Exhibit 3.95

DFI/CORP/38 RECORD 2/00 | United States of America |  | ||||||

| State of Wisconsin | ||||||||

DEPARTMENT OF FINANCIAL INSTITUTIONS

To All to Whom These Presents Shall Come, Greeting:

I, RAY ALLEN, Deputy Administrator, Division of Corporate & Consumer Services, Department of Financial Institutions, do hereby certify that the annexed copy has been compared by me with the record on file in the Corporation Section of the Division of Corporate & Consumer Services of this department and that the same is a true copy thereof and the whole of such record; and that I am the legal custodian of said record, and that this certification is in due form.

| IN TESTIMONY WHEREOF, I have hereunto set my hand and affixed the official seal of the Department.

| |||

| ||||

RAY ALLEN, Deputy Administrator Division of Corporate & Consumer Services Department of Financial Institutions | ||||

| DATE: JUN 21 2010 | BY: | |||

Effective July 1, 1996, the Department of Financial Institutions assumed the functions previously performed by the Corporations Division of the Secretary of State and is the successor custodian of corporate records formerly held by the Secretary of State.

CERTIFICATE TO AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

METAVANTE CORPORATION

The undersigned, N. “Norrie” J. Daroga, Senior Vice President, Secretary and General Counsel of Metavante Corporation (the “Corporation”), hereby certifies as follows:

1. The Amended and Restated Articles of Incorporation attached hereto asExhibit A supersede and replace the heretofore existing Articles of Incorporation of Metavante Corporation and all amendments thereto.

2. The Amended and Restated Articles of Incorporation contain amendments to the heretofore existing Articles of Incorporation, which amendments require the approval of the shareholders of the Corporation.

3. The Amended and Restated Articles of Incorporation attached hereto were adopted on September 5, 2000 by the Board of Directors and the shareholders of the Corporation in accordance with Section 180.1003 of the Wisconsin Statutes.

4. Effective upon the filing of the Amended and Restated Articles of Incorporation attached hereto, the outstanding stock certificates representing the no par value common stock of the Corporation which was issued and outstanding prior to the adoption of the Amended and Restated Articles of Incorporation shall remain outstanding and shall be deemed for all corporate purposes to evidence ownership of the same number of duly authorized, validly issued, fully paid and non-assessable shares of the newly created $.01 par value per share common stock of the

Corporation. Such newly created $.01 par value per share common stock of the Corporation shall be subject in all respects to the terms and conditions of the Amended and Restated Articles of Incorporation.

IN WITNESS WHEREOF, the undersigned has executed this Certificate this 5th day of September, 2000.

| METAVANTE CORPORATION | ||

| By: | /s/ Norrie J. Daroga | |

| N. “Norrie” J. Daroga, Senior Vice President, Secretary and General Counsel | ||

This instrument was drafted by:

Randall J. Erickson

Godfrey & Kahn, S. C.

780 North Water Street

Milwaukee, Wisconsin 53202

2

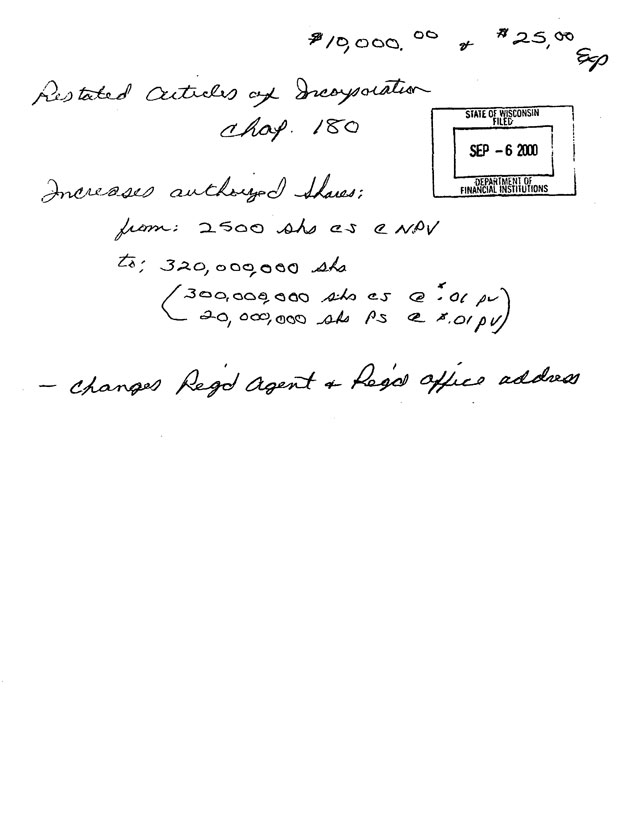

Exhibit A

RESTATED

ARTICLES OF INCORPORATION

OF

METAVANTE CORPORATION

These amended and restated Articles of Incorporation supercede and replace the heretofore existing Articles of Incorporation of Metavante Corporation, as amended, a Wisconsin corporation organized under Chapter 180 of the Wisconsin Statutes.

ARTICLE I

NAME

The name of the Corporation is Metavante Corporation.

ARTICLE II

PURPOSES

The Corporation is authorized to engage in any lawful activity for which corporations may be organized under the Wisconsin Business Corporation Law and any successor provisions.

