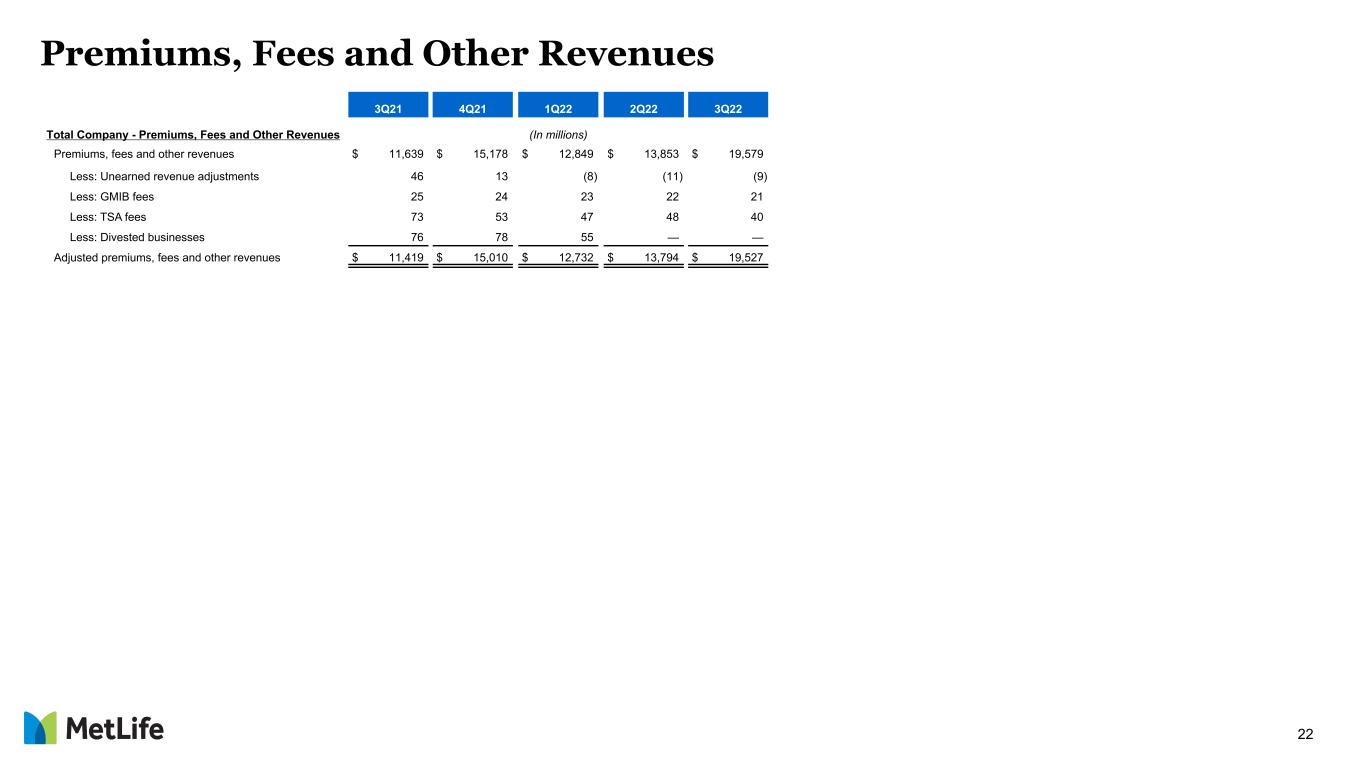

22 Premiums, Fees and Other Revenues 3Q21 4Q21 1Q22 2Q22 3Q22 Total Company - Premiums, Fees and Other Revenues (In millions) Premiums, fees and other revenues $ 11,639 $ 15,178 $ 12,849 $ 13,853 $ 19,579 Less: Unearned revenue adjustments 46 13 (8) (11) (9) Less: GMIB fees 25 24 23 22 21 Less: TSA fees 73 53 47 48 40 Less: Divested businesses 76 78 55 — — Adjusted premiums, fees and other revenues $ 11,419 $ 15,010 $ 12,732 $ 13,794 $ 19,527

23