SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement Under Section 14(d)(4) of the Securities Exchange Act of 1934

Myogen, Inc.

(Name of Subject Company)

Myogen, Inc.

(Name of Person Filing Statement)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

62856E 10 4

(CUSIP Number of Class of Securities)

Andrew D. Dickinson

Vice President and General Counsel

Myogen, Inc.

7575 West 103rd Avenue, Suite 102

Westminster, Colorado 80021

(303) 410-6666

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications on Behalf of Person Filing Statement)

With a copy to:

Stephen Fraidin, Esq.

Thomas W. Christopher, Esq.

William B. Sorabella, Esq.

Kirkland & Ellis LLP

Citigroup Center, 153 East 53rd Street

New York, New York 10022

(212) 446-4800

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Item 1. Subject Company Information.

(a) Subject Company.The name of the subject company to which this Solicitation/Recommendation Statement on Schedule 14D-9 (this “Schedule 14D-9”) relates is Myogen, Inc., a Delaware corporation (“Myogen” or the “Company”). The address of the principal executive offices of the Company is 7575 West 103rd Avenue, Suite 102, Westminster, Colorado 80021, and its telephone number is (303) 410-6666.

(b) Class of Securities.The title of the class of equity securities to which this Schedule 14D-9 relates is the common stock, $0.001 par value per share, of the Company (the “Common Stock”). As of the close of business on October 11, 2006, there were 43,440,061 shares of Common Stock issued and outstanding.

Item 2. Identity and Background of Filing Person.

(a) Name and Address.The name, address and telephone number of the Company, which is the person filing this Schedule 14D-9, are set forth in Item 1(a) above.

(b) Tender Offer.This Schedule 14D-9 relates to a tender offer by Mustang Merger Sub, Inc., a Delaware corporation (“Purchaser”) and a wholly-owned subsidiary of Gilead Sciences, Inc., a Delaware corporation (“Gilead”), disclosed in a Tender Offer Statement on Schedule TO, dated October 16, 2006 (as amended or supplemented from time to time, the “Schedule TO”), to purchase all of the outstanding shares of Common Stock at a purchase price of $52.50 per share, net to the seller in cash (the “Offer Price”), upon the terms and subject to the conditions set forth in the Offer to Purchase, dated October 16, 2006 (as amended or supplemented from time to time, the “Offer to Purchase”), and in the related Letter of Transmittal (as amended or supplemented from time to time, the “Letter of Transmittal”, which together with the Offer to Purchase constitute the “Offer”). The Schedule TO was filed with the Securities and Exchange Commission (the “SEC”) on October 16, 2006. Copies of the Offer to Purchase and Letter of Transmittal are filed as Exhibits (a)(1)(A) and (a)(1)(B) hereto, respectively, and are incorporated herein by reference.

The Offer is being made pursuant to an Agreement and Plan of Merger, dated as of October 1, 2006 (as such agreement may be amended from time to time, the “Merger Agreement”), by and among Gilead, Purchaser and the Company. The Merger Agreement provides, among other things, that following the consummation of the Offer and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement and in accordance with the relevant provisions of the Delaware General Corporation Law (the “DGCL”) and other applicable law, Purchaser will merge with and into the Company (the “Merger”), and each share of Common Stock that is outstanding and that has not been accepted for purchase pursuant to the Offer (other than shares of Common Stock that are held by (a) Purchaser, Gilead or the Company (or by any direct or indirect wholly-owned subsidiary of Gilead, Purchaser or the Company), which will be canceled, and (b) stockholders, if any, who properly exercise their appraisal rights under the DGCL) will be converted into the right to receive cash in an amount equal to the Offer Price. Upon the effective time of the Merger (the “Effective Time”), the Company will become a wholly-owned subsidiary of Gilead. A copy of the Merger Agreement is filed as Exhibit (e)(1) hereto and is incorporated herein by reference.

As set forth in the Schedule TO, the address of the principal executive offices of Gilead and Purchaser is 333 Lakeside Drive, Foster City, California 94404, and their telephone number is (650) 574-3000.

Item 3. Past Contracts, Transactions, Negotiations and Agreements.

Except as set forth in this Schedule 14D-9, including in the Information Statement of the Company attached to this Schedule 14D-9 asAnnex I hereto, which is incorporated by reference herein (the “Information Statement”), as of the date hereof, there are no material agreements, arrangements or understandings or any actual or potential conflicts of interest between the Company or its affiliates and: (i) its executive officers, directors or affiliates; or (ii) Gilead, Purchaser or their respective executive officers, directors or affiliates. The Information Statement is being furnished to the Company’s stockholders pursuant to Section 14(f) of the

2

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 14f-1 promulgated under the Exchange Act in connection with Purchaser’s right pursuant to the Merger Agreement to designate persons to the board of directors of the Company (the “Myogen Board”) after acquiring a majority of the Common Stock pursuant to the Offer (such time hereinafter referred to as the “Acceptance Time”).

(a) Arrangements with Current Executive Officers and Directors of the Company.

Information Statement

Certain agreements, arrangements or understandings between the Company or its affiliates and certain of its directors, executive officers and affiliates are described in the Information Statement.

Director and Officer Exculpation, Indemnification and Insurance

Section 145 of the DGCL permits a Delaware corporation to include in its charter documents, and in agreements between the corporation and its directors and officers, provisions expanding the scope of indemnification beyond that specifically provided by current law. The Company has included in its certificate of incorporation, as amended and restated (the “Charter”), a provision to eliminate the personal liability of its directors for monetary damages to the fullest extent under applicable law. In addition, the bylaws of the Company (the “Bylaws”) provide that the Company is required to indemnify its directors and officers to the fullest extent not prohibited by the DGCL or any other applicable law and is required to advance to any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding by reason of the fact that he or she is or was a director or other officer, of the Company, or is or was serving at the request of the Company as a director or executive officer of another corporation, partnership, joint venture, trust or other enterprise, prior to the final disposition of the proceeding, promptly following request therefor.

The Company also has entered into indemnification agreements with each of its directors and executive officers which provide that the Company is required to indemnify and hold harmless each of its directors and executive officers party to such an indemnification agreement to the fullest extent authorized or permitted by the provisions of the Bylaws and the DGCL. This description of the indemnification agreements entered into between the Company and each of its directors and executive officers is qualified in its entirety by reference to the form of the indemnification agreement filed as Exhibit (e)(2) hereto, which is incorporated herein by reference.

Pursuant to the Merger Agreement, for a period of six years following the Effective Time, Gilead has agreed to cause the certificate of incorporation and bylaws of the surviving corporation in the Merger to contain provisions with respect to indemnification, advancement of expenses and exculpation that are at least as favorable as the indemnification, advancement of expenses and exculpation provisions contained in the Charter and Bylaws immediately prior to the Effective Time and to honor such provisions. In addition, the Merger Agreement provides that, for a period of six years following the Acceptance Time, Gilead will cause the surviving corporation in the Merger to honor the obligations of the Company to exculpate, indemnify, hold harmless or advance expenses under all indemnification agreements in effect as of the date of the Merger Agreement between the Company and any of its directors and officers.

The Merger Agreement further provides that, for a period of six years after the Acceptance Time, Gilead will maintain in effect the Company’s directors’ and officers’ liability insurance in effect as of the date of the Merger Agreement in respect of acts or omissions occurring (or allegedly occurring) at or prior to the Acceptance Time, on terms and conditions no less favorable to any of the Company’s directors and officers as of the date of the Merger Agreement than in effect on the date of the Merger Agreement. However, Gilead will not be obligated to pay an annual premium in excess of 300% of the amount paid by the Company for such coverage for its last full fiscal year. In lieu of maintaining such insurance for the six-year period after the Acceptance Time, the Company may purchase a prepaid “tail” policy on the directors’ and officers’ liability insurance policy that covers the six-year period after the Acceptance Time, which the surviving corporation in the Merger will maintain in full force and effect.

