Exhibit 99.1

MetLife

© PNTS

John McCallion

Vice President Investor Relations

INVESTOR DAY 2012

MetLife

Safe Harbor Statement

These materials may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operations and financial results.

Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the actual future results of MetLife, Inc., its subsidiaries and affiliates. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties, and other factors that might cause such differences include the risks, uncertainties and other factors identified in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission (the “SEC”). These factors include: (1) difficult conditions in the global capital markets; (2) concerns over U.S. fiscal policy and the trajectory of the national debt of the U.S., as well as rating agency downgrades of U.S. Treasury securities; (3) uncertainty about the effectiveness of governmental and regulatory actions to stabilize the financial system, the imposition of fees relating thereto, or the promulgation of additional regulations; (4) increased volatility and disruption of the capital and credit markets, which may affect our ability to seek financing or access our credit facilities; (5) impact of comprehensive financial services regulation reform on us; (6) economic, political, legal, currency and other risks relating to our international operations, including with respect to fluctuations of exchange rates; (7) exposure to financial and capital market risk, including as a result of the disruption in Europe and possible withdrawal of one or more countries from the Euro zone; (8) changes in general economic conditions, including the performance of financial markets and interest rates, which may affect our ability to raise capital, generate fee income and market-related revenue and finance statutory reserve requirements and may require us to pledge collateral or make payments related to declines in value of specified assets; (9) potential liquidity and other risks resulting from our participation in a securities lending program and other transactions; (10) investment losses and defaults, and changes to investment valuations; (11) impairments of goodwill and realized losses or market value impairments to illiquid assets; (12) defaults on our mortgage loans; (13) the defaults or deteriorating credit of other financial institutions that could adversely affect us; (14) our ability to address unforeseen liabilities, asset impairments, or rating actions arising from acquisitions or dispositions, including our acquisition of American Life Insurance Company and Delaware American Life Insurance Company (collectively, “ALICO”) and to successfully integrate and manage the growth of acquired businesses with minimal disruption; (15) uncertainty with respect to the outcome of the closing agreement entered into with the United States Internal Revenue Service in connection with the acquisition of ALICO;

2

MetLife

Safe Harbor Statement (continued)

(16) the dilutive impact on our stockholders resulting from the settlement of common equity units issued in connection with the acquisition of ALICO or otherwise; (17) MetLife, Inc.’s primary reliance, as a holding company, on dividends from its subsidiaries to meet debt payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; (18) downgrades in our claims paying ability, financial strength or credit ratings; (19) ineffectiveness of risk management policies and procedures; (20) availability and effectiveness of reinsurance or indemnification arrangements, as well as default or failure of counterparties to perform; (21) discrepancies between actual claims experience and assumptions used in setting prices for our products and establishing the liabilities for our obligations for future policy benefits and claims; (22) catastrophe losses; (23) heightened competition, including with respect to pricing, entry of new competitors, consolidation of distributors, the development of new products by new and existing competitors, distribution of amounts available under U.S. government programs, and for personnel; (24) unanticipated changes in industry trends; (25) changes in assumptions related to investment valuations, deferred policy acquisition costs, deferred sales inducements, value of business acquired or goodwill; (26) changes in accounting standards, practices and/or policies; (27) increased expenses relating to pension and postretirement benefit plans, as well as health care and other employee benefits; (28) exposure to losses related to variable annuity guarantee benefits, including from significant and sustained downturns or extreme volatility in equity markets, reduced interest rates, unanticipated policyholder behavior, mortality or longevity, and the adjustment for nonperformance risk; (29) deterioration in the experience of the “closed block” established in connection with the reorganization of Metropolitan Life Insurance Company; (30) adverse results or other consequences from litigation, arbitration or regulatory investigations; (31) inability to protect our intellectual property rights or claims of infringement of the intellectual property rights of others; (32) discrepancies between actual experience and assumptions used in establishing liabilities related to other contingencies or obligations; (33) regulatory, legislative or tax changes relating to our insurance, banking, international, or other operations that may affect the cost of, or demand for, our products or services, or increase the cost or administrative burdens of providing benefits to employees; (34) the effects of business disruption or economic contraction due to disasters such as terrorist attacks, cyberattacks, other hostilities, or natural catastrophes, including any related impact on our disaster recovery systems, cyber- or other information security systems and management continuity planning; (35) the effectiveness of our programs and practices in avoiding giving our associates incentives to take excessive risks; and (36) other risks and uncertainties described from time to time in MetLife, Inc.’s filings with the SEC.

MetLife, Inc. does not undertake any obligation to publicly correct or update any forward-looking statement if MetLife, Inc. later becomes aware that such statement is not likely to be achieved. Please consult any further disclosures MetLife, Inc. makes on related subjects in reports to the SEC.

3

MetLife

Explanatory Note on Non-GAAP Financial Information

All references in these presentations (except in this Explanatory Note on Non-GAAP Financial Information slide) to operating earnings, premiums, fees and other revenues and return on equity, should be read as operating earnings available to common shareholders, premiums, fees and other revenues (operating) and operating return on MetLife, Inc.’s common equity, excluding AOCI, respectively.

Operating earnings is the measure of segment profit or loss that MetLife uses to evaluate segment performance and allocate resources. Consistent with accounting principles generally accepted in the United States of America (“GAAP”) accounting guidance for segment reporting, operating earnings is MetLife’s measure of segment performance. Operating earnings is also a measure by which MetLife senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans.

Operating earnings is defined as operating revenues less operating expenses, both net of income tax. Operating earnings available to common shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or exited by MetLife, Inc. (“Divested Businesses”). Operating revenues also excludes net investment gains (losses) (“NIGL”) and net derivative gains (losses) (“NDGL”).

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to NIGL and NDGL and certain variable annuity guaranteed minimum income benefits (“GMIB”) fees (“GMIB Fees”);

Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are hedges of investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations, (iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iv) excludes certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to securitization entities that are variable interest entities (“VIEs”) consolidated under GAAP; and

Other revenues are adjusted for settlements of foreign currency earnings hedges.

4

MetLife

Explanatory Note on Non-GAAP Financial Information (Continued)

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

• Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to NIGL and NDGL, (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments associated with surrenders or terminations of contracts (“Market Value Adjustments”);

• Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium on derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes amounts related to net investment income earned on contractholder-directed unit-linked investments;

• Amortization of deferred policy acquisition costs (“DAC”) and value of business acquired (“VOBA”) excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB Fees and GMIB Costs, and (iii) Market Value Adjustments;

• Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

• Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

• Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and (iii) acquisition and integration costs.

Operating return on MetLife, Inc. common equity is defined as operating earnings available to common shareholders divided by average GAAP common equity.

MetLife believes the presentation of operating earnings and operating earnings available to common shareholders as MetLife measures it for management purposes enhances the understanding of the company’s performance by highlighting the results of operations and the underlying profitability drivers of the business. Operating revenues, operating expenses, operating earnings, operating earnings available to common shareholders, operating earnings available to common shareholders per diluted common share, operating return on MetLife, Inc.’s common equity and operating return on MetLife, Inc.’s common equity, excluding AOCI, should not be viewed as substitutes for the following financial measures calculated in accordance with GAAP: GAAP revenues, GAAP expenses, GAAP income (loss) from continuing operations, net of income tax, GAAP net income (loss) available to MetLife, Inc.’s common shareholders, GAAP net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share, return on MetLife, Inc.’s common equity and return on MetLife, Inc.’s common equity, excluding AOCI, respectively.

5

MetLife

Explanatory Note on Non-GAAP Financial Information (Continued)

For the historical periods presented, reconciliations of non-GAAP measures used in this presentation to the most directly comparable GAAP measures are included in this Appendix to the presentation materials and are on the Investor Relations portion of our Internet website. Additional information about our historical results is also available on our Internet website in our Quarterly Financial Supplements for the corresponding periods.

The non-GAAP measures used in this presentation should not be viewed as substitutes for the most directly comparable GAAP measures.

In these presentations, we sometimes refer to sales activity for various products. These sales statistics do not correspond to revenues under GAAP, but are used as relevant measures of business activity.

In these presentations, we provide guidance on our future earnings, premiums, fees and other revenues, and return on common equity on an operating or non-GAAP basis. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is not accessible on a forward-looking basis because we believe it is not possible to provide other than a range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or without the range and from period to period and may have a significant impact on GAAP net income.

6

MetLife

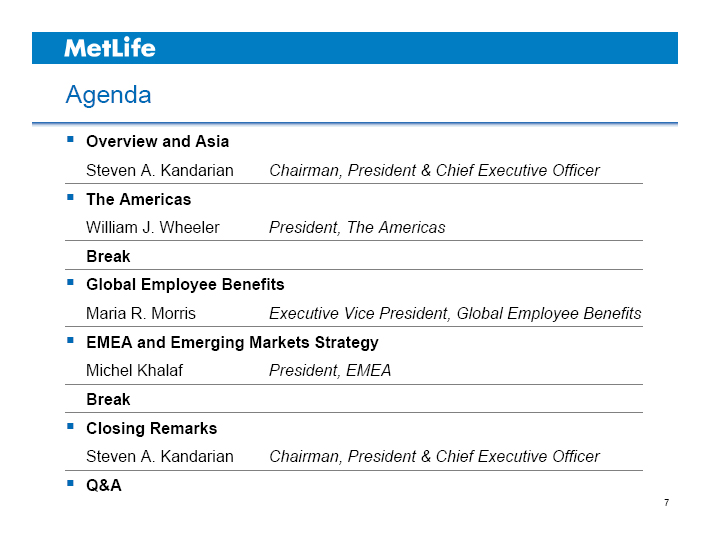

Agenda

Overview and Asia

Steven A. Kandarian Chairman, President & Chief Executive Officer

The Americas

William J. Wheeler President, The Americas

Break

Global Employee Benefits

Maria R. Morris Executive Vice President, Global Employee Benefits

EMEA and Emerging Markets Strategy

Michel Khalaf President, EMEA

Break

Closing Remarks

Steven A. Kandarian Chairman, President & Chief Executive Officer

Q&A

7

MetLife

MetLife

© PNTS

Steven A. Kandarian

Chairman, President & Chief Executive Officer

INVESTOR DAY 2012

MetLife

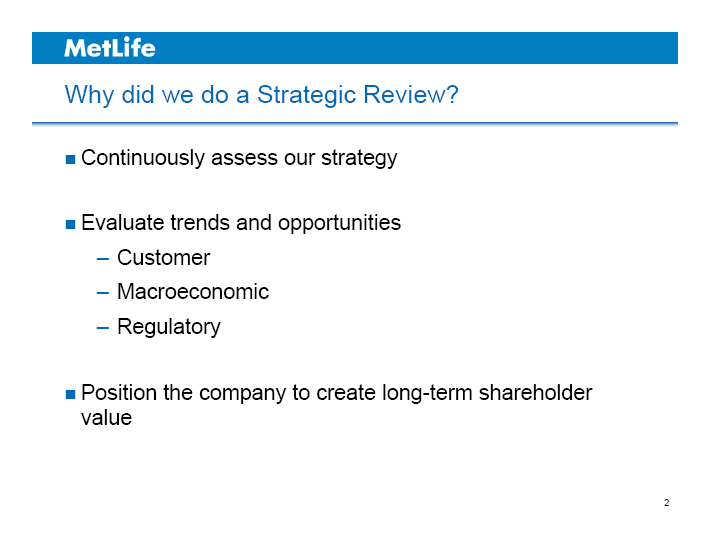

Why did we do a Strategic Review?

Continuously assess our strategy

Evaluate trends and opportunities

– Customer

– Macroeconomic

– Regulatory

Position the company to create long-term shareholder value

2

MetLife

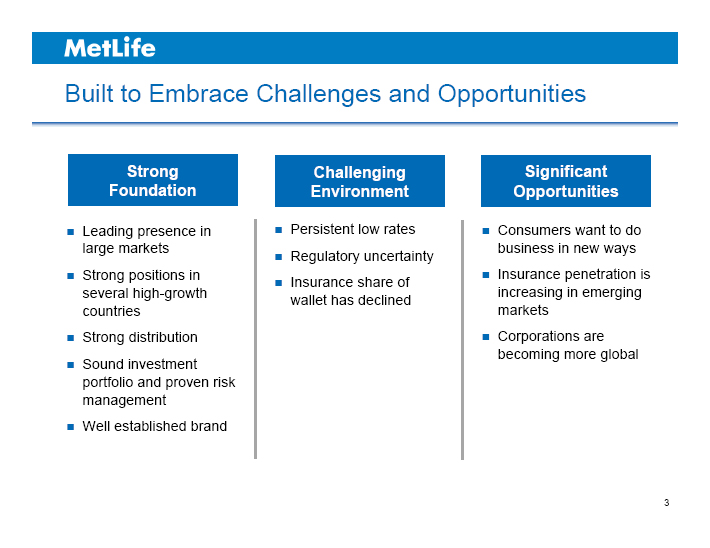

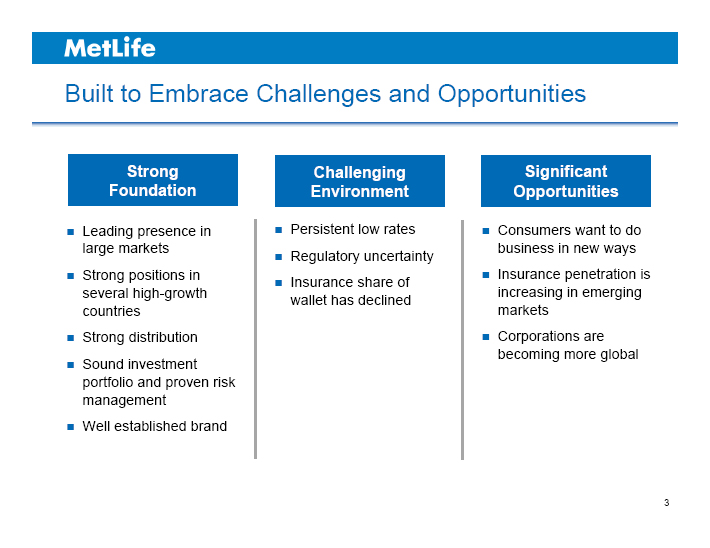

Built to Embrace Challenges and Opportunities

Strong Foundation

Challenging Environment

Significant Opportunities

Leading presence in large markets

Strong positions in several high-growth countries

Strong distribution

Sound investment portfolio and proven risk management

Well established brand

Persistent low rates

Regulatory uncertainty

Insurance share of wallet has declined

Consumers want to do business in new ways

Insurance penetration is increasing in emerging markets

Corporations are becoming more global

3

MetLife

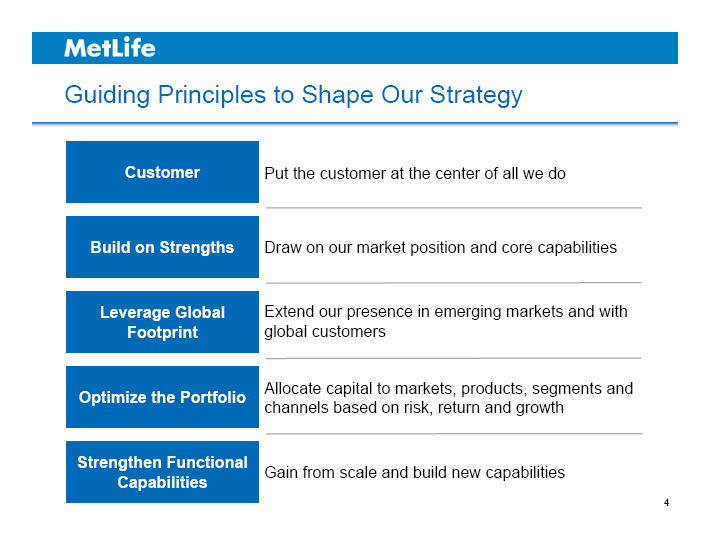

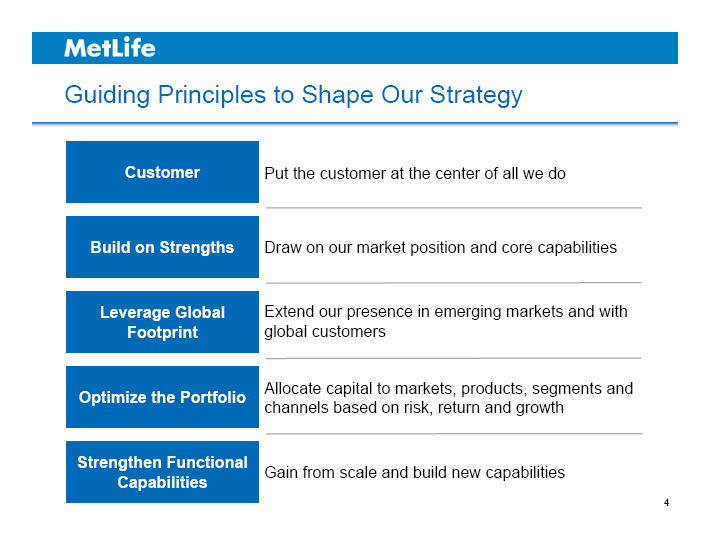

Guiding Principles to Shape Our Strategy

Customer Put the customer at the center of all we do

Build on Strengths Draw on our market position and core capabilities

Leverage Global Footprint Extend our presence in emerging markets and with global customers

Optimize the Portfolio Allocate capital to markets, products, segments and channels based on risk, return and growth

