Exhibit 99.1

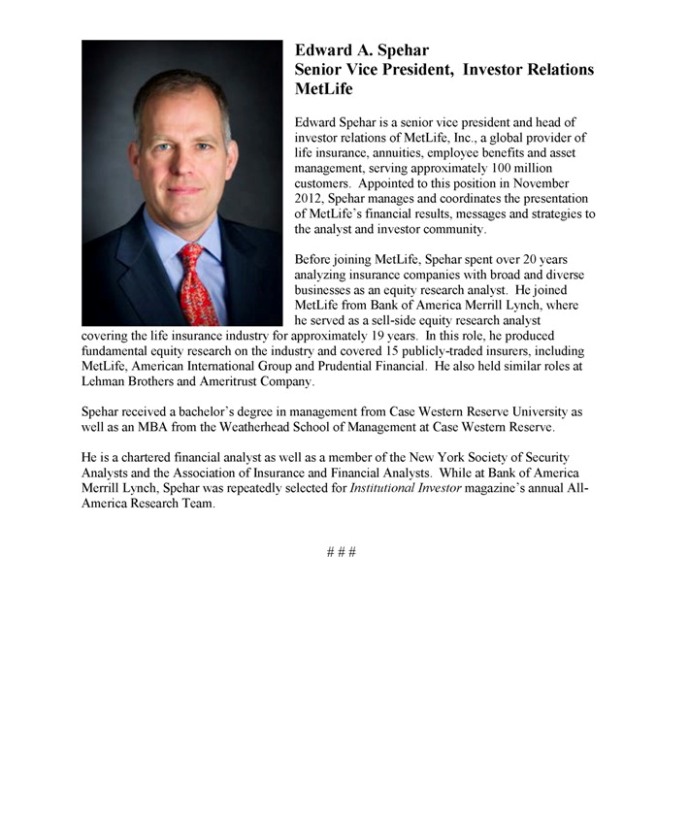

Edward A. Spehar

Senior Vice President & Head of Investor Relations

September 17, 2014

ASIA INVESTOR DAY 2014

MetLife

Cautionary Statement on Forward-Looking Statements and Non-GAAP Financial Information

This presentation may contain or incorporate by reference forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company does not undertake any obligation to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved. Additional discussion of forward-looking statements may be included in other slides in this presentation; if so, please refer to those slides for more information.

This presentation and accompanying materials may also contain measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Additional discussion of non-GAAP financial information may be included in other slides in these materials, on the Investor Relations portion of MetLife’s website (www.metlife.com), or elsewhere on that website; if so, please refer to those slides or the website for more information.

MetLife

Agenda

Update on MetLife & Importance of Asia

John C.R. Hele Chief Financial Officer, MetLife, Inc.

Asia: Overview

Christopher G. Townsend President, Asia

Asia: Financial Overview

Toby Brown Chief Financial Officer, Asia

Asia: Digital Strategy

Kathy Awanis Vice President, Direct & e-Business, Asia

Asia: Accident & Health Strategies

Dr. Nirmala Menon Head of Designated Markets & Health, Asia

Break

Japan: Overview

Sachin N. Shah Chairman, President & Chief Executive Officer, MetLife Japan

Japan: Multi-Channel Distribution

Koichiro Yamaguchi Chief Distribution Officer, MetLife Japan

Japan: Global Brand/Customer Centricity

Atsushi Yagai Chief Customer Marketing Officer, MetLife Japan

Japan: Financial Overview

Greg Brennan Chief Financial Officer, MetLife Japan

Closing Remarks

Christopher G. Townsend President, Asia

Q&A

MetLife

MetLife

John C.R. Hele

Chief Financial Officer MetLife, Inc.

September 17, 2014

ASIA INVESTOR DAY 2014

MetLife

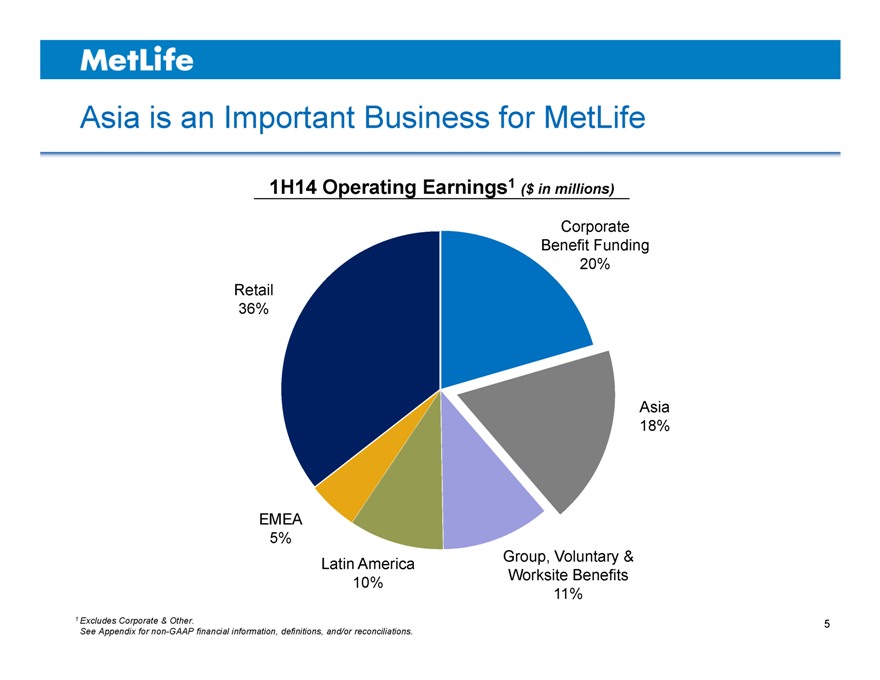

Asia is an Important Business for MetLife

1H14 Operating Earnings1 ($ in millions)

Corporate Benefit Funding 20% Retail 36%

Asia 18%

EMEA 5%

Group, Voluntary & Latin America Worksite Benefits 10% 11%

1 | | Excludes Corporate & Other. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

MetLife

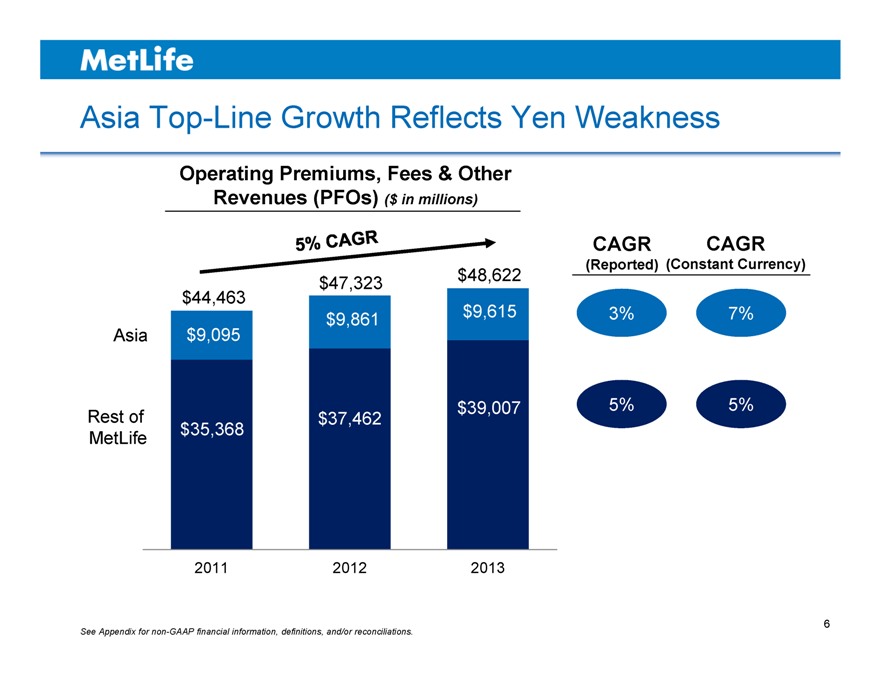

Asia Top-Line Growth Reflects Yen Weakness

Operating Premiums, Fees & Other Revenues (PFOs) ($ in millions)

CAGR CAGR

(Reported) (Constant Currency)

$47,323 $48,622

$44,463

$9,861 $9,615 3% 7%

Asia $9,095

Rest of $37,462 $39,007 5% 5%

MetLife $35,368

2011 2012 2013

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

MetLife

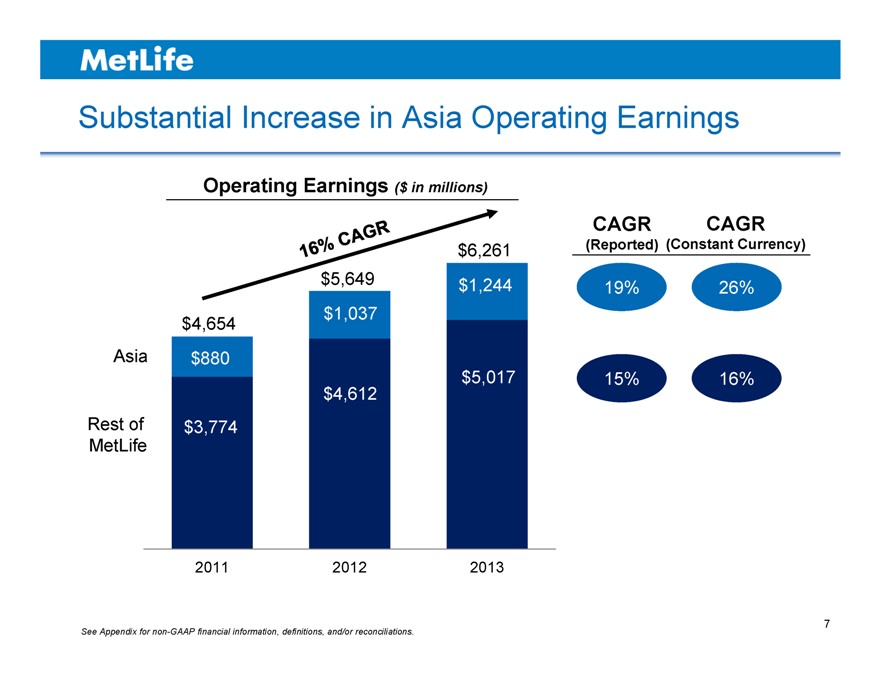

Substantial Increase in Asia Operating Earnings

Operating Earnings ($ in millions)

CAGR CAGR

$6,261 (Reported) (Constant Currency)

$5,649 $1,244 19% 26%

$4,654 $1,037

Asia $880

$5,017 15% 16%

$4,612

Rest of $3,774

MetLife

2011 2012 2013

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

MetLife

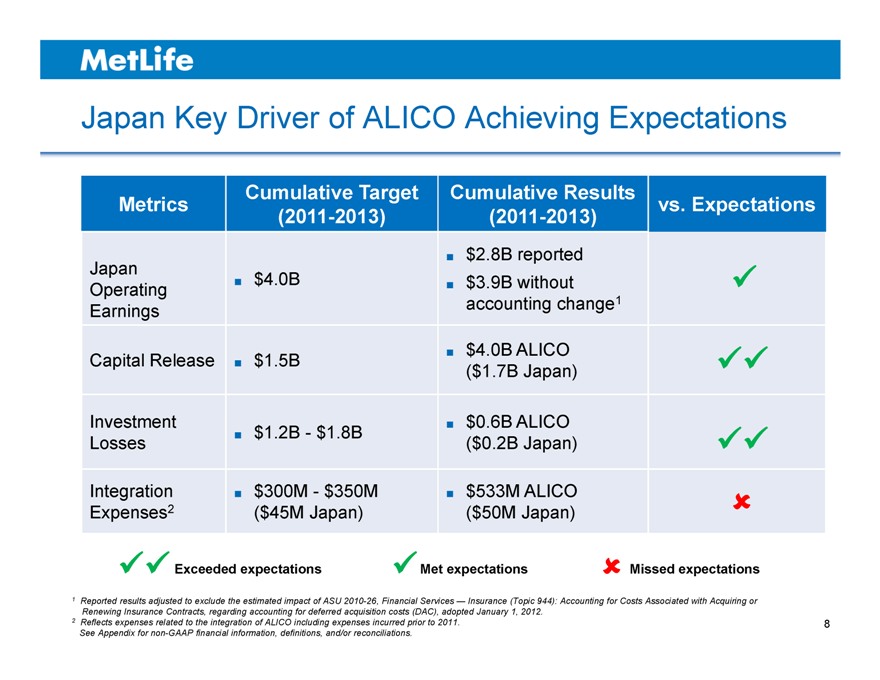

Japan Key Driver of ALICO Achieving Expectations

Cumulative Target Cumulative Results

Metrics vs. Expectations

(2011-2013) (2011-2013)

$2.8B reported

Japan $4.0B

Operating $3.9B without

Earnings accounting change1

Capital Release $1.5B $4.0B ALICO

($1.7B Japan)

Investment $0.6B ALICO

Losses $1.2B—$1.8B ($0.2B Japan)

Integration $300M—$350M $533M ALICO

Expenses2 ($45M Japan) ($50M Japan)

?Exceeded expectations ?Met expectations ?Missed expectations

1 Reported results adjusted to exclude the estimated impact of ASU 2010-26, Financial Services — Insurance (Topic 944): Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts, regarding accounting for deferred acquisition costs (DAC), adopted January 1, 2012.

2 Reflects expenses related to the integration of ALICO including expenses incurred prior to 2011. See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

MetLife

Long-term Story is More than Japan

High single to low double digit operating earnings growth from Asia over long term

Anticipate rapid growth outside Japan over long term

Improving cash generation in Japan is key objective

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

9

MetLife

Key Takeaways

Asia is an important market for MetLife

Japan results favorable relative to ALICO pricing expectations

Continued success in Japan, strong growth from rest of Asia

10

MetLife

MetLife

Christopher G. Townsend

President Asia

September 17, 2014

ASIA INVESTOR DAY 2014

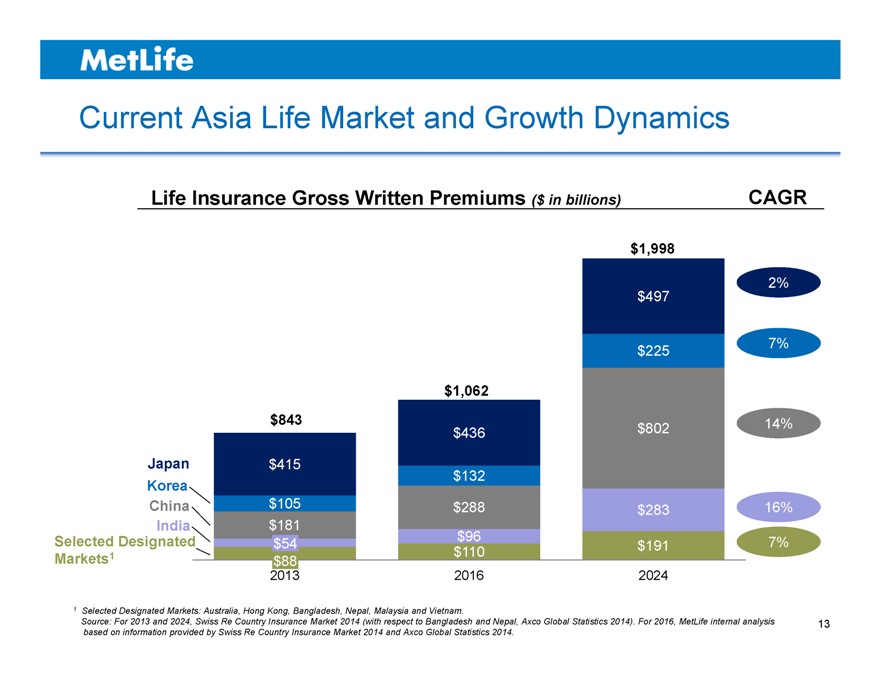

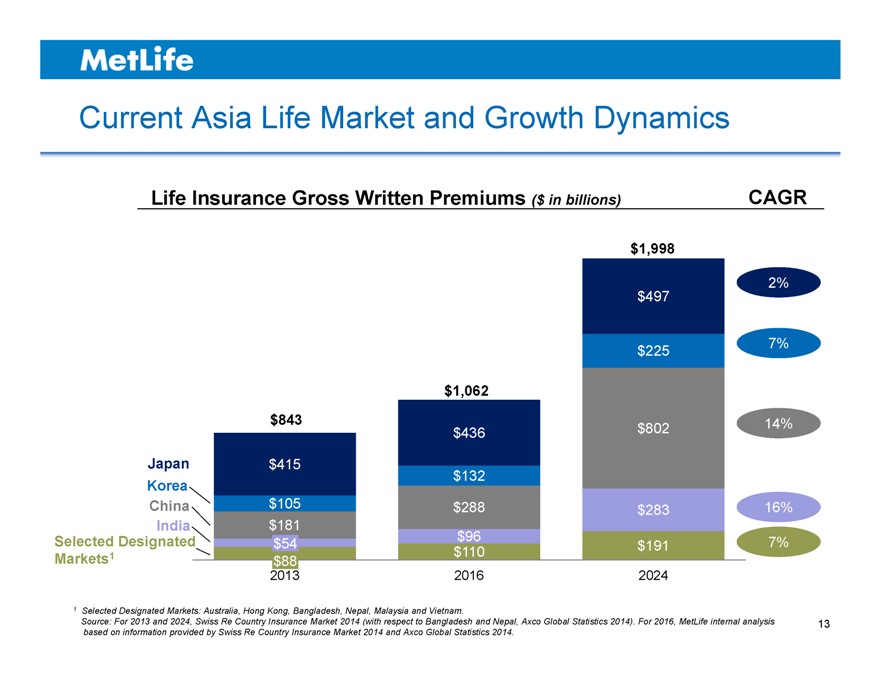

Current Asia Life Market and Growth Dynamics

Life Insurance Gross Written Premiums ($ in billions) CAGR

$1,998

2%

$497

$225 7%

$1,062

$843 $802 14%

$436

Japan $415

$132

Korea

China $105 $288 $283 16%

India $181

Selected Designated $54 $96 $191 7%

Markets1 $88 $110

2013 2016 2024

1 | | Selected Designated Markets: Australia, Hong Kong, Bangladesh, Nepal, Malaysia and Vietnam. |

Source: For 2013 and 2024, Swiss Re Country Insurance Market 2014 (with respect to Bangladesh and Nepal, Axco Global Statistics 2014). For 2016, MetLife internal analysis based on information provided by Swiss Re Country Insurance Market 2014 and Axco Global Statistics 2014.

13

MetLife

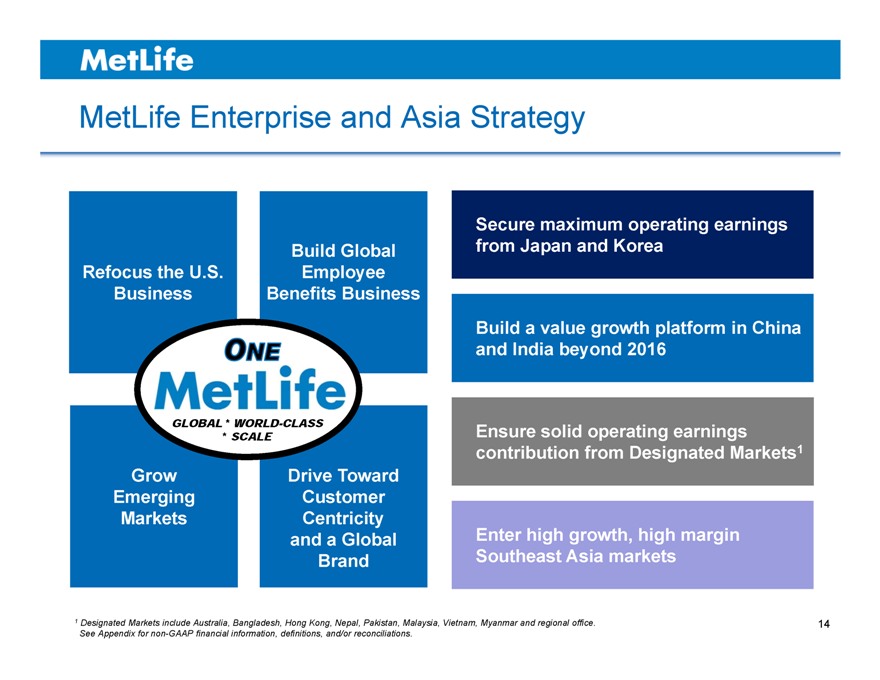

MetLife Enterprise and Asia Strategy

Secure maximum operating earnings

Build Global from Japan and Korea

Refocus the U.S. Employee

Business Benefits Business

Build a value growth platform in China

and India beyond 2016

GLOBAL * WORLD-CLASS

* | | SCALE Ensure solid operating earnings |

contribution from Designated Markets1

Grow Drive Toward

Emerging Customer

Markets Centricity

and a Global Enter high growth, high margin

Brand Southeast Asia markets

1 Designated Markets include Australia, Bangladesh, Hong Kong, Nepal, Pakistan, Malaysia, Vietnam, Myanmar and regional office. See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

14

MetLife

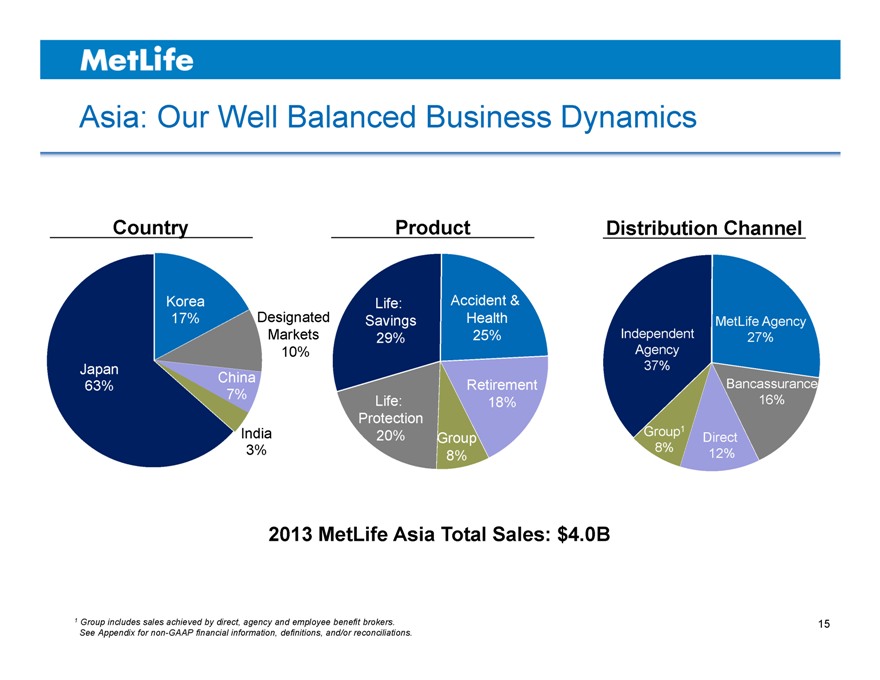

Asia: Our Well Balanced Business Dynamics

Country Product Distribution Channel

Korea Life: Accident &

17% Designated Savings Health MetLife Agency

Markets 29% 25% Independent 27%

10% Agency

Japan 37%

China

63% Retirement Bancassurance

7% Life: 18% 16%

Protection

India 20% Group1 Direct

Group

3% 8% 8% 12%

2013 MetLife Asia Total Sales: $4.0B

1 Group includes sales achieved by direct, agency and employee benefit brokers. See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

15

MetLife

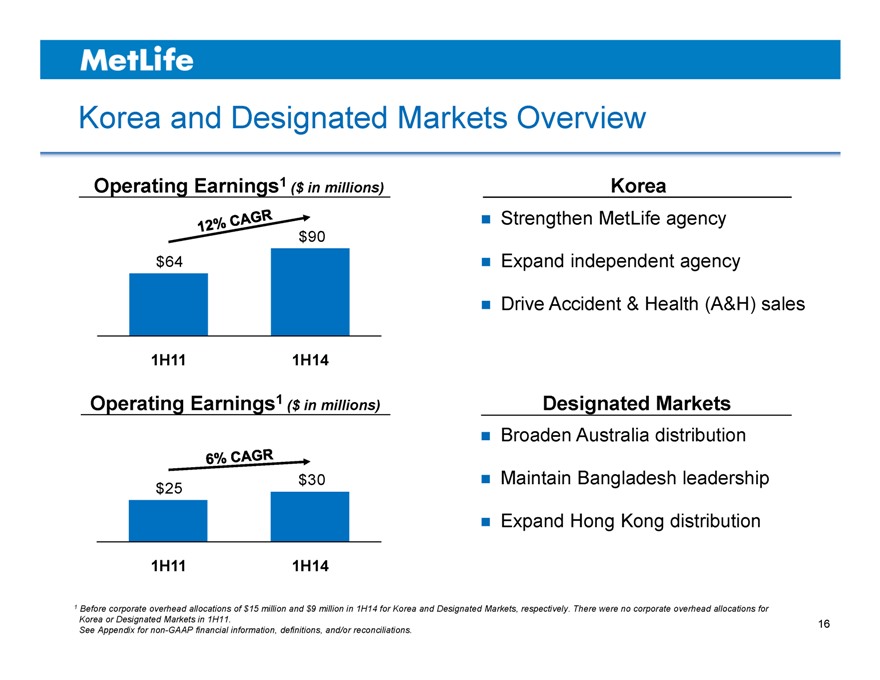

Korea and Designated Markets Overview

Operating Earnings1 ($ in millions)

$90

$64

1H11 1H14

Operating Earnings1 ($ in millions)

$25 $30

1H11 1H14

Korea

Strengthen MetLife agency Expand independent agency Drive Accident & Health (A&H) sales

Designated Markets

Broaden Australia distribution Maintain Bangladesh leadership Expand Hong Kong distribution

1 Before corporate overhead allocations of $15 million and $9 million in 1H14 for Korea and Designated Markets, respectively. There were no corporate overhead allocations for Korea or Designated Markets in 1H11.

