Filed by Charles River Laboratories International, Inc.

pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Charles River Laboratories International, Inc.

(Commission File No.: 001-15943)

|

[GRAPHIC OMITTED]

Baird 2010 Growth

Stock Conference

Charles River and

WuXi PharmaTech:

The First Global

Early-Stage CRO

James C. Foster

Chairman, President and CEO

May 19, 2010

[GRAPHIC OMITTED]

charles river

(C) 2010 Charles River Laboratories International, Inc.

slide01

|

|

Safe Harbor Statement

This document includes "forward- looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements may

be identified by the use of words such as "anticipate," "believe," "expect,"

"estimate," "plan," "outlook," and "project" and other similar expressions that

predict or indicate future events or trends or that are not statements of

historical matters. These statements are based on current expectations and

beliefs of Charles River Laboratories ("Charles River") and WuXi PharmaTech

(Cayman) Inc ("WuXi"), and involve a number of risks and uncertainties that

could cause actual results to differ materially from those stated or implied by

the forward-looking statements. Those risks and uncertainties include, but are

not limited to: 1) the possibility that the companies may be unable to obtain

stockholder or regulatory approvals required for the combination; 2) problems

may arise in successfully integrating the businesses of the two companies

(including retention of key WuXi executives); 3) the acquisition may involve

unexpected costs; 4) the combined company may be unable to achieve cost and

revenue synergies; 5) the businesses may suffer as a result of uncertainty

surrounding the acquisition; and 6) the industry may be subject to future

regulatory or legislative actions and other risks that are described in

Securities and Exchange Commission ("SEC") reports filed or furnished by Charles

River and WuXi.

In addition, these statements include statements regarding the projected 2010

financial performance of WuXI, the availability of funding for our customers and

the impact of economic and market conditions on them generally, the anticipated

strength of our balance sheet, the effects of our 2009 and 2010 cost-saving

actions and other actions designed to manage expenses, operating costs and

capital spending, and to streamline efficiency, and the ability of the Company

to withstand the current market conditions. Forward-looking statements are based

on Charles River's current expectations and beliefs, and involve a number of

risks and uncertainties that are difficult to predict and that could cause

actual results to differ materially from those stated or implied by the

forward-looking statements. Those risks and uncertainties include, but are not

limited to: the ability to successfully integrate the businesses we acquire; the

ability to successfully develop and commercialize SPC's technology platform; a

decrease in research and development spending, a decrease in the level of

outsourced services, or other cost reduction actions by our customers; the

ability to convert backlog to sales; special interest groups; contaminations;

industry trends; new displacement technologies; USDA and FDA regulations;

changes in law; continued availability of products and supplies; loss of key

personnel; interest rate and foreign currency exchange rate fluctuations;

changes in tax regulation and laws; changes in generally accepted accounting

principles; and any changes in business, political, or economic conditions due

to the threat of future terrorist activity in the U.S. and other parts of the

world, and related U.S. military action overseas. A further description of these

risks, uncertainties, and other matters can be found in the Risk Factors

detailed in Charles River's Annual Report on Form 10-K as filed on February 19,

2010, as well as other filings we make with the SEC.

Because forward-looking statements involve risks and uncertainties, actual

results and events may differ materially from results and events currently

expected by Charles River and WuXi. Charles River and WuXi assume no obligation

and expressly disclaim any duty to update information contained in this filing

except as required by law.

[GRAPHIC OMITTED]

2 charles river

slide02

|

|

Regulation G

This presentation includes discussion of non-GAAP financial measures with

respect to Charles River and also with respect to WuXi included in WuXi's

first-quarter 2010 earnings release filed on Form 6-K with the SEC on May 12,

2010. We believe that the inclusion of these non-GAAP financial measures

provides useful information to allow investors to gain a meaningful

understanding of our core operating results and future prospects, without the

effect of one-time charges, consistent with the manner in which management

measures and forecasts the Company's performance. The non-GAAP financial

measures included in this presentation are not meant to be considered superior

to or a substitute for results of operations prepared in accordance with GAAP.

The company intends to continue to assess the potential value of reporting

non-GAAP results consistent with applicable rules and regulations. In accordance

with Regulation G, you can find the comparable GAAP measures and reconciliations

to those GAAP measures on our website at ir.criver.com, or with respect to WuXI,

in WuXi's current report on Form 6-K filed with the SEC on May 12, 2010,

available at the SEC's website, www.sec.gov.

Additional Information

This document may be deemed to be solicitation material in respect of the

proposed combination of Charles River and WuXi. In connection with the proposed

transaction, Charles River will file a preliminary proxy statement and a

definitive proxy statement with the SEC. The information contained in the

preliminary filing will not be complete and may be changed. Before making any

voting or investment decisions, investors and security holders are urged to read

the definitive proxy statement when it becomes available and any other relevant

documents filed with the SEC because they will contain important information.

