QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

UNITED SURGICAL PARTNERS INTERNATIONAL, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

UNITED SURGICAL PARTNERS INTERNATIONAL, INC.

15305 Dallas Parkway

Suite 1600

Addison, Texas 75001

April 15, 2003

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of United Surgical Partners International, Inc. (the "Company") to be held on May 12, 2003, at 10:30 a.m., local time, at the Hotel Inter-Continental, 15201 Dallas Parkway, Addison, Texas 75001. Please find enclosed a notice to stockholders, a proxy statement describing the business to be transacted at the meeting, a form of proxy for use in voting at the meeting and an annual report for the Company.

At the annual meeting, you will be asked (i) to elect four directors of the Company, (ii) to ratify the selection of KPMG LLP as the independent accountants for the Company for the fiscal year ending December 31, 2003 and (iii) to act upon such other business as may properly come before the annual meeting or any adjournment thereof.

We hope that you will be able to attend the annual meeting, and we urge you to read the enclosed proxy statement before you decide to vote. Even if you do not plan to attend, please complete, sign, date and return the enclosed proxy as promptly as possible. It is important that your shares be represented at the meeting.

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the annual meeting in person. However, to ensure your representation at the meeting, you are urged to complete, sign, date and return, in the enclosed postage paid envelope, the enclosed proxy as promptly as possible. Returning your proxy will help the Company assure that a quorum will be present at the meeting and avoid the additional expense of duplicate proxy solicitations. Any stockholder attending the meeting may vote in person even if he or she has returned a proxy.

UNITED SURGICAL PARTNERS INTERNATIONAL, INC.

15305 Dallas Parkway

Suite 1600

Addison, Texas 75001

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 12, 2003

PLEASE TAKE NOTICE THAT the 2003 annual meeting of stockholders (the "Annual Meeting") of United Surgical Partners International, Inc., a Delaware corporation (the "Company"), will be held on May 12, 2003, at 10:30 a.m., local time, at the Hotel Inter-Continental, 15201 Dallas Parkway, Addison, Texas 75001, to consider and vote on the following matters:

- (1)

- Election of four directors of the Company to serve until the annual meeting of the Company's stockholders in 2006;

- (2)

- Ratification of the selection of KPMG LLP as independent accountants of the Company for the fiscal year ending December 31, 2003; and

- (3)

- Such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The close of business on March 25, 2003 (the "Record Date"), has been fixed as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. Only holders of record of the Company's common stock, par value $.01 per share, at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours for the ten days preceding the Annual Meeting at the Company's offices at the address on this notice and at the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return the enclosed proxy as promptly as possible. You may revoke your proxy before the Annual Meeting as described in the proxy statement under the heading "Solicitation and Revocability of Proxies."

UNITED SURGICAL PARTNERS INTERNATIONAL, INC.

15305 Dallas Parkway

Suite 1600

Addison, Texas 75001

(972) 713-3500

PROXY STATEMENT

SOLICITATION AND REVOCABILITY OF PROXIES

The board of directors (the "Board") of United Surgical Partners International, Inc. (the "Company") requests your proxy for use at the 2003 annual meeting of stockholders (the "Annual Meeting") to be held on May 12, 2003, at 10:30 a.m., local time, at the Hotel Inter-Continental, 15201 Dallas Parkway, Addison, Texas 75001, and at any postponement or adjournment thereof. By signing and returning the enclosed proxy, you authorize the persons named on the proxy to represent you and to vote your shares at the Annual Meeting. This proxy statement and the form of proxy were first mailed to stockholders of the Company on or about April 15, 2003.

This solicitation of proxies is made by the Board and will be conducted primarily by mail. Officers, directors and employees of the Company may solicit proxies personally or by telephone, telegram or other forms of wire or facsimile communication. The Company may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of the Company's common stock, par value $.01 per share ("Common Stock"), that those companies hold of record. The costs of the solicitation, including reimbursement of such forwarding expenses, will be paid by the Company.

If you attend the Annual Meeting, you may vote in person. If you are not present at the Annual Meeting, your shares can be voted only if you have returned a properly signed proxy or are represented by another proxy. You may revoke your proxy at any time before it is exercised at the Annual Meeting by (a) signing and submitting a later-dated proxy to the secretary of the Company, (b) delivering written notice of revocation of the proxy to the secretary of the Company or (c) voting in person at the Annual Meeting. In the absence of any such revocation, shares represented by the persons named on the proxies will be voted at the Annual Meeting.

VOTING AND QUORUM

The only outstanding voting securities of the Company are shares of Common Stock. As of the close of business on March 25, 2003 (the "Record Date"), there were 27,135,252 shares of Common Stock outstanding and entitled to be voted at the Annual Meeting.

Each outstanding share of Common Stock is entitled to one vote. The presence, in person or by proxy, of a majority of the shares of Common Stock issued and outstanding and entitled to vote as of the Record Date shall constitute a quorum at the Annual Meeting. If a quorum is not present, in person or by proxy, at the Annual Meeting or any postponement or adjournment thereof, the chairman of the meeting or the holders of a majority of the Common Stock entitled to vote who are present or represented by proxy at the Annual Meeting have the power to adjourn the Annual Meeting from time to time without notice, other than an announcement at the Annual Meeting (unless the Board, after such adjournment, fixes a new record date for the adjourned meeting) until a quorum is present. At any such adjourned meeting at which a quorum is present, in person or by proxy, any business may be transacted that may have been transacted at the Annual Meeting had a quorum originally been present; provided that, if the adjournment is for more than 30 days or if after the adjournment a new record

1

date is fixed for the adjourned meeting, a notice of the adjourned meeting must be given to each stockholder of record entitled to vote at the adjourned meeting. Proxies solicited by this proxy statement may be used to vote in favor of any motion to adjourn the Annual Meeting. The persons named on the proxies intend to vote in favor of any motion to adjourn the Annual Meeting to a subsequent day if, prior to the Annual Meeting, such persons have not received sufficient proxies to approve the proposals described in this proxy statement. If such a motion is approved but sufficient proxies are not received by the time set for the resumption of the Annual Meeting, this process will be repeated until sufficient proxies to vote in favor of the proposals to be presented to the stockholders at the Annual Meeting have been received or it appears that sufficient proxies will not be received. Abstentions and broker non-votes will count in determining if a quorum is present at the Annual Meeting. A broker non-vote occurs if a broker or other nominee attending the meeting in person or submitting a proxy does not have discretionary authority and has not received voting instructions with respect to a particular item.

PROPOSAL ONE—ELECTION OF CLASS II DIRECTORS

The Company's certificate of incorporation provides that the Board shall be divided into three classes, designated Class I, Class II and Class III. Directors serve for staggered terms of three years each. The terms of Class I, Class II and Class III directors expire in 2005, 2003 and 2004, respectively. The Board has designated Messrs. Joel T. Allison, D. Scott Mackesy, Jerry P. Widman and David P. Zarin, M.D. as nominees for election as Class II directors of the Company at the Annual Meeting (each, a "Nominee"). Each of the Nominees currently serves as a Class II director. If elected, each Nominee will serve until the expiration of his term at the annual meeting of the Company's stockholders in 2006 and until his successor is elected and qualified or until his earlier death, resignation or removal from office. For information about each Nominee, see "Directors."