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

16

MetLife

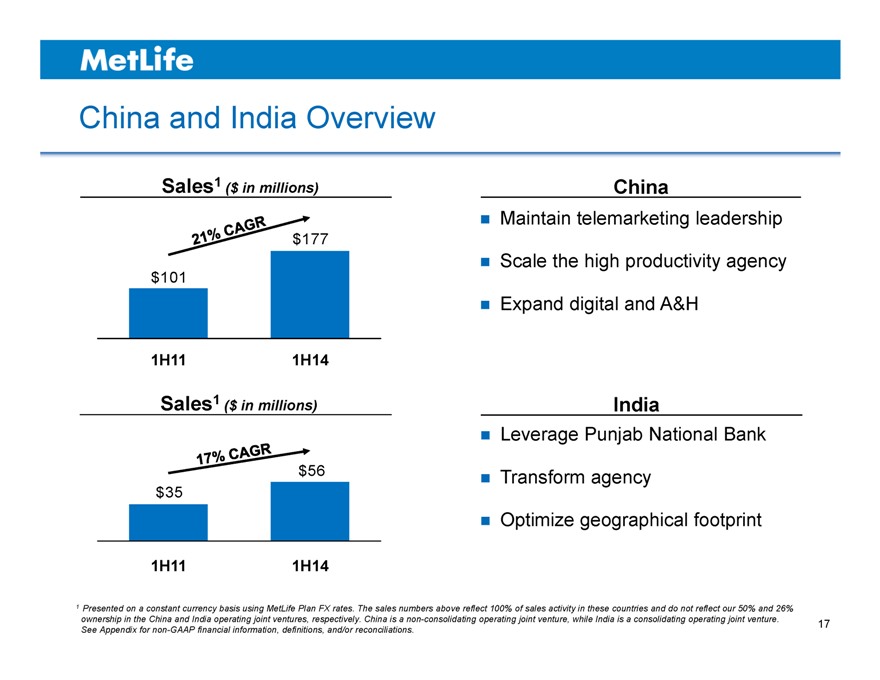

China and India Overview

Sales1 ($ in millions)

$177

$101

1H11 1H14

Sales1 ($ in millions)

$56

$35

1H11 1H14

China

Maintain telemarketing leadership Scale the high productivity agency Expand digital and A&H

India

Leverage Punjab National Bank Transform agency Optimize geographical footprint

1 Presented on a constant currency basis using MetLife Plan FX rates. The sales numbers above reflect 100% of sales activity in these countries and do not reflect our 50% and 26% ownership in the China and India operating joint ventures, respectively. China is a non-consolidating operating joint venture, while India is a consolidating operating joint venture. See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

17

MetLife

Areas of Focus to Drive Value

Transform distribution to drive productivity Increase product profitability Focus on customer experience Improve efficiency and leverage scale

18

MetLife

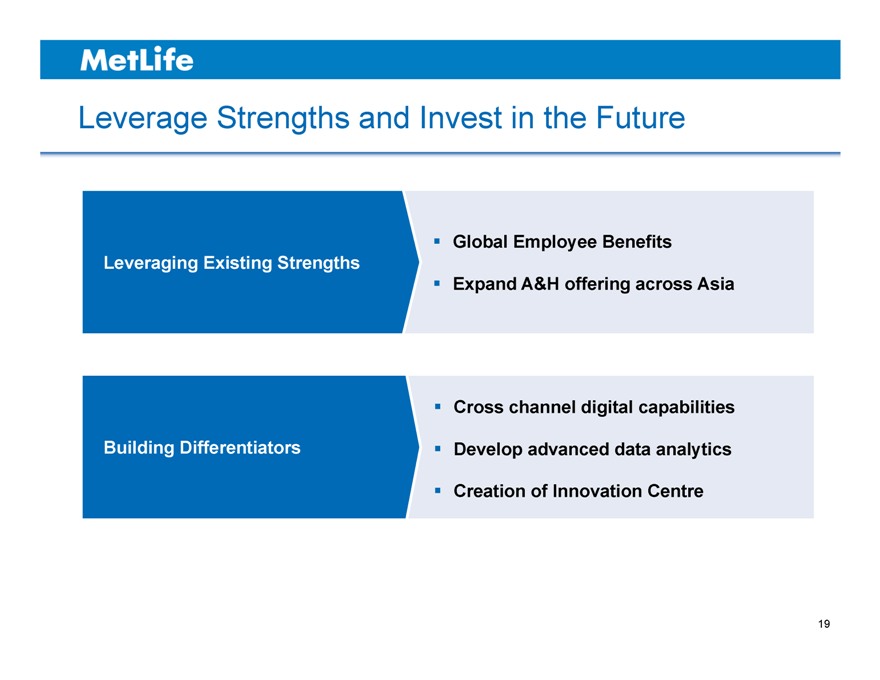

Leverage Strengths and Invest in the Future

Leveraging Existing Strengths

Building Differentiators

Global Employee Benefits

Expand A&H offering across Asia

Cross channel digital capabilities Develop advanced data analytics Creation of Innovation Centre

19

MetLife

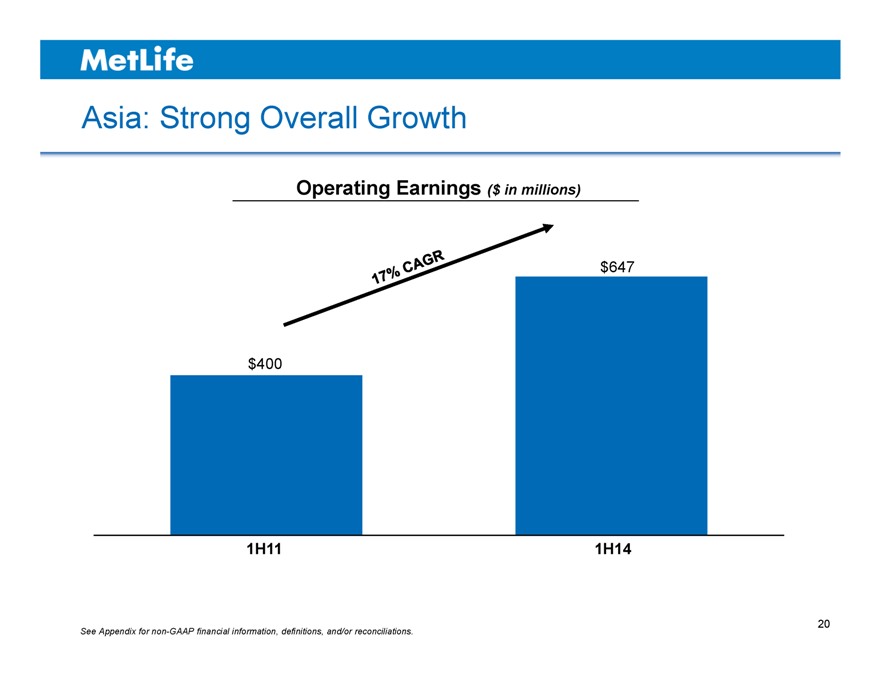

Asia: Strong Overall Growth

Operating Earnings ($ in millions)

$647

$400

1H11 1H14

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

20

MetLife

Key Takeaways

Asia – the industry’s most attractive growth opportunity Clear strategy and strong execution Proven capabilities to be leveraged across Asia Meaningful contributor to the MetLife Enterprise

21

MetLife

Metlife

Toby Brown

Chief Financial Officer Asia

September 17, 2014

ASIA INVESTOR DAY 2014

MetLife

Introduction

Solid year-to-date results Focus on operating efficiency Improve cash generation

Drive value creation through product mix, pricing discipline and capital management

24

MetLife

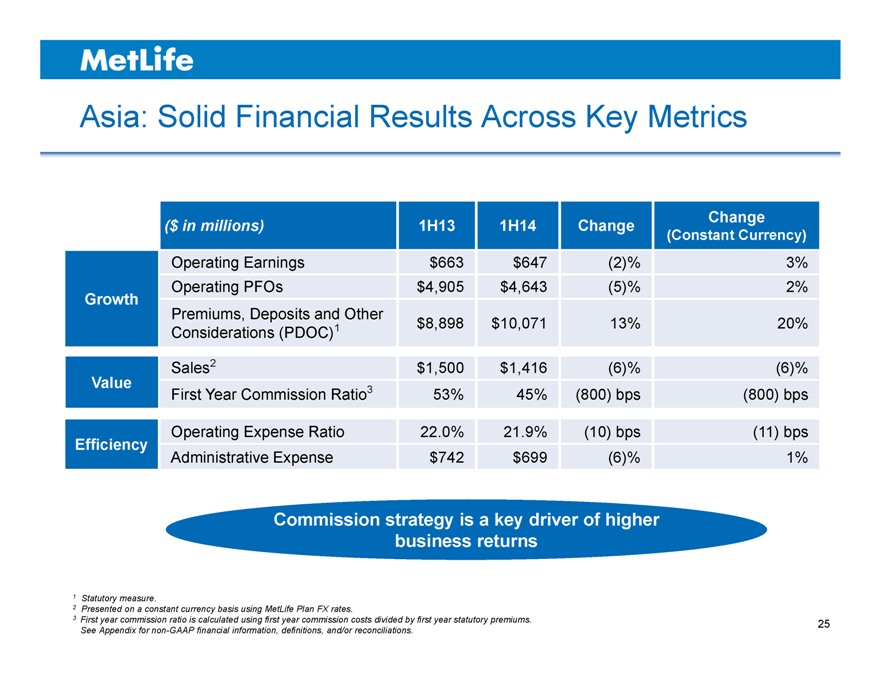

Asia: Solid Financial Results Across Key Metrics

($ in millions) 1H13 1H14 Change Change

(Constant Currency)

Operating Earnings $663 $647 (2)% 3%

Operating PFOs $4,905 $4,643 (5)% 2%

Growth

Premiums, Deposits and Other

Considerations (PDOC)1 $8,898 $10,071 13% 20%

Sales2 $1,500 $1,416 (6)% (6)%

Value First Year Commission Ratio3 53% 45% (800) bps (800) bps

Operating Expense Ratio 22.0% 21.9% (10) bps (11) bps

Efficiency

Administrative Expense $742 $699 (6)% 1%

Commission strategy is a key driver of higher business returns

2 | | Presented on a constant currency basis using MetLife Plan FX rates. |

3 First year commission ratio is calculated using first year commission costs divided by first year statutory premiums. See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

25

MetLife

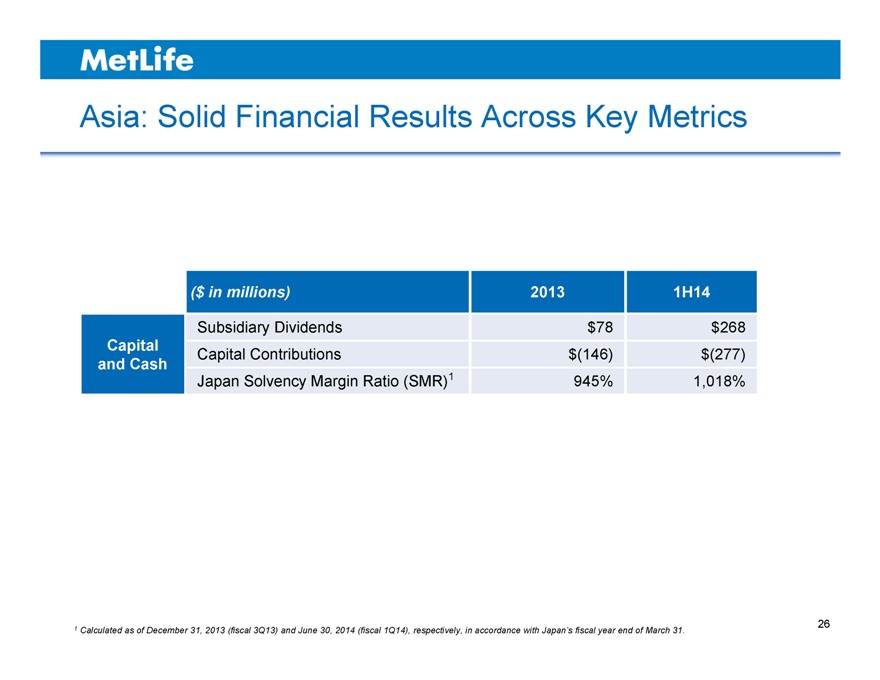

Asia: Solid Financial Results Across Key Metrics

($ in millions) 2013 1H14

Subsidiary Dividends $78 $268

Capital Capital Contributions $(146) $(277)

and Cash

Japan Solvency Margin Ratio (SMR)1 945% 1,018%

1 Calculated as of December 31, 2013 (fiscal 3Q13) and June 30, 2014 (fiscal 1Q14), respectively, in accordance with Japan’s fiscal year end of March 31.

26

MetLife

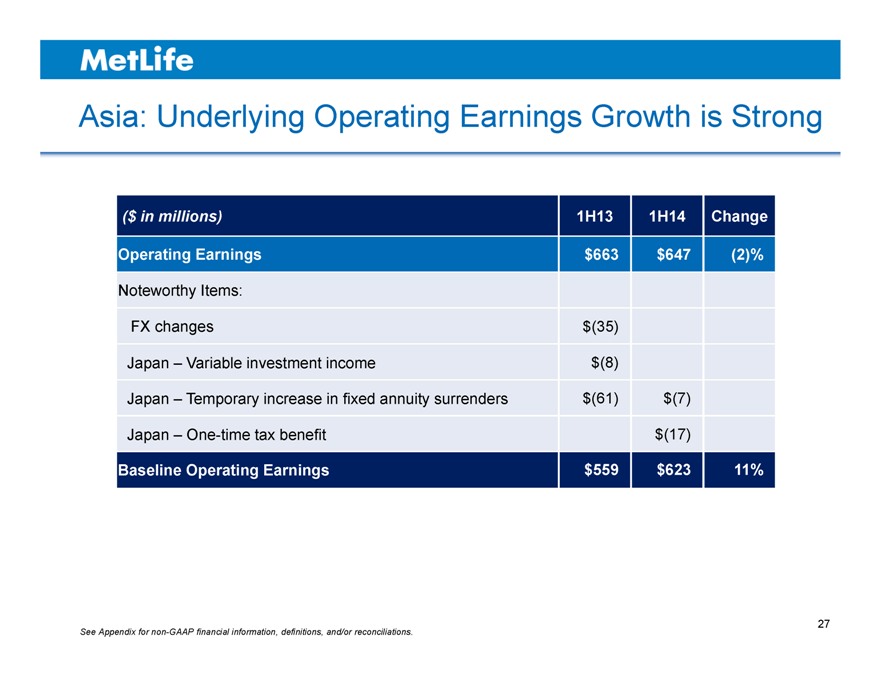

Asia: Underlying Operating Earnings Growth is Strong

($ in millions) 1H13 1H14 Change

Operating Earnings $663 $647 (2)%

Noteworthy Items:

FX changes $(35)

Japan – Variable investment income $(8)

Japan – Temporary increase in fixed annuity surrenders $(61) $(7)

Japan – One-time tax benefit $(17)

Baseline Operating Earnings $559 $623 11%

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

27

MetLife

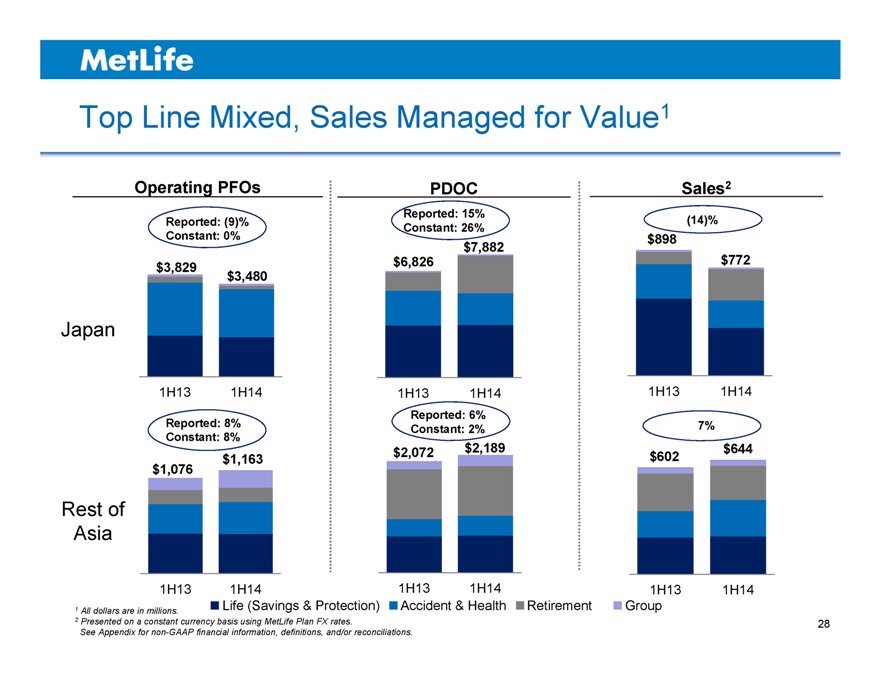

Top Line Mixed, Sales Managed for Value1

Operating PFOs PDOC Sales2

Reported: 15%

Reported: (9)% (14)%

Constant: 26%

Constant: 0% $898

$7,882

$3,829 $6,826 $772

$3,480

Japan

1H13 1H14 1H13 1H14 1H13 1H14

Reported: 6%

Reported: 8% Constant: 2% 7%

Constant: 8%

$2,072 $2,189 $602 $644

$1,163

$1,076

Rest of

Asia

1H13 1H14 1H13 1H14 1H13 1H14

Life (Savings & Protection) Accident & Health Retirement Group

1 | | All dollars are in millions. |

2 | | Presented on a constant currency basis using MetLife Plan FX rates. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

28

MetLife

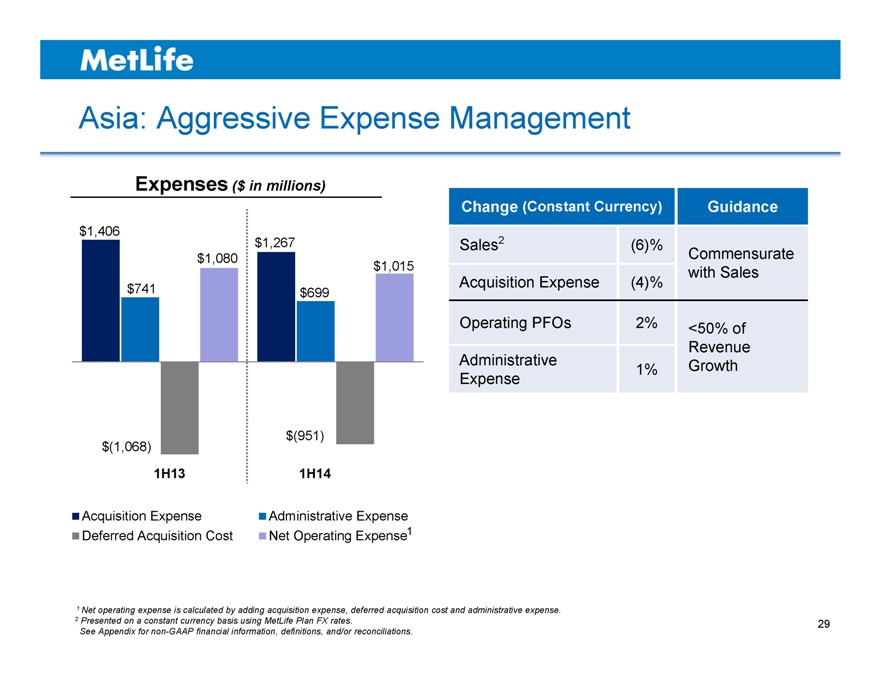

Asia: Aggressive Expense Management

Expenses ($ in millions)

$1,406

$1,267

$1,080 $1,015

$741 $699

$(951)

$(1,068)

1H13 1H14

Acquisition Expense Administrative Expense

Deferred Acquisition Cost Net Operating Expense1

Change (Constant Currency) Guidance

Sales2 (6)% Commensurate

Acquisition Expense (4)% with Sales

Operating PFOs 2% <50% of

Revenue

Administrative 1% Growth

Expense

1 Net operating expense is calculated by adding acquisition expense, deferred acquisition cost and administrative expense.

