Entegris Analyst Meeting JULY 12, 2016 Exhibit 99.1

2 | Analyst Meeting 2016 01 Welcome, Agenda, Safe Harbor Steven Cantor, VP, Corporate Relations 02 A World Class Specialty Materials Company Bertrand Loy, President and CEO 03 Leveraging Technology Breadth To Drive Key Opportunities James O’Neill, CTO 04 Strong Financial Discipline To Grow Shareholder Value Greg Graves, Executive VP and CFO 05 Q&A 06 Meeting Close AGENDA

3 | Analyst Meeting 2016 Certain information contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve substantial risks and uncertainties that could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Statements that include such words as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “may,” “will,” “should” or the negative thereof and similar expressions as they relate to Entegris or our management are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These risks include, but are not limited to, fluctuations in the market price of Entegris’ stock, Entegris’ future operating results, other acquisition and investment opportunities available to Entegris, general business and market conditions and other factors. Additional information concerning these and other risk factors may be found in previous financial press releases issued by Entegris and Entegris’ periodic public filings with the Securities and Exchange Commission, including discussions appearing under the headings “Risks Relating to our Business and Industry,” “Risks Related to Our Indebtedness,” “Manufacturing Risks,” “International Risks” and “Risks Related to Owning Our Common Stock” in Item 1A of our Annual Report on Form 10–K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission on February 29, 2016, as well as other matters and important factors disclosed previously and from time to time in the filings of Entegris with the U.S. Securities and Exchange Commission. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we undertake no obligation to update publicly any forward-looking statements contained herein. SAFE HARBOR

Bertrand Loy President and CEO A World Class Specialty Materials Company JULY 12, 2016

ENTEGRIS: CREATING COMPELLING LONG-TERM VALUE FOR SHAREHOLDERS Mission Critical Supplier Stable, Recurring Revenue, Strong Cash Flow, and Earnings Leverage Above-Market Growth Electronic Materials | Analyst Meeting 2016

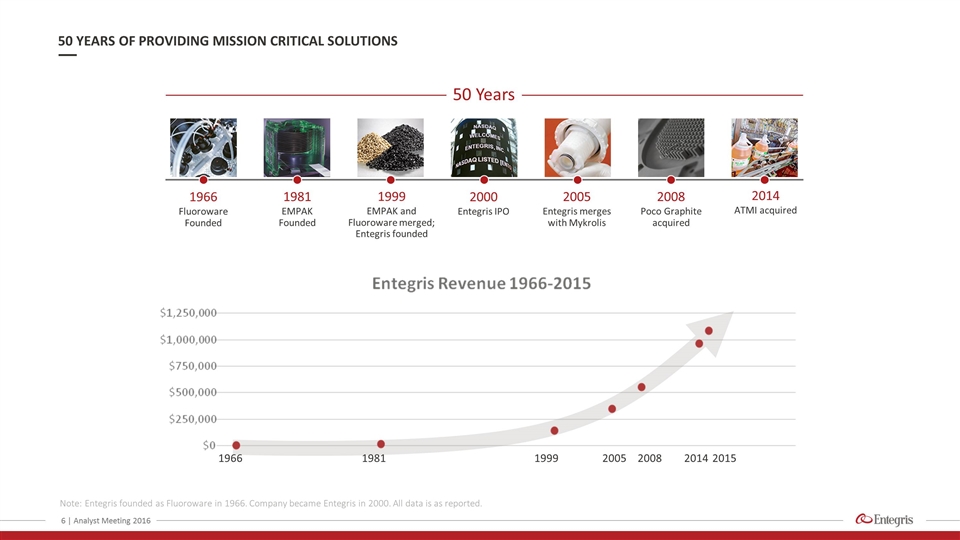

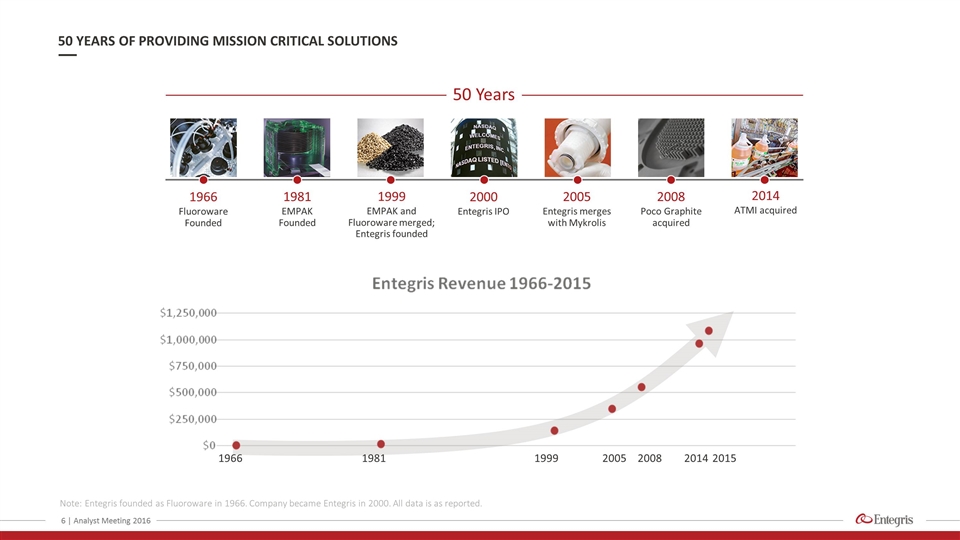

50 YEARS OF PROVIDING MISSION CRITICAL SOLUTIONS Note: Entegris founded as Fluoroware in 1966. Company became Entegris in 2000. All data is as reported. 1966 Fluoroware Founded 1981 EMPAK Founded 1999 EMPAK and Fluoroware merged; Entegris founded 2000 Entegris IPO 2005 Entegris merges with Mykrolis 2008 Poco Graphite acquired 2014 ATMI acquired 50 Years | Analyst Meeting 2016 1966 1981 1999 2005 2008 2014 2015

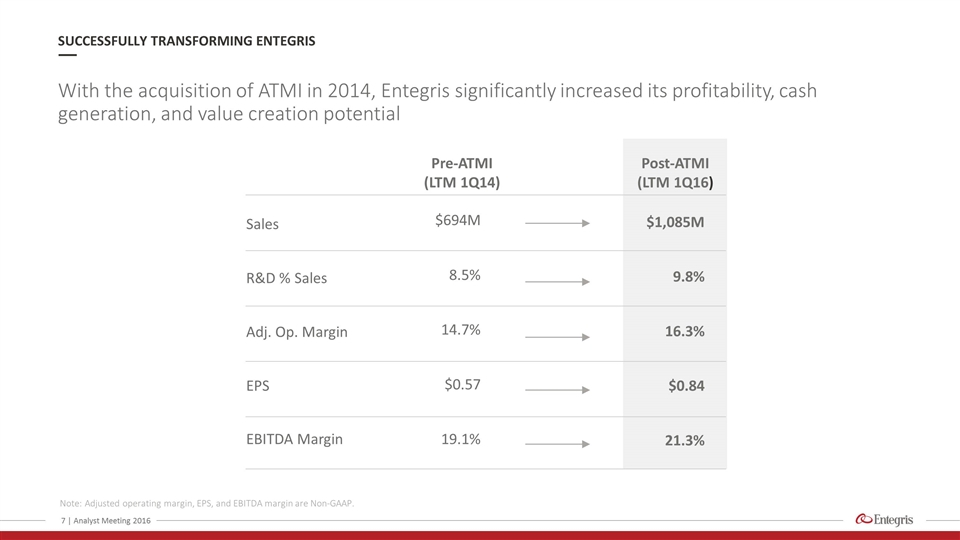

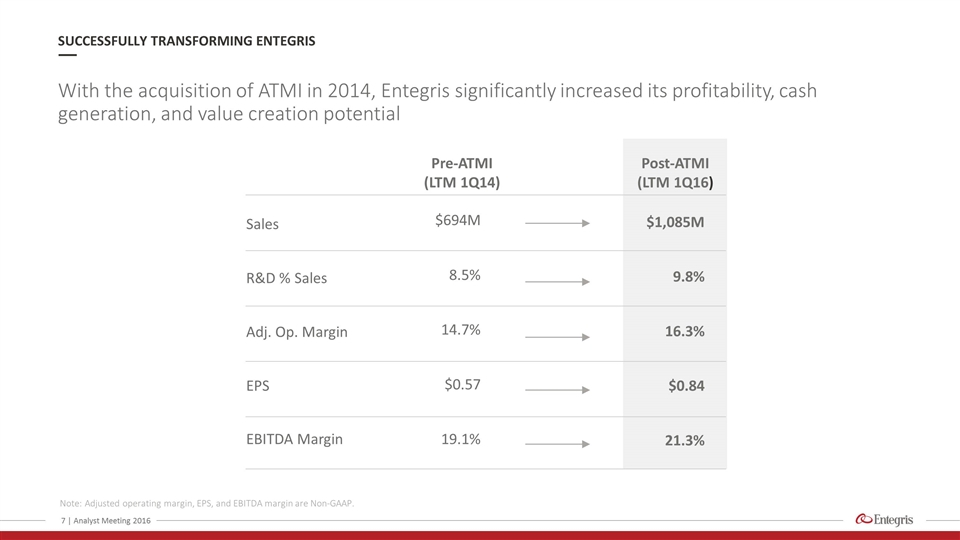

SUCCESSFULLY TRANSFORMING ENTEGRIS With the acquisition of ATMI in 2014, Entegris significantly increased its profitability, cash generation, and value creation potential Note: Adjusted operating margin, EPS, and EBITDA margin are Non-GAAP. $694M $1,085M Sales R&D % Sales Adj. Op. Margin EPS EBITDA Margin Pre-ATMI (LTM 1Q14) Post-ATMI (LTM 1Q16) 8.5% 9.8% 14.7% 16.3% $0.57 $0.84 19.1% 21.3% | Analyst Meeting 2016

Entegris provides yield-enhancing materials and solutions for the most advanced manufacturing environments through a unique combination of technology breadth and market focus that is unmatched in its industry YIELD-ENHANCING MATERIALS SOLUTIONS Advanced Chemicals | Analyst Meeting 2016 Selected peers and competitors Filtration and Purification Materials Handling

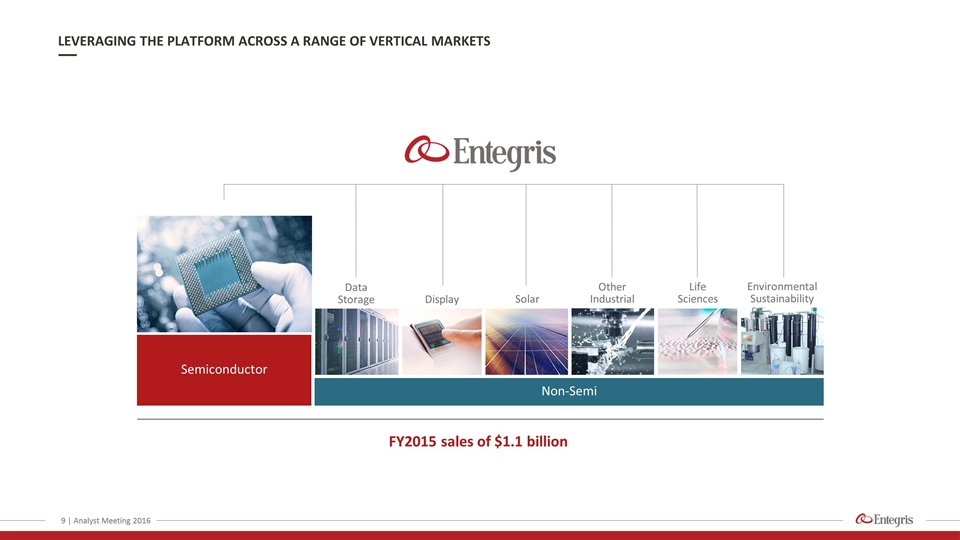

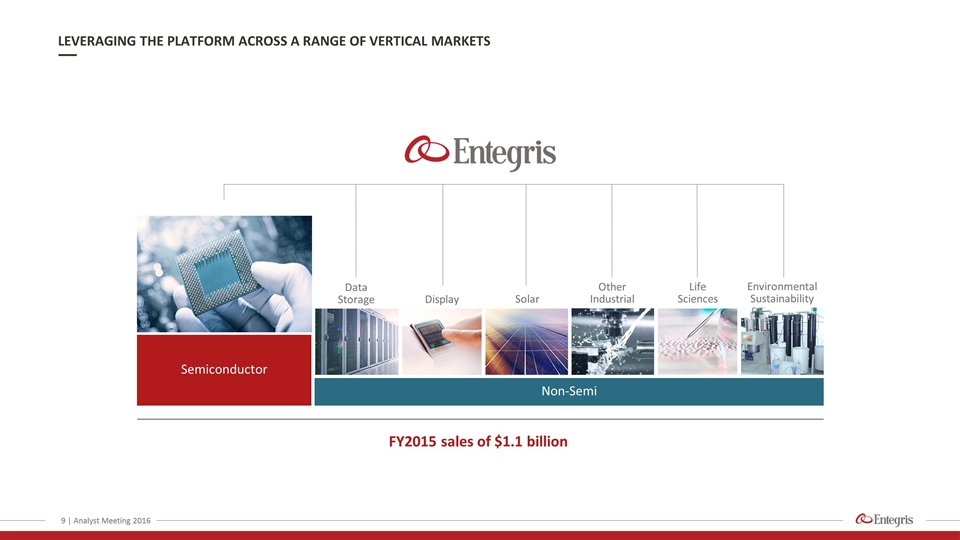

LEVERAGING THE PLATFORM ACROSS A RANGE OF VERTICAL MARKETS FY2015 sales of $1.1 billion Non-Semi Data Storage Life Sciences Solar Display Other Industrial Environmental Sustainability Semiconductor | Analyst Meeting 2016

