Exhibit 99.1

Exhibit 99.1

Endo – The Path Forward

June 5, 2013

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Forward Looking Statements; Non-GAAP Financial Measures

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Investors should note that many factors, as more fully described under the caption “Risk Factors” in our Form 10-K, Form 10-Q and Form 8-K filings with the Securities and Exchange Commission and as otherwise enumerated herein or therein, could affect our future financial results and could cause our actual results to differ materially from those expressed in forward-looking statements contained in our Annual Report on Form 10-K. The forward-looking statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

This presentation may refer to non-GAAP financial measures, including adjusted diluted EPS, that are not prepared in accordance with accounting principles generally accepted in the United States and that may be different from non-GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8-K filed with the SEC for Endo’s reasons for including those non-GAAP financial measures in this presentation. No reconciliation to GAAP amounts has been provided because the majority of the amounts excluded from the comparable GAAP amounts are not currently possible to estimate with a reasonable degree of accuracy.

© 2013 Endo Pharmaceuticals Inc. All rights reserved 2

Assessment of strategy and businesses

Initiated a comprehensive business assessment in late March

Incorporated input from a variety of stakeholders, including investors and customers

Developed a revised strategy

@2013 Endo Pharmaceuticals, Inc. All rights reserved

.

New Strategic Direction for Endo

Aspire to be a top tier specialty healthcare company

Shift focus from integrated health solutions to

maximizing value of each of our core businesses

Participate in specialty areas offering above average

growth and favorable margins

Transform our operating model to maximize growth

potential and cash flow generation

Continue our commitment to serving our patients

and customers

Allows Endo to maximize shareholder value by

adapting to market realities and portfolio changes

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Near-term implications of our revised strategic direction

| | 1 | | Drive organic growth through our core businesses |

| | 2 | | Explore strategic alternatives for HealthTronics |

| | 3 | | Implement lean operating model |

| | 4 | | Sharpen R&D focus on near-term opportunities |

| | 5 | | Pursue accretive, value-creating M&A opportunities |

| | 6 | | Optimize capital structure |

@20

13 Endo Pharmaceuticals, Inc. All rights reserved.

Endo Pharmaceuticals

Drive performance of growth assets: SUPPRELIN® LA, Voltaren® Gel, FORTESTA® Gel

Maximize potential of late stage assets, e.g., BEMA-buprenorphine, AVEED™

Optimize value capture for OPANA® ER

Adopt a targeted model for product commercialization

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Qualitest

Maximize sales from existing core products and capitalize on market opportunities

Drive launches from ANDA pipeline

Expand generics R&D capabilities to enter additional attractive segments with high barriers to entry

Make capital investments to improve margins and upgrade capabilities

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

AMS

Men’s health: Maintain profitability and grow implant

volume

Women’s health: Limit product decline with a focus

on physician education

Prostate Health: Leverage Goliath clinical and

economic data to drive performance

International: Maximize growth and margins by

optimizing go-to-market models

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

HealthTronics

HealthTronics has limited fit with new strategic direction given its services focus and margin structure

In process of evaluating strategic options for

HealthTronics (as a full business or for its component parts)

