SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

| Check | the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

ONVIA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

2009 PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Seattle, Washington

April 8, 2009

Dear Stockholder:

You are invited to attend the annual meeting of the stockholders of Onvia, Inc. (the “Annual Meeting”). It will be held on Friday, May 8, 2009 at 11:00 a.m. Pacific Time, at our executive offices located at 509 Olive Way, Suite 400, Seattle, Washington 98101.

At the Annual Meeting, we will consider and vote on the following matters, which are described in more detail in this Proxy Statement:

| | 1. | Election of two directors to serve a term of three years. |

| | 2. | Any other business that may properly come before the Annual Meeting. |

Please read this Proxy Statement carefully to learn more about these and related matters. Our Annual Report for 2008 is also included to give you more information about our progress.

Your vote is important. Please vote your shares before the Annual Meeting, using the Internet, the phone or your proxy card or voting instruction form. Please vote before the Annual Meeting, even if you plan to attend. Thank you.

|

| Sincerely, |

|

|

| Michael D. Pickett |

Chairman of the Board, Chief Executive Officer, and President |

Notice of Annual Meeting of Stockholders

| | |

| When: | | 11:00 a.m., Pacific Time, Friday, May 8, 2009 |

| |

| Where: | | 509 Olive Way, Suite 400 Seattle, Washington 98101 |

| |

| Record Date: | | March 18, 2009 |

| |

| Agenda: | | 1. Election of two directors to serve a term of three years. |

| |

| | 2. Any other business that may properly come before the Annual Meeting. |

The Board of Directors urges you to vote FOR item 1.

More information on all of these matters is included in the following Proxy Statement. You are entitled to vote on these matters and to attend the Annual Meeting if you held Onvia shares as of the close of business on our record date, March 18, 2009.

This Proxy Statement is being sent to Onvia’s stockholders on or about April 8, 2009.

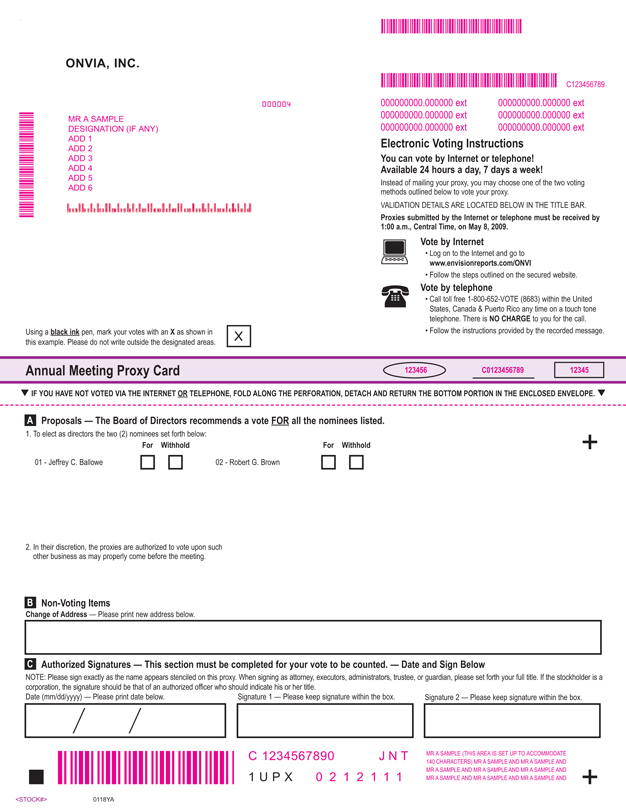

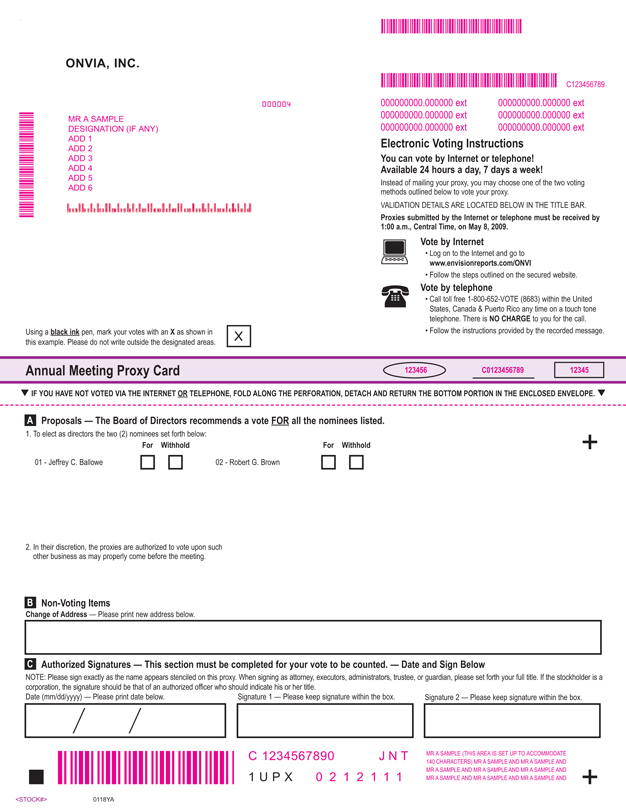

Voting Instructions—YOUR VOTE IS IMPORTANT!

Please vote your shares, whether or not you plan to attend the Annual Meeting, by completing and returning your proxy card or using the Internet or phone and following the instructions on your proxy card or voting instruction form. This helps to ensure the presence of a quorum at our Annual Meeting so we can transact business. When you vote your shares promptly, you also help save costs we might otherwise incur for additional proxy solicitation. Voting now by Internet, phone or mail will not prevent you from changing your vote later. Instructions for changing your vote are given on page 2.

For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose related to the Annual Meeting, during ordinary business hours at our executive offices located at 509 Olive Way, Suite 400, Seattle, Washington 98101.

PLEASE DO NOT SUBMIT A PAPER PROXY CARD OR VOTING INSTRUCTION FORM

IF YOU ARE VOTING BY INTERNET OR PHONE.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on May 8, 2009.

This Proxy Statement and Annual Report for 2008 are available athttp://www.edocumentview.com/ONVI.

ONVIA, INC.

509 Olive Way, Suite 400

Seattle, Washington 98101

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 8, 2009

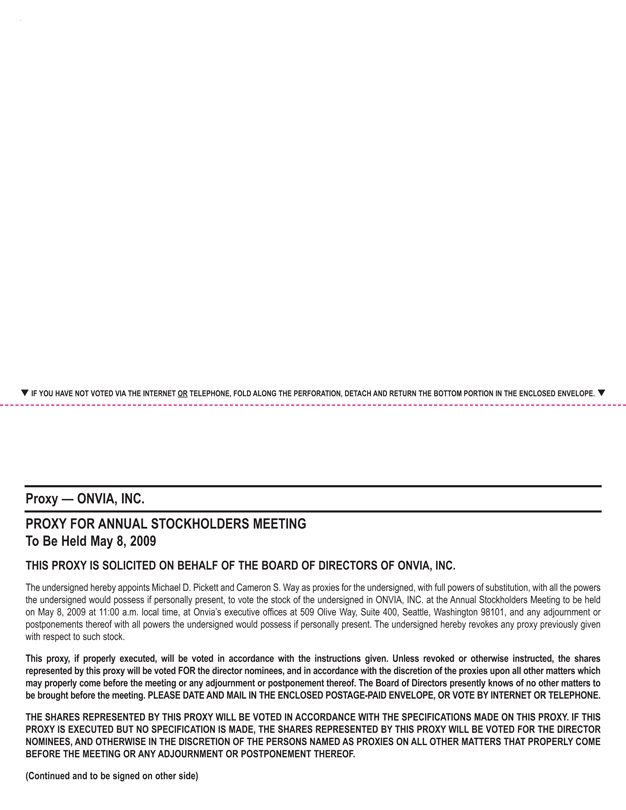

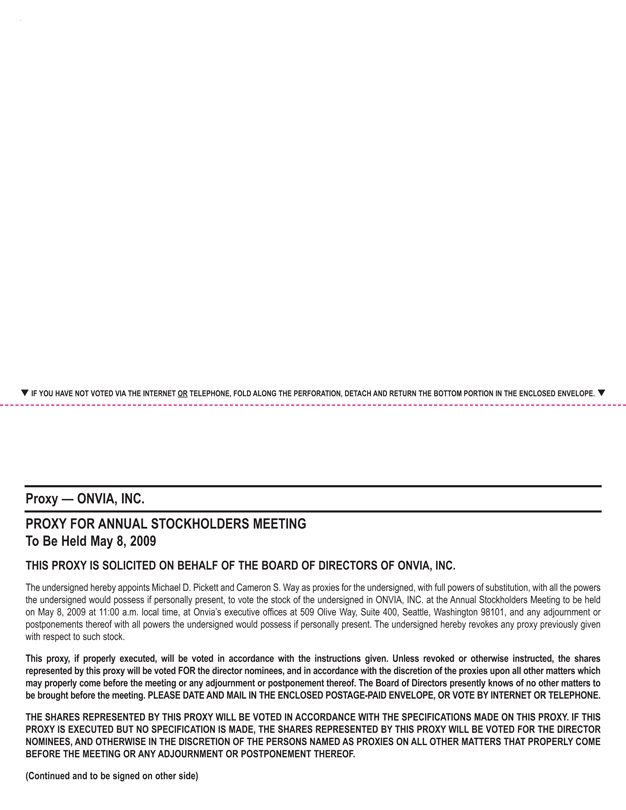

Our Board of Directors is issuing this Proxy Statement to solicit proxies for the Annual Meeting of Stockholders on May 8, 2009 at 509 Olive Way, Suite 400, Seattle, Washington 98101. This Proxy Statement contains important information about the business matters that will be voted on at the Annual Meeting. This Proxy Statement and proxy card were first sent to stockholders on or about April 8, 2009.

