Exhibit 99.1

Contents

Cautionary statement regarding forward-looking information:

Some statements in this Annual Report contain ‘forward-looking’ statements as defined in Section 21E of the United States Securities Exchange Act of 1934. They represent our expectations for our business, and involve risks and uncertainties. You can identify these statements by the use of words such as ‘believes’, ‘expects’, ‘may’, ‘will’, ‘should’, ‘intends’, ‘plans’, ‘anticipates’, ‘estimates’ or other similar words. We have based these forward-looking statements on our current expectations and projections about future events. We believe that our expectations and assumptions with respect to these forward-looking statements are reasonable. However, because these forward-looking statements involve known and unknown risks, uncertainties and other factors which are in some cases beyond our control, our actual results or performance may differ materially from those expressed or implied by such forward-looking statements.

Explanatory notes:

Comparative information in the Operating and Financial Review is based on constant exchange rates. Net turnover is turnover after deducting excise duties. Profit and normalised earnings are stated before goodwill and exceptional items. Volumes are quoted in nine-litre cases unless otherwise specified.

Brands:

All brands mentioned in this Annual Report are trademarks and are registered and/or otherwise protected in accordance with applicable law.

Allied Domecq

…is a dynamic marketing-led brands company. We operate globally in the businesses of Spirits & Wine and Quick Service Restaurants. We will deliver growth through a relentless focus on maximising our portfolio, our presence and the talents of our people. There’s a lot happening at Allied Domecq. It’s time to take a new look…

1

our portfolio…

…we operate globally building powerful, exciting brands that drive profitable growth and strong consistent cash flows. By building and innovating our brand portfolio through effective marketing, we will retain consumers who enjoy our brands and attract and excite new consumers to win greater market share.

Spirits & Wine

Allied Domecq Spirits &Wine operates through over 50 businesses worldwide, and owns or controls distribution of approximately 90% of our sales volume. We own or distribute 14 of the top 100 international premium spirit brands and our brand portfolio commands world No.1 or No.2 positions in six leading categories.

Core brands

We focus on nine core brands which account for over half of our Spirits & Wine profit.

| |

| |

| |

| | | | | |

Ballantine’s

5.9m cases

Third largest Scotch

whisky worldwide | | Beefeater

2.4m cases

World’s leading

imported gin | | Canadian Club

2.6m cases

No. 3 premium

Canadian whisky | |

| | | | | |

Key markets:

Spain, France, Germany,

Italy, South Korea, Japan, duty free | | Key markets:

Spain, US, Nordic | | Key markets:

US, Canada, duty free | |

| |

| |

| |

| |

| |

|

Courvoisier

1.1m cases

No.1 cognac in UK

and No. 3 in US | | Kahlúa

3.0m cases

World’s No.1

coffee liqueur | | Maker’s Mark

0.5m cases

Premium handcrafted

Kentucky bourbon | | Malibu

3.0m cases

No. 2 single

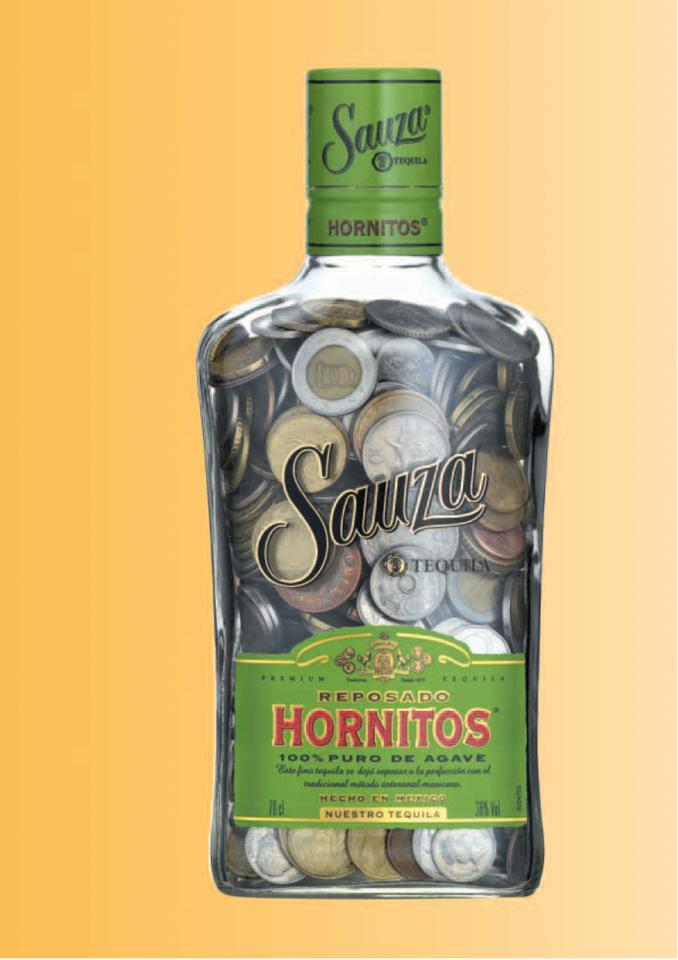

liqueur worldwide | | Sauza

2.9m cases

Second largest

tequila worldwide | | Tia Maria

0.8m cases

UK’s leading

coffee liqueur |

| | | | | | | | | | |

Key markets:

US, UK, Asia | | Key markets:

US, Canada, Australia | | Key market:

US | | Key markets:

US, UK, France, Spain | | Key markets:

US, Mexico | | Key markets:

UK, Spain |

Premium wine

We are successfully building and running an international business in premium branded wines. Our focus is driving growth in key markets through a specialist sales capability and, where appropriate, leveraging synergies through our existing distribution.

| |

| |

| |

| |

|

| | | | | | | | |

California - US

A leading producer of

premium Californian wine | | New Zealand

New Zealand’s leading

wine producer | | Champagne - France

Third largest

champagne producer | | Bodegas y Bebidas -

Spain

Spain’s leading wine

producer | | Argentina

A leading producer of

premium Argentine wine |

| | | | | | | | |

Key brands:

Clos du Bois, Gary Farrell,

Buena Vista, William Hill,

Haywood, Atlas Peak,

Mumm Cuvée Napa | | Key brands:

Montana, Brancott,

Lindauer, Church Road,

Corbans, Stoneleigh

| | Key brands:

G. H. Mumm & Cie,

Perrier Jouët

| | Key brands:

Campo Viejo, Siglo,

Ysios, Aura, Tarsus,

Marques de Arienzo | | Key brands:

Graffigna,

Bodegas Balbi |

2

Quick Service Restaurants

Our Quick Service Restaurants business comprises three great brands and is among the top five in the industry with over 12,000 franchised outlets worldwide. The principal locations are in the US, Canada, Japan, South Korea and the Philippines.

| |

| |

|

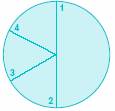

| | | | |

Dunkin’ Donuts | | Baskin-Robbins | | Togo’s |

The world’s largest coffee and baked goods chain operates in over 28 countries | | The world’s largest ice cream franchise operates in over 50 countries | | The legendary Californian sandwich shop |

| | | | |

| | | | >420 distribution points |

No.1 in the US for serving coffee, donuts, bagels and muffins

>6,100 distribution points | | No.1 in the US for serving ice cream

>5,400 distribution points | | |

3

…our presence

…we operate globally in over 50 markets. We have increased our exposure to key markets through investment in distribution and sales capabilities. Our focus is on capitalising existing market strengths and building positions in growth markets. Through prioritising, developing and extending our geographic presence, we will establish strong positions in key markets across the world.

