SCHEDULE 14A INFORMATION

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement |

¨ Definitive Additional Materials |

¨ Soliciting Material Under Rule 14a-12 |

ONVIA. COM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Onvia Stockholder Letter

Dear Fellow Stockholders:

In 2001, Onvia became singularly focused on the business-to-government (B2G) marketplace, helping businesses secure government contracts and government agencies find suppliers online. Companies, large and small, are recognizing the vast opportunities in the $600 billion federal, state, and local government marketplace and the importance of subscribing to Onvia’s service to access these markets.

Onvia’s initial business model focused on attracting business-to-business (B2B) exchange customers by selling computer and office products at deep discounts. With negative gross margins and slow B2B exchange revenue growth, Onvia was losing tens of millions of dollars each quarter. In 2001, we disposed of the B2B businesses because it was unclear whether these businesses could be successful without raising additional capital.

Onvia today is a market leader connecting businesses to government contracts. We aggregate and classify over 20,000 new opportunities each month from over 50,000 federal, state, and local government buying entities, then match and distribute these opportunities to our growing list of over 25,000 subscribing businesses. In addition, more than 400 local agencies use Onvia to manage their vendor database and distribute new solicitations. These services allow government and businesses to cost-effectively match the opportunities with the right supplier.

Onvia is now completely focused on high margin subscription based revenues. Margins for Q1 2002 exceeded 75%. The outlook for Onvia is strong. Since January of 2001 Onvia has:

| • | completed the integration of the acquisitions of three B2G leaders: Globe-1, DemandStar, and ProjectGuides; |

| • | increased B2G revenues by 456% over the last four fiscal quarters; |

| • | reduced our operating expenses by 70% since the end of Q1 2001; |

| • | increased deferred revenue from paid subscriptions to $2.6 million at the end of Q1 2001; |

| • | grown the subscriber base to over 25,000 businesses; and |

| • | built a strong balance sheet for future growth and potential corporate transactions. |

We are projecting to reach cash flow profitability, including the cost of idle lease facilities, in Q2 2003 with over $35 million cash on hand.

In March of 2002, the Board of Directors declared a cash distribution/return of capital to stockholders of approximately $31 million and in May approved and recommended to stockholders a reverse stock split by a ratio of 1-for-10. These actions recognize the dramatic change in Onvia’s business model, which required less cash to operate successfully and a capital structure in line with a company of our size. Subsequent to the special cash distribution and proposed reverse stock split, Onvia will retain over $5 per share in cash.

The reverse stock split also reflects a strong desire to remain listed on Nasdaq. We believe the continued successful operation of the business, combined with the reverse stock split will enable Onvia to meet the Nasdaq listing requirements. In addition, the reverse stock split is expected to create a stock price more suitable for attracting new investors, including institutional investors.

Our revenue per subscriber growth of over 118% in the last four quarters demonstrates the success of our service. With high gross margins, automated processes and a staff of approximately 100, we have created a model with a recurring subscription revenue stream and a relatively fixed cost structure. Onvia’s strong balance sheet positions us to opportunistically expand our business.

In the case of Onvia and the year 2001, it is truly appropriate to show our gratitude to Onvia’s employees, both current and past, for their belief in and dedication to achieving something meaningful for the stockholders of Onvia. The accomplishments in 2001 clearly position Onvia and our stockholders to benefit from the commitment of our employees. Thank you.

|  | |

| Michael D. Pickett | Clayton W. Lewis | |

Chief Executive Officer, Acting Chief Financial Officer, and Chairman of the Board | President, Chief Operating Officer |

Notice of Annual Meeting of Stockholders

To Be Held July 11, 2002

Notice is hereby given that the annual meeting of the stockholders of Onvia.com, Inc., a Delaware corporation, will be held on July 11, 2002, at 1:00 p.m. local time, at our principal executive offices located at 1260 Mercer Street, Seattle, Washington 98109, for the following purposes:

| 1. | To elect two Class II directors to hold office for a three-year term and until their respective successors are elected and qualified. |

| 2. | To consider and approve an amendment to our Certificate of Incorporation to effect a reverse split of our outstanding common stock by a ratio of 1-for-10 and to effect a decrease in the number of authorized shares of our common stock from 265,000,000 to 13,000,000. |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2002. |

| 4. | To transact such other business as may properly come before the meeting. |

Stockholders of record at the close of business on May 28, 2002 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices.

We cordially invite all stockholders to attend the meeting in person. However, whether or not you expect to attend the meeting in person, please mark, date, sign, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided to ensure your representation and the presence of a quorum at the meeting. If you send in your proxy card and then decide to attend the meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

By order of the Board of Directors,

Michael D. Pickett

Chief Executive Officer, Acting Chief Financial

Officer, and Chairman of the Board

Seattle, Washington

June 24, 2002

IMPORTANT: Please fill in, date, sign and promptly mail the enclosed proxy card in the accompanying postage-paid envelope to assure that your shares are represented at the meeting. If you attend the meeting, you may choose to vote in person even if you have previously sent in your proxy card.

ONVIA.COM, INC.

1260 Mercer Street

Seattle, WA 98109

PROXY STATEMENT

FOR THE

2002 ANNUAL MEETING OF STOCKHOLDERS

JULY 11, 2002

Our Board of Directors is soliciting proxies for the 2002 Annual Meeting of Stockholders. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully. Voting materials, which include this proxy statement, the enclosed proxy card and our 2001 Annual Report, are being mailed to stockholders on or about June 24, 2002.

In this proxy statement, unless the context otherwise requires, the terms “we,” “us,” “our,” and the “Company” refer to Onvia.com, Inc., a Delaware corporation.

We have summarized below important information with respect to the annual meeting.

Voting Securities

Only stockholders of record who owned our common stock as of the close of business on May 28, 2002 will be entitled to vote at the meeting and any adjournment thereof. As of that time, we had 76,587,717 shares of common stock outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the annual meeting. Each stockholder of record as of that date is entitled to one vote for each share of common stock held by him or her.

Time and Place of the Annual Meeting

The annual meeting is being held on Thursday, July 11, 2002 at 1:00 p.m. local time at our principal executive offices located at 1260 Mercer Street, Seattle, Washington 98109.

Proposals to be Voted On at This Year’s Annual Meeting

You are being asked to vote on the following proposals:

1. To elect two Class II directors to hold office for a three-year term and until their respective successors are elected and qualified.

2. To consider and approve an amendment to our Certificate of Incorporation to effect a reverse split of our outstanding common stock by a ratio of 1-for-10 and to effect a decrease in the number of authorized shares of our common stock from 265,000,000 to 13,000,000.

3. To ratify the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2002.

4. To transact such other business as may properly come before the meeting.

The Board of Directors recommends a vote FOR each proposal.

Multiple Proxy Cards

If you received more than one proxy card, it means that you hold shares in more than one account. Please sign and return all proxy cards to ensure that all your shares are voted.

Quorum Requirement

Our Bylaws provide that a majority of all of the shares of stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and “broker non-votes” will be counted as present for purposes of determining the presence of a quorum.

Proxies Not Returned and Broker Non-Votes

If your shares are held in your name, you must return your proxy (or attend the annual meeting in person) in order to vote on the proposals. If your shares are held in street name and you do not vote your proxy, your brokerage firm may either:

| • | vote your shares on routine matters, or |

| • | leave your shares unvoted. |

Under the rules that govern brokers who have record ownership of shares that are held in street name for their clients, brokers may vote such shares on behalf of their clients with respect to routine matters (such as the election of directors or the ratification of auditors), but not with respect to non-routine matters (such as a proposal submitted by a stockholder). If the proposals to be acted upon at any meeting include both routine and non-routine matters, the broker may turn in a proxy card for uninstructed shares that vote FOR the routine matters, but expressly states that the broker is not voting on non-routine matters. This is called a “broker non-vote.”

