Exhibit 99.1

ENDO

PHARMACEUTICALS

ENDO PHARMACEUTICALS

grow. collaborate. innovate. thrive.

Credit Suisse Healthcare Conference

November 10, 2010

grow. collaborate. innovate. thrive.

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding, among other things, the company’s financial position, results of operations, market position, product development and business strategy, as well as estimates of future net sales, future expenses, future net income and future earnings per share. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “intend,” “guidance” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Investors should note that many factors, as more fully described under the caption “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2009 and Part II, Item 1A of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2010 and as otherwise enumerated herein or therein, could affect our future financial results and could cause our actual results to differ materially from those expressed in forward-looking statements contained in our Annual Report on Form 10-K. Important factors that could cause our actual results to differ materially from the expectations reflected in the forward-looking statements in our Annual Report on Form 10-K include those factors described herein under the caption “Risk Factors” and in documents incorporated by reference, including, among others: our ability to successfully develop, commercialize and market new products; timing and results of pre-clinical or clinical trials on new products; our ability to obtain regulatory approval of any of our pipeline products; competition for the business of our branded and generic products, and in connection with our acquisition of rights to intellectual property assets; market acceptance of our future products; government regulation of the pharmaceutical industry; our dependence on a small number of products; our dependence on outside manufacturers for the manufacture of most of our products; our dependence on third parties to supply raw materials and to provide services for certain core aspects of our business; new regulatory action or lawsuits relating to our use of narcotics in most of our core products; our exposure to product liability claims and product recalls and the possibility that we may not be able to adequately insure ourselves; our ability to protect our proprietary technology; the successful efforts of manufacturers of branded pharmaceuticals to use litigation and legislative and regulatory efforts to limit the use of generics and certain other products; our ability to successfully implement our acquisition and in-licensing strategy; regulatory or other limits on the availability of controlled substances that constitute the active ingredients of some of our products and products in development; the availability of third-party reimbursement for our products; the outcome of any pending or future litigation or claims by third parties or the government, and the performance of indemnitors with respect to claims for which we have the right to be indemnified; our dependence on sales to a limited number of large pharmacy chains and wholesale drug distributors for a large portion of our total revenues; significant litigation expenses to defend or assert patent infringement claims; any interruption or failure by our suppliers, distributors and collaboration partners to meet their obligations pursuant to various agreements with us; a determination by a regulatory agency that we are engaging or have engaged in inappropriate sales or marketing activities, including promoting the “off- label” use of our products; existing suppliers become unavailable or lose their regulatory status as an approved source, causing an inability to obtain required components, raw materials or products on a timely basis or at commercially reasonable prices; the loss of branded product exclusivity periods and related intellectual property.

grow. collaborate. innovate. thrive.

STRONG OPERATING PERFORMANCE

17% 3-YEAR CAGR FOR REVENUE*

Sustaining our Growth

$mm

$2.2B - $ 2.3B

$2,000

$1.63B - $ 1.68B

$1,461

$1,500

$1,261

$1,086

$910

$1,000

$820

$596

$615

$399

$345

$366

$356

$500

$217

$285

$295

$110

$171 $0

2002 2003 2004 2005 2006 2007 2008 2009 2010E 2011E

Revenue Cash Flow from Operations

* Revenue CAGR 2006-2009.

3

grow. collaborate. innovate. thrive.

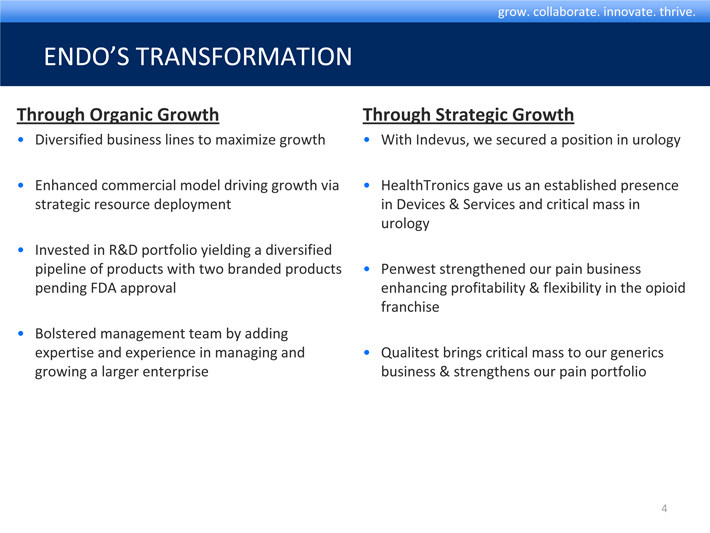

ENDO’S TRANSFORMATION

Through Organic Growth

Diversified business lines to maximize growth

Enhanced commercial model driving growth via strategic resource deployment

Invested in R&D portfolio yielding a diversified pipeline of products with two branded products pending FDA approval