In the interim, we remain fully committed to our customers

9

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

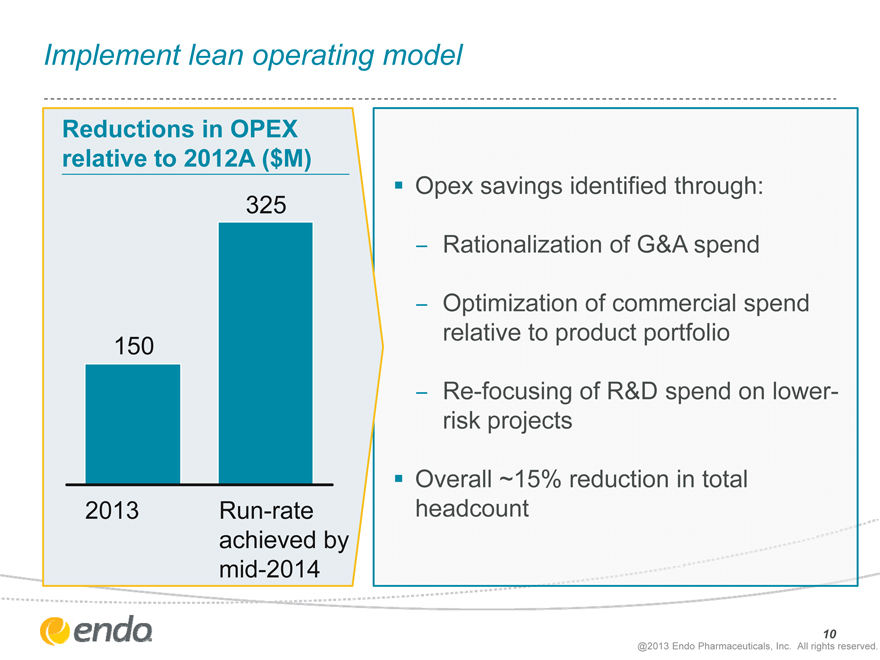

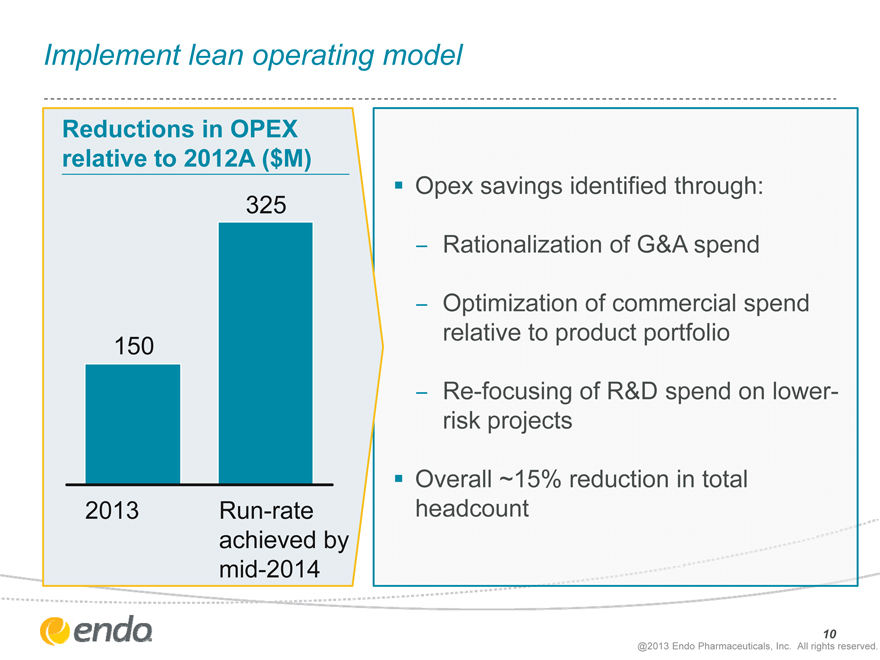

Implement lean operating model

Reductions in OPEX

relative to 2012A ($M)

? Opex savings identified through:

325

? Rationalization of G&A spend

? Optimization of commercial spend

150 relative to product portfolio

? Re-focusing of R&D spend on lower-

risk projects

? Overall ~15% reduction in total

2013 Run-rate headcount

achieved by

mid-2014

10

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Sharpen R&D Focus

Prudently invest in the near-term while preserving our capability to drive long-term organic growth

Refocus branded pharma R&D on development capabilities and late stage development programs

Focus AMS R&D footprint while preserving development expertise and select late-stage assets

Invest in Qualitest to strengthen generics capabilities in attractive segments

Monetize non-core programs / projects

Share capabilities and platforms across Endo businesses to drive further efficiencies

11

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Pursue accretive, value-creating M&A opportunities

Guiding Principles for M&A

Focus on shareholder value creation

Pursue opportunities with near-term accretion

??Target on market opportunities

??Focus on cost synergies and revenue upsides

Execute deals within rigorous capital allocation framework using robust hurdle rates

Evaluate a range of opportunities

??Opportunistic without constraint of current therapeutic footprint

12

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Optimize capital structure

Grow EBITDA through cost reductions and accretive acquisitions

Optimize working capital

Maintain capital structure flexibility to support acquisitions and drive shareholder value

13

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Strengthen talent and organization

Move to integrated and empowered business units with decentralized decision making and well-defined accountabilities

Retain, augment, and develop top talent with both strategic and operational expertise

Strengthen company culture by emphasizing incentive structure designed to deliver high-performance orientation

Develop and deploy lean and agile operating structure with enhanced execution capabilities and operating efficiencies

14

@2013 Endo Health solutions Inc. All rights reserved.