Broker non-votes will be counted for the purpose of determining the presence of a quorum, but will not be counted for the purpose of determining the number of votes cast.

We encourage you to provide instructions to your brokerage firm by voting your proxy. This ensures that your shares will be voted at the meeting.

Abstentions

Abstentions are counted as shares that are present and entitled to vote for the purposes of determining the presence of a quorum and as votes AGAINST for purposes of determining the approval of any matter submitted to the stockholders for a vote.

Proxy Solicitation

The accompanying proxy is solicited by our Board of Directors for use at the annual meeting. We will bear the costs of soliciting proxies. In addition to soliciting stockholders by mail through our employees, we will request banks, brokers and other custodians, nominees and fiduciaries to solicit customers for whom they hold our stock and will reimburse them for their reasonable, out-of-pocket costs. We may use the services of our directors, officers, and others to solicit proxies, personally or by telephone or otherwise, without additional compensation. We have not retained the services of a proxy solicitor.

2

Voting of Proxies

The shares represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the annual meeting. If the proxy card specifies a choice with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. Any proxy card which is returned but not marked will be voted FOR each of the director nominees, FOR each of the other proposals discussed in this proxy statement, and as the proxy holders deem desirable for any other matters that may come before the meeting. Broker non-votes will not be considered as voting with respect to any matter for which the broker does not have voting authority. A stockholder giving a proxy has the power to revoke his or her proxy at any time before it is exercised by delivering to the Secretary of the Company a written instrument revoking the proxy with a later date, or by attending the meeting and voting in person.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

We have a classified Board of Directors of seven members consisting of Class I directors, Class II directors and Class III directors, who will serve until the annual meetings of stockholders to be held in 2004, 2002 and 2003, respectively, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates. Any additional directorships resulting from an increase in the number of directors are distributed among the three classes so that, as nearly as possible, each class consists of an equal number of directors. There are currently two Class I directors, two Class II directors and two Class III directors serving on the Board of Directors, and one vacancy.

Nominees for Directors

The terms of the Class II directors will expire on the date of the upcoming meeting. Accordingly, two persons are to be elected to serve as Class II directors of the Board of Directors at the meeting. The Board of Directors has nominated for election by the stockholders to those two positions the current Class II members of the Board of Directors, Michael D. Pickett and Nancy J. Schoendorf. If elected, the nominees will serve as directors until our annual meeting of stockholders in 2005 and until their respective successors are elected and qualified.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for these nominees. In the event that either nominee is unable or declines to serve as a director for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for any substitute nominee who shall be designated by the Board of Directors.

Vote Required and Board of Directors’ Recommendation

If a quorum representing a majority of all outstanding shares of our common stock is present and voting, either in person or by proxy, the two nominees for Class II director receiving the highest number of votes will be elected as Class II directors. Votes withheld from any nominee, abstentions, and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the voting.

The Board of Directors unanimously recommends a vote FOR each of the nominees named above.

3

The following table sets forth, for our current directors, including the Class II nominees to be elected at this meeting, certain information with respect to their ages and background.

Name | Age | Position with Onvia.com | Director Since | |||

Class I directors whose terms expire at the 2004 annual meeting of stockholders: | ||||||

| Kenneth A. Fox (2) | 31 | Director | 1999 | |||

| Steven D. Smith (1) | 43 | Director | 2000 | |||

Class II directors nominated for election at the 2002 annual meeting of stockholders: | ||||||

| Michael D. Pickett | 54 | Chief Executive Officer, Acting Chief Financial Officer, and Chairman of the Board | 1999 | |||

| Nancy J. Schoendorf (1)(2) | 47 | Director | 1999 | |||

Class III directors whose terms expire at the 2003 annual meeting of stockholders: | ||||||

| Jeffrey C. Ballowe (1)(2) | 46 | Director | 1999 | |||

| William W. Ericson | 43 | Director | 1999 | |||

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

Class II Director Nominees

Michael D. Pickett has served as a director of the Company since February 1999, as Chief Executive Officer and Chairman of the Board of the Company since April 2001, and as Acting Chief Financial Officer of the Company since September 2001. Mr. Pickett also served as President and Chief Operating Officer of the Company from April to December 2001 and as Chairman of the Board from February 1999 to August 2000. From July 1999 to August 2000, Mr. Pickett served as Chief Executive Officer of Hardware.com, Inc., an online source for total home improvement solutions, which was acquired by the Company in September 2000. From July 1997 to March 1999, Mr. Pickett was Chairman and Chief Executive Officer of Technology Solutions Network, LLC, a provider of turnkey technology solutions for small businesses. From October 1983 to February 1996, Mr. Pickett served in a variety of positions and most recently as Chairman, Chief Executive Officer and President of Merisel, Inc., a wholesale distributor of computer hardware and software products and a provider of logistics services. Mr. Pickett holds a Bachelor of Arts in Business Administration from the University of Southern California.

Nancy J. Schoendorf has served as a director of the Company since February 1999. Ms. Schoendorf has been a general partner of Mohr, Davidow Ventures, a venture capital firm, since 1993, and Managing Partner of Mohr, Davidow since 1997. Prior to joining Mohr, Davidow, Ms. Schoendorf spent 17 years in the computer industry, including holding management positions with Hewlett-Packard, Software Publishing Corporation, and Sun Microsystems, Inc. Ms. Schoendorf currently serves as director of Agile Software Corporation and several privately held companies. Ms. Schoendorf holds a Bachelor of Science in Computer Science from Iowa State University and a Master of Business Administration from Santa Clara University.

Class III Directors Continuing until 2003

Jeffrey C. Ballowe has served as a director of the Company since December 1999. From 1986 to 1998, Mr. Ballowe held various management positions at Ziff-Davis, including President of the Interactive Media and Development Group. Before leaving Ziff-Davis at the end of 1998, Mr. Ballowe led the launches of five magazines, ZDNet on the Web, TechTV (f.k.a. ZDTV), and the initial ZD/Softbank investments in Yahoo!, USWeb, GameSpot and Herring Communications. Mr. Ballowe also serves as a director of VerticalNet and is on the advisory board of Internet Capital Group. Mr. Ballowe holds a Bachelor of Arts in Economics and French

4

from Lawrence University, a Master of Arts in French from the University of Wisconsin and a Master of Business Administration from the University of Chicago.

William W. Ericson has served as a director of the Company since September 1999. Since March 2000, Mr. Ericson has been a partner at Mohr, Davidow Ventures, a venture capital firm. From August 1995 to March 2000, Mr. Ericson was an attorney at Venture Law Group, a law firm specializing in the representation of technology companies. Prior to joining Venture Law Group, Mr. Ericson was an associate in the Palo Alto, California office of the law firm of Brobeck, Phleger and Harrison, LLP from October 1992 through August 1995. Mr. Ericson holds a Bachelor of Science in Foreign Service from Georgetown University and a Juris Doctor from the Northwestern University School of Law.

Class I Directors Continuing until 2004

Kenneth A. Fox has served as a director of the Company since February 1999. In March 1996, Mr. Fox co-founded Internet Capital Group, Inc., an Internet company primarily engaged in managing and operating a network of business-to-business ecommerce companies. Mr. Fox has served as one of Internet Capital Group’s Managing Directors since its inception. Mr. Fox has also served as a director of Internet Capital Group since February 1999. Prior to forming Internet Capital Group, Mr. Fox was the Director of West Coast Operations for Safeguard Scientifics, Inc., a leader in incubating, operating and developing technology companies in the Internet infrastructure market, and was Director of West Coast operations for Technology Leaders II, LP, a venture capital partnership, from 1994 to 1996. Mr. Fox serves as a director of AUTOVIA Corporation, Commerx, Inc., Deja.com, Inc., Entegrity Solutions Corporation, Internet Commerce Systems, Inc., and Vivant! Corporation. Mr. Fox holds a Bachelor of Science in Economics from Pennsylvania State University.

