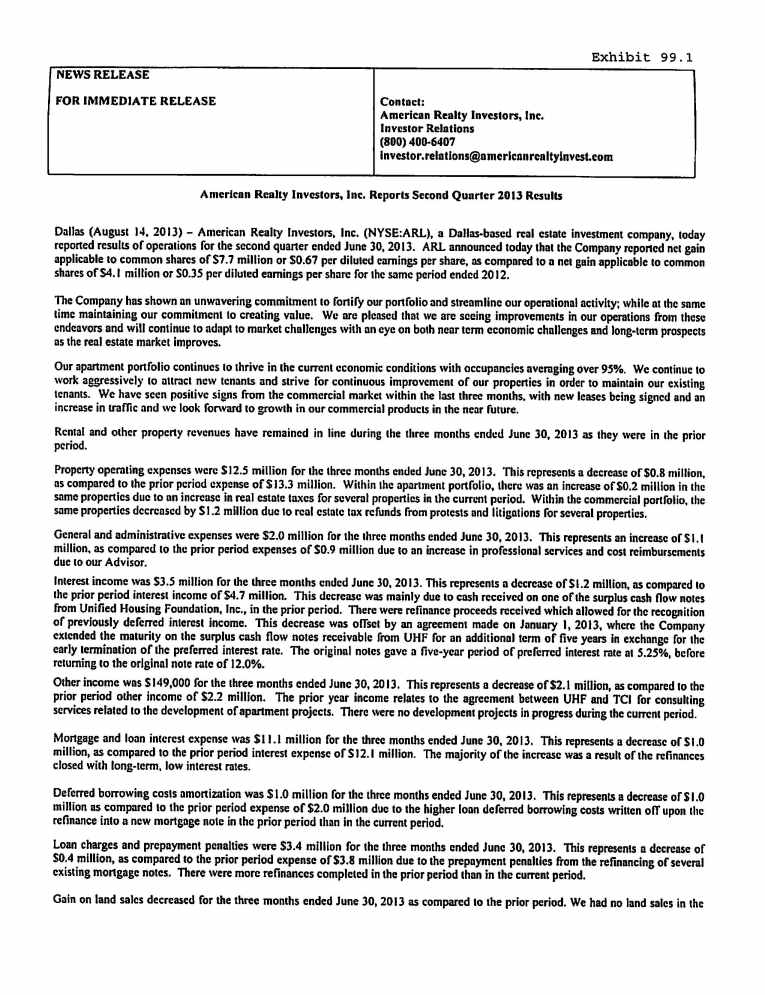

| AMERICAN REALTY INVESTORS, INC. | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (unaudited) | |

| | | June 30, | | | June 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | (dollars in thousands, except share and per share amounts) | |

| Revenues: | | | | | | | | | | | | |

Rental and other property revenues (including $166 and $167 for the three months and $331 and $335 for the six months ended 2013 and 2012 respectively from related parties) | | $ | 27,182 | | | $ | 27,284 | | | $ | 53,973 | | | $ | 53,912 | |

| | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | |

Property operating expenses (including $194 and $244 for the three months and $424 and $509 for the six months ended 2013 and 2012 respectively from related parties) | | | 12,544 | | | | 13,253 | | | | 25,577 | | | | 26,116 | |

| Depreciation and amortization | | | 5,445 | | | | 4,941 | | | | 10,304 | | | | 9,918 | |

General and administrative (including $1,044 and $1,017 for the three months and $1,986 and $1,936 for the six months ended 2013 and 2012 respectively from related parties) | | | 2,043 | | | | 919 | | | | 4,257 | | | | 3,777 | |

| Provision on impairment of notes receivable and real estate assets | | | 800 | | | | - | | | | 800 | | | | - | |

| Advisory fee to related party | | | 2,487 | | | | 2,700 | | | | 5,042 | | | | 5,359 | |

| Total operating expenses | | | 23,319 | | | | 21,813 | | | | 45,980 | | | | 45,170 | |

| Operating income | | | 3,863 | | | | 5,471 | | | | 7,993 | | | | 8,742 | |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

Interest income (including $3,420 and $4,624 for the three months and $6,493 and $7,865 for the six months ended 2013 and 2012 respectively from related parties) | | | 3,512 | | | | 4,723 | | | | 7,053 | | | | 8,063 | |

Other income (including $0 and $1,500 for the three months and $0 and $3,000 for the six months ended 2013 and 2012 respectively from related parties) | | | 149 | | | | 2,235 | | | | 2,685 | | | | 3,981 | |