3

Employment Agreements with Executive Officers

The Company has entered into employment agreements with each of J. William Freytag, Ph.D., the Company’s Chairman of the Board, President and Chief Executive Officer, Robert F. Caspari, M.D., the Company’s Senior Vice President of Commercial Operations and Medical Affairs, Andrew D. Dickinson, the Company’s Vice President of Corporate Development and General Counsel, Michael J. Gerber, M.D., the Company’s Senior Vice President of Clinical Development and Regulatory Affairs, Richard J. Gorczynski, Ph.D., the Company’s Senior Vice President of Research and Development, and Joseph L. Turner, the Company’s Senior Vice President of Finance and Administration, Chief Financial Officer, Treasurer and Assistant Secretary, each of which contains a change of control provision as described below.

Each of such employment agreements provides that the employment with the Company of the applicable executive officer is “at-will” and may be altered or terminated by either the executive officer party to the agreement or the Company at any time. Dr. Freytag’s employment agreement provides that, in the event of a termination of his employment without “cause” or voluntary resignation for “good reason” (each as defined in the employment agreement), he is entitled to a severance payment equal to 12 months’ salary or, if such termination or resignation occurs as of, or within 13 months after, a change of control, a severance payment equal to 18 months’ salary, and in each such case, payment of any accrued but unused vacation and payment of premiums under group health insurance COBRA continuation coverage for up to twelve months after the date of termination or resignation. The employment agreement with each of the other executive officers provides that, in the event of a termination of the executive officer’s employment without “cause” or voluntary resignation for “good reason” (each as defined in each applicable employment agreement), the executive officer party thereto is entitled to a severance payment equal to six months’ salary or, if such termination or resignation occurs as of, or within 13 months after, a change in control, a severance payment equal to 12 months’ salary, and in each such case payment of any accrued but unused vacation and payment of premiums under group health insurance COBRA continuation coverage for up to six months after the date of termination or resignation. The consummation of the Offer will constitute a change in control under each of the employment agreements.

In the event of a termination of employment without “cause” or voluntary resignation for “good reason” (each as defined in the employment agreement) of Dr. Freytag, Dr. Caspari, Mr. Dickinson, Dr. Gerber, Dr. Gorczynski or Mr. Turner during the 13 months following the consummation of the Offer, such executive officer would be entitled to receive approximately $712,500, $275,000, $263,000, $325,000, $260,000 and $270,000, respectively, in salary pursuant to his employment agreement, in addition to the other benefits noted above.

The description of the employment agreements entered into between the Company and each of its executive officers is qualified in its entirety by reference to the form of the employment agreement, which is filed as Exhibit (e)(3) hereto and is incorporated herein by reference.

Potential Acceleration of Option Vesting Upon Termination of Employment

Pursuant to the Merger Agreement, at the Acceptance Time Gilead will assume all outstanding options to purchase Common Stock, which thereafter will be exerciseable for shares of common stock of Gilead. Neither the consummation of the Offer nor the completion of the Merger will accelerate the vesting of the assumed options, which will continue to vest in accordance with their terms. However, pursuant to the Company’s 2003 Equity Incentive Plan (together with any predecessor plan, the “Option Plan”), if a change in control (as defined in the Option Plan) occurs and on, or within thirteen (13) months after, the effective time of the change in control the continuous service of a participant in the plan terminates due to an involuntary termination (other than for death or disability) without cause (as defined in the Option Plan) or due to a voluntary termination with good reason (as defined in the Option Plan), then, as of the date of termination of continuous service, the vesting and exercisability of the participant’s stock options and other stock-based awards will be accelerated in full. The consummation of the Offer will constitute a change in control under the Company’s Option Plan.

4

The description of the Option Plan is qualified in its entirety by reference to the Option Plan, which is filed as Exhibit (e)(4) hereto and is incorporated herein by reference.

As of October 8, 2006, the Company’s directors and executive officers held in the aggregate options to purchase 2,465,859 shares of Common Stock, 915,899 of which were unvested as of that date, with exercise prices ranging from $1.15 to $40.98 per share and an aggregate weighted average exercise price of $12.83 per share.

Acceleration of Offering Period Under Employee Stock Purchase Plan

Pursuant to the Merger Agreement, each outstanding purchase right under the Company’s Employee Stock Purchase Plan (the “ESPP”) will be exercised to purchase shares of Common Stock on the day that is one (1) business day prior to the Acceptance Time. The Company will make any pro-rata adjustments that may be necessary to reflect the shortened offering period but will otherwise treat such shortened offering period as a fully effective and completed offering period for all purposes under the ESPP. Immediately following the Acceptance Time, the Company will terminate the ESPP.

Assumption by Gilead of Myogen Stock Options; Section 16 Matters

Pursuant to the Merger Agreement, at the Acceptance Time Gilead will assume all options to purchase Common Stock, which thereafter will be exercisable for shares of common stock of Gilead. Each assumed Myogen stock option will continue to have, and be subject to the same terms and conditions of the option immediately prior to the Acceptance Time (including any repurchase rights or vesting provisions, if applicable), except that the number of shares for which the option is exerciseable and the exercise price per share under the option will be adjusted pursuant to a ratio determined in accordance with the Merger Agreement.

Pursuant to the Merger Agreement, the Myogen Board will, to the extent necessary, take appropriate action to approve, for purposes of Section 16(b) of the Exchange Act, the deemed disposition and cancellation of the Company stock options pursuant to the Merger Agreement, and the board of directors of Gilead (the “Gilead Board”) will take appropriate action to approve, for purposes of Section 16(b) of the Exchange Act, the deemed grant of options to purchase Gilead common stock under the Company stock options assumed pursuant to the Merger Agreement. Continuing employees are not third party beneficiaries of the Merger Agreement.

Employee Plans

The Merger Agreement provides that, from and after the Effective Time, Gilead will permit all employees of the Company who are offered and timely accept employment by Gilead or any of its subsidiaries or who continue their employment with the Company at or after the Acceptance Time to participate in the benefit plans, programs and arrangements of Gilead to the same extent as similarly situated employees of Gilead or its subsidiaries, subject to any necessary transition period and subject to any applicable plan provisions, contractual requirements or legal requirements. Continuing employees will be given credit under such plans, programs and arrangements for all years of service with the Company prior to the Effective Time for purposes of eligibility, vesting in respect of a matching contribution under a plan, program or arrangement intended to qualify under Section 401(k) of the Internal Revenue Code and the determination of rate of vacation accrual.

2006 Employee Bonus

The Merger Agreement provides that, from and after the Effective Time, Gilead will cause the Company to honor the obligations of the Company to pay to each employee of the Company who is offered and timely accepts employment by Gilead or any of its subsidiaries or who continues his or her employment with the Company at or after the Acceptance Time the ordinary course performance bonus earned by such employee during the year 2006 consistent with past practice.

5

(b) Arrangements with Purchaser and Gilead.

Merger Agreement

The summary of the Merger Agreement contained in Section 12 of the Offer to Purchase and the description of the conditions of the Offer contained in Section 13 of the Offer to Purchase are incorporated herein by reference. Such summary and description are qualified in their entirety by reference to the Merger Agreement, which is filed as Exhibit (e)(1) hereto and is incorporated herein by reference.

The Merger Agreement is filed as an exhibit to this Schedule 14D-9 and is incorporated herein by reference to provide information regarding its terms. The Merger Agreement contains representations and warranties that Myogen, Gilead and Purchaser made solely to each other as of specific dates. Those representations and warranties were made solely for purposes of the Merger Agreement and may be subject to important qualifications and limitations agreed to by the parties. Moreover, some of those representations and warranties may not be accurate or complete as of any specified date, may be subject to a standard of materiality provided for in the Merger Agreement or may have been used for the purpose of allocating risk among Myogen, Gilead and Purchaser rather than establishing matters as facts.

