Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Exhibit 99.1

[GRAPHIC]

[LOGO]

invigorated

Annual Report and Accounts 2003

We will deliver growth through a relentless focus on maximising our portfolio, our presence and the talents of our people. There's a lot happening at Allied Domecq...Why not take a fresh look.

Cautionary statement regarding forward-looking information: Some statements in this Annual Report contain ‘forward-looking’ statements as defined in Section 21E of the United States Securities Exchange Act of 1934. They represent our expectations for our business, and involve risks and uncertainties. You can identify these statements by the use of words such as ‘believes’, ‘expects’, ‘may’, ‘will’, ‘should’, ‘intends’, ‘plans’, ‘anticipates’, ‘estimates’ or other similar words. We have based these forward-looking statements on our current expectations and projections about future events. We believe that our expectations and assumptions with respect to these forward-looking statements are reasonable. However, because these forward-looking statements involve known and unknown risks, uncertainties and other factors which are in some cases beyond our control, our actual results or performance may differ materially from those expressed or implied by such forward-looking statements.

Explanatory notes

Net turnover is turnover excluding excise duty. Profit and normalised earnings are stated before goodwill and exceptional items, which include the benefit of the Mexican excise rebate. Organic growth comparisons exclude the contribution of acquisitions until they have been incorporated in the business for a full 12 months from the date of acquisition. Volumes are quoted in nine litre cases unless otherwise specified.

Brands

All brands mentioned in this Annual Report are trademarks and are registered and/or otherwise protected in accordance with applicable law.

Contents

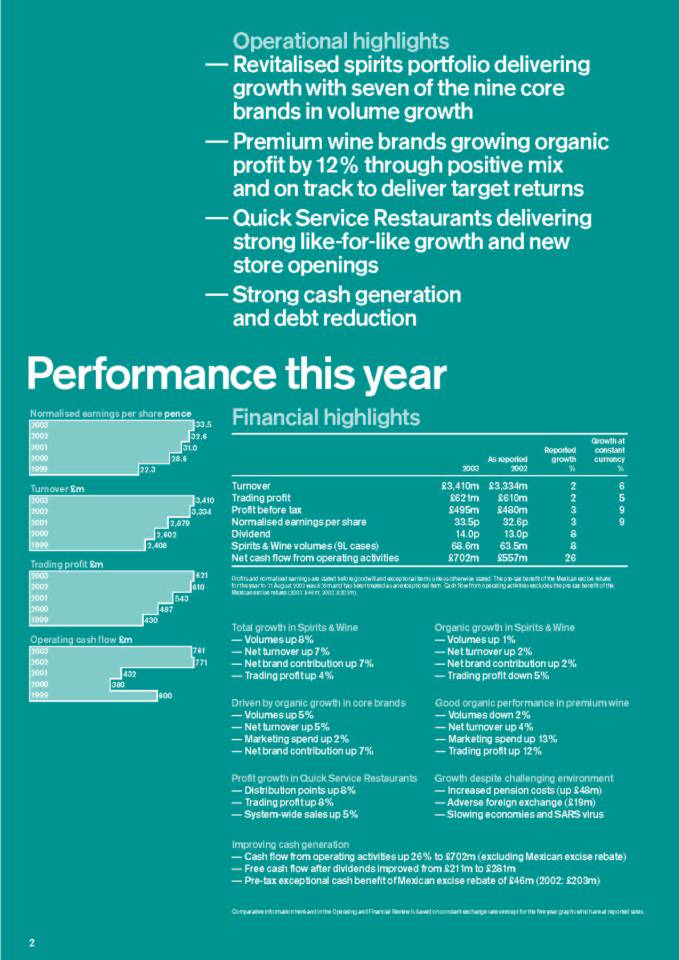

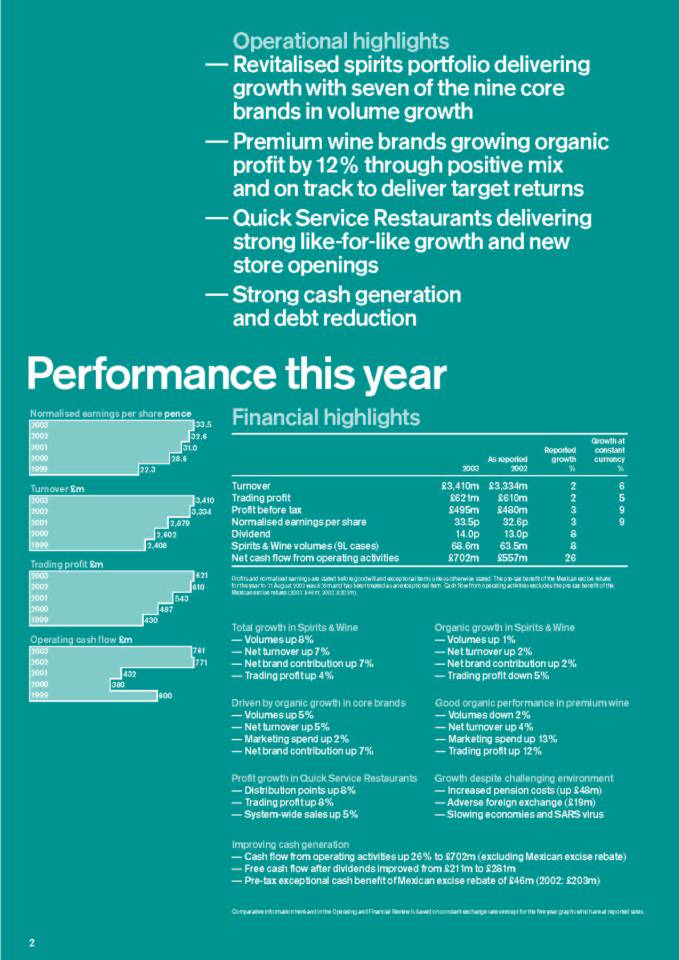

Operational highlights

• Revitalised spirits portfolio delivering growth with seven of the nine core brands in volume growth

• Premium wine brands growing organic profit by 12% through positive mix and on track to deliver target returns

• Quick Service Restaurants delivering strong like-for-like growth and new store openings

• Strong cash generation and debt reduction

Performance this year

Normalised earnings per share pence

2003 | - | 33.5 | |

2002 | - | 32.6 | |

2001 | - | 31.0 | |

2000 | - | 28.6 | |

1999 | - | 22.3 | |

| | | |

Turnover £m | |

| | | |

2003 | - | 3,410 | |

2002 | - | 3,334 | |

2001 | - | 2,879 | |

2000 | - | 2,602 | |

1999 | - | 2,408 | |

| | | |

Trading profit £m | |

| | | |

2003 | - | 621 | |

2002 | - | 610 | |

2001 | - | 543 | |

2000 | - | 487 | |

1999 | - | 430 | |

| | | |

Operating cash flow £m | |

| | | |

2003 | - | 761 | |

2002 | - | 771 | |

2001 | - | 432 | |

2000 | - | 380 | |

1999 | - | 600 | |

Financial highlights

| | | | As reported | | Reported

growth | | Growth at

constant

currency | |

| | 2003 | | 2002 | | % | | % | |

| | | | | | | | | |

Turnover | | £3,410 | m | £3,334 | m | 2 | | 6 | |

Trading profit | | £621 | m | £610 | m | 2 | | 5 | |

Profit before tax | | £495 | m | £480 | m | 3 | | 9 | |

Normalised earnings per share | | 33.5 | p | 32.6 | p | 3 | | 9 | |

Dividend | | 14.0 | p | 13.0 | p | 8 | | | |

Spirits & Wine volumes (9L cases) | | 68.6 | m | 63.5 | m | 8 | | | |

Net cash flow from operating activities | | £702 | m | £557 | m | 26 | | | |

Profits and normalised earnings are stated before goodwill and exceptional items unless otherwise stated. The pre-tax benefit of the Mexican excise rebate for the year to 31 August 2003 was £38m and has been treated as an exceptional item. Cash flow from operating activities excludes the pre-tax benefit of the Mexican excise rebate (2003: £46m; 2002: £203m).

Total growth in Spirits & Wine

• Volumes up 8%

• Net turnover up 7%

• Net brand contribution up 7%

• Trading profit up 4%

Driven by organic growth in core brands

• Volumes up 5%

• Net turnover up 5%

• Marketing spend up 2%

• Net brand contribution up 7%

Profit growth in Quick Service Restaurants

• Distribution points up 8%

• Trading profit up 8%

• System-wide sales up 5%

Organic growth in Spirits & Wine

• Volumes up 1%

• Net turnover up 2%

• Net brand contribution up 2%

• Trading profit down 5%

Good organic performance in premium wine

• Volumes down 2%

• Net turnover up 4%

• Marketing spend up 13%

• Trading profit up 12%

Growth despite challenging environment

• Increased pension costs (up £48m)

• Adverse foreign exchange (£19m)

• Slowing economies and SARS virus

Improving cash generation

• Cash flow from operating activities up 26% to £702m (excluding Mexican excise rebate)

• Free cash flow after dividends improved from £211m to £281m

• Pre-tax exceptional cash benefit of Mexican excise rebate of £46m (2002: £203m)

Comparative information here and in the Operating and Financial Review is based on constant exchange rates except for the five year graphs which are at reported rates.

2

[GRAPHIC]

Chairman’s statement

We have produced strong results again this year. Continued earnings growth, accelerated core brand performance and increasingly strong cash generation have been achieved despite difficult trading conditions and slowing economies. We have had to absorb two non-trading impacts: increased pension and foreign exchange costs. Reported earnings per share are up 3%, but excluding these two non-trading items, shows growth of 20%.

Over the past four years, our brands have been revitalised through increased marketing investment, targeted acquisitions in growing categories and innovation. This investment is now delivering with eight of our nine core brands recording net turnover growth. New products are strengthening the portfolio with encouraging results. Tia Lusso was launched last year and has already established itself as the number two cream liqueur in the UK. This year has seen new brand extensions for both Kahlúa and Beefeater.