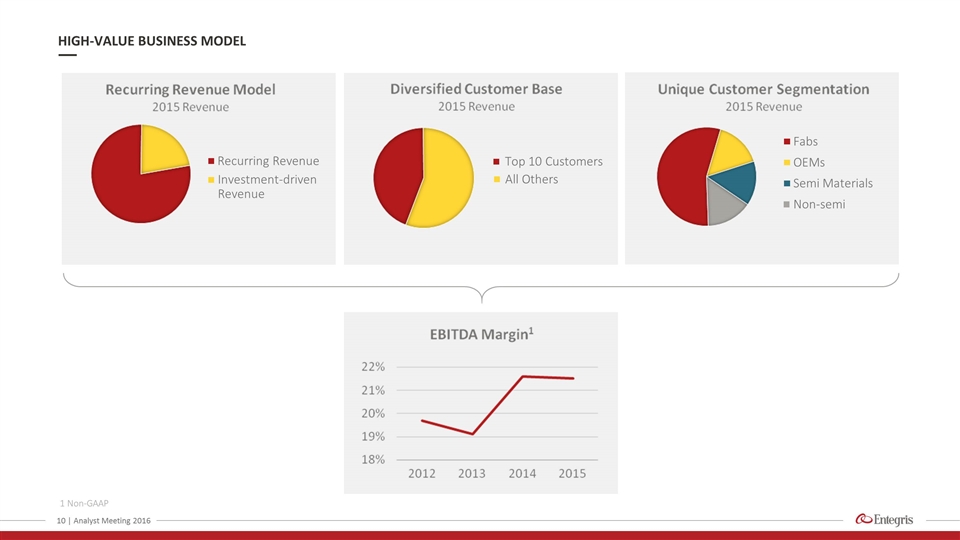

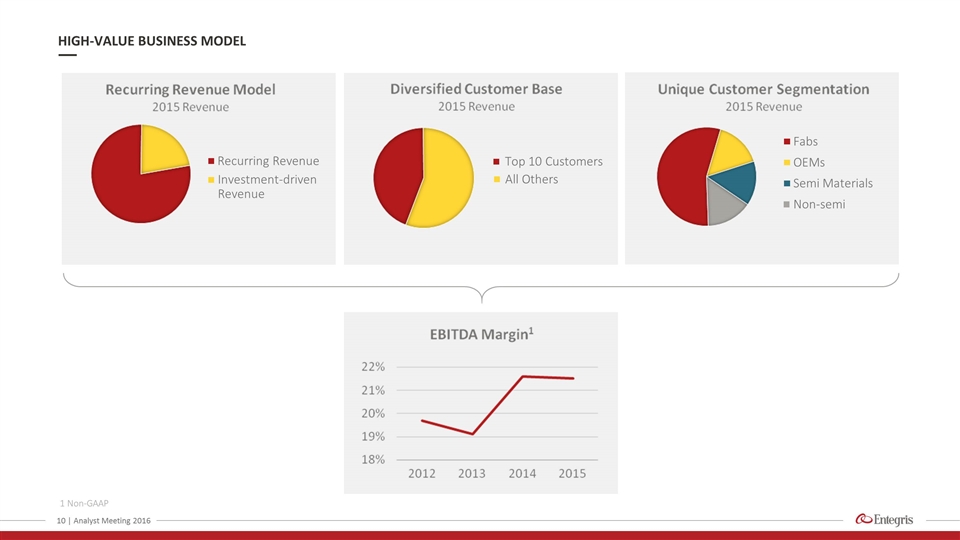

1 Non-GAAP HIGH-VALUE BUSINESS MODEL | Analyst Meeting 2016 Recurring Revenue Investment-driven Revenue Top 10 Customers All Others Fabs Semi Materials OEMs Non-semi

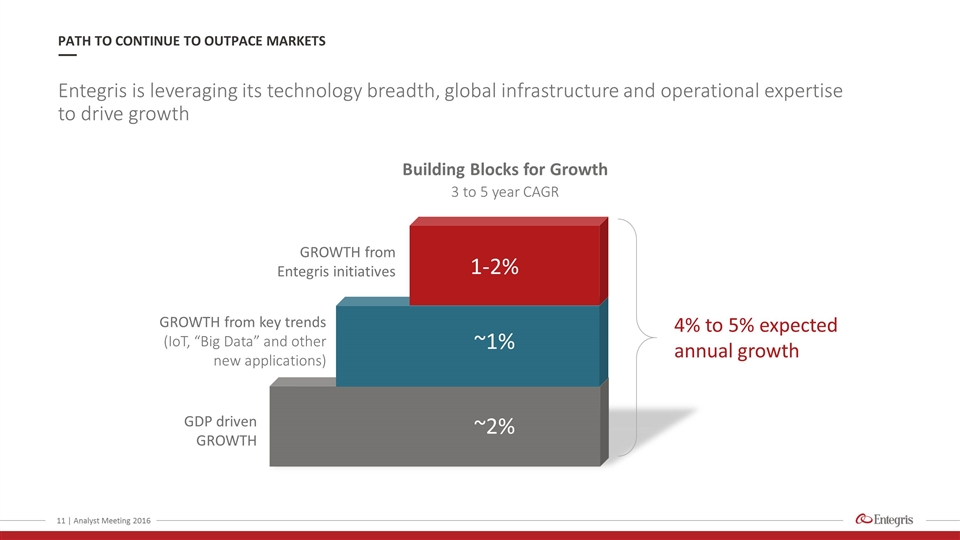

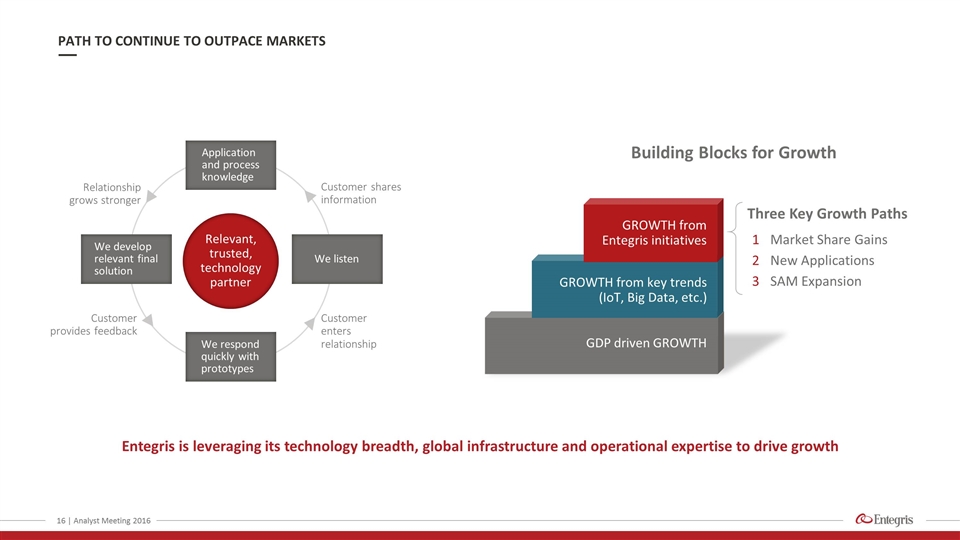

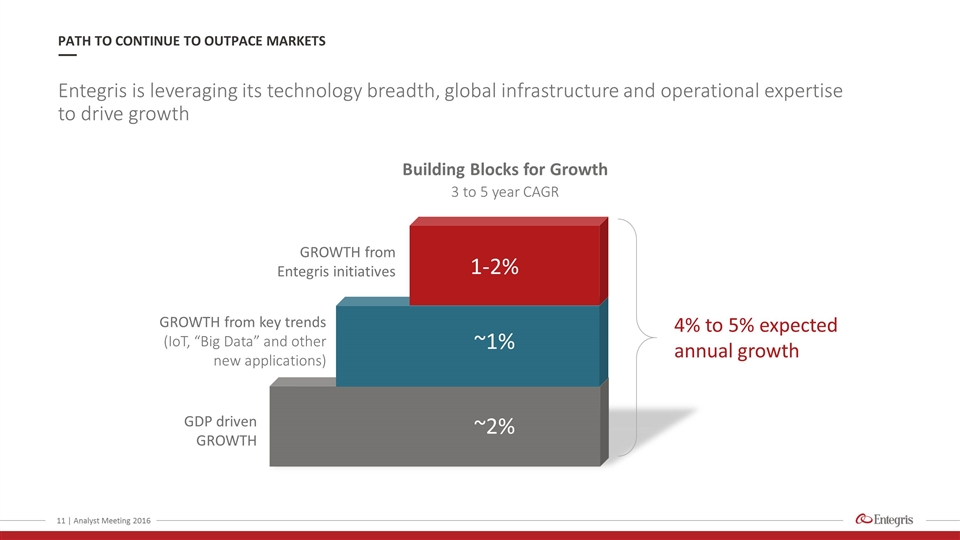

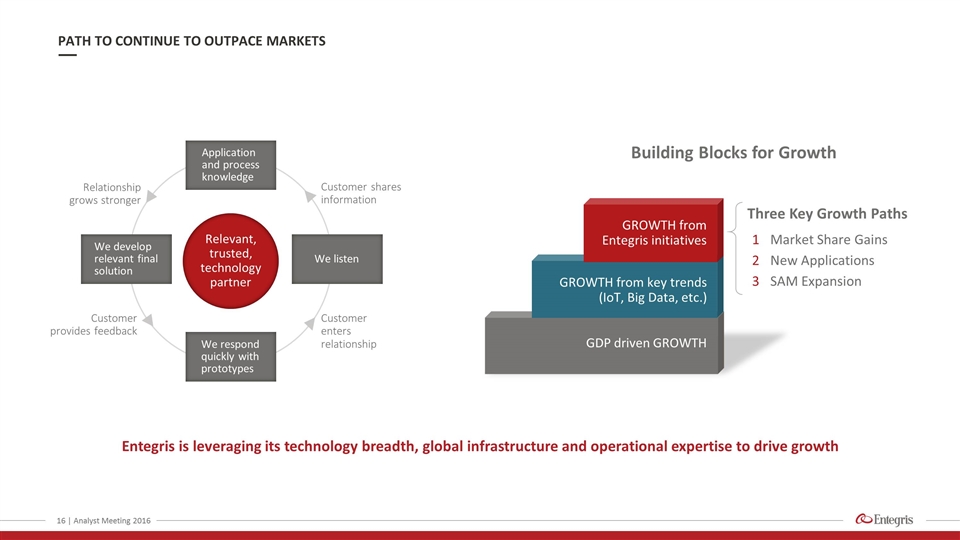

Entegris is leveraging its technology breadth, global infrastructure and operational expertise to drive growth PATH TO CONTINUE TO OUTPACE MARKETS | Analyst Meeting 2016 3 to 5 year CAGR 4% to 5% expected annual growth 1-2% GROWTH from Entegris initiatives GROWTH from key trends (IoT, “Big Data” and other new applications) GDP driven GROWTH ~1% ~2% Building Blocks for Growth

Customer Value Proposition Enabling higher yields, improved performance, reduced cost of ownership MAKING ENTEGRIS THE SUPPLIER OF CHOICE Global Responsiveness Operational Excellence Technology Portfolio Creating value by leveraging best-in-class technology with global infrastructure close to customers and a relentless focus of operational excellence | Analyst Meeting 2016

