Bread Financial First Quarter 2023 Results April 27, 2023 © 2 0 2 2 B r e a d F i n a n c i a l | C o n f i d e n t i a l & P r o p r i e t a r y 1 Ralph Andretta | President & CEO Perry Beberman | EVP & CFO Exhibit 99.2

2©2023 Bread Financial Forward-Looking Statements This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “project,” “plan,” “likely,” “may,” “should” or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make regarding, and the guidance we give with respect to, our anticipated operating or financial results, future financial performance and outlook, future dividend declarations, and future economic conditions. We believe that our expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that are difficult to predict and, in many cases, beyond our control. Accordingly, our actual results could differ materially from the projections, anticipated results or other expectations expressed in this release, and no assurances can be given that our expectations will prove to have been correct. Factors that could cause the outcomes to differ materially include, but are not limited to, the following: macroeconomic conditions, including market conditions, inflation, rising interest rates, unemployment levels and the increased probability of a recession, and the related impact on consumer payment rates, savings rates and other behavior; global political and public health events and conditions, including the ongoing war in Ukraine and the continuing effects of the global COVID-19 pandemic; future credit performance, including the level of future delinquency and write-off rates; the loss of, or reduction in demand from, significant brand partners or customers in the highly competitive markets in which we compete; the concentration of our business in U.S. consumer credit; inaccuracies in the models and estimates on which we rely, including the amount of our Allowance for credit losses and our credit risk management models; the inability to realize the intended benefits of acquisitions, dispositions and other strategic initiatives; our level of indebtedness and ability to access financial or capital markets; pending and future legislation, regulation, supervisory guidance, and regulatory and legal actions, including, but not limited to, those related to financial regulatory reform and consumer financial services practices, as well as any such actions with respect to late fees, interchange fees or other charges; impacts arising from or relating to the transition of our credit card processing services to third party service providers that we completed in 2022; failures or breaches in our operational or security systems, including as a result of cyberattacks, unanticipated impacts from technology modernization projects or otherwise; and any tax liability, disputes or other adverse impacts arising out of or relating to the spinoff of our former LoyaltyOne segment or the recent bankruptcy filings of Loyalty Ventures Inc. and certain of its subsidiaries. The foregoing factors, along with other risks and uncertainties that could cause actual results to differ materially from those expressed or implied in forward-looking statements, are described in greater detail under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking statements speak only as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise. Non-GAAP Financial Measures We prepare our Consolidated Financial Statements in accordance with accounting principles generally accepted in the United States of America (GAAP). However, certain information included herein constitutes non- GAAP financial measures. Our calculations of non-GAAP financial measures may differ from the calculations of similarly titled measures by other companies. In particular, Pretax pre-provision earnings (PPNR) is calculated by increasing/decreasing Income from continuing operations before income taxes by the net provision/release in Provision for credit losses. PPNR less gain on portfolio sales then decreases PPNR by the gain on any portfolio sales in the period. We use PPNR and PPNR less gain on portfolio sales as metrics to evaluate our results of operations before income taxes, excluding the volatility that can occur within Provision for credit losses and the one-time nature of a gain on the sale of a portfolio. Tangible common equity over Tangible assets (TCE/TA) represents Total stockholders’ equity reduced by Goodwill and intangible assets, net, (TCE) divided by Tangible assets (TA), which is Total assets reduced by Goodwill and intangible assets, net. We use TCE/TA as a metric to evaluate the Company’s capital adequacy and estimate its ability to cover potential losses. Tangible book value per common share represents TCE divided by shares outstanding. We use Tangible book value per common share as a metric to estimate the Company’s potential value in relation to tangible assets per share. We believe the use of these non-GAAP financial measures provide additional clarity in understanding our results of operations and trends. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures, please see the “Reconciliation of GAAP to Non-GAAP Financial Measures”.

3©2023 Bread Financial 2023 Focus Areas Responsible Growth Support organic growth and new brand partner launches that deliver long-term value Enhance Balance Sheet Build capital and reduce parent-level debt; ensure proactive credit, liquidity, and interest rate risk management Strategically Invest Deliver exceptional value and experiences through marketing, loyalty, and technology innovation Optimize Data & Technology Leverage new capabilities to create additional value and drive efficiencies

4©2023 Bread Financial Enhanced credit risk management and underlying credit distribution Strengthened balance sheet and funding mixStrong corporate governance Prudent balance sheet management Expense discipline Proactive risk management Active recession readiness playbook Enhanced core capabilities Strengthened Financial Resilience Bread Financial is positioned to perform well through a full economic cycle Loan loss reserve materially higher Capital ratios significantly improved Increased mix of direct-to-consumer deposits Reduced debt levels Diversification across products and partners Prudent and proactive line management Credit mix shift to higher quality over time Well-established risk appetite metrics

5©2023 Bread Financial Strong, Stable Funding Base Growing online direct-to-consumer deposits; small average account size >90% FDIC insured Diverse funding sources Disciplined Financial Management Prudent interest rate risk management No Held-to-Maturity securities Liquidity portfolio held nearly all in cash at Fed Prudent Balance Sheet Management Loan loss reserve materially higher Capital ratios significantly improved Increased direct-to- consumer deposits Reduced debt Strengthened balance sheet and funding mix +$4.4B -39% +3x +300bps DTC deposits since 1Q20 to $5.6 billion reserve rate increase since CECL Day 1 parent debt reduction since 1Q20 TCE/TA ratio increase since 1Q20 to 9.1%

6©2023 Bread Financial First Quarter 2023 Financial Highlights $1,289 million Revenue $455 million Net Income $9.08 Diluted EPS Year-over-year comparisons • Credit sales of $7.4 billion increased 7% driven by brand partner additions and growth across brand partners • First quarter average loans of $19.4 billion grew 17% • Revenue, including gain on portfolio sale, increased 40%, well above total non-interest expense growth of 28% • Net income increased $245 million driven by PPNR improvement, that included a $230 million pretax gain on portfolio sale, and a lower provision for credit losses, due to both the sale of the BJ's portfolio and seasonal paydowns • Credit performance metrics in the quarter were impacted by the transition of our credit card processing services in June 2022, as expected

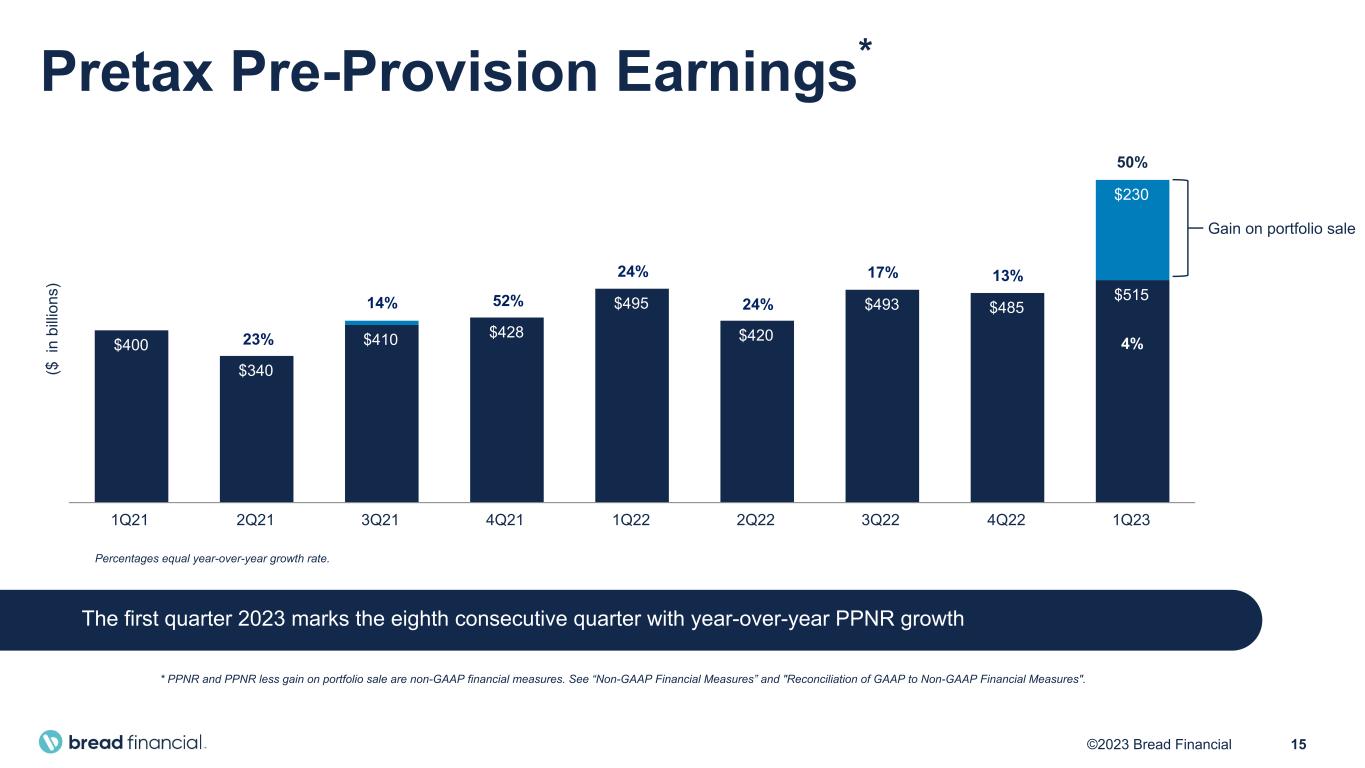

7©2023 Bread Financial $ in millions PPNR Growth* $495 $515 $230 1Q22 1Q23 * PPNR and PPNR less gain on portfolio sale are non-GAAP financial measures. See “Non-GAAP Financial Measures” and "Reconciliation of GAAP to Non-GAAP Financial Measures". nm – Not meaningful, denoting a variance of 100 percent or more. ($ in millions, except per share) 1Q23 1Q22 $ Chg % Chg Total interest income $ 1,335 $ 1,068 $ 267 25% Total interest expense 218 79 139 nm Net interest income 1,117 989 128 13% Total non-interest income 172 (68) 240 nm Revenue 1,289 921 368 40% Net principal losses 342 199 143 71% Reserve (release) build (235) (6) (229) nm Provision for credit losses 107 193 (86) (45%) Total non-interest expenses 544 426 118 28% Income before income taxes 638 302 336 nm Provision for income taxes 183 91 92 nm Net income $ 455 $ 211 $ 244 nm Net income per diluted share $ 9.08 $ 4.21 $ 4.87 nm Weighted avg. shares outstanding – diluted 50.1 50.0 Pretax pre-provision earnings (PPNR)* $ 745 $ 495 $ 250 50% Less: Gain on portfolio sale (230) — (230) nm PPNR less gain on portfolio sale* $ 515 $ 495 $ 20 4% +50% Financial Results Continuing Operations +4% Gain on portfolio sale

