UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-09729 |

|

| iShares Trust |

| (Exact name of registrant as specified in charter) |

|

c/o BlackRock Fund Advisors |

| | |

| 400 Howard Street, San Francisco, CA | | 94105 |

| (Address of principal executive offices) | | (Zip code) |

| | |

The Corporation Trust Company 1209 Orange Street, Wilmington, DE 19801 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | | (415) 670-2000 |

| | |

| Date of fiscal year end: | | August 31, 2023 |

| |

| Date of reporting period: | | August 31, 2023 |

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

| | |

| | AUGUST 31, 2023 |

iShares Trust

· iShares MSCI Brazil Small-Cap ETF | EWZS | NASDAQ

· iShares MSCI China ETF | MCHI | NASDAQ

· iShares MSCI China Small-Cap ETF | ECNS | NYSE Arca

· iShares MSCI Indonesia ETF | EIDO | NYSE Arca

· iShares MSCI Peru and Global Exposure ETF | EPU | NYSE Arca

· iShares MSCI Philippines ETF | EPHE | NYSE Arca

· iShares MSCI Poland ETF | EPOL | NYSE Arca

· iShares MSCI Qatar ETF | QAT | NASDAQ

· iShares MSCI Saudi Arabia ETF | KSA | NYSE Arca

· iShares MSCI UAE ETF | UAE | NASDAQ

The Markets in Review

Dear Shareholder,

Despite an uncertain economic landscape during the 12-month reporting period ended August 31, 2023, the resilience of the U.S. economy in the face of ever tighter financial conditions provided an encouraging backdrop for investors. While inflation was near multi-decade highs at the beginning of the period, it declined precipitously as commodity prices dropped. Labor shortages also moderated, although wages continued to grow and unemployment rates reached the lowest levels in decades. This robust labor market powered further growth in consumer spending, backstopping the economy.

Equity returns were solid, as the durability of consumer sentiment eased investors’ concerns about the economy’s trajectory. The U.S. economy resumed growth in the third quarter of 2022 and continued to expand thereafter. Most major classes of equities rose, as large-capitalization U.S. stocks and developed market equities advanced strongly. However, small-capitalization U.S. stocks and emerging market equities posted more modest gains.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as investors reacted to elevated inflation and attempted to anticipate future interest rate changes. The corporate bond market also faced inflationary headwinds, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates seven times during the 12-month period. Furthermore, the Fed wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities that reach maturity. However, the Fed declined to raise interest rates at its June 2023 meeting, the first time it paused its tightening in the current cycle, before again raising rates in July 2023.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has decelerated the pace of interest rate hikes and recently opted for two pauses, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period to keep inflation under control. Furthermore, ongoing structural changes may mean that the Fed will be hesitant to cut interest rates in the event of faltering economic activity lest inflation accelerate again. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt.

While we favor an overweight position to developed market equities in the long term, we prefer an underweight stance in the near term. Expectations for corporate earnings remain elevated, which seems inconsistent with macroeconomic constraints. Nevertheless, we are overweight on emerging market stocks in the near term as growth trends for emerging markets appear brighter. We also believe that stocks with an AI tilt should benefit from an investment cycle that is set to support revenues and margins. In credit, there are selective opportunities in the near term despite tightening credit and financial conditions. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries, U.S. inflation-linked bonds, U.S. mortgage-backed securities, and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| | | | |

| Total Returns as of August 31, 2023 |

| | | |

| | | 6-Month | | 12-Month |

| | |

U.S. large cap equities (S&P 500® Index) | | 14.50% | | 15.94% |

| | |

U.S. small cap equities (Russell 2000® Index) | | 0.99 | | 4.65 |

| | |

International equities (MSCI Europe, Australasia, Far East Index) | | 4.75 | | 17.92 |

| | |

Emerging market equities

(MSCI Emerging Markets Index) | | 3.62 | | 1.25 |

| | |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | 2.47 | | 4.25 |

| | |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | 0.11 | | (4.71) |

| | |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | 0.95 | | (1.19) |

| | |

Tax-exempt municipal bonds

(Bloomberg Municipal Bond Index) | | 1.04 | | 1.70 |

| | |

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 4.55 | | 7.19 |

|

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

Market Overview

iShares Trust

Global Market Overview

Global equity markets advanced during the 12 months ended August 31, 2023 (“reporting period”), supported by continued economic growth and moderating inflation. The MSCI ACWI, a broad global equity index that includes both developed and emerging markets, returned 13.95% in U.S. dollar terms for the reporting period. Despite concerns about the impact of higher interest rates and rising prices, the global economy continued to grow, albeit at a slower pace than during the initial post-coronavirus pandemic recovery. Inflation began to subside in most regions of the world, and lower energy prices reduced pressure on consumers, leading consumer and business sentiment to improve. While the Russian invasion of Ukraine continued to disrupt trade in Europe and elsewhere, market adaptation lessened the economic impact of the ongoing war. The prices of several key commodities, including oil, natural gas, and wheat, either stabilized or declined during the reporting period, easing pressure on the world’s economies.

The U.S. Federal Reserve (“Fed”) tightened monetary policy rapidly, raising short-term interest rates seven times over the course of the reporting period. The pace of tightening decelerated as the Fed twice lowered the increment of increase before pausing entirely in June 2023, the first time it declined to take action since the tightening cycle began. However, the Fed then raised interest rates again at its July 2023 meeting and stated that it would continue to monitor economic data. The Fed also continued to decrease the size of its balance sheet by reducing the store of U.S. Treasuries it had accumulated to stabilize markets in the early phases of the pandemic.

Despite the tightening financial conditions, the U.S. economy demonstrated continued strength, and U.S. equities advanced. The economy returned to growth in the third quarter of 2022 and showed robust, if slightly slower, growth thereafter. Consumers powered the economy, increasing their spending in both nominal and inflation-adjusted terms. A strong labor market bolstered spending, as unemployment remained low, and the number of employed persons reached an all-time high. Tightness in the labor market drove higher wages, although wage growth slowed as the reporting period continued.

European stocks outpaced their counterparts in most other regions of the globe, advancing strongly for the reporting period despite modest economic growth. European stocks benefited from a solid recovery following the early phases of the war in Ukraine. While the conflict disrupted critical natural gas supplies, new sources were secured and prices declined, while a warm winter helped moderate consumption. The European Central Bank (“ECB”) responded to the highest inflation since the introduction of the euro by raising interest rates eight times and beginning to reduce the size of its debt holdings.

Stocks in the Asia-Pacific region gained, albeit at a slower pace than other regions of the world. Japan returned to growth in the fourth quarter of 2022 and first half of 2023, as strong business investment and exports helped boost the economy and support Japanese equities. However, Chinese stocks were negatively impacted by slowing economic growth. While investors were initially optimistic following China’s lifting of several pandemic-related lockdowns in December 2022, subsequent performance disappointed, and tensions with the U.S. increased. Emerging market stocks advanced modestly, as the resilient global economic environment reassured investors. The declining value of the U.S. dollar relative to many other currencies and the slowing pace of the Fed’s interest rate increases also supported emerging market stocks.