Bolstered management team by adding expertise and experience in managing and growing a larger enterprise

Through Strategic Growth

With Indevus, we secured a position in urology

HealthTronics gave us an established presence in Devices & Services and critical mass in urology

Penwest strengthened our pain business enhancing profitability & flexibility in the opioid franchise

Qualitest brings critical mass to our generics business & strengthens our pain portfolio

4

grow. collaborate. innovate. thrive.

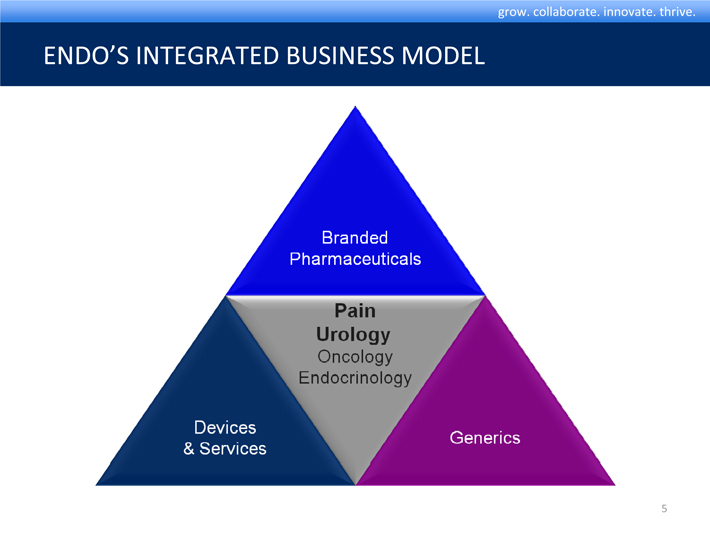

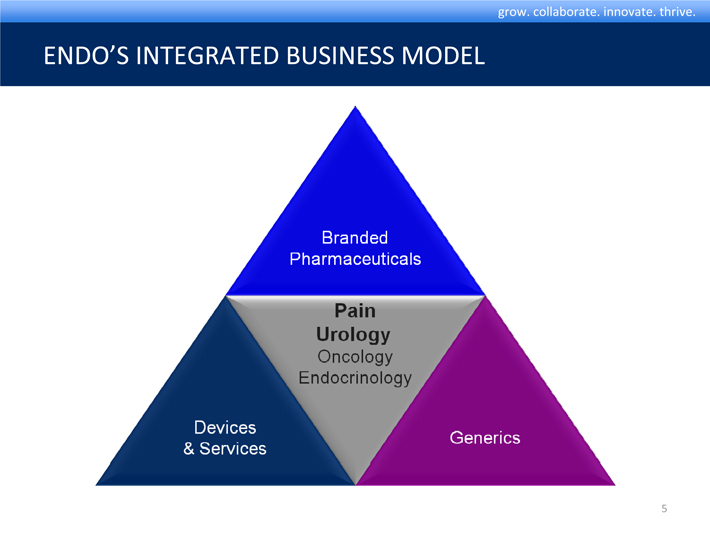

ENDO’S INTEGRATED BUSINESS MODEL

Branded Pharmaceuticals

Devices & Services

Generics

5

grow. collaborate. innovate. thrive.

STRONG CORE BUSINESS SUPPORTING GROWTH

Frova

Frovatriotan succinate

think

OPANA ER

(oxymorphone HCI)

Extended-release tablets

think

OPANA

(oxymorphone HCI)

Voltaren Gel

(diclofenac sodium topical gel) 1%

Lidoderm

LIDOCAINE PATH 5%

A Custom Fit for PHN Pain

Percocet

(oxycodone and acetaminophen tablets, USP)

VALSTAR

Valrubicin Sterile Solution for Intravesical Instillation

ONCE-YEARLY

SUPPRELIN LA

(histrelin acetate) subcutaneous implant

ONCE-YEARLY

VANTAS

(histrelin implant)

6

grow. collaborate. innovate. thrive.

