Earnings Summary February 14, 2023 Fourth Quarter 2022 Exhibit 99.2

This presentation contains forward looking statements. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward looking statements. These forward looking statements may include statements about the ongoing impacts of the COVID-19 pandemic and the conflict in Ukraine on the Company’s operations and markets, including supply chain issues and inflationary pressures related thereto; future period guidance or projections; the Company’s performance relative to its markets, including the drivers of such performance; market and technology trends, including the duration and drivers of any growth trends and the impact of the COVID-19 pandemic on such trends; the development of new products and the success of their introductions; the focus of the Company’s engineering, research and development projects; the Company’s ability to execute on our business strategies, including with respect to Company’s expansion of its manufacturing presence in Taiwan and in Colorado Springs; the Company’s capital allocation strategy, which may be modified at any time for any reason, including share repurchases, dividends, debt repayments and potential acquisitions; the impact of the acquisitions the Company has made and commercial partnerships the Company has established, including the acquisition of CMC Materials, Inc. (“CMC Materials”); the closing of any announced divestitures, including the timing thereof; trends relating to the fluctuation of currency exchange rates; future capital and other expenditures, including estimates thereof; the Company’s expected tax rate; the impact, financial or otherwise, of any organizational changes; the impact of accounting pronouncements; quantitative and qualitative disclosures about market risk; and other matters. These forward looking statements are based on current management expectations and assumptions only as of the date of this Quarterly Report, are not guarantees of future performance and involve substantial risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from the results expressed in, or implied by, these forward looking statements. These risks and uncertainties include, but are not limited to, weakening of global and/or regional economic conditions, generally or specifically in the semiconductor industry, which could decrease the demand for the Company’s products and solutions; the level of, and obligations associated with, the Company’s indebtedness, including the debts incurred in connection with the acquisition of CMC Materials; risks related to the acquisition and integration of CMC Materials, including unanticipated difficulties or expenditures relating thereto; the ability to achieve the anticipated synergies and value-creation contemplated by the acquisition of CMC Materials and the diversion of management time on transaction-related matters; risks related to the COVID-19 pandemic and the conflict in Ukraine on the global economy and financial markets, as well as on the Company, its customers and suppliers, which may impact its sales, gross margin, customer demand and its ability to supply its products to its customers; raw material shortages, supply and labor constraints and price increases, pricing and inflationary pressures and rising interest rates; operational, political and legal risks of the Company’s international operations; the Company’s dependence on sole source and limited source suppliers; the Company’s ability to meet rapid demand shifts; the Company’s ability to continue technological innovation and introduce new products to meet customers’ rapidly changing requirements; substantial competition; the Company’s concentrated customer base; the Company’s ability to identify, complete and integrate acquisitions, joint ventures, divestitures or other similar transactions; the Company’s ability to consummate pending transactions on a timely basis or at all and the satisfaction of the conditions precedent to consummation of such pending transactions, including the satisfaction of regulatory conditions on the terms expected, at all or in a timely manner; the Company’s ability to effectively implement any organizational changes; the Company’s ability to protect and enforce intellectual property rights; the increasing complexity of certain manufacturing processes; changes in government regulations of the countries in which the Company operates, including the imposition of tariffs, export controls and other trade laws and restrictions and changes to national security and international trade policy, especially as they relate to China; fluctuation of currency exchange rates; fluctuations in the market price of the Company’s stock; and other risk factors and additional information described in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including under the heading “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed on February 4, 2022, and in the Company’s other SEC filings. Except as required under the federal securities laws and the rules and regulations of the SEC, the Company undertakes no obligation to update publicly any forward-looking statements or information contained herein, which speak as of their respective dates. This presentation contains references to “Adjusted EBITDA,” “Adjusted EBITDA – as a % of Net Sales,” “Adjusted Operating Income,” “Adjusted Operating Margin,” “Adjusted Gross Profit,” “Adjusted Gross Margin – as a % of Net Sales,” “Adjusted Segment Profit,” “Adjusted Segment Profit Margin,” “Non-GAAP Operating Expenses,” "Non-GAAP Tax Rate," “Non-GAAP Net Income,” “Diluted Non- GAAP Earnings per Common Share,” "Free Cash Flow" and other measures that are not presented in accordance GAAP. The non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures but should instead be read in conjunction with the GAAP financial measures. Further information with respect to and reconciliations of such measures to the most directly comparable GAAP measure can be found attached to this presentation. 2 Safe Harbor

3 $ in millions, except per share data 4Q22 3Q22 4Q21 4Q22 over 4Q21 4Q22 over 3Q22 Net Revenue $946.1 $993.8 $635.2 48.9% (4.8%) Gross Margin 42.8% 37.4% 46.5% Operating Expenses $260.7 $356.8 $135.5 92.4% (26.9%) Operating Income $143.8 $14.9 $159.5 (9.9%) 865.7% Operating Margin 15.2% 1.5% 25.1% Tax Rate 11.9% 8.7% 20.2% Net Income (Loss) $57.4 $(73.7) $118.2 (51.4%) (177.9%) Diluted Earnings (Loss) Per Common Share $0.38 $(0.50) $0.87 (56.3%) (176.0%) Summary – Consolidated Statement of Operations (GAAP)