Voting Rights and Quorum

Stockholders eligible to vote at the Annual Meeting are those identified as owners of record at the close of business on the record date, March 18, 2009. Each outstanding share of common stock is entitled to one vote on all items presented at the Annual Meeting. At the close of business on March 18, 2009, the Company had 8,254,833 shares of common stock outstanding and entitled to vote.

A majority of the outstanding shares of common stock present in person or represented by proxy constitutes a quorum for the transaction of business at the Annual Meeting. Votes for and against, abstentions, and “broker non-votes” will be counted as present in determining the presence of a quorum.

Time and Place of the Annual Meeting

The Annual Meeting is being held on Friday, May 8, 2009 at 11:00 a.m. local time at our executive offices located at 509 Olive Way, Suite 400, Seattle, Washington 98101.

Multiple Proxy Cards

If you received more than one proxy card, it means that you hold shares in more than one account. Please sign and return all proxy cards to ensure that all of your shares are voted.

Proxies Not Returned and Broker Non-Votes

If your shares are held in your name, you must return your proxy, vote by telephone or via the internet, or attend the Annual Meeting in person in order to vote on the proposals. If your shares are held in street name and you do not vote your proxy, your brokerage firm may either:

| | • | | vote your shares on routine matters; or |

| | • | | leave your shares unvoted. |

Under the rules that govern brokers who have record ownership of shares that are held in street name for their clients, brokers may vote such shares on behalf of their clients with respect to routine matters (such as the election of directors), but not with respect to non-routine matters. If the proposals to be acted upon at any meeting include both routine and non-routine matters, the broker may turn in a proxy card for uninstructed shares that vote FOR the routine matters (election of directors), but the broker may not vote on non-routine matters in the absence of client instruction. This is called a “broker non-vote.”

Broker non-votes will be counted for the purpose of determining the presence of a quorum, but will not be counted for the purpose of determining the number of votes cast.

1

We encourage you to provide instructions to your brokerage firm by completing and returning your proxy card. This ensures that your shares will be voted at the Annual Meeting.

Vote Required to Pass a Proposal

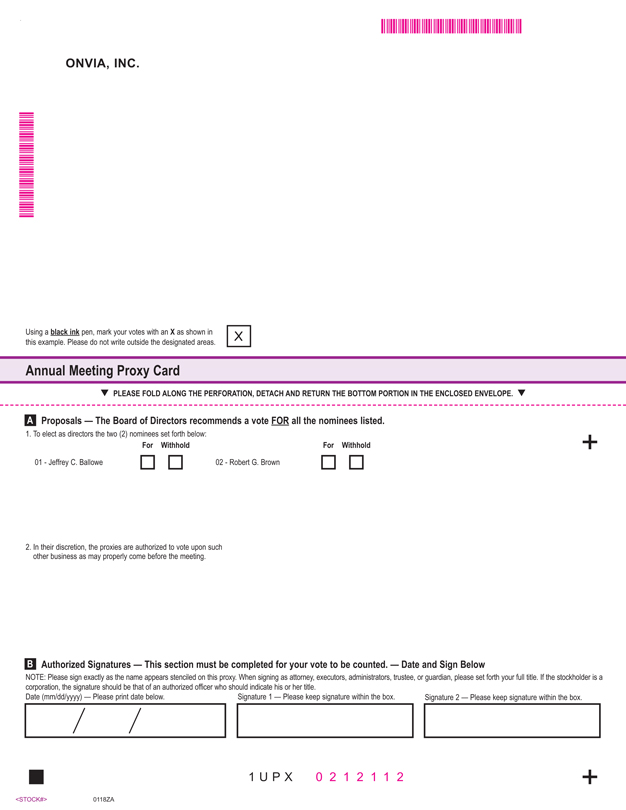

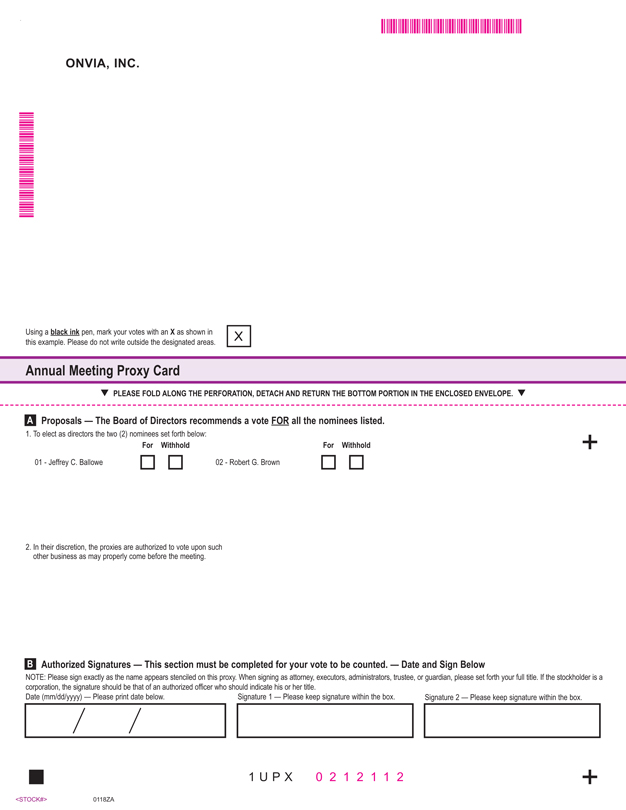

Once a quorum is present, the director candidates, of which there are two, who receive the two highest number of votes cast will be elected.

Proxy Solicitation

The accompanying proxy is solicited by our Board of Directors for use at the Annual Meeting. We will bear the costs of soliciting proxies. In addition to soliciting stockholders by mail and through our employees, we may request banks, brokers, custodians, nominees, and fiduciaries to solicit customers for whom they hold shares of our common stock, and will reimburse them for their reasonable, out-of-pocket costs. We may use the services of our directors, officers, and others to solicit proxies, personally, by telephone or otherwise, without additional compensation. We have not retained the services of a proxy solicitor in connection with the Annual Meeting.

Voting of Proxies and Revocation

The shares represented by the proxy cards received, properly marked, dated, signed, and not revoked, will be voted at the Annual Meeting. If the proxy card specifies a choice with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. Any proxy card which is returned but not marked will be voted FOR each of the director nominees and in accordance with the best judgment of the named proxies on any other matters that may come before the meeting. Broker non-votes will not be considered as voting with respect to any matter for which the broker does not have voting authority. A stockholder giving a proxy has the power to revoke his or her proxy at any time before it is exercised by delivering to the Secretary of the Company a written instrument revoking the proxy with a later date, or by attending the Annual Meeting and voting in person.

We urge you to promptly vote and submit your proxy by telephone, over the Internet, or by signing, dating, and returning the accompanying proxy card in the enclosed, prepaid, return envelope. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

2

PROPOSAL NO. 1: ELECTION OF DIRECTORS

THE BOARD RECOMMENDS A VOTE “FOR” THE DIRECTOR NOMINEES

We have a classified Board of Directors of seven members consisting of three Class I directors, two Class II directors, and two Class III directors, each of whom will serve until the Annual Meetings to be held in 2010, 2011, and 2009, respectively, and until their respective successors are duly elected and qualified. At each Annual Meeting, directors are elected for a term of three years to succeed those directors whose terms expire at the Annual Meeting dates.

Two Class III directors are to be elected at this Annual Meeting. Upon the recommendation of the Nominating and Governance Committee, the Board of Directors has nominated current Class III directors Jeffrey C. Ballowe and Robert G. Brown for election by the stockholders. If elected, the nominees will serve as directors until our 2012 Annual Meeting, and until their respective successors are duly elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as the Board of Directors may designate.

If a quorum representing a majority of all outstanding shares of our common stock is present and voting, either in person or by proxy, the two nominees for Class III directors receiving the highest number of votes will be elected as Class III directors. Votes withheld from any nominee, abstentions, and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the voting.

Biographical information regarding our current directors, including the Class III director nominees, is set forth below.

The Board of Directors unanimously recommends a vote “FOR” each of the nominees named below.