Our acquisitions of Malibu and the distribution rights for Stolichnaya have given us access to the fast-growing categories of rum and vodka. This year both Malibu and Stolichnaya have grown share in their key markets. We are also benefiting from an increased exposure to premium wine which is growing far faster than spirits and beer in many mature markets. Our expansion into wine over the past three years is enhancing the growth profile of the business.

At Allied Domecq we are proud of our brands and encourage people to enjoy them responsibly. The consumption of alcohol has a long history and its association with relaxation, enjoyment and sociability is at the heart of our business.

As such, we are the first company to include responsible drinking messages in all of our new brand advertising. Most recently, we established an independent third party panel to review our marketing material and advise on compliance against our marketing code.

Our Quick Service Restaurants business has again delivered good profit growth with Dunkin’ Donuts outpacing the industry. Encouragingly this has come from both new store openings and growth in like-for-like sales. This business shows good growth prospects for the future.

I would like to acknowledge the contributions made by our Non-Executive Directors. In particular, David Malpas who retired from the Board in October and Peter Jacobs and Sir Ross Buckland who will retire at the conclusion of the AGM in January. I want to thank them for their role in the success of Allied Domecq over recent years. The Board has benefited from their wisdom, guidance and perspective. I am delighted to welcome three new Non-Executive Directors: Bruno Angelici of AstraZeneca, Paul Adams of British American Tobacco and John Rishton of British Airways. I look forward to working with them in the coming years.

These strong results are a testament to the leadership of Philip Bowman and the hard work and dedication of his management team and staff, and I thank them for their contribution over the past year.

/s/ Gerry Robinson | |

|

Gerry Robinson |

Chairman |

3

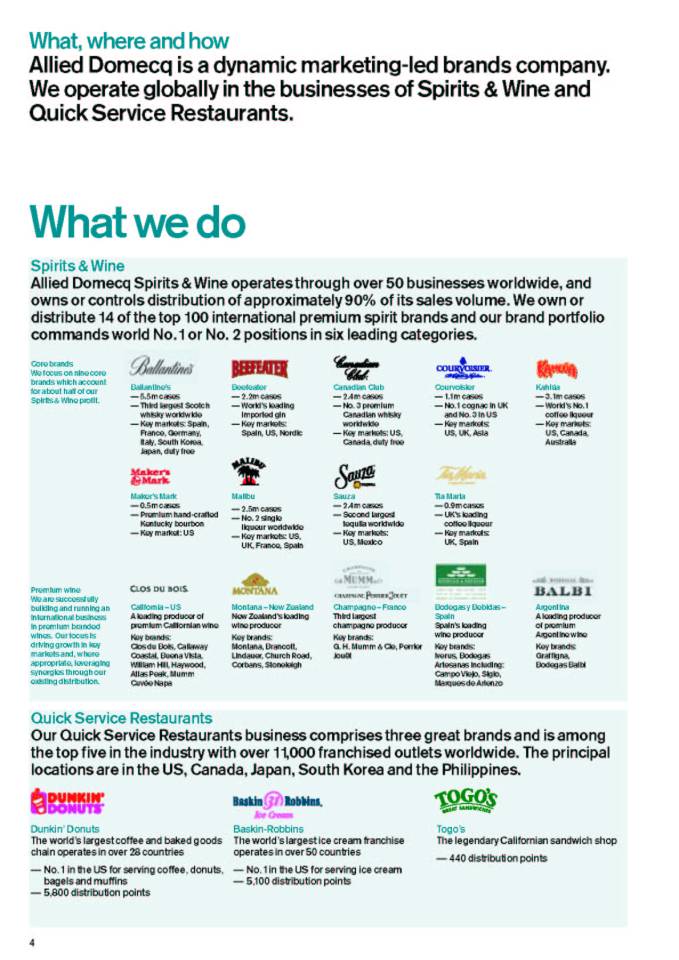

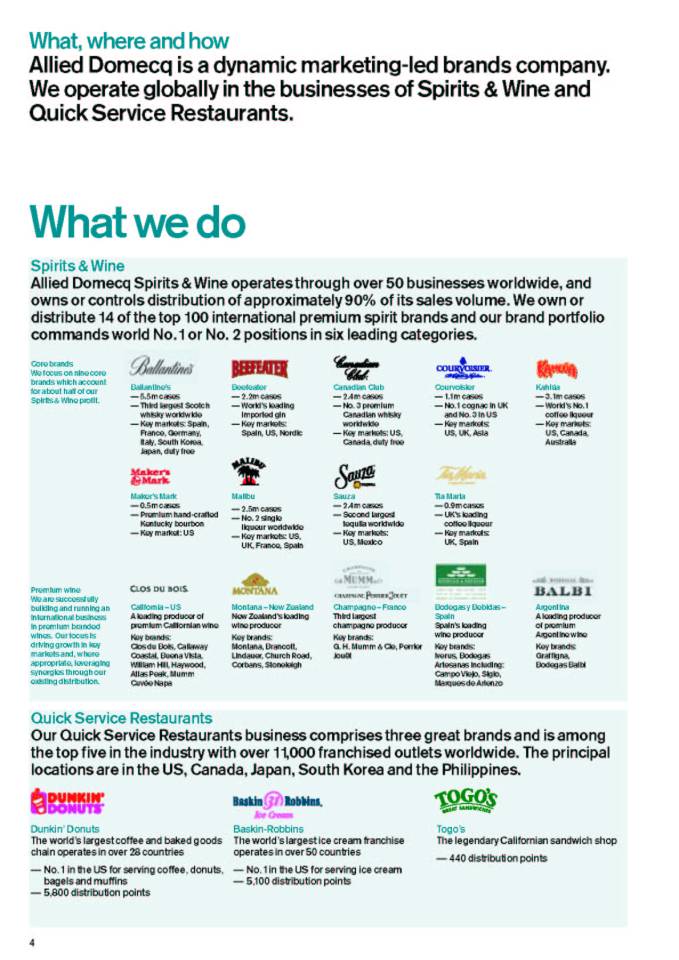

What, where and how

Allied Domecq is a dynamic marketing-led brands company.

We operate globally in the businesses of Spirits & Wine and Quick Service Restaurants.

What we do

Spirits & Wine

Allied Domecq Spirits & Wine operates through over 50 businesses worldwide, and owns or controls distribution of approximately 90% of its sales volume. We own or distribute 14 of the top 100 international premium spirit brands and our brand portfolio commands world No. 1 or No. 2 positions in six leading categories.

Core brands

We focus on nine core brands which account for about half of our Spirits & Wine profit.

[GRAPHIC]

Ballantine’s

• 5.5m cases

• Third largest Scotch whisky worldwide

• Key markets: Spain, France, Germany, Italy, South Korea, Japan, duty free

[GRAPHIC]

Beefeater

• 2.2m cases

• World’s leading imported gin

• Key markets: Spain, US, Nordic

[GRAPHIC]

Canadian Club

• 2.4m cases

• No. 3 premium Canadian whisky worldwide

• Key markets: US, Canada, duty free

[GRAPHIC]

Courvoisler

• 1.1m cases

• No. 1 cognac in UK and No. 3 in US

• Key markets: US, UK, Asia

[GRAPHIC]

Kahlúa

• 3.1m cases

• World’s No. 1 coffee liqueur

• Key markets: US, Canada, Australia

[GRAPHIC]

Maker's Mark

• 0.5m cases

• Premium hand-crafted Kentucky bourbon

• Key market: US

[GRAPHIC]

Malibu

• 2.5m cases

• No. 2 single liqueur worldwide

• Key markets: US, UK, France, Spain

[GRAPHIC]

Sauza

• 2.4m cases

• Second largest tequila worldwide

• Key markets: US, Mexico

[GRAPHIC]

Tia Maria

• 0.9m cases

• UK’s leading coffee liqueur

• Key markets: UK, Spain

Premium wine We are successfully building and running an international business in premium branded wines. Our focus is driving growth in key markets and, where appropriate, leveraging synergies through our existing distribution.

[GRAPHIC]

California – US

A leading producer of premium Californian wine

Key brands: Clos du Bois, Callaway Coastal, Buena Vista, William Hill, Haywood, Atlas Peak, Mumm Cuvée Napa

[GRAPHIC]

Montana – New Zealand

New Zealand’s leading wine producer

Key brands: Montana, Brancott, Lindauer, Church Road, Corbans, Stoneleigh

[GRAPHIC]

Champagne – France

Third largest champagne producer

Key brands: G. H. Mumm & Cie, Perrier Jouët

[GRAPHIC]

Bodegas y Bebidas – Spain

Spain’s leading wine producer

Key brands: Iverus, Bodegas Artesanas including: Campo Viejo, Siglo, Marques de Arienzo

[GRAPHIC]

Argentina

A leading producer of premium Argentine wine

Key brands: Graffigna, Bodegas Balbi

Quick Service Restaurants

Our Quick Service Restaurants business comprises three great brands and is among the top five in the industry with over 11,000 franchised outlets worldwide. The principal locations are in the US, Canada, Japan, South Korea and the Philippines.