ARTICLE III

CAPITAL STOCK

The aggregate number of shares which the Corporation shall have the authority to issue, the designation of each class of shares, the authorized number of shares of each class and the par value thereof per share shall be as follows:

Designation of Class | Par Value Per Share | Authorized Number of Shares | ||||||

Common Stock | $ | .01 | 300,000,000 | |||||

Preferred Stock | $ | .01 | 20,000,000 | |||||

The preferences, limitations and relative rights of shares of each class and series thereof, if any, and the authority of the Board of Directors of the Corporation to create and to designate series of Preferred Stock and to determine the preferences, limitations and relative rights as between series shall be as follows:

A. Common Stock.

1.Voting. Except as otherwise provided by law and except as may be determined by the Board of Directors of the Corporation with respect to shares of Preferred Stock as provided in Section B. below, only the holders of shares of Common Stock shall be entitled to vote for the election of directors of the Corporation and for all other corporate

purposes. Except as otherwise provided by law, upon any such vote, each holder of Common Stock shall be entitled to one vote for each share of Common Stock held of record by such shareholder.

2.Dividends. Subject to the provisions of paragraph (2) of Section B, below, the holders of Common Stock shall be entitled to receive such dividends as may be declared thereon from time to time by the Board of Directors of the Corporation, in its discretion, out of any funds of the Corporation at the time legally available for payment of dividends.

3.Liquidation. In the event of the voluntary or involuntary dissolution, liquidation or winding up of the Corporation, after there have been paid to or set aside for the holders of shares of Preferred Stock the full preferential amounts, if any, to which they are entitled as provided in paragraph (3) of Section B, below, the holders of outstanding shares of Common Stock shall be entitled to share ratably, according to the number of shares held by each, in the remaining assets of the Corporation available for distribution.

B.Preferred Stock.

1.Series and Variations Between Series. The Board of Directors of the Corporation is authorized, to the full extent permitted under the Wisconsin Business Corporation Law and the provisions of this Section B, to provide for the issuance of the Preferred Stock in one or more series, each of such series to be distinctively designated, and to have such voting rights, redemption or conversion rights, dividend or distribution rights, preferences with respect to dividends or distributions, or other preferences, limitations or relative rights as shall be provided by the Board of Directors of the Corporation consistent with the provisions of the Wisconsin Business Corporation Law and this Article III. The Board of Directors of the Corporation, unless otherwise provided when the series is established, may increase or decrease the number of shares of any series, provided that the number of shares of any series shall not be reduced below the number of shares then outstanding.

2.Dividends. Before any dividends (other than a dividend payable solely in Common Stock) shall be paid or set apart for payment upon shares of Common Stock, the holders of each series of Preferred Stock shall be entitled to receive dividends at the rate (which may be fixed or variable) and at such times as specified in the particular series, if any. The holders of shares of Preferred Stock shall have no rights to participate with the holders of shares of Common Stock in any dividends in excess of the preferential dividends, if any, fixed for such Preferred Stock.

3.Liquidation. In the event of liquidation, dissolution or winding up (whether voluntary or involuntary) of the Corporation, the holders of shares of Preferred Stock shall be entitled to be paid the full amount payable on such shares upon the liquidation, dissolution or winding up of the Corporation fixed by the Board of Directors with respect to such shares, if any, before any amount shall be paid to the holders of the Common Stock

2

ARTICLE IV

BOARD OF DIRECTORS

A.Number. The number of directors (exclusive of directors, if any, elected by the holders of one or more series of Preferred Stock, voting separately as a series pursuant to the provision of these Articles of Incorporation applicable thereto) shall not be less than one (1) nor more than fifteen (15) directors, the exact number of directors to be determined from time to time by resolution adopted by the affirmative vote of a majority of the entire Board of Directors then in office.

B.Classification of Board. The directors shall be divided into three classes, designated Class I, Class II and Class III. Class I directors shall be elected initially for a one-year term, Class II directors shall be elected initially for a two-year term and Class III directors shall be elected initially for a three-year term. At each succeeding annual meeting of shareholders beginning in 2001, successors to the class of directors whose term expires at that annual meeting shall be elected for a three-year term. Each class shall consist, as nearly as possible, of one-third of the total number of directors constituting the entire Board of Directors. If the number of directors is changed by resolution of the Board of Directors pursuant to this Article IV, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each class as nearly equal as possible, but in no case shall a decrease in the number of directors shorten the term of any incumbent director.

C.Tenure and Vacancies. A director shall hold office until the annual meeting for the year in which his or her term expires and until his or her successor shall be elected and shall qualify. Any newly created directorship resulting from an increase in the number of directors and any other vacancy on the Board of Directors, however caused, shall be filled by the vote of a majority of the directors then in office, although less than a quorum, or by a sole remaining director. Any director so elected to fill any vacancy on the Board of Directors, including a vacancy created by an increase in the number of directors, shall hold office for the remaining term of directors of the class to which he or she has been elected and until his or her successor shall be elected and shall qualify.

D.Removal of Directors. Exclusive of directors, if any, elected by the holders of one or more classes or series of Preferred Stock, no director of the Corporation may be removed from office, except for Cause and by the affirmative vote of not less than 75% of the outstanding shares of capital stock of the Corporation entitled to vote at a meeting of shareholders duly called for such purpose. As used in this Article IV, the term “Cause” shall mean solely malfeasance arising from the performance of a director’s duties which has a materially adverse effect on the business of the Corporation.