8©2023 Bread Financial $17.4 $17.1 $17.3 $17.4 $17.8 $18.2 $18.8 $20.3 $19.9 Wholesale deposits Direct-to-consumer deposits Unsecured borrowings Secured borrowings 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 $18.9 $18.8 $19.1 $19.8 $20.4 $21.0 $21.8 $23.6 $23.5 Credit card and other loans Cash and investment securities 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Av er ag e in te re st -b ea rin g lia bi lit ie s ($ in b ill io ns ) Av er ag e in te re st -e ar ni ng a ss et s ($ in b ill io ns ) Interest-Earning Asset Yields & Mix 23.8% 23.9% 25.6% 25.2% 25.6% 25.0% 27.2% 26.0% 26.6% 19.9% 19.5% 20.8% 20.6% 20.9% 20.5% 22.3% 22.4% 22.7% 17.7% 17.3% 18.9% 18.8% 19.4% 18.6% 19.9% 19.1% 19.0% Loan yield Avg. earning asset yield Net interest margin Interest-Bearing Liability Costs & Funding Mix 2.5% 2.3% 2.1% 1.9% 1.8% 2.1% 2.8% 3.9% 4.4% 1.9% 1.8% 1.6% 1.4% 1.3% 1.5% 2.2% 3.1% 3.5% Cost of total Interest-bearing liabilities Cost of deposits Net Interest Margin 84% 81% 81% 81% 81% 81% 81% 84% 83% 16% 19% 19% 19% 19% 19% 19% 16% 17% 27% 26% 28% 26% 28% 29% 26% 25% 23% 16% 17% 16% 14% 11% 11% 10% 10% 9% 11% 13% 15% 18% 19% 22% 27% 26% 28% 46% 44% 41% 42% 42% 38% 37% 39% 40%

9©2023 Bread Financial Direct-to-Consumer Deposit Growth Strong growth in Bread SavingsTM direct-to-consumer deposits diversifies our funding mix ($ in b ill io ns ) Average Direct-to-Consumer Deposit Growth $1.9 $2.3 $2.7 $3.1 $3.3 $3.9 $4.9 $5.4 $5.6 1.2% 1.0% 0.8% 0.8% 0.8% 1.1% 2.0% 2.9% 3.5% Direct-to-consumer deposits Cost of direct-to-consumer deposits 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Average Direct-to-Consumer Deposit Mix 30% 19% 41% 28% 1Q22 1Q23 % of total deposits % of total funding +70%

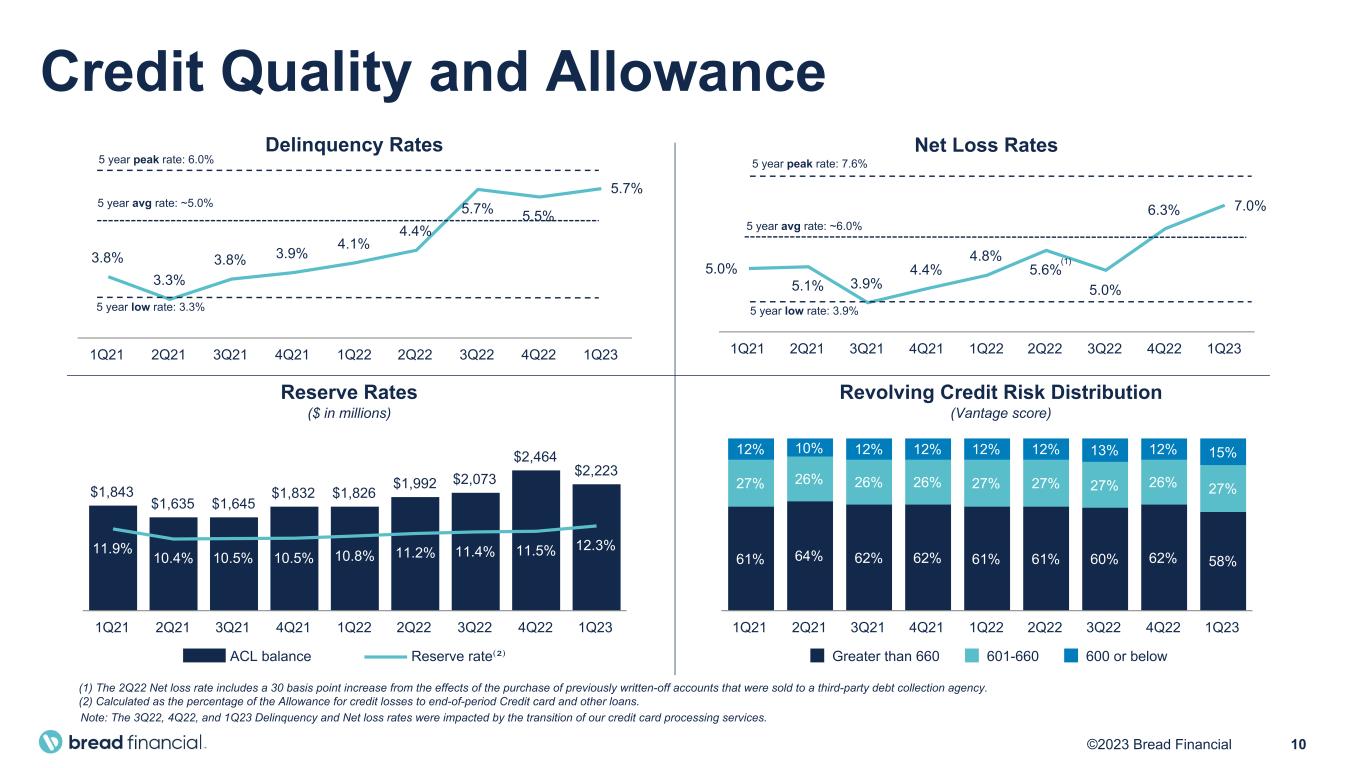

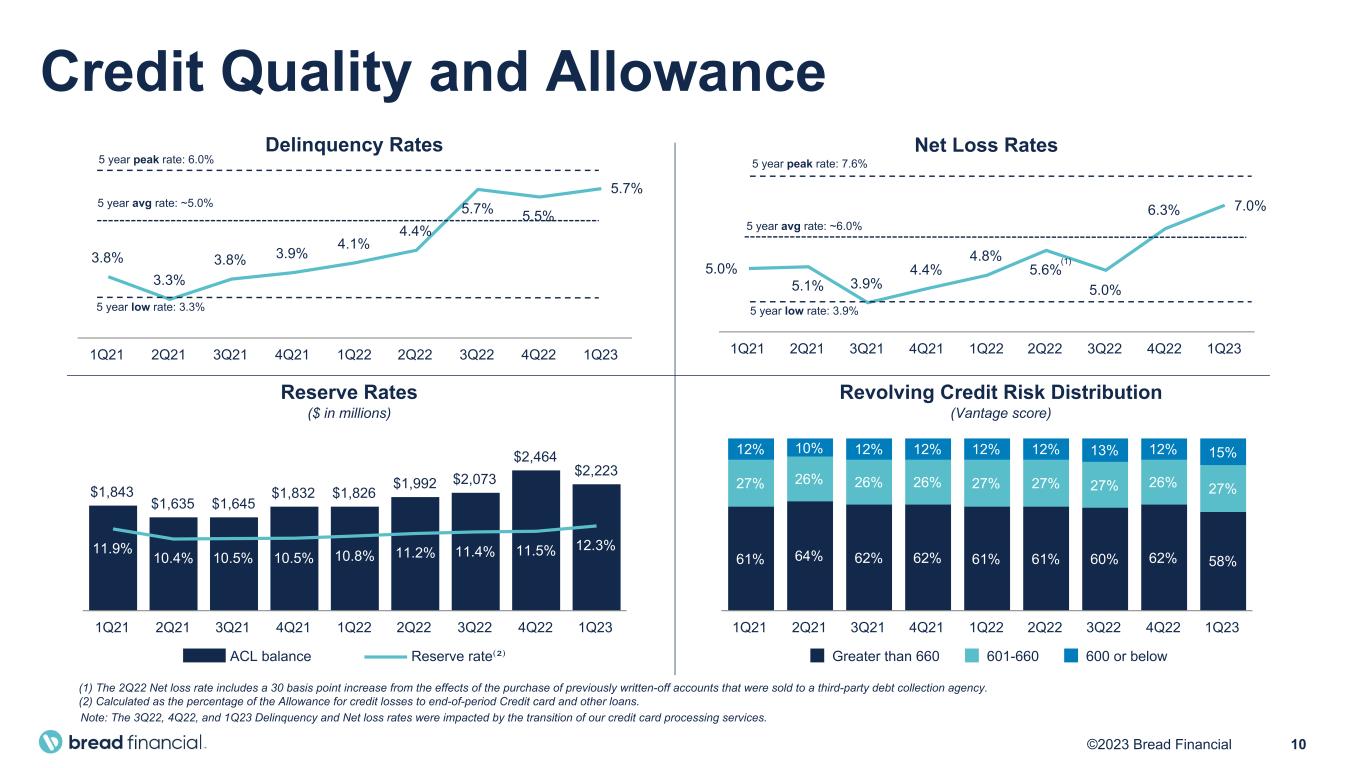

10©2023 Bread Financial $1,843 $1,635 $1,645 $1,832 $1,826 $1,992 $2,073 $2,464 $2,223 11.9% 10.4% 10.5% 10.5% 10.8% 11.2% 11.4% 11.5% 12.3% ACL balance Reserve rate⁽²⁾ 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Net Loss Rates 5.0% 5.1% 3.9% 4.4% 4.8% 5.6% 5.0% 6.3% 7.0% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Delinquency Rates 3.8% 3.3% 3.8% 3.9% 4.1% 4.4% 5.7% 5.5% 5.7% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 5 year peak rate: 7.6% 5 year low rate: 3.9% 5 year avg rate: ~6.0% 5 year peak rate: 6.0% 5 year avg rate: ~5.0% 5 year low rate: 3.3% 61% 64% 62% 62% 61% 61% 60% 62% 58% 27% 26% 26% 26% 27% 27% 27% 26% 27% 12% 10% 12% 12% 12% 12% 13% 12% 15% Greater than 660 601-660 600 or below 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Reserve Rates ($ in millions) Revolving Credit Risk Distribution (Vantage score) Credit Quality and Allowance (1) The 2Q22 Net loss rate includes a 30 basis point increase from the effects of the purchase of previously written-off accounts that were sold to a third-party debt collection agency. (2) Calculated as the percentage of the Allowance for credit losses to end-of-period Credit card and other loans. (1) Note: The 3Q22, 4Q22, and 1Q23 Delinquency and Net loss rates were impacted by the transition of our credit card processing services.

