The St. Regis San Francisco Entegris 2015 Analyst Meeting Entegris 2015 Analyst Meeting July 14, 2015 July 14, 2015 Exhibit 99.1 |

Entegris 2015 Analyst Meeting | 2 Agenda Agenda 1:30 PM Welcome, Agenda, Safe Harbor Steven Cantor VP, Corporate Relations 1:35 PM A Premier Materials and Solutions Provider Bertrand Loy President and CEO 1:50 PM A Platform for Growth and Stability Todd Edlund SVP and COO Differentiation in a Disruptive Environment James O’Neill CTO 2:15 PM Financial Perspective Greg Graves Executive VP and CFO Q&A 3:30 PM Meeting Close |

Entegris 2015 Analyst Meeting | 3 Safe Harbor Safe Harbor Certain information contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current management expectations only as of the date of this presentation, and involve substantial risks and uncertainties that could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Statements that include such words as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “may,” “will,” “should” or the negative thereof and similar expressions as they relate to Entegris or our management are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These risks include, but are not limited to, fluctuations in the market price of Entegris’ stock, Entegris’ future operating results, risks relating to the integration of ATMI, Inc. into Entegris, other acquisition and investment opportunities available to Entegris, general business and market conditions and other factors. Additional information concerning these and other risk factors may be found in previous financial press releases issued by Entegris and Entegris’ periodic public filings with the Securities and Exchange Commission, including discussions appearing under the headings “Risks Relating to our Business and Industry,” “Manufacturing Risks,” “International Risks,” and “Risks Related to Owning Our Securities” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as well as other matters and important factors disclosed previously and from time to time in the filings of Entegris with the U.S. Securities and Exchange Commission. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we undertake no obligation to update publicly any forward-looking statements contained herein. |

Bertrand Loy President and CEO Bertrand Loy President and CEO A Premier Materials and Solutions Provider A Premier Materials and Solutions Provider |

Entegris 2015 Analyst Meeting | 5 The ATMI acquisition has been a success and is creating significant value for all stakeholders IoT and new technology trends will continue to drive growth in our end markets Positioned to outperform market by leveraging our unique combination of technology breadth, global capabilities and customer relationships Recurring, unit-driven sales across the ecosystem provides stable business model Proven execution, strong operating leverage and disciplined capital allocation will drive significant EPS expansion Key Takeaways Key Takeaways |

Entegris 2015 Analyst Meeting | 6 *Trailing twelve months, as reported, Non-GAAP, ending 3/28/15 Entegris Today Entegris Today Revenues $1.1 Billion * EBITDA Margin 22% * EPS $0.78 * Unit-Driven Sales 77% |

Entegris 2015 Analyst Meeting | 7 Enhanced scale and growth potential Significant cost synergies Efficient balance sheet EPS expansion Transaction closed April 2014, one year later… ATMI – A Transformational Deal ATMI – A Transformational Deal We’re not just a bigger platform, we’re a better company Complementary platforms fully integrated $30 million annual synergies in place Lower cost of capital as a result of favorable debt structure Unlocking EPS growth in 2014-15 |