Confidentiality Agreements

On August 3, 2006, the Company and Gilead entered into a confidentiality and exclusivity agreement (the “Confidentiality Agreement”). Under the terms of the Confidentiality Agreement, Gilead agreed that, subject to certain exceptions, any information of a confidential or proprietary nature concerning the Company furnished to it or to its representatives by or on behalf of the Company following the execution and delivery of the Confidentiality Agreement will be used by Gilead and its representatives solely for the purpose of considering, evaluating, negotiating or financing the possible transaction and will not be disclosed to any third party by Gilead or its representatives except as provided in the Confidentiality Agreement. Gilead further agreed that, subject to certain exceptions, neither it nor its representatives would solicit certain employees of the Company to leave his or her employment with the Company or hire or in any other way knowingly interfere with the employment relationship between the Company and any of such employees prior to August 3, 2007. The Confidentiality Agreement supercedes the Mutual Confidential Disclosure Agreement, dated as of May 19, 2006 (the “Initial Confidentiality Agreement”), between Gilead and Myogen, except that the Initial Confidentiality Agreement continues in full force and effect with respect to confidential information disclosed thereunder prior to August 3, 2006. The Initial Confidentiality Agreement provides that the parties thereto will not disclose confidential information exchanged between the parties in connection with their evaluation of a transaction between the parties or use such information other than for that purpose.

In addition, under the Confidentiality Agreement, the Company agreed that from noon Pacific time on August 7, 2006 through noon Pacific time on August 21, 2006, the Company would not, and would not permit any of its representatives to, directly or indirectly, solicit or encourage the initiation or submission of any expression of interest, inquiry, proposal or offer from any person relating to or in connection with an alternative business combination proposal or participate in any discussions or negotiations, or enter into any agreement with, or provide any non-public information to, any person relating to or in connection with an alternative business combination proposal. These provisions of the Confidentiality Agreement providing for an exclusive negotiation period expired by their terms on August 21, 2006.

Under the Confidentiality Agreement, Gilead also agreed that it would not, and would cause its representatives not to, directly or indirectly, acquire or seek to acquire in any manner, beneficial ownership of any of the Company’s securities or assets, or take certain other actions to influence in any manner the management or policies or affairs of the Company prior to August 3, 2007 except as provided in the Confidentiality Agreement. These restrictions on acquisitions of beneficial ownership and other actions set forth in the Confidentiality Agreement terminated upon the execution and delivery of the Merger Agreement.

6

Such summary and description are qualified in their entirety by reference to the Initial Confidentiality Agreement and the Confidentiality Agreement, which are filed as Exhibits (e)(5) and (e)(6) hereto, respectively, and are incorporated herein by reference.

Item 4. The Solicitation or Recommendation.

(a) Recommendation.

The Myogen Board has unanimously: (1) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are advisable, fair to and in the best interests of the Company’s stockholders; (2) approved the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, on the terms and subject to the conditions set forth therein; and (3) resolved to recommend that the Company’s stockholders accept the Offer, tender their shares of Common Stock to Purchaser pursuant to the Offer and, if required by Delaware law, vote their shares of Common Stock in favor of the adoption of the Merger Agreement in accordance with the applicable provisions of Delaware law.

A copy of the letter to the Company’s stockholders communicating the Myogen Board’s recommendation is filed as Exhibit (a)(2)(A) hereto and is incorporated herein by reference.

(b) Background and Reasons for the Recommendation.

Background of the Merger

Since 1998, the Company’s management has periodically explored and assessed, and discussed with the Myogen Board, strategic alternatives for the Company, including, among other things, strategies to grow the Company’s business and operations through co-development and co-promotion partnerships and licensing agreements with large pharmaceutical, biopharmaceutical and biotechnology companies (collectively, “Target Partner Companies”).

During the second half of 2005, senior management of the Company initiated a more formalized process to identify and initiate discussions with various Target Partner Companies potentially interested in pursing a strategic collaboration or licensing arrangement relating to one or more of Myogen’s two major compounds, ambrisentan and darusentan. As part of this process, the Company had preliminary discussions with many of the Target Partner Companies, not including Gilead, to assess opportunities of mutual interest. The Company’s senior management team regularly reviewed with the Myogen Board from time to time the status of these discussions and Myogen’s strategy to maximize the long-term success of Myogen and stockholder value.

In October and November 2005, the Company increased its efforts to evaluate and negotiate potential collaborations or licensing arrangements with respect to ambrisentan, the Company’s lead drug candidate. These efforts with respect to the partnering activities were independent of (but ultimately led to) the efforts regarding a sale transaction described below. The Company assessed the interest in a collaboration or licensing arrangement relating to ambrisentan through numerous meetings with potential partners. Based upon these meetings, Myogen prepared and provided a draft proposal to potential partners who expressed the most interest in, and were perceived as having the desire and capability to rapidly close, a major collaboration or licensing transaction. GlaxoSmithKline plc (“GSK”) was one of the four potential partners.

In November 2005, the Company’s management team determined that it was likely that the Company could finalize a mutually acceptable licensing agreement with respect to ambrisentan with one or more potential partners. The Company’s management team and the Myogen Board also determined that, prior to entering into any licensing agreement relating to ambrisentan, it would be appropriate to engage a financial advisor to conduct a limited survey of certain Target Partner Companies to understand the level of interest, if any, in a larger strategic collaboration that could, but would not necessarily, involve an acquisition of Myogen.

7

On November 4, 2005, the Myogen Board held a meeting at which the Myogen Board appointed three members of the Myogen Board, including Dr. Freytag, to an engagement committee (the “Engagement Committee”) and authorized the Engagement Committee to negotiate with and engage Goldman Sachs & Co. (“Goldman Sachs”) to act as the financial advisor to the Company in connection with a potential business combination transaction involving the Company. At that meeting, representatives of Goldman Sachs presented a review of the current biotechnology mergers and acquisitions environment, a preliminary analysis of Myogen’s business and financial profile, a preliminary financial analysis of Myogen and a discussion of the potential impact of the upcoming Phase 3 clinical trial of ambrisentan. Representatives of Goldman Sachs also discussed potential strategic alternatives available to Myogen, which included selling the Company, undertaking acquisitions or licensing arrangements and pursuing additional equity financing in order to remain independent. Goldman Sachs discussed potential acquirors as well as potential acquisition candidates. Thereafter, representatives of Goldman Sachs and Myogen also negotiated and finalized an engagement letter, which was not signed until July 2006 as described below.

After receiving approval from the Myogen Board and the Engagement Committee, the Company requested that Goldman Sachs, on behalf of the Company, conduct a limited “market check.” During a two-week period in late November and early December 2005, representatives of Goldman Sachs contacted approximately fifteen parties that the Company and Goldman Sachs believed could potentially be interested in pursuing a business combination transaction with Myogen, including a potential partner which is referred to herein as “Company A”. The representatives of Goldman Sachs did not contact Gilead and, other than contacting Company A, did not contact any of the other parties that were in discussions with the Company at that time regarding ambrisentan collaboration and licensing arrangements.

Commencing in December 2005 and continuing through February 2006, the Company allowed four parties that had expressed an interest in possibly entering into a collaboration or licensing arrangement regarding ambrisentan, including GSK and Company A, to conduct a due diligence investigation relating to ambrisentan. At this time the Company also began preliminary negotiations with each of these four parties regarding a possible collaboration arrangement.

On December 12, 2005, Myogen publicly announced favorable results from the first Phase 3 clinical trial of ambrisentan.