Strengthen Functional Capabilities Gain from scale and build new capabilities

4

MetLife

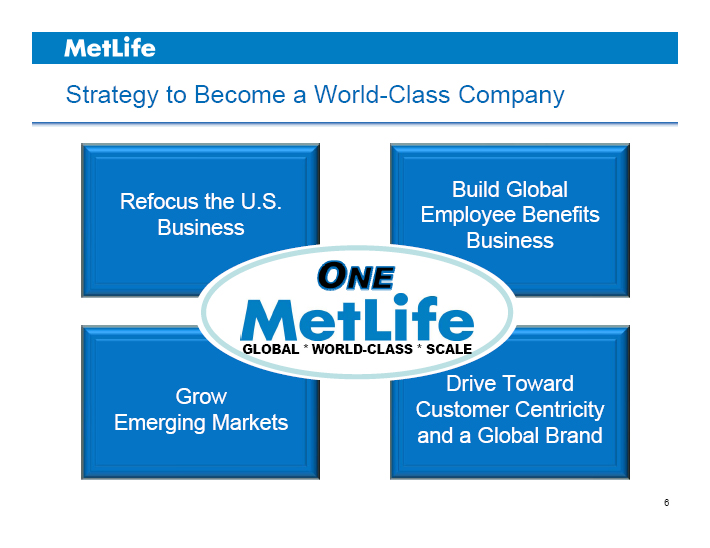

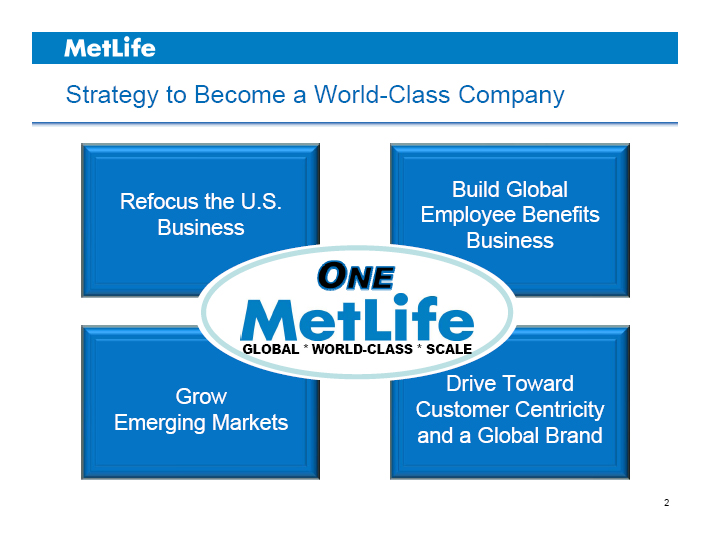

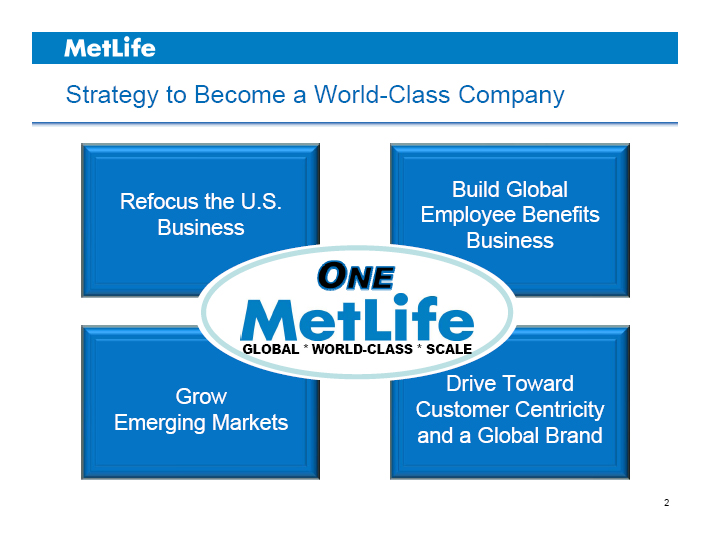

Strategy to Become a World-Class Company

ONE MetLife

GLOBAL * WORLD-CLASS * SCALE

Global: Operate as a Global Company

World-Class: Raise the Bar to be a World-Class Company

Scale: Leverage Our Scale to Create Efficiencies

5

MetLife

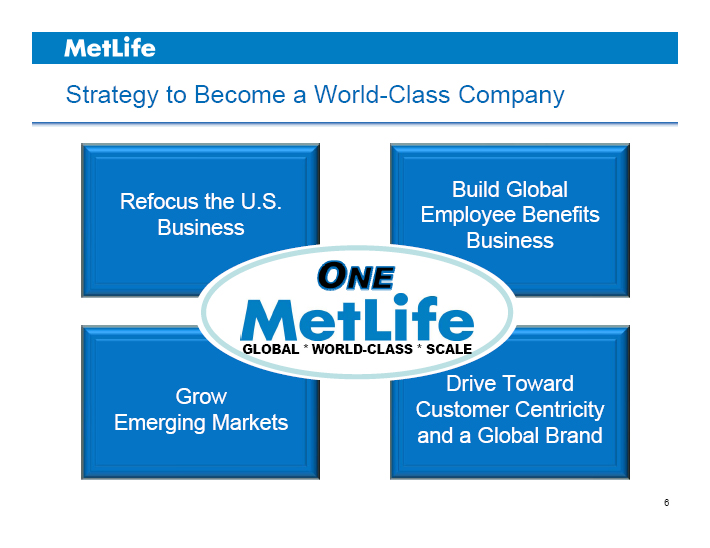

Strategy to Become a World-Class Company

ONE MetLife

GLOBAL * WORLD-CLASS * SCALE

Refocus the U.S. Business

Build Global Employee Benefits Business

Grow Emerging Markets

Drive Toward Customer Centricity and a Global Brand

6

MetLife

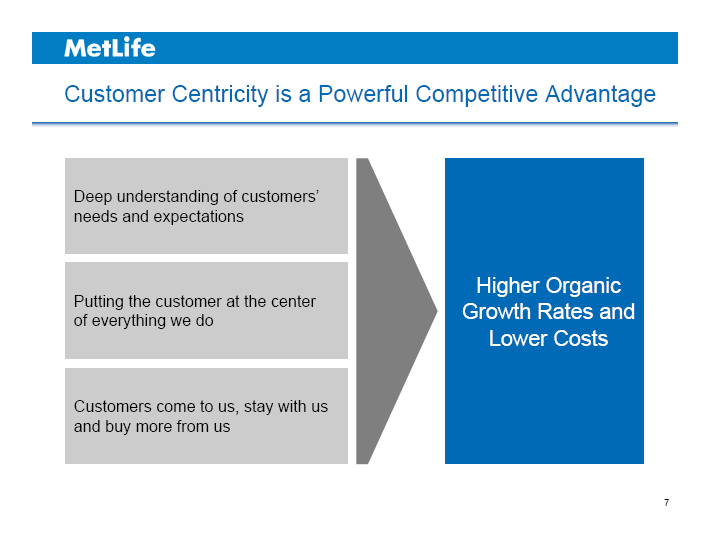

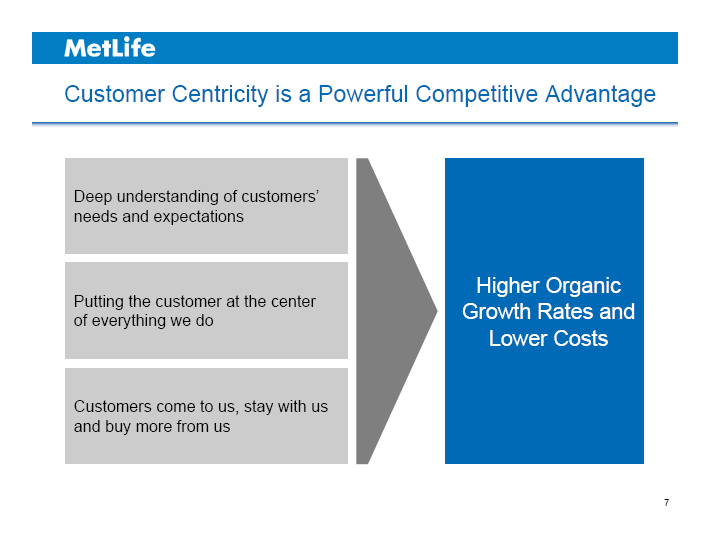

Customer Centricity is a Powerful Competitive Advantage

Deep understanding of customers’ needs and expectations

Putting the customer at the center of everything we do

Customers come to us, stay with us and buy more from us

Higher Organic Growth Rates and Lower Costs

7

MetLife

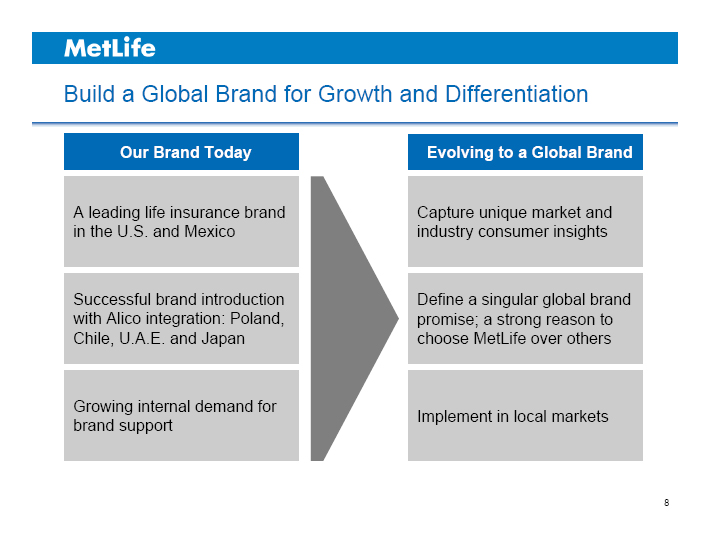

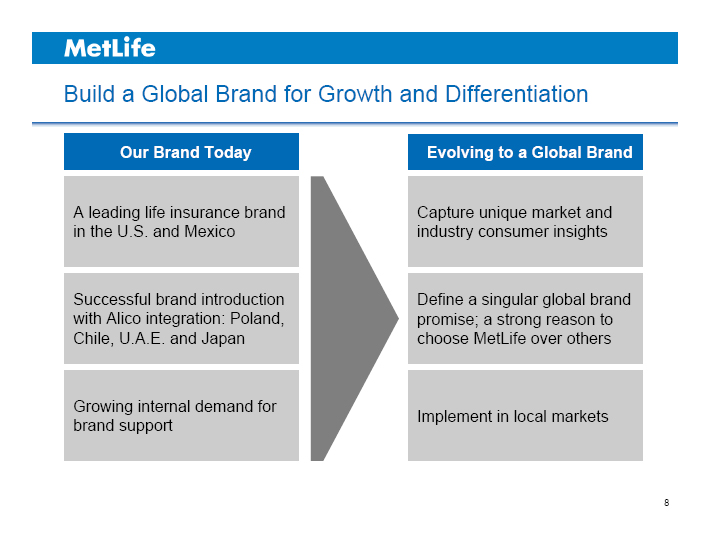

Build a Global Brand for Growth and Differentiation

Our Brand Today Evolving to a Global Brand

A leading life insurance brand in the U.S. and Mexico

Successful brand introduction with Alico integration: Poland, Chile, U.A.E. and Japan

Growing internal demand for brand support

Capture unique market and industry consumer insights

Define a singular global brand promise; a strong reason to choose MetLife over others

Implement in local markets

8

MetLife

© PNTS

Strategic Goals

MetLife

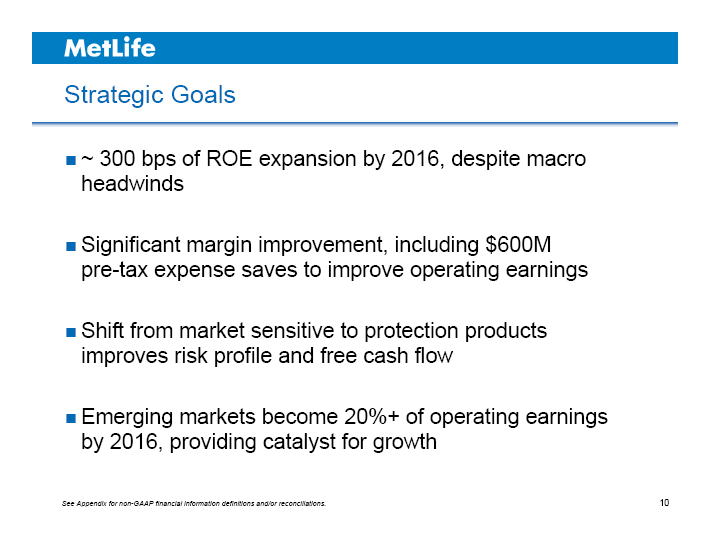

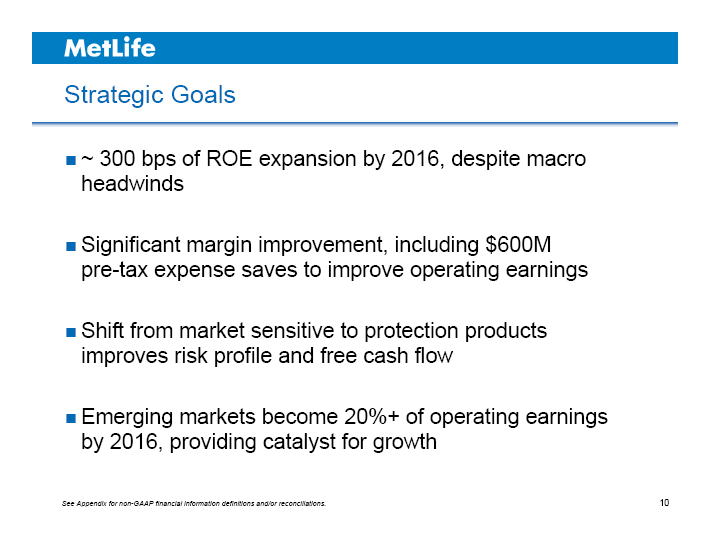

Strategic Goals

~ 300 bps of ROE expansion by 2016, despite macro headwinds

Significant margin improvement, including $600M pre-tax expense saves to improve operating earnings

Shift from market sensitive to protection products improves risk profile and free cash flow

Emerging markets become 20%+ of operating earnings by 2016, providing catalyst for growth

See Appendix for non-GAAP financial information definitions and/or reconciliations.

10

MetLife

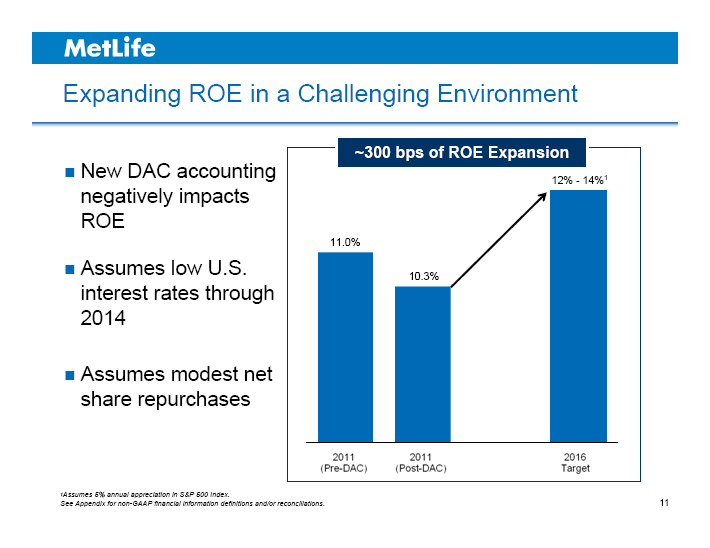

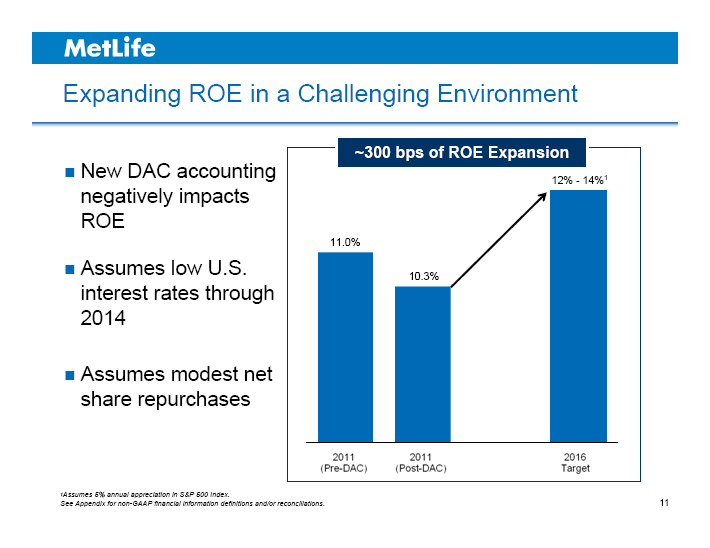

Expanding ROE in a Challenging Environment

New DAC accounting negatively impacts ROE

Assumes low U.S. interest rates through 2014

Assumes modest net share repurchases

~300 bps of ROE Expansion

12% - 14%1

11.0%

10.3%

2011 (Pre-DAC) 2011 (Post-DAC) 2016 Target

1Assumes 5% annual appreciation in S&P 500 Index.

See Appendix for non-GAAP financial information definitions and/or reconciliations. 11

MetLife

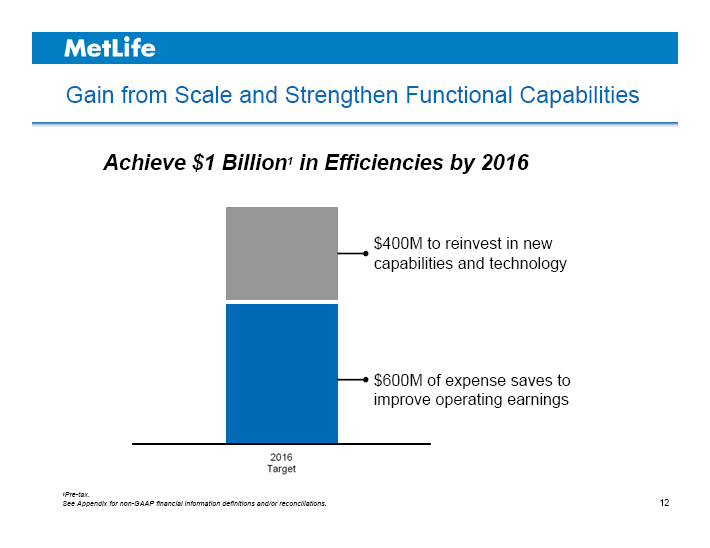

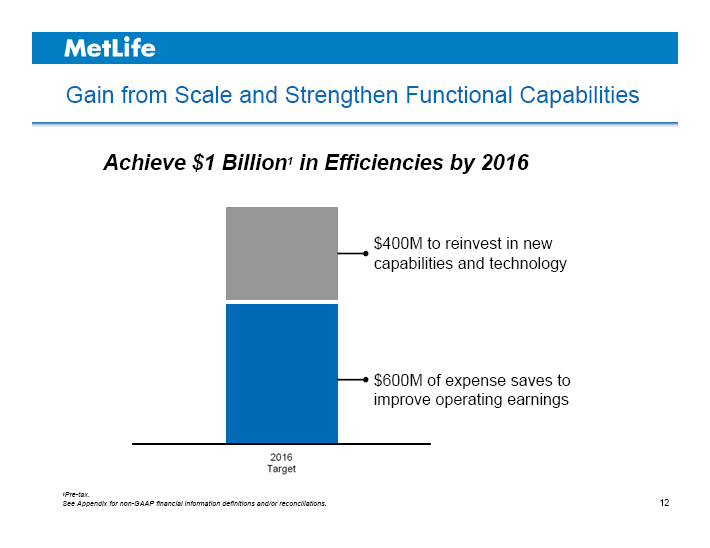

Gain from Scale and Strengthen Functional Capabilities

Achieve $1 Billion1 in Efficiencies by 2016

$400M to reinvest in new capabilities and technology

$600M of expense saves to improve operating earnings

2016 Target

1Pre-tax.

See Appendix for non-GAAP financial information definitions and/or reconciliations. 12

MetLife

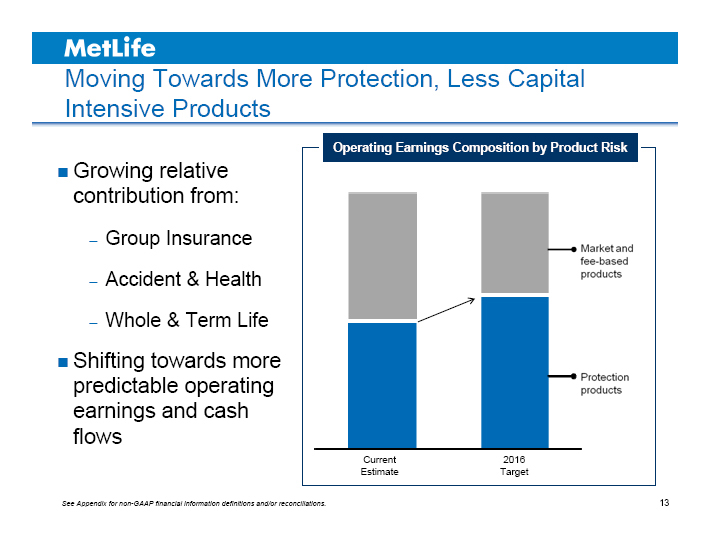

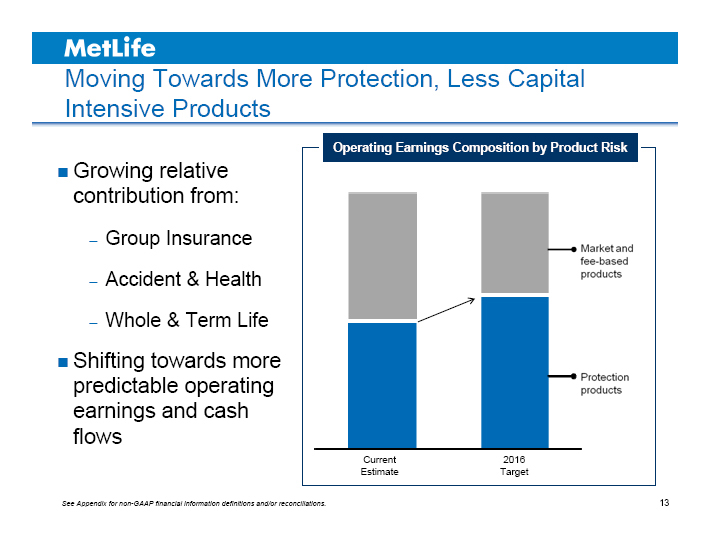

Moving Towards More Protection, Less Capital Intensive Products

Growing relative contribution from:

– Group Insurance

– Accident & Health

– Whole & Term Life

Shifting towards more predictable operating earnings and cash flows

Operating Earnings Composition by Product Risk

Market and fee-based products

Protection products

Current Estimate

2016 Target

See Appendix for non-GAAP financial information definitions and/or reconciliations. 13

MetLife

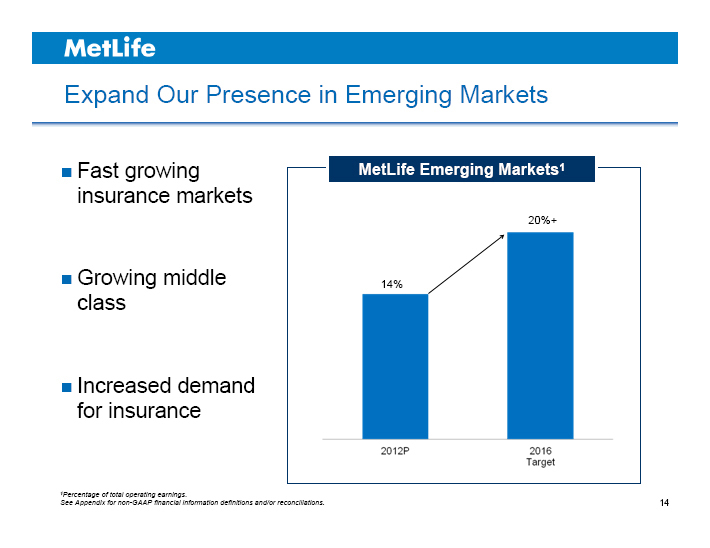

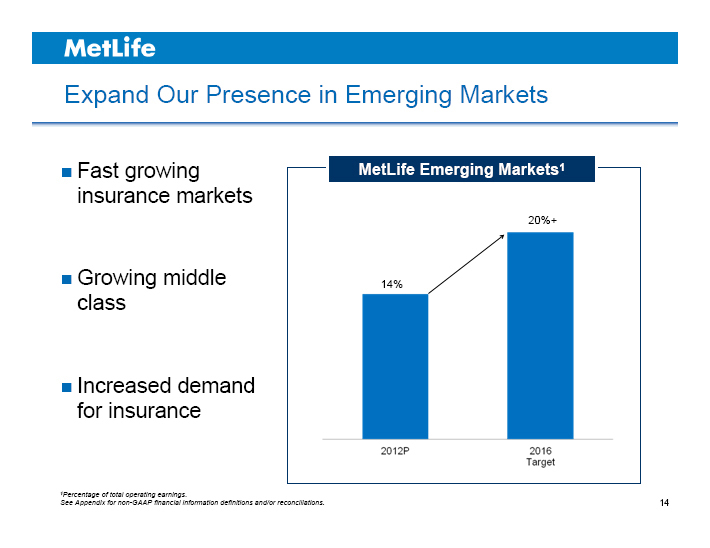

Expand Our Presence in Emerging Markets

Fast growing insurance markets

Growing middle class

Increased demand for insurance

MetLife Emerging Markets1

20%+

14%

2012P 2016 Target

1Percentage of total operating earnings.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

14

MetLife

© PNTS

Asia

MetLife

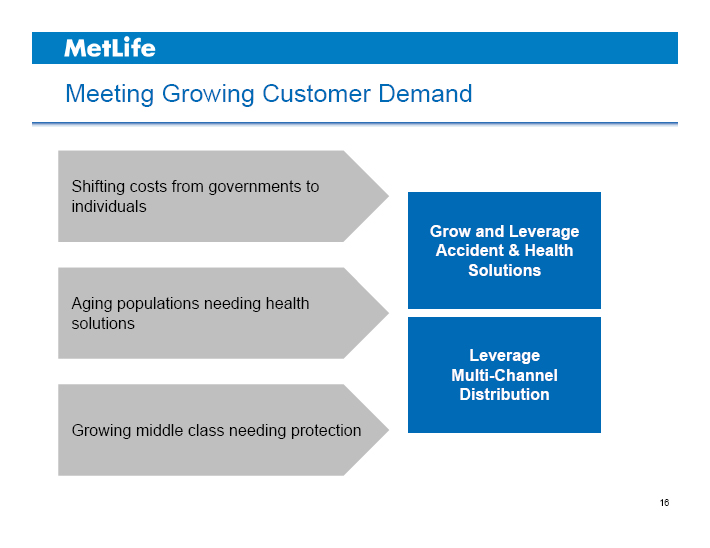

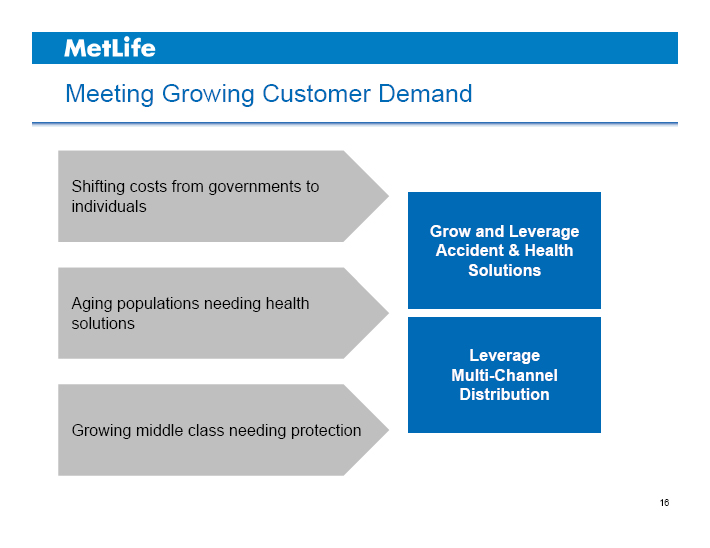

Meeting Growing Customer Demand

Shifting costs from governments to individuals

Grow and Leverage Accident & Health Solutions

Aging populations needing health solutions

Leverage Multi-Channel Distribution

Growing middle class needing protection

16

MetLife

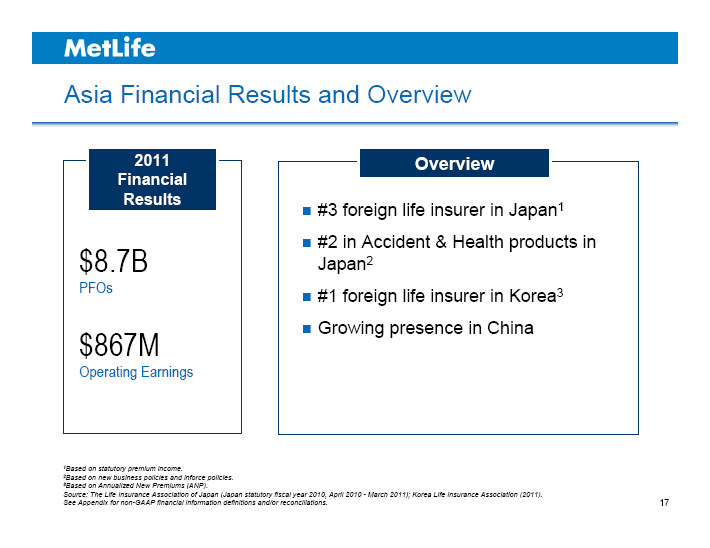

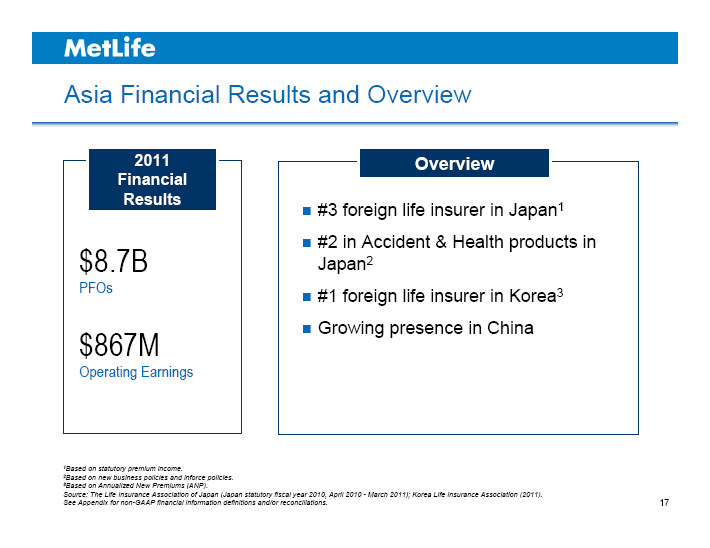

Asia Financial Results and Overview

2011 Financial Results

$8.7B PFOs

$867M Operating Earnings

Overview

#3 foreign life insurer in Japan1

#2 in Accident & Health products in Japan2

#1 foreign life insurer in Korea3

Growing presence in China

1Based on statutory premium income.