North America | | | | | |

| | Key markets: | | Turnover: | |

| US, Canada | | £720m | |

| | | | |

| Key brands: | | Net turnover: | |

| Kahlúa, Stolichnaya, | | £632m | |

| Beefeater, Sauza, | | | |

| Canadian Club, | | Trading profit: | |

| Courvoisier, Malibu, | | £183m | |

| Maker’s Mark | | | |

| | | | |

| | | | |

| | | | | |

Latin America | | | | | |

| | Key markets: | | Turnover: | |

| Mexico, Argentina, | | £332m | |

| Brazil | | | |

| | | Net turnover: | |

| Key brands: | | £268m | |

| Sauza, Presidente, | | | |

| Don Pedro, | | Trading profit: | |

| Ballantine’s, Anejo | | £44m | |

| Los Reyes, Azteca | | | |

| de Oro | | | |

| | | | |

| | | | | |

QSR | | | | | |

| | Key markets: | | Turnover: | |

| US, Canada, Japan, | | £226m | |

| South Korea, | | | |

| Philippines | | Net turnover: | |

| | | £226m | |

| Key brands: | | | |

| Dunkin’ Donuts, | | Trading profit: | |

| Baskin-Robbins, | | £86m | |

| Togo’s | | | |

| | | | | |

Europe | | | | | |

| | Key markets: | | Turnover: | |

| Spain, UK, France, | | £1,069m | |

| Germany | | | |

| | | Net turnover: | |

| Key brands: | | £734m | |

| Ballantine’s, | | | |

| Malibu, Beefeater, | | Trading profit: | |

| Tia Maria, Whisky | | £139m | |

| DYC, Courvoisier | | | |

| | | | |

| | | | | |

Asia Pacific | | | | | |

| | Key markets: | | Turnover: | |

| South Korea, | | £320m | |

| Japan, Australia, | | | |

| Philippines | | Net turnover: | |

| | | £226m | |

| Key brands: | | | |

| Ballantine’s, | | Trading profit: | |

| Imperial, Fundador, | | £68m | |

| Kahlúa | | | |

| | | | |

| | | | |

| | | | | |

Premium Wine | | | | | |

| | Key markets: | | Turnover: | |

| US, New Zealand, | | £517m | |

| Spain, UK, France, | | | |

| Argentina | | Net turnover: | |

| | | £475m | |

| Key brands: | | | |

| Clos du Bois, Mumm, | | Trading profit: | |

| Perrier Jouët, | | £98m | |

| Montana, Iverus, | | | |

| Bodegas Artesanas | | | |

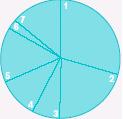

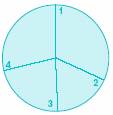

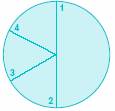

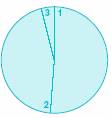

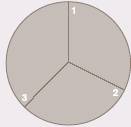

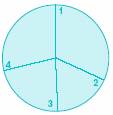

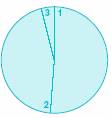

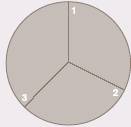

Net turnover by business area%

Total £2,611m

| | Spirits & Wine | | £m | | % | | | |

1 | | North America | | 632 | | 24 | |

| |

2 | | Europe | | 734 | | 28 | | |

3 | | Latin America | | 268 | | 10 | | |

4 | | Asia Pacific | | 226 | | 9 | | |

5 | | Premium Wine | | 475 | | 18 | | |

6 | | Other | | 50 | | 2 | | |

7 | | QSR | | 226 | | 9 | | |

| | Total | | 2,611 | | | | |

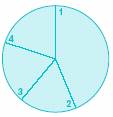

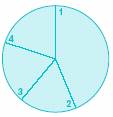

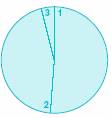

Trading profit by business area %

Total £657m

| | Spirits & Wine | | £m* | | % | | | |

1 | | North America | | 183 | | 29 | |

| |

2 | | Europe | | 139 | | 22 | | |

3 | | Latin America | | 44 | | 7 | | |

4 | | Asia Pacific | | 68 | | 11 | | |

5 | | Premium Wine | | 98 | | 15 | | |

6 | | Other | | 16 | | 2 | | |

7 | | QSR | | 86 | | 14 | | |

| | Total | | 634 | | | | |

* Excludes £23m of Britannia

4

…our people

…our 12,000 employees worldwide are the key to unlocking the value of our brands. We encourage our people to be passionate about our brands by providing opportunities for development, rewarding good performance and recognising achievement. By developing our people, harnessing their talents and being an ‘employer of choice’, we will attract and retain the best people to deliver our business goals.

Our people | |

| | | |

| |

| | |

| | | |

| | | |

| |

|

| | | | | | | | | | |

| |

| | | |

| | | |

|

| | | | | | | | | | |

| |

| |

| | | |

| |

|

| | | | | | | | | | |

| | | |

| |

| |

| | |

| | | | | | | | | | |

| |

| | | |

| |

| |

|

| | | | | | | | | | |

Ed Valle

Marketing

QSR

US

Maura Hoey

Process Improvement

QSR

US

Barbara Jackson

Marketing

US

Lourdes Herreramoro

Corporate Affairs

Mexico | | Sandy Mayo

Marketing

Nicola Marston

Marketing

UK

Elena Colmenero

HR

Spain

Graham Callard

Marketing

UK

Neil Brettell

Marketing

Wendy Cavill

Marketing

UK | | Allison O’Hanlon

HR

Dick Blanchard

HR

US

Su-Kyong Lee

Administration

Korea

Anjali Radcliffe

Corporate Affairs

UK | | Keith Seard

Finance

US

Yu-Cheon Kim

HR Deputy Manager

Korea

Sam Bishop

Information Technology

UK

Stephanie Kwan

Financial Analyst

QSR

US | | Katie Duncan

Corporate Affairs

Alan Tang

Finance

UK

Jong-Soo Kim

Sales Manager

Korea

Manuel Martínez Teofilo

Production

Eneas Crúz

Production

Mexico

Sheridan MacDonald

Administration

UK

Su-Jin Kwak

Senior Sales Manager

Korea | | Luis Alfonso Diaz

HR

Mexico

Ellen Walker

Product Development

QSR

US

Ramon Fernandez

Marketing

Barbara Benesova

HR

Holger Félix

Commercial Process

and Information

Mexico

Mario González

Warehouse

Mexico |

5

…our performance

Financial highlights

| | 2004 | | Restated

2003 | | Growth | | Growth at

constant

currency | |

| | | | | | % | | % | |

| | | | | | | | | |

Spirits & Wine net turnover | | £ | 2,385 | m | £ | 2,387 | m | 0 | | 5 | |

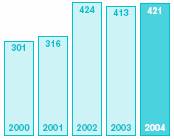

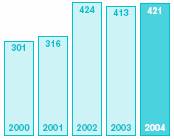

Marketing investment behind Spirits & Wine | | £ | 421 | m | £ | 413 | m | 2 | | 6 | |

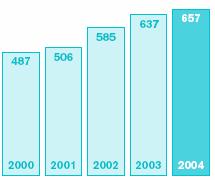

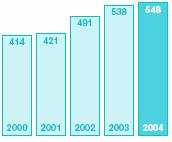

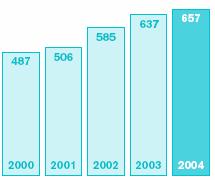

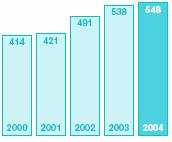

Group trading profit | | £ | 657 | m | £ | 637 | m | 3 | | 11 | |

Group profit before tax | | £ | 521 | m | £ | 491 | m | 6 | | 15 | |

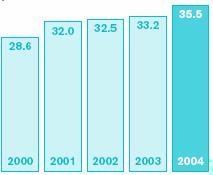

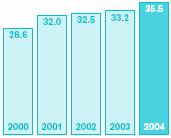

Normalised earnings per share | | 35.5 | p | 33.2 | p | 7 | | 16 | |

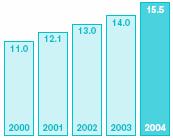

Dividend | | 15.5 | p | 14.0 | p | 11 | | | |

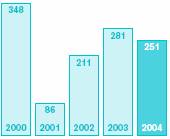

Net cash flow from operating activities | | £ | 655 | m | £ | 702 | m | | | | |

Free cash flow (after dividends) | | £ | 251 | m | £ | 243 | m | | | | |

Figures are stated before goodwill and exceptional items. Figures for the year ended 31 August 2003 have been restated for ‘FRS 17 – Retirement benefits’, ‘UITF 38 – Accounting for ESOP Trusts’ and ‘FRS 5 – Reporting the substance of transactions – Application Note G’, see page 33. Cash flow from operating activities excludes the pre-tax benefit of the Mexican excise rebate (2004: £nil; 2003: £46m); free cash flow excludes the post-tax benefit (2004: £nil; 2003: £38m).

Business highlights

Spirits & Wine

• Volumes up 2%

• Net turnover up 5%

• Marketing spend up 6%

• Net brand contribution up 4%

• Trading profit up 9%

Core brands

• Volumes up 8%

• Net turnover up 7%

• Marketing spend up 9%

• Net brand contribution up 7%

Premium wine

• Volumes flat

• Net turnover up 7%

• Marketing spend up 9%

• Trading profit up 13%

Quick Service Restaurants

• Distribution points up 6%

• Combination stores up 18%

• System-wide sales up 12%

• Trading profit up 21%

Delivering improved efficiencies and cash flow

• Efficiency improvements – overheads flat, benefiting from restructuring activities

• Strong cash generation – £251m free cash flow (£407m before dividends)

• Continued debt reduction – £471m reduction

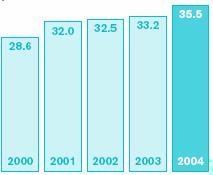

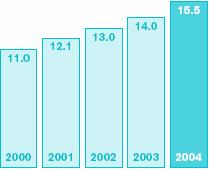

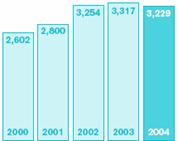

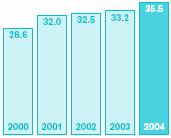

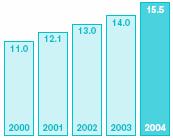

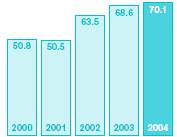

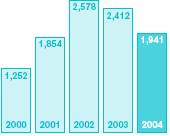

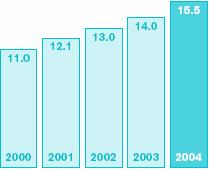

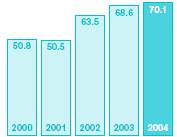

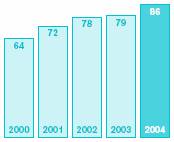

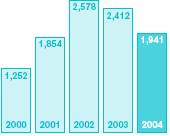

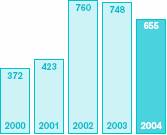

Normalised earnings per share | | Dividends per Ordinary Share | | Turnover £m* | |

pence* | | pence | | | |

| |

| |

| |

Figures here and in the Operating and Financial Review are stated before goodwill and exceptional items, and comparative information is based on constant exchange rates unless otherwise specified. All five-year graphs are at reported rates. *Turnover, trading profit and earnings per share for 2001 to 2003 have been restated for the impact of ‘FRS 17 – Retirement benefits’ and ‘Application Note G – revenue recognition’ an amendment to ‘FRS 5 – Reporting the substance of transactions’.