| | |

| 4 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

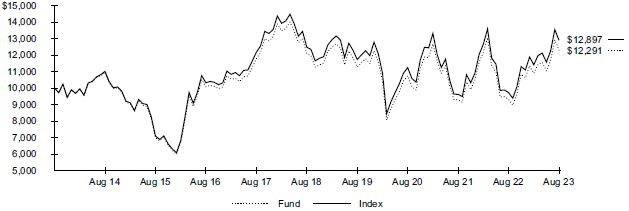

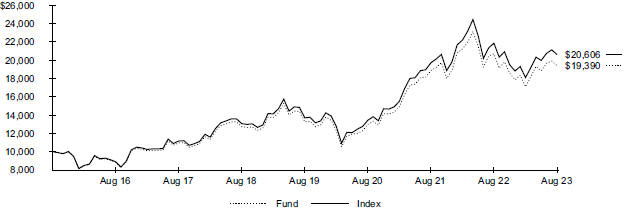

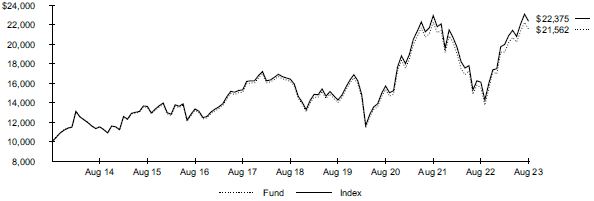

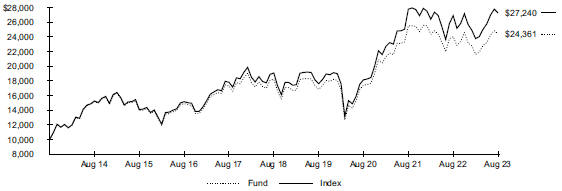

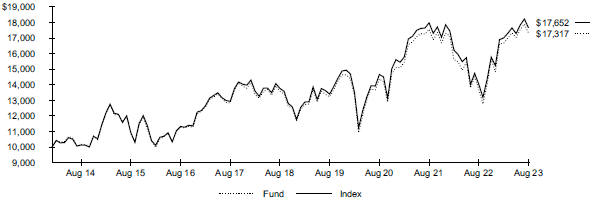

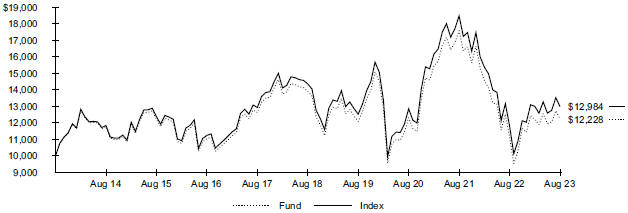

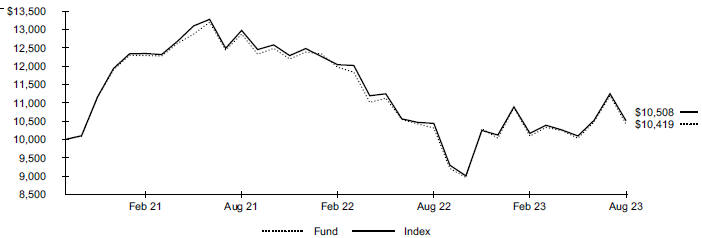

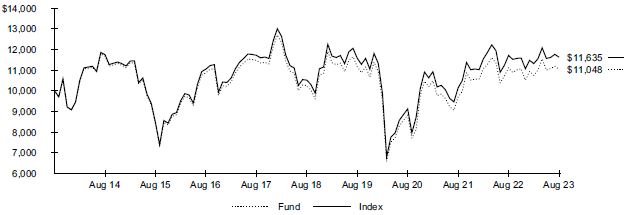

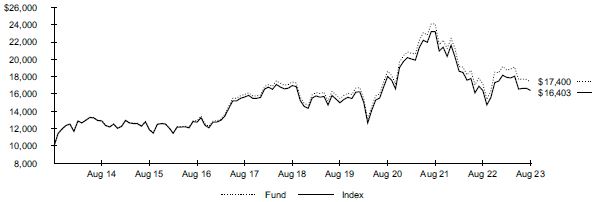

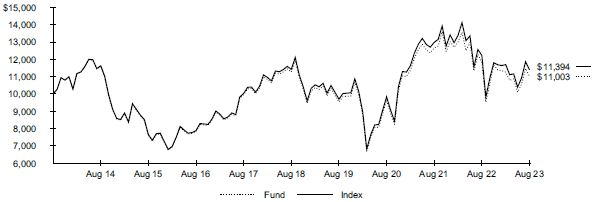

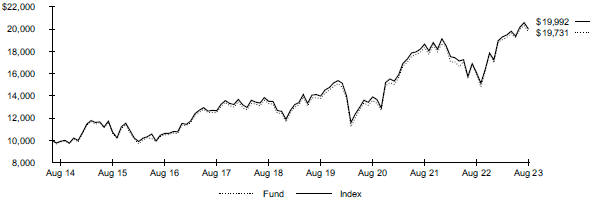

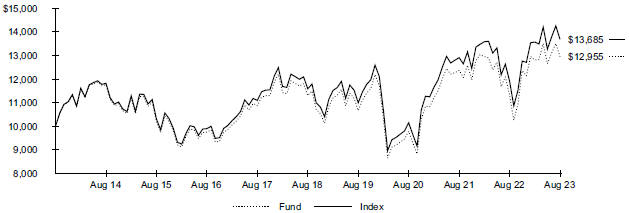

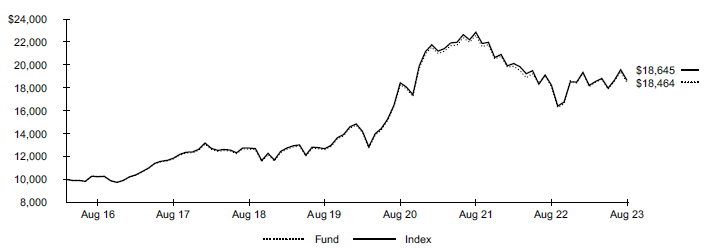

| Fund Summary as of August 31, 2023 | | iShares® MSCI Brazil Small-Cap ETF |

Investment Objective

The iShares MSCI Brazil Small-Cap ETF (the “Fund”) seeks to track the investment results of an index composed of small-capitalization Brazilian equities, as represented by the MSCI Brazil Small Cap Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

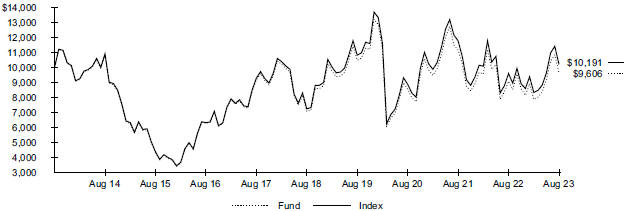

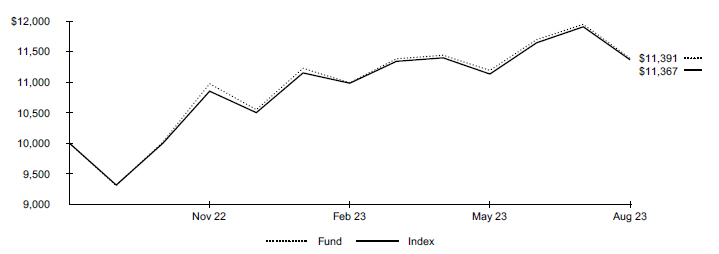

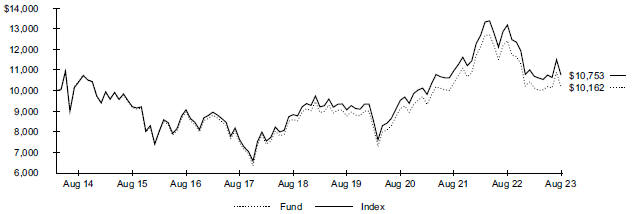

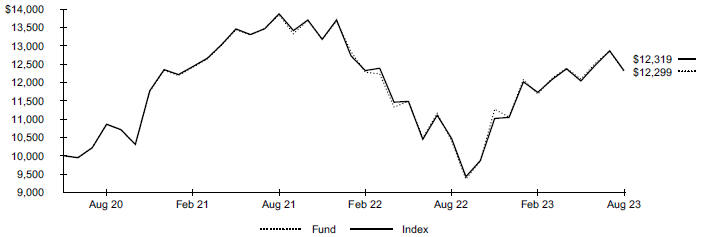

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | 5.95 | % | | | 6.35 | % | | | (0.40 | )% | | | | | 5.95 | % | | | 36.06 | % | | | (3.94 | )% |

Fund Market | | | 7.31 | | | | 6.21 | | | | (0.27 | ) | | | | | 7.31 | | | | 35.16 | | | | (2.67 | ) |

Index | | | 6.30 | | | | 7.11 | | | | 0.19 | | | | | | 6.30 | | | | 41.01 | | | | 1.91 | |

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23) |

| |

| Expenses

Paid During the Period |

(a) | | | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23) |

| |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | $ 1,000.00 | | | | $ 1,222.10 | | | | $ 3.30 | | | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Brazil Small-Cap ETF |

Portfolio Management Commentary

Small-capitalization Brazilian stocks advanced during the reporting period. After contracting in the fourth quarter of 2022, Brazil’s economy grew faster than anticipated in the first quarter of 2023, driven by a surge in agricultural output. The Brazilian real strengthened notably against the U.S. dollar, and low unemployment combined with an easing in the inflation rate paved the way for Brazil’s central bank to lower interest rates for the first time in three years.

The industrials sector contributed the most to the Index’s performance, led by the capital goods industry. Higher-than-expected totals for deliveries and new orders of airplanes supported aerospace and defense companies. Robust revenues in executive and commercial aviation also benefited the industry. In addition, indications of easing in supply-chain issues led manufacturers of airplanes to issue more optimistic forward guidance. Also within the capital goods industry, machinery companies contributed, as strong sales of buses, trailer trucks, and auto parts drove higher revenues for construction machinery and heavy transportation equipment companies.

The real estate sector also contributed to the Index’s performance, as companies involved in building and managing shopping malls drove gains in the real estate management and development industry. Following years of coronavirus pandemic-related lockdowns that kept consumers at home or buying online, Brazilian shoppers began returning to brick-and-mortar stores, boosting profits for mall operators.

On the downside, the information technology sector detracted from the Index’s return. Margins for companies in the IT services industry that process credit card payments came under pressure due to increased competition and lower cost efficiency. An analyst downgrade reflecting concerns over a slowdown in the volume of payments processed further weighed on the industry.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

| |

Industrials | | | 22.0% | |

Consumer Discretionary | | | 20.8 | |

Consumer Staples | | | 11.7 | |

Utilities | | | 10.2 | |

Materials | | | 9.6 | |

Real Estate | | | 8.5 | |

Health Care | | | 5.6 | |

Financials | | | 5.1 | |

Energy | | | 4.8 | |

Information Technology | | | 1.7 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

| |

Embraer SA | | | 4.9% | |

Aliansce Sonae Shopping Centers SA | | | 3.5 | |

Metalurgica Gerdau SA (Preferred) | | | 2.8 | |

3R Petroleum Oleo E Gas SA | | | 2.8 | |

BRF SA | | | 2.7 | |

Multiplan Empreendimentos Imobiliarios SA | | | 2.5 | |

Transmissora Alianca de Energia Eletrica SA | | | 2.4 | |

Cyrela Brazil Realty SA Empreendimentos e Participacoes | | | 2.2 | |

GPS Participacoes e Empreendimentos SA | | | 2.2 | |

Sao Martinho SA | | | 2.0 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 6 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