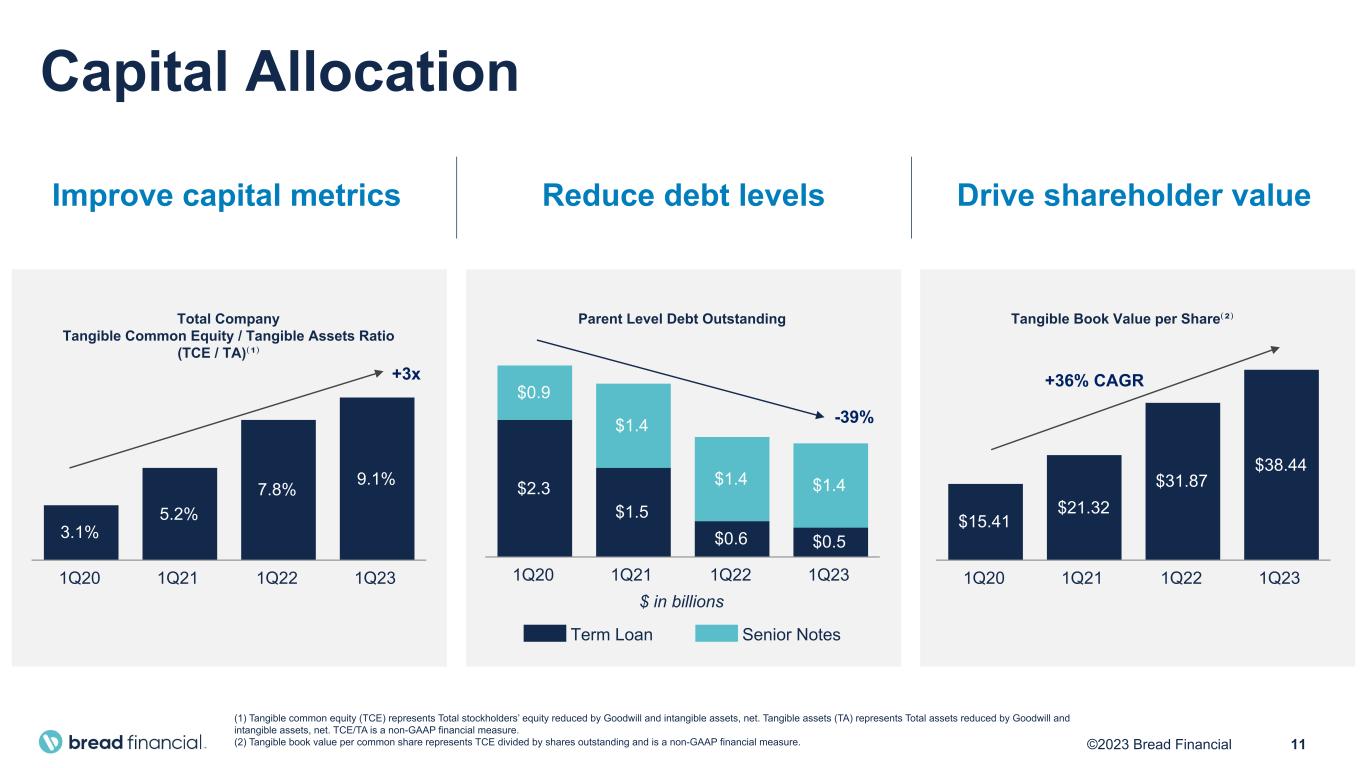

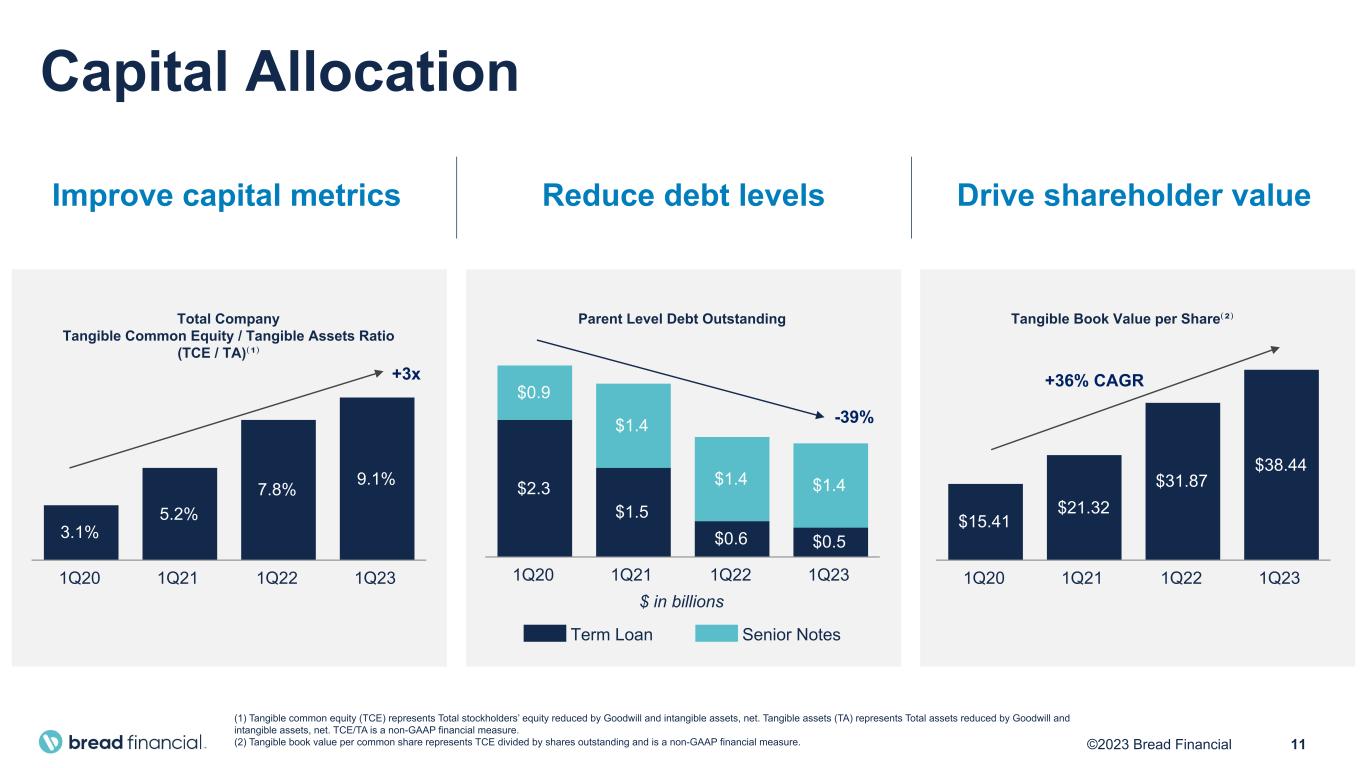

11©2023 Bread Financial (1) Tangible common equity (TCE) represents Total stockholders’ equity reduced by Goodwill and intangible assets, net. Tangible assets (TA) represents Total assets reduced by Goodwill and intangible assets, net. TCE/TA is a non-GAAP financial measure. (2) Tangible book value per common share represents TCE divided by shares outstanding and is a non-GAAP financial measure. Capital Allocation Tangible Book Value per Share⁽²⁾ $15.41 $21.32 $31.87 $38.44 1Q20 1Q21 1Q22 1Q23 Total Company Tangible Common Equity / Tangible Assets Ratio (TCE / TA)⁽¹⁾ 3.1% 5.2% 7.8% 9.1% 1Q20 1Q21 1Q22 1Q23 +3x +36% CAGR Drive shareholder valueImprove capital metrics $ in billions Parent Level Debt Outstanding $2.3 $1.5 $0.6 $0.5 $0.9 $1.4 $1.4 $1.4 Term Loan Senior Notes 1Q20 1Q21 1Q22 1Q23 -39% Reduce debt levels

12©2023 Bread Financial Full Year 2022 Actuals Full Year 2023 Outlook Commentary Average loans $17,768 million Up mid- single digits • We expect full year 2023 average credit card and other loans to grow in the mid-single digit range relative to 2022. Revenue $3,826 million Aligned with loan growth • Net interest margin is expected to remain similar to the 2022 full year rate of 19.2%. • Revenue guidance excludes the gain on portfolio sale. Total non-interest expenses $1,932 million Positive operating leverage • We expect to deliver full year positive operating leverage while we continue to strategically invest in technology modernization, marketing, and product innovation to drive growth and efficiencies. • With the magnitude of the gain on portfolio sale, we plan to invest up to $30 million of the gain in 2023 to accelerate our business transformation. Excluding the gain on portfolio sale from revenue and this $30 million investment from total expenses, we expect to achieve nominal positive operating leverage for the full year. Net loss rate 5.4% ~7% • Our outlook is inclusive of customer accommodations related to the 2022 transition of our credit card processing services as well as continued pressure on consumers’ ability to pay due to persistent inflation. • We remain confident in our long-term guidance of a through-the-cycle average net loss rate below our historical average of 6%. 2023 Financial Outlook Our 2023 financial outlook assumes a more challenging macroeconomic landscape with continued inflationary pressures and an unemployment rate gradually moving to the mid-to-upper 4% range by year end 2023. Our 2023 full year outlook remains unchanged from our guidance provided in January 2023

Appendix © 2 0 2 2 B r e a d F i n a n c i a l | C o n f i d e n t i a l & P r o p r i e t a r y 1 3