E.Nominations of Directors. No person, except those nominated by or at the direction of the Board of Directors, shall be eligible for election as a director at any annual or special meeting of shareholders unless a written request, in the form established by the Corporation’s By-laws, that a person’s name be placed in nomination is received from a shareholder of record by the Secretary of the Corporation, together with the written consent of such person to serve as a

3

director, (i) with respect to an election held at an annual meeting of shareholders, not less than one hundred twenty (120) days prior to the anniversary date of the annual meeting of shareholders in the immediately preceding year, or (ii) with respect to an election held at a special meeting of shareholders for the election of directors, not later than the close of business on the eighth day following the date of the earlier of public announcement or notice of such meeting.

Notwithstanding anything contained in these Articles of Incorporation to the contrary, this Article IV may be amended, altered or repealed only by the affirmative vote of the holders of not less than 75% of the outstanding total shares of stock of the Corporation entitled to vote at a meeting of shareholders duly called for such purpose and by the affirmative vote of the holders of not less than 75% of the outstanding shares of each class or series, if any, entitled to vote thereon at such meeting.

ARTICLE V

PREEMPTIVE RIGHTS

No holder of any shares of the Corporation shall have any preemptive or subscription rights nor be entitled, as of right, to purchase or subscribe for any part of the unissued shares of the Corporation or of any additional shares issued by reason of any increase of authorized shares of the Corporation or other securities whether or not convertible into shares of the Corporation.

ARTICLE VI

SHARE DIVIDENDS

A dividend payable in shares of any class or series of the Corporation may be paid in shares of any other class or series.

ARTICLE VII

SHAREHOLDER ACTION

The shareholders of the Corporation shall not be entitled to take action without a meeting by less than unanimous consent.

ARTICLE VIII

AMENDMENT OF BY-LAWS

Notwithstanding any other provision of these Articles of Incorporation or the Corporation’s By-laws, the Corporation’s By-laws may be amended, altered or repeated, and new By-laws may be enacted, only by the affirmative vote of the holders of not less than 75% of the outstanding shares of capital stock of the Corporation entitled to vote at a meeting of shareholders duly called for such purpose and by the affirmative vote of the holders of not less

4

ARTICLE VIII

AMENDMENT OF BY-LAWS

Notwithstanding any other provision of these Articles of Incorporation or the Corporation’s By-laws, the Corporation’s By-laws may be amended, altered or repealed, and new By-laws may be enacted, only by the affirmative vote of the holders of not less than 75% of the outstanding shares of capital stock of the Corporation entitled to Vote at a meeting of shareholders duly called for such purpose and by the affirmative vote of the holders of not less than 75% of the outstanding shares of each class or series, if any, entitled to vote thereon at such meeting, or by a vote of not less than a majority of the entire Board of Directors then in office.

Notwithstanding anything contained in these Articles of Incorporation to the contrary, this Article VIII may be amended, altered or repealed only by the affirmative vote of the holders of not less than 75% of the outstanding total shares of stock of the Corporation entitled to vote at a meeting of shareholders duly called for such purpose and by the affirmative vote of the holders of not less than 75% of the outstanding shares of each class or series, if any, entitled to vote thereon at such meeting.

ARTICLE IX

VOTING PROVISION

Pursuant to Section 180.1706 of the Wisconsin Statutes, the voting requirements of Sections 180.1003(3), 180.1103(3), 180.1202(3), 180.1402(3), and 180.1404(2) of the Wisconsin Statutes apply to the Corporation.

ARTICLE X

REGISTERED OFFICE

The address of the registered office of the Corporation is44 East Mifflin Street, Madison, Wisconsin 53703. The name of its initial registered agent at such address isCT Corporation System.

This instrument was drafted by:

Randall J. Erickson

Godfrey & Kahn, S.C.

780 North Water Street

Milwaukee, Wisconsin 53202

5

Sec. 179.77, 180.1105, 181.1105, and 183.1204 Wis. Stats. | State of Wisconsin DEPARTMENT OF FINANCIAL INSTITUTIONS Division of Corporate & Consumer Services

ARTICLES OF MERGER |  |

1. Non-Surviving Parties to the Merger:

Company Name:

NuEdge Systems, LLC

Indicate (X) | ¨ Limited Partnership (Ch. 179, Wis. Stats.) | Organized under the | ||

Entity Type | ¨ Business Corporation (Ch. 180, Wis. Stats.) | laws of | ||

| ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) | Delaware | |||

| x Limited Liability Company (Ch. 183, Wis. Stats.) | (state or country) |

Company Name:

Indicate (X) | ¨ Limited Partnership (Ch. 179, Wis. Stats.) | Organized under the | ||||

Entity Type | ¨ Business Corporation (Ch. 180, Wis. Stats.) | laws of | ||||

| ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) | ||||||

| ¨ Limited Liability Company (Ch. 183, Wis. Stats.) | (state or country) |

Schedule more non-surviving parties as an additional page.