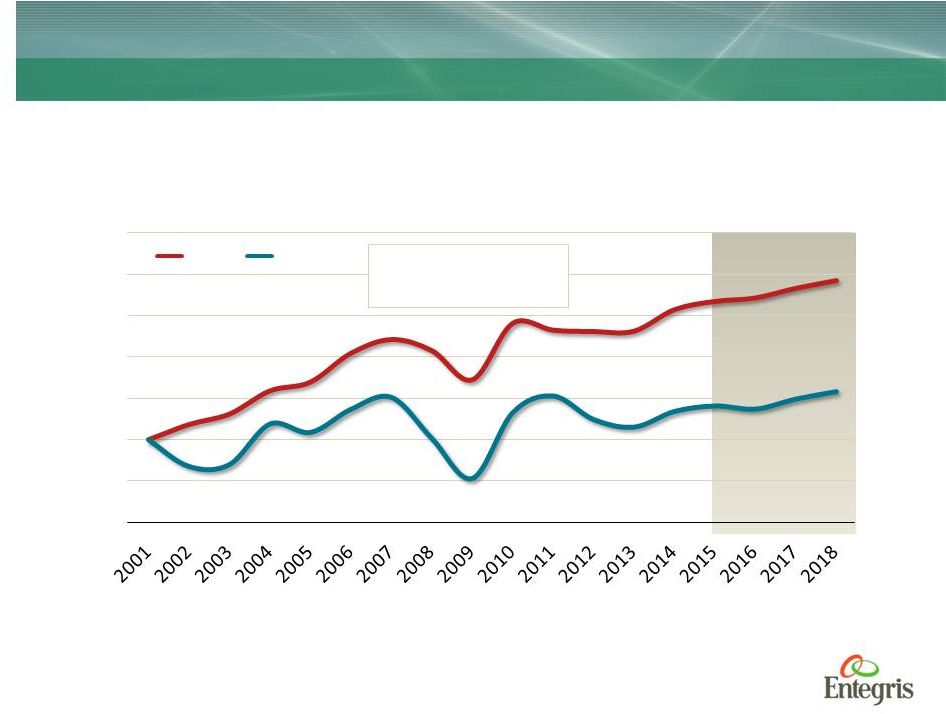

Entegris 2015 Analyst Meeting | 8 Over time, unit growth (MSI) far exceeds industry capital spending (WFE) MSI = millions of square inches of silicon; WFE = wafer fab equipment Source: Gartner, April 2015 Positive Unit Growth in the Industry Positive Unit Growth in the Industry 2001-2018 CAGR: MSI 6.5% WFE 2.8% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 Normalized Growth: MSI and WFE 2001-2018 MSI WFE |

Entegris 2015 Analyst Meeting | 9 Entegris will Benefit from the Internet of Things Entegris will Benefit from the Internet of Things Hyperconnectivity and big data are driving IC growth Servers/Storage More powerful and ubiquitous server farms PC | mobile | wearable Infrastructure | health | auto home | everywhere Sensors Devices |

Entegris 2015 Analyst Meeting | 10 MSI = millions of square inches of silicon; nm = nanometer Source: Gartner, April 2015 A Unit-Driven Model + Sticky Solutions = Greater Stability A Unit-Driven Model + Sticky Solutions = Greater Stability Semiconductor Industry Year-End Capacity by Linewidth (MSI/Year) Growth at the leading edge Stable recurring revenue at legacy nodes 0 500 1,000 1,500 2,000 2,500 3,000 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 Year 0.5 micron - 130 nm 90 nm - 45 nm 32 nm - 22 nm 14 nm - 10 nm |

Entegris 2015 Analyst Meeting | 11 Supplying solutions across the ecosystem *Trailing twelve months, as reported, Non-GAAP, ending 3/28/15 Uniquely Diverse Customer Mix Uniquely Diverse Customer Mix Equipment Makers Device Makers Materials Suppliers 2 3 4 5 6-10 All others 57.0% 10% 5% 5% 6% 14% Customer Rank Top 10 Customers Comprise Approx. 43% of Sales* 1 3% |

Entegris 2015 Analyst Meeting | 12 Customer Value Proposition: Higher yields, improved performance, reduced costs Leveraging technology, people and processes to address customer needs The Three Pillars of Our Organic Growth Strategy The Three Pillars of Our Organic Growth Strategy Global Infrastructure Operational Excellence Technology Portfolio |

Entegris 2015 Analyst Meeting | 13 Leveraging the Platform to Adjacent Markets Leveraging the Platform to Adjacent Markets *Trailing twelve months, as reported, ending 3/28/15 LED Data Storage Entegris Entegris Flat Panel Resource Efficiency Other Industrial Non-Semi 21% Solar Semiconductor 79% Life Sciences Revenue by Market* |

Entegris 2015 Analyst Meeting | 14 Going Forward – Creating Value for Stakeholders Going Forward – Creating Value for Stakeholders Growth in excess of market (100-200 bps) Achieve target model Pay down debt EPS growth Growth in excess of market (100-200 bps) Achieve target model Pay down debt EPS growth Financial objectives Investment priorities R&D Internal capabilities New market development Superior profitability Financial discipline Target model |

Todd Edlund SVP and COO Todd Edlund SVP and COO A Platform for Growth and Stability A Platform for Growth and Stability |

Entegris 2015 Analyst Meeting | 16 Customer Value Proposition: Higher yields, improved performance, reduced costs Leveraging technology, people and processes to address customer needs The Three Pillars of Our Organic Growth Strategy The Three Pillars of Our Organic Growth Strategy Global Infrastructure Operational Excellence Technology Portfolio |

