QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424(b)(4)

Registration No. 333-114840

PROSPECTUS

12,000,000 Shares

Common Stock

This is an offering of 12,000,000 shares of Blount International, Inc. ("Blount International") common stock.

Blount International's common stock is listed on the New York Stock Exchange under the symbol "BLT."

Simultaneously with this offering of common stock, Blount, Inc., a subsidiary of Blount International, Inc., is offering $175.0 million aggregate principal amount of its 87/8% Senior Subordinated Notes due 2012.

Investing in the common stock involves risks. "Risk Factors" begins on page 13.

| | Per Share

| | Total

|

|---|

| Public offering price | | $ | 10.00 | | $ | 120,000,000 |

| Underwriting discounts and commissions | | $ | 0.60 | | $ | 7,200,000 |

| Proceeds to Blount International (before expenses) | | $ | 9.40 | | $ | 112,800,000 |

We have granted the underwriters a 30-day option to purchase up to 1,800,000 additional shares of common stock at the public offering price less the underwriting discount to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lehman Brothers, on behalf of the underwriters, expects to deliver these shares on or about August 9, 2004.

Joint Book-Running Lead Managers

Joint-Lead Manager

UBS INVESTMENT BANK |

|

ROBERT W. BAIRD & CO. |

August 4, 2004

TABLE OF CONTENTS

| | Page

|

|---|

| Prospectus Summary | | 1 |

| Risk Factors | | 13 |

| Forward-Looking Statements | | 19 |

| Use of Proceeds | | 20 |

| Capitalization | | 21 |

| Dilution | | 22 |

| Unaudited Pro Forma Condensed Consolidated Financial Data | | 23 |

| Price Range of Common Stock and Dividend Policy | | 27 |

| Selected Historical Consolidated Financial Data | | 28 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 29 |

| Business | | 51 |

| Management | | 64 |

| Principal Stockholders | | 75 |

| Certain Relationships and Related Transactions | | 77 |

| Description of Our Indebtedness | | 78 |

| Description of Capital Stock | | 82 |

| The Note Offering | | 84 |

| Market Information | | 85 |

| Certain U.S. Federal Tax Consequences for Non-U.S. Holders | | 86 |

| Underwriting | | 88 |

| Legal Matters | | 92 |

| Experts | | 92 |

| Where You Can Find More Information | | 92 |

| Index to Financial Statements | | F-1 |

(i)

Unless the context otherwise requires, (i) "we," "us," "our," and similar terms refer to Blount International, Inc. and its subsidiaries, (ii) "Blount" and "the company" refers to Blount, Inc., (iii) "the corporation" and "Blount International" refers to Blount International, Inc. and (iv) the "guarantors" refers to, collectively, Blount International, Inc., Dixon Industries, Inc., Fabtek Corporation, Frederick Manufacturing Corporation, Gear Products, Inc., Omark Properties, Inc., BI L.L.C., 4520 Corp., Inc. and Windsor Forestry Tools LLC.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell or buy only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

(ii)

PROSPECTUS SUMMARY

This summary may not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision, including the information presented under the heading "Risk Factors" and the more detailed information in the financial statements and related notes appearing elsewhere in this prospectus.

Unless otherwise indicated, the industry data that appear in this prospectus are derived from publicly available sources that we believe are reliable but that we have not independently verified.

Unless the context otherwise requires, the information in this prospectus assumes that the underwriters do not exercise their over-allotment option.

Our Company

We are a leading provider of equipment, accessories and replacement parts to the global forestry and construction industries. We concentrate on manufacturing and marketing branded products in focused end markets, serving professional loggers, construction workers, homeowners, equipment dealers and distributors and original equipment manufacturers ("OEMs"). We believe that we are a global leader in chainsaw chain, guide bars and other accessories and a leading provider of timber harvesting equipment and zero-turn riding lawnmowers to the North American markets. Our products are sold under long-standing brand names, includingOregon,ICS,Prentice, Hydro-Ax andDixon, which are well-recognized in their respective industries. Approximately 40% of our sales in 2003 were generated outside of the United States, in over 100 countries around the world.

Our consolidated sales for the year ended December 31, 2003 of $559.1 million were derived from our three business segments: Outdoor Products—$358.8 million, Industrial and Power Equipment—$165.0 million and Lawnmower—$35.7 million (less inter-segment eliminations of $0.4 million). For the same period, consolidated EBITDA was $93.6 million, operating income was $83.8 million and consolidated net loss was $33.7 million. Our consolidated sales for the quarter ended March 31, 2004 were $165.6 million, derived as follows: Outdoor Products—$102.1 million; Industrial and Power Equipment—$54.0 million and Lawnmower—$9.6 million (less inter-segment eliminations of $0.1 million). For the same period, consolidated EBITDA was $31.1 million, operating income was $27.2 million and consolidated net income was $6.9 million. For a definition of EBITDA and a reconciliation to consolidated net income or net loss, see "—Summary Historical Consolidated Financial and Other Data".

| | Outdoor Products

| | Industrial and Power

Equipment

| | Lawnmower

|

|---|

| Sales (dollar amounts in millions)(1) | | $ 358.8 | | $ 165.0 | | $ 35.7 |

% of Sales(1) |

|

64% |

|

30% |

|

6% |

Selected Product Lines |

|

• Saw chain, guide bars and other chainsaw accessories |

|

• Timber harvesting equipment

• Gears |

|

• Zero-turning-radius riding lawnmowers |

| | | • Concrete cutting chain | | • Rotational bearings | | |

| | | • Lawnmower blades | | | | |

Selected Brand Names |

|

• Oregon |

|

• Prentice |

|

• Dixon |

| | | • Windsor | | • Hydro-Ax | | |

| | | • ICS | | • Timberking | | |

| | | | | • CTR | | |

Primary End Users |

|

• Professional loggers |

|

• Professional loggers |

|

• Landscape professionals |

| | | • Construction workers | | • Construction workers | | • Homeowners |

| | | • Homeowners | | • Utilities | | |

- (1)

- For the year ended December 31, 2003.

1

Outdoor Products

Our Outdoor Products segment is comprised of the Oregon Cutting Systems Division, Frederick Manufacturing Corporation, Windsor Forestry Tools LLC and ICS. Oregon produces a broad range of cutting chain, chainsaw guide bars, cutting chain drive sprockets and maintenance tools used primarily in portable gasoline and electric chainsaws and mechanical timber harvesting equipment. Frederick manufactures lawnmower blades which it distributes with lawnmower related replacement parts and certain other outdoor care products produced by third party manufacturers. Windsor produces cutting chains and sprockets for chainsaws, as well as mechanical timber harvesting equipment support products, which it distributes along with guide bars produced by Oregon's Canadian facility. ICS manufactures specialized concrete cutting equipment for construction markets around the globe. Approximately 60% of the Outdoor Products segment's sales in 2003 were generated from outside the United States. Our Outdoor Products segment's contribution to our consolidated operating income for the year ended December 31, 2003 was $86.2 million and for the three months ended March 31, 2004 was $26.3 million.

Industrial and Power Equipment

Our Industrial and Power Equipment ("IPEG") segment is comprised of the Forestry and Industrial Equipment Division ("FIED"), Fabtek Corporation and Gear Products, Inc. FIED manufactures a wide variety of timber harvesting equipment, including loaders and crawler feller bunchers under thePrenticebrand name, feller bunchers under theHydro-Axbrand name and delimbers, slashers and skidders under theCTRbrand name. Fabtek Corporation manufactures cut-to-length timber harvesting equipment, including forwarders, harvesters and harvester heads. Gear Products, Inc. manufactures bearings, winch drives and swing drives used to provide hydraulic power transmission in heavy equipment used in the utility, timber harvesting and industrial markets. Our Industrial and Power Equipment segment's contribution to our consolidated operating income for the year ended December 31, 2003 was $11.7 million and for the three months ended March 31, 2004 was $4.8 million.

Lawnmower

Our Lawnmower segment is comprised of Dixon Industries, Inc., which manufactures zero-turning-radius (ZTR) lawnmowers and related attachments. Dixon sells its products through distribution channels comprised of full-service dealers, North American distributors and export distributors. Although the financial performance of the Lawnmower segment has been adversely affected over the past twelve months by weather, competition and a distribution channel shift, the segment's operating performance has been historically strong. Our Lawnmower segment's contribution to our consolidated operating income for the year ended December 31, 2003 was a loss of $1.2 million and for the three months ended March 31, 2004 was a loss of $0.2 million.