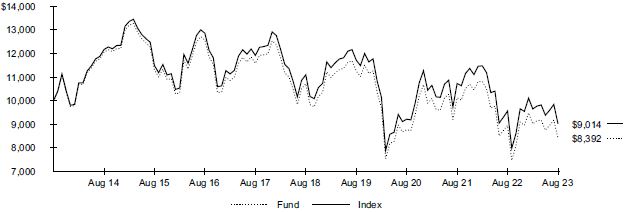

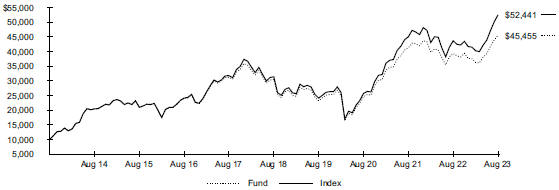

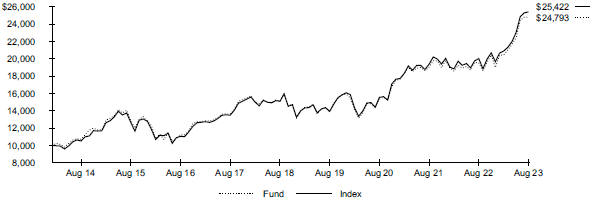

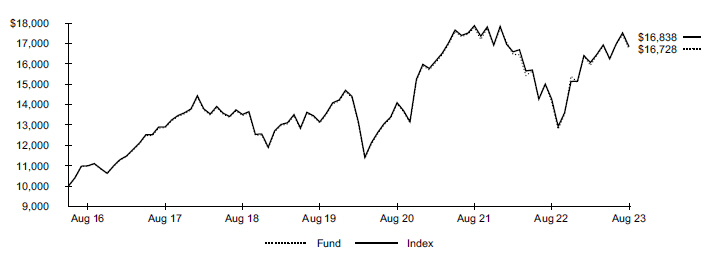

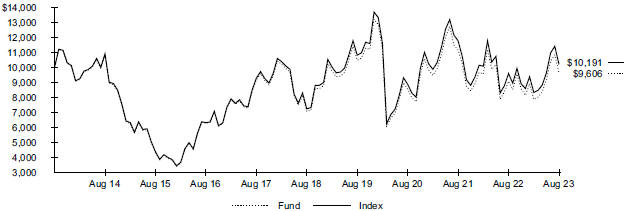

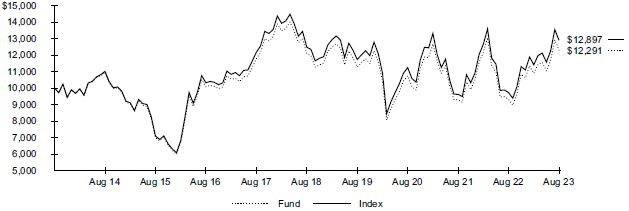

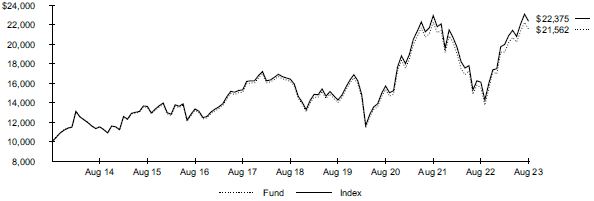

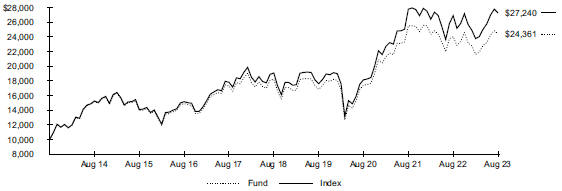

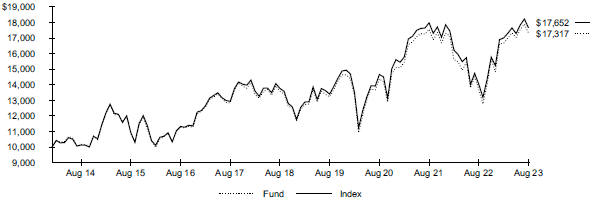

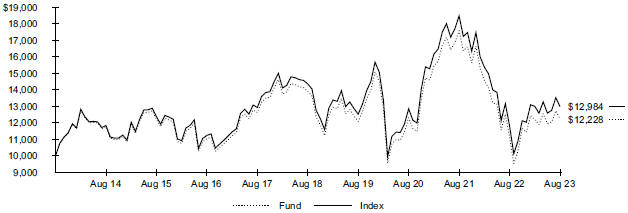

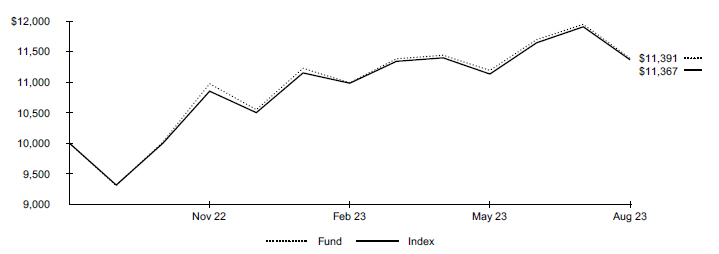

| Fund Summary as of August 31, 2023 | | iShares® MSCI China ETF |

Investment Objective

The iShares MSCI China ETF (the “Fund”) seeks to track the investment results of an index composed of Chinese equities that are available to international investors, as represented by the MSCI China Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

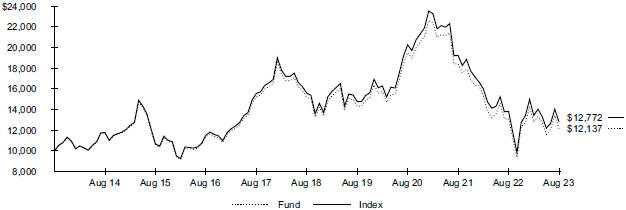

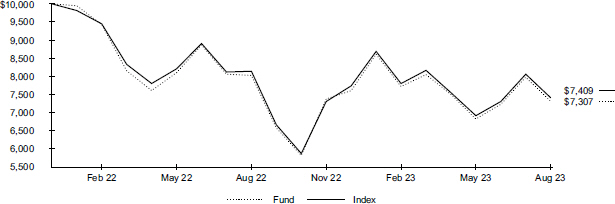

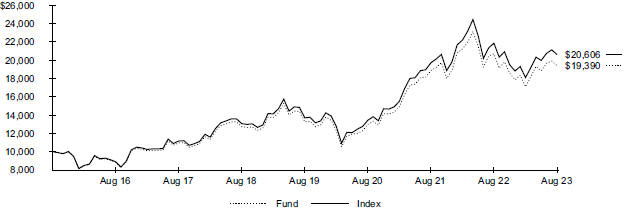

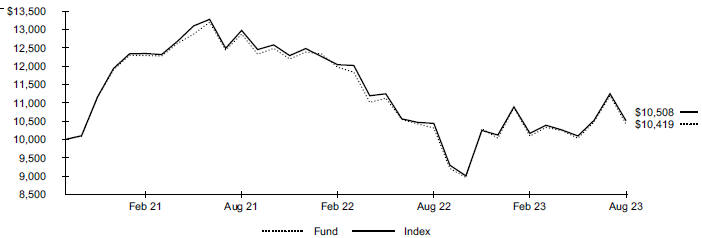

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | (7.39 | )% | | | (4.40 | )% | | | 1.96 | % | | | | | (7.39 | )% | | | (20.13 | )% | | | 21.37 | % |

Fund Market | | | (7.41 | ) | | | (4.42 | ) | | | 1.97 | | | | | | (7.41 | ) | | | (20.23 | ) | | | 21.56 | |

Index | | | (7.53 | ) | | | (3.89 | ) | | | 2.48 | | | | | | (7.53 | ) | | | (18.01 | ) | | | 27.72 | |

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value

(08/31/23 |

) | |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 949.30 | | | | $ 2.90 | | | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI China ETF |

Portfolio Management Commentary

Chinese equities declined during the reporting period, negatively impacted by slowing economic growth. While investors were initially optimistic following China’s lifting of several coronavirus pandemic-related lockdowns in December 2022, subsequent economic performance disappointed.

The consumer discretionary sector detracted the most from the Index’s return, driven by the internet and direct marketing retail industry. The reopening of China’s economy dented the profit margins of food delivery service providers, as the end of pandemic-related lockdowns led to reduced demand. In addition, increased competition in the food delivery space, including from one of China’s largest technology firms, weighed on the industry. Some Chinese e-commerce platforms reduced prices during the reporting period with the goal of gaining market share. Investors grew concerned about the impact of lowered prices on profitability, which further pressured the stocks of internet and direct marketing retail companies.

China’s healthcare sector detracted notably from the Index’s return. Life sciences tools and services companies were pressured by a U.S. executive order introducing a national biotechnology and biomanufacturing initiative. Given the program’s stated goal of reducing American reliance on China, stocks of Chinese companies engaged in contract drug research declined.

The consumer staples sector also detracted, driven by the packaged foods and meats industry. A major supplier of flavorings drew scrutiny for its use of additives in products sold domestically. In addition, the profits of pork producers were dampened by the confluence of decreasing pork prices, an oversupply of the meat, and lower consumer demand.