The definitive proxy statement will be mailed to the shareholders of Charles

River seeking their approval of the proposed transaction. Charles River's

shareholders will also be able to obtain a copy of the definitive proxy

statement free of charge by directing a request to: Charles River Laboratories,

251 Ballardvale Street, Wilmington, MA 01887, Attention: General Counsel. In

addition, the preliminary proxy statement and definitive proxy statement will be

available free of charge at the SEC's website, www.sec.gov or shareholders may

access copies of the documentation filed with the SEC by Charles River and on

Charles River's website at www.criver.com.

Charles River and its directors and executive officers and other members of

management and employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information regarding Charles

River's directors and executive officers is available in Charles River's proxy

statement for its 2010 annual meeting of shareholders, which was filed with the

SEC on March 30, 2010. Information regarding the persons who may, under the

rules of the SEC, be considered participants in the solicitation of Charles

River shareholders in connection with the proposed transaction will be set forth

in the preliminary proxy statement when it is filed with the SEC.

This document does not constitute an offer of any securities for sale or a

solicitation of an offer to buy any securities. The Charles River shares to be

issued in the proposed transaction have not been and will not be registered

under the Securities Act of 1933, as amended (the "Securities Act"), and may not

be offered or sold in the United States absent registration or an applicable

exemption from registration requirements. Charles River intends to issue such

Charles River shares pursuant to the exemption from registration set forth in

Section 3(a)(10) of the Securities Act.

[GRAPHIC OMITTED]

3 charles river

slide03

|

|

The New Charles River

> Charles River signed a definitive agreement to acquire WuXi PharmaTech for

~$1.6B(1) in cash and stock on April 26th

> The combination creates the first early-stage contract research

organization (CRO)

> Offers a full range of products and services from molecule creation to

first-in-human testing

> Charles River's expertise in in vivo biology combined with WuXi's expertise

in chemistry creates a CRO capable of supporting clients' early-stage drug

development efforts on a global basis

> Drives CRL shareholder value through profitable growth

(1) Based on CRL's 04/23/2010 closing stock price.

[GRAPHIC OMITTED]

4 charles river

slide04

|

|

> A leading in vivo biology company

> $1.20B in net sales (FY `09)

> Unique portfolio of products and services focused on the research and

development continuum for new drugs

> A multinational company with ~8,000 employees worldwide

[] ~70 facilities in 16 countries

o Continuous expansion to support client needs

[GRAPHIC OMITTED]

Source: Based on Charles River's FY 2009 net sales.

[GRAPHIC OMITTED]

5 charles river

slide05

|

|

WuXi Today

> A leading chemistry company

> $270M in net sales (FY09)

> Service portfolio supports clients early with molecule creation, extending

downstream through laboratory and manufacturing services

> Largest China-based CRO with ~4,200 employees worldwide

[] One of the largest employers of chemists in the world

[] 7 facilities in China and U.S. to support clients globally

[GRAPHIC OMITTED]

6 Source: Based on WuXi's information as disclosed in its Form 20-F filed with

the SEC on 04/23/2010 and other public documents.

[GRAPHIC OMITTED]

6 charles river

slide06

|

|

WuXi Overview

Headquarters

Service Offerings

Employees

Facilities

Customers

* Current Good Manufacturing Practice

> Shanghai, China

> Laboratory services, consisting of synthetic and medicinal chemistry,

DMPK/ADME, biology, microbiology, in vivo pharmacology, toxicology,

pharmaceutical development, analytical services, biopharmaceutical, in

vitro and in vivo biocompatibility testing and efficacy testing

> Manufacturing services, focusing on advanced intermediates and active

pharmaceutical ingredients (APIs)

> ~4,200 employees (~3,800 in China and ~400 in the U.S.)

~ 2.0M ft2 of lab facilities and manufacturing space

> China:

> 1.0M ft(2) total research facilities in Shanghai and Tianjin

[X] 293K ft(2) total cG

|X| 293K ft(2) total cGMP* quality process development and

manufacturing facilities in Shanghai

[X] 314K ft(2) drug safety evaluation center in Suzhou

> United States:

[X] 209K ft(2) total three state-of-the-art FDA-registered facilities

in St. Paul, MN, Philadelphia, PA and Atlanta, GA

> Over 800 clients worldwide including 100+ for pharmaceutical services and

700+ for biologics and device services

> 100% repeat busine from top 10 customers

Source: Based on WuXi's information as disclosed in its Form 20-F filed

with the SEC on 04/23/2010 and other public documents.