Competitive Strengths

We believe the following competitive strengths have been instrumental to our success:

Leading market positions and strong brand names. We maintain leading market positions in each of our business segments. Approximately 61% of our revenues are generated from products with top three market share positions. We believe that ourOregon brand is well known to end users and that we are a leader in the production of cutting chain and guide bars worldwide. We believe our global market share (based on volume) in chainsaw chain and guide bars is approximately 57% and 52%, respectively. Our Industrial and Power Equipment segment is a North American market leader in feller bunchers, loaders and slashers/delimbers for timber harvesting. Dixon pioneered the development of zero-turn riding lawnmowers for both residential and commercial applications and remains a leading manufacturer of zero-turn riding lawnmowers. Our high quality products and brands have allowed us to

2

cultivate a loyal customer base and develop leading positions in many of our markets. We believe the strength of our long-standing brands, which are well recognized in their respective industries, provides us with a significant advantage over our competitors.

Strong sales to the aftermarket. Our saw chain and guide bar businesses manufacture products which are consumed rapidly and must be replaced frequently. The markets for these products are characterized by a high degree of recurring revenues from sales to the aftermarket. Typical professional loggers, for example, change their saw chains, on average, every ten days. Approximately 76% of our saw chain sales are replacement sales. Such sales generate higher margins than sales directly to OEMs or industrial users.

Balanced and diversified business mix. We have been successful in achieving a balanced diversification with respect to geography, customer base, distribution channels and product lines:

- •

- In 2003, approximately 40% of our sales were generated from outside of the United States, in more than 100 different countries;

- •

- Our products are sold to a broad customer base. In 2003, approximately 5% of our sales were to consumers, 77% were to dealers and distributors (consisting of over 9,500 dealers and distributors), and the remaining 18% were to OEMs. We generally have long-standing relationships with our leading customers, including The Electrolux Group, which represents approximately 10% of our sales, and with many of our other top 10 customers, who represent an aggregate of approximately 18% of our sales; and

- •

- Our distribution channels are broad and varied and include (i) direct sales to OEMs; (ii) sales to distributors who in turn sell to dealers; (iii) sales to dealers; and (iv) sales through competitive bidding processes.

Low cost operator. We have incorporated a philosophy of continuous improvement throughout our operations by focusing on such areas as purchasing costs, manufacturing efficiency, product development, material utilization and selling, general and administrative costs and activities. For example, our Outdoor Products segment has been practicing Total Quality Management principles since the mid-1980s. As a result, the cost to produce a foot of saw chain is less today than it was in 1982. We believe that our focus on continuous improvement initiatives has enabled us to achieve operating margins that are higher than those of our competitors, even during market downturns.

Strong and experienced management team. Our management team is well regarded in the industry, and our senior managers have an average of over 28 years of relevant operating experience. James Osterman, our President and Chief Executive Officer, has over 44 years of experience with us. Kenneth Saito, President of the Oregon Cutting Systems Group, and Dennis Eagan, President of the IPEG segment, each have over 28 years of industry experience. We believe that our team has substantial depth in critical operational areas and has demonstrated success in achieving growth, reducing costs, integrating businesses and improving efficiency.

Company Strategy

Our goal is to maintain leadership positions in a focused number of substantial end markets. The key elements of our business strategy are the following:

Continue to expand market leadership positions. We intend to further expand our market leadership positions by continuing to capitalize on our long-standing brand names, which are well recognized in their respective industries, our strong customer relationships and our expertise in developing innovative products. This strategy has enabled us to achieve leading positions in many of our product lines, including chainsaw chain, guide bars, log loaders, automated timber harvesting equipment and delimbing equipment, providing us with a competitive advantage. In addition, in March

3

2003, we entered into a long-term marketing and supply agreement with Caterpillar Inc., through which we intend to expand the distribution channels of our IPEG segment, which we believe will allow us to grow our sales and market share in the timber harvesting equipment market.

Expand our low cost production capabilities. We continuously seek ways to lower costs, enhance product quality, improve manufacturing efficiencies and increase product output. In addition to our continuous improvement program, we have identified several special programs to reduce costs over the next several years in each of our business segments. These programs include consolidation within the Outdoor Products segment, consolidation of Windsor's manufacturing plants and the implementation of an enterprise resource planning software system. In addition, we are in the preliminary stages of constructing a 110,000 square foot manufacturing plant in Fuzhou, China. The plant is being built to meet increasing capacity needs and to reduce overall manufacturing costs. We also intend to establish a purchasing operation in Fuzhou that will focus on securing high quality, low-cost raw materials to be utilized in our North American facilities. We believe our on-going cost saving initiatives will enable us to continue to lower our manufacturing costs and enhance our operating margins.

Expand our international presence. International expansion has also been a strong source of growth for us. Our international sales have grown from $188 million in 2001 to $228 million in 2003. Although certain of our foreign markets face economic and political uncertainty, we believe our ongoing investments in Canada, Brazil, the European Union and China will support continued growth in international sales. Although changes in currency exchange rates could slow our strong international growth, we believe current currency exchange rates, especially with respect to the weakness of the U.S. dollar in comparison to the European euro, generally have helped our international growth. Through our relationship with Caterpillar Inc., we expect that our IPEG segment will gain entry into several international markets where it currently does not have a significant presence, including Russia and South America. As a result of our alliance with Caterpillar Inc., sales generated outside of North America in our IPEG segment have increased from 1.7% of total segment sales in 2003 to 3.5% of total segment sales in the first quarter of 2004. We expect that the continued expansion of our international presence will be a significant source of growth in the future.

Continue to develop new products. We have consistently introduced new products or improvements to existing products into the marketplace to meet customer demand and offer competitive alternatives:

- •

- Oregon has a long history of industry "firsts", dating back to our development of the first modern chainsaw chain in 1947; we continue to focus our efforts on improving our existing products in order to provide our customers with the highest degree of quality, performance and safety;

- •

- ICS successfully introduced the first and only series of concrete cut-off chainsaws, which provide construction contractors with an efficient alternative to the traditional circular saws that are currently used in the concrete cutting industry;

- •

- FIED introduced our first log-skidder in 2002, which complements our existing timber harvesting equipment product line and has enabled FIED to gain access to new distribution channels and to expand the Blount quality image; and

- •

- Dixon has introduced two new zero-turning-radius riding lawn mower product lines over the past two years: (i) the Zeeter line is an entry level model with retail prices starting below $2,000 per unit, offering an alternative to entry level tractor style mowers and (ii) the Ram line is Dixon's first all steel body unit and provides Dixon's loyal customer base with a product similar to those recently offered by our competitors.

We intend to continue to design and develop new products and make meaningful improvements to our existing products to better meet our customers needs and improve our product mix and profit margins.

4

Pursue strategic acquisitions. We have historically made strategic bolt-on acquisitions in our selected end markets. Since 1990, we have successfully integrated numerous strategic acquisitions in, or related to, our existing businesses, including most recently Fabtek Corporation in September 2000 and Windsor Forestry Tools LLC in October 2000. We believe we have obtained significant benefits through the acquisition of related businesses that have allowed us to leverage our existing manufacturing capabilities and distribution networks. We will continue to selectively pursue complementary strategic acquisitions that allow us to leverage the marketing, engineering and manufacturing strengths of our operations and grow our sales to new and existing customers.

Recent Developments

We recently announced a summary of our operating results for the quarter ended June 30, 2004. The following preliminary unaudited consolidated financial data summarizes our results of operations for the quarter ended June 30, 2004 and certain balance sheet data as of June 30, 2004, as well as comparative data for the quarter ended June 30, 2003. We have not yet filed our Quarterly Report on Form 10-Q for the period, and therefore our operating results for the quarter ended June 30, 2004 have not been reviewed, or subject to any agreed upon procedures or otherwise passed upon, by PricewaterhouseCoopers LLP and are subject to completion of our normal quarter-end closing procedures which may result in changes to these results.