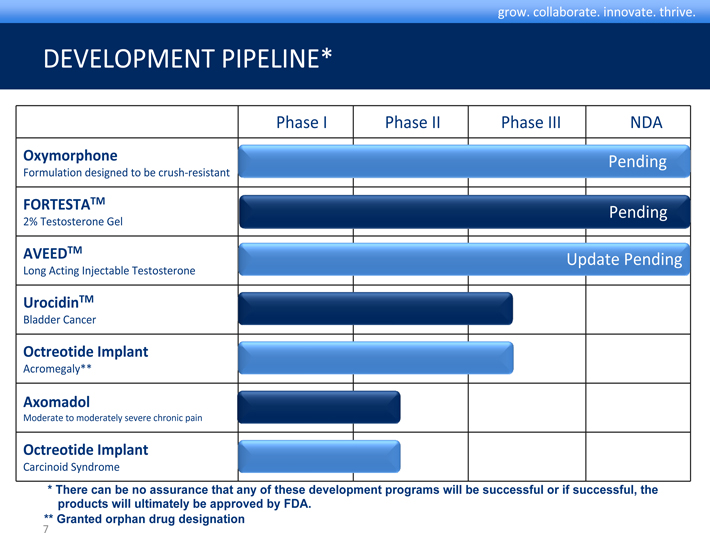

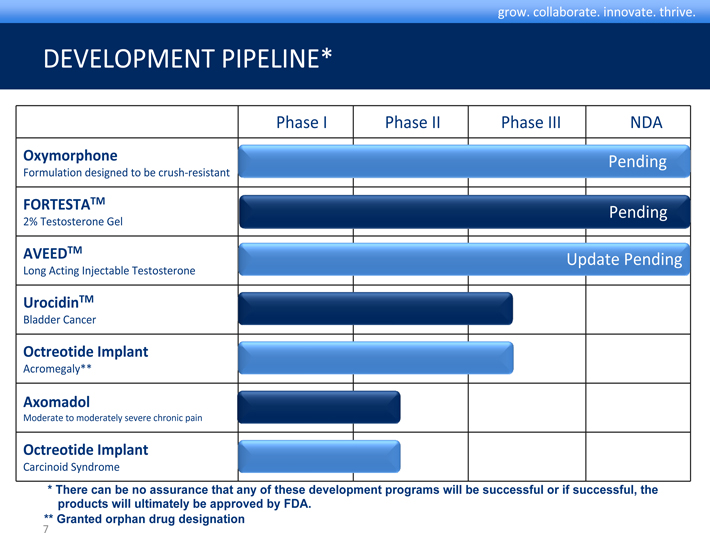

DEVELOPMENT PIPELINE*

Phase I Phase II Phase III NDA

Oxymorphone Pending

Formulation designed to be crush-resistant

FORTESTATM

Pending

2% Testosterone Gel

AVEEDTM

Long Acting Injectable Testosterone Update Pending

UrocidinTM

Bladder Cancer

Octreotide Implant

Acromegaly**

Axomadol

Moderate to moderately severe chronic pain

Octreotide Implant

Carcinoid Syndrome

* There can be no assurance that any of these development programs will be successful or if successful, the products will ultimately be approved by FDA.

** Granted orphan drug designation

7

grow. collaborate. innovate. thrive.

LONG-ACTING OPIOID FRANCHISE

Opana ER

Settlement with generic companies provides for 2013 entry on primary dosage forms.

30% TRx growth YOY in Q3 2010

Gaining share; Growing source of cash flow.

Completed Acquisition of Penwest

$0.05 accretive to adjusted diluted EPS in 2010

Advances our leadership and growth in pain management

NDA submission for new formulation of Oxymorphone

Long-acting Oxymorphone designed to be crush-resistant

PDUFA Date of January 7, 2011

think

OPANA ER

(oxymorphone HCI)

Extended-release tablets

8

grow. collaborate. innovate. thrive.

HealthTronics

HEALTHTRONICS OVERVIEW

Leading provider of urology services

Leader in lithotripsy, BPH laser and cryosurgery

Emerging urologic businesses in:

Anatomic pathology

Radiation therapy

Unique business relationship with 1/3 of urologists in U.S.

Total solution for the urology marketplace

Improve patient care

Enhance practice economics

9

grow. collaborate. innovate. thrive.