[GRAPHIC OMITTED]

7 charles river

slide07

|

|

WuXi Overview -- History

[GRAPHIC OMITTED]

Source: Based on WuXi's information as disclosed in its Form 20-F

filed with the SEC on 04/23/2010 and other public documents.

[GRAPHIC OMITTED]

8 charles river

slide08

|

|

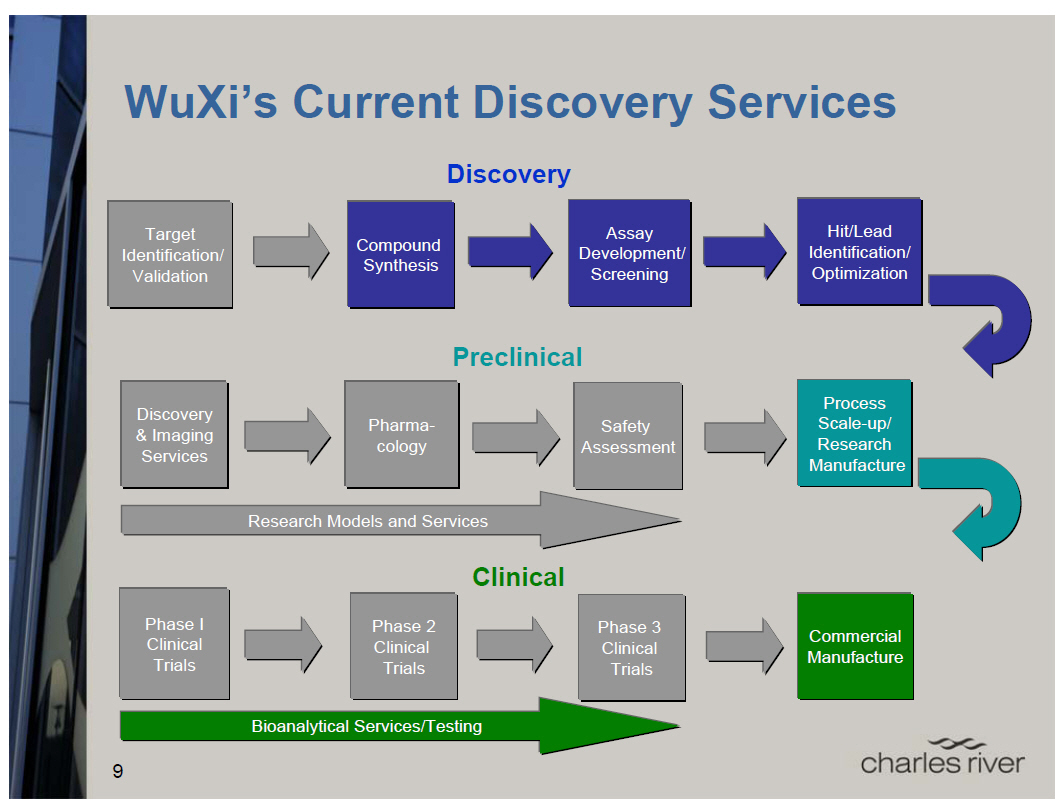

WuXi's Current Discovery Services

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

9 charles river

slide09

|

|

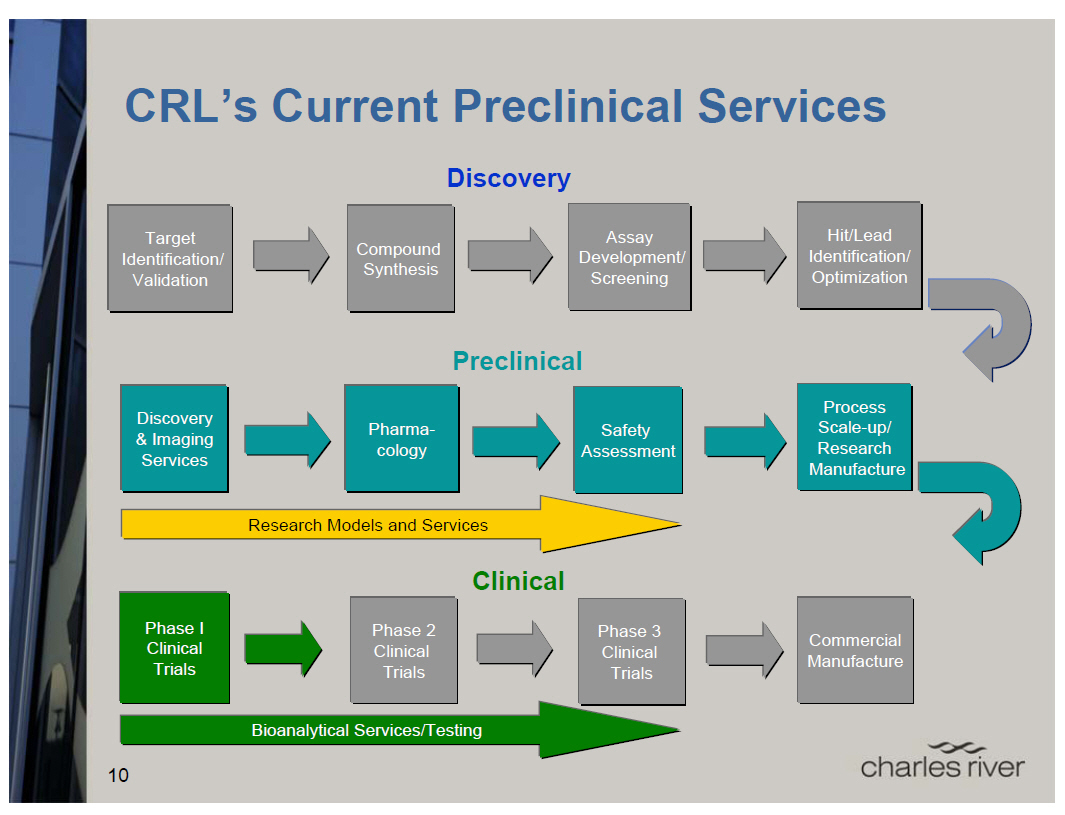

CRL's Current Preclinical Services

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

10 charles river

slide10

|

|

The New CRL: Global Integrated Services

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

11 charles river

slide11

|

|

Drives Profitable Revenue Growth

> WuXi provides opportunity to enhance revenue growth while expanding Charles

River's margins

> Discovery and Chemistry services

[X] Fastest-growing business segment as pharmas increasingly choose t

outsource

[X] Significant growth opportunity for WuXi's new downstream services

o Service biology, DMPK/ADME, formulation, process research,

bioanalytical chemistry, manufacturing

> GLP safety assessment in China

[X] Expands the development and scope of GLP capabilities in China

> Manufacturing services

[X] Emerging opportunity for active pharmaceutical ingredients (APIs) for

clinical trial and commercial-scale manufacturing services in China

> New business opportunities

[X] Drives more business upstream and downstream with existing and

prospective clients based on unprecedented scope of early-stage

portfolio

> Expanded portfolio drives market share gains

[GRAPHIC OMITTED]

12 charles river

slide12

|

|

Leverages Increasing Strategic Importance of China

> Supportive of global pharmas who view China as the new frontier for drug development

> Pharmas are taking advantage of cost leverage by placing chemistry in China

[X] Lower cost, highly skilled scientists with advanced degrees

> Emerging opportunities for chemistry, safety assessment and manufacturing

services as clients advance development activities in China

[X] Charles River gains largest early-stage provider in China

> Enables clients to choose where to place work

[GRAPHIC OMITTED]