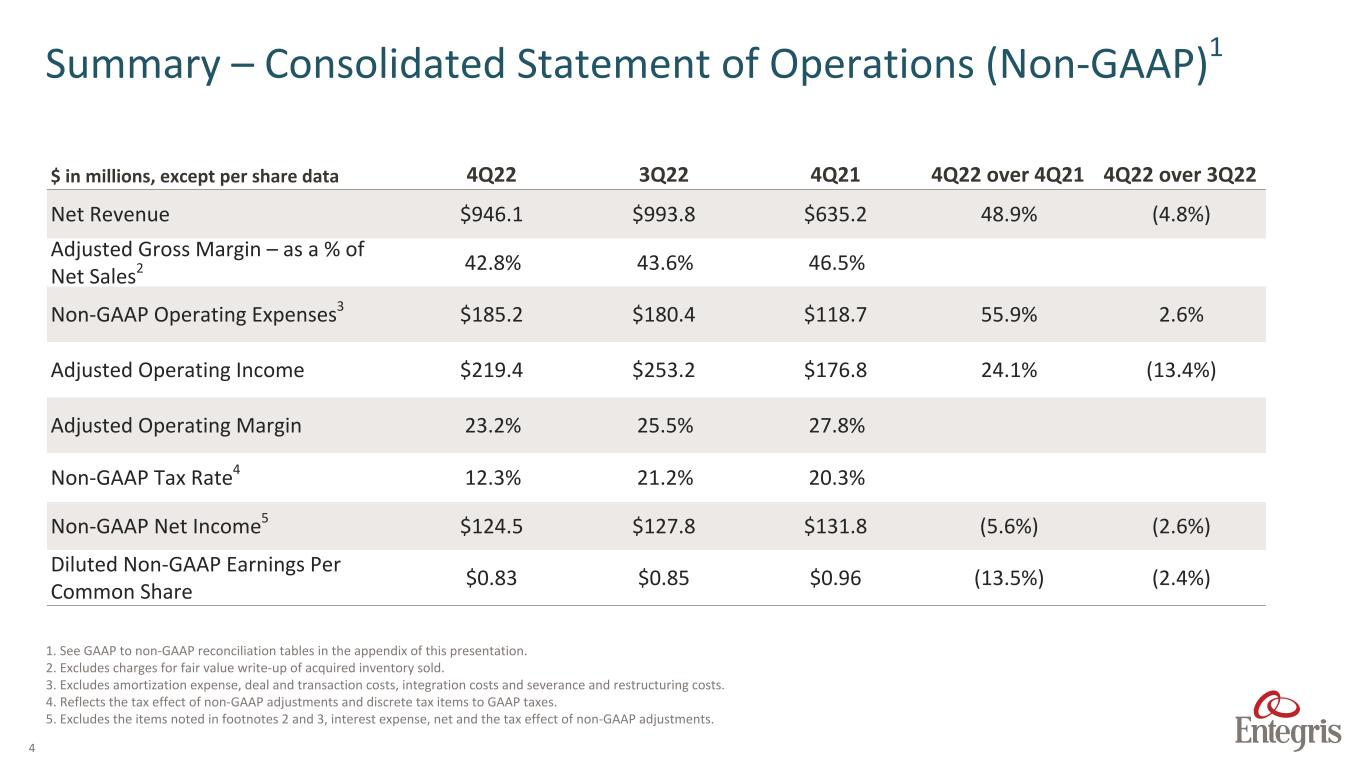

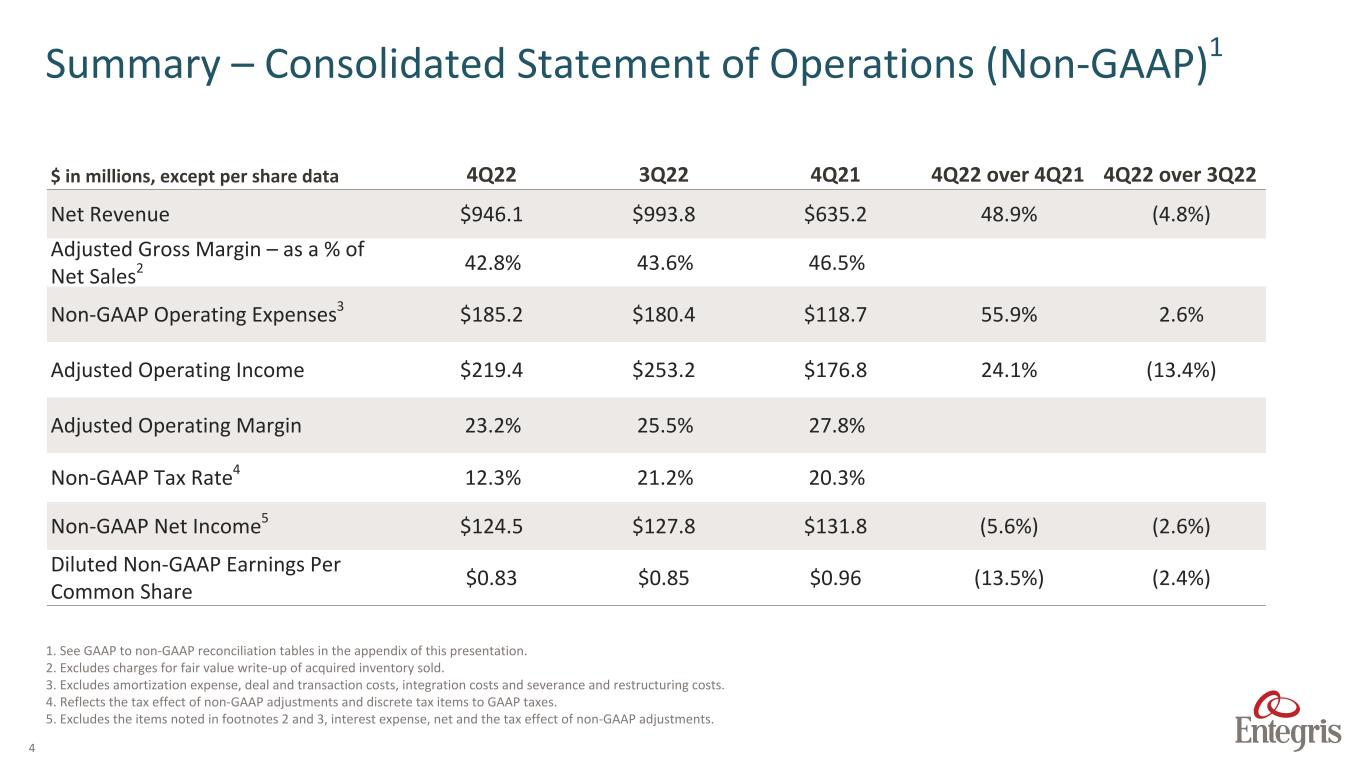

4 $ in millions, except per share data 4Q22 3Q22 4Q21 4Q22 over 4Q21 4Q22 over 3Q22 Net Revenue $946.1 $993.8 $635.2 48.9% (4.8%) Adjusted Gross Margin – as a % of Net Sales2 42.8% 43.6% 46.5% Non-GAAP Operating Expenses3 $185.2 $180.4 $118.7 55.9% 2.6% Adjusted Operating Income $219.4 $253.2 $176.8 24.1% (13.4%) Adjusted Operating Margin 23.2% 25.5% 27.8% Non-GAAP Tax Rate4 12.3% 21.2% 20.3% Non-GAAP Net Income5 $124.5 $127.8 $131.8 (5.6%) (2.6%) Diluted Non-GAAP Earnings Per Common Share $0.83 $0.85 $0.96 (13.5%) (2.4%) Summary – Consolidated Statement of Operations (Non-GAAP)1 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. 2. Excludes charges for fair value write-up of acquired inventory sold. 3. Excludes amortization expense, deal and transaction costs, integration costs and severance and restructuring costs. 4. Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5. Excludes the items noted in footnotes 2 and 3, interest expense, net and the tax effect of non-GAAP adjustments.

5 $ in millions, except per share data Year ended December 31, 2022 Year ended December 31, 2021 Year-over-Year Net Revenue $3,282.0 $2,298.9 42.8% Gross Margin 42.5% 46.1% Operating Expenses $916.4 $507.9 80.4% Operating Income $480.0 $551.8 (13.0%) Operating Margin 14.6% 24.0% Tax Rate 15.4% 14.6% Net Income $208.9 $409.1 (48.9%) Diluted Earnings Per Common Share $1.46 $3.00 (51.3%) Summary – Consolidated Statement of Operations (GAAP)

6 $ in millions, except per share data Year ended December 31, 2022 Year ended December 31, 2021 Year-over-Year Net Revenue $3,282.0 $2,298.9 42.8% Adjusted Gross Margin – as a % of Net Sales2 44.4% 46.1% Non-GAAP Operating Expenses3 $620.5 $451.0 37.6% Adjusted Operating Income $837.9 $609.1 37.6% Adjusted Operating Margin 25.5% 26.5% Non-GAAP Tax Rate4 16.3% 16.1% Non-GAAP Net Income5 $534.2 $469.4 13.8% Diluted Non-GAAP Earnings Per Common Share $3.73 $3.44 8.4% Summary – Consolidated Statement of Operations (Non-GAAP)1 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. 2. Excludes charges for fair value write-up of acquired inventory sold, integration costs and severance and restructuring costs. 3. Excludes amortization expense, deal and transaction costs, integration costs and severance and restructuring costs. 4. Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5. Excludes the items noted in footnotes 2 and 3, the loss on debt extinguishment and the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes.

7 $ in millions, except per share data 1Q22 2Q22 3Q22 4Q22 FY2022 Net Revenue $969.1 $1,011.9 $993.8 $946.1 $3,920.9 Gross Margin 45.2% 42.4% 37.4% 42.8% 41.9% Operating Expenses $218.2 $226.9 $356.8 $260.7 $1,062.6 Operating Income $219.9 $201.9 $14.9 $143.8 $580.5 Operating Margin 22.7% 19.9% 1.5% 15.2% 14.8% EBITDA $289.2 $271.3 $125.4 $239.1 $925.0 Tax Rate 16.1% 24.8% 8.7% 11.9% 21.5% Net Income (Loss) $160.3 $140.1 $(73.7) $57.4 $284.1 Diluted Earnings (Loss) Per Common Share $1.06 $0.93 $(0.50) $0.38 $1.85 Summary Consolidated Statement of Operations (GAAP)- Proforma The above pro forma results include the addition of CMC Materials, Inc.’s financials recorded prior to the consummation of the merger with the Company on July 6, 2022 to the Company’s reported financials and are provided as a complement to, and should be read in conjunction with, the consolidated financial statements to better facilitate the assessment and measurement of the Company’s operating performance. Intercompany sales between the Company and CMC Materials, Inc have been eliminated. No other adjustments have been included.

8 $ in millions, except per share data 1Q22 2Q22 3Q22 4Q22 FY2022 Net Revenue $958.2 $1,011.7 $993.8 $946.1 $3,909.8 Adjusted Gross Margin – as a % of Net Sales2 44.5% 42.0% 43.6% 42.8% 43.2% Non-GAAP Operating Expenses3 $177.4 $178.8 $180.4 $185.1 $721.7 Adjusted Operating Income $248.8 $245.8 $253.2 $219.4 $967.2 Adjusted Operating Margin 26.0% 24.3% 25.5% 23.2% 24.7% Adjusted EBITDA $296.6 $294.0 $298.4 $261.3 $1,150.3 Non-GAAP Tax Rate4 15.3% 22.9% 21.2% 12.3% 18.1% Non-GAAP Net Income5 $137.6 $120.0 $127.6 $124.6 $509.8 Diluted Non-GAAP Earnings Per Common Share $0.91 $0.80 $0.85 $0.83 $3.39 Summary – Consolidated Statement of Operations (Non-GAAP)- Proforma 1 1. See GAAP Proforma to non-GAAP Proforma reconciliation tables in the appendix of this presentation. 2. Excludes charges for fair value write-up of acquired inventory sold, wood treatment and incremental depreciation expense 3. Excludes amortization and incremental depreciation expense, deal costs, and integration costs. 4. Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5. Excludes the items noted in footnotes 2 and 3,incremental interest expense, interest rate swap gain, loss on extinguishment of debt, net and the tax effect of non-GAAP adjustments.