Entegris 2015 Analyst Meeting | 17 Breadth of Entegris Portfolio Breadth of Entegris Portfolio Market leadership positions across the entire IC wafer fabrication process A leader in yield-enabling materials and solutions for advanced manufacturing Lithography Advanced Photoresist Packaging Advanced Photoresist Packaging Filtration and Dispense Filtration and Dispense Gas/Liquid Purification Gas/Liquid Purification Etch Gas Filters and Diffusers Gas Filters and Diffusers Gas Purification Gas Purification Specialty Materials Specialty Materials Deposition Copper Plating Copper Plating CVD and ALD Deposition Materials CVD and ALD Deposition Materials Gas Filtration and Purification Gas Filtration and Purification Clean Formulated Cleans Formulated Cleans Filtration Filtration Fluid Handling Fluid Handling Containers Containers CMP Formulated Cleans Formulated Cleans Filtration Filtration CMP Cleaning Brushes CMP Cleaning Brushes Implant Safe Gas Delivery Systems Safe Gas Delivery Systems Electrostatic Chucks Electrostatic Chucks Fab Facility Advanced FOUPs Advanced FOUPs AMC Filtration AMC Filtration Bulk Chemical Delivery Bulk Chemical Delivery Wafer Shippers Wafer Shippers Gas Purification Gas Purification Reticle Pods Reticle Pods Specialty Materials Specialty Materials Specialty Materials Specialty Materials Formulated Cleans Formulated Cleans Pad Conditioners Pad Conditioners TECHNOLOGY BREADTH/DEPTH |

Entegris 2015 Analyst Meeting | 18 Direct engagement by engineering teams Pilot capability at most sites Direct engagement by engineering teams Pilot capability at most sites Growing our share *NDAs and JDAs – Entegris only prior to 2014 Deepening Our Collaboration with Strategic Customers Deepening Our Collaboration with Strategic Customers Relevant, Trusted Technology Partner Relevant, Trusted Technology Partner Application and Process Knowledge Application and Process Knowledge We Develop Relevant Final Solution We Develop Relevant Final Solution We Listen We Listen We Respond Quickly with Prototypes We Respond Quickly with Prototypes Expanded applications excellence Faster new product development 12 25 47 67 2011 2012 2013 2014 Joint Development Agreements* with Top IDMs and OEMs TECHNOLOGY BREADTH/DEPTH |

Entegris 2015 Analyst Meeting | 19 6.4% 7.1% 8.0% 9.1% 9.8% 2011 2012 2013 2014 2015 YTD Entegris R&D/Sales* Half of increase focused on advanced research and core science Technical resources in Asia have grown by 30% Actively engaged with customers defining 10 nm processes – focus of our 2015 new product launches Maintained commitment to target model Entegris Has a Full Product Pipeline Entegris Has a Full Product Pipeline Shifting resources towards R&D to be the preferred partner for 1x nodes *2011-14 as reported prior to acquisition of ATMI on April 30, 2014 TECHNOLOGY BREADTH/DEPTH |

Entegris 2015 Analyst Meeting | 20 Gases and Gas- Wetted Surfaces Solids and Solid Materials Delivery Wet Chemistries and Wetted Surfaces Entegris has unique ability to “put the pieces together” in the materials space Technology Breadth and Depth: Unlocking the Power of the New Entegris Technology Breadth and Depth: Unlocking the Power of the New Entegris Customers Care About: Technology Performance Process Yield Device Cost Device Equipment Materials Co-optimized wet chemical handling solutions Material sensing and control Application-based clean gas delivery solutions Improved gas purifier capacity and efficiency New precursors Enabling delivery systems Feedgas monitoring and control TECHNOLOGY BREADTH/DEPTH |

Entegris 2015 Analyst Meeting | 21 Taking advantage of our unique breadth of knowledge and product portfolio to move faster for our customers New Initiatives Beginning on Many Levels New Initiatives Beginning on Many Levels Value-added cross-selling of existing products Value-added cross-selling of optimized products New product development projects to produce a synergistic solution Fully integrated combinations of technologies 2017 2018 2015 New Platform (Co-Marketing) Co-Optimization Co-Development Integrated Solutions 2016 TECHNOLOGY BREADTH/DEPTH |