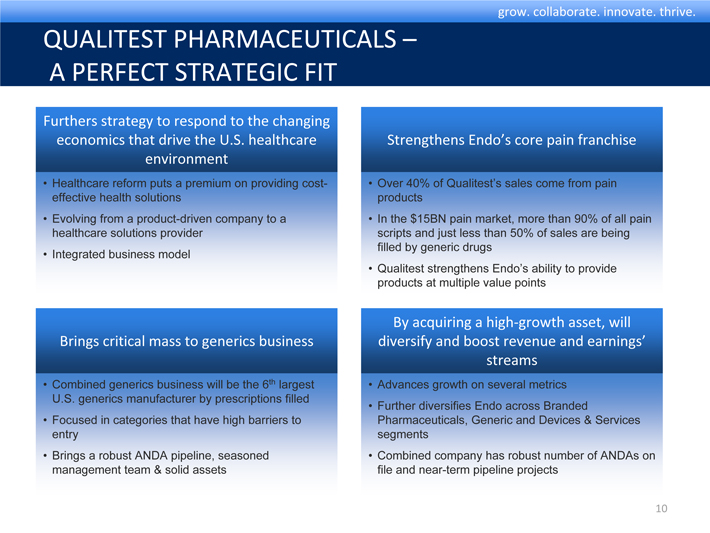

QUALITEST PHARMACEUTICALS – A PERFECT STRATEGIC FIT

Furthers strategy to respond to the changing economics that drive the U.S. healthcare environment

Healthcare reform puts a premium on providing cost-effective health solutions

Evolving from a product-driven company to a healthcare solutions provider

Integrated business model

Strengthens Endo’s core pain franchise

Over 40% of Qualitest’s sales come from pain products

In the $15BN pain market, more than 90% of all pain scripts and just less than 50% of sales are being filled by generic drugs

Qualitest strengthens Endo’s ability to provide products at multiple value points

Brings critical mass to generics business

Combined generics business will be the 6th largest U.S. generics manufacturer by prescriptions filled

Focused in categories that have high barriers to entry

Brings a robust ANDA pipeline, seasoned management team & solid assets

By acquiring a high-growth asset, will diversify and boost revenue and earnings’ streams

Advances growth on several metrics

Further diversifies Endo across Branded

Pharmaceuticals, Generic and Devices & Services segments

Combined company has robust number of ANDAs on file and near-term pipeline projects

10

grow. collaborate. innovate. thrive.

QUALITEST COMPANY PROFILE

Sixth Largest U.S. Generics Company

A cost competitive producer of products in categories with high barriers to entry (controlled substances, liquids)

175 product families covering multiple therapeutic areas

Strong History of Growth Supported by Robust Future Pipeline

2010E Sales of approximately $350MM, which has grown at a three-year CAGR of 21%

Poised for strong growth with 30 ANDAs under active review, a robust pipeline of ANDAs expected to be filed and new product launches

Seasoned Management Team and High Quality Assets

Team has significant experience running a growing generics business

Four manufacturing/distribution facilities – three in Huntsville, AL and one in Charlotte, NC

11

grow. collaborate. innovate. thrive.