9 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. Microcontamination Control (MC) $ in millions 4Q22 3Q22 4Q21 4Q22 over 4Q21 4Q22 over 3Q22 Net Revenue $284.7 $280.6 $258.9 10.0% 1.5% Segment Profit $107.4 $105.3 $94.2 14.0% 2.0% Segment Profit Margin 37.7% 37.5% 36.4% Adj. Segment Profit1 $107.4 $105.3 $94.2 14.0% 2.0% Adj. Segment Profit Margin1 37.7% 37.5% 36.4% Sales growth (YOY) was strong in gas purification and liquid filtration. –––––– Segment profit margin (adjusted) increase was driven primarily by higher volumes and solid execution, offset in part by higher ER&D investment. 4Q22 Highlights

10 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. Advanced Materials Handling (AMH) $ in millions 4Q22 3Q22 4Q21 4Q22 over 4Q21 4Q22 over 3Q22 Net Revenue $213.9 $210.4 $197.7 8.2% 1.7% Segment Profit $48.0 $42.1 $45.3 6.0% 14.0% Segment Profit Margin 22.5% 20.0% 22.9% Adj. Segment Profit1 $48.0 $42.1 $45.3 6.0% 14.0% Adj. Segment Profit Margin1 22.5% 20.0% 22.9% Sales growth (YOY) was strongest in wafer and fluid handling and liquid packaging solutions. –––––– Segment profit margin (adjusted) decline (YOY) was primarily driven by additional ER&D investment. Segment profit margin (adjusted) increase (SEQ) was primarily the result of certain inventory charges in Q3 not recurring and favorable product mix 4Q22 Highlights

11 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. 2. 4Q21 is reported on a proforma basis, see proforma GAAP to proforma non-GAAP reconciliation tables in the appendix of this presentation. Sales decline was seen across most product lines and was primarily driven by the softening in the semi market and the impact from the export restrictions in China. –––––– Segment profit margin (adjusted) decline was driven primarily by greater investment in ER&D, lower volumes and unfavorable mix. $ in millions 4Q22 3Q22 4Q21 4Q22 over 4Q21 4Q22 over 3Q22 Net Revenue1 $204.2 $224.2 $205.7 (0.7%) (8.9%) Segment Profit1 $14.8 $34.2 $41.4 (64.3%) (56.7%) Segment Profit Margin 7.3% 15.3% 20.1% Adj. Segment Profit1 $14.8 $39.3 $40.2 (63.2%) (62.3%) Adj. Segment Profit Margin1 7.3% 17.5% 19.5% Specialty Chemicals and Engineered Materials (SCEM)2 4Q22 Highlights

12 Advanced Planarization Solutions (APS)2 $ in millions 4Q22 3Q22 4Q21 4Q22 over 4Q21 4Q22 over 3Q22 Net Revenue $253.8 $293.9 $284.4 (10.8%) (13.6%) Segment Profit1 $56.7 $18.9 $80.2 (29.3%) 200.0% Segment Profit Margin 22.3% 6.4% 28.2% Adj. Segment Profit1 $56.4 $75.7 $73.7 (23.5%) (25.5%) Adj. Segment Profit Margin1 22.2% 25.8% 25.9% Sales decline was primarily driven by the impact of the softening semi market. –––––– Segment profit margin (adjusted) decline was driven primarily by lower volumes and unfavorable product mix. 4Q22 Highlights 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. 2. 4Q21 is reported on a proforma basis, see proforma GAAP to proforma non-GAAP reconciliation tables in the appendix of this presentation.

13 $ in millions 4Q22 3Q22 4Q21 $ Amount % Total $ Amount % Total $ Amount % Total Cash, Cash Equivalents & Restricted Cash $563.4 5.6% $754.7 7.4% $402.6 12.6% Accounts Receivable, net $535.5 5.3% $519.8 5.1% $347.4 10.9% Inventories $812.8 8.0% $823.6 8.1% $475.2 14.9% Net PP&E $1,393.3 13.7% $1,383.7 13.7% $654.1 20.5% Total Assets $10,138.9 $10,133.4 $3,191.9 Current Liabilities $761.9 7.5% $841.0 8.3% $379.0 11.9% Long-term Debt, Excluding Current Maturities $5,632.9 55.6% $5,627.7 55.5% $937.0 29.4% Total Liabilities $6,920.9 68.3% $7,017.1 69.2% $1,478.1 46.3% Total Shareholders’ Equity $3,218.0 31.7% $3,116.3 30.8% $1,713.8 53.7% AR – DSOs 51.6 47.7 49.9 Inventory Turns 2.6 2.8 1 3.0 Summary – Balance Sheet Items 1.Excludes inventory step-up amortization

14 $ in millions 4Q22 3Q22 4Q21 Beginning Cash Balance $754.7 $2,743.2 $475.8 Cash provided by operating activities 32.1 145.5 116.0 Capital expenditures (147.4) (126.7) (76.6) Proceeds from revolving credit facilities and debt — 2,810.4 50.0 Payments on revolving credit facilities and debt (70.0) (223.0) (50.0) Acquisition of business, net of cash — (4,474.9) (89.7) Repurchase and retirement of common stock — — (17.1) Payments for dividends (14.9) (14.9) (10.9) Other investing activities (5.7) — — Other financing activities 5.1 (93.8) 6.0 Effect of exchange rates 9.6 (11.1) (0.9) Ending Cash Balance $563.4 $754.7 $402.6 Free Cash Flow1 ($115.3) $18.8 $39.3 Adjusted EBITDA2 $261.2 $298.4 $199.6 Adjusted EBITDA – as a % of net sales2 27.6% 30.0% 31.4% Cash Flows 1. Equals cash from operations less capital expenditures. 2. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation.

15 GAAP $ in millions, except per share data 1Q23 Guidance 4Q22 Actual 3Q22 Actual Net Revenue $880 - $910 $946.1 $993.8 Operating Expenses $285 - $290 $260.7 $356.8 Net Income (Loss) $8 - $16 $57.4 -$73.7 Diluted Earnings (Loss) per Common Share $0.05 - $0.10 $0.38 -$0.50 Operating Margin 10% - 12% 15.2% 1.5% Non-GAAP $ in millions, except per share data 1Q23 Guidance 4Q22 Actual 3Q22 Actual Net Revenue $880 - $910 $946.1 $993.8 Non-GAAP Operating Expenses1 $200 - $205 $185.2 $180.4 Non-GAAP Net Income1 $75 - $83 $124.5 $127.8 Diluted non-GAAP Earnings per Common Share1 $0.50 - $0.55 $0.83 $0.85 Adjusted EBITDA Margin 25% - 26% 27.6% 30.0% Outlook 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation.