The Board has no reason to believe that any of the Nominees will be unable or unwilling to serve if elected. If a Nominee becomes unable or unwilling to serve, your proxy will be voted for the election of a substitute nominee recommended by the current Board, or the number of the Company's directors will be reduced.

Required Vote and Recommendation

The election of directors requires the affirmative vote of a plurality of the shares of Common Stock present or represented by proxy and entitled to vote at the Annual Meeting. Under Delaware law, abstentions and broker non-votes will not have any effect on the election of a particular director. Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted for the election of each of the Nominees.

The Board recommends that the stockholders vote "FOR" the election of each of the Nominees.

PROPOSAL TWO—RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS

On February 25, 2003, the Board ratified the selection of KPMG LLP as the Company's independent accountants for the fiscal year ending December 31, 2003. The Company expects that representatives of KPMG LLP will be present at the Annual Meeting to respond to appropriate questions and will have an opportunity to make a statement if they desire to do so.

If the appointment of KPMG LLP as the Company's independent accountants is not ratified at the Annual Meeting, the Board will consider the appointment of other independent accountants. The Board may terminate the appointment of KPMG LLP as independent accountants without the approval of the Company's stockholders whenever the Board deems termination necessary or appropriate.

2

Required Vote and Recommendation

Ratification of KPMG LLP as the Company's independent accountants for the fiscal year ending December 31, 2003, requires the affirmative vote of a majority of the shares of Common Stock present or represented by proxy and entitled to vote at the Annual Meeting. Under Delaware law, an abstention will have the same legal effect as a vote against the ratification of KPMG LLP, and each broker non-vote will reduce the absolute number, but not the percentage, of affirmative votes necessary for approval of the ratification. Unless otherwise instructed on the proxy or unless authority to vote is withheld, the enclosed proxy will be voted for the ratification of the selection of KPMG LLP as the Company's independent accountants for the fiscal year ending December 31, 2003.

The Board recommends that stockholders vote "FOR" the ratification of the selection of KPMG LLP as the Company's independent accountants for the fiscal year ending December 31, 2003.

DIRECTORS

The following tables set forth certain information regarding the Nominees and the other directors of the Company:

Name of Nominee

| | Age

| | Title

| | Director's

Term Ending

|

|---|

| Joel T. Allison | | 55 | | Director | | 2003 |

| D. Scott Mackesy | | 34 | | Director | | 2003 |

| Jerry P. Widman | | 60 | | Director | | 2003 |

| David P. Zarin, M.D. | | 54 | | Director | | 2003 |

Joel T. Allison was appointed as a director of the Company in March 2002. Mr. Allison has served as president and chief executive officer of Baylor Health Care System ("BHCS") since 2000 and served as its senior executive vice president from 1993 until 2000.

D. Scott Mackesy has served as a director of the Company since its inception in February 1998. Mr. Mackesy has been a general partner at Welsh, Carson, Anderson & Stowe since October 2001 and prior to that time was a principal since January 1998. Prior to joining Welsh, Carson, Anderson & Stowe, Mr. Mackesy was senior research analyst and vice president in the Investment Research Department at Morgan Stanley Dean Witter from January 1996 to January 1998. Mr. Mackesy is also a member of the board of directors of LabOne, Inc. and several private companies.

Jerry P. Widman was appointed as a director of the Company in September 2002. Mr. Widman was the chief financial officer of Ascension Health from 1982 until his retirement in June 2001. Mr. Widman currently serves on the board of directors of Bon Secours Health System, CareMedic Systems, Inc. and ArthroCare Corporation.

3

David P. Zarin, M.D. has served as a director of the Company since February 2000. Dr. Zarin has practiced otolaryngology in Houston, Texas since 1979. Dr. Zarin was a founding partner and serves as vice president of Texas ENT Specialists, PA, formed in 1997. Dr. Zarin was also a founding partner and a director of TOPS Surgical Specialty Hospital, which was acquired by the Company in July 1999. Dr. Zarin has served as a chairman and president of the medical staff of TOPS Specialty Hospital since 1999.

Name of Director

| | Age

| | Title

| | Director's

Term Ending

|

|---|

| Donald E. Steen | | 56 | | Chief Executive Officer and Chairman of the Board | | 2004 |

| James C. Crews | | 65 | | Director | | 2005 |

| John C. Garrett, M.D. | | 61 | | Director | | 2005 |

| Thomas L. Mills | | 55 | | Director | | 2004 |

| Boone Powell, Jr. | | 66 | | Director | | 2004 |

| Paul B. Queally | | 39 | | Director | | 2004 |

| William H. Wilcox | | 51 | | President and Director | | 2005 |

Donald E. Steen founded the Company in February 1998 and has served as its chief executive officer and chairman since that time. Mr. Steen served as president of the International Group of HCA—The Healthcare Company, formerly known as Columbia/HCA Healthcare Corporation, from 1995 until 1997 and as president of the Western Group of HCA from 1994 until 1995. Mr. Steen founded Medical Care International, Inc., a pioneer in the surgery center business, in 1982. Mr. Steen is also a member of the board of directors of Horizon Health Corporation and Kinetic Concepts, Inc.

James C. Crews was appointed to the Board in December 2001. Mr. Crews retired in May 2000 from Banner Health Arizona where he was chief executive officer from September 1999 until his retirement. From 1991 to 1999, Mr. Crews served as president and chief executive officer at Samaritan Health System in Phoenix, Arizona.

John C. Garrett, M.D., joined the Board in February 2001. Dr. Garrett had been a director of OrthoLink, which was acquired by the Company in February 2001, since July 1997. Dr. Garrett founded Resurgens, P.C. in 1986, where he continues his specialized orthopedics practice in arthroscopic and reconstructive knee surgery. Dr. Garrett is a Fellow of the American Academy of Orthopedic Surgeons.

Thomas L. Mills has served as a director of the Company since September 1999. Mr. Mills is the chairman of the audit and compliance committee. Mr. Mills has been a partner in the law firm of Winston & Strawn since 1995, specializing in health law.

Boone Powell, Jr. has served as a director of the Company since June 1999. Mr. Powell served as the chairman of BHCS until June 2001 and served as its president and chief executive officer from 1980 until 2000. Mr. Powell is also a member of the board of directors of Abbott Laboratories and US Oncology.

Paul B. Queally has served as a director of the Company since its inception in February 1998. Mr. Queally has been a general partner at Welsh, Carson, Anderson & Stowe since January 1996. Prior to joining Welsh, Carson, Anderson & Stowe, Mr. Queally was a general partner at the Sprout Group, which was the private equity group of Donaldson, Lufkin & Jenrette Securities Corporation. Mr. Queally is also a member of the board of directors of AmComp, Inc., Amerisafe, Inc., Concentra Managed Care, Inc., LabOne, Inc., MedCath Corporation and SHPS, Inc.

William H. Wilcox joined the Company as its president and a director in September 1998. Mr. Wilcox served as president and chief executive officer of United Dental Care, Inc. from 1996 until joining the Company. Mr. Wilcox served as president of the Surgery Group of HCA and president and chief executive officer of the Ambulatory Surgery Division of HCA from 1994 until 1996.

