Investor Presentation

February 2004

Safe Harbor Disclosure Notice

The information contained in this presentation is as of February 12, 2004. AsiaInfo assumes no obligation to update any forward-looking statements contained in this presentation as a result of new information or future events or developments.

This presentation contains forward-looking information about AsiaInfo’s operating results and business prospects that involve substantial risks and uncertainties. You can identify these statements by the fact that they use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. Among the factors that could cause actual results to differ materially are the following: government telecommunications infrastructure and budgetary policy in China; our ability to maintain our concentrated customer base; the long and variable cycles for our products and services that can cause our revenues and operating results to vary significantly from period to period; our ability to meet our working capital requirements; our ability to retain our executive officers; our ability to attract and retain skilled personnel; potential liabilities we are exposed to because we extend warranties to our customers; risks associated with cost overruns and delays; our ability to develop or acquire new products or enhancements to our software products that are marketable on a timely and cost-effective basis; our ability to adequately protect our proprietary rights; the competitive nature of the markets we operate in; political and economic policies of the Chinese government. A further list and description of these risks, uncertainties, and other matters can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2002, and in our periodic reports on Forms 10-Q and 8-K (if any) ) filed with the United States Securities and Exchange Commission and available at www.sec.gov.

2004-2-13 AsiaInfo Technologies (China), Ltd. 2

Agenda

• Company History

• Our Telecom Business

• Expansion into New Vertical Markets

• New Business Line: Service Provider

• Recurring Revenues from Professional Maintenance and Support Services

• Financial Overview

• Conclusion

2004-2-13 AsiaInfo Technologies (China), Ltd. 3

Company Overview

• A leading provider of total customer solutions in China, with a focus on telecom network solutions and software solutions, as well as HR Management (HRM) and Business Intelligence (BI) solutions targeted toward multiple industries.

– Deep relationships with telecom clients across the value chain to provide high-end telecom solutions.

– Leveraging software and service expertise across multiple industries.

– Generating recurring revenue from professional maintenance and support services.

– Entering the Service Provider (SP) business.

• International quality software with local relationships and understanding.

• Positive outlook for 2004 and beyond.