Steven D. Smith has served as a director of the Company since January 2000. Since March 1997, Mr. Smith has served as Managing Director of GE Equity, a subsidiary of GE Capital. From August 1990 to February 1997, Mr. Smith served in a variety of positions at GE Capital, most recently as Managing Director, Ventures. Mr. Smith holds a Bachelor of Business Administration from Southern Methodist University and a Master of Business Administration from The Wharton School of Business at the University of Pennsylvania.

There are no family relationships among any of the directors or executive officers of the Company.

Board Meetings and Committees

The Board of Directors held a total of twelve meetings during the fiscal year ended December 31, 2001. Each director, except for Steven D. Smith, who attended eight of the twelve meetings of the entire Board, attended at least 75% of the total number of meetings of the Board and all of the committees on which such director served during this time. The Board of Directors has a Compensation Committee and an Audit Committee. It does not have a nominating committee or a committee performing the functions of a nominating committee.

Mr. Ballowe, Ms. Schoendorf, and Mr. Smith were members of the Audit Committee during fiscal 2001, with Mr. Smith serving as the chairperson. The functions of the Audit Committee include recommending the engagement of the independent public auditors, monitoring the effectiveness of the audit effort, and monitoring our financial and accounting organization and its system of internal accounting controls. The Audit Committee held four meetings during the fiscal year ended December 31, 2001.

Mr. Ballowe, Ms. Schoendorf, and Mr. Fox were members of the Compensation Committee during fiscal 2001. The functions of the Compensation Committee include establishing and administering our policies regarding annual executive salaries and cash incentives and long-term equity incentives. The Compensation Committee held four meetings during the fiscal year ended December 31, 2001.

5

Director Compensation

Our directors currently do not receive cash compensation for their services as members of the Board of Directors, however they are reimbursed for out-of-pocket expenses incurred in connection with activities as directors, including attendance at Board and committee meetings. Our directors are generally eligible to participate in our Amended and Restated 1999 Stock Option Plan (“1999 Plan”). In addition, directors who are also employees of the Company are eligible to participate in our 2000 Employee Stock Purchase Plan (“ESPP”). Each of our non-employee directors receive automatic annual stock option grants to purchase 10,000 shares of our common stock under our 2000 Directors’ Stock Option Plan (“2000 Directors’ Plan”) on the date of our annual meeting. During the 2001 fiscal year, each of our non-employee directors received an option to purchase 10,000 shares of our common stock under our 2000 Directors’ Plan.

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION

TO EFFECT A 1-FOR-10 REVERSE SPLIT OF THE COMMON STOCK

AND REDUCE THE AUTHORIZED SHARES FROM 265,000,000 TO 13,000,000

Background

Our Board of Directors has proposed amending Article IV (A) of our Certificate of Incorporation to effect a one-for-ten reverse stock split in which of all the issued and outstanding shares of our common stock, referred to as “old common stock,” will be combined and reconstituted as a smaller number of shares of common stock, referred to as “new common stock,” in a ratio of ten shares of old common stock for each share of new common stock. In addition, Article IV (A) will be amended to reduce our authorized shares of common stock from 265,000,000 to 13,000,000.

By approving the proposed amendment, the stockholders will be authorizing the Board to implement the reverse split on July 17, 2002.

Purpose of the Reverse Stock Split

The purpose of the reverse stock split is to facilitate the continued listing of our common stock on the Nasdaq National Market. On February 14, 2002, we received a notice from Nasdaq that we had failed to comply with the continued listing requirements for the Nasdaq National Market on the basis that, during the previous 30 trading days, our common stock had failed to maintain a minimum bid price of $1.00 per share. On May 16, 2002, we received notice from Nasdaq that our common stock would be delisted from the Nasdaq National Market. We appealed the determination that we were not in compliance with Nasdaq’s listing requirements to a listing qualifications panel and have been granted a hearing on June 20, 2002. During the hearing, we intend to advise the panel that we will take affirmative steps to achieve compliance by effecting a reverse stock split. In accordance with Nasdaq rules, our common stock will continue to be listed on the National Market pending the outcome of the hearing.

We have recently implemented several business initiatives designed to improve our operating performance. These initiatives include our efforts to achieve increased revenue from existing products, bulk license sales and related services, and our efforts to reduce our internal operating costs. However, such efforts have not been, and may not be, successful in increasing the trading price of our common stock to a level sufficient to maintain compliance with Nasdaq’s listing requirements.

A reverse stock split should have the effect of increasing the trading price of our common stock, because it will result in a proportionate increase in our earnings per share. The Board of Directors believes that the

6

proposed reverse stock split is likely to result in the bid price of our common stock increasing over the $1.00 minimum bid price requirement. However, the market price of our common stock may not rise in proportion to the reduction in the number of outstanding shares resulting from the reverse split. Moreover, our share price has been subject to a downward trend over the past several months, and the price may not remain above $1.00 even if it exceeds that price initially following the reverse split.

If the market price of our common stock remains below $1.00 per share and we are no longer listed on the Nasdaq National Market, our common stock may be deemed to be penny stock. If our common stock is considered penny stock, it would be subject to rules that impose additional sales practices on broker-dealers who sell our securities. For example, broker-dealers must make a special suitability determination for the purchaser, receive the purchaser’s written consent to the transaction prior to sale, and make special disclosures regarding sales commissions, current stock price quotations, recent price information and information on the limited market in penny stock. Because of these additional obligations, some broker-dealers may not effect transactions in penny stocks, which could severely limit the market liquidity of our common stock and the ability of investors to trade our common stock.

If the market price for our common stock stays above $1.00 per share but our public float does not stay above $5 million for a sustained period of time, we may not qualify for continued listing on the Nasdaq National Market but may qualify for listing on the Nasdaq SmallCap Market. As of June 14, 2002, the market value of our public float was approximately $7,792,971. However, if the price of our common stock were to drop below approximately $0.14 per share prior to the reverse split, or below approximately $1.35 per share following the reverse split, our public float would not stay above $5 million. Listing on the Nasdaq SmallCap Market would enable us to return to the Nasdaq National Market if and when we got back into compliance with the public float requirement. If we could not qualify for listing on the Nasdaq SmallCap Market, then we would not be eligible for listing again on the Nasdaq National Market unless we complied with the initial listing requirements, which are significantly more stringent than the continued listing requirements.

If a delisting from the Nasdaq National Market were to occur, and our common stock did not qualify for listing on the Nasdaq SmallCap Market, our common stock would be limited to trading on over-the-counter quotation services, such as the OTC Bulletin Board or the Pink Sheets, that handle high-risk ventures and are not regulated by the Securities and Exchange Commission. Such alternatives are generally considered to be less efficient markets and not as broad as the Nasdaq National Market or the Nasdaq SmallCap Market.

Effectiveness of the Reverse Stock Split

If this proposal is approved by stockholders, the reverse split will become effective on July 17, 2002. Even if the reverse stock split is approved by stockholders, our Board of Directors has discretion to decline to carry out the reverse split if it determines that the reverse split is not necessary to avoid the delisting of our common stock or if it determines that the reverse split will not be beneficial for any other reason. Upon the filing of the amendment to our Certificate of Incorporation with the Delaware Secretary of State, all the old common stock will be converted into new common stock as set forth in the amendment.

