SCHEDULE 14 C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

(Amendment No. )

Check the appropriate box:

x Preliminary Information Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

o Definitive Information Statement

Secured Financial Network, Inc.

(Name of Registrant As Specified in Charter)

x No fee required.

o Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

| | 1) | Title of each class of securities to which transaction applies: N/A |

| | 2) | Aggregate number of securities to which transaction applies: N/A |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined: N/A |

| | 4) | Proposed maximum aggregate value of transaction: N/A |

o Fee paid previously with preliminary materials.

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount previously paid: none |

| 2) | Form, Schedule or Registration Statement No.: N/A |

SECURED FINANCIAL NETWORK, INC.

1500 West Cypress Creek Road

Suite 411

Fort Lauderdale, Florida 33309

Telephone: (954) 769-1335

Dear Stockholders:

We are writing to advise you that the holders of a majority of our outstanding common stock have approved an amendment to our Articles of Incorporation (the “Charter Amendment”) to:

| | • | change the name of our company to “RedFin Network, Inc.”, and |

| | • | increase the number of our authorized shares of common stock from 100,000,000 shares to 250,000,000 shares and creating a class of preferred stock consisting of 20,000,000 shares. |

These actions were approved on March 3, 2011 by our Board of Directors. In addition, the holders of a majority of our issued and outstanding voting securities have approved these actions by written consent in lieu of a special meeting effective March [X], 2011 in accordance with the relevant sections of the Nevada Revised Statutes.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The accompanying Information Statement is furnished only to inform our stockholders of these actions described above before they take place in accordance with Rule 14c-2 of the Securities Exchange Act of 1934. This Information Statement is first mailed to you on or about March [X], 2011.

Please feel free to call us at 954-769-1335 should you have any questions on the enclosed Information Statement. We thank you for your continued interest in our company.

For the Board of Directors of

SECURED FINANCIAL NETWORK, INC.

March [X], 2011 By: /s/ Jeffrey L. Schultz

Jeffrey L. Schultz, CEO

SECURED FINANCIAL NETWORK, INC.

INFORMATION STATEMENT

TABLE OF CONTENTS

| | Page No. |

| General | 1 |

| Principal Stockholders | 1 |

| The Charter Amendment | 2 |

| Delivery of Documents to Stockholders Sharing an Address | 5 |

| Where You Can Find More Information | 5 |

| | |

| Exhibits: | |

| Exhibit A - Articles of Amendment to our Articles of Incorporation | |

SECURED FINANCIAL NETWORK, INC.

1500 West Cypress Creek Road

Suite 411

Fort Lauderdale, Florida 33309

INFORMATION STATEMENT REGARDING ACTIONS

TAKEN BY WRITTEN CONSENT OF MAJORITY STOCKHOLDERS

IN LIEU OF A SPECIAL MEETING

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL

This Information Statement is being furnished to the stockholders of Secured Financial Network, Inc. in connection with the written consent of the holders of a majority of our issued and outstanding voting securities approving the Charter Amendment. This action was approved by our Board of Directors on March 3, 2011 and on [X], 2011 the holders of approximately [X]% of our issued and outstanding common stock, being our only class of voting securities, also consented to these actions by a written consent in lieu of a special meeting of stockholders in accordance with the Nevada Revised Statutes.

The elimination of the need for a meeting of stockholders to approve these actions is made possible by Section 78.320 of the Nevada Revised Statutes which provides that any action to be taken at an annual or special meeting of stockholders may be taken without a meeting, if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power. In order to eliminate the costs involved in holding a special meeting we utilized the written consent of the holders of a majority in interest of our voting securities.

This Information Statement, which is first being mailed on or about March [X], 2011, is being delivered to inform you of the corporate actions described herein before they take effect in accordance with Rule 14c-2 of the Securities Exchange Act of 1934. No dissenter’s rights are afforded to our stockholders under Nevada law as a result of the approval of the Charter Amendment.

The entire cost of furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record by them and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

PRINCIPAL STOCKHOLDERS

At March 3, 2011 we had 66,515,552 shares of our common stock issued and outstanding. The following table sets forth information regarding the beneficial ownership of our common stock as of March 3, 2011 by:

| | • | each person known by us to be the beneficial owner of more than 5% of our common stock; |

| | • | each of our named executive officers; and |

| | • | our named executive officers, directors and director nominees as a group. |