6

Chairman’s statement

These results reflect the continued transformation of Allied Domecq into a business that can drive sustained brand growth and improving earnings. This has been achieved against a background of challenging economies and adverse foreign exchange movements. Reported earnings per share grew by 7% but on constant currencies, earnings per share were up 16%. This is the fifth year of earnings growth since the sale of the UK pub business in 1999. Over this time, earnings per share have grown by almost 60% and this has been achieved after absorbing over £100m of adverse foreign exchange and pension costs. This reflects the consistent underlying strength of the business.

The Spirits & Wine business was a key driver of these results with profits up 9% at constant currencies. We saw the strongest performances in the US and in Europe, supported by excellent growth from the core spirits brands with volumes up 8%. The strength of the core brand performance is a reflection of the sustained investment in brand building over the past few years. In addition, we have continued to revitalise the portfolio through innovation. For example, we launched the new Malibu flavours, mango and pineapple, which have delivered encouraging early results. We have also introduced premium brand extensions such as Ballantine’s Black, Stolichnaya Elit and Imperial 17 year old.

The premium wine brands also performed strongly with profits up 13% in spite of the challenges facing the wine industry in some markets around the world. We continue to benefit from the diversity that our broad geographic portfolio brings and from the strength of our brands and our sales and marketing capabilities. The portfolio has also benefited from innovation with the introduction of new brands and brand extensions. We are confident that the business remains firmly on track to meet our return on investment targets.

We own some of the world’s best known spirits and wine brands, as well as leading quick service restaurant brands. More importantly, we recognise that we have a duty to market our products responsibly and to encourage our consumers to drink responsibly. At Allied Domecq, we aim to go ‘beyond compliance’ and have developed a code of marketing practices that is being applied worldwide. It goes beyond existing legislation or voluntary codes and sets a standard if there is neither. In support, we have a marketing review board, with independent experts to ensure compliance with the code. We have also been rolling out responsible drinking messages as part of our advertising. Further information on these activities and other areas was published this year in our first social report.

Others have also recognised our progress in this area; for example, we continue to lead the beverages sector in the Business in the Community Corporate Responsibility Index.

It has also been an excellent year for our Quick Service Restaurants business, with profits up 21%. The key drivers have been strong like-for-like growth through innovation and new store openings. Same store sales growth at Dunkin’ Donuts has continued to outpace the industry, supported by its successful innovation programme around new coffee offerings such as latte, cappuccino and espresso. We have also continued to extend the presence of the brands across the US and internationally.

Allied Domecq today is a very different business from that of five years ago, with a stronger portfolio of brands and improved access to key growth markets. This good progress reflects the strength of the management team led by Philip Bowman and the valuable contribution made by all the employees at Allied Domecq.

/s/ Gerry Robinson | |

|

Sir Gerry Robinson |

Chairman |

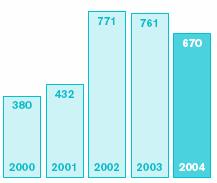

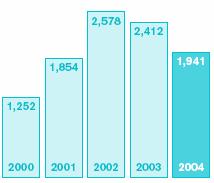

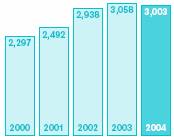

Trading profit £m* | | Operating cash flow £m | | Net debt £m | |

| | | | | |

| |

| |

| |

7

8

a fresh twist

Let’s be straight about this. There has to be a point to being different. And for us that’s being brave. And quick. And nimble.

Take wine. People said you couldn’t make money out of it. So we went in worldwide. With good reason. Producing in five

countries on four continents. And the result? Profits up 13% this year.

9

10

investing in brands

Our business is about brands. We’re spending more on our core brands, and spending better, because consumers will pay a premium for a brand that they know and they trust. Increased sales, premium prices, higher margins, and faster growth mean more cash to continue investing. It’s a virtuous circle. It’s the lifeblood. It’s where the value comes from.

11

12

getting connected

It’s good to talk. But we prefer to listen. Hear what people tell us. Like what sort of coffee they want. And how quickly. And how they want it at a good price. And how it tastes better when the language is simple – like small, medium and large. And that’s why Dunkin’ Donuts sells more cups of coffee in the US than anyone else. Did you hear that?

13

14

round thinking

We bottle bubbles. Think bubbles. We find out what consumers want. See a need, like super-premium vodka in the US. We think around it. We could buy one. No. Let’s bottle Stolichnaya Elit. Or we see an opportunity in flavoured white spirits. We think about that too. And bottle Malibu in mango. Or maybe tempt Spain with a premium Scotch? Yes. Hola Ballantine’s Black.

15

16

switched on

Don’t get us wrong, we know what we’re doing. But we also know that whatever you do there’s a better way of doing it.

There always is. And that’s what we’re always looking for. The new way. The way beyond best practice. The process,

the thinking, the structure to give us an edge. No one here gets fired for challenging the status quo.

17

18

handle with care

You can’t be too careful selling alcohol. It’s not just another product. Of course we want people to enjoy our brands – but responsibly. And we lead by example, acting responsibly, promoting our brands to a stringent code of standards. Then we let an independent panel guard the code. They won’t let us challenge even the spirit of those standards. It’s not worth it.

19

20

the world over

There’s just one bottle of money and the whole world to spend it in. So we put some into markets like China where growth is high. We like the look of Russia and South America too. So they have some. Europe and the US have different needs. But we see where the best opportunities are and pour our resources accordingly.

21

22

working together

It doesn’t matter if you’ve got the greatest brands (which we have) and the greatest strategy (which we do). Unless you’ve also got the best people, you’re like a day-old doughnut. It’s people who unlock the value in the brands. It’s people who take the strategy and make it work. We know what our people are worth and where we’d be without them.

23

Operating and financial review

‘We have delivered earnings growth of 16% reflecting a strong performance from the core spirits brands and good profit growth from our premium wines and Quick Service Restaurants.’

Philip Bowman,

Chief Executive

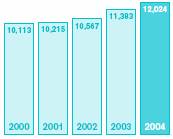

Normalised earnings per share

Pence

Dividends per Ordinary Share

Pence

Summary

At constant currency, normalised earnings per share have grown by 16% and reported normalised earnings per share have increased by 7% to 35.5p. The three key drivers have been:

• The growth of Spirits & Wine gross profit, particularly from the core brands, which contributed the majority of the incremental gross profit;

• The good mix growth of the premium wine brands; and

• The strong growth in Quick Service Restaurants.

From a geographic perspective, the growth in Spirits & Wine profit has been driven by good trading in North America, a recovery involumes in Spain and strong value growth in the premium wine portfolio in the US and UK. This has been partly offset by declines in some markets in Western Europe and in Asia Pacific due to localeconomic and trading challenges. Encouragingly we stabilised the profit declines in Asia Pacific during the secondhalf. The Quick Service Restaurants business has delivered double-digit profit growth by implementing its strategy of driving same store sales growth, new store openings and cost efficiencies.

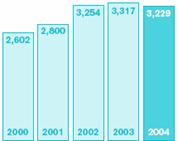

At constant exchange rates, Spirits & Wine net turnover grew £105m (5%) to £2,385m. However, Quick Service Restaurants turnover declined by £7m reflecting the final transition of Baskin-Robbins from producing and selling ice cream to US franchisees (which is now fully contracted out) to a wholly royalty-based model. Group turnover grew by 2% at constant exchange rates. Reported turnover for the Group declined by £88m (3%) to £3,229m of which £161m related to adverse year-on- year foreign exchange movements.

At constant currency, normalised profit before tax increased by 15%. Reported profit before tax increased 6% to £521m which reflects an adverse foreign currency translation and transaction movement of £38m on restating the profit for the prior period at this year’s rates.

The Directors are recommending a final dividend of 9.67p per share giving a total for the year of 15.5p, an increase of 11%.

Outlook

Looking ahead, we anticipate that the continued momentum of the core brands, supported by our focused marketing investment, will drive volume and turnovergrowth, as well as higher gross margins, even though certain markets remain challenging. The premium wine brands are on track to meet the five-year return on investment targets that we set out two years ago. We anticipate that further innovation and new store openings will continue to drive double-digit profit growth in our Quick Service Restaurants business. Together, this momentum will provide us with the platform to deliver continued earnings growth in 2005.

Business drivers

Our strategy is delivering good growth in the core spirits and premium wine brands and from Quick Service Restaurants. We focus on three areas to drive competitive advantage and sustainable future growth:

• Portfolio: By building and innovating our brand portfolio through effective marketing, we will retain consumers who enjoy our brands and attract and excite new consumers to win greater market share.

• Presence: Through prioritising, developing and extending our geographic presence, we will establish strong positions in key markets across the world.

• People: By developing our people, harnessing their talents and being an ‘employer of choice’, we will attract and retain the best people to deliver our business goals.