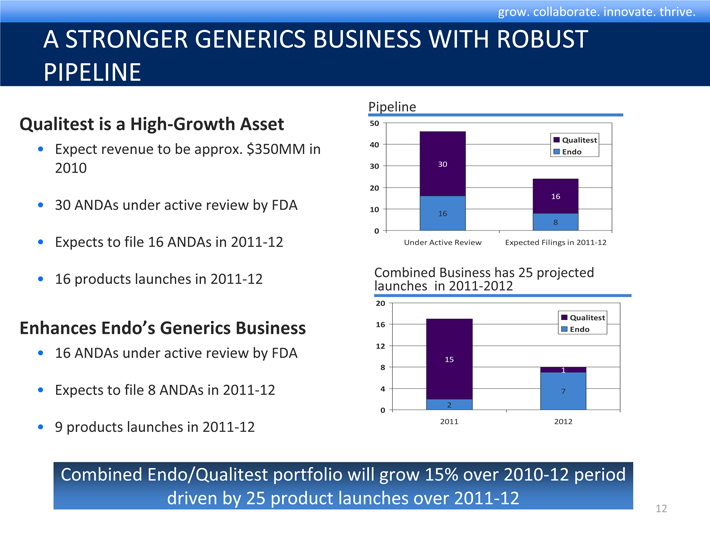

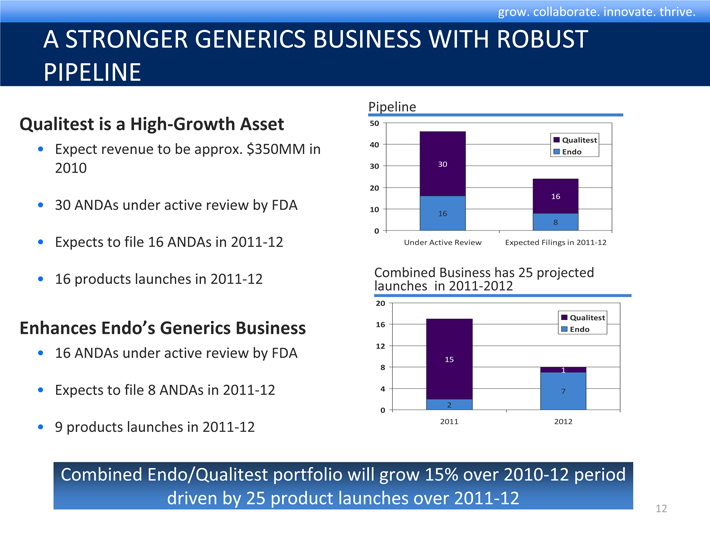

A STRONGER GENERICS BUSINESS WITH ROBUST PIPELINE

Qualitest is a High-Growth Asset

Expect revenue to be approx. $350MM in 2010

30 ANDAs under active review by FDA

Expects to file 16 ANDAs in 2011-12

16 products launches in 2011-12

Enhances Endo’s Generics Business

16 ANDAs under active review by FDA

Expects to file 8 ANDAs in 2011-12

9 products launches in 2011-12

Pipeline

50

Qualitest 40 Endo

30 30

20

16

10

16

8

0

Under Active Review Expected Filings in 2011-12

Combined Business has 25 projected launches in 2011-2012

20

Qualitest 16 Endo

12

15

8 1

4 7 2

0

2011 2012

Combined Endo/Qualitest portfolio will grow 15% over 2010-12 period driven by 25 product launches over 2011-12

12

grow. collaborate. innovate. thrive.

