Exhibit 99.1

Description of Video Fourth Quarter and Full Year 2016 Financial Update

From Chief Financial Officer John Hele

This exhibit (video transcript and slides) contains forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or that are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company is not required to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

This exhibit (video transcript and slides) also contains measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Information regarding those non-GAAP financial measures and the reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures is provided in the company’s Fourth Quarter 2016 Financial Supplement, and/or the company’s earnings news release dated February 1, 2017 for the three months and full year ended December 31, 2016, as well as in the Non-GAAP Financial Information included as Exhibit 99.2 to the company’s Current Report on Form 8-K, dated February 2, 2017. This exhibit (video transcript and slides) and such Exhibit 99.2 are each exhibits to the company’s Current Report on Form 8-K, dated February 2, 2017.

Video Transcript and Description:

[Shows slide 1]

[MetLife Executive Vice President & CFO John Hele speaks from a studio at MetLife’s corporate headquarters in New York City]

Hi, I’m John Hele and I am joining you from MetLife’s global headquarters in New York City to discuss our fourth quarter and full year 2016 results.

2016 was a significant year for MetLife. We announced and made substantial progress on the planned separation of Brighthouse Financial, we launched a new enterprise strategy and brand, and we shed our systemically important financial institution—or SIFI—designation.

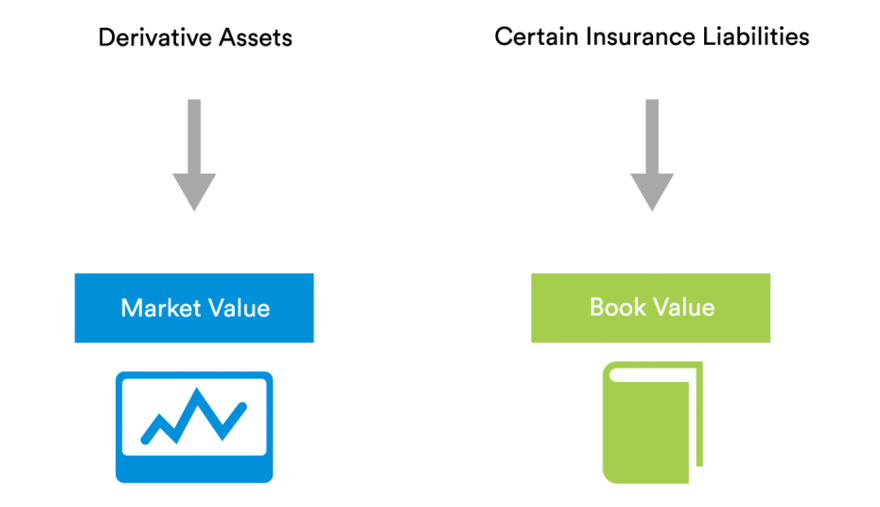

After dropping to record lows in mid-2016, interest rates rose sharply in the fourth quarter, characterized by an 85 basis point increase in the 10-year U.S. treasury yield. For many years, MetLife has purchased derivatives to protect the company against the impact of low interest rates. These derivatives are assets carried at market value, but many of the liabilities they protect are at book value. This creates what is known as asymmetrical and non-economic accounting.[Shows slide 2]

Due to the strong upward movement in rates, we experienced large derivative losses that impacted our fourth quarter and full year 2016 net income results.

Economically, rising interest rates are very good for MetLife’s businesses and are a positive development.

In the fourth quarter of 2016, MetLife reported a net loss of 2.1 billion dollars, compared to net income of 785 million dollars in the prior-year period. As I previously noted, this fourth quarter net loss included post-tax net derivative losses of 3.2 billion dollars, most of which was asymmetrical and non-economic.