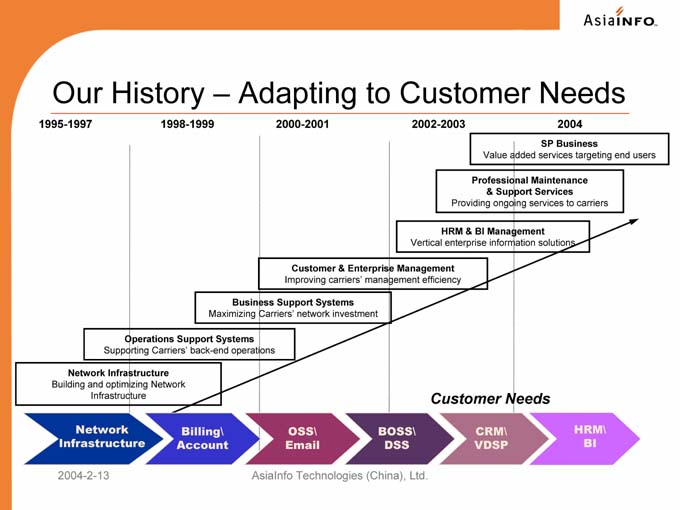

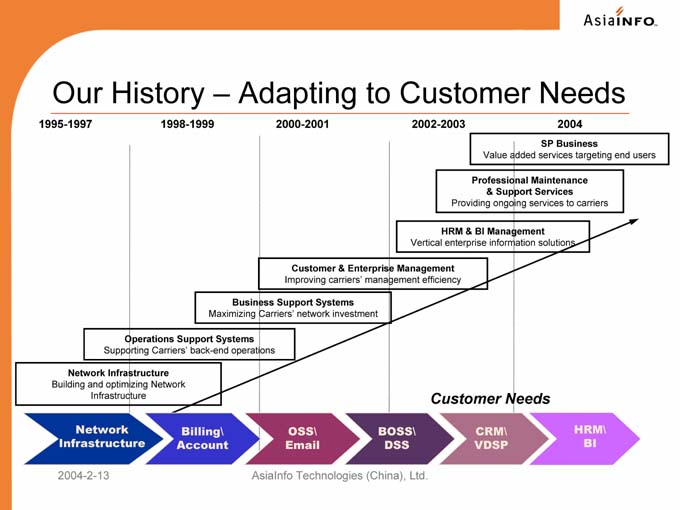

Our History – Adapting to Customer Needs

1995-1997 1998-1999 2000-2001 2002-2003 2004

SP Business

Value added services targeting end

Professional Maintenance

& Support Services

Providing ongoing services to carriers

HRM & BI Management

Vertical enterprise information solutions

Customer & Enterprise Management

Improving carriers’ management efficiency

Business Support Systems

Maximizing Carriers’ network investment

Operations Support Systems

Supporting Carriers’ back-end operations

Network Infrastructure

Building and optimizing Network

Infrastructure Customer Needs

Network Billing\ OSS\ BOSS\ CRM\ HRM\

Infrastructure Account Email DSS VDSP BI

2004-2-13 AsiaInfo Technologies (China), Ltd. 5

China’s Telecom Market Environment

• Rapid industry revenue and subscriber base growth:

– China’s telecom carriers revenue growing faster than overall international market rate.

– Fixed-line subscribers will continue to grow, but the growth rate will decline.

– China has the world’s largest mobile market and it’s growing rapidly – expected to surpass 300 million by the end of 2005.

– China’s Internet users are expected to exceed 100 million in 2004 and reach 123 million in 2005.

• Industry restructuring largely completed:

– Capital expenditure will be cautious but is expected to grow by 6% per year in 2005 and 2006.

– Capital expenditure in operation support systems is expected to increase in 2005-2006 at a penetration rate of 7.2%.

– Investment in 3G networks and NGN (Next Generation Network) is expected to grow in 2005-2006.

• Increased competition and public listings pressuring China’s telecom carriers to enhance efficiency and improve Average Revenue Per User.

• Trend towards more broadband-based applications, indicating future IP-related opportunities.