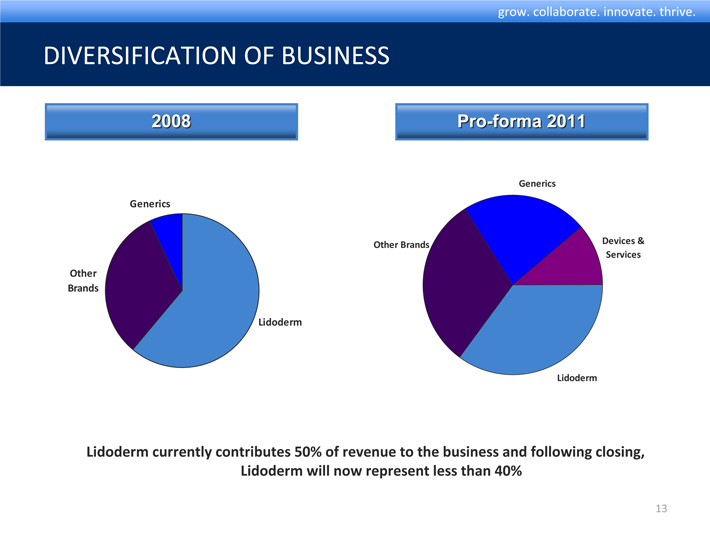

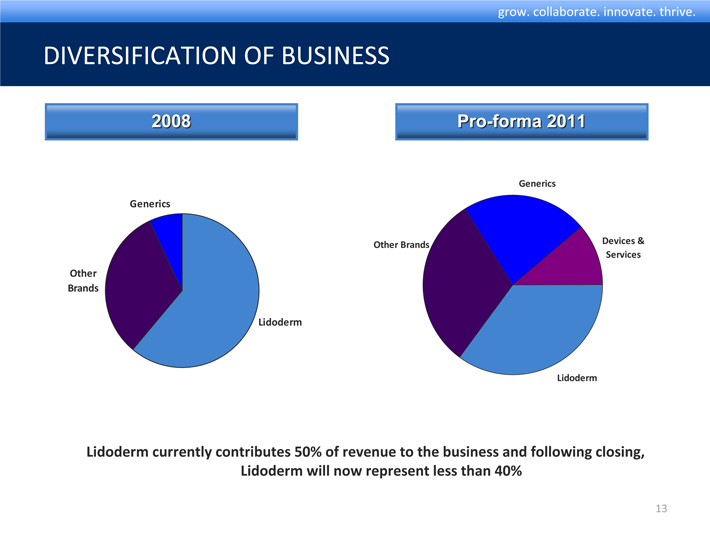

DIVERSIFICATION OF BUSINESS

2008

Generics

Other Brands

Lidoderm

Pro-forma 2011

Generics

Devices & Services Other Brands

Lidoderm

Lidoderm currently contributes 50% of revenue to the business and following closing, Lidoderm will now represent less than 40%

13

grow. collaborate. innovate. thrive.

GROWTH PROSPECTS

Qualitest Business Growth Prospects

Qualitest stand-alone sales expected to grow at a double-digit CAGR over 2010-2012

– 16 product launches expected in 2011-12

Qualitest stand-alone revenue is estimated to be roughly $400MM in 2011

Combined Company Growth Prospects

Pro forma generics sales CAGR of at least 15% over 2010-2012

– 25 product launches expected in 2011-12

Generics revenue is forecast to be more than $500MM for 2011

Consolidated pro forma gross margin of approximately 70% on an adjusted basis

Qualitest EPS accretion on an adjusted basis is approximately $0.40 for first full-year after close

14

grow. collaborate. innovate. thrive.

A PERFECT STRATEGIC FIT

Furthers our stated strategy to build a healthcare company better able to respond to the changing economics that drive the U.S. healthcare environment

Adds critical mass to our current generics business, alongside Branded Pharmaceuticals and Devices & Services

As a high-growth asset, will significantly diversify and accelerate the growth of Endo’s revenue and earnings’ streams

Enhances our core pain franchise

15

grow. collaborate. innovate. thrive.

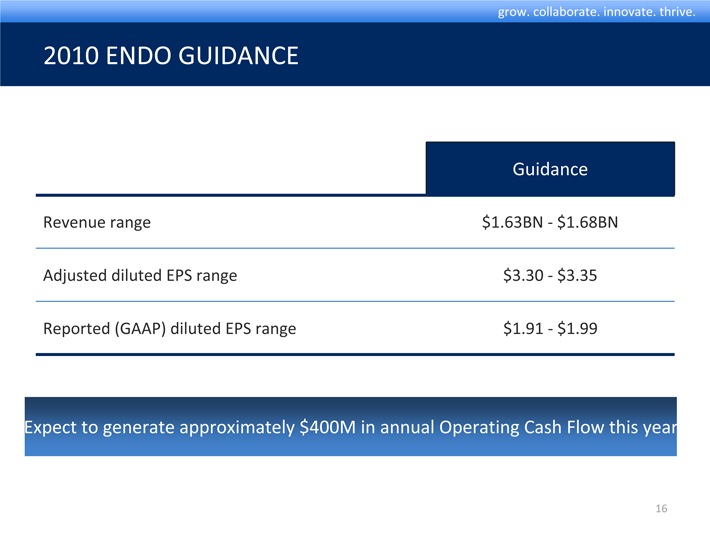

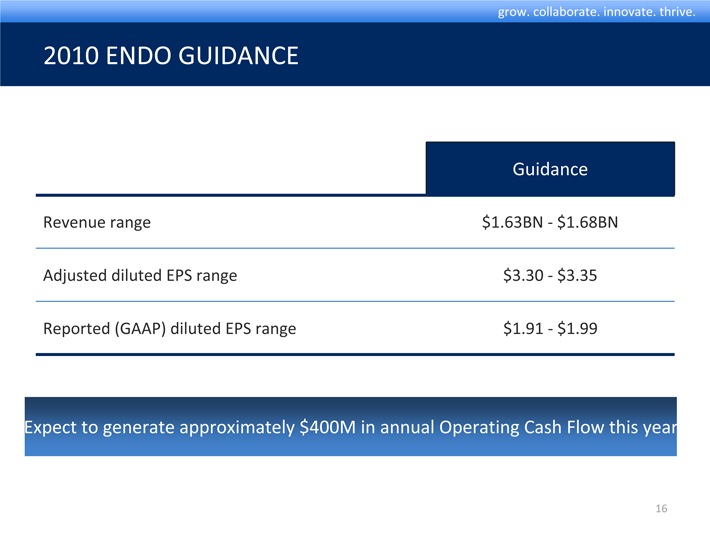

2010 ENDO GUIDANCE

Guidance

Revenue range $1.63BN - $1.68BN

Adjusted diluted EPS range $3.30 - $3.35

Reported (GAAP) diluted EPS range $1.91 - $1.99

Expect to generate approximately $400M in annual Operating Cash Flow this year

16

grow. collaborate. innovate. thrive.