Entegris 2015 Analyst Meeting | 22 Invested in infrastructure to serve global customer base Global Infrastructure with Local R&D, Manufacturing and Support Global Infrastructure with Local R&D, Manufacturing and Support Deep technical expertise and application knowledge Unique capabilities to enhance speed, effectiveness and efficiency of material development process Differentiating Product Development Dedicated customer support organization focused on specific customer needs Collaborative customer engagements leverage global state-of-the-art infrastructure and tech centers Strong Customer Relationships Korea Tech Center Taiwan Tech Center Analytical Services Lab i2M Center Danbury Tech Center San Diego Tech Center Tokyo Applications Lab GLOBAL INFRASTRUCTURE |

Entegris 2015 Analyst Meeting | 23 14 nm 100 nm 7 nm 32 nm Evolving Requirements for Operational Excellence Evolving Requirements for Operational Excellence ISO 14000 On-Time Delivery Cost Competitive Roadmap Alignment ISO 9001 EICC ISO 14000 On-Time Delivery Cost Competitive Roadmap Alignment ISO 16949 ISO 9001 EICC ISO 14000 Conflict Minerals On-Time Delivery Cost Competitive Cost of Ownership Roadmap Alignment Product Cleanliness Advanced Metrology Quality Standards Pushed to Suppliers Advanced Quality Systems Statistical Process Control ISO 16949 ISO 9001 Sustainability Availability Cost Technology Quality OPERATIONAL EXCELLENCE Requirements continue to grow |

Entegris 2015 Analyst Meeting | 24 One of only 19 suppliers to receive this award for 2014 “Intel recognizes Entegris’ dedication in providing excellent performances across cost, quality, availability, technology and sustainability. We are looking forward to Entegris’ continuing success and partnership in 2015” – Tim Hendry, Intel VP and Director of Fab Materials Operations Entegris Received Intel’s 2014 Preferred Quality Supplier Award Entegris Received Intel’s 2014 Preferred Quality Supplier Award OPERATIONAL EXCELLENCE |

James A. O’Neill, Ph.D. Chief Technology Officer James A. O’Neill, Ph.D. Chief Technology Officer Differentiation in a Disruptive Environment Differentiation in a Disruptive Environment |

Entegris 2015 Analyst Meeting | 26 Keeping on Moore’s Law has required innovations in: Lithography (Multi-patterning and EUV) 3D Device Structures (3D NAND, FinFET) New materials (high k, cobalt, Ge, III-V, etc.) Technology Inflection Points Keep Moore’s Law Moving Ahead Technology Inflection Points Keep Moore’s Law Moving Ahead Increased complexity, shortening lead times, yield sensitivity |

Entegris 2015 Analyst Meeting | 27 Why Materials Matter: Advanced Electronics Require Advanced Materials Why Materials Matter: Advanced Electronics Require Advanced Materials Increasing impact of materials innovation on chip performance Source: Left – Semico Research; right – Entegris, Linx Consulting Node in nm Positioned to benefit from increased reliance on formulated materials and growing complexity Chips Becoming More Reliant on Materials... Relevant Impact on Performance ...And More Complex Process Steps to Manufacture Chip 65 45/40 32/28 22/20 14 Scaling Design Materials Node in nm 0 400 800 1,200 1,600 2,000 2,400 2,800 65 45/40 32/28 22/20 14 10 |

Entegris 2015 Analyst Meeting | 28 Insuring Contamination-Free Materials From Production to Consumption Insuring Contamination-Free Materials From Production to Consumption Contamination can occur at multiple points in a chemical’s journey to the wafer Entegris has the technology to control contamination across the fluidics stream – from production to consumption Materials + Contamination Control = Yield, Cost, Performance Manufacturing 14 days cycle time Transportation 45 days cycle time Inventory 60 days cycle time Sub-fab 7 days cycle time Tool 1 day cycle time |

Entegris 2015 Analyst Meeting | 29 Litho 1 Right image: Intel High-k Penryn microchip 2009 Key Disruptive Technologies Below 14 nm Key Disruptive Technologies Below 14 nm Multi Patterning and EUV New Structures FinFET Device Metal gate Ge/Si S/D PMOS New Materials High-k metal gate transistor New defect sources, greater sensitivity to defects Challenging yield ramps Difficult product introduction schedules Fin Height Fin Width Gate Length Litho 2 Post Develop. Bake Etch for Line Control |