Source: China Ministry of Information Industry (MII) and iResearch

Our Strengths in the Telecom Market

Our Competencies

Adapting to Sales & Marketing

Industry Expertise Technology customer needs Project Management

Capability

Our Solutions

Business Customer

Network Business

Management Operation Support Relationship SMS / Email / VC

Intelligence

Systems Management

Network Security Supply Chain Service Management

Billing

Infrastructure Management Management Platform

Our Business Lines

Network/System Professional

Software Solutions Maintenance and Service Provider

Integration

Support Services

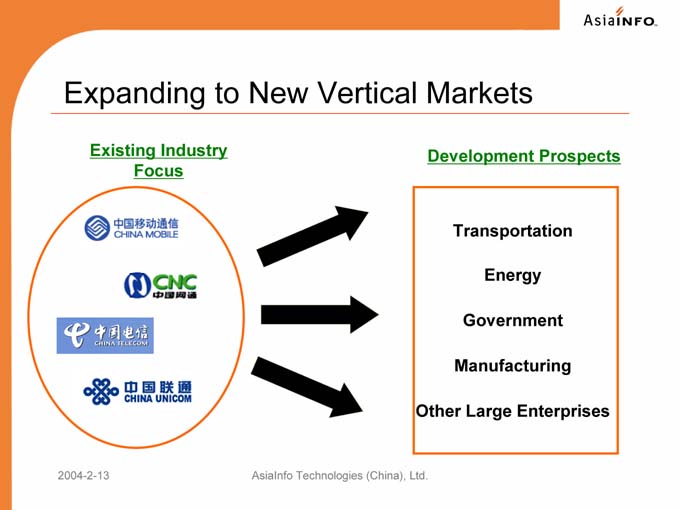

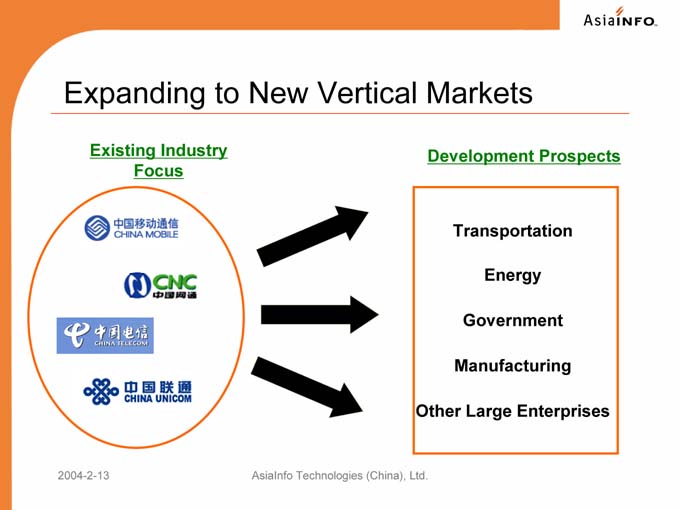

Expanding to New Vertical Markets

Existing Industry Development Prospects

Focus

Transportation

Energy

Government

Manufacturing

Other Large Enterprises

2004-2-13 AsiaInfo Technologies (China), Ltd. 8

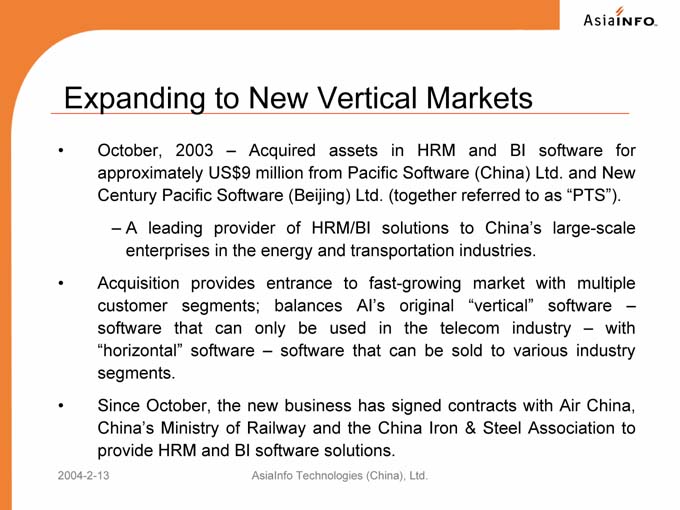

Expanding to New Vertical Markets

• October, 2003 – Acquired assets in HRM and BI software for approximately US$9 million from Pacific Software (China) Ltd. and New Century Pacific Software (Beijing) Ltd. (together referred to as “PTS”).

– A leading provider of HRM/BI solutions to China’s large-scale enterprises in the energy and transportation industries.

• Acquisition provides entrance to fast-growing market with multiple customer segments; balances AI’s original “vertical” software –software that can only be used in the telecom industry – with “horizontal” software – software that can be sold to various industry segments.

• Since October, the new business has signed contracts with Air China, China’s Ministry of Railway and the China Iron & Steel Association to provide HRM and BI software solutions.

2004-2-13 AsiaInfo Technologies (China), Ltd. 9

Opportunities in HRM and BI Markets

• Rapid global growth:

– Global HR services expenditures expected to reach US$103.3 billion by 2007 (IDC).

– Global BI market expected to grow by an average annual growth rate of 27% over the next two years (IDC).

• China’s market is also expanding quickly:

– More than 60% of Chinese enterprises expected to invest in HRM systems in the next two years (CCID).

– China’s HRM market will reach a scale of $100-150 million by 2005 (CCID).

• Chinese large enterprises focusing on improving efficiency due to increasing market competition and encouragement from government.

• AsiaInfo’s in-depth China knowledge is a strong competitive advantage over international players.