Certificates and Fractional Shares

As soon as practicable after the effective date of the reverse stock spit, we will request that all stockholders return their stock certificates representing shares of old common stock outstanding on the effective date in exchange for certificates representing the number of whole shares of new common stock into which the shares of old common stock have been converted as a result of the reverse stock split. Each stockholder will receive a letter of transmittal from our transfer agent containing instructions on how to exchange certificates.Stockholders should not destroy any stock certificate and should not submit their old certificates to the transfer agent until they receive these instructions. In order to receive new certificates, stockholders must surrender their old

7

certificates in accordance with the transfer agent’s instructions, together with the properly executed and completed letter of transmittal. Stockholders whose shares are held by their stockbroker do not need to submit old certificates for exchange. These shares will automatically reflect the new quantity of shares based on the exchange ratio of the reverse stock split.

Beginning on the effective date of the reverse stock split, each old certificate, until exchanged as described above, will be deemed for all purposes to evidence ownership of the number of whole shares of new common stock into which the shares evidenced by the old certificates have been converted.

We will not issue fractional shares. Any fractional shares created as a result of the reverse split will be rounded down to the nearest whole share.

Effects of the Reverse Stock Split

The principal effect of the reverse stock split will be to decrease the number of shares of common stock outstanding from approximately 76,587,717 shares to approximately 7,658,771 shares. In addition, the reverse split will result in a proportionate decrease in the number of shares authorized for issuance under our stock option and stock purchase plans and the number of shares of common stock issuable upon exercise of outstanding options, and a proportionate increase in the exercise prices of outstanding options. As a result, following the effective date, the number of shares of common stock issuable upon the exercise of outstanding options will be reduced from approximately 6,302,542 shares to approximately 630,254 shares.

The reduction in the number of outstanding shares is expected to increase the trading price of our common stock, although there can be no assurance that such price will increase in proportion to the ratio of the reverse stock split ratio. The trading price of our common stock depends on many factors, including many which are beyond our control. The higher stock price may increase investor interest and reduce resistance of brokerage firms to recommend the purchase of our common stock. On the other hand, to the extent that negative investor sentiment regarding our common stock is not based on our underlying business fundamentals, the reverse split might not overcome that sentiment enough to increase our stock price to a level that consistently exceeds $1.00 per share.

The liquidity of our common stock may be adversely affected by the reduced number of shares outstanding after the reverse stock split. In addition, the split will increase the number of stockholders who own “odd lots,” which consist of blocks of fewer than 100 shares. Stockholders who hold odd lots may be required to pay higher brokerage commissions when they sell their shares and may have greater difficulty in making sales.

The shares of new common stock will be fully paid and non-assessable. The amendment will not change the terms of our common stock. The shares of new common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the common stock now authorized. No stockholder’s percentage ownership of common stock will be altered except for the effect of rounding fractional shares.

The reduction in the number of outstanding shares will affect the presentation of stockholders’ equity in our balance sheet. Because the par value of the shares of our common stock is not changing as a result of the reverse stock split, our stated capital, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced proportionately on the effective date of the reverse stock split. Correspondingly, our additional paid-in capital, which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares of our common stock, will be increased by a number equal to the decrease in stated capital.

The reverse split is not intended as, and will not have the effect of, a “going private” transaction. We will continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934.

8

No Dissenter’s Rights

Stockholders are not entitled to dissenter’s rights with respect to the proposed amendment to our Certificate of Incorporation to effect the reverse stock split and we will not independently provide our stockholders with any such right.

Federal Income Tax Consequences of the Reverse Stock Split

The following summary of the federal income tax consequences of the reverse stock split is based on current law, including the Internal Revenue Code of 1986, as amended, and is for general information only. The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder, and the discussion below may not address all the tax consequences for a particular stockholder. For example, foreign, state and local tax consequences are not discussed below. Accordingly, each stockholder should consult his or her tax adviser to determine the particular tax consequences to him or her of a reverse stock split, including the application and effect of federal, state, local and/or foreign income tax and other laws.

Generally, a reverse stock split will not result in the recognition of gain or loss for federal income tax purposes. The adjusted basis of shares of new common stock will be the same as the adjusted basis of shares of old common stock. The holding period of shares of new common stock will include the stockholder’s respective holding periods for shares of old common stock. We will not recognize a gain or loss as a result of the reverse stock split.

Decrease in Authorized Shares

In connection with the reverse stock split, the proposed amendment to our Certificate of Incorporation will reduce the number of shares of our common stock authorized for issuance from 265,000,000 to 13,000,000. The purpose of the decrease in authorized shares is to reduce the amount of annual franchise fees that we are required to pay as a result of being incorporated in Delaware. The annual franchise fee in Delaware is calculated based on the number of shares of stock that a company has authorized for issuance. A reduction in the number of shares authorized for issuance will reduce the annual franchise fee we are required to pay.

Our Certificate of Incorporation currently authorizes the issuance of up to 265,000,000 shares of our common stock. Of those shares, 76,587,717 shares were issued and outstanding as of May 28, 2002 and 11,245,189 unissued shares were reserved for issuance under our equity compensation plans, leaving 177,167,094 shares of our common stock unissued and unreserved. After the effective date of the reverse stock split, our Certificate of Incorporation will authorize the issuance of up to 13,000,000 shares of our common stock. Of that number, approximately 7,658,771 will be issued and outstanding and approximately 1,124,519 unissued shares will be reserved for issuance under our equity compensation plans, leaving 4,216,709 shares of our common stock unissued and unreserved.

A reduction in the number of shares authorized for issuance may mean that we have insufficient shares available for issuance in connection with a stock dividend, raising additional capital, acquiring other businesses, establishing strategic relationships with corporate partners or providing equity incentives to employees and officers or for other corporate purposes. In the event that the Board of Directors determines that it is necessary or appropriate to issue additional shares beyond those authorized for issuance, a future amendment to our Certificate of Incorporation may be required which would require stockholder approval.

Vote Required and Board of Directors’ Recommendation

Approval of this proposal requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will have the same effect as a negative vote on this proposal. If there are not sufficient votes to approve this proposal at the time of the meeting, the meeting may be adjourned in

9

order to permit further solicitation of proxies by the Board of Directors. However, no proxy voted against this proposal will be voted in favor of an adjournment or postponement of the meeting to solicit additional votes in favor of this proposal.

The Board of Directors unanimously recommends a vote FOR approval of the amendment

to our Certificate of Incorporation to effect a reverse split of our common stock and to effect a decrease in the number of authorized shares of our common stock.

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has selected Deloitte & Touche LLP as our independent auditors to audit our consolidated financial statements for the fiscal year ending December 31, 2002. Deloitte & Touche LLP has served as our independent auditors since its appointment in fiscal year 1999. A representative of Deloitte & Touche LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Stockholder ratification of the selection of Deloitte & Touche LLP as our independent auditors is not required by our Bylaws or otherwise. The Board of Directors is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the selection, the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board of Directors in its discretion, may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors determines that such a change could be in our best interests and the best interests of our stockholders.

The aggregate fees billed by Deloitte & Touche LLP for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2001 and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for that fiscal year were approximately $251,000.

The aggregate fees billed by Deloitte & Touche LLP for services rendered to the Company, other than the services described above, for the fiscal year ended December 31, 2001 were approximately $177,000, including audit related services of approximately $103,000 and non-audit services of approximately $74,000. Audit related services generally include fees for consents and comfort letters and for the audit of the Company’s employee benefit plan.

No fees were paid to Deloitte & Touche LLP for financial information systems design and implementation.

The audit committee of the Board of Directors has considered the role of Deloitte & Touche LLP in providing non-audit services to the Company and has concluded that such services are compatible with Deloitte & Touche LLP’s independence as our auditors.

Vote Required and Board of Directors’ Recommendation

Approval of this proposal requires the affirmative vote of a majority of the votes cast at the annual meeting of stockholders, as well as the presence of a quorum representing a majority of all outstanding shares of our common stock, either in person or by proxy. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal.