On December 14, 2005, the Myogen Board held a regularly scheduled meeting in Westminster, Colorado. At that meeting, the Company’s management team reviewed the status of the licensing and collaboration discussions relating to ambrisentan. In addition, representatives of Goldman Sachs reviewed the results of the market check and indicated that five parties had expressed an interest in reviewing additional information regarding Myogen and its products with a view toward a potential business combination if Myogen were to undertake a formal auction or sale process. While the Myogen Board determined that there was moderate strategic interest on the part of certain companies in Myogen and its products, the Myogen Board concluded that it was premature for the Company to undertake an auction or sale process in light of the fact that, among other things, (i) the results of the second pivotal Phase 3 trial of ambrisentan (ARIES-1) were not expected to be received and reported until April or May 2006, (ii) the Company was in continuing discussions with the U.S. Food and Drug Administration (the “FDA”) and the European Agency for the Evaluation of Medicinal Productsregarding the design of Phase 3 studies relating to darusentan, and (iii) any significant delay in the Company’s collaboration discussions with GSK could result in the Company losing an opportunity to obtain distribution or license rights to Flolan (which was then being discussed in connection with that collaboration). Flolan, an intravenous product for the treatment of patients with pulmonary arterial hypertension, was manufactured and sold by GSK at that time and was considered by the Company to be strategically complementary to ambrisentan.

In February 2006, the Company received written non-binding proposals or expressions of interest from all four of the potential partners that had expressed an interest in a possible collaboration or licensing arrangement regarding ambrisentan. Myogen’s management team believed, based on the proposals received and management’s experience, that the Company would be in a position to promptly enter into a collaboration or licensing arrangement with one of the potential partners on terms that would be acceptable to the Company.

8

On February 21, 2006, the Myogen Board held a regularly scheduled meeting at the Company’s offices in Westminster, Colorado. During the meeting, the Company’s senior management team reviewed the then-current status of the ambrisentan collaboration and licensing negotiations. The Myogen Board concluded that GSK’s collaboration proposal at that time was superior to the then-current proposals received from the other potential partners.

On March 1, 2006, the Myogen Board held a telephonic meeting. Among other things, the Myogen Board reviewed the status of the Company’s discussions with GSK, Company A and the two other potential partners. Dr. Freytag informed the Myogen Board that Company A had indicated that it was interested in exploring a broader strategic transaction with the Company that might involve a business combination. Dr. Freytag indicated that the likelihood of receipt of an actual offer from Company A was uncertain, the terms of the possible offer were unknown and any offer would likely be subject to conditions, including a due diligence review of the Company and the receipt of positive results from the ARIES-1 trial of ambrisentan. Dr. Freytag informed the Myogen Board that Company A had also indicated that, although it would likely be less interested in a strategic transaction with the Company if Myogen entered into a collaboration agreement relating to ambrisentan with another party, such a transaction would not preclude Company A’s strategic interest in Myogen. Dr. Freytag further informed the Myogen Board, however, that the Company’s senior management team believed, after consultation with the Company’s financial advisor, that it was unlikely that the proposed collaboration transaction with GSK would make the Company materially less attractive to other third parties interested in a possible strategic transaction with the Company.

During the same meeting, the Company’s senior management team informed the Myogen Board that they continued to believe that a collaboration transaction with GSK with respect to ambrisentan and Flolan would be more beneficial to the Company than the collaboration or licensing arrangements negotiated with the other potential partners, including Company A. In addition, the senior management team indicated that they believed that any delay in finalizing and executing a collaboration transaction with GSK could result in GSK terminating discussions in order to pursue potentially competing offers from third parties to acquire rights to Flolan. At the meeting, representatives from the Company’s regular outside legal counsel reviewed the relevant Delaware legal principles for the Myogen Board to consider in the context of the process the Myogen Board had followed to date in considering strategic alternatives, including engagement of outside advisors and the survey of third parties potentially interested in strategic transactions with the Company. After discussion, the Myogen Board concluded that the Company should proceed with finalizing and entering into the proposed collaboration arrangements with GSK.

After concluding the meeting of the Myogen Board, on March 1, 2006, the Company notified GSK that it was prepared to proceed with the collaboration arrangements with respect to ambrisentan and Flolan that had been negotiated between the parties. At that time, the Company notified the other potential partners that the Company intended to execute a broad collaboration agreement relating to ambrisentan with an undisclosed third party (GSK).

On March 2, 2006, the Company received a letter from the Chief Executive Officer of Company A indicating that he was attempting to reach Dr. Freytag to convey a specific (though non-binding) offer to purchase all of the outstanding shares of the Company’s stock at a substantial premium to the then-current trading price. The letter also indicated that the non-binding offer had been conveyed verbally to representatives of Goldman Sachs earlier that day and that Company A would convene a meeting of its board on March 3, 2006 to ratify the offer.

On March 3, 2006, the Myogen Board held a telephonic meeting to once again review the then-current terms of the proposed collaboration transaction with GSK and the terms of the non-binding offer received from Company A. Representatives of Goldman Sachs reviewed the terms of Company A’s offer with the Myogen Board. The Company’s senior management team indicated to the Myogen Board that they believed there was a high risk that the non-binding offer from Company A would not result in a completed transaction (or a completed transaction at the specified price) because, among other things, Company A’s offer was preliminary in nature (as Company A had not conducted substantive due diligence on the Company other than ambrisentan) and would

9

likely be renegotiated by Company A at a later point. The Myogen Board also discussed other aspects of the offer, including whether the execution of the proposed collaboration agreements with GSK would necessarily preclude a strategic transaction with Company A or other third parties. Representatives of the Company’s regular outside legal counsel once again reviewed for the Myogen Board its fiduciary duties in the context of the strategic review process and collaboration negotiations that had occurred through that date. After extensive discussion, the Myogen Board unanimously concluded that the Company should enter into the collaboration arrangements with GSK but continue to explore broader opportunities for maximizing stockholder value with Company A and other third parties in the future.

After the meeting of the Myogen Board was adjourned, the Company executed the ambrisentan and Flolan collaboration agreements with GSK. In addition, Dr. Freytag contacted the Chief Executive Officer of Company A and informed him that Myogen had executed a broad collaboration with respect to ambrisentan and an undisclosed complimentary product (Flolan) for the treatment of pulmonary hypertension with an undisclosed third party (GSK). Dr. Freytag also indicated that the proposed collaboration did not grant the undisclosed third party (GSK) any rights to darusentan and that Myogen was open to proceeding with broader strategic discussions if Company A remained interested. Company A’s Chief Executive Officer indicated that Company A was not interested in pursuing broader strategic discussions at that time.

During March and April 2006, Myogen undertook preparations for an offering of equity securities of the Company that would be commenced in the event that results of the ARIES-1 clinical trial of ambrisentan were favorable and well-received when released publicly.

In April 2006, Myogen announced favorable results of the ARIES-1 clinical trial of ambrisentan and confirmed its intention to file a new drug application (“NDA”) with the FDA for ambrisentan during the fourth quarter of 2006. Following the announcement of the results, Myogen elected not to proceed with the previously planned equity offering.

In late April 2006, a representative of Lazard Frères & Co. LLC (“Lazard”) contacted Dr. Freytag. The representative indicated that Gilead was carefully considering potential acquisition targets and that John F. Milligan, Ph.D., Gilead’s Executive Vice President and Chief Financial Officer, was interested in meeting Dr. Freytag in person in the near future to learn more about Myogen, its products and its product candidates. Dr. Freytag informed the representative of Lazard that he was open to such a meeting even though Myogen was not actively pursuing a possible business combination at that time and instead was preparing to grow its business through future financing and in-licensing or other product acquisition transactions of its own. Prior to April 2006, Lazard had provided investment banking and related financial advisory services to the Company. In addition, Lazard had been assisting the Company with various business development initiatives in the months and weeks prior to the phone call between Dr. Freytag and the representative of Lazard. Shortly after the April 2006 call between Dr. Freytag and the representative of Lazard, the Company and Lazard ceased working collaboratively on such business development initiatives.

On May 19, 2006, Gilead and the Company executed the Initial Confidentiality Agreement.

