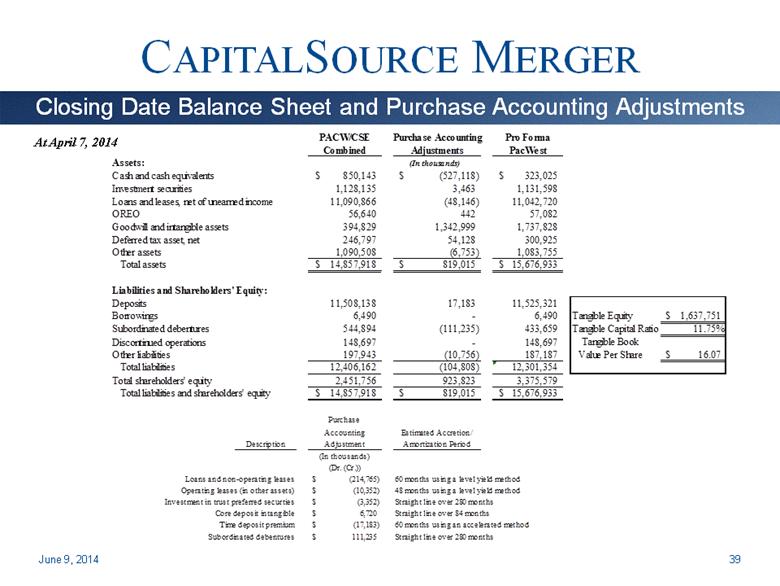

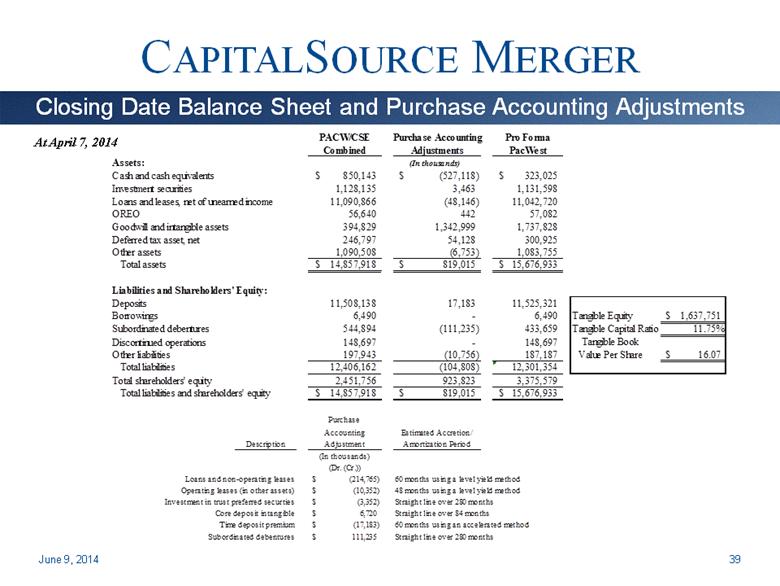

| CAPITALSOURCE MERGER June 9, 2014 39 Closing Date Balance Sheet and Purchase Accounting Adjustments At April 7, 2014 PACW/CSE Purchase Accounting Pro Forma Combined Adjustments PacWest Assets: (In thousands) Cash and cash equivalents 850,143 $ (527,118) $ 323,025 $ Investment securities 1,128,135 3,463 1,131,598 Loans and leases, net of unearned income 11,090,866 (48,146) 11,042,720 OREO 56,640 442 57,082 Goodwill and intangible assets 394,829 1,342,999 1,737,828 Deferred tax asset, net 246,797 54,128 300,925 Other assets 1,090,508 (6,753) 1,083,755 Total assets 14,857,918 $ 819,015 $ 15,676,933 $ Liabilities and Shareholders' Equity: Deposits 11,508,138 17,183 11,525,321 Borrowings 6,490 - 6,490 Tangible Equity 1,637,751 $ Subordinated debentures 544,894 (111,235) 433,659 Tangible Capital Ratio 11.75% Discontinued operations 148,697 - 148,697 Other liabilities 197,943 (10,756) 187,187 16.07 $ Total liabilities 12,406,162 (104,808) 12,301,354 Total shareholders' equity 2,451,756 923,823 3,375,579 Total liabilities and shareholders' equity 14,857,918 $ 819,015 $ 15,676,933 $ Purchase Accounting Estimated Accretion/ Description Adjustment Amortization Period (In thousands) (Dr. (Cr.)) Loans and non-operating leases (214,765) $ 60 months using a level yield method Operating leases (in other assets) (10,352) $ 48 months using a level yield method Investment in trust preferred securties (3,352) $ Straight line over 280 months Core deposit intangible 6,720 $ Straight line over 84 months Time deposit premium (17,183) $ 60 months using an accelerated method Subordinated debentures 111,235 $ Straight line over 280 months Tangible Book Value Per Share |