[GRAPHIC]

Dunkin’ Donuts

The world’s largest coffee and baked goods chain operates in over 28 countries

• No. 1 in the US for serving coffee, donuts, bagels and muffins

• 5,800 distribution points

[GRAPHIC]

Baskin-Robbins

The world’s largest ice cream franchise operates in over 50 countries

• No. 1 in the US for serving ice cream

• 5,100 distribution points

[GRAPHIC]

Togo’s

The legendary Californian sandwich shop

• 440 distribution points

4

Where we do it

| | Turnover | | Trading profit | | Key markets | | Key brands | |

North America | | £751m | | £182m | | US, Canada | | Kahlúa, Stolichnaya, Beefeater, Sauza, Canadian Club, Courvoisier, Malibu, Maker’s Mark | |

Europe | | £1,086m | | £114m | | Spain, UK, France Germany | | Ballantine’s, Malibu, Beefeater, Tia Maria, Whisky DYC, Courvoisier | |

QSR | | £259m | | £79m | | US, Canada, Japan, South Korea, Philippines | | Dunkin’ Donuts, Baskin-Robbins, Togo’s | |

Latin America | | £386m | | £54m | | Mexico, Argentina, Brazil | | Sauza, Presidente, Don Pedro, Ballantine’s, Añejo Los Reyes, Azteca de Oro | |

Asia Pacific | | £377m | | £78m | | South Korea, Japan, Australia, Philippines | | Ballantine’s, Imperial, Fundador, Kahlúa | |

Premium Wine | | £504m | | £95m | | US, New Zealand, Spain, UK, France, Argentina | | Closdu Bois, Mumm, Perrier Jouët, Montana, Iverus, Bodegas Artesanas | |

Turnover by business area %

Total £3,410m

[CHART]

Spirits & Wine | | £m | | % | |

1 | Europe | | 1,086 | | 32 | |

2 | North America | | 751 | | 22 | |

3 | Latin America | | 386 | | 11 | |

4 | Asia Pacific | | 377 | | 11 | |

5 | Premium Wine | | 504 | | 15 | |

6 | Other | | 47 | | 1 | |

7 | QSR | | 259 | | 8 | |

| Total | | 3,410 | | | |

Trading profit by business area %*

Total £621m

[CHART]

Spirits & Wine | | £m | | % | |

1 | Europe | | 114 | | 19 | |

2 | North America | | 182 | | 30 | |

3 | Latin America | | 54 | | 9 | |

4 | Asia Pacific | | 78 | | 13 | |

5 | Premium Wine | | 95 | | 16 | |

| Other | | (1 | ) | 0 | |

6 | QSR | | 79 | | 13 | |

| Total | | 601 | | | |

* Excludes £20m of Britannia

5

[GRAPHIC]

Size matters? Perhaps. But biggest is rarely best. We prefer being smart. Clever in the face of change – change in the world we serve and change in the ways we work. We’re happy to be different. Look. See what we can achieve when we take some of the world’s most famous brands. Add know-how, substance and scale. Apply insight. Then finish with a dash of bravado.

positively different

[GRAPHIC]

If you build a wall without proper foundations, it will tumble down. Our business is about brands, and what we do with them. Investing in them provides the structure we need to drive our sales and grow the value of the business. We’re becoming a marketing-led company, investing more money and dedicating an ever greater share of that spending to our core brands. And we’re spending better too – with precision and to measured effect.

building brands

[GRAPHIC]

If you want to know how people enjoy our products, just ask. We can tell you. The who, the what, the why, where and who with. We’re spending more on research to understand our consumers better. Understanding means we can invest in the right way behind the right brands in the right markets. And by keeping an ear to the ground, we can predict what they will want in the future.

ear to the ground

[GRAPHIC]

One. Explore what consumers want. Two. Look at your portfolio. Three. Meet the need from existing brands. Or buy one. Or launch one. Our capacity to develop and deliver fresh ideas gives us that option. Take Tia Lusso, now well established in the UK in little over a year. In the US, current growth is in white spirits and rum. So enter WET by Beefeater and Kuya spiced fusion rum from Kahlúa – extending the portfolio, responding to trends.

exploratory thinking

[GRAPHIC]

Even a job well done can always be done better. Faster. Smarter. At lower cost. And we’re always looking to improve the ways we work. But chasing best practice isn’t enough. We’re looking for emerging practice – the brave new ideas that challenge accepted wisdom and outdated processes. The joined up thinking that gets us there first. Because when we get there, we know how to make money out of it.

creative solutions

[GRAPHIC]

We’re lucky. We can operate globally, building powerful and exciting brands. But with this opportunity comes responsibility. Alcohol isn’t just another consumer product, and we’re not just another employer. We actively promote responsible drinking. And wherever we operate we apply the same high standards to protecting our workforce, respecting the environment and caring for local communities. And we ask: judge us by what we do, not by what we say.

responsible thinking

[GRAPHIC]

You need the brands of course, but you need distribution strength to sell them. You need presence. In mature markets – North America, Western Europe – we’re consolidating relationships, improving partnerships with our distributors. And we’re building from strength in the growth markets of today and of tomorrow – South Korea, Eastern Europe, the EU accession countries, Latin America. It’s a cliché – but no less true: We really are well positioned for growth.

more coverage

[GRAPHIC]

It’s not just what we do, but how we do it that brings our brands to life. By developing people and harnessing talents, we attract and retain the best to deliver our business goals. People are the key to unlocking the value in the brands, and we reward good performance. We asked our employees: What kind of company would you like to work for? They said: One that makes time to celebrate success together.

celebrating success

[GRAPHIC]

Operating and financial review

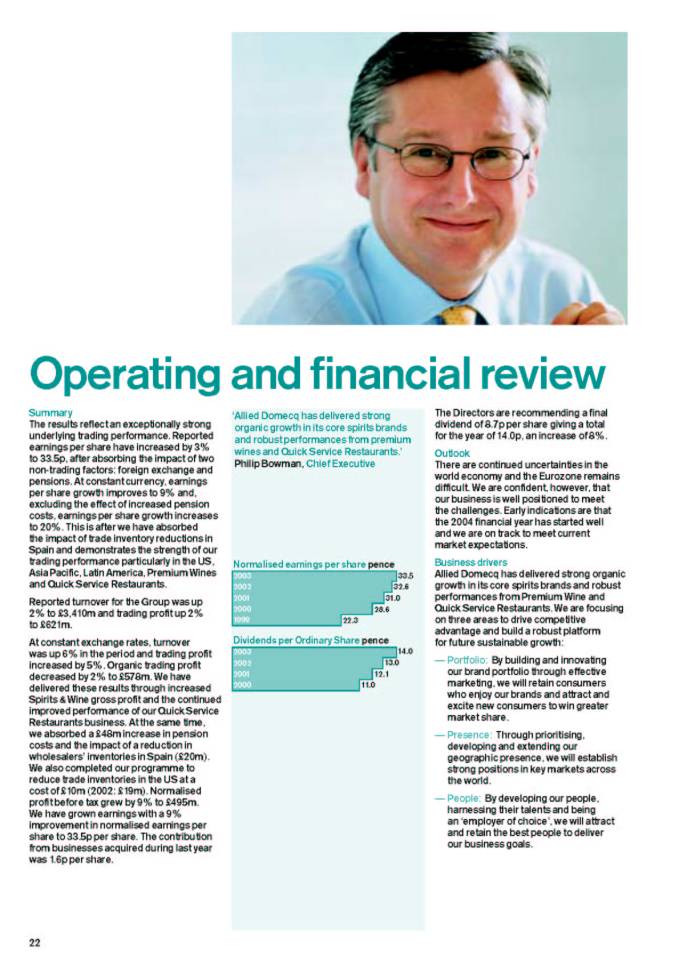

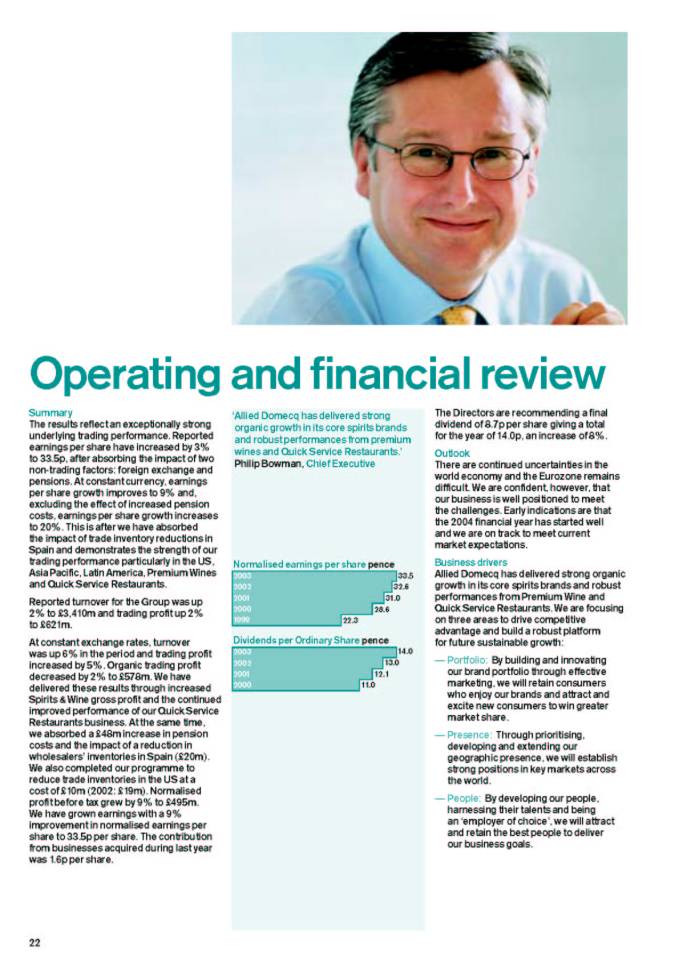

‘Allied Domecq has delivered strong organic growth in its core spirits brands and robust performances from premium wines and Quick Service Restaurants.’ Philip Bowman, Chief Executive

Normalised earnings per share pence

2003 | — | 33.5 | |

2002 | — | 32.6 | |

2001 | — | 31.0 | |

2000 | — | 28.6 | |

1999 | — | 22.3 | |

| | | |

Dividends per Ordinary Share pence |

| | | |

2003 | — | 14.0 | |

2002 | — | 13.0 | |

2001 | — | 12.1 | |

2000 | — | 11.0 | |

Summary

The results reflect an exceptionally strong underlying trading performance. Reported earnings per share have increased by 3% to 33.5p, after absorbing the impact of two non-trading factors: foreign exchange and pensions. At constant currency, earnings per share growth improves to 9% and, excluding the effect of increased pension costs, earnings per share growth increases to 20%. This is after we have absorbed the impact of trade inventory reductions in Spain and demonstrates the strength of our trading performance particularly in the US, Asia Pacific, Latin America, Premium Wines and Quick Service Restaurants.

