SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

REGENERATION TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

REGENERATION TECHNOLOGIES, INC.

11621 Research Circle

Alachua, Florida 32615

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Regeneration Technologies, Inc., to be held on Monday, April 28, 2003 at 10:00 a.m., Eastern time, at the University of Florida Hotel & Conference Center, 1714 SW 34th Street, Gainesville, Florida.

The accompanying formal Notice of Meeting and Proxy Statement set forth proposals for your consideration this year. You are being asked to elect one director to serve for a term of three years.

At the meeting, we will also report on our affairs and provide a discussion period for questions and comments of general interest to stockholders.

We look forward to personally greeting those of you who are able to be present at the meeting. However, whether or not you are able to be with us at the meeting, it is important that your shares be represented. Accordingly, we request that you sign, date and mail, at your earliest convenience, the enclosed proxy in the envelope provided for your use.

Thank you for your cooperation.

Very truly yours, |

|

|

Brian K. Hutchison Chairman, President and Chief Executive Officer |

March 31, 2003

REGENERATION TECHNOLOGIES, INC.

11621 Research Circle

Alachua, Florida 32615

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice Is Hereby Given that the Annual Meeting of Stockholders of Regeneration Technologies, Inc. will be held on Monday, April 28, 2003 at 10:00 a.m., Eastern time, at the University of Florida Hotel & Conference Center, 1714 SW 34th Street, Gainesville, Florida for the following purposes:

| | (1) | | To elect one director to serve for the ensuing three years; and |

| | (2) | | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Only stockholders of record at the close of business on March 26, 2003 will be entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

We cordially invite all stockholders to attend the Annual Meeting in person.However, whether or not you plan to attend the Annual Meeting in person, we urge you to complete, date and sign the enclosed form of proxy and return it promptly in the envelope provided. No postage is required if you mail the proxy in the United States. Stockholders who attend the Annual Meeting may revoke their proxy and vote their shares in person.

By Order of the Board of Directors |

|

|

Thomas F. Rose Vice President, Chief Financial Officer and Secretary |

Alachua, Florida

March 31, 2003

REGENERATION TECHNOLOGIES, INC.

11621 Research Circle

Alachua, Florida 32615

PROXY STATEMENT

GENERAL INFORMATION

Policy Solicitation

This Proxy Statement (first mailed on or about March 31, 2003) is furnished to the holders of our common stock as part of the solicitation by our board of directors of proxies for use at the Annual Meeting of Stockholders or at any adjournment thereof. The Annual Meeting will be held on Monday, April 28, 2003, at 10:00 a.m., Eastern time, at the University of Florida Hotel & Conference Center, 1714 SW 34th Street, Gainesville, Florida.

We are holding the Annual Meeting in order to elect one director to serve for the ensuing three years.

Management is not currently aware of any other matters to come before the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons designated as proxies intend to vote in accordance with their best judgment on these matters.

Proxies for use at the Annual Meeting are being solicited by our board of directors. Proxies will be solicited chiefly by mail; however, certain of our officers, directors, employees and agents, none of whom will receive additional compensation for their efforts, may solicit proxies by telephone or other personal contact. We will bear the cost of the solicitation of the proxies, including postage, printing and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares of our common stock.

Revocability and Voting of Proxy

We are enclosing a form of proxy for use at the Annual Meeting and a return envelope for the proxy. You may revoke the authority granted by the execution of a proxy at any time before the effective exercise of the powers conferred by that proxy by: (1) filing with the Secretary a written notice of revocation or a duly executed proxy bearing a later date, or (2) voting in person at the Annual Meeting. Shares of our common stock represented by properly executed and unrevoked proxies will be voted in accordance with the instructions specified in such proxies.

Record Date and Voting Rights

On March 26, 2003, there were 26,117,551 shares of our common stock outstanding, each of which is entitled to one vote upon each of the matters to be presented at the Annual Meeting. Only stockholders of record at the close of business on March 26, 2003 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. The holders of a majority of the outstanding shares of our common stock, present in person or by proxy and entitled to vote, will constitute a quorum at the Annual Meeting. If you do not vote for a nominee or proposal, or you indicate “withholding authority” or “abstain” on your proxy card, your vote will not count either for or against the nominee or proposal. Also, if your broker does not vote on the proposal, it will have no effect on the vote with respect to the proposal. However, abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum.

The affirmative vote of the holders of a plurality of the shares of our common stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required for the election of directors.

SECURITY OWNERSHIP OF OFFICERS, DIRECTORS

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information as of March 26, 2003 regarding the beneficial ownership of our common stock by: (1) each person known by us to own beneficially more than 5% of our outstanding common stock; (2) each of our directors and nominees for director; (3) each executive officer named in the Summary Compensation Table below; and (4) all of our directors and executive officers as a group. Except as otherwise specified, the named beneficial owner has the sole voting and investment power over the shares listed. Unless otherwise indicated, the address of the beneficial owner is: c/o Regeneration Technologies, Inc., 11621 Research Circle, Alachua, Florida 32615.