Entegris®, the Entegris Rings Design®, and other product names are trademarks of Entegris, Inc. as listed on entegris.com/trademarks. All product names, logos, and company names are trademarks or registered trademarks of their respective owners. Use of them does not imply any affiliation, sponsorship, or endorsement by the trademark owner. ©2020 Entegris, Inc. All rights reserved. 16

Appendix 17

18 Reconciliation of GAAP Gross Profit to Adjusted Gross Profit Three months ended Twelve months ended $ in thousands December 31, 2022 December 31, 2021 October 1, 2022 December 31, 2022 December 31, 2021 Net sales $946,070 $635,204 $993,828 $3,282,033 $2,298,893 Gross profit-GAAP $404,525 $295,090 $371,671 $1,396,413 $1,059,664 Adjustments to gross profit: Charge for fair value mark-up of acquired inventory sold — 428 61,932 61,932 428 Adjusted gross profit $404,525 $295,518 $433,603 $1,458,345 $1,060,092 Gross margin – as a % of net sales 42.8% 46.5% 37.4% 42.5% 46.1% Adjusted gross margin – as a % of net sales 42.8% 46.5% 43.6% 44.4% 46.1%

19 Reconciliation of GAAP Operating Expenses and Tax Rate to Non-GAAP Operating Expenses and Tax Rate Three months ended $ in millions December 31, 2022 December 31, 2021 October 1, 2022 GAAP operating expenses $260.7 $135.5 $356.8 Adjustments to operating expenses: Deal and transaction costs 0.3 4.7 31.9 Integration costs 18.5 (0.1) 20.8 Contractual and non-cash integration costs 3.5 — 58.4 Gain on sale (0.3) — — Amortization of intangible assets 53.5 12.2 65.3 Non-GAAP operating expenses $185.2 $118.7 $180.4 GAAP tax rate 11.9% 20.2% 8.7% Other 0.4% 0.1% 12.5% Non-GAAP tax rate 12.3% 20.3% 21.2%

20 $ in thousands Three Months Ended Twelve months ended December 31, 2022 December 31, 2021 October 1, 2022 December 31, 2022 December 31, 2021 Net sales $946,070 $635,204 $993,828 $3,282,033 $2,298,893 Net (loss) income $57,427 $118,219 $(73,703) $208,920 $409,126 Net (loss) income – as a % of net sales 6.1% 18.6% (7.4%) 6.4% 17.8% Adjustments to net (loss) income: Income tax (benefit) expense 7,783 30,003 (7,015) 38,160 69,950 Interest expense, net 82,013 9,434 82,755 208,975 40,997 Other expense, net (3,447) 1,888 12,852 23,926 31,695 GAAP - Operating income 143,776 159,544 14,889 479,981 551,768 Operating margin - as a % of net sales 15.2% 25.1% 1.5% 14.6% 24.0% Charge for fair value write-up of acquired inventory sold — 428 61,932 61,932 428 Deal and transaction costs 258 4,744 31,867 39,543 4,744 Integration costs 18,558 (186) 20,762 50,731 3,780 Contractual and non-cash integration costs 3,553 — 58,411 61,964 — Gain on sale (254) — — (254) — Severance and restructuring costs — — — — 529 Amortization of intangible assets 53,462 12,240 65,346 143,953 47,856 Adjusted operating income 219,353 176,770 253,207 837,850 609,105 Adjusted operating margin - as a % of net sales 23.2% 27.8% 25.5% 25.5% 26.5% Depreciation 41,882 22,801 45,203 135,371 90,311 Adjusted EBITDA $261,235 $199,571 $298,410 $973,221 699,416 Adjusted EBITDA – as a % of net sales 27.6% 31.4% 30.0% 29.7% 30.4% Reconciliation of GAAP Net Income to Adjusted Operating Income and Adjusted EBITDA

21 $ in thousands, except per share data Three months ended Twelve months ended December 31, 2022 December 31, 2021 October 1, 2022 December 31, 2022 December 31, 2021 GAAP net (loss) income $57,427 $118,219 $(73,703) $208,920 $409,126 Adjustments to net (loss) income: Charge for fair value write-up of inventory acquired — 428 61,932 61,932 428 Deal and transaction costs 258 4,744 31,867 39,543 4,744 Integration costs 18,558 (186) 20,762 50,731 3,780 Contractual and non-cash integration costs 3,553 — 58,411 61,964 — Severance and restructuring costs — — — — 529 Loss on extinguishment of debt and modification 1,052 — 2,235 3,287 23,338 Gain on sale (254) — (254) — Interest expense, net — — 2,397 29,822 — Amortization of intangible assets 53,462 12,240 65,346 143,953 47,856 Tax effect of adjustments to net income and discrete items1 (9,605) (3,662) (41,477) (65,728) (20,411) Non-GAAP net income $124,451 $131,783 $127,770 $534,170 $469,390 Diluted earnings per common share $0.38 $0.87 $(0.50) $1.46 $3.00 Effect of adjustments to net income $0.45 $0.10 $1.35 $2.27 $0.44 Diluted non-GAAP earnings per common share $0.83 $0.96 $0.85 $3.73 $3.44 Weighted average diluted shares outstanding 149,909 136,629 148,570 143,146 136,574 Effect of adjustment to diluted weighted average shares outstanding — — 1,099 — — Diluted non-GAAP weighted average shares outstanding 149,909 136,629 149,669 143,146 136,574 Reconciliation of GAAP Net Income and Diluted Earnings per Common Share to Non-GAAP Net Income and Diluted Non-GAAP Earnings per Common Share 1. The tax effect of pre-tax adjustments to net income was calculated using the applicable marginal tax rate during the respective years.

22 $ in millions First-Quarter 2023 Outlook Reconciliation GAAP net income to non-GAAP net income GAAP net income $8 - $16 Adjustments to net income: Deal, transaction and integration costs 20 Amortization of intangible assets 65 Income tax effect (18) Non-GAAP net income $75 - $83 First-Quarter 2023 Outlook Reconciliation GAAP diluted earnings per share to non-GAAP diluted earnings per share Diluted earnings per common share $0.05 - $0.10 Adjustments to diluted earnings per common share: Deal, transaction and integration costs 0.14 Amortization of intangible assets 0.43 Income tax effect (0.12) Diluted non-GAAP earnings per common share $0.50 - $0.55 $ in millions First-Quarter 2023 Outlook Reconciliation GAAP operating expenses to non-GAAP operating expenses GAAP operating expenses $285 - $290 Adjustments to net income: Deal, transaction and integration costs 20 Amortization of intangible assets 65 Non-GAAP operating expenses $200 - $205 Reconciliation of GAAP Outlook to Non-GAAP Outlook

23 Reconciliation of GAAP Outlook to Non-GAAP Outlook Continued First -Quarter Outlook Reconciliation GAAP Operating Margin to non-GAAP Operating Margin and Adjusted EBITDA Margin April 1, 2023 Net sales $880 - $910 GAAP - Operating income $89 - $106 Operating margin - as a % of net sales 10% - 12% Deal, transaction and integration costs 20 Amortization of intangible assets 65 Adjusted operating income $174 - 191 Adjusted operating margin - as a % of net sales 20% - 21% Depreciation 40 Adjusted EBITDA $214 - $231 Adjusted EBITDA - as a % of net sales 25% - 26%