Reported turnover for the Group was up 2% to £3,410m and trading profit up 2% to £621m.

At constant exchange rates, turnover was up 6% in the period and trading profit increased by 5%. Organic trading profit decreased by 2% to £578m. We have delivered these results through increased Spirits & Wine gross profit and the continued improved performance of our Quick Service Restaurants business. At the same time, we absorbed a £48m increase in pension costs and the impact of a reduction in wholesalers’ inventories in Spain (£20m). We also completed our programme to reduce trade inventories in the US at a cost of £10m (2002: £19m). Normalised profit before tax grew by 9% to £495m. We have grown earnings with a 9% improvement in normalised earnings per share to 33.5p per share. The contribution from businesses acquired during last year was 1.6p per share.

The Directors are recommending a final dividend of 8.7p per share giving a total for the year of 14.0p, an increase of 8%.

Outlook

There are continued uncertainties in the world economy and the Eurozone remains difficult. We are confident, however, that our business is well positioned to meet the challenges. Early indications are that the 2004 financial year has started well and we are on track to meet current market expectations.

Business drivers

Allied Domecq has delivered strong organic growth in its core spirits brands and robust performances from Premium Wine and Quick Service Restaurants. We are focusing on three areas to drive competitive advantage and build a robust platform for future sustainable growth:

• Portfolio: By building and innovating our brand portfolio through effective marketing, we will retain consumers who enjoy our brands and attract and excite new consumers to win greater market share.

• Presence: Through prioritising, developing and extending our geographic presence, we will establish strong positions in key markets across the world.

• People: By developing our people, harnessing their talents and being an ‘employer of choice’, we will attract and retain the best people to deliver our business goals.

22

[GRAPHIC]

We are reinvigorating our No. 1 US brand, Kahlúa, with an exciting new marketing campaign called ‘Unleash it’. Launched in October 2002, the campaign is already helping to deliver improved consumption trends.

[GRAPHIC]

Stolichnaya is the world’s top selling vodka and we refreshed our marketing for the brand in the US with a new campaign called ‘Little truths’.

Portfolio: Through a focused programme of effective marketing and innovation over recent years, we have revitalised the growth of our portfolio – particularly our core brands. Our ‘Go play’ programme of marketing activity has stimulated continued market share growth for Ballantine’s across Europe. New marketing programmes and executions were launched during the year for Kahlúa, Sauza, Malibu and Stolichnaya to build brand equity and drive future growth. We have also continued our focus on the effectiveness of our marketing spend.

Innovation is also fuelling growth in our core brands. The successful launch of Tia Lusso, a cream liqueur extension of Tia Maria, has helped to grow the Tia Maria brand by 14%. During the year, we continued our innovation programme with the launch of WET by Beefeater – a premium extension of Beefeater, and Kuya – a spiced fusion rum extension of Kahlúa. In addition, we have developed a range of ready-to-drinks in markets such as Mexico and Australia which are growing strongly.

The portfolio continues to benefit from the targeted acquisitions made over the past three years in growing categories such as rum, vodka and premium wine. Malibu has exceeded our expectations with good share growth in its key markets. Stolichnaya has continued to grow volume and share in the competitive US vodka market. Our premium wine brands have delivered strong growth demonstrating the resilience of our wine operations – remaining firmly on track to meet their targeted returns.

Presence: We have increased our exposure to key markets through focused investment in distribution and sales capabilities. We will capitalise upon existing market strengths and establish new positions in markets with the capacity for growth. For example, we have further strengthened our partnership with US distributors with the continued implementation of our ‘first choice supplier’ approach, with new contracts established in Illinois and California. Our strong portfolio and distributor relationships have helped us to grow market share in the US. We have significantly increased our sales force capabilities, particularly in the on-trade in the UK and US. The profits from our Asia Pacific business have increased fourfold since we invested in Jinro Ballantines in South Korea in 2000. We have established market-leading positions in a number of key countries in Central & Eastern Europe which will continue to drive future growth in Europe.

We have also doubled the pace at which we are opening new distribution points in our Quick Service Restaurants business such that distribution points increased by 8% in the year. There remain considerable opportunities to increase our brand presence within the US and internationally and we have a programme to open over 1,000 new distribution points in 2004.

23

Operating and financial review

[GRAPHIC]

Our people are at the heart of what we do at Allied Domecq. By continuing to attract the right people, harnessing their talents and creating incentives to reward success we will continue to build a culture based on quality and competence.

Spirits & Wine revenue £m

2003 | — | 3,151 | |

2002 | — | 3,018 | |

2001 | — | 2,571 | |

2000 | — | 2,297 | |

1999 | — | 2,110 | |

| | | |

Spirits & Wine advertising and promotion £m |

| | | |

2003 | — | 437 | |

2002 | — | 443 | |

2001 | — | 330 | |

2000 | — | 301 | |

1999 | — | 272 | |

| | | |

Spirits & Wine trading profit £m |

| | | |

2003 | — | 522 | |

2002 | — | 516 | |

2001 | — | 458 | |

2000 | — | 414 | |

1999 | — | 369 | |

People: Our people are key to unlocking the value of our brands. We encourage our people to be passionate about our brands by providing opportunities for development, rewarding good performance and recognising achievement. Through rigorous evaluation and effective recruitment, we have progressively increased the quality of our people. There is also now a clearer link between performance and reward to create the right environment to drive the success of our people and our brands.

Measured by turnover, our Spirits & Wine business is 49% larger than it was in 1999 as a result of targeted acquisitions and organic growth. We are leveraging this increased scale by introducing new ways of working. This will reduce overlap between central, regional and market-focused functions and will allow us to be leaner and more responsive – to speed up decision making and to push accountability out into the business. This is enabling us to be more competitive and to respond more quickly to customers and changing market conditions. Our objective is to grow the profitable volume of our brands while optimising the efficiency of our operations.

Spirits & Wine

| | Total | | Organic | |

| | 2003 | | Growth

% | | 2003 | | Growth

% | |

Volume | | | | | | | | | |

(9L cases) | | 68.6 | m | 8 | | 64.2 | m | 1 | |

Net turnover | | £ | 2,480 | m | 7 | | £ | 2,352 | m | 2 | |

Advertising and promotion | | £ | 437 | m | 1 | | £ | 414 | m | (5 | ) |

Trading profit | | £ | 522 | m | 4 | | £ | 479 | m | (5 | ) |

We have grown our Spirits & Wine net turnover through organic growth and acquisition. Total Spirits & Wine volumes and net turnover increased by 8% and 7% respectively. Trading profit grew 4%.

Before acquisitions, volumes and net turnover grew 1% and 2% respectively. On an organic basis, trading profit declined by 5% primarily as a result of the increased pension costs (£48m). We have also absorbed the impact of the trade inventory reductions in Spain (£20m) and US (£10m). These results reflect a performance against a prior year that was particularly strong in the second half.

Marketing excellence: During the year we increased advertising and promotion spend by 1%. Before acquisitions, advertising and promotion declined by 5%, following a 21% increase last year. This decline is driven partly by a 32% reduction in Asia Pacific following a 57% increase last year driven by new campaigns for Imperial and Ballantine’s Masters. Spend in the region was reduced during the second half because of the short-term impact of SARS. We have also reduced spend behind the Mexican brandies and our other Spirits & Wine brands. There has also been some reduction as a result of the transitioning of marketing assignments between advertising agencies.

Over the past four years we have progressively increased our investment in marketing our spirits portfolio particularly our core brands. Advertising and promotion has increased by 59% since 1999 while turnover has increased by 49% over the same period. Advertising and promotion for spirits brands, measured as a percentage of net turnover, has increased by two percentage points since 1999 to 20%. Our wine brands, including premium wine brands, typically require lower levels of spend at around 11% of net turnover.

24

[GRAPHIC]

‘Go play’ is the first fully integrated through-the-line campaign for Ballantine’s – our largest brand. Launched in 2002, it has helped to drive Ballantine’s market share to new heights in Europe.

[GRAPHIC]

Canadian Club has been revitalised with market share growth in its key market – the US. We have also launched a successful range of ready-to-drinks in Australia.

[GRAPHIC]

Courvoisier has delivered strong growth and has retained its position as the No. 1 cognac in the UK.

In addition, we are increasingly rigorous in the way we allocate spend between brands and markets: directing more spend behind new marketing campaigns and product launches particularly for the core brands and withdrawing spend from less effective areas. The investment is increasingly focused behind the core brands which now receive 57% of the advertising and promotion spend. Our organic spend behind the core brands increased by 2% in the year, particularly behind Kahlúa and Tia Maria. We have also increased organic spend behind the premium wine brands by 13%, particularly the champagnes which have performed well.

Over the past four years, we have sought to improve the effectiveness of our marketing spend through improved consumer research techniques, media and brand tracking studies and through the way we work with our agencies. During the year, we completed the agency realignment programme that we started in 2001, rationalising from over 150 marketing agencies to one global agency. This programme has already generated annual savings of around £20m since 2001 and will ensure that we continue to leverage improved efficiencies for future marketing activities. As a result, we are achieving a greater impact from our increased spend such that we anticipate that our ongoing investment is likely to track broadly in line with sales growth with some variation as specific brand campaign and innovation opportunities arise.

Brand review

We manage our Spirits & Wine portfolio as four groups: core brands, local market leaders, premium wine and other Spirits & Wine brands. Brand performance is reviewed below under these groups.

Core brands: The volumes and net turnover of our core brands, on a like-for-like basis, both grew by 5% driven by strong growth across nearly all the brands. Organic advertising and promotion behind the core brands was up 2% resulting in net brand contribution up 7%.