Unless otherwise indicated, the business address of each person listed is in care of 1500 West Cypress Creek Road, Suite 411, Fort Lauderdale, FL 33309. The percentages in the table have been calculated on the basis of treating as outstanding for a particular person, all shares of our common stock outstanding on that date and all shares of our common stock issuable to that holder in the event of exercise of outstanding options, warrants, rights or conversion privileges owned by that person at that date which are exercisable within 60 days of that date. Except as otherwise indicated, the persons listed below have sole voting and investment power with respect to all shares of our common stock owned by them, except to the extent that power may be shared with a spouse.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | % of Class |

| | | |

Jeffrey L. Schultz (1) | 8,270,334 | 12.4% |

Michael E. Fasci (2) | 5,119,211 | 7.7% |

All officers and directors as a group (two persons) (1) (2) | 13,389,545 | 20.1% |

James W. Struckert (3) | 20,765,646 | 31.2% |

HEB, LLC (4) | 5,852,792 | 8.8% |

Commercial Holding AG (5) | 7,128,959 | 10.7% |

(1) The number of shares beneficially owned by Mr. Schultz includes shares owned as joint tenants with his wife.

(2) The number of shares beneficially owned by Mr. Fasci includes shares of our common stock held of record by Process :

| | • | 2,871,520 shares of common stock held by Mr. Fasci, |

| | • | 1,030,000 shares of common stock held of record by Process Engineering Services, Inc., Inc., a company owned by Mr. Fasci and over which he holds voting and dispositive control, and |

| | • | Process Engineering Services, Inc. also owns 200,000 warrants exercisable at $0.10 and another 200,000 warrants exercisable at $0.50. These warrants expired March 1, 2010. |

(3) Information concerning Mr. Stuckert’s ownership of our securities is based upon his filings with the Securities and Exchange Commission. The registered holder’s address is 500 W. Jefferson Street, Louisville, KY 40202.

(4) The registered holder’s address is 777 Main Street, Suite 3100, Fort Worth, TX 76102.

(5) The registered holder’s address is 325 Main Street, Suite 240, Lexington, KY 40507.

THE CHARTER AMENDMENT

On March 3, 2011 our Board of Directors approved the Charter Amendment that will:

| | • | change our corporate name to “RedFin Network, Inc.” (the “Name Change”), and |

| | • | increase the aggregate number of common shares authorized for issuance from 100,000,000 shares to 250,000,000 shares and create a series of 20,000,000 shares of undesignated preferred stock, commonly referred to as “blank check” preferred stock because the Board has discretion to designate one or more series of the preferred stock with the rights, privileges and preferences of each series to be fixed by the Board from time to time in the future without stockholder approval (the “Recapitalization”). |

On March [X], 2011 the holders of a majority of our outstanding common stock approved the Charter Amendment.