2. Surviving Business Entity:

Company Name;

Metavante Corporation

Indicate (X) | ¨ Limited Partnership (Ch. 179, Wis. Stats.) | Organized under the | ||

Entity Type | x Business Corporation (Ch. 180, Wis. Stats.) | laws of | ||

| ¨ Nonstock Corporation (Ch. 181, Wis. Stats.) | Wisconsin | |||

| ¨ Limited Liability Company (Ch. 183, Wis. Stats.) | (state or country) |

FILING FEE—$150.00 | ||

DFI/CORP/2000(R02/10/03) Use of this form is voluntary. | 1 of 5 |

ARTICLES OF MERGER

3. The Plan of Merger included in this document was approved by each business entity that is a party to the merger in the manner required by the laws applicable to each business entity, and in accordance with ss. 180.1103, 180.1104 and 183.1202, if applicable.

CONTINGENCY STATEMENT—The surviving business entity of this merger is a domestic or foreign nonstock corporation. The Plan of Merger included in this document was approved by each business entity that is a party to the merger in the manner required by the laws applicable to each business entity, and in accordance with ss. 180.1103, 180.1104 and 183.1202, if applicable, and by a person other than the members or the board, if the approval of such person is required under s. 181.1103 (2) (c).

| ¨ | The approval of members is not required, and the Plan of Merger was approved by a sufficient vote of the board. |

| ¨ | The number of votes cast by each class of members to approve the Plan of Merger were sufficient for approval by that class. |

Membership Class | Number of Memberships | Number of Votes Entitled to | For | Against | ||||

(Append or attach the PLAN OF MERGER. OptionalPlan of Merger template on Pages 4 & 5)

4. (OPTIONAL) Effective Date and Time of Merger

These articles of merger, when filed, shall be effective on10/21/04 (date) at12:00 p.m (time)

(An effective date declared under this article may not be earlier than the date the document is delivered to the department for filing, nor more than 90 days after its delivery.If no affective data and time is declared, the effective date and time will be determined by ss. 179.11(2), 180.0123, 181.0123 or 183.0111, whichever section governs the surviving domestic entity.)

5. Executed on October 20, 2004 (date) by the surviving business entity on behalf of all parties to the merger. | /s/ Norrie J. Daroga | |

| (Signature) | ||

Mark (X) below the title of the person executing the document | ||

For a limited partnership Title:¨General Partner | /s/ Norrie J. Daroga | |

| (Printed Name) | ||

| For a corporation | ||

For a limited liability company Title:¨Member OR¨Manager | Title:¨President OR¨Secretary or other officer title Senior Vice President | |

| This document was drafted by: | John J. Lott, Esq. | |

| (Name the individual who drafted the document) | ||

DFI/CORP/2000(R02/10/03) | 2 of 5 |

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (the “Agreement”), dated the 20th day of October, 2004, is made and entered into by and between METAVANTE CORPORATION, a Wisconsin corporation (“Metavante”), and NUEDGE SYSTEMS, LLC, a Delaware limited liability company (“NuEdge”) (Metavante and NuEdge are jointly referred to herein as the “Merging Parties”).

RECITALS

A. NuEdge is the non-surviving company. Metavante is the surviving corporation. NuEdge is a wholly owned subsidiary of Metavante, and Metavante is the sole member of NuEdge.

B. The Board of Directors of Metavante, on behalf of Metavante and as the sole member of NuEdge, deems it advisable for the mutual benefit of the Merging Parties that NuEdge be merged with and into Metavante under and pursuant to the Wisconsin Business Corporation Law (the “WBCL”) and the Delaware Limited Liability Company Act (the “DLLCA”).

C. The Board of Directors of Metavante, on behalf of Metavante and as the sole member of NuEdge, has approved the merger of NuEdge with and into Metavante under the terms and conditions set forth below.

AGREEMENTS

In consideration of the Recitals and the mutual agreements below, the parties agree as follows:

ARTICLE I

THE MERGER

At the Effective Time (as defined below), upon the terms and subject to the conditions of this Agreement, and in accordance with the WBCL and DLLCA, NuEdge shall be merged with and into Metavante (the “Merger”). Following the Merger, Metavante shall continue as the surviving corporation (the “Surviving Corporation”) and the separate existence of NuEdge shall cease.

ARTICLE II

EFFECTIVE TIME

Subject to the terms and conditions set forth in this Agreement, Articles of Merger shall be duly executed and acknowledged by NuEdge and Metavante and thereafter delivered to (a) the Wisconsin Department of Financial Institutions and (b) the Secretary of State of the State of Delaware for filing pursuant to the WBCL and DLLCA, respectively, on or prior to the Effective Time. The Merger shall become effective at November, Central Standard Time on 10/21/2004 (the “Effective Time”).

ARTICLE III

EFFECTS OF THE MERGER

The Merger shall have the effects set forth in the WBCL and DLLCA. Without limiting the generality of the foregoing, at the Effective Time all the properties, rights, privileges, powers and franchises of NuEdge and Metavante shall vest in the Surviving Corporation and all debts, liabilities and duties of NuEdge and Metavante shall become the debts, liabilities and duties of the Surviving Corporation.

ARTICLE IV

ARTICLES OF INCORPORATION AND BY-LAWS

The Articles of Incorporation, as amended, if applicable, of Metavante in effect at the Effective Time shall be the Articles of Incorporation of the Surviving Corporation.