Strategic priorities for next 12-18 months

Key priorities

??Drive organic growth

??Progress late-stage pipeline

??Improve operating margins through OPEX optimization

??Explore alternatives for non-core assets (HealthTronics and select R&D programs)

??Execute 2-3 accretive deals and integrate successfully

??Optimize capital structure

??Implement new organizational model and bolster key talent

??Successfully deploy Qualitest CAPEX program and capture upsides

15

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

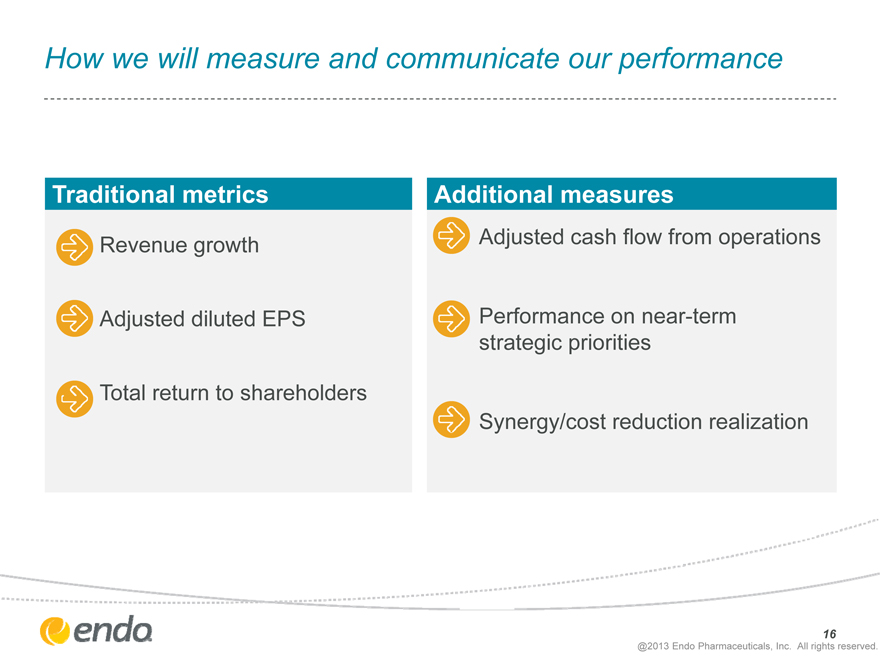

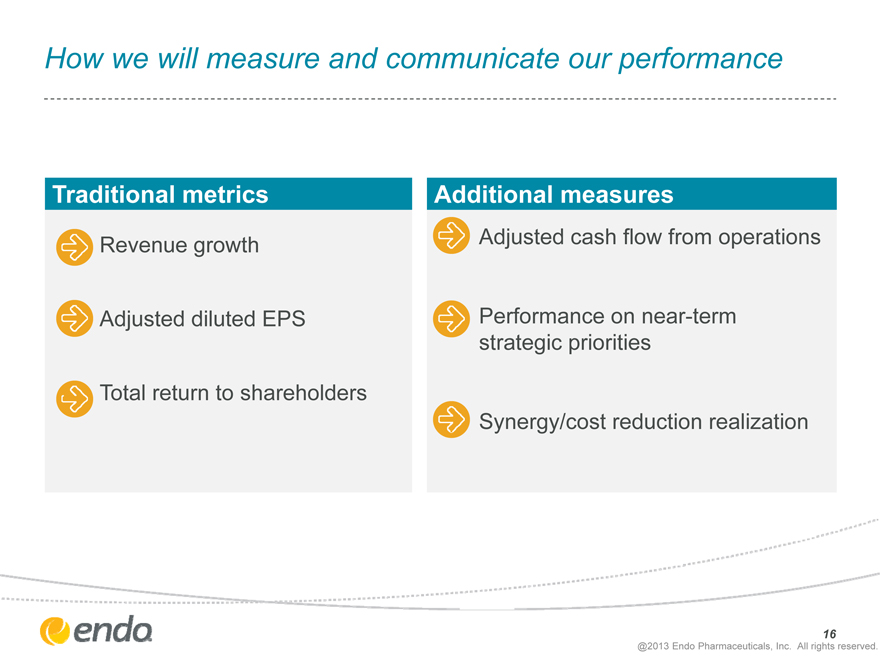

How we will measure and communicate our performance

Traditional metrics Additional measures

Revenue growth Adjusted cash flow from operations

Adjusted diluted EPS Performance on near-term strategic priorities