On the upside, interactive media and services companies, in the communication services sector, contributed to the Index’s return. The Chinese government’s easing stance on the regulation of internet firms toward the end of 2022 buoyed investor sentiment, supporting the industry.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

| |

Consumer Discretionary | | | 31.2% | |

Communication Services | | | 20.4 | |

Financials | | | 14.9 | |

Information Technology | | | 5.9 | |

Consumer Staples | | | 5.5 | |

Health Care | | | 5.4 | |

Industrials | | | 5.3 | |

Materials | | | 3.3 | |

Real Estate | | | 3.0 | |

Energy | | | 2.9 | |

Utilities | | | 2.2 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

| |

Tencent Holdings Ltd. | | | 13.8% | |

Alibaba Group Holding Ltd. | | | 9.4 | |

Meituan, Class B | | | 4.2 | |

Pinduoduo Inc. | | | 2.9 | |

China Construction Bank Corp., Class H | | | 2.6 | |

Baidu Inc. | | | 2.0 | |

NetEase Inc. | | | 2.0 | |

Ping An Insurance Group Co. of China Ltd., Class H | | | 2.0 | |

JD.com Inc., Class A | | | 1.9 | |

BYD Co. Ltd., Class H | | | 1.6 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 8 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

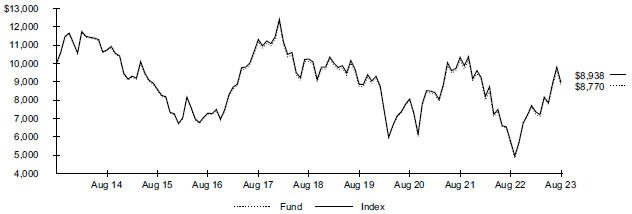

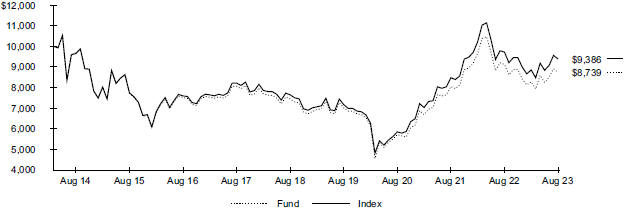

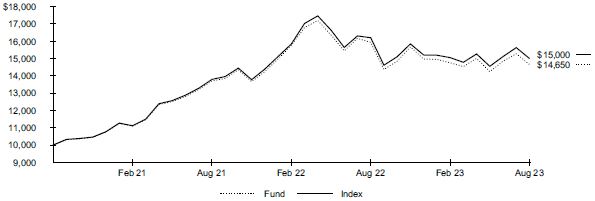

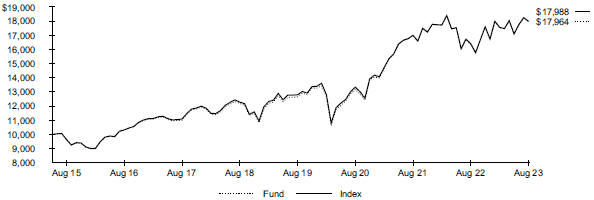

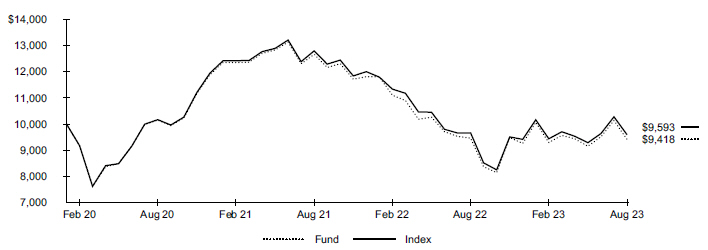

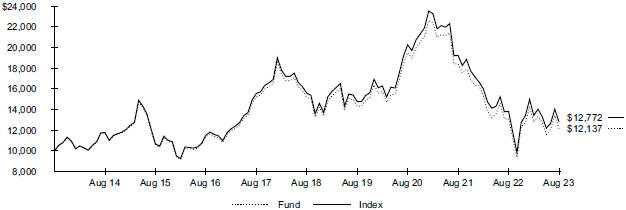

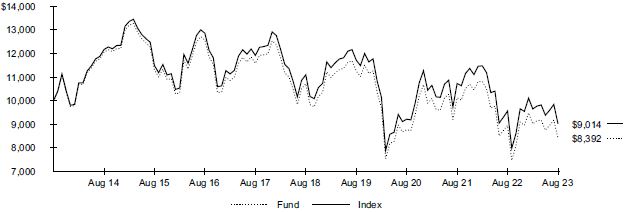

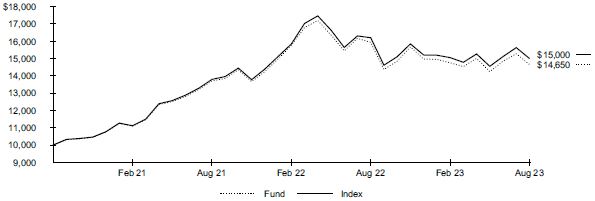

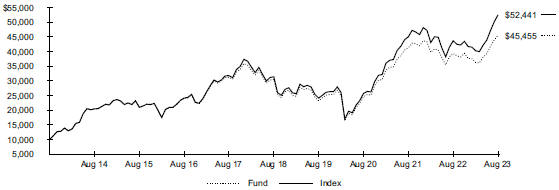

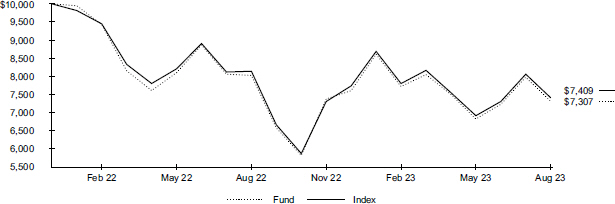

| Fund Summary as of August 31, 2023 | | iShares® MSCI China Small-Cap ETF |

Investment Objective

The iShares MSCI China Small-Cap ETF (the “Fund”) seeks to track the investment results of an index composed of small-capitalization Chinese equities that are available to international investors, as represented by the MSCI China Small Cap Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

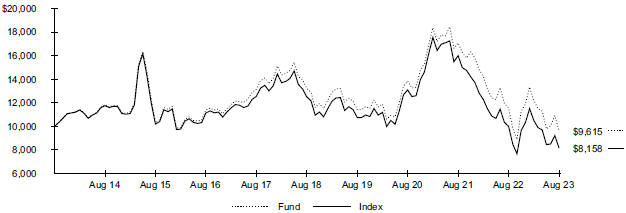

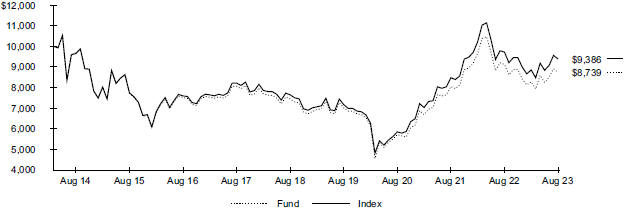

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | (16.74 | )% | | | (6.16 | )% | | | (0.39 | )% | | | | | (16.74 | )% | | | (27.24 | )% | | | (3.85 | )% |

Fund Market | | | (15.81 | ) | | | (6.14 | ) | | | (0.28 | ) | | | | | (15.81 | ) | | | (27.15 | ) | | | (2.76 | ) |

Index | | | (18.45 | ) | | | (8.16 | ) | | | (2.02 | ) | | | | | (18.45 | ) | | | (34.68 | ) | | | (18.42 | ) |

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 787.90 | | | | $ 2.66 | | | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI China Small-Cap ETF |

Portfolio Management Commentary

Small-capitalization Chinese equities declined sharply during the reporting period, negatively impacted by slowing economic growth and increased tensions between China and the U.S. While investors were initially optimistic following China’s lifting of several coronavirus pandemic-related lockdowns in December 2022, subsequent economic performance disappointed. Significant outflows of foreign investment from Chinese equities and the advancement of an economic decoupling from other countries as the Chinese government aims for greater supply chain independence also weighed on Chinese markets.

The real estate sector detracted the most from the Index’s return, as lower demand from home buyers continued to depress China’s housing market. Despite support from the Chinese government through guarantees of repayment for onshore bonds, the real estate management and development industry declined as high debt levels and difficulties in accessing capital pressured several companies. Investors reacted negatively to reports that property developers facing a cash-flow shortfall suspended payment of offshore debt obligations.

The consumer discretionary sector detracted significantly from the Index’s performance amid consumer pessimism, declining spending, and a slowdown in retail sales growth. In the specialty retail industry, competition from online sellers and continuing COVID-19 outbreaks pressured brick-and-mortar retailers. The challenging economic environment also pressured companies in the consumer durables industry, including sellers of home electronics and power tools.

The information technology sector also detracted, as investor concerns about oversupply of solar panels and related technology pressured the semiconductors and semiconductor equipment industry. Also within the sector, technology hardware and equipment companies focused on producing LCD screens for cars declined amid a reduction in demand for Chinese automobiles. The industrials sector also detracted meaningfully from the Index’s performance, notably among providers of industrial waste treatment in the commercial services and supplies industry.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

| |

Health Care | | | 21.6% | |

Consumer Discretionary | | | 12.6 | |

Real Estate | | | 12.5 | |

Industrials | | | 11.3 | |

Information Technology | | | 10.7 | |

Communication Services | | | 9.2 | |

Materials | | | 7.8 | |

Financials | | | 5.3 | |

Utilities | | | 3.9 | |

Consumer Staples | | | 3.9 | |

Energy | | | 1.2 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

| |

HUTCHMED China Ltd. | | | 1.8% | |

JinkoSolar Holding Co. Ltd. | | | 1.7 | |

Lifetech Scientific Corp. | | | 1.5 | |

Hello Group Inc. | | | 1.4 | |

Chindata Group Holdings Ltd. | | | 1.4 | |

Weimob Inc. | | | 1.4 | |

Keymed Biosciences Inc. | | | 1.4 | |

Fu Shou Yuan International Group Ltd. | | | 1.2 | |

MMG Ltd. | | | 1.2 | |

China Education Group Holdings Ltd. | | | 1.2 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 10 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