2Based on new business policies and inforce policies.

3Based on Annualized New Premiums (ANP).

Source: The Life Insurance Association of Japan (Japan statutory fiscal year 2010, April 2010 - March 2011); Korea Life Insurance Association (2011).

See Appendix for non-GAAP financial information definitions and/or reconciliations.

17

MetLife

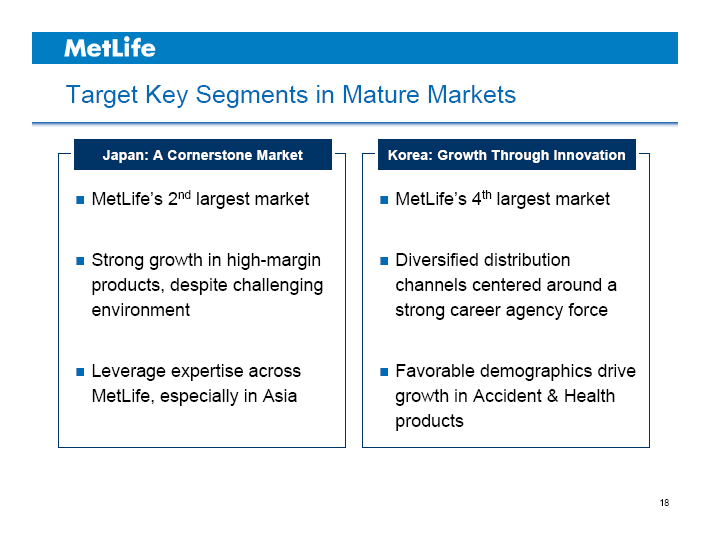

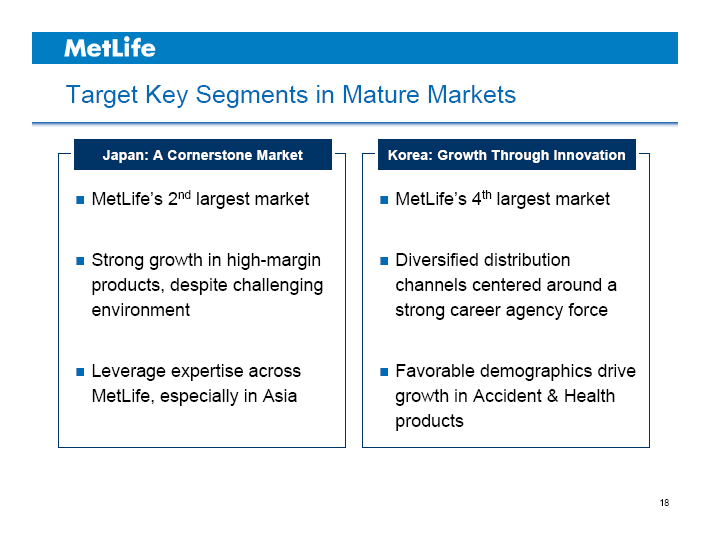

Target Key Segments in Mature Markets

Japan: A Cornerstone Market

MetLife’s 2nd largest market

Strong growth in high-margin products, despite challenging environment

Leverage expertise across MetLife, especially in Asia

Korea: Growth Through Innovation

MetLife’s 4th largest market

Diversified distribution channels centered around a strong career agency force

Favorable demographics drive growth in Accident & Health products

18

MetLife

Asia: Seeking Growth in Emerging Markets

Top 5 life insurer in both the Direct Marketing and Bancassurance channels in China

Expanding our agency model into more Chinese provinces and cities

Several other attractive, fast-growing insurance markets

Source: China Insurance Regulatory Commission, based on GWP figures for full year 2011; National Insurance Industry Communication Club.

19

MetLife

Asia Key Takeaways

Asia is a key segment and contributor to 2016 goals

Growing market share in mature markets

Opportunistically pursue organic and inorganic growth in emerging markets

20

MetLife

Summary of Strategic Review

We have a strong foundation to leverage

Key initiatives capitalize on trends and opportunities

ROE expansion despite macro headwinds

Improved risk profile and free cash flow

See Appendix for non-GAAP financial information definitions and/or reconciliations.

21

MetLife

MetLife

William J. Wheeler

President

The Americas

INVESTOR DAY 2012

MetLife

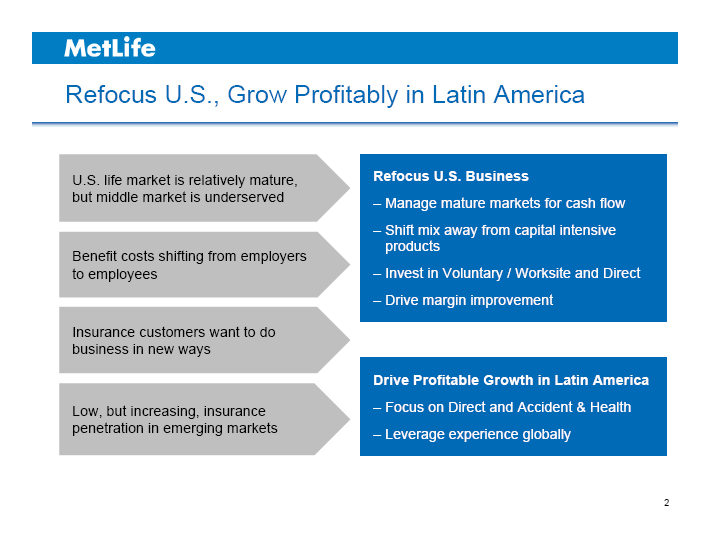

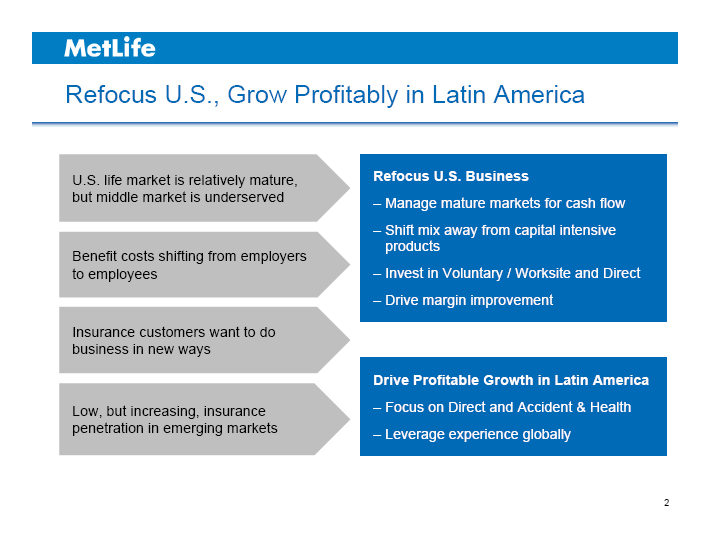

Refocus U.S., Grow Profitably in Latin America

U.S. life market is relatively mature, but middle market is underserved

Benefit costs shifting from employers to employees

Insurance customers want to do business in new ways

Low, but increasing, insurance penetration in emerging markets

Refocus U.S. Business

– Manage mature markets for cash flow

– Shift mix away from capital intensive products

– Invest in Voluntary / Worksite and Direct

– Drive margin improvement

Drive Profitable Growth in Latin America

– Focus on Direct and Accident & Health

– Leverage experience globally

2

MetLife

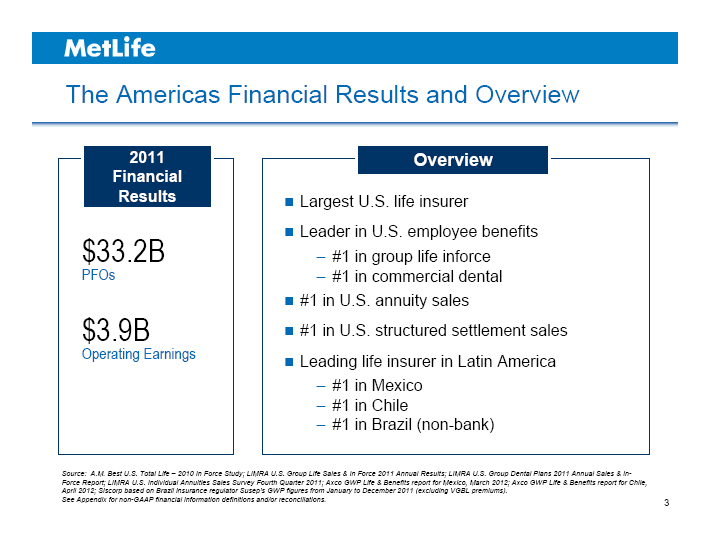

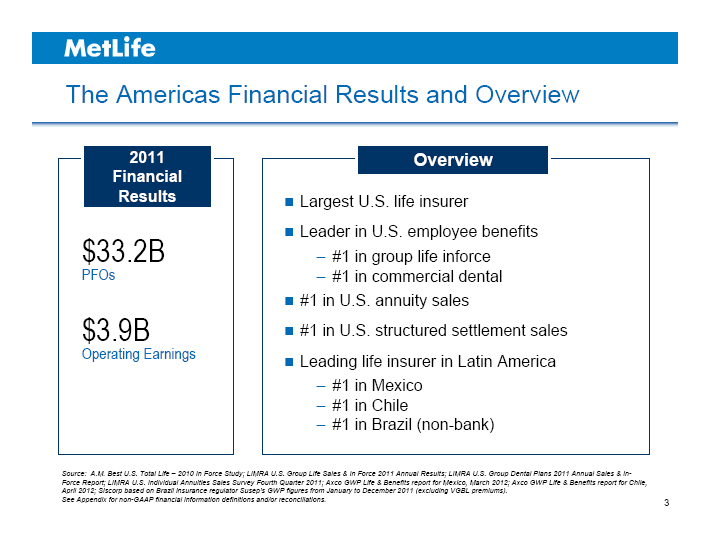

The Americas Financial Results and Overview

2011 Financial Results

$33.2B PFOs

$3.9B Operating Earnings

Overview

Largest U.S. life insurer

Leader in U.S. employee benefits

– #1 in group life inforce

– #1 in commercial dental

#1 in U.S. annuity sales

#1 in U.S. structured settlement sales

Leading life insurer in Latin America

– #1 in Mexico

– #1 in Chile

– #1 in Brazil (non-bank)

Source: A.M. Best U.S. Total Life – 2010 In Force Study; LIMRA U.S. Group Life Sales & In Force 2011 Annual Results; LIMRA U.S. Group Dental Plans 2011 Annual Sales & In-Force Report; LIMRA U.S. Individual Annuities Sales Survey Fourth Quarter 2011; Axco GWP Life & Benefits report for Mexico, March 2012; Axco GWP Life & Benefits report for Chile, April 2012; Siscorp based on Brazil insurance regulator Susep’s GWP figures from January to December 2011 (excluding VGBL premiums).

See Appendix for non-GAAP financial information definitions and/or reconciliations.

3

MetLife

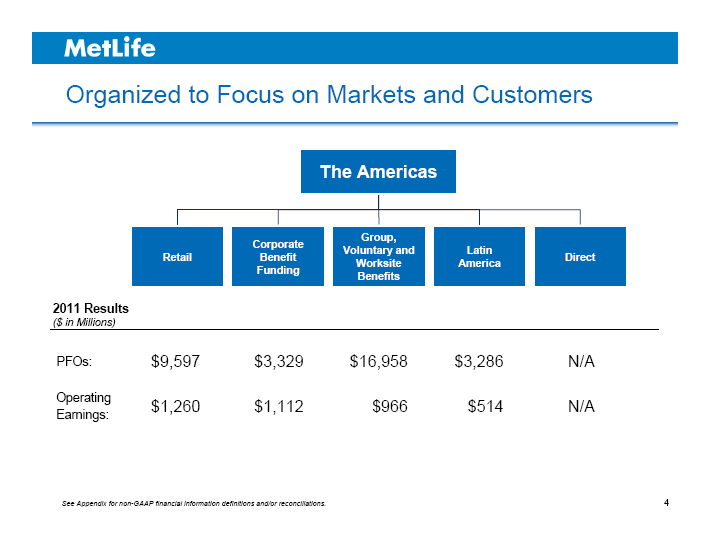

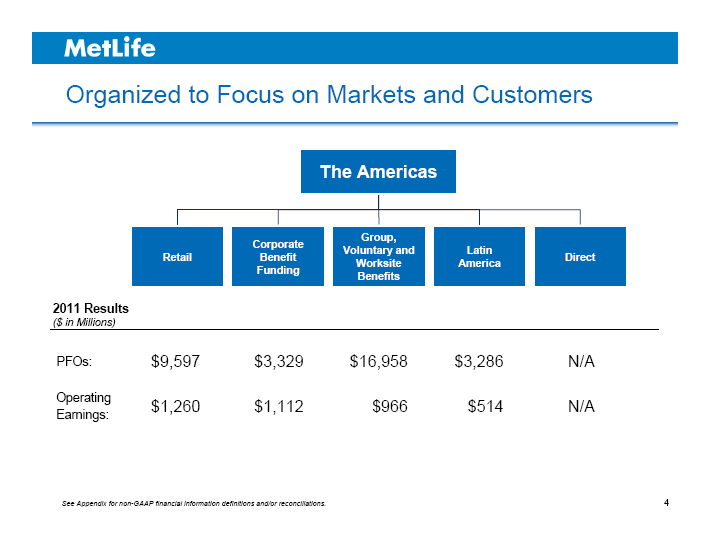

Organized to Focus on Markets and Customers

The Americas

Retail

Corporate Benefit Funding

Group, Voluntary and Worksite Benefits

Latin America

Direct

2011 Results

($ in Millions)

PFOs: $9,597 $3,329 $16,958 $3,286 N/A

Operating Earnings: $1,260 $1,112 $966 $514 N/A

See Appendix for non-GAAP financial information definitions and/or reconciliations.

4

MetLife

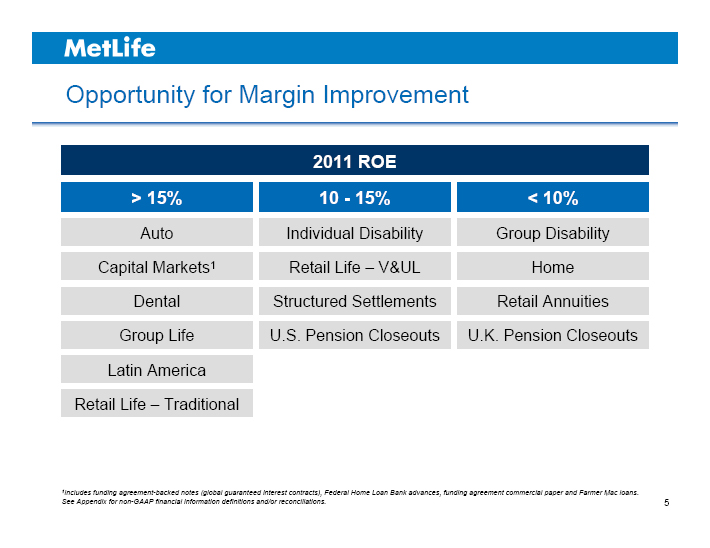

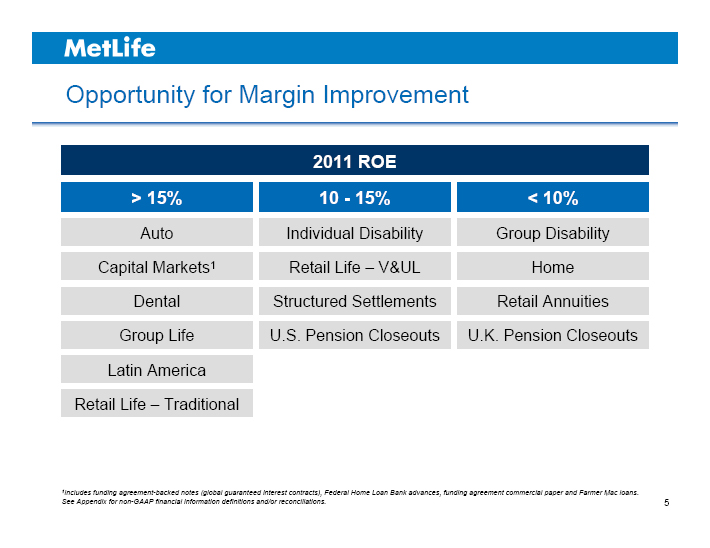

Opportunity for Margin Improvement

2011 ROE

> 15% 10 - 15% < 10%

Auto Individual Disability Group Disability

Capital Markets1 Retail Life – V&UL Home

Dental Structured Settlements Retail Annuities

Group Life U.S. Pension Closeouts U.K. Pension Closeouts

Latin America

Retail Life – Traditional

1Includes funding agreement-backed notes (global guaranteed interest contracts), Federal Home Loan Bank advances, funding agreement commercial paper and Farmer Mac loans.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

5

MetLife

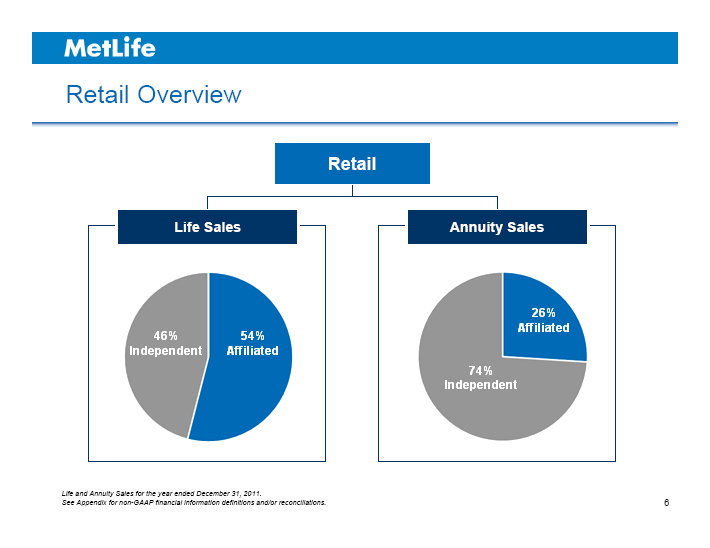

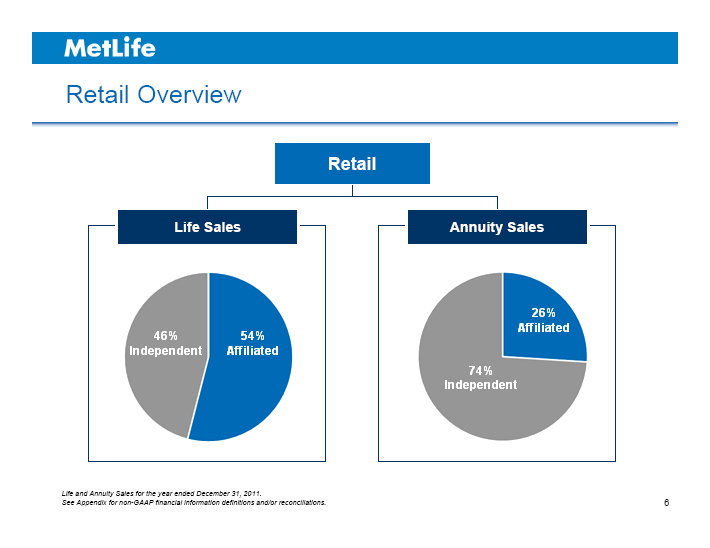

Retail Overview

Retail

Life Sales

46% Independent

54% Affiliated

Annuity Sales

26% Affiliated

74% Independent

Life and Annuity Sales for the year ended December 31, 2011.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

6

MetLife

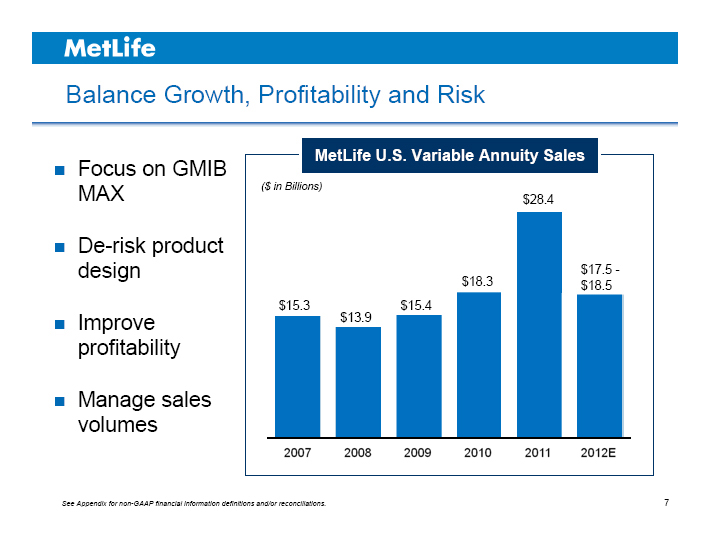

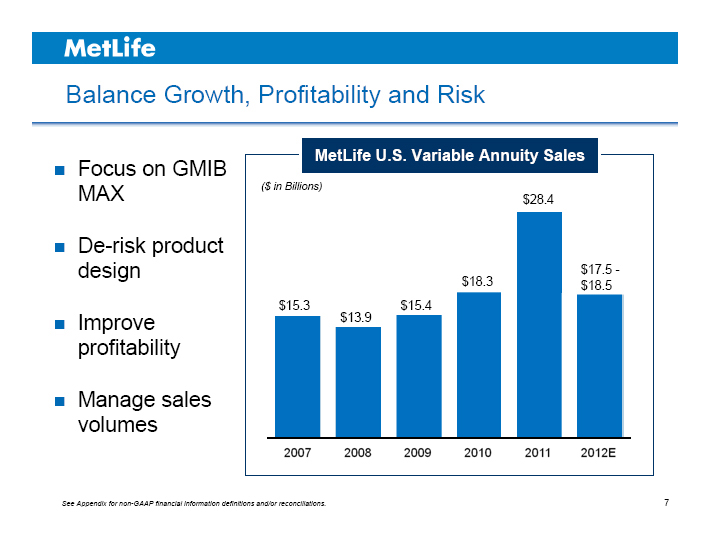

Balance Growth, Profitability and Risk

Focus on GMIB MAX

De-risk product design

Improve profitability

Manage sales volumes

MetLife U.S. Variable Annuity Sales

($ in Billions)

$15.3 $13.9 $15.4 $18.3 $28.4 $17.5 - $18.5

2007 2008 2009 2010 2011 2012E

See Appendix for non-GAAP financial information definitions and/or reconciliations.