| | | Shares Beneficially Owned(1)

|

Name and address of Beneficial Owner

| | Number

| | Percent

|

Brian K. Hutchison(2) | | 104,000 | | * |

Thomas F. Rose | | — | | * |

Caroline A. Hartill(3) | | 8,000 | | * |

Charles Randal Mills(3) | | 28,280 | | * |

Louis E. Barnes III(3) | | 34,540 | | * |

Thomas E. Brewer(4) | | 6,000 | | * |

Frederick C. Preiss(4) | | — | | * |

Philip R. Chapman(5) | | 1,025,582 | | 3.9 |

Peter F. Gearen(3) | | 28,800 | | * |

Michael J. Odrich(6) | | 1,643,885 | | 6.3 |

David J. Simpson(7) | | 4,157 | | * |

|

RS Investment Management Co. LLC 555 California Street, Suite 2500 San Francisco, California 94104(8) | | 2,975,600 | | 11.4 |

|

LB I Group Inc. c/o Lehman Brothers Inc. 3 World Financial Center New York, New York 10285(6) | | 1,629,485 | | 6.2 |

|

Federated Kaufmann Fund 140 East 45th Street, 43rd Floor New York, New York 10017(9) | | 1,500,000 | | 5.7 |

|

All executive officers and directors included above as a group (9 persons)(10) | | 2,877,244 | | 11.0 |

| * | | Represents beneficial ownership of less than 1%. |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power and/or investment power with respect to those securities. Shares of common stock issuable pursuant to options, to the extent such options are exercisable or convertible within 60 days after March 26, 2003, are treated as outstanding for purposes of computing the percentage of the person holding such securities but are not treated as outstanding for purposes of computing the percentage of any other person. |

| (2) | | Includes an option to purchase 100,000 shares of our common stock. |

| (3) | | Represents options to purchase shares of our common stock. |

| (4) | | Ceased to be employed by us during 2002. Mr. Brewer holds an option to purchase 6,000 shares of our common stock which expires on June 16, 2003. |

| (5) | | Euro-America-II, L.P. holds 962,558 shares of our common stock and options to purchase 15,336 shares of our common stock, which Mr. Chapman may be deemed to beneficially own by virtue of his position as a partner in a partnership that is a member of the general partner of Euro-America-II, L.P. Mr. Chapman |

2

| | disclaims beneficial ownership of all shares other than those held in his name and to the extent of his pecuniary interest in Euro-America-II, L.P. |

| (6) | | Mr. Odrich’s holding includes an option to purchase 14,400 shares of our common stock which is held in his name. We have been advised that Mr. Odrich has investment control with respect to shares of our common stock held by LB I Group Inc., a wholly-owned subsidiary of Lehman Brothers Holdings Inc. The LB I holding includes an option to purchase 14,400 shares of our common stock. Mr. Odrich disclaims beneficial ownership of all shares other than those held in his name. |

| (7) | | Mr. Simpson holds 4,000 shares of common stock in his own name and his wife owns 157 shares of common stock as part of an individual retirement account. Mr. Simpson disclaims beneficial ownership of all shares other than those held in his name. |

| (8) | | Information is derived from a Schedule 13G, dated December 31, 2002 (the “RSI Schedule 13G”) filed by RS Investment Management Co. LLC, or RSI, with the Securities and Exchange Commission. Such filing states that RSI is deemed to have beneficial ownership as of December 31, 2002 of 2,975,600 shares. |

| (9) | | Information supplied by beneficial owner. |

| (10) | | Includes options to purchase 243,756 shares of our common stock. Does not reflect any shares that may be held by Messrs. Brewer or Preiss, who are no longer employed by us. |

3

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Our board is divided into three classes with each director serving a three-year term and one class being elected each year. Mr. Chapman is in the class of directors whose term expires in 2003. Each of these individuals will serve as a director until his term ends, subject to his earlier death, resignation or removal.

At the Meeting, Mr. Chapman is to be elected to serve a three-year term expiring at the 2006 Annual Meeting of Stockholders. It is the intention of the persons named in the accompanying form of proxy to nominate as a director and to vote such proxy for the election of the nominee named below. In the event any nominee should become unable to serve as a director, an eventuality which management has no reason to believe will occur, proxies may be voted for another nominee. The nominee has consented to be named and has indicated his intent to serve if elected.

The nominee and our continuing directors, their respective ages, the year in which each first became one of our directors and their principal occupations or employment during the past five years are as follows:

Director

| | Age

| | Year First Became Director

| | Employment History

|

|

NOMINEE FOR ELECTION FOR A TERM ENDING 2006 |

|

Philip R. Chapman | | 41 | | 1998 | | Mr. Chapman has served as a member of our board of directors since we began operations in February 1998. He is the President of Venad Administrative Services, Inc., a management services company, and has been a General Partner of Adler & Company, an investment management company, since 1995. Mr. Chapman is also a director of Shells Seafood Restaurants, Inc. He holds a B.S. and an M.B.A. from Columbia University. |

CONTINUING DIRECTORS TERM ENDING 2004 |

|

Brian K. Hutchison | | 43 | | 2002 | | Mr. Hutchison joined us on December 1, 2001 as President and Chief Executive Officer and became Chairman of the Board in December 2002. Prior to this time, he served 12 years in various positions for Stryker Corporation, a leading worldwide medical services company, most recently as Vice President of worldwide product development and distribution and previously as Senior Vice President and Chief Operating Officer for Stryker Howmedica’s Osteonics Division. Mr. Hutchison earned a B.S. in Business Administration from Grand Valley State University in 1981. He also completed the Program for Management Development from Harvard Business School in 1995. |

4

Director

| | Age

| | Year First Became Director

| | Employment History

|

|

David J. Simpson | | 56 | | 2002 | | Mr. Simpson has served as a member of our board of directors since October 2002. He served as formerly Chief Financial Officer and Secretary of Stryker Corporation, a leading worldwide medical products and services company, from June 1987 until January 1, 2003, when he was appointed Executive Vice President of Stryker Corporation. He had previously been Vice President and Treasurer of Rexnord Inc., a manufacturer of Industrial and aerospace products since 1985. Simpson earned a bachelor’s degree of business administration in accounting and finance from Western Michigan University and attended the advanced management program at Harvard University. |