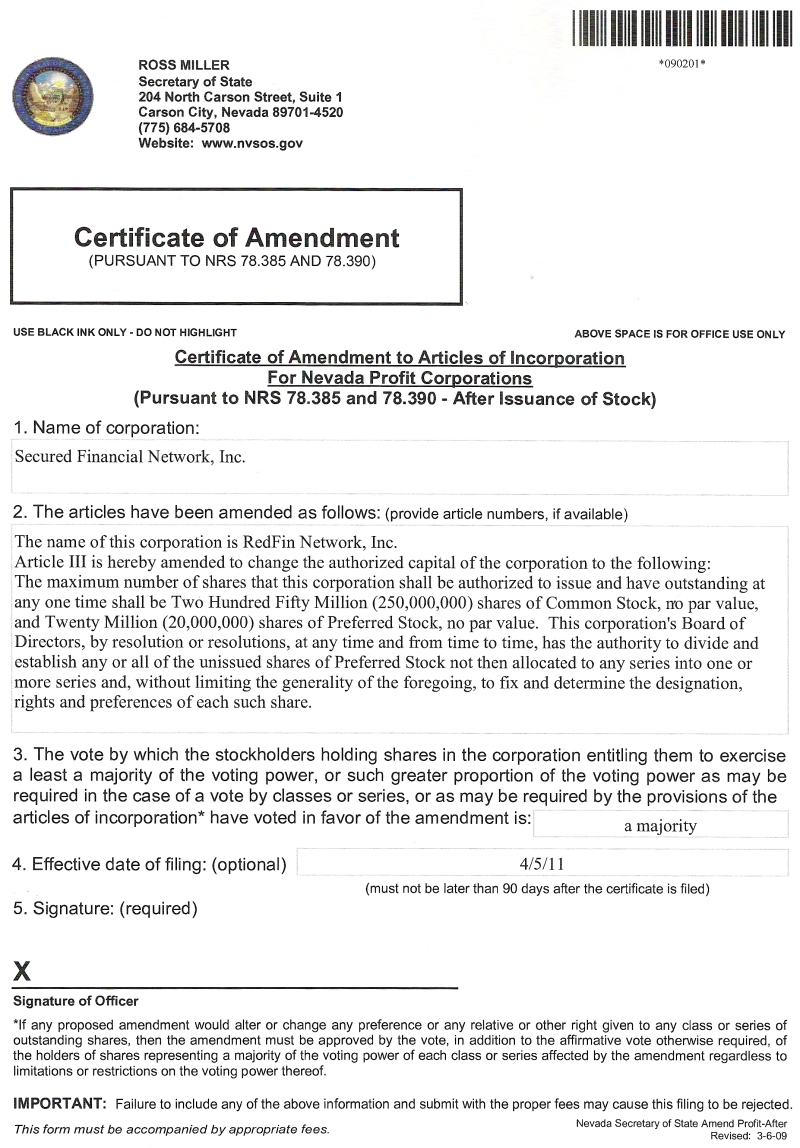

The form of Charter Amendment to be filed with the Department of State of the State of Nevada to effect the Name Change and Recapitalization is attached to this Information Statement as Exhibit A.

The text of the form of Charter Amendment is, however, subject to amendment to reflect any changes that may be required by the office of the Department of State of the State of Nevada or that the Board of Directors may determine to be necessary or advisable ultimately to comply with applicable law. Other than the changes in our Articles of Incorporation, as amended, by the Name Change and the Recapitalization, all other provisions of our Articles of Incorporation, as amended, will remain unchanged upon the filing of the Charter Amendment.

Our principal business activities are conducted through our wholly-owned subsidiary, RedFin Network, Inc., a Florida corporation. Our Board of Directors and consenting stockholders believe it is in the best interests of our company to change our corporate name to provide more consistent branding for our business.

Of the 100,000,000 shares of common stock which are presently authorized, there are 66,515,552 shares of common stock outstanding on March [X], 2011, together with options and warrants to purchase an additional 5,500,000 shares of common stock. The additional common shares contemplated by the Charter Amendment would become part of the existing class of common shares, and the additional shares, when issued, would have the same rights and privileges as the common shares now issued. There are no preemptive rights relating to the common shares.

Our Board of Directors and consenting stockholders believe that the increase in the authorized common shares and the creation of the blank check preferred stock is in our best interests as well as those of our stockholders and believe that it is advisable to authorize such additional shares of common stock and have them available in connection with the possible future financing transactions, other possible future transactions, such as corporate mergers, acquisitions, other business combinations or other uses not presently determinable and as may be deemed to be feasible and in our best interests.

The Board and the consenting stockholders also believe that the authorization of blank check, undesignated preferred shares would also provide us with greater flexibility with respect to our capital structure for such purposes as future financings, corporate mergers, acquisitions or other business combinations. Blank check preferred stock is commonly authorized by publicly traded companies and is frequently used as a preferred means of raising capital and making acquisitions. In particular, in recent years, smaller companies have been required to utilize senior classes of securities to raise capital, with the terms of those securities being highly negotiated and tailored to meet the needs of both investors and the issuing companies. Such senior securities typically include liquidation and dividend preferences, protections, conversion privileges and other rights not found in common stock. We presently lack the authority to issue preferred stock and, accordingly, are limited to issuing common stock or debt securities to raise capital. By authorizing a class of blank check preferred stock, we would increase our flexibility in structuring future transactions.

The additional common shares to be authorized by the filing of the Charter Amendment may be issued by direction of the Board of Directors at such times, in such amounts and upon such terms as the Board of Directors may determine, without further approval of our stockholders unless, in any instance, such approval is expressly required by law. The increase the number of authorized common shares may affect the rights of existing holders of common shares to the extent that future issuances of common shares reduce each existing stockholder’s proportionate ownership and voting rights in our company. In addition, possible dilution caused by future issuances of common shares could lead result in a decline in the market price of our common shares, assuming a market for our common stock continues of which there is no assurance. The adoption of the Charter Amendment will not of itself cause any change in the capital accounts of our company.

Upon the filing of the Charter Amendment, subject to the provisions of our Articles of Incorporation and the limitations prescribed by law, the Board would be expressly authorized, at its discretion, to adopt resolutions to issue shares of preferred stock, to fix the number of shares and to change the number of shares constituting any series and to provide for or change the voting powers, designations, preferences and relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, including dividend rights (including whether the dividends are cumulative), dividend rates, terms of redemption (including sinking fund provisions), redemption prices, conversion rights and liquidation preferences of the shares constituting any series of the preferred stock, in each case without any further action or vote by the stockholders. The Board would be required to make any determination to issue shares of preferred stock based on its judgment as to our best interests and those of our stockholders. The Charter Amendment will give the Board flexibility, without further stockholder action, to issue preferred stock on such terms and conditions as the Board deems to be in the best interests of our company and our stockholders.

