DESCRIPTION OF THE SENIOR NOTES

A description of the specific terms of the Senior Notes of MetLife, Inc. being offered is set forth below. The description is qualified in its entirety by reference to the Indenture, dated as of November 9, 2001 (the “Indenture”), between MetLife, Inc. and The Bank of New York Mellon Trust Company, N.A. (as successor in interest to J.P. Morgan Trust Company, National Association (as successor in interest to Bank One Trust Company, N.A.)), as trustee (the “Trustee”), as supplemented by the Thirty-Sixth Supplemental Indenture, to be dated as of July 11, 2022 (the “Supplemental Indenture”), between MetLife, Inc. and the Trustee, under which the Senior Notes will be issued. The Indenture has been qualified as an indenture under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”). The terms of the Indenture are those provided in the Indenture, as supplemented by the Supplemental Indenture, and those made part of the Indenture by the Trust Indenture Act. MetLife, Inc. has filed a copy of the Indenture with the SEC under the Exchange Act and the Indenture is incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part.

The following description of certain terms of the Senior Notes and certain provisions of the Indenture, as supplemented by the Supplemental Indenture, supplements the description under “Description of Debt Securities” in the accompanying prospectus. To the extent that the following description is not consistent with that contained in the accompanying prospectus under “Description of Debt Securities” you should rely on this description. This description is only a summary of the material terms and does not purport to be complete. We urge you to read the Indenture, as supplemented by the Supplemental Indenture, in its entirety because it, and not this description, will define your rights as a beneficial holder of the Senior Notes.

Certain Terms of the Senior Notes

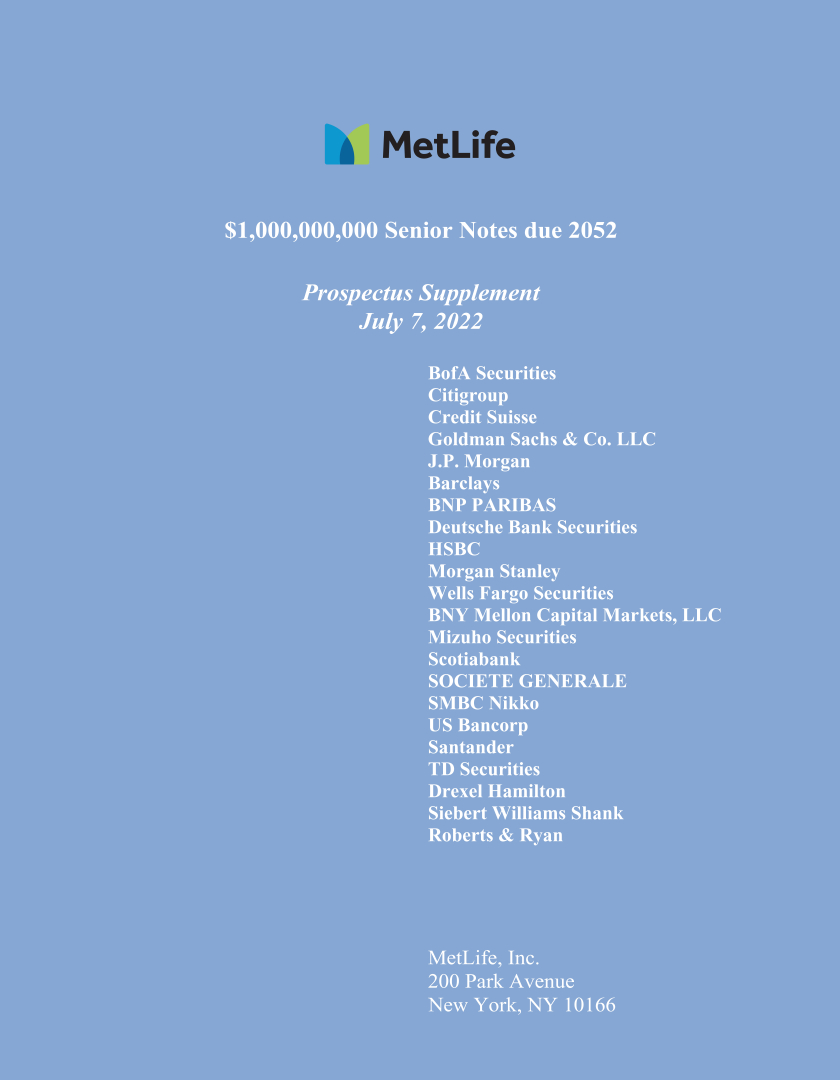

The Senior Notes will consist of one series of senior debt securities described in the accompanying prospectus. MetLife, Inc. will issue the Senior Notes under the Indenture, as supplemented by the Supplemental Indenture. The Senior Notes will initially be limited in aggregate principal amount to $1,000,000,000. There is no limit on the aggregate principal amount of Senior Notes that MetLife, Inc. may issue. The Senior Notes will be issued in denominations of $2,000 and integral multiples of $1,000 in excess thereof.

The Senior Notes will mature on July 15, 2052 (the “Stated Maturity Date”) and will bear interest at 5.000% per annum. Interest on the Senior Notes will accrue from July 11, 2022 or from the most recent interest payment date to which interest has been paid or duly provided for.

Interest on the Senior Notes will be payable semi-annually in arrears on January 15 and July 15 of each year, commencing January 15, 2023 (or, if such day is not a Business Day (as defined below), on the next succeeding Business Day (without any interest or other payment in respect of any such delay), with the same force and effect as if made on the date the payment was originally payable), to the persons in whose names the Senior Notes are registered at the close of business on the preceding January 1 or July 1, as the case may be (whether or not a Business Day), provided that interest payable at the Stated Maturity Date or upon redemption will be paid to the person to whom principal is payable. Interest on the Senior Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months. The Trustee will act as paying agent for the Senior Notes.

Notwithstanding anything to the contrary in this prospectus supplement, so long as the Senior Notes are in book-entry form, MetLife, Inc. will make payments of principal, premium, if any, and interest through the Trustee to DTC.

“Business Day” means, with respect to the Senior Notes, any day other than a day on which the federal or state banking institutions in the Borough of Manhattan, The City of New York, are authorized or obligated by law, executive order or regulation to close.

The Senior Notes will not be entitled to any sinking fund.

S-12