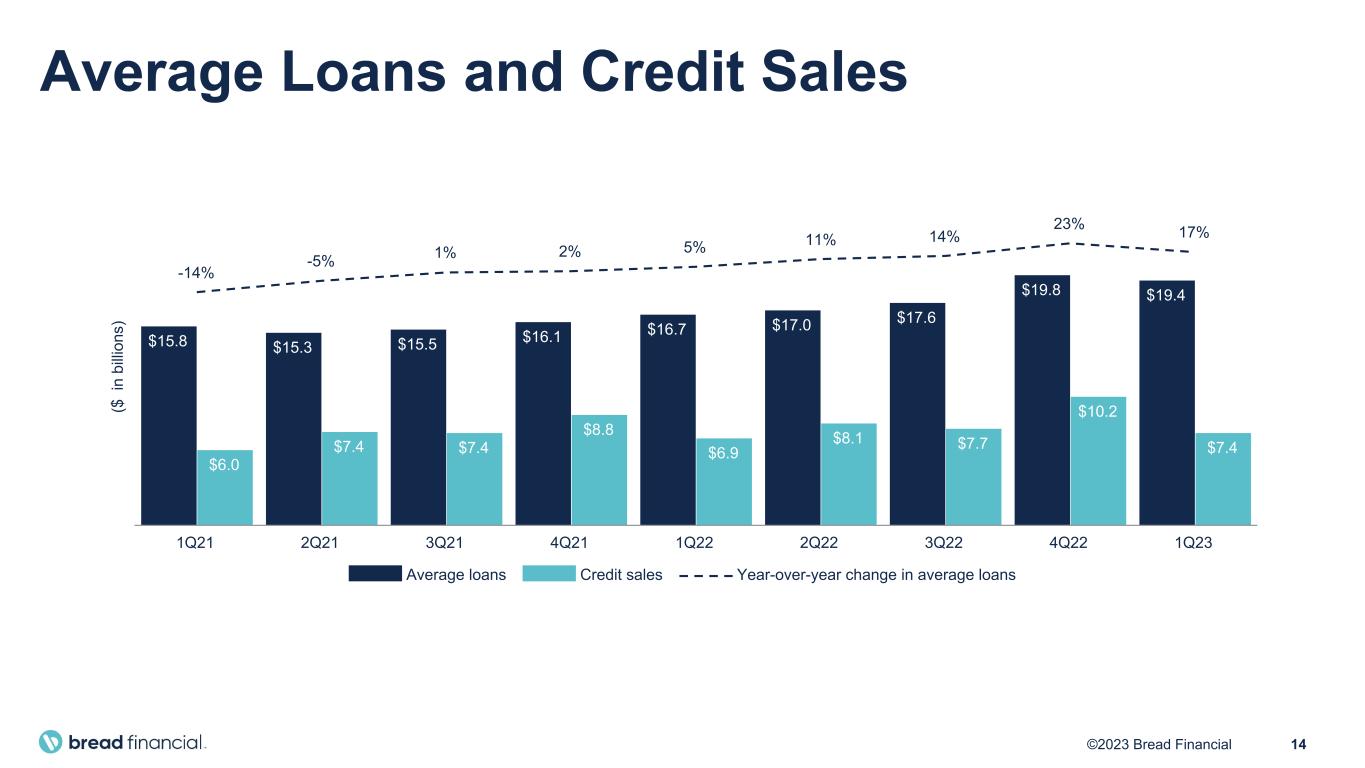

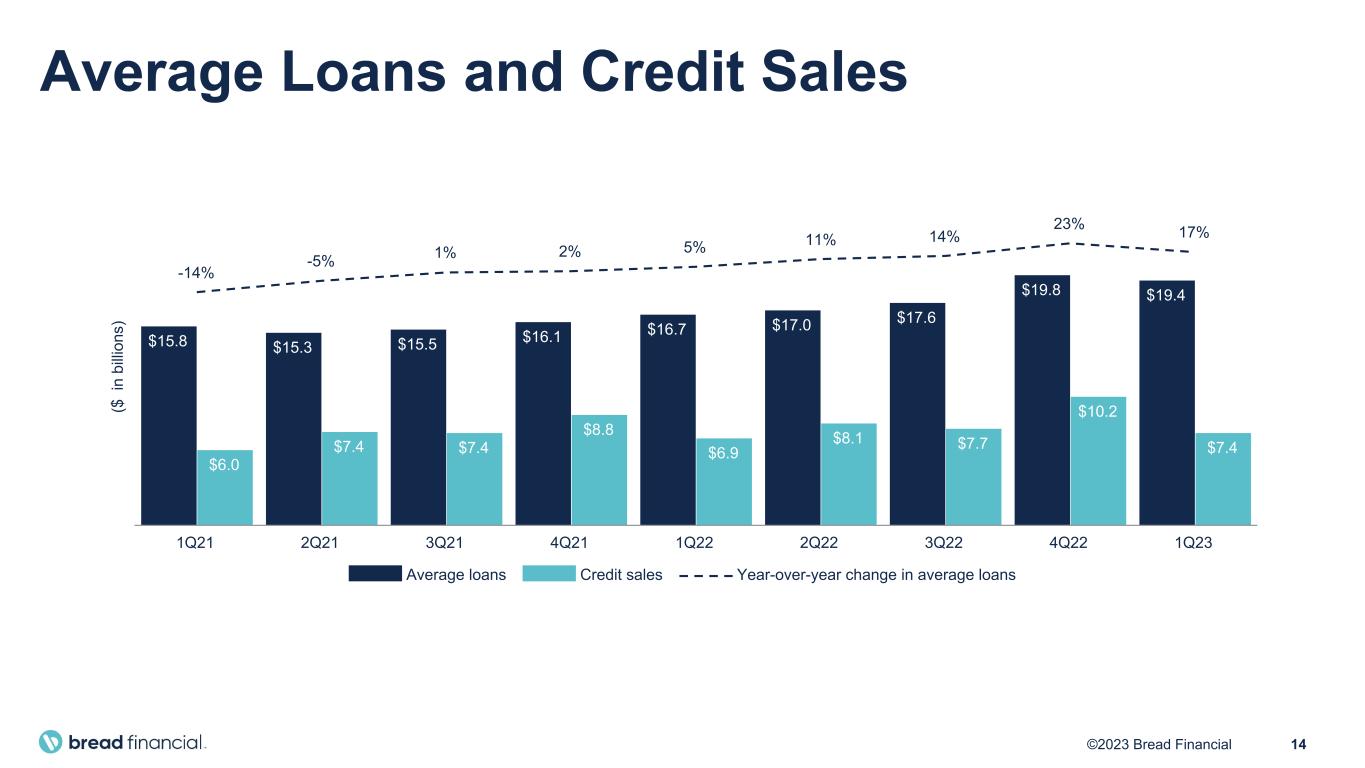

14©2023 Bread Financial ($ i n bi lli on s) $15.8 $15.3 $15.5 $16.1 $16.7 $17.0 $17.6 $19.8 $19.4 $6.0 $7.4 $7.4 $8.8 $6.9 $8.1 $7.7 $10.2 $7.4 -14% -5% 1% 2% 5% 11% 14% 23% 17% Average loans Credit sales Year-over-year change in average loans 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Average Loans and Credit Sales

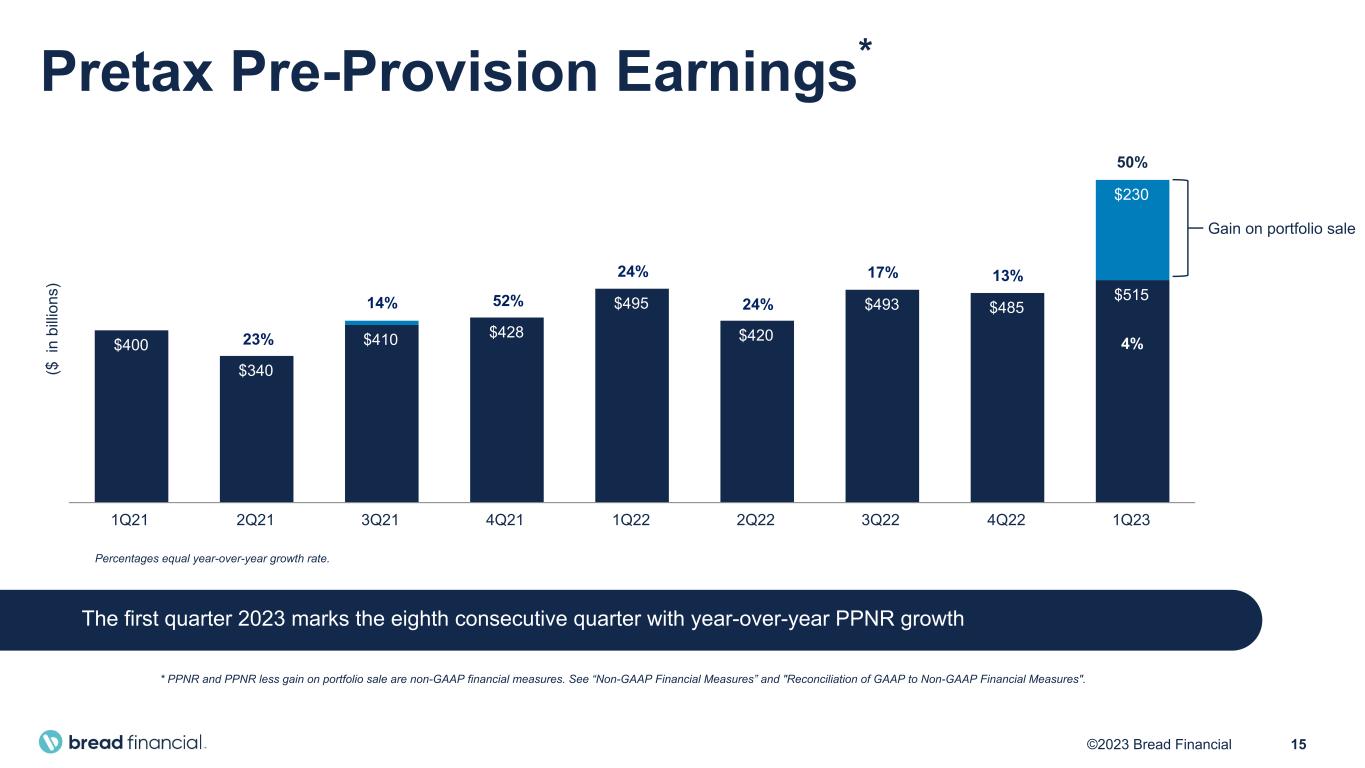

15©2023 Bread Financial ($ i n bi lli on s) $400 $340 $410 $428 $495 $420 $493 $485 $515 $230 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Pretax Pre-Provision Earnings* The first quarter 2023 marks the eighth consecutive quarter with year-over-year PPNR growth * PPNR and PPNR less gain on portfolio sale are non-GAAP financial measures. See “Non-GAAP Financial Measures” and "Reconciliation of GAAP to Non-GAAP Financial Measures". 14% 52% 24% 24% 17% 50% 23% Percentages equal year-over-year growth rate. 13% Gain on portfolio sale 4%

16©2023 Bread Financial Efficiency Ratio* 46% 42% 1Q22 1Q23 $ in millions Total Non-Interest Expenses $426 $544 1Q22 1Q23 Total non-interest expenses increased 28% versus 1Q22 • Employee compensation and benefit costs increased primarily driven by continued digital and technology modernization-related hiring and customer care and collections staffing • Card and processing expenses increased due to increased fraud costs and higher direct mail and statement volumes • Information processing and communications expenses increased as a result of the transition of our credit card processing services and other software licensing expenses Total Non-Interest Expenses $41 $38 $19 $8 $13 $(1) Employee comp. & benefits: Card and processing: Info. processing & comm.: Marketing: Depreciation & amortization: Other: 23% 46% 34% 26% 63% —% +28% -4% 1Q23 vs. 1Q22 Change in Non-Interest Expenses * Efficiency ratio represents Total non-interest expenses divided by Total net interest and non-interest income.

