Exhibit 99.1

2012 Investor Day

Endo Health Solutions

October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved

1

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Statements including words such as “believes,” “expects,”

“anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Investors should note that many factors, as more fully described under the caption “Risk Factors” in our Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange Commission and as otherwise enumerated herein or therein, could affect our future financial results and could cause our actual results to differ materially from those expressed in forward-looking statements contained in our Annual Report on Form 10-K. The forward-looking statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

© 2012 Endo Pharmaceuticals Inc. All rights reserved

2

Non-GAAP Financial Measures; Trademarks

This presentation may refer to non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States and that may be different from non-GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8-K filed with the SEC for Endo’s reasons for including those non-GAAP financial measures in this presentation. Reconciliations of certain non-GAAP financial measures to the most directly comparable GAAP financial measures are provided at the end of this presentation.

All product and service names appearing in a typeface different from that of the surrounding text or with a trademark symbol, including the Endo and product logos, are trademarks and/or service marks owned by or licensed to Endo, its subsidiaries or its affiliates other than Voltaren®, which is a registered trademark of Novartis Corporation, BEMA®, which is a registered trademark of BioDelivery Sciences International, Inc., Lidoderm®, which is a registered trademark of Hind Health Care, Inc., Frova®, which is a registered trademark of Vernalis Development Limited and Urocidin®, which is a trademark of Bioniche Life Sciences Inc.

© 2012 Endo Pharmaceuticals Inc. All rights reserved

3

2012 Investor Day

Endo Health Solutions Vision & Strategy

David Holveck

President and Chief Executive Officer

October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved

4

2012 Investor Day Agenda

Welcome

• Blaine Davis, SVP Corporate Affairs Endo Strategy and Vision

• Dave Holveck, President & CEO

Qualitest

• Julie McHugh, Chief Operating Officer AMS

• Camille Farhat, President, AMS

HealthTronics

• Kelly Huang, President, HealthTronics Endo Pharmaceuticals

• Julie McHugh, Chief Operating Officer R&D

• Ivan Gergel, EVP, Research & Development Finance

• Alan Levin, EVP & Chief Financial Officer Closing Comments

• Dave Holveck, President & CEO

Q&A

• All Speakers

© 2012 Endo Pharmaceuticals Inc. All rights reserved

5

Endo Health Solutions—Transformation

2008 – 2011 Diversifying our Business Created Optionality

2012 – 2013 Transformation to Offset Pharmaceutical Loss

of Exclusivity

2014 – Beyond Sustaining Growth, Durability & Long Term

Expansion

© 2012 Endo Pharmaceuticals Inc. All rights reserved

6

Endo Health Solutions Today Has

Track record of revenue growth and profitability

Durable cash flow

Organic and long-term growth across business segments

Disciplined capital allocation

International capabilities

Diversified pipeline

© 2012 Endo Pharmaceuticals Inc. All rights reserved

7

Diversifying Our Business

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

8

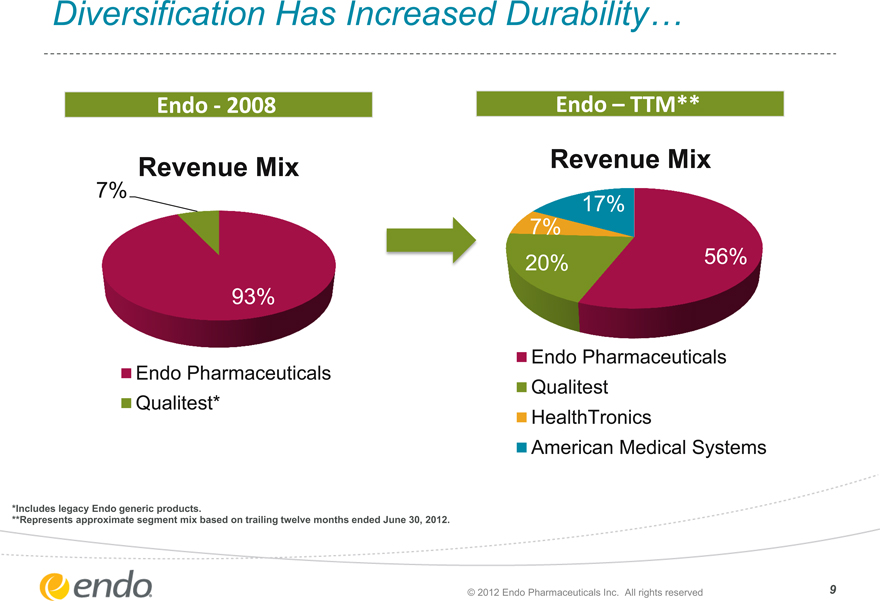

Diversification Has Increased Durability…

Endo - 2008

Revenue Mix

7%

93%

Endo Pharmaceuticals Qualitest*

Endo – TTM**

Revenue Mix

17%

7% 20%

Endo Pharmaceuticals Qualitest HealthTronics American Medical Systems

*Includes legacy Endo generic products.

**Represents approximate segment mix based on trailing twelve months ended June 30, 2012.

© 2012 Endo Pharmaceuticals Inc. All rights reserved

9

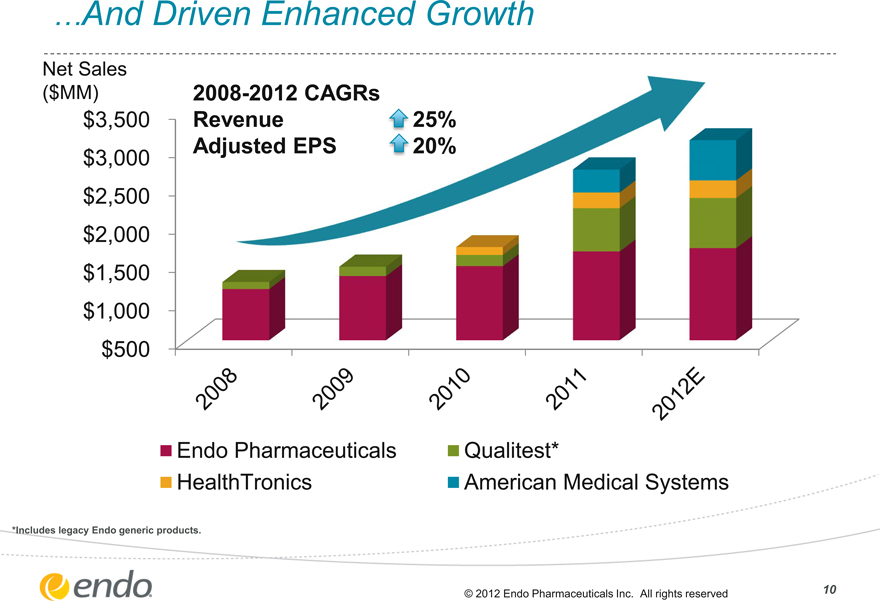

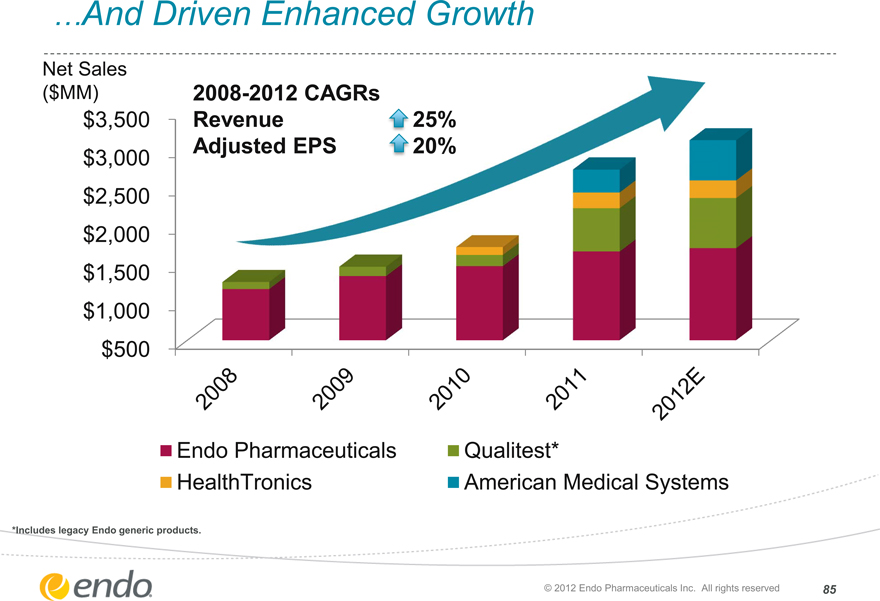

…And Driven Enhanced Growth

Net Sales

($MM)

$3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500

2008-2012 CAGRs

Revenue 25%

Adjusted EPS 20%

2008 2009 2010 2011 2012E

Endo Pharmaceuticals HealthTronics

Qualitest*

American Medical Systems

*Includes legacy Endo generic products.

© 2012 Endo Pharmaceuticals Inc. All rights reserved

10

Transforming Our Enterprise

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

11

Vision & Mission

VISION

To enable better care by redefining healthcare value

MISSION

To meet the needs of today’s healthcare customers by providing high quality and effective solutions that improve treatment outcomes, access to care, and economic value

© 2012 Endo Pharmaceuticals Inc. All rights reserved

12

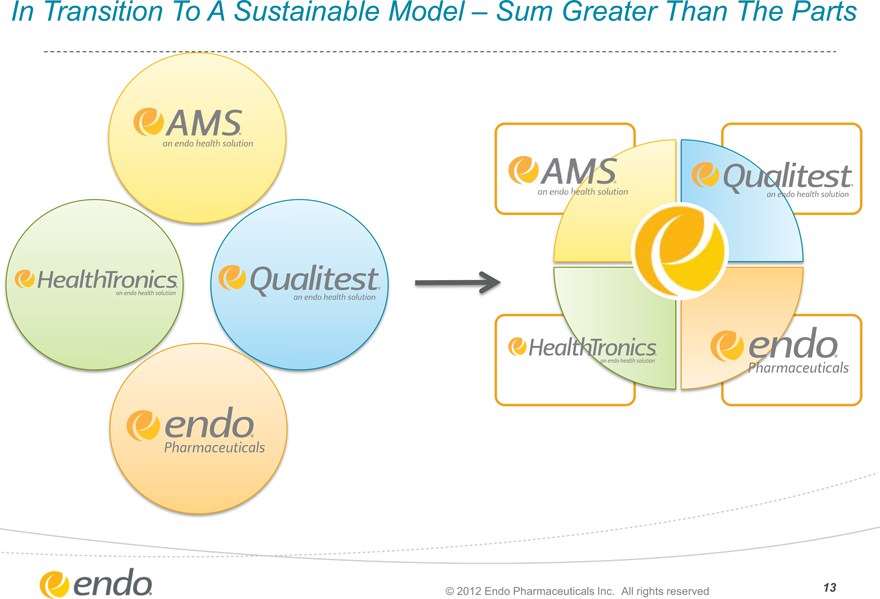

In Transition To A Sustainable Model – Sum Greater Than The Parts

AMS an endo health solution

HealthTronics an endo health solution

Qualitest an endo health solution

endo Pharmaceuticals

AMS an endo health solution

Qualitest an endo health solution

HealthTronics an endo health solution

endo Pharmaceuticals

© 2012 Endo Pharmaceuticals Inc. All rights reserved

13

Focused Investment In Growth Markets

Pain – Leader in Pain Management

o ~$1.8B in sales across business in pain management in 2012 o 9 out of 10 pain medications currently filled by generic products o 7 out of 10 pain medications can be filled by our portfolio o U.S. Chronic Pain Market was valued to be $14B in 2010 o Pipeline of products to solidify leadership position

Urology – Market Leader in Devices with Leading Distribution Channel

o Aging demographics support growth o US urological market to reach $6.3 billion by 2017; 4% CAGR o Minimally invasive procedures expand markets o Unique market position and channel enhance product uptake o International opportunities for growth

© 2012 Endo Pharmaceuticals Inc. All rights reserved

14

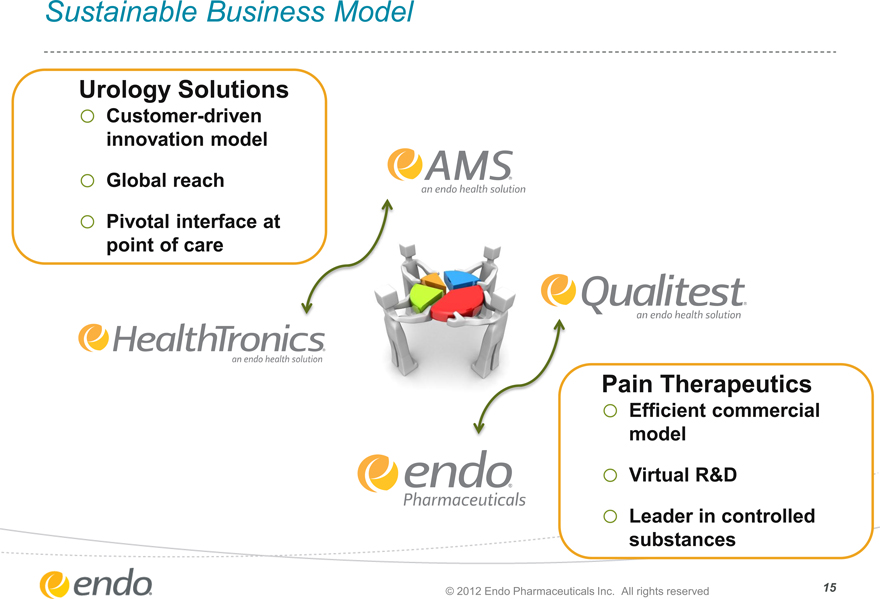

Sustainable Business Model

Urology Solutions

o Customer-driven

innovation model

o Global reach

o Pivotal interface at

point of care

AMS an endo health solution

Qualitest an endo health solution

HealthTronics an endo health solution

endo Pharmaceuticals

Pain Therapeutics

o Efficient commercial

model

o Virtual R&D

o Leader in controlled

substances

© 2012 Endo Pharmaceuticals Inc. All rights reserved

15

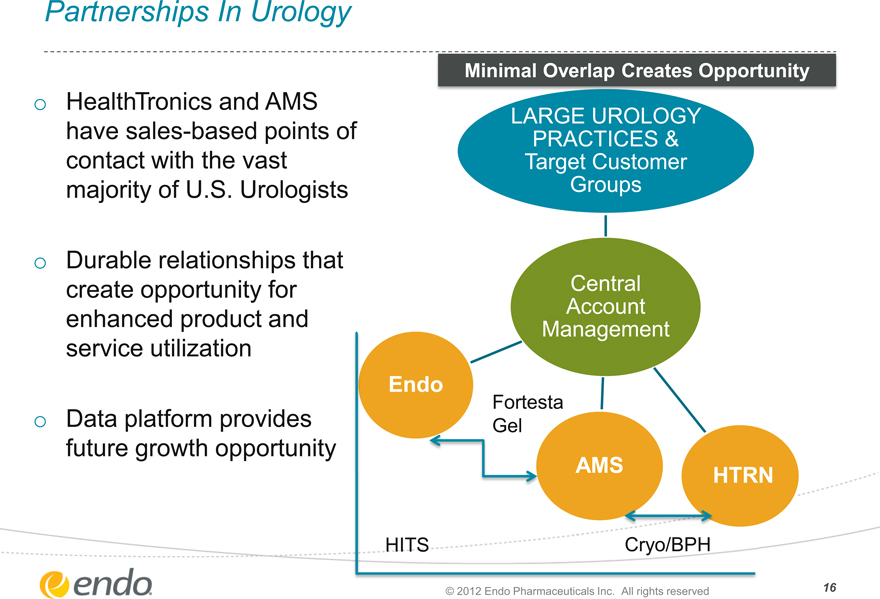

Partnerships In Urology

HealthTronics and AMS have sales-based points of contact with the vast majority of U.S. Urologists

Durable relationships that create opportunity for enhanced product and service utilization

Data platform provides future growth opportunity

Minimal Overlap Creates Opportunity

LARGE UROLOGY PRACTICES & Target Customer

Groups

Central Account Management

Endo

Fortesta Gel

AMS

HTRN

HITS

Cryo/BPH

© 2012 Endo Pharmaceuticals Inc. All rights reserved

16

Sustaining Growth & Profitability

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

17

Qualitest Has Outperformed Expectations

Durable business with sustained double digit revenue growth and improving margins through 2015

Brought us enhanced supply chain flexibility o Manufacture of Percocet® and Endocet® transferred to Huntsville facility in early 2012 o Preserving nearly $200 million of annual sales that previously would have been at-risk to the Novartis facility shutdown

Accelerated synergy capture of $50 million in 2012

o Manufacturing cost reductions versus third party o API savings created by qualifying a second source of supply for more products

© 2012 Endo Pharmaceuticals Inc. All rights reserved

18

Investment In Innovation – R&D

Research and Development diverse growth opportunities:

o Branded Pharmaceuticals - Pain and Urology

o Generics - higher value lines of business

o Devices that enhance current technologies

© 2012 Endo Pharmaceuticals Inc. All rights reserved

19

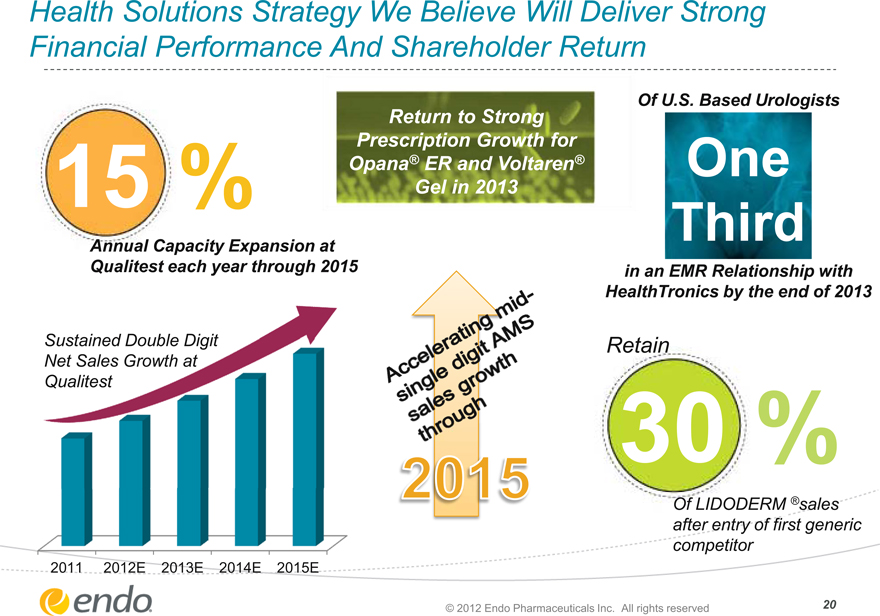

Health Solutions Strategy We Believe Will Deliver Strong Financial Performance And Shareholder Return

15%

Annual Capacity Expansion at

Qualitest each year through 2015

Sustained Double Digit

Net Sales Growth at Qualitest

2011 2012E 2013E 2014E 2015E

Return to Strong Prescription Growth for Opana® ER and Voltaren® Gel in 2013

Accelerating mid-single digit AMS

Sales growth through

2015

Of U.S. Based Urologists

One Third

in an EMR Relationship with HealthTronics by the end of 2013

Retain

30%

Of LIDODERM ®sales after entry of first generic competitor

© 2012 Endo Pharmaceuticals Inc. All rights reserved

20

Endo Health Solutions Will Continue To Have

Track record of revenue growth and profitability

Durable cash flow

Organic and long-term growth across business segments Disciplined capital allocation International capabilities Diversified pipeline

© 2012 Endo Pharmaceuticals Inc. All rights reserved

21

2012 Investor Day

Qualitest

Julie McHugh

Chief Operating Officer

October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved

22

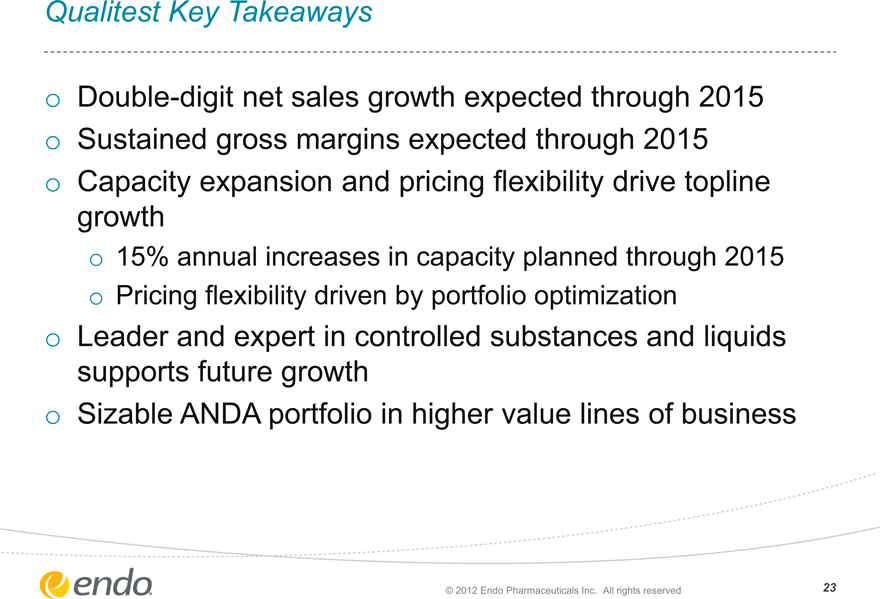

Qualitest Key Takeaways

Double-digit net sales growth expected through 2015 Sustained gross margins expected through 2015 Capacity expansion and pricing flexibility drive topline growth

15% annual increases in capacity planned through 2015 Pricing flexibility driven by portfolio optimization

Leader and expert in controlled substances and liquids supports future growth Sizable ANDA portfolio in higher value lines of business