ENTEGRIS PROPRIETARY AND CONFIDENTIAL – INTERNAL 24 $ in millions Q120 Q220 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 FY 2020 FY 2021 FY 2022 Sales SCEM $ 190.9 $ 181.1 $ 181.6 $ 198.5 $ 193.8 $ 224.3 $ 218.5 $ 220.7 $ 221.4 $ 225.4 $ 224.2 $ 204.2 $ 752.1 $ 857.3 $ 875.2 MC 159.3 183.8 193.5 205.6 207.1 227.5 225.9 258.9 266.6 274.1 280.6 284.7 742.2 919.4 1106.0 AMH 116.1 126.4 144.4 151.7 148.5 172.5 186.2 197.7 198.1 224.1 210.4 213.9 538.6 704.9 846.5 APS 237.5 239.8 243.1 258.0 263.4 265.6 269.8 284.4 299.1 305.3 293.9 253.8 978.4 1,083.2 1152.1 Inter-segment elimination (8.9) (9.9) (8.9) (11.0) (11.7) (11.6) (11.1) (11.5) (16.1) (17.0) (15.3) (10.5) (38.7) (45.9) (58.9) Total Sales $ 694.9 $ 721.2 $ 753.7 $ 802.8 $ 801.1 $ 878.3 $ 889.3 $ 950.2 $ 969.1 $ 1,011.9 $ 993.8 $ 946.1 $ 2,972.6 $ 3,518.9 $ 3,920.9 Segment Profit (Loss) SCEM $ 53.3 $ 49.7 $ 43.3 $ 34.9 $ (165.4) $ 57.2 $ 36.9 $ 41.4 $ 52.2 $ 38.1 $ 34.2 $ 14.8 $ 181.2 $ (29.9) $ 139.3 FV Step-up — — — — (5.1) — — — — — 5.1 — — (5.1) 5.1 SCEM Segment Profit (Loss) Adjusted $ 53.3 $ 49.7 $ 43.3 $ 34.9 $ (170.5) $ 57.2 $ 36.9 $ 41.4 $ 52.2 $ 38.1 $ 39.3 $ 14.8 $ 181.2 $ (35.0) $ 144.4 MC 50.2 62.1 64.9 71.7 70.6 78.1 78.4 94.2 98.6 100.1 105.3 107.4 248.9 321.3 411.4 AMH 20.6 22.8 33.3 34.3 32.1 42.1 40.5 45.3 46.7 46.9 42.1 48.0 111.0 160.0 183.7 APS 60.6 69.2 67.1 72.6 72.8 71.9 68.5 80.2 88.9 84.9 18.9 56.7 269.5 293.4 249.4 Depreciation ³ (7.0) (7.0) (7.0) (7.0) (7.0) (7.0) (7.0) (7.0) (7.0) (7.0) — — (28.0) (28.0) (14.0) FV Step-up ⁴ — — — — (56.8) — — — — — 56.8 — — (56.8) 56.8 APS Segment Profit Adjusted $ 53.6 $ 62.2 $ 60.1 $ 65.6 $ 9.0 $ 64.9 $ 61.5 $ 73.2 $ 81.9 $ 77.9 $ 75.7 $ 56.7 $ 241.5 $ 208.6 $ 292.2 Total Segment Profit (Loss) $ 177.7 $ 196.8 $ 201.6 $ 206.5 $ (58.8) $ 242.3 $ 217.3 $ 254.1 $ 279.4 $ 263.0 $ 262.4 $ 226.9 $ 782.6 $ 654.9 $ 1,031.7 Proforma GAAP Segment Trend Data Unaudited¹ ² ¹ During the three months ended October 1, 2022, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on four reportable segments: Specialty Chemicals and Engineered Materials (SCEM), Microcontamination Control (MC), Advanced Material Handling (AMH) and Advanced Planarization Solutions (APS). The following prior year information has been recast to reflect this realignment ² The above pro forma results include the addition of CMC Materials, Inc.’s net sales and segment profit amounts recorded prior to the consummation of the merger with the Company on July 6, 2022 to the Company’s reported GAAP net sales and segment profit amounts related to businesses that were transferred to the above business segments after the effectiveness of the merger and are provided as a complement to, and should be read in conjunction with, the condensed financial statements to better facilitate the assessment and measurement of the Company’s operating performance. Intercompany sales between the Company and CMC Materials, Inc have been eliminated, see table below. ³ Represents the preliminary pro forma adjustment to recognize changes to straight-line depreciation expense resulting from the fair value adjustments to acquired property, plant, and equipment. The preliminary fair value of the property, plant and equipment may not represent the actual value of the property, plant and equipment when the Merger is completed resulting in a potential difference in straight-line depreciation expense, and that difference may be material. ⁴ Represents the additional cost of goods sold recognized in connection with the step-up of inventory valuation. Entegris will recognize the increased value of inventory in cost of sales as the inventory is sold, which for purposes of these pro forma presentation is assumed to occur within the first quarter of 2021 based on inventory turns and is non-recurring in nature.

ENTEGRIS PROPRIETARY AND CONFIDENTIAL – INTERNAL 25 $ in millions Q120 Q220 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 FY 2020 FY 2021 FY 2022 Total Segment Profit (Loss) $ 177.7 $ 196.8 $ 201.6 $ 206.5 $ (58.8) $ 242.3 $ 217.3 $ 254.1 $ 279.4 $ 263.0 $ 262.4 $ 226.9 $ 782.6 $ 654.9 $ 1,031.7 Amortization of intangible assets 34.8 30.7 29.7 28.9 28.4 28.8 28.6 28.1 28.5 28.3 65.3 53.5 124.1 113.9 175.6 Additional Amortization ⁵ 31.4 31.4 31.4 31.4 31.4 31.4 31.4 31.4 31.4 31.4 — — 125.6 125.6 62.8 Stock based ⁶ compensation — — — — 6.1 — — — — — — — — 6.1 — Transaction Expenses ⁷ — — — — 184.6 — — (11.1) (17.8) (22.3) (111.0) (22.4) — 173.5 (173.5) Unallocated expenses 17.6 20.7 26.1 24.2 23.8 25.5 19.2 33.0 38.0 39.9 120.3 29.7 88.6 101.5 227.9 Total Operating Income (Loss) $ 93.9 $ 114.0 $ 114.4 $ 122.0 $ (333.1) $ 156.6 $ 138.1 $ 172.7 $ 199.3 $ 185.7 $ 187.8 $ 166.1 $ 444.3 $ 134.3 $ 738.9 Proforma GAAP Segment Trend Data Unaudited¹ ² (continued) ¹ During the three months ended October 1, 2022, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on four reportable segments: Specialty Chemicals and Engineered Materials (SCEM), Microcontamination Control (MC), Advanced Material Handling (AMH) and Advanced Planarization Solutions (APS). The following prior year information has been recast to reflect this realignment ² The above pro forma results include the addition of CMC Materials, Inc.’s net sales and segment profit amounts recorded prior to the consummation of the merger with the Company on July 6, 2022 to the Company’s reported GAAP net sales and segment profit amounts related to businesses that were transferred to the above business segments after the effectiveness of the merger and are provided as a complement to, and should be read in conjunction with, the condensed financial statements to better facilitate the assessment and measurement of the Company’s operating performance. Intercompany sales between the Company and CMC Materials, Inc have been eliminated, see table below. ⁵ Represents estimated incremental straight-line amortization expense resulting from the allocation of purchase consideration to definite-lived intangible assets subject to amortization. ⁶ Represents the incremental pro forma stock-based compensation expense for accelerated vesting upon the change in control for stock options, restricted stock units, restricted stock shares, phantom units, and other deferred restricted stock units. ⁷ Represents one-time transaction-related costs for both Entegris and CMC that have yet to be expensed or accrued in the historical financial statements in connection with the Merger including bank fees, legal fees, consulting fees, severance payments, retention payments, CICSPA, and other transaction expenses.

ENTEGRIS PROPRIETARY AND CONFIDENTIAL – INTERNAL 26 $ in millions Q120 Q220 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 FY 2020 FY 2021 FY 2022 Sales - GAAP SCEM $ 190.9 $ 181.1 $ 181.6 $ 198.5 $ 193.8 $ 224.3 $ 218.5 $ 220.7 $ 221.4 $ 225.4 $ 224.2 $ 204.2 $ 752.1 $ 857.3 $ 875.2 MC 159.3 183.8 193.5 205.6 207.1 227.5 225.9 258.9 266.6 274.1 280.6 284.7 742.2 919.4 1106.0 AMH 116.1 126.4 144.4 151.7 148.5 172.5 186.2 197.7 198.1 224.1 210.4 213.9 538.6 704.9 846.5 APS 237.5 239.8 243.1 258.0 263.4 265.6 269.8 284.4 299.1 305.3 293.9 253.8 978.4 1083.2 1152.1 Inter-segment elimination (8.9) (9.9) (8.9) (11.0) (11.7) (11.6) (11.1) (11.5) (16.1) (17.0) (15.3) (10.5) (38.7) (45.9) (58.9) Total Sales $ 694.9 $ 721.2 $ 753.7 $ 802.8 $ 801.1 $ 878.3 $ 889.3 $ 950.2 $ 969.1 $ 1,011.9 $ 993.8 $ 946.1 $ 2,972.6 $ 3,518.9 $ 3,920.9 Adjusted Segment Sales SCEM $ 175.9 $ 162.3 $ 163.4 $ 181.2 $ 178.3 $ 205.2 $ 197.3 $ 205.7 $ 210.5 $ 225.2 $ 224.2 $ 204.2 $ 682.8 $ 786.5 $ 864.1 MC 159.26 183.8 193.5 205.6 207.1 227.5 225.9 258.9 266.6 274.1 280.6 284.7 742.2 919.4 1106.0 AMH 116.14 126.4 144.4 151.7 148.5 172.5 186.2 197.7 198.1 224.1 210.4 213.9 538.6 704.9 846.5 APS 237.5 239.8 243.1 258.0 263.4 265.6 269.8 284.4 299.1 305.3 293.9 253.8 978.4 1083.2 1152.1 Inter-segment elimination (8.9) (9.9) (8.9) (11.0) (11.7) (11.6) (11.1) (11.5) (16.1) (17.0) (15.3) (10.5) (38.7) (45.9) (58.9) Total Adjusted Sales $ 679.9 $ 702.4 $ 735.5 $ 785.5 $ 785.6 $ 859.2 $ 868.1 $ 935.2 $ 958.2 $ 1,011.7 $ 993.8 $ 946.1 $ 2,903.3 $ 3,448.1 $ 3,909.8 Adjusted SCEM segment Sales: SCEM segment Sales $ 190.9 $ 181.1 $ 181.6 $ 198.5 $ 193.8 $ 224.3 $ 218.5 $ 220.7 $ 221.4 $ 225.4 $ 224.2 $ 204.2 $ 752.1 $ 857.3 $ 875.2 Removal of wood treatment sales (15.0) (18.8) (18.2) (17.3) (15.5) (19.1) (21.2) (15.0) (10.9) (0.2) — — (69.3) (70.8) (11.1) SCEM adjusted segment sales $ 175.9 $ 162.3 $ 163.4 $ 181.2 $ 178.3 $ 205.2 $ 197.3 $ 205.7 $ 210.5 $ 225.2 $ 224.2 $ 204.2 $ 682.8 $ 786.5 $ 864.1 Proforma Non-GAAP Segment Trend Data Unaudited¹ ² ¹ During the three months ended October 1, 2022, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on four reportable segments: Specialty Chemicals and Engineered Materials (SCEM), Microcontamination Control (MC), Advanced Material Handling (AMH) and Advanced Planarization Solutions (APS). The following prior year information has been recast to reflect this realignment ² The above pro forma results include the addition of CMC Materials, Inc.’s net sales and segment profit amounts recorded prior to the consummation of the merger with the Company on July 6, 2022 to the Company’s reported GAAP net sales and segment profit amounts related to businesses that were transferred to the above business segments after the effectiveness of the merger and are provided as a complement to, and should be read in conjunction with, the condensed financial statements to better facilitate the assessment and measurement of the Company’s operating performance. Intercompany sales between the Company and CMC Materials, Inc have been eliminated, see table below.