Creating New Opportunities

AsiaInfo’s Core Competencies AsiaInfo’s Offerings

• Industry Expertise • Business Operation

• Project management Support Systems

• Technology • Business Intelligence

Development • Network Management

• Adapting to Customer • Customer Relationship

Needs Management

• Sales & Marketing • Application Solutions

Capabilities • HR Management

Solutions

CROSS SELLING OPPORTUNITIES

2004-2-13 AsiaInfo Technologies (China), Ltd. 11

Our Products and Solutions

AI OpenBOSS

Billing, Mediation, Invoicing

AI OpenApp

Email, Messaging, AI OpenBI

Video Conference Data-warehouse Solution,

Data-mining Application

AI OpenHRM

Human Resources AI OpenNetXpert

Management System Customer Network Management

Platform and Application,

Disaster Recovery

AI OpenPRM AI OpenCRM

Channel Mgmt, Settlement, Order Entry,

Content Mgmt Call Center, Invoicing,

Order Management

2004-2-13 AsiaInfo Technologies (China), Ltd. 12

New Business Line: Service Provider

• With the boom of China’s mobile text messaging business, new value-added telecom services are rapidly developing. AsiaInfo is now moving to enter this quickly growing and attractive Service Provider (SP) market.

• Worldwide trends are positive:

- Revenue from Wireless Data Services will grow at a 96% CAGR from 2001 to 2006, to reach US$20 billion worldwide by 2006 (Gartner Group).

- Revenue of Internet Service Providers will grow at a 38% CAGR from 2001 to 2006, to reach US$10-20 billion each year (Gartner Group).

• Huge market potential in China:

- Mobile data services are expected to grow at an annual rate of 96%, while Internet services are expected to maintain an annual growth rate of 38% (Gartner Group).

- Investments in VAS of China’s four largest operators are expected to reach an annual growth rate of 78% in the next two years (Gartner Group).

- China’s SMS market is expected to reach US$4 billion by 2004 (Norson).