We estimate that our consolidated sales for the quarter ended June 30, 2004 were approximately $169.2 million as compared to $131.2 million for the same period in 2003. On a segment basis for the quarter ended June 30, 2004, we estimate that sales at: (1) Outdoor Products were approximately $102.2 million as compared to $87.9 million for the same period in 2003; (2) Industrial and Power Equipment were approximately $53.1 million as compared to $33.2 million for the same period in 2003; and (3) Lawnmower were approximately $14.2 million as compared to $10.2 million for the same period in 2003. For the quarter ended June 30, 2004, we estimate that (1) operating income was approximately $28.5 million as compared to $19.3 million for the same period in 2003 and (2) net income was approximately $8.0 million as compared to a net loss of $0.7 million for the same period in 2003.

We estimate that our consolidated sales for the six months ended June 30, 2004 were approximately $334.8 million as compared to $254.1 million for the same period in 2003. On a segment basis for the six months ended June 30, 2004, we estimate that sales at: (1) Outdoor Products were approximately $204.3 million as compared to $173.1 million for the same period in 2003; (2) Industrial and Power Equipment were approximately $107.1 million as compared to $63.1 million for the same period in 2003; and (3) Lawnmower were approximately $23.8 million as compared to $18.1 million for the same period in 2003. For the six months ended June 30, 2004, we estimate that (1) operating income was approximately $55.7 million as compared to $37.6 million for the same period in 2003 and (2) net income was approximately $14.9 million as compared to a net loss of $0.2 million for the same period in 2003.

The year over year improvement in sales and profitability was primarily due to an approximately double-digit percentage increase in unit volume, for all three of our business segments. We estimate that (1) our order backlog increased by approximately 4.8% to approximately $130.3 million as of June 30, 2004 from $124.4 million as of March 31, 2004, (2) depreciation and amortization for the quarter ended June 30, 2004 were approximately $3.8 million as compared to $3.2 million for the same period in 2003 and (3) depreciation and amortization for the six months ended June 30, 2004 were approximately $7.6 million as compared to $6.5 million for the same period in 2003.

As of June 30, 2004, we had aggregate outstanding indebtedness of $607.6 million, which does not give effect to the refinancing transactions. See "Capitalization," "Use of Proceeds" and "The Refinancing Transactions."

5

Lehman Brothers Merchant Banking Group

As of March 31, 2004, Lehman Brothers Merchant Banking Partners II, L.P. ("Lehman Brothers Merchant Banking Partners"), which is controlled by Lehman Brothers Merchant Banking Group, and its affiliates owned 85.0% of Blount International's outstanding common stock and 100% of its Convertible Preferred Equivalent Security. Lehman Brothers Merchant Banking Group was established in 1986 to achieve significant long-term capital appreciation through investments in private equity and equity linked securities. Today, the team has over 20 dedicated professionals with offices in New York and London. Since 1986, Lehman Brothers Merchant Banking Group has raised and managed six investment vehicles, with committed capital in excess of $3.6 billion.

The Refinancing Transactions

This offering is one of a series of refinancing transactions which also includes:

- •

- the issuance by Blount of $175.0 million of its 87/8% Senior Subordinated Notes due 2012;

- •

- an amendment and restatement of our credit facilities pursuant to which we will borrow $374.9 million;

- •

- the redemption in full of Blount, Inc.'s 7% Senior Notes due 2005;

- •

- the redemption in full of Blount, Inc.'s 13% Senior Subordinated Notes due 2009; and

- •

- the prepayment in full of Blount International, Inc.'s 12% Convertible Preferred Equivalent Security due 2012.

The foregoing transactions are collectively referred to in this prospectus as the "refinancing transactions."

We expect the net proceeds from the share offering to be $112.2 million, and we expect the net proceeds from the note offering to be $169.4 million. The amendment and restatement of our credit facilities will, among other things, provide for an additional $229.9 million of borrowings as compared to our existing credit facilities, and we intend to borrow $374.9 million under the amended and restated credit facilities as a part of the refinancing transactions.

Immediately prior to the refinancing transactions, we estimate that there will be:

- •

- $150.0 million of 7% Senior Notes outstanding, which are redeemable at a make-whole premium;

- •

- $323.2 million of 13% Senior Subordinated Notes outstanding, which are redeemable, beginning August 1, 2004, at 106.500% of the aggregate principal amount thereof, or $344.2 million; and

- •

- $29.0 million (composed of the prepayment premium of 102.400% of the aggregate principal amount thereof, plus accrued and unpaid interest) will be outstanding in respect of the 12% Convertible Preferred Equivalent Security.

We expect to complete the prepayment of the 12% Convertible Preferred Equivalent Security, which is held by an affiliate of Lehman Brothers Merchant Banking Partners, concurrently with the closing of the note offering and the share offering. We expect to complete the redemption of the 7% Senior Notes and the 13% Senior Subordinated Notes not later than 30 days after the closing of the note offering and the share offering pursuant to optional redemption procedures set forth in the indentures governing the notes. Pending the redemption of the 7% Senior Notes and the 13% Senior Subordinated Notes, we will deposit net proceeds from the note offering and the share offering in an amount equal to the aggregate redemption price for those notes in a special deposit account maintained by one of our banks.

After the refinancing transactions, we will have utilized $374.9 million of our amended restated credit facilities, and we estimate that we will have approximately $37.2 million in availability remaining under the revolving credit facility. See "Unaudited Pro Forma Condensed Consolidated Financial Data", "Capitalization" and "Description of Our Indebtedness."

6

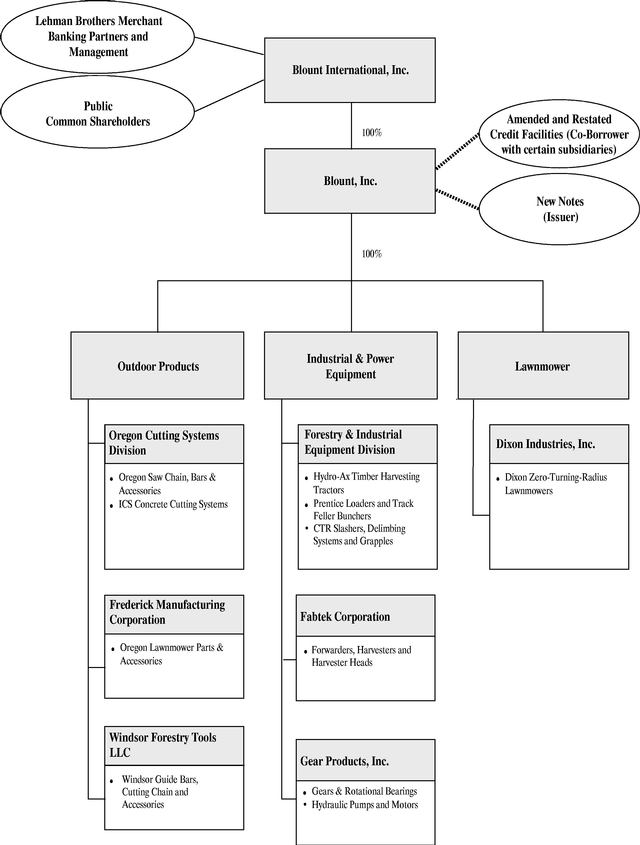

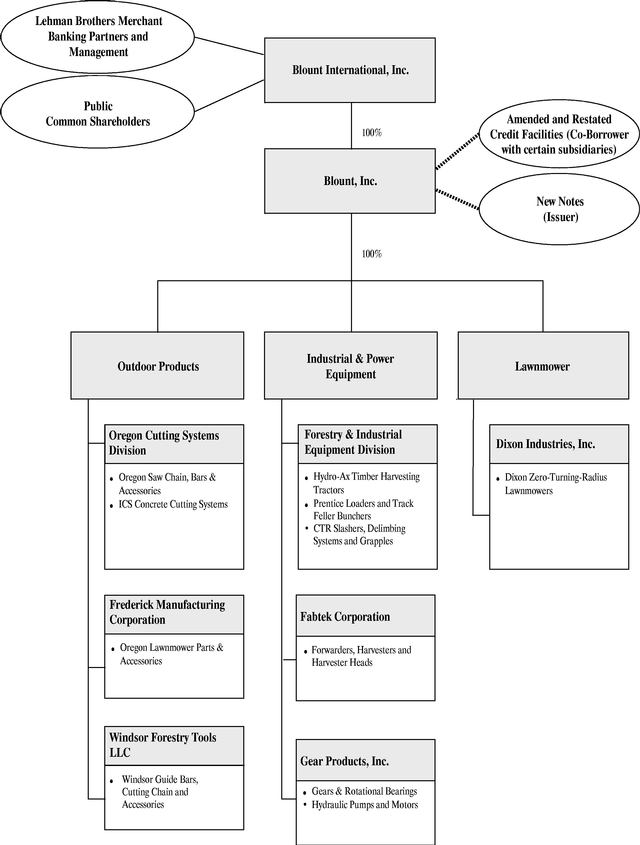

Organizational Chart

The following sets forth a summary of our organizational structure and primary brands, as well as our ownership and capitalization structure, after giving effect to the refinancing transactions.