Total return to shareholders

Synergy/cost reduction realization

16

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

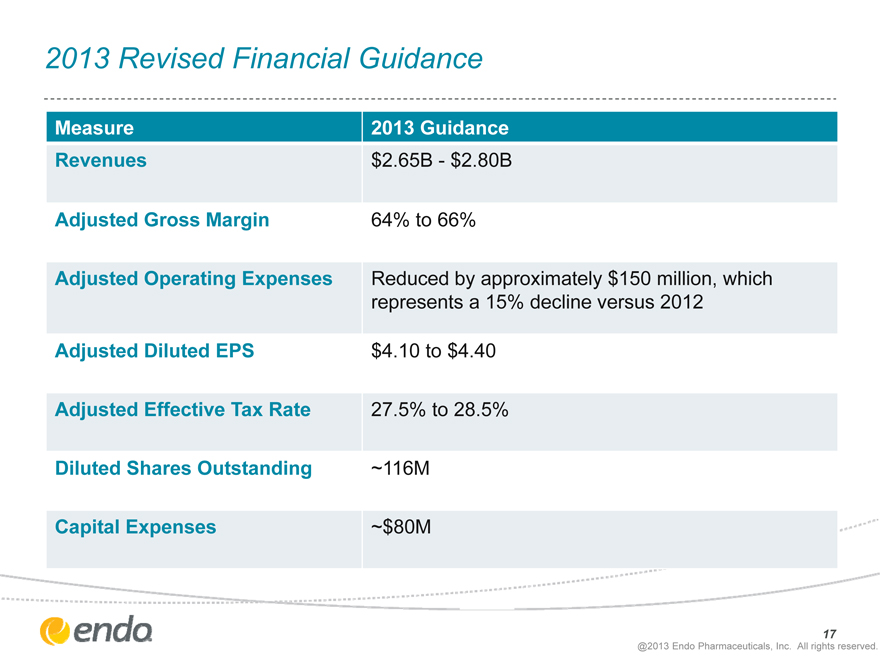

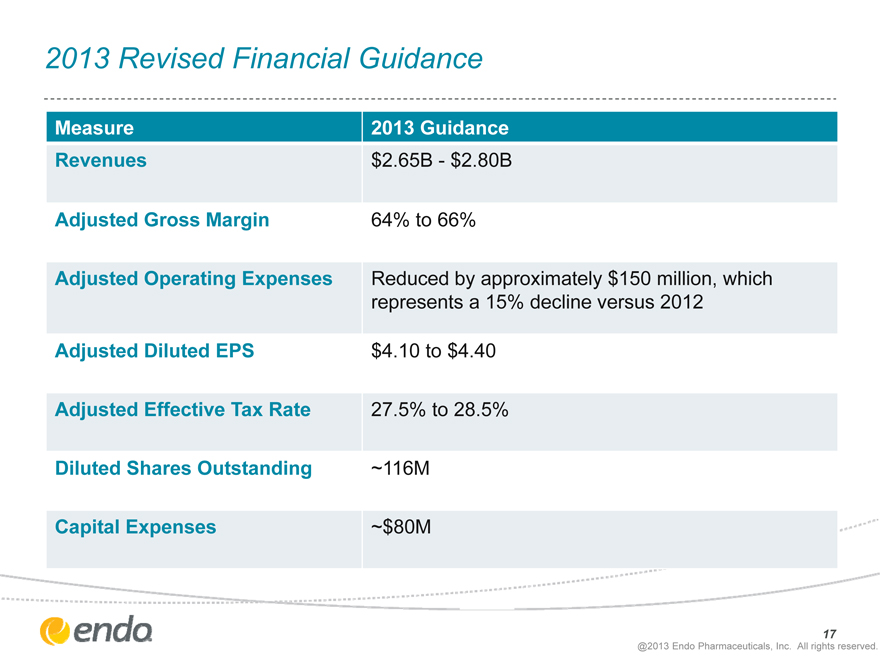

2013 Revised Financial Guidance

Measure 2013 Guidance Revenues $2.65B—$2.80B

Adjusted Gross Margin 64% to 66%

Adjusted Operating Expenses Reduced by approximately $150 million, which represents a 15% decline versus 2012

Adjusted Diluted EPS $4.10 to $4.40 Adjusted Effective Tax Rate 27.5% to 28.5% Diluted Shares Outstanding ~116M

Capital Expenses ~$80M

17

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Endo – The Path Forward

June 5, 2013

18

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

Appendix

19

@2013 Endo Pharmaceuticals, Inc. All rights reserved.