Entegris 2015 Analyst Meeting | 30 Process Implications of Inflection Point Innovations Process Implications of Inflection Point Innovations Multi-patterning Entegris’ broad portfolio of solutions helps our customers address the challenge of multipatterning Lithography Advanced Photoresist Packaging Advanced Photoresist Packaging Filtration and Dispense Filtration and Dispense Gas/Liquid Purification Gas/Liquid Purification Etch Gas Filters and Diffusers Gas Filters and Diffusers Gas Purification Gas Purification Specialty Materials Specialty Materials Deposition Copper Plating Copper Plating CVD and ALD Deposition Materials CVD and ALD Deposition Materials Gas Filtration and Purification Gas Filtration and Purification Clean Formulated Cleans Formulated Cleans Filtration Filtration Fluid Handling Fluid Handling Containers Containers CMP Formulated Cleans Formulated Cleans Filtration Filtration CMP Cleaning Brushes CMP Cleaning Brushes Implant Safe Gas Delivery Systems Safe Gas Delivery Systems Electrostatic Chucks Electrostatic Chucks Fab Facility Advanced FOUPs Advanced FOUPs AMC Filtration AMC Filtration Bulk Chemical Delivery Bulk Chemical Delivery Wafer Shippers Wafer Shippers Gas Purification Gas Purification Reticle Pods Reticle Pods Specialty Materials Specialty Materials Specialty Materials Specialty Materials Formulated Cleans Formulated Cleans Pad Conditioners Pad Conditioners Advanced Photoresist Packaging Filtration and Dispense CVD and ALD Deposition Materials Formulated Cleans Filtration Fluid Handling Containers Advanced FOUPs AMC Filtration Reticle Pods Formulated Cleans Gas Filters and Diffusers Gas Purification Specialty Materials |

Entegris 2015 Analyst Meeting | 31 Process Implications of Inflection Point Innovations Process Implications of Inflection Point Innovations 3D NAND Lithography Advanced Photoresist Packaging Advanced Photoresist Packaging Filtration and Dispense Filtration and Dispense Gas/Liquid Purification Gas/Liquid Purification Etch Gas Filters and Diffusers Gas Filters and Diffusers Gas Purification Gas Purification Specialty Materials Specialty Materials Deposition Copper Plating Copper Plating CVD and ALD Deposition Materials CVD and ALD Deposition Materials Gas Filtration and Purification Gas Filtration and Purification Clean Formulated Cleans Formulated Cleans Filtration Filtration Fluid Handling Fluid Handling Containers Containers CMP Formulated Cleans Formulated Cleans Filtration Filtration CMP Cleaning Brushes CMP Cleaning Brushes Implant Safe Gas Delivery Systems Safe Gas Delivery Systems Electrostatic Chucks Electrostatic Chucks Fab Facility Advanced FOUPs Advanced FOUPs AMC Filtration AMC Filtration Bulk Chemical Delivery Bulk Chemical Delivery Wafer Shippers Wafer Shippers Gas Purification Gas Purification Reticle Pods Reticle Pods Specialty Materials Specialty Materials Specialty Materials Specialty Materials Formulated Cleans Formulated Cleans Pad Conditioners Pad Conditioners CVD and ALD Deposition Materials Gas Filtration and Purification Formulated Cleans Filtration Fluid Handling Containers Safe Gas Delivery Systems Electrostatic Chucks Advanced FOUPs Gas Filters and Diffusers Gas Purification Specialty Materials Formulated Cleans Entegris solutions are integral to the implementation of advanced device structures like 3D NAND |