Our increased investment in these areas, particularly advertising and promotion, over the past four years is driving robust brand growth and strong financial results.

24

(1) Pepe Padilla

Operations

Spain

(2) Hugh Abedin-Zadeh

Audit Services

UK

(3) Hey-Won Kim

Logistics

Korea

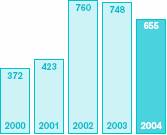

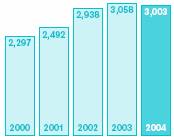

Spirits & Wine volumes

million cases

Spirits & Wine revenue

£m

Spirits & Wine advertising and promotion

£m

Spirits & Wine trading profit

£m

Spirits & Wine

| | 2004 | | 2003 | | Growth | |

| | | | | | % | |

Volume (9L cases) | | 70.1 | m | 68.6 | m | 2 | |

Net turnover | | £ | 2,385 | m | £ | 2,280 | m | 5 | |

Advertising and promotion | | £ | 421 | m | £ | 396 | m | 6 | |

Trading profit | | £ | 548 | m | £ | 503 | m | 9 | |

Spirits & Wine net turnover has increased through the growth of our core spirits brands and premium wine brands. Net turnover grew 5% with two percentage points from volume growth and three percentage points from price/mix improvements. Gross profit increased by £64m, or 5%, reflecting volume growth (£32m), price/mix improvements (£30m) and a lower cost of goods (£2m). The core brands and premium wines are the key drivers of the gross profit improvement.

Trading profit grew £45m (9%) after advertising and promotion investment increased by £25m (6%). Overheads were held flat even after investing significantlyin our sales and marketing capabilities in the US and behind the premium wine brands. This has been achieved by driving efficiency benefits from the restructuring of the Spirits & Wine operations. The increase in advertising and promotion spend has been directed behind selectedbrand market combinations, particularly Sauza in the US and Mexico, Ballantine’s in Spain, Malibu in the US and Spain, Kahlúa in the US, Whisky DYC in Spain and Imperial in South Korea. This continues to reflect the rigorous way in which we allocate spend behind brands and markets; directing more behind the core brands including new campaigns and innovation, and withdrawing spend from less effective areas. As a result,we are continuing to achieve greater impact from our marketing investment.

Brand review

We manage the Spirits & Wine portfolio as four groups: core brands, local market leaders, premium wine and other Spirits &Wine brands.

Core brand volumes grew 8% and net turnover increased by 7% driven by strong growth across nearly all the brands. There is one percentage point of mix dilutioncaused by the successful growth of the lower margin ready-to-drink extensions, which grew volumes by 15%. Excluding the ready-to-drinks, core brand volumes and net turnover both grew by 7%. Advertisingand promotion behind the core brands was up 9% resulting in net brand contribution increasing by 7%.

Spirits & Wine volume and net turnover growth

| | Volume

million

9L cases | | Volume

growth | | Net

turnover

growth | |

| | | | % | | % | |

Core brands | | | | | | | |

Ballantine’s | | 5.9 | | 6 | | 6 | |

Beefeater | | 2.4 | | 8 | | 10 | |

Canadian Club | | 2.6 | | 7 | | 0 | |

Courvoisier | | 1.1 | | 3 | | 3 | |

Kahlúa | | 3.0 | | (1 | ) | 2 | |

Maker’s Mark | | 0.5 | | 10 | | 15 | |

Malibu | | 3.0 | | 17 | | 15 | |

Sauza | | 2.9 | | 20 | | 16 | |

Tia Maria | | 0.8 | | (11 | ) | (13 | ) |

Core brands | | 22.2 | | 8 | | 7 | |

| | | | | | | |

Local market leaders | | 11.7 | | (2 | ) | (2 | ) |

| | | | | | | |

Premium wine | | 15.6 | | 0 | | 7 | |

| | | | | | | |

Other Spirits & Wine brands | | | | | | | |

Other spirits | | 12.7 | | 0 | | 4 | |

Other wine | | 7.9 | | 5 | | 3 | |

Other Spirits & Wine total | | 20.6 | | 2 | | 3 | |

Total | | 70.1 | | 2 | | 5 | |

The core brands are key drivers of gross profit growth with their premium positioning commanding high margins. The average gross profit per case of the core brands is more than twice that of the rest of the portfolio. As a result, they contributed the majority of the incremental Spirits & Wine gross profit. Ballantine’s and Beefeater grew well reflecting a recovery in volumes in Spain. Canadian Club volumes grew 7% with flat turnover growth reflecting the price repositioning in the US and mix dilution

25

Operating and financial review

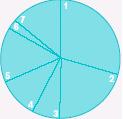

Spirits & Wine volumes

70.1m nine-litre cases

| | | | | % | |

| 1 | Core brands | | 32 | |

2 | Local market leaders | | 17 | |

3 | Premium wine | | 22 | |

4 | Other Spirits & Wine | | 29 | |

| | | | |

| | | | | |

Spirits & Wine net turnover | | | | | | |

£2,385m | | | | | | |

| | | | | | |

| | | | | % | |

| 1 | Core brands | | 44 | |

| 2 | Local market leaders | | 17 | |

| 3 | Premium wine | | 19 | |

| 4 | Other Spirits & Wine | | 20 | |

| | | | | |

| | | | | |

| | | | | |

Spirits & Wine advertising and promotion | | | |

£421m | | | | | | |

| | | | | | |

| | | | | % | |

| 1 | Core brands | | 59 | |

| 2 | Local market leaders | | 16 | |

| 3 | Premium wine | | 11 | |

| 4 | Other Spirits & Wine | | 14 | |

| | | | | |

| | | | | |

| | | | | |

Spirits & Wine net brand contribution | | | |

£1,011m | | | | | | |

| | | | | | |

| | | | | % | |

| 1 | Core brands | | 50 | |

| 2 | Local market leaders | | 17 | |

| 3 | Premium wine | | 15 | |

| 4 | Other Spirits & Wine | | 18 | |

| | | | | |

| | | | | |

| | | | | |

from the growth of ready-to-drinks in Australia. Excluding the ready-to-drinks, Canadian Club volumes grew 3% on net turnover down 1%. Courvoisier grew both volumes and net turnover by 3% reflecting good growth in the UK. Kahlúa volumes fell by 1% but price/mix improved net turnover by 2%. Price increases on Maker’s Mark helped to grow net turnover 15% while volumes were up 10%. Malibu grew volumes 17% and net turnover by 15% reflecting a mix dilution from the successful growth of ready-to-drinks in Australia. Excluding the ready-to-drinks, volumes and net turnover both grew 13%. Sauza volumes grew 20% and net turnover was up 16% reflecting price decreases in Mexico following declines in raw material costs. In the US, Sauza grew both volumes and net turnover by 13%. Tia Maria volumes declined by 11% and net turnover fell by13%. This decline mainly reflects the one-off benefit of the initial distribution effect of the Tia Lusso launch which was not repeated this year and lower Tia Maria sales which were affected in the short-term by the focus on Tia Lusso. Looking ahead, we have developed a new marketing campaign to revitalise the Tia Maria brand.

The recovery in core brand volumes in Spain accounted for one percentage point of volume growth and overall core brand volume growth was 7% excluding the Spanish market.

The local market leader brands are important contributors to overall profit and cash generation. In addition, they provide important local scale to support the development of the core brands in key markets. Among the local market leader brands, the strong growth of Stolichnaya in the US and the recovery of volumes of Whisky DYC and Centenaries in Spain were offset by volume declines in the Mexican brandies and Imperial whisky. As a result, overall local market leader volumes and net turnover both declined by 2%. Marketing investment was reduced across the local market leaders by 2% and net brand contribution declined by 2%.

The premium wine brands continued to deliver a significant price/mix improvement with flat volumes and net turnover up by 7%. Marketing spend increased by 9% to deliver a trading profit increase of 13%.

The volumes of the other Spirits & Wine brands grew by 2% with net turnover up by 3%.

Market review – Spirits & Wine

The key geographic drivers are the strong growth in core brand volumes in North America which delivered good turnover and profit growth, a recovery in volumes in Spain and good value growth in the premium wine portfolio. These good results were in part offset by declines in some Western European markets as a result of unfavorable macro-economic conditions and in South Korea where the current consumer credit problems have affected consumption patterns.

The regional performance of our businesses reviewed below.

North America

| | Growth | |

| | % | |

Volumes (9L cases) | | 5 | |

Net turnover | | 9 | |

Advertising and promotion | | 10 | |

Trading profit | | 15 | |

Strong trading in our North American business delivered a net turnover increase of 9% to £632m with volumes up 5%. Trading profit grew 15% to £183m after advertising and promotion grew by 10%.

In the US, we have continued to grow our share of the spirits market, reflecting the strength of our core brand portfolio and the benefits of our partnership approach with US distributors. As a result, we have grown volumes in the US by 7% and achieved good price/mix improvements to increase net turnover by 10%. Price improvements have been achieved particularly behind Maker’s Mark, Malibu and Stolichnaya. To support this momentum, we increased our marketing investment by 11% with the increase being directed mainly behind Malibu, Sauza and Kahlúa.

26

(1) We have successfully revitalized Canadian Club with global volumes up 7%. The brand grew share in the US and benefited from the success of its ready-to-drink extensions in Australia.