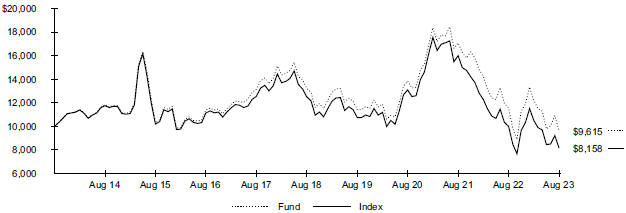

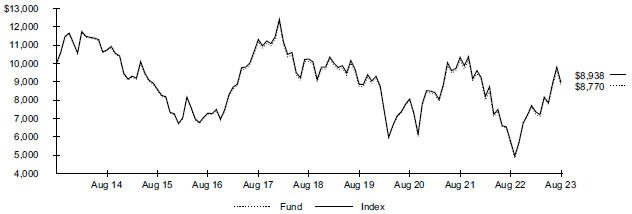

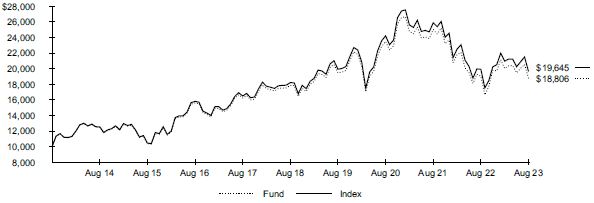

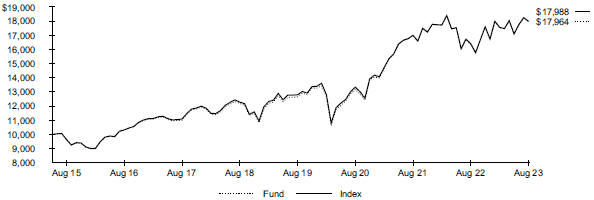

| Fund Summary as of August 31, 2023 | | iShares® MSCI Indonesia ETF |

Investment Objective

The iShares MSCI Indonesia ETF (the “Fund”) seeks to track the investment results of a broad-based index composed of Indonesian equities, as represented by the MSCI Indonesia IMI 25/50 Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

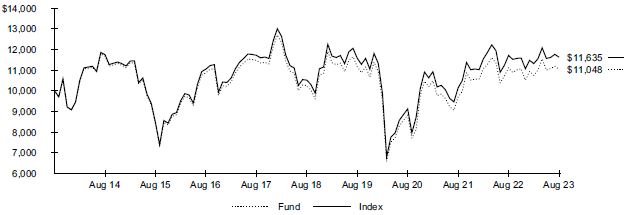

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | (0.66 | )% | | | 1.50 | % | | | 1.00 | % | | | | | (0.66 | )% | | | 7.74 | % | | | 10.48 | % |

Fund Market | | | (0.11 | ) | | | 1.63 | | | | 1.73 | | | | | | (0.11 | ) | | | 8.43 | | | | 18.74 | |

Index | | | (0.68 | ) | | | 2.03 | | | | 1.53 | | | | | | (0.68 | ) | | | 10.59 | | | | 16.35 | |

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Index performance through May 28, 2019 reflects the performance of MSCI Indonesia Investable Market Index. Index performance beginning on May 29, 2019 reflects the performance of the MSCI Indonesia IMI 25/50 Index.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 1,027.70 | | | | $ 3.02 | | | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Indonesia ETF |

Portfolio Management Commentary

Stocks in Indonesia declined slightly during the reporting period as the country’s central bank raised its benchmark interest rate five times to address persistent inflation. Inflation moderated to within the central bank’s 2-4% annual target. Despite the increases, the country’s economy grew at a steady rate, driven by moderate growth in consumer spending and an expansion in manufacturing. In particular, orders for new goods rose at their fastest rate in more than two years, and unemployment fell amid the strong demand. However, exports, which account for about a quarter of Indonesia’s economic output, declined from all-time highs in mid-2022 despite the government’s effort to strengthen trade partnerships.

The communication sector detracted the most from the Index’s return. The stock price of a large operator of cellular towers declined, reflecting recognition of substantial investment losses in an online provider of e-commerce and financial services. The consumer discretionary sector also detracted, led by the same online e-commerce provider. The materials sector also detracted from the Index’s return, as declining copper prices weighed on the metals and mining industry, while a construction materials stock went to zero after a trading suspension on the Indonesian exchange.

The financials sector contributed the most to the Index’s return. Diversified banks, including those specializing in the growing microfinancing market focused on rural and small-business loans, benefited from rising interest rates. Net interest income margins expanded as higher loan yields outpaced more modest growth in deposit costs, and loan growth helped further boost overall bank industry earnings. Credit agencies also upgraded their ratings on key banks based on their government support.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

| |

Financials | | | 51.2% | |

Materials | | | 9.6 | |

Consumer Staples | | | 9.5 | |

Communication Services | | | 6.7 | |

Industrials | | | 5.7 | |

Energy | | | 5.7 | |

Consumer Discretionary | | | 5.5 | |

Health Care | | | 2.6 | |

Real Estate | | | 2.5 | |

Other (each representing less than 1%) | | | 1.0 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

| |

Bank Central Asia Tbk PT | | | 20.9% | |

Bank Rakyat Indonesia Persero Tbk PT | | | 15.4 | |

Bank Mandiri Persero Tbk PT | | | 8.6 | |

Telkom Indonesia Persero Tbk PT | | | 4.4 | |

Astra International Tbk PT | | | 4.1 | |

Bank Negara Indonesia Persero Tbk PT | | | 3.1 | |

GoTo Gojek Tokopedia Tbk PT | | | 3.0 | |

Sumber Alfaria Trijaya Tbk PT | | | 2.1 | |

Adaro Energy Indonesia Tbk PT | | | 1.9 | |

Charoen Pokphand Indonesia Tbk PT | | | 1.9 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 12 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

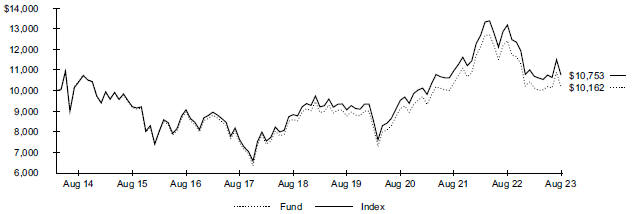

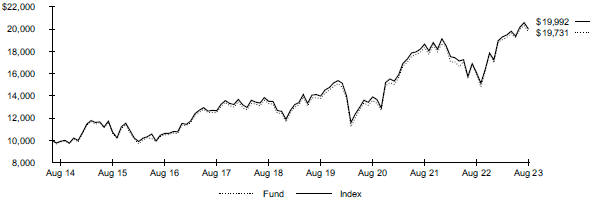

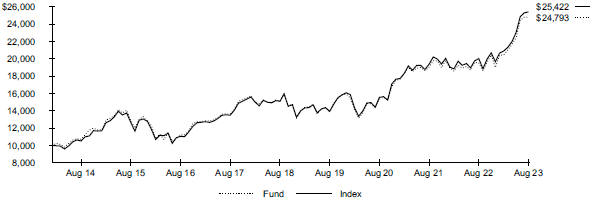

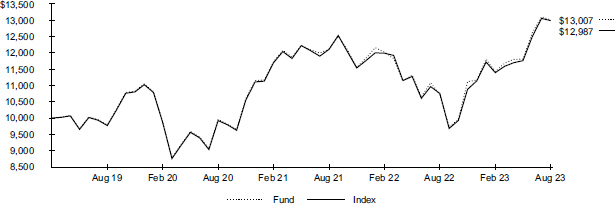

| Fund Summary as of August 31, 2023 | | iShares® MSCI Peru and Global Exposure ETF |

Investment Objective

The iShares MSCI Peru and Global Exposure ETF (the “Fund”) (formerly iShares MSCI Peru ETF) seeks to track the investment results of an equity index with exposure to Peru, as defined by the index provider, as represented by the MSCI All Peru Capped Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

On March 29, 2023, the Board approved a proposal to change the Fund’s name and investment objective. These changes became effective on April 10, 2023.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | 32.09 | % | | | 0.34 | % | | | 2.08 | % | | | | | 32.09 | % | | | 1.70 | % | | | 22.91 | % |

Fund Market | | | 31.17 | | | | 0.38 | | | | 1.95 | | | | | | 31.17 | | | | 1.91 | | | | 21.28 | |

Index | | | 32.63 | | | | 0.67 | | | | 2.58 | | | | | | 32.63 | | | | 3.39 | | | | 28.97 | |

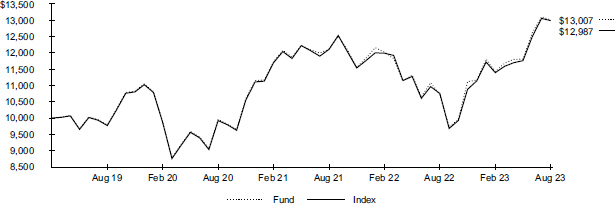

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 1,128.80 | | | | $ 3.17 | | | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Peru and Global Exposure ETF |

Portfolio Management Commentary

Stocks in companies with exposure to Peru increased substantially for the reporting period. Early in the reporting period, increased exports and domestic demand drove solid economic growth and boosted the country’s equity market. As the world’s second-largest copper producer, Peru further benefited from a rebound in global copper prices. After a yearlong series of interest rate increases halted in January 2023, persistent inflation moderated but remained higher than Peru’s central bank’s target. As the reporting period progressed, poor weather dramatically reduced production in the nation’s fishing and agriculture industries, limiting economic output. The country’s government, beset with political turmoil and social unrest as it removed its president in an impeachment trial, lowered its calendar-year growth forecasts through 2024. Yet Peru’s equity market remained relatively resilient, retaining most of its earlier gains.