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2002.

10

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of June 14, 2002, certain information with respect to the beneficial ownership of our common stock by (i) each stockholder known by us to be the beneficial owner of more than 5% of our common stock, (ii) each of our directors and nominees for director, (iii) the Named Executive Officers identified in the Summary Compensation Table below, and (iv) all executive officers and directors as a group.

Name of Beneficial Owner (1) | Number of Shares Beneficially Owned (2) | Percent of Class (3) | |||

| Mohr, Davidow Ventures (4) | 14,578,144 | 19.0 | % | ||

2775 Sand Hill Road, Suite 240 Menlo Park, California 94025 | |||||

| Internet Capital Group, Inc. (5) | 17,214,810 | 22.5 | % | ||

44 Montgomery Street, Suite 3705 San Francisco, California 94014 | |||||

| GE Capital Equity Investments (6) | 4,319,000 | 5.6 | % | ||

c/o Capital Equity Investments, Inc. 120 Long Ridge Road Stamford, Connecticut 06927 | |||||

| Nancy J. Schoendorf (4) (7) | 14,548,144 | 19.0 | % | ||

c/o Mohr, Davidow Ventures 2775 Sand Hill Road, Suite 240 Menlo Park, California 94025 | |||||

| Kenneth A. Fox (5) (8) | 17,214,810 | 22.5 | % | ||

c/o Internet Capital Group, Inc. 44 Montgomery Street, Suite 3705 San Francisco, California 94014 | |||||

| Steven D. Smith (6) (9) | 4,319,000 | 5.6 | % | ||

c/o Capital Equity Investments, Inc. 120 Long Ridge Road Stamford, Connecticut 06927 | |||||

| Michael D. Pickett (10) | 2,516,869 | 3.3 | % | ||

| William W. Ericson (11) | 14,756,102 | 19.3 | % | ||

c/o Mohr, Davidow Ventures 2775 Sand Hill Road, Suite 240 Menlo Park, California 94025 | |||||

| Jeffrey C. Ballowe (12) | 165,625 | * | |||

85 Estrada Calabasa Santa Fe, New Mexico 87501 | |||||

| Clayton W. Lewis (13) | 333,632 | * | |||

| Irvine N. Alpert (14) | 58,854 | * | |||

| Matthew S. Rowley (15) | 83,438 | * | |||

| Edward S. Jordan (16) | 150,120 | * | |||

| Kristen M. McLaughlin (17) | 670,717 | * | |||

| Glenn S. Ballman (18) | 7,374,625 | 9.6 | % | ||

| Clark C. Westmoreland (19) | 0 | * | |||

| All directors and officers as a group (9 persons) (20) | 39,478,330 | 51.5 | % |

11

| * | Less than 1%. |

| (1) | Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information in the footnotes to this table. |

| (2) | Under the rules of the Securities and Exchange Commission, a person is deemed to be the beneficial owner of shares that can be acquired by such person within 60 days upon the exercise of options, warrants or other convertible securities. |

| (3) | Calculated on the basis of 76,587,717 shares of common stock outstanding as of June 14, 2002, provided that any additional shares of common stock that a stockholder has the right to acquire within 60 days after June 14, 2002 are deemed to be outstanding for the purpose of calculating that stockholder’s percentage beneficial ownership. |

| (4) | Consists of 9,481,910 shares held by Mohr, Davidow Ventures V, L.P., 4,322,540 shares held by Mohr, Davidow Ventures V-L, L.P. and 713,694 shares held by Mohr, Davidow Ventures V, L.P. as nominee for Mohr, Davidow Ventures Entrepreneurs’ Network Fund II (A), L.P. and Mohr, Davidow Ventures Entrepreneurs’ Network Fund II (B), L.P. Also includes 30,000 shares subject to options exercisable by Ms. Schoendorf and 30,000 shares subject to options exercisable by Mr. Ericson within 60 days of June 14, 2002. Ms. Schoendorf is a director of the Company and a member of Fifth MDV Partners, L.L.C., the General Partner of Mohr, Davidow Ventures V, L.P. and Mohr, Davidow Ventures V, L.P. as nominee for Mohr, Davidow Ventures, the general partner of Mohr, Davidow Ventures, V, L.P. Ms. Schoendorf disclaims beneficial ownership of shares held by these entities except to the extent of her pecuniary interest in them. Mr. Ericson is a director of the Company and a member of Mohr, Davidow Ventures. Mr. Ericson disclaims beneficial ownership of the shares held by the entities affiliated with Mohr, Davidow Ventures except to the extent of his pecuniary interest in them. |

| (5) | Includes 30,000 shares subject to options exercisable by Mr. Fox within 60 days of June 14, 2002. Shares held directly by Thornbury Insurance Co., a wholly owned subsidiary of Internet Capital Group, Inc. Mr. Fox is a director of the Company and managing director of Internet Capital Group, Inc. Mr. Fox disclaims beneficial ownership of those shares except to the extent of his pecuniary interest in them. |

| (6) | Includes 30,000 shares subject to options exercisable by Mr. Smith within 60 days of June 14, 2002. Mr. Smith is a Managing Director of GE Equity, a subsidiary of GE Capital. Mr. Smith disclaims beneficial ownership of those shares except to the extent of his pecuniary interest in them. |

| (7) | Includes 30,000 shares issuable upon exercise of options granted under the 2000 Directors’ Plan, which will be vested within 60 days of June 14, 2002. |

| (8) | Includes 30,000 shares issuable upon exercise of options granted under the 2000 Directors’ Plan, which will be vested within 60 days of June 14, 2002. |

| (9) | Includes 30,000 shares issuable upon exercise of options granted under the 2000 Directors’ Plan, which will be vested within 60 days of June 14, 2002. |

| (10) | Includes 1,451,779 shares issuable upon exercise of options granted under the 1999 Plan and 20,000 under the 2000 Directors’ Plan, which will be vested within 60 days of June 14, 2002. |

| (11) | Consists of 207,958 shares held by Mr. Ericson and 14,518,144 shares held by entities affiliated with Mohr, Davidow Ventures. Also, includes 30,000 shares issuable upon exercise of options granted under the 2000 Directors’ Plan, which will be vested within 60 days of June 14, 2002. Mr. Ericson is a director of the Company and a member of Mohr, Davidow Ventures. Mr. Ericson disclaims beneficial ownership of the shares held by the entities affiliated with Mohr, Davidow Ventures except to the extent of his pecuniary interest in them. |

| (12) | Includes 30,000 shares issuable upon exercise of options granted under the 2000 Directors’ Plan, which will be vested within 60 days of June 14, 2002. Also includes 15,625 shares issuable upon exercise of options granted under the 1999 Plan, which will be vested within 60 days of June 14, 2002. |

| (13) | Includes 198,332 shares issuable upon exercise of options granted under the 1999 Plan, which will be vested within 60 days of June 14, 2002. |

| (14) | Includes 29,084 shares issuable upon exercise of options granted under the 1999 Plan, which will be vested within 60 days of June 14, 2002. |

12

| (15) | Includes 72,334 shares issuable upon exercise of option granted under the 1999 Plan, which will be vested within 60 days of June 14, 2002. |

| (16) | Mr. Jordan left the Company on February 4, 2002. |

| (17) | Ms. McLaughlin left the Company on July 18, 2001. |

| (18) | Mr. Ballman left the Company on April 3, 2001. |

| (19) | Mr. Westmoreland left the Company on December 17, 2001. |

| (20) | Includes 1,734,286 shares of common stock subject to options exercisable within 60 days of June 14, 2001. |

13

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows the compensation earned by (a) the person who served as our Chief Executive Officer during the fiscal year ended December 31, 2001, (b) the other most highly compensated individuals who served as executive officers through December 31, 2001, and (c) two executive officers who departed during the fiscal year ended December 31, 2001 (the “Named Executive Officers”) during the fiscal years ended December 31, 1999, 2000 and 2001.