7

MetLife

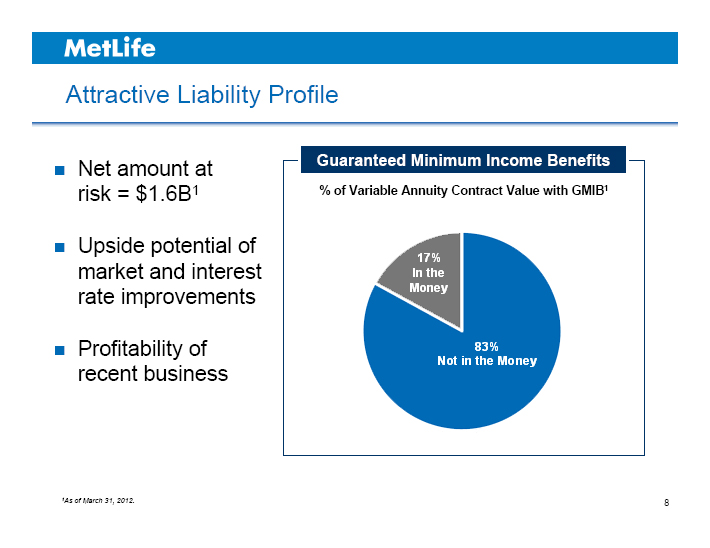

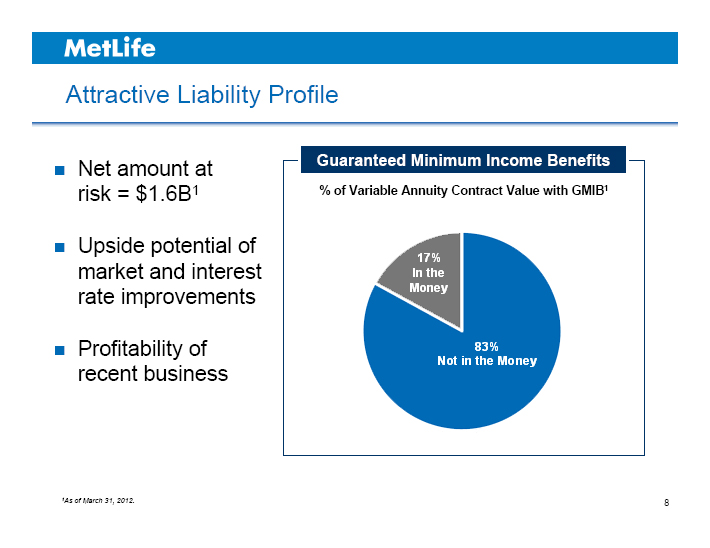

Attractive Liability Profile

Net amount at risk = $1.6B1

Upside potential of market and interest rate improvements

Profitability of recent business

Guaranteed Minimum Income Benefits

% of Variable Annuity Contract Value with GMIB1

17% In the Money

83% Not in the Money

1As of March 31, 2012.

8

MetLife

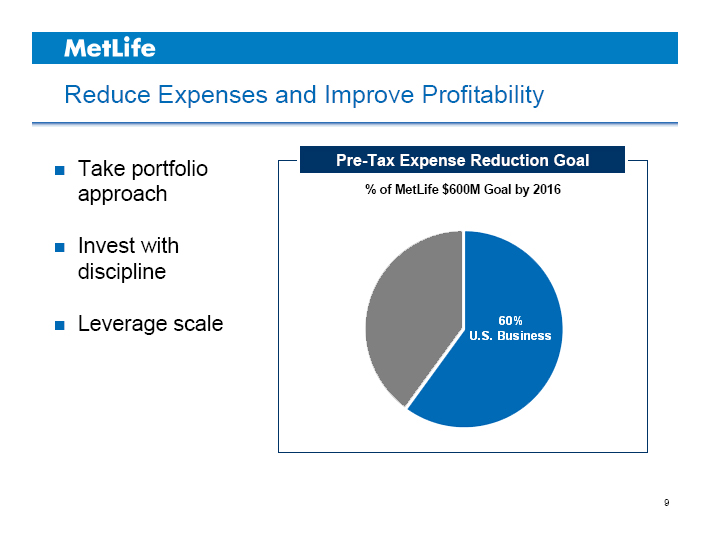

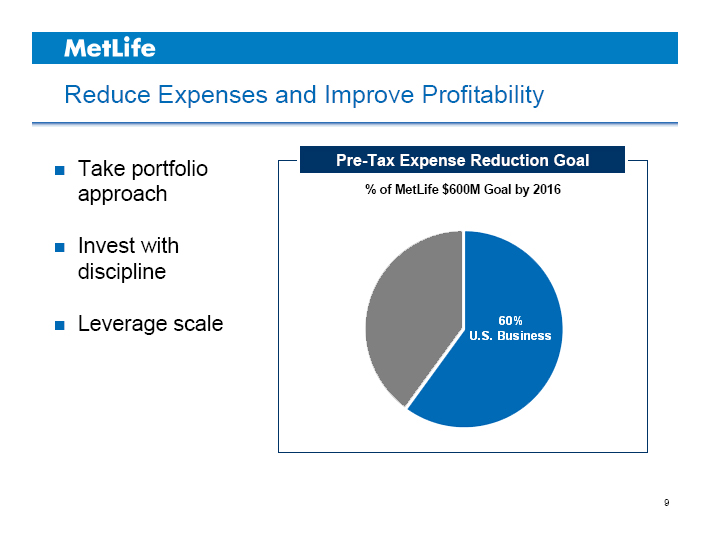

Reduce Expenses and Improve Profitability

Take portfolio approach

Invest with discipline

Leverage scale

Pre-Tax Expense Reduction Goal

% of MetLife $600M Goal by 2016

60% U.S. Business

9

MetLife

Retail: Manage Margins and Capital

Leading franchise

Rebalance risk and growth

Improve profitability and ROE

See Appendix for non-GAAP financial information definitions and/or reconciliations.

10

MetLife

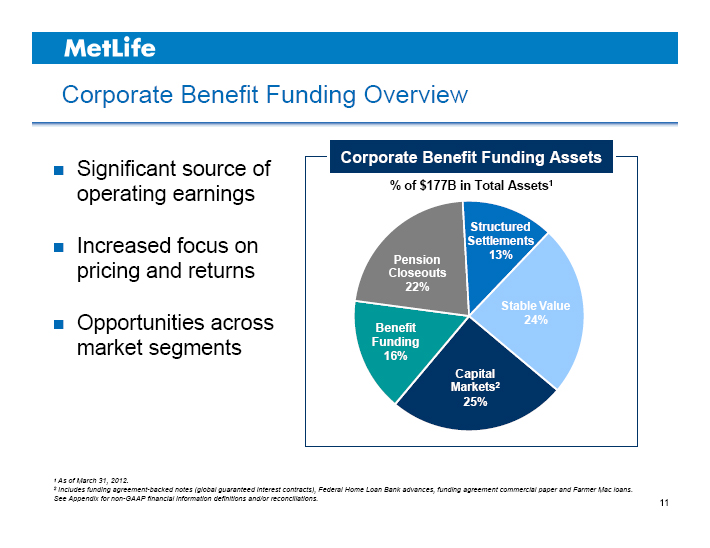

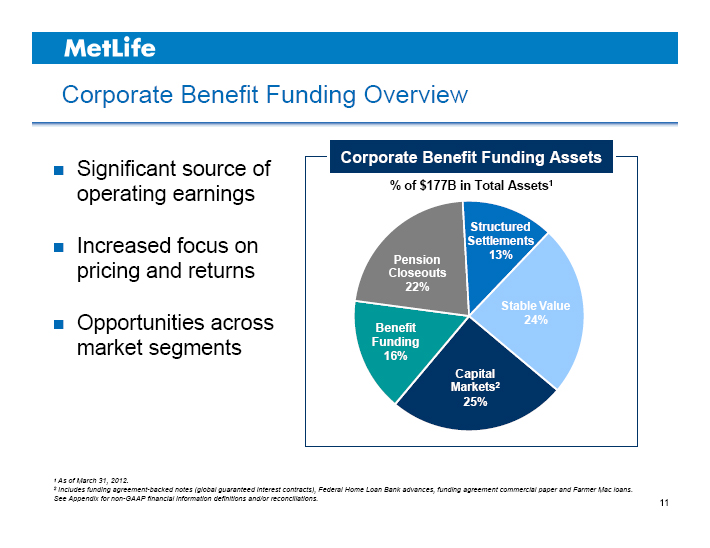

Corporate Benefit Funding Overview

Significant source of operating earnings

Increased focus on pricing and returns

Opportunities across market segments

Corporate Benefit Funding Assets

% of $177B in Total Assets1

Pension Closeouts 22%

Structured Settlements 13%

Stable Value 24%

Capital Markets2 25%

Benefit Funding 16%

1 As of March 31, 2012.

2 Includes funding agreement-backed notes (global guaranteed interest contracts), Federal Home Loan Bank advances, funding agreement commercial paper and Farmer Mac loans.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

11

MetLife

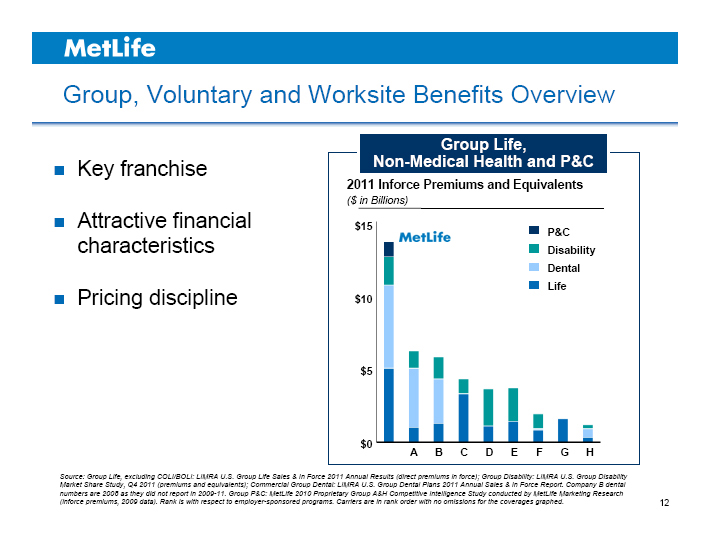

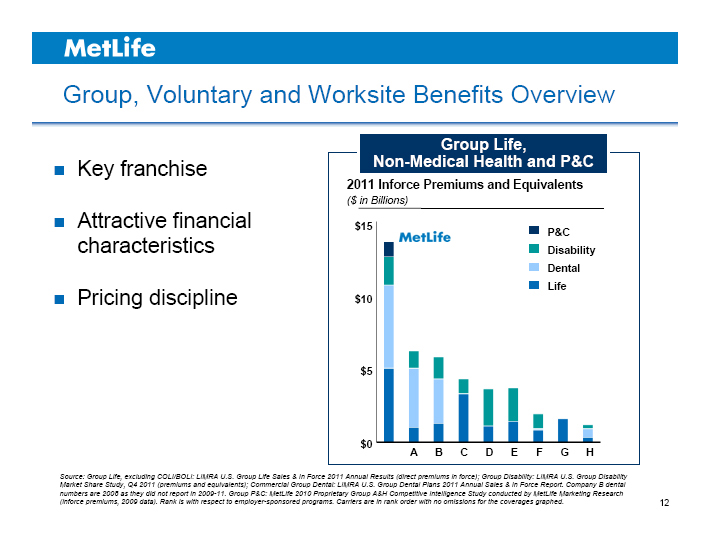

Group, Voluntary and Worksite Benefits Overview

Key franchise

Attractive financial characteristics

Pricing discipline

Group Life,

Non-Medical Health and P&C

2011 Inforce Premiums and Equivalents

($ in Billions)

$15

$10

$5

$0

A B C D E F G H

P&C

Disability

Dental

Life

Source: Group Life, excluding COLI/BOLI: LIMRA U.S. Group Life Sales & In Force 2011 Annual Results (direct premiums in force); Group Disability: LIMRA U.S. Group Disability Market Share Study, Q4 2011 (premiums and equivalents); Commercial Group Dental: LIMRA U.S. Group Dental Plans 2011 Annual Sales & In Force Report. Company B dental numbers are 2008 as they did not report in 2009-11. Group P&C: MetLife 2010 Proprietary Group A&H Competitive Intelligence Study conducted by MetLife Marketing Research (inforce premiums, 2009 data). Rank is with respect to employer-sponsored programs. Carriers are in rank order with no omissions for the coverages graphed.

12

MetLife

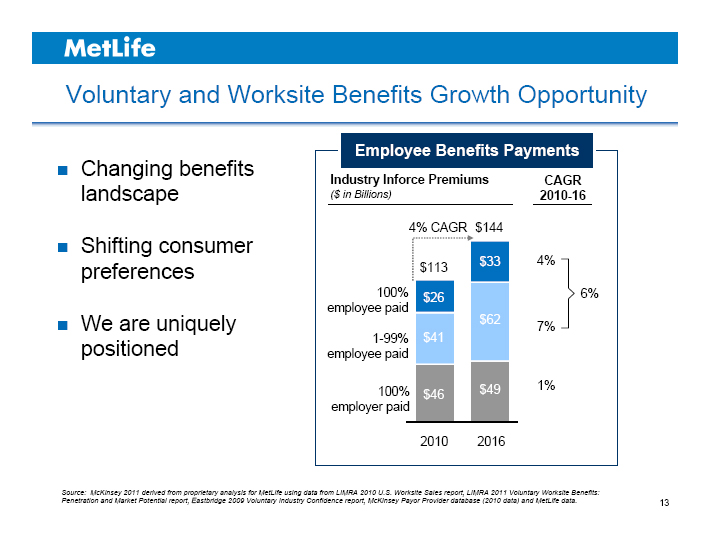

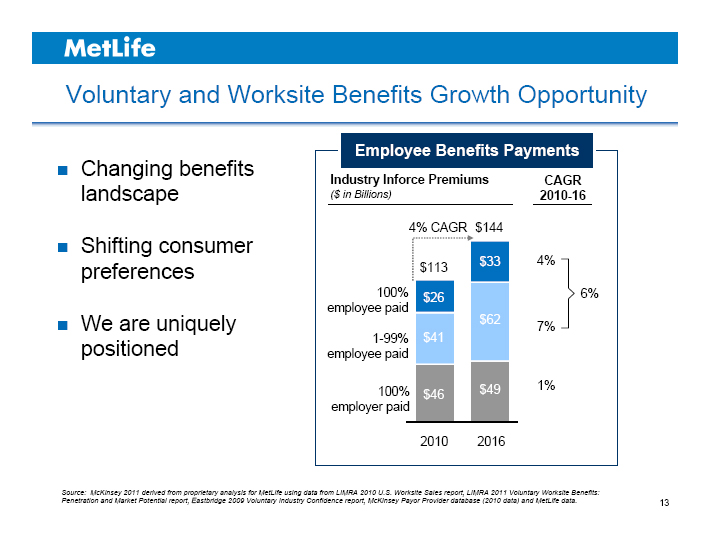

Voluntary and Worksite Benefits Growth Opportunity

Changing benefits landscape

Shifting consumer preferences

We are uniquely positioned

Employee Benefits Payments

Industry Inforce Premiums

($ in Billions)

4% CAGR $144

$113 $33

100% employee paid $26 $62

1-99% employee paid $41

100% employer paid $46 $49

2010 2016

CAGR

2010-16

4%

7%

1%

6%

Source: McKinsey 2011 derived from proprietary analysis for MetLife using data from LIMRA 2010 U.S. Worksite Sales report, LIMRA 2011 Voluntary Worksite Benefits:

Penetration and Market Potential report, Eastbridge 2009 Voluntary Industry Confidence report, McKinsey Payor Provider database (2010 data) and MetLife data.

13

MetLife

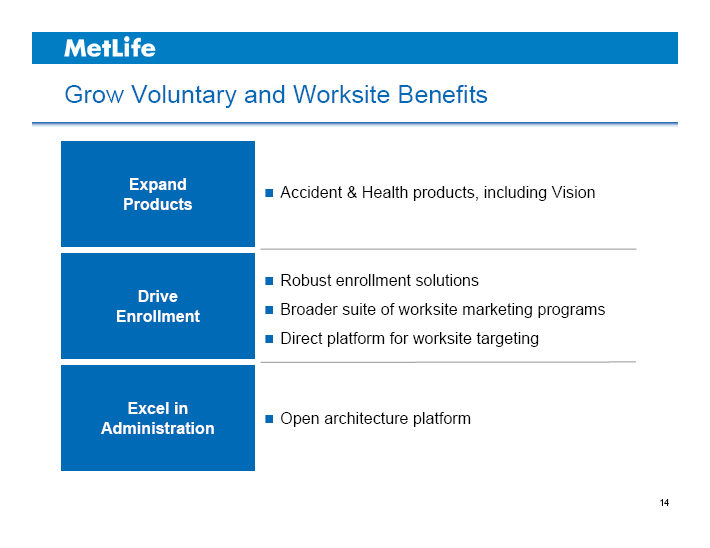

Grow Voluntary and Worksite Benefits

Expand Products

Accident & Health products, including Vision

Drive Enrollment

Robust enrollment solutions

Broader suite of worksite marketing programs

Direct platform for worksite targeting

Excel in Administration

Open architecture platform

14

MetLife

Group, Voluntary and Worksite Benefits Strategy

Leverage position in large market

Increase presence in mid-market

Grow voluntary products / worksite benefits

15

MetLife

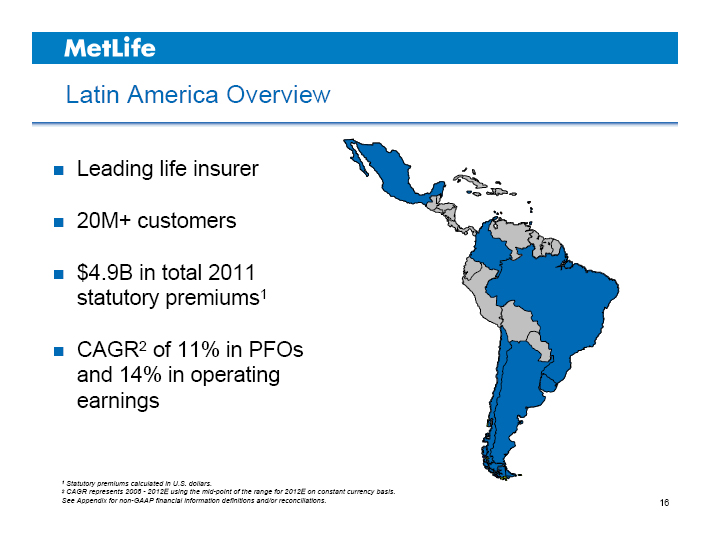

Latin America Overview

Leading life insurer

20M+ customers

$4.9B in total 2011 statutory premiums1

CAGR2 of 11% in PFOs and 14% in operating earnings

1 Statutory premiums calculated in U.S. dollars.

2 CAGR represents 2008 - 2012E using the mid-point of the range for 2012E on constant currency basis.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

16

MetLife

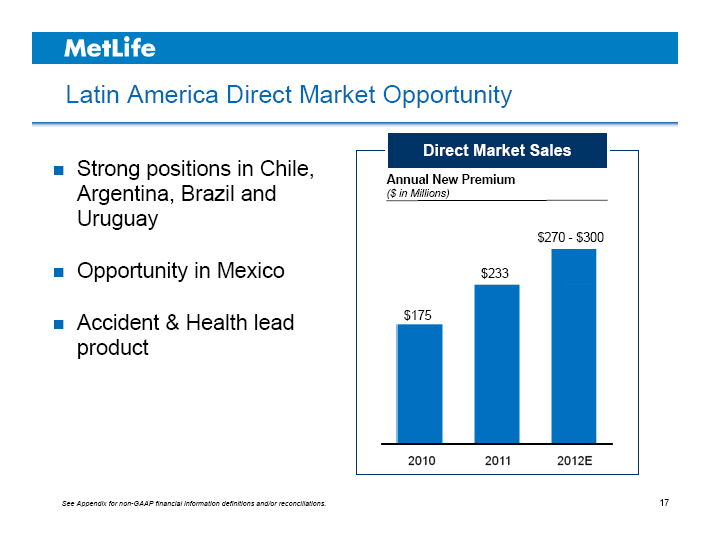

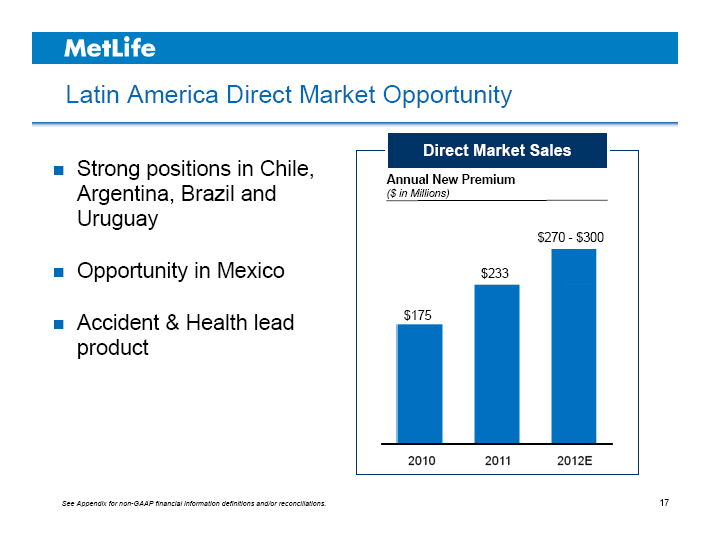

Latin America Direct Market Opportunity

Strong positions in Chile, Argentina, Brazil and Uruguay

Opportunity in Mexico

Accident & Health lead product

Direct Market Sales

Annual New Premium

($ in Millions)

$175 $233 $270 - $300

2010 2011 2012E

See Appendix for non-GAAP financial information definitions and/or reconciliations.