|

CONTINUING DIRECTORS TERM ENDING 2005 |

|

Peter F. Gearen | | 54 | | 1998 | | Dr. Gearen has served as a member of our board of directors since we began operations in February 1998. Dr. Gearen was Chief of Staff at the Shands Hospital at the University of Florida and served as Assistant Dean of Clinical Affairs at the University of Florida College of Medicine from 1992 until 1999. He also has been an Associate Professor of Orthopedics at the University of Florida College of Medicine since 1993. He was appointed Chairman of the Department of Orthopedics in May 2002. Dr. Gearen holds a B.A. from Spring Hill College and an M.D. from the Stritch Loyola Medical School. |

|

Michael J. Odrich | | 38 | | 1998 | | Mr. Odrich has served as a member of our board of directors since we began operations in February 1998. Mr. Odrich is a Managing Director of Lehman Brothers Inc. and head of its Private Equity Division. He also is a member of the Lehman Brothers Operating Committee and Investment Committee. Mr. Odrich holds a B.A. from Stanford University and received an M.B.A. from Columbia University. Mr. Odrich also serves on the board of directors of PEMSTAR, Inc., an electronics manufacturing services company. |

Our board of directors met six times during 2002, with each director attending at least 75% of the total number of meetings.

Our board of directors has an Audit Committee and a Compensation Committee. Our Compensation Committee is currently comprised of Messrs. Chapman and Simpson. This committee is charged with reviewing

5

and approving the compensation and benefits of our key executive officers, administering our employee benefits plans and making recommendations to the full board of directors regarding these matters. The Compensation Committee met once during 2002.

Our Audit Committee is currently comprised of Messrs. Chapman, Gearen and Simpson. The functions performed by our Audit Committee include recommending to our board of directors the engagement of independent accountants for our annual audit and for advisory and other consulting services and reviewing our audited financial statements and accounting practices. We have adopted an Audit Committee Charter, a copy of which was attached to our proxy statement filed with the Securities and Exchange Commission on April 29, 2001 in connection with our 2001 Annual Meeting of Stockholders. The Audit Committee met ten times during 2002. Messrs. Chapman, Gearen and Simpson are independent directors as defined in the current rules of The Nasdaq Stock Market and under the Sarbanes-Oxley Act of 2002.

At present, we do not have a nominating committee. Nominees for positions on our board of directors are selected by our full Board of Directors. Members of our Compensation and Audit Committees are appointed by our board of directors.

Vote Required

Directors must be elected by a plurality of votes cast at the meeting. This means the nominees receiving the greatest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote shall be elected as directors. If you do not vote for a nominee, or you indicate “withholding authority” on your proxy card, your vote will not count either for or against the nominee. Also, if your broker does not vote on this proposal it will have no effect on the election.

THE BOARD OF DIRECTORS DEEMS THE ELECTION OF THE NOMINEE LISTED ABOVE AS DIRECTOR TO BE IN REGENERATION TECHNOLOGIES’ BEST INTERESTS AND IN THE BEST INTERESTS OF ITS STOCKHOLDERS AND RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEE.

6

EXECUTIVE OFFICERS OF THE COMPANY

Our executive officers and their respective ages and positions as of March 26, 2003 were as follows:

NAME

| | AGE

| | POSITION WITH THE COMPANY

|

Brian K. Hutchison | | 43 | | Chairman, President and Chief Executive Officer |

|

Thomas F. Rose | | 52 | | Vice President, Chief Financial Officer and Secretary |

|

Caroline A. Hartill | | 46 | | Vice President of Quality Assurance and Regulatory Affairs |

|

Charles Randal Mills | | 31 | | Vice President of Operations |

|

Louis E. Barnes, III | | 39 | | Vice President of Cardiovascular |

Brian K. Hutchison has served as our President and Chief Executive Officer since December 2001, and became Chairman of the Board in December 2002. Prior to this time, he served 12 years in various positions for Stryker Corporation, a leading worldwide medical services company, most recently as Vice President of worldwide product development and distribution and previously as Senior Vice President and Chief Operating Officer for Stryker Howmedica’s Osteonics Division. Mr. Hutchison earned a bachelor’s degree in Business Administration from Grand Valley State University in 1981. He also completed the Program for Management Development from Harvard Business School in 1995.

Thomas F. Rose has served as our Vice President, Chief Financial Officer and Secretary since May 2002. Mr. Rose served the previous ten years as vice president and chief financial officer at A. M. Todd Group, based in Kalamazoo, Michigan. From 1988 to1991, Mr. Rose was vice president and corporate controller for Sotheby’s Holdings Inc. in New York. Prior to this, Mr. Rose was an audit partner with Ernst & Whinney (currently Ernst & Young) in New York, providing audit, tax and consulting services for clients in a variety of industries for fifteen years. Mr. Rose earned a bachelor’s degree in business administration from Western Michigan University.

Caroline A. Hartill has served as our Vice President of Quality Assurance and Regulatory Affairs since December 2002 and our Executive Director of Quality Assurance and Regulatory Affairs since October 2001. Prior to that, Ms. Hartill was an independent consultant working with biotechnology and medical device companies worldwide. Ms. Hartill earned a bachelor’s degree in health sciences from Birmingham University in England, as well as a master’s degree in management from the University of Wolverhampton in England. Ms. Hartill has also earned master’s level credits in sterilization science from Manchester University.

Charles Randal Mills has served as our Vice President of Operations since May 2002 and our Director of Regulatory and Technical Affairs since January 2000. From 1998 until 1999, he served as our Senior Technical Affairs Manager. Dr. Mills was with the University of Florida Tissue Bank from 1994 until 1998, most recently as the Manager of Biomedical Services. Dr. Mills holds a bachelor’s degree in microbiology and physiology from the University of Florida. He completed his post-graduate training in clinical pathology at the Shands Hospital of the University of Florida, where he also received his Ph.D.

Louis E. Barnes, III has served as our Vice President of Cardiovascular since August 2000. Prior to that he served in various positions within the company. From 1992 to 1998, Mr. Barnes served in various positions with LifeNet Transplant Services, a tissue processing and procurement company, his last position being Director of Professional Services. Mr. Barnes holds a bachelor’s degree in Education from the University of Georgia.