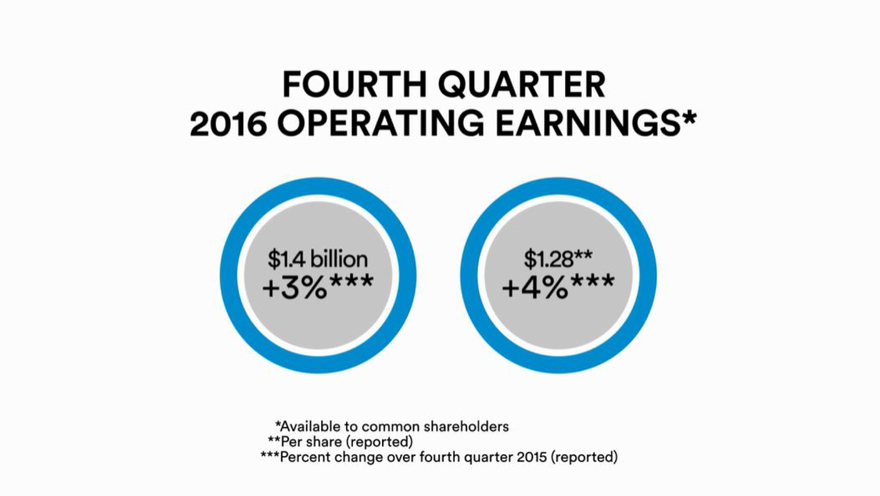

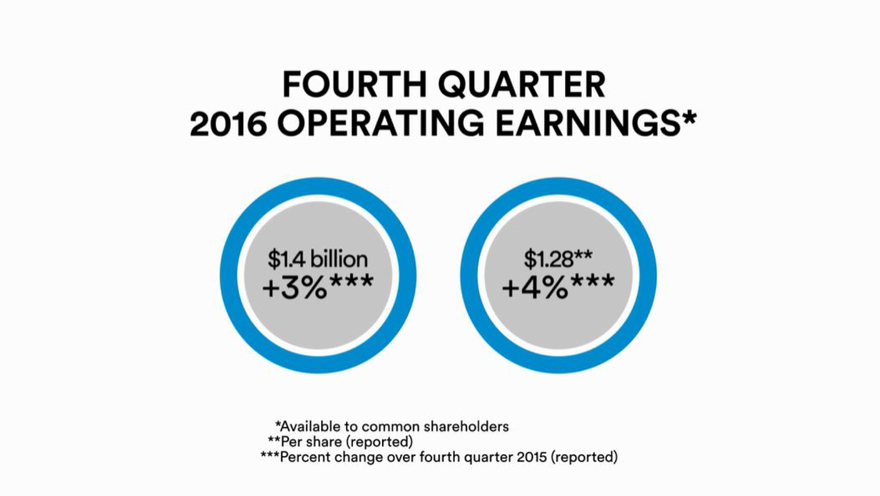

In the fourth quarter of 2016, MetLife reported operating earnings of 1.4 billion dollars, up 3 percent from the fourth quarter of 2015. On a per share basis, operating earnings were 1 dollar and 28 cents, up 4 percent.[Shows slide 3]

Overall, MetLife fourth quarter 2016 operating earnings were aided by expense control, higher variable investment income and a lower tax rate, offset in part by weaker underwriting results.