4

Board Compensation

Members of the Board who are also officers or employees of the Company do not receive compensation for their services as directors. Each director is generally granted an award of options to purchase up to 8,500 shares of Common Stock upon becoming a director, at an exercise price equal to the fair market value of the Common Stock on the date of grant. In each case, the stock options granted to the directors have a four-year vesting schedule. Non-employee members of the Board are entitled to a $10,000 annual retainer, a $2,500 fee for attendance at meetings of the Board, a $2,500 fee for attendance at audit and compliance committee meetings and a $1,000 fee for attendance at options and compensation committee meetings. All directors are entitled to reimbursement of their reasonable out-of-pocket expenses in connection with their travel to and attendance at meetings of the Board or committees thereof.

Indemnification of Directors and Officers

The Company has entered into agreements to indemnify its directors and executive officers. Under these agreements, the Company is obligated to indemnify its directors and officers to the fullest extent permitted under the Delaware General Corporate Law for expenses, including attorneys' fees, judgments, fines and settlement amounts incurred by them in any action or proceeding arising out of their services as a director or officer. The Company believes that these agreements are helpful in attracting and retaining qualified directors and officers.

Term of Office

The Company's certificate of incorporation provides that the Board shall be divided into three classes, designated Class I, Class II and Class III. Directors serve for staggered terms of three years each. Messrs. Crews, Garrett and Wilcox currently serve as Class I directors, whose terms expire at the annual meeting of stockholders in 2005. Messrs. Allison, Mackesy, Widman and Zarin currently serve as Class II directors whose terms expire at the Annual Meeting. Messrs. Mills, Powell, Queally and Steen currently serve as Class III directors whose terms expire at the annual meeting of stockholders in 2004.

MEETINGS AND COMMITTEES OF DIRECTORS

The Board had five meetings during the Company's fiscal year ended December 31, 2002 and approved certain matters by unanimous written consent on eight separate occasions. The Board has four standing committees: the executive committee, the audit and compliance committee, the nominating and corporate governance committee and the options and compensation committee. Each of the directors attended at least 75% of the aggregate of all meetings held by the Board and, if applicable, all meetings of committees of the Board on which such director served during 2002, except that Mr. Widman did not attend one of the two meetings of the Board held after his appointment to the Board in September 2002.

The executive committee is comprised of Messrs. Steen (Chairman), Garrett and Queally. The executive committee has and may exercise all of the powers and authority of the Board in the management of the business and affairs of the Company, subject to the limitations on such powers or authority as are provided by applicable law or by the Board. The executive committee had two meetings during the Company's fiscal year ended December 31, 2002 and approved certain matters by unanimous written consent on four separate occasions.

The audit and compliance committee is comprised of Messrs. Mills (Chairman), Crews, Widman and Zarin. The audit and compliance committee is appointed by the Board and assists the Board in fulfilling its responsibility to oversee:

- •

- the integrity of the Company's accounting and financial reporting processes;

5

- •

- the preparation by management of the financial statements and other financial reporting information of the Company;

- •

- the integrity of the Company's systems of internal accounting and financial controls;

- •

- the annual independent audit of the Company's financial statements;

- •

- the independence and performance of the outside accountants for the Company; and

- •

- the implementation of and compliance with the Company's Corporate Compliance Plan.

The role and other responsibilities of the audit and compliance committee are set forth in the committee's charter. The audit and compliance committee will review and reassess the adequacy of the audit and compliance committee charter annually and recommend any proposed changes to the Board for approval. The Board has determined that each of Messrs. Mills, Crews, Widman and Zarin meet the independence requirements of the National Association of Securities Dealers, Inc. ("Nasdaq") and that each of them has the requisite accounting or related financial management expertise contemplated by the rules of Nasdaq. The audit and compliance committee had nine meetings during the Company's fiscal year ended December 31, 2002.

The nominating and corporate governance committee is comprised of Messrs. Garrett (Chairman), Powell and Queally. The primary functions of the nominating and corporate governance committee are to advise the Board on the appropriate composition of the Board, to identify and recommend to the Board qualified nominees for service on the Board or committees thereof, to assess director performance and to provide advice regarding, and to recommend to the Board, appropriate corporate governance practices. The nominating and corporate governance committee will consider nominees recommended by stockholders upon written submission of such recommendation to the secretary of the Company in accordance with the terms of the Company's bylaws. The nominating and corporate governance committee had one meeting during the Company's fiscal year ended December 31, 2002.

The options and compensation committee is comprised of Messrs. Queally (Chairman), Mackesy and Powell. The primary functions of the options and compensation committee are to review and recommend the compensation arrangements for the Company's directors and officers and monitor and administer the Company's equity-based incentive plans. The options and compensation committee had one meeting during the Company's fiscal year ended December 31, 2002 and approved certain matters by unanimous written consent on six separate occasions.

6

EXECUTIVE OFFICERS

The following table sets forth certain information regarding the executive officers of the Company:

Name of Officer

| | Age

| | Title

|

|---|

Donald E. Steen |

|

56 |

|

Chief Executive Officer and Chairman of the Board |

William H. Wilcox |

|

51 |

|

President and Director |

Mark A. Kopser |

|

38 |

|

Senior Vice President and Chief Financial Officer |

Dale L. Stegall |

|

56 |

|

Senior Vice President and General Counsel |

John J. Wellik |

|

41 |

|

Senior Vice President, Chief Accounting Officer, Compliance Officer and Secretary |

The executive officers named above were elected by the Board to serve in such capacities until their respective successors have been duly elected and qualified, or until their earlier death, resignation or removal from office. Biographical information on Messrs. Steen and Wilcox is set forth previously in this proxy statement. See "Directors."

Mark A. Kopser joined the Company as its senior vice president and chief financial officer in May 2000. Prior to that time, Mr. Kopser served as chief financial officer for the International Division of HCA from 1997 until 2000 and as chief financial officer for the London Division of HCA from 1992 until 1996.

Dale L. Stegall joined the Company as the chief administrative officer of OrthoLink in February 2001 and was appointed senior vice president and general counsel of the Company in August 2001. Mr. Stegall was a founder of OrthoLink and served as OrthoLink's senior vice president, general counsel and secretary from its inception in 1996 until February 2001. From 1973 to 1996, Mr. Stegall was in the private practice of law and served as a healthcare consultant in Nashville, Tennessee. Mr. Stegall retired from the Company on January 3, 2003.

John J. Wellik is the senior vice president, chief accounting officer, compliance officer and secretary of the Company. Prior to joining the Company in April 1999, Mr. Wellik served as vice president and controller for Dynamex, Inc., a transportation services company, from November 1997 until February 1999. Mr. Wellik also served as an assistant controller for American Pad & Paper Company from May 1997 until November 1997. Mr. Wellik served in various accounting management positions, including director of financial accounting for Avnet, Inc., an electronics distributor, from July 1993 until February 1997.

7

EXECUTIVE COMPENSATION

The following table contains summary information concerning the total compensation paid to or earned for the fiscal year ended December 31, 2002, by the chief executive officer and by the four other most highly compensated executive officers of the Company serving in this capacity as of December 31, 2002, whose total annual salary and bonus exceeded $100,000 for that fiscal year. Such persons are referred to herein as the "Named Executive Officers."