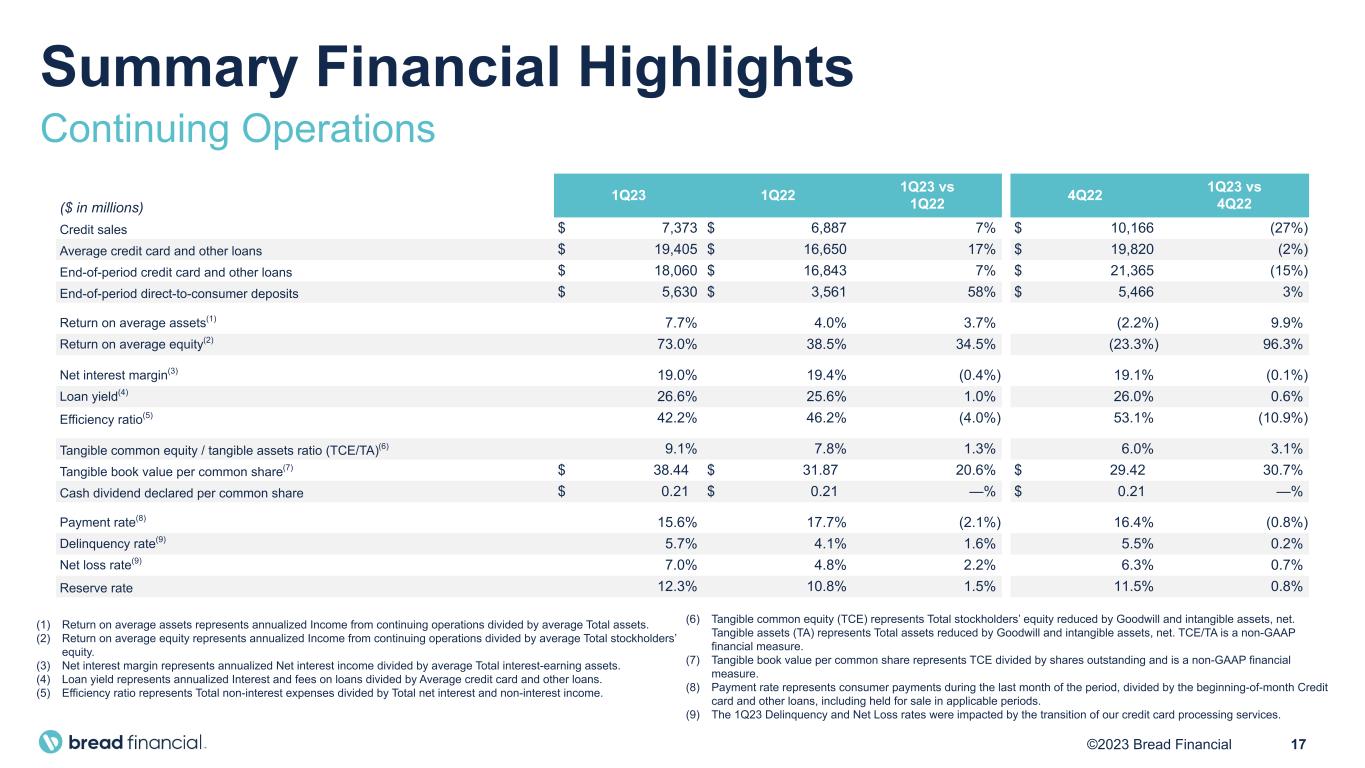

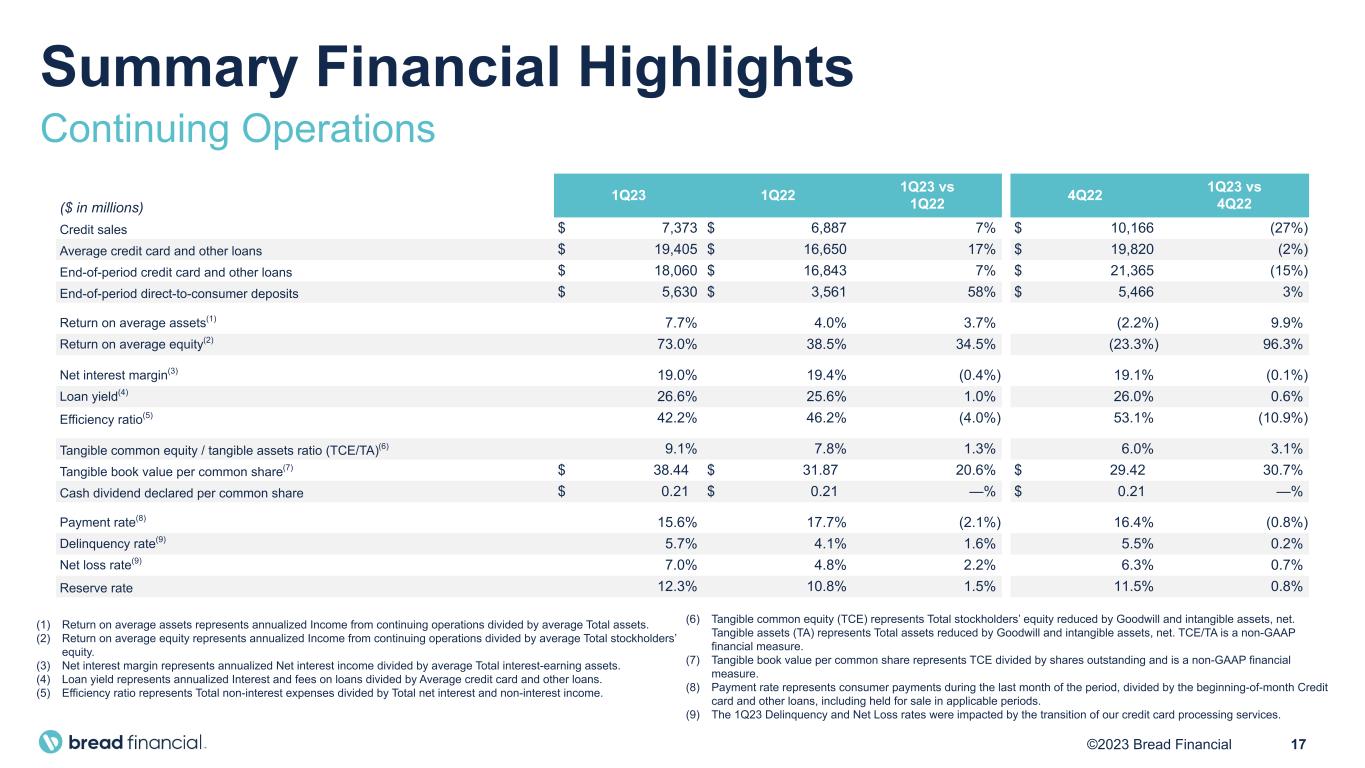

17©2023 Bread Financial (1) . (2) . (3) . (4) . (5) . (6) Tangible common equity (TCE) represents Total stockholders’ equity reduced by Goodwill and intangible assets, net. Tangible assets (TA) represents Total assets reduced by Goodwill and intangible assets, net. TCE/TA is a non-GAAP financial measure. (7) Tangible book value per common share represents TCE divided by shares outstanding and is a non-GAAP financial measure. (8) Payment rate represents consumer payments during the last month of the period, divided by the beginning-of-month Credit card and other loans, including held for sale in applicable periods. (9) The 1Q23 Delinquency and Net Loss rates were impacted by the transition of our credit card processing services. ($ in millions) 1Q23 1Q22 1Q23 vs 1Q22 4Q22 1Q23 vs 4Q22 Credit sales $ 7,373 $ 6,887 7% $ 10,166 (27%) Average credit card and other loans $ 19,405 $ 16,650 17% $ 19,820 (2%) End-of-period credit card and other loans $ 18,060 $ 16,843 7% $ 21,365 (15%) End-of-period direct-to-consumer deposits $ 5,630 $ 3,561 58% $ 5,466 3% Return on average assets(1) 7.7% 4.0% 3.7% (2.2%) 9.9% Return on average equity(2) 73.0% 38.5% 34.5% (23.3%) 96.3% Net interest margin(3) 19.0% 19.4% (0.4%) 19.1% (0.1%) Loan yield(4) 26.6% 25.6% 1.0% 26.0% 0.6% Efficiency ratio(5) 42.2% 46.2% (4.0%) 53.1% (10.9%) Tangible common equity / tangible assets ratio (TCE/TA)(6) 9.1% 7.8% 1.3% 6.0% 3.1% Tangible book value per common share(7) $ 38.44 $ 31.87 20.6% $ 29.42 30.7% Cash dividend declared per common share $ 0.21 $ 0.21 —% $ 0.21 —% Payment rate(8) 15.6% 17.7% (2.1%) 16.4% (0.8%) Delinquency rate(9) 5.7% 4.1% 1.6% 5.5% 0.2% Net loss rate(9) 7.0% 4.8% 2.2% 6.3% 0.7% Reserve rate 12.3% 10.8% 1.5% 11.5% 0.8% Summary Financial Highlights Continuing Operations (1) Return on average assets represents annualized Income from continuing operations divided by average Total assets. (2) Return on average equity represents annualized Income from continuing operations divided by average Total stockholders’ equity. (3) Net interest margin represents annualized Net interest income divided by average Total interest-earning assets. (4) Loan yield represents annualized Interest and fees on loans divided by Average credit card and other loans. (5) Efficiency ratio represents Total non-interest expenses divided by Total net interest and non-interest income.

