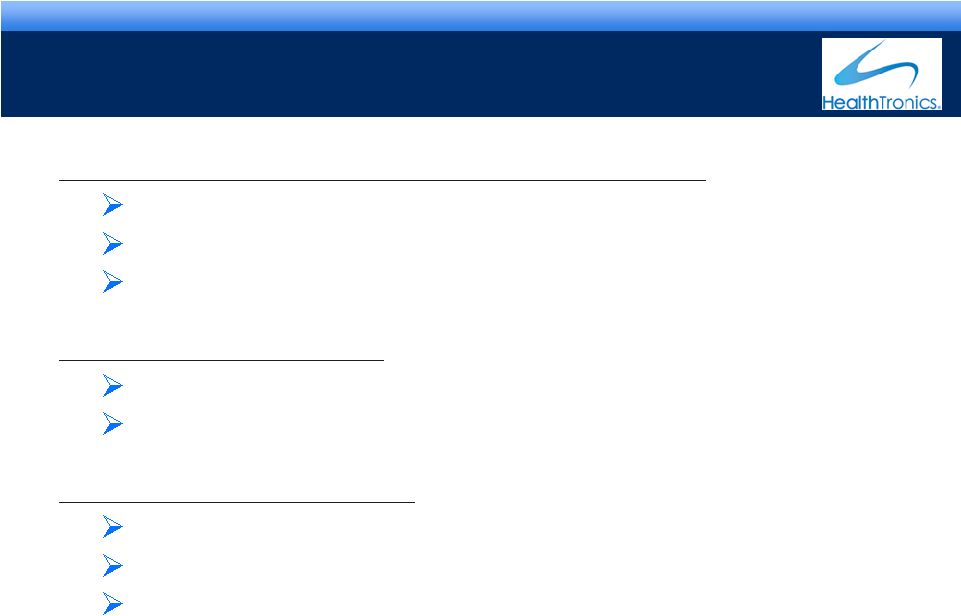

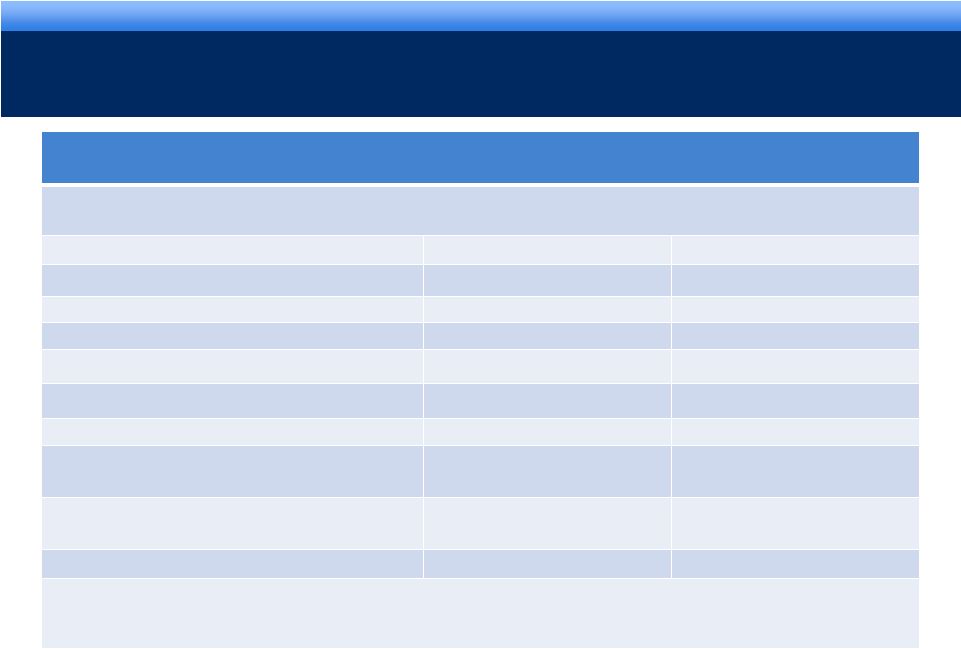

grow. collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc. RECONCILIATION OF NON-GAAP MEASURES 20 For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2010 Lower End of Range Upper End of Range Projected GAAP diluted income per common share $2.06 $2.14 Upfront and milestone-related payments to partners $0.20 $0.15 Amortization of commercial intangible assets $0.59 $0.59 Costs incurred in connection with continued efforts to enhance the cost structure of the Company $0.05 $0.05 Indevus related costs and change in fair value of contingent consideration $0.01 $0.01 Costs related to the acquisition of HealthTronics, Inc. $0.41 $0.41 Interest expense adjustment for ASC 470-20 and the amortization of the premium on debt acquired from Indevus $0.15 $0.15 Tax effect of pre-tax adjustments at the applicable tax rates and certain other expected cash tax savings as a result of the Indevus and HealthTronics acquisitions ($0.27) ($0.25) Diluted adjusted income per common share guidance $3.20 $3.25 The company's guidance is being issued based on certain assumptions including: •Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results •Includes all completed business development transactions as of March 31, 2010 and the announced acquisition of HealthTronics, Inc. |