7

EXECUTIVE COMPENSATION

The following table sets forth information concerning all cash and non-cash compensation for fiscal 2002, 2001 and 2000 awarded to, earned by or paid to our chief executive officer and our four most highly compensated executive officers other than our chief executive officer who were serving as executive officers at December 31, 2002, as well as two former executive officers who were not serving as executive officers at December 31, 2002.

Summary Compensation Table

| | | | | Annual Compensation

| | Long-Term Compensation Awards

| | | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Restricted Stock Awards ($)

| | Number of Securities Underlying Options/SARs (#)

| | LTIP Payouts ($)

| | All Other Compensation ($)

| |

Brian K. Hutchison Chairman, President and Chief Executive Officer | | 2002 2001 2000 | | $ | 352,054 20,192 — | | $ | 210,000 61,400 — | | — — — | | 600,000 500,000 — | | — — — | | — — — | |

|

Thomas F. Rose(1) Vice President, Chief Financial Officer and Secretary | | 2002 2001 2000 | | | 118,059 — — | | | 75,000 — — | | — — — | | 200,000 — — | | — — — | | 1,233 — — | (2) |

|

Caroline A. Hartill Vice President of Quality Assurance and Regulatory Affairs | | 2002 2001 2000 | | | 159,808 — — | | | 30,000 — — | | — — — | | 40,000 — — | | — — — | | 9,161 | (3) |

|

Charles Randal Mills Vice President of Operations | | 2002 2001 2000 | | | 140,190 — — | | | 40,000 — — | | — — — | | 100,000 — — | | — — — | | 7,765 — — | (4) |

|

Louis E. Barnes, III Vice President of Cardiovascular | | 2002 2001 2000 | | | 151,362 123,597 — | | | 20,000 — — | | — — — | | 60,000 35,000 — | | — — — | | 9,082 7,261 — | (3) |

|

Thomas E. Brewer(5) | | 2002 2001 2000 | | | 207,276 177,333 155,831 | | | — — — | | — — — | | — 30,000 — | | — — — | | 3,648 12,261 10,500 | (2) |

|

Frederick C. Preiss(6) | | 2002 2001 2000 | | | 183,400 178,500 156,281 | | | — 40,000 50,309 | | — — — | | — 30,000 132,000 | | — — — | | — 9,907 10,471 | (2) |

| (1) | | Mr. Rose began employment with us effective May 1, 2002. |

| (2) | | Represents payment for term life insurance. |

| (3) | | Represents matching contributions under our 401(k) Plan. |

| (4) | | Includes matching contributions under our 401(k) Plan of $7,481 and payment of $284 for term life insurance. |

| (5) | | Mr. Brewer ceased to be employed by us effective October 20, 2002. |

| (6) | | Mr. Preiss ceased to be employed by us effective May 8, 2002. |

8

The following table sets forth information on option grants in the fiscal year ended December 31, 2002 to the persons named in the Summary Compensation Table.

Option Grants in Last Fiscal Year

Name

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal Year

| | Exercise or Base Price Per Share

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1)

|

| | | | | | 5%

| | 10%

|

Brian K. Hutchison | | 600,000 | | 46.3 | | $ | 4.80 | | 5/29/2012 | | $ | 4,691,217 | | $ | 7,469,978 |

Thomas F. Rose | | 200,000 | | 15.4 | | | 4.80 | | 5/29/2012 | | | 1,563,739 | | | 2,489,993 |

Caroline A. Hartill | | 40,000 | | 3.1 | | | 4.80 | | 5/29/2012 | | | 312,748 | | | 497,999 |

Charles Randal Mills | | 100,000 | | 7.7 | | | 4.80 | | 5/29/2012 | | | 1,417,138 | | | 2,256,556 |

Louis E. Barnes III | | 60,000 | | 4.6 | | | 4.80 | | 5/29/2012 | | | 469,122 | | | 746,998 |

Thomas E. Brewer | | 20,000 | | 1.5 | | | 4.80 | | 6/16/2003 | | | 156,374 | | | 248,999 |

Frederick C. Preiss | | — | | — | | | — | | — | | | — | | | — |

| (1) | | Potential realizable value is based on the assumption that the price per share of common stock appreciates at the assumed annual rate of stock appreciation for the option term. The assumed 5% and 10% annual rates of appreciation compounded annually over the term of the option are set forth in accordance with the rules and regulations adopted by the Securities and Exchange Commission and do not represent our estimate of stock price appreciation. |

The following table sets forth information with respect to: (1) exercises of stock options during fiscal year 2002 and (2) unexercised stock options held at December 31, 2002 by the persons named in the Summary Compensation Table.

Aggregated Option Exercises In Last Fiscal Year

And Fiscal Year-End Option Values

| | | Option Exercises

| | Number of Unexercised Options Held at Fiscal Year End

| | Value of Unexercised In-the-Money Options at Fiscal Year End(2)

|

Name

| | Shares Acquired On Exercise

| | Value Realized(1)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Brian K. Hutchison | | — | | — | | 100,000 | | 1,000,000 | | | — | | $ | 3,186,000 |

Thomas F. Rose | | — | | — | | — | | 200,000 | | | — | | | 1,062,000 |

Caroline A. Hartill | | — | | — | | 8,000 | | 72,000 | | $ | 320 | | | 213,680 |

Charles Randal Mills | | — | | — | | 28,280 | | 127,360 | | | 80,198 | | | 561,859 |

Louis E. Barnes III | | — | | — | | 34,540 | | 102,400 | | | 113,149 | | | 295,888 |