© 2012 Endo Pharmaceuticals Inc. All rights reserved

23

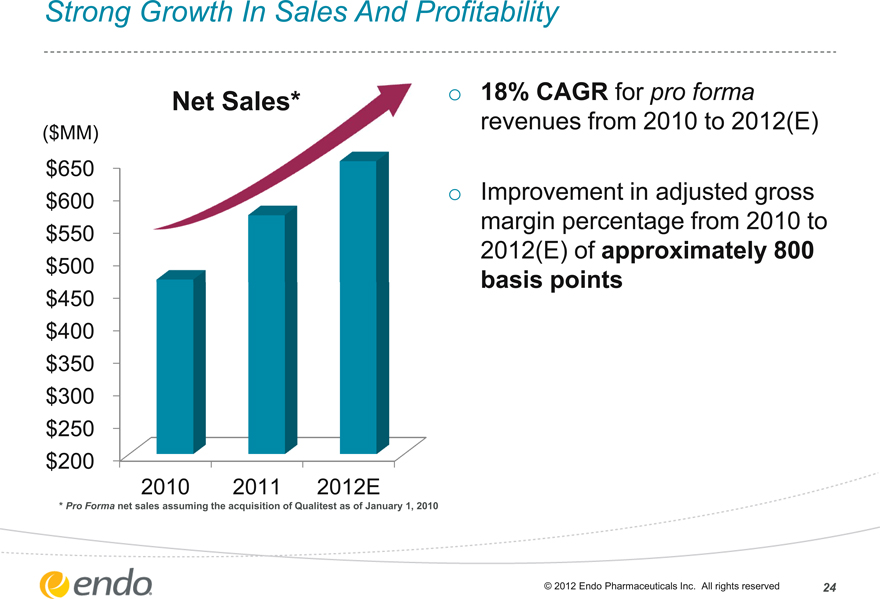

Strong Growth In Sales And Profitability

Net Sales*

($MM)

$650 $600 $550 $500 $450 $400 $350 $300 $250 $200

2010 2011 2012E

* Pro Forma net sales assuming the acquisition of Qualitest as of January 1, 2010

18% CAGR for pro forma revenues from 2010 to 2012(E)

Improvement in adjusted gross margin percentage from 2010 to 2012(E) of approximately 800 basis points

© 2012 Endo Pharmaceuticals Inc. All rights reserved

24

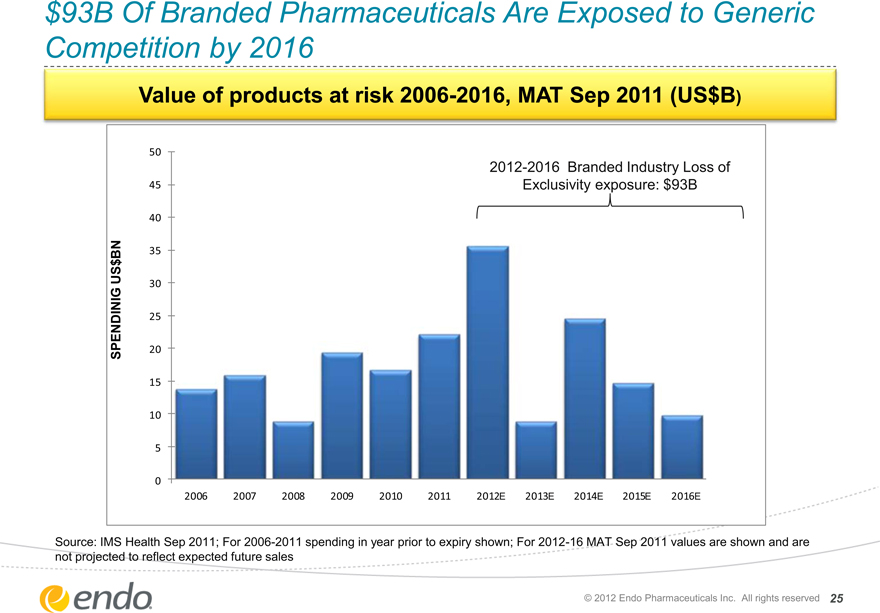

$93B Of Branded Pharmaceuticals Are Exposed to Generic Competition by 2016

Value of products at risk 2006-2016, MAT Sep 2011 (US$B)

2012-2016 Branded Industry Loss of

Exclusivity exposure: $93B

50

45

40

BN 35

$

US 30

SPENDING US$BN

25

20

15

10

5

0

2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Source: IMS Health Sep 2011; For 2006-2011 spending in year prior to expiry shown; For 2012-16 MAT Sep 2011 values are shown and are not projected to reflect expected future sales

© 2012 Endo Pharmaceuticals Inc. All rights reserved

25

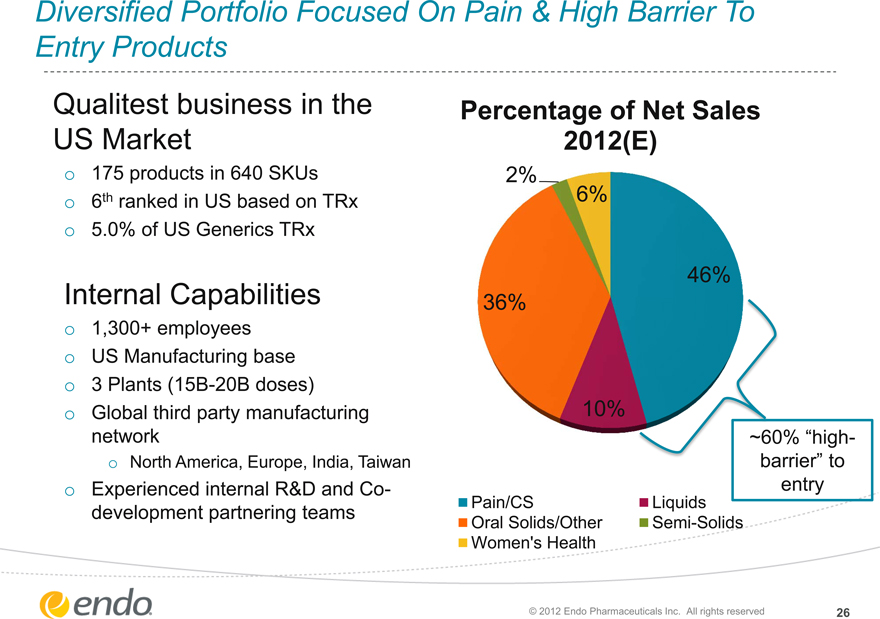

Diversified Portfolio Focused On Pain & High Barrier To Entry Products

Qualitest business in the US Market

175 products in 640 SKUs 6th ranked in US based on TRx 5.0% of US Generics TRx

Internal Capabilities

1,300+ employees US Manufacturing base

3 Plants (15B-20B doses) Global third party manufacturing network

North America, Europe, India, Taiwan

Experienced internal R&D and Co-development partnering teams

Percentage of Net Sales 2012(E)

2% 6%

46% 36%

10%

~60% “high-barrier” to entry

Pain/CS Liquids Oral Solids/Other Semi-Solids Women’s Health

© 2012 Endo Pharmaceuticals Inc. All rights reserved

26

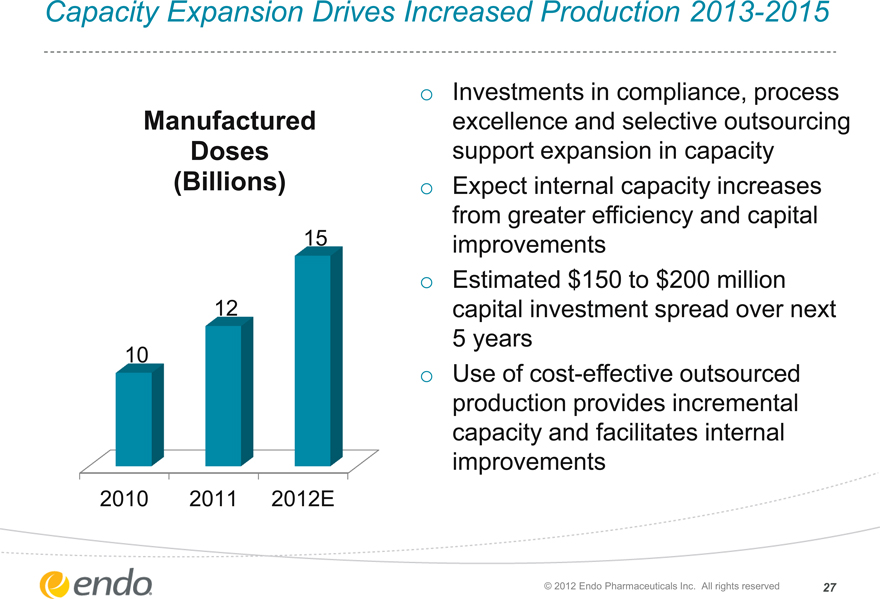

Capacity Expansion Drives Increased Production 2013-2015

Manufactured Doses (Billions)

15

12

10

2010 2011 2012E

Investments in compliance, process excellence and selective outsourcing support expansion in capacity Expect internal capacity increases from greater efficiency and capital improvements Estimated $150 to $200 million capital investment spread over next 5 years Use of cost-effective outsourced production provides incremental capacity and facilitates internal improvements

© 2012 Endo Pharmaceuticals Inc. All rights reserved

27

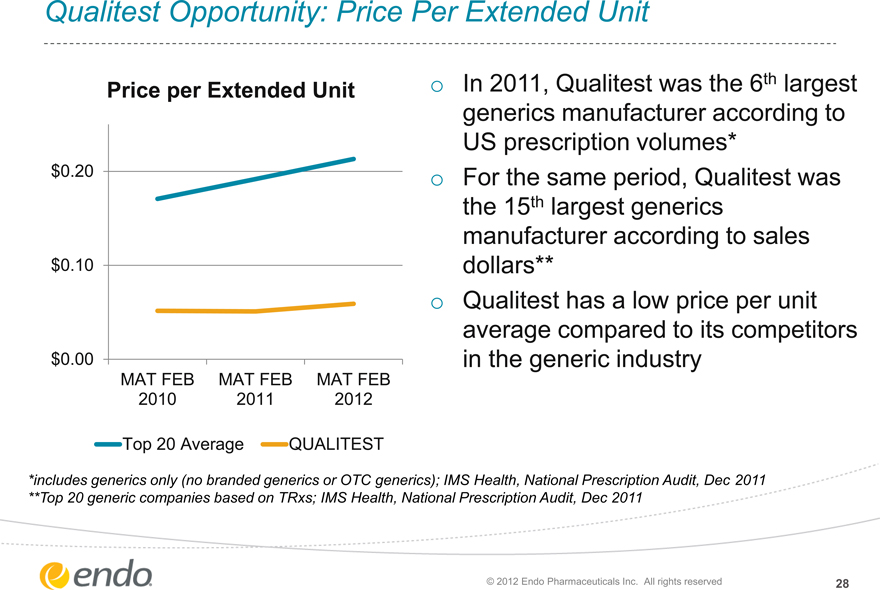

Qualitest Opportunity: Price Per Extended Unit

Price per Extended Unit

$0.20

$0.10

$0.00

MAT FEB MAT FEB MAT FEB 2010 2011 2012

Top 20 Average QUALITEST

In 2011, Qualitest was the 6th largest generics manufacturer according to US prescription volumes* For the same period, Qualitest was the 15th largest generics manufacturer according to sales dollars** Qualitest has a low price per unit average compared to its competitors in the generic industry

*includes generics only (no branded generics or OTC generics); IMS Health, National Prescription Audit, Dec 2011 **Top 20 generic companies based on TRxs; IMS Health, National Prescription Audit, Dec 2011

© 2012 Endo Pharmaceuticals Inc. All rights reserved

28

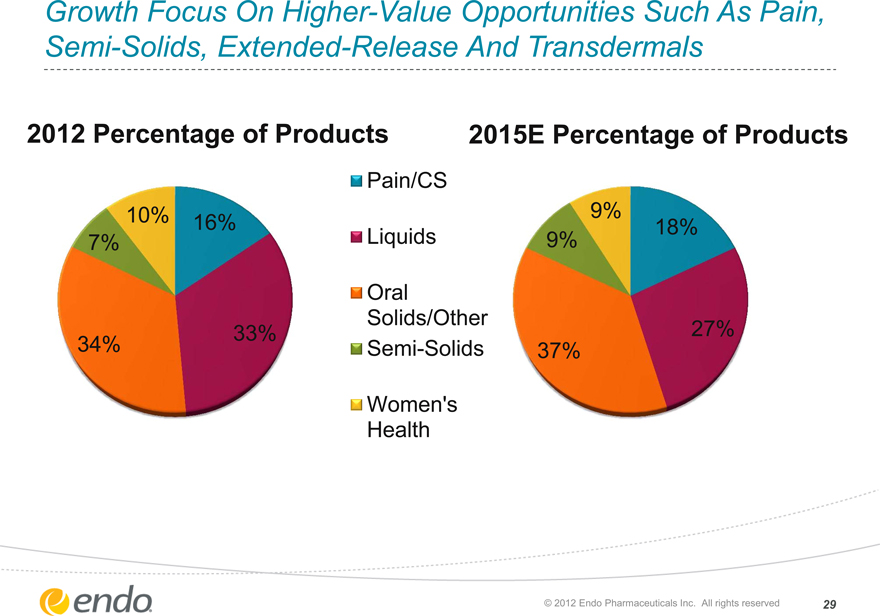

Growth Focus On Higher-Value Opportunities Such As Pain, Semi-Solids, Extended-Release And Transdermals

2012 Percentage of Products 2015E Percentage of Products

10% 16% 7%

33% 34%

9%

18% 9%

27% 37%

Pain/CS

Liquids

Oral Solids/Other

Semi-Solids

Women’s Health

© 2012 Endo Pharmaceuticals Inc. All rights reserved

29

R&D—Balance Of Organic Development And Strategic Acquisition

Pipeline investments differentiated based on portfolio needs

Capitalizing on current infrastructure scale and expertise in core technologies

Accelerating pipeline and commercial products through external partnerships, licensing and asset acquisitions

© 2012 Endo Pharmaceuticals Inc. All rights reserved

30

Qualitest Pipeline Supports Growth Forecast

Approximately 40 ANDAs under review at FDA

ANDA portfolio addresses products with approximately $12 billion in brand and generic sales for the 12 months ending June 30, 2012

Over 50% of the ANDAs support therapeutic categories where Qualitest has competitive advantage:

Pain and Controlled Substances Liquids

Women’s Health

Expect consistent pace of ANDA filings over 2013-2015

Pursuing partnerships in select other lines of business

© 2012 Endo Pharmaceuticals Inc. All rights reserved

31

Qualitest Key Takeaways

Double-digit net sales growth expected through 2015 Sustained or improving margin expected through 2015 Capacity expansion and pricing flexibility drive topline growth

15% annual increases in capacity planned through 2015 Pricing flexibility driven by portfolio optimization

Leader and expert in controlled substances and liquids supports future growth Sizable ANDA portfolio in higher value lines of business

© 2012 Endo Pharmaceuticals Inc. All rights reserved

32

2012 Investor Day

AMS

Camille Farhat President, AMS October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved

33

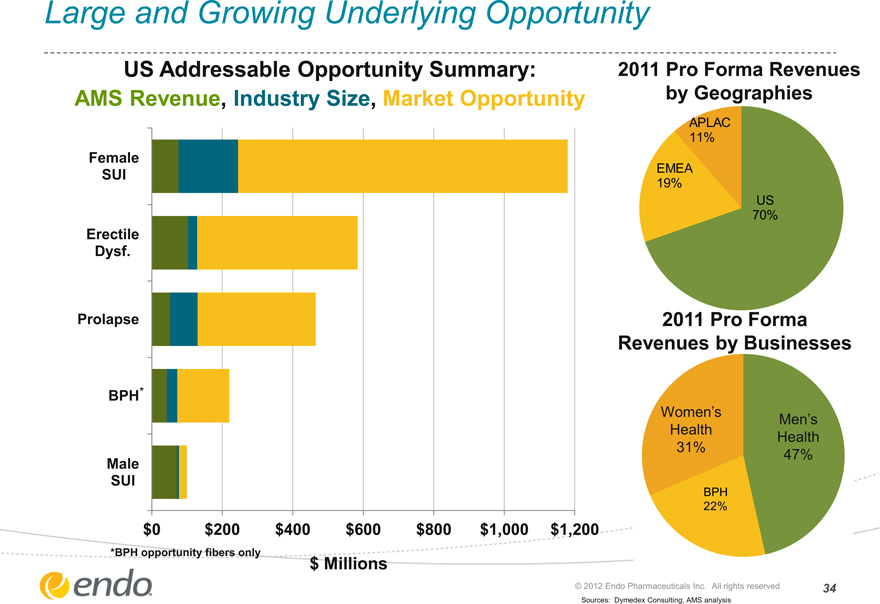

Large and Growing Underlying Opportunity

US Addressable Opportunity Summary: AMS Revenue, Industry Size, Market Opportunity

Female

SUI

Erectile

Dysf.

Prolapse

BPH*

Male

SUI

$0 $200 $400 $600 $800 $1,000 $1,200

*BPH opportunity fibers only

$ Millions

2011 Pro Forma Revenues by Geographies

APLAC 11%

EMEA 19%

US 70%

2011 Pro Forma Revenues by Businesses

Women’s Men’s

Health Health

31% 47%

BPH

22%

© 2012 Endo Pharmaceuticals Inc. All rights reserved

Sources: Dymedex Consulting, AMS analysis

34

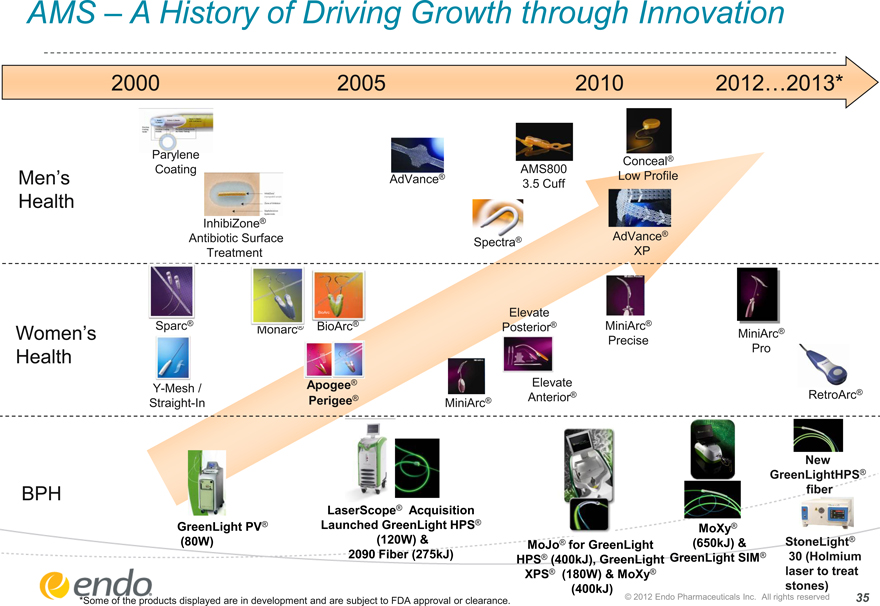

AMS – A History of Driving Growth through Innovation 2000 2005 2010 2012…2013* Men’s Health Women’s Health BPH GreenLight PV® (80W) LaserScope® Acquisition Launched GreenLight HPS® (120W) & 2090 Fiber (275kJ) MoXy® (650kJ) & GreenLight SIM®

MoJo® for GreenLight HPS® (400kJ), GreenLight XPS® (180W) & MoXy®

(400kJ) Sparc® Y-Mesh / Straight-In Elevate Posterior® Monarc® BioArc® MiniArc® Elevate Anterior®

Apogee® Perigee® BioArcBioArcMiniArc® Precise MiniArc® Pro RetroArc® AMS800 3.5 Cuff Conceal® Low Profile AdVance®

AdVance®

XP InhibiZone® Antibiotic Surface Treatment Parylene Coating StoneLight® 30 (Holmium laser to treat stones) New GreenLightHPS® fiber Spectra® *Some of the products displayed are in development and are subject to FDA approval or clearance. © 2012 Endo Pharmaceuticals Inc. All rights reserved

35

AMS Uniquely Positioned to Capitalize on Relationships and Reputation

© 2012 Endo Pharmaceuticals Inc. All rights reserved

36

AMS Growth Projections 2012—2015

Key Business Drivers

Men’s Health Steady profitable growth

Women’s Health Data, therapy awareness and education to return to growth, with support from physician training

BPH Increase utilization through clinical evidence, training, and access

International Therapy Awareness

2012 2015E

Mid-to-High Single Digit Growth

$515M-$535M

Men’s Health Women’s Health BPH

AMS = solid, balanced growth from all businesses

© 2012 Endo Pharmaceuticals Inc. All rights reserved

37

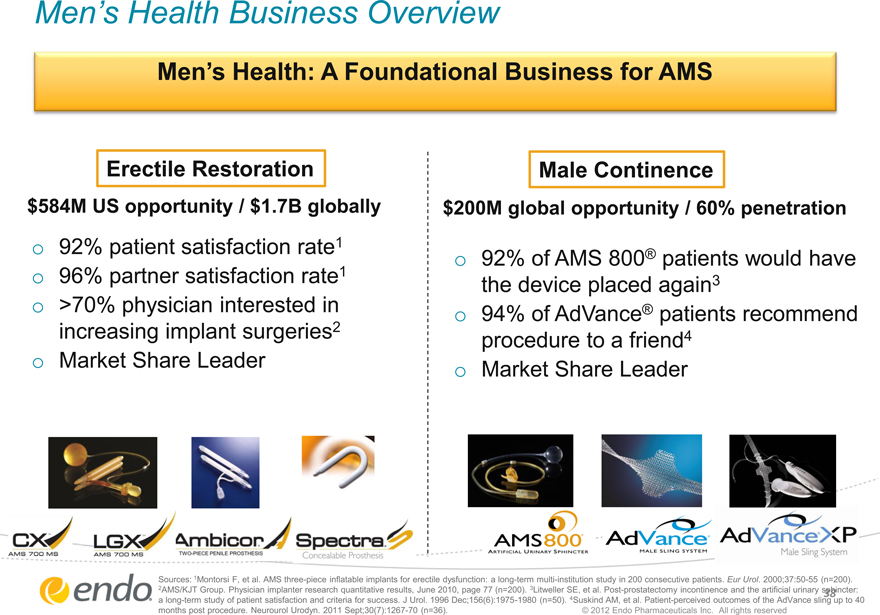

Men’s Health Business Overview

\Men’s Health: A Foundational Business for AMS

Erectile Restoration

$584M US opportunity / $1.7B globally

92% patient satisfaction rate1 96% partner satisfaction rate1 >70% physician interested in increasing implant surgeries2 Market Share Leader

Male Continence

$200M global opportunity / 60% penetration

92% of AMS 800® patients would have the device placed again3 94% of AdVance® patients recommend procedure to a friend4 Market Share Leader

Sources: 1Montorsi F, et al. AMS three-piece inflatable implants for erectile dysfunction: a long-term multi-institution study in 200 consecutive patients. Eur Urol. 2000;37:50-55 (n=200). 2AMS/KJT Group. Physician implanter research quantitative results, June 2010, page 77 (n=200). 3Litweller SE, et al. Post-prostatectomy incontinence and the artificial urinary sphincter: a long-term study of patient satisfaction and criteria for success. J Urol. 1996 Dec;156(6):1975-1980 (n=50). 4Suskind AM, et al. Patient-perceived outcomes of the AdVance sling up to months post procedure. Neurourol Urodyn. 2011 Sept;30(7):1267-70 (n=36).