2 | | Presented on a constant currency basis using MetLife Plan FX rates. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

29

MetLife

Improving Cash Generation in Asia

Target to increase distributions to holding company

30% of Japan operating earnings in near-term and 50% long-term

Net positive cash flow from the rest of Asia, excluding inorganic growth

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

30

MetLife

Strategic Objective is to Optimize Use of Cash

Mature Businesses

“Maximize Cash Distribution”

Japan Korea Bangladesh

Growth Businesses

“Self-Funding”

China India Malaysia Vietnam Hong Kong Australia

31

MetLife

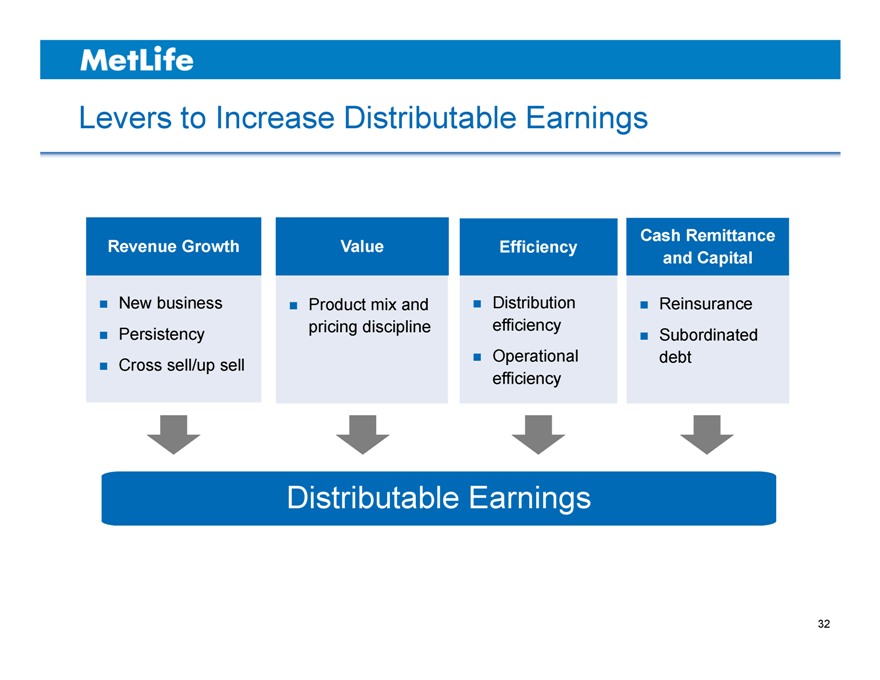

Levers to Increase Distributable Earnings

Revenue Growth

New business Persistency Cross sell/up sell

Value

Efficiency

Cash Remittance and Capital

Product mix and pricing discipline

Distribution efficiency Operational efficiency

Reinsurance Subordinated debt

Distributable Earnings

32

MetLife

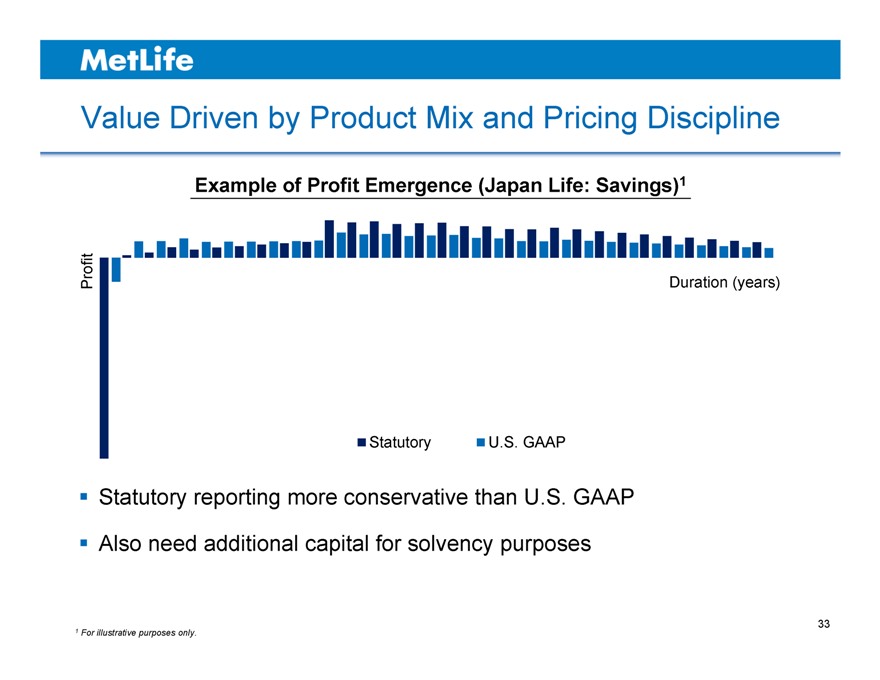

Value Driven by Product Mix and Pricing Discipline

Example of Profit Emergence (Japan Life: Savings)1

Profit Duration (years)

Statutory U.S. GAAP

Statutory reporting more conservative than U.S. GAAP

Also need additional capital for solvency purposes

1 | | For illustrative purposes only. |

33

MetLife

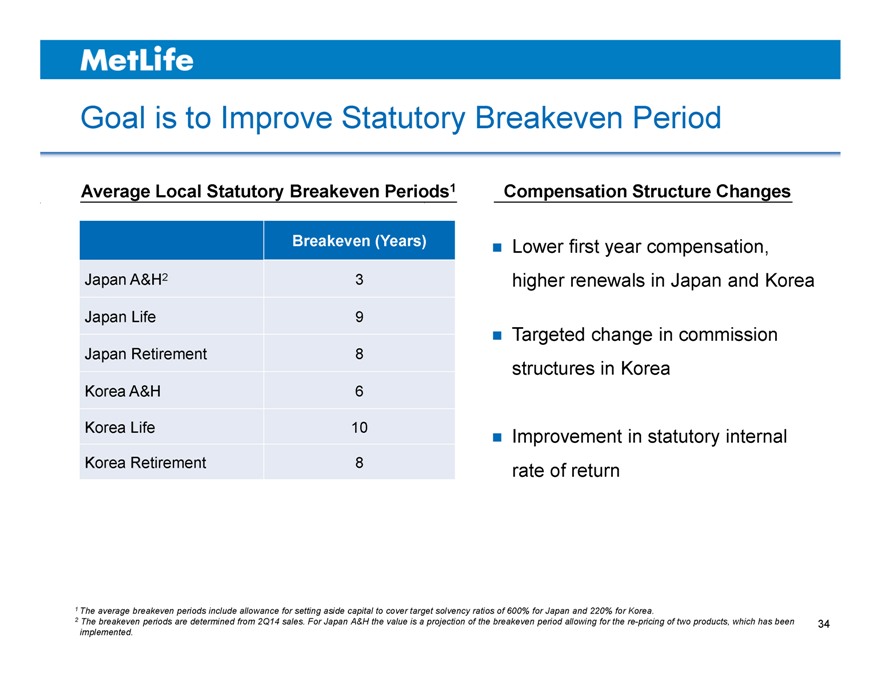

Goal is to Improve Statutory Breakeven Period

Average Local Statutory Breakeven Periods1

Breakeven (Years)

Japan A&H2 3

Japan Life 9

Japan Retirement 8

Korea A&H 6

Korea Life 10

Korea Retirement 8

Compensation Structure Changes

Lower first year compensation, higher renewals in Japan and Korea

Targeted change in commission structures in Korea

Improvement in statutory internal rate of return

1 The average breakeven periods include allowance for setting aside capital to cover target solvency ratios of 600% for Japan and 220% for Korea.

2 The breakeven periods are determined from 2Q14 sales. For Japan A&H the value is a projection of the breakeven period allowing for the re-pricing of two products, which has been implemented.

34

MetLife

Effective Use of Reinsurance in Japan

Executed transactions in 2011 and 2012 to accelerate the emergence of profits and cash flows in Japan

Utilized deferred tax assets of ~$450M and funded material cash remittance of ~$1.6B

Low cost of capital

Annual cost ~$200M today, declines to ~$100M in 2016 and zero in 2021

Reinsurance remains a valuable potential tool for the future

35

MetLife

Effective Use of Subordinated Debt in China

Need to fund new business growth and plan for uncertainty of new solvency regime in China

Subordinated debt issued by MetLife joint venture in China in 2Q14

10-year issue, 8% coupon, callable at the end of year 5

Key benefits

Lower cost of capital Tax efficient

Natural currency hedge for portion of MetLife investment

36

MetLife

Key Takeaways

Solid year-to-date results Focus on operating efficiency Improve cash generation

Drive value creation through product mix, pricing discipline and capital management

37

MetLife

Metlife

Kathy Awanis

Vice President, Direct & e-Business Asia

September 17, 2014

ASIA INVESTOR DAY 2014

MetLife

Introduction

Digital in Asia is a significant opportunity

Consumer digital behavior is impacting offline purchasing Digital provides cross channel engagement to customers Digital is a differentiator for MetLife

40

MetLife

What is Digital?

Automation and augmentation of offline activities Ease and speed of access Integration of physical and digital operations

Customer data richness, transparency, big data analytics, social media

41

MetLife

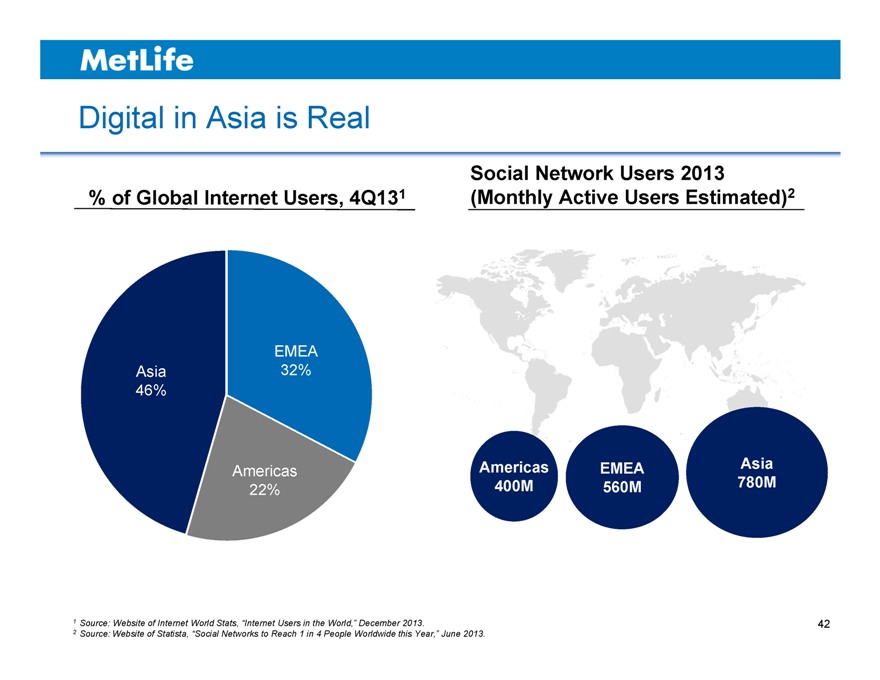

Digital in Asia is Real

% of Global Internet Users, 4Q131

Social Network Users 2013 (Monthly Active Users Estimated)2

EMEA Asia 32% 46%

Americas EMEA Asia

Americas

400M 560M 780M

22%

1 | | Source: Website of Internet World Stats, “Internet Users in the World,” December 2013. |

2 | | Source: Website of Statista, “Social Networks to Reach 1 in 4 People Worldwide this Year,” June 2013. |

42

MetLife

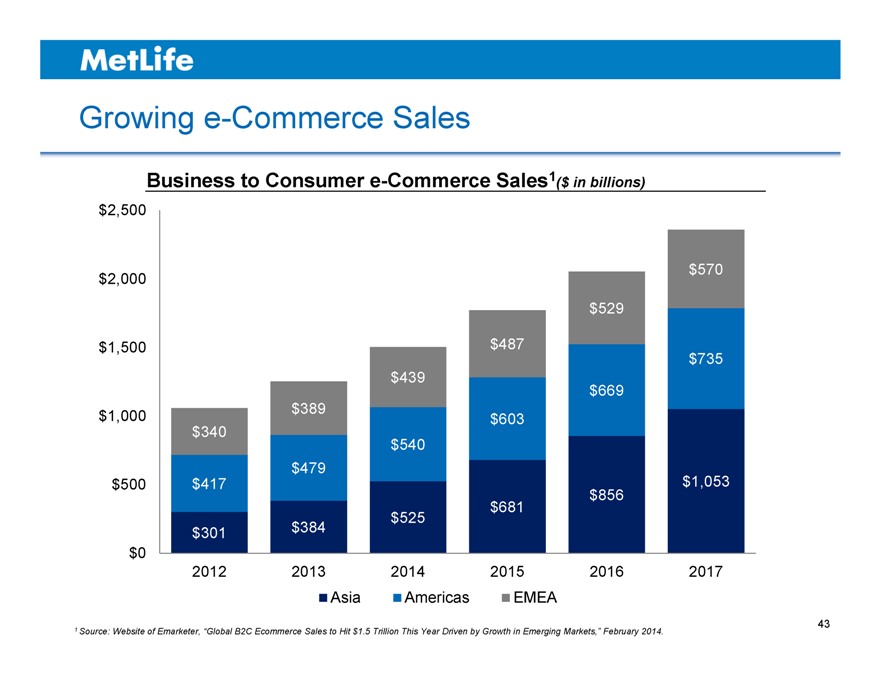

Growing e-Commerce Sales

Business to Consumer e-Commerce Sales1($ in billions)

$2,500

$2,000 $570

$ 529

$1,500 $ 487

$735

$ 439

$ 669

$ 389

$1,000 $ 603

$ 340

$ 540

$ 479

$500 $ 417 $1,053

$ 856

$ 681

$ 525

$ 301 $ 384

$0

2012 2013 2014 2015 2016 2017

Asia Americas EMEA

1 Source: Website of Emarketer, “Global B2C Ecommerce Sales to Hit $1.5 Trillion This Year Driven by Growth in Emerging Markets,” February 2014.

43

MetLife

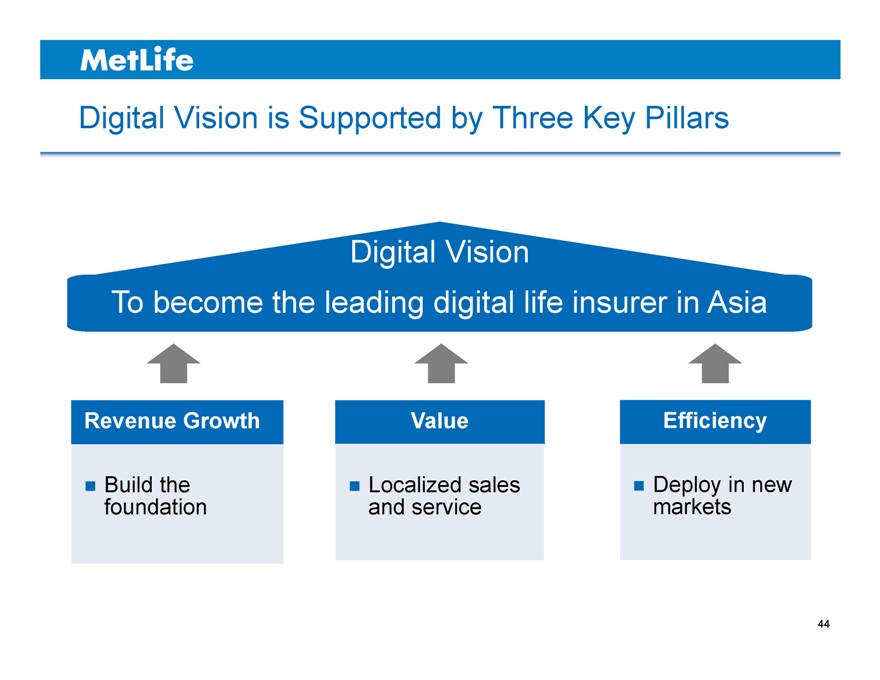

Digital Vision is Supported by Three Key Pillars

Digital Vision

To become the leading digital life insurer in Asia

Revenue Growth Value Efficiency

Build the Localized sales Deploy in new

foundation and service markets

44

MetLife

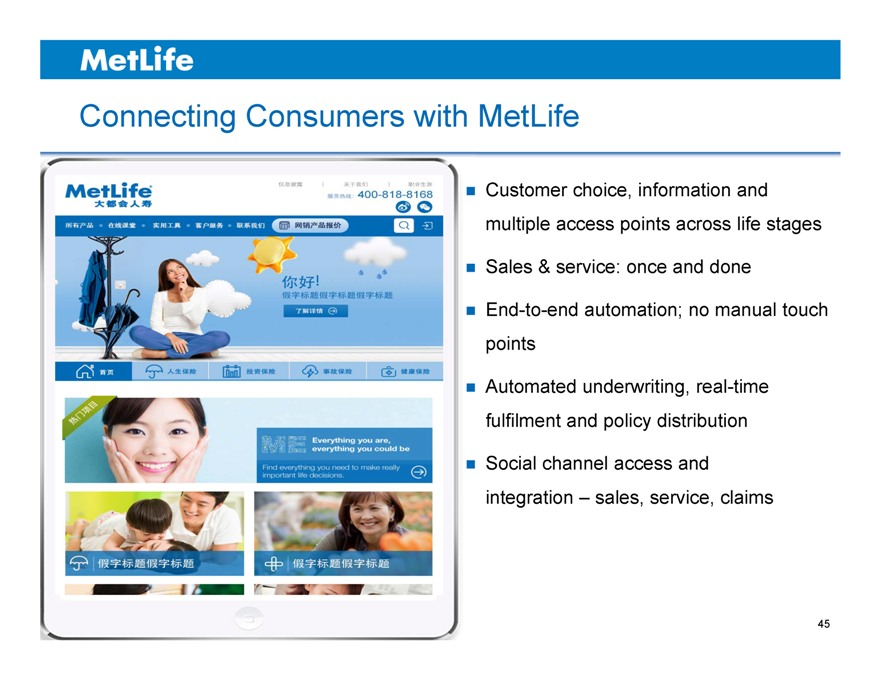

Connecting Consumers with MetLife

Customer choice, information and multiple access points across life stages

Sales & service: once and done

End-to-end automation; no manual touch points

Automated underwriting, real-time fulfilment and policy distribution

Social channel access and integration – sales, service, claims

45

MetLife

Engaged & Empowered Consumers

Dedicated self-service portal supporting all distribution channels

Secure access to all information through consumer dashboards

Self-service tools and real-time alerts on preferred devices/channels

Full integration with sales, service and social platforms

Education and loyalty programs increasing awareness

46

MetLife

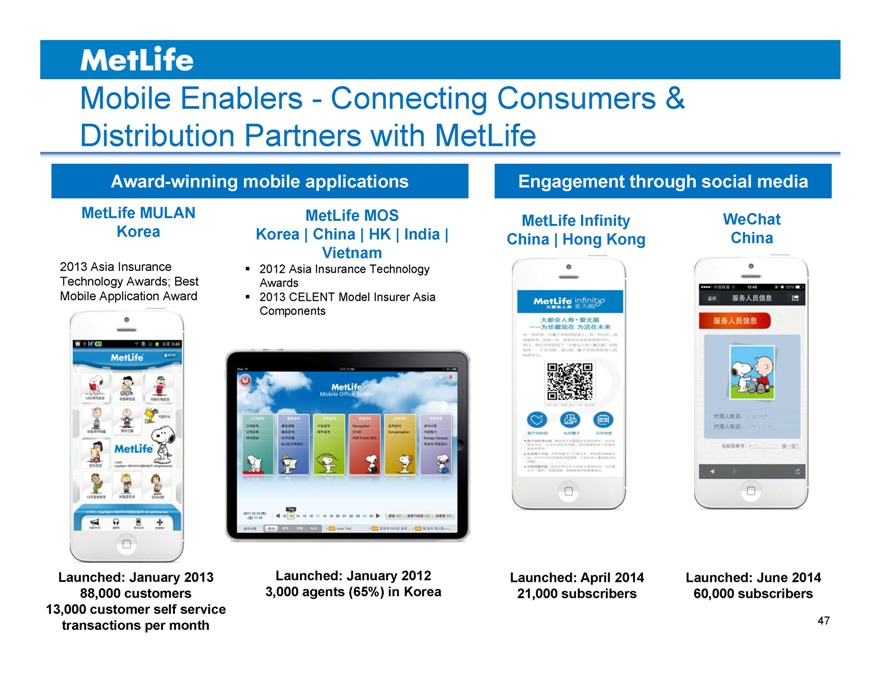

Mobile Enablers—Connecting Consumers & Distribution Partners with MetLife

Award-winning mobile applications Engagement through social media

MetLife MULAN MetLife MOS MetLife Infinity WeChat

Korea Korea | China | HK | India | China | Hong Kong China

Vietnam

2013 Asia Insurance 2012 Asia Insurance Technology

Technology Awards; Best Awards

Mobile Application Award 2013 CELENT Model Insurer Asia

Components

Launched: January 2013 Launched: January 2012 Launched: April 2014 Launched: June 2014

88,000 customers 3,000 agents (65%) in Korea 21,000 subscribers 60,000 subscribers

13,000 customer self service

transactions per month

47

MetLife

Key Takeaways

Digital in Asia is a significant opportunity

Consumer digital behavior is impacting offline purchasing Digital provides cross channel engagement to customers Digital is a differentiator for MetLife

48

MetLife

Metlife

Dr. Nirmala Menon

Head of Designated Markets & Health Asia

September 17, 2014

ASIA INVESTOR DAY 2014

MetLife

Introduction

A&H is an attractive business opportunity MetLife is well positioned in this market Strong track record Customer focused strategy

51

MetLife

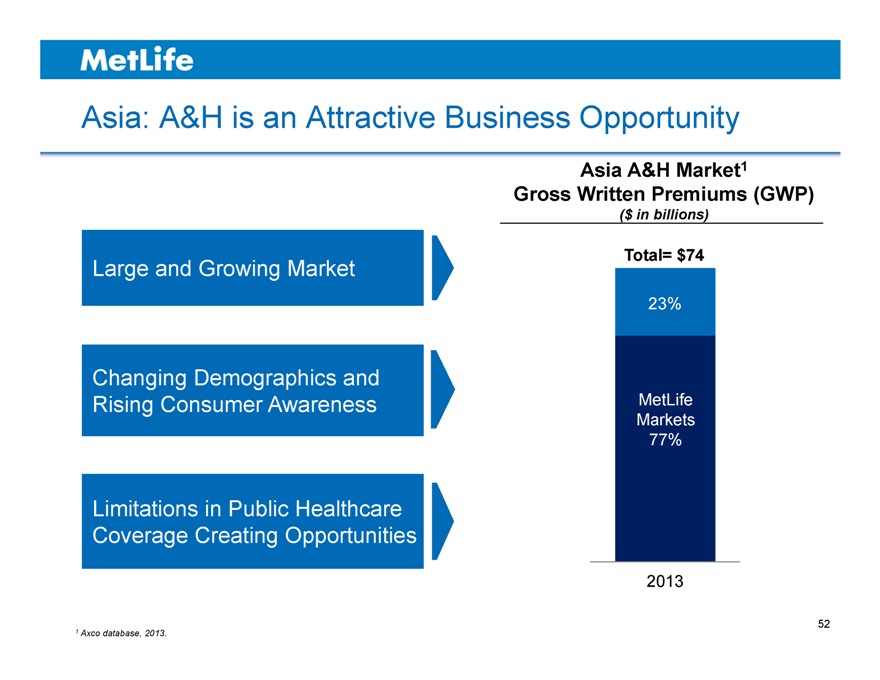

Asia: A&H is an Attractive Business Opportunity

Large and Growing Market

Changing Demographics and Rising Consumer Awareness

Limitations in Public Healthcare Coverage Creating Opportunities

Asia A&H Market1

Gross Written Premiums (GWP)

($ in billions)

Total= $74

23%

MetLife

Markets

77%

2013

52

MetLife

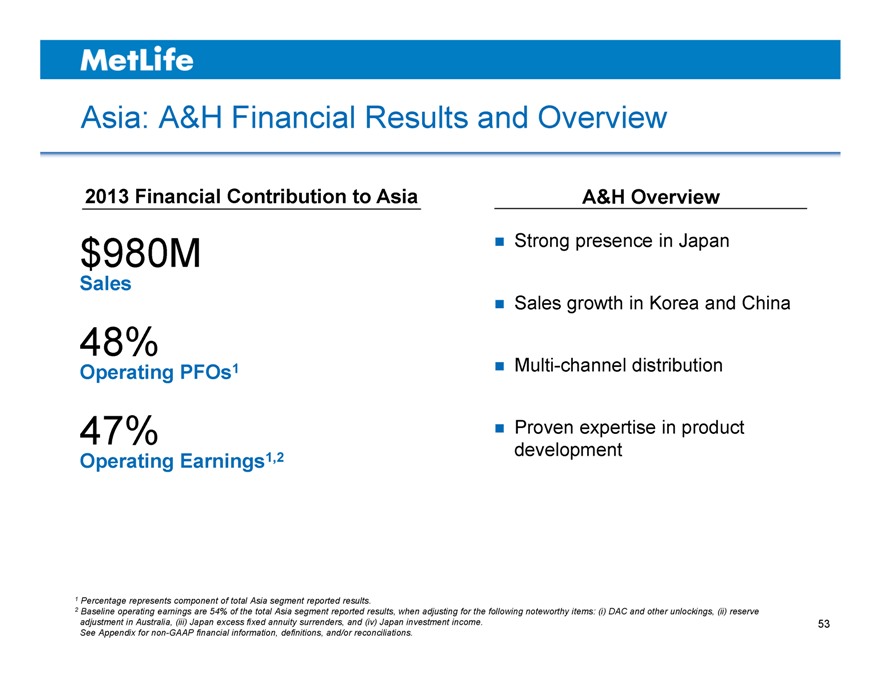

Asia: A&H Financial Results and Overview

2013 Financial Contribution to Asia

$980M

Sales

48%

Operating PFOs1

47%

Operating Earnings1,2

A&H Overview

Strong presence in Japan Sales growth in Korea and China Multi-channel distribution

Proven expertise in product development

1 | | Percentage represents component of total Asia segment reported results. |

2 Baseline operating earnings are 54% of the total Asia segment reported results, when adjusting for the following noteworthy items: (i) DAC and other unlockings, (ii) reserve adjustment in Australia, (iii) Japan excess fixed annuity surrenders, and (iv) Japan investment income.

