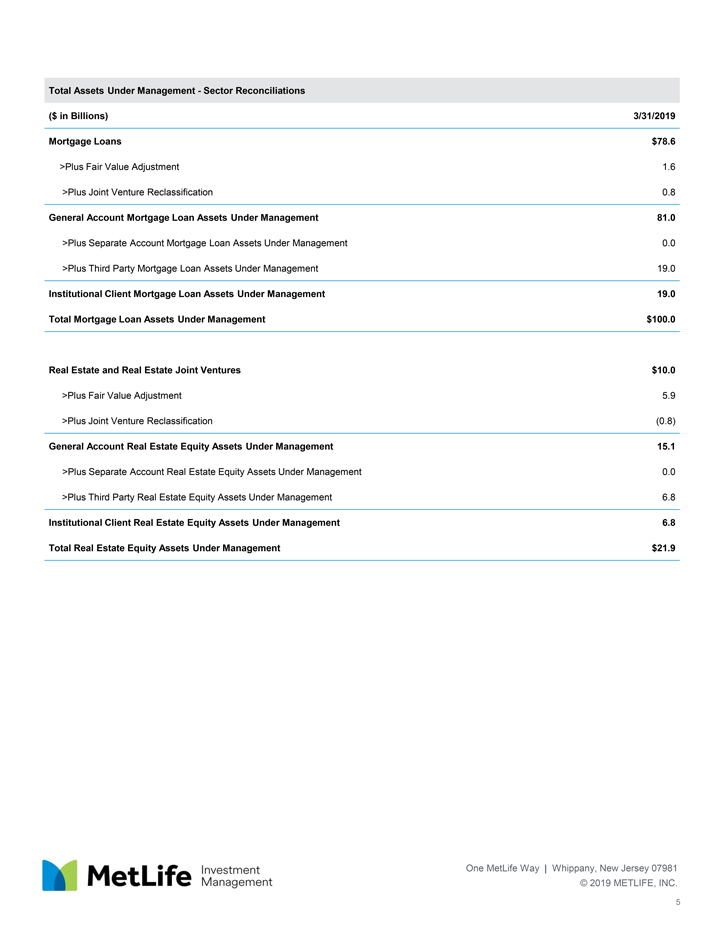

Explanatory Note onNon-GAAP Financial Information In this Fact Sheet, MetLife presents certain measures relating to its assets under management (“AUM”) that are not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”). MetLife believes that thesenon-GAAP financial measures enhance the understanding of the depth and breadth of its investment management services on behalf of its general account (“GA”) investment portfolio, separate account (“SA”) investment portfolios and unaffiliated/third party clients. MetLife uses these measures to evaluate its asset management business. The followingnon-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with GAAP:Non-GAAP financial measures: Comparable GAAP financial measures: (i) Total AUM (i) Total Investments (ii) GA AUM (ii) Total Investments (iii) Total Mortgage Loan AUM (iii) Mortgage Loans (iv) GA Mortgage Loan AUM (iv) Mortgage Loans (v) Total Real Estate Equity AUM; and (v) Real Estate and Real Estate Joint Ventures; and (vi) GA Real Estate Equity AUM (vi) Real Estate and Real Estate Joint Ventures Reconciliations of thesenon-GAAP measures to the most directly comparable GAAP financial measures are set forth in the tables below. Our definitions ofnon-GAAP and other financial measures discussed herein may differ from those used by other companies. Total Assets Under Management, General Account Assets Under Management, Gross Market Value of Commercial Real Estate Under Management and related measures: Total Assets Under Management (“Total AUM”) (as well as all other measures based on Total AUM, such as Total Mortgage Loan AUM, Total Commercial Mortgage Loan AUM, Total Agricultural Mortgage Loan AUM and Total Real Estate Equity AUM) are comprised of GA AUM (or the respective measure based on GA AUM) plus Institutional Client AUM (or the respective measure based on Institutional Client AUM) (each, as defined below). General Account Assets Under Management (“GA AUM”) (as well as other measures based on GA AUM, such as GA Mortgage Loan AUM, GA Commercial Mortgage Loan AUM, GA Agricultural Mortgage Loan AUM, GA Residential Mortgage Loan AUM and GA Real Estate Equity AUM) are used by MetLife to describe assets in its GA investment portfolio which are actively managed and stated at estimated fair value. MetLife believes the use of GA AUM (as well as the other measures based on GA AUM) enhances the understanding and comparability of its GA investment portfolio. GA AUM are comprised of GA Total Investments and cash and cash equivalents, excluding policy loans, other invested assets, contractholder-directed equity securities and fair value option securities, as substantially all of these assets are not actively managed in MetLife’s GA investment portfolio. Mortgage loans and real estate and real estate joint ventures included in GA AUM (at net asset value, net of deduction for encumbering debt), have been adjusted from carrying value to estimated fair value. Classification of GA AUM by sector is based on the nature and characteristics of the underlying investments which can vary from how they are classified under GAAP. Accordingly, the underlying investments within certain real estate and real estate joint ventures that are primarily commercial mortgage loans (at net asset value, net of a deduction of encumbering debt) have been reclassified to exclude them from GA Real Estate Equity AUM and include them in both GA Mortgage Loan AUM and GA Commercial Mortgage Loan AUM. Gross Market Value of Commercial Real Estate Assets Under Management (“Gross Commercial Real Estate AUM”) are comprised of Gross Market Value of Commercial Mortgage Loan AUM (“Gross Commercial Mortgage Loan AUM”) plus Gross Market Value of Real Estate Equity AUM (“Gross Real Estate Equity AUM”). Gross Commercial Mortgage Loan AUM and Gross Real Estate Equity AUM are comprised of Total Commercial Mortgage Loan AUM and Total Real Estate Equity AUM, respectively, each plus an adjustment to state at gross market value. For Gross Commercial Mortgage Loan AUM, this adjustment is the amount of encumbering debt related to the joint venture investments, with the underlying investments primarily in commercial mortgage loans (at net asset value, before deduction for encumbering debt) included in both GA Commercial Mortgage Loan AUM and Total Commercial Mortgage Loan AUM. For Gross Real Estate Equity AUM, this adjustment is the amount of encumbering debt related to Total Real Estate Equity AUM. The following additional information is relevant to an understanding of our assets under management: Institutional Client Assets Under Management (“Institutional Client AUM”) (as well as other measures based on Institutional Client AUM, such as Institutional Client Mortgage Loan AUM and Institutional Real Estate Equity AUM) are comprised of the respective portion of each of SA AUM and TP AUM (each, as defined below). MIM manages Institutional Client AUM in accordance with client contractual investment strategy guidelines (“Mandates”). Separate Account Assets Under Management (“SA AUM”) (as well as other measures based on SA AUM, such as SA Mortgage Loan AUM and SA Real Estate Equity AUM) are comprised of the respective portion of separate account investment portfolios, which are managed by MetLife and stated at estimated fair value. SA AUM (as well as the other measures based on SA AUM) are the respective portions of the separate account assets of MetLife insurance companies which are included in MetLife, Inc.’s consolidated financial statements at estimated fair value. Investment Management One MetLife Way Whippany, New Jersey 07981 2019 METLIFE, INC.