17

MetLife

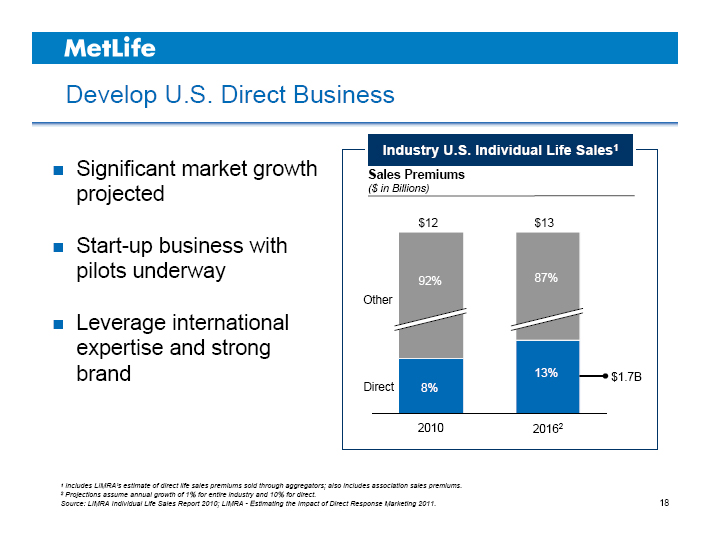

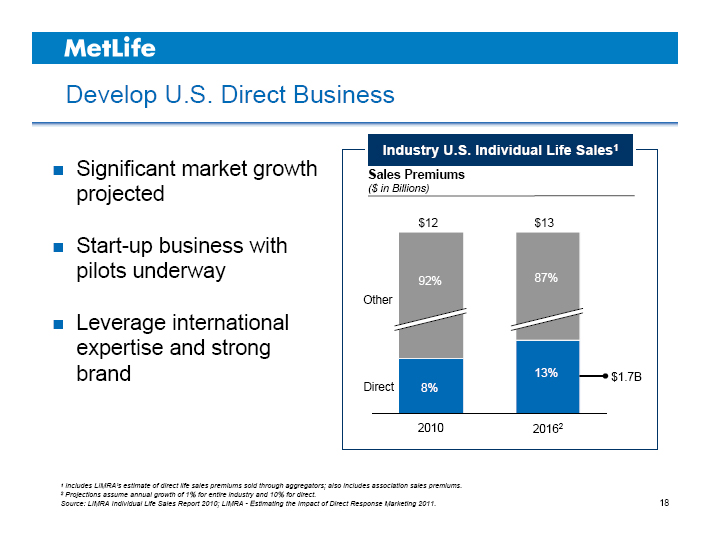

Develop U.S. Direct Business

Significant market growth projected

Start-up business with pilots underway

Leverage international expertise and strong brand

Industry U.S. Individual Life Sales1

Sales Premiums

($ in Billions)

$12 $13

Other 92% 87%

Direct 8% 13% $1.7B

2010 20162

1 Includes LIMRA’s estimate of direct life sales premiums sold through aggregators; also includes association sales premiums.

2 Projections assume annual growth of 1% for entire industry and 10% for direct.

Source: LIMRA Individual Life Sales Report 2010; LIMRA - Estimating the Impact of Direct Response Marketing 2011.

18

MetLife

Key Takeaways

Focus more energy and resources on growth areas while managing mature businesses for cash flow

Improve margins through expense reductions in mature businesses

Reduce market-based risk, increase protection risk

Drive operating earnings growth and meaningful improvement in ROE

See Appendix for non-GAAP financial information definitions and/or reconciliations.

19

MetLife

MetLife © PNTS

Maria R. Morris

Executive Vice President Global Employee Benefits

INVESTOR DAY 2012

MetLife

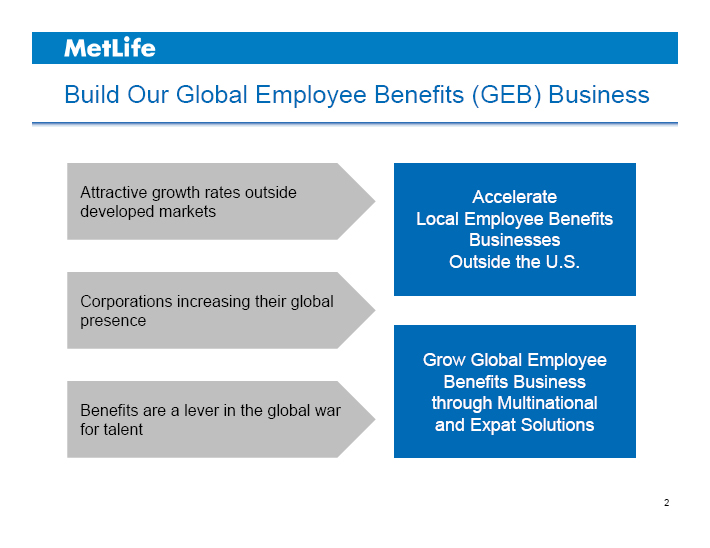

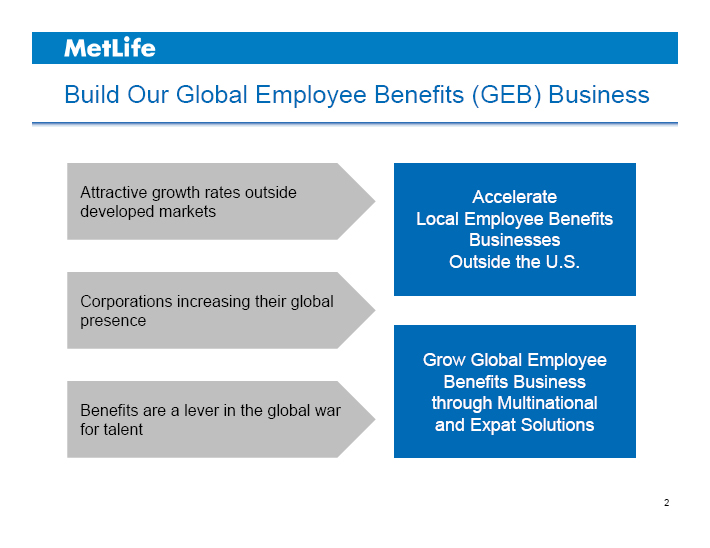

Build Our Global Employee Benefits (GEB) Business

Attractive growth rates outside developed markets

Corporations increasing their global presence

Benefits are a lever in the global war for talent

Accelerate Local Employee Benefits Businesses Outside the U.S.

Grow Global Employee Benefits Business through Multinational and Expat Solutions

2

MetLife

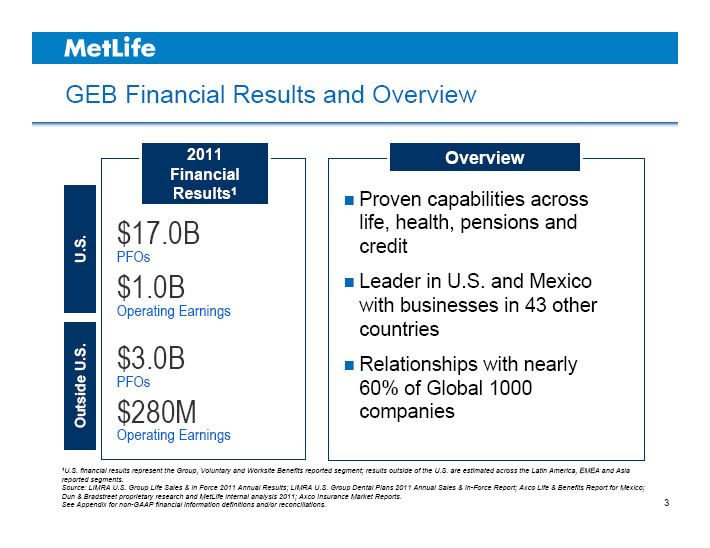

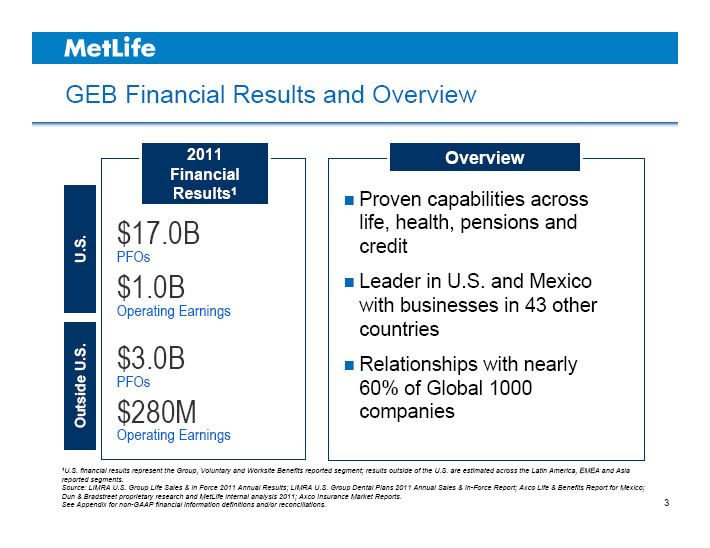

GEB Financial Results and Overview

U.S.

Outside U.S.

2011 Financial Results1

$17.0B

PFOs

$1.0B

Operating Earnings

$3.0B

PFOs

$280M

Operating Earnings

Overview

Proven capabilities across life, health, pensions and credit

Leader in U.S. and Mexico with businesses in 43 other countries

Relationships with nearly

60% of Global 1000 companies

1U.S. financial results represent the Group, Voluntary and Worksite Benefits reported segment; results outside of the U.S. are estimated across the Latin America, EMEA and Asia reported segments.

Source: LIMRA U.S. Group Life Sales & In Force 2011 Annual Results; LIMRA U.S. Group Dental Plans 2011 Annual Sales & In-Force Report; Axco Life & Benefits Report for Mexico; Dun & Bradstreet proprietary research and MetLife internal analysis 2011; Axco Insurance Market Reports.

See Appendix for non-GAAP financial information definitions and/or reconciliations. 3

MetLife

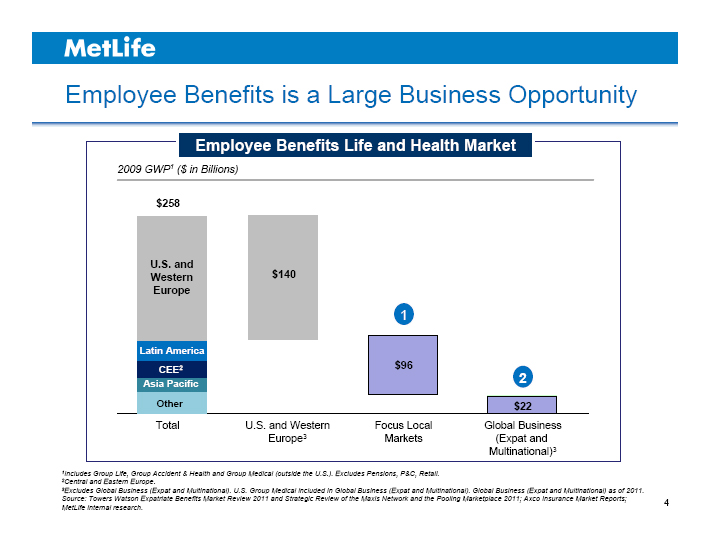

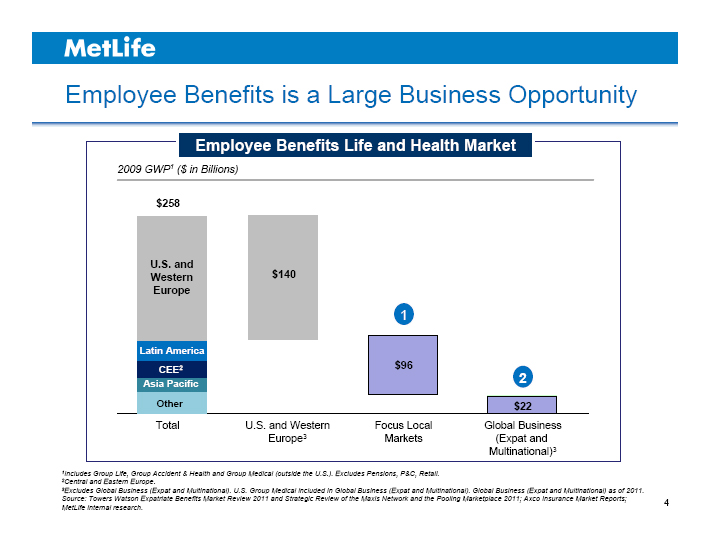

Employee Benefits is a Large Business Opportunity

Employee Benefits Life and Health Market

2009 GWP1 ($ in Billions)

$258

U.S. and Western Europe

Latin America CEE2 Asia Pacific Other

Total

$140

U.S. and Western Europe3

1 $96

Focus Local Markets

2 $22

Global Business (Expat and Multinational)3

1Includes Group Life, Group Accident & Health and Group Medical (outside the U.S.). Excludes Pensions, P&C, Retail.

2Central and Eastern Europe.

3Excludes Global Business (Expat and Multinational). U.S. Group Medical included in Global Business (Expat and Multinational). Global Business (Expat and Multinational) as of 2011.

Source: Towers Watson Expatriate Benefits Market Review 2011 and Strategic Review of the Maxis Network and the Pooling Marketplace 2011; Axco Insurance Market Reports; MetLife internal research.

4

MetLife

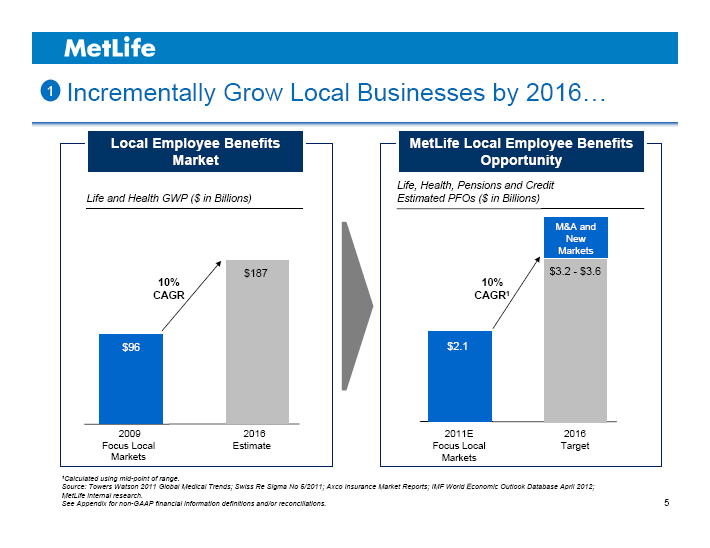

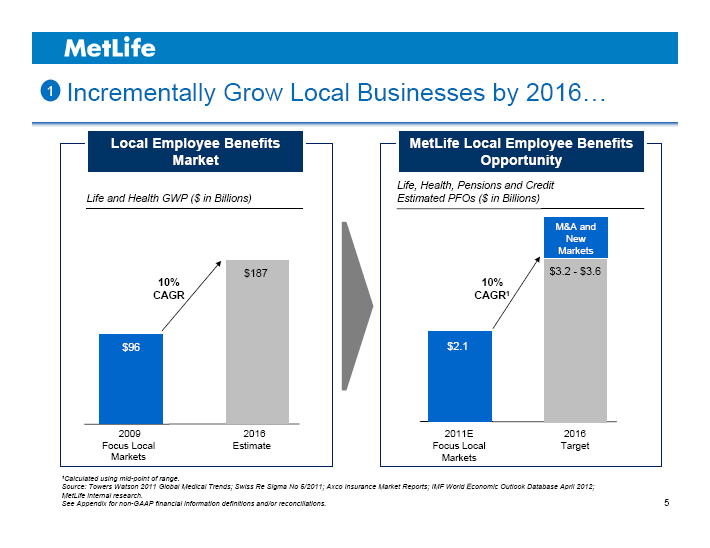

1 Incrementally Grow Local Businesses by 2016…

Local Employee Benefits Market

Life and Health GWP ($ in Billions)

$187

10%

CAGR

$96

2009

Focus Local Markets

2016 Estimate

MetLife Local Employee Benefits Opportunity

Life, Health, Pensions and Credit Estimated PFOs ($ in Billions)

M&A and New Markets

$3.2 - $3.6

10% CAGR1

$2.1

2011E Focus Local Markets

2016 Target

1Calculated using mid-point of range.

Source: Towers Watson 2011 Global Medical Trends; Swiss Re Sigma No 5/2011; Axco Insurance Market Reports; IMF World Economic Outlook Database April 2012;

MetLife internal research.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

5

MetLife

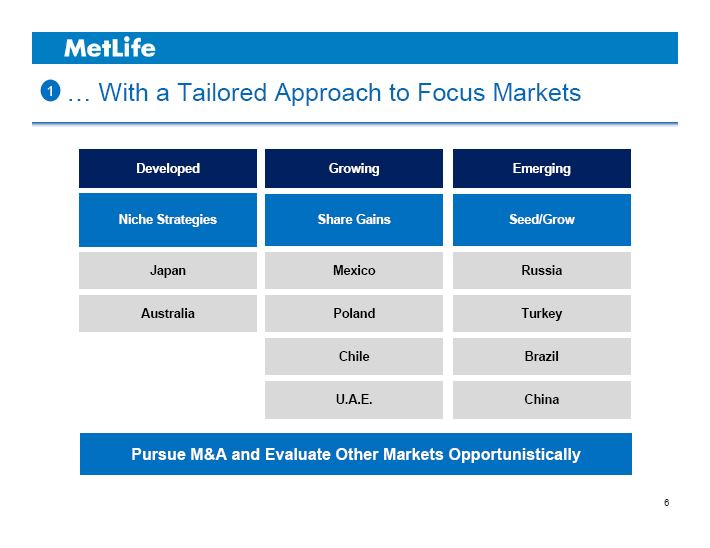

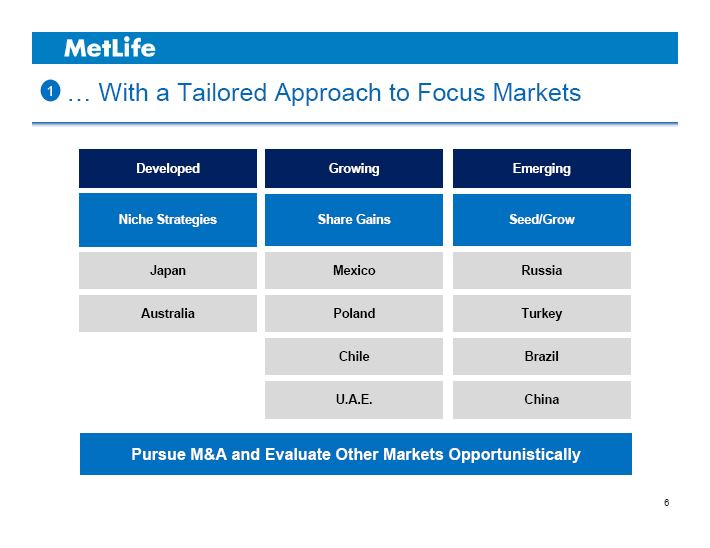

1 … With a Tailored Approach to Focus Markets

Developed Niche Strategies Japan Australia

Growing Share Gains Mexico Poland Chile U.A.E.

Emerging Seed/Grow Russia Turkey Brazil China

Pursue M&A and Evaluate Other Markets Opportunistically

6

MetLife

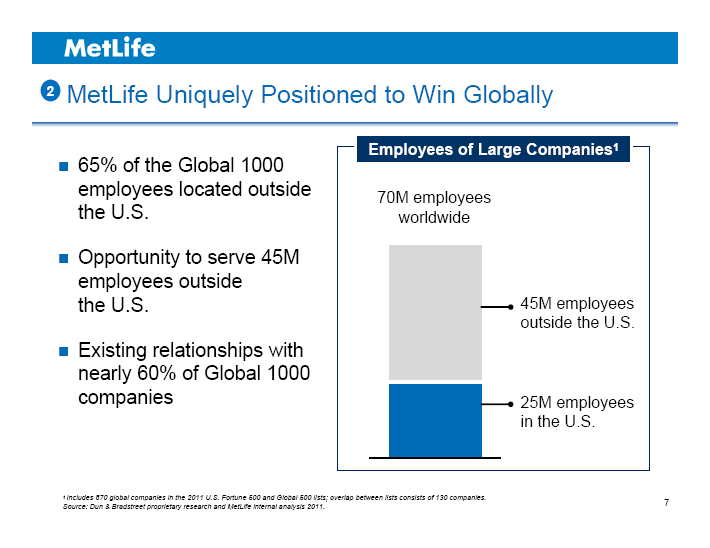

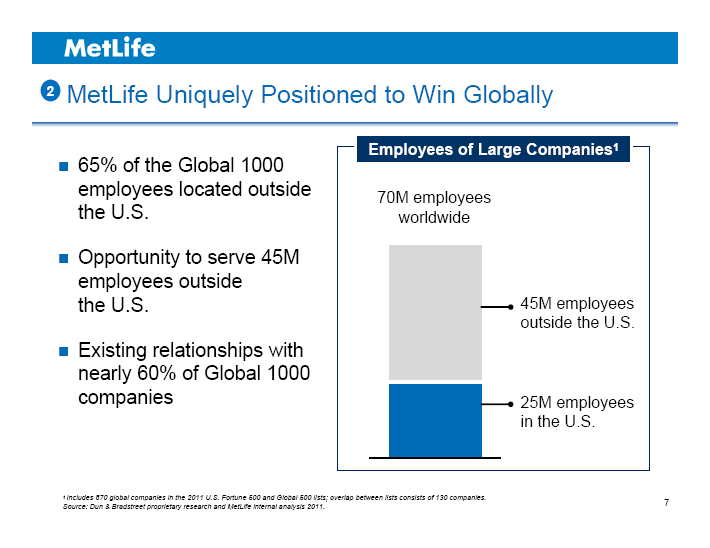

2 MetLife Uniquely Positioned to Win Globally

65% of the Global 1000 employees located outside the U.S.

Opportunity to serve 45M employees outside the U.S.

Existing relationships with nearly 60% of Global 1000 companies

Employees of Large Companies1

70M employees worldwide

45M employees outside the U.S.

25M employees in the U.S.

1 Includes 870 global companies in the 2011 U.S. Fortune 500 and Global 500 lists; overlap between lists consists of 130 companies.