Mortgage and loan interest (including $581 and $931 for the three months and $865 and $1,853 for the six months ended 2013 and 2012 respectively from related parties) | | | (11,065 | ) | | | (12,061 | ) | | | (22,169 | ) | | | (24,488 | ) |

| Deferred borrowing costs amortization | | | (960 | ) | | | (1,975 | ) | | | (3,436 | ) | | | (2,887 | ) |

| Loan charges and prepayment penalties | | | (3,380 | ) | | | (3,769 | ) | | | (7,362 | ) | | | (6,161 | ) |

| Loss on sale of investments | | | - | | | | - | | | | - | | | | (362 | ) |

| Earnings from unconsolidated investees | | | (25 | ) | | | 33 | | | | 188 | | | | 150 | |

| Total other expenses | | | (11,769 | ) | | | (10,814 | ) | | | (23,041 | ) | | | (21,704 | ) |

| Loss before gain on land sales, non-controlling interest, and taxes | | | (7,906 | ) | | | (5,343 | ) | | | (15,048 | ) | | | (12,962 | ) |

| Gain (loss) on land sales | | | - | | | | 4,738 | | | | (35 | ) | | | 3,716 | |

| Loss from continuing operations before tax | | | (7,906 | ) | | | (605 | ) | | | (15,083 | ) | | | (9,246 | ) |

| Income tax benefit | | | 6,423 | | | | 2,217 | | | | 8,931 | | | | 2,625 | |

| Net income (loss) from continuing operations | | | (1,483 | ) | | | 1,612 | | | | (6,152 | ) | | | (6,621 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | |

| Income (loss) from discontinued operations | | | 276 | | | | 1,666 | | | | 216 | | | | (757 | ) |

| Gain on sale of real estate from discontinued operations | | | 18,074 | | | | 4,668 | | | | 25,301 | | | | 8,256 | |

| Income tax expense from discontinued operations | | | (6,423 | ) | | | (2,217 | ) | | | (8,931 | ) | | | (2,625 | ) |

| Net income from discontinued operations | | | 11,927 | | | | 4,117 | | | | 16,586 | | | | 4,874 | |

| Net income (loss) | | | 10,444 | | | | 5,729 | | | | 10,434 | | | | (1,747 | ) |

| Net (income) loss attributable to non-controlling interest | | | (2,090 | ) | | | (1,064 | ) | | | (1,706 | ) | | | 112 | |

| Net income (loss) attributable to American Realty Investors, Inc. | | | 8,354 | | | | 4,665 | | | | 8,728 | | | | (1,635 | ) |

| Preferred dividend requirement | | | (613 | ) | | | (613 | ) | | | (1,226 | ) | | | (1,226 | ) |

| Net income (loss) applicable to common shares | | $ | 7,741 | | | $ | 4,052 | | | $ | 7,502 | | | $ | (2,861 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings per share - basic | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | $ | (0.36 | ) | | $ | (0.01 | ) | | $ | (0.79 | ) | | $ | (0.67 | ) |

| Income from discontinued operations | | | 1.03 | | | | 0.36 | | | | 1.44 | | | | 0.42 | |

| Net income (loss) applicable to common shares | | $ | 0.67 | | | $ | 0.35 | | | $ | 0.65 | | | $ | (0.25 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings per share - diluted | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | $ | (0.36 | ) | | $ | (0.01 | ) | | $ | (0.79 | ) | | $ | (0.67 | ) |

| Income from discontinued operations | | | 1.03 | | | | 0.36 | | | | 1.44 | | | | 0.42 | |

| Net income (loss) applicable to common shares | | $ | 0.67 | | | $ | 0.35 | | | $ | 0.65 | | | $ | (0.25 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average common share used in computing earnings per share | | | 11,525,389 | | | | 11,525,389 | | | | 11,525,389 | | | | 11,525,389 | |

| Weighted average common share used in computing diluted earnings per share | | | 11,525,389 | | | | 11,525,389 | | | | 11,525,389 | | | | 11,525,389 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Amounts attributable to American Realty Investors, Inc. | | | | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | $ | (3,573 | ) | | $ | 548 | | | $ | (7,858 | ) | | $ | (6,509 | ) |

| Income from discontinued operations | | | 11,927 | | | | 4,117 | | | | 16,586 | | | | 4,874 | |

| Net income (loss) applicable to American Realty Investors, Inc. | | $ | 8,354 | | | $ | 4,665 | | | $ | 8,728 | | | $ | (1,635 | ) |