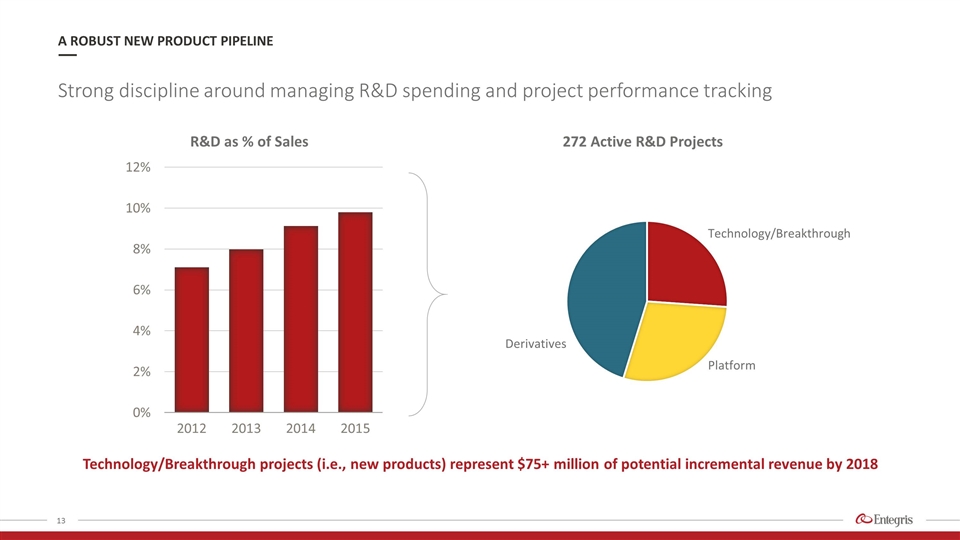

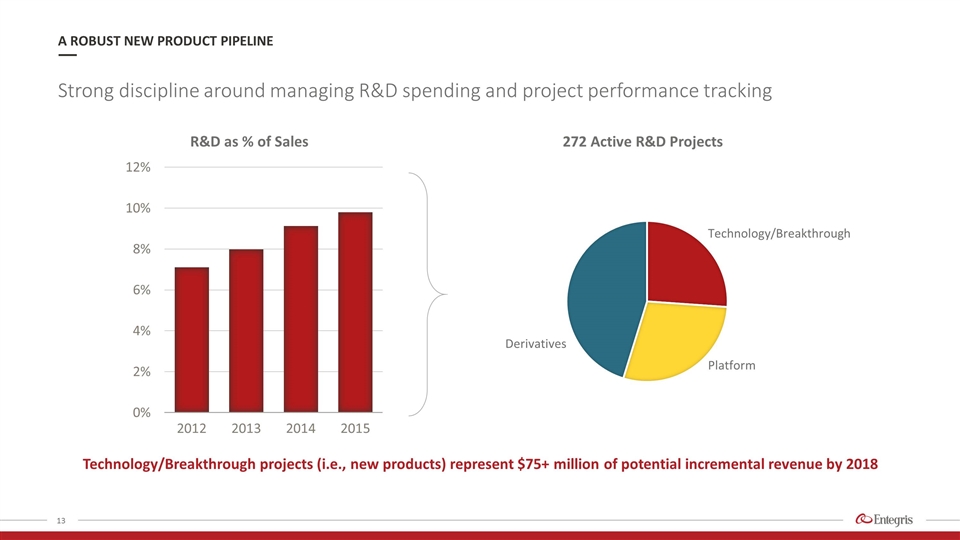

1 Technology/Breakthrough projects (i.e., new products) represent $75+ million of potential incremental revenue by 2018 Strong discipline around managing R&D spending and project performance tracking A ROBUST NEW PRODUCT PIPELINE Technology/Breakthrough Platform Derivatives

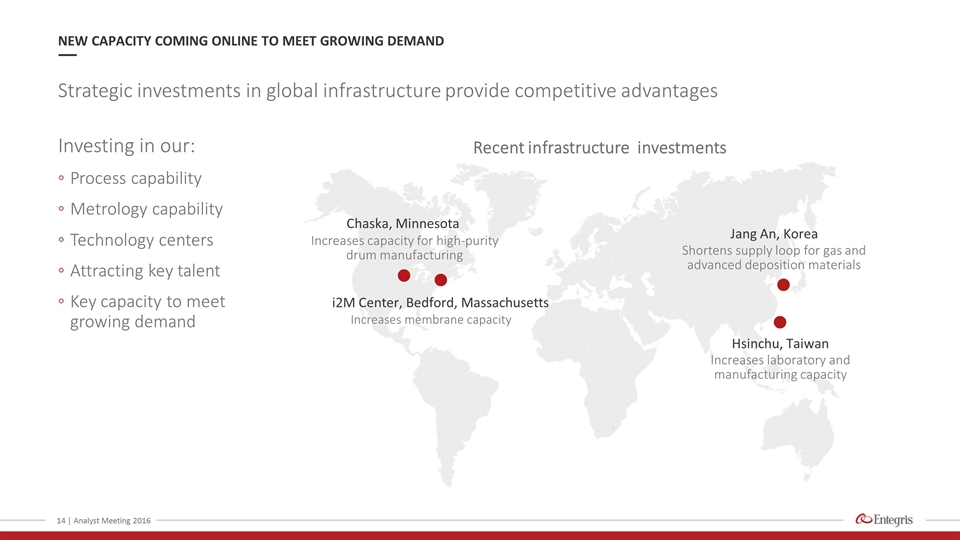

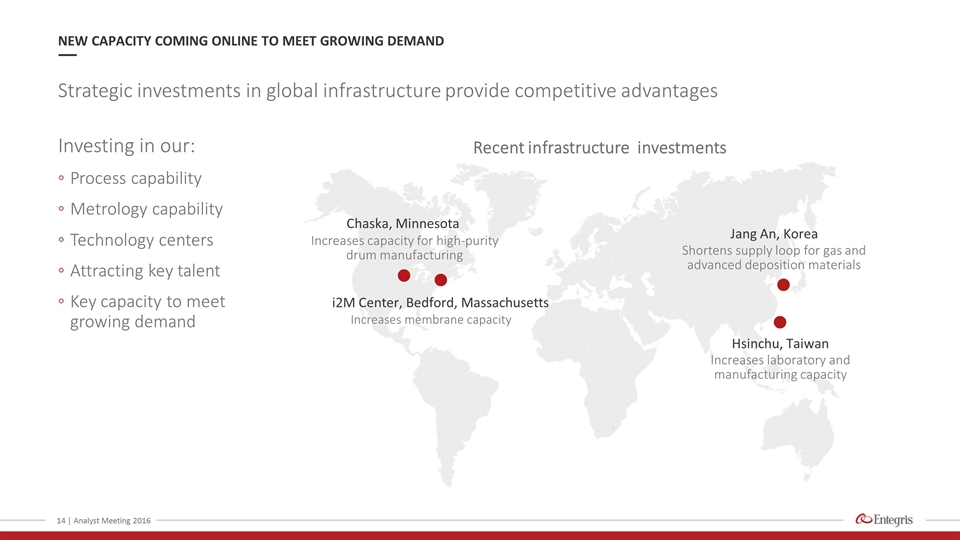

Investing in our: Process capability Metrology capability Technology centers Attracting key talent Key capacity to meet growing demand Strategic investments in global infrastructure provide competitive advantages NEW CAPACITY COMING ONLINE TO MEET GROWING DEMAND | Analyst Meeting 2016 Shortens supply loop for gas and advanced deposition materials Jang An, Korea Increases capacity for high-purity drum manufacturing Chaska, Minnesota Increases laboratory and manufacturing capacity Hsinchu, Taiwan Increases membrane capacity i2M Center, Bedford, Massachusetts Recent infrastructure investments

Entegris’ quality levels are approaching six sigma best in class Note: Index reflects numbers of customer complaints ACHIEVING WORLD-CLASS QUALITY | Analyst Meeting 2016

Entegris is leveraging its technology breadth, global infrastructure and operational expertise to drive growth PATH TO CONTINUE TO OUTPACE MARKETS | Analyst Meeting 2016 Three Key Growth Paths Market Share Gains New Applications SAM Expansion Customer shares information Customer enters relationship Customer provides feedback Relationship grows stronger Relevant, trusted, technology partner Application and process knowledge We develop relevant final solution We listen We respond quickly with prototypes GROWTH from Entegris initiatives GROWTH from key trends (IoT, Big Data, etc.) GDP driven GROWTH Building Blocks for Growth

James A. O’Neill, Ph.D. Chief Technology Officer Leveraging Technology Breadth To Drive Key Opportunities JULY 12, 2016

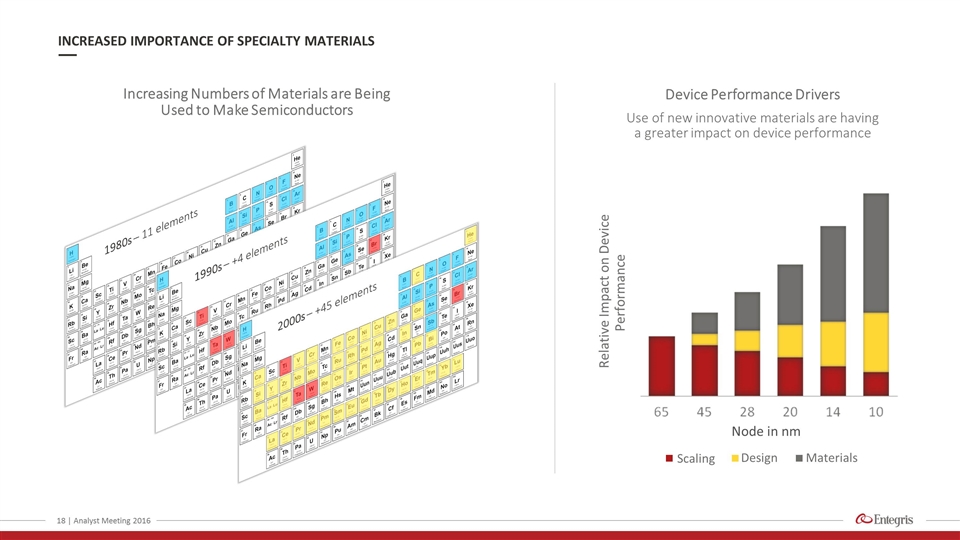

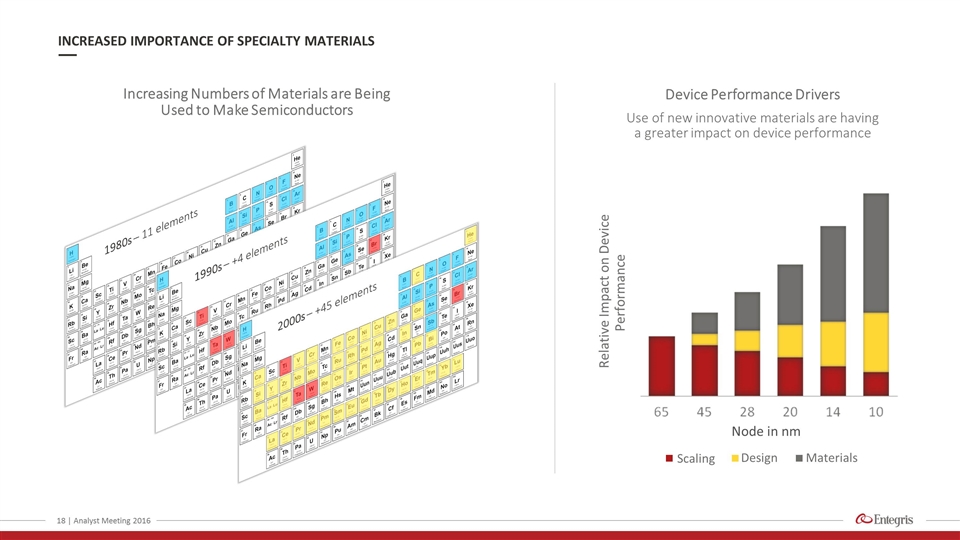

INCREASED IMPORTANCE OF SPECIALTY MATERIALS Increasing Numbers of Materials are Being Used to Make Semiconductors Node in nm Relative Impact on Device Performance Device Performance Drivers Use of new innovative materials are having a greater impact on device performance | Analyst Meeting 2016 1980s – 11 elements 1990s – +4 elements 2000s – +45 elements Scaling Materials Design