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

53

MetLife

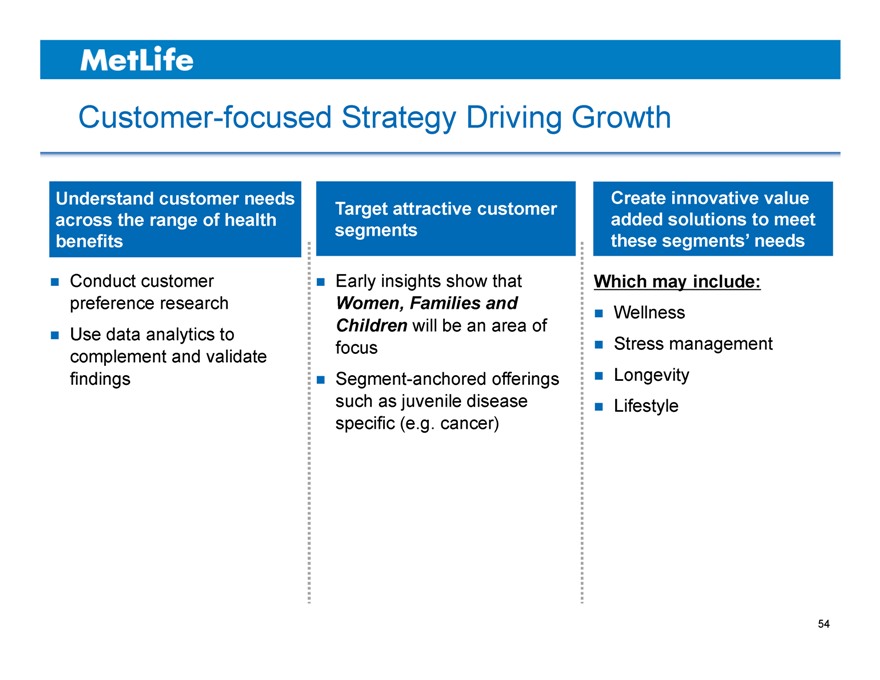

Customer-focused Strategy Driving Growth

Understand customer needs across the range of health benefits

Conduct customer preference research Use data analytics to complement and validate findings

Target attractive customer segments

Early insights show that

Women, Families and Children will be an area of focus Segment-anchored offerings such as juvenile disease specific (e.g. cancer)

Create innovative value added solutions to meet these segments’ needs

Which may include:

Wellness

Stress management Longevity Lifestyle

54

MetLife

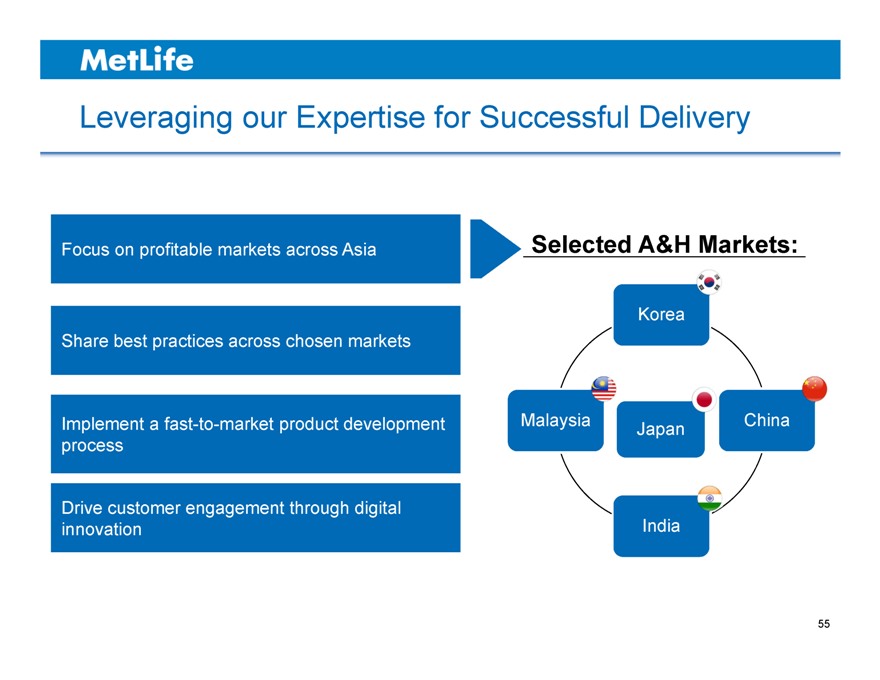

Leveraging our Expertise for Successful Delivery

Focus on profitable markets across Asia Selected A&H Markets:

Korea

Share best practices across chosen markets

Implement a fast-to-market product development Malaysia Japan China

process

Drive customer engagement through digital

innovation India

55

MetLife

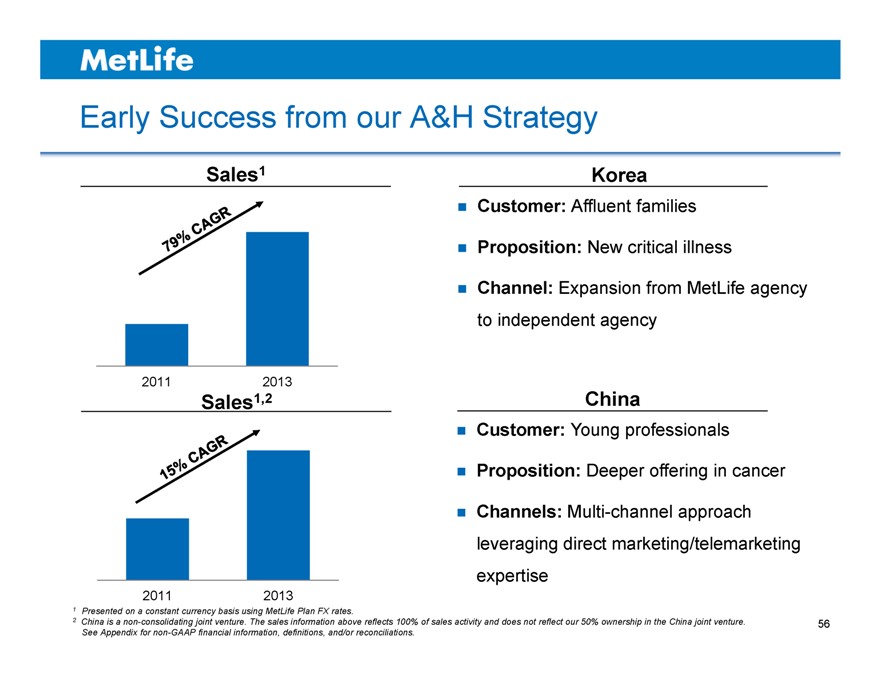

Early Success from our A&H Strategy

Sales1

2011 2013

Sales1,2

2011 2013

1 | | Presented on a constant currency basis using MetLife Plan FX rates. |

2 China is a non-consolidating joint venture. The sales information above reflects 100% of sales activity and does not reflect our 50% ownership in the China joint venture.

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

Korea

Customer: Affluent families

Proposition: New critical illness

Channel: Expansion from MetLife agency to independent agency

China

Customer: Young professionals

Proposition: Deeper offering in cancer

Channels: Multi-channel approach leveraging direct marketing/telemarketing expertise

56

MetLife

Key Takeaways

A&H is an attractive business opportunity

MetLife is well positioned to make the most of this opportunity

Drive profitable growth in our five key markets by creating a distinctive value proposition which is in line with customer needs

57

MetLife

Metlife

Sachin N. Shah

Chairman, President & Chief Executive Officer MetLife Japan

September 17, 2014

ASIA INVESTOR DAY 2014

MetLife

Introduction

MetLife Japan is unique platform with significant opportunities for sustainable profitable growth

We have a track record of outperforming the market

We are accelerating value creation through improved persistency, cost and capital management

These factors are steadily improving dividend capacity

60

MetLife

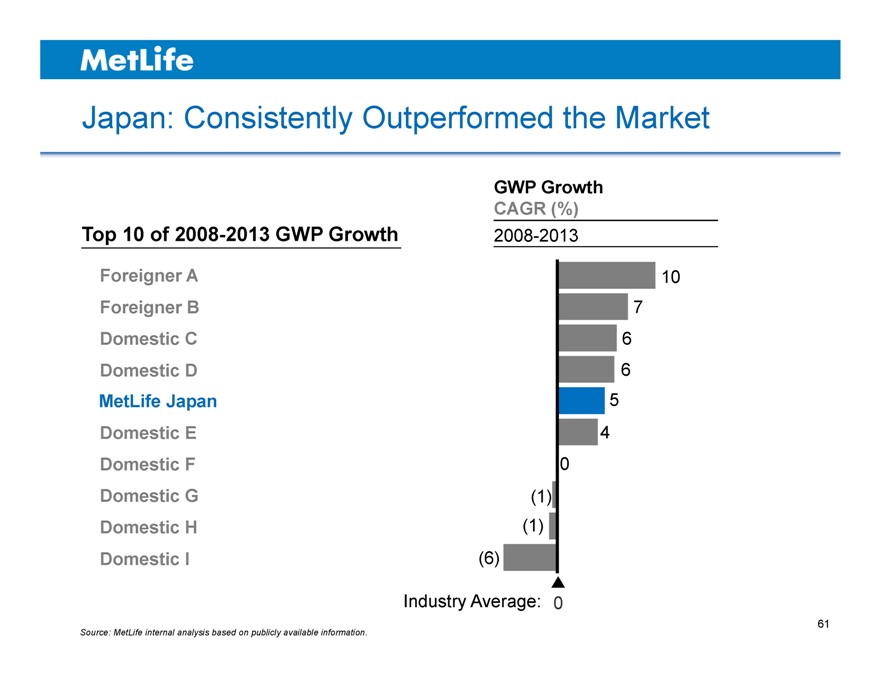

Japan: Consistently Outperformed the Market

GWP Growth

CAGR (%)

Top 10 of 2008-2013 GWP Growth 2008-2013

Foreigner A 10

Foreigner B 7

Domestic C 6

Domestic D 6

MetLife Japan 5

Domestic E 4

Domestic F 0

Domestic G (1)

Domestic H (1)

Domestic I (6)

Industry Average: 0

Source: MetLife internal analysis based on publicly available information.

61

MetLife

Japan: Macro Trends Driving Profitable Growth Opportunities

Social safety net under pressure

Growing reliance on private sector solutions Increasing affluent and senior population Shifting consumer purchasing patterns Potential growth opportunities from Abenomics

62

MetLife

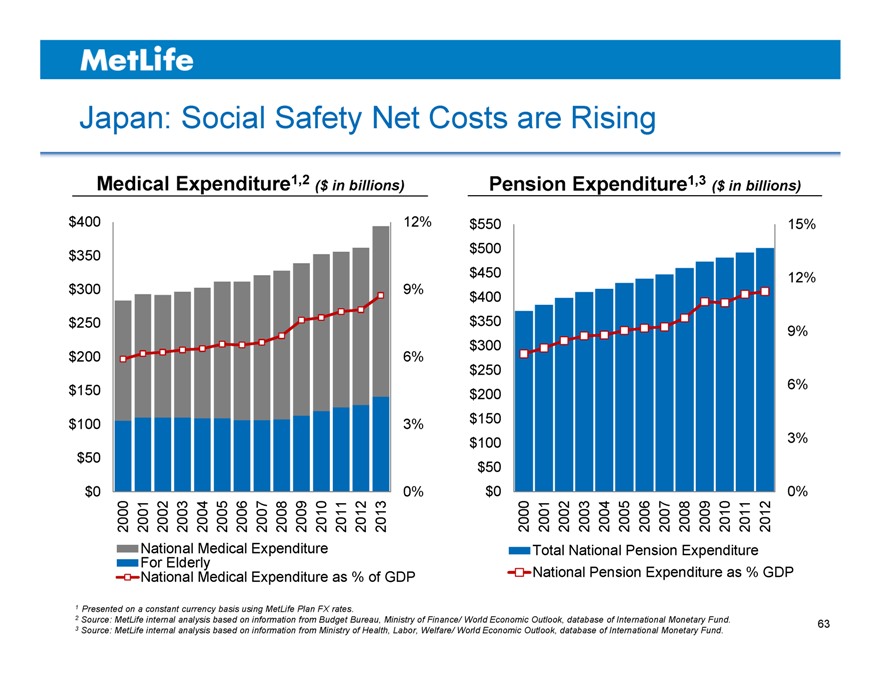

Japan: Social Safety Net Costs are Rising

Medical Expenditure1,2 ($ in billions) Pension Expenditure1,3 ($ in billions)

$400 12% $550 15%

$350 $500

$450 12%

$300 9% $400

$250 $350 9%

$300

$200 6%

$250

$150 $200 6%

$100 3% $150

$100 3%

$50 $50

$0 0% $0 0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

National Medical Expenditure Total National Pension Expenditure

For Elderly

National Medical Expenditure as % of GDP National Pension Expenditure as % GDP

1 | | Presented on a constant currency basis using MetLife Plan FX rates. |

2 Source: MetLife internal analysis based on information from Budget Bureau, Ministry of Finance/ World Economic Outlook, database of International Monetary Fund.

3 Source: MetLife internal analysis based on information from Ministry of Health, Labor, Welfare/ World Economic Outlook, database of International Monetary Fund.

63

MetLife

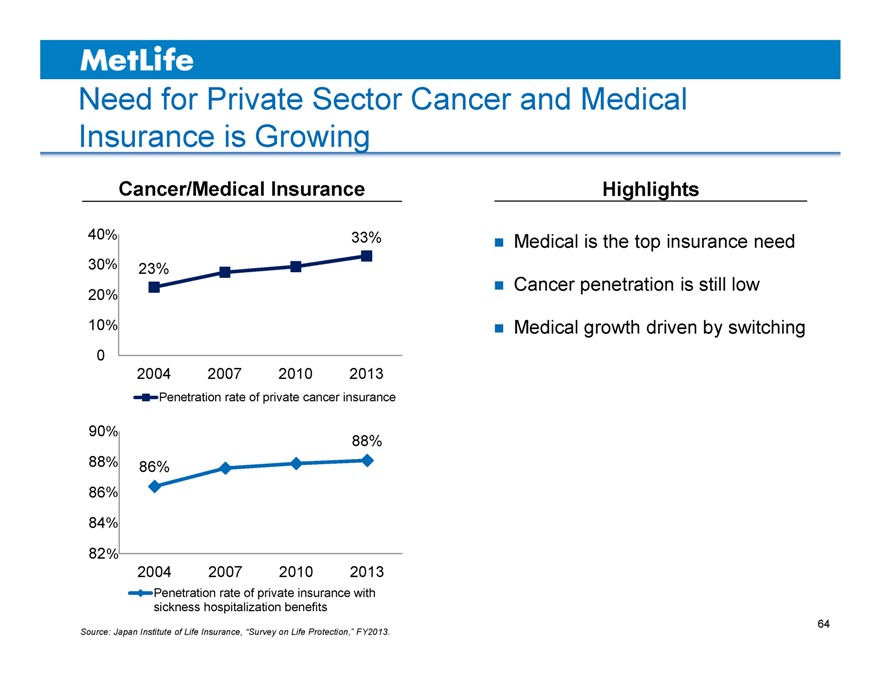

Need for Private Sector Cancer and Medical Insurance is Growing

Cancer/Medical Insurance

40% 33%

30% 23%

20%

10%

0

2004 2007 2010 2013

Penetration rate of private cancer insurance

90% 88%

88% 86%

86%

84%

82%

2004 2007 2010 2013

Penetration rate of private insurance with

sickness hospitalization benefits

Highlights

Medical is the top insurance need Cancer penetration is still low Medical growth driven by switching

Source: Japan Institute of Life Insurance, “Survey on Life Protection,” FY2013.

64

MetLife

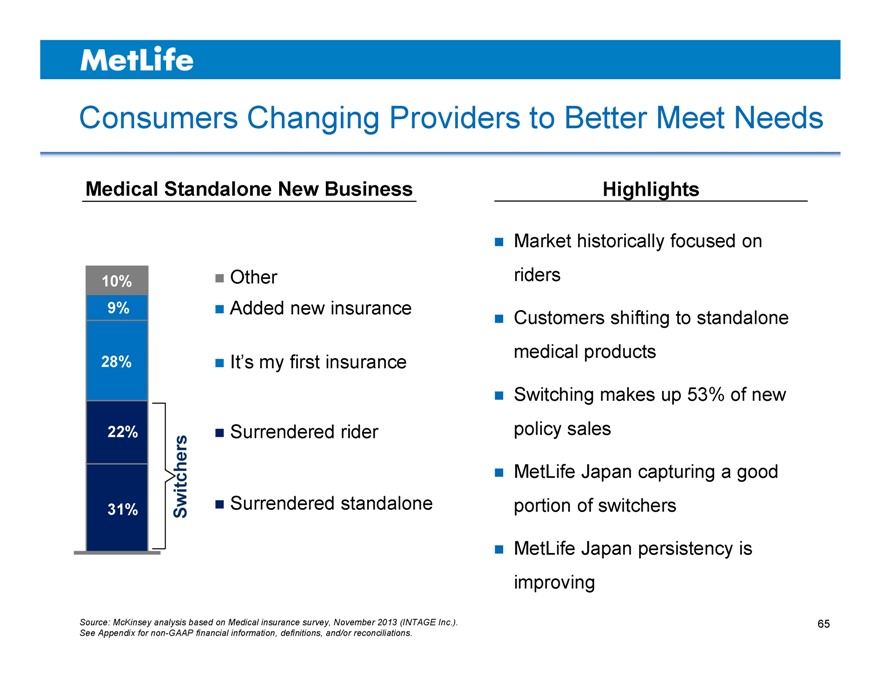

Consumers Changing Providers to Better Meet Needs

Medical Standalone New Business

10% Other

9% Added new insurance

28% It’s my first insurance

22% Surrendered rider

31% Switchers Surrendered standalone

Highlights

Market historically focused on riders

Customers shifting to standalone medical products

Switching makes up 53% of new policy sales

MetLife Japan capturing a good portion of switchers

MetLife Japan persistency is improving

Source: McKinsey analysis based on Medical insurance survey, November 2013 (INTAGE Inc.). See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

65

MetLife

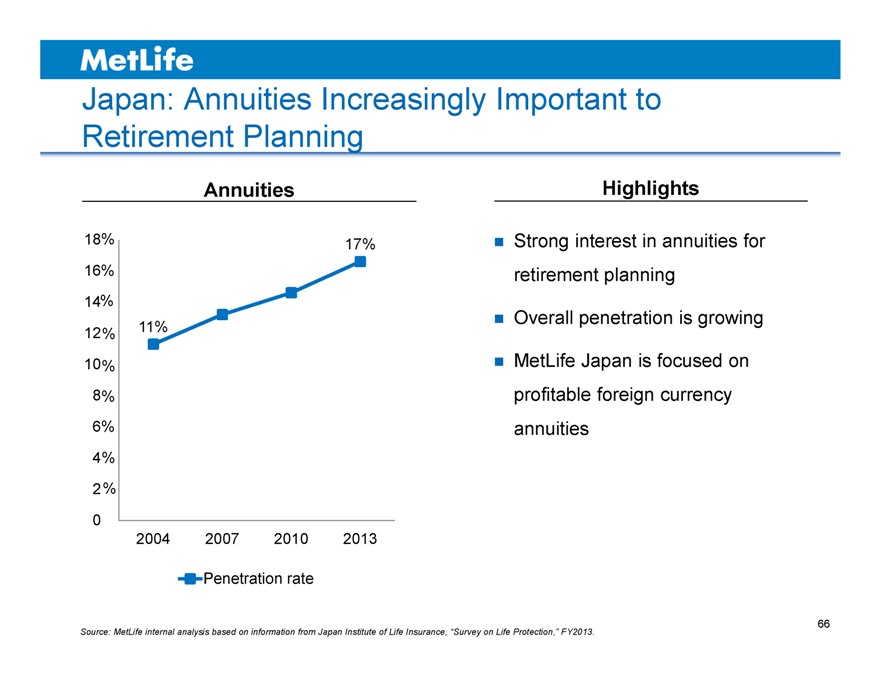

Japan: Annuities Increasingly Important to Retirement Planning

Annuities

18% 17%

16%

14%

12% 11%

10%

8%

6%

4%

0

2004 2007 2010 2013

Penetration rate

Highlights

Strong interest in annuities for retirement planning

Overall penetration is growing

MetLife Japan is focused on profitable foreign currency annuities

Source: MetLife internal analysis based on information from Japan Institute of Life Insurance, “Survey on Life Protection,” FY2013.