Ballantine’s has benefited from the ‘Go play’ campaign launched in 2002 and has grown share strongly across its key markets in Europe and Asia Pacific. Both Ballantine’s and Beefeater have continued to grow market share in Spain. However, despite these gains, both brands have recorded declines in overall shipment volumes as a result of the change in buying patterns by wholesalers in Spain. Outside Spain, Ballantine’s volumes grew 3% and Beefeater volumes were flat.

Canadian Club has grown share in the US and performed well with ready-to-drink extensions in Australia driving total volumes up 9% and net turnover up 7%. Excluding the ready-to-drink extensions, the Canadian Club mother brand grew volumes by 5% and net turnover by 6%. Courvoisier has performed well in the US and UK with overall volumes up by 5% and net turnover up by 4% although it has slowed in the second half against a very strong performance last year.

25

Operating and financial review

Spirits & Wine volumes

68.6m nine litre cases

[CHART]

1 Core brands | | 30 | % |

2 Local market leaders | | 17 | % |

3 Premium wine | | 23 | % |

4 Other Spirits & Wine | | 30 | % |

Spirits & Wine net turnover

£2,480m

[CHART]

1 Core brands | | 44 | % |

2 Local market leaders | | 19 | % |

3 Premium wine | | 19 | % |

4 Other Spirits & Wine | | 18 | % |

Spirits & Wine advertising and promotion

£437m

[CHART]

1 Core brands | | 57 | % |

2 Local market leaders | | 18 | % |

3 Premium wine | | 11 | % |

4 Other Spirits & Wine | | 14 | % |

Spirits & Wine net brand contribution

£1,023m

[CHART]

1 Core brands | | 48 | % |

2 Local market leaders | | 20 | % |

3 Premium wine | | 15 | % |

4 Other Spirits & Wine | | 17 | % |

[GRAPHIC]

The launch of Tia Lusso last year helped to grow Tia Maria volumes by 14% this year.

[GRAPHIC]

Our acquisition of Malibu in May 2002 has exceeded our expectations delivering market share growth in the US, the UK and Spain.

Spirits & Wine volume and net turnover growth

| | Volume

million

cases | | Volume

growth

% | | Net

turnover

growth

% | |

Core brands | | | | | | | |

Ballantine’s | | 5.5 | | (4 | ) | (3 | ) |

Beefeater | | 2.2 | | (2 | ) | 2 | |

Canadian Club | | 2.4 | | 9 | | 7 | |

Courvoisier | | 1.1 | | 5 | | 4 | |

Kahlúa | | 3.1 | | 1 | | 1 | |

Maker’s Mark | | 0.5 | | 14 | | 16 | |

Malibu (organic) | | 0.8 | | 50 | | 47 | |

Sauza | | 2.4 | | 28 | | 20 | |

Tia Maria | | 0.9 | | 14 | | 15 | |

Organic core brands | | 18.9 | | 5 | | 5 | |

Malibu (acquired) | | 1.7 | | — | | — | |

| | | | | | | |

Local market leaders | | 11.9 | | (4 | ) | (6 | ) |

| | | | | | | |

Organic premium wine | | 13.1 | | (2 | ) | 4 | |

Premium wine acquisitions | | 2.7 | | — | | — | |

| | | | | | | |

Other Spirits & Wine brands | | | | | | | |

Other spirits | | 12.7 | | 2 | | 5 | |

Other wine | | 7.6 | | 4 | | (1 | ) |

Other Spirits & Wine Total | | 20.3 | | 3 | | 4 | |

Total

(including acquisitions) | | 68.6 | | 8 | | 7 | |

Organic

(excluding acquisitions) | | 64.2 | | 1 | | 2 | |

The performance of Kahlúa has improved this year with volumes and net turnover both up 1%. This has been driven by good performances in Latin America and duty free and the launch of a new advertising campaign, ‘Unleash it’, in the US. Kahlúa has also benefited from the launch in the US of Kuya, a spiced fusion rum. This is the world’s first fusion rum which is aimed at 21-29 year olds and is being promoted through the ‘Do Ya Kuya?’ campaign. Maker’s Mark had another good year with volumes up 14% and net turnover up 16%. Malibu is now fully integrated as one of our core brands and has begun contributing to the organic portfolio growth with three months of like-for-like sales. The brand has performed well in its core markets with market share growth in the UK, US, France and Spain.

Sauza became the world’s fastest growing international distilled spirit brand with significant market share growth in both US and Mexico. Sauza volumes grew 28% and net turnover grew 20% with pricing down, driven by the reduced cost of the raw material, agave. A new fully integrated marketing campaign, ‘Get lost’ has helped to drive brand awareness. The Tia Maria brand has continued to benefit from the successful launch of Tia Lusso, a new light cream liqueur. Overall Tia Maria volumes grew by 14% and net turnover by 15%.

Local market leaders: Stolichnaya has continued to perform strongly in the US with good market share gains in volume and value. A new marketing campaign, ‘Little truths’, was launched this summer to fuel future brand growth. The range of Stolichnaya flavours was also expanded with Stolichnaya Cranberi and Stolichnaya Citros. Hiram Walker Liqueurs benefited from the successful launch of a new range of fruit liqueurs in North America called Fruja which helped to grow its volumes and net turnover up by 12%. Fundador continued to build on its position as the largest international spirit brand in the Philippines with 6% growth in volumes and 11% improvement in net turnover. The combined impact of a decline in the shipment volumes of Whisky DYC and Centenario, because of the change in buying patterns by wholesalers in Spain, and declines in Mexican brandies caused overall local market leader brand volumes to fall by 4% and net turnover to decline by 6%. Outside Spain, the local market leader volumes grew 1%.

26

[GRAPHIC]

We own two premium champagne brands, G.H. Mumm & Cie and Perrier Jouët, which have grown volumes 16% and net turnover 17%.

[GRAPHIC]

We are now capitalising on the fast-growing premium wine category. We have established a strong presence with a good mix of brands from key wine markets around the world. Our premium wine brands grew organic profits 12% and we are firmly on track to meet our targeted returns.

Premium wine: The premium wine business grew volumes by 18% primarily as a result of the acquisition of Bodegas y Bebidas in December 2001 and Mumm Cuvée Napa in May 2002. Before the benefit of acquisitions, premium wine volumes fell 2% while net turnover grew 4% primarily as a result of the improving mix. A full review of the premium wine brands is provided in the regional review on page 30.

Other Spirits & Wine brands: The volumes of other Spirits & Wine brands were up 3% with net turnover up 4%, while net brand contribution grew by 6%. This has been driven by strong performances by the ready-to-drink brands, Caribe Cooler and Spirit by Terry, in Mexico and by good growth in various North American brands such as Wiser’s whisky and Polar Ice.

Market review

The regional performance of our business is reviewed below.

Europe

| | Organic

Growth

% | | Total

Growth

% | |

Volumes (9L cases) | | (6 | ) | (2 | ) |

Net turnover | | (3 | ) | 2 | |

Advertising and promotion | | 8 | | 16 | |

Trading profit | | (33 | ) | (21 | ) |

Reported net turnover grew 2% to £762m while trading profit declined 21% to £114m. Before acquisitions, trading profit was down 33% reflecting net turnover down 3% and advertising and promotion up 8%. Europe’s profit decline reflects increased marketing investment behind the launch of Tia Lusso. It was also affected by a change in the buying patterns by Spanish wholesalers as they reduced inventories. Outside Spain, our organic European volumes were flat and net turnover grew 2% reflecting the sluggish economies in the region, particularly Germany and France. Organic net brand contribution outside Spain declined 5% reflecting the increased marketing spend for the launch of Tia Lusso.

Our business in Spain grew its volume and value share of the total spirits market, which continued to grow at around 2% in the year to July 2003. However, a change in buying patterns by Spanish wholesalers caused shipment volumes to fall by 17% on an organic basis for the year. The whisky category has continued to grow, although at a slower rate than last year, but Ballantine’s has gained share by growing twice as fast as the category. We have continued to invest behind Ballantine’s ‘Go play’ in Spain with an 18% increase in advertising and promotion to drive awareness in this important market. Beefeater has continued to make progress with strong market share gains in the gin category. Centenario has increased its share of the brandy category by two percentage points making it the clear category leader. Malibu has performed very well under our ownership with good growth in the on-trade helping to grow its market share.

The UK business had a good year with market share gains in the off-trade driven by strong performances by Teacher’s, Courvoisier, Tia Maria and Malibu. Courvoisier grew volumes 6% and has retained its position as the number one selling cognac in the UK. Tia Maria grew volumes 33% as a result of the launch of Tia Lusso, which has become the number two selling cream liqueur in the UK. Malibu has performed particularly strongly as the fastest growing speciality liqueur brand in the on-trade.

27

Operating and financial review

[GRAPHIC]

WET by Beefeater was launched in December in the US as a premium extension to the world’s leading imported gin.

[GRAPHIC]

Kuya is the world’s first spiced fusion rum made by combining imported rums, natural spices and citrus flavours. It was launched in May 2003 to extend the appeal of Kahlúa and to tap into the fast growing category of spiced rum.

Germany and France have both experienced sluggish economies which have slowed consumer spending. However, key brands have made good progress with market share growth in these markets. In Germany, Ballantine’s has established itself as the market leader in whisky. Ballantine’s has also achieved market share gains in France where Malibu has also returned to growth.

North America

| | Organic

Growth

% | | Total

Growth

% | |

Volumes (9L cases) | | 4 | | 9 | |

Net turnover | | 7 | | 12 | |

Advertising and promotion | | (4 | ) | 3 | |

Trading profit | | 20 | | 31 | |

Our North American business delivered a strong performance with reported net turnover up 12% to £649m and trading profit up 31% to £182m. This was driven primarily by the growth of core brand volumes and acquisitions. On an organic basis, net turnover grew 7% on volumes up 4% leading to an increase in trading profit of 20%. Organic advertising and promotion spend grew by 3% in the second half primarily behind new above-the-line campaigns for the core brands.