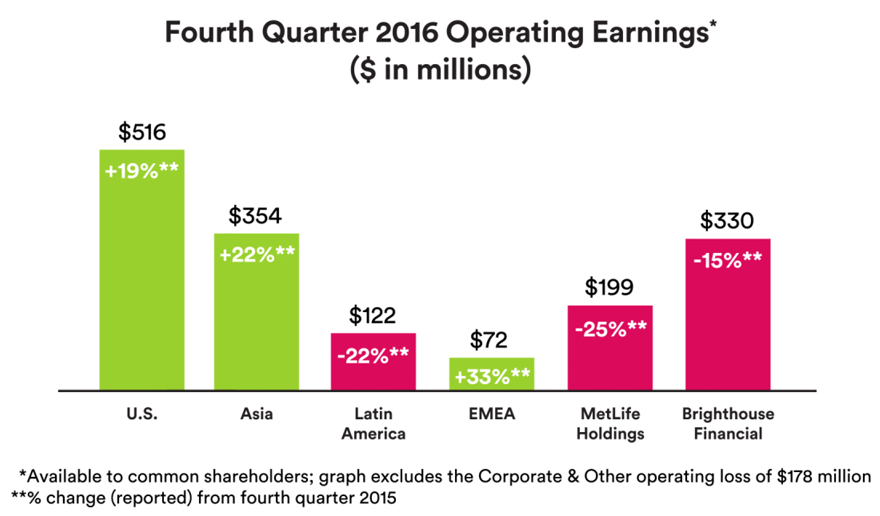

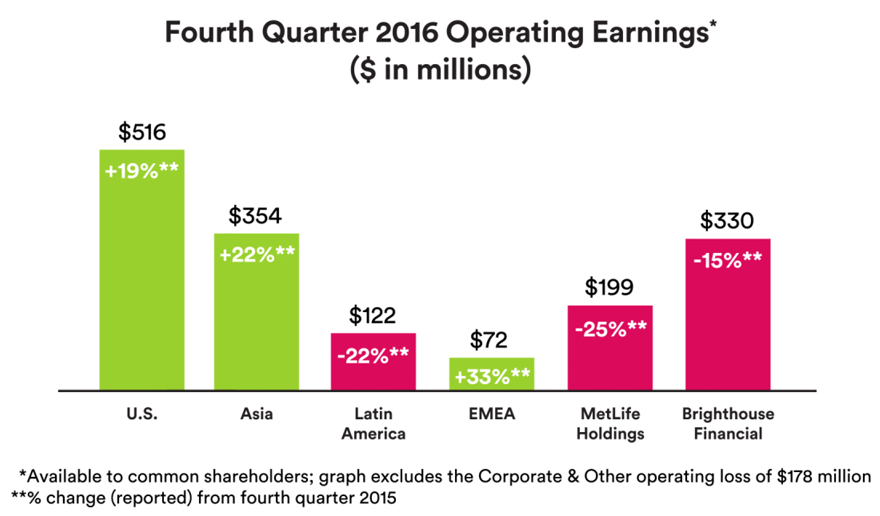

On a segment basis, the U.S., Asia, and EMEA delivered operating earnings above last year’s fourth quarter. Volume growth was a common theme helping to drive up year-over-year operating earnings for these segments.[Shows slide 4]

A number of different factors impacted year-over-year operating earnings in Latin America, MetLife Holdings and Brighthouse Financial, resulting in lower operating earnings.

Details regarding the key factors impacting our business segments’ performance are outlined in our fourth quarter and full year 2016 earnings news release dated February first.