On May 26, 2006, as discussed by phone between Dr. Freytag and a representative of Lazard in late April 2006, Dr. Freytag, Dr. Milligan and the representative of Lazard met in Broomfield, Colorado to discuss the possibility of a business combination involving Myogen and Gilead or some other type of strategic transaction. Dr. Freytag reviewed Myogen’s products and product candidates with the parties. Dr. Milligan indicated that Gilead would conduct preliminary due diligence of Myogen by assessing publicly available information.

Between May 26, 2006 and July 10, 2006, Dr. Freytag and Andrew D. Dickinson, the Company’s Vice President of Corporate Development and General Counsel, participated in several phone calls with Dr. Milligan and a representative of Lazard. Dr. Freytag and Mr. Dickinson updated Dr. Milligan and the representative of Lazard on the progress of the Company’s products and product candidates during those calls. Dr. Milligan and the representative of Lazard generally updated Dr. Freytag and Mr. Dickinson on Gilead’s progress-to-date in their due diligence review of Myogen.

10

In early July 2006, the Vice President of Corporate Development of Company A contacted Mr. Dickinson and inquired about Myogen’s interest in resuming discussions regarding a possible business combination transaction. The parties agreed to meet at Myogen’s offices on July 10, 2006.

On July 10, 2006, Dr. Freytag and Mr. Dickinson met with two members of Company A’s executive management team at the Company’s offices in Westminster, Colorado. The parties generally discussed the status of Myogen’s drug development programs and its interest in exploring a broad strategic collaboration. The representatives from Company A indicated that they would discuss Company A’s interest in entering into broad strategic discussions with Myogen with their colleagues, including Company A’s Chief Executive Officer.

Subsequent to that meeting and through August 6, 2006, Mr. Dickinson participated in brief follow-up phone calls with members of Company A’s corporate and business development team. The parties generally discussed the status of Myogen’s drug development programs and the level of each party’s interest in exploring a broader strategic collaboration. Mr. Dickinson reiterated that Myogen was willing to engage in strategic discussions with Company A as long as Company A evidenced a serious interest in acquiring all of the common stock of the Company at a valuation generally consistent with that proposed by Company A in March 2006. A representative of Company A indicated that Company A would expect to offer Myogen’s stockholders a substantial premium but that the offer price was unlikely to exceed $50.00 per share. In addition, the representative of Company A indicated that Company A had not, in fact, previously expected to acquire all of the Company’s outstanding common stock at the premium indicated by its prior letter, dated March 2, 2006, and that any binding offer price, if Company A were to have made an actual offer, would likely have been lower after Company A had completed its due diligence investigation of the Company and held negotiations between the parties.

On July 11, 2006, Dr. Freytag received a call from Dr. Milligan. Dr. Milligan indicated that Gilead had completed its due diligence review of publicly available information regarding Myogen and that Gilead was interested in conducting a due diligence review of non-public information to further determine its level of interest in acquiring the Company. Dr. Milligan further indicated that he would discuss the potential acquisition of the Company with the Gilead Board at its next scheduled meeting. Dr. Freytag agreed to discuss Gilead’s expression of interest with the Myogen Board.

On July 12, 2006, the Myogen Board held a regularly scheduled meeting at the Company’s offices in Westminster, Colorado. Among other things, Dr. Freytag reviewed his recent discussions with Dr. Milligan and representatives of Lazard and Mr. Dickinson’s recent discussions with representatives of Company A. He also confirmed that the Company’s senior management team and other employees were working diligently on preparing the NDA relating to ambrisentan for filing with the FDA and that the Company’s senior management team believed that any disruption to the NDA preparation or filing timeline could harm the Company. As a result, Dr. Freytag recommended that the Company move forward with Gilead only if Gilead delivered a letter to the Company indicating a serious interest in acquiring the Company at a substantial premium to its then-current trading price. In addition, Dr. Freytag recommended that the Company postpone conducting a broad auction process until it was clear that Gilead or another party, including Company A, had a serious interest in acquiring the Company on acceptable terms. The Myogen Board instructed Dr. Freytag and other members of the Company’s senior management team to move forward with further discussions with Gilead subject to receipt of a letter from Gilead indicating serious interest at a price level of $50.00 per share or greater. The Myogen Board also instructed Dr. Freytag and the Company’s senior management team to postpone conducting a broad auction process until the terms recommended by Dr. Freytag were satisfied.

On July 13, 2006, Dr. Freytag and Mr. Dickinson met with a representative of Lazard at the Company’s offices in Westminster, Colorado. The representative of Lazard described Gilead’s interest in advancing its discussions with Myogen regarding an acquisition of the Company. Dr. Freytag and Mr. Dickinson reviewed the Myogen Board’s instructions with the representative of Lazard, including that any further discussions were conditioned upon Myogen’s receipt of a letter from Gilead indicating a serious interest in acquiring the Company and its specific price level of interest. The representative of Lazard agreed to discuss Myogen’s request with Dr. Milligan.

11

On July 17, 2006, Dr. Freytag called Dr. Milligan. Dr. Freytag reviewed the Myogen Board’s instructions with Dr. Milligan, including the request for a letter from Gilead indicating a serious interest in acquiring the Company and its specific price level of interest. Dr. Freytag further explained to Dr. Milligan that this requirement arose in part from the Myogen Board’s concern that discussions with Gilead or any other party could impact the NDA preparation and filing timeline and the risk of such impact would be warranted only if Gilead or another third party were prepared to acquire the Company at a significant premium. Dr. Milligan indicated that there was a regularly scheduled meeting of the Gilead Board on July 26, 2006 and that he would ascertain the level of Gilead’s interest in acquiring Myogen with the Gilead Board at that time.

On July 27, 2006, Dr. Freytag and Dr. Milligan spoke by phone. Dr. Milligan informed Dr. Freytag that he had reviewed Gilead’s interest in and preliminary analysis of Myogen with the Gilead Board. He further indicated that Gilead was willing to provide a non-binding letter expressing Gilead’s interest in acquiring all of the outstanding shares of Myogen stock for $50.00 per share and that he would forward that letter to Dr. Freytag. Dr. Freytag agreed to review the letter with the Myogen Board.

Later that day, Dr. Freytag received Gilead’s non-binding expression of interest signed by John C. Martin, Ph.D., Gilead’s President and Chief Executive Officer. Dr. Martin indicated that, subject to completion of its due diligence investigation of the Company and other conditions, Gilead was interested in a potential acquisition of all of the Company’s stock for $50.00 per share. In addition, Gilead requested that Myogen exclusively negotiate with Gilead for a period of 30 days.

That evening, the Company engaged Kirkland & Ellis LLP (“Kirkland & Ellis”) to serve as its outside legal counsel in connection with a possible strategic transaction.

On July 28, 2006, the Myogen Board held a telephonic meeting. At that meeting, Dr. Freytag reviewed Gilead’s letter dated July 27, 2006. After extensive discussion, including a review of the Myogen Board’s fiduciary duties by representatives of Kirkland & Ellis and a brief discussion of tactical considerations by representatives of Goldman Sachs, the Myogen Board instructed the Company’s senior management team to facilitate a further due diligence review of the Company and enter into acquisition discussions with Gilead following the execution of an acceptable confidentiality and standstill agreement. In consideration for Gilead’s willingness to devote the resources necessary to proceed with a due diligence investigation of the Company and acquisition negotiations between the parties, the Board also authorized Dr. Freytag and the Company’s senior management team to agree to a two-week exclusive negotiation period with Gilead with the understanding that the Company intended to conduct a “market check” prior to or after the execution of any definitive transaction agreement.

After adjourning the meeting of the Myogen Board, Dr. Freytag sent an e-mail to Dr. Milligan stating that he had reviewed Gilead’s letter with the Myogen Board and the Company’s legal counsel and financial advisor. He indicated that Gilead’s offer was an interesting starting point for further discussion and that the Company expected Gilead to discover additional value in the proposed combination of the companies following Gilead’s completion of its detailed due diligence investigation of the Company. In addition, Dr. Freytag indicated that the Company was prepared to work exclusively with Gilead for a two-week period subject to the condition that Myogen be permitted to conduct an updated market check prior to or after the execution of a definitive agreement negotiated by the parties. Finally, Dr. Freytag indicated that Kirkland & Ellis was preparing a confidentiality, standstill and exclusivity agreement for Gilead’s review and that a draft of such agreement would be delivered to Gilead and its outside legal counsel in the near future.