Thomas E. Brewer | | — | | — | | 6,000 | | 87,200 | | | — | | | 486,792 |

Frederick C. Preiss | | — | | — | | 12,800 | | 101,600 | | | 42,368 | | | 516,872 |

| (1) | | The “value realized” represents the difference between the exercise price of the option and the closing price of our common stock on The Nasdaq Stock Market on the date of exercise. |

| (2) | | The value for an “in-the-money” option represents the difference between the exercise price of the option and the closing price of our common stock on The Nasdaq Stock Market on December 31, 2002 of $10.11. |

9

Equity Compensation Plan Information

The following table provides information as of December 31, 2002, with respect to the shares of our common stock that may be issued under our existing equity compensation plan.

| | | (A) | | (B) | | (C) |

Plan Category

| | Number of Securities to be Issued upon Exercise of Outstanding Options

| | Weighted Average Exercise Price of Outstanding Options

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A)

|

Equity Compensation Plans Approved by Stockholders | | 3,495,881 | | $ | 7.60 | | 317,127 |

|

Equity Compensation Plans Not Approved by Stockholders | | 0 | | | 0 | | 0 |

|

Total | | 3,495,881 | | $ | 7.60 | | 317,127 |

Employment Agreements

We entered into an employment agreement with Mr. Hutchison effective December 1, 2001. The agreement provides for an annual base salary of $350,000 for the first two years, after which his salary will be reviewed annually by our board of directors. The agreement expires on November 30, 2004. Mr. Hutchison is also eligible to receive an annual bonus, beginning in the first fiscal quarter of 2003, in an amount to be determined by our board of directors provided we achieve certain specified goals. When he entered into the employment agreement with us, Mr. Hutchison received a sign-on bonus and related tax gross-up totalling $61,400, temporary housing and moving expenses and an option to purchase 500,000 shares of our common stock. This option is subject to a stock option agreement under which one-fifth of the option vests on each anniversary of the date of the grant. In May 2002, Mr. Hutchison received an additional option to purchase 600,000 shares of our common stock, which also is subject to five-year vesting.

Our agreement with Mr. Hutchison provides for us to pay for a $1.0 million life insurance policy payable to a beneficiary of Mr. Hutchison’s choosing. Mr. Hutchison is also eligible to receive standard employee benefits and matching contributions to our 401(k) plan of up to 6% of his salary up to the maximum excludable dollar amount permitted by the Internal Revenue Code.If we terminate Mr. Hutchison without “cause,” he will be entitled to severance pay equal to his salary and benefits for one year from the date of termination. In the event of termination for “cause,” Mr. Hutchison will not be entitled to severance pay. In either case, or in the case of a voluntary termination by Mr. Hutchison, he will be precluded from competing with us for two years following termination.

We entered into an employment agreement with Mr. Rose effective May 1, 2002. The agreement provides for an annual base salary of $180,000 for the first two years, after which his annual base salary will be reviewed annually. The agreement expires on May 1, 2004, subject to automatic renewal. Mr. Rose is also eligible to receive a bonus at any time during the year, or after the close of the year. When he entered into the agreement, Mr. Rose also received an option to purchase 200,000 shares of our common stock. This option is subject to a stock option agreement under which one-fifth of the option vests each anniversary date of the grant.

We entered into an employment agreement with Ms. Hartill effective October 31, 2001. The agreement provides for an annual base salary of $150,000 for the first two years, after which her annual base salary will be reviewed annually. The agreement expires on October 31, 2003. Ms. Hartill is also eligible to receive a bonus at any time during the year, or after the close of the year. When she entered into the agreement, Ms. Hartill also received an option to purchase 40,000 shares of our common stock. This option is subject to a stock option agreement under which one-fifth of the option vests each anniversary date of the grant.

10

We entered into an employment agreement with Mr. Barnes effective June 21, 2000. The agreement provides for an annual base salary of $120,000 for the first two years, after which the annual base salary will be reviewed annually. Mr. Barnes’s base salary for 2002 was $151,362. Mr. Barnes is also eligible to receive a bonus at any time during the year, or after the close of the year. When he entered into the agreement, Mr. Barnes also received an option to purchase 7,500 shares of our common stock. This option is subject to a stock option agreement under which one-fifth of the option vests each anniversary date of the grant.

In June 1998, we entered into an employment agreement with Mr. Brewer which was terminated in September 2002 when Mr. Brewer left our employ. Mr. Brewer’s most recent annual base salary under the agreement was $204,141. In September 2002, we entered into a Separation Agreement and Release with Mr. Brewer under which we agreed to pay him six months of his base salary beginning in November 2002. In addition, we agreed to pay Mr. Brewer $7,851 biweekly for consulting services provided to the Company, along with his COBRA continuation premiums, through June 30, 2003 and pay his executive life insurance premiums through May 10, 2003. Under the agreement, Mr. Brewer agreed to a general release of any liability we may have had to him, including under his employment agreement. Mr. Brewer is precluded under his Separation Agreement and Release from competing with us through September 20, 2003.

In November 1998, we entered into an employment agreement with Mr. Preiss which was terminated in April 2002 when Mr. Preiss left our employ. Mr. Preiss’s most recent annual base salary under the agreement was $183,400. In April 2002, we entered into a Separation Agreement and Release with Mr. Preiss under which we agreed to pay him six months of his base salary beginning in May 2002. In addition, as part of the agreement, we agreed to pay Mr. Preiss $7,054 biweekly for consulting services provided to the Company, along with his COBRA continuation premiums, and pay his executive life insurance premiums through December 31, 2002. Under the agreement, Mr. Brewer agreed to a general release of any liability we may have had to him, including under his employment agreement. Mr. Preiss is precluded under his Separation Agreement and Release from competing with us through April 8, 2003.