Summary Compensation Table

Annual Compensation | Long-Term Compensation Awards Securities Underlying Options | All Other Compensation | |||||||||||

Name and Principal Position | Year | Salary | Bonus | ||||||||||

| Michael D. Pickett (1) | 2001 | $ | 234,434 | $ | 37,813 | 3,029,804 | $ | 35,866 | |||||

| Chief Executive Officer, Acting Chief Financial Officer, and Chairman of the Board | 2000 | 76,538 | — | — | 26,200 | ||||||||

| Clayton W. Lewis (2) | 2001 | 181,202 | 48,458 | 150,000 | — | ||||||||

| President and Chief Operating Officer | 2000 | 104,583 | 18,000 | 100,000 | — | ||||||||

| Irvine N. Alpert (3) | 2001 | 101,227 | 1,240 | 180,000 | — | ||||||||

| Vice President, AEC Markets | 2000 | — | — | — | — | ||||||||

| Matthew S. Rowley (4) | 2001 | 132,258 | 29,645 | 155,500 | — | ||||||||

| Chief Information Officer | 2000 | 38,269 | 25,000 | 19,500 | — | ||||||||

| Edward S. Jordan (5) | 2001 | 105,645 | 20,156 | — | — | ||||||||

| Former Vice President, Government Sales | 2000 | — | — | — | — | ||||||||

| Kristen M. McLaughlin (6) | 2001 | 199,690 | 97,544 | — | 119,560 | ||||||||

| Former Chief Strategy Officer | 2000 | 118,333 | 32,044 | — | — | ||||||||

| 1999 | 80,000 | 5,000 | 1,600,000 | 1,850 | |||||||||

| Clark C. Westmoreland (7) | 2001 | 143,111 | 121,875 | 150,000 | — | ||||||||

| Former Vice President, Operations | 2000 | 41,240 | 37,500 | 250,000 | — | ||||||||

| (1) | Mr. Pickett commenced his employment with the Company as President and Chief Operating Officer in August 2000. In April 2001, Mr. Pickett became Chief Executive Officer and Chairman. Mr. Pickett’s annual salary rate as of December 31, 2001 is $250,000. Mr. Pickett’s other compensation consists of housing expenses of $35,866 paid by the Company on Mr. Pickett’s behalf in connection with Mr. Pickett’s employment agreement. |

| (2) | Mr. Lewis commenced his employment with the Company as Director of Business Development in March 1999. In December 2001, Mr. Lewis became President and Chief Operating Officer. Mr. Lewis’s annual salary rate as of December 31, 2001 is $200,000. |

| (3) | Mr. Alpert commenced his employment with the Company as Vice President, AEC Markets in July 2001. Mr. Alpert’s annual salary rate as of December 31, 2001 is $180,000. |

| (4) | Mr. Rowley commenced his employment with the Company as Development Manager in August 2000. In July 2001, Mr. Rowley became Chief Information Officer. Mr. Rowley’s annual salary rate as of December 31, 2001 is $170,000. |

| (5) | Mr. Jordan commenced his employment with the Company in March 2001 and left the Company in February 2002. Mr. Jordan’s salary reflects gross salary paid to him by the Company through February 4, 2002. Mr. Jordan’s annual salary at the time of his departure was $150,000. |

| (6) | Ms. McLaughlin commenced her employment with the Company in June 1998 and left the Company in July 2001. Ms. McLaughlin’s salary reflects gross salary paid to her by the Company through July 18, 2001 |

14

| and includes forgiveness of $119,560 due under loans from the Company to Ms. McLaughlin pursuant to Ms. McLaughlin’s retention bonus agreement dated as of March 30, 2001. Ms. McLaughlin’s annual salary at the time of her departure was $200,000. |

| (7) | Mr. Westmoreland commenced his employment with the Company in October 2000 and left the Company in December 2001. Mr. Westmoreland’s salary reflects gross salary paid to him by the Company through December 17, 2001. Mr. Westmoreland’s annual salary at the time of his departure was $200,000. |

Employment Agreements

Mr. Pickett and the Company entered into an employment agreement in March 2001. The employment agreement was subsequently amended in February 2002, after Mr. Pickett resigned his position as President in January 2002, to provide for an annual base salary of $120,000, a monthly stipend of $3,800, and a bonus of $125,000 based on achievement of criteria or the occurrence of certain events determined by the Board, which was paid in June 2002. Upon termination of employment by the Company without cause or by Mr. Pickett for good reason, Mr. Pickett will receive a lump sum payment of $250,000 and 12 months of benefits and accelerated vesting of all unvested options granted under the Company’s 2000 Directors’ Plan and all unvested shares pursuant to that certain amended Common Stock Purchase Agreement dated as of April 9, 1999. In addition, upon such termination, 757,451 shares subject to options granted in connection with Mr. Pickett’s employment agreement shall vest and become exercisable. Upon a change in control transaction, 50% of the then unvested options granted to Mr. Pickett in connection with his employment agreement and 50% of the then unvested shares subject to the amended Common Stock Purchase Agreement shall vest and the remaining unvested options and shares shall vest and become exercisable upon termination of employment by the Company without cause or by Mr. Pickett for good reason within 12 months of a change in control transaction.

Mr. Lewis and the Company entered into an employment agreement in September 2001, which provided for an annual base salary of $200,000. The employment agreement was subsequently amended in February 2002, after Mr. Lewis was designated as President and Chief Operating Officer, to increase Mr. Lewis’s annual salary to $220,000 and to provide for a bonus of up to $80,000 based on achievement of criteria determined by the Board. In addition, Mr. Lewis was granted options to purchase 870,000 shares of the Company’s common stock with vesting to begin immediately in 48 equal monthly installments, as long as Mr. Lewis is employed by the Company. Upon termination of employment by the Company without cause or by Mr. Lewis for good reason, Mr. Lewis will receive 12 months base salary, benefits, and accelerated vesting of all unvested options granted under the 1999 Plan. Upon a change in control transaction, 50% of the then unvested options granted to Mr. Lewis prior to February 2002 shall vest and the remaining, unvested options and shares shall vest and become exercisable upon termination of employment by the Company without cause or by Mr. Lewis for good reason within 12 months of a change in control transaction. Mr. Lewis’s options granted in February 2002 shall not be accelerated in the event of a change in control transaction for one year from the date of grant, after which time such options shall be accelerated in the event of a change in control transaction as described for options granted prior to February 2002.

Mr. Alpert and the Company entered into an agreement in February 2002, which provides for an annual base salary of $180,000. In addition, Mr. Alpert was granted options to purchase 169,000 shares of the Company’s common stock, with vesting to begin immediately in 48 equal monthly installments, as long as Mr. Alpert is employed by the Company. Upon termination of employment by the Company without cause or by Mr. Alpert for good reason, Mr. Alpert will receive six months base salary, benefits, and accelerated vesting of all unvested options granted under the 1999 Plan. Upon a change in control transaction, 25% of the then unvested options granted to Mr. Alpert prior to February 2002 shall vest and the remaining unvested options shall vest and become exercisable upon termination of employment by the Company without cause or by Mr. Alpert for good reason within 12 months of a change in control transaction. Mr. Alpert’s options granted in February 2002 shall not be accelerated in the event of a change in control transaction for one year from the date of grant, after which time such options shall be accelerated in the event of a change in control transaction as described above for options granted prior to February 2002. Mr. Alpert and the Company also entered into a Commission and Bonus Plan in

15

September 2001, which provides that Mr. Alpert will receive up to fifteen percent of earned revenue from contracts Mr. Alpert secures. Mr. Alpert will also receive up to $2,000 per quarter based on achievement of criteria determined by the President and Chief Operating Officer.