7

The Share Offering

| Common Stock Offered by Blount International, Inc. | | 12,000,000 shares. |

Common Stock to be Outstanding Immediately After This Offering |

|

42,883,103 shares. The number of shares of Blount International common stock that will be outstanding after this offering is based on the number of shares outstanding as of March 31, 2004 and, unless otherwise stated or the context otherwise requires, excludes the exercise of the underwriter's over-allotment option. |

Over-Allotment Option |

|

1,800,000 shares. |

Concurrent Note Offering |

|

In a separate, concurrent offering, Blount International's wholly owned subsidiary, Blount, is offering $175.0 million aggregate principal amount of its 87/8% Senior Subordinated Notes due 2012. The note offering is being made exclusively by a separate prospectus. Blount International and certain subsidiaries of Blount will fully and unconditionally guarantee all of the obligations on the notes. See the section entitled "The Note Offering." |

Use of Proceeds |

|

We intend to use the net proceeds from this offering, together with the net proceeds from the note offering and borrowings under our amended and restated credit facilities, to repay certain of our existing indebtedness and pay transaction fees and expenses incurred in connection with the refinancing transactions. See "Use of Proceeds" and "Description of Our Indebtedness." |

New York Stock Exchange Listing |

|

Blount International's common stock is listed on the New York Stock Exchange under the symbol "BLT." |

Risk Factors |

|

You should carefully read and consider the information set forth under the caption "Risk Factors" and all other information set forth in this prospectus before investing in Blount International's common stock. |

8

Summary Historical Consolidated Financial and Other Data

The following tables set forth our summary historical consolidated financial and other data as of the dates and for the periods indicated. You should read the following summary historical financial data in conjunction with "Selected Historical Consolidated Financial Data," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and the consolidated financial statements and the notes thereto included elsewhere in this prospectus. The summary historical consolidated financial statements as of and for the years ended December 31, 2003, 2002 and 2001 are derived from our consolidated financial statements for such periods which have been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm. The summary historical financial statements as of and for the twelve months and three months ended March 31, 2004 and as of and for the three months ended March 31, 2003 are derived from our unaudited consolidated financial statements for such periods and, in the opinion of management, reflect all adjustments, consisting of only normal recurring adjustments, necessary to present fairly the data presented for such periods. Our audited consolidated financial statements for the years ended December 31, 2003, 2002 and 2001 and as of December 31, 2003 and 2002 and our unaudited consolidated financial statements as of March 31, 2004 and for the three months ended March 31, 2004 and 2003 are included elsewhere in this prospectus. The historical consolidated financial data is presented for informational purposes only and does not purport to project our financial position as of any future date or our results of operation for any future period.

The summary pro forma balance sheet data as of March 31, 2004 has been prepared to give pro forma effect to the refinancing transactions as if they had occurred on March 31, 2004. The pro forma financial ratios for the twelve months ended March 31, 2004 have been prepared to give pro forma effect to the refinancing transactions as if they had occurred as of April 1, 2003. The summary pro forma financial data is for informational purposes only and should not be considered indicative of actual results that would have been achieved had the refinancing transactions actually been consummated on such dates and do not purport to indicate results of operations as of any future date or for any future period.

| | Twelve Months

Ended March 31,

| | Three

Months Ended

March 31,

| | Year Ended

December 31,

| |

|---|

| | 2004

| | 2004

| | 2003

| | 2003

| | 2002

| | 2001(1)

| |

|---|

| | (unaudited)

| | (unaudited)

| |

| |

| |

| |

|---|

| | (Dollar amounts in millions)

| |

|---|

| Statements of Income (Loss) Data: | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 601.8 | | $ | 165.6 | | $ | 122.9 | | $ | 559.1 | | $ | 479.5 | | $ | 468.7 | |

| Cost of sales | | | 397.9 | | | 108.6 | | | 80.1 | | | 369.4 | | | 318.3 | | | 312.3 | |

| | |

| |

| |

| |

| |

| |

| |

| Gross profit | | $ | 203.9 | | $ | 57.0 | | $ | 42.8 | | $ | 189.7 | | $ | 161.2 | | $ | 156.4 | |

| Selling, general and administrative expenses(2) | | | 111.2 | | | 29.8 | | | 24.3 | | | 105.7 | | | 91.5 | | | 95.5 | |

| Restructuring expenses | | | — | | | — | | | 0.2 | | | 0.2 | | | 7.2 | | | 16.2 | |

| | |

| |

| |

| |

| |

| |

| |

| Operating income (loss) | | $ | 92.7 | | $ | 27.2 | | $ | 18.3 | | $ | 83.8 | | $ | 62.5 | | $ | 44.7 | |

| Interest expense, net | | | 69.1 | | | 17.4 | | | 17.3 | | | 69.0 | | | 71.1 | | | 94.5 | |

| Other income (expense)(3) | | | (3.4 | ) | | 0.1 | | | (0.1 | ) | | (3.6 | ) | | (0.7 | ) | | (9.1 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Income (loss) from continuing operations before income taxes | | $ | 20.2 | | $ | 9.9 | | $ | 0.9 | | $ | 11.2 | | $ | (9.3 | ) | $ | (58.9 | ) |

| Net income (loss) from continuing operations | | $ | (27.3 | ) | $ | 6.9 | | $ | 0.5 | | $ | (33.7 | ) | $ | (4.8 | ) | $ | (37.6 | ) |

| Net income (loss) | | $ | (27.3 | ) | $ | 6.9 | | $ | 0.5 | | $ | (33.7 | ) | $ | (5.7 | ) | $ | (43.6 | ) |

| Earnings per share: | | | | | | | | | | | | | | | | | | | |

| | Basic: | | | | | | | | | | | | | | | | | | | |

| | | Net income (loss) from continuing operations | | $ | (0.88 | ) | $ | 0.22 | | $ | 0.02 | | $ | (1.09 | ) | $ | (0.16 | ) | $ | (1.22 | ) |

| | | Net income (loss) | | $ | (0.88 | ) | $ | 0.22 | | $ | 0.02 | | $ | (1.09 | ) | $ | (0.19 | ) | $ | (1.42 | ) |

| | Diluted: | | | | | | | | | | | | | | | | | | | |

| | | Net income (loss) from continuing operations | | $ | (0.83 | ) | $ | 0.21 | | $ | 0.01 | | $ | (1.09 | ) | $ | (0.16 | ) | $ | (1.22 | ) |

| | | Net income (loss) | | $ | (0.83 | ) | $ | 0.21 | | $ | 0.01 | | $ | (1.09 | ) | $ | (0.19 | ) | $ | (1.42 | ) |

| Shares used in earnings per share computations (in millions): | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 30.9 | | | 30.9 | | | 30.8 | | | 30.8 | | | 30.8 | | | 30.8 | |

| | Diluted | | | 32.8 | | | 32.8 | | | 32.0 | | | 30.8 | | | 30.8 | | | 30.8 | |

| | | | | | | | | | | | | | | | | | | | |

9

Balance Sheet Data (at end of applicable period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | $ | 18.4 | | $ | 18.4 | | $ | 11.9 | | $ | 35.2 | | $ | 26.4 | | $ | 47.6 | |

| Working capital | | | 91.8 | | | 91.8 | | | 118.4 | | | 83.4 | | | 91.0 | | | 82.7 | |

| Property, plant and equipment | | | 91.7 | | | 91.7 | | | 91.4 | | | 92.0 | | | 90.7 | | | 96.2 | |

| Total assets | | | 405.4 | | | 405.4 | | | 414.7 | | | 400.4 | | | 428.0 | | | 444.8 | |

| Total debt | | | 610.2 | | | 610.2 | | | 627.6 | | | 610.5 | | | 627.5 | | | 641.0 | |

| Stockholders' equity (deficit) | | | (390.3 | ) | | (390.3 | ) | | (368.3 | ) | | (397.3 | ) | | (368.9 | ) | | (349.9 | ) |