2011 ENDO GUIDANCE

Guidance

Revenue range $2.2BN - $2.3BN

Adjusted diluted EPS range $4.15 - $4.25

Reported (GAAP) diluted EPS range $2.05 - $2.15

Assumes the close of the Qualitest acquisition by late Q4 2010 or in early 2011

17

ENDO

PHARMACEUTICALS

ENDO PHARMACEUTICALS

grow. collaborate. innovate. thrive.

grow. collaborate. innovate. thrive.

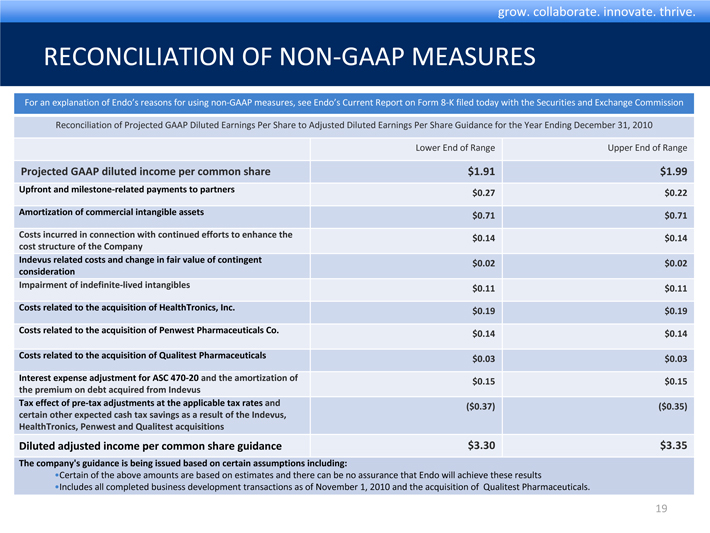

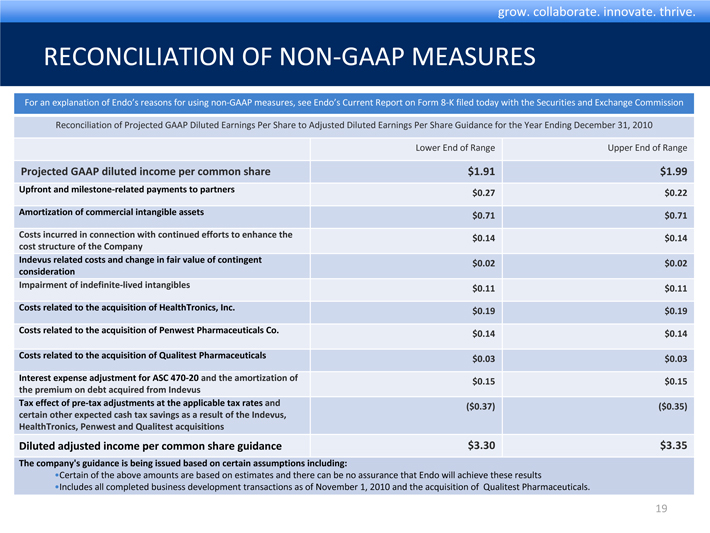

RECONCILIATION OF NON-GAAP MEASURES

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2010

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share $1.91 $1.99

Upfront and milestone-related payments to partners $0.27 $0.22

Amortization of commercial intangible assets $0.71 $0.71

Costs incurred in connection with continued efforts to enhance the $0.14 $0.14 cost structure of the Company

Indevus related costs and change in fair value of contingent $0.02 $0.02 consideration

Impairment of indefinite-lived intangibles $0.11 $0.11

Costs related to the acquisition of HealthTronics, Inc. $0.19 $0.19

Costs related to the acquisition of Penwest Pharmaceuticals Co. $0.14 $0.14

Costs related to the acquisition of Qualitest Pharmaceuticals $0.03 $0.03

Interest expense adjustment for ASC 470-20 and the amortization of $0.15 $0.15 the premium on debt acquired from Indevus

Tax effect of pre-tax adjustments at the applicable tax rates and ($0.37) ($0.35) certain other expected cash tax savings as a result of the Indevus, HealthTronics, Penwest and Qualitest acquisitions

Diluted adjusted income per common share guidance $3.30 $3.35

The company’s guidance is being issued based on certain assumptions including:

Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

Includes all completed business development transactions as of November 1, 2010 and the acquisition of Qualitest Pharmaceuticals.