Dr. Freytag followed up his e-mail with a brief call to Dr. Milligan. During their conversation, Dr. Freytag reiterated the Company’s position as conveyed in his prior e-mail. Dr. Milligan agreed to have Gilead’s legal counsel review the draft confidentiality, standstill and exclusivity agreement upon receipt.

On July 31, 2006, the Company executed the previously negotiated exclusive engagement letter with Goldman Sachs confirming the terms under which Goldman Sachs would serve as Myogen’s financial advisor in

12

connection with a possible strategic transaction. The parties agreed that the engagement letter was effective as of November 4, 2005, the date on which the Company and Goldman Sachs had agreed on the terms of the engagement letter to be executed in connection with Goldman Sachs’ assistance with the preliminary “market check”.

On the same day, the Company executed a conflict waiver agreement with Cooley Godward Kronish LLP, then known as Cooley Godward LLP (“Cooley”), pursuant to which the Company agreed that Cooley, which had previously represented the Company in several matters, could represent Gilead in connection with the proposed acquisition transaction between the parties subject to the terms and conditions set forth in the waiver agreement. Gilead executed a similar conflict waiver agreement with Cooley.

On August 3, 2006, Gilead and Myogen executed the Confidentiality Agreement, which, among other things, granted to Gilead an exclusive negotiating period regarding an acquisition transaction commencing at noon Pacific time on August 7, 2006 and continuing through noon Pacific time on August 21, 2006.

On August 7 and August 8, 2006, members of the Company’s senior management team, including Dr. Freytag and Mr. Dickinson, made a presentation and provided additional information about the Company to members of Gilead’s management team, including Dr. Martin, Dr. Milligan and other representatives of Gilead, in connection with Gilead’s due diligence investigation of the Company, at Cooley’s offices in Broomfield, Colorado. Representatives of Lazard and Goldman Sachs also attended these due diligence meetings.

From August 8 through September 30, 2006, members of the Company’s senior management team held numerous follow-up conference calls with representatives of Gilead, Cooley and Lazard for the purpose of providing further due diligence information about the Company.

On August 9, 2006, Rick Gorczynski, Ph.D., the Company’s Senior Vice President of Research and Development, and Eric N. Olson, Ph.D., a founder of and consultant to the Company, met with representatives of Gilead’s research and development team at Gilead’s offices in Foster City, California. Gilead’s representatives at the meeting included Norbert W. Bischofberger, Ph.D., Gilead’s Executive Vice President, Research and Development, and William A. Lee, Ph.D., Gilead’s Senior Vice President, Research. Dr. Gorczynski and Dr. Olson presented an overview of Myogen’s drug discovery platform and related research projects.

On August 18, 2006, Dr. Milligan had a conference call with Dr. Freytag to discuss Gilead’s position based on its due diligence review of the Company conducted to date. Dr. Milligan explained that, while Gilead understood that the exclusivity period would be expiring on August 21, 2006, Gilead was not prepared to enter into discussions with respect to a definitive merger agreement or terms of the potential transaction. However, Dr. Milligan indicated that Gilead would like to continue its due diligence investigation of the Company.

On August 21, 2006, the exclusive negotiating period provided for in the Confidentiality Agreement expired by its terms. On that day, subsequent to the expiration of Gilead’s exclusivity period, the Myogen Board held a telephonic meeting. At the meeting, Dr. Freytag reviewed the Company’s progress to date with Gilead and representatives of Goldman Sachs made a presentation to the Myogen Board regarding Myogen’s business and financial profile and performance, including a preliminary financial analysis of Myogen. At the meeting, the Myogen Board also discussed whether it was advisable to engage in a similar, parallel process with Company A. After extensive discussion, the Myogen Board instructed Dr. Freytag to continue the ongoing process with Gilead and to open parallel strategic discussions with Company A subject to certain conditions, including the receipt by Myogen of a letter from Company A indicating its interest in acquiring Myogen at a price of $50.00 per share or more and the execution by Company A of a satisfactory confidentiality and standstill agreement.

Subsequent to the Myogen Board meeting and following the expiration of Gilead’s exclusivity period, Goldman Sachs contacted the Executive Vice President of Corporate Development of Company A. Goldman

13

Sachs indicated that Myogen was open to proceeding with discussions regarding a mutually beneficial business combination transaction with Company A subject to the conditions determined by the Myogen Board.

On August 25, 2006, Company A delivered a non-binding indication of interest to Dr. Freytag pursuant to which Company A proposed to acquire all of the outstanding common stock of Myogen for a range of $44.00 to $50.00 per share in cash. Company A indicated that it would be in a position to give more specific price guidance to the Company after completion of its due diligence investigation of the Company.

On August 30, 2006, Myogen executed a confidentiality and standstill agreement with Company A that included a standstill provision prohibiting Company A for a period of 12 months from the date of the agreement from offering to acquire or acquiring the Company, or taking certain related actions, including soliciting proxies, without the prior written consent of the Myogen Board.

On August 31 and September 1, 2006, members of the Company’s senior management team, including Dr. Freytag, presented due diligence information regarding the Company to representatives of Company A’s management team at a hotel located in Westminster, Colorado. Representatives of Goldman Sachs and Company A’s financial advisor also attended the meetings and presentations.

From September 2 through September 30, 2006, members of Myogen’s senior management team held numerous follow up conference calls with representatives of Company A, its outside legal counsel and its financial advisors for the purpose of providing further due diligence information to Company A.

On September 7, 2006, Dr. Milligan and a representative of Lazard held a conference call with Dr. Freytag, Mr. Dickinson and Joseph L. Turner, the Company’s Chief Financial Officer. During that conference call, Dr. Milligan informed the group that Gilead had completed its additional due diligence investigation of the Company and that it intended to submit a revised, non-binding indication of interest to acquire all of the outstanding shares of Myogen common stock for $45.00 per share. He further indicated that he would forward an updated non-binding letter indicating such interest to Dr. Freytag. Dr. Freytag indicated that an offer at that price level would not likely be acceptable to the Myogen Board but that he would review the letter with the Myogen Board. Dr. Freytag also indicated that the Company was willing to continue the due diligence process and discussions with Gilead with the expectation that the Company could assist Gilead in identifying the additional value that would be required to secure a transaction with the Company.

Later that day, Dr. Freytag received the revised, non-binding letter of interest from Gilead. The terms of the letter were consistent with the terms described by Dr. Milligan on the conference call earlier that day.

On September 15, 2006, the Company received a non-binding letter of interest from Company A. Pursuant to the terms of that letter, Company A proposed to acquire all of the outstanding common stock of the Company for $48.00 per share in cash, subject to satisfactory completion of due diligence and other customary conditions.

Later that day, the Myogen Board held a telephonic meeting to review the letter received from Company A and the status of the Company’s discussions with Company A and Gilead. The Myogen Board instructed Dr. Freytag and the other members of the Company’s senior management team to continue their strategic discussions with both companies. In addition, the Myogen Board authorized Goldman Sachs to update the market check the Company had initiated in November 2005 by contacting parties that had expressed general interest in participating in a broad strategic process relating to Myogen and two additional parties that had not previously been contacted.

Also on September 15, 2006, a representative of Goldman Sachs called a representative of Lazard to inform him that the Company had received an indication of interest from another party that was significantly higher than Gilead’s offer. Later that day, Dr. Milligan and the representative of Lazard spoke to Dr. Freytag, and Dr. Freytag also indicated that Myogen had received an indication of interest from another party.