© 2012 Endo Pharmaceuticals Inc. All rights reserved

38

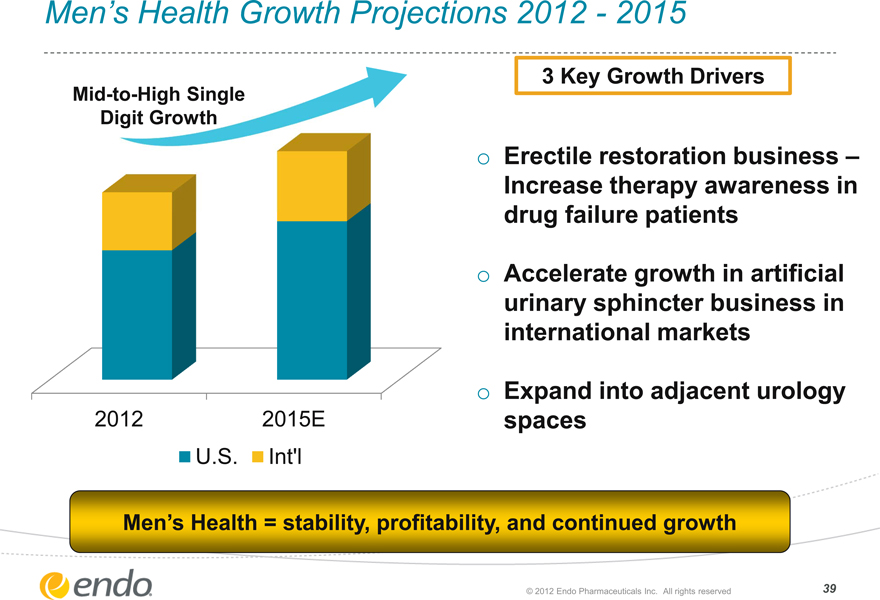

Men’s Health Growth Projections 2012—2015

Mid-to-High Single Digit Growth

2012 2015E

U.S. Int’l

3 Key Growth Drivers

Erectile restoration business – Increase therapy awareness in drug failure patients

Accelerate growth in artificial urinary sphincter business in international markets

Expand into adjacent urology spaces

Men’s Health = stability, profitability, and continued growth

© 2012 Endo Pharmaceuticals Inc. All rights reserved

39

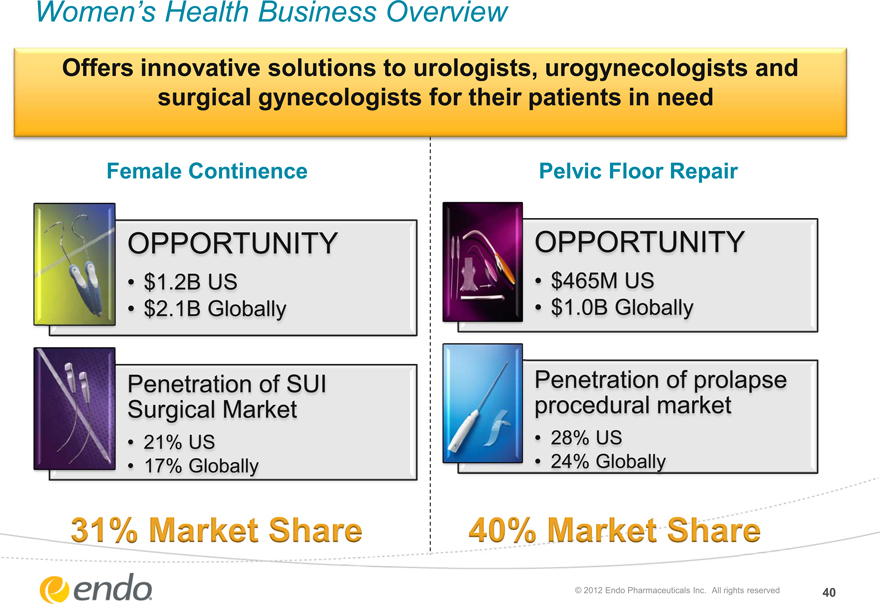

Women’s Health Business Overview

Offers innovative solutions to urologists, urogynecologists and surgical gynecologists for their patients in need

Female Continence

Pelvic Floor Repair

OPPORTUNITY

$1.2B US

$2.1B Globally

$465M US

$1.0B Globally

Penetration of SUI Surgical Market

21% US 17% Globally

Penetration of prolapse procedural market

28% US 24% Globally

31% Market Share 40% Market Share

© 2012 Endo Pharmaceuticals Inc. All rights reserved

40

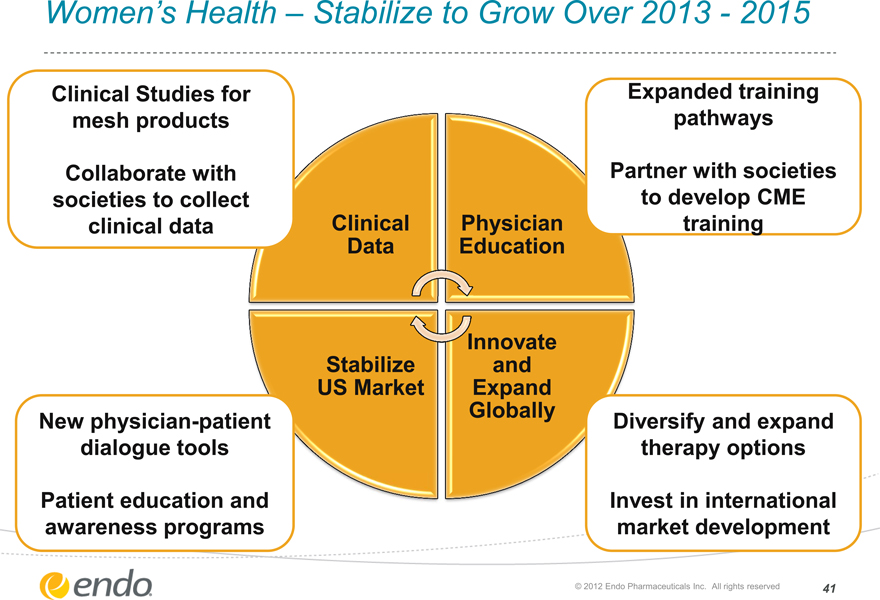

Women’s Health – Stabilize to Grow Over 2013—2015

Clinical Studies for mesh products

Collaborate with societies to collect clinical data

Clinical

Data

Physician Education

Expanded training pathways

Partner with societies to develop CME training

New physician-patient dialogue tools

Patient education and awareness programs Stabilize

US Market

Innovate and Expand Globally

Diversify and expand therapy options

Invest in international market development

© 2012 Endo Pharmaceuticals Inc. All rights reserved

41

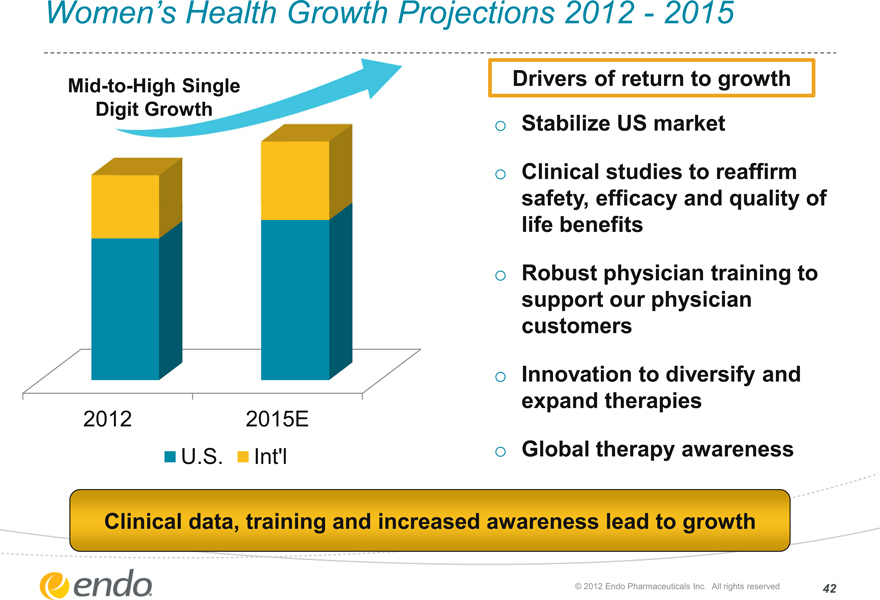

Women’s Health Growth Projections 2012—2015

Mid-to-High Single Digit Growth

2012

2015E

U.S.

Int’l

Drivers of return to growth

Stabilize US market

Clinical studies to reaffirm safety, efficacy and quality of life benefits

Robust physician training to support our physician customers

Innovation to diversify and expand therapies

Global therapy awareness

Clinical data, training and increased awareness lead to growth

© 2012 Endo Pharmaceuticals Inc. All rights reserved

42

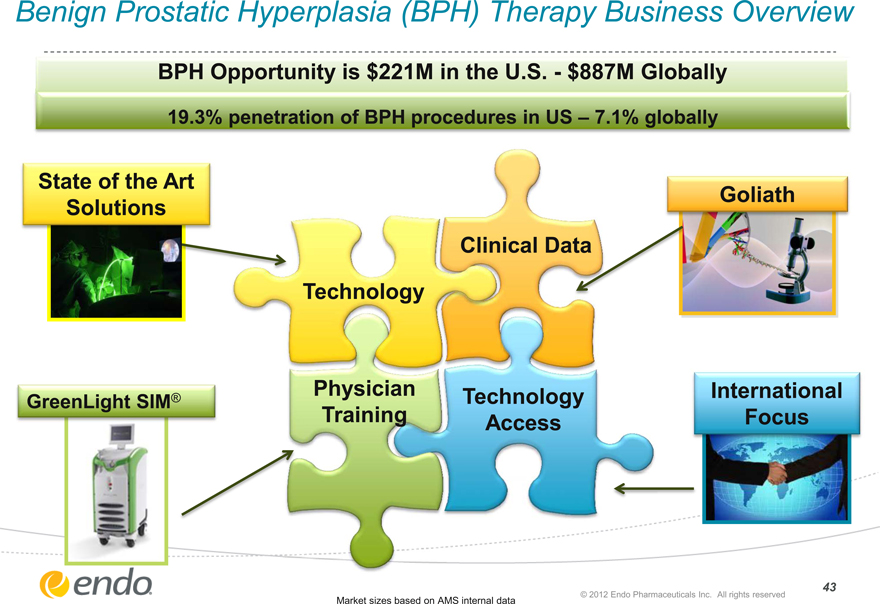

Benign Prostatic Hyperplasia (BPH) Therapy Business Overview

BPH Opportunity is $221M in the U.S.—$887M Globally

19.3% penetration of BPH procedures in US – 7.1% globally

State of the Art Solutions

GreenLight SIM®

Technology

Physician Training

Clinical Data

Technology Access

Goliath

International Focus

Market sizes based on AMS internal data

© 2012 Endo Pharmaceuticals Inc. All rights reserved

43

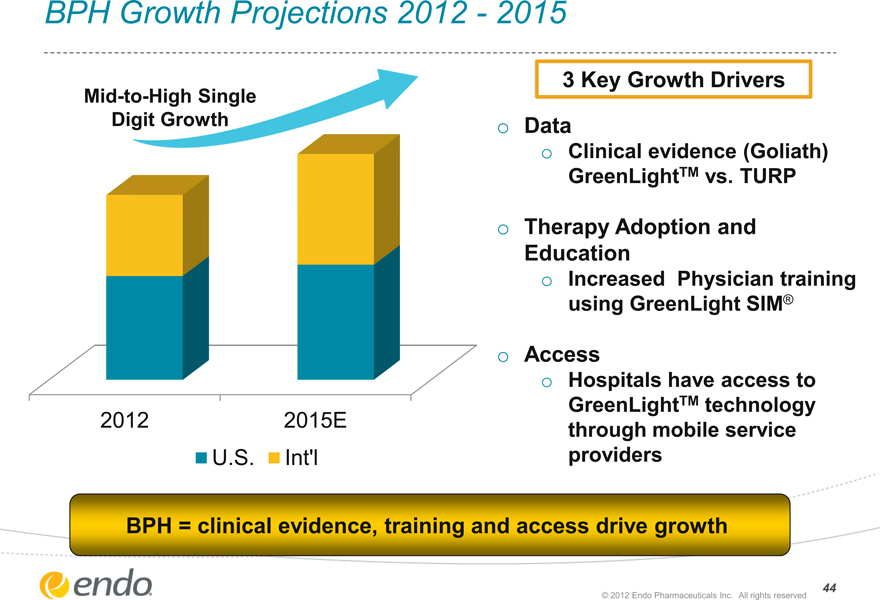

BPH Growth Projections 2012—2015

Mid-to-High Single Digit Growth

2012

2015E

U.S.

Int’l

3 Key Growth Drivers

Data

Clinical evidence (Goliath) GreenLightTM vs. TURP

Therapy Adoption and Education

Increased Physician training using GreenLight SIM®

Access

Hospitals have access to GreenLightTM technology through mobile service providers

BPH = clinical evidence, training and access drive growth

© 2012 Endo Pharmaceuticals Inc. All rights reserved

44

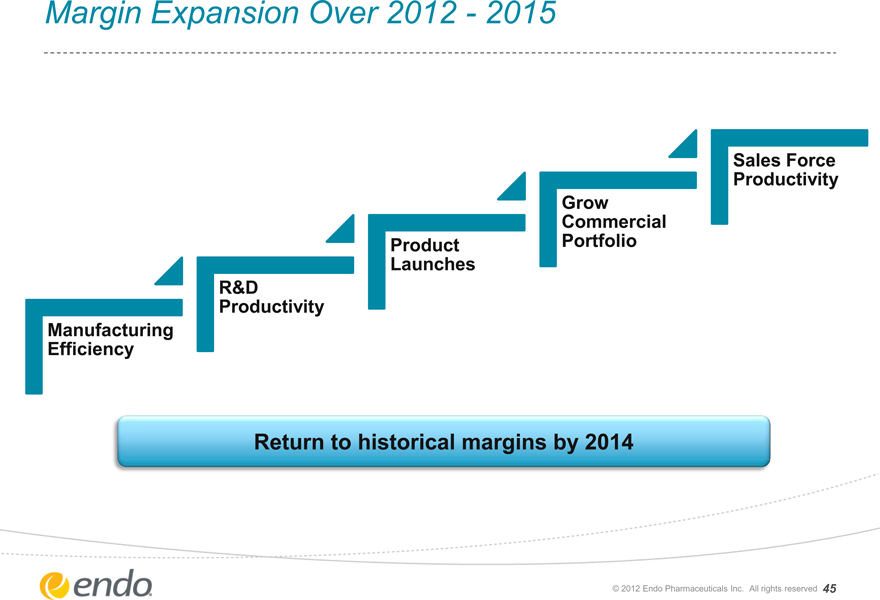

Margin Expansion Over 2012—2015

Manufacturing Efficiency

R&D Productivity

Product Launches

Grow Commercial Portfolio

Sales Force Productivity

Return to historical margins by 2014

© 2012 Endo Pharmaceuticals Inc. All rights reserved

45

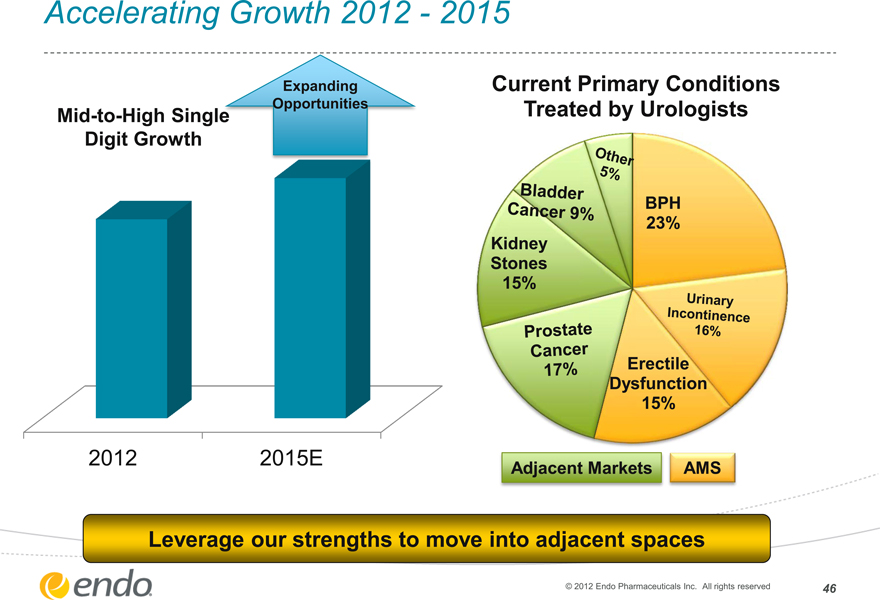

Accelerating Growth 2012—2015

Mid-to-High Single Digit Growth

Expanding Opportunities

2012

2015E

Current Primary Conditions Treated by Urologists

Other 5%

Bladder Cancer 9%

Kidney Stones 15%

Prostate Cancer 17%

BPH 23%

Urinary Incontinence 16%

Erectile Dysfunction 15%

Adjacent Markets

AMS

Leverage our strengths to move into adjacent spaces

© 2012 Endo Pharmaceuticals Inc. All rights reserved

46

AMS Key Takeaways

Strong organic growth opportunities remain within AMS core business lines – mid-to-high single digit CAGR 2012-2015

AMS is uniquely positioned in urology

Leverage Endo partnership to enhance leadership in urology

Expect to return operating margin to historical levels (high 20 percent to low 30 percent by 2014)

Opportunities in adjacent spaces with existing customers

© 2012 Endo Pharmaceuticals Inc. All rights reserved

47

2012 Investor Day

HealthTronics

Kelly Huang

President, HealthTronics October 4, 2012

©2012 HealthTronics, Inc. All rights reserved.

48

HealthTronics Key Takeaways

HealthTronics has deep, durable relationships with the US-based Urology community

HealthTronics has a stable, core business that is profitable and cash flow positive

HealthTronics has several platforms for growth including Cryotherapy, Electronic Medical Records and Data-Enabled Services & Analytics

HealthTronics, through its channel presence in Urology, has strategic value for the Endo enterprise

©2012 HealthTronics, Inc. All rights reserved.

49

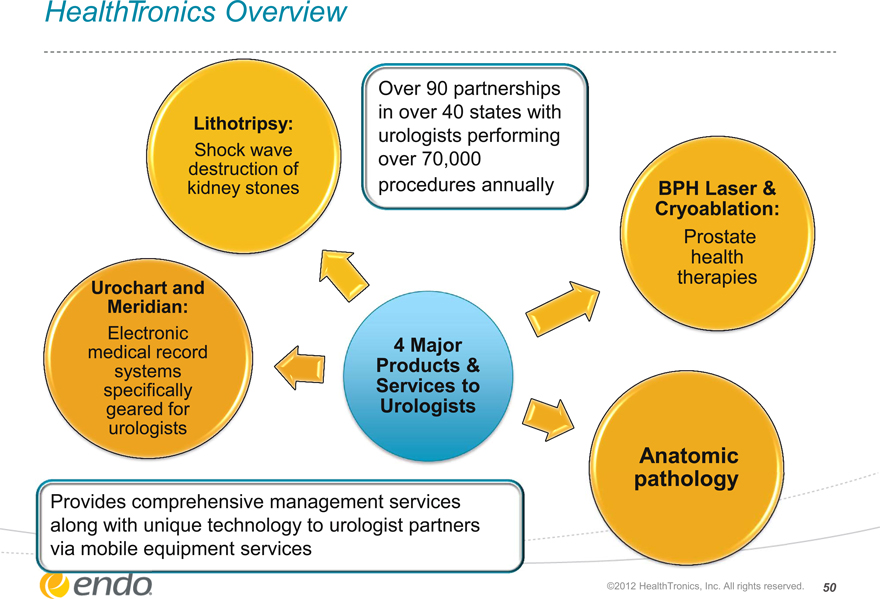

HealthTronics Overview

Lithotripsy:

Shock wave destruction of kidney stones

Over 90 partnerships in over 40 states with urologists performing over 70,000 procedures annually

BPH Laser & Cryoablation:

Prostate health therapies

Urochart and Meridian:

Electronic medical record systems specifically geared for urologists

4 Major Products & Services to Urologists

Anatomic pathology

Provides comprehensive management services along with unique technology to urologist partners via mobile equipment services

©2012 HealthTronics, Inc. All rights reserved.

50

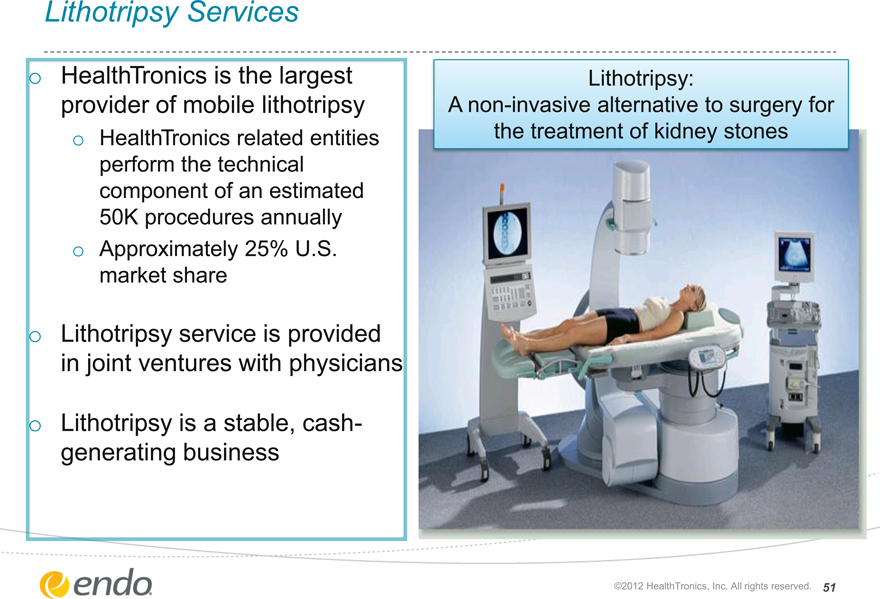

Lithotripsy Services

HealthTronics is the largest provider of mobile lithotripsy

HealthTronics related entities perform the technical component of an estimated 50K procedures annually

Approximately 25% U.S. market share

Lithotripsy service is provided in joint ventures with physicians

Lithotripsy is a stable, cash- generating business

Lithotripsy:

A non-invasive alternative to surgery for the treatment of kidney stones

©2012 HealthTronics, Inc. All rights reserved.