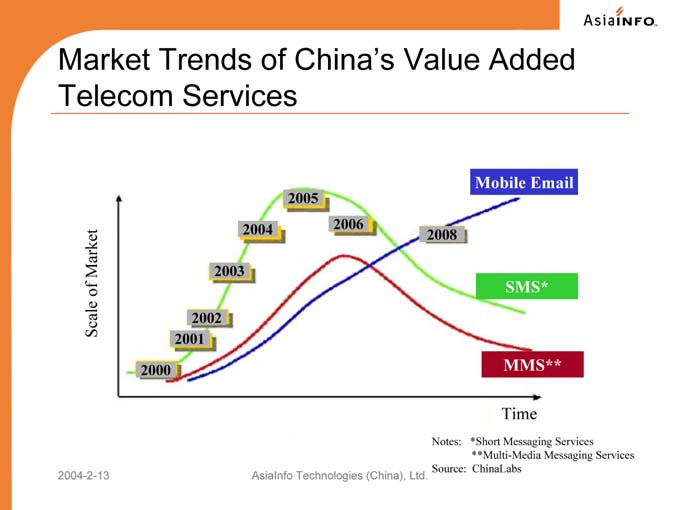

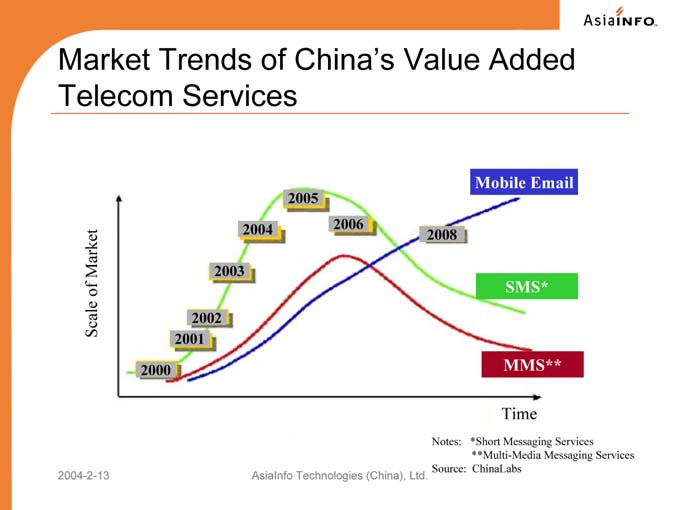

Market Trends of China’s Value Added Telecom Services

Mobile Email

2005

2004 2006

2008

2003

SMS*

Scale of Market 2002

2001

2000 MMS**

Time

Notes: *Short Messaging Services **Multi-Media Messaging Services Source: ChinaLabs

2004-2-13 AsiaInfo Technologies (China), Ltd. 14

AsiaInfo is Well Positioned to Enter SP Market

• AsiaInfo is already:

-The largest carrier-class email solution provider in China (60m licenses). -The leading solution provider of mobile email and SMS for China Mobile.

-A unique solution provider of multimedia messaging solution (email and mobile mail) and video conferencing for China Unicom.

-The leading solution provider of mobile-based stock transaction platform for China Unicom.

-A provider of broadband solutions for China Telecom and China Netcom.

• Company pursuing efforts with carriers to develop and offer advanced value added services to end users:

- MOU signed with Tianjin Mobile for mobile email services in February 2004.

- Established a New Services Strategic Business Unit focusing on SP related business.

- Exploring opportunities for direct investments in SP area.

Recurring Revenue from Professional Maintenance and Support Services

• Expansion of software solutions business to provide post sales services.

• Telecom carriers in China are paying more attention to professional maintenance of their supporting systems.

• AsiaInfo has already signed two agreements with Shanghai Mobile and Liaoning Mobile for long term professional maintenance and support services.

• AsiaInfo’s long term strategic relationships with carriers give a competitive advantage in this area.

2004-2-13 AsiaInfo Technologies (China), Ltd. 16

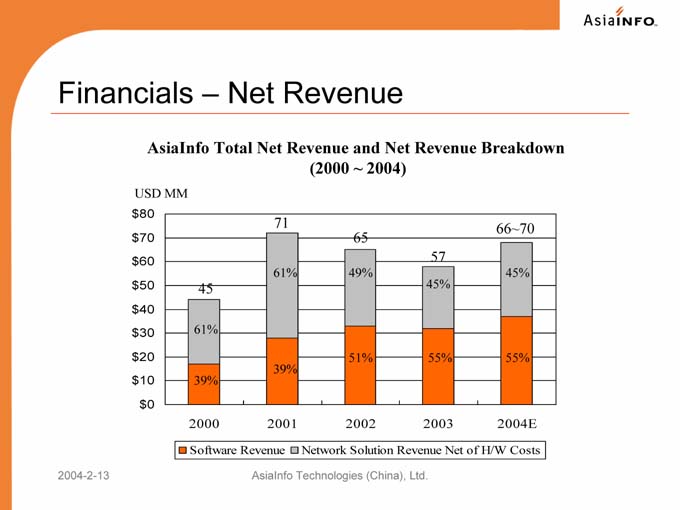

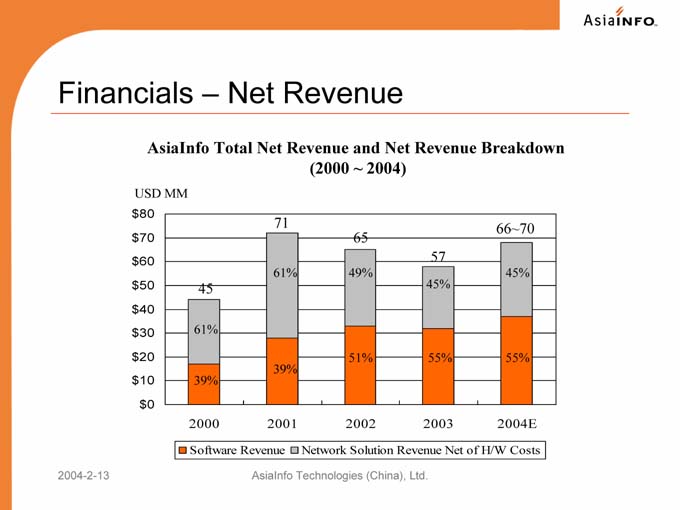

Financials – Net Revenue

AsiaInfo Total Net Revenue and Net Revenue Breakdown (2000 ~ 2004)