The By-Laws, as amended and/or restated, if applicable, of Metavante in effect at the Effective Time shall be the By-Laws of the Surviving Corporation until amended in accordance with the WBCL.

ARTICLE V

DIRECTORS AND OFFICERS

A. The directors of Metavante at the Effective Time shall be the directors of the Surviving Corporation, to hold office in accordance with the Articles of Incorporation and By-Laws, as either may be amended and/or restated, if applicable, of the Surviving Corporation until such director’s successor is duly elected or appointed and qualified.

B. The officers of Metavante at the Effective Time shall be the officers of the Surviving Corporation, to hold office in accordance with the Articles of Incorporation and By-Laws, as either may be amended and/or restated, if applicable, of the Surviving Corporation until such officer’s successor is duly elected or appointed and qualified.

2

ARTICLE VI

CANCELLATION OF MEMBERSHIP INTERESTS

A. At the Effective Time, each membership interest of NuEdge which is issued and outstanding immediately prior to the Effective Time shall, by virtue of the Merger and without any action on the part of NuEdge or Metavante, be canceled, retired and cease to exist.

B. At the Effective Time, each share of Metavante’s outstanding common stock (“Metavante Common Stock”) shall remain outstanding and continue to benefit the holders thereof.

ARTICLE VII

MISCELLANEOUS

A. This Agreement may not be modified, amended or supplemented except by mutual written agreement of Metavante and NuEdge. Either party may waive in writing any term or condition contained in this Agreement and intended to be for its benefit; provided, however, that no waiver by a party, whether by conduct or otherwise, in any one or more instances, shall be deemed or construed as a further or continuing waiver of any such term or condition.

B. This Agreement represents the entire agreement of the parties with respect to the subject matter hereof and no provision or document of any kind shall be included in or form a part of this Agreement except by mutual, written consent of Metavante and NuEdge.

C. The provisions contained in this Agreement are severable. If any provision of this Agreement is determined for any reason to be invalid, illegal or unenforceable, such determination shall not affect the validity, legality or enforceability of the remaining provisions, and the rights and obligations of the parties shall be construed and enforced as though this Agreement did not contain such invalid, illegal or unenforceable provision.

D. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Wisconsin. Section headings are solely for the convenience of the reader and are not intended for interpretation or construction of this Agreement.

[Remainder of page intentionally left blank; signature page follows]

3

IN WITNESS WHEREOF, the parties hereto have caused this Agreement and Plan of Merger to be executed as of the day of October, 2004.

| METAVANTE CORPORATION | ||

| BY | ||

| (signature) | ||

| (print name) |

| (title) |

| NUEDGE SYSTEMS, LLC | ||

| BY: Metavante Corporation, Sole Member | ||

| By: | ||

| (signature) | ||

| (print name) | ||

| (title) | ||

4

ARTICLES OF MERGER

John J. Lott, Esq.

Reinhart Boerner Van Deuren s.c.

1000 North Water Street, Suite 2100

Milwaukee, WI 53202

Your return address and phone number during the day: ( 414 ) 298—8197

INSTRUCTIONS: (Ref. Ss. 179.77, 180.1105,181.1105, and 183.1204, Wis. Stats. for document content)

Submit one original and one exact copy to Department of Financial Institutions, P O Box 7846, Madison WI, 53707-7846, together with a filing fee of $150.00, payable to the department. Filing fee is non-refundable. (If sent by Express or Priority U.S. mail, address to 345 W. Washington Ave, 3rd Floor, Madison WI, 53703.) Sign the document manually or otherwise as allowed under sec. 179.14 (lg) (c), 180.0103 (16), 181.0103 (23) or 183.0107 (lg) (c).NOTICE: This form may be used to accomplish a filing required or permitted by statute to be made with the department. Information requested may be used for secondary purposes. If you have any questions, please contact the Division of Corporate & Consumer Services at 608-261-7577. Hearing impaired may call 608-266-8818 for TDY. This document can be made available in alternate formats upon request to qualifying individuals with disabilities.

1. Enter the company name, type of business entity, and state of organization of each non-surviving party to the merger. Definitions of foreign entity types are set forth in ss. 179.01(4), 180.0103(9), 181.0103(13) and 183.0102(8), Wis. Stats.

2. Enter the company name, type of business entity, and state of organization of the surviving business entity.

3. This Article states the manner in which the Plan of Merger was approved. If the surviving entity is a domestic or foreign nonstock corporation, complete the CONTINGENCY STATEMENT. Append or attach the Plan of Merger. APlan of Merger template is available on pages 4 & 5. Its use is optional.

4. (Optional) If the merger is to take effect at a time other than the close of business on the day the articles of merger are delivered to the department for filing, state the effective date or date and time. An effective date may not be earlier than the date the document is delivered to the Department of Financial Institutions, nor a date more than 90 days after its delivery.

5. Enter the date of execution and the name and title of the person signing the document. If, for example, the surviving business entity is a domestic limited liability company, the Articles of Merger would be signed by a Member or Manager of the limited liability company; if the surviving business entity is a corporation, by an officer of the corporation, etc.

If the document is executed in Wisconsin, sec. 182.01(3) provides that it shall not be filed unless the name of the person (individual) who drafted it is printed, typewritten or stamped thereon in a legible manner. If the document is not executed in Wisconsin, enter that remark.