Stocks in Peru, which represented approximately 74% of the Index on average for the reporting period, contributed the most to the Index’s return, led by the materials sector. Mining accounts for 10% of Peru’s economic output and 60% of its exports. In the metals and mining industry, large copper producers benefited from rising prices, primarily early in the reporting period, though these prices remained lower than the previous year. Nonetheless, higher sales volumes, increased production, and reduced operating costs helped earnings exceed expectations and boosted returns on equity, even after prices moderated. Substantial investment in mines for future production persisted, some for projects not slated to commence until the early 2030s.

Materials stocks in Canada and the U.K. also contributed to the Index’s performance. Metals and mining companies in both countries operate precious metals mines in Peru, and their stocks increased alongside rising silver and gold prices.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

| |

Materials | | | 48.4% | |

Financials | | | 26.3 | |

Consumer Staples | | | 8.6 | |

Consumer Discretionary | | | 5.2 | |

Industrials | | | 3.8 | |

Energy | | | 3.1 | |

Real Estate | | | 2.4 | |

Utilities | | | 2.2 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

| |

Southern Copper Corp. | | | 22.7% | |

Credicorp Ltd. | | | 22.2 | |

Cia. de Minas Buenaventura SAA | | | 4.7 | |

Alicorp SAA | | | 4.6 | |

Sociedad Minera Cerro Verde SAA | | | 3.5 | |

Ferreycorp SAA | | | 3.1 | |

PetroTal Corp. | | | 3.1 | |

Hochschild Mining PLC | | | 3.0 | |

InRetail Peru Corp. | | | 2.8 | |

Laureate Education Inc., Class A | | | 2.8 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 14 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

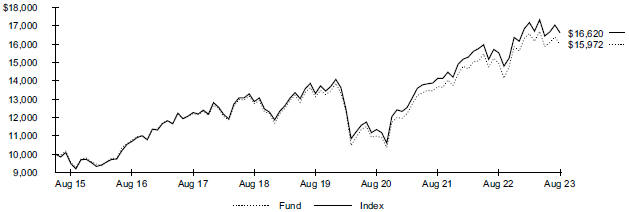

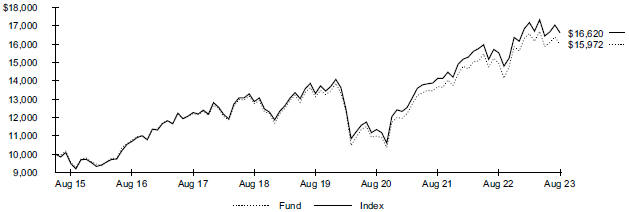

| Fund Summary as of August 31, 2023 | | iShares® MSCI Philippines ETF |

Investment Objective

The iShares MSCI Philippines ETF (the “Fund”) seeks to track the investment results of a broad-based index composed of Philippine equities, as represented by the MSCI Philippines IMI 25/50 Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | (6.16 | )% | | | (4.79 | )% | | | (1.74 | )% | | | | | (6.16 | )% | | | (21.75 | )% | | | (16.08 | )% |

Fund Market | | | (5.54 | ) | | | (4.79 | ) | | | (1.55 | ) | | | | | (5.54 | ) | | | (21.76 | ) | | | (14.49 | ) |

Index | | | (5.70 | ) | | | (4.07 | ) | | | (1.03 | ) | | | | | (5.70 | ) | | | (18.75 | ) | | | (9.86 | ) |

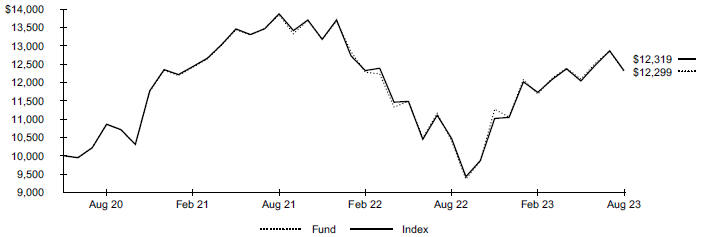

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Index performance through November 30, 2020 reflects the performance of the MSCI Philippines Investible Market Index (IMI). Index performance beginning on December 1, 2020 reflects the performance of the MSCI Philippines IMI 25/50 Index.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 931.20 | | | | $ 2.87 | | | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Philippines ETF |

Portfolio Management Commentary

Stocks in the Philippines declined for the reporting period. The Philippine central bank raised interest rates repeatedly to curb the inflation that accompanied the country’s most rapid economic growth in more than four decades. Five increases pushed the bank’s policy rate to its highest level since 2008. The tighter monetary policy helped curb surging food prices, which drove inflation to a 14-year high in January 2023. Inflation eventually moderated but remained higher than the central bank’s 2-4% annual target. Meanwhile, manufacturing output waned as interest rates increased, contracting for the first time in two years. The reduced activity contributed to slower-than-expected economic growth, and the country’s stock market declined sharply toward the end of the reporting period.

The real estate sector detracted the most from the Index’s return. Real estate management and development companies, including a large mall operator and residential builder, reported considerably higher net income. Rental fees on retail leases increased along with rising demand at cinema and other entertainment venues, reflecting higher consumer spending. Nevertheless, the industry’s stocks fell along with the broader market as the reporting period ended. The communication services sector also detracted from performance. Stock in the country’s largest wireless telecommunication services company dropped sharply amid an investigation into equipment cost overruns. In the integrated telecommunication services industry, higher interest rates increased financing costs for providing broadband services.

On the upside, the financials sector, led by banks, contributed to the Index’s return. The country’s robust economic growth supported improved business in the Philippine banking industry, strengthening banks’ capital position. Net interest margins—the difference between the interest banks pay on customer deposits and interest they charge for loans — rose amid higher interest rates, and growth in loan volume for large lenders significantly increased profitability.

Portfolio Information

SECTOR ALLOCATION

| | | | |

| |

| |

| Sector | | Percent of

Total Investments(a) | |

| |

| |

Industrials | | | 28.5% | |

Financials | | | 25.9 | |

Real Estate | | | 18.3 | |

Consumer Discretionary | | | 8.0 | |

Consumer Staples | | | 6.2 | |

Utilities | | | 6.1 | |

Communication Services | | | 4.6 | |

Energy | | | 1.5 | |

Materials | | | 0.9 | |

| |

TEN LARGEST HOLDINGS

| | | | |

| |

| |

| Security | | Percent of

Total Investments(a) | |

| |

| |

BDO Unibank Inc. | | | 10.9% | |

SM Prime Holdings Inc. | | | 9.7 | |

Bank of the Philippine Islands | | | 6.9 | |

SM Investments Corp. | | | 6.4 | |

Ayala Land Inc. | | | 5.7 | |

Ayala Corp. | | | 5.2 | |

International Container Terminal Services Inc. | | | 4.4 | |

Jollibee Foods Corp. | | | 4.3 | |

Metropolitan Bank & Trust Co. | | | 4.0 | |

Manila Electric Co. | | | 4.0 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 16 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

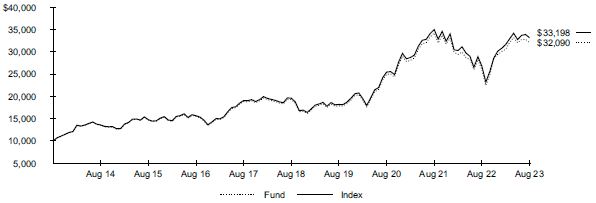

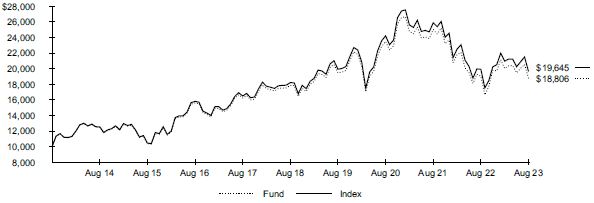

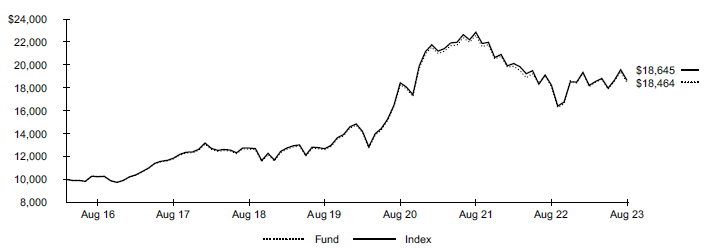

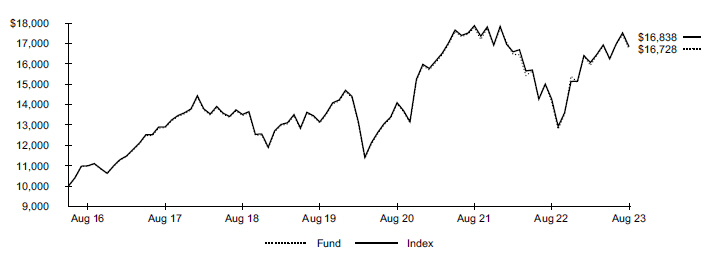

| Fund Summary as of August 31, 2023 | | iShares® MSCI Poland ETF |

Investment Objective

The iShares MSCI Poland ETF (the “Fund”) seeks to track the investment results of a broad-based index composed of Polish equities, as represented by the MSCI Poland IMI 25/50 Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

Fund NAV | | | 55.04 | % | | | (2.81 | )% | | | (1.30 | )% | | | | | 55.04 | % | | | (13.28 | )% | | | (12.30 | )% |

Fund Market | | | 55.27 | | | | (2.73 | ) | | | (1.32 | ) | | | | | 55.27 | | | | (12.92 | ) | | | (12.40 | ) |

Index | | | 55.34 | | | | (2.67 | ) | | | (1.12 | ) | | | | | 55.34 | | | | (12.67 | ) | | | (10.62 | ) |

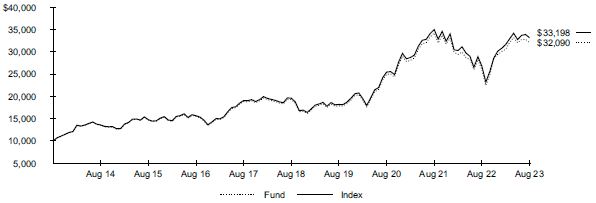

GROWTH OF $10,000 INVESTMENT

(AT NET ASSET VALUE)

Certain sectors and markets performed exceptionally well based on market conditions during the one-year period. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such exceptional returns will be repeated.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value

(03/01/23) |

| |

| Ending

Account Value

(08/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value

(08/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | $ 1,000.00 | | | | $ 1,214.90 | | | | $ 3.29 | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Poland ETF |

Portfolio Management Commentary

Stocks in Poland rose for the reporting period as declining inflation rates, climbing wages, and increased consumer confidence led to stronger consumer spending. Although interest rates remained at elevated levels, the Polish central bank announced a possible interest rate cut in September. Amid a tight housing market, the Polish government offered first-time homebuyers subsidies to offset high mortgage rates, among the most expensive in Europe. The housing subsidies and revived mortgage-lending activity, which had been on track for the weakest levels since 2005. The value of Polish stocks in U.S. dollar terms also increased, as the Polish zloty strengthened relative to the U.S. dollar, boosted by a record trade surplus, declining oil prices, and a recovery in the euro.