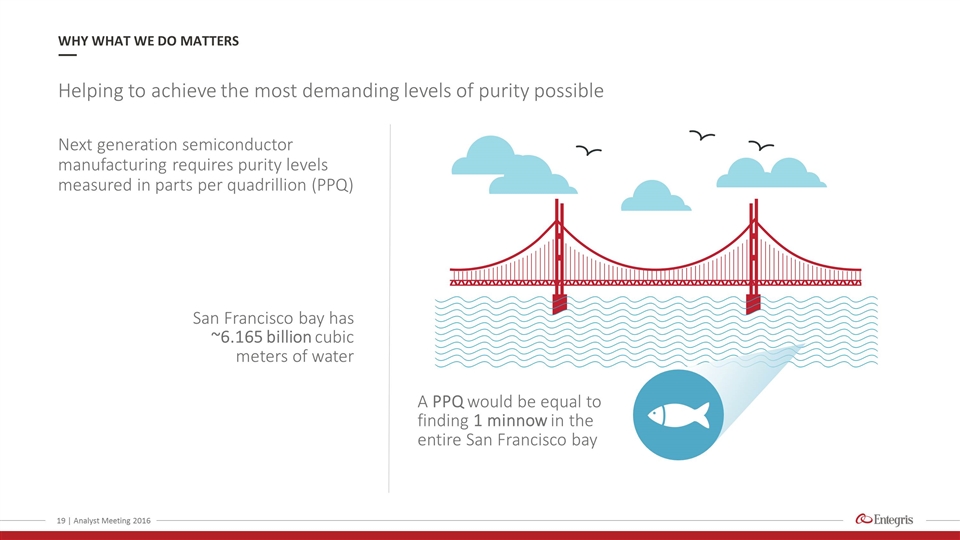

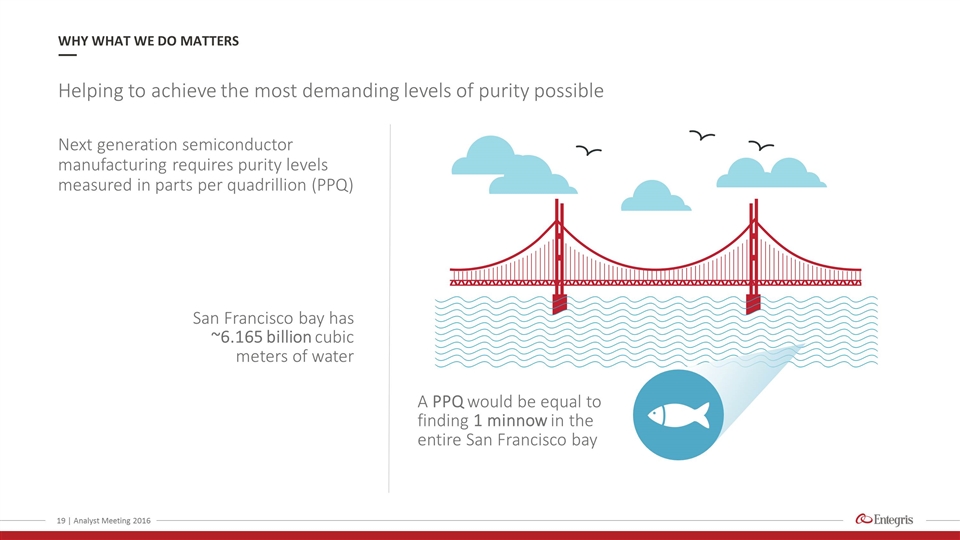

Next generation semiconductor manufacturing requires purity levels measured in parts per quadrillion (PPQ) Helping to achieve the most demanding levels of purity possible WHY WHAT WE DO MATTERS San Francisco bay has ~6.165 billion cubic meters of water A PPQ would be equal to finding 1 minnow in the entire San Francisco bay | Analyst Meeting 2016

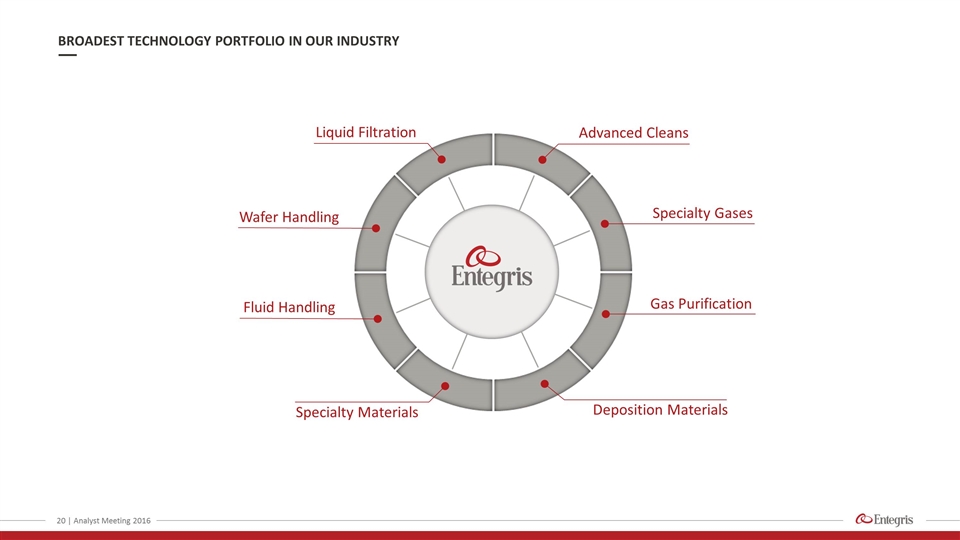

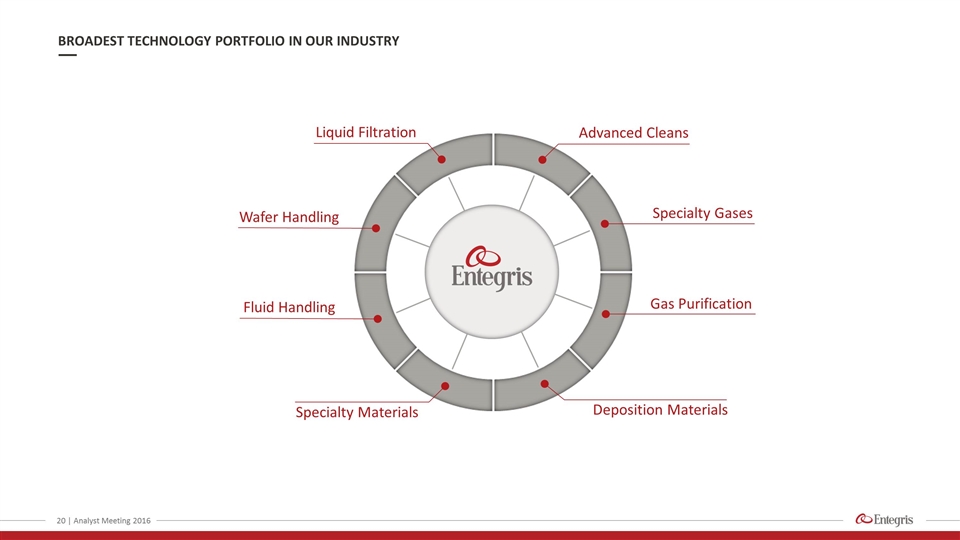

BROADEST TECHNOLOGY PORTFOLIO IN OUR INDUSTRY Liquid Filtration Advanced Cleans Specialty Gases Gas Purification Deposition Materials Fluid Handling Wafer Handling Specialty Materials | Analyst Meeting 2016

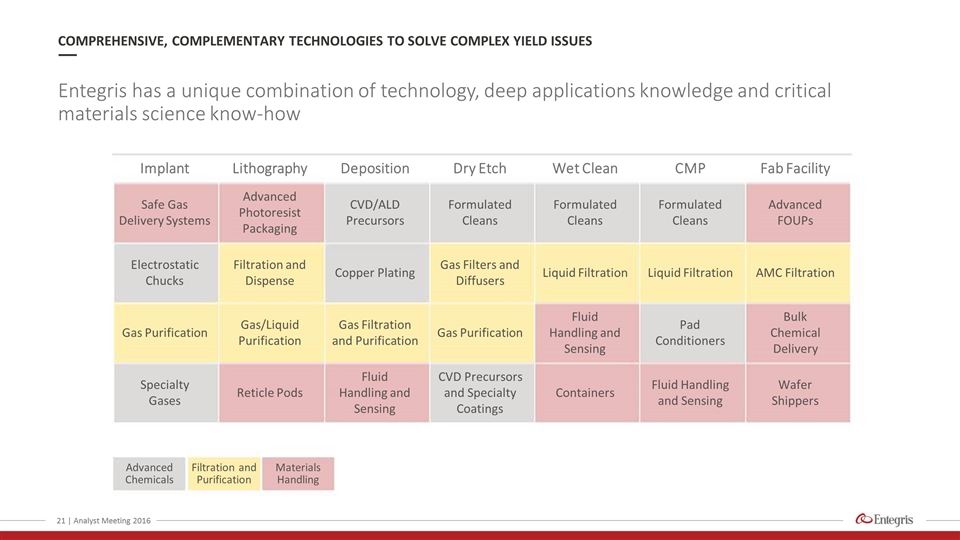

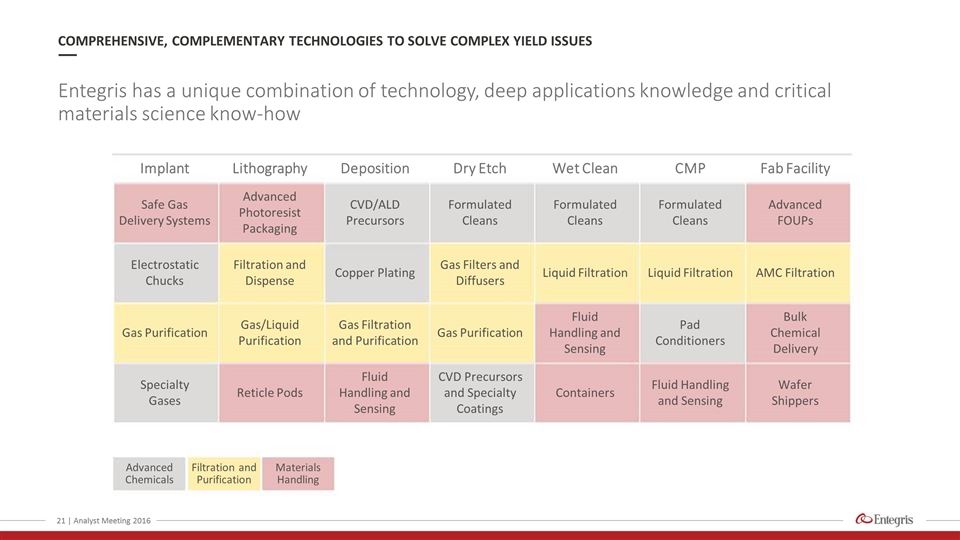

COMPREHENSIVE, COMPLEMENTARY TECHNOLOGIES TO SOLVE COMPLEX YIELD ISSUES Entegris has a unique combination of technology, deep applications knowledge and critical materials science know-how Advanced Chemicals Filtration and Purification | Analyst Meeting 2016 Materials Handling Implant Lithography Deposition Dry Etch Wet Clean CMP Fab Facility Safe Gas Delivery Systems Advanced Photoresist Packaging CVD/ALD Precursors Formulated Cleans Formulated Cleans Formulated Cleans Advanced FOUPs Electrostatic Chucks Filtration and Dispense Copper Plating Gas Filters and Diffusers Liquid Filtration Liquid Filtration AMC Filtration Gas Purification Gas/Liquid Purification Gas Filtration and Purification Gas Purification Fluid Handling and Sensing Pad Conditioners Bulk Chemical Delivery Specialty Gases Reticle Pods Fluid Handling and Sensing CVD Precursors and Specialty Coatings Containers Fluid Handling and Sensing Wafer Shippers

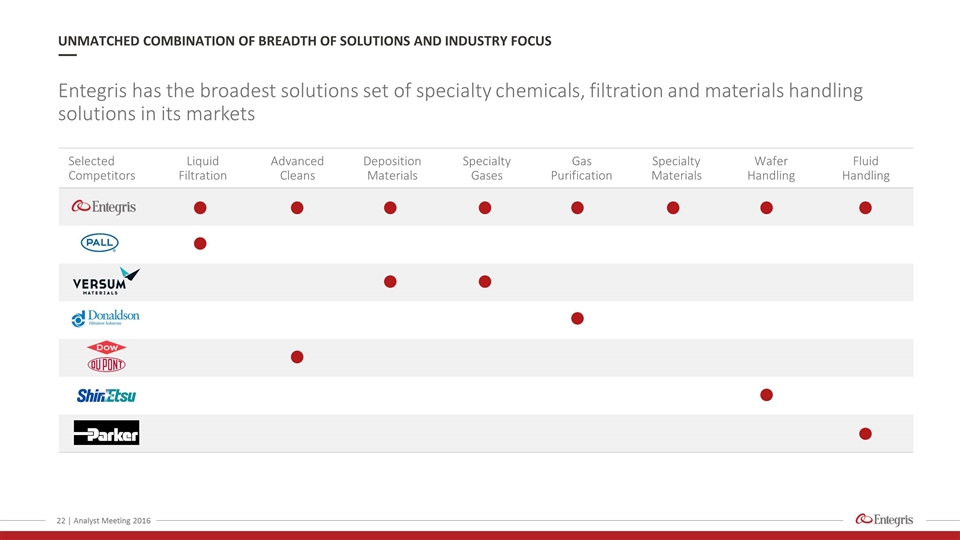

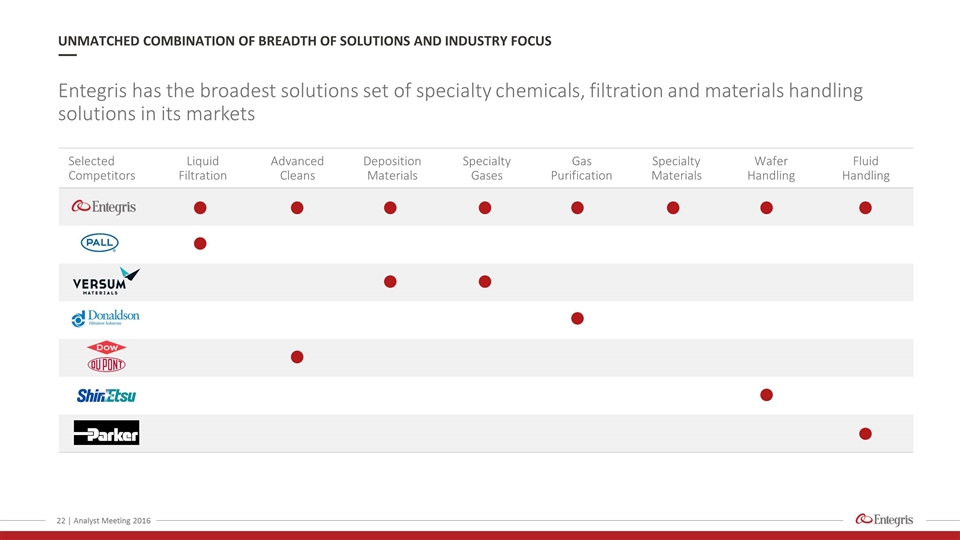

Entegris has the broadest solutions set of specialty chemicals, filtration and materials handling solutions in its markets UNMATCHED COMBINATION OF BREADTH OF SOLUTIONS AND INDUSTRY FOCUS Selected Competitors Liquid Filtration Advanced Cleans Deposition Materials Specialty Gases Gas Purification Specialty Materials Wafer Handling Fluid Handling | Analyst Meeting 2016