The approval of the Charter Amendment could have material anti-takeover consequences, including:

• the ability of our Board of Directors to issue additional common shares without additional stockholder approval may be deemed to have an anti-takeover effect because unissued common shares could be issued by the Board of Directors in circumstances that may have the effect of deterring takeover bids. For example, without further stockholder approval, the Board of Directors could strategically sell common shares in a private transaction to purchasers who would oppose a takeover. In addition, because stockholders do not have preemptive rights under the Articles of Incorporation, the rights of existing stockholders may (depending on the particular circumstances in which the additional common shares are issued) be diluted by any such issuance and increase the potential cost to acquire control of our company. Although the Board of Directors was motivated by business and financial considerations in proposing this amendment, and not by the threat of any attempt to accumulate shares or otherwise gain control of our company, stockholders should nevertheless be aware that approval of the Charter Amendment could facilitate our efforts to deter or prevent changes of control in the future. The Board of Directors does not intend to issue any additional common shares except on terms that it deems to be in the best interest of our company and our stockholders; and

• our Articles of Incorporation do not presently authorized the issuance of any preferred stock. Once the Charter Amendment is filed with the Secretary of State of Nevada, our Board of Directors will be able to issue up to 20,000,000 preferred shares, in one or more series and with such rights and preferences, including voting rights, as determined by our Board of Directors without further stockholder approval. The Board of Directors could designate one or more series of preferred shares with rights and preferences, including super-majority voting rights, and issue the preferred shares. The preferred shares could make our acquisition by means of a tender offer, a proxy contest or otherwise, more difficult, and could also make the removal of incumbent officers and directors more difficult. As a result, these provisions may have an anti-takeover effect. These provisions could limit the price that future investors might be willing to pay in the future for our common shares and could have the effect of delaying, deferring or preventing a change in control of our company. The issuance of preferred shares could also effectively limit or dilute the voting power of our stockholders. According, such provisions of our Articles of Incorporation may discourage or prevent an acquisition or disposition of our business that could otherwise be in the best interests of our stockholders.

The Charter Amendment was not adopted to deter, any effort to obtain control of our company and is not being adopted as an anti-takeover measure. We have no arrangements, agreements, or understandings in place at the present time for the issuance or use of any additional shares of common stock or the shares of preferred stock to be authorized by the Charter Amendment.

The laws of Nevada require that, in order for us to amend our Articles of Incorporation through the Charter Amendment, the amendment must be approved by the affirmative vote of the holders of a majority of our common shares. The Charter Amendment was approved on [X], 2011. The Charter Amendment, including the Name Change and the Recapitalization, will become effective on the effective date of the applicable certificate of amendment to our Articles of Incorporation with the office of the Department of State of the State of Nevada, which we would expect to be 20 days after this Information Statement was first mailed to our stockholders. However, the exact timing of the filing of the Charter Amendment will be determined by the Board of Directors based upon its evaluation as to when such action will be most advantageous to us and our stockholders, and the Board of Directors reserves the right to delay filing the amendment for up to 12 months following stockholder approval thereof. In addition, the Board of Directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the filing of the Charter Amendment if, at any time prior to filing the amendment, the Board of Directors, in its sole discretion, determines that it is no longer in the best interests of our company and our stockholders.

Under Nevada law there are no appraisal rights available to our stockholders in connection with the Charter Amendment.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for information statements with respect to two or more stockholders sharing the same address by delivering a single information statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. We and some brokers deliver a single information statement to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they are or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate information statement, or if you currently receive multiple information statements and would prefer to participate in householding, please notify your broker if your shares are held in a brokerage account or us if you hold registered shares. You can notify us by sending a written request to Secured Financial Network, Inc., 1500 W. Cypress Creek Road, Suite 411, Fort Lauderdale, FL 33309, Attention: Corporate Secretary, or by faxing a communication to 954-990-6622.

WHERE YOU CAN FIND MORE INFORMATION

This Information Statement refers to certain documents that are not presented herein or delivered herewith. Such documents are available to any person, including any beneficial owner of our shares, to whom this Information Statement is delivered upon oral or written request, without charge. Requests for such documents should be directed to Corporate Secretary, Secured Financial Network, Inc., 1180 SW 36 Avenue, Pompano Beach, Florida 33069.

We file annual and special reports and other information with the SEC. Certain of our SEC filings are available over the Internet at the SEC's web site at http://www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facilities:

Public Reference Room Office

100 F Street, N.E.

Room 1580

Washington, D.C. 20549

You may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Callers in the United States can also call 1-202-551-8090 for further information on the operations of the public reference facilities.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Jeffrey L. Schultz

Jeffrey L. Schultz,

Chief Executive Officer

Pompano Beach, Florida

March [X], 2011

EXHIBIT A