Entegris 2015 Analyst Meeting | 32 Process Implications of Inflection Point Innovations Process Implications of Inflection Point Innovations Cobalt Lithography Advanced Photoresist Packaging Advanced Photoresist Packaging Filtration and Dispense Filtration and Dispense Gas/Liquid Purification Gas/Liquid Purification Etch Gas Filters and Diffusers Gas Filters and Diffusers Gas Purification Gas Purification Specialty Materials Specialty Materials Deposition Copper Plating Copper Plating CVD and ALD Deposition Materials CVD and ALD Deposition Materials Gas Filtration and Purification Gas Filtration and Purification Clean Formulated Cleans Formulated Cleans Filtration Filtration Fluid Handling Fluid Handling Containers Containers CMP Formulated Cleans Formulated Cleans Filtration Filtration CMP Cleaning Brushes CMP Cleaning Brushes Implant Safe Gas Delivery Systems Safe Gas Delivery Systems Electrostatic Chucks Electrostatic Chucks Fab Facility Advanced FOUPs Advanced FOUPs AMC Filtration AMC Filtration Bulk Chemical Delivery Bulk Chemical Delivery Wafer Shippers Wafer Shippers Gas Purification Gas Purification Reticle Pods Reticle Pods Specialty Materials Specialty Materials Specialty Materials Specialty Materials Formulated Cleans Formulated Cleans Pad Conditioners Pad Conditioners The effect of integrating cobalt ripples through other process modules where Entegris plays Copper Plating CVD and ALD Deposition Materials Formulated Cleans Filtration Fluid Handling Containers Formulated Cleans Filtration CMP Cleaning Brushes Advanced FOUPs AMC Filtration Gas Filtration and Purification Gas Filtration and Purification |

Entegris 2015 Analyst Meeting | 33 Introduction of Cobalt Drives a New Product Cycle Introduction of Cobalt Drives a New Product Cycle Copper interconnect resistivity and reliability degrades as linewidth decreases – new metallurgy needed Copper Interconnect Copper Interconnect TaN/Ta Barrier Cobalt barrier, via, cap Cobalt contact Entegris Solutions Snorkel FOUPs ALD/CVD precursors Precursor delivery systems Post CMP clean formulations Cu and Co plating formulations Post Etch clean formulations Advanced filtration Wire Via IC Cross Section |

Entegris 2015 Analyst Meeting | 34 What matters to the customer Wet Process Sector Example Wet Process Sector Example Yield Metal contamination Organic contamination Particle contamination Wet Etch and Clean Performance Advanced process materials Device composition, geometry, properties Material compatibility Throughput Cost Lifetime Maintenance |

Entegris 2015 Analyst Meeting | 35 Peroxide Monitor - - Bath Life 2016 Formulated Chemistry Cooptimized Filtration Peroxide Monitor Integrated capabilities roadmap: copper post-etch residue removal Entegris Wet Etch and Clean Roadmap Example Entegris Wet Etch and Clean Roadmap Example Customer Benefit Performance Yield Cost InVue™ CR-288 concentration monitor QuickChange® NX filters TitanKlean® 9c Future Regeneration Filtration Performance Driver Year Clean Chemistry Particle Filter TiN Removal 2014 Formulated Chemistry Independent Filtration Particle Reduction 2015 Formulated Chemistry Matched Filtration Regeneration Filter - - Impurity Removal |

Entegris 2015 Analyst Meeting | 36 What these Inflection Point Technologies Mean for Entegris What these Inflection Point Technologies Mean for Entegris Technology Commentary Multi- patterning More process steps drives increased use of cleans and filtration Low temperature CVD precursors required for patterning films Increased need for general contamination control 3D NAND Challenging etch and deposition processes Fluorine-free tungsten is a key enabler FinFET Moderating need for implant gas delivery solutions offset by increased need for CVD/ALD precursors Specialty coatings required for high-temperature implant steps Cobalt Use of cobalt drives new product cycle Additional device metal layers drives incremental use of materials Key inflection point technologies represent an incremental revenue opportunity well in excess of $100M by 2018 |

Greg Graves Executive Vice President and CFO Greg Graves Executive Vice President and CFO Financial Perspective Financial Perspective |

Entegris 2015 Analyst Meeting | 38 Going Forward – Creating Value for Stakeholders Going Forward – Creating Value for Stakeholders Growth in excess of market (100-200 bps) Achieve target model Pay down debt EPS growth Growth in excess of market (100-200 bps) Achieve target model Pay down debt EPS growth Financial objectives Investment priorities R&D Internal capabilities New market development Superior profitability Financial discipline Target model |

Entegris 2015 Analyst Meeting | 39 Our Scorecard Our Scorecard Financial Objectives FY14 Q115 Growth in excess of market Achieve target model Pay down debt EPS growth |