The US business has delivered a robust trading performance to record overall market share gains reflecting the strength of our brand portfolio and the benefits of our partnership approach with our US distributors. Our focused approach has delivered good growth across the brand portfolio.

Sauza has become a million case brand in the US with volumes up 16% to 1.1m cases and net turnover up 14%. The strong market share gains have been helped by the launch of a new marketing campaign, ‘Get lost’. The fully integrated campaign features national and regional print adverts, broadcast advertising and a national tour encompassing over 1,000 events. Maker’s Mark continues to outpace the bourbon category with volumes up 17% and net turnover up 19%.

The fast-growing vodka category has become increasingly competitive but Stolichnaya has continued to gain share with volumes up 14%. The brand has benefited from the launch in June of a new campaign, ‘Little truths’, which is running in leading magazines and on billboards and radio. Hiram Walker Liqueurs are up 12% as they begin to receive increased focus and as they benefit from the launch of a new range of fruit liqueurs called Fruja.

Kahlúa has begun to show improving consumer trends over recent months as the new campaign called ‘Unleash it’ has begun to receive above-the-line investment during the second half. Volumes show a 1% decline but net turnover up 1%. The brand was also extended with the launch of Kuya in the US – a spiced fusion rum which combines imported rums with spices and citrus flavours.

Our US business has benefited significantly from the addition of Malibu which has grown market share of the rum category. Courvoisier has grown volumes by 6%, thereby taking market share. Beefeater volumes grew well helped by the premium brand extension WET by Beefeater, which has been launched in key on-trade outlets in selected cities. Canadian Club continued to grow share with volumes up 8%.

28

[GRAPHIC]

Sauza is the fastest growing international distilled spirit. Sauza volumes grew 28% this year and gained share in its key markets of the US and Mexico. We also launched the first fully integrated through-the-line campaign for Sauza called ‘Get lost’.

[GRAPHIC]

We have invested in leading-edge consumer segmentation studies to understand better our target consumers and their drink preferences. These consumer insights form the foundation of all our marketing and innovation activities.

In August, Jim Clerkin was appointed President of the North American spirits business. During the year, we have implemented a new organisational structure, which is allocating increased resource closer to the market. It is particularly directed at brand building in the on-trade channel and towards improving our market share in the Control States. This is supporting a better understanding of customers and consumers and further strengthening our relationships with distributors. Our objective is to work closely with our US distributors through a programme where we are their ‘first choice supplier’. We are focused on developing long-term partnerships, which are sustainable and mutually beneficial.

During the second half, we completed our initiative to reduce the inventories in the US supply chain with a £10m impact on trading profit. The de-stock resulted in a reduction in shipments compared with depletions of 270,000 cases and primarily affected Kahlúa, Canadian Club, Beefeater and Hiram Walker Liqueurs. During the last fiscal year, this planned de-stock had an adverse trading profit impact of £19m, £8m of which was incurred in the first half of the year.

Latin America

| | Organic

Growth

% | | Total

Growth

% | |

Volumes (9L cases) | | 14 | | 15 | |

Net turnover | | 8 | | 9 | |

Advertising and promotion | | (9 | ) | (9 | ) |

Trading profit | | 8 | | 10 | |

Despite challenging trading conditions in many economies across the region, reported net turnover was up 9% to £303m and trading profit was up 10% to £54m (excluding the Mexican excise rebate). Improving agave supply and our recent investment in research and development to improve yields has resulted in reduced tequila production costs and, together with a successful series of promotions, has helped to grow Sauza volumes in the region by 41%. Mexican brandy volumes declined by 4% reflecting the ongoing declines across the domestic brandy category. As a result, we have reduced spend behind the Mexican brandy portfolio such that overall organic advertising and promotion for the region declined by 9%. This follows a 27% increase last year. We have maintained our position as market leader of the ready-to-drink category in Mexico with volumes and net turnover up 13% and 25% respectively. This has been driven by Spirit by Terry and Caribe Cooler, a wine cooler.

We have achieved good performances in Argentina and Brazil in spite of the difficult economic environment. Our Argentine business has benefited significantly from the acquisition of Graffigna in July 2001, making it the leading Spirits & Wine business in Argentina. We have regained leadership of the whisky category in Argentina through strong growth of Old Smuggler and the launch of Teacher’s. In Brazil, Ballantine’s, Teacher’s and Brandy Domecq have all performed well.

29

Operating and financial review

[GRAPHIC]

Ballantine’s is our largest brand and is the No. 2 Scotch in Europe.

[GRAPHIC]

Fundador is the largest international spirits brand in the Philippines.

[GRAPHIC]

Maker’s Mark is a hand crafted premium batch bourbon with cult status among bourbon drinkers. The brand has continued to grow strongly with volumes up 14% driven by its unique marketing support.

During the period, the pre-tax profit of the Mexican excise rebate following the Mexican Supreme Court ruling was £38m. This has been treated as an exceptional item. This is the final payment giving a pre-tax total of £298m received over the last three years.

Asia Pacific

| | Organic

Growth

% | | Total

Growth

% | |

Volumes (9L cases) | | 5 | | 7 | |

Net turnover | | 0 | | 1 | |

Advertising and promotion | | (32 | ) | (32 | ) |

Trading profit | | 27 | | 30 | |

Asia Pacific has delivered strong trading profit growth in spite of a slowdown in the region in the second half caused by weaker economies and the impact of SARS on the duty free channel in a number of markets. Trading profit was up 30% to £78m while net turnover grew 1% to £258m. On an organic basis, trading profit grew 27%. The profit growth has been driven principally by South Korea and good performances in the Philippines, Australia, the Middle East and Thailand duty free. Organic advertising and promotion declined, following a 57% increase in marketing investment last year. This decline is principally behind Ballantine’s, following the launch costs for Ballantine’s Masters last year, and Imperial, after a large increase last year for the ‘Imperial Keeper’ campaign. We also reviewed our spend in the second half as a result of the SARS impact in the region.

Our South Korean business, Jinro Ballantines, grew strongly in the year with market share growth over the last year. Ballantine’s volumes grew 8% driven particularly by growth in the super-premium aged Ballantine’s range. Imperial remains the clear leader in premium whisky and the largest volume whisky brand in Korea although its volumes declined by 1% reflecting slowdown in the overall Scotch category during the second half. This category slowdown was driven by a weaker Korean economy and by pressures on consumer credit.

Fundador continues to perform well in the Philippines with volumes up 6% and net turnover growth of 11% driven by market share growth. Fundador is the largest international spirits brand in the Philippines. Our business in Australia has benefited from growth in the Canadian Club mother brand and CC Club and CC Cola ready-to-drinks supported by the successful ‘similar yet different’ message.

Premium Wine

| | Organic

Growth

% | | Total

Growth

% | |

Volumes (9L cases) | | (2 | ) | 18 | |

Net turnover | | 4 | | 18 | |

Advertising and promotion | | 13 | | 23 | |

Trading profit | | 12 | | 23 | |

Our premium wine brands have performed well against tough trading conditions in many wine markets around the world. Reported net turnover grew 18% to £463m and trading profit up 23% to £95m. We remain firmly on track to meet our stated targets to grow the returns from our premium wines. This demonstrates the resilience of our wine brands and the benefits of their broad geography which provides a natural hedge against variations in recent wine cycles.

30

[GRAPHIC]

Montana is New Zealand’s largest winemaker with vineyards in Gisborne, Hawke’s Bay, Waipara and Marlborough. We produce a matchless range of quality still and sparkling wines.

[GRAPHIC]

On an organic basis, trading profit grew 12% to £86m with volumes down 2% but net turnover up 4%. This growth in turnover on declining volumes is directly in line with our plans to improve the mix of the business by shifting our focus towards premium wine brands. This is a long-term strategy that we are implementing across all our premium wine operations. For example, Bodegas y Bebidas is part way through its transition to a premium branded business focusing on the high value DO wines. As a result, volume reductions at Bodegas y Bebidas distort the overall organic volumes, which have otherwise grown by 1%.

We have made good progress in the US where organic volumes have grown 2%. This was driven mainly by a 5% volume growth of our largest US brand, Clos du Bois. Volumes were also helped by good growth from Perrier Jouët and our Montana brand, Brancott. Brancott has benefited significantly from being added to our comprehensive distribution network in the US with volumes up 17% and a doubling of net brand contribution. Mumm Cuvée Napa joined the portfolio in May 2002 and like-for-like volumes increased 7%. There have been declines in some non-core domestic brands as we have repositioned the portfolio towards our premium brands.

Our UK wine business performed very strongly with organic volumes up 32%. The main drivers have been the good performance of Mumm champagne and our Argentine wine, Graffigna, which is now sold through our distribution network in the UK and has more than doubled its volumes.

The Australian and New Zealand wine businesses performed well in spite of the difficult trading conditions caused by an oversupply of certain grape varietals and pricing pressure in the region. Our volumes in these markets grew 1%. In New Zealand, Montana has continued to grow market share in the super premium category where it also successfully grew sparkling wine volumes by 5%. The Montana portfolio grew strongly in Australia with volumes up 39% as we have extended our distribution presence.

Global Operations and Duty Free

The productivity of our Global Operations has continued to improve largely as a result of increased production volumes through our existing sites. For example, we have benefited from the integration of Malibu production at our sites in Dumbarton, Jerez and Walkerville. The strong growth of Courvoisier has improved productivity measures at Jarnac. In addition, procurement is now fully co-ordinated across our Spirits & Wine business, and that has enabled us to leverage synergies, especially in the areas of packaging and other services.

31

Operating and financial review

‘We have continued to deliver earnings growth and improved cash generation. Free cash flow has increased in each of the last three years driven by our focus on working capital management.’