51

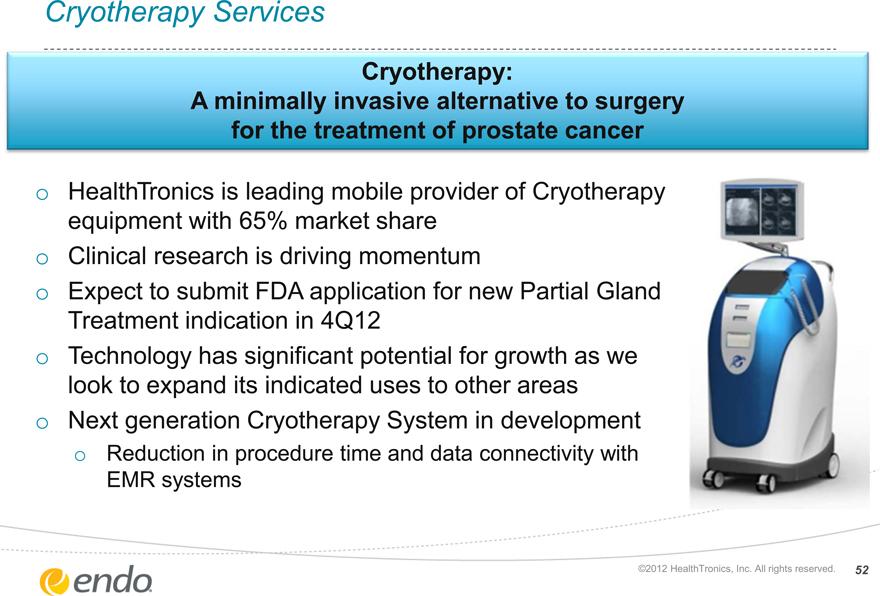

Cryotherapy Services

Cryotherapy:

A minimally invasive alternative to surgery for the treatment of prostate cancer

HealthTronics is leading mobile provider of Cryotherapy equipment with 65% market share

Clinical research is driving momentum

Expect to submit FDA application for new Partial Gland Treatment indication in 4Q12 Technology has significant potential for growth as we look to expand its indicated uses to other areas

Next generation Cryotherapy System in development

Reduction in procedure time and data connectivity with EMR systems

©2012 HealthTronics, Inc. All rights reserved.

52

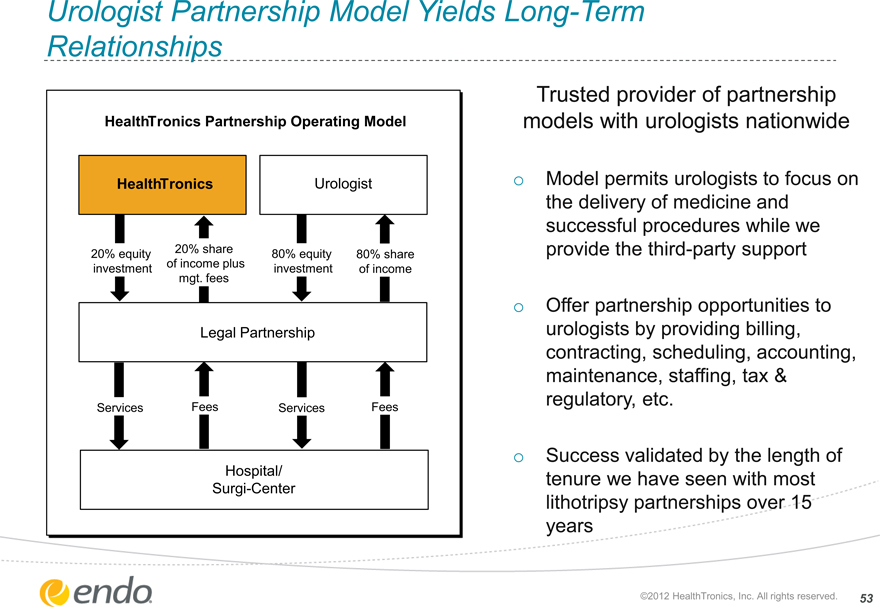

Urologist Partnership Model Yields Long-Term Relationships

HealthTronics Partnership Operating Model

HealthTronics

Urologist

20% equity investment

20% share of income plus mgt. fees

80% equity investment

80% share of income

Legal Partnership

Services

Fees

Services

Fees

Hospital/ Surgi-Center

Trusted provider of partnership models with urologists nationwide

Model permits urologists to focus on the delivery of medicine and successful procedures while we provide the third-party support

Offer partnership opportunities to urologists by providing billing, contracting, scheduling, accounting, maintenance, staffing, tax & regulatory, etc.

Success validated by the length of tenure we have seen with most lithotripsy partnerships over 15 years

©2012 HealthTronics, Inc. All rights reserved.

53

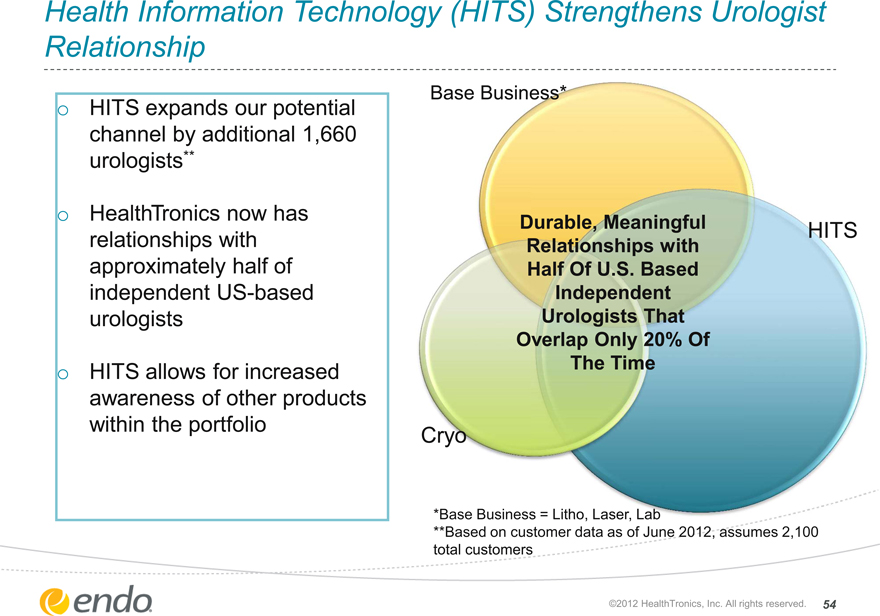

Health Information Technology (HITS) Strengthens Urologist Relationship

HITS expands our potential channel by additional 1,660 urologists**

HealthTronics now has relationships with approximately half of independent US-based urologists

HITS allows for increased awareness of other products within the portfolio

Base Business*

Durable, Meaningful Relationships with Half Of U.S. Based Independent Urologists That Overlap Only 20% Of The Time

HITS

Cryo

*Base Business = Litho, Laser, Lab

**Based on customer data as of June 2012, assumes 2,100 total customers

©2012 HealthTronics, Inc. All rights reserved.

54

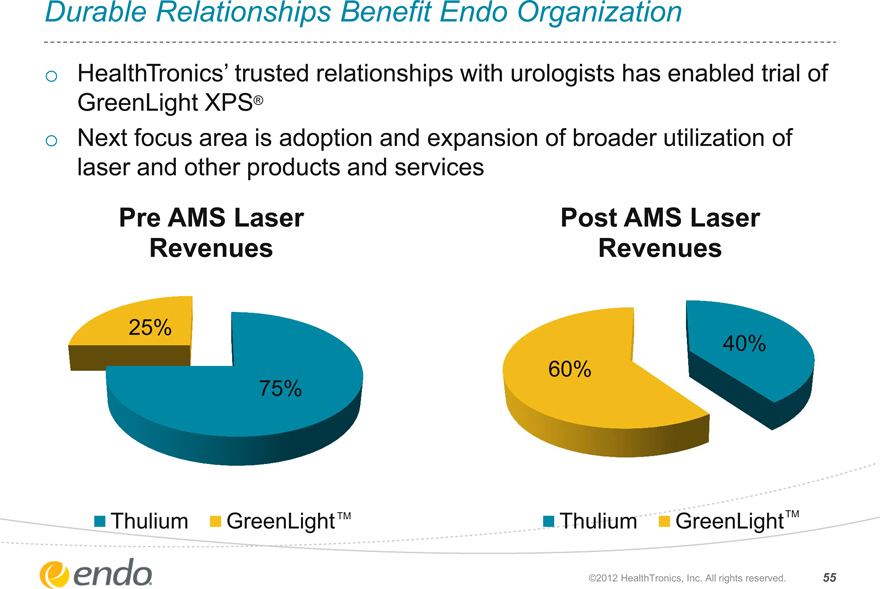

Durable Relationships Benefit Endo Organization

HealthTronics’ trusted relationships with urologists has enabled trial of

GreenLight XPS®

Next focus area is adoption and expansion of broader utilization of laser and other products and services

Pre AMS Laser Revenues

Post AMS Laser Revenues

25%

75%

60%

40%

Thulium

GreenLightTM

Thulium

GreenLightTM

©2012 HealthTronics, Inc. All rights reserved.

55

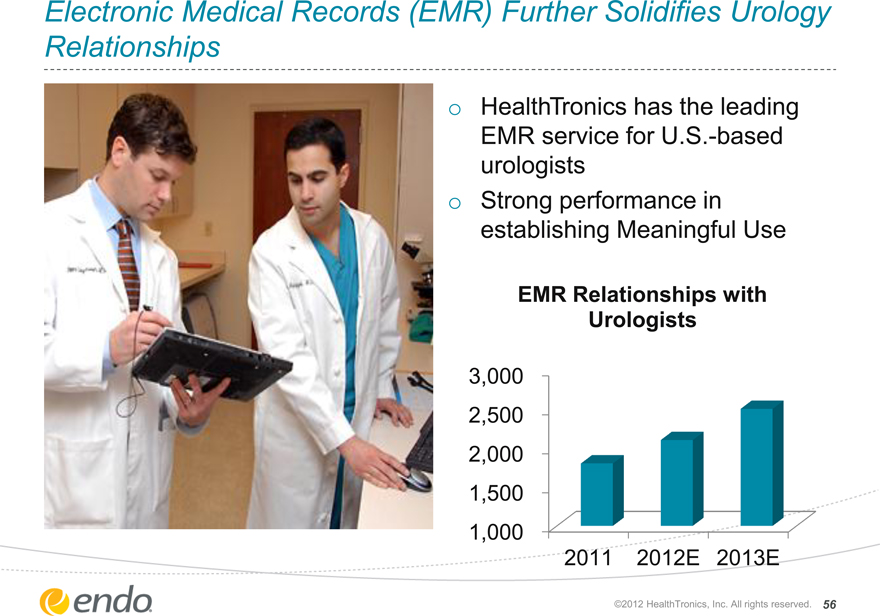

Electronic Medical Records (EMR) Further Solidifies Urology Relationships

HealthTronics has the leading EMR service for U.S.-based urologists

Strong performance in establishing Meaningful Use

EMR Relationships with Urologists

3,000

2,500

2,000

1,500

1,000

2011 2012E 2013E

©2012 HealthTronics, Inc. All rights reserved.

56

Electronic Medical Records (EMR) In The Future

EMR supports how doctors practice medicine in seamless manner driving urologist adoption

EMR generated data will grow in the future as there is increased emphasis on:

Patient-Centric Solutions

Outcomes Based Reimbursement

Reduced Readmission & Revision to Lower Costs

EMR Will Be Crucial to a Physician’s Practice

Inter-op Clinical Decision Support

Patient-Specific Outcome Correlations

Practice Economic Performance

Revenue Opportunities, e.g. Clinical Enrollment

©2012 HealthTronics, Inc. All rights reserved.

57

HealthTronics Key Takeaways

HealthTronics has deep, durable relationships with the US-based Urology community

HealthTronics has a stable, core business that is profitable and is cash flow positive

HealthTronics has several platforms for growth including Cryotherapy, Electronic Medical Records and Data-Enabled Services & Analytics

HealthTronics, through its channel presence in Urology, has strategic value for the Endo enterprise

©2012 HealthTronics, Inc. All rights reserved.

58

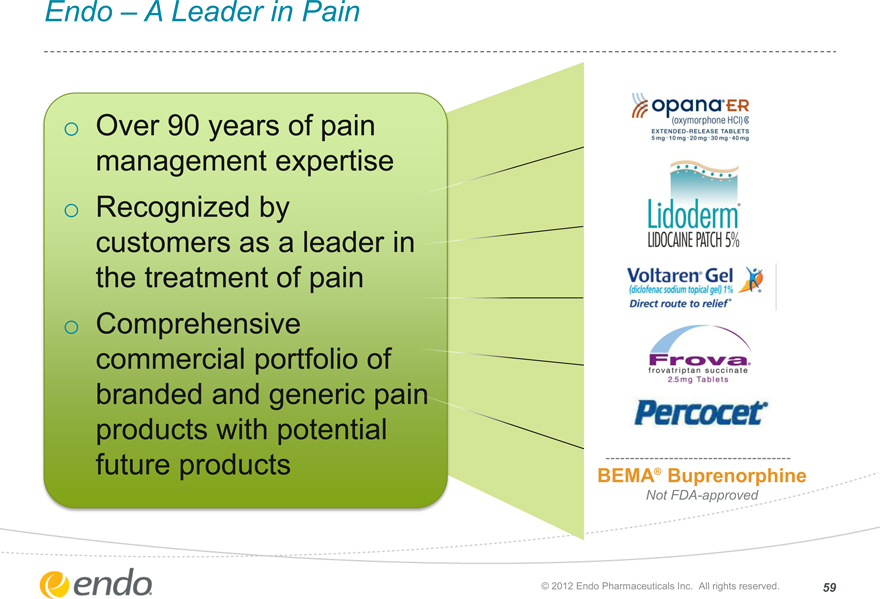

Endo – A Leader in Pain

Over 90 years of pain management expertise

Recognized by customers as a leader in the treatment of pain

Comprehensive commercial portfolio of branded and generic pain products with potential future products

BEMA® Buprenorphine

Not FDA-approved

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

59

2012 Investor Day

Endo Pharmaceuticals

Julie McHugh

Chief Operating Officer

October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved

60

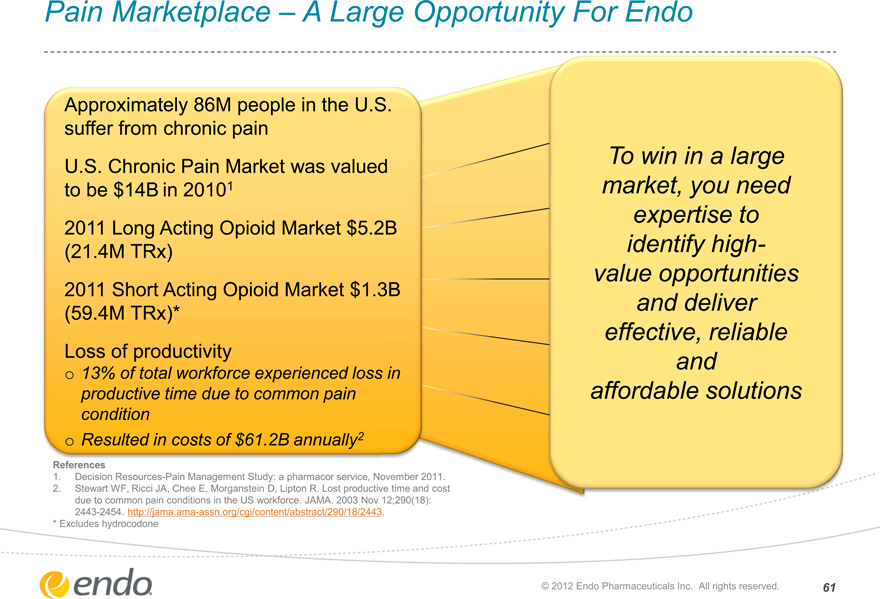

Pain Marketplace – A Large Opportunity For Endo

Approximately 86M people in the U.S. suffer from chronic pain U.S. Chronic Pain Market was valued to be $14B in 20101 2011 Long Acting Opioid Market $5.2B (21.4M TRx) 2011 Short Acting Opioid Market $1.3B (59.4M TRx)* Loss of productivity

13% of total workforce experienced loss in productive time due to common pain condition Resulted in costs of $61.2B annually2

To win in a large market, you need expertise to identify high- value opportunities and deliver effective, reliable and affordable solutions

References

1. Decision Resources-Pain Management Study: a pharmacor service, November 2011.

2. Stewart WF, Ricci JA, Chee E, Morganstein D, Lipton R. Lost productive time and cost due to common pain conditions in the US workforce. JAMA. 2003 Nov 12;290(18): 2443-2454. http://jama.ama-assn.org/cgi/content/abstract/290/18/2443.

* Excludes hydrocodone

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

61

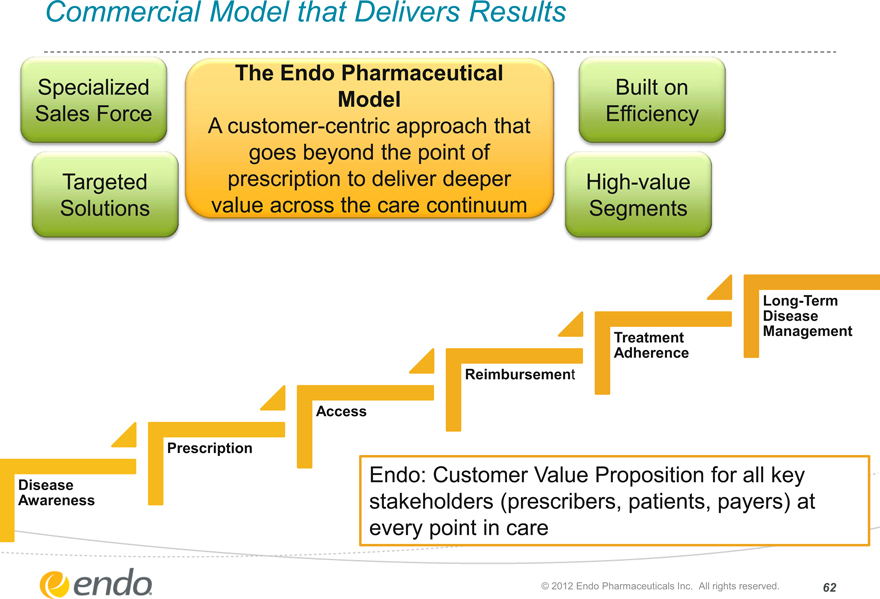

Commercial Model that Delivers Results

Specialized

Sales Force

Targeted Solutions

The Endo Pharmaceutical Model

A customer-centric approach that goes beyond the point of prescription to deliver deeper value across the care continuum

Built on

Efficiency

High-value Segments

Disease Awareness

Prescription

Access

Reimbursement

Treatment Adherence

Long-Term Disease Management

Endo: Customer Value Proposition for all key stakeholders (prescribers, patients, payers) at every point in care

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

62

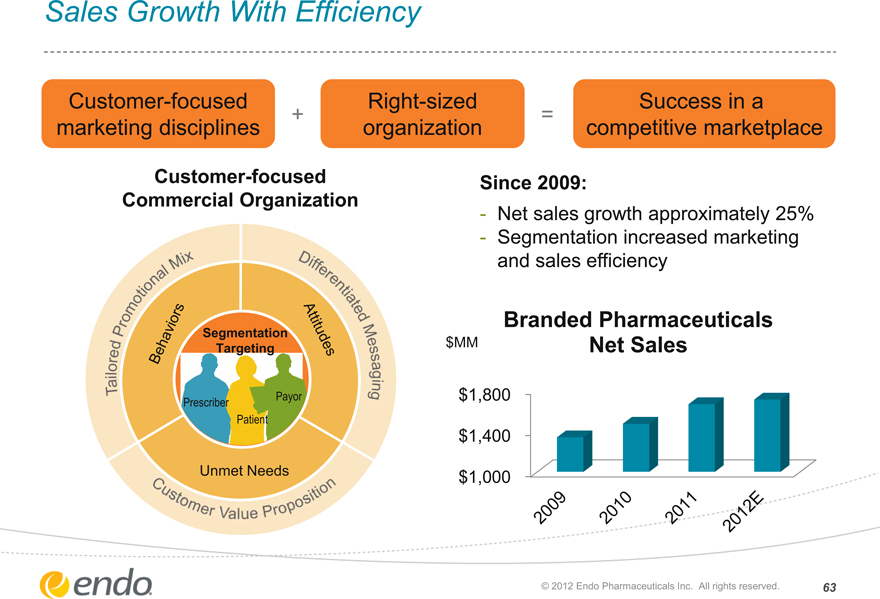

Sales Growth With Efficiency

Customer-focused marketing disciplines

+

Right-sized organization

=

Success in a competitive marketplace

Customer-focused Commercial Organization

Tailored Promotional Mix

Differentiated Messaging

Customer Value Proposition

Behaviors Attitudes

Segmentation Targeting

Payor

Prescriber

Patient

Unmet Needs

Since 2009:

Net sales growth approximately 25% Segmentation increased marketing and sales efficiency

Branded Pharmaceuticals Net Sales

$MM

$ 1,800

$ 1,400

$ 1,000

2009

2010

2011

2012E

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

63

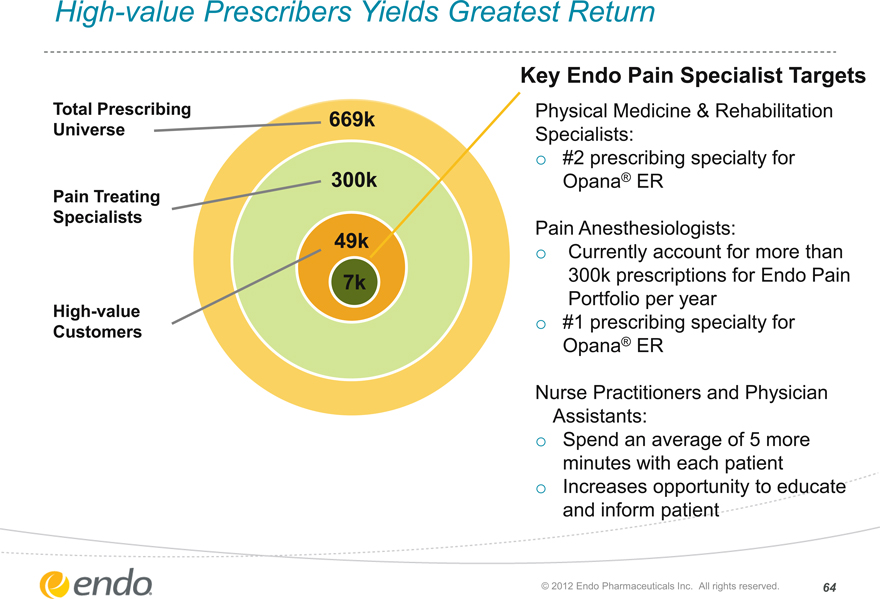

High-value Prescribers Yields Greatest Return

Total Prescribing Universe

Pain Treating Specialists

High-value Customers

669k

300k

49k

7k

Key Endo Pain Specialist Targets

Physical Medicine & Rehabilitation Specialists:

#2 prescribing specialty for Opana® ER

Pain Anesthesiologists:

Currently account for more than 300k prescriptions for Endo Pain Portfolio per year

#1 prescribing specialty for Opana® ER

Nurse Practitioners and Physician Assistants:

Spend an average of 5 more minutes with each patient Increases opportunity to educate and inform patient

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

64

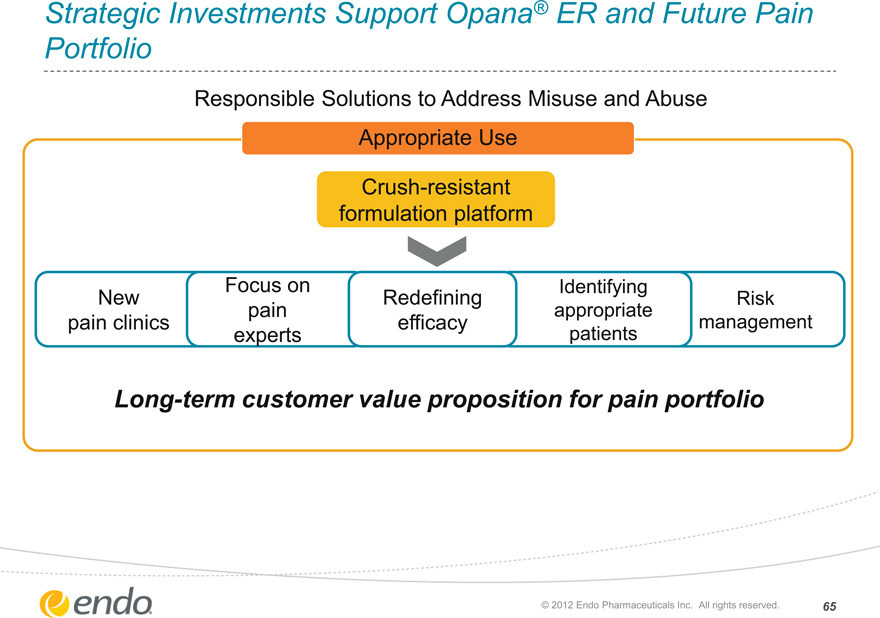

Strategic Investments Support Opana® ER and Future Pain Portfolio

Responsible Solutions to Address Misuse and Abuse

Appropriate Use

Crush-resistant formulation platform

New pain clinics

Focus on pain experts

Redefining efficacy

Identifying appropriate patients

Risk management

Long-term customer value proposition for pain portfolio

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

65

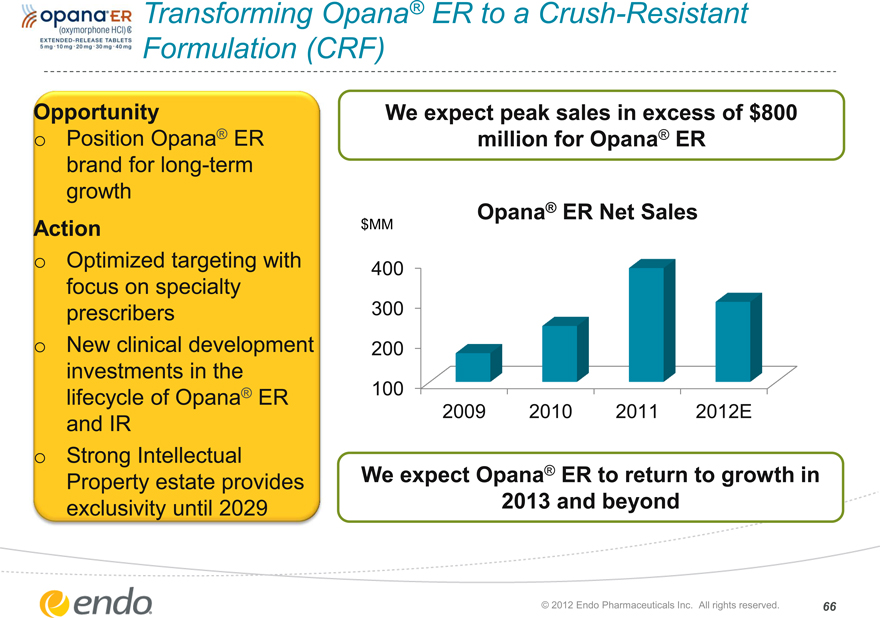

Transforming Opana® ER to a Crush-Resistant Formulation (CRF)

Opportunity

Position Opana® ER brand for long-term growth

Action

Optimized targeting with focus on specialty prescribers New clinical development investments in the lifecycle of Opana® ER and IR

Strong Intellectual

Property estate provides exclusivity until 2029

We expect peak sales in excess of $800 million for Opana® ER

Opana® ER Net Sales

$MM

400

300

200

100

2009

2010

2011

2012E

We expect Opana® ER to return to growth in 2013 and beyond

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

66

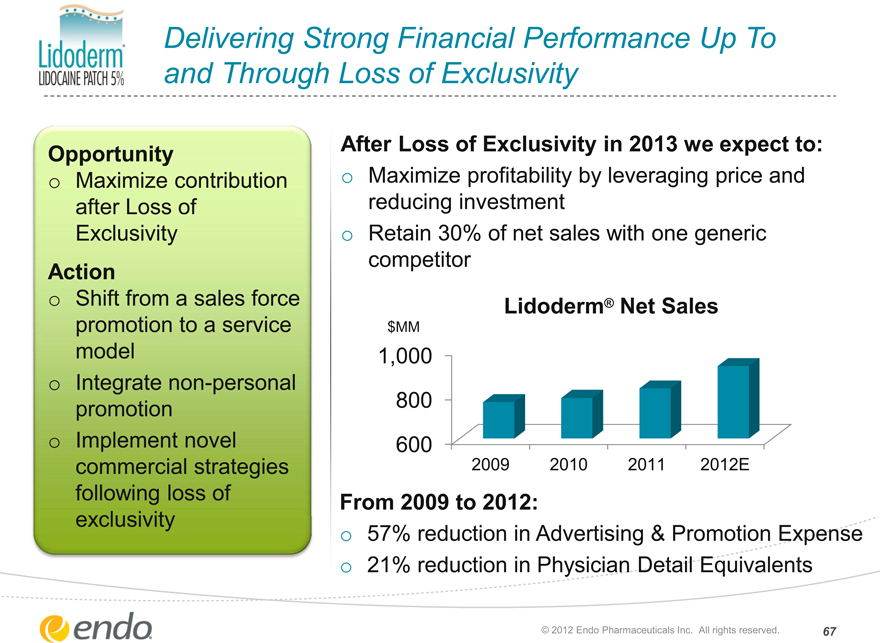

Delivering Strong Financial Performance Up To and Through Loss of Exclusivity

Opportunity

Maximize contribution after Loss of Exclusivity

Action

Shift from a sales force promotion to a service model

Integrate non-personal promotion Implement novel commercial strategies following loss of exclusivity

After Loss of Exclusivity in 2013 we expect to:

Maximize profitability by leveraging price and reducing investment Retain 30% of net sales with one generic competitor

Lidoderm® Net Sales

$MM

1,000

800,

600

2009

2010

2011

2012E

From 2009 to 2012:

57% reduction in Advertising & Promotion Expense 21% reduction in Physician Detail Equivalents

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

67

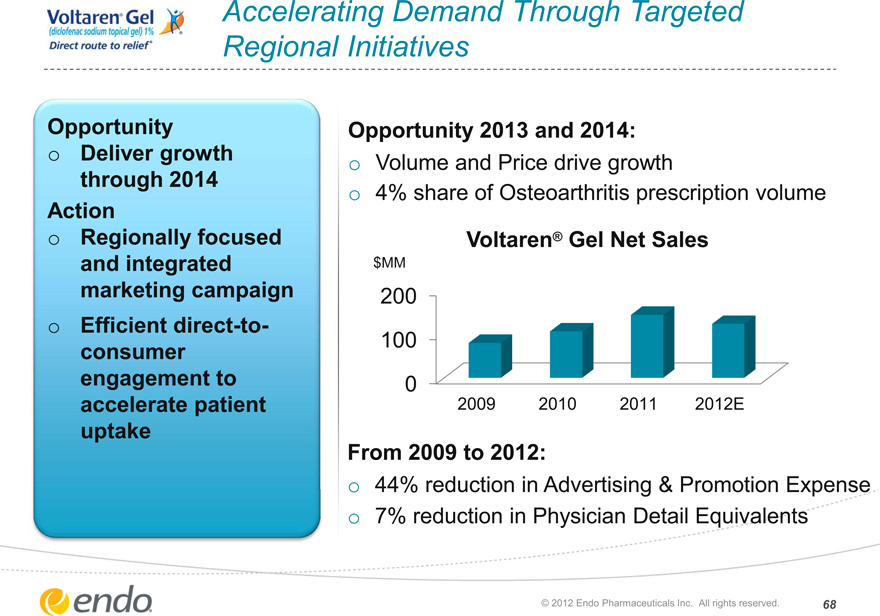

Accelerating Demand Through Targeted Regional Initiatives

Opportunity

Deliver growth through 2014

Action

Regionally focused and integrated marketing campaign Efficient direct-to-consumer engagement to accelerate patient uptake

Opportunity 2013 and 2014:

Volume and Price drive growth

4% share of Osteoarthritis prescription volume

Voltaren® Gel Net Sales

$MM

200

100

0

2009

2010

2011

2012E

From 2009 to 2012:

44% reduction in Advertising & Promotion Expense 7% reduction in Physician Detail Equivalents

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

68

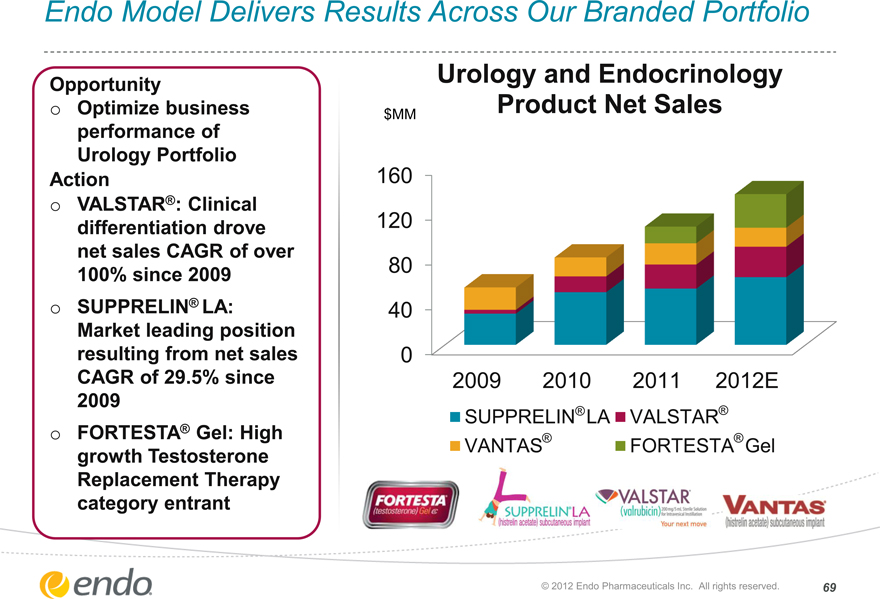

Endo Model Delivers Results Across Our Branded Portfolio

Opportunity

Optimize business performance of Urology Portfolio

Action

VALSTAR®: Clinical differentiation drove net sales CAGR of over 100% since 2009 SUPPRELIN® LA: Market leading position resulting from net sales CAGR of 29.5% since 2009 FORTESTA® Gel: High growth Testosterone Replacement Therapy category entrant

Urology and Endocrinology Product Net Sales

$MM

160

120

80

40

0

2009

2010

2011

2012E

SUPPRELIN® LA

VANTAS®

VALSTAR®

FORTESTA® Gel

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

69

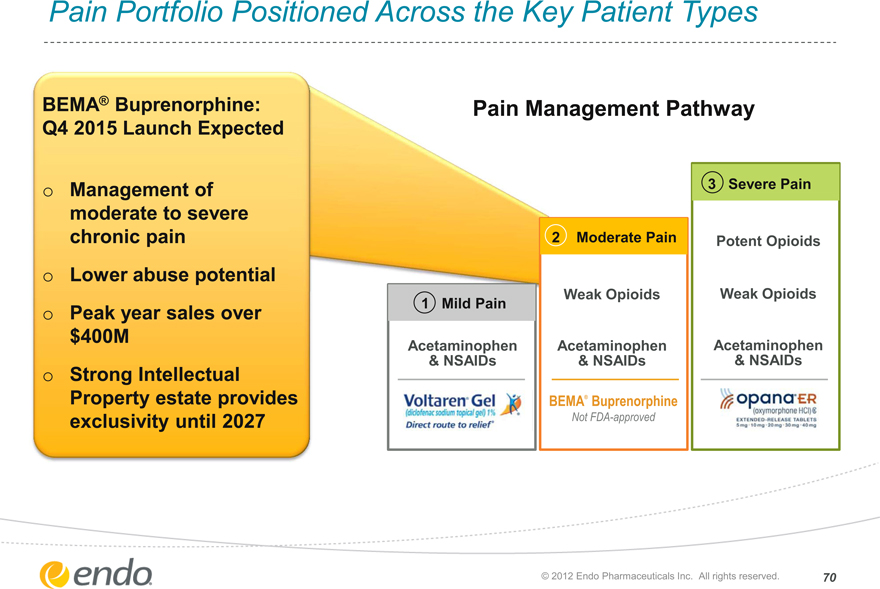

Pain Portfolio Positioned Across the Key Patient Types

BEMA® Buprenorphine: Q4 2015 Launch Expected

Management of moderate to severe chronic pain Lower abuse potential Peak year sales over $400M

Strong Intellectual Property estate provides exclusivity until 2027

Pain Management Pathway

1 Mild Pain

Acetaminophen

& NSAIDs

2 Moderate Pain

Weak Opioids

Acetaminophen

& NSAIDs

BEMA® Buprenorphine

Not FDA-approved

3 Severe Pain

Potent Opioids Potent Opioids

Weak Opioids

Acetaminophen

& NSAIDs

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

70

Pharmaceutical Business —Strong Growth Potential

Commercial model allows Endo to manage through the loss of exclusivity for Lidoderm® and support our competitive position BD Opportunities

Long-term patent exclusivity on portfolio growth drivers:

Opana® ER Intellectual Property through 2029

C

BEMA® Buprenorphine Intellectual Property through 2027

BEMA® Buprenorphine launch expected late 2015

Expect multiple Branded Pharmaceuticals products to exceed $100M in sales by 2017

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

71

2012 Investor Day

Research & Development

Ivan Gergel

Chief Scientific Officer

October 4, 2012

©2012 Endo Pharmaceuticals Inc. All rights reserved.

72

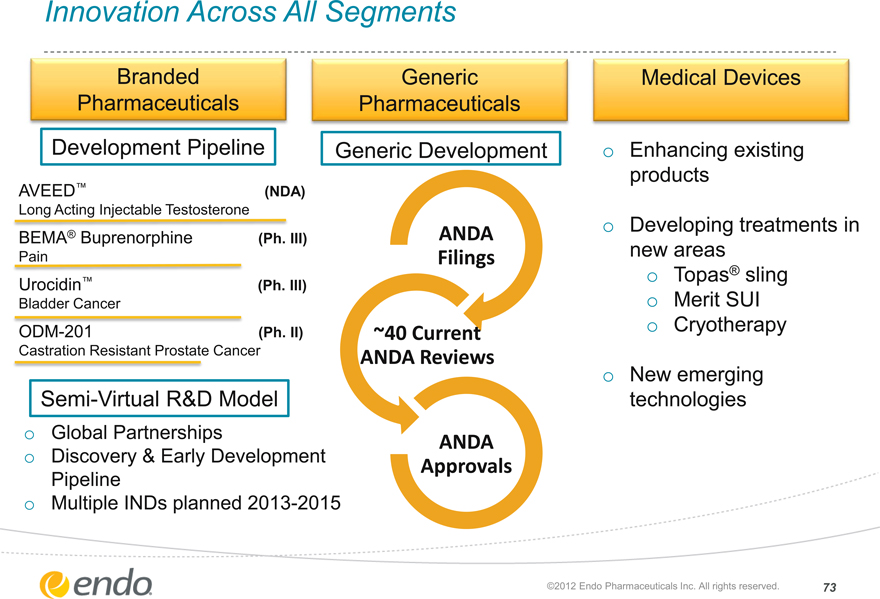

Innovation Across All Segments

Branded Pharmaceuticals

Generic

Pharmaceuticals

Medical Devices

Development Pipeline

Generic Development

AVEED™ (NDA)

Long Acting Injectable Testosterone

BEMA® Buprenorphine (Ph. III)

Pain

Urocidin™ (Ph. III)

Bladder Cancer

ODM-201 (Ph. II)

Castration Resistant Prostate Cancer

Semi-Virtual R&D Model

Global Partnerships

Discovery & Early Development Pipeline Multiple INDs planned 2013-2015

ANDA Filings

~40 Current ANDA Reviews

ANDA Approvals

Enhancing existing

products

Developing treatments in

new areas

Topas® sling

Merit SUI Cryotherapy

New emerging technologies

©2012 Endo Pharmaceuticals Inc. All rights reserved.

73

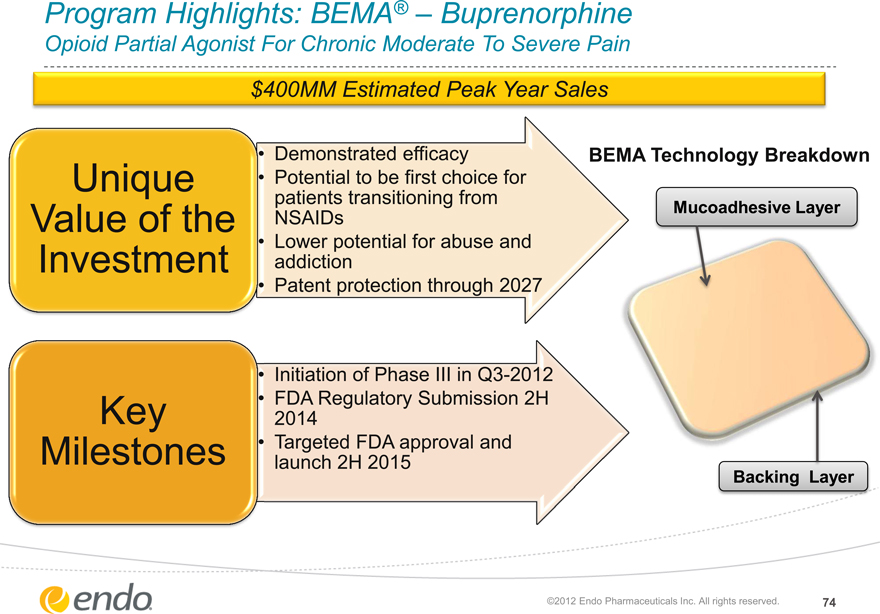

Program Highlights: BEMA® – Buprenorphine

Opioid Partial Agonist For Chronic Moderate To Severe Pain

$400MM Estimated Peak Year Sales

Unique Value of the Investment

Demonstrated efficacy

Potential to be first choice for patients transitioning from NSAIDs

Lower potential for abuse and addiction

Patent protection through 2027

BEMA Technology Breakdown

Mucoadhesive Layer

Key Milestones

Initiation of Phase III in Q3-2012 FDA Regulatory Submission 2H 2014 Targeted FDA approval and launch 2H 2015

Backing Layer

©2012 Endo Pharmaceuticals Inc. All rights reserved.

74

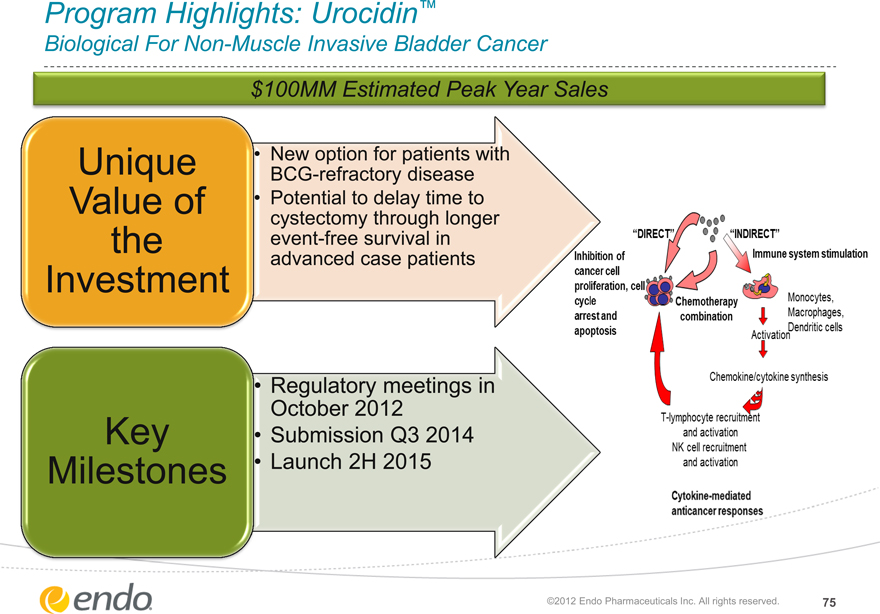

Program Highlights: Urocidin™

Biological For Non-Muscle Invasive Bladder Cancer

$100MM Estimated Peak Year Sales

Unique Value of the Investment

New option for patients with BCG-refractory disease Potential to delay time to cystectomy through longer event-free survival in advanced case patients

“DIRECT” “INDERECT”

Inhibition of cancer cell proliferation, cell cycle arrest and apoptosis

Immune system stimulation

Chemotherapy combination

Monocytes, Macrophages, Dendritic cells

Activation

Chemokine/cytokines synthesis

T-lymphocyte recruitment and activation NK cell recruitment and activation

Cytokine-mediated anticancer responses

Key Milestones

Regulatory meetings in

October 2012

Submission Q3 2014 Launch 2H 2015

©2012 Endo Pharmaceuticals Inc. All rights reserved.