(2) Sauza grew volumes by 20% this year and gained share in its key markets of the US and Mexico. The brand continues to benefit from its innovative marketing campaign, ‘Get Lost’.

(3) Maker’s Mark is a handcrafted premium batch bourbon. Volumes were up 10% supported by the brand’s unique marketing campaign.

(4) Beefeater grew volumes 8% supported by continued market share gains in Spain. In the US, we have run a new campaign called ‘This Is Gin’ which has many different executions including billboards, coasters and taxis.

(5) Stolichnaya continued to perform well in the US with volumes up 9%. We launched a new campaign in October 2004 called ‘Frozen’ to build brand equity and support future growth.

Malibu has continued to increase its market share of the rum category in the US. Volumes grew 31% with net turnover up 35%, reflecting the successful launch of the new flavours, mango and pineapple. The original coconut flavor has also continued to perform well with volumes up 13%. This reflects the success of the ‘Seriously Easy Going’ campaign.

Sauza grew both volumes and net turnover by 13% in the US. It continued to grow its share of the tequila category as we increased our investment in the successful ‘Get Lost’ marketing campaign. Maker’s Mark had another strong year with further share growth with volumes up 14% and net turnover up 18%.

Stolichnaya continued to perform well with volumes up 9% and net turnover up 11% helped by the introduction of brand extensions such as Stolid Razberi and Stoli Elit. Beefeater grew volumes by 4% and net turnover by 5% supported by a new advertising campaign called ‘This Is Gin’ which has been trialled in three cities and will be rolled out to further cities during 2005.

Our programme to revitalise Canadian Club has delivered volumes up 4% with flat net turnover reflecting the effect of planned price repositioning across selected States. As a result, Canadian Club has also grown its share of the Canadian whisky category. Kahlúa continued to deliver positive consumption trends with net turnover up 3% on flat volumes. Courvoisier volumes fell 2% following a strong performance last year.

Our strategy in the US is continuing to drive market share gains. The ‘first choice supplier’ programme with US distributors has brought further benefits as we have extended the contracts to new States. Around 55% of our Open State volume is now covered by these new contracts which are long-term partnerships based on sustainability and mutual benefit. In addition, the new team we put in place to manage the Control States has provided the necessary focus to drive market share gains.

Europe

| | Growth | |

| | % | |

Volumes (9L cases) | | 0 | |

Net turnover | | 2 | |

Advertising and promotion | | (3 | ) |

Trading profit | | 14 | |

Trading profit grew 14% to £139m reflecting a recovery in volumes in Spain and a good performance in the UK and Central and Eastern Europe, offset by declines in other Western European markets caused by the challenging trading conditions. Net turnover grew 2% to £734m on flat volumes. Advertising and promotion declined by 3% as we reallocated our resources into higher growth markets in the US and Asia. In addition, cost saving initiatives held overheads flat. Outside Spain, our European volumes and net turnover both declined 3% despite the core brands growing share in key markets.

Our business in Spain grew volumes by 8% and net turnover by 12% reflecting the recovery in our volumes following last year’s destock by Spanish wholesalers. Ballantine’s grew volumes by 16% and net turnover by 20% and, while the Scotch whisky category is now in decline, the brand has continued to grow its market share to an all-time high. We have significantly increased our investment behind the Ballantine’s ‘Go Play’ campaign in Spain to maintain the brand’s momentum. Volumes for Beefeater grew 9% while net turnover grew 16%. Beefeater became the market leader in the gin category by value with strong market share gains. We have also recently launched WET by Beefeater, a premium brand extension, in high-end on-premise accounts. Malibu has continued to gain share following new television advertising and more than 1,000 on-trade promotion events. The volumes for Whisky DYC increased by 6%, as the new marketing campaign, ‘DYC Une’, helped to improve awareness among target consumers. While the brandy market continues to decline, Centenario has maintained its leadership of the category with a 25% share.

27

(1) Courvoisier grew well in the UK with volumes up 9%, extending its leadership of the cognac category. A new campaign is being launched in late 2004.

(2) The ‘Unleash It’ campaign has helped to reinvigorate Kahlúa in the US through a combination of print and TV executions. A refreshed campaign is being launched for 2005.

(3) Seung-Jin Baik

Marketing Korea

(4) Adriana Vilchis

Presidency Assistant

Daniel Hernandez

Finance Barbara

Benesova

HR

Mexico

The UK business has continued to deliver profit growth. Courvoisier extended its leadership of the cognac category with both volumes and net turnover up 9%. The brand is benefiting from new listings, a programme of on-trade events, particularly around cocktails, and an advertising programme in style magazines. Malibu has continued to grow share in both the on- and off-trade with volumes and net turnover up 8%. A new national TV and cinema campaign with the ‘Seriously Easy Going’ message increased brand awareness along with a marketing focus on mixing with cranberry. Volumes for the overall Tia Maria trademark declined when compared against high volumes associated with the Tia Lusso launch programme last year. However, Tia Lusso has retained its position as the number two selling cream liqueur by value in the UK.

The rest of Western Europe, such as France and Germany, has experienced sluggish economies and slower consumer spending. However, key brands have made good progress with market share growth in these challenging markets. For example, in France, legislative changes including price decreases have made the trading climate difficult, although we achieved market share gains with Ballantine’s. In Germany, while the spirits market has continued to decline, Ballantine’s increased its leadership of the Scotch whisky category. Ballantine’s has also achieved share gains in other markets so that its overall European market share has reached an all-time high.

In addition, we have reviewed our distribution arrangements in a number of our European markets and introduced new partnership arrangements in the Czech Republic, Benelux, Poland and Switzerland. These partnerships provide a more efficient route to market and are delivering overhead savings, improved scale and access. In Central and Eastern Europe, we have seen good profit growth in a number of markets such as Romania, Hungary and Russia and have benefited from the new distribution arrangements in the Czech Republic and Poland.

Latin America

| | Growth | |

| | % | |

Volumes (9L cases) | | 4 | |

Net turnover | | 3 | |

Advertising and promotion | | 6 | |

Trading profit | | 5 | |

Trading profit grew 5% to £44m while net turn over grew 3% to £268m despite the challenging market conditions. This performance reflects a significant improvement in the second half, with volumes up 10%, net turnover up 13% and trading profit up £6m. The key drivers forth year are the growth of the core brands, particularly Sauza in Mexico, and our Argentine wines, which have been partially offset by a decline in Mexican brandies.

Our Mexican business continued to extend its position as the leading spirits business. Sauza continued to grow its share to become the second largest tequila brand in Mexico. Volumes were up 36% and net turnover grew 27% reflecting price reductions caused by the highly competitive tequila market as well as declines in the raw material costs. We have also increased our focus on the core brands which have delivered good growth in Ballantine’s and Kahlúa. The domestic brandy category continues to be affected by the growth of the illegal spirits market in Mexico, which has resulted in a 5% decline in our Mexican brandy volumes. However, our brands have maintained their leadership of the category, and we delivered a better performance in the second half with brandy volumes up 7% driven by Presidente, albeit against weaker comparatives. We have continued to work with the Mexican government on initiatives to tackle the growth of the illegal spirits market. The recently implemented regimes apply excise duties on all alcohol imports and production in order to prevent its diversion to the illegal market. It is too early to determine the effectiveness of these initiatives.

In Argentina, we have extended our market leadership through growth of our core spirits brands, such as Tia Maria and Beefeater, and our Argentine wine portfolio. The Argentine wine portfolio helped to grow

28

(5) We have continued to refresh the ‘Go Play’ campaign for Ballantine’s – our largest brand. This successful campaign was launched in 2002 and has helped to grow Ballantine’s market share to an all-time high in Europe.

(6) We have launched a new campaign for Tia Maria in the UK to revitalise the brand’s growth.

(7) Richard Swan

Global Supply Chain

UK

(8) Kyung-Joon Yoon

Sales Manager

Korea

our domestic wine volumes by 40% and net turnover by 78%. In Brazil, our Latin American wines have also helped to grow our overall Brazilian volumes by 5%. Ballantine’s also continued to perform well in the other Latin American markets.

Asia Pacific

| | Growth | |

| | % | |

Volumes (9L cases) | | 2 | |

Net turnover | | (3 | ) |

Advertising and promotion | | 15 | |

Trading profit | | (4 | ) |

The challenging trading conditions in South Korea, where a consumer credit squeeze has triggered a significant slowdown in the overall spirits market, has caused the regional trading profit to decline by 4% to £68m. Net turnover for the region fell by 3% to £226m while volumes grew 2%. Core brand volumes in the region grew 14% offsetting the declines in local market leader brands in South Korea and the Philippines. Outside of South Korea, we experienced strong growth in the rest of the region with volumes up 11% driven by good performances in Greater China, Australasia and the emerging new markets.

The consumer credit squeeze in South Korea has slowed consumer spending which has badly affected the spirits industry. As a result the whisky category has declined by 26% since August 2003 but our total market share improved by 1.4 percentage points to 34%. We improved our share across the premium, deluxe and super-premium categories. The premium (12 year old) category has been most affected, declining 29%, while Imperial Scotch whisky maintained its market leadership with volumes down 22%. We have, however, continued to grow our share of the premium whisky category to an all-time high. The more premium-priced brands have fared better as the consumer base is relatively less affected by the credit squeeze. This trend is continuing to support a mix benefit for Ballantine’s aged whisky. In addition, in December we successfully launched Imperial 17 year old Scotch to broaden our access to this more premium-priced category. This was the main driver for the 15% increase in advertising and promotion in the Asia Pacific region. Our work with Imperial 17 year old and Ballantine’s Masters has grown our share of the deluxe premium category in South Korea.