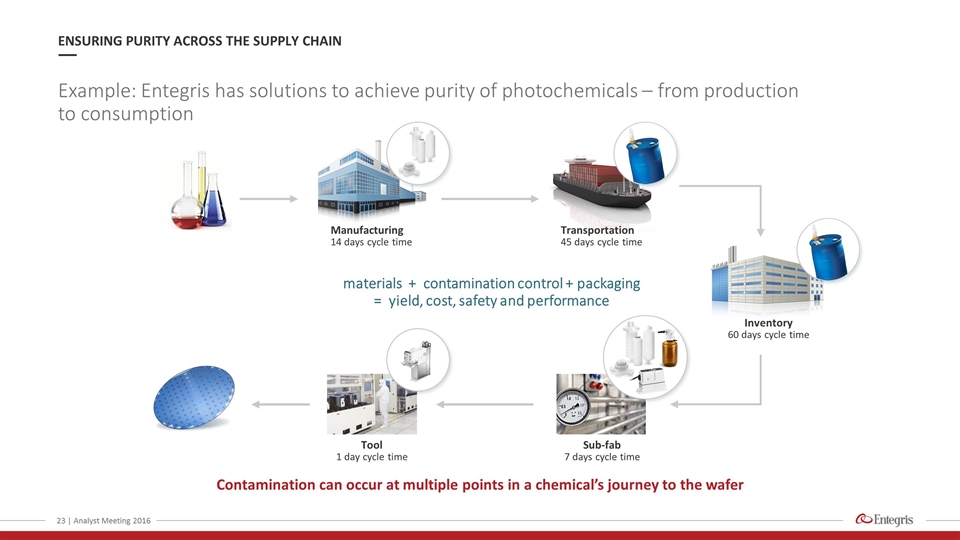

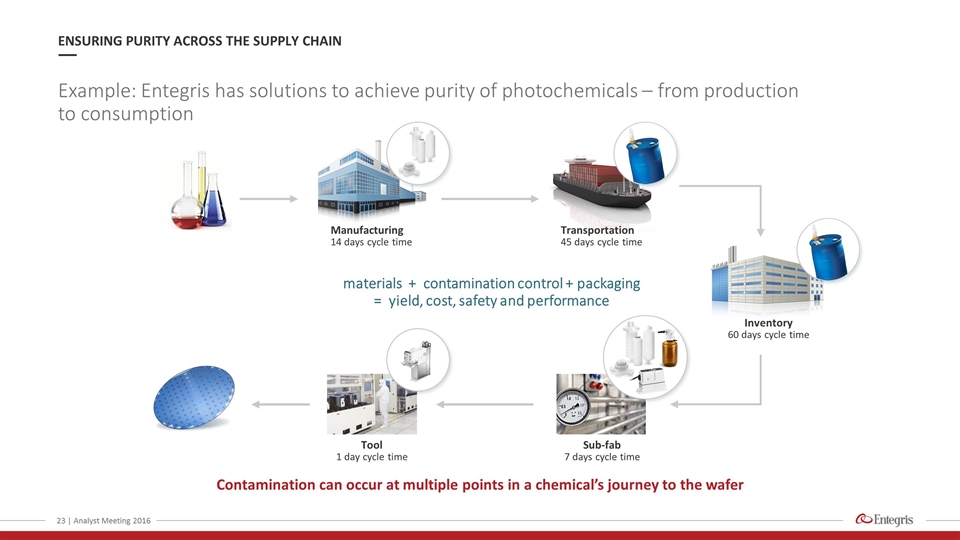

Contamination can occur at multiple points in a chemical’s journey to the wafer Example: Entegris has solutions to achieve purity of photochemicals – from production to consumption ENSURING PURITY ACROSS THE SUPPLY CHAIN Manufacturing 14 days cycle time Inventory 60 days cycle time Sub-fab 7 days cycle time Tool 1 day cycle time materials + contamination control + packaging = yield, cost, safety and performance | Analyst Meeting 2016 Transportation 45 days cycle time

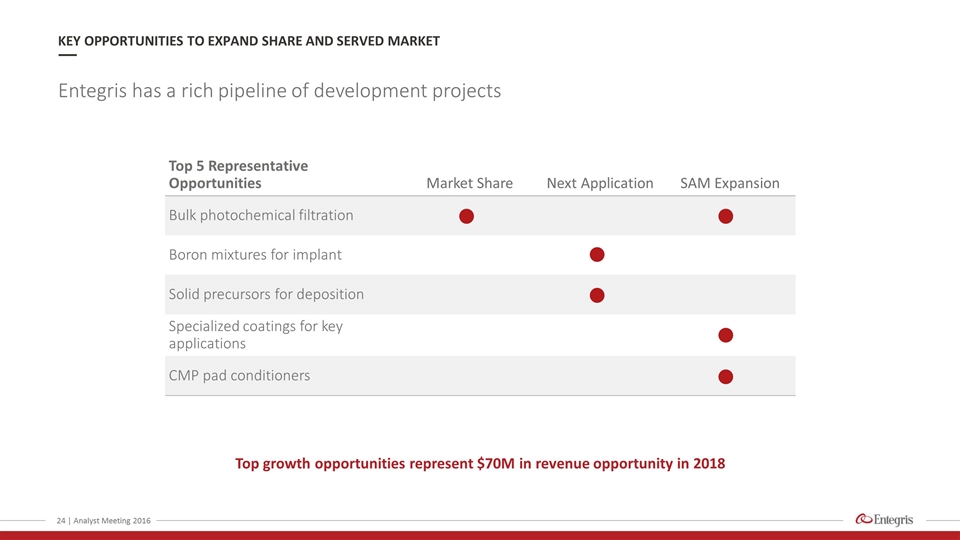

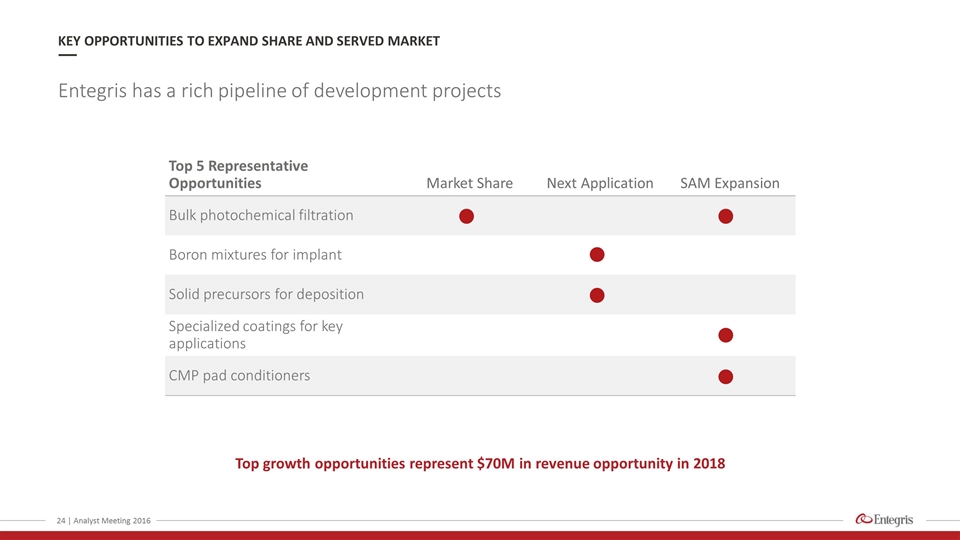

Top growth opportunities represent $70M in revenue opportunity in 2018 Entegris has a rich pipeline of development projects KEY OPPORTUNITIES TO EXPAND SHARE AND SERVED MARKET Top 5 Representative Opportunities Market Share Next Application SAM Expansion Bulk photochemical filtration Boron mixtures for implant Solid precursors for deposition Specialized coatings for key applications CMP pad conditioners | Analyst Meeting 2016

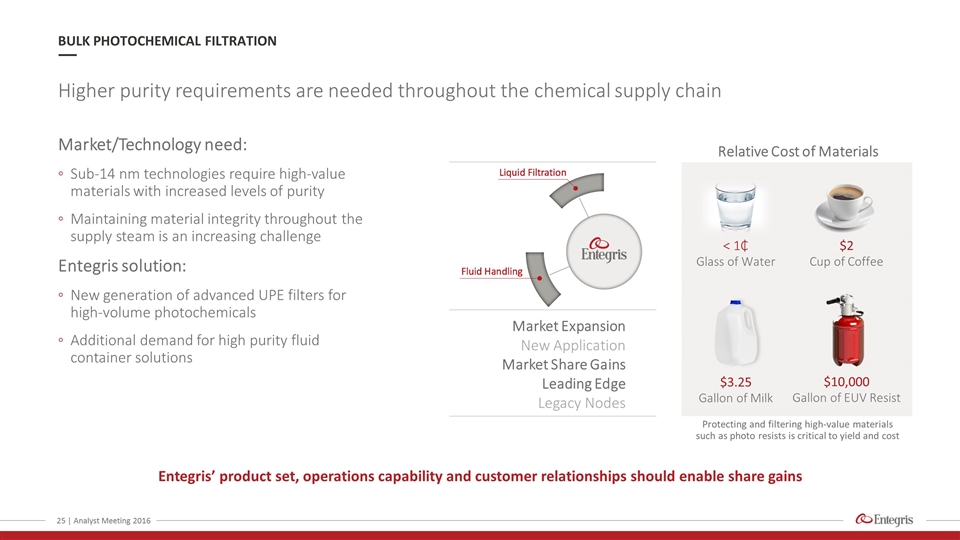

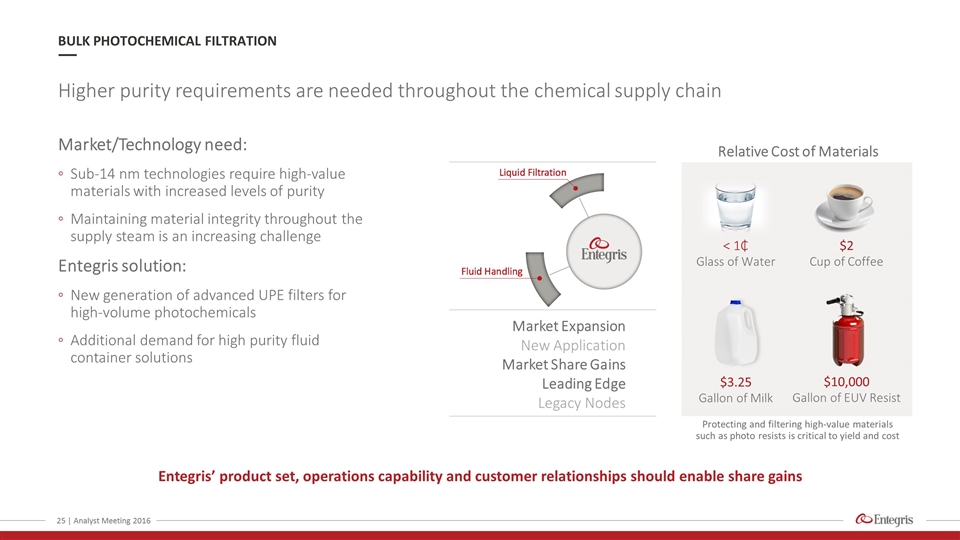

Market/Technology need: Sub-14 nm technologies require high-value materials with increased levels of purity Maintaining material integrity throughout the supply steam is an increasing challenge Entegris solution: New generation of advanced UPE filters for high-volume photochemicals Additional demand for high purity fluid container solutions Entegris’ product set, operations capability and customer relationships should enable share gains Higher purity requirements are needed throughout the chemical supply chain BULK PHOTOCHEMICAL FILTRATION | Analyst Meeting 2016 Relative Cost of Materials $2 Cup of Coffee $3.25 Gallon of Milk $10,000 Gallon of EUV Resist < 1₵ Glass of Water Market Expansion New Application Market Share Gains Leading Edge Legacy Nodes Protecting and filtering high-value materials such as photo resists is critical to yield and cost