75

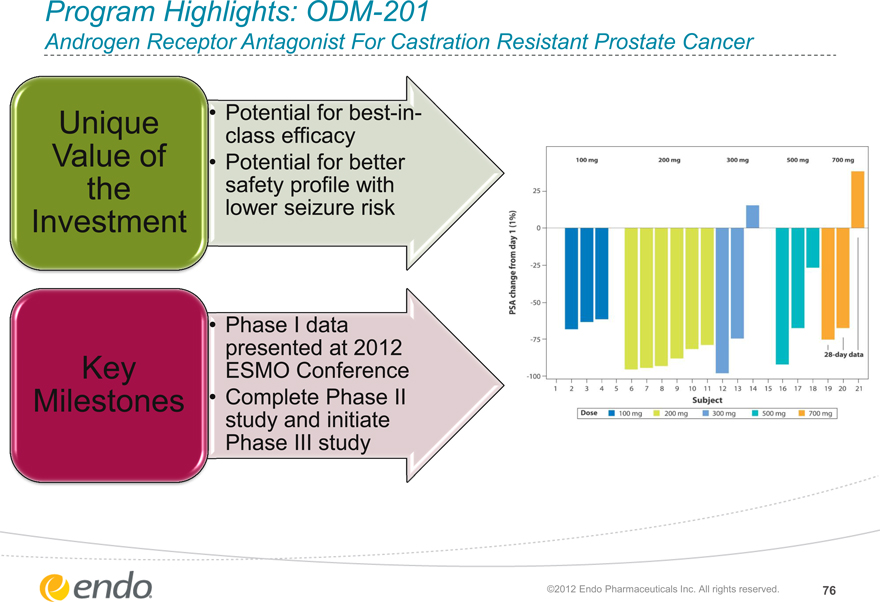

Program Highlights: ODM-201

Androgen Receptor Antagonist For Castration Resistant Prostate Cancer

Unique Value of the Investment

Potential forbest-in-class efficacy

Potential for better safety profile with lower seizure risk

Key Milestones

Phase I data presented at 2012 ESMO Conference Complete Phase II study and initiate

Phase III study

©2012 Endo Pharmaceuticals Inc. All rights reserved.

76

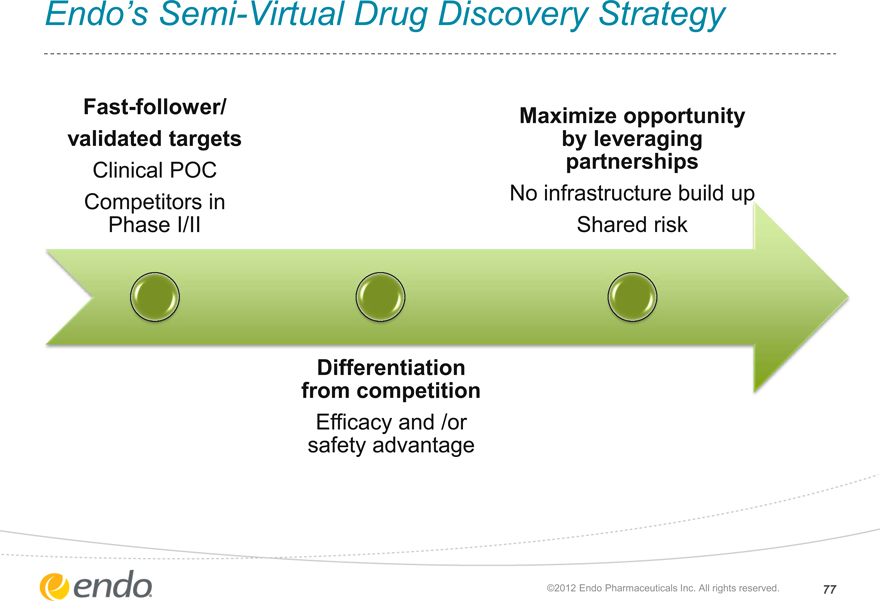

Endo’s Semi-Virtual Drug Discovery Strategy

Fast-follower/ validated targets

Clinical POC Competitors in Phase I/II

Maximize opportunity by leveraging partnerships

No infrastructure build up Shared risk

Differentiation from competition

Efficacy and /or safety advantage

©2012 Endo Pharmaceuticals Inc. All rights reserved.

77

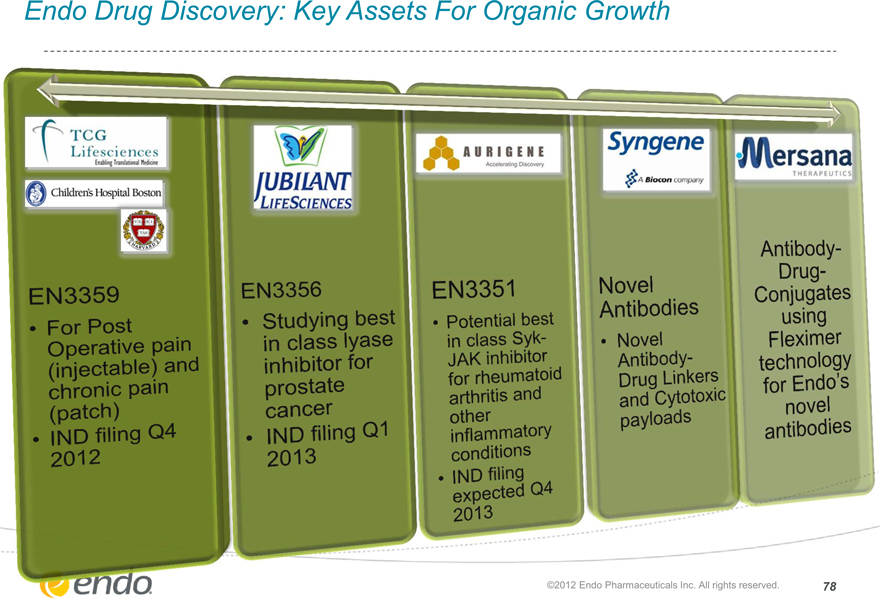

Endo Drug Discovery: Key Assets For Organic Growth

EN3359

For Post Operative pain (injectable and chronic pain (patch)

IND filing Q4 2012

EN3356

Studying best in class lyase inhibitor for prostate cancer

IND filing Q1 2013

EN3351

Potential best in class Syk-JAK inhibitor for rheumatoid arthritis and other inflammatory conditions

IND filing expected Q4 2013

Novel Antibodies

Novel Antibody-Drug Linkers and Cytotoxic payloads

Antibody-Drug-Conjugates using Fleximer technology for Endo’s novel antibodies

©2012 Endo Pharmaceuticals Inc. All rights reserved.

78

Qualitest Pipeline Approach – Organic Development And Strategic Acquisition Of Products And Target Technologies

Differentiate pipeline investments based on portfolio

Strengthen current infrastructure scale and expertise in core technologies e.g. controlled substances, extended release, liquids

Accelerate pipeline and commercial products through external partnerships and licensing

©2012 Endo Pharmaceuticals Inc. All rights reserved.

79

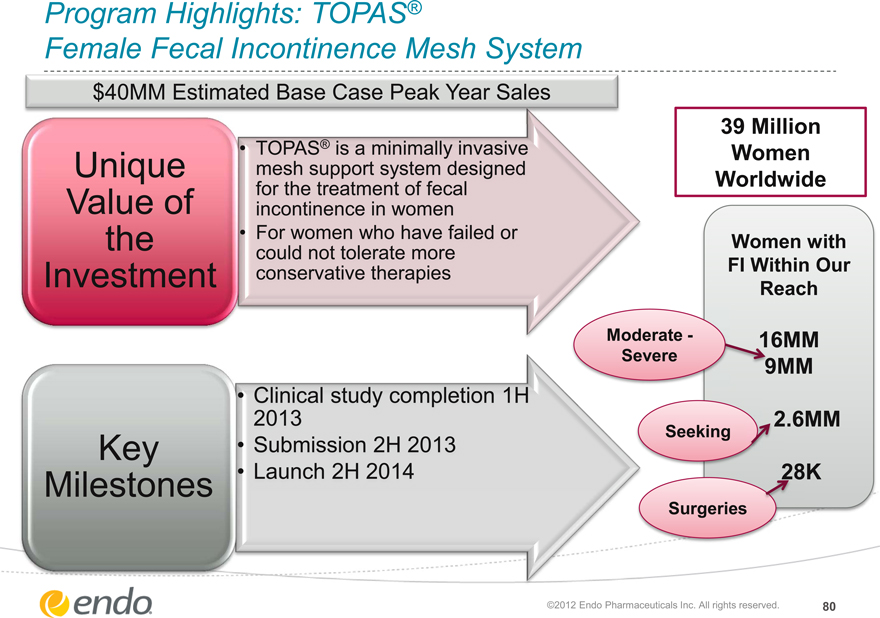

Program Highlights: TOPAS®

Female Fecal Incontinence Mesh System

$40MM Estimated Base Case Peak Year Sales

Unique Value of the Investment

TOPAS® is a minimally invasive mesh support system designed for the treatment of fecal incontinence in women For women who have failed or could not tolerate more conservative therapies

Key Milestones

Clinical study completion 1H 2013

Submission 2H 2013

Launch 2H 2014

39 Million Women Worldwide

Women with FI Within Our Reach

Moderate—Severe

16MM 9MM

Seeking

2.6MM

Surgeries

28K

©2012 Endo Pharmaceuticals Inc. All rights reserved.

80

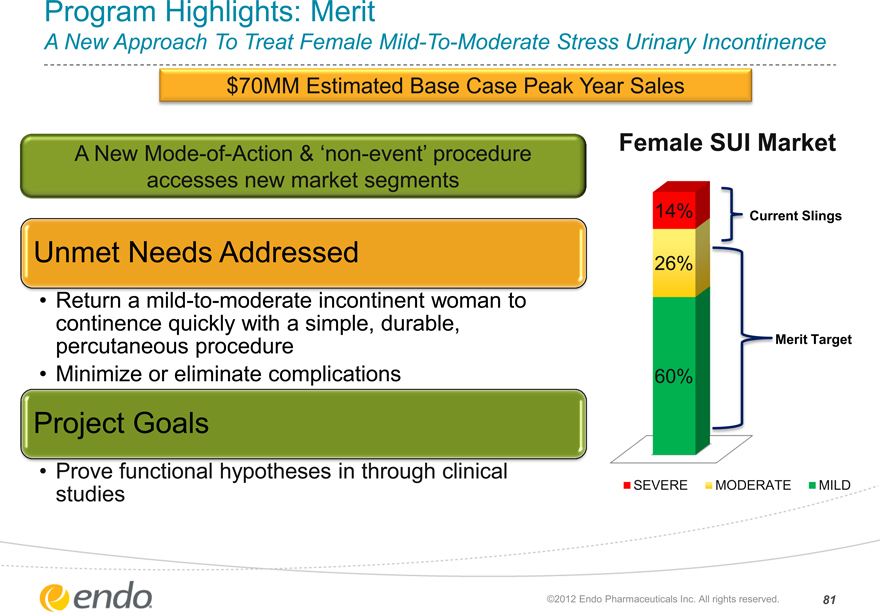

Program Highlights: Merit

A New Approach To Treat Female Mild-To-Moderate Stress Urinary Incontinence

$70MM Estimated Base Case Peak Year Sales

A New Mode-of-Action & ‘non-event’ procedure accesses new market segments

Unmet Needs Addressed

• Return a mild-to-moderate incontinent woman to continence quickly with a simple, durable, percutaneous procedure

• Minimize or eliminate complications

Project Goals

• Prove functional hypotheses in through clinical studies

Female SUI Market

14%

26%

60%

Current Slings

Merit Target

SEVERE MODERATE MILD

©2012 Endo Pharmaceuticals Inc. All rights reserved. 81

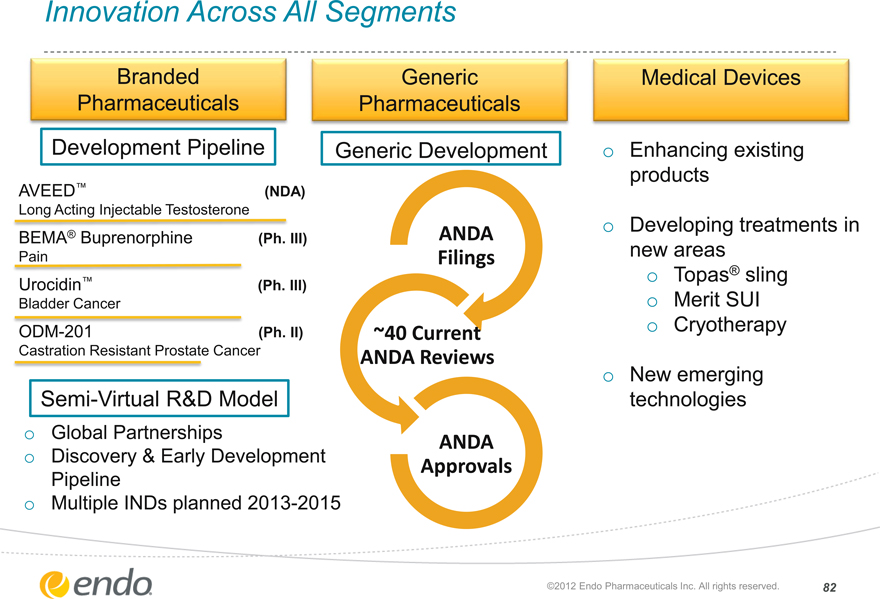

Innovation Across All Segments

Branded Pharmaceuticals

Development Pipeline

Generic

Pharmaceuticals

Generic Development

Medical Devices

AVEED™ (NDA)

Long Acting Injectable Testosterone

BEMA® Buprenorphine (Ph. III)

Pain

Urocidin™ (Ph. III)

Bladder Cancer

ODM-201 (Ph. II)

Castration Resistant Prostate Cancer

Semi-Virtual R&D Model

o Global Partnerships o Discovery & Early Development Pipeline o Multiple INDs planned 2013-2015

ANDA Filings

~40 Current ANDA Reviews

ANDA Approvals

Enhancing existing products

Developing treatments in new areas o Topas® sling o Merit SUI o Cryotherapy

New emerging technologies

©2012 Endo Pharmaceuticals Inc. All rights reserved. 82

2012 Investor Day

Finance

Alan Levin

Chief Financial Officer

October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved 83

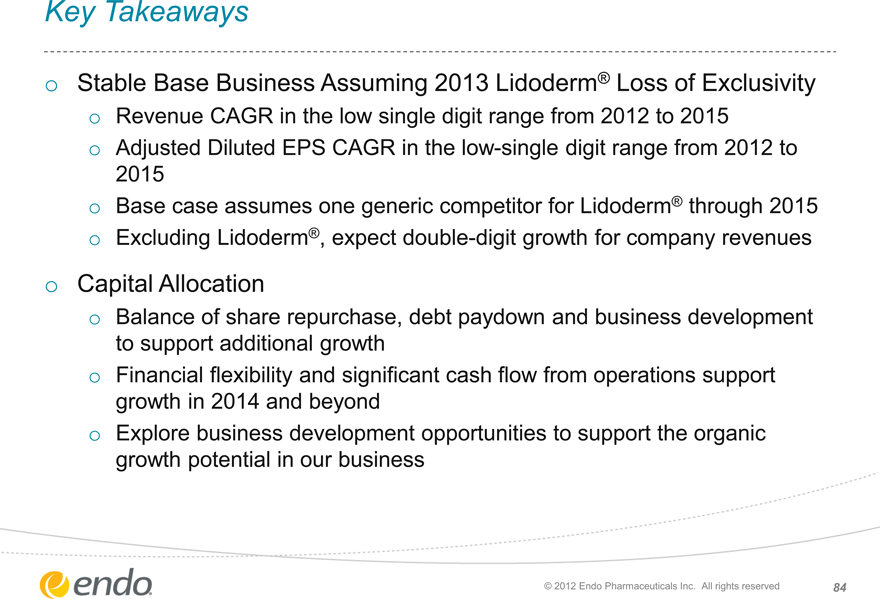

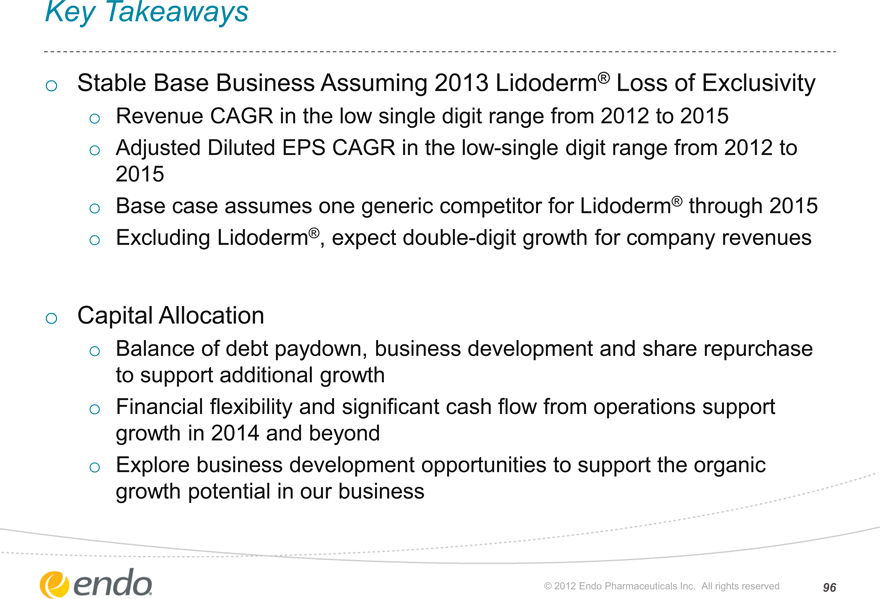

Key Takeaways

Stable Base Business Assuming 2013 Lidoderm® Loss of Exclusivity

Revenue CAGR in the low single digit range from 2012 to 2015 Adjusted Diluted EPS CAGR in the low-single digit range from 2012 to

2015

Base case assumes one generic competitor for Lidoderm® through 2015 Excluding Lidoderm®, expect double-digit growth for company revenues

Capital Allocation

Balance of share repurchase, debt paydown and business development to support additional growth Financial flexibility and significant cash flow from operations support growth in 2014 and beyond Explore business development opportunities to support the organic growth potential in our business

© 2012 Endo Pharmaceuticals Inc. All rights reserved 84

…And Driven Enhanced Growth

Net Sales

($MM)

$3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500

2008-2012 CAGRs Revenue

Adjusted EPS

25%

20%

2008 2009 2010 2011 2012E

Endo Pharmaceuticals HealthTronics

Qualitest*

American Medical Systems

*Includes legacy Endo generic products.

© 2012 Endo Pharmaceuticals Inc. All rights reserved 85

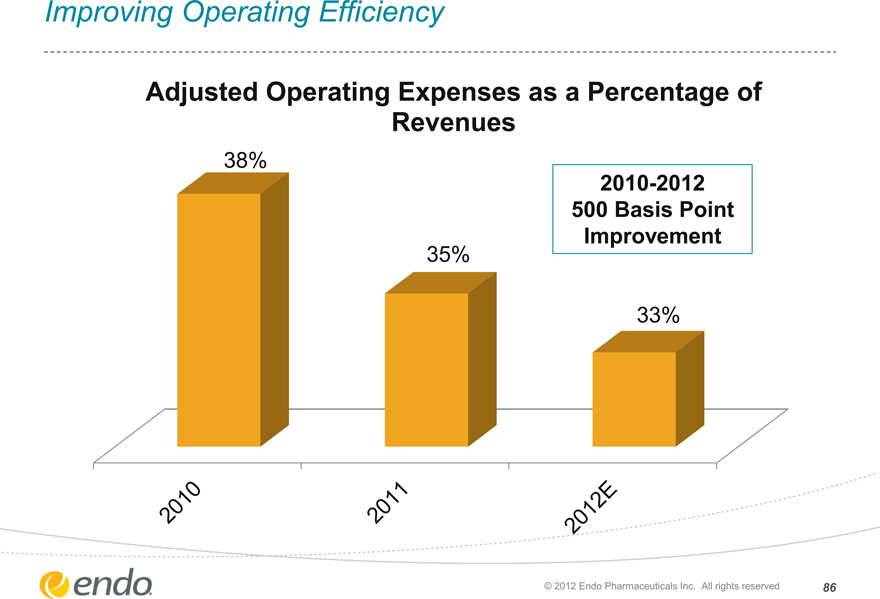

Improving Operating Efficiency

Adjusted Operating Expenses as a Percentage of Revenues

38%

35%

33%

2010-2012 500 Basis Point

Improvement

2010 2011 2012E

© 2012 Endo Pharmaceuticals Inc. All rights reserved 86

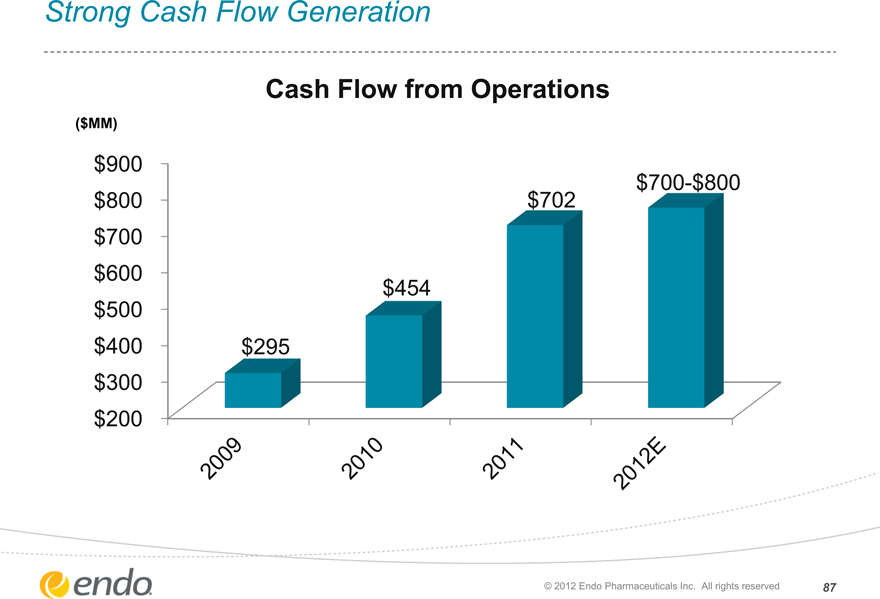

Strong Cash Flow Generation

Cash Flow from Operations

($MM)