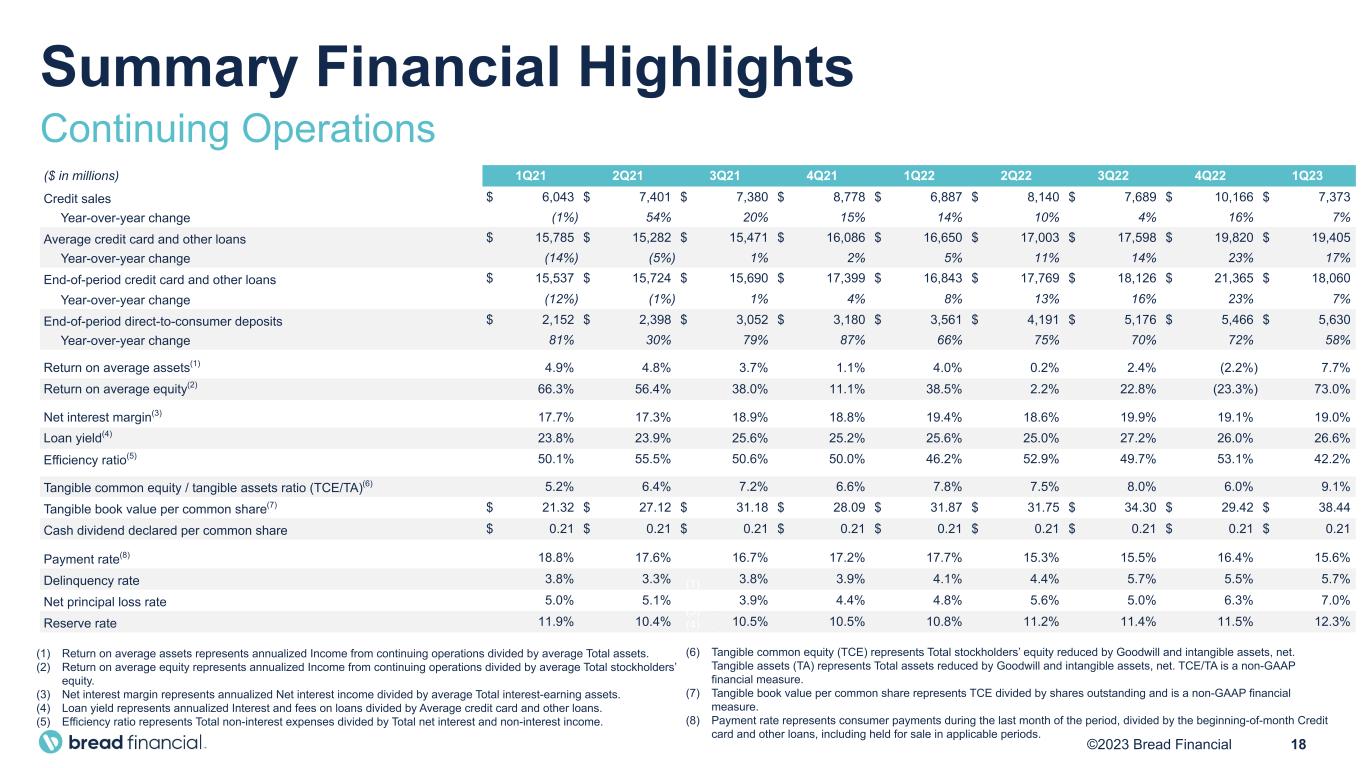

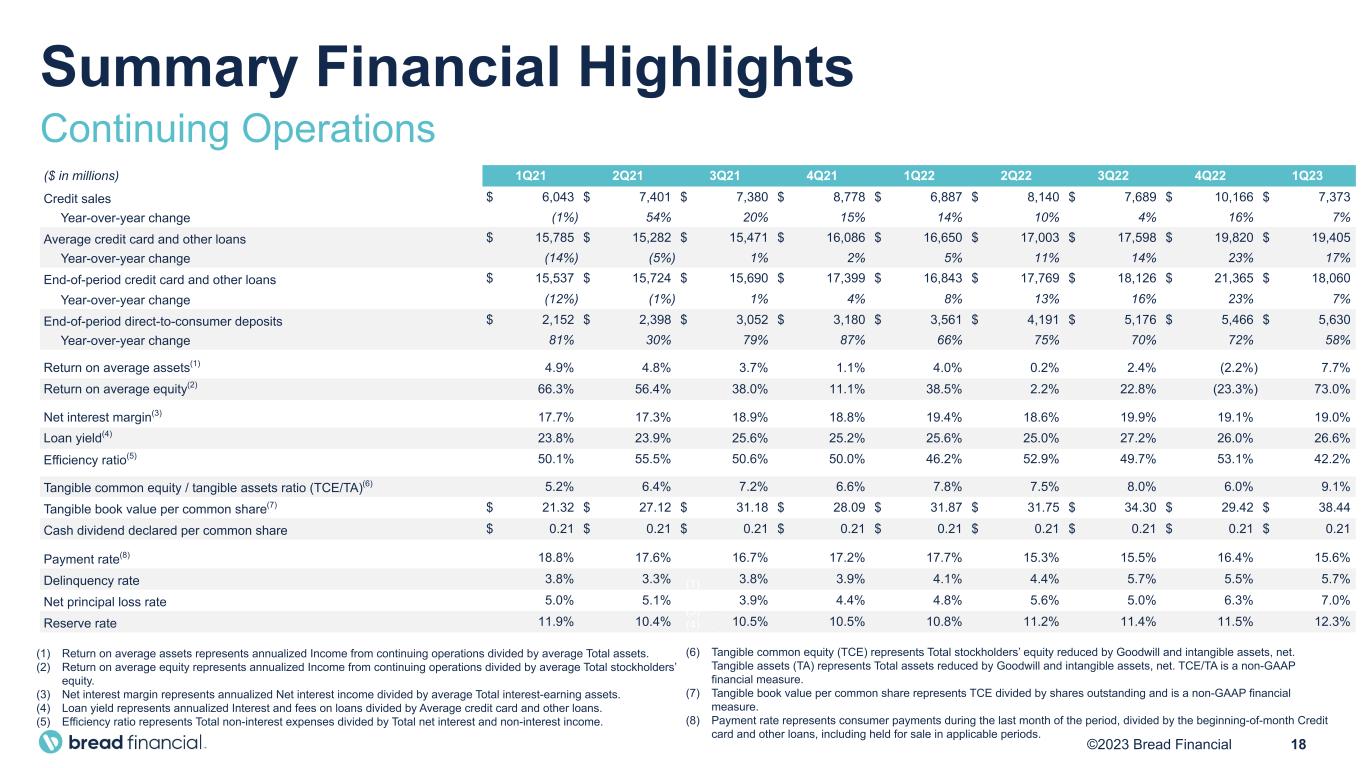

18©2023 Bread Financial ($ in millions) 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Credit sales $ 6,043 $ 7,401 $ 7,380 $ 8,778 $ 6,887 $ 8,140 $ 7,689 $ 10,166 $ 7,373 Year-over-year change (1%) 54% 20% 15% 14% 10% 4% 16% 7% Average credit card and other loans $ 15,785 $ 15,282 $ 15,471 $ 16,086 $ 16,650 $ 17,003 $ 17,598 $ 19,820 $ 19,405 Year-over-year change (14%) (5%) 1% 2% 5% 11% 14% 23% 17% End-of-period credit card and other loans $ 15,537 $ 15,724 $ 15,690 $ 17,399 $ 16,843 $ 17,769 $ 18,126 $ 21,365 $ 18,060 Year-over-year change (12%) (1%) 1% 4% 8% 13% 16% 23% 7% End-of-period direct-to-consumer deposits $ 2,152 $ 2,398 $ 3,052 $ 3,180 $ 3,561 $ 4,191 $ 5,176 $ 5,466 $ 5,630 Year-over-year change 81% 30% 79% 87% 66% 75% 70% 72% 58% Return on average assets(1) 4.9% 4.8% 3.7% 1.1% 4.0% 0.2% 2.4% (2.2%) 7.7% Return on average equity(2) 66.3% 56.4% 38.0% 11.1% 38.5% 2.2% 22.8% (23.3%) 73.0% Net interest margin(3) 17.7% 17.3% 18.9% 18.8% 19.4% 18.6% 19.9% 19.1% 19.0% Loan yield(4) 23.8% 23.9% 25.6% 25.2% 25.6% 25.0% 27.2% 26.0% 26.6% Efficiency ratio(5) 50.1% 55.5% 50.6% 50.0% 46.2% 52.9% 49.7% 53.1% 42.2% Tangible common equity / tangible assets ratio (TCE/TA)(6) 5.2% 6.4% 7.2% 6.6% 7.8% 7.5% 8.0% 6.0% 9.1% Tangible book value per common share(7) $ 21.32 $ 27.12 $ 31.18 $ 28.09 $ 31.87 $ 31.75 $ 34.30 $ 29.42 $ 38.44 Cash dividend declared per common share $ 0.21 $ 0.21 $ 0.21 $ 0.21 $ 0.21 $ 0.21 $ 0.21 $ 0.21 $ 0.21 Payment rate(8) 18.8% 17.6% 16.7% 17.2% 17.7% 15.3% 15.5% 16.4% 15.6% Delinquency rate 3.8% 3.3% 3.8% 3.9% 4.1% 4.4% 5.7% 5.5% 5.7% Net principal loss rate 5.0% 5.1% 3.9% 4.4% 4.8% 5.6% 5.0% 6.3% 7.0% Reserve rate 11.9% 10.4% 10.5% 10.5% 10.8% 11.2% 11.4% 11.5% 12.3% Summary Financial Highlights Continuing Operations (1) Return on average assets represents annualized Income from continuing operations divided by average Total assets. (2) Return on average equity represents annualized Income from continuing operations divided by average Total stockholders’ equity. (3) Net interest margin represents annualized Net interest income divided by average Total interest-earning assets. (4) Loan yield represents annualized Interest and fees on loans divided by Average credit card and other loans. (5) Efficiency ratio represents Total non-interest expenses divided by Total net interest and non-interest income. (1) . (2) . (3) . (4) . (5) . (6) Tangible common equity (TCE) represents Total stockholders’ equity reduced by Goodwill and intangible assets, net. Tangible assets (TA) represents Total assets reduced by Goodwill and intangible assets, net. TCE/TA is a non-GAAP financial measure. (7) Tangible book value per common share represents TCE divided by shares outstanding and is a non-GAAP financial measure. (8) Payment rate represents consumer payments during the last month of the period, divided by the beginning-of-month Credit card and other loans, including held for sale in applicable periods.