Summary Compensation Table

| |

| |

| |

| |

| |

| | Long-Term

Compensation

| |

| |

|---|

| | Annual

Compensation

| |

| |

| |

| |

|---|

| |

| |

| | Securities

Underlying

Options

(#)

| |

| |

|---|

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual Compensation

($)

| | Restricted Stock Awards

($)

| | All Other

Compensation

($)

| |

|---|

Donald E. Steen

Chief Executive Officer and Chairman of the Board |

|

2002

2001

2000 |

|

420,000

400,000

300,000 |

|

420,000

400,000

200,000 |

(2)

|

120,000

—

— |

(3)

|

—

—

— |

|

125,000

100,000

166,666 |

|

5,500

5,250

1,708 |

(4)

(4)

(4) |

William H. Wilcox

President |

|

2002

2001

2000 |

|

368,750

350,000

300,000 |

|

368,750

350,000

175,000 |

(2)

|

80,000

—

— |

(3)

|

—

—

— |

|

100,000

146,666

50,000 |

|

5,500

5,250

1,500 |

(4)

(4)

(4) |

Mark A. Kopser

Senior Vice President and Chief Financial Officer |

|

2002

2001

2000 |

|

228,542

211,250

138,885 |

|

171,407

159,000

50,000 |

|

—

—

— |

|

139,650

—

— |

|

15,000

45,000

116,666 |

|

5,500

1,613

— |

(4)

(4)

|

Dale L. Stegall (1)

Senior Vice President and General Counsel |

|

2002

2001 |

|

240,000

250,274 |

|

120,000

100,000 |

|

—

— |

|

—

— |

|

5,000

36,666 |

|

6,000

5,250 |

(4)

(4) |

John J. Wellik

Senior Vice President, Chief Accounting Officer, Compliance Officer and Secretary |

|

2002

2001

2000 |

|

178,073

146,250

127,500 |

|

88,334

74,000

60,000 |

|

—

—

— |

|

99,750

—

— |

|

20,000

25,000

13,333 |

|

5,500

5,250

2,550 |

(4)

(4)

(4) |

- (1)

- Mr. Stegall retired from the Company on January 3, 2003.

- (2)

- Half of the amount shown was paid in cash and the other half was deferred at the Named Executive Officer's election pursuant to the Company's Deferred Compensation Plan. See "—Deferred Compensation Plan."

- (3)

- Consists solely of contributions by the Company to the Named Executive Officer's Supplemental Retirement Plan account. See "—Supplemental Retirement Plan."

- (4)

- Consists solely of contributions to the Named Executive Officer's 401(k) plan account.

8

Option Grants in 2002

The following table provides certain information regarding stock options granted to the Named Executive Officers in 2002.

| |

| |

| |

| |

| | Potential Realizable Values at Assumed Annual Rates of Stock Price Appreciation for Option Term($)(2)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| | Percent of Total Options Granted To Employees in Fiscal Year(%)

| |

| |

|

|---|

| | Exercise Price or Base Price

($/Share)(1)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Donald E. Steen | | 125,000 | (3) | 15.8 | | 25.78 | | 7/3/12 | | 2,026,613 | | 5,135,835 |

| William H. Wilcox | | 100,000 | (3) | 12.7 | | 25.78 | | 7/3/12 | | 1,621,290 | | 4,108,668 |

| Mark A. Kopser | | 15,000 | (3) | 1.9 | | 25.78 | | 7/3/12 | | 243,194 | | 616,300 |

| Dale L. Stegall | | 5,000 | (3) | .6 | | 25.78 | | 7/3/12 | | 81,065 | | 205,433 |

| John J. Wellik | | 20,000 | (3) | 2.5 | | 25.78 | | 7/3/12 | | 324,258 | | 821,734 |

- (1)

- The exercise price is based on the fair market value of the underlying Common Stock on the date of grant, as reasonably determined by the options and compensation committee.

- (2)

- In accordance with the rules of the Securities and Exchange Commission (the "Commission"), shown are the gains or "option spreads" that would exist for the respective options granted. These gains are based on the assumed rates of annual compound stock price appreciation of 5% and 10% from the date the option was granted over the full option term. These assumed annual compound rates of stock price appreciation are mandated by the rules of the Commission and do not represent our estimate or projection of future prices of the Common Stock.

- (3)

- The options are subject to a four year vesting schedule, with one-fourth becoming exercisable on July 3 of each of 2003, 2004, 2005 and 2006.

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides certain information with respect to stock options held by the Named Executive Officers as of December 31, 2002.

| |

| |

| | Number of Securities

Underlying Options at

Fiscal Year-End(#)

| | Value of Unexercised

In-The-Money Options

at Fiscal Year-End($)(1)

|

|---|

| | Shares

Acquired

on

Exercise (#)

| |

|

|---|

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Donald E. Steen | | 50,000 | | 770,000 | | 344,432 | | 283,332 | | 1,997,931 | | 176,664 |

| William H. Wilcox | | — | | — | | 322,773 | | 240,555 | | 1,761,292 | | 142,999 |

| Mark A. Kopser | | — | | — | | 69,584 | | 107,082 | | 248,669 | | 248,662 |

| Dale L. Stegall | | — | | — | | 9,167 | | 32,499 | | 15,684 | | 47,048 |

| John J. Wellik | | 1,000 | | 750 | | 18,167 | | 47,499 | | 46,134 | | 24,797 |

- (1)

- The price per share of Common Stock for the last trade reported by the Nasdaq National Market on December 31, 2002 was $15.62.

Employment Agreements

Donald E. Steen. On November 15, 2002, the Company entered into an employment agreement with Donald E. Steen. The agreement provides that (i) the Board may remove Mr. Steen from the position of chief executive officer at any time after the second anniversary of the agreement, (ii) on the fourth anniversary of the agreement, unless otherwise agreed by Mr. Steen and the Company, Mr. Steen shall resign as chief executive officer and continue to serve as chairman of the Board until the seventh anniversary of the agreement (such three-year period is referred to herein as the "secondary term"), devoting approximately 75% of his business time to the Company's business, and (iii) for a two-year period commencing on the seventh anniversary of the agreement (the "final term"), Mr. Steen shall continue to serve as chairman of the Board, unless otherwise agreed by Mr. Steen and USPI, devoting approximately 50% of his business time to the Company's business. The employment

9

agreement provides for annual base compensation of $475,000. Mr. Steen is also eligible for a performance bonus of up to 100% of his annual base salary. During any time when Mr. Steen is only serving as chairman, his annual base salary will be reduced to 75% of his base salary plus his average annual bonus for the two preceding years; provided, however, that during the final term, his base salary shall equal 50% of the base salary in effect at the time of his resignation as chief executive officer plus his average annual bonus for the two preceding years. In the event that the Company terminates the employment agreement other than for cause, Mr. Steen would be entitled to continue to receive his annual base salary and bonus as follows: (i) if termination occurs during the first two years of the agreement, severance shall be due for two years after termination, (ii) if termination occurs during the third or fourth year of the agreement, severance shall be due for three years after termination, and (iii) if termination occurs after the first four years of the agreement, severance shall be due from the termination until the ninth anniversary of the agreement. The employment agreement further provides that all of Mr. Steen's stock options automatically become fully vested if the Company terminates the agreement for any reason other than for cause.

William H. Wilcox. On November 15, 2002, the Company entered into a two-year employment agreement, which renews for successive two-year terms unless terminated by either party, with William H. Wilcox that provides that he will serve as the Company's president. The employment agreement provides for annual base compensation of $415,000. Mr. Wilcox is also eligible for a performance bonus of up to 100% of his annual base salary. In the event the Company terminates the employment agreement other than for cause, Mr. Wilcox would be entitled to receive his annual base salary plus the average annual bonus awarded to Mr. Wilcox for the prior two calendar years for a period of 24 months following termination. The employment agreement further provides that if the Company terminates the agreement for any reason other than for cause, all of Mr. Wilcox's stock options automatically become fully vested.