Graham Hetherington,

Chief Financial Officer

Quick Service Restaurants distribution points

11,383 points

[CHART]

1 Dunkin’ Donuts | | 51 | % |

2 Baskin-Robbins | | 45 | % |

3 Togo’s | | 4 | % |

Quick Service Restaurants system-wide sales

£2,742m

[CHART]

1 North America | | 85 | % |

2 International | | 15 | % |

Quick Service Restaurants trading profit £m

2003 | — | 79 | |

2002 | — | 78 | |

2001 | — | 72 | |

2000 | — | 64 | |

1999 | — | 53 | |

Our Duty Free operations have performed well within a difficult environment. The first half saw strong organic growth and showed a recovery against the previous year which was affected by the events of 11 September 2001. However, the impact of the SARS virus, the Iraq war and slowing economies in many markets caused the recovery to falter in the second half reflecting a decline in passenger traffic. Our actions to mitigate these effects was successful with Ballantine’s Aged performing particularly well, retaining its market leadership position in super premium scotch in duty free. The addition of Malibu and our premium wine brands has made a very positive contribution to our Duty Free business. In particular, our premium wines have benefited from the access to this channel provided by our global distribution network.

Quick Service Restaurants

• Distribution points up 8%

• Number of combination stores up 37%

• System-wide sales growth of 5%

• Trading profit up 8% to £79m

The strong profit growth in our Quick Service Restaurants business has been driven by continued growth in same store sales and the contribution from new stores. Distribution points increased by 8% as we significantly increased the pace of store openings in both the US and internationally during the year. We have plans to rapidly expand the number of distribution points over the coming year. Overall turnover has fallen by 11% to £259m reflecting the final stage in the process to full outsourcing of ice cream manufacture for Baskin-Robbins to Dean Foods in the US.

Dunkin’ Donuts delivered a 7% growth in system-wide sales driven by a 4.4% increase in US same store sales and a 7% increase in global distribution points. Its same store sales growth has continued to outpace the overall QSR industry driven by effective marketing work and innovation. Dunkin’ Donuts has promoted the sale of boxed donuts through a programme called ‘express donuts’ which are 12 packs containing the top six flavours. This programme has also been supported by a new campaign, ‘Who brought the donuts?’, which encourages the purchase of boxed donuts, thereby increasing the value of each customer transaction. In addition, Dunkin’ Donuts has driven its successful innovation programme with new beverage offerings such as caramel iced coffee and lemonade coolatta which benefited from a promotional competition with MTV called ‘Route to Cool’. We have also continued our focus on coffee with sales of ‘coffee by the pound’ growing well and a successful trial of a broader range of coffee offerings such as cappuccino, latte and espresso.

Baskin-Robbins same store sales in the US declined by 4.5% and global system-wide sales were up 1% for the year reflecting the poor weather in key US markets and the sluggish US economy – particularly in its core market of California. Global distribution points increased by 9%. Baskin-Robbins ran movie tie-ins with ‘X2: X-Men United’ and ‘Sinbad’ with new flavours such as Oreo X-Mint, X-Treme Berry Sherbet and Sinbad’s Triple Punch Sherbet. Free-Scoop Nights continue to attract significant publicity to drive brand awareness.

32

[GRAPHIC]

Dunkin’ Donuts sales growth has continued to outpace the QSR industry driven by its cutting edge marketing and new product development. We’re No. 1 in the US for serving coffee, donuts, bagels and muffins.

[GRAPHIC]

Baskin-Robbins is the world’s largest ice cream franchise. It’s famous for its innovative flavours with a flavour library approaching 1,000 different offerings. We sell the full range of frozen ice cream treats such as cones, cakes, sundaes, shakes and ‘Blasts’.

[GRAPHIC]

Togo’s is a popular sandwich brand on the West Coast of the US, selling great sandwiches with generous portions of high-quality, fresh ingredients. We also offer a selection of soups, salads and vegetarian selections.

Togo’s has also been affected by the poor economic situation in California resulting in a 5% decline in system-wide sales. Togo’s has been refreshing its product offering with the introduction of toasted sandwiches, a new line of breads, meat and cheese and has expanded into a new range of salads and lighter meals as well as kids’ meals.

Our strategy of multi-branded combination stores continues to be a driver of growth in new store openings, with a 37% increase in the number of combination stores to over 1,100 stores. This strategy is supported by our brands’ complementary day-part offering and brings significant benefits to our franchisees through improved scale and operating efficiencies, along with increased choices for consumers.

In January 2003, Jon Luther was appointed as Chief Executive Officer of the Quick Service Restaurants business. During 2003, we restructured the business to concentrate around the three brands and to provide improved focus on operational systems and standards, menu and product development and the expansion of the international business. The reorganisation has resulted in a leaner and more focused organisation providing operational synergies. This resulted in an exceptional charge of £9m which will generate annual cost savings of £7m.

Britannia soft drinks

The Group’s share of Britannia’s profits for the period was £20m (2002: £16m).

Taxation

The normalised tax rate for the year has decreased from 25% to 24%, as we continue to manage our tax liabilities. We anticipate that the normalised rate for the year ending 31 August 2004 will remain at this level.

Goodwill and exceptional items

Goodwill amortisation totalled £40m (2002: £38m), the increase reflecting a full year of amortisation relating to the acquisition of Bodegas y Bebidas.

The exceptional items of £28m reflect the benefit of the Mexican excise rebate: pre-tax £38m (2002: £213m); post-tax £25m (2002: £138m). It also includes a charge for the restructuring of Quick Service Restaurants (£9m) and the completion of the acquisition integration programme announced in 2002 (£3m).

Cash flow

Net cash flow from operating activities was £748m (2002: £760m) and free cash flow was £281m (2002: £211m). Cash flow benefited from a rebate of excise duty (net of tax) in Mexico of £38m this year (2002: £128m). If this non-repeatable item is excluded, free cash flow improved by £160m to £243m. This improvement is a result of improved working capital management, particularly debtor and creditor management, and lower tax payments.

Net debt decreased by £166m during the period from £2,578m to £2,412m which includes an adverse currency translation impact on our borrowings of £82m largely as a result of the strengthening Euro partially offset by a weakening US dollar.

Treasury operations

The Group treasury operates as a centralised service managing interest rate and foreign exchange risk and financing. The Board agrees and reviews policies and financial instruments for risk management.

33

Operating and financial review

[GRAPHIC]

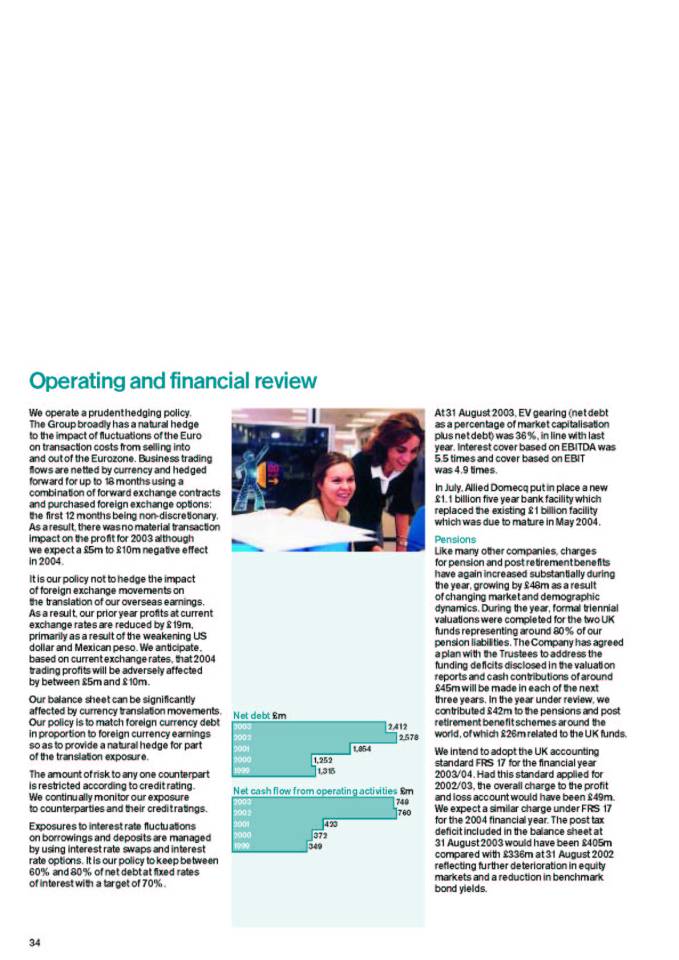

Net debt £m

2003 | - | 2,412 | |

2002 | - | 2,578 | |

2001 | - | 1,854 | |

2000 | - | 1,252 | |

1999 | - | 1,315 | |

| | | |

Net cash flow from operating activities £m |

| | | |

2003 | - | 748 | |

2002 | - | 760 | |

2001 | - | 423 | |

2000 | - | 372 | |

1999 | - | 349 | |

We operate a prudent hedging policy. The Group broadly has a natural hedge to the impact of fluctuations of the Euro on transaction costs from selling into and out of the Eurozone. Business trading flows are netted by currency and hedged forward for up to 18 months using a combination of forward exchange contracts and purchased foreign exchange options: the first 12 months being non-discretionary. As a result, there was no material transaction impact on the profit for 2003 although we expect a £5m to £10m negative effect in 2004.

It is our policy not to hedge the impact of foreign exchange movements on the translation of our overseas earnings. As a result, our prior year profits at current exchange rates are reduced by £19m, primarily as a result of the weakening US dollar and Mexican peso. We anticipate, based on current exchange rates, that 2004 trading profits will be adversely affected by between £5m and £10m.

Our balance sheet can be significantly affected by currency translation movements. Our policy is to match foreign currency debt in proportion to foreign currency earnings so as to provide a natural hedge for part of the translation exposure.

The amount of risk to any one counterpart is restricted according to credit rating. We continually monitor our exposure to counterparties and their credit ratings.