The surviving entity in the merger is alerted to record a conveyance of title ownership of all real estate located Wisconsin, pursuant to sec. 179.77(6)(c), 180.1106(1)(b), 181.1106(2) or 183.1205(2), whichever is applicable.

| DFI/CORP/2000(R02/10/03) | 3 of 5 |

ARTICLES OF MERGER OF

DERIVION CORPORATION

WITH AND INTO

METAVANTE CORPORATION

In accordance with Section 180.1105 of the Wisconsin Business Corporation Law, METAVANTE CORPORATION, a Wisconsin corporation (“Metavante Corporation”) and DERIVION CORPORATION, a Wisconsin corporation (“Derivion”), hereby adopt the following Articles of Merger:

ARTICLE I

The parties proposing to merge are Metavante Corporation and Derivion (the “Merger”).

ARTICLE II

At the effective time of the Merger, Derivion shall be merged with and into Metavante Corporation. After the Merger, Metavante Corporation shall be the surviving company and the separate existence and identity of Derivion shall cease to exist.

ARTICLE III

Additional terms and conditions of the Merger are set forth in the Agreement and Plan of Merger attached hereto as Exhibit A (the “Agreement”).

ARTICLE IV

The Agreement was approved by Metavante Corporation and Derivion in accordance with Section 180.1104 of the Wisconsin Business Corporation Law.

ARTICLE V

The effective time of the Merger shall be 11:59 p.m. (central time) on December 30, 2005.

IN WITNESS WHEREOF, the parties hereto have caused these Articles of Merger to be executed as of the 27th day of December 2005.

| METAVANTE CORPORATION | ||

| BY | /s/ Norrie J. Daroga | |

Norrie J. Daroga, Executive Vice President and Corporate Secretary | ||

| DERIVION CORPORATION | ||

| BY | /s/ Michael D. Hayford | |

| Michael D. Hayford, President | ||

This document was drafted by John J. Lott, Esq.

This document must be filed with the Wisconsin Department of Financial Institutions.

| Please return to: | Tanya R. Braga, Paralegal Reinhart Boerner Van Deuren s.c. 1000 North Water Street Suite 2100 Milwankee, WI 53202 |

2

EXHIBIT A

AGREEMENT AND PLAN OF MERGER OF

DERIVION CORPORATION

WITH AND INTO

METAVANTE CORPORATION

THIS AGREEMENT AND PLAN OF MERGER, dated this 27th day of December, 2005, is made and entered into by and between DERIVION CORPORATION, a Wisconsin corporation (“Derivion”) and METAVANTE CORPORATION, a Wisconsin corporation (“Metavante Corporation) (together, Derivion and Metavante Corporation shall be referred to hereinafter as the “Merging Corporations”).

RECITALS

A. Metavante Corporation owns all of the issued and outstanding shares of the capital stock of Derivion.

B. The Board of Directors of Metavante Corporation and the Sole Director of Derivion deem it to be in the best interest of the Merging Corporations that Derivion merge with and into Metavante Corporation (the “Merger”).

AGREEMENTS

In consideration of the recital and mutual agreements which follow, the parties agree as follows:

ARTICLE I

PLAN OF MERGER

1. At the “Effective Time” of the Merger (as defined in section 5 of this Agreement), Derivion will be merged with and into Metavante Corporation in accordance with section 180.1104 of the Wisconsin Business Corporation Law. After the Merger, Metavante Corporation will be the surviving entity, and the separate existence and identity of Derivion shall cease.

2. At the Effective Time of the Merger:

(a) Metavante Corporation shall possess all the rights, privileges, immunities and franchises, of a public nature as well as of a private nature, of each of the Merging Corporations;

(b) All property, real, personal and mixed and all debts due on whatever account, including subscriptions to shares and all other chooses in action, and every interest, of or belonging to or due to each of the Merging Corporations, shall be taken and deemed to be transferred to and vested in Metavante Corporation without further act or deed;

(c) Title to any real estate, or any interest therein, vested in each of the Merging Corporations shall not revert or be in any way impaired by reason of the Merger:

(d) Metavante Corporation shall be responsible and liable for all the liabilities and obligations of each of the Merging Corporations;

(e) Any claim existing or action or proceeding pending by or against either of the Merging Corporations may be prosecuted to judgment as if the Merger had not taken place, or Metavante Corporation may be substituted as the party in interest; and

(f) Neither the rights of creditors nor any liens upon the property of the Merging Corporations shall be impaired by the Merger.

3. At the Effective Time of the Merger, each share of the $.01 par value common stock of Derivion shall be cancelled. All of the issued and outstanding shares of stock of the surviving entity shall remain outstanding and will not be affected by the Merger.

4. The Effective Time of the Merger shall be 11:59 p.m. (central time) on December 30, 2005.

(SIGNATURE PAGE TO FOLLOW)

2

IN WITNESS WHEREOF, Derivion and Metavante Corporation have caused this Agreement and Plan of Merger to be executed.

| METAVANTE CORPORATION | ||

| BY | /s/ Norrie J. Daroga | |

Norrie J. Daroga, Executive Vice President and Corporate Secretary | ||

| DERIVION CORPORATION | ||

| BY | /s/ Michael D. Hayford | |

| Michael D. Hayford, President | ||

** TOTAL PAGE. 12 **

3

ARTICLES OF MERGER OF

METAVANTE INTERNATIONAL, INC.