2001 Equity-Based Compensation Plan

The Company adopted its 2001 Equity-Based Compensation Plan on February 13, 2001. At any given time, the number of shares of Common Stock issued and issuable, upon the exercise of outstanding and future awards or the lapse of forfeiture restrictions for outstanding and future awards, under the plan may not exceed the lesser of 300,000,000 shares of 12.5% of the total number of shares of Common Stock then outstanding, assuming the exercise of all outstanding options and warrants and the conversion of all securities convertible or exchangeable into Common Stock. Shares of Common Stock relating to forfeited awards will again be available for purposes of these share limitations but not for purposes of share limitations imposed by Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"). The plan provides for grants of incentive stock options, within the meaning of Section 422 of the Code, to employees of the Company, including officers and employee-directors, and for grants of nonstatutory stock options, restricted stock awards, stock appreciation rights, phantom stock awards and annual incentive awards to employees, consultants and nonemployee directors of the Company. The purposes of the plan are:

- •

- to attract and retain the best available personnel for positions of substantial responsibility;

- •

- to provide additional incentives to the Company's employees and consultants; and

- •

- to promote the success of the Company's business.

The Board or the options and compensation committee, to the extent it is directed to do so by the Board, administers the plan. The options and compensation committee will at all times will be comprised of two or more individuals that constitute "outside directors" for purposes of Section 162(m) of the Code and, in the discretion of the Board, "nonemployee directors" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act"). The Board or the options and compensation committee will designate the individuals to receive awards, the number of shares subject to the awards and the terms and conditions of each award, subject to the terms of the plan.

10

While the Board or the options and compensation committee determines the terms of awards granted under the plan, the term of any incentive stock option cannot exceed ten years from the date of grant. Further, any incentive stock option granted to an employee who possesses more than ten percent of the total combined voting power of all classes of the Company's shares within the meaning of Section 422(b)(6) of the Code cannot be exercisable after the expiration of five years from the date of grant.

While the options and compensation committee determines the exercise price of options granted under the plan, the exercise price of any incentive stock option granted to an employee who possesses more than ten percent of the total combined voting power of all classes of the Company's shares within the meaning of Section 422(b)(6) of the Code must be at least 110% of the fair market value of the underlying share at the time the option is granted. The exercise price of options granted under the plan will be paid in full in a manner prescribed by the options and compensation committee.

The plan is not currently subject to the Employee Retirement Income Security Act of 1974 ("ERISA") or Section 162(m) of the Code.

Employee Stock Purchase Plan

The Company adopted its Employee Stock Purchase Plan on February 13, 2001. A total of 500,000 shares of Common Stock are authorized for issuance under the plan. The plan provides for the grant of stock options to selected eligible employees. The purpose of the plan is to provide eligible employees with an incentive to advance the Company's interests by providing an opportunity to purchase Common Stock at a favorable price. The plan is administered by the options and compensation committee.

Any eligible employee may elect to participate in the plan by authorizing the options and compensation committee to make payroll deductions to pay the exercise price of an option at the time and in the manner prescribed by the options and compensation committee. This payroll deduction may be a specific amount or a designated percentage to be determined by the employee, but the specific amount may not be less than an amount established by the Company and the designated percentage may not exceed an amount of eligible compensation established by the Company from which the deduction is made. In no event will an employee be granted an option under the plan that would permit the purchase of stock with a fair market value in excess of $25,000, or to purchase more than 5,000 shares in any six month period.

There are two six-month offering periods in each calendar year. The date of grant and the date of exercise for the first option period is January 1 and June 30, respectively, and the date of grant and date of exercise for the second option period is July 1 and December 31, respectively. The exercise price of options granted under the plan is an amount equal to the lesser of 85% of the fair market value of the Common Stock on the date of exercise or on the date of grant.

The plan is designed to comply with Section 423 of the Code and thus is eligible for the favorable tax treatment afforded by Section 423.

1998 Stock Option and Restricted Stock Purchase Plan

The Company adopted its 1998 Stock Option and Restricted Stock Purchase Plan (the "1998 Stock Option Plan") on April 30, 1998. A total of 2,000,000 shares of Common Stock are authorized for issuance under the plan. As a result of the adoption of the 2001 Equity-Based Plan, the Company will not grant any additional options under the 1998 Stock Option Plan. The 1998 Stock Option Plan provides for grants of incentive stock options to employees of the Company, including officers and employee-directors, and for grants of non-qualified stock options and the right to purchase restricted

11

stock to officers, other employees, directors and consultants of the Company. The purposes of the 1998 Stock Option Plan are to:

- •

- promote the interest of the Company and its stockholders by providing an opportunity to selected employees, officers, directors and other persons to purchase Common Stock; and

- •

- attract, retain and motivate employees of the Company and other persons and to encourage employees of the Company and other persons to devote their best efforts to the business and financial success of the Company.

The options and compensation committee administered the 1998 Stock Option Plan. The options and compensation committee designated the individuals to receive options or stock purchase awards, the number of shares subject to options or stock purchase awards, and the terms and conditions of each option or stock purchase award granted under the 1998 Stock Option Plan.

While the options and compensation committee determined the terms of options or stock purchase awards granted under the 1998 Stock Option Plan, the term of any incentive stock option cannot exceed ten years from the date of the grant and any incentive stock option granted to an employee who possesses more than ten percent of the total combined voting power of all classes of the Company's voting stock within the meaning of Section 422(b)(6) of the Code cannot be exercisable after the expiration of five years from the date of grant.

The 1998 Stock Option Plan is not currently subject to ERISA or Section 162(m) of the Code.

The options and compensation committee determined the exercise price of options granted under the 1998 Stock Option Plan. Incentive stock options were granted at the fair market value of the underlying stock at the time the option was granted. Further, the exercise price of any incentive stock option granted to an employee who possessed more than ten percent of the total combined voting power of all classes of the Company's voting stock within the meaning of Section 422(b)(6) of the Code must have been at least 110% of the fair market value of the underlying stock at the time the option was granted. The exercise price of options granted under the plan will be paid in full in a manner prescribed by the options and compensation committee.

The options and compensation committee determined the purchase price for shares of Common Stock sold pursuant to stock purchase awards. The purchase price need not be equal to the fair market value of Common Stock. The purchase price is payable in cash or, at the discretion of the committee, with the grantee's promissory note, secured by the stock subject to the award, or any other consideration approved by the committee.

Deferred Compensation Plan

In order to attract and retain key executives and persons providing management services to the Company, the Company maintains the Deferred Compensation Plan (the "DCP"). The Board designates those persons who are eligible to participate in the DCP. In 2002, only Messrs. Steen and Wilcox were eligible to participate in the DCP. The DCP enables participants to defer all or a portion of their bonus in any calendar year, as long as the deferral election is made in the calendar year prior to the year to which the bonus relates; provided, however, that the deferral of a bonus payable in 2002 could be made any time within the first thirty (30) days of the plan year beginning on February 12, 2002.

All bonus deferrals are deemed invested in Common Stock and, at the time of distribution, will be paid in Common Stock. The number of shares of Common Stock deemed purchased with any bonus deferral will equal the deferred portion of the bonus divided by 80% of the lesser of (a) the fair market value of the Common Stock on the first business day of the plan year or (b) the fair market value of the Common Stock on the last day of the plan year.