In Australia, our volumes grew 29% driven particularly by the success of our ready-to-drink extensions and good growth from Ballantine’s and Malibu. The ready-to-drink formats are based on Canadian Club, with CC Club and CC Cola growing volumes by 40%, and the recent launch of Malibu Chill which has been very well received. The base Malibu brand also grew strongly in Australia with volumes up 25%. In the Philippines, Fundador has maintained its position as the largest international spirits brand but incurred volume declines of 14% as a result of increasing competition from low-priced Spanish imports and the difficult economy. Sales in Japan improved this year, driven particularly by Ballantine’s aged whisky.

Our business in China has progressed in building organisational capabilities and a sales network. This delivered good growth from a small base such that volumes grew by 75% driven by Ballantine’s, up 90%, and Courvoisier, up 74%.

Premium Wine

| | Growth | |

| | % | |

Volumes (9L cases) | | 0 | |

Net turnover | | 7 | |

Advertising and promotion | | 9 | |

Trading profit | | 13 | |

29

(1) Clos du Bois is our largest US wine brand and grew volumes by 13% this year. We started a new campaign in September 2004 called ‘All The French You Need To Know’.

(2) Trudy Stewart

Contract Administrator

QSR

US

(3) Michael O’Donovan

Research & Development

QSR

US

(4) Joseph Falcao

Strategic Planning

QSR

US

(5) The strong US same store sales at Dunkin’ Donuts continues to outpace the industry which reflects its successful programme of innovation and marketing. The new range of espresso, latte and cappuccino drinks we launched in October 2003 has reinforced Dunkin’ Donuts’ No. 1 position in the US for selling coffee by the cup.

(6) Togo’s is a popular sandwich brand on the West Coast of the US. During the year, we have worked with our franchisees to refurbish around half our stores to refresh the brand’s appeal to consumers.

(7) We have trialled a new store format for Baskin-Robbins in California with encouraging early results. It includes new products such as soft serve ice cream to which customers can create their own toppings and a new beverage bar to increase our focus on high margin beverages.

The premium wine brands have grown strongly with trading profit up 13% to £98m. Net turnover increased by 7% to £475m on flat volumes which reflects a strong price/mix improvement of 7%. Advertising and promotion increased 9% primarily behind our champagne brands. Our continued focus on value and mix improvement is delivering improving returns on investment and we are on track to reach our targets. These excellent results have been achieved at a time when many other wine companies have struggled against a challenging wine market. It demonstrates the strength of our wine brands and the benefits of our geographic diversity which have provided a natural hedge against recent variations in wine cycles. We have also improved our capital efficiency both by better working capital management and through disposal of non-strategic assets. These capital savings along with the profit growth are driving higher returns.

Our premium-priced wines (£5 or US$7 retail price and above) represent around 55% of the portfolio by volume but around 85% of the portfolio by value. Our strategy is to shift the mix of our wine portfolio towards these more premium categories and away from the value category. As a result, we delivered flat overall volume growth reflecting a strong performance in the premium categories offset by the declines in the value categories. It was helped by a significant growth in premium wine volumes during the second half with overall volumes up 4% and net turnover up 9%.

We had a very strong year in the US, our largest wine market, with overall volumes up 14% and net turnover up 17%. Our largest US brand, Clos du Bois, was the key driver with volumes up 13%. Its core chardonnay varietal grew well and we also benefited from the introduction of a new shiraz varietal. The successful launches of the Jerry Garcia label and Mumm ‘M’ were also helpful growth drivers. Mumm Cuvée Napa experienced overall strong growth with volumes up 14%. The addition of the Gary Farrell icon wines into the portfolio has also helped to improve the credibility and breadth of the US domestic portfolio. The other key growth driver was the continued introduction of wine imports into the US market, particularly from New Zealand, Champagne and Spain. The New Zealand wines, which we market under the Brancott label in the US, delivered volume growth of 38% and our champagne volumes in the US increased by 36%. Both our domestic and imported brands benefited from broader distribution and improved sales and marketing capabilities within the US market.

The UK wine business delivered good growth with volumes up 7% and net turnover up 10%. There was good growth from a range of brands from different production regions. The New Zealand brands grew volumes and net turnover by 9% in spite of the supply shortage resulting from last year’s reduced grape harvest. The Spanish Rioja brands benefited from the strength of our UK distribution, with Campo Viejo volumes up 24% and net turnover up 34%. The champagnes have also delivered net turnover growth of 6% as we have increased prices, particularly on Mumm. Our largest Argentine wine brand, Graffigna, also saw good growth with volumes up 17% and net turnover up 26%.

Our wine sales in Australia and New Zealand had a slow start to the year. The domestic sales in New Zealand declined, primarily reflecting the grape supply shortage caused by last year’s frost damage. Consolidation among the retailers also put pressure on sales. However, we restructured our operations in New Zealand and Australia and, coupled with the improving supply situation, we saw good net turnover growth across all brand categories in the second half. The grape harvest in 2004 was at record levels and will support future growth even though overall supply remains tight in the New Zealand market. The premium positioning of our portfolio and the tension in grape supply will support continued value growth from our New Zealand operations.

In Spain, we restructured our operations and continued to focus on driving the mix shift from low value table wine to more premium categories. In the second half, our volumes grew 5% and net turnover grew 10% with good growth across the premium portfolio. In the year as a whole,

30

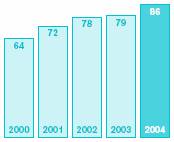

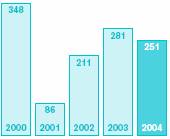

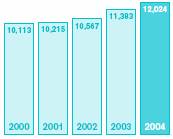

Quick Service Restaurants trading profit

£m

Quick Service Restaurants distribution points

Quick Service Restaurants distribution points | | | |

12,024 points | | | | | | |

| | | | | | |

| | | | | % | |

| 1 | Dunkin’ Donuts | | 51 | |

| 2 | Baskin-Robbins | | 45 | |

| 3 | Togo’s | | 4 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Quick Service Restaurants system-wide sales | | | |

£2,718m | | | | | | |

| | | | | | |

| | | | | % | |

| 1 | North America | | 84 | |

| 2 | International | | 16 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

volumes declined 7% but delivered seven percentage points of price/mix improvement to give flat overall turnover.

Global Operations and Duty Free

During the year, we restructured our Global Operations activities around a simpler functional model based upon regional manufacturing units, supply chain, procurement, finance, human resources and technical operations. This new structure is enabling us to leverage our global scale more effectively, to transfer best practice, to speed up decision-making and deliver better utilisation of our assets. Global Operations has continued to improve productivity by 3% for Spirits & Wine, measured as cases produced per employee. This improvement has been achieved across the key production centres.

Our Duty Free business has grown well with core brand volumes up 8%. The growth came from nearly all the brands with particularly strong performances from aged Ballantine’s in Asia, Sauza in the US and Europe, Beefeater and Canadian Club in the US. Traffic numbers have improved during the year, particularly in Asia and the US which were affected by the SARS virus and the Gulf War, respectively, last year. The premium wine brands also performed well with good growth from across the portfolio following improved distribution and listings in airport shops.

Quick Service Restaurants

• Distribution points up 6%

• Number of combination stores up 18%

• System-wide sales growth of 12%

• Turnover down 3%

• Trading profit up 21%

Quick Service Restaurants had an excellent year with profits up 21% to £86m driven by continued growth in same store sales, the contribution from new stores and from the cost savings resulting from last year’s reorganisation. Distribution points increased by 6% with new store openings in both the US and internationally. Global system-wide sales increased by 12%. However, overall turnover has fallen by 3% (£7m) to £226m, reflecting the final transition of Baskin-Robbins from producing and selling ice cream to US franchisees (which is now fully contracted out) to a wholly royalty-based model. Excluding the effect of this outsourcing, turnover is up 6%. Gross profit increased by 6% to £208m.

Dunkin’ Donuts is the key growth driver for QSR with a 13% increase in global system-wide sales. This reflects US same store sales up 6.9% and a 6% increase in global distribution points. The same store sales growth exceeds the rate for the overall industry and is driven by innovation and excellent marketing. In particular, a new range of coffee offerings including latte, cappuccino and espresso products was launched in October 2003. During the summer, the range was extended to include iced coffee options which also proved very popular. The launch exceeded all expectations and helped beverages to grow by 13%. The launch has been supported by the introduction of new high-speed coffee machines that support Dunkin’ Donuts’ reputation for speed, quality and value for money. On the baked goods side, we introduced a new apple pie product and new breakfast sandwich formats.

Baskin-Robbins grew global system-wide sales by 10%. This was driven by same store sales growth and a 7% increase in new store openings. US same store sales grew 2.1%, benefiting from a movie co-promotion with the recent Dreamworks film, Shrek 2, which saw the launch of new flavours such as Fiona’s Fairytale, Shrek’d Out Chocolate Mint and Shrek’s Hot Sludge Sundae. We also relaunched Cappuccino Blast for the summer with good results and successfully trialled a new store format in California. The key innovations for the new store concept are a beverage bar, a new cake display and the introduction of a new soft-serve ice cream to which customers can add their own toppings. The initial

31

‘Our focus on consistent profit growth and working capital management is delivering improved cash flows. As a result, we have continued to reduce our net debt.’