Class III Director Nominees (Terms Expire at the 2009 Annual Meeting)

Jeffrey C. Ballowe, age 53, has served as a director of the Company since December 1999. Before leaving Ziff Davis at the end of 1997, Mr. Ballowe led the launches of five magazines, ZDNet on the Web, ZDTV (became TechTV), and the initial ZD/Softbank investments in Yahoo!, Inc. Mr. Ballowe has served on a number of public and private company boards besides Onvia, including NBCi. He currently serves as non-executive chairman of the board of OnQueue Technologies, Inc., as a member of the board of directors of Transpera, Inc., and as an advisor to several venture-backed companies in the nexus between media and technology including Anvato, Inc. and Transpera, Inc. Mr. Ballowe is the co-founder and past president of the not-for-profit Electronic Literature Organization.

Robert G. Brown,age 62, has served as a director of the Company since November 2004 and the lead director since October 2005. Mr. Brown is currently President of Brightwood Advisors, a private company providing business consulting to technology companies and investors. Prior to Brightwood Advisors, Mr. Brown was Group President with Harte-Hanks, a provider of direct marketing services, and President and CEO of ZD Market Intelligence, a division of Ziff Davis, Inc.

Class I Directors (Terms Expire at the 2010 Annual Meeting)

Steven D. Smith, age 50, has served as a director of the Company since January 2000. Mr. Smith is currently a venture partner at GTI LLC, a private equity investment company, and an independent consultant to Ritchie Capital Management, a private equity investment company, where he served as the Senior Managing Director from December 2004 to December 2007. From March 1997 to April 2003, Mr. Smith served as Managing Director of GE Equity, a private equity investment company and a subsidiary of GE Capital. From August 1990 to February 1997, Mr. Smith served in a variety of positions at GE Capital, most recently as Managing Director, Ventures.

3

James L. Brill, age 57, has served as a director of the Company since March 2004. Since January 1, 2007, he has served as Senior Vice President of Finance and Chief Financial Officer of On Assignment, Inc., a staffing agency for science and healthcare professionals. From July 1999 to December 2006, he served as Vice President of Finance and Chief Financial Officer of Diagnostic Products Corporation, a medical diagnostics manufacturer. From August 1998 to June 1999, Mr. Brill served as Chief Financial Officer of Jafra Cosmetics International, a cosmetics manufacturer, and Vice President of Finance and Administration and Chief Financial Officer of Vertel Corporation from 1996 to 1998.

D. Van Skilling, age 75, has served as a director of the Company since November 2004. He has been President of Skilling Enterprises since March 1999. He retired in April 1999 as Chairman and CEO of Experian Information Systems Inc., positions he held since Experian was formed in 1996. Previously he was employed by TRW, Inc. for twenty-seven years, and was Executive Vice President from 1989 to 1996. He currently serves on the boards of directors of First American Corporation, First Advantage Corporation, and The American Business Bank, and is Chairman of the Board of Trustees of Colorado College.

Class II Directors (Terms Expire at the 2011 Annual Meeting)

Michael D. Pickett, age 61, has served as a director of the Company since February 1999, as Chief Executive Officer and Chairman of the Board of the Company from February 1999 to August 2000 and since April 2001, and as President since September 2004. Mr. Pickett also served as President and Chief Operating Officer of the Company from August 2000 to April 2001. From July 1999 to August 2000, Mr. Pickett served as Chief Executive Officer of Hardware.com, Inc., an online source for total home improvement solutions, which was acquired by the Company in September 2000. From July 1997 to March 1999, Mr. Pickett was Chairman and Chief Executive Officer of Technology Solutions Network, LLC, a provider of turnkey technology solutions for small businesses. From October 1983 to February 1996, Mr. Pickett served in a variety of positions and most recently as Chairman, Chief Executive Officer, and President of Merisel, Inc., a wholesale distributor of computer hardware and software products and a provider of logistics services.

Roger L. Feldman, age 47, has served as a director of the Company since March 2004. Mr. Feldman is a principal of West Creek Capital, an investment firm he co-founded in 1992. Prior to forming West Creek Capital, Mr. Feldman was an investment banker and an attorney.

There are no family relationships among any of the directors or executive officers of the Company.

Our Board of Directors unanimously recommends that you vote “FOR” each of the director nominees named above.

4

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 27, 2009, certain information with respect to the beneficial ownership of Onvia’s common stock by: (i) each stockholder known by the Company to be the beneficial owner of more than 5% of its common stock; (ii) each of its directors; (iii) the Named Executive Officers identified in the 2008 Summary Compensation Table; and (iv) all executive officers and directors as a group.

| | | | | |

Name and Address of Beneficial Owner(1) | | Number of Shares

Beneficially Owned (2) | | Percent of

Class(3) | |

Asamara, LLC(4) | | 1,598,239 | | 19.38 | % |

Nadel and Gussman Energy, LLC | | | | | |

James F. Adelson | | | | | |

Stephen J. Heyman | | | | | |

15 East 5th Street, 32nd Floor | | | | | |

Tulsa, OK 74103 | | | | | |

Michael D. Pickett,Director, CEO and President(5) | | 966,952 | | 10.66 | % |

509 Olive Way, Suite 400 | | | | | |

Seattle, WA 98101 | | | | | |

Diker Management, LLC(6) | | 815,242 | | 9.89 | % |

Diker GP, LLC | | | | | |

Charles M. Diker | | | | | |

Mark N. Diker | | | | | |

745 Fifth Avenue, Suite 1409 | | | | | |

New York, NY 10151 | | | | | |

Federated Investors, Inc.(7) | | 782,098 | | 9.48 | % |

Voting Shares Irrevocable Trust | | | | | |

John F. Donahue | | | | | |

Rhodora J. Donahue | | | | | |

J. Christopher Donahue | | | | | |

Federated Investors Tower | | | | | |

1001 Liberty Avenue | | | | | |

Pittsburgh, PA 15222-3779 | | | | | |

Burnham Asset Management Corporation(8) | | 734,469 | | 8.91 | % |

Burnham Securities, Inc. | | | | | |

1325 Avenue of the Americas | | | | | |

New York, NY 10019 | | | | | |

Roger L. Feldman,Director(9)(10) | | 707,572 | | 8.54 | % |

1919 Pennsylvania Avenue NW, Suite 725 | | | | | |

Washington, DC 20006 | | | | | |

Harvey Hanerfeld(9)(11) | | 676,802 | | 8.21 | % |

1919 Pennsylvania Avenue NW, Suite 725 | | | | | |

Washington, DC 20006 | | | | | |

Irvine N. Alpert,Executive Vice President(12) | | 156,357 | | 1.86 | % |

Jeffrey C. Ballowe,Director(13) | | 113,075 | | 1.37 | % |

Cameron S. Way,Chief Financial Officer(14) | | 60,743 | | * | |

Robert G. Brown,Director(15) | | 49,602 | | * | |

James Brill,Director(16) | | 48,250 | | * | |

Steven D. Smith,Director(17) | | 47,250 | | * | |

D. Van Skilling,Director(18) | | 46,776 | | * | |

Eric T. Gillespie,Senior Vice President, Products, Technology and Information (19) | | 45,598 | | * | |

Michael J. Tannourji,Senior Vice President of Sales and Marketing(20) | | 31,501 | | * | |

All directors and officers as a group (12 persons)(21) | | 2,360,552 | | 24.49 | % |

5

| (1) | Except as otherwise indicated, the persons or entities named in this table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information in the footnotes to this table. |

| (2) | Under the rules of the SEC, a person is deemed to be the beneficial owner of shares that can be acquired by such person upon the exercise of options within 60 days of February 27, 2009. |

| (3) | Calculated on the basis of 8,246,828 shares of common stock outstanding as of February 27, 2009, provided that any additional shares of common stock that a stockholder has the right to acquire within 60 days after February 27, 2009 are deemed to be outstanding for the purpose of calculating that stockholder’s beneficial ownership. |

| (4) | According to Schedule 13D filed on June 17, 2005. Asamara, LLC has sole voting and dispositive power over 1,236,481 shares. Nadel and Gussman Energy, LLC has sole voting and dispositive power over 361,758 shares. James F. Adelson and Stephen J. Heyman are managers of Asamara, LLC and Nadel and Gussman Energy, LLC. Mr. Adelson and Mr. Heyman are reported to have shared voting and dispositive power over 1,598,239 shares. |

| (5) | Includes 138,234 shares of common stock, 1,740 shares of common stock held in the Onvia Unitized Stock Fund, or Unitized Fund, under the Onvia, Inc. Savings and Retirement Plan, or 401(k) Plan, 822,978 shares issuable upon exercise of options granted to Mr. Pickett under the Amended and Restated 1999 Stock Option Plan, or 1999 Plan, and 4,000 shares issuable upon exercise of options granted to Mr. Pickett under the 2000 Directors’ Stock Option Plan, or Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (6) | According to Schedule 13G/A filed on February 12, 2009. Diker GP, LLC, is the general partner of Diker Value-Tech Fund, LP, Diker Value Tech QP Fund, LP, Diker Micro-Value Fund, LP, Diker Micro-Value QP Fund, LP, Diker Micro and Small Cap Fund, LP, and Diker M&S Cap Master, Ltd. (collectively, the “Diker Funds”), and beneficially owns 735,726 shares. Diker Management, LLC is the investment manager of Diker Funds, and beneficially owns 815,242 shares. Charles M. Diker and Mark N. Diker are the managing members of Diker GP, LLC and Diker Management, LLC, and beneficially own 815,242 shares. |