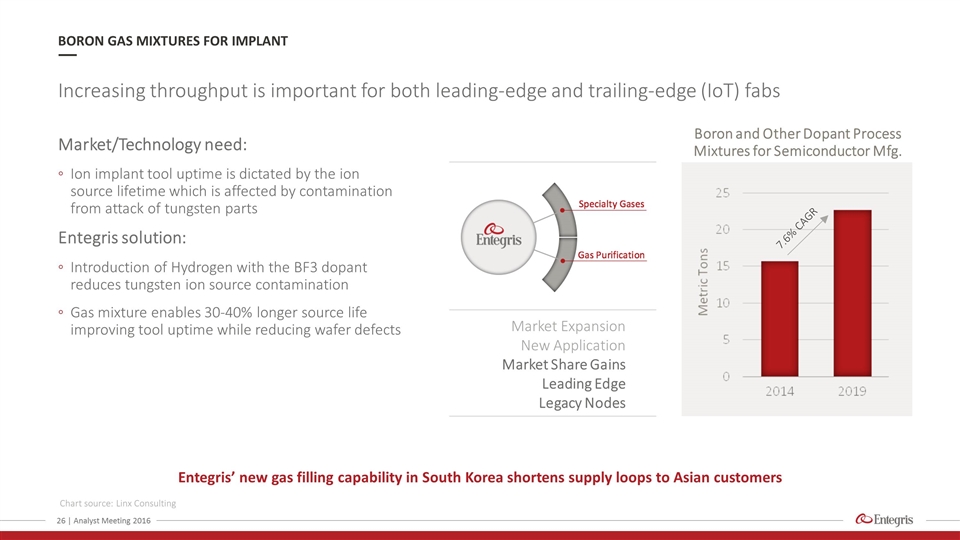

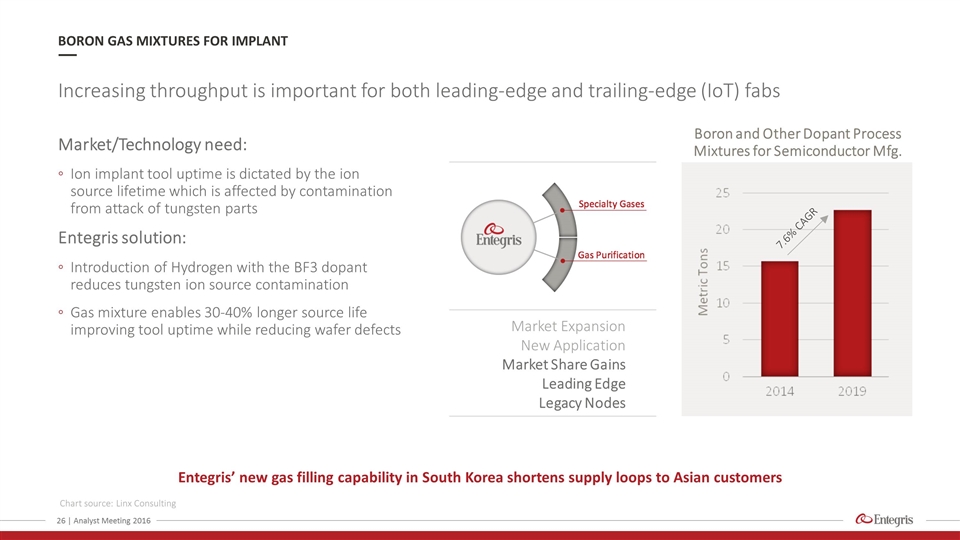

Market/Technology need: Ion implant tool uptime is dictated by the ion source lifetime which is affected by contamination from attack of tungsten parts Entegris solution: Introduction of Hydrogen with the BF3 dopant reduces tungsten ion source contamination Gas mixture enables 30-40% longer source life improving tool uptime while reducing wafer defects Chart source: Linx Consulting Entegris’ new gas filling capability in South Korea shortens supply loops to Asian customers Increasing throughput is important for both leading-edge and trailing-edge (IoT) fabs BORON GAS MIXTURES FOR IMPLANT | Analyst Meeting 2016 7.6% CAGR Market Expansion New Application Market Share Gains Leading Edge Legacy Nodes Boron and Other Dopant Process Mixtures for Semiconductor Mfg.

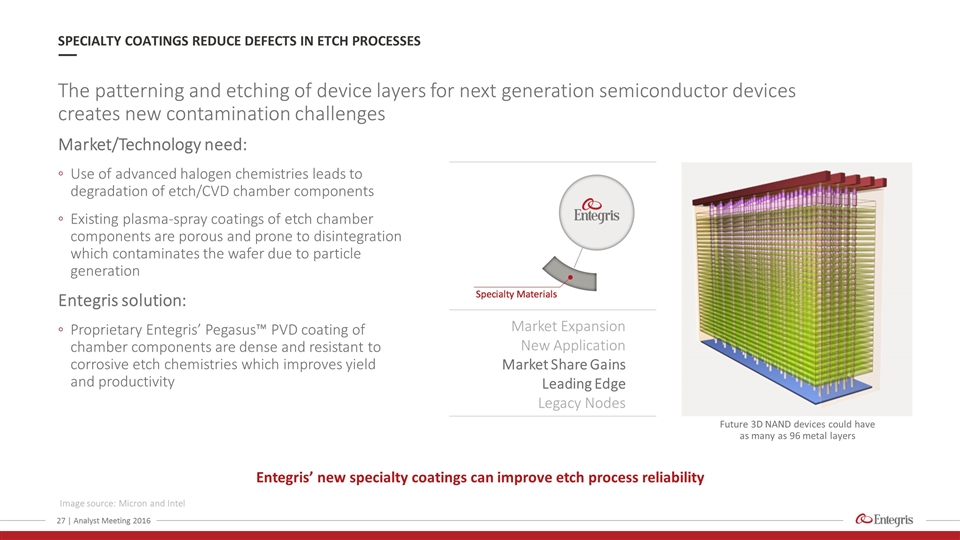

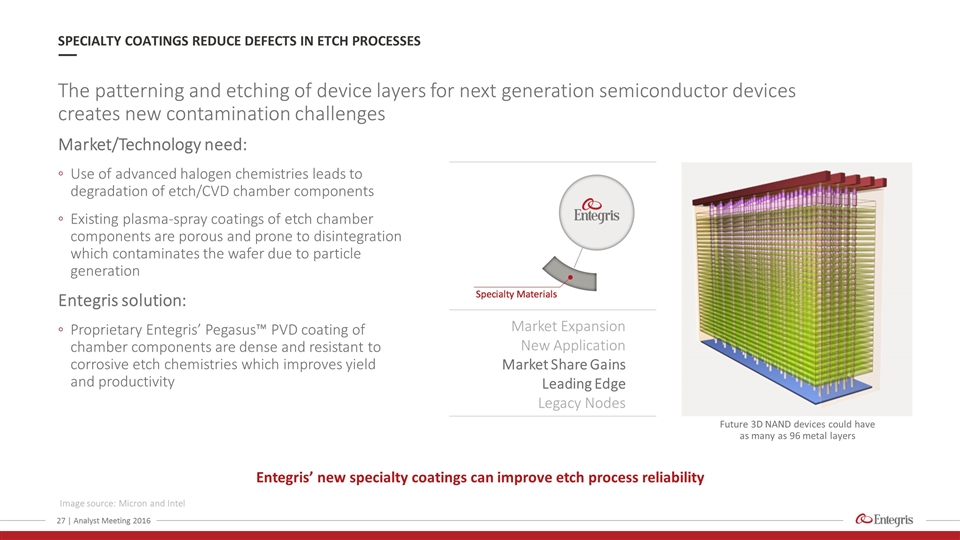

Entegris’ new specialty coatings can improve etch process reliability Market/Technology need: Use of advanced halogen chemistries leads to degradation of etch/CVD chamber components Existing plasma-spray coatings of etch chamber components are porous and prone to disintegration which contaminates the wafer due to particle generation Entegris solution: Proprietary Entegris’ Pegasus™ PVD coating of chamber components are dense and resistant to corrosive etch chemistries which improves yield and productivity Image source: Micron and Intel The patterning and etching of device layers for next generation semiconductor devices creates new contamination challenges SPECIALTY COATINGS REDUCE DEFECTS IN ETCH PROCESSES | Analyst Meeting 2016 Market Expansion New Application Market Share Gains Leading Edge Legacy Nodes Future 3D NAND devices could have as many as 96 metal layers

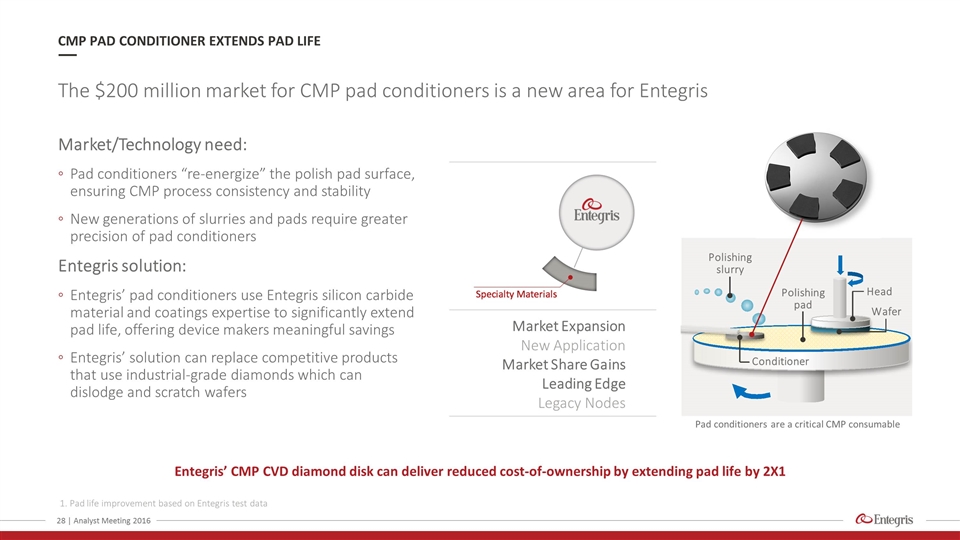

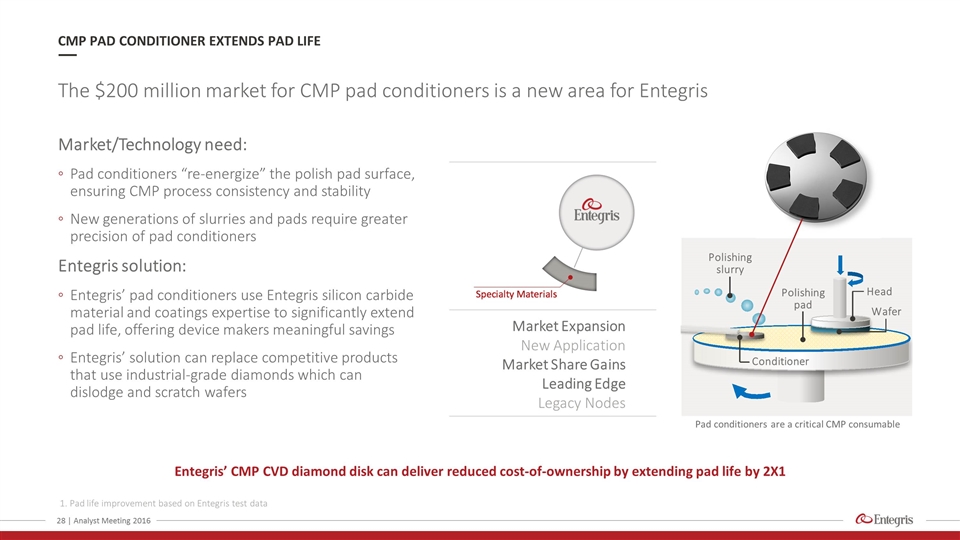

Market/Technology need: Pad conditioners “re-energize” the polish pad surface, ensuring CMP process consistency and stability New generations of slurries and pads require greater precision of pad conditioners Entegris solution: Entegris’ pad conditioners use Entegris silicon carbide material and coatings expertise to significantly extend pad life, offering device makers meaningful savings Entegris’ solution can replace competitive products that use industrial-grade diamonds which can dislodge and scratch wafers 1. Pad life improvement based on Entegris test data Entegris’ CMP CVD diamond disk can deliver reduced cost-of-ownership by extending pad life by 2X1 The $200 million market for CMP pad conditioners is a new area for Entegris CMP PAD CONDITIONER EXTENDS PAD LIFE | Analyst Meeting 2016 Head Polishing slurry Polishing pad Wafer Conditioner Pad conditioners are a critical CMP consumable Market Expansion New Application Market Share Gains Leading Edge Legacy Nodes

