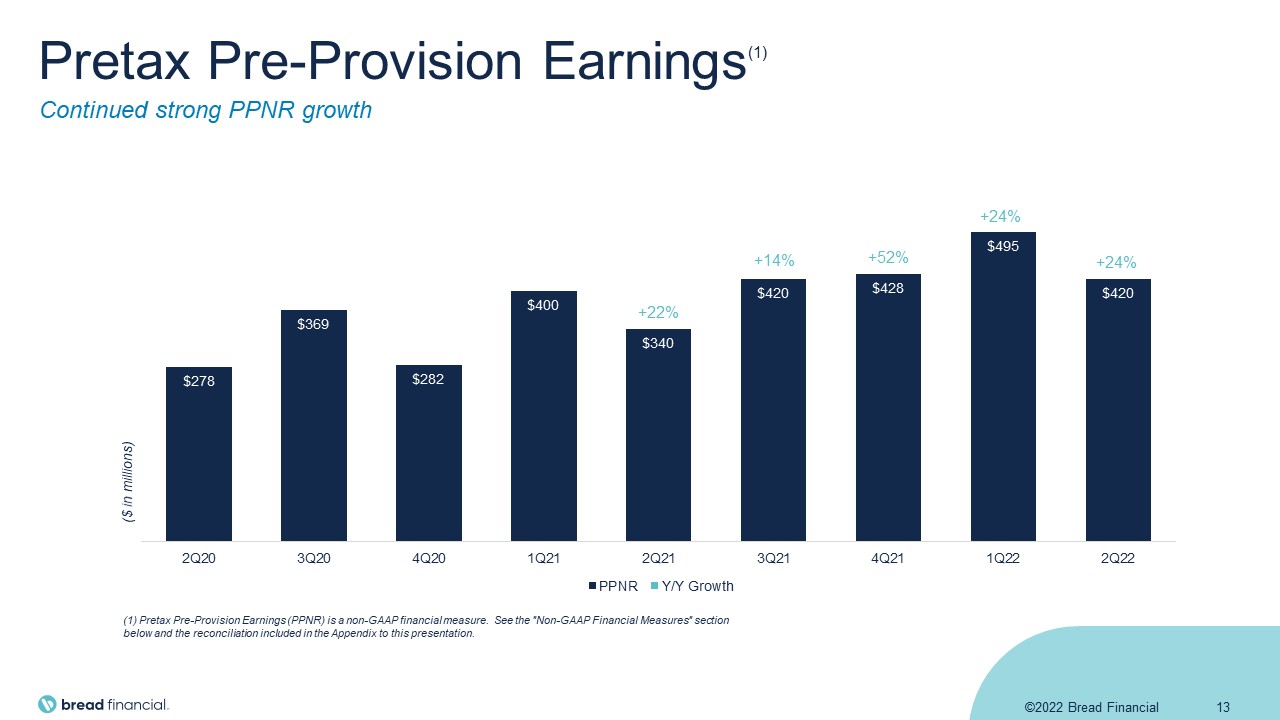

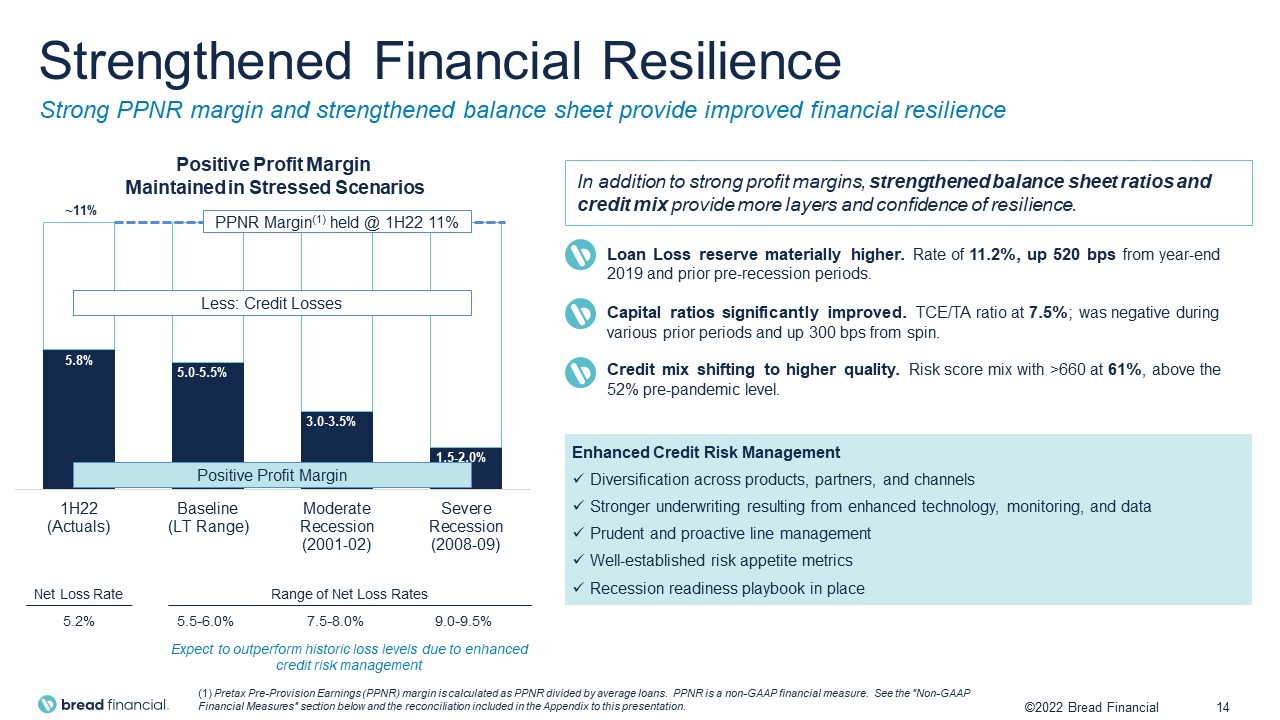

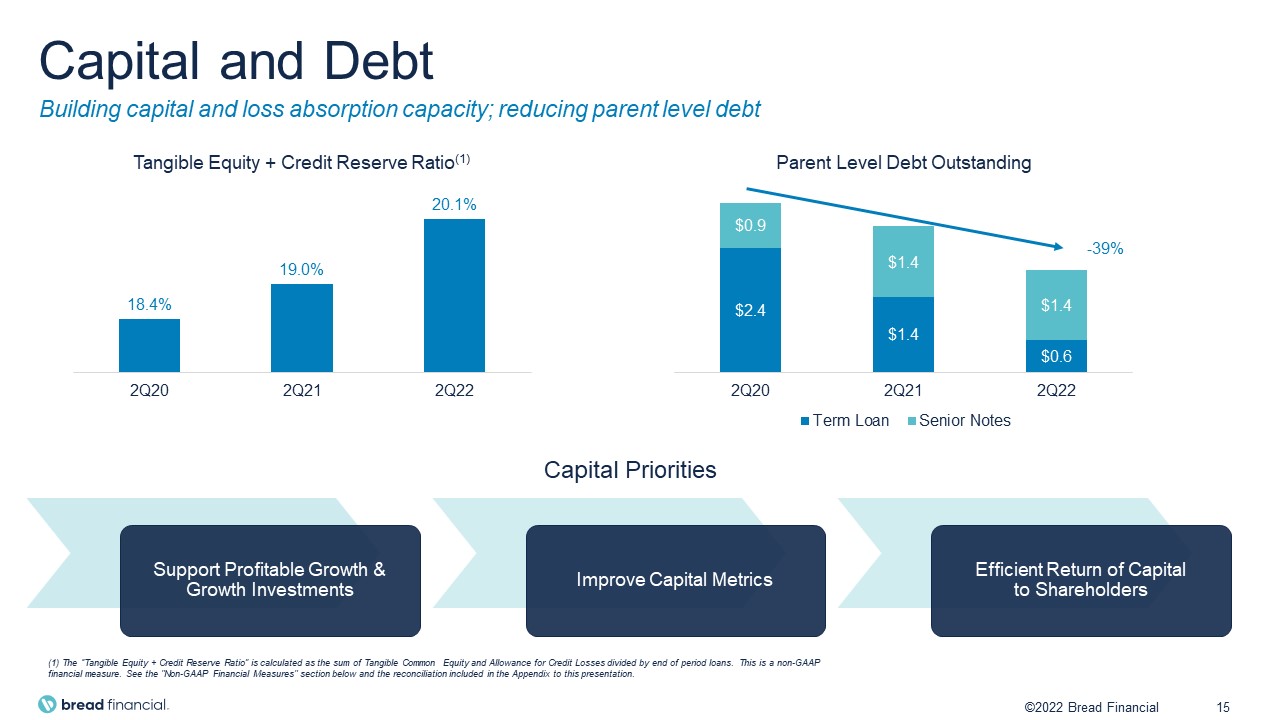

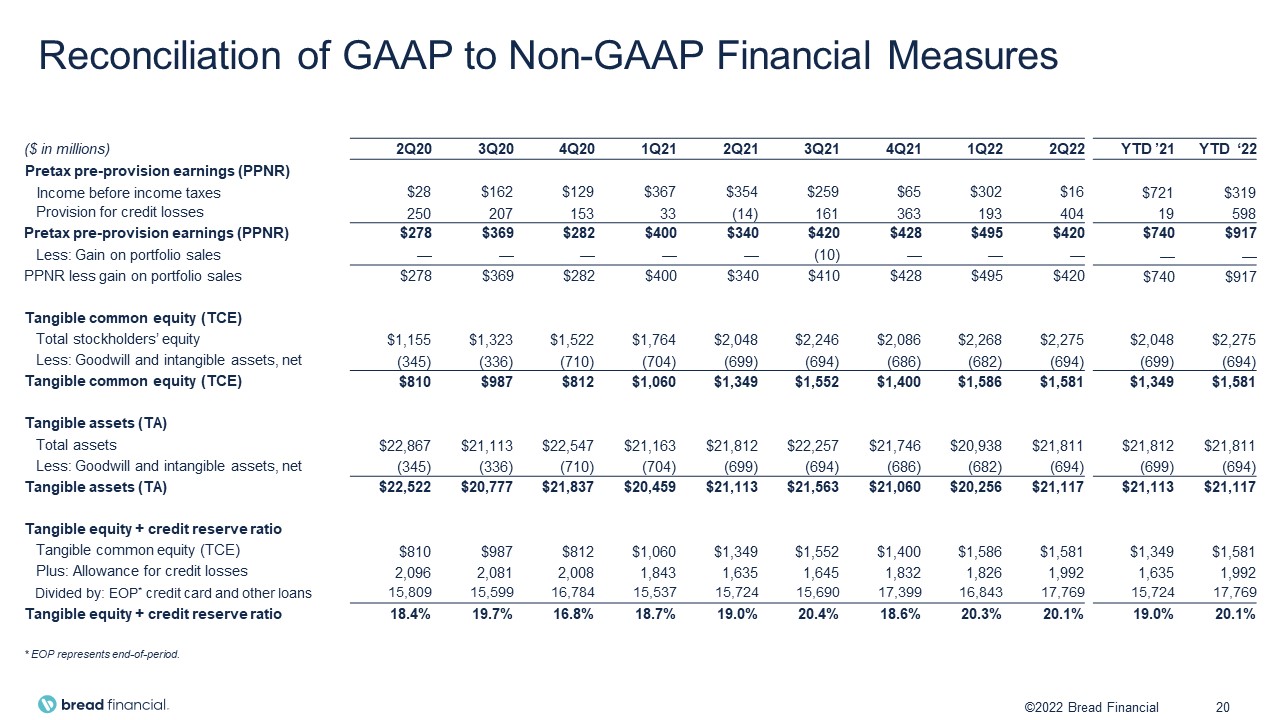

Reconciliation of GAAP to Non-GAAP Financial Measures 20 ©2022 Bread Financial ($ in millions) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 YTD ’21 YTD ‘22 Pretax pre-provision earnings (PPNR) Income before income taxes $28 $162 $129 $367 $354 $259 $65 $302 $16 $721 $319 Provision for credit losses 250 207 153 33 (14) 161 363 193 404 19 598 Pretax pre-provision earnings (PPNR) $278 $369 $282 $400 $340 $420 $428 $495 $420 $740 $917 Less: Gain on portfolio sales — — — — — (10) — — — — — PPNR less gain on portfolio sales $278 $369 $282 $400 $340 $410 $428 $495 $420 $740 $917 Tangible common equity (TCE) Total stockholders’ equity $1,155 $1,323 $1,522 $1,764 $2,048 $2,246 $2,086 $2,268 $2,275 $2,048 $2,275 Less: Goodwill and intangible assets, net (345) (336) (710) (704) (699) (694) (686) (682) (694) (699) (694) Tangible common equity (TCE) $810 $987 $812 $1,060 $1,349 $1,552 $1,400 $1,586 $1,581 $1,349 $1,581 Tangible assets (TA) Total assets $22,867 $21,113 $22,547 $21,163 $21,812 $22,257 $21,746 $20,938 $21,811 $21,812 $21,811 Less: Goodwill and intangible assets, net (345) (336) (710) (704) (699) (694) (686) (682) (694) (699) (694) Tangible assets (TA) $22,522 $20,777 $21,837 $20,459 $21,113 $21,563 $21,060 $20,256 $21,117 $21,113 $21,117 Tangible equity + credit reserve ratio Tangible common equity (TCE) $810 $987 $812 $1,060 $1,349 $1,552 $1,400 $1,586 $1,581 $1,349 $1,581 Plus: Allowance for credit losses 2,096 2,081 2,008 1,843 1,635 1,645 1,832 1,826 1,992 1,635 1,992 Divided by: EOP* credit card and other loans 15,809 15,599 16,784 15,537 15,724 15,690 17,399 16,843 17,769 15,724 17,769 Tangible equity + credit reserve ratio 18.4% 19.7% 16.8% 18.7% 19.0% 20.4% 18.6% 20.3% 20.1% 19.0% 20.1% * EOP represents end-of-period.