66

MetLife

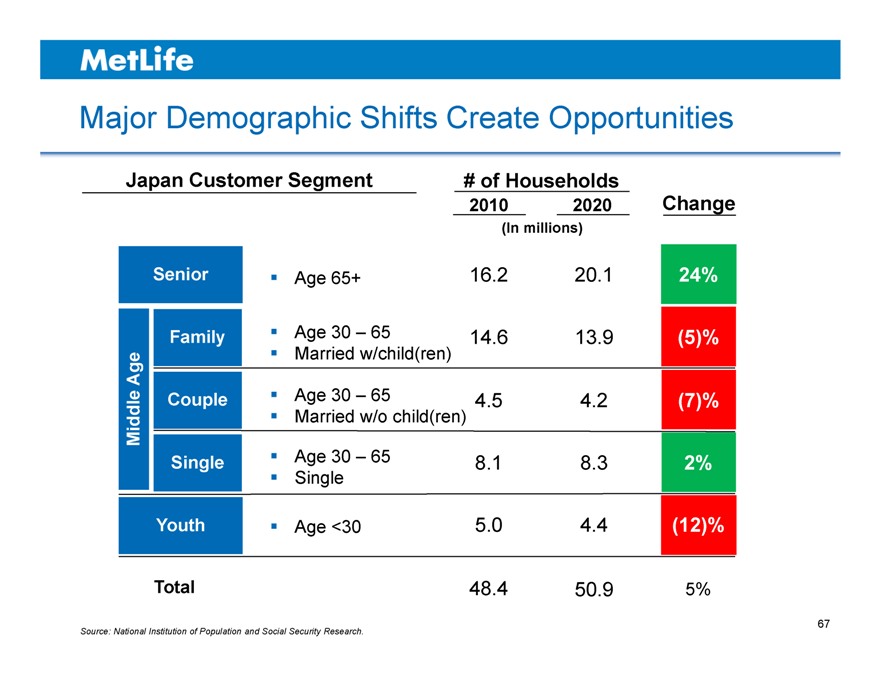

Major Demographic Shifts Create Opportunities

Japan Customer Segment # of Households

2010 2020 Change

(In millions)

Senior Age 65+ 16.2 20.1 24%

Family Age 30 – 65 14.6 13.9 (5)%

Married w/child(ren)

Age

Couple Age 30 – 65 4.5 4.2 (7)%

Middle Married w/o child(ren)

Single Age 30 – 65 8.1 8.3 2%

Single

Youth Age <30 5.0 4.4 (12)%

Total 48.4 50.9 5%

67

MetLife

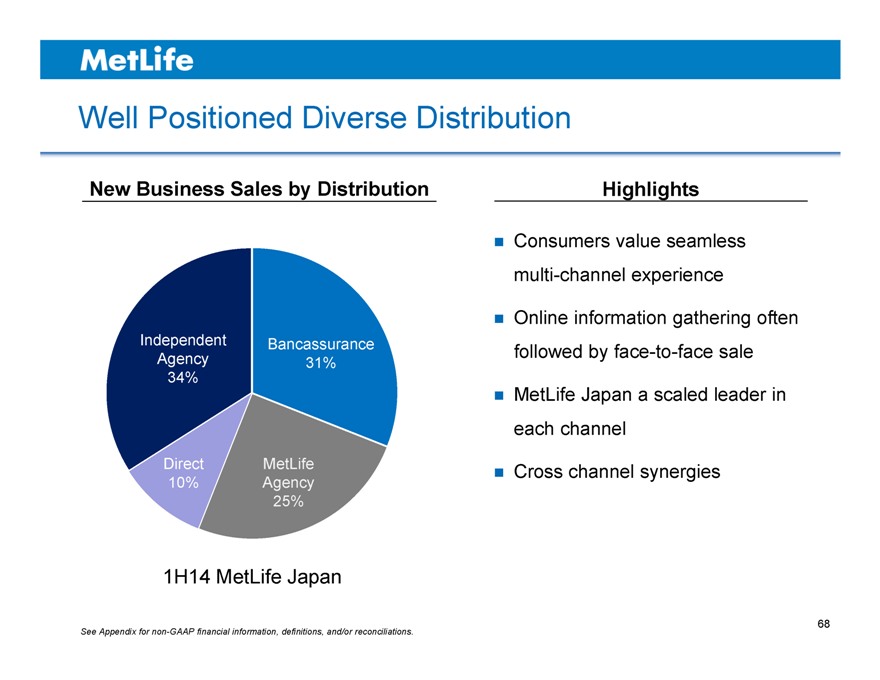

Well Positioned Diverse Distribution

New Business Sales by Distribution

Highlights

Independent Bancassurance

Agency 31%

34%

Direct MetLife

10% Agency

25%

1H14 MetLife Japan

Consumers value seamless multi-channel experience

Online information gathering often followed by face-to-face sale

MetLife Japan a scaled leader in each channel

Cross channel synergies

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

68

MetLife

Broad, Diversified Product Portfolio

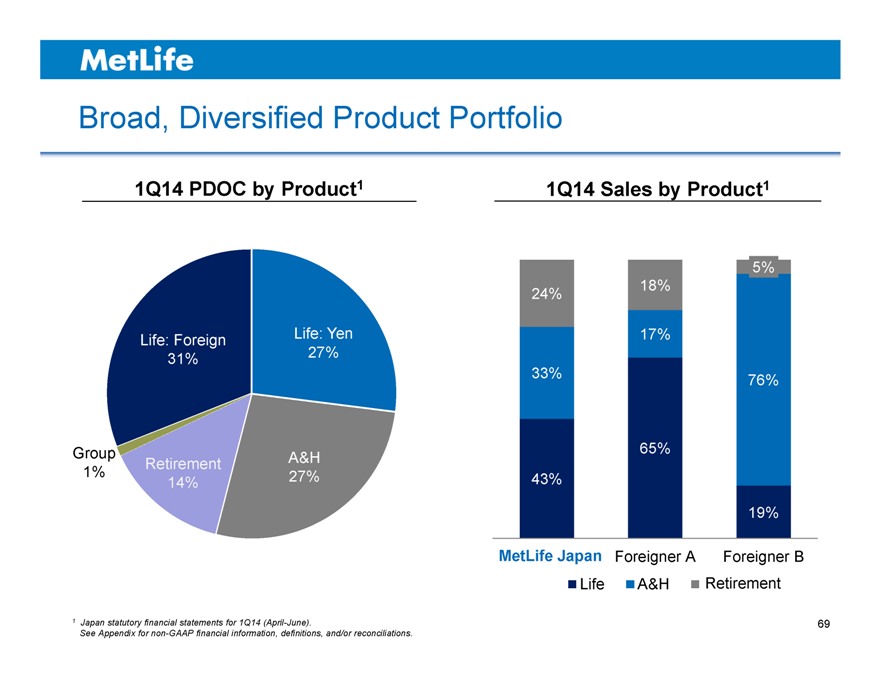

1Q14 PDOC by Product1

Life: Foreign Life: Yen 31% 27%

Group A&H Retirement

1% 27% 14%

1 | | Japan statutory financial statements for 1Q14 (April-June). |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

1Q14 Sales by Product1

5%

24% 18%

17%

33% 76%

65%

43%

19%

MetLife Japan Foreigner A Foreigner B

Life A&H Retirement

69

MetLife

Balancing Value and Volume

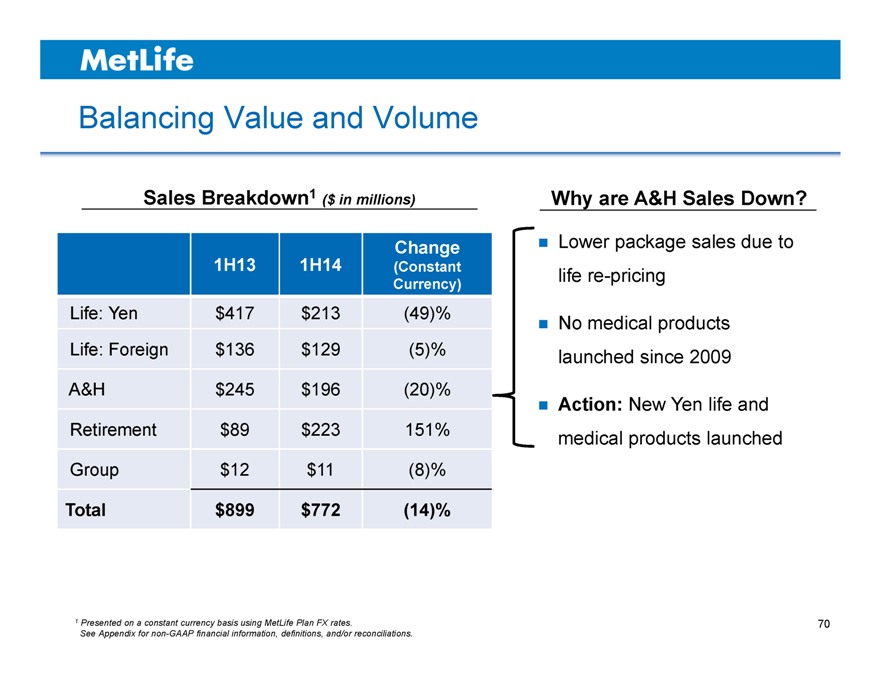

Sales Breakdown1 ($ in millions)

Why are A&H Sales Down?

Change

1H13 1H14 (Constant

Currency)

Life: Yen $417 $213 (49)%

Life: Foreign $136 $129 (5)%

A&H $245 $196 (20)%

Retirement $89 $223 151%

Group $12 $11 (8)%

Total $899 $772 (14)%

Lower package sales due to life re-pricing

No medical products launched since 2009

Action: New Yen life and medical products launched

1 | | Presented on a constant currency basis using MetLife Plan FX rates. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

70

MetLife

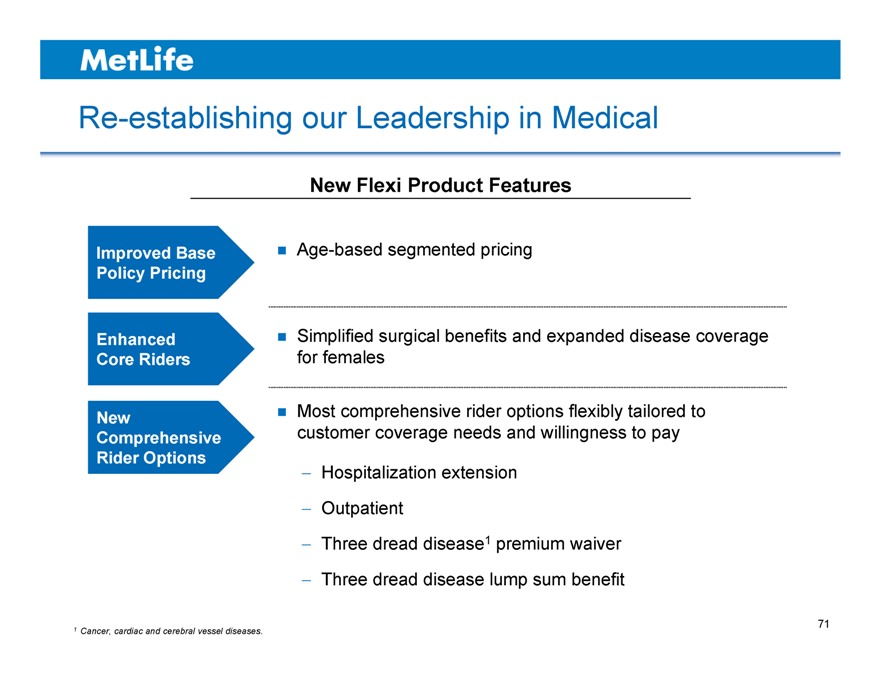

Re-establishing our Leadership in Medical

New Flexi Product Features

Improved Base Policy Pricing

Enhanced Core Riders

New

Comprehensive Rider Options

Age-based segmented pricing

Simplified surgical benefits and expanded disease coverage for females

Most comprehensive rider options flexibly tailored to customer coverage needs and willingness to pay

Hospitalization extension Outpatient

Three dread disease1 premium waiver Three dread disease lump sum benefit

71

MetLife

1 | | Cancer, cardiac and cerebral vessel diseases. |

71

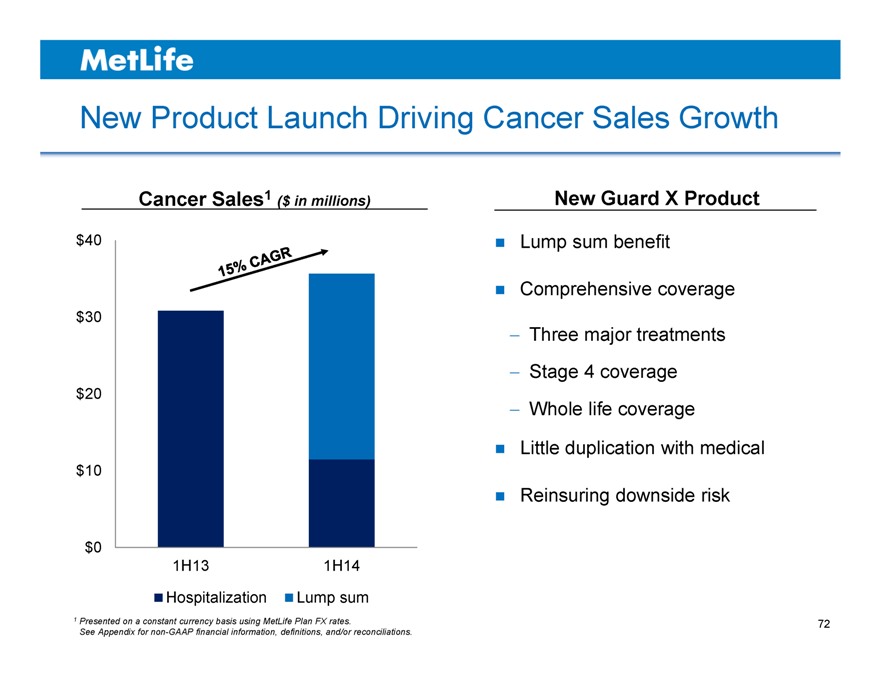

New Product Launch Driving Cancer Sales Growth

Cancer Sales1 ($ in millions)

$40

$30

$20

$10

$0

1H13 1H14

Hospitalization Lump sum

1 | | Presented on a constant currency basis using MetLife Plan FX rates. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

New Guard X Product

Lump sum benefit

Comprehensive coverage

Three major treatments Stage 4 coverage Whole life coverage

Little duplication with medical

Reinsuring downside risk

72

MetLife

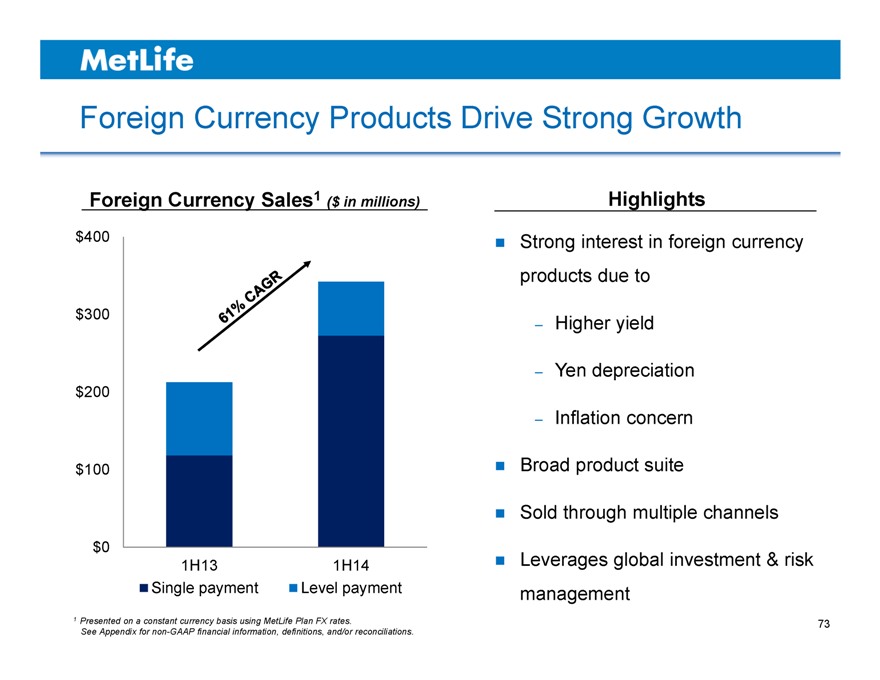

Foreign Currency Products Drive Strong Growth

Foreign Currency Sales1 ($ in millions)

$400

$300

$200

$100

$0

1H13 1H14

Single payment Level payment

Highlights

Strong interest in foreign currency products due to

– Higher yield

– Yen depreciation

– Inflation concern Broad product suite

Sold through multiple channels

Leverages global investment & risk management

1 | | Presented on a constant currency basis using MetLife Plan FX rates. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

73

MetLife

Key Takeaways

Significant opportunities for profitable growth Differentiated channel and product portfolio More focus on value and volume Growing in cancer and foreign currency products Re-establishing our leadership in medical

74

MetLife

Metlife

Koichiro Yamaguchi

Chief Distribution Officer MetLife Japan

September 17, 2014

ASIA INVESTOR DAY 2014

Metlife

Consumer Behavior Leading the Channel Shift1

Consumer channel preferences are increasingly diverse

Direct growing rapidly, and is often used for information gathering prior to purchasing in other channels

Bancassurance and independent agency projected to grow by mid-single digits

Career agency and “sales lady” channels are in decline

1 | | Source: Boston Consulting Group analysis. |

77

Metlife

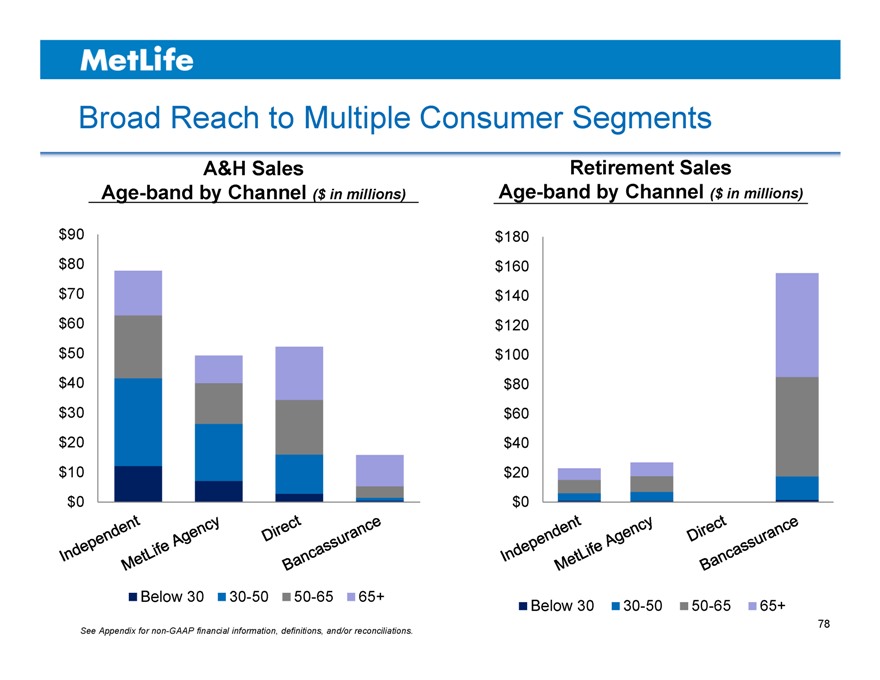

Broad Reach to Multiple Consumer Segments

A&H Sales

Age-band by Channel ($ in millions)

$90

$80

$70

$60

$50

$40

$30

$20

$10

$0

Below 30 30-50 50-65 65+

Retirement Sales

Age-band by Channel ($ in millions)

$180

$160

$140

$120

$100

$80

$60

$40

$20

$0

Below 30 30-50 50-65 65+

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

78

Metlife

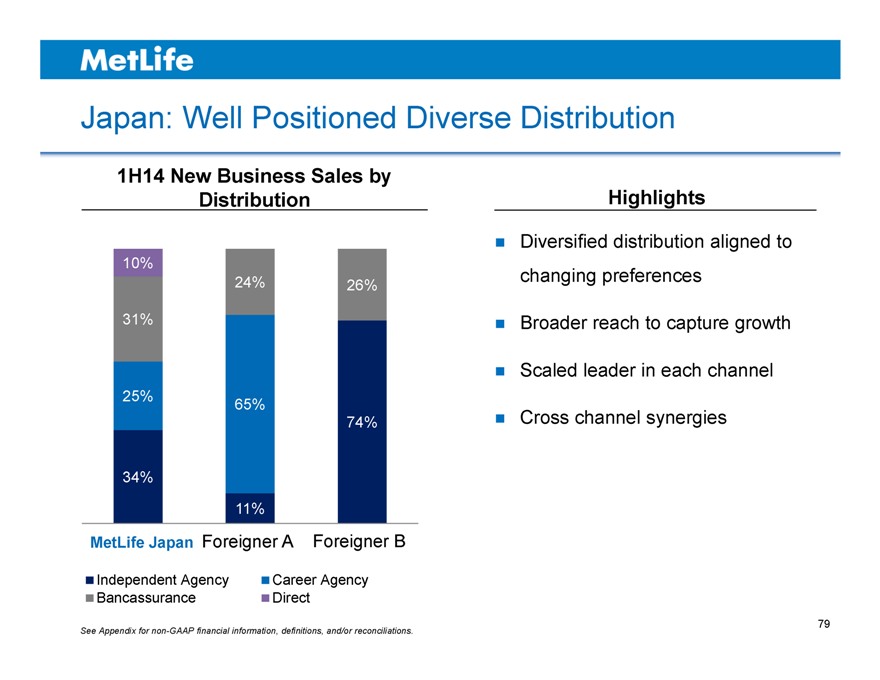

Japan: Well Positioned Diverse Distribution

1H14 New Business Sales by

Distribution

10%

24% 26%

31%

25% 65%

74%

34%

11%

MetLife Japan Foreigner A Foreigner B

Independent Agency Career Agency

Bancassurance Direct

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

Highlights

Diversified distribution aligned to changing preferences

Broader reach to capture growth Scaled leader in each channel Cross channel synergies