ENTEGRIS PROPRIETARY AND CONFIDENTIAL – INTERNAL 27 $ in millions Q120 Q220 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 FY 2020 FY 2021 FY 2022 Segment Profit - GAAP SCEM $ 53.3 $ 49.7 $ 43.3 $ 34.9 $ (170.5) $ 57.2 $ 36.9 $ 41.4 $ 52.2 $ 38.1 $ 39.3 $ 14.8 $ 181.2 $ (35.0) $ 144.4 MC 50.2 62.1 64.9 71.7 70.6 78.1 78.4 94.2 98.6 100.1 105.3 107.4 248.9 321.3 411.4 AMH 20.6 22.8 33.3 34.3 32.1 42.1 40.5 45.3 46.7 46.9 42.1 48.0 111.0 160.0 183.7 APS 53.6 62.2 60.1 65.6 9 64.9 61.5 73.2 81.9 77.9 75.7 56.7 241.5 208.6 292.2 Total Segment profit (loss) $ 177.7 $ 196.8 $ 201.6 $ 206.5 $ (58.8) $ 242.3 $ 217.3 $ 254.1 $ 279.4 $ 263.0 $ 262.4 $ 226.9 $ 782.6 $ 654.9 $ 1,031.7 Amortization of intangible assets 66.2 62.1 61.1 60.3 59.8 60.2 60 59.5 59.9 59.7 65.3 53.5 249.7 239.5 238.4 Unallocated expenses 17.6 20.7 26.1 24.2 214.5 25.5 19.2 21.9 20.2 17.6 9.3 7.3 88.6 281.1 54.4 Total Operating Income (Loss) $ 93.9 $ 114.0 $ 114.4 $ 122.0 $ (333.1) $ 156.6 $ 138.1 $ 172.7 $ 199.3 $ 185.7 $ 187.8 $ 166.1 $ 444.3 $ 134.3 $ 738.9 Adjusted Segment Profit (Loss) SCEM segment profit (loss) $ 53.3 $ 49.7 $ 43.3 $ 34.9 $ (170.5) $ 57.2 $ 36.9 $ 41.4 $ 52.2 $ 38.1 $ 39.3 $ 14.8 $ 181.2 $ (35.0) $ 144.4 Adjustments for wood treatment (10.6) (13.3) (12.9) (12.9) (11.5) (14.2) (15.7) (10.7) (7.4) 0.3 — — (49.7) (52.1) (7.1) Impairment charges — — 2.3 7.3 208.2 3.1 11.7 9.4 — — — — 9.6 232.4 — Integration Expenses — (1.6) — — — — — — — — — — (1.6) — — FV Mark-up of Inventory sold 0.2 — — — 5.1 — — 0.4 — — 0.2 5.5 — Other adjustments 0.1 0.3 — 0.1 (1.0) — 2.9 (0.3) (3.3) — — — 0.5 1.6 (3.3) Severance - Restructuring 0.2 0.5 0.3 0.2 — 0.1 0.1 — — — — — 1.2 0.2 — SCEM adjusted segment profit $ 43.2 $ 35.6 $ 33.0 $ 29.6 $ 30.3 $ 46.2 $ 35.9 $ 40.2 $ 41.5 $ 38.4 $ 39.3 $ 14.8 $ 141.4 $ 152.6 $ 134.0 MC segment Profit $ 50.2 $ 62.1 $ 64.9 $ 71.7 $ 70.6 $ 78.1 $ 78.4 $ 94.2 $ 98.6 $ 100.1 $ 105.3 $ 107.4 $ 248.9 $ 321.3 $ 411.4 FV Mark-up of Inventory sold 0.1 — — — — — — — — — — — 0.1 — — Severance - Restructuring 0.2 0.5 0.3 0.2 0.1 0.1 0.1 — — — — — 1.2 0.3 — MC adjusted segment profit $ 50.5 $ 62.6 $ 65.2 $ 71.9 $ 70.7 $ 78.2 $ 78.5 $ 94.2 $ 98.6 $ 100.1 $ 105.3 $ 107.4 $ 250.2 $ 321.6 $ 411.4 Proforma Non-GAAP Segment Trend Data Unaudited¹ ² (continued) ¹ During the three months ended October 1, 2022, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on four reportable segments: Specialty Chemicals and Engineered Materials (SCEM), Microcontamination Control (MC), Advanced Material Handling (AMH) and Advanced Planarization Solutions (APS). The following prior year information has been recast to reflect this realignment ² The above pro forma results include the addition of CMC Materials, Inc.’s net sales and segment profit amounts recorded prior to the consummation of the merger with the Company on July 6, 2022 to the Company’s reported GAAP net sales and segment profit amounts related to businesses that were transferred to the above business segments after the effectiveness of the merger and are provided as a complement to, and should be read in conjunction with, the condensed financial statements to better facilitate the assessment and measurement of the Company’s operating performance. Intercompany sales between the Company and CMC Materials, Inc have been eliminated, see table below.