| (7) | According to Schedule 13G/A filed on February 10, 2009. Federated Investors, Inc. is the parent holding company of Federated Equity Management Company of Pennsylvania and Federated Global Investment Management Corp., which act as investment advisers to various registered investment companies and separate accounts that own shares of Onvia common stock. All of the outstanding voting stock of Federated Investors, Inc. is held in the Voting Shares Irrevocable Trust for which John F. Donahue, Rhodora J. Donahue, and J. Christopher Donahue act as trustees. |

| (8) | According to Schedule 13G filed on December 5, 2008. Burnham Asset Management Corporation serves as the investment manager for a number of managed accounts and has shared dispositive authority over 734,469 shares, with respect to which Burnham Asset Management Corporation disclaims beneficial ownership. Burnham Securities, Inc. is a registered broker-dealer with a number of discretionary accounts and has shared dispositive authority over 103,000 shares, with respect to which Burnham Securities disclaims beneficial ownership. |

| (9) | Mr. Feldman and Mr. Hanerfeld are the sole owners and managing members of West Creek Capital, LLC (“West Creek”), which is the investment adviser to West Creek Partners Fund L.P., or Partners Fund, which owns 407,502 shares. West Creek is a party to an agreement allowing West Creek to vote an additional 238,684 shares owned by Winterville, LLC. Mr. Feldman is a member owner of Oliver Street Capital, LLC, which owns 8,396 shares and Mr. Feldman personally owns 14,750 shares. Mr. Feldman and Mr. Hanerfeld may be deemed to have the shared power to direct the voting and disposition of the shares owned by the Partners Fund, Winterville, and Oliver Street Capital. |

6

| (10) | Mr. Feldman’s beneficial ownership includes 407,502 shares owned by the Partners Fund, 238,684 shares owned by Winterville, 8,386 shares owned by Oliver Street Capital, 14,750 shares personally owned by Mr. Feldman, 31,250 shares issuable upon exercise of options granted to Mr. Feldman under the 1999 Plan and 7,000 shares issuable upon exercise of options granted to Mr. Feldman under the Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (11) | Mr. Hanerfeld’s beneficial ownership includes 407,502 shares owned by the Partner’s Fund, 238,684 shares owned by Winterville, 8,386 shares owned by Oliver Street Capital, and 22,230 shares personally owned by Mr. Hanerfeld. |

| (12) | Includes 6,029 shares of common stock, 1,740 shares of common stock held in the Unitized Fund under the Onvia 401(k) Plan, and 148,588 shares issuable upon exercise of options granted to Mr. Alpert under the 1999 Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (13) | Includes 82,199 shares of common stock, 25,876 shares issuable upon exercise of options granted under the 1999 Plan, and 5,000 shares issuable upon exercise of options granted to Mr. Ballowe under the Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (14) | Includes 5,891 shares of common stock, 1,022 shares of common stock held in the Unitized Fund under the Onvia 401(k) Plan, and 53,830 shares issuable upon exercise of options granted to Mr. Way under the 1999 Plan, which are exercisable within 60 days of February 27, 2009. |

| (15) | Includes 10,000 shares of common stock, 32,602 shares issuable upon exercise of options granted to Mr. Brown under the 1999 Plan, and 7,000 shares issuable upon exercise of options granted under the Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (16) | Includes 10,000 shares of common stock, 31,250 shares issuable upon exercise of options granted under the 1999 Plan, and 7,000 shares issuable upon exercise of options granted to Mr. Brill under the Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (17) | Includes 36,250 shares issuable upon exercise of options granted under the 1999 Plan and 11,000 shares issuable upon exercise of options granted to Mr. Smith under the Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (18) | Includes 11,966 shares of common stock, 27,810 shares issuable upon exercise of options granted under the 1999 Plan, and 7,000 shares issuable upon exercise of options granted to Mr. Skilling under the Directors’ Plan, all of which are exercisable within 60 days of February 27, 2009. |

| (19) | Includes 10,600 shares of common stock and 34,998 shares issuable upon exercise of options granted to Mr. Gillespie under the 1999 Plan, which are exercisable within 60 days of February 27, 2009. |

| (20) | Includes 11,501 shares of common stock and 20,000 shares issuable upon exercise of options granted to Mr. Tannourji under the 1999 Plan, which are exercisable within 60 days of February 27, 2009. |

| (21) | Includes 1,393,901 shares of common stock subject to options exercisable within 60 days of February 27, 2009. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, its executive officers, and persons who beneficially own more than 10% of its common stock to file initial reports of beneficial ownership and reports of changes in beneficial ownership of Onvia’s common stock with the Securities and Exchange Commission, or SEC. These individuals are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports that they file.

To the Company’s knowledge, based solely on its review of the copies of such reports furnished to the Company and written representations from certain reporting persons that no other reports were required, the Company believes that during 2008 all reporting persons complied with all applicable filing requirements.

7

CORPORATE GOVERNANCE

Determination of Director Independence

After review and consideration of the applicable legal standards for director independence, the Board of Directors has determined that each of the following directors is an “independent director” as defined by the NASDAQ Marketplace Rules:

Jeffrey C. Ballowe

James L. Brill

Robert G. Brown

Roger L. Feldman

D. Van Skilling

Steven D. Smith

These directors are referred to as “Independent Directors” in this Proxy Statement. The Board of Directors has also determined that each member of the three committees of the Board of Directors meets the independence requirements applicable to those committees prescribed by NASDAQ, the SEC and/or the Internal Revenue Service. The Board of Directors has further determined that Mr. Brill, a member of the Audit Committee, is an “Audit Committee Financial Expert,” as such term is defined in Item 407(d) of Regulation S-K promulgated by the SEC.

Board Attendance and Board Committees

Our Board of Directors met seven times during 2008. During the year, all of our directors attended 75% or more of the Board meetings and meetings of the committees on which they served. Our Board has three standing committees: Audit, Compensation, and Nominating and Governance.

| | | | | | |

Name | | Audit | | Compensation | | Nominating

and

Governance |

Jeffrey C. Ballowe | | | | X | | |

James L. Brill | | Chair | | | | X |

Robert G. Brown | | X | | | | |

Roger L. Feldman | | | | X | | Chair |

Michael D. Pickett | | | | | | |

Steven D. Smith | | X | | | | |

D. Van Skilling | | | | Chair | | X |

Total Meetings in 2008 | | 5 | | 8 | | 1 |

Mr. Brill, Mr. Brown, and Mr. Smith, were members of the Audit Committee during 2008, with Mr. Brill serving as the chair. Mr. Brill met the Audit Committee Financial Expert criteria as described above. All other members of the Audit Committee are financially literate and are financially sophisticated, as required by NASDAQ, based on their professional experiences. The Audit Committee retains our independent auditors, reviews their independence, reviews and approves the planned scope of our annual audit, reviews and approves any fee arrangements with our auditors, oversees their work, reviews and pre-approves, as appropriate, any non-audit services that they may perform, reviews the adequacy of accounting and financial controls, reviews our critical accounting policies, and reviews and approves any related person transactions. The Audit Committee met five times in 2008. For 2009, Mr. Brill, Mr. Smith, and Mr. Brown will continue to serve on the Audit Committee, with Mr. Brill serving as the chair. The Audit Committee operates under a written charter adopted by the Board of Directors in March 2004.

Mr. Ballowe, Mr. Feldman, and Mr. Skilling were members of the Compensation Committee during 2008, with Mr. Skilling serving as the chair. The Compensation Committee establishes and administers our policies

8

regarding annual executive salaries, cash incentives, and long-term equity incentives. The Compensation Committee met eight times in 2008. For 2009, Mr. Ballowe, Mr. Feldman, and Mr. Skilling will continue to serve on the Compensation Committee, with Mr. Skilling serving as the chair.

Mr. Brill, Mr. Feldman, and Mr. Skilling were members of the Nominating and Governance Committee during 2008, with Mr. Feldman serving as the chair. The Nominating and Governance Committee identifies and recruits individuals to serve as directors of the Company, makes recommendations to the Board of Directors regarding director membership and chairs of the Board’s committees, advises the Board of Directors with respect to matters of Board composition and procedures, develops and recommends to the Board of Directors corporate governance guidelines, considers nominations to the Board of Directors received from stockholders, monitors Company compliance with Onvia’s Code of Business Ethics and Conduct, a copy of which is available on the Company’s website at www.onvia.com, and oversees the annual evaluation of the effectiveness of the Board of Directors and its committees. The Nominating and Governance Committee met once in 2008. For 2009, Mr. Feldman, Mr. Skilling, and Mr. Brill will continue to serve on the Nominating and Governance Committee, with Mr. Feldman serving as the chair.

After consultation with the Nominating and Governance Committee, our Board unanimously elected Mr. Brown to serve as lead director in 2005, to act as a liaison between the Board of Directors and the Company’s management team, to ensure constructive relationships among the directors, and to provide leadership to enhance effectiveness at Board meetings. Our Board reconfirmed Mr. Brown as our lead director for 2009.

The charters of our Audit Committee, Compensation Committee, and Nominating and Governance Committee are available on our website at www.onvia.com.