The financials sector contributed the most to the Index’s performance, led by the banking industry. Banks posted record profits, mainly from increased interest income as higher interest rates increased the gap between the rates the banks charge for loans and the rates they pay for deposits. The improved economic outlook kept loan defaults at low levels, decreasing costs for credit risk. However, banks also made provisions for legal costs arising from foreign currency mortgage loans after the top EU court ruled against them. Many Poles took out mortgage loans in Swiss francs, attracted by Switzerland’s lower interest rates, but sued the banks after weakening in the Polish zloty raised payment levels.

The consumer discretionary sector also contributed to the Index’s strong performance, led by the textiles and apparel industry. Fashion retailers with value-oriented brands benefited from budget-conscious consumers shopping for more affordable clothing and growing demand in markets in southern Europe.

Portfolio Information

SECTOR ALLOCATION

| | | | |

| |

| |

| Sector | | Percent of

Total Investments(a) | |

| |

| |

Financials | | | 39.6% | |

Consumer Discretionary | | | 13.6 | |

Energy | | | 12.5 | |

Materials | | | 8.9 | |

Communication Services | | | 7.3 | |

Consumer Staples | | | 6.8 | |

Utilities | | | 6.1 | |

Information Technology | | | 2.9 | |

Industrials | | | 2.3 | |

| |

TEN LARGEST HOLDINGS

| | | | |

| |

| |

| Security | | Percent of

Total Investments(a) | |

| |

| |

Polski Koncern Naftowy ORLEN SA | | | 12.5% | |

Powszechna Kasa Oszczednosci Bank Polski SA | | | 10.9 | |

Powszechny Zaklad Ubezpieczen SA | | | 8.3 | |

Bank Polska Kasa Opieki SA | | | 6.4 | |

Dino Polska SA | | | 6.0 | |

LPP SA | | | 4.9 | |

KGHM Polska Miedz SA | | | 4.7 | |

Santander Bank Polska SA | | | 4.4 | |

Allegro.eu SA | | | 4.4 | |

CD Projekt SA | | | 3.8 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 18 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

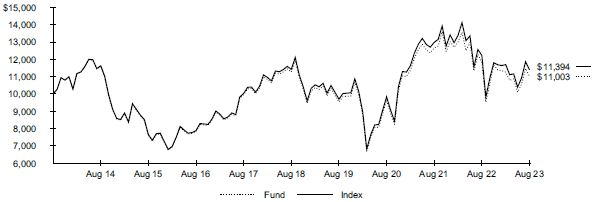

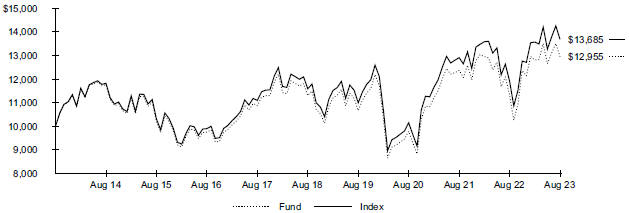

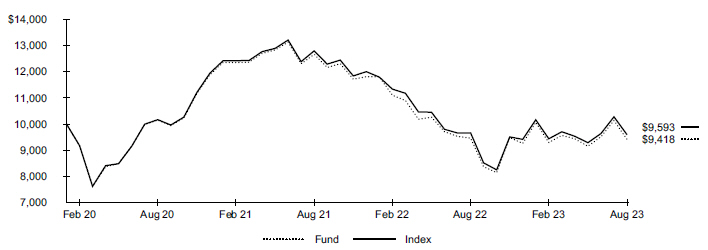

| Fund Summary as of August 31, 2023 | | iShares® MSCI Qatar ETF |

Investment Objective

The iShares MSCI Qatar ETF (the “Fund”) seeks to track the investment results of an index composed of Qatar equities, as represented by the MSCI All Qatar Capped Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | 1 Year | | | 5 Years | | | Since

Inception | |

| | | | | | | |

Fund NAV | | | (18.16 | )% | | | 3.41 | % | | 0.17% | | | | | (18.16 | )% | | | 18.25 | % | | | 1.62 | % |

Fund Market | | | (16.95 | ) | | | 3.54 | | | 0.34 | | | | | (16.95 | ) | | | 19.01 | | | | 3.25 | |

Index | | | (18.43 | ) | | | 4.01 | | | 0.78 | | | | | (18.43 | ) | | | 21.74 | | | | 7.53 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was April 29, 2014. The first day of secondary market trading was May 1, 2014.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | |

| | |

| Beginning

Account Value

(03/01/23) |

| |

| Ending

Account Value

(08/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value

(08/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | | | $ 1,000.00 | | | | $ 1,003.40 | | | | $ 2.98 | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Qatar ETF |

Portfolio Management Commentary

Stocks in Qatar declined considerably for the reporting period, as exports, which accounted for more than a third of the nation’s economic output in 2022, fell substantially and the economy weakened. Prices for liquefied natural gas (“LNG”), Qatar’s largest export product, dropped by more than two thirds, as global markets adjusted to supply disruptions caused by Russia’s invasion of Ukraine in early 2022. LNG shipments to Europe decreased markedly in 2023. The value of the country’s crude oil exports also declined. Combined, the lower values for oil and LNG reduced Qatar’s trade surplus. The country’s economy stalled after it hosted the 2022 FIFA World Cup soccer tournament, which had prompted a dramatic increase in construction. Meanwhile, the central bank raised its benchmark interest rate significantly to reduce inflation, and price gains moderated. As it did so, however, economic activity unrelated to oil and gas production contracted.

The financials sector detracted the most from the Index’s return. Bank stocks declined, reflecting banks’ significant loan exposure to oil and gas businesses faced with lower prices. Although rising interest rates often benefit banks, Qatari banks’ net interest income—the difference between the interest banks pay on customer deposits and what they charge for loans—declined as overall deposits dropped and non-performing loans increased. Government deposits at the nation’s banks decreased considerably in response to the government’s debt reduction plan. In addition, hyperinflation in Turkey reduced earnings for Qatari lenders with operations there.

In the industrials sector, industrial conglomerates also detracted from performance, as their earnings fell following the World Cup amid waning construction demand. The materials sector also detracted amid sharp profit declines in the chemicals industry related to falling commodities prices.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of

Total Investments(a) | |

| |

| |

Financials | | | 55.0% | |

Industrials | | | 11.5 | |

Energy | | | 9.2 | |

Materials | | | 7.1 | |

Communication Services | | | 5.6 | |

Real Estate | | | 5.3 | |

Utilities | | | 3.6 | |

Consumer Staples | | | 1.9 | |

Health Care | | | 0.8 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of

Total Investments(a) | |

| |

| |

Qatar National Bank QPSC | | | 22.5% | |

Qatar Islamic Bank SAQ | | | 11.0 | |

Industries Qatar QSC | | | 5.9 | |

Commercial Bank PSQC (The) | | | 5.5 | |

Masraf Al Rayan QSC | | | 4.5 | |

Qatar Gas Transport Co. Ltd. | | | 4.1 | |

Ooredoo QPSC | | | 3.9 | |

Qatar International Islamic Bank QSC | | | 3.7 | |

Mesaieed Petrochemical Holding Co. | | | 3.6 | |

Qatar Fuel QSC | | | 3.6 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 20 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

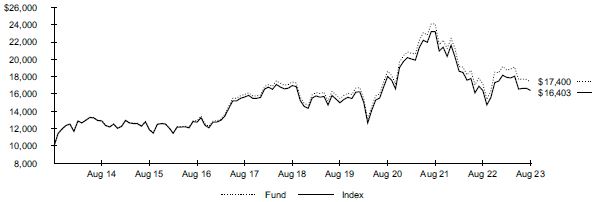

| Fund Summary as of August 31, 2023 | | iShares® MSCI Saudi Arabia ETF |

Investment Objective

The iShares MSCI Saudi Arabia ETF (the “Fund”) seeks to track the investment results of a broad-based index composed of Saudi Arabian equities, as represented by the MSCI Saudi Arabia IMI 25/50 Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception | | | | | 1 Year | | | 5 Years | | | Since Inception | |

| | | | | | | |

Fund NAV | | | (6.20 | )% | | | 8.76 | % | | | 8.67 | % | | | | | (6.20 | )% | | | 52.19 | % | | | 93.90 | % |

Fund Market | | | (5.66 | ) | | | 8.95 | | | | 8.69 | | | | | | (5.66 | ) | | | 53.51 | | | | 94.10 | |

Index | | | (5.62 | ) | | | 9.54 | | | | 9.51 | | | | | | (5.62 | ) | | | 57.68 | | | | 106.06 | |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was September 16, 2015. The first day of secondary market trading was September 17, 2015.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 1,134.80 | | | | $ 3.98 | | | | | $ 1,000.00 | | | $ 1,021.50 | | | | $ 3.77 | | | | 0.74 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI Saudi Arabia ETF |

Portfolio Management Commentary

Stocks in Saudi Arabia declined during the reporting period, as lower crude oil prices and rising interest rates constricted economic growth. The world’s largest oil exporter, Saudi Arabia derives the majority of its government and export revenue from that commodity. As global prices declined, the Saudi government reduced production in an attempt to stabilize the market. The cuts, however, substantially reduced economic output even as non-oil activities exhibited strength. Saudi Arabia pegs its currency to the U.S. dollar, so as the Fed raised interest rates to contain inflation, the Saudi Central Bank followed suit, raising borrowing costs to their highest level since 2001. That further constrained growth for an economy that grew fastest of all the Group of 20 large economies in 2022.