Mr. Rowley and the Company entered into an employment agreement in September 2001, which provides for an annual base salary of $170,000 and a performance bonus of $85,000, which was paid in January 2002. In February 2002, Mr. Rowley was granted options to purchase 245,000 shares of the Company’s common stock, with vesting to begin immediately in 48 equal monthly installments, as long as Mr. Rowley is employed by the Company. Upon termination of employment by the Company without cause or by Mr. Rowley for good reason, Mr. Rowley will receive six months base salary, benefits, and accelerated vesting of all unvested options granted under the 1999 Plan. Upon a change in control transaction, 25% of the then unvested options granted prior to February 2002 to Mr. Rowley shall vest and the remaining unvested options shall vest and become exercisable upon termination of employment by the Company without cause or by Mr. Rowley for good reason within 12 months of a change in control transaction. Mr. Rowley’s options granted in February 2002 shall not be accelerated in the event of a change in control for one year from the date of grant, after which time such options shall be accelerated in the event of a change in control transaction as described above for options granted prior to February 2002.

OPTION GRANTS IN LAST FISCAL YEAR

The following table provides information with respect to stock options granted to the Named Executive Officers during the fiscal year ended December 31, 2001. In addition, as required by the SEC rules, the table sets forth the hypothetical gains that would exist for the options based on assumed rates of annual compound stock price appreciation during the option term. The exercise price may be paid in cash, in shares of common stock valued at fair market value on the exercise date or through a cashless exercise procedure involving a same-day sale of the purchased shares. No stock appreciation rights were granted to these individuals during the year.

Number of Securities Underlying Options Granted | % of Total Options Granted to Employees in Last Fiscal Year(1) | Exercise Price Per Share(6) | Expiration Date | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term(5) | ||||||||||||

Name | 5% | 10% | ||||||||||||||

| Michael D. Pickett (2) | 3,029,804 | 65.1 | % | $ | 0.66 | 3/7/11 | $ | 1,250,341 | $ | 3,168,611 | ||||||

| Clayton W. Lewis (2) | 150,000 | 3.2 | % | 0.66 | 3/7/11 | 61,902 | 156,872 | |||||||||

| Irvine N. Alpert (2) | 180,000 | 3.9 | % | 0.41 | 8/31/11 | 46,412 | 117,618 | |||||||||

| Matthew S. Rowley (3) | 4,000 | * | 0.66 | 3/7/11 | 1,660 | 4,207 | ||||||||||

| Matthew S. Rowley (2) | 50,000 | 1.1 | % | 0.75 | 7/12/11 | 23,584 | 59,765 | |||||||||

| Matthew S. Rowley (2) | 101,500 | 2.2 | % | 0.65 | 7/20/11 | 41,491 | 105,147 | |||||||||

| Edward S. Jordan (4) | — | — | — | — | — | — | ||||||||||

| Kristen M. McLaughlin (4) | — | — | — | — | — | — | ||||||||||

| Clark C. Westmoreland (4) | 150,000 | 3.2 | % | 0.66 | 3/7/11 | 62,261 | 157,781 | |||||||||

| * | Less than 1%. |

| (1) | Based on a total of 4,651,374 option shares granted to employees, consultants, and directors during 2001 under the 1999 Plan and the 2000 Directors’ Plan. |

| (2) | Options vest ratably over a 48-month period. The options have a 10-year term, but are subject to earlier termination in connection with termination of employment. In the event of certain change in control transactions, see “Employment Agreements” above. |

| (3) | Options vest 25% after the first year of service and ratably each month over the remaining 36-month period. The options have a 10-year term, but are subject to earlier termination in connection with termination of employment. In the event of certain change in control transactions, see “Employment Agreements” above. |

16

| (4) | Mr. Jordan left the Company on February 4, 2002, Ms. McLaughlin left the Company on July 18, 2001, and Mr. Westmoreland left the Company on December 17, 2001. On Mr. Westmoreland’s termination date, the Company accelerated vesting of 103,127 options held by Mr. Westmoreland (see “Other Related Party Transactions” below). |

| (5) | The potential realizable value illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their terms, assuming the specified compounded rates of appreciation of the market price per share for the date of grant to the end of the option term. Actual gains, if any, on stock option exercise are dependent upon a number of factors, including the future performance of the common stock and the timing of option exercises, as well as the optionees’ continued employment throughout the vesting period. There can be no assurance that the amounts reflected in this table will be achieved. |

| (6) | To properly apply generally accepted accounting practices, the Company decreased the exercise price per share by $0.39, the amount of the cash distribution which occurred in May 2002, or, if the option was “in-the-money” at the time of distribution, the exercise price per share was decreased by an amount which maintains the ratio between the option exercise price and the market value of the common stock both before and after the distribution. The exercise prices per share set forth in the table above reflect pre-distribution exercise prices. |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

The following table provides certain information with respect to stock options exercised by the Named Executive Officers during the last fiscal year ended December 31, 2001. The table also provides the number of shares covered by stock options as of the end of the fiscal year, and the value of in-the-money stock options, which represents the positive difference between the exercise price of a stock option and the market price of the shares subject to such option at the end of the fiscal year. No stock appreciation rights were outstanding during fiscal year ended December 31, 2001.

Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised In-The-Money Options at Fiscal Year End | |||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

| Michael D. Pickett (1) | 1,019,934 | 2,049,870 | $ | 0 | $ | 0 | ||||

| Clayton W. Lewis (1) | 65,208 | 204,792 | 0 | 0 | ||||||

| Irvine N. Alpert (2) | 15,000 | 175,000 | 1,950 | 21,450 | ||||||

| Matthew S. Rowley (1) | 40,236 | 134,764 | 0 | 0 | ||||||

| Edward S. Jordan (1)(3) | 59,986 | 30,014 | 0 | 0 | ||||||

| Kristen M. McLaughlin (3) | — | — | — | — | ||||||

| Clark C. Westmoreland (1)(3) | 240,626 | 159,374 | 0 | 0 | ||||||

| (1) | The exercise price of the options is higher than the closing market price as of December 31, 2001. |

| (2) | Based on the $0.54 per share closing price of the Company’s common stock on the Nasdaq National Market on December 31, 2001, less the exercise price of options. |

| (3) | Mr. Jordan left the Company on February 4, 2002, Ms. McLaughlin left the Company on July 18, 2001, and Mr. Westmoreland left the Company on December 17, 2001. |

17

EQUITY COMPENSATION PLAN INFORMATION

We currently maintain three compensation plans that provide for the issuance of our common stock to officers, directors, other employees, or consultants. These consist of the Amended and Restated 1999 Stock Option Plan (“1999 Plan”), the 2000 Directors’ Stock Option Plan (“2000 Directors’ Plan”), and the 2000 Employee Stock Purchase Plan (“ESPP”), all of which have been approved by stockholders. The following table sets forth information regarding outstanding options and shares reserved for future issuance under the foregoing plans as of December 31, 2001:

Plan Category(1) | Number of shares to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of shares remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a)) (c) | |||||

| Equity compensation plans approved by stockholders | 5,788,880 | $ | 2.46 | 8,538,427 | (2) | |||

| (1) | The information presented in this table excludes options assumed by the Company in connection with acquisitions of other companies. As of December 31, 2001, 489,654 shares of the Company’s common stock were issuable upon exercise of these assumed options, at a weighted average exercise price of $3.91 per share. |

| (2) | These shares include 600,000 shares that are reserved for issuance under the ESPP. The shares that are reserved for issuance under the 1999 Plan are subject to automatic increase on January 1 of each year by a number of shares equal to 4% of our outstanding shares as of the close of business on December 31. |

Legal Proceedings

From June through July 2001, five securities class action lawsuits were filed in the United States District Court for the Southern District of New York against the Company, two former officers, and the lead underwriters of the Company’s initial public offering (“IPO”). Each of the five class actions alleges that the defendants issued and sold the Company’s common stock pursuant to the February 29, 2000 Prospectus without disclosing that the underwriters in the offering had solicited (and later received) excessive and undisclosed commissions from certain investors in exchange for allocations in the IPO. The lawsuits also allege that the Registration Statement and Prospectus failed to disclose that the underwriters allocated shares in the IPO to certain customers in exchange for the customers’ promises to purchase additional shares in the aftermarket at pre-determined prices above the IPO price, thereby manipulating the market price for the shares in the aftermath. The lawsuits were consolidated in April 2002.