Exposures to interest rate fluctuations on borrowings and deposits are managed by using interest rate swaps and interest rate options. It is our policy to keep between 60% and 80% of net debt at fixed rates of interest with a target of 70%.

At 31 August 2003, EV gearing (net debt as a percentage of market capitalisation plus net debt) was 36%, in line with last year. Interest cover based on EBITDA was 5.5 times and cover based on EBIT was 4.9 times.

In July, Allied Domecq put in place a new £1.1 billion five year bank facility which replaced the existing £1 billion facility which was due to mature in May 2004.

Pensions

Like many other companies, charges for pension and post retirement benefits have again increased substantially during the year, growing by £48m as a result of changing market and demographic dynamics. During the year, formal triennial valuations were completed for the two UK funds representing around 80% of our pension liabilities. The Company has agreed a plan with the Trustees to address the funding deficits disclosed in the valuation reports and cash contributions of around £45m will be made in each of the next three years. In the year under review, we contributed £42m to the pensions and post retirement benefit schemes around the world, of which £26m related to the UK funds.

We intend to adopt the UK accounting standard FRS 17 for the financial year 2003/04. Had this standard applied for 2002/03, the overall charge to the profit and loss account would have been £49m. We expect a similar charge under FRS 17 for the 2004 financial year. The post tax deficit included in the balance sheet at 31 August 2003 would have been £405m compared with £336m at 31 August 2002 reflecting further deterioration in equity markets and a reduction in benchmark bond yields.

34

Constant exchange rate reporting

The following tables provide a reconciliation between the 2002 reported results and those shown at constant exchange rates in the Operating and Financial Review.

Geographical analysis – Group trading profit

In line with previous statements, the trading profits of the regions shown in this review are on a management reporting basis at constant exchange rates, rather than on a statutory basis at each year’s actual exchange rates, as shown in note 2 to the accounts. The table bottom right shows the foreign exchange effect of restating last year’s reported trading profit for each region at this year’s actual exchange rates. ‘Others’ in the table includes Global Operations (including profit from the sale of bulk whisky), stand-alone Duty Free operations and central costs not allocated to marketing regions. In addition, the table sets out the impact of market transfers on last year’s regional Spirits & Wine trading profits. The market transfers column includes the movement of European Duty Free from Europe to our stand-alone Duty Free operations reported in ‘Others’. The column also includes the movement of some existing Spanish wine operations from Europe to Premium Wine and the reallocation of central costs, primarily central marketing costs such as consumer research activities, to the regions. The profit decline in ‘Others’ principally reflects increased pension costs (£48m) partly offset by the year-on-year benefit of some one-off costs which were not repeated in the current year.

| | 2002 | | 2003 | |

Group | | Reported

2002 | | Foreign

exchange | | At 2003

exchange | | Reported

2003 | | Growth

at 2003

exchange | |

| | £m | | £m | | £m | | £m | | % | |

Turnover | | 3,334 | | (114 | ) | 3,220 | | 3,410 | | 6 | |

Trading profit | | 610 | | (19 | ) | 591 | | 621 | | 5 | |

Finance charges | | (130 | ) | (6 | ) | (136 | ) | (126 | ) | (7 | ) |

Profit before tax | | 480 | | (25 | ) | 455 | | 495 | | 9 | |

Taxation | | (120 | ) | 6 | | (114 | ) | (119 | ) | 4 | |

Minority interests | | (13 | ) | — | | (13 | ) | (16 | ) | 23 | |

Earnings | | 347 | | (19 | ) | 328 | | 360 | | 10 | |

Weighted average number of Ordinary Shares (millions) | | 1,066 | | | | 1,066 | | 1,075 | | | |

Earnings per share (pence) | | 32.6 | | | | 30.8 | | 33.5 | | 9 | |

| | 2002 | | 2003 | |

Spirits & Wine | | Reported

2002 | | Foreign

exchange | | At 2003

exchange | | Reported

2003 | | Growth

at 2003

exchange | |

| | £m | | £m | | £m | | £m | | % | |

Turnover | | 3,018 | | (88 | ) | 2,930 | | 3,151 | | 8 | |

Duty | | (638 | ) | 20 | | (618 | ) | (671 | ) | 9 | |

Net turnover | | 2,380 | | (68 | ) | 2,312 | | 2,480 | | 7 | |

Advertising and promotion | | 443 | | (9 | ) | 434 | | 437 | | 1 | |

The foreign exchange adjustment restates prior year profits and sales at current year average exchange rates. Where this would distort the reporting of underlying performance following a material devaluation or under conditions of hyperinflation, profits and sales are not restated and retain their original value as reported in pounds sterling.

Geographical analysis – Group trading profit

| | 2002 | | 2003

Total | | 2003

Organic | |

| | Reported

2002 | | Market

transfers | | Foreign

exchange | | At 2003

exchange | | 2003 | | Growth

at 2003

exchange | | 2003 | | Growth

at 2003

exchange | |

| | £m | | £m | | £m | | £m | | £m | | % | | £m | | % | |

Europe | | 160 | | (27 | ) | 12 | | 145 | | 114 | | (21 | ) | 97 | | (33 | ) |

North America | | 169 | | (11 | ) | (19 | ) | 139 | | 182 | | 31 | | 167 | | 20 | |

Latin America | | 61 | | (3 | ) | (9 | ) | 49 | | 54 | | 10 | | 53 | | 8 | |

Asia Pacific | | 66 | | (4 | ) | (2 | ) | 60 | | 78 | | 30 | | 76 | | 27 | |

Premium Wine | | 68 | | 8 | | 1 | | 77 | | 95 | | 23 | | 86 | | 12 | |

Others | | (8 | ) | 37 | | 3 | | 32 | | (1 | ) | (103 | ) | — | | (100 | ) |

Spirits & Wine | | 516 | | — | | (14 | ) | 502 | | 522 | | 4 | | 479 | | (5 | ) |

QSR | | 78 | | — | | (5 | ) | 73 | | 79 | | 8 | | 79 | | 8 | |

Britannia | | 16 | | — | | — | | 16 | | 20 | | 25 | | 20 | | 25 | |

Total | | 610 | | — | | (19 | ) | 591 | | 621 | | 5 | | 578 | | (2 | ) |

35

Corporate social responsibility

Building a sustainable business

‘There is no doubt that our continued drinks sector leadership position in the BiE index reflects the consistent hard work of all the Global Operations team to ensure that our policy objective of ‘beyond compliance’ is implemented. There is no room for complacency and every operating unit has its plan to deliver continual improvements in environmental and health and safety performance.’ Richard Turner, President, Global Operations

[GRAPHIC]

Allied Domecq and the Texas Package Store Association (TPSA) partnering together to combat underage access to beverage alcohol by using point of sale material.

‘Corporate Social Responsibility is not a response to a changing environment. It is a belief that either exists in the management of a corporation or doesn’t. The management of Allied Domecq has such a belief and has undertaken some significant initiatives during 2003 to make the belief a tangible reality.’ Kim Manley, Chief Marketing Officer

Allied Domecq builds brands people want in order to deliver maximum return to its shareholders. But we can only maintain and optimise this return if we recognise the impact that our products and our actions have on society, on the environment, our consumers and our employees.

We need to plan to build a long-term, sustainable business. And we do – committing ourselves to delivering sustainability in three critical areas: economic, environmental and social. Within Allied Domecq we call this our triple bottom line.

Economic – While we clearly exist to make a profitable return on the money invested in our business, our performance measurements take as much account of the way in which we achieve results as the results themselves.

Sustainability criteria run right through our business planning processes, and employees are expected to carry out their every day activities to maximise the positive impact on the triple bottom line.

Environmental – We are an acknowledged sector leader in environmental policy. This was again recognised in two important benchmarking surveys: the Business in the Environment index where we lead the drinks sector as we have in each of the seven years that the BiE index has been established; and in our continued inclusion in the Dow Jones sustainability index.

The adoption of ISO 14001 as the global production standard has committed the business to making continual improvements in our production processes to minimise their environmental impact. Over 80% of the Group has plans and targets for water use improvements, waste reduction and energy efficiency. Some examples of the practical effect of our environmental policy can be found in the environment section of our website (www.allieddomecq.com), and our full Environmental, Health and Safety Report will be updated in early 2004.

Social – As one of the world’s largest producers of beverage alcohol we recognise our social responsibilities. Alcohol can be a source of pleasure, positive social interaction and can be life enhancing. However, if abused it can cause considerable damage to the individual and to society.

We take enormous care when marketing our products to ensure that we do not encourage excessive consumption or inadvertently target those under the legal drinking age. By being proactive in developing a Global Marketing Code we have helped to raise industry standards.

Last year we announced that we were leading the industry by including responsible drinking messages in all of our new brand communications, thereby helping to promote beneficial patterns of consumption.

This year we have another industry first with the creation of a third party review board which advises the Company on compliance with our own standards for marketing, and identifies any external risks that we need to take into account when executing new campaigns. The review board will operate transparently with regular meeting reports on our corporate website.

Allied Domecq is a member of a number of national bodies established with our industry partners to develop programmes to reduce the abuse of alcohol by young people, encourage sensible alcohol consumption and discourage drinking and driving. We will also work with any organisation that seeks to reduce the harm that can result from inappropriate consumption of our products by targeting potentially risky occasions.

36

USA

Allied Domecq Spirits North America has formed a partnership with the Texas Package Store Association (TPSA) in a joint social responsibility initiative to combat underage drinking. TPSA represents retailers in Texas, and Allied Domecq will be working with retailers to launch a Point of Sale programme to educate parents on the risks of illegal under age access to beverage alcohol.

UK

As part of the Bristol mosaic we have funded a new interactive exhibit in the award winning science and discovery centre @Bristol. Mainly targeted at teenagers, the exhibit allows visitors to explore how alcohol affects our health and behaviour.

Scotland