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA (4) | | $ | 103.2 | | $ | 31.1 | | $ | 21.4 | | $ | 93.6 | | $ | 74.1 | | $ | 76.1 | |

| Net cash provided by (used in) operating activities | | | 52.9 | | | (12.1 | ) | | (9.2 | ) | | 55.8 | | | 28.8 | | | 47.8 | |

| Net cash provided by (used in) investing activities | | | (16.1 | ) | | (3.5 | ) | | (4.5 | ) | | (17.1 | ) | | (32.9 | ) | | 189.1 | |

| Net cash provided by (used in) financing activities | | | (30.3 | ) | | (1.2 | ) | | (0.8 | ) | | (29.9 | ) | | (17.1 | ) | | (194.1 | ) |

| Depreciation and amortization (5) | | | 13.9 | | | 3.8 | | | 3.2 | | | 13.4 | | | 13.8 | | | 28.0 | |

| Purchases of property, plant and equipment additions | | | 16.0 | | | 3.5 | | | 4.0 | | | 16.5 | | | 17.1 | | | 11.5 | |

| Acquisitions of businesses | | | — | | | — | | | — | | | — | | | — | | | 1.3 | |

| | As of

March 31,

| |

| |

| |

| |

| |

| |

|---|

| | 2004

| |

| |

| |

| |

| |

| |

|---|

| | (unaudited)

| |

| |

| |

| |

| |

| |

|---|

Pro Forma Balance Sheet Data: (6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | $ | 5.3 | | | | | | | | | | | |

| Property, plant and equipment | | | 91.7 | | | | | | | | | | | |

| Total assets | | | 399.1 | | | | | | | | | | | |

| Total debt | | | 549.9 | | | | | | | | | | | |

| Stockholders' equity (deficit) | | | (325.2 | ) | | | | | | | | | | |

| | Twelve Months

Ended March 31,

| |

| |

| |

| |

| |

|

|---|

| | 2004

| |

| |

| |

| |

| |

|

|---|

| | (unaudited)

| |

| |

| |

| |

| |

|

|---|

| Pro Forma Financial Ratios: (6)(7) | | | | | | | | | | | | |

| Operating income/Pro forma interest expense, net | | 2.61 | | | | | | | | | | |

| EBITDA/Pro forma interest expense, net | | 2.91 | | | | | | | | | | |

| Pro forma Total debt/Operating income | | 5.93 | | | | | | | | | | |

| Pro forma Total debt/EBITDA | | 5.33 | | | | | | | | | | |

| | Twelve Months

Ended March 31,

| | Three

Months Ended

March 31,

| | Year Ended

December 31,

| |

|---|

| | 2004

| | 2004

| | 2003

| | 2003

| | 2002

| | 2001(1)

| |

|---|

| | (Dollar amounts in millions)

| |

|---|

| Segment Operating Data: | | | | | | | | | | | | | | | | | | | |

| Sales: | | | | | | | | | | | | | | | | | | | |

| | Outdoor Products | | $ | 375.7 | | $ | 102.1 | | $ | 85.2 | | $ | 358.8 | | $ | 307.4 | | $ | 307.4 | |

| | Industrial and Power Equipment | | | 189.1 | | | 54.0 | | | 29.9 | | | 165.0 | | | 131.7 | | | 120.6 | |

| | Lawnmower | | | 37.4 | | | 9.6 | | | 7.9 | | | 35.7 | | | 41.4 | | | 43.0 | |

| | Inter-Segment Elimination | | | (0.4 | ) | | (0.1 | ) | | (0.1 | ) | | (0.4 | ) | | (1.0 | ) | | (2.3 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | | Total sales | | $ | 601.8 | | $ | 165.6 | | $ | 122.9 | | $ | 559.1 | | $ | 479.5 | | $ | 468.7 | |

| | | | | | | | | | | | | | | | | | | | |

10

Segment contribution (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Outdoor Products | | $ | 90.7 | | $ | 26.3 | | $ | 21.8 | | $ | 86.2 | | $ | 67.7 | | $ | 69.4 | |

| | Industrial and Power Equipment | | | 16.5 | | | 4.8 | | | — | | | 11.7 | | | 5.2 | | | (1.7 | ) |

| | Lawnmower | | | (0.7 | ) | | (0.2 | ) | | (0.7 | ) | | (1.2 | ) | | 2.7 | | | 0.9 | |

| | Inter-Segment Elimination | | | — | | | — | | | — | | | — | | | 0.3 | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | Contribution from segments | | $ | 106.5 | | $ | 30.9 | | $ | 21.1 | | $ | 96.7 | | $ | 75.9 | | $ | 68.6 | |

Sales backlog: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Outdoor Products | | $ | 73.0 | | $ | 73.0 | | $ | 51.2 | | $ | 66.7 | | $ | 42.9 | | $ | 32.9 | |

| | Industrial and Power Equipment | | | 49.5 | | | 49.5 | | | 9.4 | | | 47.7 | | | 10.3 | | | 12.9 | |

| | Lawnmower | | | 1.9 | | | 1.9 | | | 0.5 | | | 4.9 | | | 3.1 | | | 3.1 | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total backlog | | $ | 124.4 | | $ | 124.4 | | $ | 61.1 | | $ | 119.3 | | $ | 56.3 | | $ | 48.9 | |

- (1)

- Gives effect to the sale of the our Sporting Equipment Segment ("SEG") on December 7, 2001. Results of SEG are included in discontinued operations.

- (2)

- Includes stock-based compensation expense of $0.1 million for the year ended December 31, 2003 and $0.1 million for the three months ended March 31, 2004. Includes an expense of $0.6 million for the curtailment of a proposed financing plan for the year ended December 31, 2002.

- (3)

- Includes $0.1 million for gain on securities held in an executive trust for the year ended December 31, 2003 and $0.2 million for the three months ended March 31, 2004. Includes loss on the early extinguishment of debt of $2.8 million, $0.5 million and $8.4 million for the years ended December 31, 2003, 2002 and 2001, respectively. Includes loss on sales of capital assets of $0.8 million, $1.6 million and $0.5 million for the years ended December 31, 2003, 2002 and 2001, respectively. Includes proceeds of $2.1 million from a life insurance policy for a former company executive in the year ended December 31, 2002.

- (4)

- EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Our credit facilities contain a measure of EBITDA that includes additional (and different) adjustments. Management uses EBITDA principally as a measure of operating performance for the corporation on a consolidated basis, and for each of our operating segments. EBITDA is a non-GAAP measure and the components of our calculation may differ materially from similar measures used by other companies. EBITDA is not a measure of our liquidity or financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measure derived in accordance with GAAP or an as alternative to cash flow from operating activities. The use of EBITDA instead of net income has limitations as an analytical tool, including the inability to determine profitability, the exclusion of interest expense and associated significant cash requirements, the exclusion of income tax expenses or benefits which may ultimately be realized through the payment or receipt of cash and the exclusion of depreciation and amortization, which represents significant and unavoidable operating costs, given the capital expenditures needed to maintain our business. Management compensates for these limitations by relying primarily on our GAAP results and by using EBITDA only supplementally. Our management believes EBITDA is useful to the investors because it enables investors to evaluate how management views our business and because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies with substantial financial leverage. The following table reconciles net income or net loss to EBITDA:

| | Twelve Months

Ended March 31,

| | Three Months Ended March 31,

| | Year Ended

December 31,

| |

|---|

| | 2004

| | 2004

| | 2003

| | 2003

| | 2002

| | 2001

| |

|---|

| | (Dollar amounts in millions)

| |

|---|

| Net income (loss) (A) | | $ | (27.3 | ) | $ | 6.9 | | $ | 0.5 | | $ | (33.7 | ) | $ | (5.7 | ) | $ | (43.6 | ) |

Interest expense, net (B) |

|

|

69.1 |

|

|

17.4 |

|

|

17.3 |

|

|

69.0 |

|

|

71.1 |

|

|

94.5 |

|

| Provision (benefit) for income taxes (C) | | | 47.5 | | | 3.0 | | | 0.4 | | | 44.9 | | | (5.1 | ) | | (2.8 | ) |

| Depreciation and amortization (D) | | | 13.9 | | | 3.8 | | | 3.2 | | | 13.4 | | | 13.8 | | | 28.0 | |

| | |

| |

| |

| |

| |

| |

| |

| EBITDA | | $ | 103.2 | | $ | 31.1 | | $ | 21.4 | | $ | 93.6 | | $ | 74.1 | | $ | 76.1 | |

- (A)

- Includes net loss from discontinued operations of $0.9 million and $6.0 million for the years ended December 31, 2002 and 2001, respectively.