14

From September 18, 2006 through September 20, 2006, representatives of Goldman Sachs conducted conference calls with representatives of several pharmaceutical companies regarding their potential interest in the Company and its product candidates. Goldman Sachs indicated to these parties that Myogen had received two serious offers at significant premiums to the then-current market price of the Company’s common stock and that, if these parties were interested in a possible transaction with the Company, they would need to move quickly given that Myogen was close to concluding negotiations with the two bidders. By September 27, 2006, all parties that had been contacted by Goldman Sachs had responded to Goldman Sachs, and none were interested in participating in a competitive auction process for the acquisition of the Company at the indicated price level and within the required time frame.

On September 19, 2006, the Myogen Board held a regularly scheduled meeting at the Company’s offices in Westminster, Colorado. At the meeting, the Myogen Board reviewed the then-current proposals from Company A and Gilead with the Company’s senior management team and its outside financial and legal advisors. Representatives of Goldman Sachs made a presentation to the Myogen Board regarding Myogen’s business and financial profile and performance, including an updated preliminary financial analysis of Myogen, as well as the terms of the proposals from Company A and Gilead. The Myogen Board authorized the Company’s senior management team to continue negotiations with both Company A and Gilead.

On September 20, 2006, Dr. Freytag called the Chief Executive Officer of Company A. Dr. Freytag indicated that he had reviewed Company A’s proposal with the Myogen Board and that the Myogen Board was disappointed with the revised proposal. Nonetheless, Dr. Freytag indicated that the Company was willing to move forward with further negotiations with Company A with the understanding that Company A would need to identify additional value in Myogen in order to secure a transaction with the Company. Dr. Freytag also indicated that Company A was involved in a competitive process with another undisclosed bidder (Gilead).

On September 21, 2006, Dr. Freytag participated in a conference call with Dr. Milligan and a representative of Lazard. At that time, Dr. Freytag encouraged Gilead to increase its proposed offer price. When asked if a proposed purchase price of $51.00 per share would make Gilead’s price higher than the offer price of the other party, Dr. Freytag responded in the affirmative. Dr. Freytag also indicated that the Company would respond to any remaining diligence requests of Gilead if Gilead submitted a revised indication of interest with a significantly increased price per share. Later that day, Gilead sent a revised, non-binding indication of interest to Dr. Freytag. The letter indicated that Gilead was interested in acquiring all of the outstanding common stock of the Company for $51.00 per share in cash subject to a number of conditions, including completion of its due diligence review of the Company and negotiation of mutually acceptable definitive agreements. Following receipt of the revised letter, Dr. Freytag called Dr. Martin and Dr. Milligan to indicate the Company’s receipt of Gilead’s revised proposal and that the Company was prepared to move forward with the negotiation of a definitive merger agreement on the basis of the revised proposal.

On September 22, 2006, Dr. Freytag contacted the Chief Executive Officer of Company A and indicated that its offer to purchase all of the outstanding capital stock of the Company for $48.00 per share was no longer competitive. Dr. Freytag once again encouraged Company A to review its valuation of the Company and to increase its proposed purchase price for the Company’s outstanding common stock.

On September 24, 2006, Kirkland & Ellis distributed a draft of a definitive merger agreement separately to representatives of each of Gilead and Company A and instructed each to provide any comments on the draft agreement on September 26, 2006.

On September 26, 2006, five members of Company A’s due diligence team visited the Company’s offices in Westminster, Colorado. Members of Myogen’s senior management team, including Dr. Freytag, Mr. Dickinson and Dr. Gorczynski, met with the due diligence team and provided additional due diligence information and answered numerous questions.

15

The Company received a revised draft of the definitive merger agreement from Company A on September 26, 2006. That evening, Dr. Freytag, Mr. Dickinson and representatives of Kirkland & Ellis and Goldman Sachs participated in a conference call with Dr. Milligan and other representatives of Gilead, Cooley and Lazard regarding Gilead’s general comments to the draft of the definitive merger agreement. Shortly after completing the call, Cooley forwarded a revised draft of the definitive merger agreement to the Company and its counsel.

On September 26 and September 27, 2006, Dr. Freytag and representatives of Goldman Sachs held numerous conference calls with members of the executive management teams of Gilead and Company A and their respective advisors regarding the proposed strategic transaction process.

On September 27 and September 28, 2006, representatives of Goldman Sachs instructed each party to submit a revised draft of the definitive merger agreement and updated offer price to the Company by the evening of September 28, 2006, in advance of a telephonic meeting of the Myogen Board to be held on the morning of September 29, 2006.

Also on September 27, 2006, Dr. Freytag, Mr. Dickinson, other members of the Company’s management team and representatives of Kirkland & Ellis held a conference call with representatives of Company A and its legal counsel to review and negotiate the draft definitive merger agreement between Company A and Myogen with Company A and its legal counsel via conference call.

On September 28, 2006, Dr. Freytag, Mr. Dickinson, other members of the Company’s management team and representatives of Kirkland & Ellis held a series of conference calls with both Gilead and Company A and their respective legal counsels to review and negotiate the respective draft definitive merger agreements with each of Gilead and Company A. The definitive merger agreement negotiated with Company A was finalized in all material respects (except for price) that evening but was not approved by either company’s board of directors or executed.

Also on September 28, 2006, Gregg H. Alton, Gilead’s Senior Vice President and General Counsel, and Mr. Dickinson spoke by telephone to discuss the key outstanding issues in the draft definitive merger agreement between the Company and Gilead. Shortly after this discussion, Gilead and Myogen representatives and their respective outside legal counsels held a conference call to negotiate several issues under the agreement. Also on that day, as referred to above, a representative of Goldman Sachs e-mailed a representative of Lazard indicating that Gilead should submit its final price and proposed merger agreement by that evening, in preparation for a meeting of the Myogen Board on the morning of September 29, 2006. Later that evening, Cooley, on behalf of Gilead, sent a revised draft of the definitive merger agreement between the Company and Gilead to Kirkland & Ellis.

Despite the Company’s prior request, neither Gilead nor Company A submitted an updated acquisition proposal to Myogen on September 28, 2006.

On the morning of September 29, 2006, a member of Company A’s executive management team called Dr. Freytag and indicated that Company A was increasing its offer to $50.00 per share. The representative also indicated that Company A would send the revised offer to Dr. Freytag in writing shortly thereafter. Dr. Freytag informed the representative that, although the increased offer was attractive to Myogen, it was nevertheless less than another offer received by the Company. Dr. Freytag agreed to discuss the revised offer with the Myogen Board but asked the representative of Company A to consider whether Company A would be willing to make a higher offer.

On the morning of September 29, 2006, the Myogen Board held a telephonic meeting. During the meeting, Dr. Freytag and Mr. Dickinson reviewed the status of the then-current negotiations with each of Gilead and Company A. Representatives of Goldman Sachs and Kirkland & Ellis also updated the Myogen Board with respect to financial and legal aspects of the proposed transactions, respectively.

Throughout the day on September 29, 2006, representatives from the Company, Kirkland & Ellis, Gilead and Cooley participated in several conference calls regarding the draft definitive merger agreement between

16

Gilead and Myogen submitted by Gilead. The parties tentatively resolved the major open issues relating to the agreement that evening, and the Company agreed to review a revised version of the proposed agreement to be prepared by Gilead early the following morning.

On the evening of September 29, 2006, Myogen received the revised, written offer from Company A that had been discussed that morning. The offer letter indicated that Company A would commit to purchase all of the outstanding common stock of the Company for $50.00 per share in cash on the terms and subject to the conditions of the draft definitive merger agreement that had been previously negotiated by the parties. The letter further provided that the offer would expire at 5:00 p.m. Eastern time on September 30, 2006.

During the morning of September 30, 2006, Dr. Milligan, a representative of Lazard, Dr. Freytag and Mr. Dickinson held a conference call. Dr. Milligan informed Dr. Freytag and Mr. Dickinson that Gilead’s best and final offer to acquire all of the outstanding shares of the Company’s common stock was $52.50 per share in cash. Dr. Freytag indicated that he would present the updated bid to the Myogen Board that day.