ENTEGRIS PROPRIETARY AND CONFIDENTIAL – INTERNAL 28 $ in millions Q120 Q220 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 FY 2020 FY 2021 FY 2022 Adjusted Segment Profit AMH segment Profit $ 20.6 $ 22.8 $ 33.3 $ 34.3 $ 32.1 $ 42.1 $ 40.5 $ 45.3 $ 46.7 $ 46.9 $ 42.1 $ 48.0 $ 111.0 $ 160.0 $ 183.7 FV Mark-up of Inventory sold — — 0.2 — — — — — — — — — 0.2 — — Severance - Restructuring 0.1 0.8 0.2 0.1 — — 0.1 — — — — — 1.2 0.1 — AMH adjusted segment profit $ 20.7 $ 23.6 $ 33.7 $ 34.4 $ 32.1 $ 42.1 $ 40.6 $ 45.3 $ 46.7 $ 46.9 $ 42.1 $ 48.0 $ 112.4 $ 160.1 $ 183.7 APS segment profit $ 53.6 $ 62.2 $ 60.1 $ 65.6 $ 9.0 $ 64.9 $ 61.5 $ 73.2 $ 81.9 $ 77.9 $ 75.7 $ 56.7 $ 241.5 $ 208.6 $ 292.2 FV Mark-up of Inventory sold APS — — — — 56.8 — — — — — — — — 56.8 — Other adjustments 0.2 0.1 0.1 0.1 — 1.5 (0.2) 0.5 — — — (0.3) 0.5 1.8 (0.3) APS adjusted segment profit $ 53.8 $ 62.3 $ 60.2 $ 65.7 $ 65.8 $ 66.4 $ 61.3 $ 73.7 $ 81.9 $ 77.9 $ 75.7 $ 56.4 $ 242.0 $ 267.2 $ 291.9 Unallocated expenses $ 17.6 $ 20.7 $ 26.1 $ 24.2 $ 214.5 $ 25.5 $ 19.2 $ 21.9 $ 20.2 $ 17.6 $ 9.3 $ 7.3 $ 88.6 $ 281.1 $ 54.4 Other adjustments 0.5 1.9 0.5 1.1 (0.4) (1.6) (0.3) 2.7 0.3 0.1 0.1 0.1 4.0 0.4 0.6 Deal, transaction & integration costs 3.8 3.6 5.5 3.7 194.9 4.0 3.5 — — — — — 16.6 202.4 — Adjusted unallocated expenses $ 13.3 $ 15.2 $ 20.1 $ 19.4 $ 20.0 $ 23.1 $ 16.0 $ 19.2 $ 19.9 $ 17.5 $ 9.2 $ 7.2 $ 68.0 $ 78.3 $ 53.8 Total Adjusted Segment Profit $ 168.2 $ 184.1 $ 192.1 $ 201.6 $ 198.9 $ 232.9 $ 216.3 $ 253.4 $ 268.7 $ 263.3 $ 262.4 $ 226.6 $ 746.0 $ 901.5 $ 1,021.0 Adjusted unallocated expenses 13.3 15.2 20.1 19.4 20.0 23.1 16.0 19.2 19.9 17.5 9.2 7.2 68.0 78.3 53.8 Total adjusted operating Income $ 154.9 $ 168.9 $ 172.0 $ 182.2 $ 178.9 $ 209.8 $ 200.3 $ 234.2 $ 248.8 $ 245.8 $ 253.2 $ 219.4 $ 678.0 $ 823.2 $ 967.2 Proforma Non-GAAP Segment Trend Data Unaudited¹ ² (continued) ¹ During the three months ended October 1, 2022, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on four reportable segments: Specialty Chemicals and Engineered Materials (SCEM), Microcontamination Control (MC), Advanced Material Handling (AMH) and Advanced Planarization Solutions (APS). The following prior year information has been recast to reflect this realignment ² The above pro forma results include the addition of CMC Materials, Inc.’s net sales and segment profit amounts recorded prior to the consummation of the merger with the Company on July 6, 2022 to the Company’s reported GAAP net sales and segment profit amounts related to businesses that were transferred to the above business segments after the effectiveness of the merger and are provided as a complement to, and should be read in conjunction with, the condensed financial statements to better facilitate the assessment and measurement of the Company’s operating performance. Intercompany sales between the Company and CMC Materials, Inc have been eliminated, see table below. $ in millions Q120 Q220 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 FY 2020 FY 2021 FY 2022 Intercompany sales and COGS ² $ 1.6 $ 1.9 $ 1.5 $ 2.7 $ 2.3 $ 2.5 $ 2.1 $ 2.0 $ 4.7 $ 3.6 $ 3.0 $ 1.5 $ 7.7 $ 8.9 $ 12.8

29 Reconciliation of Proforma GAAP Net Sales to Proforma Non-GAAP Net Sales $ in millions 1Q22 2Q22 3Q22 4Q22 FY2022 Proforma GAAP net sales $969.1 $1,011.9 $993.8 $946.1 $3,920.9 Removal of Wood treatment 10.9 0.2 — — 11.1 Proforma Non-GAAP net sales $958.2 $1,011.7 $993.8 $946.1 $3,909.8 Reconciliation of Proforma GAAP Gross Profit to Proforma Adjusted Gross Profit $ in millions 1Q22 2Q22 3Q22 4Q22 FY2022 Proforma Gross Margin $438.0 $428.8 $371.7 $404.5 $1,643.0 Proforma Gross Margin -as a % of GAAP net sales 45.2 % 42.4 % 37.4 % 42.8 % 41.9 % Inventory step-up — — 61.9 — 61.9 Wood treatment (7.4) 0.3 — — (7.1) Incremental Depreciation expense (4.5) (4.5) — — (9.0) Proforma Non-GAAP gross margin $426.1 $424.6 $433.6 $404.5 $1,688.8 Proforma Gross Margin - as a % of Non-GAAP net sales 44.5 % 42.0 % 43.6 % 42.8 % 43.2 %

30 Reconciliation of Proforma GAAP Operating Expenses and GAAP Tax Rate to Proforma Non-GAAP Operating Expenses and Non- GAAP Tax Rate $ in millions 1Q22 2Q22 3Q22 4Q22 FY2022 Proforma GAAP Operating Expense $218.2 $226.9 $356.8 $260.7 $1,062.6 Deal costs 17.3 12.1 31.9 0.3 61.6 Integration costs 0.7 10.2 79.2 22.1 112.2 Other (3.2) — — (0.3) (3.5) Amortization of intangible assets 28.5 28.3 65.3 53.5 175.6 Incremental depreciation expense (2.5) (2.5) — — (5.0) Proforma Non-GAAP Operating Expense $177.4 $178.8 $180.4 $185.1 $721.7 GAAP tax rate 16.1% 24.8% 8.7% 11.9% 21.5% Other (0.8%) (1.9%) 12.6% 0.3% (3.4%) Non-GAAP tax rate 15.3% 22.9% 21.2% 12.3% 18.1%

31 $ in millions 1Q22 2Q22 3Q22 4Q22 FY2022 Net sales $969.1 $1,011.9 $993.8 $946.1 $3,920.9 Net income (loss) 160.3 140.1 (73.8) 57.5 284.1 Net income (loss) – as a % of proforma GAAP net sales 16.5 % 13.8 % (7.4) % 6.1 % 7.2 % Adjustments to net income (loss): Income tax expense (benefit) 30.9 46.3 (7.0) 7.8 78.0 Interest expense, net 22.4 5.7 82.8 82.0 192.9 Other expense, net 6.3 9.8 12.9 (3.5) 25.5 Proforma GAAP Operating Income $219.9 $201.9 $14.9 $143.8 $580.5 Proforma GAAP Operating Income - as a % of proforma GAAP net sales 22.7 % 20.0 % 1.5 % 15.2 % 14.8 % Amortization of intangible assets 28.5 28.3 65.3 53.5 175.6 Depreciation 40.8 41.1 45.2 41.8 168.9 Adjusted EBITDA $289.2 $271.3 $125.4 $239.1 $925.0 Adjusted EBITDA as a % of proforma GAAP net sales 29.8 % 26.8 % 12.6 % 25.3 % 23.6 % Reconciliation of Proforma GAAP Net Income to Proforma Adjusted Operating Income and Adjusted EBITDA

32 $ in millions 1Q22 2Q22 3Q22 4Q22 FY2022 Net sales $969.1 $1,011.9 $993.8 $946.1 $3,920.9 Net income (loss) 160.3 140.1 (73.8) 57.5 284.1 Net income (loss) – as a % of proforma GAAP net sales 16.5 % 13.8 % (7.4) % 6.1 % 7.2 % Adjustments to net income (loss): Income tax expense (benefit) 30.9 46.3 (7.0) 7.8 78.0 Interest expense, net 22.4 5.7 82.8 82.0 192.9 Other expense, net 6.3 9.8 12.9 (3.5) 25.5 Proforma GAAP Operating Income $219.9 $201.9 $14.9 $143.8 $580.5 Proforma GAAP Operating Income - as a % of proforma GAAP net sales 22.7 % 20.0 % 1.5 % 15.2 % 14.8 % Wood treatment (net margin impact) (7.4) 0.3 — — (7.1) Charge for fair value write-up of acquired inventory sold — — $61.9 — $61.9 Deal costs 17.3 12.1 31.9 0.3 61.6 Integration costs 0.7 10.2 79.2 22.1 112.2 Other (3.2) — — (0.3) (3.5) Amortization of intangible assets 28.5 28.3 65.3 53.5 175.6 Incremental depreciation expense (7.0) (7.0) — — (14.0) Proforma Operating Income - Non-GAAP $248.8 $245.8 $253.2 $219.4 $967.2 Proforma Non-GAAP Operating Income - as a % of proforma Non-GAAP net sales 26.0 % 24.3 % 25.5 % 23.2 % 24.7 % Depreciation 47.8 48.2 45.2 41.9 183.1 Adjusted EBITDA $296.6 $294.0 $298.4 $261.3 $1,150.3 Adjusted EBITDA as a % of proforma Non-GAAP net sales 31.0% 29.1% 30.0% 27.6% 29.3% Reconciliation of Proforma GAAP Net Income to Proforma Adjusted Operating Income and Adjusted EBITDA Non-GAAP