USD MM

$ 80

71 66~70

$ 70 65

$ 60 57

61% 49% 45%

$ 50 45 45%

$ 40

$ 30 61%

$ 20 51% 55% 55%

39%

$ 10 39%

$ 0

2000 2001 2002 2003 2004E

Software Revenue Network Solution Revenue Net of H/W Costs

2004-2-13 AsiaInfo Technologies (China), Ltd. 17

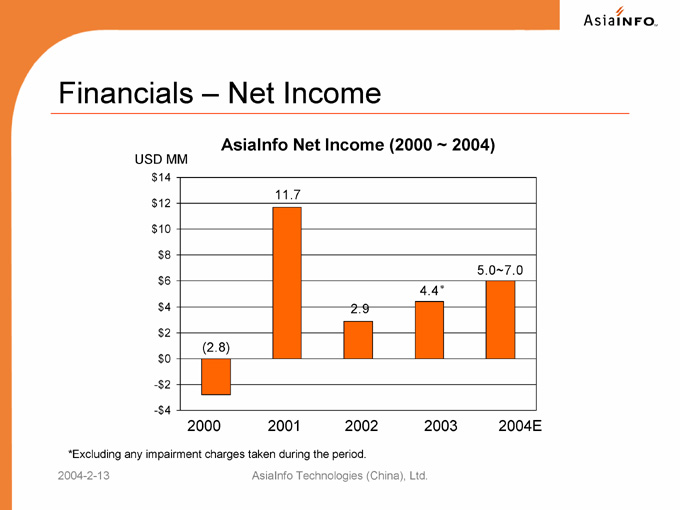

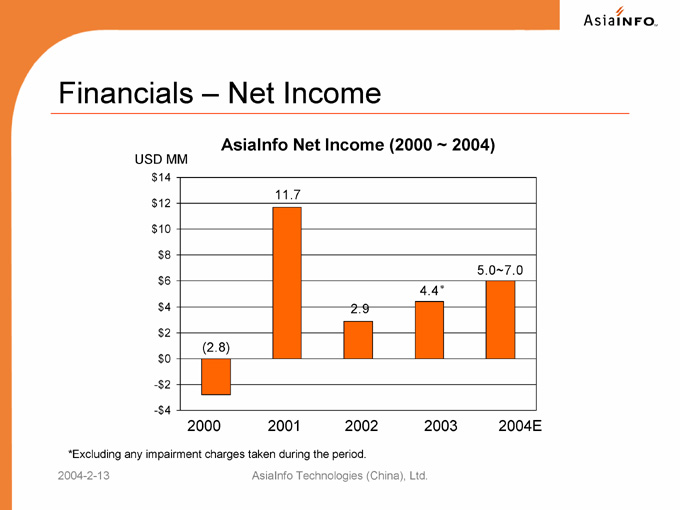

Financials – Net Income

AsiaInfo Net Income (2000 ~ 2004)

USD MM

$ 14

11.7

$ 12

$ 10

$ 8

5.0~7.0

$ 6

4.4*

$ 4 2.9

$ 2

(2.8)

$ 0

- $ 2

- $ 4

2000 2001 2002 2003 2004E

*Excluding any impairment charges taken during the period.

2004-2-13 AsiaInfo Technologies (China), Ltd. 18

Conclusion

• AsiaInfo optimistic about growth opportunities in 2004 and beyond.

• Moving into new attractive vertical markets and diversifying customer base.

• Expanding revenue streams to include professional maintenance and support services and SP business.

A strong strategy for future success.

Thank you! Questions?