Later that morning, a member of the executive management team of Company A called Dr. Freytag and indicated that Company A was authorized to submit a bid to acquire all of the outstanding shares of the Company’s common stock at a price of $52.00 per share in cash and that this offer would be Company A’s best and final offer. When told that Company A’s bid was not the highest bid, the member of Company A’s management team indicated that Company A was not prepared to offer more than $52.00 per share and he orally withdrew the increase in Company A’s bid to $52.00 per share.

On September 30, 2006, the Myogen Board met at a hotel adjacent to the Denver International Airport to review and consider Gilead’s and Company A’s bids. Dr. Freytag, Mr. Dickinson and representatives of Goldman Sachs updated the Myogen Board on the status of negotiations with Gilead and Company A. Representatives of Kirkland & Ellis reviewed the Myogen Board’s fiduciary duties in the context of a transaction of this kind and summarized the terms of the definitive merger agreement as negotiated with Gilead. Representatives of Goldman Sachs presented their financial analysis of Myogen and the terms of the proposed acquisition. Goldman Sachs then delivered to the Myogen Board its oral opinion, subsequently confirmed in writing, to the effect that, as of October 1, 2006 and based upon and subject to the factors and assumptions set forth therein, the $52.50 per share in cash to be received by the holders of shares of Common Stock in the Offer and the Merger pursuant to the Merger Agreement was fair from a financial point of view to such holders. For a further discussion of Goldman Sachs’ opinion, see “Opinion of Myogen’s Financial Advisor” below. The Myogen Board then considered the possibility of remaining independent and compared this against the value of the acquisition proposals received to date, including the revised Gilead offer. In doing so, the Myogen Board considered, among other things, the various risks and benefits relating to remaining independent, including the development and other risks related to ambrisentan and darusentan, against the benefits of the Gilead offer, including the substantial premium, the amount of that premium in light of the estimated value of the ambrisentan opportunity and the results of the market check process undertaken by Goldman Sachs on the Company’s behalf. For a further discussion of the deliberations of the Myogen Board, see “Reasons for Recommendation” below. After discussion among the participants in the meeting to address questions from the Myogen Board, the Myogen Board, by a unanimous vote, approved the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, subject to final changes approved by the Company’s senior management, determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are advisable, fair to, and in the best interests of, Myogen and its stockholders and recommended that the Myogen stockholders accept the Offer, tender their shares of Common Stock to Purchaser pursuant to the Offer and, if required by Delaware law, vote their shares of Common Stock in favor of the adoption of the Merger Agreement in accordance with the applicable provisions of Delaware law.

Following the meeting of the Myogen Board, Dr. Freytag called Dr. Milligan and a representative of Lazard and informed them that the Myogen Board had approved entering into a definitive merger agreement with Gilead. Dr. Milligan informed Dr. Freytag that the proposed definitive merger agreement would be submitted for approval at a meeting of the Gilead Board to be held on October 1, 2006.

17

That afternoon and evening and early the following morning, Mr. Dickinson, Kirkland & Ellis, Cooley and members of Gilead’s management team negotiated final changes to the draft definitive merger agreement between the parties.

On October 1, 2006, at a special meeting, the Gilead Board unanimously approved the merger agreement negotiated between the parties and the transactions contemplated thereby. Immediately following the meeting of the Gilead Board, Dr. Milligan called Mr. Freytag and informed him that the Gilead Board had approved the definitive merger agreement and the transactions contemplated thereby. Thereafter, the Company, Gilead and Purchaser executed the Merger Agreement.

On October 2, 2006, Myogen and Gilead issued a joint press release announcing the execution of the Merger Agreement.

Reasons for Recommendation

In evaluating the Merger Agreement and the other transactions contemplated thereby, including the Offer and the Merger, and recommending that the Myogen stockholders accept the Offer, tender their shares of Common Stock to Purchaser pursuant to the Offer and, if required by Delaware law, vote their shares of Common Stock in favor of the adoption of the Merger Agreement in accordance with the applicable provisions of Delaware law, the Myogen Board consulted with the Company’s senior management, legal counsel and financial advisor and considered a number of factors, including the following:

| | • | | Financial Condition and Prospects of the Company.The Myogen Board considered its knowledge and familiarity with the Company’s business, financial condition and results of operations, as well as the Company’s financial plan and prospects if it were to remain an independent company. The Myogen Board discussed the Company’s current financial plan, including the risks associated with achieving and executing upon the Company’s business plan. The Myogen Board considered that the holders of Common Stock would continue to be subject to the risks and uncertainties of the Company’s financial plan and prospects unless the Common Stock was acquired for cash. These risks and uncertainties included risks relating to Myogen’s ability to successfully develop and market its current products, potential difficulties or delays in its clinical trials, Myogen’s ability to prepare and prosecute the NDA for ambrisentan, regulatory developments involving current and future products and its effectiveness at managing its financial resources (including financing its research and development activities and the commercialization of any products approved by the FDA through licensing and other agreements), as well as the other risks and uncertainties discussed in the Company’s filings with the SEC. |

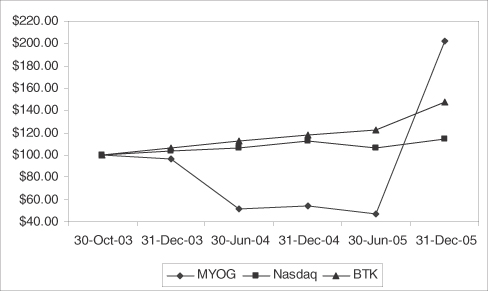

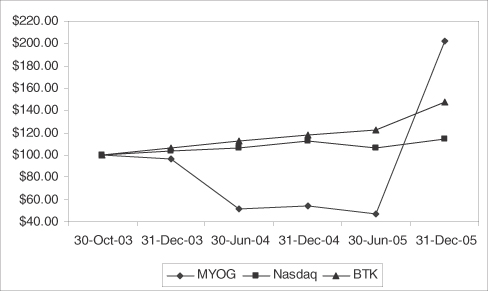

| | • | | Offer Price; Historical Trading Prices.With assistance from Goldman Sachs, the Myogen Board reviewed the historical market prices, volatility and trading information with respect to the Common Stock, including the fact that the Offer Price represented a premium of 49.7% over the $35.08 closing price per share of the Common Stock on the Nasdaq on September 29, 2006, the last trading day prior to the execution of the Merger Agreement. The Myogen Board considered that the Offer Price represented a premium of approximately 51.6% over the average closing price of the Common Stock during the one month prior to the execution of the Merger Agreement, a premium of 72.2% over the average closing price of the Common Stock during the one year prior to the execution of the Merger Agreement and a premium of 200.7% over the average closing price of the Common Stock during the period from the initial public offering of shares of Common Stock until the last trading day prior to the execution of the Merger Agreement. |

| | • | | Cash Tender Offer; Certainty of Value.The Myogen Board considered that the Offer provides for a cash tender offer for all Common Stock held by Myogen stockholders to be followed by the Merger in which all of the outstanding shares of Common Stock (other than shares of Common Stock that are held by (a) Purchaser, Gilead or the Company (or by any direct or indirect wholly-owned Subsidiary of Gilead, Purchaser or the Company), which will be canceled, and (b) stockholders, if any, who properly exercise their appraisal rights under the DGCL) would be converted into cash equal to the Offer Price, thereby enabling Myogen stockholders, at the earliest possible time, to obtain the benefits of the transaction in |

18

| | exchange for their shares of Common Stock and eliminating many uncertainties in valuing the merger consideration to be received by the Myogen stockholders in the Merger and any potential coercive effects of a two-step transaction in which the consideration payable in the first-step tender offer might differ from the consideration payable in the second-step merger. |