Graham Hetherington,

Chief Financial Officer

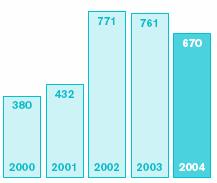

Net debt

£m

Net cash flow from operating activities

£m

results are encouraging. To support the international business, which accounts for almost half of Baskin-Robbins stores, we introduced a global advertising fund in conjunction with the franchisees to deliver a more co-ordinated and cost-effective approach to marketing in our international markets.

The difficult economic conditions in California and the increasingly competitive environment has held back the sales of Togo’s which recorded an 8% decline in system-wide sales. However, the store innovation and refurbishment programme, which has now covered around half of the stores, is delivering improved results. The new store formats provide improved menu boards and we have introduced new products such as low carbohydrate bread and new salad dressings.

Multi-branded stores, which combine the Dunkin’ Donuts and Baskin-Robbins restaurants in one location, increased by 18% to over 1,300 store locations. This is a key driver of new store openings and is supported by the brands’ complementary day-part offering and brings significant benefits to our franchisees through improved scale and operating efficiencies, along with increased choice for consumers.

This year’s results also reflect the benefit of the restructuring that we implemented during 2003. The new structure has increased the focus on the three brands and is improving operational systems and standards, menu and product development and the expansion of the international business. We have also generated cost savings in the period of £6m.

Britannia Soft Drinks

The Group’s share of Britannia’s profits for the period was £23m (2003: £20m). Allied Domecq and the other shareholders of Britannia Soft Drinks Limited have also agreed subject, inter alia, to market conditions, to consider an initial public offering of Britannia Soft Drinks, between 1 January 2005 and 31 December 2008. Allied Domecq has a 23.75% share of Britannia Soft Drinks Limited.

Taxation

The normalised tax charge for the year has remained at 24%, in line with last year.

Goodwill and exceptional items

Goodwill amortisation totalled £40m (2003: £40m). The exceptional items include profits on property disposals (£14m),an additional profit on the disposal of Panrico (£20m), offset by costs incurred in restructuring the Spirits & Wine business (£31m) and asset write-downs (£5m).

Property disposals related primarily to assets within the premium wine business. The consideration for the disposal of our 50% interest in Panrico in March 2000 included an additional payment of £20m to be paid by the end of March 2006 or earlier, contingent upon future events. On 19 August 2004, we agreed to receive this payment from Panrico in full and final settlement of the original sale and purchase agreement.

The restructuring programme is aimed at reducing the overlap between central, regional and market-focused functions and has enabled us to be leaner and more efficient, speed up decision-making and reinforce accountability throughout the business. The programme has delivered operational savings this year of £15m.

Cash flow

Last year, cash flow benefited from the Mexican excise rebate of £38m (net of tax) and the timing of duty payments of around £40m. Excluding these non-repeatable items, free cash flow improved by £88m despite absorbing a number of additional outlays such as increased pension contributions and restructuring costs. We have continued to focus on trade working capital management and reducing the level of capital expenditure and active management of the asset base through disposals of non-strategic assets. Our interest payments were £10m lower compared with last year, benefiting from the lower average net debt.

32

(1) Louise Crawford

Pensions

UK

(2) Heather Sabia

Sales

US

(3) Jong-Mi Lee

Assistant Manager

Korea

(4) Juan Laso

Treasury

Spain

Free cash flow after dividends

£m

Treasury operations and foreign exchange

The Group operates a centralised treasury managing interest rate and foreign exchange risk and financing. The Board agrees and reviews risk management policies.

We operate a prudent hedging policy. Net currency exposures on transactions are hedged forward for between 12 and 18 months using a blend of foreign exchange forwards and options. As hedges fall away, if the currencies remain depreciated, the margins of the imported products are negatively affected.

It is our policy not to hedge the impact of foreign exchange movements on the translation of our overseas earnings into Sterling. For constant rate reporting purposes, our prior year profit before tax was reduced by £38m, primarily due to the weakening of the US dollar and Mexican peso.

We anticipate, based on current exchange rates and the hedge contracts in place, that trading profit will be adversely affected during the next financial year by around £30m, including £20m from currency exposures on transactions.

Our balance sheet is also exposed to currency translation impacts. Our policy is to match our currency of debt in proportion to foreign currency earnings in order to reduce this exposure.

The amount of risk to any counterparty is restricted according to their credit rating. We continually monitor our exposure to counterparties and for any changes in their credit rating.

Exposures to interest rate fluctuations charged against our borrowings are managed using interest rate swaps and interest rate options. It is our policy to keep between 60% and 80% of net debt at fixed rates of interest with a target of 70%.

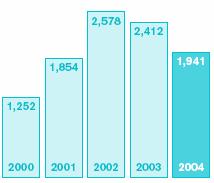

Net debt has reduced by £471m during the year from £2,412m to £1,941m. This improvement includes a favourable currency translation impact on our borrowings of £193m, which is largely due to the US dollar weakness. Net debt reduction from cash flows was £278m, benefiting from the Panrico receipt (£20m).

At 31 August 2004, EV gearing (net debt as a percentage of market capitalisation plus net debt) was 28% (2003: 36%). Interest cover based on normalised EBITDA was 5.4 times and cover based on normalised EBITA was 4.8 times.

Pensions

As anticipated, the profit and loss charge under FRS 17 was £51m (2003: £49m), with a £32m (2003: £29m) charge within trading profit and a £19m (2003: £20m) impact within finance charges. Within the framework of FRS 17, we are able to confirm the charge for 2005 will be similar to 2004.

The post-tax deficit included in the balance sheet at 31 August 2004 was £387m compared with £405m at 31 August 2003.

New accounting standards and other global GAAP issues

UK standards

We have adopted ‘FRS 17 – Retirement benefits’ from 1 September 2003 which has led to a restatement of the figures for the year ended 31 August 2003, with a £16m increase in trading profit, a £20m increase in finance charges and a £1m decrease in the tax charge.

The amendment to ‘FRS 5 – Reporting the substance of transactions’ has resulted in a number of items which were previously classified as operating costs (£69m) and advertising and promotion (£24m) to be treated as discounts, reducing turnover by £93m for the year ended 31 August 2003. Trading profit was not affected.

33

(1) Chung-Hwan Moon

Production

Korea

(2) Maria Gálvez

IT

Spain

(3) Kev Rowlands

Finance

UK

(4) Raquel Campillo

Paralegal

Spain

(5) Richard Hill

World Wines

UK

(6) John Petch

Customer Management

Lani Montoya

Human Resources

US

The impact of these accounting standards on the profit and loss account for the year ended 31 August 2003 is summarised in the tables opposite.

We have also complied with ‘UITF 38 – Accounting for ESOP Trusts’ which has resulted in a reclassification of shares held in employee trusts from investments to Shareholders’ funds, reducing net assets by £129m at 31 August 2003. There were no changes to reported profits for the year ended 31 August 2003.

International Financial Reporting Standards

All EU companies listed on an EU stock exchange will be required to report their consolidated accounts in accordance with International Financial Reporting Standards (‘IFRS’), as published by the International Accounting Standards Board (‘IASB’), for all accounting periods commencing on or after 1 January 2005.

Accordingly, we will present our first set of full financial statements under IFRS for the year ending 31 August 2006. This will require a full profit and loss account, balance sheet and cash flow statement for the year ending 31 August 2005 for comparative purposes. For US GAAP reporting, the US Securities and Exchange Commission has yet to determine whether we are also required to present comparatives for the year ended 31 August 2004.

We have established a project team to ensure that appropriate processes and procedures are in place to achieve the transition to IFRS. The project team is addressing all implementation aspects, including changes to accounting policies, systems implications and wider business issues that may arise. The implementation plan is dependent upon the completion of the standard-setting process by the IASB and the endorsement of such standards by the EU.

The Group has not yet determined the full effects of adopting IFRS. However, at this stage we believe that the major differences between our current accounting practice and IFRS will relate to accounting for financial instruments, accounting for business combinations, and accounting for fixed assets and stock under the agriculture standard.

US GAAP

In the course of our preparatory work to convert our financial statements from UK GAAP to IFRS, we have identified the need to correct our prior reconciliation to US GAAP. The correction relates to the foreign currency translation of certain assets and liabilities in connection with the functional currencies used in past business combinations. The Group has restated the US GAAP reconciliation for prior periods and the impact in 2003 was a £1m charge on net income, a £105m credit to comprehensive income and a £26m reduction in Shareholders’ equity. Further information can be found on page 82. This reconciliation does not affect any of our UK GAAP financial statements or cash flows under US or UK GAAP.

34

Constant exchange rate reporting

The following tables provide a reconciliation between the 2003 reported results and those shown at constant exchange rates in the Operating and Financial Review.