2003 Incentive Compensation Plan

In February 2003 our board of directors approved our 2003 Incentive Compensation Plan. If we achieve certain sales, profit, cash flow and asset levels, the bonus structure allows for the creation of an incentive pool and eligible employees, including certain members of our management, receive cash awards from the pool on the basis of the achievement of company and individual goals.

Compensation of Directors

Our directors who are also our employees or officers do not receive any compensation specifically related to their activities as directors, other than reimbursement for expenses incurred relating to their attendance at meetings of our board of directors. Beginning January 1, 2003, our non-employee directors are eligible to receive an annual retainer of $15,000, to be paid in quarterly installments. In addition, our non-employee directors are eligible to receive a stipend of up to $2,000 per meeting, $500 to $2,000 per committee meeting and reimbursement for their expenses incurred relating to their attendance at meetings of the board of directors and committees thereof. Under our Omnibus Stock Plan, at the discretion of our board of directors or Compensation Committee, our directors also are eligible to receive awards of non-qualified stock options. In 2002, one of our non-employee directors received a grant of an option to purchase 3,000 shares of our common stock. In 2001, none of our non-employee directors received stock option grants.

Omnibus Stock Plan

In July 1998, our board of directors and stockholders adopted the Regeneration Technologies, Inc. Omnibus Stock Plan. A maximum of 4,406,400 shares were authorized for issuance pursuant to that plan. Through December 31, 2002, we issued options to purchase 4,089,273 shares of our common stock to our directors,

11

officers, employees and various third parties which provide services to us. As of December 31, 2002, options to purchase 831,696 shares were exercisable. The exercise prices of the options granted under the Omnibus Stock Plan range from $1.30 to $14.95. As of March 7, 2003, there were 267,127 shares of our common stock available for issuance under the plan.

The purposes of the plan are to promote our long-term growth and profitability by providing key personnel with incentives to improve stockholder value and to enable us to attract, retain and reward skilled employees. The plan permits the granting of stock options (including incentive stock options qualifying under Section 422 of the Internal Revenue Code of 1986 and non-qualified stock options), stock appreciation rights, restricted or unrestricted stock awards, phantom stock, performance awards, or any combination of the foregoing.

The plan is administered by our board of directors or any committee it may designate for this purpose. The board of directors makes the determination with respect to awards under the plan, including which eligible individuals are to receive awards under the plan and the specific terms, vesting conditions, if any, and number of shares of stock to which each award relates. Additionally, the board of directors may grant awards with different terms and conditions and also may accelerate the vesting of outstanding awards and options at any time. At the time the options are granted, the board of directors will set the price at which options can be exercised. However, options intended to qualify as incentive stock options as defined in Section 422 of the Internal Revenue Code of 1986 must have an exercise price at least equal to fair market value.

Option holders do not and will not have any rights as stockholders until they have exercised their options. The number of shares of our common stock covered by awards will be adjusted in the event of any stock split, merger, recapitalization or similar corporate event. This plan has a term of ten years, and expires in July 2009.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee has been an employee of ours. None of our executive officers serves as a member of the board of directors or the Compensation Committee of any other entity that has one or more executive officers serving as a member of our board of directors or our Compensation Committee.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

To our knowledge, our directors, executive officers and beneficial owners of more than ten percent of our common stock are in compliance with the reporting requirements of Section 16(a) under the Securities Exchange Act of 1934, other than the late filing of one report on Form 3 by Mr. Barnes.

12

REPORT OF THE COMPENSATION COMMITTEE

General. The Compensation Committee, presently consisting of Messrs. Chapman and Simpson, is responsible for the planning, review and administration of Regeneration Technologies’ executive compensation program. Prior to the establishment of the Compensation Committee, the board of directors administered the executive compensation programs, monitored corporate performance and its relationship to compensation of executive officers and made appropriate decisions concerning matters of executive compensation.

Our objective on the committee is to provide a superior return to stockholders. To support this objective, we believe we must attract, retain and motivate top quality executive talent. The executive compensation program we adopt is a critical tool in this process. The executive compensation program is designed to link executive compensation to Regeneration Technologies’ performance through at-risk compensation opportunities, providing significant reward to executives based on Regeneration Technologies’ success. The executive compensation program consists of base salary, annual cash incentive opportunities and long-term incentives represented by stock options.

Base Salary. The Compensation Committee recognizes the importance of a competitive compensation structure in retaining and attracting senior executives. The Compensation Committee annually reviews and establishes executive salary levels. The salaries received by executives generally reflect their levels of responsibility and other factors such as assessments of individual performance.

The compensation of Mr. Hutchison, our Chairman, President and Chief Executive Officer, was $562,054 during 2002. In December 2001, Regeneration Technologies hired Mr. Hutchison to serve as Chief Executive Officer and President of the company. In approving Mr. Hutchison’s employment agreement, the Compensation Committee recognized that in order to attract and retain an executive such as Mr. Hutchison, a competitive salary and benefits package would be required. Accordingly, it was decided that an annual salary of $350,000 for the first two years and annual review thereafter, together with the other benefits afforded under the agreement, would be appropriate. The Compensation Committee also decided that the immediate grant of an option to purchase 500,000 shares of Regeneration Technologies’ common stock, with the potential for further grants over the next three years totaling an additional 500,000 shares, would be an appropriate means to tie Mr. Hutchison’s compensation to the performance of the entire enterprise. In May 2002, the full board of directors (including the then-current Compensation Committee members) decided to grant Mr. Hutchison an option to purchase an additional 600,000 shares in lieu of the potential additional grants under his employment agreement.

Year 2003 Incentive Compensation Plan. Executive officers are eligible for annual cash performance bonuses under the Year 2003 Incentive Compensation Plan. If we achieve certain sales, profit, cash flow and asset levels, the bonus structure allows for the creation of an incentive pool and eligible employees, including certain members of our management, receive cash awards from the pool on the basis of Company and individual goals. The Compensation Committee believes that this form of compensation helps to more closely align the interests of employees with the interests of stockholders.