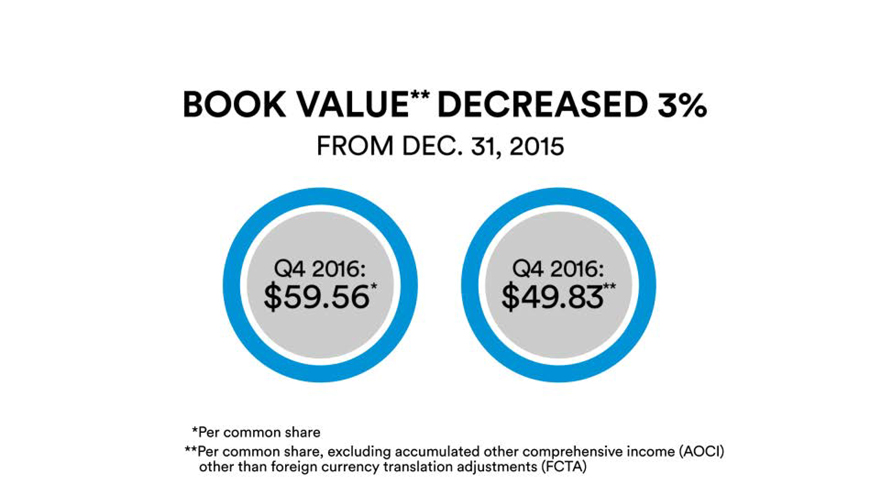

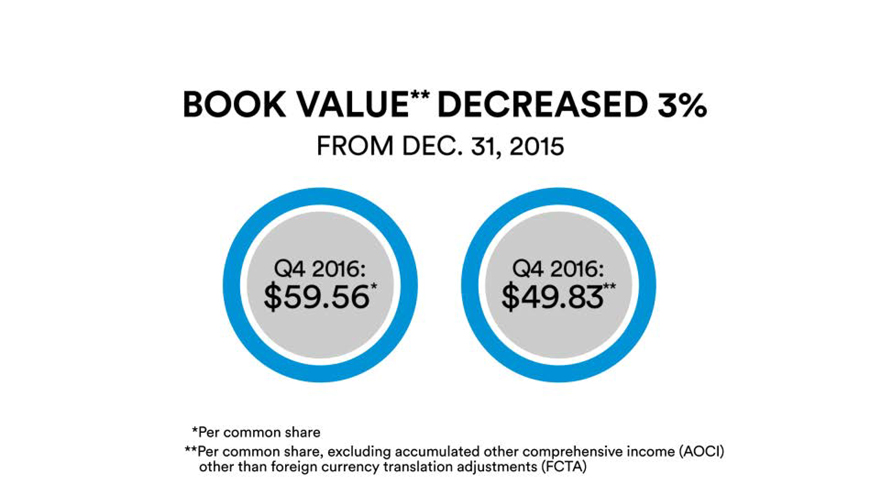

Book value per common share was down 3 percent to 49 dollars and 83 cents. [Shows slide 5]

For the full year 2016, MetLife delivered net income of 697 million dollars. As I mentioned earlier, net derivative losses impacted full year 2016 net income.

Full year operating earnings were 5.1 billion dollars, down 7 percent over 2015. On a per share basis, 2016 operating earnings were 4 dollars and 59 cents, down 6 percent from 2015.

As we move forward in 2017, we believe that higher interest rates and a more favorable regulatory environment, combined with our new enterprise strategy, capital management and expense discipline, will position us for value creation.

Thank you for watching.

[Shows slide 6]

Slide 1

Fourth Quarter and Full Year 2016

Financial Update

Slide 2

Derivative Assets Market Value Certain Insurance Liabilities Book Value

Slide 3

FOURTH QUARTER 2016 OPERATING EARNINGS*

%1.4 billion +3%***

$1.28**

+4%***

*Available to common shareholders

**Per share (reprted)

***Percent change over fourth quarter 2015 (reported)

Slide 4

Fourth Quarter 2016 Operating Earnings* ($ in millions) $516 $354 $122 $72 $199 $330

+19%** +22%** -22%** +33%** -25%** -15%**

U.S. Asia Latin America EMEA MetLife Holdings Brighthouse Financial

* Available to common shareholders; graph excludes the Corporate & Other operating loss of $178 **% change (reported) from fourth quarter 2015

Slide 5

BOOK VALUE** DECREASED 3%

FROM DEC. 31, 2015

Q4 2016: $59.56*

Q4 2016: $49.83**

Slide 6

MetLife

Navigating life together

This video contains forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or that are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company is not required to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

The video also contains measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Information regarding those non-GAAP financial measures and the reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures is provided in the company’s Fourth Quarter 2016 Financial Supplement and/or the company’s earnings news release dated Feb. 1, 2017 for the three months and full year ended Dec. 31, 2016, which may be obtained on the web page where you accessed this video and the Investor Relations section of www.metlife.com.