Geographical analysis – Group turnover and trading profit

In line with previous statements, the trading profits of the regions shown in this review are on a management reporting basis at constant exchange rates, rather than on a statutory basis at each year’s actual exchange rates, as shown in note 2 to the accounts. The table to the right shows the foreign exchange effect of restating last year’s reported trading profit for each region at this year’s actual exchange rates. ‘Others’ in the table includes Global Operations (including profit from the sale of bulk whisky), stand-alone duty free operations and central costs not allocated to sales and marketing regions. The profit decline in ‘Others’ principally reflects increased central marketing costs and the additional costs associated with the implementation of the requirements of the Sarbanes-Oxley Act of 2002 and International Financial Reporting Standards.

| | 2003 | | 2004 | |

| | Reported

2003 | | FRS 5/

FRS 17

restatement | | Foreign

exchange | | At 2004

exchange | | Reported

2004 | | Growth

at 2004

exchange | |

| | £m | | £m | | £m | | £m | | £m | | % | |

Group | | | | | | | | | | | | | |

Turnover | | 3,410 | | (93 | ) | (161 | ) | 3,156 | | 3,229 | | 2 | |

Trading profit | | 621 | | 16 | | (43 | ) | 594 | | 657 | | 11 | |

Finance charges | | (126 | ) | (20 | ) | 5 | | (141 | ) | (136 | ) | (4 | ) |

Profit before tax | | 495 | | (4 | ) | (38 | ) | 453 | | 521 | | 15 | |

Taxation | | (119 | ) | 1 | | 9 | | (109 | ) | (125 | ) | 15 | |

Minority interests | | (16 | ) | — | | — | | (16 | ) | (14 | ) | (13 | ) |

Earnings | | 360 | | (3 | ) | (29 | ) | 328 | | 382 | | 16 | |

Weighted average number of Ordinary | | | | | | | | | | | | | |

Shares (millions) | | 1,075 | | — | | — | | 1,075 | | 1,076 | | | |

Normalised earnings per share (pence) | | 33.5 | | (0.3 | ) | (2.7 | ) | 30.5 | | 35.5 | | 16 | |

| | 2003 | | 2004 | |

| | Reported

2003 | | FRS 5/

FRS 17

restatement | | Foreign

exchange | | At 2004

exchange | | Reported

2004 | | Growth

at 2004

exchange | |

| | £m | | £m | | £m | | £m | | £m | | % | |

Spirits & Wine | | | | | | | | | | | | | |

Turnover | | 3,151 | | (93 | ) | (135 | ) | 2,923 | | 3,003 | | 3 | |

Duty | | (671 | ) | — | | 28 | | (643 | ) | (618 | ) | (4 | ) |

Net turnover | | 2,480 | | (93 | ) | (107 | ) | 2,280 | | 2,385 | | 5 | |

Advertising and promotion | | (437 | ) | 24 | | 17 | | (396 | ) | (421 | ) | 6 | |

Trading profit | | 522 | | 16 | | (35 | ) | 503 | | 548 | | 9 | |

Geographical analysis – Group net turnover

| | 2003 | | 2004 | |

| | Reported

2003 | | FRS 5/

FRS 17

restatement | | Foreign

exchange | | At 2004

exchange | | Reported

2004 | | Growth

at 2004

exchange | |

| | £m | | £m | | £m | | £m | | £m | | % | |

North America | | 649 | | (15 | ) | (55 | ) | 579 | | 632 | | 9 | |

Europe | | 762 | | (49 | ) | 10 | | 723 | | 734 | | 2 | |

Latin America | | 303 | | (2 | ) | (41 | ) | 260 | | 268 | | 3 | |

Asia Pacific | | 258 | | (12 | ) | (14 | ) | 232 | | 226 | | (3 | ) |

Premium Wine | | 463 | | (12 | ) | (5 | ) | 446 | | 475 | | 7 | |

Others | | 45 | | (3 | ) | (2 | ) | 40 | | 50 | | 25 | |

Spirits & Wine | | 2,480 | | (93 | ) | (107 | ) | 2,280 | | 2,385 | | 5 | |

QSR | | 259 | | — | | (26 | ) | 233 | | 226 | | (3 | ) |

Total | | 2,739 | | (93 | ) | (133 | ) | 2,513 | | 2,611 | | 4 | |

Geographical analysis – Group trading profit

| | 2003 | | 2004 | |

| | Reported

2003 | | FRS 5/

FRS 17

restatement | | Foreign

exchange | | At 2004

exchange | | Reported

2004 | | Growth

at 2004

exchange | |

| | £m | | £m | | £m | | £m | | £m | | % | |

North America | | 182 | | — | | (23 | ) | 159 | | 183 | | 15 | |

Europe | | 114 | | — | | 8 | | 122 | | 139 | | 14 | |

Latin America | | 54 | | — | | (12 | ) | 42 | | 44 | | 5 | |

Asia Pacific | | 78 | | — | | (7 | ) | 71 | | 68 | | (4 | ) |

Premium Wine | | 95 | | — | | (8 | ) | 87 | | 98 | | 13 | |

Others | | (1 | ) | 16 | | 7 | | 22 | | 16 | | (27 | ) |

Spirits & Wine | | 522 | | 16 | | (35 | ) | 503 | | 548 | | 9 | |

QSR | | 79 | | — | | (8 | ) | 71 | | 86 | | 21 | |

Britannia | | 20 | | — | | — | | 20 | | 23 | | 15 | |

Total | | 621 | | 16 | | (43 | ) | 594 | | 657 | | 11 | |

35

Corporate social responsibility

Our Shareholders don’t want us chasing short-term profits at the expense of long-term prosperity. Rather, they want us to build a sustainable business. So we have to balance three different sets of priorities: economic, environmental and social.

We scored 92% in the 2003 Business in the Community UK index of corporate responsibility, compared with 78% in 2002. This places us in the premier league of companies, coming 24th. These figures establish us as sector leaders, ahead of both Diageo (34th) and Scottish and Newcastle (82nd) in the ‘Top 100 Companies that Count’. We’re also listed in the FTSE4Good and the Dow Jones Sustainability Index.

Economic

We exist to make money for our shareholders, both now and in the long-term. But companies are increasingly going to be judged by how they behave as well as how much they earn. Through the jobs we create, the taxes we pay and the services they help to fund, we have an impact on the wider economies of every place we operate. And experience tells us that being responsible in our approach to society and the environment makes sound business sense in the long-term.

Environmental

We strive to make a positive difference in the places where we operate – to the people who live and work there as well as to the natural environment. What we’ve already achieved in this area has put us at the forefront of our industry. The Maker’s Mark distillery in Kentucky, for example, this year achieved three international standards for quality, environmental, and health and safety (ISO 9001:2000; ISO 14001; and OHSAS 18001) and Allied Domecq is working towards all production units achieving these three standards.

We’re the leader in our sector for the eighth consecutive year in the Business in the Environment index. And we’re doing more every year though our commitment to ISO14001 as our global production standard. Over 80% of our production sites have plans in place to minimise water use, reduce waste and CO2 emissions and save energy.

Examples of the practical impact of our environmental policy can be found in the ‘our responsibilities’ section of our website (www.allieddomecq.com).

Social

As one of the world’s largest producers of alcoholic drinks we have always been aware that our business has responsibilities that go well beyond our duty to make money for shareholders.

Alcohol can be life enhancing, and brings pleasure to millions of people. But if it’s abused it can cause damage.

We’re in regular touch with the scientific, medical and public health communities, and encourage active debate on the development of public health policies for alcohol that balance government legislation, industry self-regulation and individual responsibility.

As a company that operates all over the world, we’re highly sensitive to the different attitudes to alcohol in different societies. The age at which young people are first introduced to alcohol varies widely, as do legal drinking ages. But all young people should be protected from the ill-effects of inappropriate or under-age drinking, and every year we support suitable programmes.

Whenever and wherever we market our products we take enormous care not to encourage excessive drinking, or inadvertently target people under the legal drinking age. We believe in sticking to our own marketing code, even when it’s more restrictive than local legislation.

Indeed, as far as we know, we’re the only major alcoholic drinks company in the world that asks an independent review board to check the integrity of its marketing.

The Marketing Review Board advises us on whether we are abiding by our own standards and helps us identify and address any risks that a particular campaign might pose to our reputation – locally or across the world. The board is also helping us develop our standards so that we will be able to anticipate issues and act before problems arise.

36

(1) Allied Domecq

Social Report 2004.

(2) Nori Arienza

European POS Lead Buyer Spain

(3) Allied Domecq’s corporate advertisement for responsible drinking.

We want to lead our industry in the move towards a more sustainable and self-regulatory approach to advertising, and the Marketing Review Board shows that this can be done.

In April 2004, we enhanced our ethical trading policy, the ownership of which rests ultimately with the main Board Director responsible for our social accountability. To assess compliance we issued a self-assessment questionnaire to current suppliers and, by August 2004, 715 suppliers, equating to an annualised spend of £680m, had completed it. The new policy is now part of all new and renewed contracts.

We believe our suppliers have a role to play in ensuring that we build a truly sustainable business. High workplace standards, good health and safety, fair pay and employment conditions, no discrimination or bribery, and care for the environment are elements of any successful, professionally-run business.

We’re a big company and that means we can have an influence on the ethical and environmental standards in place throughout our supply chain – though where we buy on open commodity markets we aren’t in direct control of the impact we have. But some raw materials, such as agave and grapes, do come direct from farmers, and in these cases we can work with our suppliers to improve conditions.