WITH AND INTO

METAVANTE CORPORATION

In accordance with Section 180.1105 of the Wisconsin Business Corporation Law, METAVANTE CORPORATION, a Wisconsin corporation (“Metavante Corporation”) and METAVANTE INTERNATIONAL, INC., a New Hampshire corporation (“Metavante International”), hereby adopt the following Articles of Merger:

ARTICLE I

The parties proposing to merge are Metavante Corporation and Metavante International (the “Merger”).

ARTICLE II

At the effective time of the Merger, Metavante International shall be merged with and into Metavante Corporation. After the Merger, Metavante Corporation shall be the surviving company and the separate existence and identity of Metavante International shall cease to exist.

ARTICLE III

Additional terms and conditions of the Merger are set forth in the Agreement and Plan of Merger attached hereto as Exhibit A (the “Agreement”).

ARTICLE IV

The Agreement was approved by Metavante Corporation in accordance with Section 180.1104 of the Wisconsin Business Corporation Law and by Metavante International in accordance with Section 293-A:11.04 of the New Hampshire Business Corporation Act.

ARTICLE V

The effective time of the Merger shall be 11:59 p.m. (central time) on December 30, 2005.

IN WITNESS WHEREOF, the parties hereto have caused these Articles of Merger to be executed as of the 27th day of December 2005.

| METAVANTE CORPORATION | ||

| BY | /s/ Norrie J. Daroga | |

Norrie J. Daroga, Executive Vice President and Corporate Secretary | ||

METAVANTE INTERNATIONAL INC. | ||

| BY | /s/ Michel D. Hayford | |

| Michael D. Hayford, Vice President | ||

This document was drafted by John J. Lott, Esq.

This document must be filed with the Wisconsin Department of Financial Institutions.

| Please return to: | Tanya R. Braga, Paralegal | |

| Reinhart Boerner Van Deuren s.c. | ||

| 1000 North Water Street | ||

| Suite 2100 | ||

| Milwaukee, WI 53202 |

2

EXHIBIT A

AGREEMENT AND PLAN OF MERGER OF

METAVANTE INTERNATIONAL, INC.

WITH AND INTO

METAVANTE CORPORATION

THIS AGREEMENT AND PLAN OF MERGER, dated this 27th day of December, 2005, is made and entered into by and between METAVANTE INTERNATIONAL, INC. a New Hampshire corporation (“Metavante International”) and METAVANTE CORPORATION, a Wisconsin corporation (“Metavante Corporation), (together, Metavante International and Metavante Corporation shall be referred to hereinafter as the “Merging Corporations”).

RECITALS

A. Metavante Corporation owns all of the issued and outstanding shares of the capital stock of Metavante International.

B. The Board of Directors of Metavante Corporation and the Sole Director of Metavante International deem it to be in the best interest of the Merged Entities that Metavante International merge with and into Metavante Corporation (the “Merger”).

AGREEMENTS

In consideration of the recital and mutual agreements which follow, the parties agree as follows:

ARTICLE I

PLAN OF MERGER

1. At the “Effective Time” of the Merger (as defined in section 5 of this Agreement), Metavante International will be merged with and into Metavante Corporation in accordance with section 180.1104 of the Wisconsin Business Corporation Law and section 298-A:11.04 of the New Hampshire Business Corporation Act. After the Merger, Metavante Corporation will be the surviving corporation, and the separate existence and identity of Metavante International shall cease.

2. At the Effective Time of the Merger:

(a) Metavante Corporation shall possess all the rights, privileges, immunities and franchises, of a public nature as well as of a private nature, of each of the Merging Corporations;

(b) All property, real, personal and mixed and all debts due on whatever account, including subscriptions to shares and all other chooses in action, and

every interest, of or belonging to or due to each of the Merging Corporations, shall be taken and deemed to be transferred to and vested in Metavante Corporation without further act or deed;

(c) Title to any real estate, or any interest therein, vested in each of the Merging Corporations shall not revert or be in any way impaired by reason of the Merger;

(d) Metavante Corporation shall be responsible and liable for all the liabilities and obligations of each of the Merging Corporations;

(e) Any claim existing or action or proceeding pending by or against either of the Merging Corporations may be prosecuted to judgment as if the Merger had not taken place, or Metavante Corporation may be substituted as the party in interest; and

(f) Neither the rights of creditors nor any liens upon the property of the Merging Corporations shall be impaired by the Merger.

3. At the Effective Time of the Merger, each share of the no par value common stock of Metavante International shall be cancelled without consideration. All of the issued and outstanding shares of stock of the surviving corporation shall remain outstanding and will not be affected by the Merger.

4. The Effective Time of the Merger shall be 11:59 p.m. (central time) on December 30, 2005.

(SIGNATURE PAGE TO FOLLOW)

2

IN WITNESS WHEREOF, Metavante International and Metavante Corporation have caused this Agreement and Plan of Merger to be executed.

| METAVANTE CORPORATION | ||

| BY | /s/ Norrie J. Daroga | |

Norrie J. Daroga, Executive Vice President and Corporate Secretary | ||

| METAVANTE INTERNATIONAL, INC. | ||

| BY | /s/ Michael D. Hayford | |

| Michael D. Hayford, Vice President | ||

3

ARTICLES OF MERGER OF

METAVANTE ACQUISITION COMPANY LLC

WITH AND INTO

METAVANTE CORPORATION

In accordance with Section 180.1105 of the Wisconsin Business Corporation Law, METAVANTE CORPORATION, a Wisconsin corporation (“Metavante Corporation”) and METAVANTE ACQUISITION COMPANY LLC, a Delaware limited liability company (“MAC”), hereby adopt the following Articles of Merger:

ARTICLE I

The parties proposing to merge are Metavante Corporation and MAC (the “Merger”).