13 charles river

slide13

|

|

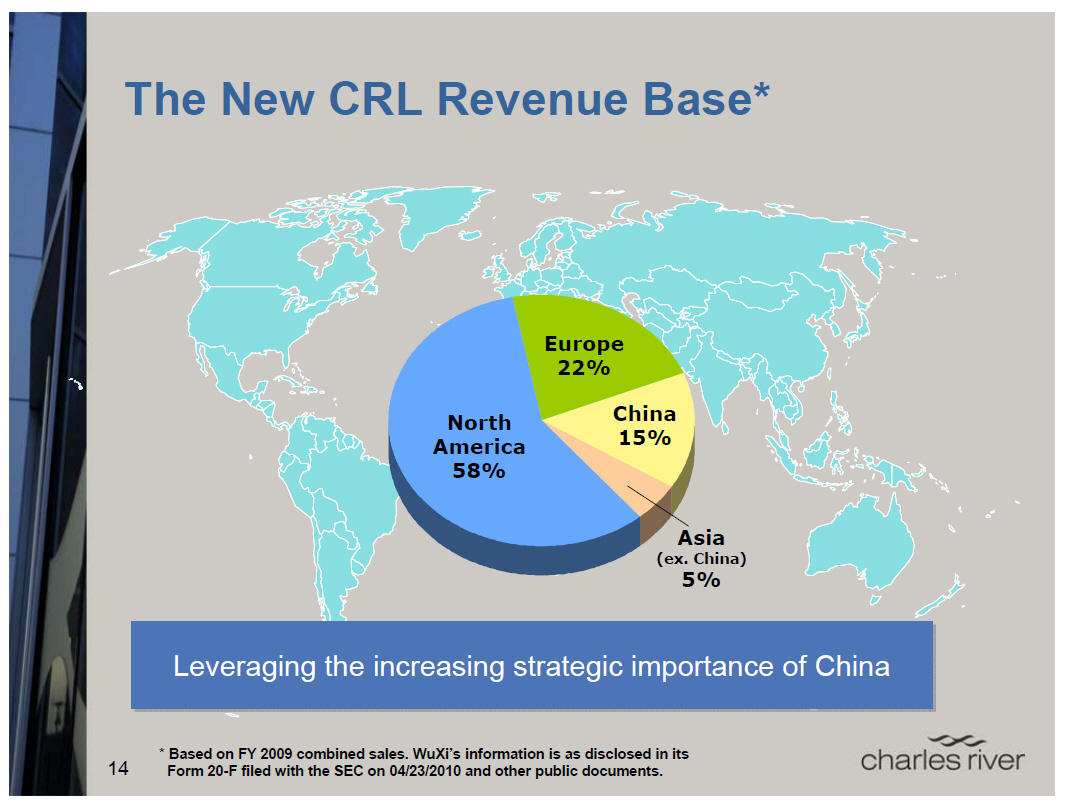

The New CRL Revenue Base*

[GRAPHIC OMITTED]

Leveraging the increasing strategic importance of China

* Based on FY 2009 combined sales. WuXi's information is as disclosed in its

Form 20-F filed with the SEC on 04/23/2010 and other public documents.

[GRAPHIC OMITTED]

14 charles river

slide14

|

|

The New CRL Business Segments

2009 Combined Sales*: $1.5B

[GRAPHIC OMITTED]

DS: Discovery Services RMS: Research Models and Services PCS: Preclinical

Services

* Based on FY 2009 combined sales, with Charles River's DIS included in DS and

WuXi's U.S.-based Laboratory Services included in PCS. WuXi's information is as

disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public

documents.

15

|

|

The New CRL Business Portfolio

Discovery Services Research Models and Services Preclinical Services

[]A leader in discovery []The market leader in [] A leader in GLP safety

chemistry services research model production assessment

[]A leading position in []Largest number of most * Both in Western markets and

non-GLP efficacy testing widely used models China

* Breadth and depth of

* DIS * Disease-specific models specialty services is key

[]Developing position in []A leading service provider competitive advantage

chemistry-based with broad capabilities [] A leader in worldwide

manufacturing * GEMS, RADS, CSS biopharmaceutical services

(BPS)

* Research and commercial []A leader in

scale [] Phase I clinic in U.S.

endotoxin detection

* Endosafe([R])-PTS[]

16

|

|

Compelling Value Proposition for Clients

[] Larger footprint with more capabilities enables clients to partner with one

company from chemistry to man

[] More attractive partner for biopharmaceutical companies looking to gain more

value from fewer service providers[] Enables clients to choose where to work:

North America, Europe or China* Charles River brand supports placement of work

in China[] Seamless transfer of therapeutics across the early-stage continuum

helps reduce time and cost to bring a drug to market* Enables sponsors to make

earlier "go/no-go" decisions

17

|

|

Enhancing Client Relationships

[] Focus on expanding existing client partnerships

* Enhances solid, high-level relationships in the same companies

* Strengthens relationships with those clients where one company is

pre-eminent* Creates new opportunities with clients where both entities

currently have minority share[] Client retention driven by breadth of

portfolio, high-quality science and exceptional service

18

|

|

Very Favorable Client Response

[] Senior management of CRL has reviewed the transaction with RandD of top 25

pharmaceutical and biotechnology clients* Response has been uniformly

positive[] Clients are viewing the acquisition as a strategic fit with CRL's in

vivo business, offering them the opportunity for larger relationships with CRL

* Clients already requesting follow-up meetings to discuss potential

expansion of relationships upstream [] Value of CRL brand seen as an advantage

in terms of standardizing products and services in China

19

|

|

The New CRL Client Base

[] Client base composed of big pharma and biotech, small and mid-tier pharma

and biotech, academic and government clients, CROs and agricultural and

chemical manufacturers[] Top 10 clients represent ~35% of combined sales[] No

single client represents more than 6% of sales

[GRAPHIC OMITTED]

* Based on FY 2009 combined sales. WuXi's information is as disclosed in its

Form 20-F filed with the SEC on 04/23/2010 and other public documents.

20

|

|

2011 General Assumptions (1)

[] Expect to recognize ~$20M of cost synergies

* Public company costs, SGandA, and refinement of operating structure[]

~4.5% average interest rate on new debt* New debt of ~$950M

[] Existing term loan is repaid

* Debt amortization begins in 4Q2010 (after close)

[] Expect to accelerate repayment with cash flow

[] Consolidated CRL non-GAAP tax rate expected to be ~25%-26% [] ~85-86M CRL

shares outstanding post-close[] Expected to be neutral (at bottom of or below

collar) to slightly accretive to non-GAAP EPS in 2011, and increasingly

accretive thereafter

(1) Combined financial information is presented as a supplementary non-GAAP

financial measure, and is not intended to be superior to or a substitute for

any financial measure prepared in accordance with GAAP. Furthermore, combined

financial information is not equivalent to pro forma financial information as

may be included in any proxy statement Charles River will file with the SEC in

connection with this transaction. For example, combined financial information

does not give effect to adjustments likely to be found in pro forma financial

information such as increased amortization and depreciation. Items excluded

from non-GAAP EPS consist of all deal-related costs including repatriation

impact.