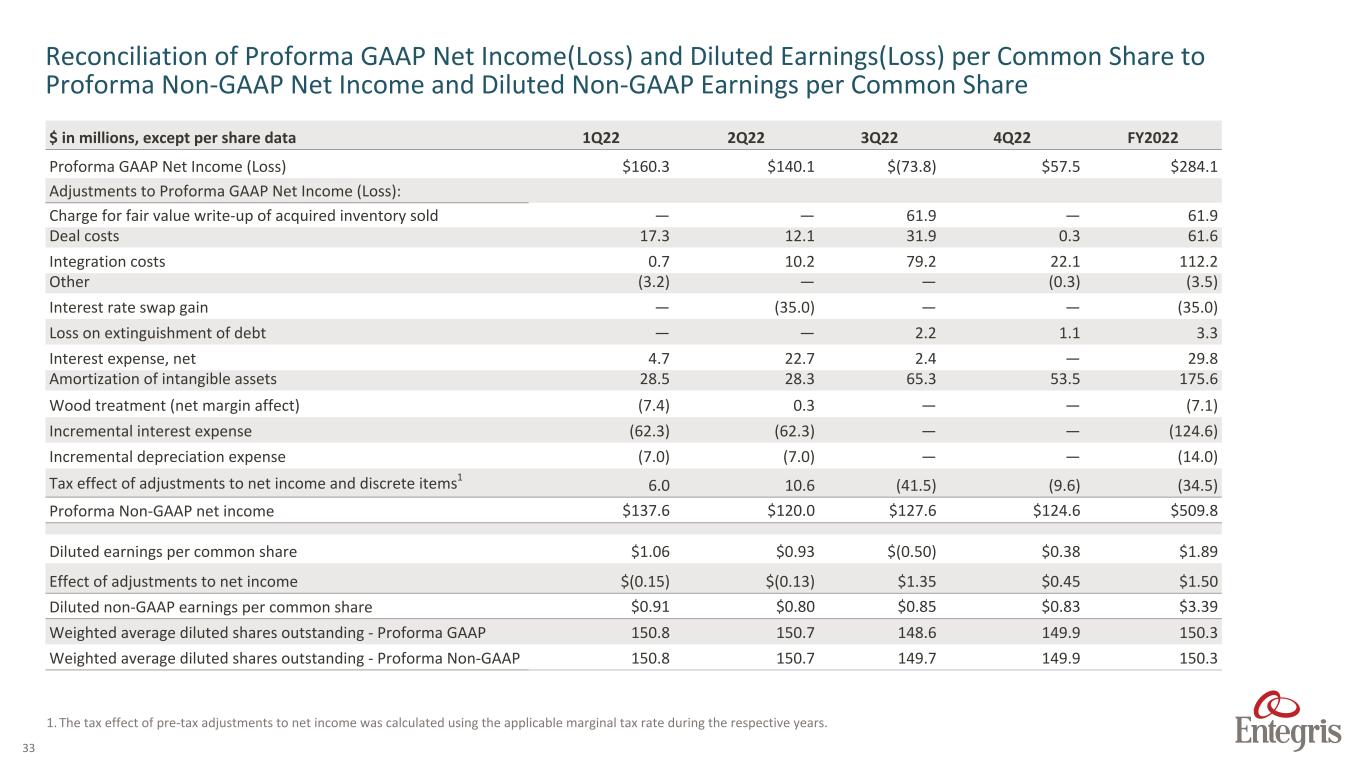

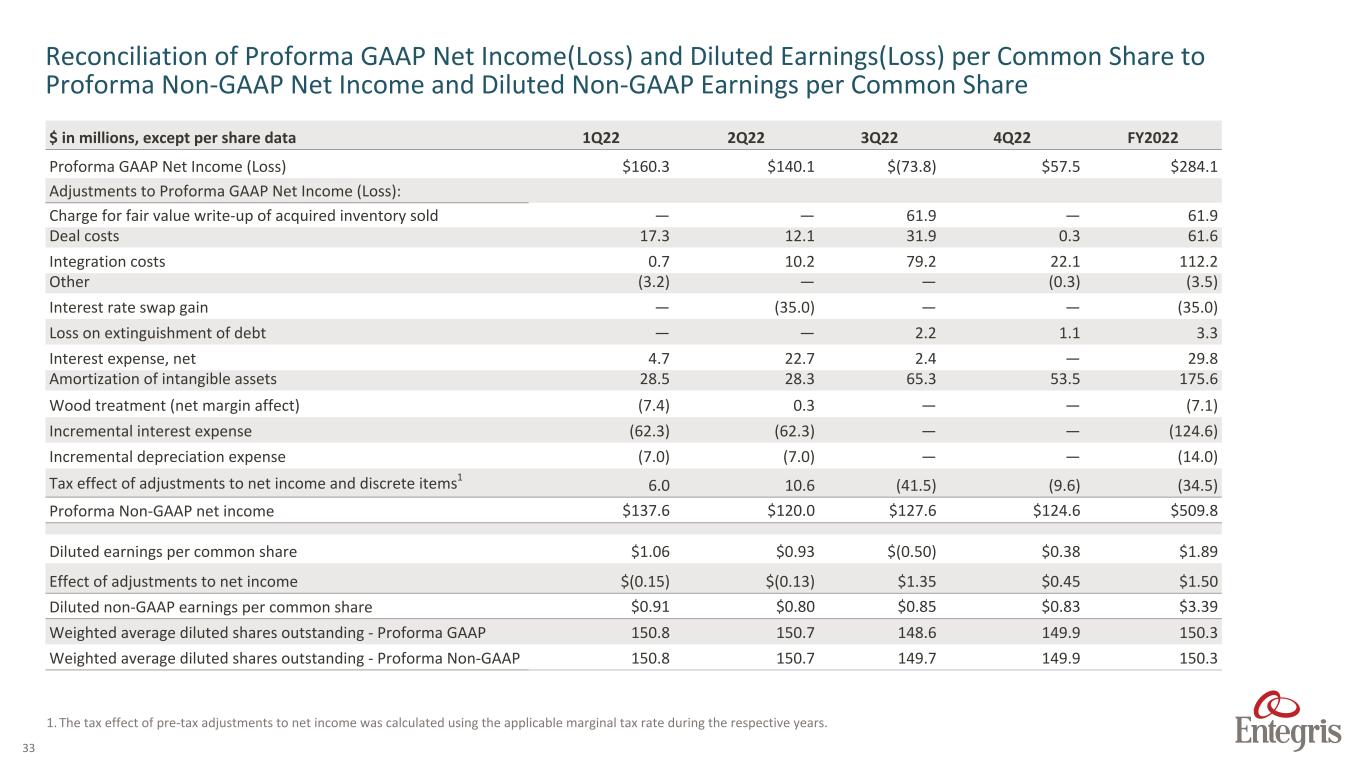

33 $ in millions, except per share data 1Q22 2Q22 3Q22 4Q22 FY2022 Proforma GAAP Net Income (Loss) $160.3 $140.1 $(73.8) $57.5 $284.1 Adjustments to Proforma GAAP Net Income (Loss): Charge for fair value write-up of acquired inventory sold — — 61.9 — 61.9 Deal costs 17.3 12.1 31.9 0.3 61.6 Integration costs 0.7 10.2 79.2 22.1 112.2 Other (3.2) — — (0.3) (3.5) Interest rate swap gain — (35.0) — — (35.0) Loss on extinguishment of debt — — 2.2 1.1 3.3 Interest expense, net 4.7 22.7 2.4 — 29.8 Amortization of intangible assets 28.5 28.3 65.3 53.5 175.6 Wood treatment (net margin affect) (7.4) 0.3 — — (7.1) Incremental interest expense (62.3) (62.3) — — (124.6) Incremental depreciation expense (7.0) (7.0) — — (14.0) Tax effect of adjustments to net income and discrete items1 6.0 10.6 (41.5) (9.6) (34.5) Proforma Non-GAAP net income $137.6 $120.0 $127.6 $124.6 $509.8 Diluted earnings per common share $1.06 $0.93 $(0.50) $0.38 $1.89 Effect of adjustments to net income $(0.15) $(0.13) $1.35 $0.45 $1.50 Diluted non-GAAP earnings per common share $0.91 $0.80 $0.85 $0.83 $3.39 Weighted average diluted shares outstanding - Proforma GAAP 150.8 150.7 148.6 149.9 150.3 Weighted average diluted shares outstanding - Proforma Non-GAAP 150.8 150.7 149.7 149.9 150.3 Reconciliation of Proforma GAAP Net Income(Loss) and Diluted Earnings(Loss) per Common Share to Proforma Non-GAAP Net Income and Diluted Non-GAAP Earnings per Common Share 1. The tax effect of pre-tax adjustments to net income was calculated using the applicable marginal tax rate during the respective years.