79

Metlife

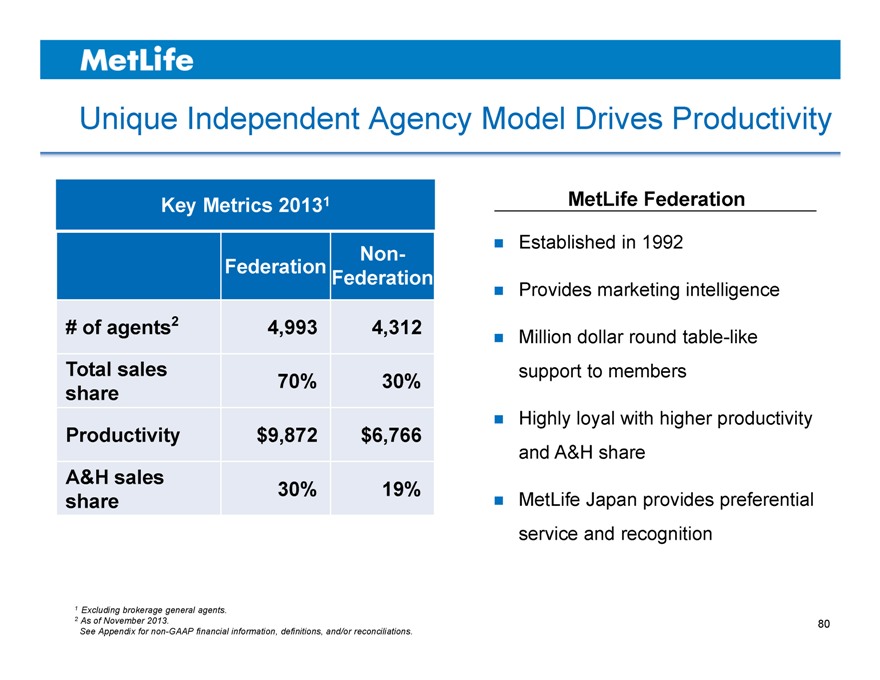

Unique Independent Agency Model Drives Productivity

Key Metrics 20131

Non-

Federation Federation

# of agents2 4,993 4,312

Total sales

share 70% 30%

Productivity $9,872 $6,766

A&H sales 30% 19%

share

MetLife Federation

Established in 1992

Provides marketing intelligence

Million dollar round table-like support to members

Highly loyal with higher productivity and A&H share

MetLife Japan provides preferential service and recognition

1 | | Excluding brokerage general agents. |

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

80

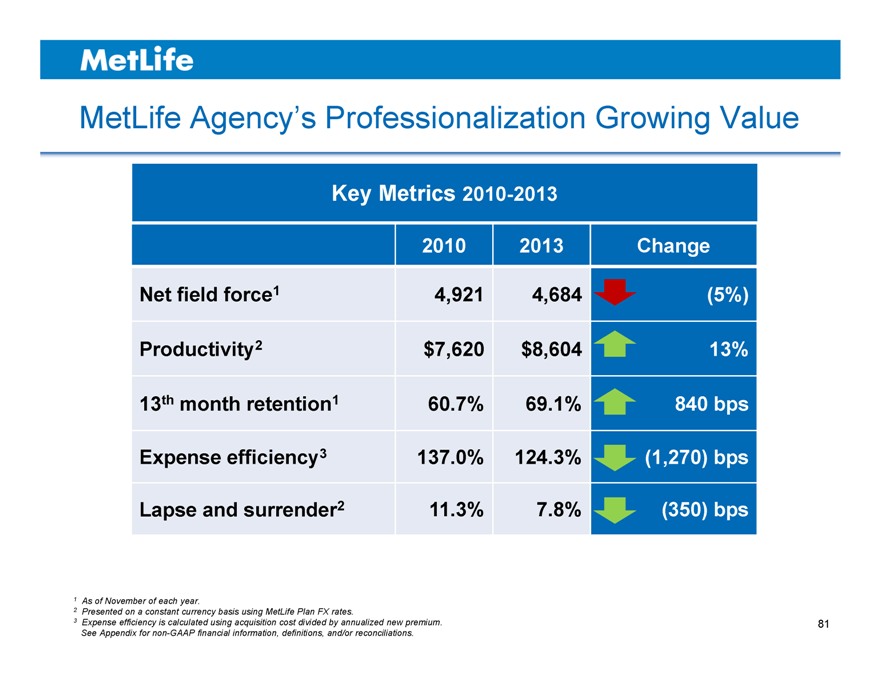

MetLife Agency’s Professionalization Growing Value

Key Metrics 2010-2013

2010 2013 Change

Net field force1 4,921 4,684 (5%)

Productivity2 $7,620 $8,604 13%

13th month retention1 60.7% 69.1% 840 bps

Expense efficiency3 137.0% 124.3% (1,270) bps

Lapse and surrender2 11.3% 7.8% (350) bps

1 As of November of each year.

2 Presented on a constant currency basis using MetLife Plan FX rates.

3 Expense efficiency is calculated using acquisition cost divided by annualized new premium. See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

81

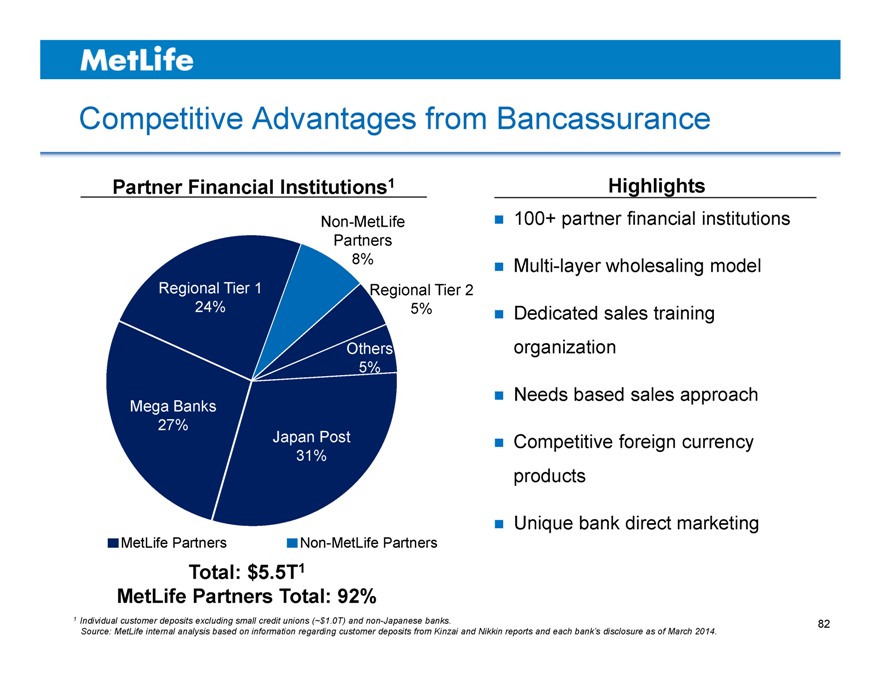

Competitive Advantages from Bancassurance

Partner Financial Institutions1

Non-MetLife Partners 8%

Regional Tier 2 5%

Regional Tier 1 24%

Others 5%

Mega banks 27%

Japan post 31%

Others 5%

Mega Banks 27%

Japan Post 31%

MetLife Partners Non-MetLife Partners

Highlights

100+ partner financial institutions

Multi-layer wholesaling model

Dedicated sales training organization

Needs based sales approach

Competitive foreign currency products

Unique bank direct marketing

Total: $5.5T1 MetLife Partners Total: 92%

1 Individual customer deposits excluding small credit unions (~$1.0T) and non-Japanese banks.

Source: MetLife internal analysis based on information regarding customer deposits from Kinzai and Nikkin reports and each bank’s disclosure as of March 2014.

82

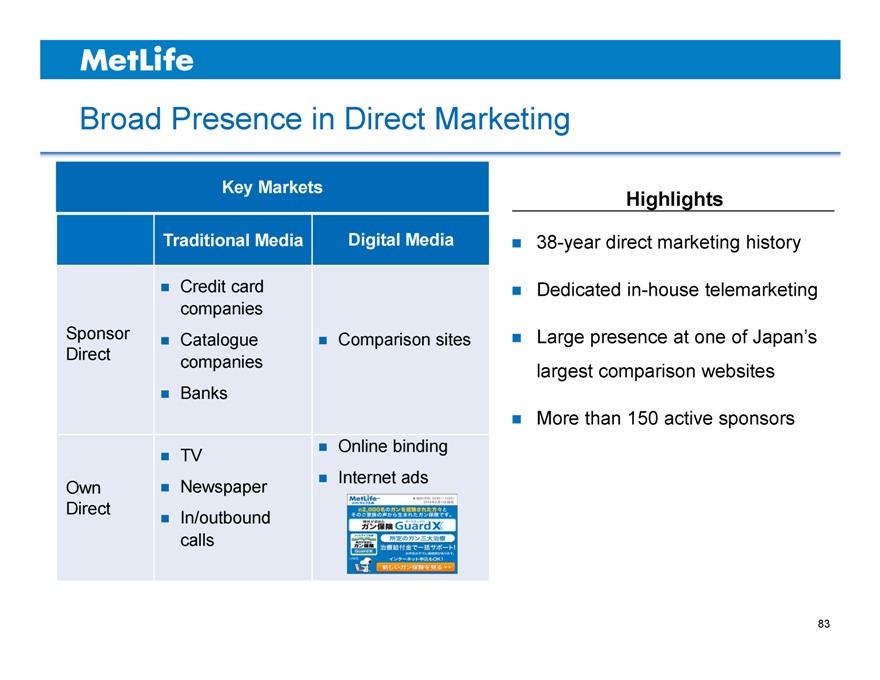

Broad Presence in Direct Marketing

Key Markets

Traditional Media Digital Media

Credit card

companies

Sponsor Catalogue Comparison sites

Direct companies

Banks

TV Online binding

Own Newspaper Internet ads

Direct In/outbound

calls

Highlights

38-year direct marketing history Dedicated in-house telemarketing

Large presence at one of Japan’s largest comparison websites

More than 150 active sponsors

83

Key Takeaways

Diversified multi-channel platform offers consumers choice Steady growth in direct marketing, both on- and offline High productivity from differentiated independent agency Professionalizing career agency to create value Accessing senior affluent market through bancassurance

84

MetLife

Atsushi Yagai

Chief Customer Marketing Officer MetLife Japan

September 17, 2014

ASIA INVESTOR DAY 2014

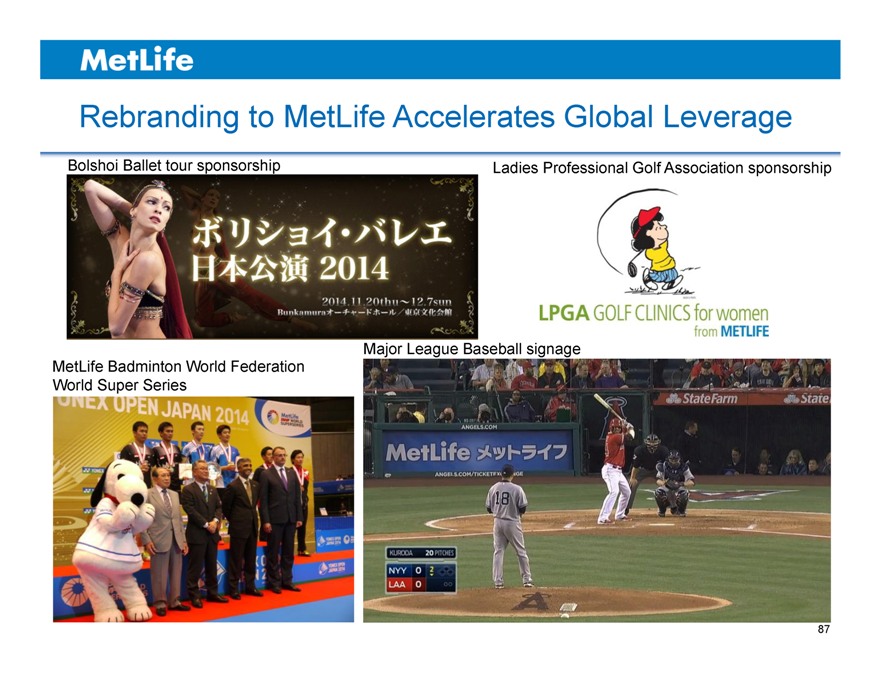

Rebranding to MetLife Accelerates Global Leverage

Bolshoi Ballet tour sponsorship Ladies Professional Golf Association sponsorship

Major League Baseball signage MetLife Badminton World Federation World Super Series

87

Leveraging Snoopy’s Popularity in Japan

Newly designed Blimp

Blimp crew truck July 1, 2014 newspaper ad

Company InfoPack for customer

Facebook ad

88

Commercial—Medical Insurance Flexi

The full video is available at http://investor.metlife.com. All other information contained on MetLife’s website is not a part of this presentation.

89

Commercial—Flexi Gold

The full video is available at http://investor.metlife.com. All other information contained on MetLife’s website is not a part of this presentation.

90

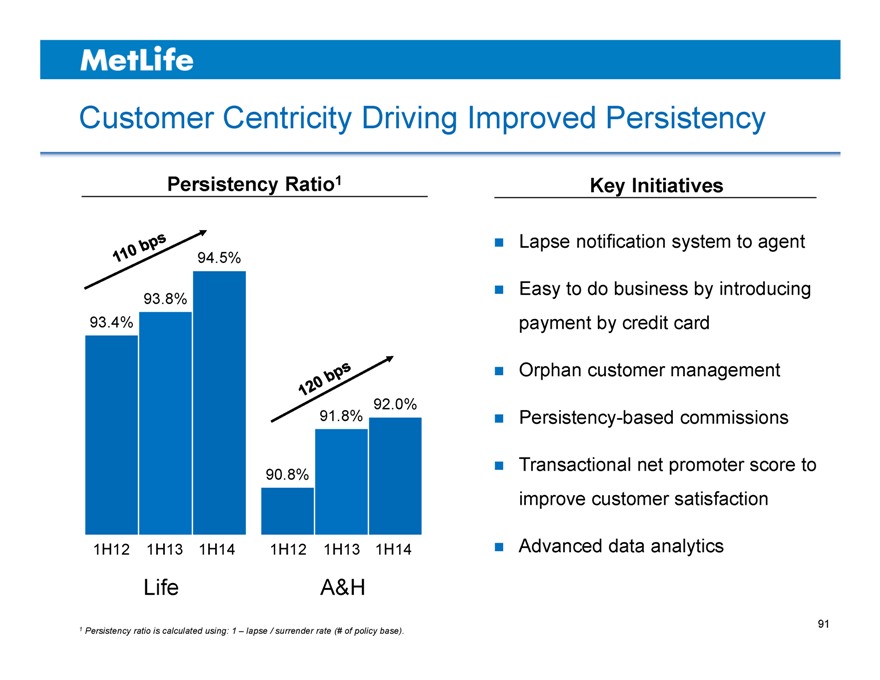

Customer Centricity Driving Improved Persistency

Persistency Ratio1

94.5%

93.8%

93.4%

91.8% 92.0%

90.8%

1H12 1H13 1H14 1H12 1H13 1H14

Key Initiatives

Lapse notification system to agent

Easy to do business by introducing payment by credit card

Orphan customer management

Persistency-based commissions

Transactional net promoter score to improve customer satisfaction

Advanced data analytics

Life A&H

1 Persistency ratio is calculated using: 1 – lapse / surrender rate (# of policy base).

91

Key Takeaways

Intense focus on improving persistency Persistency improving faster than the industry1 Room for further persistency improvements Rebranding better leverages our global brand assets Consumer affinity with Snoopy driving brand awareness

1 Source: Hoken Kenkyujo Ltd. Statistics of Life Insurance Business in Japan FY2008-2012 and LIAJ (Life Insurance Association of Japan), FY2013.

92

Metlife

Greg Brennan

Chief Financial Officer MetLife Japan

September 17, 2014

ASIA INVESTOR DAY 2014

Introduction

Core business performing solidly

Medical revenue growth driven by persistency Operating expense ratio continues to improve Japan SMR sound and well above minimum Interest rate sensitivities actively managed

See Appendix for non-GAAP financial information, definitions and/or reconciliations.

95

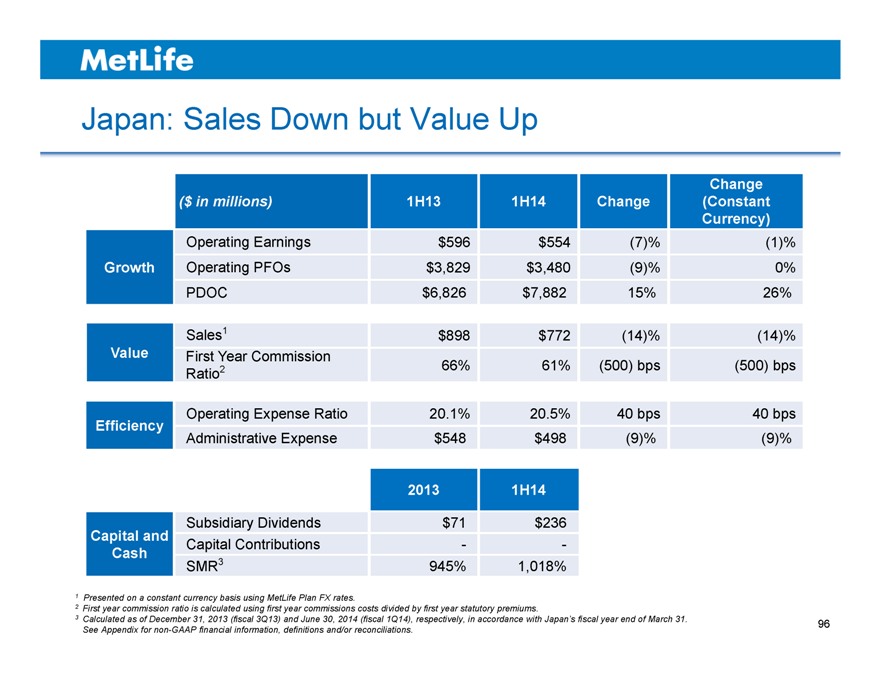

Japan: Sales Down but Value Up

Change

($ in millions) 1H13 1H14 Change (Constant

Currency)

Operating Earnings $596 $554 (7)% (1)%

Growth Operating PFOs $3,829 $3,480 (9)% 0%

PDOC $6,826 $7,882 15% 26%

Sales1 $898 $772 (14)% (14)%

Value First Year Commission

Ratio2 66% 61% (500) bps (500) bps

Operating Expense Ratio 20.1% 20.5% 40 bps 40 bps

Efficiency

Administrative Expense $548 $498 (9)% (9)%

2013 1H14

Subsidiary Dividends $71 $236

Capital and Capital Contributions ——

Cash

SMR3 945% 1,018%

1 Presented on a constant currency basis using MetLife Plan FX rates.

2 First year commission ratio is calculated using first year commissions costs divided by first year statutory premiums.

3 Calculated as of December 31, 2013 (fiscal 3Q13) and June 30, 2014 (fiscal 1Q14), respectively, in accordance with Japan’s fiscal year end of March 31. See Appendix for non-GAAP financial information, definitions and/or reconciliations.

96

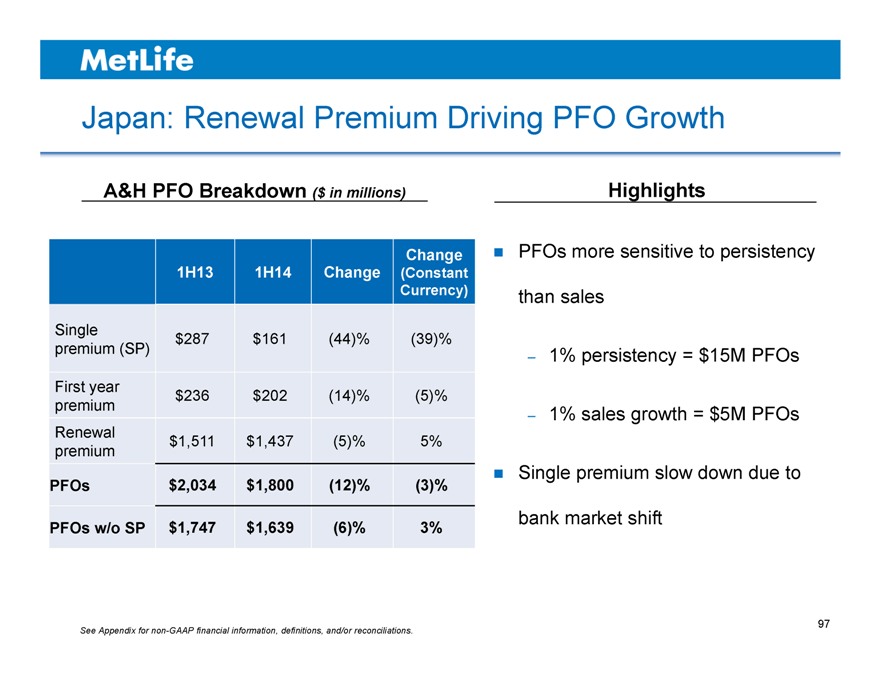

Japan: Renewal Premium Driving PFO Growth

A&H PFO Breakdown ($ in millions)

Change

1H13 1H14 Change (Constant

Currency)

Single $287 $161 (44)% (39)%

premium (SP)

First year $236 $202 (14)% (5)%

premium

Renewal $1,511 $1,437 (5)% 5%

premium

PFOs $2,034 $1,800 (12)% (3)%

PFOs w/o SP $1,747 $1,639 (6)% 3%

Highlights

PFOs more sensitive to persistency

than sales

– 1% persistency = $15M PFOs

– 1% sales growth = $5M PFOs

Single premium slow down due to

bank market shift

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

97

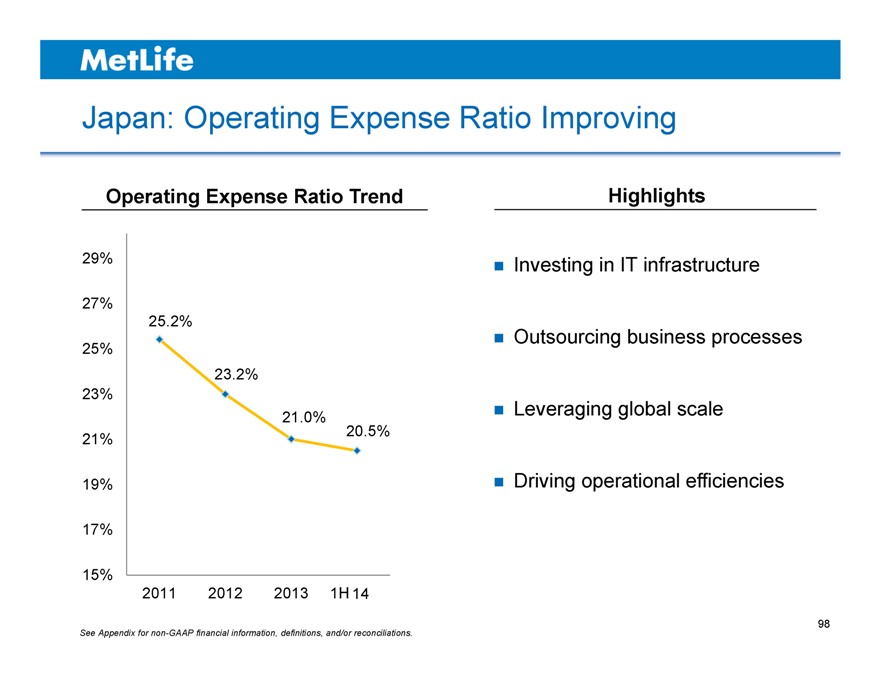

Japan: Operating Expense Ratio Improving

Operating Expense Ratio Trend

29%

27%

25.2%

25%

23.2%

23%

21.0%

21% 20.5%

19%

17%

15%

2011 2012 2013 1H 14

Highlights

Investing in IT infrastructure Outsourcing business processes Leveraging global scale Driving operational efficiencies

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

98

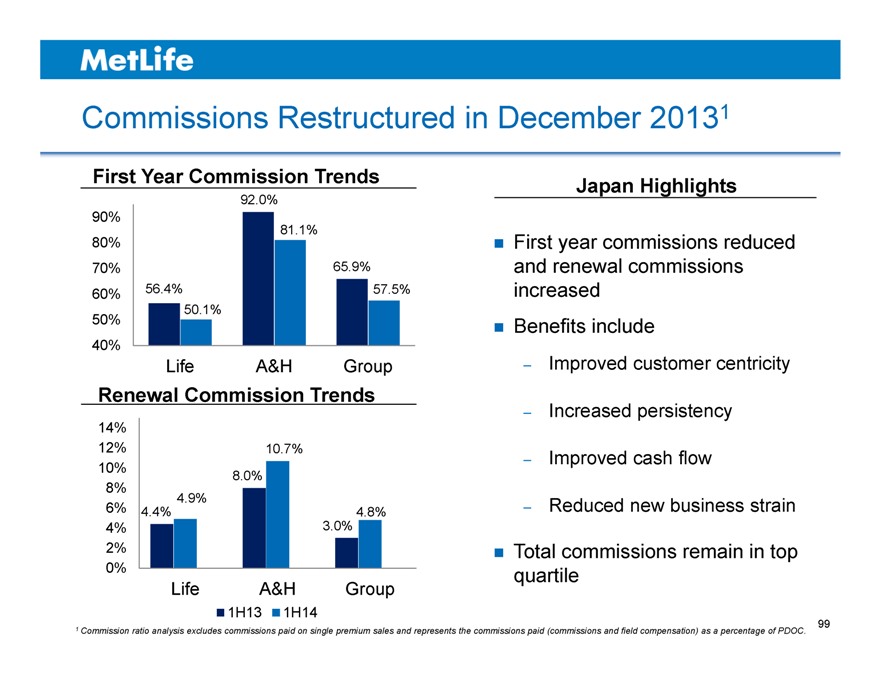

Commissions Restructured in December 20131

First Year Commission Trends

92.0%

90%

81.1%

80%

70% 65.9%

60% 56.4% 57.5%

50.1%

50%

40%

Life A&H Group

Renewal Commission Trends

14%

12% 10.7%

10% 8.0%

8%

4.9%

6% 4.4% 4.8%

4% 3.0%

2%

0%

Life A&H Group

1H13 1H14

Japan Highlights

First year commissions reduced and renewal commissions increased Benefits include

– Improved customer centricity

– Increased persistency

– Improved cash flow

– Reduced new business strain

Total commissions remain in top quartile

1 Commission ratio analysis excludes commissions paid on single premium sales and represents the commissions paid (commissions and field compensation) as a percentage of PDOC.

