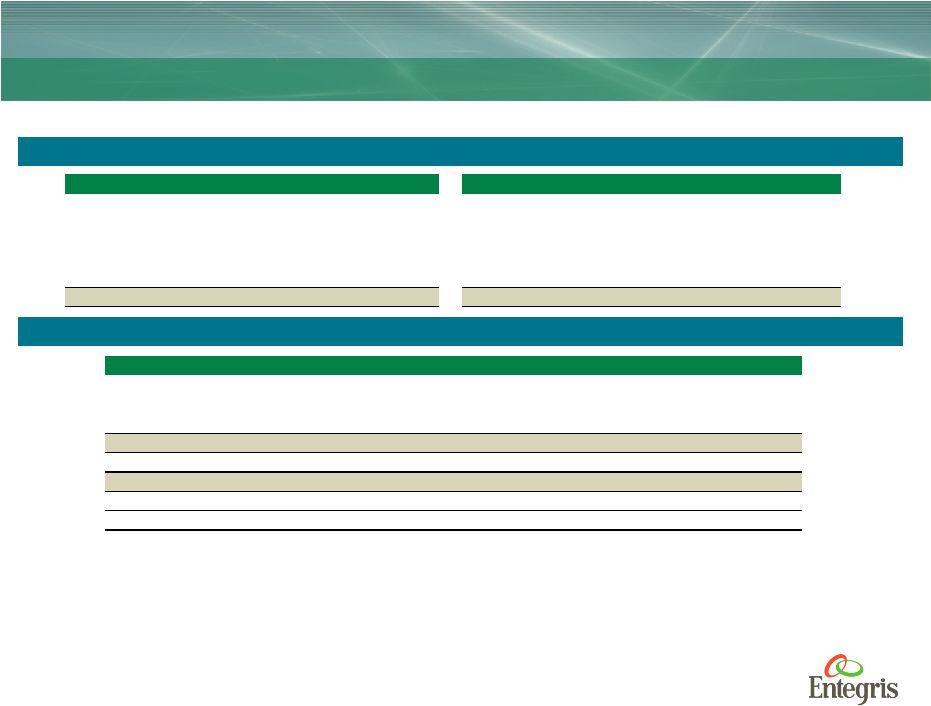

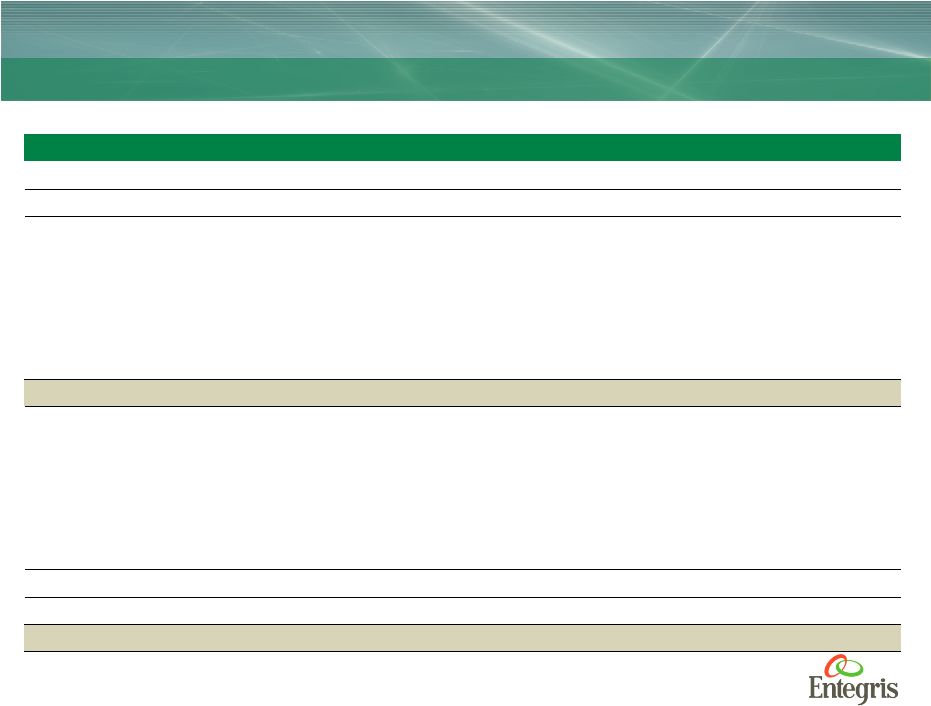

Presentation to Prospective Lenders | 2 Senior Secured Term Loan B Summary of Indicative Terms Senior Secured Term Loan B Summary of Indicative Terms Borrower: Entegris, Inc. Tranche: Senior Secured Term Loan B Security: First priority security interest in all assets of the Borrower (other than ABL collateral) and all stock and assets of the Guarantors and a 65% stock pledge of first tier foreign subsidiaries of the Borrower Second priority security interest in all ABL collateral Guarantors: All of the Borrower’s existing and future wholly owned material domestic subsidiaries, subject to customary exceptions Amount: $460 million Maturity: 7 years Amortization: 1.00% per annum Mandatory Prepayments: 100% of net proceeds from asset sales, subject to reinvestment rights 100% of net proceeds from debt issuance (other than Permitted Debt) 50% of Excess Cash Flow , subject to Secured Leverage Ratio-based step downs Financial Covenants: None Negative Covenants: The credit agreement will contain certain negative covenants typical of a transaction of this type, including limitations on incurrence of additional indebtedness, limitations on liens, limitations on restricted payments and investments, limitations on sale-leasebacks, limitations on transactions with affiliates, limitations on asset sales, limitations on mergers and consolidations and limitations on restrictions on subsidiary distributions |