Stock Options. Stock option grants have historically been used by the company as part of its compensation program for employees, including executives and management team members. The stock option program permits employees to buy a specific number of shares of common stock in the future. Since stock options gain value only if the price of the common stock increases above the option exercise price, the use of stock option grants reflects our philosophy of linking compensation to performance. In addition, the Compensation Committee believes that stock option grants to executives and management team members help to provide an incentive for their continued employment and otherwise more closely align their interests with the interests of stockholders. We also have used stock options as part of compensation packages developed to attract highly qualified employment candidates.

13

Option grants made by the Compensation Committee during 2002 to executive officers included the grant of performance options for the purchase of 1,100,000 shares of common stock. These option grants were part of the Compensation Committee’s program to provide executives with an added long-term incentive through stock-based compensation. The options vest over the next 5 years, at 20% annually on the anniversary date of the grant.

The Compensation Committee believes that linking executive compensation to individual accomplishments as well as corporate performance results in a better alignment of compensation with corporate business goals and stockholder value. As strategic and performance goals are met or exceeded, resulting in increased value to stockholders, executives are rewarded commensurately. The Compensation Committee believes that compensation levels during fiscal year 2002 adequately reflect Regeneration Technologies’ compensation goals and policies.

Compensation Committee,

Philip R. Chapman

David J. Simpson

14

REPORT OF THE AUDIT COMMITTEE

The Audit Committee, presently consisting of Messrs. Chapman, Gearen and Simpson, reviews Regeneration Technologies’ financial reporting process, its system of internal controls, its audit process and the process for monitoring compliance with laws and regulations. All of the Audit Committee members satisfy the definition of independent director as established in the rules of The Nasdaq Stock Market and the Sarbanes-Oxley Act of 2002. The board of directors adopted a written charter for the Audit Committee on October 20, 2000, which is attached to the proxy statement filed with the Securities and Exchange Commission of April 29, 2001 in connection with the 2001 Annual Meeting of Stockholders.

Management is responsible for Regeneration Technologies’ financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. Regeneration Technologies’ independent auditors are responsible for auditing those financial statements. The responsibility of the Audit Committee is to monitor and review these processes.

The Audit Committee reviewed Regeneration Technologies’ audited consolidated financial statements with the board of directors and management, and discussed with Deloitte & Touche LLP, the independent auditors during the 2002 fiscal year, the matters required to be discussed by Statement of Auditing Standard No. 61. The Audit Committee received from Deloitte & Touche LLP the written disclosures and the letter required by Independent Standards Board Standard No. 1 and discussed with them their independence.

After reviewing and discussing the audited consolidated financial statements, the Audit Committee recommended that these audited consolidated financial statements be included in Regeneration Technologies’ Annual Report on Form 10-K. The Audit Committee has appointed Deloitte & Touche LLP, independent auditors, to audit the accounts of Regeneration Technologies for the year 2003, subject to approval of the scope of the audit engagement and the estimated audit fees.

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Regeneration Technologies specifically incorporates this information by reference, and shall not otherwise be deemed filed under these acts.

Audit Committee,

Philip R. Chapman

Peter F. Gearen

David J. Simpson

15

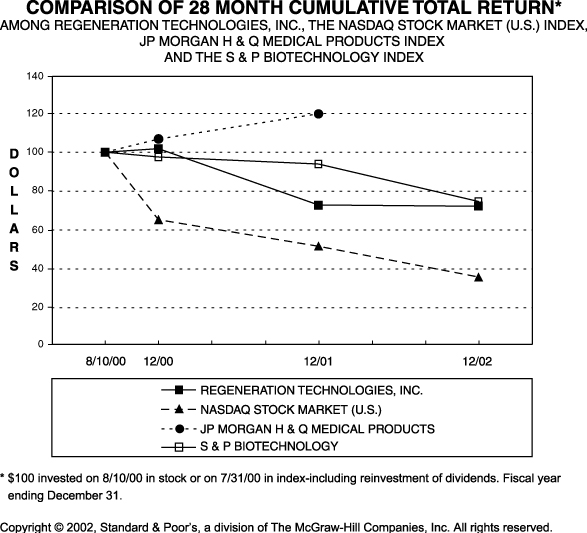

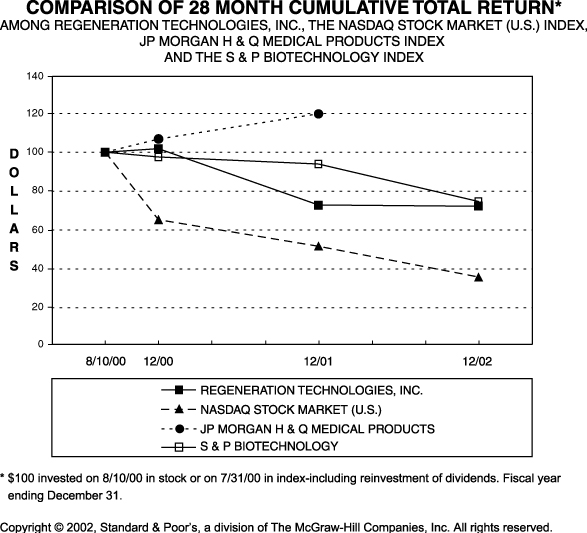

STANDARDS & POORS BIOTECHNOLOGY INDEX

COMPARISON OF STOCKHOLDER RETURN

The Securities and Exchange Commission requires us to present a chart comparing the cumulative total stockholder return on our common stock with the cumulative total stockholder return of: (1) a broad equity market index, and (2) a published industry or line-of-business index. We selected the Standards & Poors Biotechnology Index based on our good faith determination that this index fairly represent the companies which compete in the same industry or line-of-business as we do. In the prior year, we selected the JP Morgan H & Q Medical Products Index; however, that index is no longer available. The chart below compares our common stock with the Nasdaq Composite Index, the JP Morgan H & Q Medical Products Index (through December 31, 2001) and the Standards & Poors Biotechnology Index and assumes an investment of $100 on August 10, 2000 (the date our shares began trading on The Nasdaq Stock Market) in each of the common stock, the stocks comprising the Nasdaq Composite Index and the stocks comprising the Standards & Poors Biotechnology Index and the JP Morgan H & Q Medical Products Index.