$900 $800 $700 $600 $500 $400 $300 $200

$700-$800 $702

$454

$295

2009 2010 2011 2012E

© 2012 Endo Pharmaceuticals Inc. All rights reserved 87

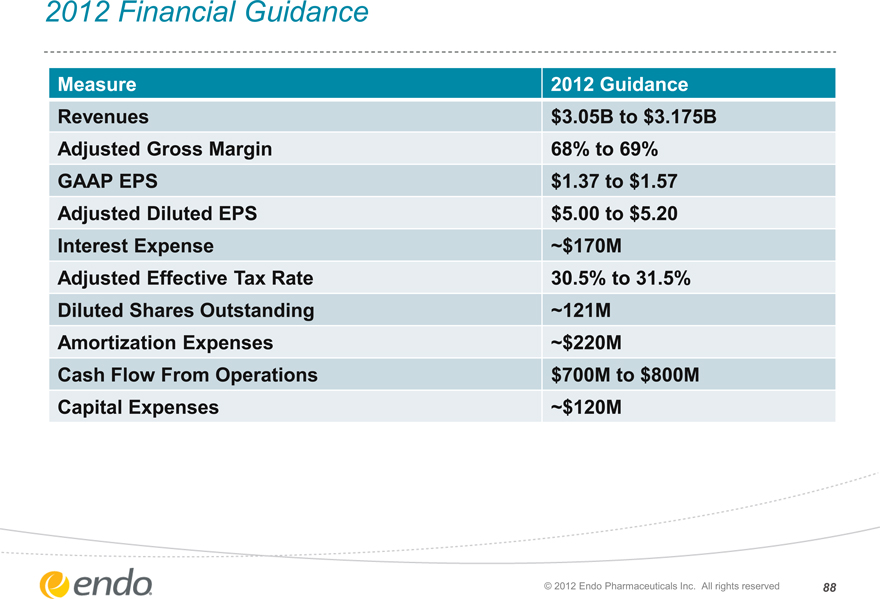

2012 Financial Guidance

Measure Revenues

Adjusted Gross Margin GAAP EPS

Adjusted Diluted EPS Interest Expense Adjusted Effective Tax Rate Diluted Shares Outstanding Amortization Expenses Cash Flow From Operations Capital Expenses

2012 Guidance $3.05B to $3.175B 68% to 69% $1.37 to $1.57 $5.00 to $5.20

~$170M

30.5% to 31.5% ~121M

~$220M $700M to $800M

~$120M

© 2012 Endo Pharmaceuticals Inc. All rights reserved 88

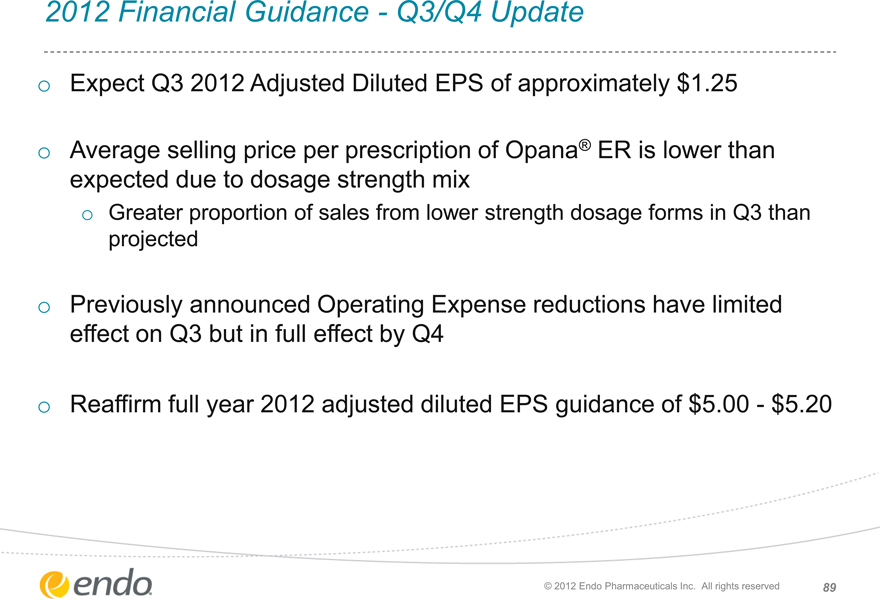

2012 Financial Guidance—Q3/Q4 Update

Expect Q3 2012 Adjusted Diluted EPS of approximately $1.25

Average selling price per prescription of Opana® ER is lower than expected due to dosage strength mix

Greater proportion of sales from lower strength dosage forms in Q3 than projected

Previously announced Operating Expense reductions have limited effect on Q3 but in full effect by Q4

Reaffirm full year 2012 adjusted diluted EPS guidance of $5.00—$5.20

© 2012 Endo Pharmaceuticals Inc. All rights reserved 89

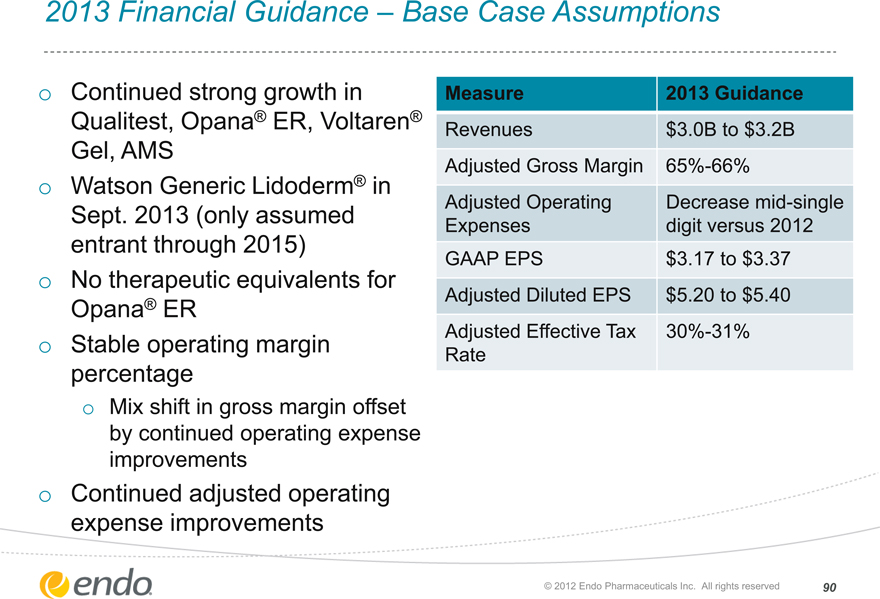

2013 Financial Guidance – Base Case Assumptions

Continued strong growth in Qualitest, Opana® ER, Voltaren® Gel, AMS

Watson Generic Lidoderm® in Sept. 2013 (only assumed entrant through 2015) No therapeutic equivalents for Opana® ER

Stable operating margin percentage

Mix shift in gross margin offset by continued operating expense improvements

Continued adjusted operating expense improvements

Measure

Revenues

Adjusted Gross Margin Adjusted Operating Expenses GAAP EPS

Adjusted Diluted EPS Adjusted Effective Tax Rate

2013 Guidance $3.0B to $3.2B 65%-66% Decrease mid-single digit versus 2012 $3.17 to $3.37 $5.20 to $5.40 30%-31%

© 2012 Endo Pharmaceuticals Inc. All rights reserved 90

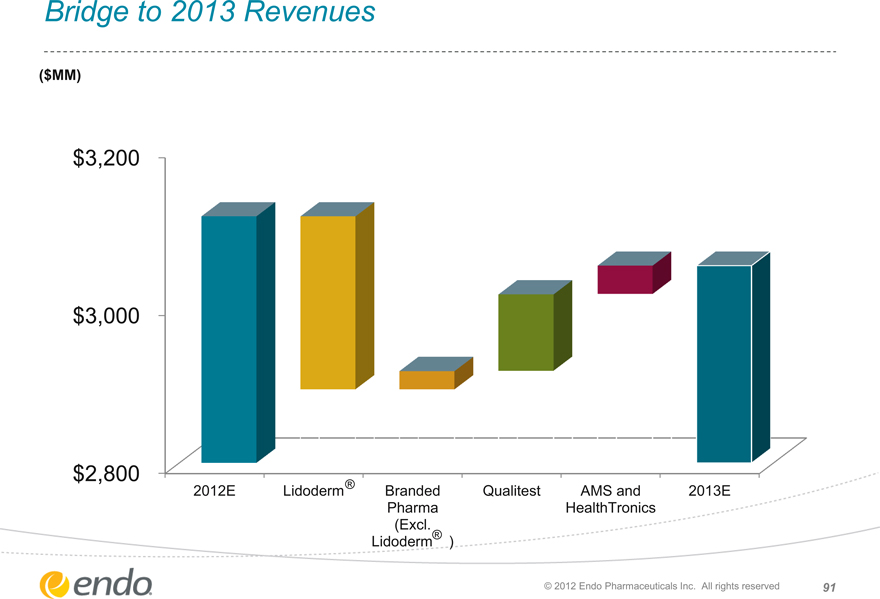

Bridge to 2013 Revenues

($MM)

$3,200 $3,000 $2,800

2012E Lidoderm®

Branded Pharma

(Excl.

Lidoderm®)

Qualitest AMS and HealthTronics

2013E

© 2012 Endo Pharmaceuticals Inc. All rights reserved 91

2012-2015 Growth Expectations

Base Case Assumptions:

Only one competitor for Lidoderm® through 2015

2012 to 2015 growth rates:

Revenue CAGR in the low single-digit range

Adjusted diluted earnings per share CAGR in the low single-digit range

2014 adjusted diluted EPS comparable to 2013

2015 adjusted diluted EPS grow versus 2014

Excluding Lidoderm®, expect double-digit growth for company revenues

92

© 2012 Endo Pharmaceuticals Inc. All rights reserved

Operating Expense Flexibility 2013-2015

Flexible cost infrastructure

Lidoderm® loss of exclusivity and continued efficiency improvements lead to expense savings of up to $100 million

Partial savings capture in 2012

Annualized by end of third quarter of 2013

Additional expense reductions of up to $50 million, over and above $100 million in Lidoderm® savings, contribute to mid-single digit percentage decreases versus prior year in both 2013 and 2014

Additional savings from: procurement, acquisition synergies, prioritized discretionary and promotional spending

© 2012 Endo Pharmaceuticals Inc. All rights reserved 93

Capital Allocation and Balance Sheet 2012—2015

Expect to achieve cumulative Adjusted EBITDA of at least $3 Billion from 2013 through 2015

On track to achieve debt to Adjusted EBITDA target ratio of 2.5x to 2.0x in 2013

$450M share repurchase program

$100M purchase during 3Q12 Additional purchases expected

Expected capital expenditures of approximately $120M in 2012 primarily driven by investments to expand capacity in Qualitest business

© 2012 Endo Pharmaceuticals Inc. All rights reserved 94

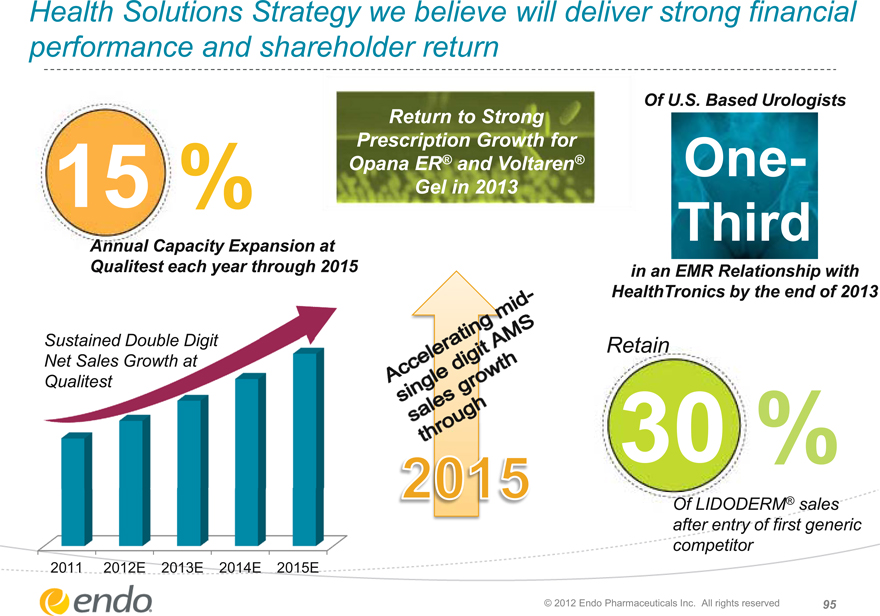

Health Solutions Strategy we believe will deliver strong financial performance and shareholder return

15%

Return to Strong Prescription Growth for Opana ER® and Voltaren® Gel in 2013

Annual Capacity Expansion at Qualitest each year through 2015

Of U.S. Based Urologists

One- Third

in an EMR Relationship with HealthTronics by the end of 2013

Sustained Double Digit Net Sales Growth at Qualitest

Accelerating mid-single digit AMS sales growth through 2015

Retain

30%

Of LIDODERM® sales after entry of first generic competitor

2011 2012E 2013E 2014E 2015E

© 2012 Endo Pharmaceuticals Inc. All rights reserved 95

Key Takeaways

Stable Base Business Assuming 2013 Lidoderm® Loss of Exclusivity

Revenue CAGR in the low single digit range from 2012 to 2015

Adjusted Diluted EPS CAGR in the low-single digit range from 2012 to

2015

Base case assumes one generic competitor for Lidoderm® through 2015

Excluding Lidoderm®, expect double-digit growth for company revenues

Capital Allocation

Balance of debt paydown, business development and share repurchase to support additional growth

Financial flexibility and significant cash flow from operations support growth in 2014 and beyond

Explore business development opportunities to support the organic growth potential in our business

© 2012 Endo Pharmaceuticals Inc. All rights reserved 96

endo® a vision for healthcare™

endo AMS Endo Pharmaceuticals HealthTronics Qualitest

97

Supplementary Financial Data

© 2012 Endo Pharmaceuticals Inc. All rights reserved 98

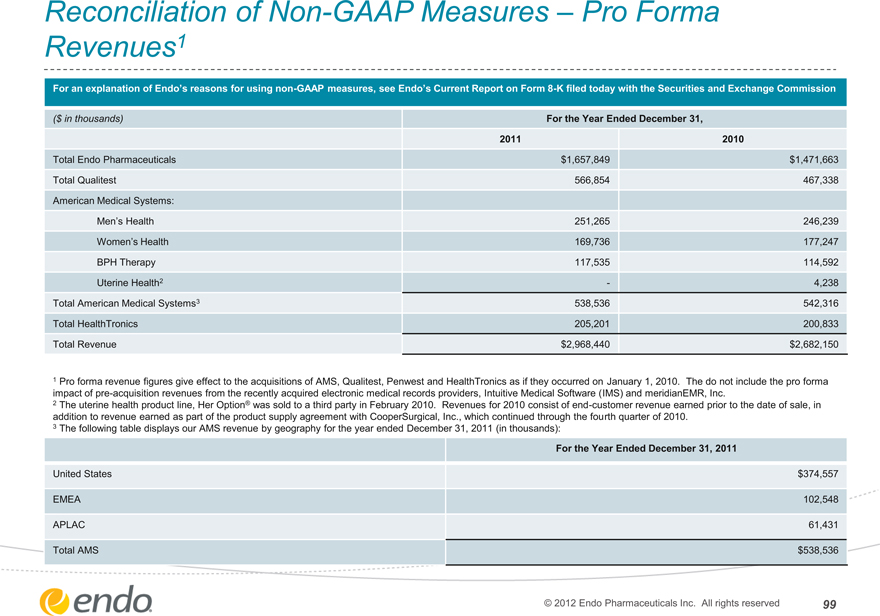

Reconciliation of Non-GAAP Measures – Pro Forma Revenues1

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission

($ in thousands)

Total Endo Pharmaceuticals Total Qualitest American Medical Systems:

Men’s Health

Women’s Health

BPH Therapy

Uterine Health2

Total American Medical Systems3 Total HealthTronics Total Revenue

For the Year Ended December 31,

2011 2010

$1,657,849 $1,471,663

566,854 467,338

251,265 246,239

169,736 177,247

117,535 114,592

— 4,238

538,536 542,316

205,201 200,833

$2,968,440 $2,682,150

1 Pro forma revenue figures give effect to the acquisitions of AMS, Qualitest, Penwest and HealthTronics as if they occurred on January 1, 2010. The do not include the pro forma impact of pre-acquisition revenues from the recently acquired electronic medical records providers, Intuitive Medical Software (IMS) and meridianEMR, Inc.

2 The uterine health product line, Her Option® was sold to a third party in February 2010. Revenues for 2010 consist of end-customer revenue earned prior to the date of sale, in addition to revenue earned as part of the product supply agreement with CooperSurgical, Inc., which continued through the fourth quarter of 2010.

3 The following table displays our AMS revenue by geography for the year ended December 31, 2011 (in thousands):

For the Year Ended December 31, 2011

United States

EMEA

APLAC

Total AMS

$374,557 102,548 61,431 $538,536

© 2012 Endo Pharmaceuticals Inc. All rights reserved 99

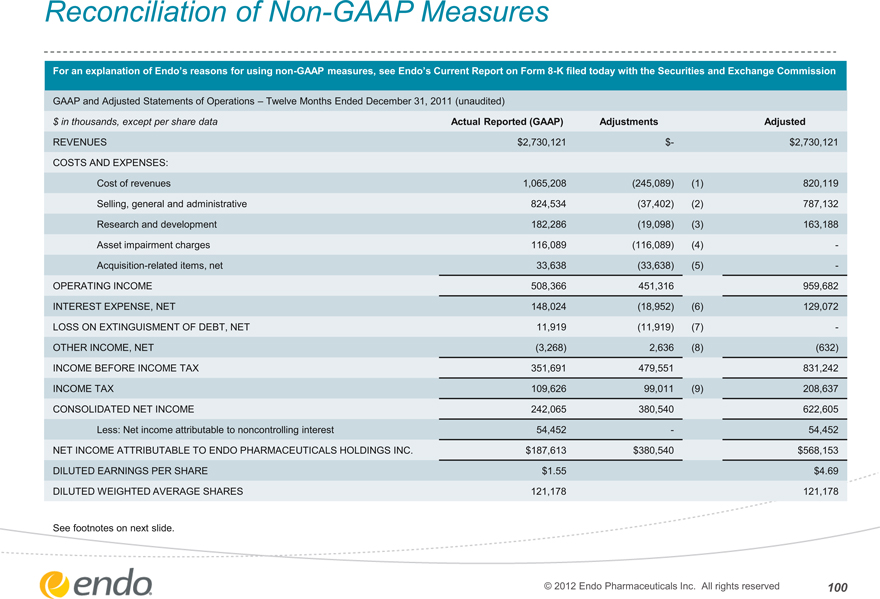

Reconciliation of Non-GAAP Measures

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission

GAAP and Adjusted Statements of Operations – Twelve Months Ended December 31, 2011 (unaudited)

$ in thousands, except per share data Actual Reported (GAAP) Adjustments Adjusted

REVENUES $2,730,121 $- $2,730,121

COSTS AND EXPENSES:

Cost of revenues 1,065,208 (245,089) (1) 820,119

Selling, general and administrative 824,534 (37,402) (2) 787,132

Research and development 182,286 (19,098) (3) 163,188

Asset impairment charges 116,089 (116,089) (4) -

Acquisition-related items, net 33,638 (33,638) (5) -

OPERATING INCOME 508,366 451,316 959,682

INTEREST EXPENSE, NET 148,024 (18,952) (6) 129,072

LOSS ON EXTINGUISMENT OF DEBT, NET 11,919 (11,919) (7) -

OTHER INCOME, NET (3,268) 2,636 (8) (632)

INCOME BEFORE INCOME TAX 351,691 479,551 831,242

INCOME TAX 109,626 99,011 (9) 208,637

CONSOLIDATED NET INCOME 242,065 380,540 622,605

Less: Net income attributable to noncontrolling interest 54,452 — 54,452

NET INCOME ATTRIBUTABLE TO ENDO PHARMACEUTICALS HOLDINGS INC. $187,613 $380,540 $568,153

DILUTED EARNINGS PER SHARE $1.55 $4.69

DILUTED WEIGHTED AVERAGE SHARES 121,178 121,178

See footnotes on next slide.

© 2012 Endo Pharmaceuticals Inc. All rights reserved 100

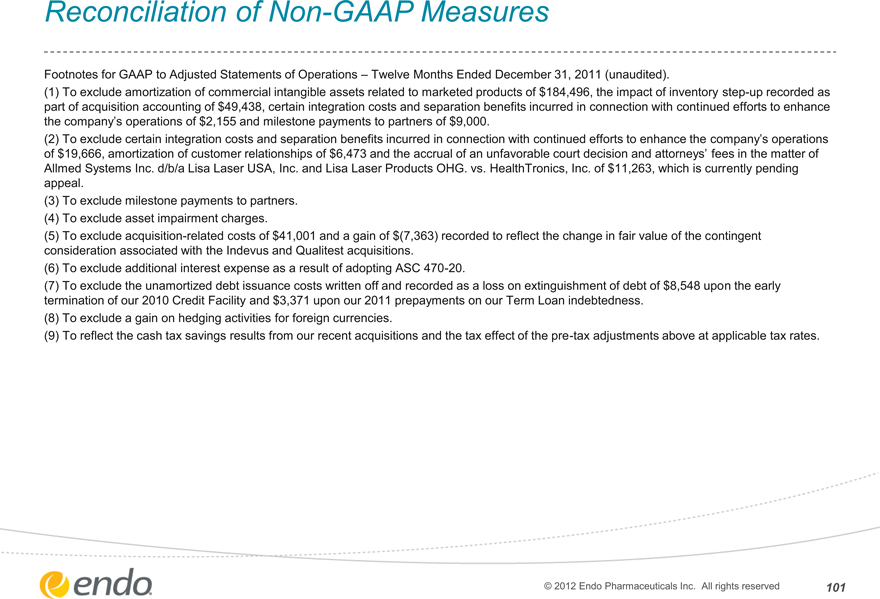

Reconciliation of Non-GAAP Measures

Footnotes for GAAP to Adjusted Statements of Operations – Twelve Months Ended December 31, 2011 (unaudited).