99

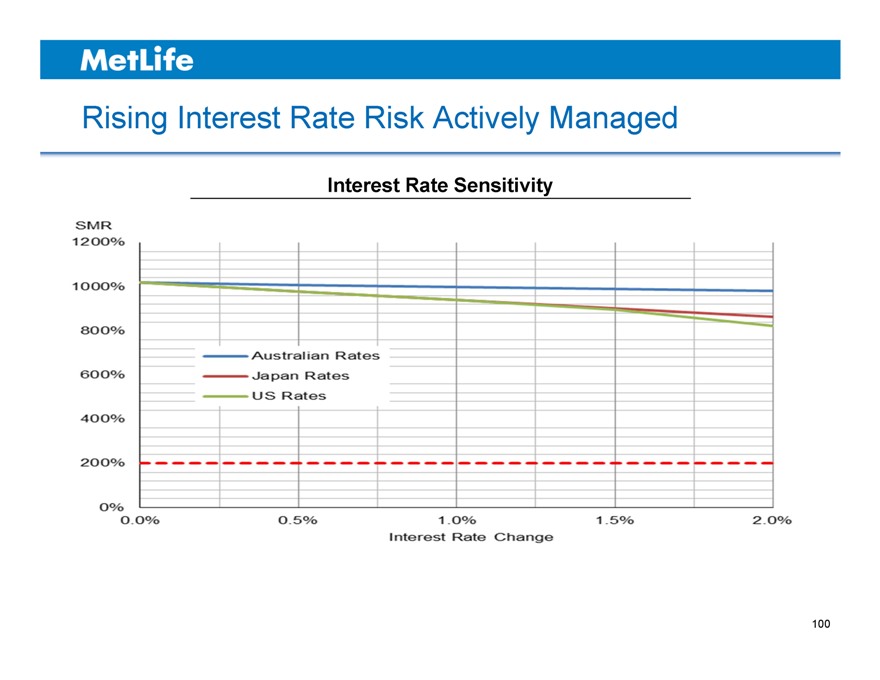

Rising Interest Rate Risk Actively Managed

Interest Rate Sensitivity

100

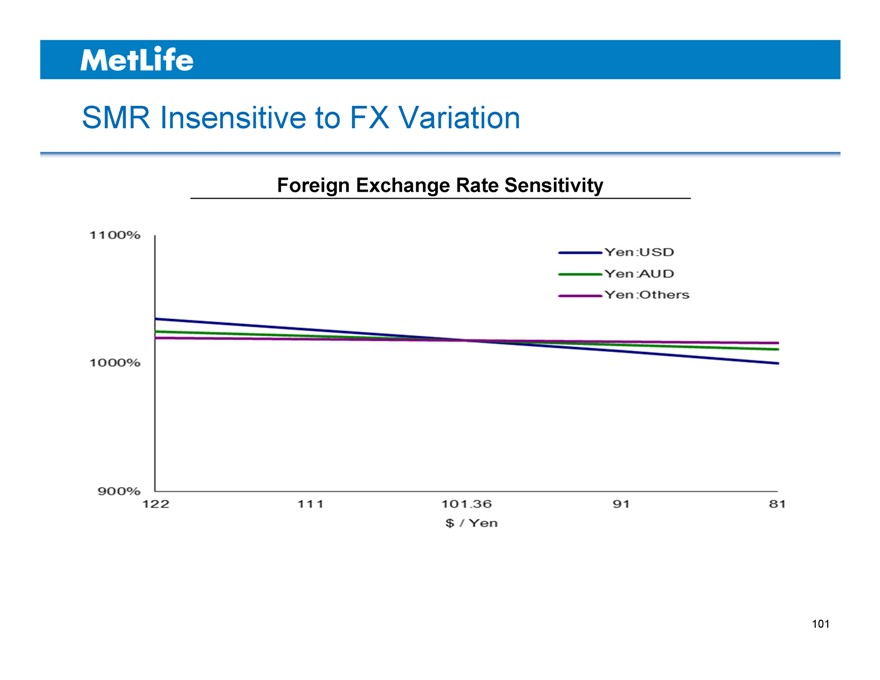

SMR Insensitive to FX Variation

Foreign Exchange Rate Sensitivity

101

Key Takeaways

Core business performing solidly

Medical revenue growth driven by persistency Operating expense ratio continues to improve Japan SMR sound and well above minimum Interest rate sensitivities actively managed

See Appendix for non-GAAP financial information, definitions and/or reconciliations.

102

MetLife

Christopher G. Townsend

President Asia

September 17, 2014

ASIA INVESTOR DAY 2014

Closing Remarks

Asia is the growth engine for the Industry

Well positioned in Japan; strong growth in key markets Investment in capabilities to win Consistent performance and improving cash generation

105

MetLife

Appendix

September 17, 2014

ASIA INVESTOR DAY 2014

Safe Harbor Statement

This presentation may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning, or are tied to future periods, in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operations and financial results.

Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the actual future results of MetLife, Inc., its subsidiaries and affiliates. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties, and other factors that might cause such differences include the risks, uncertainties and other factors identified in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission (the “SEC”). These factors include: (1) difficult conditions in the global capital markets; (2) increased volatility and disruption of the capital and credit markets, which may affect our ability to meet liquidity needs and access capital, including through our credit facilities, generate fee income and market-related revenue and finance statutory reserve requirements and may require us to pledge collateral or make payments related to declines in value of specified assets, including assets supporting risks ceded to certain of our captive reinsurers or hedging arrangements associated with those risks; (3) exposure to financial and capital market risks, including as a result of the disruption in Europe; (4) impact of comprehensive financial services regulation reform on us, as a potential non-bank systemically important financial institution, or otherwise; (5) numerous rulemaking initiatives required or permitted by the Dodd-Frank Wall Street Reform and Consumer Protection Act which may impact how we conduct our business, including those compelling the liquidation of certain financial institutions; (6) regulatory, legislative or tax changes relating to our insurance, international, or other operations that may affect the cost of, or demand for, our products or services, or increase the cost or administrative burdens of providing benefits to employees; (7) adverse results or other consequences from litigation, arbitration or regulatory investigations; (8) potential liquidity and other risks resulting from our participation in a securities lending program and other transactions; (9) investment losses and defaults, and changes to investment valuations; (10) changes in assumptions related to investment valuations, deferred policy acquisition costs, deferred sales inducements, value of business acquired or goodwill; (11) impairments of goodwill and realized losses or market value impairments to illiquid assets; (12) defaults on our mortgage loans; (13) the defaults or deteriorating credit of other financial institutions that could adversely affect us; (14) economic, political, legal, currency and other risks relating to our international operations, including with respect to fluctuations of exchange rates; (15) downgrades in our claims paying ability, financial strength or credit ratings; (16) a deterioration in the experience of the “closed block” established in connection with the reorganization of Metropolitan Life Insurance Company; (17) availability and effectiveness of reinsurance or indemnification arrangements, as well as any default or failure of counterparties to perform; (18) differences between actual claims experience and underwriting and reserving assumptions; (19) ineffectiveness of risk management

108

Safe Harbor Statement (Continued)

policies and procedures; (20) catastrophe losses; (21) increasing cost and limited market capacity for statutory life insurance reserve financings; (22) heightened competition, including with respect to pricing, entry of new competitors, consolidation of distributors, the development of new products by new and existing competitors, and for personnel; (23) exposure to losses related to variable annuity guarantee benefits, including from significant and sustained downturns or extreme volatility in equity markets, reduced interest rates, unanticipated policyholder behavior, mortality or longevity, and the adjustment for nonperformance risk; (24) our ability to address difficulties, unforeseen liabilities, asset impairments, or rating agency actions arising from business acquisitions, including our acquisition of American Life Insurance Company and Delaware American Life Insurance Company, and integrating and managing the growth of such acquired businesses, or arising from dispositions of businesses or legal entity reorganizations; (25) the dilutive impact on our stockholders resulting from the settlement of our outstanding common equity units; (26) regulatory and other restrictions affecting MetLife, Inc.’s ability to pay dividends and repurchase common stock; (27) MetLife, Inc.’s primary reliance, as a holding company, on dividends from its subsidiaries to meet debt payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; (28) the possibility that MetLife, Inc.’s Board of Directors may influence the outcome of stockholder votes through the voting provisions of the MetLife Policyholder Trust; (29) changes in accounting standards, practices and/or policies; (30) increased expenses relating to pension and postretirement benefit plans, as well as health care and other employee benefits; (31) inability to protect our intellectual property rights or claims of infringement of the intellectual property rights of others; (32) inability to attract and retain sales representatives; (33) provisions of laws and our incorporation documents may delay, deter or prevent takeovers and corporate combinations involving MetLife; (34) the effects of business disruption or economic contraction due to disasters such as terrorist attacks, cyberattacks, other hostilities, or natural catastrophes, including any related impact on the value of our investment portfolio, our disaster recovery systems, cyber- or other information security systems and management continuity planning; (35) the effectiveness of our programs and practices in avoiding giving our associates incentives to take excessive risks; and (36) other risks and uncertainties described from time to time in MetLife, Inc.’s filings with the SEC.

MetLife, Inc. does not undertake any obligation to publicly correct or update any forward-looking statement if MetLife, Inc. later becomes aware that such statement is not likely to be achieved. Please consult any further disclosures MetLife, Inc. makes on related subjects in reports to the SEC.

109

Explanatory Note on Non-GAAP Financial Information

Any references in this presentation (except in this Explanatory Note on Non-GAAP Financial Information slide and this Appendix) to net income (loss), net income (loss) per share, operating earnings, operating earnings per share, book value per share, book value per share, excluding accumulated other comprehensive income (loss) (“AOCI”) premiums, fees and other revenues and operating return on equity, should be read as net income (loss) available to MetLife, Inc.‘s common shareholders, net income (loss) available to MetLife, Inc.‘s common shareholders per diluted common share, operating earnings available to common shareholders, operating earnings available to common shareholders per diluted common share, book value per common share, book value per common share, excluding AOCI, premiums, fees and other revenues (operating) and operating return on MetLife, Inc.’s common equity, excluding AOCI, respectively.

Operating earnings is the measure of segment profit or loss that MetLife uses to evaluate segment performance and allocate resources. Consistent with accounting principles generally accepted in the United States of America (“GAAP”) accounting guidance for segment reporting, operating earnings is MetLife’s measure of segment performance. Operating earnings is also a measure by which MetLife senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under applicable compensation plans.

Operating earnings is defined as operating revenues less operating expenses, both net of income tax. Operating earnings available to common shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or exited by MetLife, Inc. and are referred to as divested businesses. Operating revenues also excludes net investment gains (losses) (“NIGL”) and net derivative gains (losses) (“NDGL”). Operating expenses also excludes goodwill impairments.

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to NIGL and NDGL and certain variable annuity guaranteed minimum income benefits (“GMIB”) fees (“GMIB Fees”);

Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are hedges of investments or that are used to replicate certain investments, but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations, (iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iv) excludes certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to securitization entities that are variable interest entities (“VIEs”) consolidated under GAAP; and

Other revenues are adjusted for settlements of foreign currency earnings hedges.

110

Explanatory Note on Non-GAAP Financial Information (Continued)

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to NIGL and NDGL, (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets and other pass through adjustments, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments associated with surrenders or terminations of contracts (“Market Value Adjustments”);

Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium on derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes amounts related to net investment income earned on contractholder-directed unit-linked investments;

Amortization of deferred policy acquisition costs (“DAC”) and value of business acquired (“VOBA”) excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB Fees and GMIB Costs, and (iii) Market Value Adjustments;

Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and (iii) acquisition and integration costs.

Operating earnings also excludes the recognition of certain contingent assets and liabilities that could not be recognized at acquisition or adjusted for during the measurement period under GAAP business combination accounting guidance.

In addition, operating return on MetLife, Inc.‘s common equity is defined as operating earnings available to common shareholders divided by average GAAP common equity.

Operating expense ratio is calculated by dividing operating expenses (other expenses net of capitalization of DAC) by premiums, fees and other revenues (operating).

111

Explanatory Note on Non-GAAP Financial Information (Continued)

MetLife believes the presentation of operating earnings and operating earnings available to common shareholders as MetLife measures it for management purposes enhances the understanding of the company’s performance by highlighting the results of operations and the underlying profitability drivers of the business. Operating revenues, operating expenses, operating earnings, operating earnings available to common shareholders, operating earnings available to common shareholders per diluted common share, book value per common share, excluding AOCI, book value per diluted common share, excluding AOCI, operating return on MetLife, Inc.’s common equity, operating return on MetLife, Inc.’s common equity, excluding AOCI, investment portfolio gains (losses) and derivative gains (losses) should not be viewed as substitutes for the following financial measures calculated in accordance with GAAP: GAAP revenues, GAAP expenses, income (loss) from continuing operations, net of income tax, net income (loss) available to MetLife, Inc.‘s common shareholders, net income (loss) available to MetLife, Inc.‘s common shareholders per diluted common share, book value per common share, book value per diluted common share, return on MetLife, Inc.’s common equity, return on MetLife, Inc.’s common equity, excluding AOCI, net investment gains (losses) and net derivative gains (losses), respectively. For the historical periods presented, reconciliations of non-GAAP measures used in this presentation and accompanying materials to the most directly comparable GAAP measures may be included in this Appendix to the presentation materials and/or are on the Investor Relations portion of our Internet website. Additional information about our historical results is also available on our Internet website in our Quarterly Financial Supplements for the corresponding periods.

The non-GAAP measures used in this presentation and accompanying materials should not be viewed as substitutes for the most directly comparable GAAP measures.

In this presentation and accompanying materials, we may refer to sales activity for various products. These sales statistics do not correspond to revenues under GAAP, but are used as relevant measures of business activity.

The impact of changes in foreign currency exchange rates is calculated using the average foreign currency exchange rates for the current period and is applied to each of the comparable periods.

In this presentation, we may provide forward-looking guidance on our future earnings, premiums, fees and other revenues, earnings per diluted common share, book value per common share and return on common equity on an operating or non-GAAP basis. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is not accessible on a forward-looking basis because we believe it is not possible to provide other than a range of net investment gains and losses and net derivative gains and losses, which can fluctuate significantly within or outside the range and from period to period and may have a significant impact on GAAP net income.

In addition, we may provide estimated historical operating results for business that is not within a single reportable segment or Corporate & Other in this presentation. A reconciliation of non-GAAP measures to the most directly comparable GAAP measures is not accessible for such results, as we calculate GAAP results only for our reportable segments and Corporate & Other.

112

Definitions

Definitions

Sales/Annualized New Premiums:

10% of single-premium deposits (mainly from retirement products such as variable annuity, fixed annuity and pensions) and 20% of single-premium deposits from credit insurance.

100% of annualized full year premiums and fees from recurring-premium policy sales of all products (mainly from risk and protection products such as individual life, accident & health and group).

114

Reconciliations

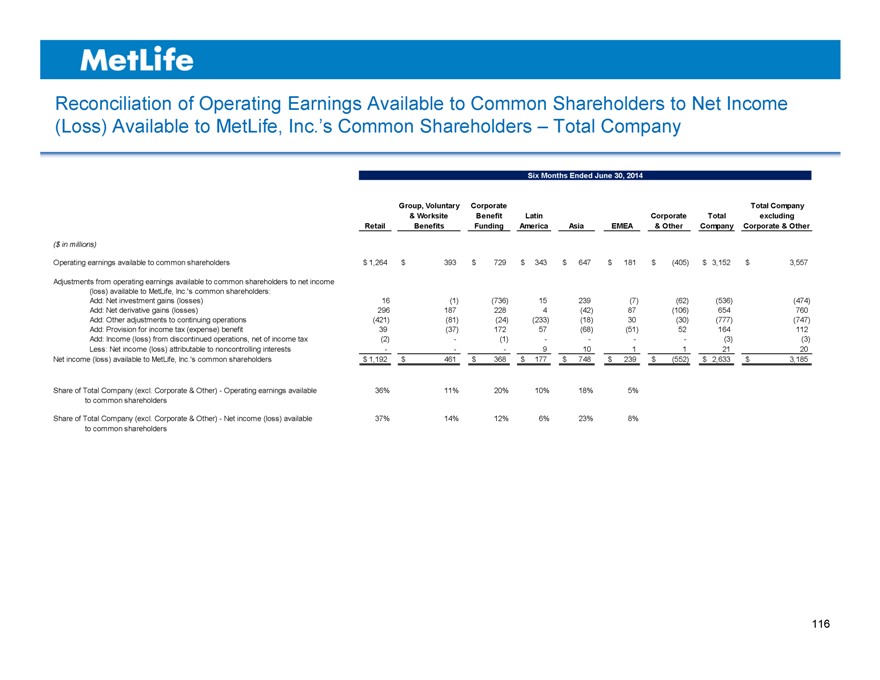

Reconciliation of Operating Earnings Available to Common Shareholders to Net Income (Loss) Available to MetLife, Inc.’s Common Shareholders – Total Company

Six Months Ended June 30, 2014

Group, Voluntary Corporate Total Company

& Worksite Benefit Latin Corporate Total excluding

Retail Benefits Funding America Asia EMEA & Other Company Corporate & Other

($ in millions)

Operating earnings available to common shareholders $ 1,264 $ 393 $ 729 $ 343 $ 647 $ 181 $ (405) $ 3,152 $ 3,557

Adjustments from operating earnings available to common shareholders to net income

(loss) available to MetLife, Inc.‘s common shareholders:

Add: Net investment gains (losses) 16 (1) (736) 15 239 (7) (62) (536) (474)

Add: Net derivative gains (losses) 296 187 228 4 (42) 87 (106) 654 760

Add: Other adjustments to continuing operations (421) (81) (24) (233) (18) 30 (30) (777) (747)

Add: Provision for income tax (expense) benefit 39 (37) 172 57 (68) (51) 52 164 112

Add: Income (loss) from discontinued operations, net of income tax (2) — (1) ——— — (3) (3)

Less: Net income (loss) attributable to noncontrolling interests — —— 9 10 1 1 21 20

Net income (loss) available to MetLife, Inc.‘s common shareholders $ 1,192 $ 461 $ 368 $ 177 $ 748 $ 239 $ (552) $ 2,633 $ 3,185

Share of Total Company (excl. Corporate & Other)—Operating earnings available 36% 11% 20% 10% 18% 5%

to common shareholders

Share of Total Company (excl. Corporate & Other)—Net income (loss) available 37% 14% 12% 6% 23% 8%

to common shareholders

116

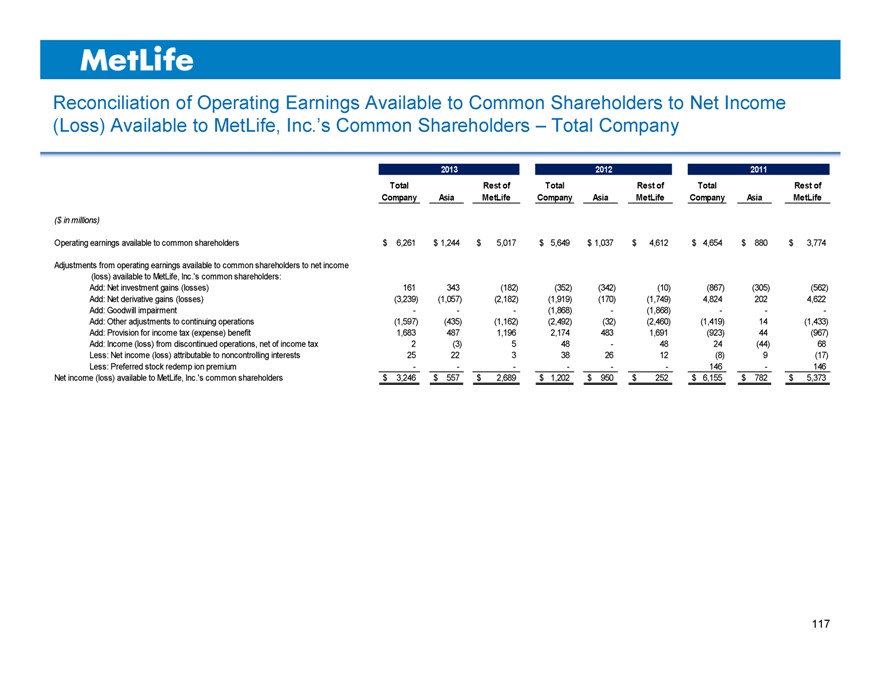

Reconciliation of Operating Earnings Available to Common Shareholders to Net Income (Loss) Available to MetLife, Inc.’s Common Shareholders – Total Company