12

Participants elect their payment date and form of distribution at the time they make their deferral election. Distributions under the DCP may be made upon termination of employment, a future date irrevocably determined by the participant at the time of the deferral election or the earlier of termination and such future date. The deferred bonus is payable, at the election of the participant, in a single lump sum or in annual installments payable over a period of two to ten years. Upon the death of a participant any unpaid amounts are paid to the participant's designated beneficiary.

The DCP is administered by the Company, but the Company may designate another person or entity to perform the Company's administrative duties. The DCP is an "unfunded" arrangement for purposes of ERISA. Accordingly, the DCP consists of a mere promise by the Company to make payments in accordance with the terms of the DCP and participants and beneficiaries have the status of general unsecured creditors of the Company. The Company may amend or terminate the DCP so long as any amendment or termination does not adversely affect the right of any participant with respect to amounts that have been credited to his account under the DCP prior to the date of such amendment or termination. A participant's account and benefits payable under the DCP are not assignable. Upon a change in control, as defined in the DCP, a participant's entire balance held under the DCP will be paid to the participant in single lump sum as soon as possible following the change in control, unless the participant makes an election within 30 days of the change of control to be paid in accordance with his payment election previously made pursuant to the DCP.

Supplemental Retirement Plan

The Company established the Supplemental Retirement Plan (the "SRP") to attract high quality executives and promote continued interest in the successful operation of the Company. The SRP is administered by the options and compensation committee of the Board. The committee designates the officers who are eligible to participate in the SRP.

Participants in the SRP may elect to defer from 10% to 100% (in 5% increments) of base salary and/or bonus under the SRP. Salary deferral elections must be submitted on or before December 31 preceding the commencement of the calendar year to which the deferral relates (or, in the case of the 2002 plan year, within 30 days of February 12, 2002), and bonus deferral elections must be made prior to a date established by the options and compensation committee. Deferral elections, once made, can not be changed or revoked, except as provided below. At the time of making a deferral election, a participant will elect to receive distribution of such deferrals at either (a) age 55 or (b) either of the two fixed dates established by the options and compensation committee for in-service payments. In addition, the Company may, from time to time, credit a participant's account with incentive contributions which will be governed by an incentive contribution agreement, the terms of which may include a substantial risk of forfeiture. Distributions will be made, as elected by the participant at the time of the deferral election, as either (a) a lump sum, (b) annual installments over five years, (c) annual installments over ten years or (d) annual installments over 15 years. If no election is made as to the form of payment, distributions will be made in a lump sum. Notwithstanding a participant's elections, a participant's accounts will be distributed on the earlier of January 1 or July 1 following termination of employment. Accounts will also be distributed upon death or, if elected, as a consequence of an unforeseeable emergency or upon disability. Participant accounts of less than $10,000 will be distributed in a lump sum regardless of the participant's election.

A participant's account will be credited with earnings and losses based on returns of the deemed investment options selected by the participant from the group of deemed investments established by the options and compensation committee. A participant's accounts may be divided into subaccounts by the options and compensation committee to the extent necessary for the administration of the SRP to account for separate deferral contributions, deferral periods, and/or forms of payment. Participants may change the form of distribution with respect to different deferral agreements; provided, however, that no more than three such changes may be submitted for any single subaccount and only one change of

13

payment election may be made with respect to any single subaccount during any three calendar year period.

Distribution of a subaccount may be postponed, past the original distribution date, to a future date; provided, however, only one such additional deferral election may be made with respect to any single subaccount and any such deferral shall only apply to balances that are scheduled to be paid six months or more after the date of such election. Furthermore, if an additional deferral election is made to change the initial starting date to the date the participant attains age 55, no payments will begin earlier than three years after such additional deferral election. Upon disability, a participant's base salary deferrals or bonus deferrals will be discontinued. Further, a participant's base salary deferral or bonus deferral may be discontinued by a showing of a financial hardship. In the event of such revocation, a participant will be ineligible to make further deferral elections for one year from the date of the options and compensation committee action approving the cessation of deferrals.

The SRP is an "unfunded" arrangement for purposes of ERISA, but deferrals are set aside in a grantor trust subject to the claims of creditors of the Company. Persons entitled to benefits under the SRP are general unsecured creditors of the Company with respect to such amounts. Participant accounts and benefits payable under the SRP are not assignable.

The options and compensation committee has the authority to amend or terminate the SRP. However, under no circumstances may any change reduce, without a participant's consent, a participant's right to amounts held in a participant's account. Upon termination of the SRP, a participant's account will be distributed in a single sum payment.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides certain information about Common Stock that may be issued upon the exercise of options under the 2001 Equity-Based Compensation Plan and the 1998 Stock Option Plan, which were the only existing equity compensation plans of the Company as of December 31, 2002.

Plan Category

| | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

| | (b) Weighted Average Exercise Price of Outstanding Options, Warrants and Rights(1)

| | (c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

| | (d) Total of Securities Reflected in Columns (a) and (c)

|

|---|

| Equity Compensation Plans Approved by Stockholders | | 3,243,590 | | $ | 17.24 | | 2,057,324 | | 5,300,914 |

| Equity Compensation Plans Not Approved by Stockholders | | — | | | — | | — | | — |

| | |

| |

| |

| |

|

| Total | | 3,243,590 | | $ | 17.24 | | 2,057,324 | | 5,300,914 |

| | |

| |

| |

| |

|

- (1)

- These amounts represent the weighted average exercise price for the total number of outstanding options.

OPTIONS AND COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Role of the Options and Compensation Committee

The options and compensation committee of the Board is currently composed of Messrs. Mackesy, Powell and Queally. Each member is a non-employee director of the Company. The options and compensation committee determines annual salary, bonus and other compensation for the Company's directors and officers. The options and compensation committee also monitors and administers all of the Company's equity-based incentive and supplemental retirement plans and, subject to the provisions

14

of each such plan, determines grants under it for all employees and consultants, including directors and executive officers. The options and compensation committee held one meeting during 2002 and approved certain matters by unanimous written consent on six separate occasions. At those meetings the options and compensation committee reviewed the Company's compensation practices and made awards of stock options to certain employees and directors of the Company.

Principles of Executive Compensation

In determining compensation levels and developing compensation programs for the Company's executive officers, the options and compensation committee analyzes the relationship between base salary, annual cash incentives, equity incentives and benefits. The underlying objectives of the Company's compensation strategy include the following:

- •

- attracting and retaining superior executive talent and motivating executives to achieve optimum short-term and long-term corporate operating results;

- •

- aligning the interests of executive officers with the creation of stockholder value and ensuring long-term growth orientation through equity-based incentive and supplemental retirement plans; and

- •

- providing a compensation package that recognizes individual contributions as well as overall business results.

Description of the Executive Compensation Program

The key elements of the Company's executive compensation program are base salary, annual cash bonuses, equity-based incentives and supplemental retirement plan contributions.

The options and compensation committee does not exclusively use quantitative methods or mathematical formulas in setting any element of compensation. In determining each component of compensation, the options and compensation committee considers all elements of an executive's total compensation package, recommendations of the chief executive officer (as discussed below) and other objective and subjective criteria as the options and compensation committee deems appropriate with respect to each executive officer. The compensation of executive officers is periodically reviewed to ensure an appropriate mix of base salary, annual cash bonuses and equity-based incentives to provide competitive total direct compensation opportunities consistent with the philosophy described below. In addition, in 2002 an independent compensation consulting firm was engaged to evaluate the Company's executive compensation program. This evaluation included a comparison of the Company's executive compensation program to the compensation programs of an industry peer group. The consulting firm concluded that the structure of the Company's executive compensation program was generally consistent with the industry peer group.