- (B)

- Cash interest paid for the years ended December 31, 2003, 2002 and 2001 was $63.9 million, $64.9 million and $92.5 million, respectively. Cash interest paid for the three months ended March 31, 2004 and 2003 was $22.8 million and $23.5 million, respectively.

- (C)

- Includes income tax benefit of $0.6 million for discontinued operations in the year ended December 31, 2002 and income tax expense of $18.5 million for discontinued operations in the year ended December 31, 2001. Cash income taxes paid net of refunds for 2003, 2002 and 2001 were $9.0 million, $5.2 million and $(1.3) million, respectively. Cash income taxes paid for the three months ended March 31, 2004 was $1.5 million and a net refund of $4.1 million was realized in the three months ended March 31, 2003.

- (D)

- Includes depreciation and amortization of $10.4 million for our former SEG segment in the year ended December 31, 2001.

- (5)

- In 2002, we adopted the non-amortization provisions of Statement of Financial Accounting Standards ("SFAS") No. 142. As a result of the adoption of SFAS 142, results for the years ended December 31, 2002 and 2003 do not include certain amounts amortization of goodwill that are included in prior years' financial results, described in Note 4 of Notes to Consolidated Financial Statements for the year ended December 31, 2003.

11

- (6)

- Pro forma to reflect the refinancing transactions as discussed in "Use of Proceeds" and as adjusted in "Capitalization." See also "Unaudited Pro Forma Condensed Consolidated Financial Data."

- (7)

- Operating income and EBITDA are presented on a historical basis as they are not affected by the refinancing transactions. Pro forma total debt gives effect to the refinancing transactions as if they had occurred on March 31, 2004 and pro forma interest expense is for the twelve months ended March 31, 2004 and gives effect to the refinancing transactions as if they had occurred on January 1, 2003. The most directly comparable GAAP financial measure to EBITDA/pro forma interest expense is operating income/pro forma interest expense, which is calculated by dividing operating income by pro forma interest expense. EBITDA/pro forma interest expense is calculated by dividing EBITDA by pro forma interest expense.

- The most directly comparable GAAP financial measure to pro forma total debt/EBITDA is pro forma total debt/operating income, which is calculated by dividing pro forma total debt by operating income. Pro forma total debt/EBITDA is calculated by dividing pro forma total debt by EBITDA.

12

RISK FACTORS

You should carefully consider the following risk factors, in addition to the other information contained in this prospectus, prior to making an investment decision. You may lose all or part of your investment.

Risks Related to Our Business

Substantial Leverage—Due to our substantial leverage, we may have difficulty operating our business and satisfying our debt obligations.

As of March 31, 2004, after giving pro forma effect to the refinancing transactions, we would have had approximately $724.3 million of total liabilities, $549.9 million of total debt and a stockholders' deficit of $325.2 million. This substantial leverage may have important consequences for us, including the following:

- •

- our ability to obtain additional financing for working capital, capital expenditures or other purposes may be impaired or such financing may not be available on terms favorable to us;

- •

- a substantial portion of our cash flow available from operations will be dedicated to the payment of principal and interest expense, which will reduce the funds that would otherwise be available to us for operations and future business opportunities;

- •

- a substantial decrease in net operating income and cash flows or an increase in expenses may make it difficult for us to meet our debt service requirements or force us to modify our operations; and

- •

- our substantial leverage may make us more vulnerable to economic downturns and competitive pressure.

The credit agreement governing our amended and restated credit facilities and the new indenture for Blount's 87/8% Senior Subordinated Notes due 2012 will contain restrictions that may affect our operations, including our and certain of our subsidiaries' ability to incur indebtedness or make acquisitions or capital expenditures. However, these restrictions will not fully prohibit us or our subsidiaries from incurring additional indebtedness, and this additional indebtedness may be substantial. The terms of our amended and restated credit facilities will allow us to incur additional indebtedness of up to approximately $37.2 million after completion of the refinancing transactions. If we, Blount or any of our subsidiaries incur additional indebtedness following the refinancing transactions, the risks outlined above could worsen.

Restrictive Covenants—The terms of our indebtedness contain a number of restrictive covenants, the breach of which could result in acceleration of the amended and restated credit facilities and the notes.

The terms of our indebtedness contain a number of restrictive covenants, the breach of which could result in acceleration of our obligations to repay amounts owed under our amended and restated credit facilities and the notes. An acceleration of our repayment obligation under our amended and restated credit facilities could result in a payment or distribution of substantially all of our assets to our secured lenders, which would materially impair our ability to operate our business as a going concern. The indenture and our amended and restated credit facilities will, among other things, restrict our and certain of our subsidiaries' ability to:

- •

- borrow money and issue preferred stock;

- •

- guarantee indebtedness of others;

- •

- pay dividends on or purchase our stock or our restricted subsidiaries' stock;

- •

- make investments;

- •

- use assets as security in other transactions;

- •

- sell certain assets or merge with or into other companies;

13

- •

- enter into sale and leaseback transactions;

- •

- enter into certain types of transactions with affiliates;

- •

- limit dividends or other payments to us;

- •

- enter into new businesses; and

- •

- make certain payments in respect of subordinated indebtedness.

See "Description of Our Indebtedness."

The amended and restated credit facilities will also prohibit Blount from prepaying principal in respect of the notes and restricts our ability to engage in any business or operations other than those incidental to our ownership of the capital stock of Blount. In addition, the amended and restated credit facilities require us to maintain certain financial ratios and satisfy certain financial condition tests, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. Our ability to meet those financial ratios and tests could be affected by events beyond our control, and there can be no assurance that we will meet those ratios and tests. A breach of any of these covenants could result in a default under any or all of the notes or the amended and restated credit facilities. Upon the occurrence of an event of default under the amended and restated credit facilities, the lenders could elect to declare all amounts outstanding under the amended and restated credit facilities, together with any accrued interest and commitment fees, to be immediately due and payable. If the borrowers were unable to repay those amounts, the lenders under the amended and restated credit facilities could enforce the guarantees from the guarantors and proceed against the collateral securing the amended and restated credit facilities. The assets of the applicable guarantors could be insufficient to repay in full that indebtedness and our other indebtedness, including the notes. See "Description of Our Indebtedness."

Litigation—We may have litigation liabilities that could result in significant costs to us.

Our historical business operations have resulted in a number of litigation matters, including litigation involving personal injury or death as a result of alleged design or manufacturing defects of our products. Some of these product liability suits seek significant or unspecified damages for serious personal injuries for which there are retentions or deductible amounts under our insurance policies. In the future we may face additional lawsuits, and it is difficult to predict the amount and type of litigation that we may face. Litigation and insurance and other related costs could result in future liabilities that are significant and which could significantly reduce our cash flows and cash balances. See "Business—Legal Proceedings."

Key Customers and Suppliers—Any loss of a few key customers or suppliers would substantially decrease our sales.

In 2003, approximately $57.8 million (approximately 10%) of our sales were to one customer (The Electrolux Group) and approximately $117.6 million (approximately 20%) of our sales were to our top four customers. While we expect these business relationships to continue, the loss of any of these customers would most likely substantially decrease our sales. Additionally, Blount's Industrial and Power Equipment segment has a joint marketing, supply and distribution arrangement with Caterpillar Inc. Any disruption in that relationship could result in a significant decline in that segment's sales.

Each of our business segments purchases some of its important materials and parts from a limited number of suppliers that meet certain quality criteria. We generally do not operate under long-term written supply contracts with our suppliers. Although alternative sources of supply are available, the sudden elimination of certain suppliers could result in manufacturing delays, an increase in costs, a reduction in product quality and a possible loss of sales in the near term.