Source: Dun & Bradstreet proprietary research and MetLife internal analysis 2011. 7

MetLife

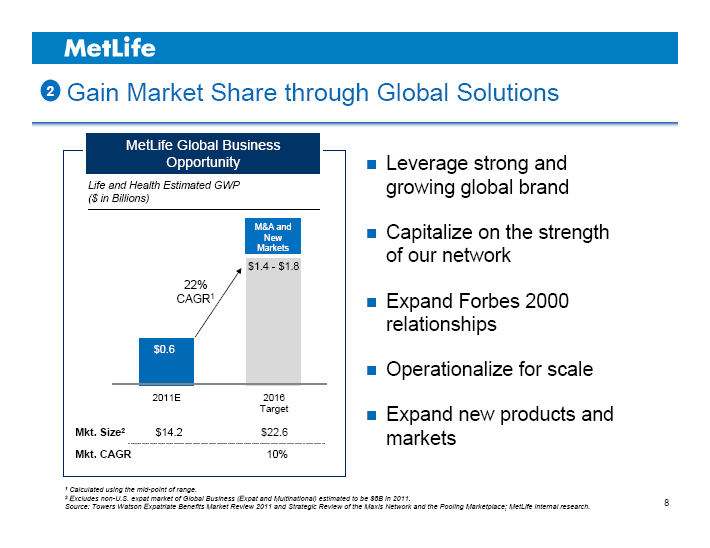

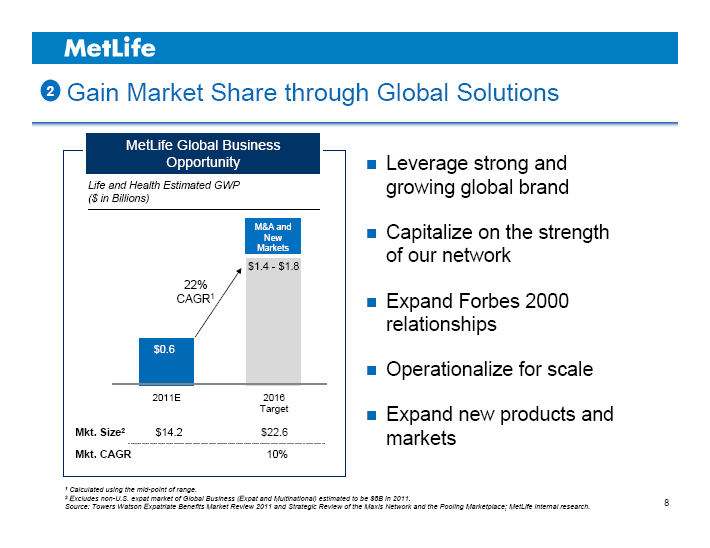

2 Gain Market Share through Global Solutions

MetLife Global Business Opportunity

Life and Health Estimated GWP ($ in Billions)

M&A and New Markets

$1.4 - $1.8

22% CAGR1

$0.6

2011E 2016 Target

Mkt. Size2 $14.2 $22.6

Mkt. CAGR 10%

Leverage strong and growing global brand

Capitalize on the strength of our network

Expand Forbes 2000 relationships

Operationalize for scale

Expand new products and markets

1 Calculated using the mid-point of range.

2 Excludes non-U.S. expat market of Global Business (Expat and Multinational) estimated to be $8B in 2011.

Source: Towers Watson Expatriate Benefits Market Review 2011 and Strategic Review of the Maxis Network and the Pooling Marketplace; MetLife internal research. 8

MetLife

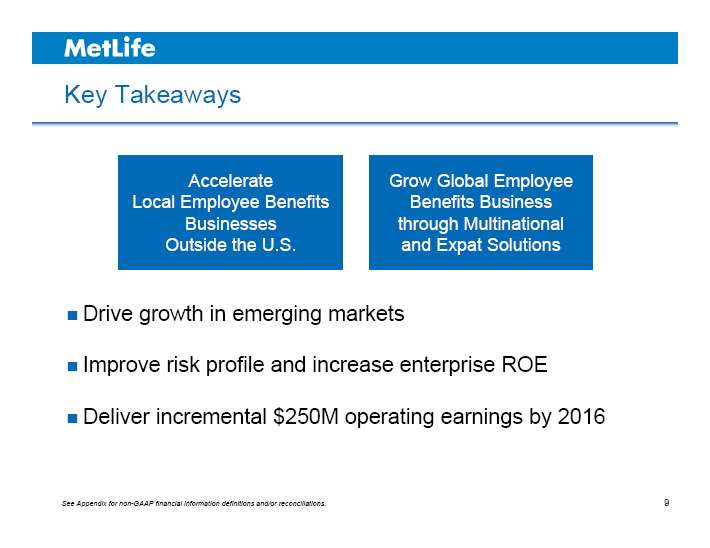

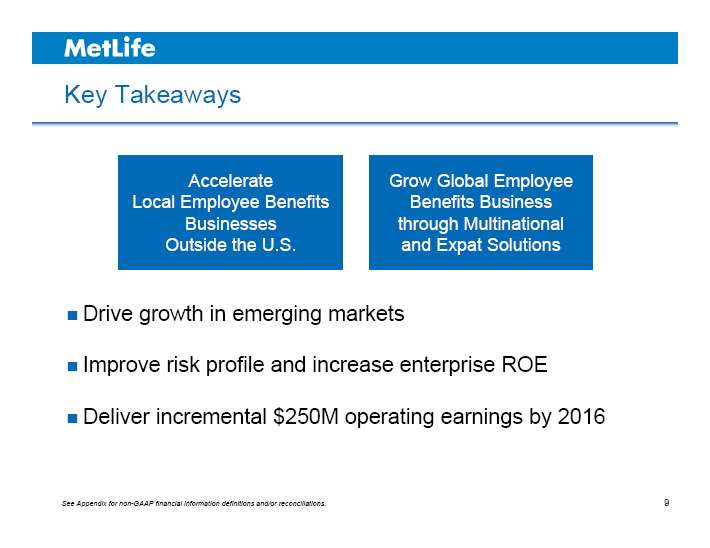

Key Takeaways

Accelerate Local Employee Benefits Businesses Outside the U.S.

Grow Global Employee Benefits Business through Multinational and Expat Solutions

Drive growth in emerging markets

Improve risk profile and increase enterprise ROE

Deliver incremental $250M operating earnings by 2016

See Appendix for non-GAAP financial information definitions and/or reconciliations. 9

MetLife

MetLife © PNTS

Michel Khalaf

President

Europe, Middle East and Africa

INVESTOR DAY 2012

MetLife

Agenda

Europe, Middle East and Africa (EMEA)

Emerging Markets Strategy

2

MetLife

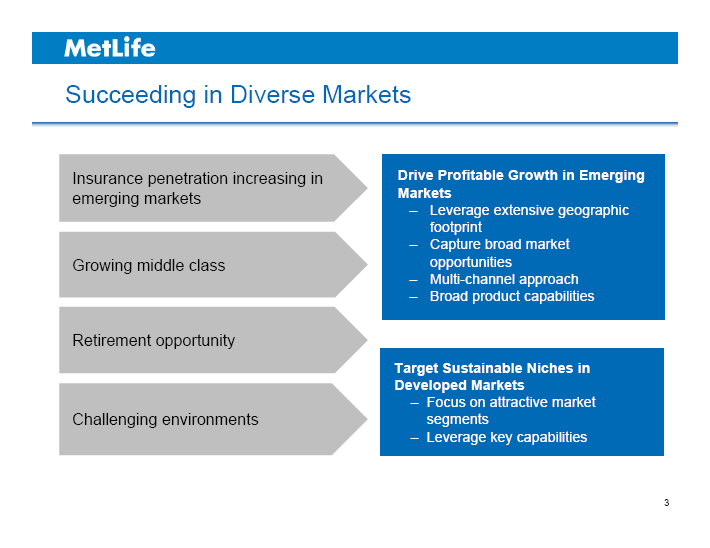

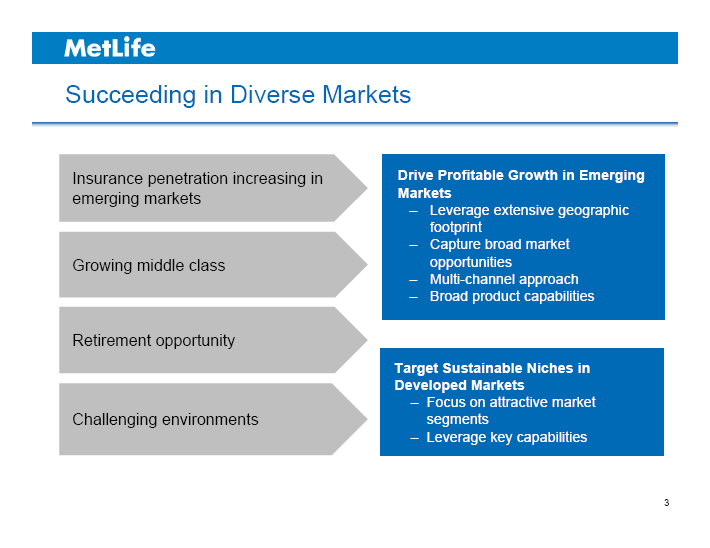

Succeeding in Diverse Markets

Insurance penetration increasing in emerging markets

Growing middle class

Retirement opportunity

Challenging environments

Drive Profitable Growth in Emerging Markets

– Leverage extensive geographic footprint

– Capture broad market opportunities

– Multi-channel approach

– Broad product capabilities

Target Sustainable Niches in Developed Markets

– Focus on attractive market segments

– Leverage key capabilities

3

MetLife

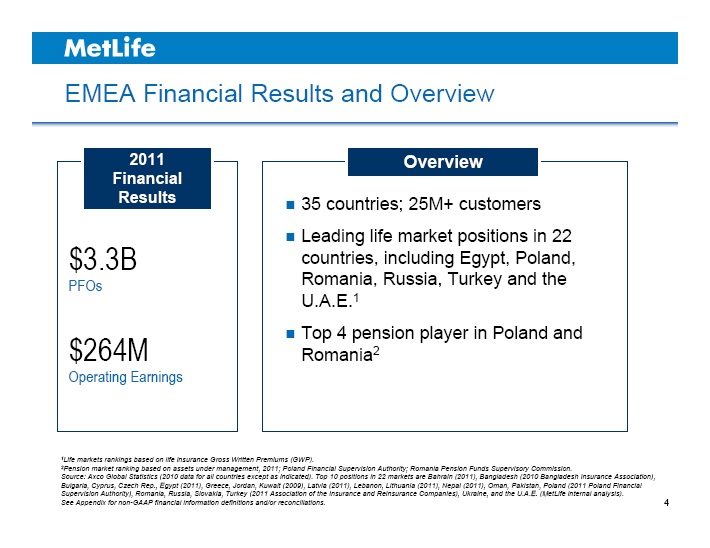

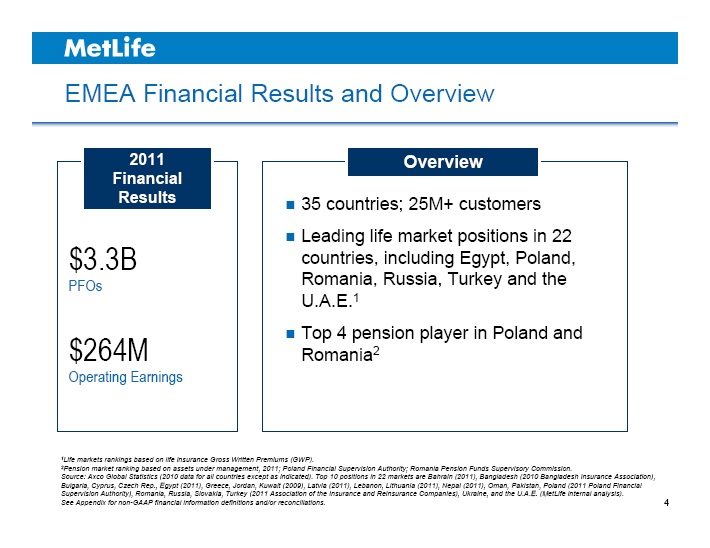

EMEA Financial Results and Overview

2011 Financial Results

$3.3B PFOs

$264M Operating Earnings

Overview

35 countries; 25M+ customers

Leading life market positions in 22 countries, including Egypt, Poland, Romania, Russia, Turkey and the U.A.E.1

Top 4 pension player in Poland and Romania2

1Life markets rankings based on life insurance Gross Written Premiums (GWP).

2Pension market ranking based on assets under management, 2011; Poland Financial Supervision Authority; Romania Pension Funds Supervisory Commission.

Source: Axco Global Statistics (2010 data for all countries except as indicated). Top 10 positions in 22 markets are Bahrain (2011), Bangladesh (2010 Bangladesh Insurance Association), Bulgaria, Cyprus, Czech Rep., Egypt (2011), Greece, Jordan, Kuwait (2009), Latvia (2011), Lebanon, Lithuania (2011), Nepal (2011), Oman, Pakistan, Poland (2011 Poland Financial Supervision Authority), Romania, Russia, Slovakia, Turkey (2011 Association of the Insurance and Reinsurance Companies), Ukraine, and the U.A.E. (MetLife internal analysis).

See Appendix for non-GAAP financial information definitions and/or reconciliations. 4

MetLife

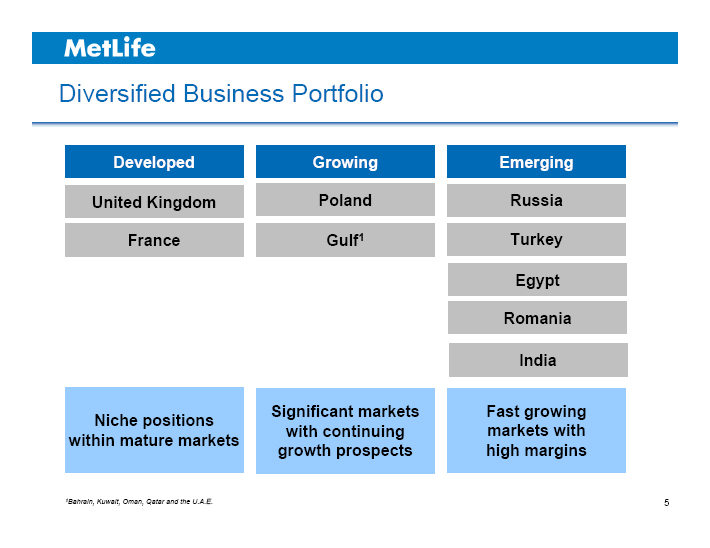

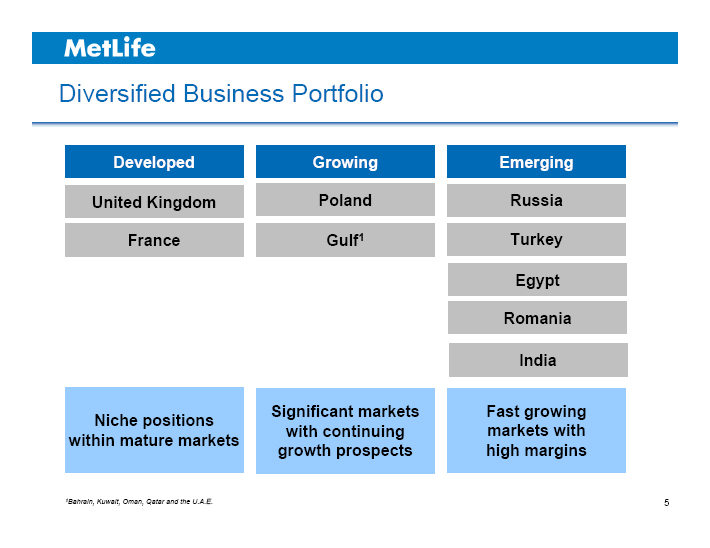

Diversified Business Portfolio

Developed United Kingdom France Niche positions within mature markets

Growing Poland Gulf1 Significant markets with continuing growth prospects

Emerging Russia Turkey Egypt Romania India Fast growing markets with high margins

1Bahrain, Kuwait, Oman, Qatar and the U.A.E. 5

MetLife

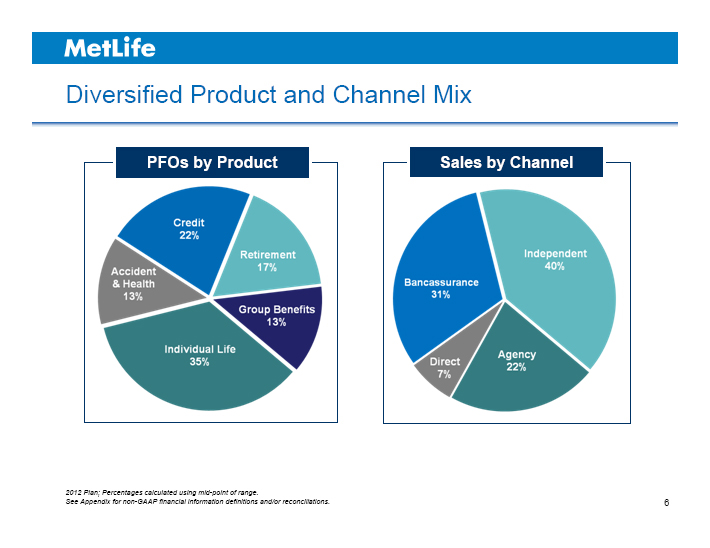

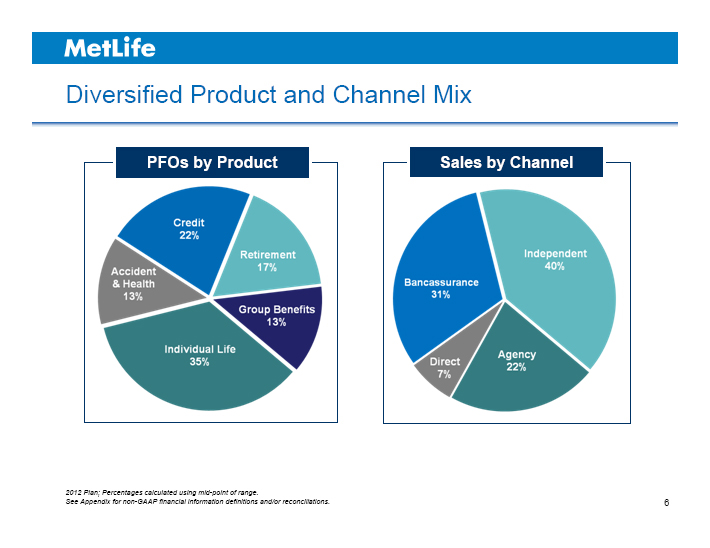

Diversified Product and Channel Mix

PFOs by Product

Accident & Health 13%

Credit 22%

Retirement 17%

Group Benefits 13%

Individual Life 35%

Sales by Channel

Bancassurance 31%

Independent 40%

Agency 22%

Direct 7%

2012 Plan; Percentages calculated using mid-point of range.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

6

MetLife

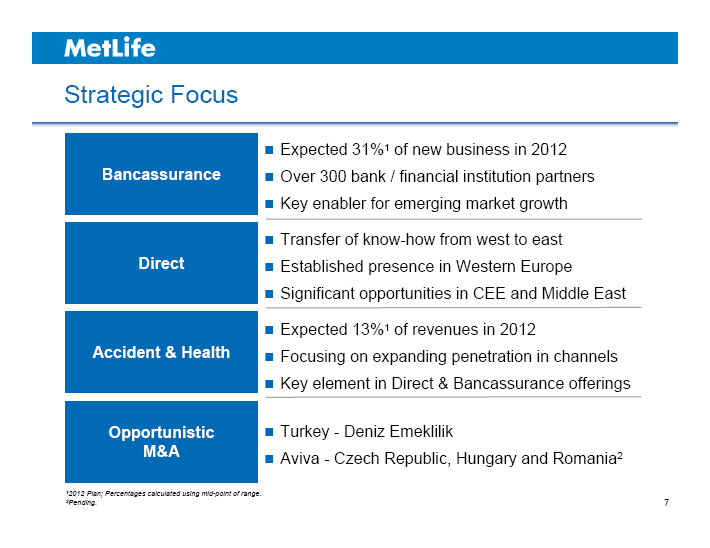

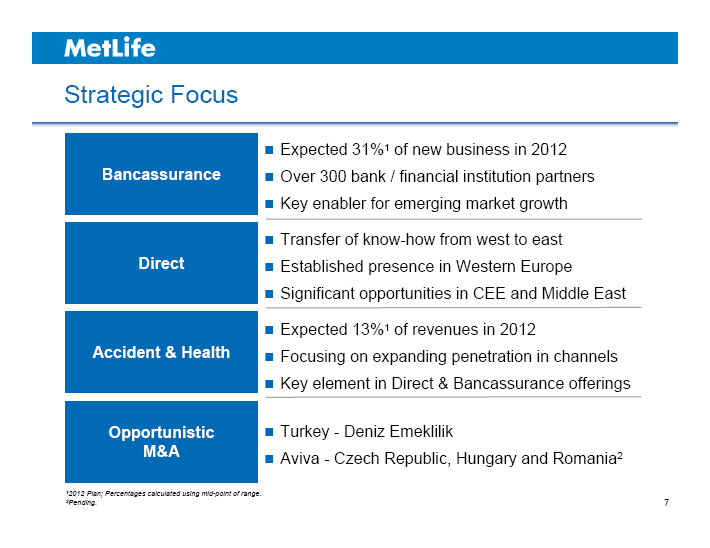

Strategic Focus

Bancassurance

Expected 31%1 of new business in 2012

Over 300 bank / financial institution partners

Key enabler for emerging market growth

Direct

Transfer of know-how from west to east

Established presence in Western Europe

Significant opportunities in CEE and Middle East

Accident & Health

Expected 13%1 of revenues in 2012

Focusing on expanding penetration in channels

Key element in Direct & Bancassurance offerings

Opportunistic M&A

Turkey - Deniz Emeklilik

Aviva - Czech Republic, Hungary and Romania2

12012 Plan; Percentages calculated using mid-point of range.

2Pending.