No specific weighting is assigned to any of the factors considered in determining annual adjustments to base salaries and cash bonuses for the executive officers.

Base Salary

The base salary of each of the executive officers, other than the chief executive officer, is reviewed annually by the options and compensation committee, with adjustments made based primarily on the recommendations of the chief executive officer. In reviewing base salaries, the options and compensation committee considers various factors, including the position of the executive officer, the compensation of officers of comparable companies within the healthcare industry, the performance of the executive officer with respect to specific objectives, increases in responsibilities and recommendations of the chief executive officer. The specific objectives for each executive officer vary each year in accordance with the scope of the officer's position, the potential inherent in that position for impacting the Company's operating and financial results and the actual operating and financial

15

contributions produced by the officer in previous years. The chief executive officer and the options and compensation committee also consider each executive officer's responsibilities related to achieving certain objectives within the context of the Company's annual business plan, including net patient service revenue, EBITDA (earnings before interest, income taxes, depreciation and amortization), net income, earnings per share and return on invested capital.

Annual Cash Bonus

Annual cash bonuses to executive officers, other than the chief executive officer, are determined by the options and compensation committee after considering the recommendations of the chief executive officer. The chief executive officer, in developing his bonus recommendations for the other executive officers for 2002, as well as the options and compensation committee in evaluating the chief executive officer's recommendations, considered the financial performance of the Company, as measured by the Company's achievement of certain EBITDA targets.

Annual Equity-Based Incentives

The options and compensation committee believes that equity ownership by management is beneficial in aligning management's and stockholders' interests in the enhancement of stockholder value. The Company formerly provided such equity-based compensation pursuant to the 1998 Stock Option Plan. In February 2001, the Company's 2001 Equity-Based Compensation Plan became effective and replaced the 1998 Stock Option Plan for purposes of providing equity-based compensation to executives and other key employees and consultants.

The 2001 Equity-Based Compensation Plan authorizes the granting of incentive stock options, nonstatutory stock options, restricted stock awards, stock appreciation rights, phantom stock awards and annual incentives to executives and other key employees and consultants of the Company. To align the interests of senior executives with the interests of stockholders, the options and compensation committee's current policy regarding such awards is to grant incentive and non-qualified stock options and restricted stock awards. Under the Company's annual equity-based incentive program, the Company determines the levels of options and/or restricted stock to be granted to each of its executives based upon such executive's position, ability to affect Company performance, tenure and the achievement of performance objectives established for the executive. All stock option grants have had an exercise price equal to the fair market value of a share of Common Stock at the time of the grant. To encourage retention, the ability to exercise options or transfer restricted stock granted under this plan is generally subject to vesting restrictions.

Compensation of the Chief Executive Officer

Mr. Steen's employment agreement had provided for an annual base salary of $400,000 for Mr. Steen until, in March 2002, the options and compensation committee voted to increase his annual base salary to $420,000. In November 2002, the options and compensation committee approved Mr. Steen's current employment agreement, which provides for a base salary of $475,000. Factors considered by the options and compensation committee in increasing Mr. Steen's base salary were his experience and achievements in the healthcare industry, the Company's operating and financial performance in 2002 and the compensation of chief executive officers of comparable companies within the healthcare industry. The options and compensation committee anticipates that any future increase in the chief executive officer's base salary will be based on the options and compensation committee's and the Board's assessment of the Company's future objectives combined with its assessment of the chief executive officer's contributions to the attainment of those objectives.

Under the terms of his employment agreement, Mr. Steen is eligible for a cash bonus of up to 100% of his base salary. In February 2003, the options and compensation committee awarded Mr. Steen a cash bonus of $420,000 based on the Company's financial performance, as measured by the

16

Company's achievement of certain EBITDA targets. The options and compensation committee anticipates that future cash bonuses paid to the chief executive officer will be based primarily on the financial performance of the Company, as well as the individual performance of the chief executive officer in supporting the Company's operating, financial and strategic success.

$1 Million Pay Deductibility Cap

The Company's executive compensation strategy is intended to be cost and tax effective. Therefore, the Company's policy is to avail itself of all proper deductions under the Code, where practical, while maintaining the flexibility to approve compensation arrangements which it deems to be in the best interests of the Company and its stockholders, but which may not always qualify for full tax deductibility. Section 162(m) of the Code generally imposes a $1 million per person annual limit on the amount the Company may deduct as compensation expense for its chief executive officer and its four other highest paid executive officers. Although the total compensation of the executive officers did not exceed this deduction limitation in 2002, certain factors involved in the Company's compensation program may impact whether the deduction limitation is exceeded in the future. The 2001 Equity-Based Compensation Plan, as drafted, permits compensation associated with awards to be excluded from the deduction limitations. However, in future years or if the company's plans are modified, certain payments under the these plans, including grants of restricted stock and certain stock options, may be included as compensation for purposes of calculating the deduction limitation, potentially impacting the deduction limitation.

As the Company moves forward in its efforts to create stockholder value in the years ahead, the options and compensation committee will continue to review, monitor and evaluate the Company's program for executive compensation to assure that it is internally effective in support of the Company's strategy, competitive in the marketplace to attract, retain and motivate the talent needed to achieve the Company's financial objectives, and appropriately rewards the creation of value on behalf of the Company's stockholders.

The options and compensation committee of the Board is:

Paul B. Queally, Chairman

D. Scott Mackesy

Boone Powell, Jr.

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

The options and compensation committee of the Board consists of Messrs. Queally (Chairman), Mackesy and Powell. None of such persons are officers or employees or former officers or employees of the Company.

Messrs. Mackesy and Queally are general partners of Welsh, Carson, Anderson & Stowe. The Company and Welsh, Carson, Anderson & Stowe are parties to certain transactions described under "Certain Relationships and Related Transactions." Mr. Allison is currently the president and chief executive officer of BHCS. The Company and BHCS are parties to certain transactions described under "Certain Relationships and Related Transactions."

AUDIT AND COMPLIANCE COMMITTEE REPORT

The audit and compliance committee of the Board is currently composed of Messrs. Mills (Chairman), Crews, Widman and Zarin. The Board, in its business judgment, has determined that all members of the audit and compliance committee meet the independence and experience requirements of Nasdaq and applicable rules and regulations of the Commission and that Mr. Widman satisfies the

17

requirements for an "audit committee financial expert." The audit and compliance committee operates pursuant to an audit and compliance committee charter.

As set forth in the charter, management of the Company is responsible for the preparation, presentation and integrity of the Company's financial statements, the Company's accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing the Company's financial statements in accordance with auditing standards generally accepted in the United States of America and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

In the performance of its oversight function, the audit and compliance committee has reviewed and discussed with the Company's management and the Company's independent auditors the Company's audited financial statements for the year ended December 31, 2002. The audit and compliance committee has also discussed with the Company's independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communications with Audit Committees, as amended by Statement on Auditing Standards No. 90. In addition, the audit and compliance committee has received the written disclosures and the letter from the Company's independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect. The audit and compliance committee has also considered whether the independent auditors' provision of non-audit services to the Company is compatible with maintaining the auditors' independence and discussed with them their independence from the Company and its management.