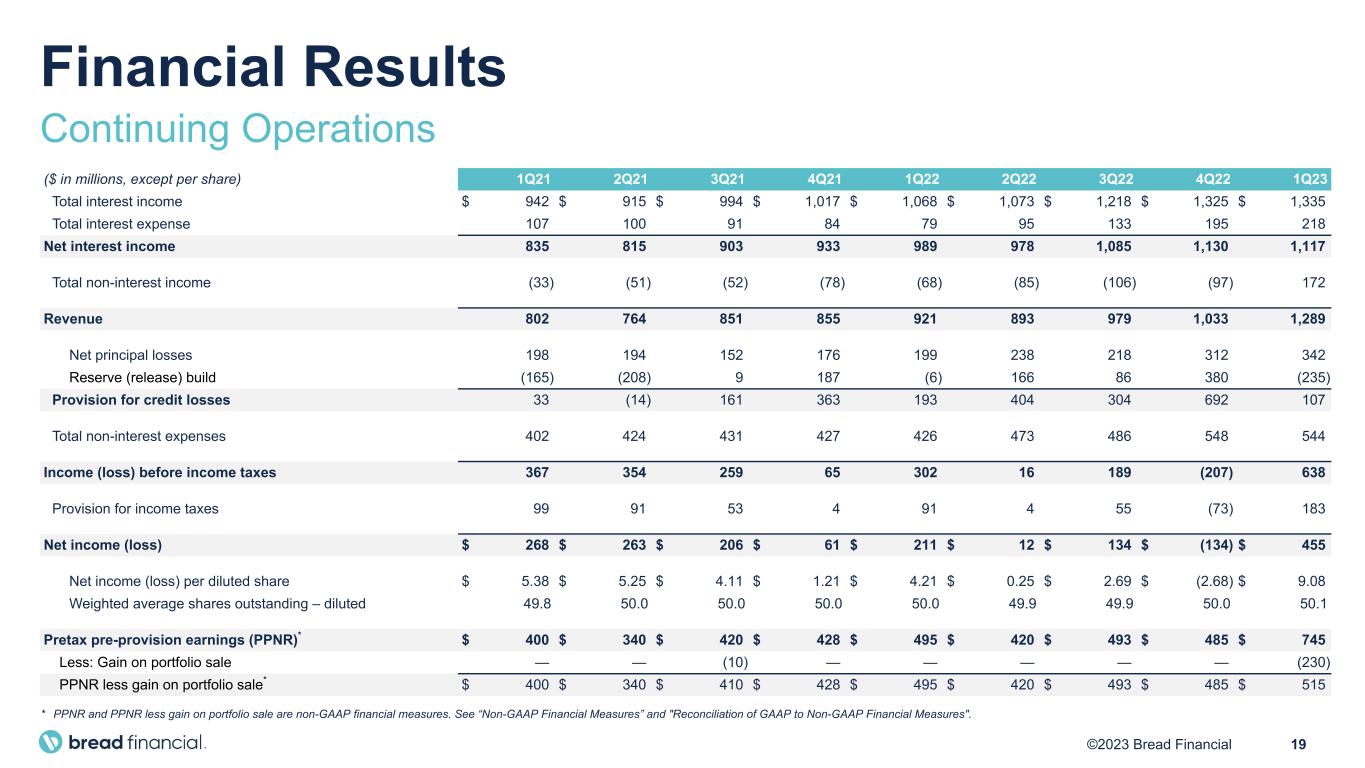

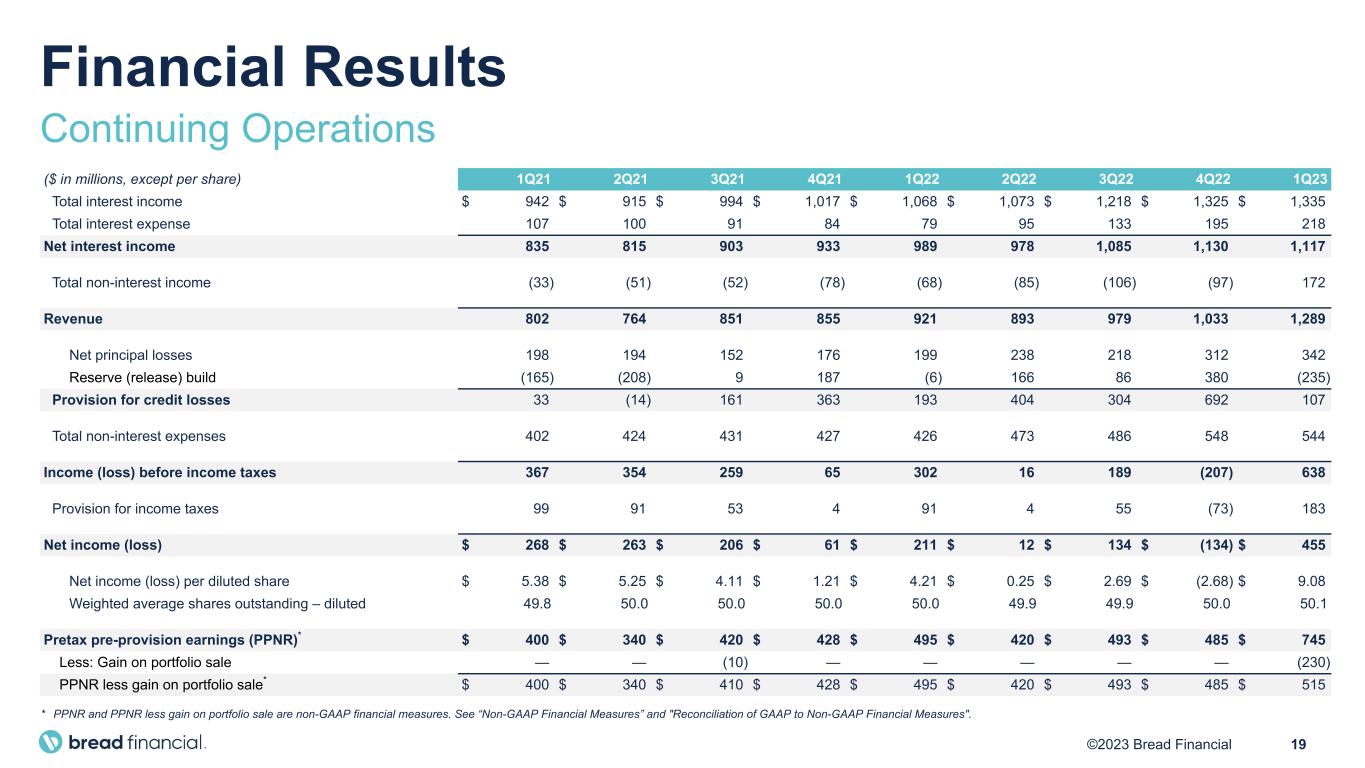

19©2023 Bread Financial ($ in millions, except per share) 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Total interest income $ 942 $ 915 $ 994 $ 1,017 $ 1,068 $ 1,073 $ 1,218 $ 1,325 $ 1,335 Total interest expense 107 100 91 84 79 95 133 195 218 Net interest income 835 815 903 933 989 978 1,085 1,130 1,117 Total non-interest income (33) (51) (52) (78) (68) (85) (106) (97) 172 Revenue 802 764 851 855 921 893 979 1,033 1,289 Net principal losses 198 194 152 176 199 238 218 312 342 Reserve (release) build (165) (208) 9 187 (6) 166 86 380 (235) Provision for credit losses 33 (14) 161 363 193 404 304 692 107 Total non-interest expenses 402 424 431 427 426 473 486 548 544 Income (loss) before income taxes 367 354 259 65 302 16 189 (207) 638 Provision for income taxes 99 91 53 4 91 4 55 (73) 183 Net income (loss) $ 268 $ 263 $ 206 $ 61 $ 211 $ 12 $ 134 $ (134) $ 455 Net income (loss) per diluted share $ 5.38 $ 5.25 $ 4.11 $ 1.21 $ 4.21 $ 0.25 $ 2.69 $ (2.68) $ 9.08 Weighted average shares outstanding – diluted 49.8 50.0 50.0 50.0 50.0 49.9 49.9 50.0 50.1 Pretax pre-provision earnings (PPNR)* $ 400 $ 340 $ 420 $ 428 $ 495 $ 420 $ 493 $ 485 $ 745 Less: Gain on portfolio sale — — (10) — — — — — (230) PPNR less gain on portfolio sale* $ 400 $ 340 $ 410 $ 428 $ 495 $ 420 $ 493 $ 485 $ 515 * PPNR and PPNR less gain on portfolio sale are non-GAAP financial measures. See “Non-GAAP Financial Measures” and "Reconciliation of GAAP to Non-GAAP Financial Measures". Financial Results Continuing Operations

20©2023 Bread Financial 1Q23 ($ in millions) Average Balance Interest Income / Expense Average Yield / Rate Cash and investment securities $ 4,087 $ 46 4.5% Credit card and other loans 19,405 1,289 26.6% Total interest-earning assets 23,492 1,335 22.7% Direct-to-consumer (Retail) 5,559 49 3.5% Wholesale deposits 7,866 68 3.5% Interest-bearing deposits 13,425 117 3.5% Secured borrowings 4,565 70 6.2% Unsecured borrowings 1,914 31 6.4% Interest-bearing borrowings 6,479 101 6.3% Total interest-bearing liabilities $ 19,904 $ 218 4.4% Net interest income $ 1,117 Net interest margin* 19.0% * Net interest margin represents annualized Net interest income divided by average Total interest-earning assets. Net Interest Margin

21©2023 Bread Financial ($ in millions, except per share amounts) 1Q23 1Q22 $ Chg % Chg Income from continuing operations, net of taxes $ 455 $ 211 $ 244 nm Income (loss) from discontinued operations, net of taxes — (1) 1 nm Net income $ 455 $ 210 $ 245 nm Net income per diluted share from continuing ops $ 9.08 $ 4.21 $ 4.87 nm Net income (loss) per diluted share from discontinued ops $ — $ (0.01) $ 0.01 nm Net income per diluted share $ 9.08 $ 4.20 $ 4.88 nm Weighted average shares outstanding – diluted (in millions) 50.1 50.0 Financial Results nm – Not meaningful, denoting a variance of 100 percent or more.