18

CERTAIN TRANSACTIONS

Loan to Former Officer

On April 10, 2000, the Company issued a loan to Kristen M. McLaughlin, who was an executive officer of the Company at the time of issuance, for $350,000 at an annual interest rate of six percent. This loan is secured by shares of the Company’s common stock and is due on the earlier of the following: (1) five years after issuance; (2) after a public offering of the Company’s common stock in which the officer is a selling stockholder; or (3) the expiration of any lock-up period imposed by contract or securities laws following an acquisition of the Company. The amount of the loan plus interest as of June 14, 2002 was $241,639.

Indemnification Agreements

The Company has entered into indemnification agreements with some of its officers and directors containing provisions requiring it to indemnify them against liabilities that may arise by reason of their status or service as officers or directors, and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified. These indemnification agreements do not cover liabilities arising from willful misconduct of a culpable nature.

Other Related Party Transactions

In 2001, the Company purchased 879,717 shares of the Company’s common stock from Glenn S. Ballman for $1.03 per share, as required by Mr. Ballman’s separation letter agreement with the Company. The purchase price per share equals the last recorded trade on the Nasdaq Stock Market on the date of purchase. The Company applied $800,000 of the net proceeds after taxes against the balance of principal and any interest due under a promissory note between Mr. Ballman and Comerica Bank (“Comerica Note”). The remaining $106,000 was applied against the balance of principal and any interest due under a promissory note between Mr. Ballman and the Company (“Company Note”). In April 2002, the Company purchased 1,403,226 shares of the Company’s common stock from Mr. Ballman for $0.62 per share, as required by Mr. Ballman’s separation letter agreement with the Company. The purchase price per share equals the last recorded trade on the Nasdaq Stock Market on the date of purchase. The Company applied $800,000 of the net proceeds after taxes against the balance of principal and any interest due under the Comerica Note. The remaining $70,000 was applied against the balance of principal and any interest due under the Company Note. In May 2002, Mr. Ballman paid all amounts due under the Comerica Note and the Company Note. As a result, Comerica returned the $3,200,000 certificate of deposit to the Company and the Company released to Mr. Ballman 6,350,000 shares of common stock used to secure its guarantee. As of June 14, 2002, Mr. Ballman held 7,374,625 shares of the Company’s common stock.

In July 2001, the Company entered into a separation agreement with Robert E. Gilmore, III. Pursuant to the terms of the separation agreement, Mr. Gilmore received $119,167, an amount equivalent to thirteen months of his base salary. As of June 14, 2002, Mr. Gilmore held no shares of the Company’s common stock.

In July 2001, the Company entered into a separation agreement with Kristin M. McLaughlin. Pursuant to the terms of the separation agreement, Ms. McLaughlin received $100,000, an amount equivalent to six months of her base salary. In addition, on Ms. McLaughlin’s termination date, the Company released 385,000 shares of common stock from its repurchase options as part of Ms. McLaughlin’s severance under the separation agreement and repurchased 254,167 shares of common stock for an aggregate purchase price of $6,442.71. From May 2001 to January 2002, the Company purchased 2,085,834 shares of common stock held by Ms. McLaughlin at their fair market value of $1,486,039. Pursuant to the terms of the retention bonus agreement between Ms. McLaughlin and the Company, the Company has a right of first refusal with respect to all shares of common stock held by Ms. McLaughlin until July 2003. As of June 14, 2002, Ms. McLaughlin held 670,717 shares of the Company’s common stock.

19

In July 2001, the Company entered into a separation agreement with Ozzie F. Ramos. Pursuant to the terms of the separation agreement, Mr. Ramos received $154,167, an amount equivalent to ten months of his base salary. On the date of his separation, Mr. Ramos held 136,454 shares of the Company’s common stock.

In July 2001, the Company entered into a separation agreement with William K. North. Pursuant to the terms of the separation agreement, Mr. North received $125,000, an amount equivalent to ten months of his base salary. On the date of his separation, Mr. North held 274,303 shares of the Company’s common stock.

In August 2001, the Company entered into a separation agreement with Robert D. Ayer. Pursuant to the terms of the separation agreement, Mr. Ayer received $70,000, an amount equivalent to six months of his base salary. From September 2001 to October 2001, the Company purchased 400,000 shares of common stock held by Mr. Ayer for an aggregate purchase price of $203,000. As of June 14, 2002, Mr. Ayer held 2,800,000 shares of the Company’s common stock.

In December 2001, the Company entered into a separation agreement with Clark C. Westmoreland. Pursuant to the terms of his separation agreement, Mr. Westmoreland received $133,333, an amount equivalent to eight months of his base salary. Mr. Westmoreland also received a bonus of $100,000 pursuant to his employment agreement with the Company. In addition, on Mr. Westmoreland’s termination date, the Company accelerated vesting of 103,127 options held by Mr. Westmoreland. As of June 14, 2002, Mr. Westmoreland held no shares of the Company’s common stock.

In December 2001, the Company entered into a separation agreement with Donald F. Bowler. Pursuant to the terms of his separation agreement, Mr. Bowler received $82,500, an amount equivalent to six months of his base salary. Mr. Bowler also received a bonus of $82,500 pursuant to his employment agreement with the Company. In addition, on Mr. Bowler’s termination date, the Company accelerated vesting of 17,500 options held by Mr. Bowler. As of June 14, 2002, Mr. Bowler held 9,000 shares of the Company’s common stock.

In December 2001, the Company entered into a separation agreement with Theresa S. Treat. Pursuant to the terms of her separation agreement, Ms. Treat received $75,000, an amount equivalent to six months of her base salary. Ms. Treat also received a bonus of $75,000 pursuant to her employment agreement with the Company. In addition, on Ms. Treat’s termination date, the Company accelerated vesting of 18,750 options. As of June 14, 2002, Ms. Treat held no shares of the Company’s common stock.

In February 2002, the Company entered into a separation agreement with Edward S. Jordan. Pursuant to the terms of his employment agreement, Mr. Jordan received $75,000, an amount equivalent to six months of his base salary. Mr. Jordan also received an incentive bonus of $12,946.43 and a bonus of $75,000 pursuant to his employment agreement with the Company. In addition, on Mr. Jordan’s termination date, the Company accelerated vesting of 6,591 options held by Mr. Jordan. As of June 14, 2002, Mr. Jordan held 150,120 shares of the Company’s common stock.

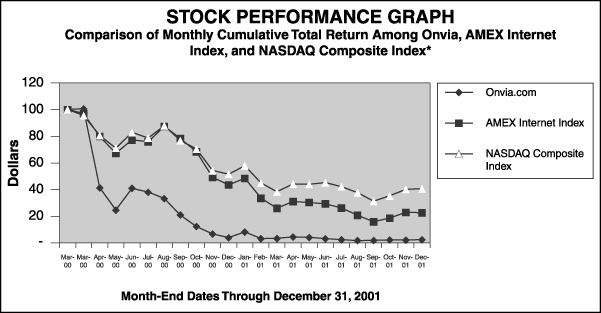

20