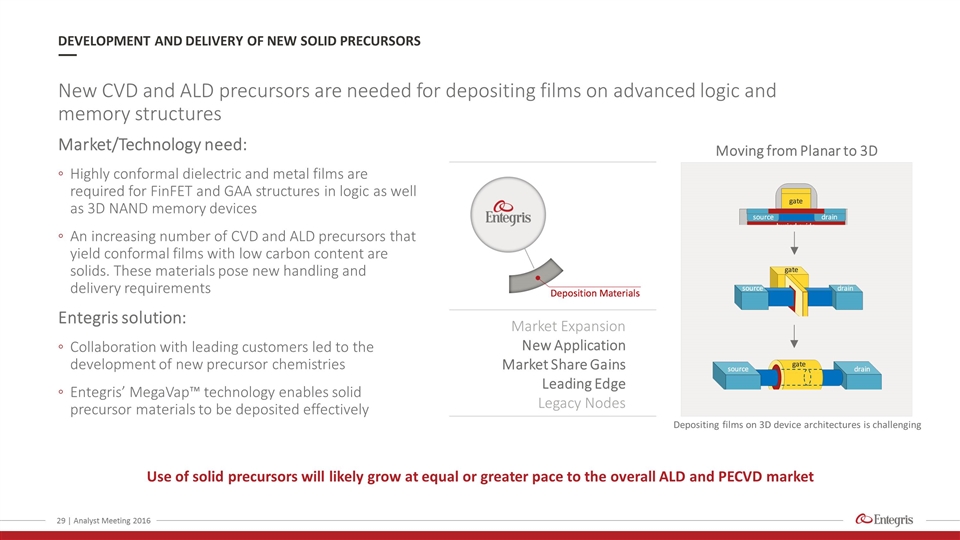

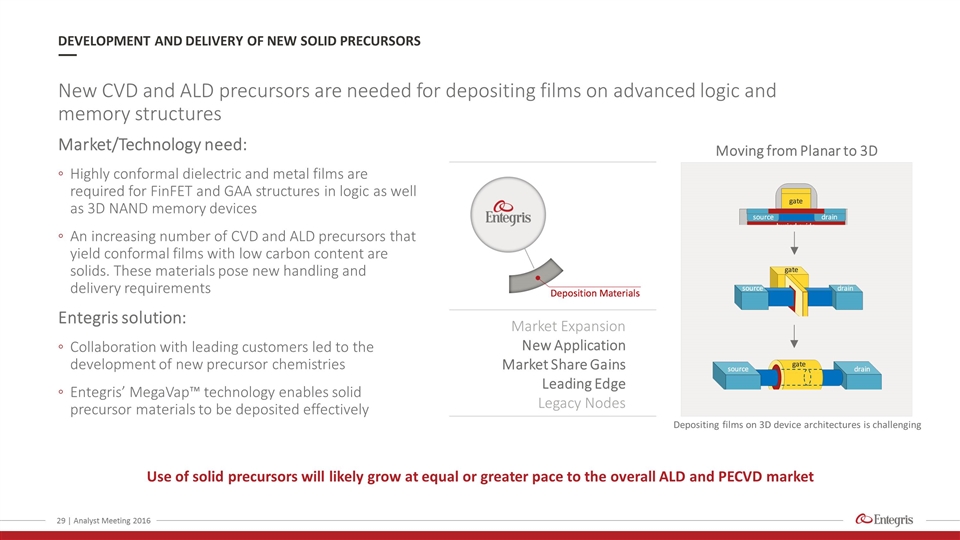

Market/Technology need: Highly conformal dielectric and metal films are required for FinFET and GAA structures in logic as well as 3D NAND memory devices An increasing number of CVD and ALD precursors that yield conformal films with low carbon content are solids. These materials pose new handling and delivery requirements Entegris solution: Collaboration with leading customers led to the development of new precursor chemistries Entegris’ MegaVap™ technology enables solid precursor materials to be deposited effectively Use of solid precursors will likely grow at equal or greater pace to the overall ALD and PECVD market New CVD and ALD precursors are needed for depositing films on advanced logic and memory structures DEVELOPMENT AND DELIVERY OF NEW SOLID PRECURSORS Market Expansion New Application Market Share Gains Leading Edge Legacy Nodes | Analyst Meeting 2016 Depositing films on 3D device architectures is challenging Moving from Planar to 3D

Greg Graves EVP, Chief Financial Officer Strong Financial Discipline To Grow Shareholder Value JULY 12, 2016

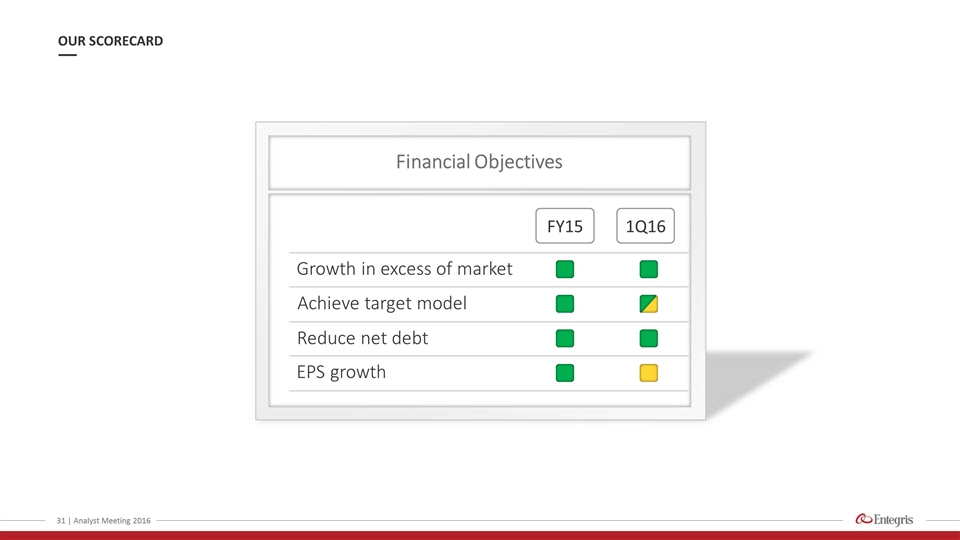

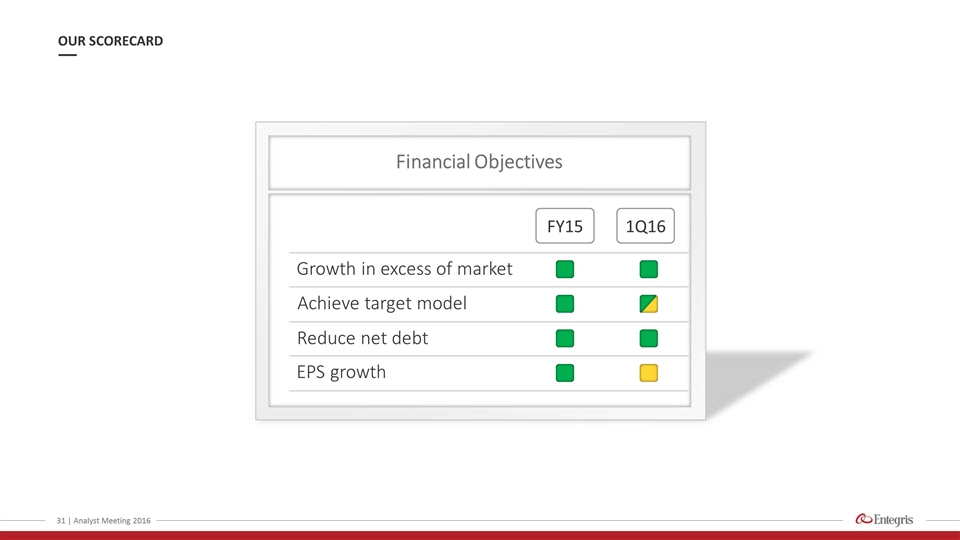

OUR SCORECARD Financial Objectives FY15 1Q16 | Analyst Meeting 2016 Growth in excess of market Achieve target model Reduce net debt EPS growth

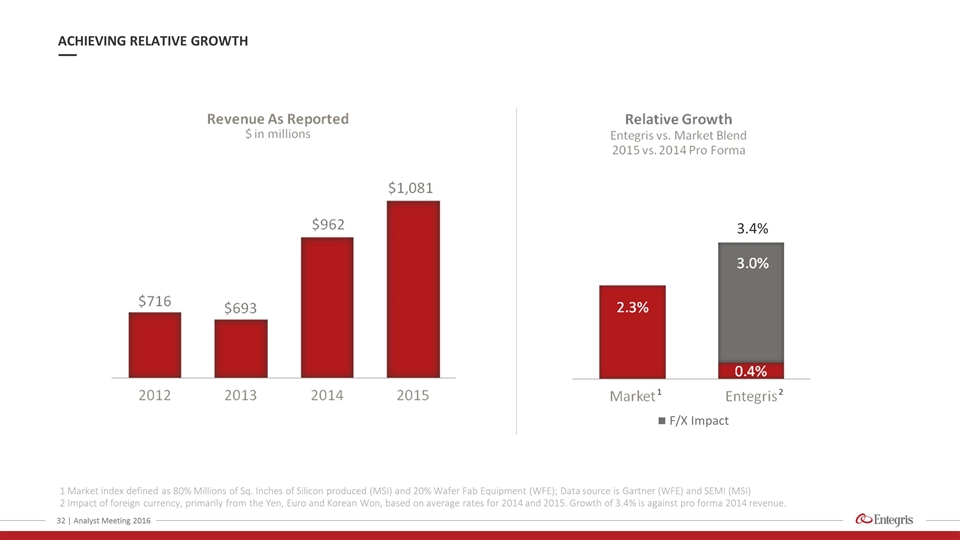

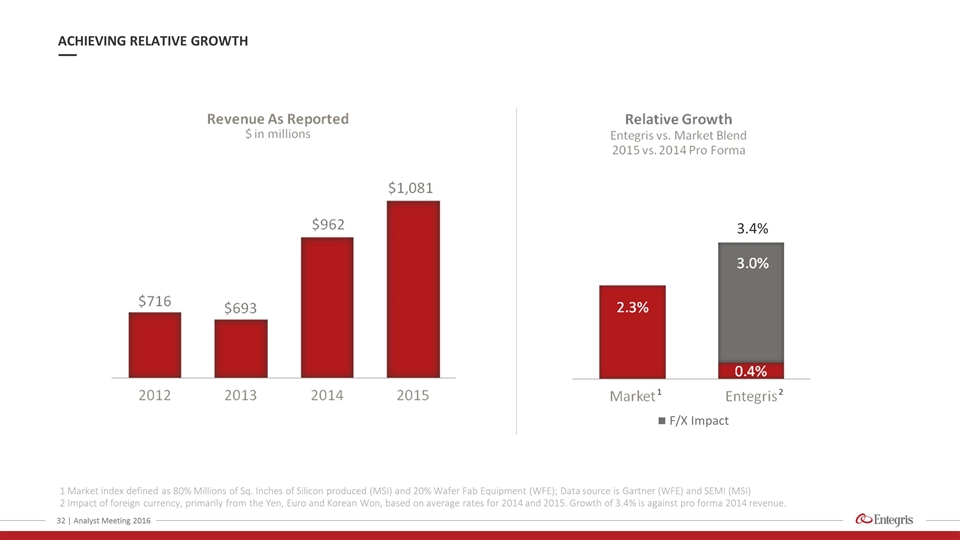

1 Market index defined as 80% Millions of Sq. Inches of Silicon produced (MSI) and 20% Wafer Fab Equipment (WFE); Data source is Gartner (WFE) and SEMI (MSI) 2 Impact of foreign currency, primarily from the Yen, Euro and Korean Won, based on average rates for 2014 and 2015. Growth of 3.4% is against pro forma 2014 revenue. ACHIEVING RELATIVE GROWTH | Analyst Meeting 2016 3.4% 2 1 F/X Impact