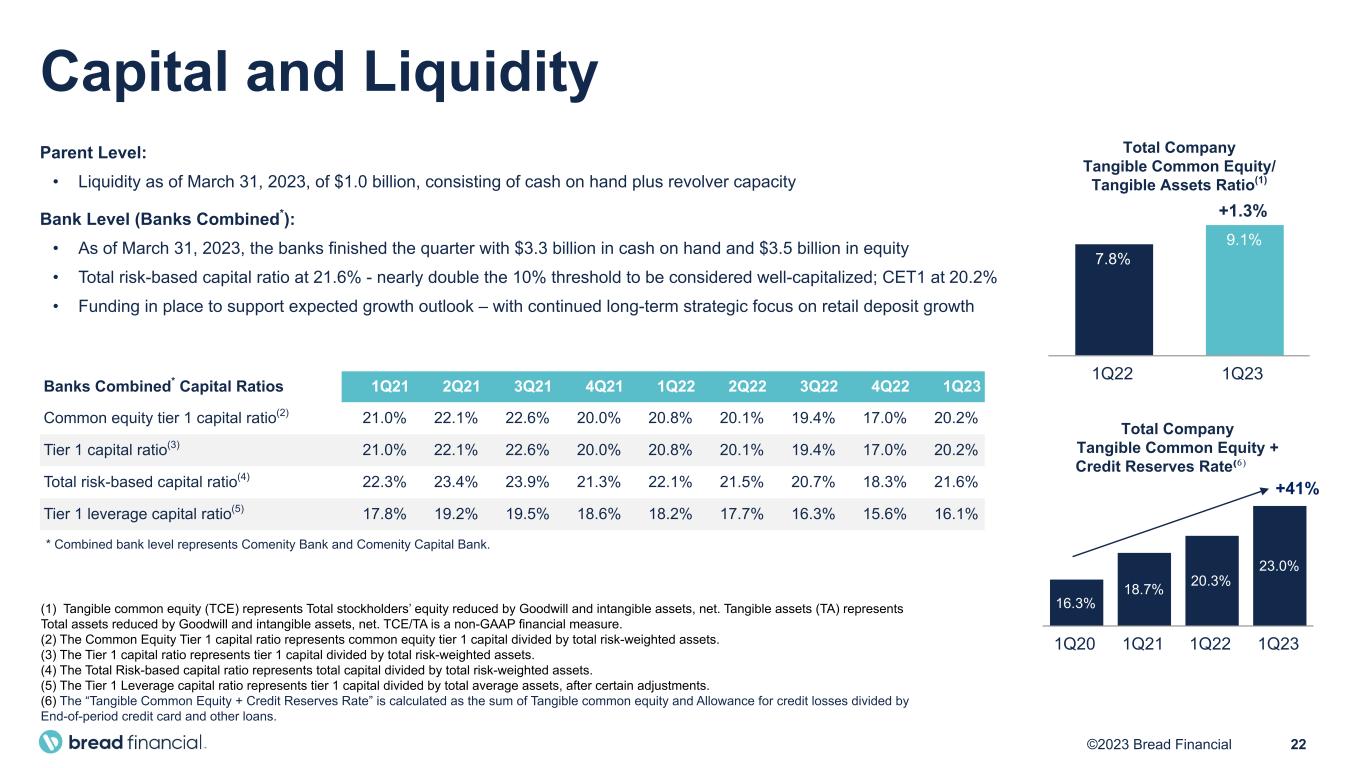

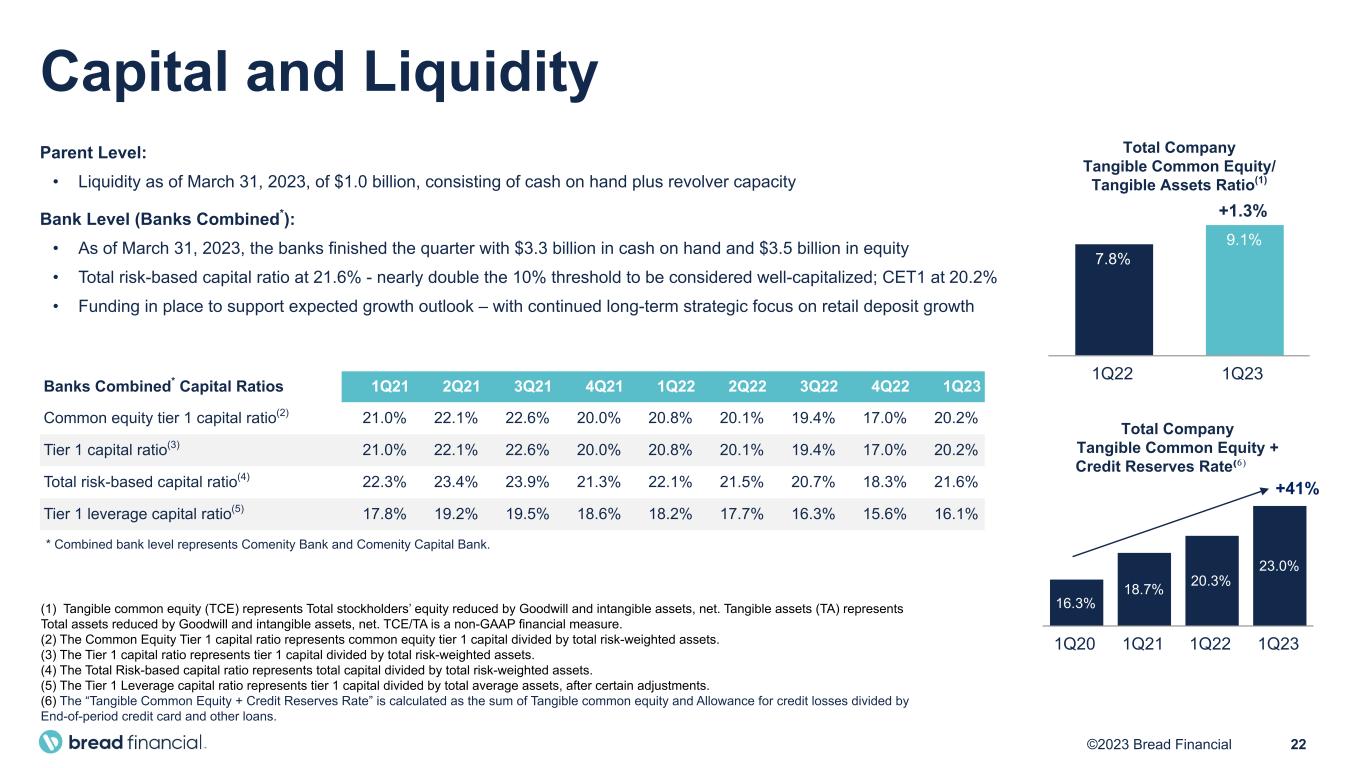

22©2023 Bread Financial Banks Combined* Capital Ratios 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Common equity tier 1 capital ratio(2) 21.0% 22.1% 22.6% 20.0% 20.8% 20.1% 19.4% 17.0% 20.2% Tier 1 capital ratio(3) 21.0% 22.1% 22.6% 20.0% 20.8% 20.1% 19.4% 17.0% 20.2% Total risk-based capital ratio(4) 22.3% 23.4% 23.9% 21.3% 22.1% 21.5% 20.7% 18.3% 21.6% Tier 1 leverage capital ratio(5) 17.8% 19.2% 19.5% 18.6% 18.2% 17.7% 16.3% 15.6% 16.1% Parent Level: • Liquidity as of March 31, 2023, of $1.0 billion, consisting of cash on hand plus revolver capacity Bank Level (Banks Combined*): • As of March 31, 2023, the banks finished the quarter with $3.3 billion in cash on hand and $3.5 billion in equity • Total risk-based capital ratio at 21.6% - nearly double the 10% threshold to be considered well-capitalized; CET1 at 20.2% • Funding in place to support expected growth outlook – with continued long-term strategic focus on retail deposit growth (1) Tangible common equity (TCE) represents Total stockholders’ equity reduced by Goodwill and intangible assets, net. Tangible assets (TA) represents Total assets reduced by Goodwill and intangible assets, net. TCE/TA is a non-GAAP financial measure. (2) The Common Equity Tier 1 capital ratio represents common equity tier 1 capital divided by total risk-weighted assets. (3) The Tier 1 capital ratio represents tier 1 capital divided by total risk-weighted assets. (4) The Total Risk-based capital ratio represents total capital divided by total risk-weighted assets. (5) The Tier 1 Leverage capital ratio represents tier 1 capital divided by total average assets, after certain adjustments. (6) The “Tangible Common Equity + Credit Reserves Rate” is calculated as the sum of Tangible common equity and Allowance for credit losses divided by End-of-period credit card and other loans. Total Company Tangible Common Equity/ Tangible Assets Ratio(1) 7.8% 9.1% 1Q22 1Q23 +1.3% Capital and Liquidity Total Company Tangible Common Equity + Credit Reserves Rate ⁶⁾ 16.3% 18.7% 20.3% 23.0% 1Q20 1Q21 1Q22 1Q23 +41% * Combined bank level represents Comenity Bank and Comenity Capital Bank.

23©2023 Bread Financial ($ in millions) 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Pretax pre-provision earnings (PPNR) Income (loss) before income taxes $ 367 $ 354 $ 259 $ 65 $ 302 $ 16 $ 189 $ (207) $ 638 Provision for credit losses 33 (14) 161 363 193 404 304 692 107 Pretax pre-provision earnings (PPNR) $ 400 $ 340 $ 420 $ 428 $ 495 $ 420 $ 493 $ 485 $ 745 Less: Gain on portfolio sale — — (10) — — — — — (230) PPNR less gain on portfolio sale $ 400 $ 340 $ 410 $ 428 $ 495 $ 420 $ 493 $ 485 $ 515 Tangible common equity (TCE) Total stockholders’ equity $ 1,764 $ 2,048 $ 2,246 $ 2,086 $ 2,268 $ 2,275 $ 2,399 $ 2,265 $ 2,716 Less: Goodwill and intangible assets, net (704) (699) (694) (687) (682) (694) (690) (799) (790) Tangible common equity (TCE) $ 1,060 $ 1,349 $ 1,552 $ 1,399 $ 1,586 $ 1,581 $ 1,709 $ 1,466 $ 1,926 Tangible assets (TA) Total assets $ 21,163 $ 21,812 $ 22,257 $ 21,746 $ 20,938 $ 21,811 $ 21,960 $ 25,407 $ 21,970 Less: Goodwill and intangible assets, net (704) (699) (694) (687) (682) (694) (690) (799) (790) Tangible assets (TA) $ 20,459 $ 21,113 $ 21,563 $ 21,059 $ 20,256 $ 21,117 $ 21,270 $ 24,608 $ 21,180 Reconciliation of GAAP to Non-GAAP Financial Measures

24©2023 Bread Financial 6.1% 5.6% 6.3% 7.0% 7.6% 5.8% 6.0% 5.0% 5.1% 3.9% 4.4% 4.8% 5.6% 5.0% 6.3% 7.0% 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 5.2% 5.9% 5.8% 6.0% 4.3% 4.7% 4.4% 3.8% 3.3% 3.8% 3.9% 4.1% 4.4% 5.7% 5.5% 5.7% 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 5 year peak rate: 7.6% 5 year low rate: 3.9% 5 year avg rate: ~6.0% 5 year peak rate: 6.0% 5 year avg rate: ~5.0% 5 year low rate: 3.3% Credit Quality Trends (2) (1) Peak Delinquency and Net loss rates occurred in 2009. (2) The 2Q22 Net loss rate includes a 30 basis point increase from the effects of the purchase of previously written-off accounts that were sold to a third-party debt collection agency. Note: The 3Q22, 4Q22, and 1Q23 Delinquency and Net loss rates were impacted by the transition of our credit card processing services. Delinquency Rates Net Loss Rates 15 year peak rate(1): 10.0% 15 year peak rate(1): 6.2%