Stockholder Communications with Directors

We have established a communication mechanism so that our stockholders can communicate with our directors. Stockholders are welcome to communicate directly with the Board of Directors by contacting our Chairman, Chief Executive Officer, and President Mr. Pickett by email atinvestorrelations@onvia.com with a subject line noting “Stockholder Communications to Michael Pickett” or by writing to Michael D. Pickett, Onvia, Inc., 509 Olive Way, Suite 400, Seattle, Washington 98101, ATTN: Stockholder Communications. Mr. Pickett will forward all such stockholder communications to the entire Board of Directors, a Board committee, or an individual director, as appropriate, at the next scheduled Board of Directors or committee meeting. No action has been taken by the Board of Directors resulting from a stockholder communication during 2008.

Director Attendance at Annual Stockholders Meetings

It is the Company’s policy to invite all directors to attend the Annual Meeting each year. Mr. Pickett attended our 2008 Annual Meeting and is planning to attend our 2009 Annual Meeting.

Code of Ethics

All of our directors, officers and employees must adhere to our code of ethics, which is publicly available on our website at www.onvia.com and is also available in print to any stockholder upon request. This code reflects our long-standing commitment to honest and ethical conduct. The code addresses a number of topics, but is designed primarily to promote:

| | • | | Ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | • | | Full, fair, accurate, timely and understandable disclosure in the reports and documents we file with the SEC and in our other public communications; |

9

| | • | | Compliance with applicable laws, rules and regulations; |

| | • | | Prompt internal reporting of violations of the code; and |

| | • | | Accountability for adherence to the ethical standards set forth in the code. |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee during 2008 was comprised of Mr. Ballowe, Mr. Feldman, and Mr. Skilling, each of whom is an Independent Director. No member of the Compensation Committee or executive officer of the Company has, or during 2008 had, a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

10

DIRECTOR NOMINATIONS

The Board of Directors has adopted procedures for nominating director candidates and considering nominees recommended by stockholders (the “Nomination Procedures”). The Nomination Procedures describe the process by which director candidates are selected, the qualifications that those candidates must and should possess, and the procedure for stockholders to submit recommendations for director nominees. The Nomination Procedures are administered by the Nominating and Governance Committee and are described below.

The Nominating and Governance Committee believes that candidates for director should meet certain minimum qualifications, including being able to read and understand financial statements, having substantial business experience, having high moral character and personal integrity, and having sufficient time to attend to their duties and responsibilities to the Company. Exceptional candidates who do not meet all of these criteria may still be considered. The Nominating and Governance Committee will also consider the potential director’s independence, whether the member would be considered an “Audit Committee Financial Expert” as described in the applicable SEC standards, and the diversity that the potential director would add to the Board of Directors in terms of gender, ethnic background, and professional experience.

The Nominating and Governance Committee identifies potential candidates through its members’ networks of contacts, by soliciting recommendations from other directors or executive officers, and, as appropriate, engaging search firms to identify and screen suitable director nominees. After the Nominating and Governance Committee has identified a potential candidate, publicly available information about the person is collected and reviewed. If the Nominating and Governance Committee decides to further pursue the potential candidate after this initial review, contact is made with the person. If the potential candidate expresses a willingness to serve on the Board of Directors, interviews are conducted with the potential candidate and additional information is requested. Candidates are chosen by a majority vote of the members of the Nominating and Governance Committee for recommendation to the Board of Directors.

Director Nominations by Stockholders

The Nominating and Governance Committee will consider director candidates recommended by stockholders on the same basis as other candidates, provided that the following procedures are followed in submitting recommendations:

| | 1. | Stockholders desiring to nominate a director candidate should submit a written recommendation to the Secretary of the Company at 509 Olive Way, Suite 400, Seattle, WA 98101. |

| | 2. | Submissions must include the potential candidate’s five-year employment history with employer names and a description of the employer’s business, the candidate’s experience with financial statements, and the candidate’s other board memberships. |

| | 3. | Submissions must be accompanied by a written consent of the director candidate to stand for election if nominated by the Nominating and Governance Committee and approved by the Board of Directors, and to serve if elected by the stockholders. |

| | 4. | Submissions must be accompanied by proof of ownership of the Company’s common stock by the person submitting the recommendation. |

| | 5. | Recommendations must be received by February 7, 2010 to be considered for nomination at the 2010 Annual Meeting. Recommendations received after February 7, 2010 will be considered for nomination at the 2011 Annual Meeting. |

11

AUDIT COMMITTEE REPORT

The Audit Committee has three members, each of whom is an Independent Director, and operates under a written charter adopted by the Board of Directors in March 2004.

The Audit Committee selects an independent registered public accounting firm to be engaged as our independent auditors. The independent auditors are responsible for performing an audit of our consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and to issue a report thereon. Management is responsible for our internal controls and the financial reporting process. The Audit Committee is responsible for monitoring and overseeing these processes.

The Audit Committee held five meetings during 2008. The meetings were designed to facilitate and encourage communications between the Audit Committee, management, and our independent registered public accounting firm, Deloitte & Touche LLP (“Deloitte”). Management represented to the Audit Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee reviewed and discussed the audited consolidated financial statements for fiscal year 2008 with management and the independent auditors.

The Audit Committee discussed and reviewed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended.

The Audit Committee has received and reviewed the written disclosures and the letter from Deloitte, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. Additionally, the Audit Committee has discussed with Deloitte the issue of its independence from the Company, and satisfied itself as to the auditors’ independence.

Based on its review of the audited consolidated financial statements and the various discussions noted above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2008.

Audit Committee

James L. Brill, Chair

Robert G. Brown

Steven D. Smith

12

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S FEES AND SERVICES

Deloitte served as our independent registered public accounting firm in 2008 and 2007. The following table shows the fees the Company paid or accrued for audit and other services provided by Deloitte for the years ended December 31, 2008 and 2007:

| | | | | | |

| | | 2008 | | 2007 |

Audit Fees | | $ | 270,200 | | $ | 247,000 |

Audit-Related Fees | | | 7,800 | | | — |

Tax Fees | | | 13,200 | | | 26,000 |

| | | | | | |

Total | | $ | 291,200 | | $ | 273,000 |

| | | | | | |

Audit Fees

Audit fees for 2008 and 2007 consist of the fees paid to Deloitte for the audit of the Company’s annual financial statements and for reviews of the Company’s financial statements included in the Company’s quarterly Reports on Form 10-Q during the fiscal years ended December 31, 2008 and 2007.

Audit-Related Fees

Audit-related fees for 2008 consist of consultations in conjuction with a comment letter received from the SEC related to the Company’s 2007 Form 10-K. Onvia’s responses to those comments were filed with the SEC on August 22, 2008. Audit-related fees for 2007 consist of services in conjunction with discussions on internal controls over financial reporting as it pertains to Sarbanes-Oxley Section 404.

Tax Fees

Tax fees for 2008 and 2007 consist of various tax compliance and consulting services for the fiscal years ended December 31, 2008 and 2007.

All Other Fees

There were no other fees that were not included above for the fiscal years ended December 31, 2008 and 2007.

The Audit Committee’s charter provides that it shall pre-approve all audit and non-audit services. The Audit Committee pre-approved all services provided by our auditor in 2008. The Audit Committee has considered the role of Deloitte in providing non-audit services to the Company and has concluded that such services are compatible with Deloitte’s independence as our auditors.

A representative of Deloitte will be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and will be available to answer questions.

13

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board has reviewed and discussed the Compensation Discussion and Analysis section of this Proxy Statement with the Company’s management and, based on such review and discussions, the Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

Compensation Committee

D. Van Skilling, Chair

Jeffrey C. Ballowe

Roger L. Feldman

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings, including this Proxy Statement, in whole or in part, the Compensation Committee Report and the Audit Committee Report shall not be deemed to be incorporated by reference into any such filings.

Compensation Discussion and Analysis

The Compensation Committee, which is comprised of Mr. Skilling, Mr. Ballowe, and Mr. Feldman, each of whom is an Independent Director, is responsible for establishing and monitoring our general compensation policies and compensation plans, as well as the specific compensation levels for executive officers, including our Chief Executive Officer. The Compensation Committee reviews and establishes annual base salary levels, annual cash bonus opportunity levels, and long-term incentive opportunities for each Named Executive Officer.

General Compensation Philosophy

Adopted by the Board of Directors, our compensation philosophy is designed to attract and retain highly-qualified executive talent, to tie annual and long-term cash and equity incentives to achievement of measurable corporate and individual performance objectives, and to align executives’ incentives with stockholder value creation. To achieve these objectives, the Compensation Committee implements and maintains compensation plans that tie a significant portion of an executive’s overall compensation to our Company’s financial performance and common stock price. Overall, the total compensation opportunity is intended to be competitive with public companies of our size and industry, and is reviewed by our Compensation Committee using independent, national survey data. Each executive officer’s compensation package is generally comprised of four elements: (i) base salary, which reflects an individual’s qualifications, scope of responsibilities, experience level, expertise, performance, and impact on Company results; (ii) cash-based annual incentive compensation tied to personal achievement and overall Company success; (iii) long-term incentives, which consist of stock options and are designed to strengthen the mutuality of interests between the executive officers and our stockholders; and (iv) other compensation programs that our executives participate in along with all of our employees, including a qualified 401(k) plan and the 2000 Employee Stock Purchase Plan, or ESPP. The Compensation Committee regularly reviews and establishes base salaries, annual cash bonus opportunity levels, and long-term incentive opportunities for each executive officer. The executive officers were not present during, and did not participate in, deliberations or decisions involving their own compensation during 2008.

