SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material Under Rule 14a-12 | | |

CENTERSTATE BANKS OF FLORIDA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:1 |

| | 4) | Proposed maximum aggregate value of transaction: |

| | 1 | Set forth the amount on which the filing fee is calculated and state how it was determined: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount previously paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

CENTERSTATE BANKS OF FLORIDA, INC.

March 26, 2004

TO THE SHAREHOLDERS OF

CENTERSTATE BANKS OF FLORIDA, INC.

You are cordially invited to attend the Annual Meeting of Shareholders of CenterState Banks of Florida, Inc. which will be held at the Winter Haven Chamber of Commerce, 2nd Floor Auditorium, 401 Avenue B NW, Winter Haven, Florida 33881, on Tuesday, April 27, 2004 beginning at 10:00 a.m.

At the Annual Meeting you will be asked to consider and vote upon the reelection of the directors to serve until the next Annual Meeting of Shareholders. You also will be asked to consider approval of the CenterState Banks of Florida, Inc. Employee Stock Purchase Plan. Shareholders also will consider and vote upon such other or further business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

We hope you can attend the meeting and vote your shares in person. In any case, we would appreciate your completing the enclosed proxy and returning it to us. This action will ensure that your preferences will be expressed on the matters that are being considered. If you are able to attend the meeting, you may vote your shares in person.

We want to thank you for your support during the past year. If you have any questions about the Proxy Statement, please do not hesitate to call us.

Sincerely,

James H. White

Chairman of the Board

CENTERSTATE BANKS OF FLORIDA, INC.

1101 FIRST STREET SOUTH, SUITE 202

WINTER HAVEN, FL 33880

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 27, 2004

Notice is hereby given that the Annual Meeting of Shareholders of CenterState Banks of Florida, Inc. (“CenterState”) will be held at Winter Haven Chamber of Commerce, 2nd Floor Auditorium, 401 Avenue B NW, Winter Haven, Florida 33881, on Tuesday, April 27, 2004 beginning at 10:00 a.m. (“Annual Meeting”), for the following purposes:

1.Elect Directors. To elect directors to serve until the Annual Meeting of Shareholders in 2005.

2.Approve Employee Stock Purchase Plan. To approve the CenterState Banks of Florida, Inc. Employee Stock Purchase Plan.

3.Other Business. To transact such other or further business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Only shareholders of record at the close of business on February 27, 2004 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. All shareholders, whether or not they expect to attend the Annual Meeting in person, are requested to complete, date, sign and return the enclosed proxy to CenterState in the accompanying envelope. The proxy may be revoked by the person executing the proxy at any time before it is exercised by filing with the Secretary of CenterState an instrument of revocation or a duly executed proxy bearing a later date, or by electing to vote in person at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

James H. White

| | | | |

| March 26, 2004 | | Chairman of the Board |

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY IN THE ENVELOPE PROVIDED WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY.

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

OF

CENTERSTATE BANKS OF FLORIDA, INC.

TO BE HELD ON

APRIL 27, 2004

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of CenterState Banks of Florida, Inc. (“CenterState”) in connection with the solicitation of proxies by the Board of Directors of CenterState from holders of the outstanding shares of the $.01 par value common stock of CenterState (“CenterState Common Stock”) for use at the Annual Meeting of Shareholders of CenterState to be held on Tuesday, April 27, 2004, and at any adjournment or postponement thereof (“Annual Meeting”). The Annual Meeting is being held to elect directors to serve until the Annual Meeting of Shareholders in 2005, to approve the CenterState Banks of Florida, Inc. Employee Stock Purchase Plan (the “Employee Plan”), and transact such other or further business as may properly come before the Annual Meeting and any adjournment or postponement thereof. The Board of Directors of CenterState knows of no other business that will be presented for consideration at the Annual Meeting other than the matters described in this Proxy Statement. This Proxy Statement is dated March 26, 2004, and it and the accompanying notice and form of proxy are first being mailed to the shareholders of CenterState on or about March 26, 2004.

The principal executive offices of CenterState are located at 1101 First Street South, Suite 202, Winter Haven, Florida 33880. The telephone number of CenterState at such offices is (863) 293-2600.

Record Date, Solicitation and Revocability of Proxies

The Board of Directors of CenterState has fixed the close of business on February 27, 2004, as the record date for the determination of CenterState shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of CenterState Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting. At the close of business on such date, there were 3,369,380 shares of CenterState Common Stock outstanding and entitled to vote held by approximately 1,300 shareholders of record. Holders of CenterState Common Stock are entitled to one vote on each matter considered and voted upon at the Annual Meeting for each share of CenterState Common Stock held of record at the close of business on February 27, 2004. The affirmative vote of the holders of a plurality of shares of CenterState Common Stock represented and entitled to vote at the Annual Meeting at which a quorum is present is required for the election of directors and the affirmative vote of a majority of the shares of stock present in person or by proxy is required for approval of the Employee Plan.