Entegris 2015 Analyst Meeting | 40 Proven execution and leverage in the operating model 1 Represents range of adjusted operating margin based on respective quarterly revenue levels. 2 Adjusted for amortization of intangible assets and one-time charges and expenses, adjusted for unrealized synergies. 3 Assumes shares outstanding equal 140 million. Target Model and Historical Performance Target Model and Historical Performance 2010 2011 2012 2013 2014 2015 $0 $50 $100 $150 $200 $250 $300 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Revenue Operating Margin Target Model 0% 5% 10% 15% 20% 25% 30% Quarterly Revenue Level Revenue ($M) $250 $280 $310 Adjusted Operating Margin 2 14% - 16% 17% - 19% 20%+ Earnings Per Share 3 $0.14 - $0.16 $0.20 - $0.22 $0.26+ 1 |

Entegris 2015 Analyst Meeting | 41 $ and share data in millions Balance Sheet Balance Sheet $2.43 in cash per share Net leverage of 1.7x EBITDA $76 million in debt repayment since close of acquisition Commitment to repay an additional $75 million by end of Q3 March 28, 2015 December 31, 2014 Assets Cash and cash equivalents $341 $390 Accounts receivable $185 $154 Inventories $166 $163 Total Assets $1,733 $1,762 Liabilities and Equity Term loan B $382 $407 Notes $360 $360 Shareholders' equity $755 $748 Common shares outstanding 140 140 |

Entegris 2015 Analyst Meeting | 42 ATMI acquisition has driven significant EPS growth 1 2012-2014 Revenue and Non-GAAP EPS as reported. 2015 and 2016 Revenue and Non-GAAP EPS based on analysts estimates as of June 15, 2015. Non-GAAP EPS excludes acquisition-related costs and integration expense. Entegris Financial Results Entegris Financial Results $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 2012 2013 2014 2015 2016 Non-GAAP Revenue and EPS 1 EPS Revenue $0 $200 $400 $600 $800 $1,000 $1,200 |

Entegris 2015 Analyst Meeting | 43 2014 Non-GAAP As Reported 2014 Pro Forma Combined Two-Year Industry Growth 3 2.4% Growth > Industry 1.25% Operating Leverage Interest Expense Reduction 4 Revenue $962 $1,076 $1,128 $1,156 $1,156 $1,156 Operating Income 1 $161 $222 $222 % of revenue 17% 19% 19% Interest expense $28 ($38) ($28) EPS 2 $0.69 $0.95 $1.00 Illustrative model – modest growth, operating leverage and debt reduction lead to $1 per share plus by 2016 1 Operating margin per revised target model including $30 million of synergies. 2 EPS assumes no other income/expense, 28% combined tax rate and 140 million shares outstanding. 3 Reflects two-year industry growth assumption based on Gartner two-year 2014-2016 CAGR estimates: MSI +2.7% and WFE +1.0% and an 80%/20% MSI/WFE weighting. 4 Assumes term loan is reduced by $300 million. Each $100 million reduction in term loan is $0.016 per share annually. EPS Growth Formula EPS Growth Formula |

Entegris 2015 Analyst Meeting | 44 By 2016, three-year cumulative cash from operations is estimated to reach more than $465 million Projected Cash From Operations and Free Cash Flow Projected Cash From Operations and Free Cash Flow 2014 2015P 2016P Capex FCF Total Cash Flow From Operations ($ in millions) $126 $160 $180 Note: 2014 is as reported. 2015 and 2016 reflect company estimates. |

Entegris 2015 Analyst Meeting | 45 Our strategy to date has been focused on debt repayment Capital Allocation Capital Allocation Flexibility Buyback Shares Repurchase 6% Notes Repay 3.5% Term Loan Retain Cash; Build Liquidity Balancing Priorities M&A EPS Growth |

Entegris 2015 Analyst Meeting | 46 The ATMI acquisition has been a success and is creating significant value for all stakeholders IoT and new technology trends will continue to drive growth in our end markets Positioned to outperform market by leveraging a unique combination of technology breadth, global capabilities and customer relationships Recurring, unit-driven sales across the ecosystem provides stable business model Proven execution, strong operating leverage and disciplined capital allocation will drive significant EPS expansion Key Takeaways Key Takeaways |

Entegris®, the Entegris Rings Design® and Creating a Material Advantage® are trademarks of Entegris, Inc. ©2015 Entegris, Inc. All rights reserved. |