The members of the audit and compliance committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the audit and compliance committee rely without independent verification on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the audit and compliance committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal control and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the audit and compliance committee's considerations and discussions referred to above do not assure that the audit of the Company's financial statements has been carried out in accordance with auditing standards generally accepted in the United States of America, that the financial statements are presented in accordance with accounting principles generally accepted in the United States of America or that the Company's auditors are in fact "independent."

Based upon the reports and the audit and compliance committee's discussions described in this report, and subject to the limitations on the role and responsibilities of the audit and compliance committee referred to above and in the audit and compliance committee charter, the audit and compliance committee recommended to the Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002.

The audit and compliance committee of the Board is:

Thomas L. Mills, Chairman

James C. Crews

Jerry P. Widman

David P. Zarin, M.D.

FEES PAID TO INDEPENDENT ACCOUNTANTS

Audit Fees. KPMG LLP billed the Company $931,032 in connection with the audit of the Company's financial statements for the year ended December 31, 2002 and in connection with the

18

review of the Company's financial statements included in the Company's Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30 and September 30, 2002.

All Other Fees. The aggregate fees billed to the Company in 2002 by KPMG LLP for services performed for 2002, other than the fees described above under "Audit Fees," were $1,497,085. Of that amount, $861,664 was incurred for audit related services, consisting primarily of review of registration statements, issuance of comfort letters to underwriters, issuance of consents and audits of financial statements of employee benefit plans and certain businesses acquired. The remaining $635,421 was incurred for non-audit services consisting primarily of due diligence assistance and tax services. KPMG LLP did not render any services related to financial information systems design and implementation during 2002.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Warrants

The Company issued a warrant, dated March 27, 2000, to Welsh, Carson, Anderson & Stowe, a stockholder owning more than 5% of the outstanding Common Stock, to purchase 266,666 shares of Common Stock at an exercise price of $.03 per share in connection with its purchase of shares of the Company's Series C convertible preferred stock. The warrant will terminate on June 18, 2009.

Registration Rights Agreement

Donald E. Steen, William H. Wilcox, Paul B. Queally, D. Scott Mackesy, John C. Garrett, M.D., Welsh, Carson, Anderson & Stowe VII, L.P., WCAS Healthcare Partners, L.P., WCAS Capital Partners III, L.P. and other holders of Common Stock are entitled under a registration rights agreement with the Company to the following registration rights for the shares of Common Stock held by them:

- •

- at any time Welsh, Carson, Anderson & Stowe VII, L.P., on behalf of the holders of registrable securities may require, on two occasions only, that the Company use its best efforts to register registrable securities for public resale;

- •

- holders of registrable securities under the agreement may require the Company to use its best efforts to register their shares of Common Stock on a Form S-3 registration statement, provided that the Company is eligible to use the form and provided further that the Company shall not be required to effect the registration more than once in any 180 day period; and

- •

- if the Company registers any Common Stock at any time, either for its own account or for the account of other security holders, holders of registrable securities under the agreement are entitled to include their shares of Common Stock in the registration, subject to the ability of the underwriters to limit the number of shares included in the offering in view of market conditions.

The Company will bear all registration expenses other than underwriting discounts and commission in connection with any registration under the registration rights agreement.

Other Transactions

The Company accepted promissory notes from the following executive officers as partial consideration for the purchase by the executive officer of Common Stock as set forth below:

Executive Officer

| | Date

of

Note

| | Principal

Amount($)

| | Interest

Rate(%)

|

|---|

| John J. Wellik | | 11/22/99 | | 26,250 | | 7 |

| John J. Wellik | | 8/15/00 | | 52,500 | | 7 |

| Dale L. Stegall | | 3/31/01 | | 70,210 | | 7 |

19

Each promissory described above was repaid during 2002.

Joel T. Allison currently serves as the president and chief executive officer of BHCS. We derived approximately 14% of our revenues from our joint ventures with BHCS in 2002.

20

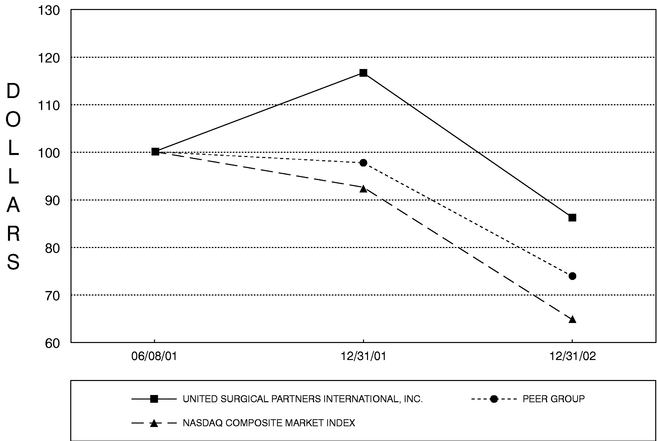

PERFORMANCE GRAPH

The Performance Graph shown below was prepared by the Company for use in this proxy statement. Historic stock price performance is not necessarily indicative of future stock performance. The graph was prepared based upon the following assumptions:

1. $100 was invested in the Common Stock, the Nasdaq Composite Market Index and the Company's Peer Group (as defined below) on June 8, 2001 (the date the Common Stock was first traded on the Nasdaq National Stock Market).

2. Peer Group investment is weighted based on the market capitalization of each individual company within the Peer Group at the beginning of the comparison period.

3. Dividends are reinvested on the ex-dividend dates.

The companies that comprise the Company's Peer Group for purposes of stockholder return comparisons are as follows: Amsurg Corp., Community Health Systems, Inc., Lifepoint Hospitals, Inc., MedCath Corporation and Province Healthcare Company.

| | Date

|

|---|

Company/Index/Market

|

|---|

| | 6/08/2001

| | 12/31/2001

| | 12/31/2002

|

|---|

| United Surgical Partners International, Inc. | | 100.00 | | 116.73 | | 86.21 |

| Peer Group | | 100.00 | | 97.66 | | 73.76 |

| NASDAQ Composite Market Index | | 100.00 | | 92.60 | | 64.59 |

21

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS, DIRECTORS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership, as of the Record Date, of the Common Stock by (i) each person known to the Company to be the beneficial owner of 5% or more of the shares of Common Stock outstanding; (ii) each director and Nominee; (iii) each Named Executive Officer; and (iv) directors and executive officers of the Company as a group. Unless otherwise indicated, to the Company's knowledge, each person has sole voting and dispositive power over the shares indicated as owned by such person, subject to applicable community property laws.

Name of Beneficial Owner

| | Number of Shares

| | Percent(1)

| |

|---|

Welsh, Carson, Anderson & Stowe VII, L.P.

320 Park Avenue, Suite 2500

New York, NY 10022-9500 | | 4,164,810 | (2) | 15.35 | % |

| Baron Capital Group, Inc. | | 2,868,100 | (3) | 10.57 | % |

| Robert Baron | | | | | |

| BAMCO, Inc. | | | | | |

Baron Capital Management, Inc.

767 Fifth Avenue

New York, NY 10153 | | | | | |

| RS Investment Management Co. LLC | | 2,549,700 | (4) | 9.4 | % |

| RS Investment Management, L.P. | | | | | |

G. Randall Hecht