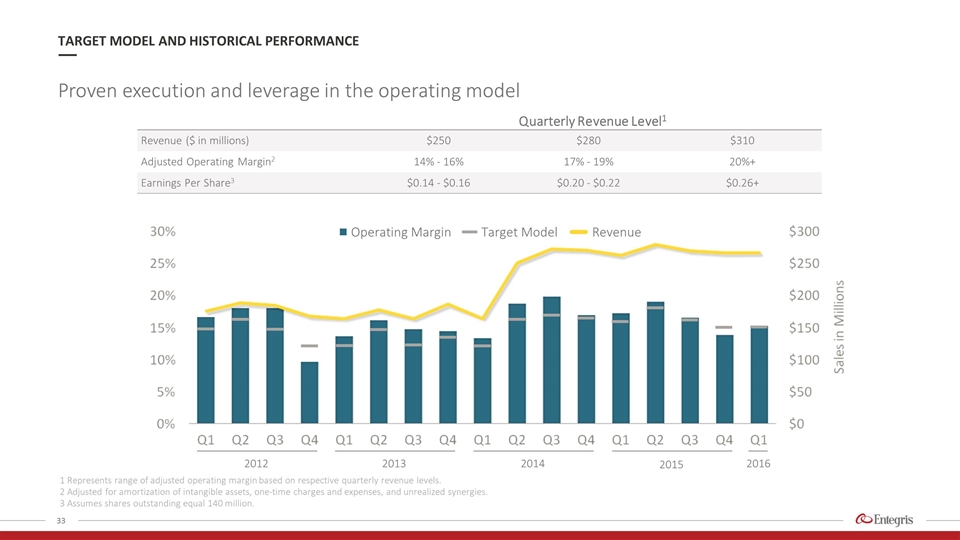

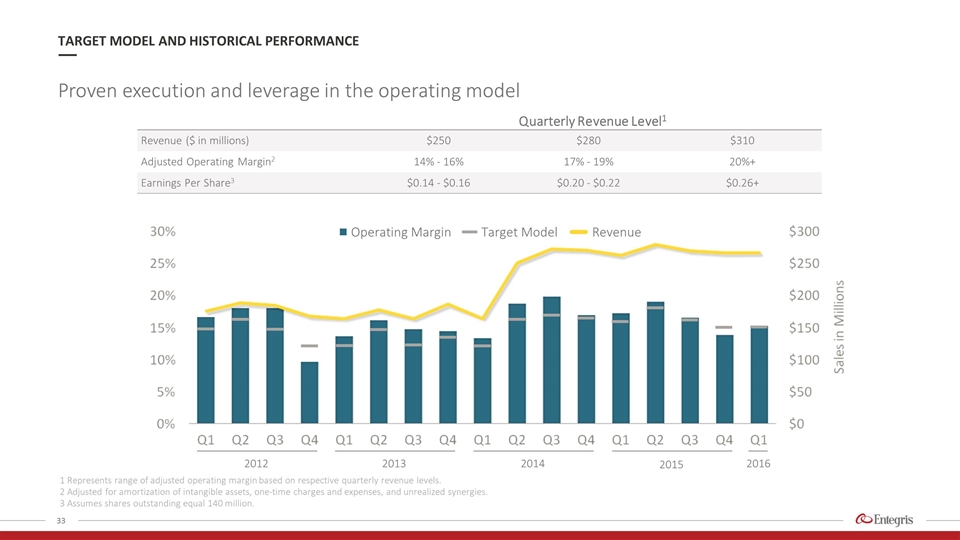

Proven execution and leverage in the operating model 1 Represents range of adjusted operating margin based on respective quarterly revenue levels. 2 Adjusted for amortization of intangible assets, one-time charges and expenses, and unrealized synergies. 3 Assumes shares outstanding equal 140 million. TARGET MODEL AND HISTORICAL PERFORMANCE Quarterly Revenue Level1 Revenue ($ in millions) $250 $280 $310 Adjusted Operating Margin2 14% - 16% 17% - 19% 20%+ Earnings Per Share3 $0.14 - $0.16 $0.20 - $0.22 $0.26+ Revenue Operating Margin Target Model 2013 2014 2015 2016 2012

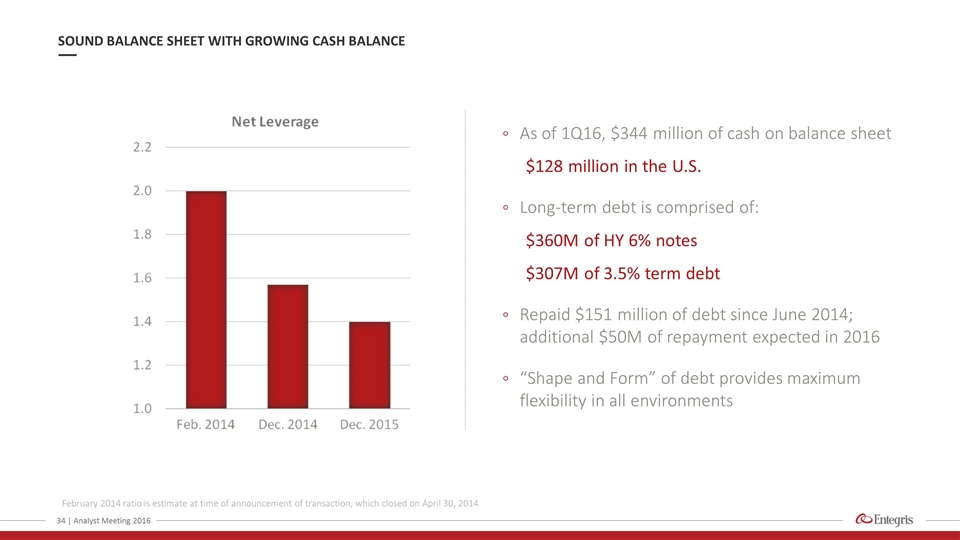

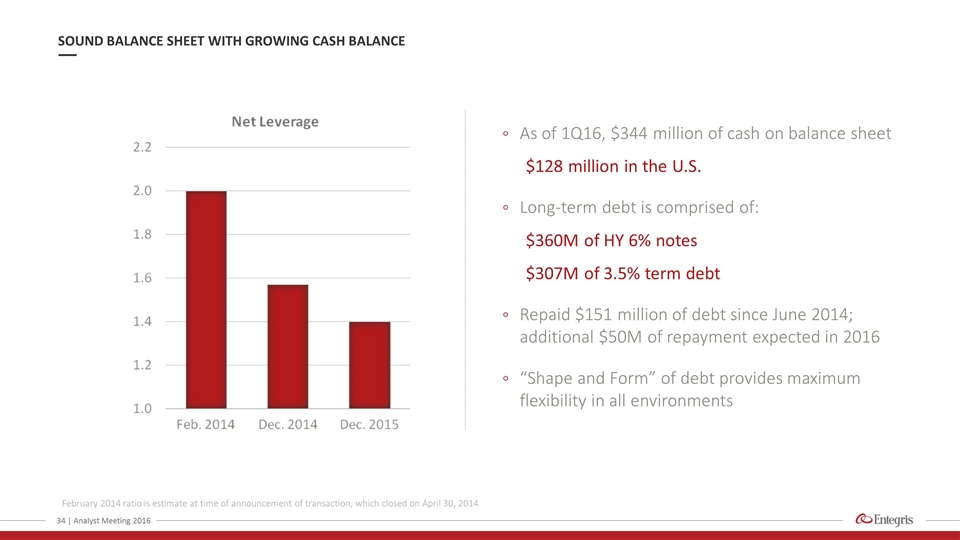

February 2014 ratio is estimate at time of announcement of transaction, which closed on April 30, 2014 SOUND BALANCE SHEET WITH GROWING CASH BALANCE | Analyst Meeting 2016 As of 1Q16, $344 million of cash on balance sheet $128 million in the U.S. Long-term debt is comprised of: $360M of HY 6% notes $307M of 3.5% term debt Repaid $151 million of debt since June 2014; additional $50M of repayment expected in 2016 “Shape and Form” of debt provides maximum flexibility in all environments

Note: Non-GAAP EPS for 2014 and 2015 adjusted for transaction costs and integration expense related to April 30, 2014 acquisition of ATMI EARNINGS PER SHARE GREW 23% IN FY2015 +23% 2012 2013 2014 2015 | Analyst Meeting 2016 1Q16 +19%

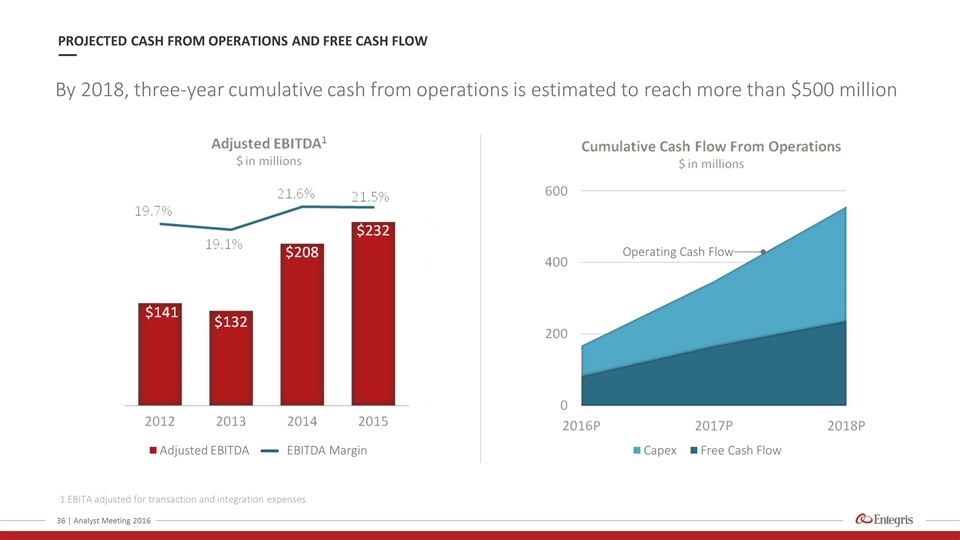

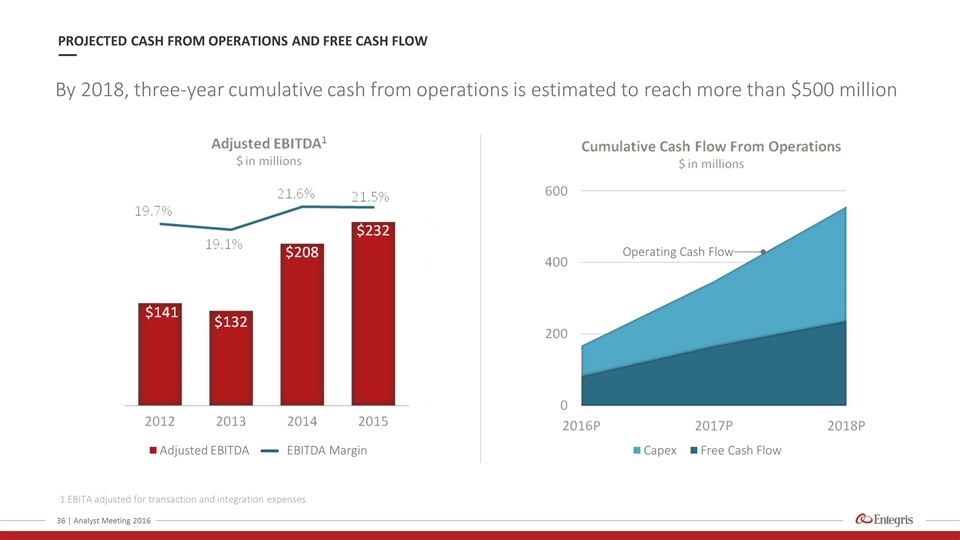

By 2018, three-year cumulative cash from operations is estimated to reach more than $500 million 1 EBITA adjusted for transaction and integration expenses PROJECTED CASH FROM OPERATIONS AND FREE CASH FLOW | Analyst Meeting 2016 Adjusted EBITDA EBITDA Margin Operating Cash Flow Capex Free Cash Flow

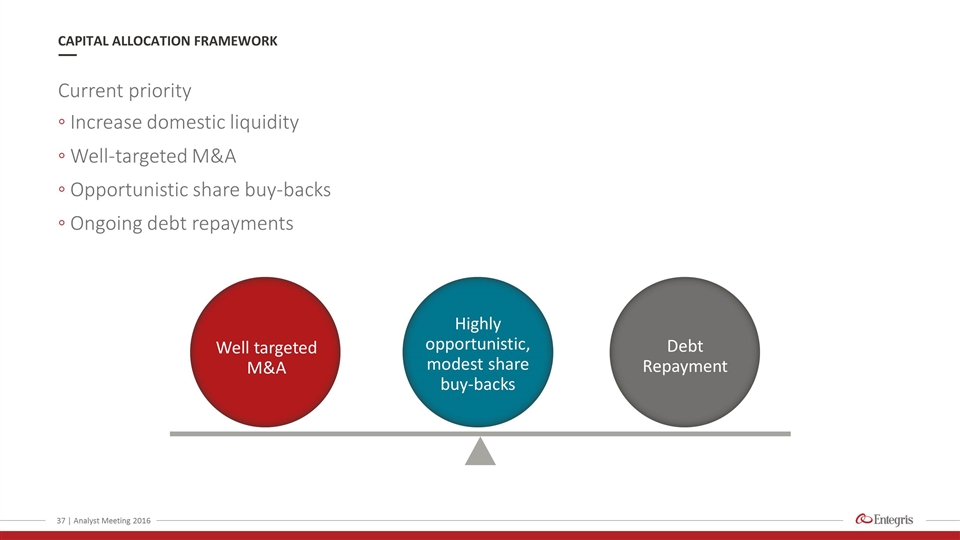

Increase domestic liquidity Well-targeted M&A Opportunistic share buy-backs Ongoing debt repayments Current priority CAPITAL ALLOCATION FRAMEWORK Highly opportunistic, modest share buy-backs Debt Repayment Well targeted M&A | Analyst Meeting 2016

ENTEGRIS: CREATING COMPELLING LONG-TERM VALUE FOR SHAREHOLDERS | Analyst Meeting 2016 Mission Critical Supplier Stable, Recurring Revenue, Strong Cash Flow, and Earnings Leverage Above-Market Growth Electronic Materials

Entegris® and the Entegris Rings Design® are trademarks of Entegris, Inc. ©2016 Entegris, Inc. All rights reserved. | Analyst Meeting 2016