(1) To exclude amortization of commercial intangible assets related to marketed products of $184,496, the impact of inventory step-up recorded as part of acquisition accounting of $49,438, certain integration costs and separation benefits incurred in connection with continued efforts to enhance the company’s operations of $2,155 and milestone payments to partners of $9,000.

(2) To exclude certain integration costs and separation benefits incurred in connection with continued efforts to enhance the company’s operations of $19,666, amortization of customer relationships of $6,473 and the accrual of an unfavorable court decision and attorneys’ fees in the matter of

Allmed Systems Inc. d/b/a Lisa Laser USA, Inc. and Lisa Laser Products OHG. vs. HealthTronics, Inc. of $11,263, which is currently pending appeal.

(3) To exclude milestone payments to partners. (4) To exclude asset impairment charges.

(5) To exclude acquisition-related costs of $41,001 and a gain of $(7,363) recorded to reflect the change in fair value of the contingent consideration associated with the Indevus and Qualitest acquisitions.

(6) To exclude additional interest expense as a result of adopting ASC 470-20.

(7) To exclude the unamortized debt issuance costs written off and recorded as a loss on extinguishment of debt of $8,548 upon the early termination of our 2010 Credit Facility and $3,371 upon our 2011 prepayments on our Term Loan indebtedness.

(8) To exclude a gain on hedging activities for foreign currencies.

(9) To reflect the cash tax savings results from our recent acquisitions and the tax effect of the pre-tax adjustments above at applicable tax rates.

© 2012 Endo Pharmaceuticals Inc. All rights reserved

101

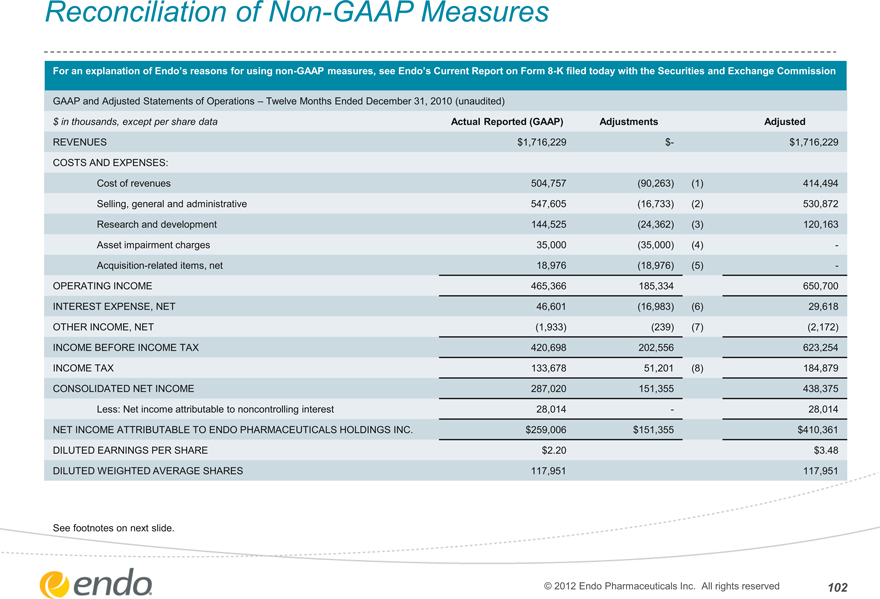

Reconciliation of Non-GAAP Measures

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission

GAAP and Adjusted Statements of Operations – Twelve Months Ended December 31, 2010 (unaudited)

$ in thousands, except per share data Actual Reported (GAAP) Adjustments Adjusted

REVENUES $1,716,229 $- $1,716,229

COSTS AND EXPENSES:

Cost of revenues 504,757 (90,263) (1) 414,494

Selling, general and administrative 547,605 (16,733) (2) 530,872

Research and development 144,525 (24,362) (3) 120,163

Asset impairment charges 35,000 (35,000) (4) -

Acquisition-related items, net 18,976 (18,976) (5) -

OPERATING INCOME 465,366 185,334 650,700

INTEREST EXPENSE, NET 46,601 (16,983) (6) 29,618

OTHER INCOME, NET (1,933) (239) (7) (2,172)

INCOME BEFORE INCOME TAX 420,698 202,556 623,254

INCOME TAX 133,678 51,201 (8) 184,879

CONSOLIDATED NET INCOME 287,020 151,355 438,375

Less: Net income attributable to noncontrolling interest 28,014 — 28,014

NET INCOME ATTRIBUTABLE TO ENDO PHARMACEUTICALS HOLDINGS INC. $259,006 $151,355 $410,361

DILUTED EARNINGS PER SHARE $2.20 $3.48

DILUTED WEIGHTED AVERAGE SHARES 117,951 117,951

See footnotes on next slide.

© 2012 Endo Pharmaceuticals Inc. All rights reserved

102

Reconciliation of Non-GAAP Measures

Footnotes for GAAP to Adjusted Statements of Operations – Twelve Months Ended December 31, 2010 (unaudited).

(1) To exclude amortization of commercial intangible assets related to marketed products of $83,974 and the impact of inventory step-up recorded as part of acquisition accounting of $6,289.

(2) To exclude certain costs incurred with connection with continued efforts to enhance the Company’s operations.

(3) To exclude a milestone-like payment and milestone and upfront payments to partners of $23,850 and certain costs incurred in connection with continued efforts to enhance the cost structure of the company of $512.

(4) To exclude asset impairment charges.

(5) To exclude acquisition-related costs of $70,396 as well as the impact, under purchase accounting, of a gain recorded to reflect the change in the company’s current estimate of fair value, in accordance with GAAP, of the contingent consideration associated with the Indevus acquisition of

($51,420).

(6) To exclude additional interest expense as a result of adopting ASC 470-20 of $17,296 and to exclude amortization of the premium on debt acquired from Indevus of ($313).

(7) To exclude changes in fair value of financial instruments, net.

(8) To reflect the cash tax savings results from our recent acquisitions and the tax effect of the pre-tax adjustments above at applicable tax rates.

© 2012 Endo Pharmaceuticals Inc. All rights reserved 103

Reconciliation of Non-GAAP Measures – Q3 2012

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with

the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Quarter Ending

September 30, 2012

Projected GAAP diluted income per common share $1.04

Upfront and milestone-related payments to partners $0.04

Amortization of commercial intangible assets and inventory step-up $0.48

Acquisition and integration costs related to recent acquisitions $0.06

Watson litigation settlement ($0.36)

Interest expense adjustment for ASC 470-20 and other treasury items $0.04

Tax effect of pre-tax adjustments at the applicable tax rates and certain other expected cash ($0.05)

tax savings as a result of recent acquisitions

Diluted adjusted income per common share guidance $1.25

The company’s guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of September 30, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved 104

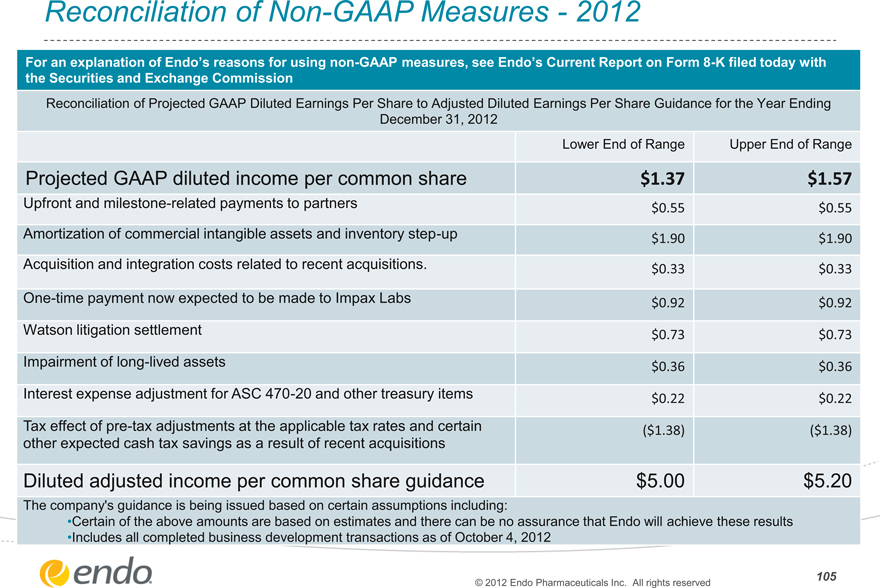

Reconciliation of Non-GAAP Measures—2012

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with

the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending

December 31, 2012

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share $1.37 $1.57

Upfront and milestone-related payments to partners $0.55 $0.55

Amortization of commercial intangible assets and inventory step-up $1.90 $1.90

Acquisition and integration costs related to recent acquisitions. $0.33 $0.33

One-time payment now expected to be made to Impax Labs $0.92 $0.92

Watson litigation settlement $0.73 $0.73

Impairment of long-lived assets $0.36 $0.36

Interest expense adjustment for ASC 470-20 and other treasury items $0.22 $0.22

Tax effect of pre-tax adjustments at the applicable tax rates and certain ($1.38) ($1.38)

other expected cash tax savings as a result of recent acquisitions

Diluted adjusted income per common share guidance $5.00 $5.20

The company’s guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of October 4, 2012

105

© 2012 Endo Pharmaceuticals Inc. All rights reserved

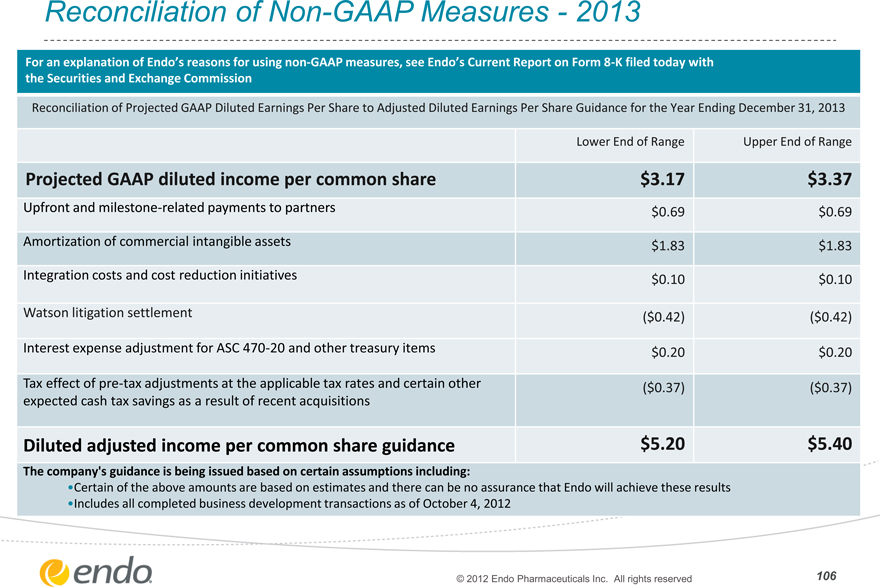

Reconciliation of Non-GAAP Measures—2013

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with

the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2013

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share $3.17 $3.37

Upfront and milestone-related payments to partners $0.69 $0.69

Amortization of commercial intangible assets $1.83 $1.83

Integration costs and cost reduction initiatives $0.10 $0.10

Watson litigation settlement ($0.42) ($0.42)

Interest expense adjustment for ASC 470-20 and other treasury items $0.20 $0.20

Tax effect of pre-tax adjustments at the applicable tax rates and certain other ($0.37) ($0.37)

expected cash tax savings as a result of recent acquisitions

Diluted adjusted income per common share guidance $5.20 $5.40

The company’s guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of October 4, 2012

© 2012 Endo Pharmaceuticals Inc. All rights reserved 106

Supplementary Information

107

© 2012 Endo Pharmaceuticals Inc. All rights reserved.

Opana® ER (oxymorphone HCl) CII extended release tablets

IMPORTANT SAFETY INFORMATION

OPANA® ER has a boxed warning as follows:

WARNING: POTENTIAL FOR ABUSE, IMPORTANCE OF PROPER PATIENT SELECTION AND LIMITATIONS OF USE

Potential for Abuse

OPANA®ER contains oxymorphone, which is a morphine-like opioid agonist and a Schedule II controlled substance, with an abuse liability similar to other opioid analgesics.

Oxymorphone can be abused in a manNer similar to other opioid agonisits, legal or illicit. This should be considered when prescribing or dispensing OPANA® ER in situations where the physician or pharmacist is concerned about an increased risk of misuse, abuse, or diversion.

Proper Patient Selection

OPANA® ER is an extended-release oral formulation of oxymorphone indicated for the management of moderate to severe pain when a continuous, around-the-clock opioid analgesic is needed for an extended period of time.

Limitations of Use

OPANA® ER is NOT intended for use as an needed analgesic.

OPANA® ER tablets are to be swallowed whole and are not to be cut, broken, chewed, dissolved, or crushed. Taking cut, broken, chewed, dissolved, or crushed OPANA® ER tablets leads to rapid release and absorption of a potentially fatal dose of oxymorphone.

Patients must not consume alcoholic beverages, or prescription or non-prescription medications containing alcohol, while on OPANA® ER therapy. The co-ingestion of alcohol with OPANA® ER may result in increased plasma levels and a potentially fatal overdose of oxymorphone.

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 108

Voltaren® Gel (diclophenac sodium topical gel) 1%

Indication

Voltaren® Gel is a nonsteroidal anti-inflammatory drug (NSAID) used for the relief of joint pain of osteoarthritis in the knees, ankles, feet, elbows, wrists, and hands. Voltaren Gel has not been studied for use on the spine, hip, or shoulder.

IMPORTANT SAFETY INFORMATION

Cardiovascular Risk

Nonsteroidal anti-inflammatory drugs (NSAIDs) may cause an increased risk of serious cardiovascular thrombotic events, myocardial infarction, and stroke, which can be fatal. This risk may increase with duration of use. Patients with cardiovascular disease or risk factors for cardiovascular disease may be at greater risk. Voltaren Gel is contraindicated for the treatment of perioperative pain in the setting of coronary artery bypass graft (CABG) surgery.

Gastrointestinal Risk

NSAIDs cause in increased risk of serious gastrointestinal adverse events including bleeding, ulceration, and perforation of the stomach or intestines, which can be fatal. These events can occur at any time during use and without warning symptoms. Elderly patients are at greater risk for serious gastrointestinal events.

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 109

Lidoderm® (lidocaine patch 5%)

Indication

LIDODERM® (lidocaine patch 5%) is indicated for relief of pain associated with post-herpetic neuralgia. Apply only to intact skin.

Important Safety Information

LIDODERM is contraindicated in patients with a history of sensitivity to local anesthetics (amide type) or any product component.

Even a used LIDODERM patch contains a large amount of lidocaine (at least 665 mg). The potential exists for a small child or pet to suffer serious adverse effects from chewing or ingesting a new or used LIDODERM patch, although the risk with this formulation has not been evaluated. It is important for patients to store and dispose of LIDODERM out of reach of children, pets, and others.

Excessive dosing, such as applying LIDODERM to larger areas or for longer than the recommended wearing time, could result in increased absorption of lidocaine and high blood concentrations leading to serious adverse effects.

Avoid contact of LIDODERM with the eye. If contact occurs, immediately wash the eye with water or saline and protect it until sensation returns. Avoid the use of external heat sources as this has not been evaluated and may increase plasma lidocaine levels.

Patients with severe hepatic disease are at greater risk of developing toxic blood concentrations of lidocaine, because of their inability to metabolize lidocaine normally. LIDODERM should be used with caution in patients receiving Class I antiarrhythmic drugs (such as tocainide and mexiletine) since the toxic effects are additive and potentially synergistic. LIDODERM should also be used with caution in pregnant (including labor and delivery) or nursing mothers.

Allergic reactions, although rare, can occur.

During or immediately after LIDODERM treatment, the skin at the site of application may develop blisters, bruising, burning sensation, depigmentation, dermatitis, discoloration, edema, erythema, exfoliation, irritation, papules, petechia, pruritus, vesicles, or may be the locus of abnormal sensation. These reactions are generally mild and transient, resolving spontaneously within a few minutes to hours. Other reactions may include dizziness, headache and nausea.

When LIDODERM is used concomitantly with local anesthetic products, the amount absorbed from all formulations must be considered.

Immediately discard used patches or remaining unused portions of cut patches in household trash in a manner that prevents accidental application or ingestion by children, pets, or others.

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 110

Endocare® Cryocare Systems

The Endocare® Cryocare Systems consists of a compact, easy-to-operate console and associated accessories that include Endocare

CryoProbe™ devices to deliver cold temperatures to the therapeutic tissue and Endocare TempProbe to monitor temperatures in the surrounding tissue. The Cryocare Systems are intended for use in open, minimally invasive or endoscopic procedures in the areas in general surgery, urology, gynecology, oncology, neurology, dermatology, ENT, proctology, pulmonary surgery and thoracic surgery. The systems are designed to freeze/ablate tissue by the application of extreme cold temperatures including prostate and kidney tissue, liver metastases, tumors, skin lesions, and warts.

Prior to using these devices, please review the Operator’s Manual and directions for use for a complete listing of indications, warnings, precautions and safety information. Rx Only

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 111

AMS 700® and Inhibizone®

The AMS 700® Series Inflatable Penile Prosthesis is intended for use in the treatment of chronic, organic, male erectile dysfunction (impotence). These devices are contraindicated in patients who have active urogenital infections or active skin infections in the region of surgery or (for the AMS 700 with InhibiZone® have a known sensitivity or allergy to rifampin, minocycline, or other tetracyclines). Implantation will make latent natural or spontaneous erections, as well as other interventional treatment options, impossible. Men with diabetes, spinal cord injuries or open sores may have an increased risk of infection. Failure to evaluate and treat device erosion may result in infection and loss of tissue. Implantation may result in penile shortening, curvature, or scarring. Possible adverse events include, but are not limited to, urogenital pain (usually associated with healing), urogenital edema, urogenital ecchymosis, urogenital erythema, reservoir encapsulation, patient dissatisfaction, auto-inflation, mechanical malfunction, and impaired urination.

Prior to using these devices, please review the Instructions for Use for a complete listing of indications, contraindications, warnings, precautions and potential adverse events. Rx Only

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 112

AMS Spectra®

The AMS Spectra® Concealable Penile Prosthesis is a sterile, non-pyrogenic, single-use implant that is intended for use in the treatment of chronic, organic, erectile dysfunction (impotence) in men who are determined to be suitable candidates for implantations surgery. These devices are contraindicated in patients who: have active urogenital infections or active skin infections in the region of surgery; patients whose proximal corporal length measurements is less than the proximal rigid section of the Spectra cylinders, or whose total intracorporal length is not within the range of 12cm to 27.5cm; patients who require repeated endoscopic procedures; or patients who have compromised tissue and as a result cannot withstand constant pressure. Implantation will make latent natural or spontaneous erections, as well as other interventional treatment options, impossible. Men with diabetes, spinal cord injuries or open sores may have an increased risk of infection. Failure to evaluate and treat device erosion may result in infection and loss of tissue. Implantation may result in penile shortening, curvature, or scarring. Possible adverse events include, but are not limited to: infection, erosion, migration, extrusion, mechanical malfunction, patient dissatisfaction, adverse tissue reaction, allergic reaction, pain, urinary obstruction, and silicone particle migration. Prior to using these devices, please review the Instructions for Use for a complete listing of indications, contraindications, warnings, precautions and potential adverse events. Rx Only

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 113

AMS 800® and Inhibizone®

The AMS 800® Urinary Control System (or Artificial Urinary Sphincter) is intended to treat urinary incontinence due to reduced outlet resistance (Intrinsic Sphincter Deficiency) following prostate surgery. The device is contraindicated in patients who are determined to be poor surgical candidates, have an irreversibly blocked lower urinary tract, have irresolvable detrusor hyperreflexia or bladder instability, or (for the AMS 800 with Inhibizone® have a known sensitivity or allergy to rifampin, minocycline or other tetracyclines). Patients with urinary tract infections, diabetes, spinal cord injuries, open sores or regional skin infections may have increased infection risk. Device-tissue erosion may occur. Proper patient evaluation, selection and counseling of realistic expectations should occur. Possible adverse events include, but are not limited to, compromised device function, pain/ discomfort, delayed wound healing, migration and recurrent incontinence.

Prior to using these devices, please review the Instructions for Use for a complete listing of indications, contraindications, warnings, precautions and potential adverse events. Rx Only

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 114

AMS AdVance®

The AMS AdVance® Male Sling System is intended for the placement of a suburethral sling for the treatment of male stress urinary incontinence (SUI). These devices are contraindicated for patients with urinary tract infections, blood coagulation disorders, a compromised immune system or any other condition that would compromise healing, with renal insufficiency, and upper urinary tract relative obstruction. Proper patient evaluation, selection and counseling of realistic expectations should occur. A six month period of non-invasive treatment (e.g., behavior modification, bladder exercises, biofeedback, extra corporeal magnetic stimulation of the pelvic floor, or drug therapy) is recommended before a sling implant is considered for males with SUI. The following warnings and precautions are advised: The possibility of urgency incontinence should be carefully considered before a sling implant is conducted.

It is recommended that good bladder function (bladder capacity >250ml and post void residual urine <50 ml) be demonstrated by candidates for a male sling.

It is recommended that the presence of bladder neck or urethral strictures be ruled out for male sling candidates.

It is recommended that a condition involving cystitis, urethritis or prostatitis be ruled out for male sling candidates.

It is recommended that detrusor instability of a neurological origin be ruled out for male sling candidates.

Possible adverse events include, but are not limited to, acute inflammatory tissue reaction and transitory local irritation which has been reported with the use of the absorbable suture. Prior to using these devices, please review the Instructions for Use for a complete listing of indications, contraindications, warnings, precautions and potential adverse events. Rx Only

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 115

Elevate®, Apogee®, Perigee®

As with any surgical procedure, inherent risks are present. Although rare, some of the most severe risks associated with prolapse procedures include bleeding (hematoma), perforation of vessels, nerves, bladder, ureter, urethra, or bowel; erosion of the implant through neighboring tissue, and infection. Some of the most common risks include; vaginal extrusion, De Novo/ worsening incontinence, dyspareunia, and pain.

If infection or erosion occur, the entire mesh may have to be removed or revised. Prolapse repair may unmask pre-existing incontinence. Do not perform this procedure on pregnant patients.

Prior to using these devices, please review the Instructions for Use for a complete listing of indications, contraindications, warnings, precautions, and potential adverse events. This document is written for professional medical audiences. Contact AMS for lay publications. AMS periodically updates product literature. If you have questions regarding the currency of this information please contact AMS. Rx Only

© 2012 Endo Pharmaceuticals Inc. All rights reserved. 116

BioArc®, MiniArc®, MiniArc Precise™, MiniArc® Pro, Monarc®, RetroArc®, Sparc®