2013 2012 2011

Total Rest of Total Rest of Total Rest of

Company Asia MetLife Company Asia MetLife Company Asia MetLife

($ in millions)

Operating earnings available to common shareholders $ 6,261 $ 1,244 $ 5,017 $ 5,649 $ 1,037 $ 4,612 $ 4,654 $ 880 $ 3,774

Adjustments from operating earnings available to common shareholders to net income

(loss) available to MetLife, Inc.‘s common shareholders:

Add: Net investment gains (losses) 161 343 (182) (352) (342) (10) (867) (305) (562)

Add: Net derivative gains (losses) (3,239) (1,057) (2,182) (1,919) (170) (1,749) 4,824 202 4,622

Add: Goodwill impairment ——— (1,868) — (1,868) —— -

Add: Other adjustments to continuing operations (1,597) (435) (1,162) (2,492) (32) (2,460) (1,419) 14 (1,433)

Add: Provision for income tax (expense) benefit 1,683 487 1,196 2,174 483 1,691 (923) 44 (967)

Add: Income (loss) from discontinued operations, net of income tax 2 (3) 5 48 — 48 24 (44) 68

Less: Net income (loss) attributable to noncontrolling interests 25 22 3 38 26 12 (8) 9 (17)

Less: Preferred stock redemp ion premium ————— — 146 — 146

Net income (loss) available to MetLife, Inc.‘s common shareholders $ 3,246 $ 557 $ 2,689 $ 1,202 $ 950 $ 252 $ 6,155 $ 782 $ 5,373

117

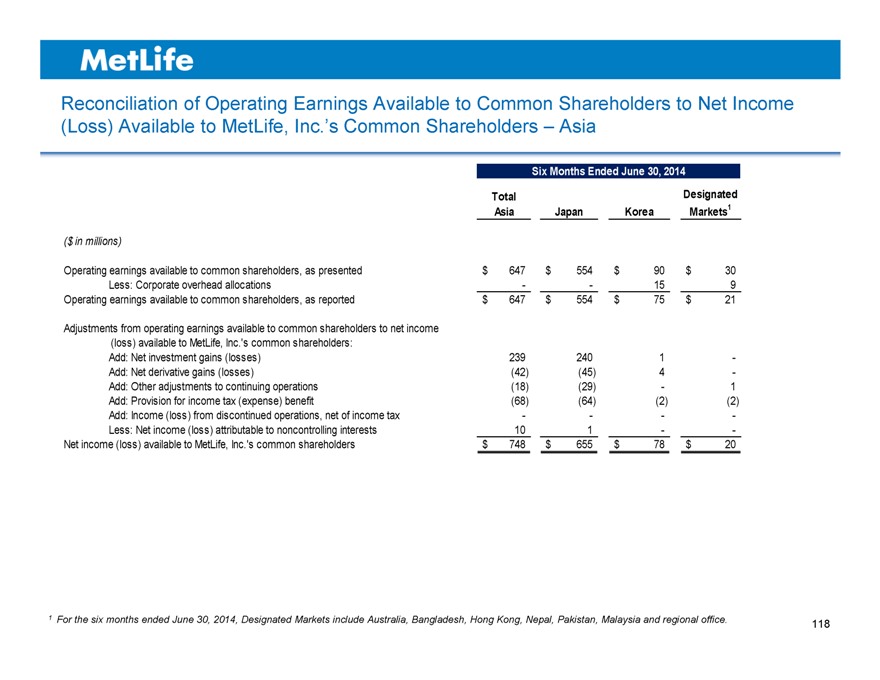

Reconciliation of Operating Earnings Available to Common Shareholders to Net Income (Loss) Available to MetLife, Inc.’s Common Shareholders – Asia

Six Months Ended June 30, 2014

Total Designated

Asia Japan Korea Markets1

($ in millions)

Operating earnings available to common shareholders, as presented $ 647 $ 554 $ 90 $ 30

Less: Corporate overhead allocations — — 15 9

Operating earnings available to common shareholders, as reported $ 647 $ 554 $ 75 $ 21

Adjustments from operating earnings available to common shareholders to net income

(loss) available to MetLife, Inc.‘s common shareholders:

Add: Net investment gains (losses) 239 240 1 -

Add: Net derivative gains (losses) (42) (45) 4 -

Add: Other adjustments to continuing operations (18) (29) — 1

Add: Provision for income tax (expense) benefit (68) (64) (2) (2)

Add: Income (loss) from discontinued operations, net of income tax — — — -

Less: Net income (loss) attributable to noncontrolling interests 10 1 — -

Net income (loss) available to MetLife, Inc.‘s common shareholders $ 748 $ 655 $ 78 $ 20

1 For the six months ended June 30, 2014, Designated Markets include Australia, Bangladesh, Hong Kong, Nepal, Pakistan, Malaysia and regional office.

118

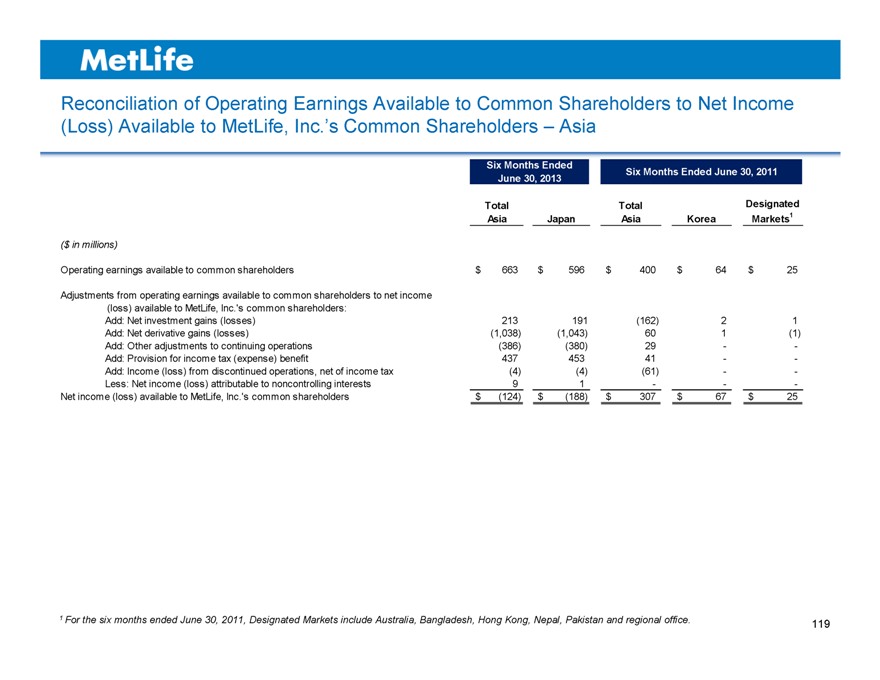

Reconciliation of Operating Earnings Available to Common Shareholders to Net Income (Loss) Available to MetLife, Inc.’s Common Shareholders – Asia

Six Months Ended Six Months Ended June 30, 2011

June 30, 2013

Total Total Designated

Asia Japan Asia Korea Markets1

($ in millions)

Operating earnings available to common shareholders $ 663 $ 596 $ 400 $ 64 $ 25

Adjustments from operating earnings available to common shareholders to net income

(loss) available to MetLife, Inc.‘s common shareholders:

Add: Net investment gains (losses) 213 191 (162) 2 1

Add: Net derivative gains (losses) (1,038) (1,043) 60 1 (1)

Add: Other adjustments to continuing operations (386) (380) 29 — -

Add: Provision for income tax (expense) benefit 437 453 41 — -

Add: Income (loss) from discontinued operations, net of income tax (4) (4) (61) — -

Less: Net income (loss) attributable to noncontrolling interests 9 1 — — -

Net income (loss) available to MetLife, Inc.‘s common shareholders $ (124) $ (188) $ 307 $ 67 $ 25

1 For the six months ended June 30, 2011, Designated Markets include Australia, Bangladesh, Hong Kong, Nepal, Pakistan and regional office.

119

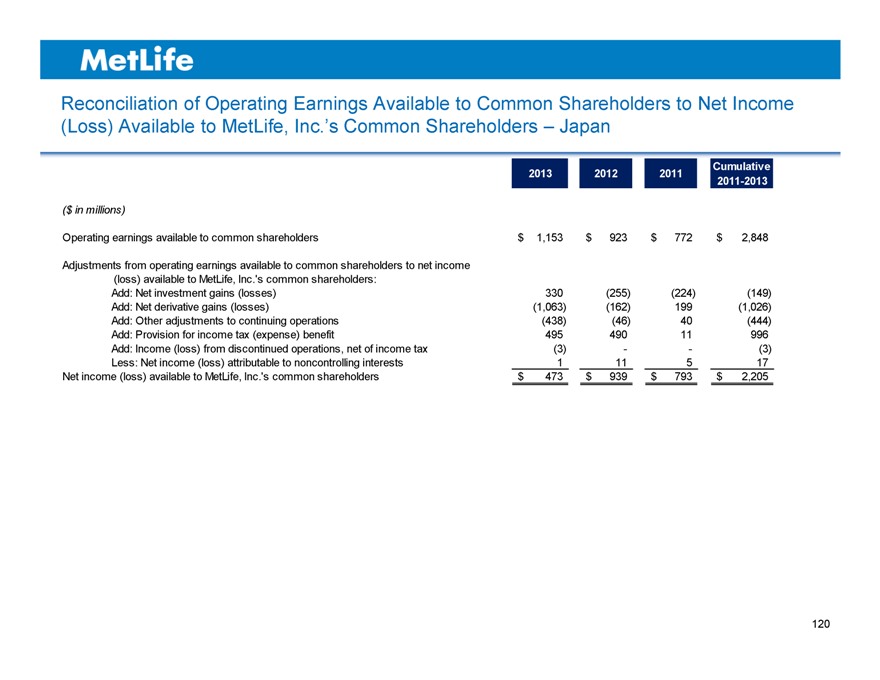

Reconciliation of Operating Earnings Available to Common Shareholders to Net Income (Loss) Available to MetLife, Inc.’s Common Shareholders – Japan

2013 2012 2011 Cumulative

2011-2013

($ in millions)

Operating earnings available to common shareholders $ 1,153 $ 923 $ 772 $ 2,848

Adjustments from operating earnings available to common shareholders to net income

(loss) available to MetLife, Inc.‘s common shareholders:

Add: Net investment gains (losses) 330 (255) (224) (149)

Add: Net derivative gains (losses) (1,063) (162) 199 (1,026)

Add: Other adjustments to continuing operations (438) (46) 40 (444)

Add: Provision for income tax (expense) benefit 495 490 11 996

Add: Income (loss) from discontinued operations, net of income tax (3) —— (3)

Less: Net income (loss) attributable to noncontrolling interests 1 11 5 17

Net income (loss) available to MetLife, Inc.‘s common shareholders $ 473 $ 939 $ 793 $ 2,205

120

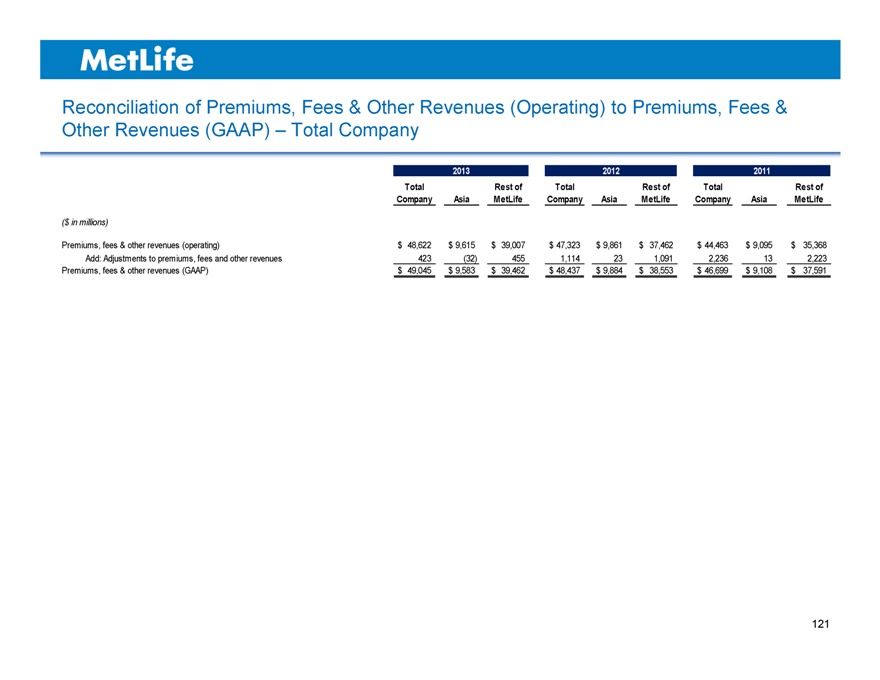

Reconciliation of Premiums, Fees & Other Revenues (Operating) to Premiums, Fees & Other Revenues (GAAP) – Total Company

2013 2012 2011

Total Rest of Total Rest of Total Rest of

Company Asia MetLife Company Asia MetLife Company Asia MetLife

($ in millions)

Premiums, fees & other revenues (operating) $ 48,622 $ 9,615 $ 39,007 $ 47,323 $ 9,861 $ 37,462 $ 44,463 $ 9,095 $ 35,368

Add: Adjustments to premiums, fees and other revenues 423 (32) 455 1,114 23 1,091 2,236 13 2,223

Premiums, fees & other revenues (GAAP) $ 49,045 $ 9,583 $ 39,462 $ 48,437 $ 9,884 $ 38,553 $ 46,699 $ 9,108 $ 37,591

121

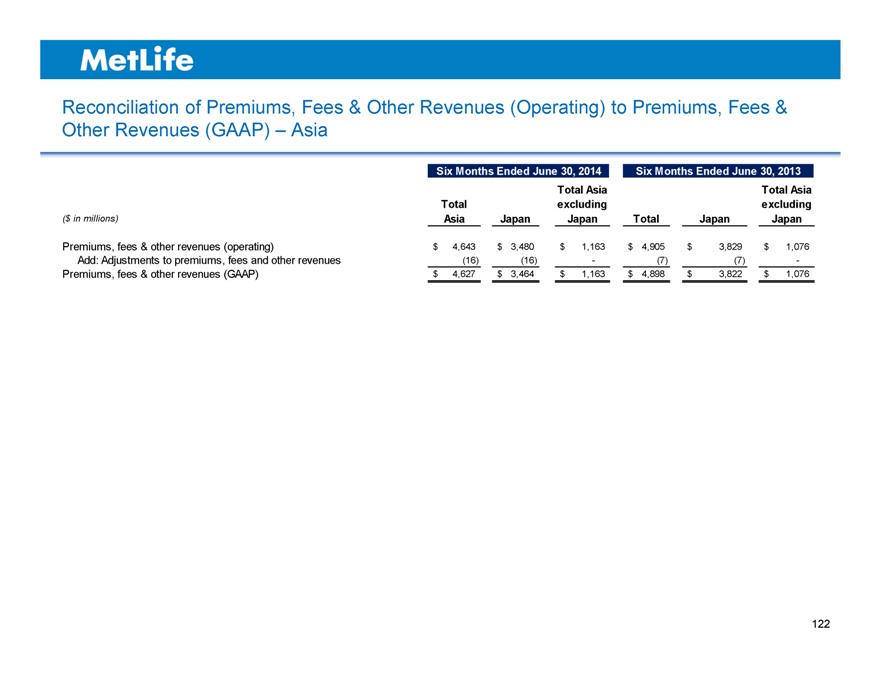

Reconciliation of Premiums, Fees & Other Revenues (Operating) to Premiums, Fees & Other Revenues (GAAP) – Asia

Six Months Ended June 30, 2014 Six Months Ended June 30, 2013

Total Asia Total Asia

Total excluding excluding

($ in millions) Asia Japan Japan Total Japan Japan

Premiums, fees & other revenues (operating) $ 4,643 $ 3,480 $ 1,163 $ 4,905 $ 3,829 $ 1,076

Add: Adjustments to premiums, fees and other revenues (16) (16) — (7) (7) -

Premiums, fees & other revenues (GAAP) $ 4,627 $ 3,464 $ 1,163 $ 4,898 $ 3,822 $ 1,076

122

MetLife

John C. R. Hele

Executive Vice President & Chief Financial Officer MetLife, Inc.

John Hele is executive vice president & chief financial officer for MetLife, Inc. and a member of the company’s executive group. Appointed to this position in September 2012, Hele oversees all financial management matters for MetLife, including financial reporting, treasury, corporate actuarial, tax, investor relations as well as mergers and acquisitions.

Prior to joining MetLife, Hele was executive vice president, chief financial officer and treasurer of Arch Capital Group Ltd., a public limited liability company that writes insurance and reinsurance globally through operations in Bermuda, the United States, Europe and Canada.

Prior to joining Arch Capital in 2009, Hele was chief financial officer and a member of the executive board of ING Group N.V., one of the largest global financial services companies. As CFO, Hele was based in Amsterdam and had responsibility for a financial function on five continents. He was also responsible for financial controls and reporting as well as capital management and tax reporting. During his six-year tenure at ING, Hele was also deputy chief financial officer, general manager, and chief insurance risk officer, responsible for global insurance risk management. Hele also served as group actuary.

Hele served as founder, president and chief executive officer of Worldinsure, Bermuda, a technology company that automated life insurance underwriting, from 1999 to 2003. Prior to that, he spent 11 years with Merrill Lynch in investment banking, marketing and finance positions in the U.S. In his last role at Merrill Lynch, Hele was responsible for providing strategic and financing advice to leading life insurance chief executive officers and chief financial officers in North and South America. Before joining Merrill Lynch, Hele held various actuarial, finance and business roles at Crown Life in Toronto.

Hele has been a member of the CFO Forum in Europe, the chair of the Chief Risk Officer Forum, and is a Fellow in the Society of Actuaries. He holds a bachelor’s degree in mathematics from the University of Waterloo, Ontario, Canada.

# # #

Christopher G. Townsend President, Asia MetLife, Inc.

Christopher Townsend is president of MetLife’s Asia region and a member of the company’s executive group. Appointed to this position in August 2012, Townsend oversees all of MetLife’s businesses in Asia. In 2013, the Asia region generated $1.2 billion in operating earnings, as well as operating premiums, fees and other revenues of $9.6 billion.

Prior to joining MetLife, Townsend was, since 2010, chief executive officer of the Asia Pacific region at AIG. In addition to leading all aspects of the business across the region, which included 4,700 employees in 15 countries, he oversaw the company’s risk, audit, compliance and investment divisions. As CEO, Townsend drove capital optimization, cost efficiency and a focus on client needs as he implemented a strategy to take advantage of opportunities to drive an above average return on equity.

From 2007 to 2010, Townsend was chief executive officer of AIG Australasia, with responsibility for the company’s businesses across Australia and New Zealand. Working with many of the company’s internal and external stakeholders, he developed and executed on a three-year plan to deliver a superior compound annual growth rate and solid combined operating ratios. In addition to reorganizing the business around its customers, he drove innovation through product development and the implementation of an e-business initiative that helped differentiate AIG from many of its key competitors.

Earlier in his career, Townsend was the CEO of AIG Hong Kong, served as senior vice president of mergers and acquisitions and also held a number of senior leadership roles in Hong Kong, London and Sydney. He joined AIG in the United Kingdom in 1991 and spent more than half of his 21-year career in the company’s Asia Pacific region.

Townsend currently sits on the board of directors for MetLife’s philanthropic organization, the MetLife Foundation, and also serves as vice chairman of the U.S.-Korea Business Council. He has previously served as a board member of the Hong Kong Federation of Insurers, governor of the American Chamber of Commerce and board member of the Insurance Council of Australia. He is a Chartered Insurer.

# # #

See Appendix for non-GAAP financial information, definitions, and/or reconciliations.

Toby Brown

Chief Financial Officer, Asia MetLife

Toby Brown is senior vice president and chief financial officer of MetLife’s Asia region. He was appointed to this position in May 2011. As chief financial officer for Asia, Brown is responsible for the overall financial leadership of MetLife’s business in Asia. His specific responsibilities include the country CFO organizations, actuarial, capital management, reinsurance, product pricing, tax, accounting and reporting, procurement financial planning and management analysis.

Brown joined MetLife when it acquired ALICO in November 2010. Prior to MetLife, he worked at American International Group (AIG) for over a decade in a range of roles, starting as an internal consultant advising and assessing both life and general insurance operations in the emerging market territories of Latin America and Central & Eastern Europe. He also spent time in Western Europe and at AIG Private Bank in Zurich.

Brown transferred permanently to the foreign AIG life business, ALICO, in 2002 where he held a number of positions of increasing responsibility within the Central & Eastern Europe Region (13 countries/22 life, pension, asset management, mutual fund, and shared service operations), most recently as regional chief financial officer and head of strategy, and immediately prior to that, as regional chief operating officer for all eight life, pension and asset management operations in Poland, Romania and the Baltics.

Before joining AIG/ALICO, Brown worked for Coopers & Lybrand (now Pricewaterhouse Coopers) in the U.K. He holds a BA degree in Accounting and Finance, and also an MBA from Manchester Business School, U.K. He is a fellow member of the Institute of Chartered Accountants in England & Wales (FCA), and a fellow member of the Association of International Accountants (FAIA). He has also completed the ALICO country management program, the AIG Financial Leadership program at NYU Stern School of Business, and the MetLife Executive Leadership program at Harvard Business School.

# # #

Kathy Awanis Vice President

Direct and e-Business, Asia MetLife

Kathy Awanis joined MetLife as vice president, direct and e-business for Asia in February 2013. She is responsible for the development and execution of regional direct sales and e-business strategy across the region. She works closely with the company’s Asia business partners to build capability and grow revenue in direct sales and in enhancing its digital business.

Awanis is a skillful business leader who, over the last 10 years, has held leadership positions across many industries including insurance, ticketing, mining and telecommunications and is a recognized expert in the development of digital platform capabilities for insurance in Asia.

Awanis has seven years of experience in the general insurance sector, commencing her insurance career at CGU Insurance Limited. Awanis has over 12 years of international experience across the e-business, marketing and technology disciplines in the ticketing (Ticketmaster), mining (BHP Billiton and Siberian-Urals Aluminum Company) and telecommunications (Ericsson) sectors in Australia, Sweden, Holland, U.K., U.S. and Russia.

Awanis joined MetLife from American Insurance Group in Singapore, where she served as the regional vice president for e-business, Asia Pacific region. In this role, she led the development of their Asia Pacific e-commerce assets. Before that, she served as their regional chief information officer and e-business for Australasia.

In her career, Awanis’ core focus has been in e-commerce, channel and distribution strategy across industries and customer segments, marketing, change management and bridging the gap in cross and multi-channel integration.

# # #

Dr. Nirmala Menon Head of Designated Markets

& Health, Asia MetLife

Dr. Nirmala Menon joined MetLife in May 2013 and currently serves as executive vice president and head of designated markets & health for MetLife’s Asia region. In this role she is responsible for leading and driving the regional business strategy in Hong Kong, Australia, and throughout South Asia. In addition, Menon leads the development and execution of MetLife’s Asia accident & health strategy.