The summary below describes in more detail the factors that the Compensation Committee considers in establishing each of the four primary components of the compensation package provided to the Named Executive Officers.

While an executive officer does not play a role in setting his or her own compensation, our Chief Executive Officer does make recommendations to the Compensation Committee concerning stock option grants, bonus plans, and individual pay increases tied to the performance of other executive officers.

14

Base Salary

The level of base salary is established primarily on the basis of an executive’s qualifications and relevant experience, the scope of his or her responsibilities, the strategic goals that he or she manages, the compensation levels of executive officers at companies of similar revenue and employee size in the ecommerce and technology industries and in the Seattle marketplace, the relationship between the executive’s performance and the Company’s results, and market rates of compensation required to retain qualified management. Generally, we believe that executive base salaries should be competitive (within a range around the median of the salaries of executives at comparable companies). The Compensation Committee used independent, national salary survey data to calibrate competitive salaries for our executive officers. The Compensation Committee reviews the base salary of each executive annually and may adjust base salary to take into account the individual’s performance, any changes in responsibility, and to maintain competitive salary levels. Company performance does not play a significant role in the determination of base salary. The Compensation Committee reviewed each executive’s base salary in December 2008 in connection with setting 2009 base salary levels. Based on this review, the Compensation Committee deferred any decisions increasing 2009 base salaries for our executives to the second half of 2009 in light of current market conditions and Onvia’s performance.

Cash-Based Incentive Compensation

At Onvia, cash-based incentive compensation takes two forms: sales incentives, or commissions, for our sales executives and a management incentive plan. Onvia’s executives who have sales responsibilities can earn commissions tied to specific sales results. Sales incentive commissions are intended to reward individual performance that will significantly impact the Company’s overall performance. The sales incentive levels are market driven and reflect what other companies of Onvia’s size within Onvia’s industry are doing based on the assessments of market practice. Mr. Alpert and Mr. Tannourji earned sales incentive compensation in 2008 and Mr. Alpert and Mr.Tannourji are on sales incentive plans for 2009. The Compensation Committee reviewed the sales incentive programs of each sales executive in January 2009 and adjusted sales incentive goals as well as targeted incentive payouts for performance.

Onvia’s 2008 Management Incentive Plan allowed for a target bonus award of 11% to 33% of base salary for participating executive officers. Mr. Way, Mr. Alpert, Mr. Gillespie, and Mr. Tannourji were participants in the 2008 Management Incentive Plan. Mr. Pickett was not a participant in the 2008 Management Incentive Plan because Mr. Pickett, as Chief Executive Officer, was evaluated separately by the Compensation Committee. The objectives of the 2008 Management Incentive Plan were to achieve certain profitability goals and annual bookings under the 2008 budget plan as well as achieve positive cash flow in 2008. Since these targets were not met, no bonuses were paid out under the 2008 Management Incentive Plan.

In January 2009, the Compensation Committee established a new management incentive plan, payable in early 2010, if the Company achieves predetermined targets based on annual bookings growth, operating cash flow, and net income metrics. All Named Executive Officers, except for Mr. Pickett, are participants. The Compensation Committee did not include Mr. Pickett in the 2009 Management Incentive Plan and has not established a separate bonus plan for Mr. Pickett. The Compensation Committee believes that the options granted to Mr. Pickett in 2004 continue to provide sufficient incentives to Mr. Pickett through 2009. The 2009 Management Incentive Plan is funded upon achievement of all three predetermined targets described above and allows for a target bonus award of 33% of base salary for Mr. Way and Mr. Gillespie. Mr. Way will receive 50% of his bonus award upon achievement of all predetermined targets and the remaining 50% upon achievement of individual performance goals. Mr. Gillespie will receive 100% of his bonus award upon achievement of corporate targets only. The 2009 Management Incentive Plan also allows for a target bonus award of $25,000 each for Mr. Alpert and Mr. Tannourji if all predetermined targets under the 2009 Management Incentive Plan and their own Sales Incentive Plans are achieved. In addition, the 2009 Management Incentive Plan allows for awards beyond target. An additional pool of 5% of bookings above target will be accrued and distributed to one or more participants based on the recommendation of the CEO and as approved by the Compensation Committee.

15

The Compensation Committee based the incentive plan on bookings growth, operating cash flow, and net income metrics for three reasons. First and most important, these targets track corporate performance that most reflect stockholder interests. Second, the targets drive and reward unified performance across the executive team. Third, the targets focus the Company on building for long-term, profitable growth. The participating executive officers earn bonuses under the 2009 Management Incentive Plan only when all targets have been reached and when predetermined individual goals have been reached (except for Mr. Gillespie whose incentive is based totally on corporate target achievement).

Long-Term Incentive Compensation

We believe the grant of long-term stock options provides executives and other key employees with an incentive to maximize long-term stockholder value. Stock option awards are designed to give the recipient a significant equity stake in the Company and thereby closely align his or her interests with those of our stockholders. Factors considered in making such awards include the individual’s position, his or her performance and responsibilities, market comparisons based on independent salary survey data, and internal comparisons among our executive officers. The Compensation Committee also takes into consideration the number of stock options that an executive officer already holds. Long-term stock options are not granted annually to our executive officers. The Compensation Committee is free to consider other factors in determining the size of the option grant made to each executive officer where it determines that the circumstances warrant alternative treatment.

Each option grant allows the executive officer to acquire shares of common stock at a fixed price per share (the fair market value on the grant date or above) over a specified period of time (up to 10 years). The options typically vest in equal periodic installments over a four or five year period, contingent upon the executive officer’s continued employment with Onvia. The majority of stock options granted in the last few years have had a five-year vesting period (but never less than a four-year vesting period), with the exercise price set higher than the fair market value of the stock on the date of grant. For example, one-fifth of the options had an exercise price set at the fair market value on the grant date, the second one-fifth was set at $1.00 above the fair market value, the third one-fifth was set at $2.00 above the fair market value, the fourth one-fifth was set at $3.00 above the fair market value, and the last one-fifth was set at $4.00 above the fair market value. Upon the recommendation of the Compensation Committee, our Board determined that such premium-priced stock options are atypical in the compensation programs of public companies of our size and within our industry and discontinued the practice. In addition, such options created higher levels of dilution to stockholders in order to deliver competitive compensation to the executives. Accordingly, all stock options granted going forward will be granted with an exercise price equal to the fair market value on the grant date.

With the exception of Mr. Tannourji and Mr. Gillespie, stock options were not granted in 2008 to our Named Executive Officers because they were not necessary to keep total compensation competitive for our Named Executive Officers. Mr. Tannourji received a new-hire stock option grant in connection with his employment by the Company, and Mr. Gillespie received a stock option grant for his assumption of additional responsibilities during 2008.

At our 2008 Annual Meeting on September 5, 2008, our stockholders approved the amendment and restatement of the Amended and Restated 1999 Stock Option Plan, or 1999 Plan, as the 2008 Equity Incentive Plan, or 2008 Plan. All stock option awards to executives, employees as well as members of the Board of Directors will be granted from the 2008 Plan going forward.

Other Compensation Programs

Onvia has a Savings and Retirement Plan, or 401(k) Plan. The 401(k) Plan is a qualified salary deferral plan in which all eligible employees may elect to have a percentage of their pre-tax compensation contributed to the 401(k) Plan, subject to certain guidelines issued by the Internal Revenue Service. The 401(k) Plan provides a discretionary matching contribution of up to 6% of all eligible employee contributions, made in the form of

16

Onvia common stock. The purpose of the Company’s matching contribution into the 401(k) Plan is to encourage employees to participate in their own retirement savings and to provide another competitive recruiting tool to attract and retain employees. The matching contributions are subject to a four year vesting schedule, with vesting measured from the employee’s date of hire. The matching contributions are made in the first quarter following each 401(k) Plan year, and employees must be employed on the last day of the 401(k) Plan year to be eligible to receive the matching contribution. In March 2009, all of our executive officers, along with other employees who made contributions into the 401(k) Plan, received matching contributions for the 2008 plan year.

Effective May 2000, we adopted the 2000 Employee Stock Purchase Plan, or ESPP, which allows an eligible employee to purchase shares of common stock, based on certain limitations, at a price equal to the lesser of 85% of the fair market value of the common stock at the beginning or end of the respective offering period. An eligible employee may purchase up to 600 shares per year. All of our Named Executive Officers, except for Mr. Pickett, who is exempt from participation because he holds more than five percent (5%) of the total combined voting power of Onvia stock, participated in the ESPP in 2008.

Onvia has not previously granted stock awards and does not have any pension or nonqualified deferred compensation plans.