21

|

|

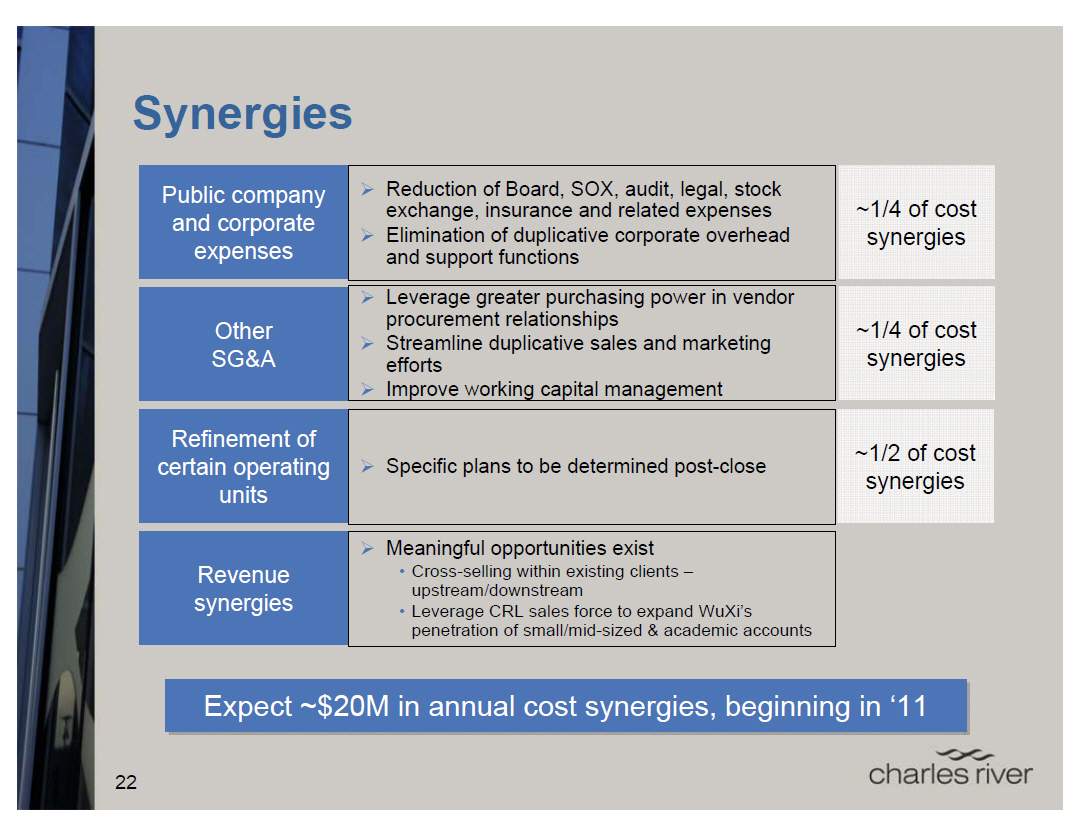

Synergies

Public company [] Reduction of Board, SOX, audit, legal, stock

and corporate exchange, insurance and related expenses ~1/4 of cost

[] Elimination of duplicative corporate overhead synergies

expenses and support functions

[] Leverage greater purchasing power in vendor

procurement relationships

Other ~1/4 of cost

[] Streamline duplicative sales and marketing

SGandA efforts synergies

[] Improve working capital management

Refinement of

certain operating [] Specific plans to be determined post-close ~1/2 of cost

units synergies

[] Meaningful opportunities exist

Revenue [] Cross-selling within existing clients --

upstream/downstream