7

MetLife

EMEA Summary

Focus on high growth markets and businesses

Leverage unique geographic footprint and global capabilities

Strong persistency despite challenging headwinds

Complement organic growth with opportunistic M&A

8

MetLife © PNTS

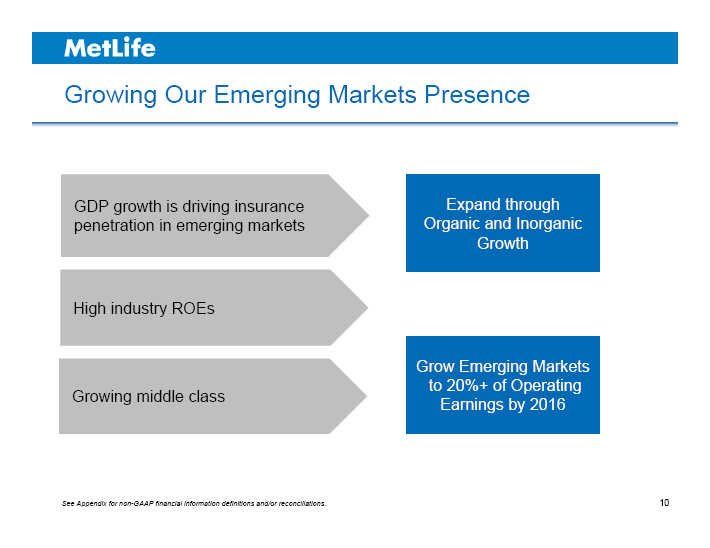

Growing Our Emerging Markets Presence

MetLife

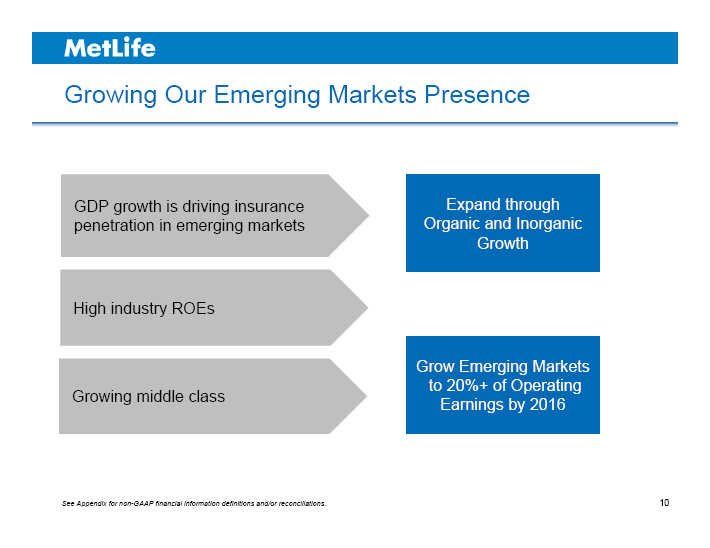

Growing Our Emerging Markets Presence

GDP growth is driving insurance penetration in emerging markets

High industry ROEs

Growing middle class

Expand through Organic and Inorganic Growth

Grow Emerging Markets to 20%+ of Operating Earnings by 2016

See Appendix for non-GAAP financial information definitions and/or reconciliations. 10

MetLife

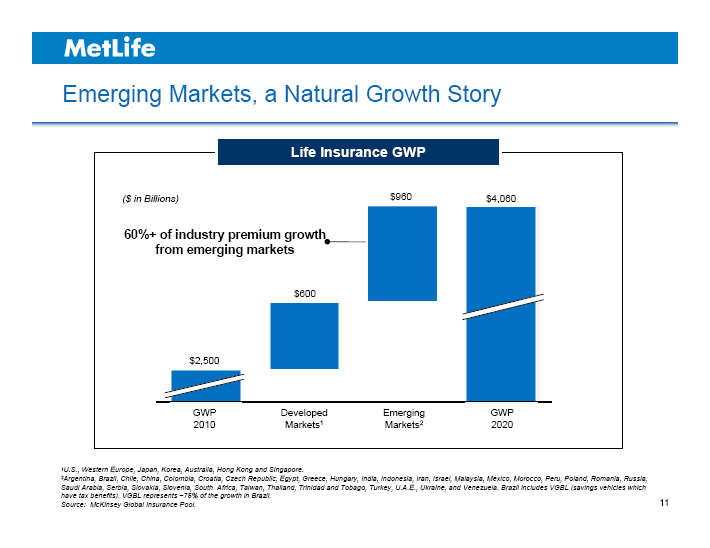

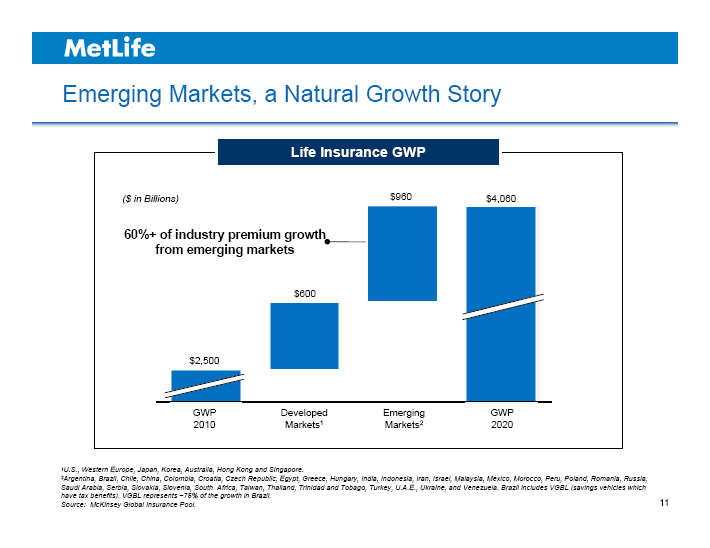

Emerging Markets, a Natural Growth Story

Life Insurance GWP

($ in Billions) $960 $4,060

60%+ of industry premium growth from emerging markets

$600

$2,500

GWP 2010

Developed Markets1

Emerging Markets2

GWP 2020

1U.S., Western Europe, Japan, Korea, Australia, Hong Kong and Singapore.

2Argentina, Brazil, Chile, China, Colombia, Croatia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Iran, Israel, Malaysia, Mexico, Morocco, Peru, Poland, Romania, Russia, Saudi Arabia, Serbia, Slovakia, Slovenia, South Africa, Taiwan, Thailand, Trinidad and Tobago, Turkey, U.A.E., Ukraine, and Venezuela. Brazil includes VGBL (savings vehicles which have tax benefits). VGBL represents ~75% of the growth in Brazil.

Source: McKinsey Global Insurance Pool. 11

MetLife

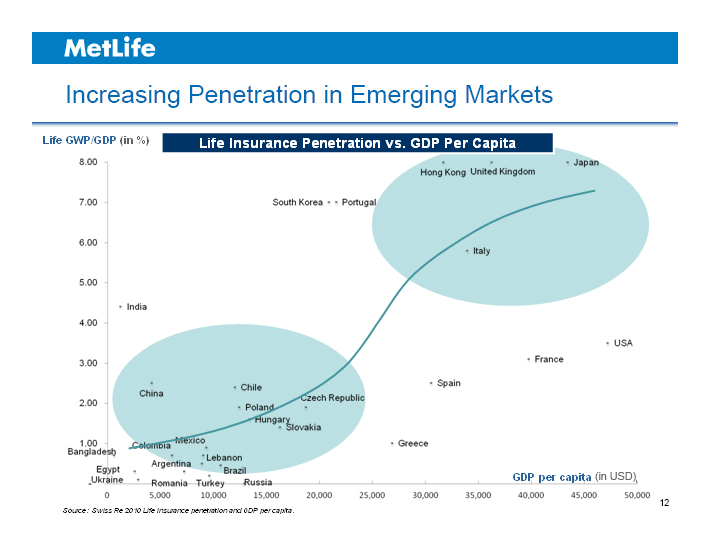

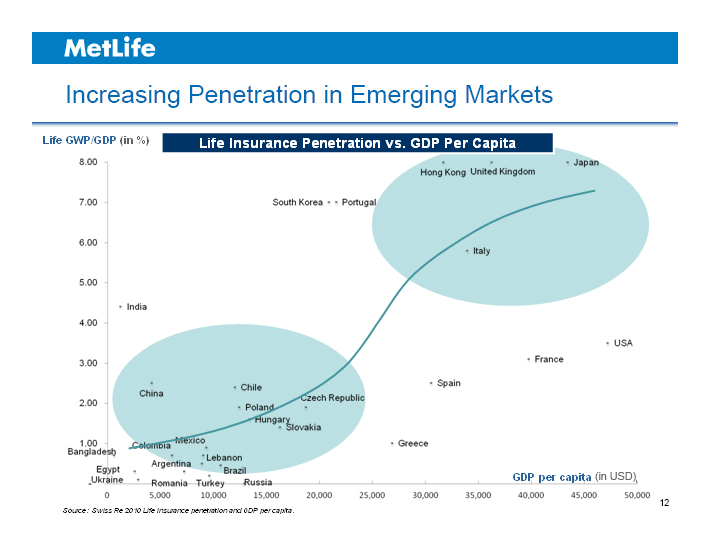

Increasing Penetration in Emerging Markets

Life GWP/GDP (in %) Life Insurance Penetration vs. GDP Per Capita

8.00 7.00 6.00 5.00 4.00 3.00 2.00 1.00

Bangladesh

Egypt

Ukraine

India

China

Colombia

Argentina

Romania

Mexico

Lebanon

Brazil

Turkey

Russia

Chile

Poland

Hungary

Slovakia

Czech Republic

South Korea Portugal

Spain

Greece

Hong Kong United Kingdom

Japan Italy

France USA

GDP per capita (in USD)

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000

Source: Swiss Re 2010 Life insurance and GDP per capita. 12

MetLife

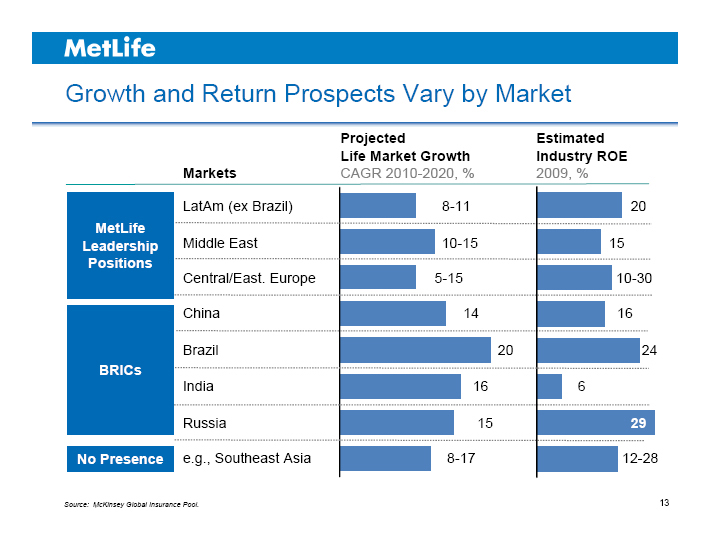

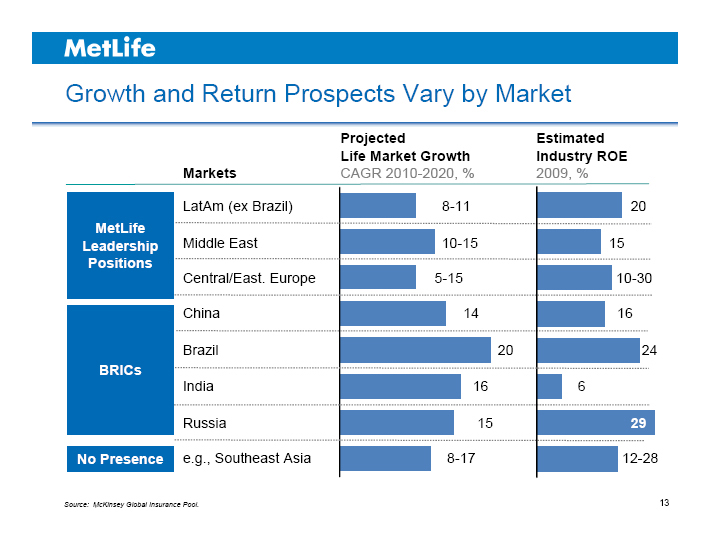

Growth and Return Prospects Vary by Market

MetLife Leadership Positions

BRICs

No Presence

Markets

LatAm (ex Brazil) Middle East Central/East. Europe China Brazil India Russia e.g., Southeast Asia

Projected Life Market Growth

CAGR 2010-2020, %

8-11 10-15 5-15 14 20 16 15 8-17

Estimated Industry ROE 2009, %

20 15 10-30 16 24 6 29 12-28

Source: McKinsey Global Insurance Pool. 13

MetLife

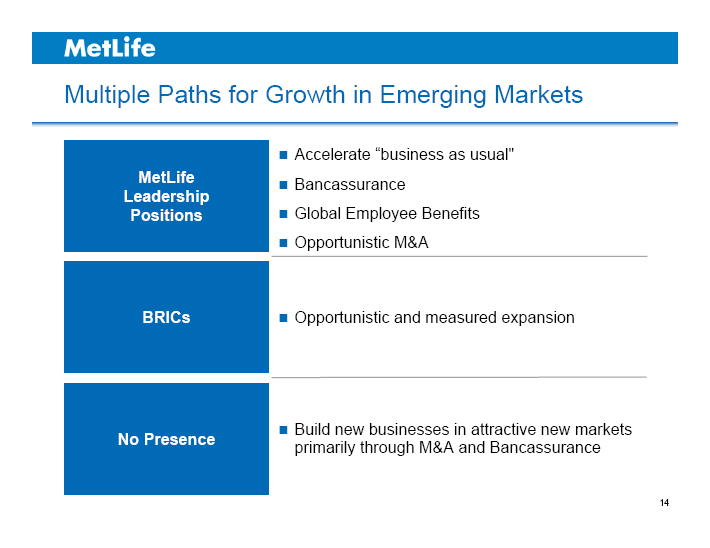

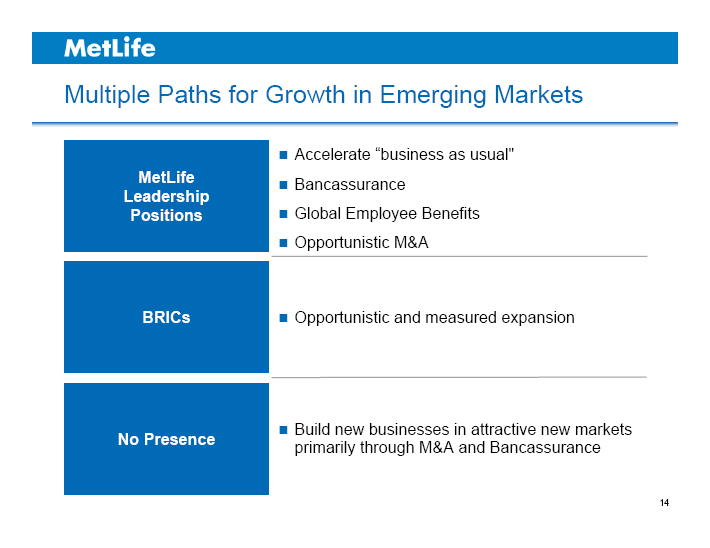

Multiple Paths for Growth in Emerging Markets

MetLife Leadership Positions

Accelerate “business as usual” Bancassurance Global Employee Benefits Opportunistic M&A

BRICs

Opportunistic and measured expansion

No Presence

Build new businesses in attractive new markets primarily through M&A and Bancassurance

14

MetLife

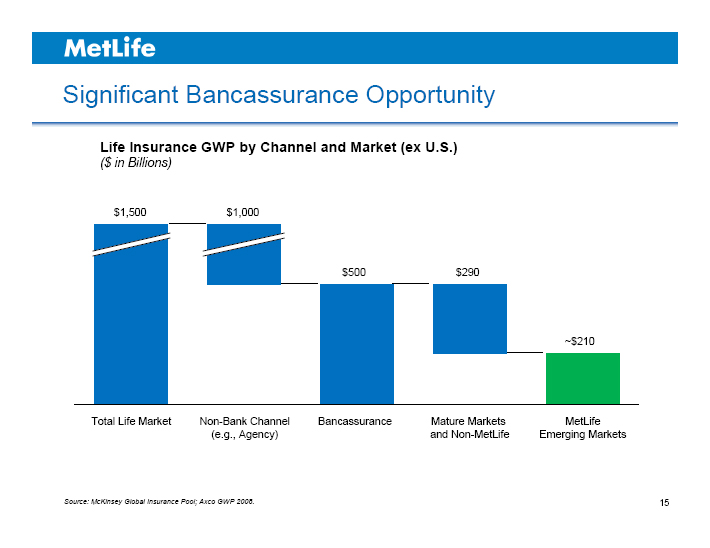

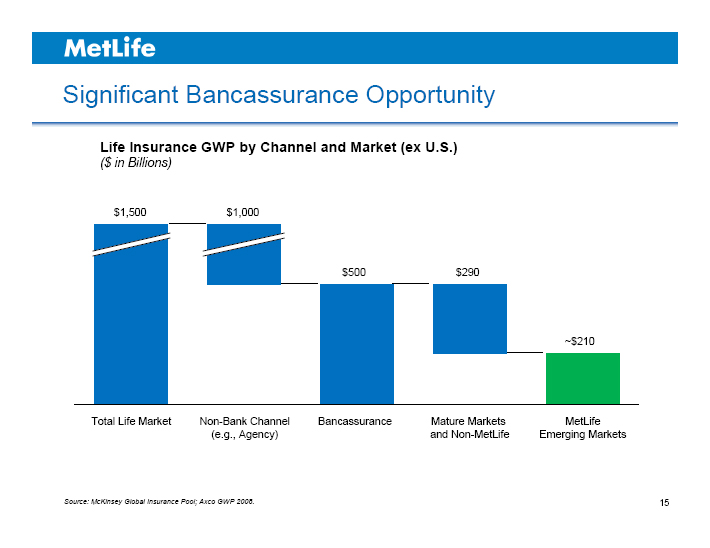

Significant Bancassurance Opportunity

Life Insurance GWP by Channel and Market (ex U.S.)

($ in Billions)

$1,500

Total Life Market

$1,000

Non-Bank Channel (e.g., Agency)

$500

Bancassurance

$290

Mature Markets and Non-MetLife

~$210

MetLife Emerging Markets

Source: McKinsey Global Insurance Pool; Axco GWP 2008. 15

MetLife

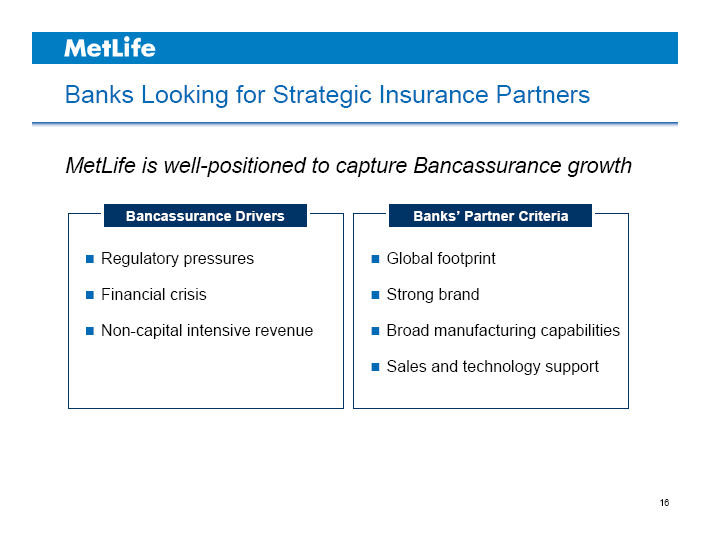

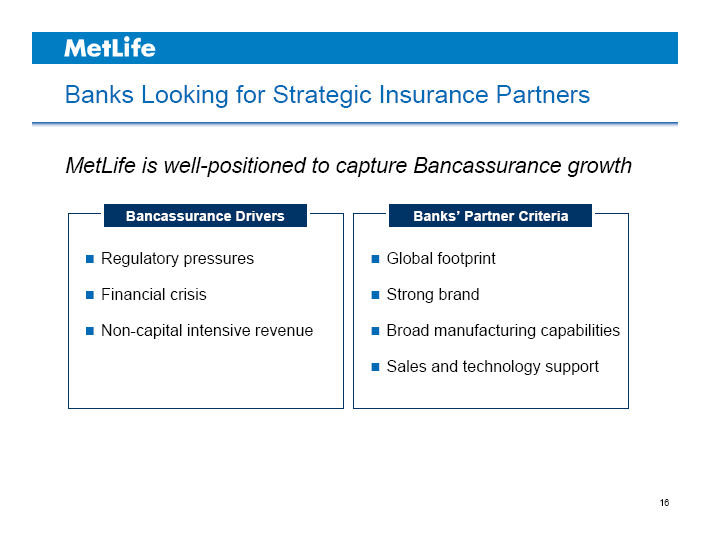

Banks Looking for Strategic Insurance Partners

MetLife is well-positioned to capture Bancassurance growth

Bancassurance Drivers

Regulatory pressures

Financial crisis

Non-capital intensive revenue

Banks’ Partner Criteria

Global footprint

Strong brand

Broad manufacturing capabilities

Sales and technology support

16

MetLife

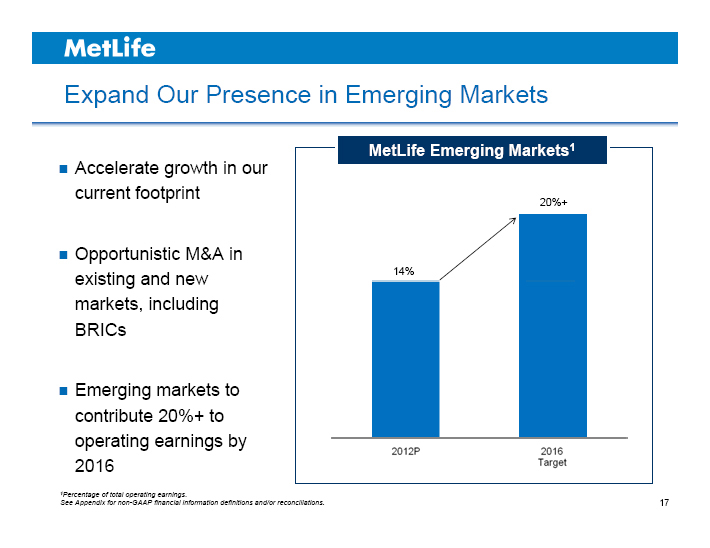

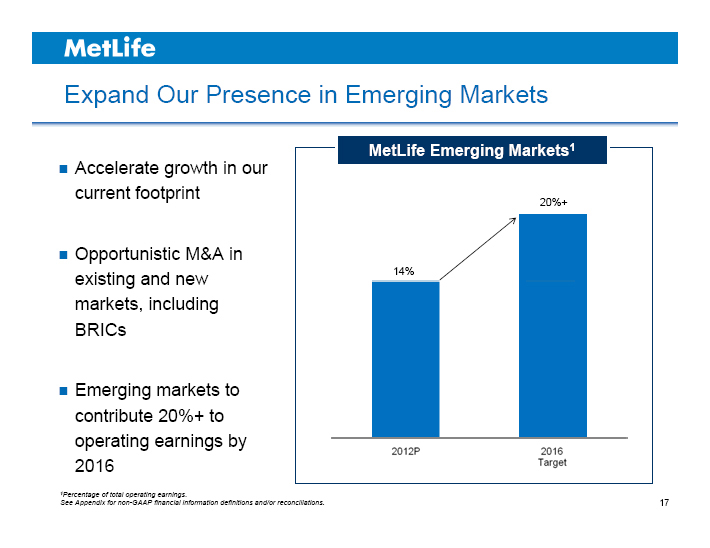

Expand Our Presence in Emerging Markets

Accelerate growth in our current footprint

Opportunistic M&A in existing and new markets, including BRICs

Emerging markets to contribute 20%+ to operating earnings by 2016

MetLife Emerging Markets1

14%

20%+

2012P

2016 Target

1Percentage of total operating earnings.

See Appendix for non-GAAP financial information definitions and/or reconciliations.

17

MetLife

MetLife

© PNTS

Steven A. Kandarian

Chairman, President & Chief Executive Officer

INVESTOR DAY 2012

MetLife

Strategy to Become a World-Class Company

Refocus the U.S. Business

Build Global Employee Benefits Business

One MetLife

Global * World-Class * Scale

Grow Emerging Markets

Drive Toward Customer Centricity and a Global Brand

2

MetLife

What Sets Us Apart

Our global platform

Leader in U.S. Employee Benefits

Proven risk management

Strong and growing global brand

3

MetLife

MetLife in 2016

Better positioned to meet customer needs

Higher ROE driven by underlying operating earnings growth, despite macro headwinds

20%+ of operating earnings from emerging markets

Sustainable competitive advantage through global platform and scale

Improved risk profile and free cash flow

See Appendix for non-GAAP financial information definitions and/or reconciliations. 4

MetLife

MetLife

© PNTS

Appendix

INVESTOR DAY 2012

MetLife

Explanatory Note on Non-GAAP Financial Information

All references in these presentations (except in this Explanatory Note on Non-GAAP Financial Information slide) to operating earnings, premiums, fees and other revenues and return on equity, should be read as operating earnings available to common shareholders, premiums, fees and other revenues (operating) and operating return on MetLife, Inc.’s common equity, excluding AOCI, respectively.

Operating earnings is the measure of segment profit or loss that MetLife uses to evaluate segment performance and allocate resources. Consistent with accounting principles generally accepted in the United States of America (“GAAP”) accounting guidance for segment reporting, operating earnings is MetLife’s measure of segment performance. Operating earnings is also a measure by which MetLife senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans.

Operating earnings is defined as operating revenues less operating expenses, both net of income tax. Operating earnings available to common shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or exited by MetLife, Inc. (“Divested Businesses”). Operating revenues also excludes net investment gains (losses) (“NIGL”) and net derivative gains (losses) (“NDGL”).