Compensation Committee’s Processes and Procedures for Consideration and Determination of Executive Compensation

The Compensation Committee has authority to administer the 2008 Plan, the ESPP and the 2009 Management Incentive Plan, and make policy recommendations from time to time with respect to our benefit plans. The Compensation Committee also oversees all of our executive compensation policies and decisions. In particular, the Committee exercises all power and authority of the Board in the administration and interpretation of our benefit plans, including establishing guidelines, selecting participants in the plans, approving grants and awards, and exercising such other power and authority as is required and permitted under the plans. The Compensation Committee also reviews and approves executive officer compensation, including, as applicable, salary, bonus and incentive compensation levels, equity compensation (including awards to induce employment), severance arrangements, change-in-control agreements, special or supplemental benefits and other forms of executive officer compensation. The Committee periodically reviews regional and industry-wide compensation practices and trends to assess the adequacy and competitiveness of our compensation programs. The Committee’s responsibilities are reflected in its charter, which is reviewed periodically by the Committee, and the Committee recommends any proposed changes to the Board. The compensation committee’s charter is available on our website at www.onvia.com. The Committee’s membership is determined annually by the full Board and includes only independent directors. The Committee meets as often as it deems appropriate, but not less frequently than annually.

Michael D. Pickett has served as our Chief Executive Officer since April 2001. His base salary for the fiscal year ended December 31, 2008 was $250,000. No other compensation, bonus, commission, or stipend was paid to Mr. Pickett during 2008 because the Compensation Committee believed that the 600,000 stock options granted to Mr. Pickett on November 29, 2004 continue to provide a competitive compensation level as well as align his interests with those of our stockholders.

With respect to Mr. Pickett, the Compensation Committee weighed: (i) the factors discussed above in “Base Salary,” “Cash-Based Incentive Compensation,” and “Long-Term Incentive Compensation,” as well as his previous experience as Chairman, President, and Chief Executive Officer of a publicly held company; (ii) the compensation levels at companies that compete with the Company for business and executive talent; and (iii) the Company’s performance, in establishing the amount of Mr. Pickett’s base salary, bonus, and stock option grant.

The Compensation Committee has not delegated any authority to make compensation decisions to any other persons. The Compensation Committee only makes recommendations about stock option grants to the Board of Directors, which makes the final decision to grant stock options.

17

Role of Executive Officers in Compensation Process

In addition to reviewing executive officers’ compensation against a group of comparable companies, the Compensation Committee also solicits appropriate input from our Chief Executive Officer regarding base salaries, cash incentives and equity grants for our executive officers. Moreover, only our Chief Executive Officer has a role in determining or recommending the amount and/or form of employee-level director compensation.

External Advisors

The Compensation Committee has the authority to engage the services of outside advisers and purchase independent salary surveys to assist the Committee in fulfilling its duties. In March 2008, the Committee engaged Milliman, Inc., an independent compensation consultant, to assist the Committee in the assessment of the competitiveness of the Company’s executive and director compensation programs compared to other public companies of our size and industry. In addition, the Committee reviewed independent national salary survey data to help the Committee assess the Company’s current executive compensation practices, including relative to a group of similar-sized companies within our industry.

Deductibility of Executive Compensation

Under Section 162(m) of the Internal Revenue Code, the Company’s deduction for certain compensation paid to Named Executive Officers is subject to an annual limit of $1 million per employee, unless it is deferred or considered performance-based. As the cash compensation paid by the Company to each of its executive officers is expected to be below $1 million and the Compensation Committee believes that options granted under the 1999 Plan to such officers will qualify as performance-based, the Compensation Committee believes that Section 162(m) will not affect the tax deductions available to the Company with respect to the compensation of its executive officers. It is the Compensation Committee’s policy to qualify, to the extent reasonable, its executive officers’ compensation for deductibility under applicable tax law. However, the Company may from time to time pay compensation to its executive officers that may not be deductible.

Timing of Awards

In making stock option grants under our option plans, our Compensation Committee has not timed the award of any stock option to coincide with the release of favorable or unfavorable information about us. The Compensation Committee has no intention of timing the award of stock options or other equity-based compensation to coincide with the release of favorable or unfavorable information about us in the future.

18

Executive Compensation

Summary Compensation Table

The following table sets forth the compensation paid to or earned by: (a) our President and Chief Executive Officer; (b) our Chief Financial Officer; and (c) our three other most highly compensated executive officers in 2008 (together, the “Named Executive Officers”).

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Option

Awards(1)

($) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total

($) |

Michael D. Pickett(2) Chairman, Chief Executive Officer and President | | 2008 | | $ | 250,000 | | $ | — | | $ | 169,397 | | $ | — | | $ | 1,587 | | $ | 420,984 |

| | 2007 | | | 250,000 | | | — | | | 283,809 | | | — | | | 3,375 | | | 537,184 |

| | 2006 | | | 250,000 | | | — | | | 437,478 | | | — | | | 3,300 | | | 690,778 |

| | | | | | | |

Cameron S. Way(3) Chief Financial Officer | | 2008 | | $ | 166,334 | | $ | — | | $ | 9,483 | | $ | — | | $ | 1,193 | | $ | 177,010 |

| | 2007 | | | 136,250 | | | 5,000 | | | 16,332 | | | — | | | 2,044 | | | 159,626 |

| | 2006 | | | 129,090 | | | 6,111 | | | 28,759 | | | — | | | 2,028 | | | 165,988 |

| | | | | | | |

Irvine N. Alpert(4) Executive Vice President | | 2008 | | $ | 180,000 | | $ | — | | $ | 31,542 | | $ | 79,068 | | $ | 1,587 | | $ | 292,197 |

| | 2007 | | | 180,000 | | | — | | | 53,727 | | | 130,116 | | | 3,375 | | | 367,218 |

| | 2006 | | | 180,000 | | | — | | | 88,849 | | | 191,747 | | | 3,300 | | | 463,896 |

| | | | | | | |

Eric T. Gillespie(5) Senior Vice President of Products, Technology and Information | | 2008 | | $ | 212,500 | | $ | — | | $ | 152,239 | | $ | — | | $ | 1,511 | | $ | 366,250 |

| | 2007 | | | 104,423 | | | 5,000 | | | 76,870 | | | — | | | 6,000 | | | 192,293 |

| | 2006 | | | — | | | — | | | — | | | — | | | — | | | — |

| | | | | | | |

Michael J. Tannourji(6) Senior Vice President of Sales and Marketing | | 2008 | | $ | 225,000 | | $ | — | | $ | 91,166 | | $ | 20,000 | | $ | 1,587 | | $ | 337,753 |

| | 2007 | | | 21,996 | | | — | | | — | | | — | | | 75,000 | | | 96,996 |

| | 2006 | | | — | | | — | | | — | | | — | | | — | | | — |

| (1) | Amounts in the Option Awards column represent the dollar amount recognized in Onvia’s financial statements as non-cash stock-based compensation for the fiscal year, excluding the impact of estimated forfeitures. Refer to Note 2 of the Consolidated Financial Statements in the Company’s Form 10-K, filed with the SEC on March 31, 2009, for a discussion of the assumptions used in the valuation of option awards. |

| (2) | Mr. Pickett’s annual base salary as of December 31, 2008 was $250,000. The 401(k) company matching contribution of $1,587 appears in the All Other Compensation column. |

| (3) | Mr. Way’s annual base salary as of December 31, 2008 was $172,000. The 401(k) matching contribution of $1,193 appears in the All Other Compensation column. |

| (4) | Mr. Alpert’s annual base salary as of December 31, 2008 was $180,000. Mr. Alpert’s non-equity incentive compensation in 2008 consists of $79,068 in sales commissions pursuant to his commission agreement with Onvia. The 401(k) matching contribution of $1,587 appears in the All Other Compensation column. |

| (5) | Mr. Gillespie’s annual base salary as of December 31, 2008 was $225,000. The 401(k) matching contribution of $1,511 appears in the All Other Compensation column. |

| (6) | Mr. Tannourji’s annual base salary as of December 31, 2008 was $225,000. The 401(k) matching contribution of $1,587 appears in the All Other Compensation column. |

Other Compensatory Arrangements

The Named Executive Officers participate in medical, dental, life and disability insurance plans provided to all of our employees.

19

2008 Grants of Plan-Based Awards

The following table presents information regarding non-equity incentive awards and options granted to the Named Executive Officers during fiscal year 2008. None of the target annual bonuses approved by the Compensation Committee was earned by the Named Executive Officers during 2008.