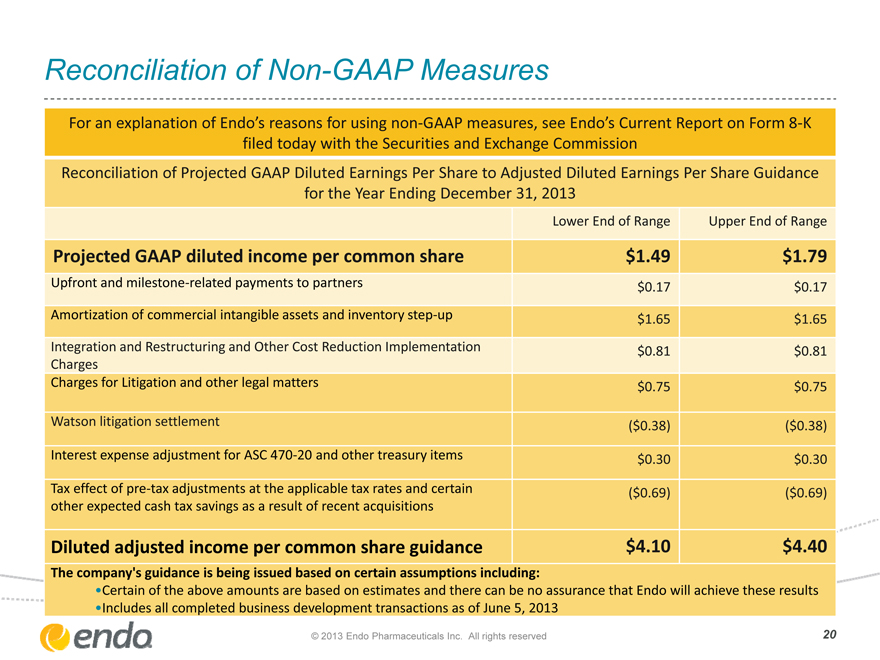

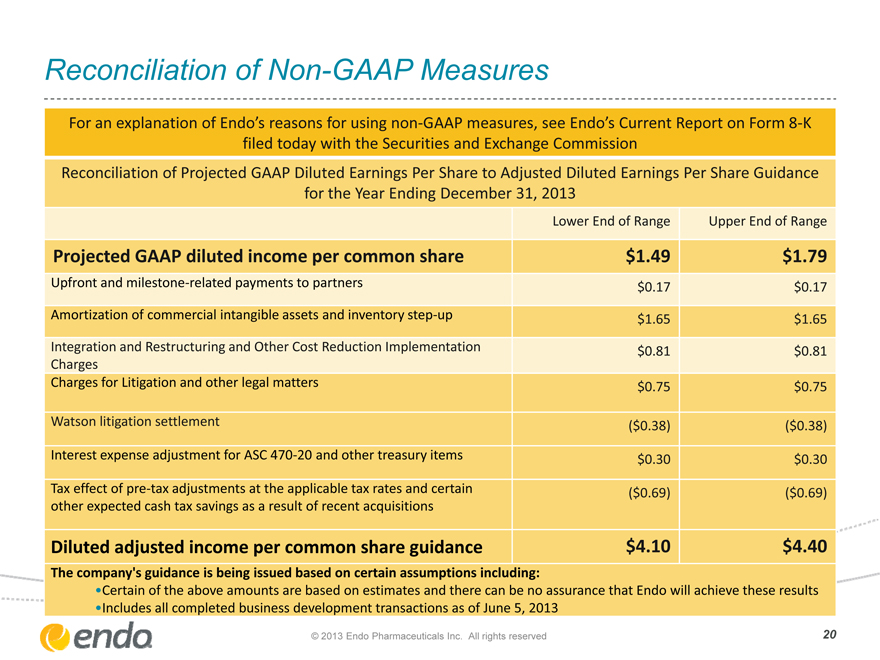

Reconciliation of Non-GAAP Measures

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K

filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance

for the Year Ending December 31, 2013

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share $1.49 $1.79

Upfront and milestone-related payments to partners $0.17 $0.17

Amortization of commercial intangible assets and inventory step-up $1.65 $1.65

Integration and Restructuring and Other Cost Reduction Implementation $0.81 $0.81

Charges

Charges for Litigation and other legal matters $0.75 $0.75

Watson litigation settlement($0.38)($0.38)

Interest expense adjustment for ASC 470-20 and other treasury items $0.30 $0.30

Tax effect of pre-tax adjustments at the applicable tax rates and certain($0.69)($0.69)

other expected cash tax savings as a result of recent acquisitions

Diluted adjusted income per common share guidance $4.10 $4.40

The company’s guidance is being issued based on certain assumptions including:

•Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

•Includes all completed business development transactions as of June 6, 2013

© 2013 Endo Pharmaceuticals Inc. All rights reserved 20