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

• Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to NIGL and NDGL and certain variable annuity guaranteed minimum income benefits (“GMIB”) fees (“GMIB Fees”);

• Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are hedges of investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations, (iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iv) excludes certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to securitization entities that are variable interest entities (“VIEs”) consolidated under GAAP; and

• Other revenues are adjusted for settlements of foreign currency earnings hedges.

2

MetLife

Explanatory Note on Non-GAAP Financial Information (Continued)

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

• Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to NIGL and NDGL, (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments associated with surrenders or terminations of contracts (“Market Value Adjustments”);

• Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium on derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes amounts related to net investment income earned on contractholder-directed unit-linked investments;

• Amortization of deferred policy acquisition costs (“DAC”) and value of business acquired (“VOBA”) excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB Fees and GMIB Costs, and (iii) Market Value Adjustments;

• Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

• Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

• Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and (iii) acquisition and integration costs.

Operating return on MetLife, Inc. common equity is defined as operating earnings available to common shareholders divided by average GAAP common equity.

MetLife believes the presentation of operating earnings and operating earnings available to common shareholders as MetLife measures it for management purposes enhances the understanding of the company’s performance by highlighting the results of operations and the underlying profitability drivers of the business. Operating revenues, operating expenses, operating earnings, operating earnings available to common shareholders, operating earnings available to common shareholders per diluted common share, operating return on MetLife, Inc.’s common equity and operating return on MetLife, Inc.’s common equity, excluding AOCI, should not be viewed as substitutes for the following financial measures calculated in accordance with GAAP: GAAP revenues, GAAP expenses, GAAP income (loss) from continuing operations, net of income tax, GAAP net income (loss) available to MetLife, Inc.’s common shareholders, GAAP net income (loss) available to MetLife, Inc.’s common shareholders per diluted common share, return on MetLife, Inc.’s common equity and return on MetLife, Inc.’s common equity, excluding AOCI, respectively.

3

MetLife

Explanatory Note on Non-GAAP Financial Information (Continued)

For the historical periods presented, reconciliations of non-GAAP measures used in this presentation to the most directly comparable GAAP measures are included in this Appendix to the presentation materials and are on the Investor Relations portion of our Internet website. Additional information about our historical results is also available on our Internet website in our Quarterly Financial Supplements for the corresponding periods.

The non-GAAP measures used in this presentation should not be viewed as substitutes for the most directly comparable GAAP measures.

In these presentations, we sometimes refer to sales activity for various products. These sales statistics do not correspond to revenues under GAAP, but are used as relevant measures of business activity.

In these presentations, we provide guidance on our future earnings, premiums, fees and other revenues, and return on common equity on an operating or non-GAAP basis. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is not accessible on a forward-looking basis because we believe it is not possible to provide other than a range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or without the range and from period to period and may have a significant impact on GAAP net income.

4

MetLife

© PNTS

Definitions

MetLife

Definitions

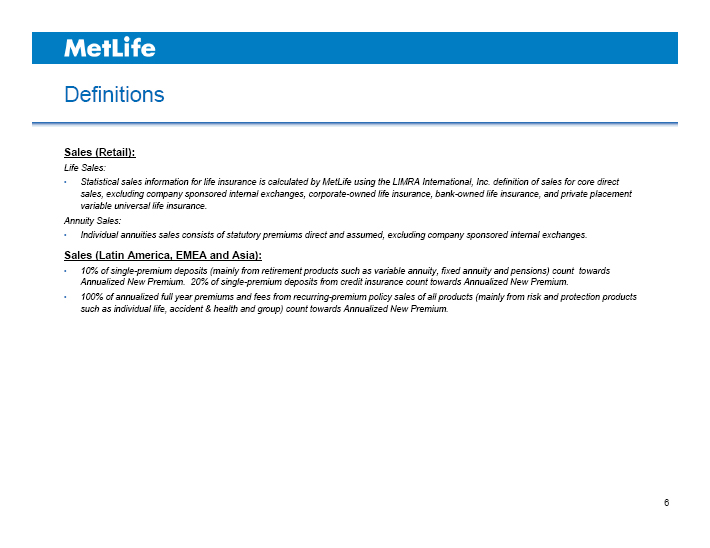

Sales (Retail):

Life Sales:

• Statistical sales information for life insurance is calculated by MetLife using the LIMRA International, Inc. definition of sales for core direct sales, excluding company sponsored internal exchanges, corporate-owned life insurance, bank-owned life insurance, and private placement variable universal life insurance.

Annuity Sales:

• Individual annuities sales consists of statutory premiums direct and assumed, excluding company sponsored internal exchanges.

Sales (Latin America, EMEA and Asia):

• 10% of single-premium deposits (mainly from retirement products such as variable annuity, fixed annuity and pensions) count towards Annualized New Premium. 20% of single-premium deposits from credit insurance count towards Annualized New Premium.

• 100% of annualized full year premiums and fees from recurring-premium policy sales of all products (mainly from risk and protection products such as individual life, accident & health and group) count towards Annualized New Premium.

6

MetLife

© PNTS

Reconciliations

MetLife

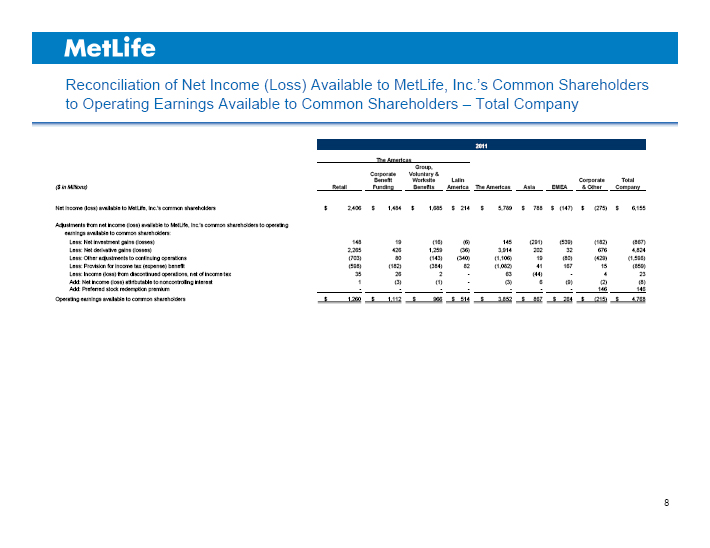

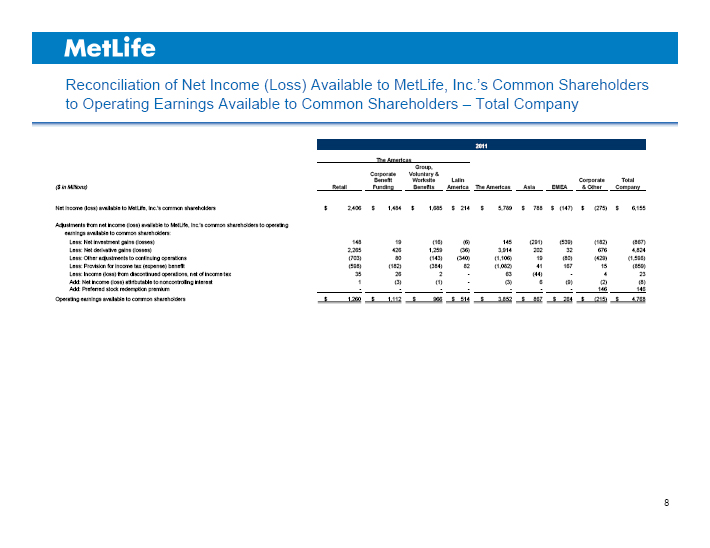

Reconciliation of Net Income (Loss) Available to MetLife, Inc.’s Common Shareholders to Operating Earnings Available to Common Shareholders – Total Company

2011

The Americas

($ in Millions) Retail Corporate Benefit Funding Group, Voluntary & Worksite Benefits Latin America The Americas Asia EMEA Corporate & Other Total Company

Net income (loss) available to MetLife, Inc.’s common shareholders $ 2,406 $ 1,484 $ 1,685 $ 214 $ 5,789 $ 788 $ (147) $ (275) $ 6,155

Adjustments from net income (loss) available to MetLife, Inc.’s common shareholders to operating earnings available to common shareholders:

Less: Net investment gains (losses) 148 19 (16) (6) 145 (291) (539) (182) ( 867)

Less: Net derivative gains (losses) 2,265 426 1,259 (36) 3,914 202 32 676 4,824

Less: Other adjustments to continuing operations (703) 80 (143) (340) (1,106) 19 (80) (429) (1,596)

Less: Provision for income tax (expense) benefit (598) (182) (384) 82 (1,082) 41 167 15 (859)

Less: Income (loss) from discontinued operations, net of income tax 35 26 2 - 63 (44) - 4 23

Add: Net income (loss) attributable to noncontrolling interest 1 (3) (1) - (3) 6 (9) (2) (8)

Add: Preferred stock redemption premium - - - - - - - 146 146

Operating earnings available to common shareholders $ 1,260 $ 1,112 $ 966 $ 514 $ 3,852 $ 867 $ 264 $ (215) $ 4,768

8

MetLife

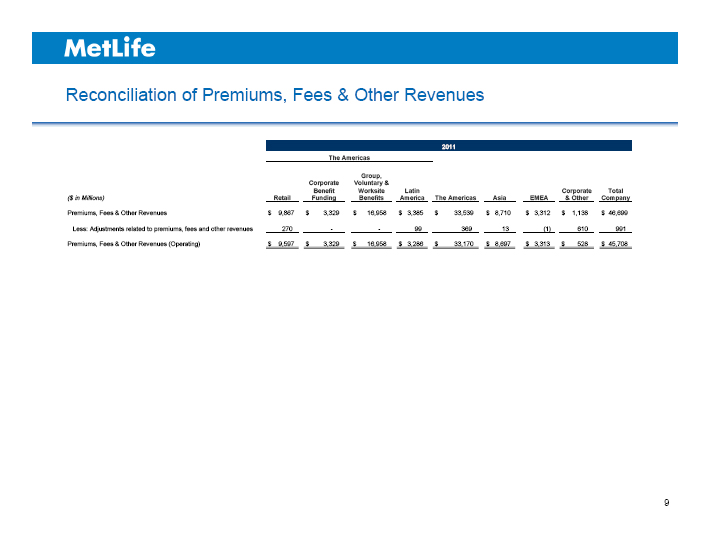

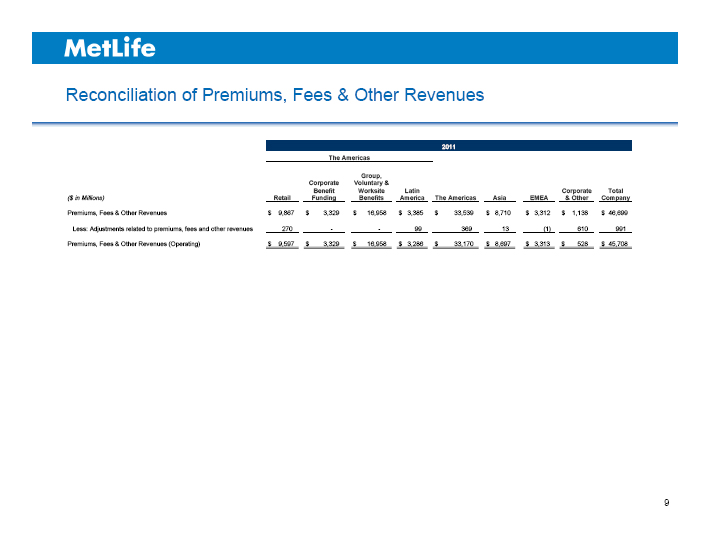

Reconciliation of Premiums, Fees & Other Revenues

2011

The Americas

($ in Millions)

Retail

Corporate Benefit Funding

Group, Voluntary & Worksite Benefits

Latin America

The Americas

Asia

EMEA

Corporate & Other

Total Company

Premiums, Fees & Other Revenues $ 9,867 $ 3,329 $ 16,958 $ 3,385 $ 33,539 $ 8,710 $ 3,312 $ 1,138 $ 46,699

Less: Adjustments related to premiums, fees and other revenues 270 - - 99 369 13 (1) 610 991

Premiums, Fees & Other Revenues (Operating) $ 9,597 $ 3,329 $ 16,958 $ 3,286 $ 33,170 $ 8,697 $ 3,313 $ 528 $ 45,708

9

MetLife

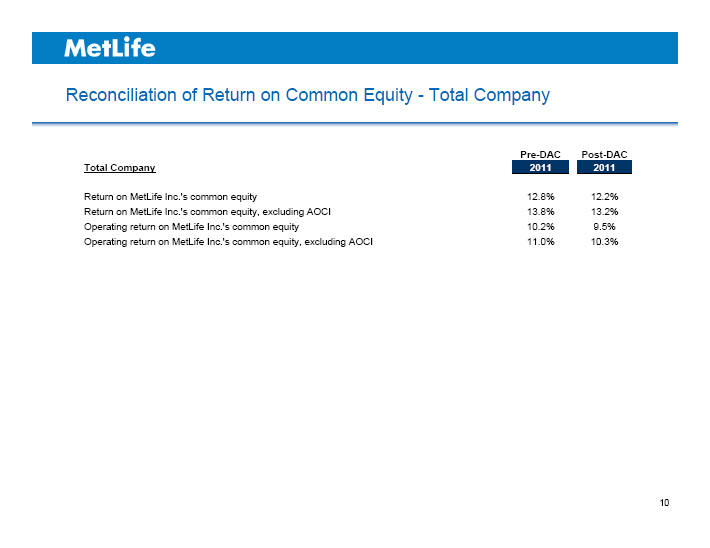

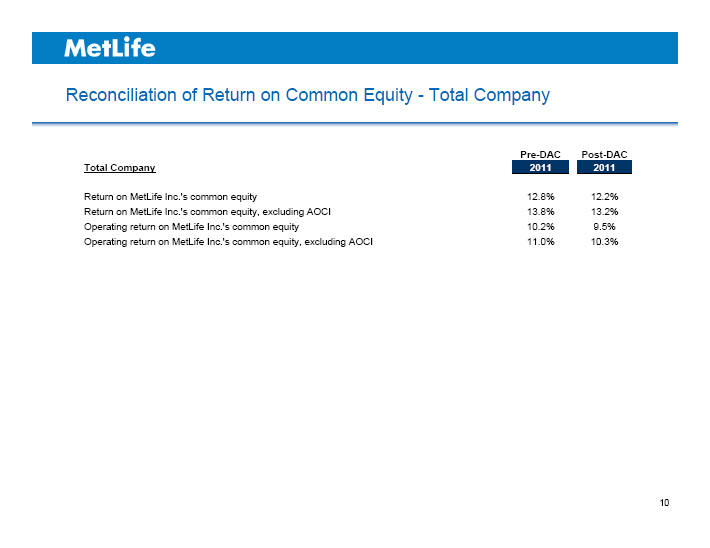

Reconciliation of Return on Common Equity - Total Company

Total Company

Pre-DAC 2011 Post-DAC 2011

Return on MetLife Inc.’s common equity 12.8% 12.2%

Return on MetLife Inc.’s common equity, excluding AOCI 13.8% 13.2%

Operating return on MetLife Inc.’s common equity 10.2% 9.5%

Operating return on MetLife Inc.’s common equity, excluding AOCI 11.0% 10.3%

10

MetLife

Steven A. Kandarian

Chairman, President & Chief Executive Officer

MetLife, Inc.

Steven A. Kandarian is chairman of the board, president and chief executive officer of MetLife, Inc. a leading global provider of insurance, annuities and employee benefit programs serving 90 million customers. He became president and CEO on May 1, 2011 and chairman of the board of directors on January 1, 2012. For 2011, MetLife had $70.2 billion in revenue and ranks 34th on the FORTUNE 500®.

Kandarian joined MetLife in April 2005 as executive vice president and chief investment officer (CIO). Since 2007, he has also overseen MetLife’s enterprise-wide strategy, which identified key areas of focus for the company. Specifically, his direction contributed to MetLife’s recent global expansion and led to significant cost savings, as well as efforts to address the insurance needs of the underserved U.S. middle market.

As CIO, Kandarian oversaw the company’s more than $450 billion general account portfolio and led a number of initiatives that strengthened the portfolio and contributed to MetLife’s bottom line. He enhanced the company’s focus on effective risk management and diversified MetLife’s investment portfolio, in part through the $5.4 billion sale of Peter Cooper Village/Stuyvesant Town in 2006. Under Kandarian’s leadership, MetLife identified the housing bubble early and reduced its exposure to sub-prime mortgage-backed securities, raised the overall quality of its corporate credit portfolio, and increased its focus on low loan-to-value commercial and agricultural mortgages. His efforts helped MetLife emerge from the 2008 credit crisis with the financial strength to complete the company’s $16 billion purchase of Alico in 2010.

From 2001 to 2004, Kandarian was executive director of the Pension Benefit Guaranty Corporation (PBGC). During his tenure, he made the public case for comprehensive reform of the pension funding rules to put the defined benefit system and the PBGC on a sound financial footing, helping to lay the groundwork for the enactment of the Pension Protection Act of 2006.

Previously, Kandarian was founder and managing partner of Orion Partners, LP, a private equity firm based in the Boston area. Earlier, he was managing director of Lee Capital Holdings. Kandarian began his career as an investment banker with Houston-based Rotan Mosle, Inc.

Kandarian is a board member of the Damon Runyon Cancer Research Foundation and a member of the Economic Club of New York and the Financial Services Forum. He earned his B.A. from Clark University, J.D. from Georgetown University Law Center, and M.B.A. from Harvard Business School.

# # #

William J. Wheeler

President, The Americas

MetLife, Inc.

William J. Wheeler is president of The Americas division of MetLife, Inc., a leading global provider of insurance, annuities and employee benefit programs serving 90 million customers. He was appointed to this position in November 2011.

As president, Wheeler oversees MetLife’s insurance and retirement businesses in the United States and Latin America. MetLife is the largest life insurer in both the U.S. and Mexico, and the company also holds leading market positions in Chile, Brazil and Argentina.

Prior to his current role, Wheeler was executive vice president and chief financial officer since December 2003. As CFO, Wheeler was responsible for overseeing all financial management matters, including financial reporting, treasury, corporate actuarial, risk management, tax, investor relations and mergers and acquisitions. Wheeler was a key architect of MetLife’s 2010 acquisition of Alico, the largest transaction in MetLife’s history, and the acquisition of Travelers Life & Annuity and related international insurance businesses in 2005. Wheeler also oversaw a number of capital management strategies and related transactions that enhanced MetLife’s financial strength and increased its liquidity at a time of severe capital market constraints, while simultaneously achieving significant annualized expense savings and implementing a number of risk management initiatives.

Prior to becoming CFO, Wheeler oversaw business development, product management and marketing activities for the company’s Individual Business and also served as chief financial officer of Institutional Business, overseeing financial reporting and planning, as well as expense management. Wheeler joined MetLife in 1997 as treasurer and played a key role in preparing MetLife to become a public company. He oversaw certain aspects of the demutualization, the development of the investor relations and shareholder services organizations, and management of the initial public offering process.

Before joining MetLife, Wheeler was an investment banker for ten years at Donaldson, Lufkin & Jenrette (DLJ). During his career at DLJ, he managed a variety of transactions, including equity and debt financings, mergers and acquisitions, leveraged buyouts, and financial advisory and restructurings in a number of different industries, including the insurance industry.

Wheeler is a member of Wabash College’s board of trustees. He holds an M.B.A. from Harvard Business School and received an A.B., magna cum laude, from Wabash College where he was elected to Phi Beta Kappa.

# # #

Maria R. Morris

Executive Vice President

Global Employee Benefits

Integration

MetLife, Inc.

Maria R. Morris is executive vice president and head of MetLife’s Global Employee Benefits business unit of MetLife Inc., the first global business unit established by the company. MetLife, Inc. is a leading global provider of insurance, annuities and employee benefit programs serving 90 million customers. Morris, who was appointed to this position in November 2011, is also responsible for integrating MetLife’s $16 billion acquisition of Alico, acquired from AIG in 2010.

Prior to her current role, Morris served as head of global technology and operations, overseeing a $1.6 billion IT portfolio and over $2.5 billion in procurable and real estate occupancy spend. Under her leadership, global technology and operations delivered a 64 basis point improvement to MetLife’s expense ratio.

In her career, Morris has successfully led and transformed large organizations to grow businesses and expand profitability. Morris previously served as executive vice president, employee benefits sales. In this role, she had oversight of the group insurance and retirement and savings sales and service teams. Under her direction, these teams achieved record sales and generated over $14 billion in annual revenue. Beginning in 2003, Morris served as senior vice president of group insurance and voluntary benefits sales and service operations. From 2000 to 2003, as the vice president of MetLife’s group and individual disability businesses, overseeing product development, management and operations, Morris nearly doubled group disability profits. As the head of the dental business from 1996 to 2000, she transformed the operating model to increase profits by 200%. Morris joined MetLife in 1984.

Morris serves as a member of the board of directors of MetLife Securities, Inc., MetLife Property and Casualty Insurance Company and MetLife Foundation. She serves as chairman of the board of directors for INROADS, Inc., the first woman in this role, and also serves on the board of the All Stars Project, Inc. She was recognized byProfiles in Diversity Journal magazine as one of a number of “Women to Watch.” She holds a B.A. from Franklin and Marshall College, where she was elected to Phi Beta Kappa.

# # #

Michel Khalaf

President, EMEA

MetLife, Inc.

Michel Khalaf is president of MetLife, Inc.’s EMEA (Europe, the Middle East and Africa) region and a member of the executive group of MetLife, Inc., a leading global provider of insurance, annuities and employee benefit programs serving 90 million customers. He was appointed to this position in November 2011.

Prior to assuming his current position, Khalaf was executive vice president and chief executive officer of MetLife’s Middle East, Africa and South Asia (MEASA) region.

Previously, Khalaf was deputy president and chief operating officer of Philamlife, AIG’s operating company in the Philippines.

Since joining Alico’s investment department in 1989, Khalaf has held a number of leadership roles in various markets around the world, including the Caribbean, France and Italy. In 1996, he assumed the position of regional senior vice president in charge of Alico’s life, pension and mutual fund operations in Poland, Romania and the Baltics as well as president and chief executive officer of Amplico Life. In 1994, he was named the first general manager of Alico’s operation in Egypt.

Khalaf is a graduate of Syracuse University with a B.S. in engineering and an M.B.A. in finance. He is a fellow of the Life Management Institute (FLMI).

# # #

John D. McCallion

Vice President, Investor Relations

MetLife

John D. McCallion is vice president and head of investor relations of MetLife, Inc., a leading global provider of insurance, annuities and employee benefit programs serving 90 million customers. Appointed to this position in February 2011, McCallion manages and coordinates the presentation of MetLife’s financial results, messages and strategies to the analyst and investor community.

Prior to overseeing MetLife’s investor relations department, McCallion was vice president and chief financial officer of the company’s investments department. In this role, he was responsible for managing the financial analysis and reporting, as well as the income and expense plan and projection process for the company’s more than $450 billion investment portfolio. He also had oversight of the impairment and valuation process for MetLife’s investments.

McCallion joined MetLife in July 2006 after spending 10 years in PricewaterhouseCoopers’ insurance audit practice, where he worked with multinational and U.S. clients in the life and property/casualty insurance industries.

McCallion received a B.S. degree in accounting from Syracuse University and an M.B.A from the University of Pennsylvania, The Wharton School. He is a certified public accountant and a member of the American Institute of Certified Public Accountants.

# # #