synergies [] Leverage CRL sales force to expand WuXi's

penetration of small/mid-sized and academic accounts

Expect ~$20M in annual cost synergies, beginning in '11

22

|

|

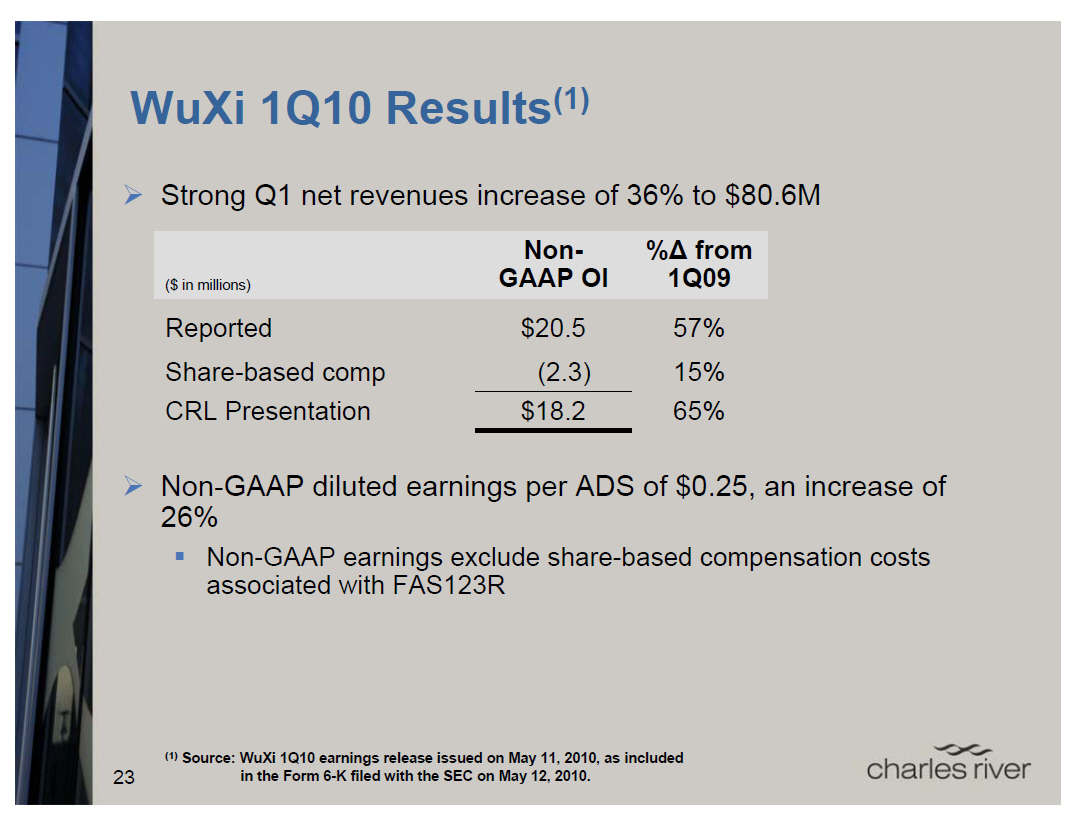

WuXi 1Q10 Results (1)

[] Strong Q1 net revenues increase of 36% to $80.6M

Non- %[] from

($ in millions) GAAP OI 1Q09

Reported $20.5 57%

Share-based comp (2.3) 15%

------------

CRL Presentation $18.2 65%

[] Non-GAAP diluted earnings per ADS of $0.25, an increase of 26%* Non-GAAP

earnings exclude share-based compensation costs associated with FAS123R

(1) Source: WuXi 1Q10 earnings release issued on May 11, 2010, as included in

the Form 6-K filed with the SEC on May 12, 2010.