16

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We began operations on February 12, 1998 when the University of Florida Tissue Bank, now known as the Southeast Tissue Alliance, or SETA, contributed to us its allograft manufacturing and processing operations, related equipment and technologies, distribution arrangements, research and development activities and certain other assets. At approximately the same time as our separation from SETA, James M. Grooms, then our President, Chief Executive Officer and Chairman, who served as an officer of SETA prior to our separation, contributed his royalty rights in certain intellectual property to us in exchange for shares of our preferred stock. We recorded the assets acquired from SETA and Mr. Grooms and the liabilities assumed from SETA at their historical cost basis since these were deemed to be transactions between entities under common control. Mr. Grooms resigned as our President and Chief Executive Officer effective December 1, 2001 and as our chairman effective April 22, 2002.

Effective January 1, 2003, we entered into an exclusive License and Distribution Services Agreement with Stryker Endoscopy, a division of Stryker Corporation, to serve as the exclusive distributor of allografts we process for use in sports medicine surgeries, including reconstruction and repair of the knee, hip, shoulder, wrist, elbow, foot and ankle. The agreement is for an initial term ending December 31, 2004 and is automatically renewable for one year periods thereafter unless prior notice is given by either party. David J. Simpson, one of our directors, currently serves as an Executive Vice President of Stryker Corporation and was Chief Financial Officer of Stryker Corporation from June 1987 until January 1, 2003.

17

AUDIT MATTERS

Independent Public Accountant

The Audit Committee has appointed Deloitte & Touche LLP, independent auditors, to audit our accounts for the year 2003, subject to the approval of the scope of the audit engagement and the estimated audit fees. We expect a representative of Deloitte & Touche LLP to be present at the Annual Meeting with the opportunity to make a statement if he or she desires to do so and to be available to respond to appropriate questions.

Audit Fees

The aggregate fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte”) for professional services rendered for the audit of our annual financial statements for the fiscal year ended December 31, 2002 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q for that fiscal year were $542,000.

Financial Information Systems Design and Implementation Fees

Deloitte rendered no professional services for information technology services relating to financial information systems design and implementation for the fiscal year ended December 31, 2002.

All Other Fees

The aggregate fees billed by Deloitte for services rendered to us, other than the services described above under “Audit Fees”, for the fiscal year ended December 31, 2002 were $1,582,576.

The Audit Committee has determined that the provision of non-audit services is compatible with maintaining the principal accountant’s independence.

STOCKHOLDER PROPOSALS

All stockholder proposals intended to be presented at our Annual Meeting of Stockholders to be held in 2004 must be received by us no later than December 1, 2003 for inclusion in the board of directors’ proxy statement and form of proxy relating to the Annual Meeting.

18

OTHER BUSINESS

Our board of directors knows of no other business to be acted upon at the Annual Meeting. However, if any other business properly comes before the Annual Meeting, it is the intention of the persons named in the enclosed proxy to vote on such matters in accordance with their best judgment.

The prompt return of your proxy will be appreciated and helpful in obtaining the necessary vote. Therefore, whether or not you expect to attend the Annual Meeting, please sign the proxy and return it in the enclosed envelope.

By Order of the Board of Directors

Dated: March 28, 2003

ANNUAL REPORT

A copy (without exhibits) of our Annual Report, including our report on Form 10-K for the fiscal year ended December 31, 2002, as filed with the Securities and Exchange Commission, has been provided with this Proxy Statement. Additional copies of the Form 10-K are available, free of charge, upon request directed to:

Investor Relations

Regeneration Technologies, Inc.

11621 Research Circle

Alachua, Florida 32615

Telephone: (386) 418-8888

Our 2002 Form 10-K is also available through our website at http://www.rtix.com/investors/financial.cfm. Our Form 10-K is not proxy soliciting material.

19

REGENERATION TECHNOLOGIES, INC.

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 28, 2003

The undersigned, a stockholder of Regeneration Technologies, Inc. (the “Corporation”), hereby constitutes and appoints Brian K. Hutchison and Thomas F. Rose and each of them, the true and lawful proxies and attorneys-in-fact of the undersigned, with full power of substitution in each of them, to vote all shares of Common Stock of the Corporation which the undersigned is entitled to vote at the Annual Meeting of Stockholders of the Corporation to be held on Monday, April 28, 2003, and at any and all adjournments or postponements thereof, as follows:

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, strike a line through the nominee’s name in the list below.)

¨ FOR the nominee listed below

(except as marked to the contrary below) | | ¨ WITHHOLDING AUTHORITY

to vote for all the nominee listed below |

Philip R. Chapman

| | (2) | | In their discretion, upon such other business as may properly come before the meeting and any and all adjournments or postponements thereof. |

Shares represented by this Proxy will be voted in accordance with the instructions indicated in item 1 above. IF NO INSTRUCTION IS INDICATED, THIS PROXY WILL BE VOTED FOR THE LISTED NOMINEE FOR DIRECTOR.

Any and all proxies heretofore given by the undersigned are hereby revoked.

Dated:

Please sign exactly as your name(s) appear hereon. If shares are held by two or more persons each should sign. Trustees, executors and other fiduciaries should indicate their capacity. Shares held by corporations, partnerships, associations, etc. should be signed by an authorized person, giving full title or authority.