14

Furthermore, we purchase certain raw materials for the manufacture of products. Some of these raw materials are subject to price volatility over periods of time. We have not hedged against the price volatility of any raw materials within our operating segments with any derivative instruments. A hypothetical immediate 10% change in the price of steel would have the estimated effect of $4.5 million on pre-tax income in 2004.

We are subject to general economic factors that are largely out of our control, any of which could, among other things, result in a decrease in sales and net income and an increase in our interest expense.

Our business is subject to a number of general economic factors that may, among other things, result in a decrease in sales and net income and an increase in our interest expense, many of which are largely out of our control. These include recessionary economic cycles and downturns in customers' business cycles, particularly our customers in the forestry industry (as discussed below), which accounted for approximately 30% of our sales in 2003, as well as downturns in the principal regional economies where our operations are located. Our amended and restated credit facilities permit us to make borrowings at interest rates that are floating. If we do not hedge against fluctuations in interest rates, any increases in interest rates could increase our interest expense payable under the amended and restated credit facilities to levels in excess of what we currently expect (we estimate a 10% increase in interest rates would increase our interest expense payable in 2004 by $0.6 million). Economic conditions may adversely affect our customers' business levels and the amount of products that they need. For example, during the global economic downturn in 2001, our sales fell by $45.2 million from the previous year. Furthermore, customers encountering adverse economic conditions may have difficulty in paying for our services and actual bad debts may exceed our allowances. Finally, terrorist activities, anti-terrorist efforts, war or other armed conflicts involving the United States or its interests abroad may result in a downturn in the U.S. and global economies and exacerbate the risks to our business described in this paragraph.

Cyclicality—Industrial and Power Equipment sales are influenced by the economic cycle of the forestry industry and future economic downturns in that industry could cause sales of the Industrial and Power Equipment segment to decrease.

The results of operations of our Industrial and Power Equipment segment are closely linked to the strength of the forestry industry. In the past, the strength of the forestry industry has been cyclical, experiencing recurring periods of economic growth and slowdown, which, correspondingly, have impacted the amount of our Industrial and Power Equipment segment's sales and have caused the amounts of its sales to vary significantly.

The length and extremity of industry cycles have varied over time, reflecting macroeconomic conditions and levels of industry capacity growth. A booming macro economy in the late 1980s helped fuel paper demand and offset industry capacity growth. However, as the broader economy retrenched into a recession in the early 1990s, pulp prices headed into a prolonged downturn, which lasted from 1991 through mid-1994. A sharp market recovery then sent pulp prices soaring, reaching historic peak levels in 1995, which proved to be one of the most profitable years on record for the paper and forest products industry. After this, the pulp market entered a period of relative weakness. Prices fell off sharply by the end of 1995 and through much of 1996, as customers sold inventory built up during the upswing. Strong growth in the U.S., combined with mill downtime, supported some modest improvement in the pulp market in 1997, but the Asian financial crisis and the strong U.S. dollar tempered this growth. By mid-1999, the industry was once again in recovery mode aided by a strong U.S. economy and modest capacity growth. However, this recovery was relatively short-lived as the economy started to falter at the end of 2000 and ultimately slid into recession in 2001, putting pressure on demand and prices for paper products. Our sales to our timber harvesting equipment customers fell by 20.4% in 2001 as compared to 2000, which contributed in part to a decline in IPEG's segment contribution of $2.8 million in 2001, as compared to 2000. The lumber market during the last 15 years has also been subject to similar short term periods of excess demand and excess supply, causing prices

15

to fluctuate. In the past year, though, the pulp and paper market and the lumber market have experienced increased market strength as the economy has improved and an upturn in advertising spending has increased demand. However, it is possible that the pulp and paper market and the lumber market could at any time experience renewed market weakness, which would cause our sales and operating income to decrease.

Foreign Sales—We have substantial foreign sales, which sales could decrease as a result of changes in local economic or political conditions, fluctuations in currency exchange rates, unexpected changes in regulatory environments and potentially adverse tax consequences.

In 2003, approximately 40% of our sales by country of destination occurred outside of the United States. International sales are subject to inherent risks, including changes in local economic or political conditions, the imposition of currency exchange restrictions, unexpected changes in regulatory environments and potentially adverse tax consequences. Under some circumstances, these factors could result in significant declines in international sales. For example, though our 2003 sales to Southeast Asia, Russia and South America were approximately 3%, 2% and 4%, respectively, of our total sales, recent economic and political uncertainty in those areas did nevertheless have an effect on our ability to achieve sales levels in those areas that are comparable to those achieved in prior years.

Some of our sales and expenses are frequently denominated in local currencies which can be affected by fluctuations in currency exchange rates in relation to the U.S. dollar. Historically, our principal exposures have been related to local currency operating costs and expenses in Canada and Brazil, and local currency sales and expenses in Europe. We currently do not use derivatives to manage foreign currency exchange risk. Any change in the exchange rates of currencies of jurisdictions into which we sell products or incur expenses could result in a significant decrease in reported sales and operating income (for example, we estimate that a 10% weaker Euro as compared to the U.S. dollar would have reduced our sales by $3.1 million in 2003).

Controlling Stockholder—Stockholders other than Lehman Brothers Merchant Banking Partners have little or no influence on decisions regarding company matters.

Lehman Brothers Merchant Banking Partners will own approximately 61.2% of our outstanding shares after the closing of the refinancing transactions. Lehman Brothers Merchant Banking Partners has the power to control our direction and policies, the election of all of our directors and the outcome of any matter requiring stockholder approval, including adopting amendments to our certificate of incorporation and approving mergers or sales of all or substantially all of our assets. Additionally, we have retained affiliates of Lehman Brothers Merchant Banking Partners to perform advisory and financing services for us in the past, and we may continue to do so in the future. The directors elected by Lehman Brothers Merchant Banking Partners have the authority to make decisions affecting the appointment of our management and capital structure, including the issuance of additional capital stock, the implementation of stock repurchase programs and the declaration of dividends. Stockholders other than Lehman Brothers Merchant Banking Partners will have little or no influence on decisions regarding such matters.

In addition, the existence of a controlling stockholder may have the effect of making it virtually impossible for a third party to acquire, or of discouraging a third party from seeking to acquire, us without the consent of Lehman Brothers Merchant Banking Partners. A third party would be required to negotiate any such transaction with Lehman Brothers Merchant Banking Partners and the interests of Lehman Brothers Merchant Banking Partners may be different from the interests of our other stockholders.

Competition—Competition may result in decreased sales and operating income.

Most of the markets in which we operate are competitive. We believe that design features, product quality, customer service and price are the principal factors considered by customers in each of our

16

business segments. Some of our competitors may have greater financial resources, lower costs, superior technology or more favorable operating conditions than we do. For example, although we have made recent improvements in our Dixon product line, which resulted in a reduction of Dixon's losses contributed to our consolidated operating income in the three months ended March 31, 2004 as compared to the three months ended December 31, 2003, Dixon experienced increased competition in the last three years which resulted in its segment contribution to our consolidated operating income declining from $0.9 million in 2001 to a loss of $(1.2) million in 2003. We may not be able to compete successfully with our existing or any new competitors and competitive pressures we face may result in decreased sales and operating income.

Environmental Matters—We face potential exposure to environmental liabilities and costs.

We are subject to various U.S. and foreign environmental laws and regulations relating to the protection of the environment, including those governing discharges of pollutants into the air and water, the management and disposal of hazardous substances and the cleanup of contaminated sites. Violations of or liabilities incurred under these laws and regulations could result in an assessment of significant costs to us, including civil or criminal penalties, claims by third parties for personal injury or property damage, requirements to investigate and remediate contamination and the imposition of natural resource damages. Furthermore, under certain environmental laws, current and former owners and operators of contaminated property or parties who sent waste to the contaminated site can be held liable for cleanup, regardless of fault or the lawfulness of the original disposal activity.

Future events, such as the discovery of additional contamination or other information concerning past releases of hazardous substances at our or other sites, changes in existing environmental laws or their interpretation, and more rigorous enforcement by regulatory authorities, may require additional expenditures by us to modify operations, install pollution control equipment, clean contaminated sites or curtail our operations. These expenditures could significantly reduce our net income and cash balances. See "Business—Environmental Matters" and "Business—Legal Proceedings."

Risks Relating to This Offering

We do not intend to pay dividends in the future.