Estimated Future Payouts Under Non-Equity Incentive Plan Awards

| | | | | | | | | | | | | | |

| | | Grant Date | | Estimated Future Payouts Under

Non-Equity Incentive Plan

Awards | | Option

Awards:

Number of

Securities

Underlying

Options

(#) | | Exercise or

Base Price

of Option

Awards

($/Sh) | | Grant Date

Fair Value

of Option

Awards

($) |

Name | | | Threshold

($) | | Target

($) | | Maximum

($) | | | |

Michael D. Pickett | | | | — | | — | | — | | — | | — | | — |

| | | | | | | |

Cameron S. Way(1) | | 03/06/2008 | | — | | 56,760 | | — | | — | | — | | — |

| | | | | | | |

Irvine N. Alpert(2) | | 03/06/2008 | | — | | 158,215 | | — | | — | | — | | — |

| | | | | | | |

Eric T. Gillespie(3) | | 03/06/2008 | | — | | 74,250 | | — | | — | | — | | — |

| | 06/25/2008 | | — | | — | | — | | 10,000 | | 5.05 | | 19,350 |

| | | | | | | |

Michael J. Tannourji(4) | | 01/23/2008 | | — | | — | | — | | 16,000 | | 7.69 | | 49,821 |

| | 01/23/2008 | | — | | — | | — | | 16,000 | | 8.69 | | 44,962 |

| | 01/23/2008 | | — | | — | | — | | 16,000 | | 9.69 | | 40,733 |

| | 01/23/2008 | | — | | — | | — | | 16,000 | | 10.69 | | 37,035 |

| | 01/23/2008 | | — | | — | | — | | 16,000 | | 11.69 | | 33,786 |

| | 03/06/2008 | | — | | 125,000 | | — | | — | | — | | — |

| (1) | Mr. Way’s target non-equity incentive reflects the target annual bonus approved by the Compensation Committee on March 6, 2008 for fiscal year 2008. |

| (2) | Mr. Alpert’s target non-equity incentive includes $133,215 in target annual incentives under his sales commission plan for fiscal year 2007, and $25,000 for his target annual bonus approved by the Compensation Committee on March 6, 2008 for fiscal year 2008. |

| (3) | Mr. Gillespie’s target non-equity incentive reflects the target annual bonus approved by the Compensation Committee on March 6, 2008 for fiscal year 2008. |

| (4) | Mr. Tannourji’s target non-equity incentive includes $100,000 in target annual incentives under his sales commission plan for fiscal year 2008, and $25,000 for his target annual bonus approved by the Compensation Committee on March 6, 2008 for fiscal year 2008. The closing market price of Onvia’s common stock on January 23, 2008, the grant date of Mr. Tannourji’s options, was $7.69. Please refer to the discussion under “Long-Term Incentive Compensation” in the Compensation Discussion and Analysis above for a discussion on the Compensation Committee’s philosophy on premium-priced options. |

20

Outstanding Equity Awards at Fiscal Year-End

The following table presents information regarding the outstanding equity awards held by each Named Executive Officer at the end of fiscal year 2008.

| | | | | | | | | |

Name | | Number of Securities

Underlying Unexercised

Options

(#) Exercisable | | Number of Securities

Underlying Unexercised

Options(1)

(#) Unexercisable | | Option

Exercise Price

($/Share) | | Option

Expiration

Date |

Michael D. Pickett(1) | | 4,000 | | — | | $ | 206.10 | | 02/28/2010 |

| | 302,979 | | — | | | 2.66 | | 08/14/2010 |

| | 490,000 | | 110,000 | | | 10.00 | | 11/29/2014 |

| | | | |

Cameron S. Way(2) | | 1,134 | | — | | $ | 1.35 | | 08/23/2009 |

| | 320 | | — | | | 21.73 | | 11/01/2010 |

| | 4,376 | | — | | | 1.77 | | 10/16/2011 |

| | 22,000 | | — | | | 2.55 | | 01/31/2013 |

| | 24,500 | | 5,500 | | | 7.50 | | 11/29/2014 |

| | | | |

Irvine N. Alpert(3) | | 15,375 | | — | | $ | 1.48 | | 8/31/2011 |

| | 16,548 | | — | | | 1.48 | | 2/22/2012 |

| | 30,000 | | — | | | 2.55 | | 1/31/2013 |

| | 81,666 | | 18,334 | | | 7.50 | | 11/29/2014 |

| | | | |

Eric T. Gillespie(4) | | 5,666 | | 14,334 | | $ | 8.95 | | 7/25/2017 |

| | 5,666 | | 14,334 | | | 9.95 | | 7/25/2017 |

| | 5,666 | | 14,334 | | | 10.95 | | 7/25/2017 |

| | 5,666 | | 14,334 | | | 11.95 | | 7/25/2017 |

| | 5,666 | | 14,334 | | | 12.95 | | 7/25/2017 |

| | — | | 10,000 | | | 5.05 | | 6/25/2018 |

| | | | |

Michael J. Tannourji(5) | | — | | 16,000 | | $ | 7.69 | | 1/23/2018 |

| | — | | 16,000 | | | 8.69 | | 1/23/2018 |

| | — | | 16,000 | | | 9.69 | | 1/23/2018 |

| | — | | 16,000 | | | 10.69 | | 1/23/2018 |

| | — | | 16,000 | | | 11.69 | | 1/23/2018 |

| (1) | Mr. Pickett’s unexercisable options have a five year vesting schedule, with twenty percent vesting upon the first anniversary of the grant date and ratable monthly vesting thereafter until fully vested in November 2009. |

| (2) | Mr. Way’s unexercisable options have a five year vesting schedule, with twenty percent vesting upon the first anniversary of the grant date and ratable monthly vesting thereafter until fully vested in November 2009. |

| (3) | Mr. Alpert’s unexercisable options have a five year ratable monthly vesting schedule and will be fully vested in November 2009. |

| (4) | Mr. Gillespie’s unexercisable options expiring on July 25, 2017 have a five year vesting schedule, with twenty percent vesting upon the first anniversary of the grant date and ratable monthly vesting thereafter until fully vested in July 2012. His unexercisable options expiring on June 25, 2018 have a four year vesting schedule, with twenty-five percent vesting upon the first anniversary of the grant date and ratable monthly vesting thereafter until fully vested in June 2012. |

| (5) | Mr. Tannourji’s unexercisable options have a five year vesting schedule, with twenty percent vesting upon the first anniversary of the grant date and ratable monthly vesting thereafter until fully vested in January 2013. |

21

Option Exercises

There were no options exercised by the Named Executive Officers during fiscal year 2008. In addition, stock awards are not a current feature of Onvia’s long-term incentive compensation program.

Pension Benefits and Non-Qualified Defined Contribution and Other Non-Qualified Deferred Compensation Plans

Onvia does not offer any pension or non-qualified deferred compensation plans. However, Onvia offers a defined contribution plan (401(k) Plan) for all of its employees pursuant to which it offers a discretionary match, made in Onvia common stock, on employee contributions up to six percent of eligible employee earnings.

Potential Payments upon Termination or Change in Control

Each of our Named Executive Officers is entitled to certain payments and benefits in the event of a termination of employment or a change in control transaction.

Mr. Pickett and the Company entered into an employment agreement in March 2001. Pursuant to this agreement, upon termination of Mr. Pickett’s employment by the Company without cause or by Mr. Pickett for good reason, he will receive a lump sum payment of $250,000, twelve months of (i) medical and dental insurance benefits, (ii) accelerated vesting of all unvested options granted to Mr. Pickett solely in his capacity as a director pursuant to Onvia’s 2000 Directors’ Stock Option Plan, and (iii) accelerated vesting of all unvested shares pursuant to that certain Common Stock Purchase Agreement dated April 9, 1999 between the Company and Mr. Pickett. Upon a change in control transaction, fifty percent of the then-unvested options granted under the 1999 Plan to Mr. Pickett shall vest, and the remaining unvested options shall vest and become exercisable upon termination of Mr. Pickett’s employment without cause or by Mr. Pickett for good reason within twelve months after a change of control transaction. Upon termination of Mr. Pickett’s employment due to Mr. Pickett’s disability, Mr. Pickett will receive base salary and medical and dental insurance benefits for ninety (90) days following the effective date of such termination.

Mr. Alpert and the Company entered into an employment agreement in February 2002. Pursuant to this agreement, upon termination of Mr. Alpert’s employment by the Company without cause or by Mr. Alpert for good reason, he will receive six months of (i) base salary, (ii) medical and dental insurance benefits, and (iii) accelerated vesting on unvested options. Upon a change in control transaction, twenty-five percent of the then-unvested options granted to Mr. Alpert shall vest, and the remaining unvested options shall vest and become exercisable upon termination of Mr. Alpert’s employment without cause or by Mr. Alpert for good reason within twelve months after a change of control transaction. Upon termination of Mr. Alpert’s employment due to Mr. Alpert’s disability, Mr. Alpert will receive base salary and medical and dental insurance benefits for ninety (90) days following the effective date of such termination.

In a separate resolution, Onvia’s Board of Directors approved a severance package for Mr. Way. Pursuant to that resolution, upon termination of Mr. Way’s employment by the Company for other than cause, or by Mr. Way for good reason, he will receive six months of base salary and accrued and unused paid time off. Upon a change in control transaction, one hundred percent of the then-unvested options granted to Mr. Way shall vest if such options are not assumed by the successor corporation (twenty-five percent if such options are assumed). If such options are assumed and Mr. Way’s employment with the Company is either terminated other than for cause or good reason within twelve (12) months of a change of control transaction, one hundred percent of Mr. Way’s then-unvested options shall vest and become exercisable.

For the other Named Executive Officers, upon termination of employment with the Company without cause or by the executive for good reason, the executive will receive six months of (i) base salary, and (ii) medical and dental insurance benefits. Upon a change in control transaction, one hundred percent of the then-unvested options

22