The financials sector detracted the most from the Index’s return, led by banks. Bank stocks declined amid fallout from the global banking crisis. The nation’s largest lender incurred a substantial loss from its investment in a large Swiss bank forced into a takeover by a key rival. In addition, lower oil prices and their impact on the broader economy weighed on bank stocks. As the economy slowed and interest rates rose, investors grew concerned about tighter liquidity, declining deposits, and an increase in the percentage of non-performing loans.

The materials sector also detracted from performance. Profits in the chemicals industry declined sharply, mirroring falling prices and weaker demand for petrochemicals, polymers, and other products.

Conversely, sectors that bolstered the Index’s return included healthcare, consumer staples, and information technology. Revenue and profit increased among healthcare facilities operators, packaged foods and meats producers, and in the IT consulting and other services industry.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

| |

Financials | | | 39.8% | |

Materials | | | 20.4 | |

Communication Services | | | 9.1 | |

Energy | | | 8.8 | |

Health Care | | | 4.8 | |

Consumer Staples | | | 4.7 | |

Consumer Discretionary | | | 3.3 | |

Utilities | | | 3.1 | |

Industrials | | | 2.3 | |

Real Estate | | | 2.3 | |

Information Technology | | | 1.4 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

| |

Al Rajhi Bank | | | 11.8% | |

Saudi National Bank (The) | | | 8.7 | |

Saudi Arabian Oil Co. | | | 7.7 | |

Saudi Basic Industries Corp. | | | 6.6 | |

Saudi Telecom Co. | | | 6.1 | |

Saudi Arabian Mining Co. | | | 3.9 | |

Riyad Bank | | | 3.7 | |

Alinma Bank | | | 3.1 | |

Saudi Awwal Bank | | | 2.9 | |

SABIC Agri-Nutrients Co. | | | 2.2 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 22 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of August 31, 2023 | | iShares® MSCI UAE ETF |

Investment Objective

The iShares MSCI UAE ETF (the “Fund”) seeks to track the investment results of an index composed of UAE equities, as represented by the MSCI All UAE Capped Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception | | | | | | 1 Year | | | 5 Years | | | Since Inception | |

| | | | | | | |

Fund NAV | | | (4.17 | )% | | | 3.23 | % | | | (1.43 | )% | | | | | | | (4.17 | )% | | | 17.24 | % | | | (12.61 | )% |

Fund Market | | | (5.19 | ) | | | 3.36 | | | | (1.44 | ) | | | | | | | (5.19 | ) | | | 18.00 | | | | (12.63 | ) |

Index | | | (3.46 | ) | | | 4.18 | | | | (0.68 | ) | | | | | | | (3.46 | ) | | | 22.73 | | | | (6.14 | ) |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was April 29, 2014. The first day of secondary market trading was May 1, 2014.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical 5% Return | |

| | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (03/01/23) |

| |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | | | | Beginning Account Value (03/01/23) | |

| Ending

Account Value (08/31/23 |

) | |

| Expenses

Paid During the Period |

(a) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

| | | | $ 1,000.00 | | | | $ 1,055.40 | | | | $ 3.06 | | | | | $ 1,000.00 | | | $ 1,022.20 | | | | $ 3.01 | | | | 0.59 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of August 31, 2023 (continued) | | iShares® MSCI UAE ETF |

Portfolio Management Commentary

Stocks in the United Arab Emirates (“U.A.E.”) declined for the reporting period. Prices and production of crude oil and natural gas, which account for about 30% of the nation’s economic output, declined. At the same time, interest rates increased along with corresponding concerns about the health of global banks, pressuring equity prices. The Central Bank of the U.A.E. anchors its base policy rate to the Fed’s interest rate policy decisions and followed its interest rate increases during the reporting period. As interest rates rose, inflation fell by more than half. Nonetheless, the nation’s economy grew at a robust pace. Manufacturing expanded at the highest rate in four years, and strong domestic demand, aided by falling prices, boosted business activity. Overall, U.A.E. economic output grew at one of the highest rates globally, almost doubling in 2022.

The communication services sector detracted the most from the Index’s return, driven by the diversified telecommunication services industry. Sales in the industry remained relatively flat amid declining subscriber growth and significant exchange rate volatility in several Middle Eastern markets. Meanwhile, a state-owned mobile network operator’s stake in a foreign mobile services company weighed on the industry amid continued operating challenges and the falling equity values of that investment. The financials sector also detracted, as profits in the banking industry declined amid impaired loans and provisions set aside to cover potential loan losses.

On the upside, the real estate sector contributed the most to the Index’s return. The real estate management and development industry advanced as real estate owners benefited from rising property values and new construction projects, fed by Dubai’s post-coronavirus pandemic recovery.

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| |

| |

| Sector | | Percent of Total Investments(a) | |

| |

Financials | | | 38.4% | |

Real Estate | | | 19.3 | |

Communication Services | | | 18.4 | |

Industrials | | | 11.8 | |

Consumer Discretionary | | | 7.1 | |

Utilities | | | 2.5 | |

Energy | | | 1.6 | |

Other (each representing less than 1%) | | | 0.9 | |

| |

| | | | |

| TEN LARGEST HOLDINGS | |

| |

| |

| Security | | Percent of Total Investments(a) | |

| |

Emirates Telecommunications Group Co. PJSC | | | 17.3% | |

First Abu Dhabi Bank PJSC | | | 15.1 | |

Emaar Properties PJSC | | | 11.5 | |

Abu Dhabi Commercial Bank PJSC | | | 4.5 | |

Aldar Properties PJSC | | | 4.4 | |

Dubai Islamic Bank PJSC | | | 4.3 | |

Emirates NBD Bank PJSC | | | 4.3 | |

Abu Dhabi Islamic Bank PJSC | | | 4.1 | |

Multiply Group | | | 3.9 | |

Abu Dhabi National Oil Co. for Distribution PJSC | | | 3.5 | |

| |

| | (a) | Excludes money market funds. | |

| | |

| 24 | | 2 0 2 3 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

ABOUT FUND PERFORMANCE / DISCLOSURE OF EXPENSES | | 25 |

| | |

Schedule of Investments August 31, 2023 | | iShares® MSCI Brazil Small-Cap ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

| | |

| Aerospace & Defense — 4.8% | | | | | | |

Embraer SA(a) | | | 2,543,873 | | | $ | 10,012,032 | |

| | | | | | | | |

| | |

| Automobile Components — 1.0% | | | | | | |

Fras-Le SA | | | 244,117 | | | | 677,329 | |

Mahle-Metal Leve SA | | | 139,202 | | | | 1,347,311 | |

| | | | | | | | |

| | |

| | | | | | | 2,024,640 | |

| | |

| Biotechnology — 0.2% | | | | | | |

Blau Farmaceutica SA(a) | | | 131,209 | | | | 468,182 | |

| | | | | | | | |

| | |

| Commercial Services & Supplies — 3.1% | | | | | | |

Ambipar Participacoes e Empreendimentos SA | | | 163,365 | | | | 689,808 | |

GPS Participacoes e Empreendimentos SA(b) | | | 1,215,393 | | | | 4,533,135 | |

Orizon Valorizacao de Residuos SA(a) | | | 179,986 | | | | 1,272,101 | |

| | | | | | | | |

| | |

| | | | | | | 6,495,044 | |

| | |

| Communications Equipment — 0.8% | | | | | | |

Intelbras SA Industria de Telecomunicacao Eletronica Brasileira | | | 355,424 | | | | 1,571,113 | |

| | | | | | | | |

| |

| Consumer Staples Distribution & Retail — 1.3% | | | | |

Grupo Mateus SA(a) | | | 1,997,428 | | | | 2,714,571 | |

| | | | | | | | |

| |

| Diversified Consumer Services — 3.8% | | | | |

Cogna Educacao(a) | | | 6,786,416 | | | | 4,001,643 | |

YDUQS Participacoes SA | | | 950,101 | | | | 3,908,191 | |

| | | | | | | | |

| | |

| | | | | | | 7,909,834 | |

| | |

| Electric Utilities — 3.9% | | | | | | |

Alupar Investimento SA | | | 551,053 | | | | 3,148,048 | |

Transmissora Alianca de Energia Eletrica SA | | | 706,777 | | | | 4,881,165 | |

| | | | | | | | |

| | |

| | | | | | | 8,029,213 | |

| | |

| Financial Services — 1.6% | | | | | | |

Cielo SA | | | 4,421,198 | | | | 3,321,222 | |

| | | | | | | | |

| | |