23

|

|

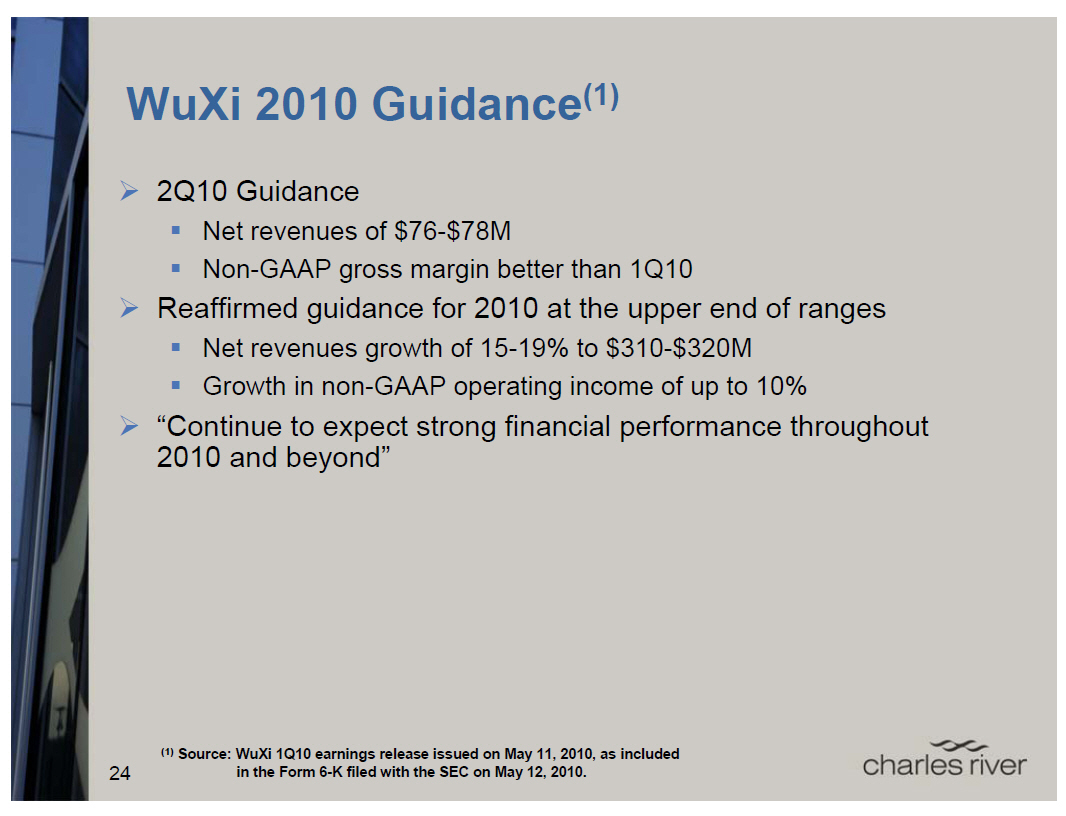

WuXi 2010 Guidance (1)

[] 2Q10 Guidance

* Net revenues of $76-$78M

* Non-GAAP gross margin better than 1Q10

[] Reaffirmed guidance for 2010 at the upper end of ranges* Net revenues growth

of 15-19% to $310-$320M

* Growth in non-GAAP operating income of up to 10%

[] "Continue to expect strong financial performance throughout 2010 and

beyond"

(1) Source: WuXi 1Q10 earnings release issued on May 11, 2010, as included in

the Form 6-K filed with the SEC on May 12, 2010.

24

|

|

Transaction Summary

Purchase price[] ~$1.6B (1), including the assumption of WuXi's debt and cash

Consideration [] $21.25 (1) total per ADS subject to collar (below) per share

[] $11.25 in cash (~53%) plus [] $10.00 of CRL common stock (~47%) determined

by exchange ratio

Exchange Ratio[] $10.00 divided by 20-day weighted average closing price prior

to closing subject to collar (below)

Collar[] At Charles River's stock price of $37.1486 or below, exchange ratio is

fixed at 0.2692; at a price of $43.1726 or above, exchange ratio is fixed at

0.2316

Premium[] 28% based on WuXi's 04/23/2010 closing price of $16.57[] 38% based on

30-day average closing price of $15.45 Ownership[] Approximately 78% Charles

River/ 22% WuXi pro forma ownership

Tax Treatment[] Taxable exchange under U.S. tax law

(1) Based on CRL's 04/23/2010 closing stock price.

25

|

|

Transaction Timeline

[] HSR Filed May 11, 2010[] Proxy to be filed shortly

[] Still on track to close by the 4Q10, subject to approval by each company's

shareholders and the satisfaction of customary closing conditions and

regulatory approvals* Shareholder meetings to be scheduled following clearance

by the SEC and the Cayman Courts

26

|

|

Integration Planning

[] Very complementary portfolios with minimal overlap

[] Integration team leaders have already met (week of 5/3)* CRL: Dave Johst,

EVP, Human Resources, General Counsel and CAO

* WX: Edward Hu, COO

[] Integration sub-teams formed and identifying key objectives* Focus on

client-facing functions

[] In process of engaging consultant to support integration effort[] Initiate

integration process immediately following close

27

|

|

WuXi Senior Management Joins CRL

[] Ge Li, PhD: Corporate EVP and President, Global Discovery and China

Services* Joins CRL Board, along with two additional directors chosen by WuXi[]

Edward Hu: Corporate SVP and General Manager, Global Discovery and China

Services[] Shuhui Chen, PhD: Corporate SVP and General Manager, Chemistry

Services and Chief Scientific Officer, China[] Suhan Tang, PhD: Corporate VP

and General Manager, Manufacturing Services[] Employment agreements with top

four executives* Each agreement has a three-year term

28

|

|

The New CRL: A Unique Opportunity

[] Combines leaders in in vivo biology and chemistry

[] Larger footprint with more capabilities enables clients to partner with one

company from chemistry to man [] Supportive of global pharmas who view China as

the new frontier for drug development [] Dramatically improves both companies'

ability to meet existing and future client needs[] WuXi provides opportunity to

drive revenue growth while expanding Charles River's margins* Expect to

generate $20M in annual cost synergies* Opportunity for meaningful revenue

synergies

29

|

| Accelerating Drug Development. Exactly. [C] 2010 Charles River Laboratories International, Inc. |