19

grow. collaborate. innovate. thrive.

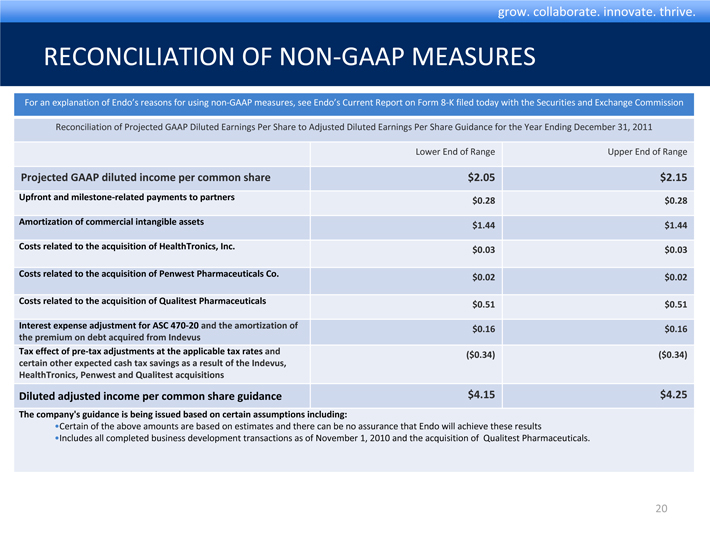

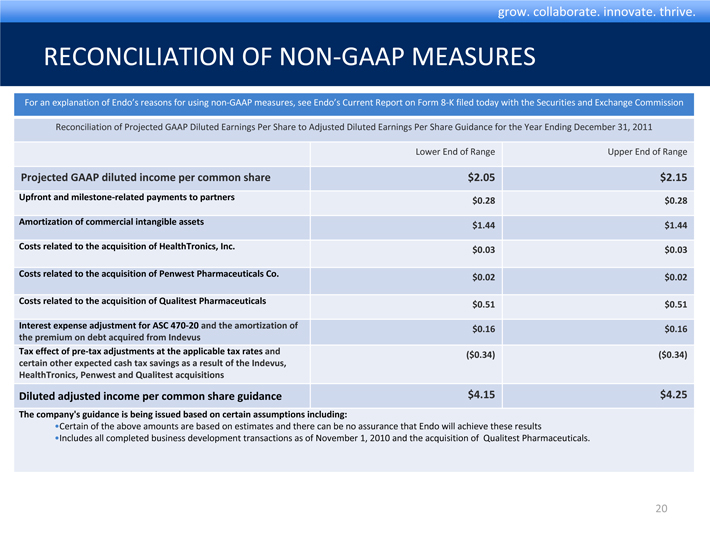

RECONCILIATION OF NON-GAAP MEASURES

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2011

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share $2.05 $2.15

Upfront and milestone-related payments to partners $0.28 $0.28

Amortization of commercial intangible assets $1.44 $1.44

Costs related to the acquisition of HealthTronics, Inc. $0.03 $0.03

Costs related to the acquisition of Penwest Pharmaceuticals Co. $0.02 $0.02

Costs related to the acquisition of Qualitest Pharmaceuticals $0.51 $0.51

Interest expense adjustment for ASC 470-20 and the amortization of $0.16 $0.16 the premium on debt acquired from Indevus

Tax effect of pre-tax adjustments at the applicable tax rates and ($0.34) ($0.34) certain other expected cash tax savings as a result of the Indevus, HealthTronics, Penwest and Qualitest acquisitions

Diluted adjusted income per common share guidance $4.15 $4.25

The company’s guidance is being issued based on certain assumptions including:

Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

Includes all completed business development transactions as of November 1, 2010 and the acquisition of Qualitest Pharmaceuticals.

20

ENDO

PHARMACEUTICALS

ENDO PHARMACEUTICALS

grow. collaborate. innovate. thrive.

Credit Suisse Healthcare Conference

November 10, 2010