Blount International intends to retain future earnings for funding growth, and therefore, Blount International does not expect to pay any dividends in the foreseeable future. In addition, our amended and restated credit facilities prohibit us from paying any dividends and the terms of the notes will limit our ability to pay dividends. See the section entitled "Price Range of Common Stock and Dividend Policy."

Future sales of our common stock in the public market could lower our stock price.

We may sell additional shares of common stock in subsequent public offerings. We may also issue additional shares of common stock to finance future transactions. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock will have on the market price of our common stock. Sales of substantial amounts of Blount International's common stock (including shares issued in connection with an acquisition), or the perception that such sales could occur, may adversely affect the prevailing market price of Blount International's common stock.

The price of our common stock may fluctuate significantly, and you could lose all or part of your investment.

Volatility in the market price of Blount International's common stock may prevent you from being able to sell your shares at or above the price you paid for your shares. The market price of Blount International's common stock could fluctuate significantly for various reasons which include:

- •

- our quarterly or annual earnings or those of other companies in our industries;

17

- •

- the public's reaction to our press releases, our other public announcements and our filings with the SEC;

- •

- changes in earnings estimates or recommendations by research analysts who track our common stock or the stock of other comparable companies;

- •

- changes in general conditions in the U.S. and global economy, financial markets or forestry industry, including those resulting from war, incidents of terrorism or responses to such events;

- •

- sales of common stock by our controlling shareholder, directors and executive officers; and

- •

- the other factors described in these "Risk Factors."

In addition, in recent years, the stock market has experienced extreme price and volume fluctuations. This volatility has had a significant impact on the market price of securities issued by many companies, including companies in our industry. For example, in each of the three preceding calendar years, Blount International's highest closing stock price has exceeded its lowest by an average of 162%. The changes in prices frequently appear to occur without regard to the operating performance of these companies. The price of our common stock could fluctuate based upon factors that have little or nothing to do with our company, and these fluctuations could materially reduce our stock price. Additionally, since January 1, 2003, daily trading volume for Blount International's common stock has averaged 19,643 shares, which may reflect that there is a limited market for Blount International's stock. This apparent lack of liquidity may accentuate fluctuations in the price of Blount International's stock, and may limit your ability to sell your stock.

These provisions could also limit the price that certain investors might be willing to pay in the future for shares of Blount International's common stock. See "Description of Capital Stock."

18

FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements," as that term is defined in the Private Securities Litigation Reform Act of 1995, which include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. These forward-looking statements include, without limitation, statements regarding: expectations as to operational improvements; expectations as to cost savings, sales growth and earnings; the time by which certain objectives will be achieved; estimates of costs relating to environmental remediation and restoration; proposed new products and services; expectations that claims, lawsuits, environmental costs, commitments, contingent liabilities, labor negotiations or agreements, or other matters will not have a material adverse effect on our consolidated financial position, results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management's goals and objectives and other similar expressions concerning matters that are not historical facts. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar expressions, as well as statements in future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management's good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Important factors that could cause such differences include, but are not limited to: whether we are fully successful in implementing our financial and operational initiatives; competition in our various industries, conditions, performance and consolidation; legislative and/or regulatory developments; the effects of adverse general economic conditions, both within the United States and globally; any adverse economic or operational repercussions from recent terrorist activities, any government response thereto and any future terrorist activities, war or other armed conflicts; changes in fuel, steel or other basic materials prices; changes in labor costs; labor stoppages; the outcome of claims and litigation; natural events such as severe weather, floods, earthquakes and abnormally dry or wet weather conditions; and other factors described under "Risk Factors."

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information. If we do update one or more forward- looking statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other forward-looking statements.

TRADEMARK NOTICE

Oregon, ICS, Hydro-Ax, Prentice, Frederick, Dixon, Fabtek, ICS, IZT, EZT, RAM, ZTR and CTR are registered or pending trademarks of Blount and its subsidiaries.

19

USE OF PROCEEDS

We estimate that we will receive net proceeds from this share offering of approximately $112.2 million, after deducting underwriters' discounts and commissions and estimated fees and expenses. Concurrently with the share offering, we are offering $175.0 million aggregate principal amount of our 87/8% Senior Subordinated Notes due 2012. We estimate that we will receive net proceeds from the note offering of approximately $169.4 million, after deducting underwriters' discounts and commissions and estimated fees and expenses. The amendment and restatement of our credit facilities will provide, among other things, for an additional $229.9 million of borrowings as compared to our existing credit facilities. We will use the net proceeds from the share offering and the note offering, together with borrowings totaling $374.9 million under the amended and restated credit facilities, (1) to (a) redeem in full the $150.0 million in aggregate principal amount of Blount, Inc.'s 7% Senior Notes outstanding, which are redeemable at a make-whole premium, (b) redeem in full the $323.2 million in aggregate principal amount of Blount, Inc.'s 13% Senior Subordinated Notes outstanding, which are redeemable, beginning August 1, 2004 at 106.500% of the aggregate principal amount thereof, or $344.2 million and (c) prepay in full Blount International, Inc.'s 12% Convertible Preferred Equivalent Security for $29.0 million (composed of the prepayment premium of 102.400% of the aggregate principal amount thereof, plus accrued and unpaid interest) and (2) to pay fees and expenses related to the refinancing transactions. See "Prospectus Summary—The Refinancing Transactions."

Our 7% Senior Notes due 2005 bear interest at the rate of 7% per year and mature on June 15, 2005. Our 13% Senior Subordinated Notes due 2009 bear interest at the rate of 13% and mature on August 1, 2009. Our 12% Convertible Preferred Equivalent Security bears interest at the rate of 12% per year and matures on March 2, 2013. An affiliate of Lehman Brothers Merchant Banking Partners holds the 12% Convertible Preferred Equivalent Security.

20

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2004 on an actual basis and on a pro forma basis to reflect the refinancing transactions.

The following table should be read in conjunction with "Selected Historical Consolidated Financial Data," "Consolidated Financial Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Description of Our Capital Stock", "Unaudited Pro Forma Condensed Consolidated Financial Data" and our consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| | As of March 31, 2004

| |

|---|

| | Actual

| | Adjustments

| | Pro Forma

| |

|---|

| | (Dollar amounts in millions)

| |

|---|

| Total debt (including current portion): | | | | | | | | | | |

| | Credit Facility: | | | | | | | | | | |

| | | Revolving credit facility(1) | | $ | — | | $ | 55.0 | | $ | 55.0 | |

| | | Term loan A | | | 28.8 | | | (28.8 | ) | | — | |

| | | Term loan B | | | 80.0 | | | 185.0 | | | 265.0 | |

| | | Canadian term loan | | | 5.4 | | | (0.5 | ) | | 4.9 | |

| | | Second Collateral Institutional Loan | | | — | | | 50.0 | | | 50.0 | |

| | Other long term debt: | | | | | | | | | | |

| | 7% senior notes due 2005 | | | 149.7 | | | (149.7 | ) | | — | |

| | 13% senior subordinated notes due 2009 | | | 323.2 | | | (323.2 | ) | | — | |

| | 87/8% senior subordinated notes due 2012 | | | — | | | 175.0 | | | 175.0 | |

| | 12% convertible preferred equivalent security due 2013 | | | 23.1 | | | (23.1 | ) | | — | |

| | |

| |

| |

| |

| | Total debt: | | $ | 610.2 | | $ | (60.3 | ) | $ | 549.9 | |

| | |

| |

| |

| |

Common stockholders' equity: |

|

|

|

|

|

|

|

|

|

|

| Common stock, $0.01 par value, 100,000,000 shares authorized, 30,883,103 shares issued and outstanding actual and 42,883,103 shares issued and outstanding pro forma | | $ | 0.3 | | $ | 0.1 | | $ | 0.4 | |

| Paid-in surplus | | | 424.9 | | | 112.1 | | | 537.0 | |

| Accumulated deficit | | | (813.1 | ) | | (47.1 | ) | | (860.2 | ) |

| Accumulated other comprehensive income | | | (2.4 | ) | | — | | | (2.4 | ) |

| | |

| |

| |

| |

| | Total stockholders' equity (deficit) | | $ | (390.3 | ) | $ | 65.1 | | $ | (325.2 | ) |

| | |

| |

| |

| |

| | | Total capitalization | | $ | 219.9 | | $ | 4.8 | | $ | 224.7 | |

| | |

| |

| |

| |

- (1)