ARTICLE II

At the effective time of the Merger, MAC shall be merged with and into Metavante Corporation. After the Merger, Metavante Corporation shall be the surviving company and the separate existence and identity of MAC shall cease to exist.

ARTICLE III

Additional terms and conditions of the Merger are set forth in the Agreement and Plan of Merger attached hereto as Exhibit A (the “Agreement”).

ARTICLE IV

The Agreement was approved by Metavante Corporation and MAC in accordance with Section 180.1104 of the Wisconsin Business Corporation Law and Section 18-209 of the Delaware Limited Liability Company Act.

ARTICLE V

The effective time of the Merger shall be 6:00 p.m. central time on May 15, 2006.

IN WITNESS WHEREOF, the parties hereto have caused these Articles of Merger to be executed as of the 26th day of April, 2006.

| METAVANTE CORPORATION | ||

| BY | /s/ Norrie J. Daroga | |

| Norrie J. Daroga, Executive Vice | ||

| President and Corporate Secretary | ||

| METAVANTE ACQUISITION COMPANY LLC | ||

| BY | /s/ Norrie J. Daroga | |

| Norrie J. Daroga, Manager | ||

This document was drafted by Lisa M. O’Donnell, Esq.

This document must be filed with the Wisconsin Department of Financial Institutions.

| Please return to: | Tanya R. Braga, Paralegal | |

| Reinhart Boerner Van Deuren s.c. | ||

| 1000 North Water Street | ||

| Suite 2100 | ||

| Milwaukee, WI 53202 |

2

EXHIBIT A

AGREEMENT AND PLAN OF MERGER OF

METAVANTE ACQUISITION COMPANY LLC

WITH AND INTO

METAVANTE CORPORATION

THIS AGREEMENT AND PLAN OF MERGER, dated this 26th day of April, 2006, is made and entered into by and between METAVANTE ACQUISITION COMPANY LLC, a Delaware limited liability company (“MAC”) and METAVANTE CORPORATION, a Wisconsin corporation (“Metavante Corporation”) (together, MAC and Metavante Corporation shall be referred to hereinafter as the “Merging Corporations”).

RECITALS

A. Metavante Corporation owns all of the membership interest of MAC.

B. The Board of Directors of Metavante Corporation and the Managers of MAC deem it to be in the best interest of the Merging Corporations that MAC merge with and into Metavante Corporation (the “Merger”).

AGREEMENTS

In consideration of the recital and mutual agreements which follow, the parties agree as follows:

ARTICLE I

PLAN OF MERGER

1. At the “Effective Time” of the Merger (as defined in Section 4 of this Agreement), MAC will be merged with and into Metavante Corporation in accordance with Section 180.1104 of the Wisconsin Business Corporation Law and Section 18-209 of the Delaware Limited Liability Company Act. After the Merger, Metavante Corporation will be the surviving entity, and the separate existence and identity of MAC shall cease.

2. At the Effective Time of the Merger.

(a) Metavante Corporation shall possess all the rights, privileges, immunities and franchises, of a public nature as well as of a private nature, of each of the Merging Corporations;

(b) All property, real, personal and mixed and all debts due on whatever account, including subscriptions to shares and all other chooses in action, and every interest, of or belonging to or due to each of the Merging Corporations, shall be taken and deemed to be transferred to and vested in Metavante Corporation without further act or deed;

(c) Title to any real estate, or any interest therein, vested in each of the Merging Corporations shall not revert or be in any way impaired by reason of the Merger;

(d) Metavante Corporation shall be responsible and liable for all the liabilities and obligations of each of the Merging Corporations;

(e) Any claim existing or action or proceeding pending by or against either of the Merging Corporations may be prosecuted to judgment as if the Merger had not taken place, or Metavante Corporation may be substituted as the party in interest; and

(f) Neither the rights of creditors nor any liens upon the property of the Merging Corporations shall be impaired by the Merger.

3. At the Effective Time of the Merger, each membership interest unit of MAC shall be cancelled. All of the issued and outstanding shares of stock of Metavante Corporation shall remain outstanding and will not be affected by the Merger.

4. The Effective Time of the Merger shall be 6:00 p.m. (central time) on May 15, 2006.

(SIGNATURE PAGE TO FOLLOW)

2

IN WITNESS WHEREOF, MAC and Metavante Corporation have caused this Agreement and Plan of Merger to be executed.

| METAVANTE CORPORATION | ||

| BY | /s/ Norrie J. Daroga | |

| Norrie J. Daroga, Executive Vice | ||

| President and Corporate Secretary | ||

| METAVANTE ACQUISITION COMPANY LLC | ||

| BY | /s/ Norrie J. Daroga | |

| Norrie J. Daroga, Manager | ||

3