Shares of CenterState Common Stock represented by a properly executed proxy, if such proxy is received prior to the vote at the Annual Meeting and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated in such proxy.IF NO INSTRUCTIONS ARE INDICATED, SUCH SHARES OF CENTERSTATE COMMON STOCK WILL BE VOTED FOR THE ELECTION AS DIRECTORS OF CENTERSTATE OF THE NOMINEES LISTED BELOW, FOR APPROVAL OF THE EMPLOYEE PLAN, AND IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS AS TO ANY OTHER MATTER WHICH MAY PROPERLY COME BEFORE THE ANNUAL MEETING.

A shareholder who has given a proxy may revoke it at any time prior to its exercise at the Annual Meeting by either (i) giving written notice of revocation to the Secretary of CenterState, (ii) properly submitting to the Secretary of CenterState a duly executed proxy bearing a later date, or (iii) appearing in person at the Annual Meeting and voting in person. All written notices of revocation or other communications with respect to revocation of proxies should be addressed as follows: CenterState Banks of Florida, Inc., 1101 First Street South, Suite 202, Winter Haven, Florida 33880, Attention: James H. White.

A copy of the 2003 Annual Report to Shareholders, including financial statements as of and for the years ended December 31, 2003 and 2002, accompanies this Proxy Statement.

PROPOSAL ONE

ELECTION OF DIRECTORS

General

The Annual Meeting is being held to elect directors of CenterState to serve a one- year term of office. Each director of CenterState serves for a term expiring at the next Annual Meeting of Shareholders, and until his successor is duly elected and qualified. Accordingly, the terms of each member of the Board expire at the Annual Meeting and, therefore, such individuals are standing for reelection to a one-year term expiring at the Annual Meeting of Shareholders in 2005.

All shares represented by valid proxies received pursuant to this solicitation and not revoked before they are exercised will be voted in the manner specified therein. If no specification is made, the proxies will be voted for the election of the nominees listed below. In the event that any nominee is unable to serve (which is not anticipated), the persons designated as proxies will cast votes for the remaining nominees and for such other persons as they may select.

Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ELECTION OF THE NOMINEES LISTED BELOW.

The following table sets forth the name of each nominee or director continuing in office of CenterState; a description of his position and offices with CenterState other than as a director, if any; a brief description of his principal occupation and business experience during at least the last five years; and certain other information including the director’s age and the number of shares of CenterState Common Stock beneficially owned by the director on February 27, 2004. Each of the following individuals is also serving as a director of either First National Bank of Osceola County, Community National Bank of Pasco County, First National Bank of Polk County, or CenterState Bank of Florida, which are wholly-owned subsidiaries of CenterState. For information concerning membership on committees of the Board of Directors, see “ELECTION OF DIRECTORS — Information About the Board of Directors and Its Committees.”

| | | | |

Nominee, Year First Elected a

Director, Age and address of

5% Shareholder

| | Information About Nominee or Director Continuing in Office

| | Amount, Percentage and

Nature of Beneficial

Ownership of

CenterState Common Stock (a)

|

James H. White, 78 3 Spencer Shores Haines City, FL 33844 1999 | | Chairman of the Board of CenterState; Director of First National Bank of Osceola County, Community National Bank of Pasco County, First National Bank of Polk County and CenterState Bank of Florida | | 188,433(b)

5.56% |

2

| | | | |

Nominee, Year First Elected a

Director, Age and address of

5% Shareholder

| | Information About Nominee or Director Continuing in Office

| | Amount, Percentage and

Nature of Beneficial

Ownership of

CenterState Common Stock (a)

|

G. Robert Blanchard, Sr., 77 1999 | | Investor | | 5,454

(c)

0.16% |

| | |

James H. Bingham, 55 1999 | | President of Concire Centers, Inc. (commercial real estate company) | | 51,022

(d)

1.51% |

| | |

Terry W. Donley, 56 1999 | | President of Donley Citrus, Inc. (citrus harvesting and production) | | 43,979

(e)

1.30% |

| | |

Bryan W. Judge, 76 1999 | | Self-employed, farming (1994-present); Chief Executive Officer of Judge Farms (1965-1994) | | 34,109

(f)

1.01% |

| | |

Lawrence W. Maxwell, 60 2002 Mountain Lake Route 17 Lake Wales, FL 33853 | | Chairman, Century Realty Funds, Inc. | | 248,240

(g)

7.35% |

| | |

Thomas E. Oakley, 61 2002 | | President, Oakley Groves, Inc., Director of Alico, Inc., a public company (citrus business) | | 40,289

(h)

1.19% |

| | |

Ernest S. Pinner, 56 2002 | | Chairman of First National Bank of Osceola County, First National Bank of Polk County and Community National Bank of Pasco County (2002 to present); Chief Executive Officer and President (2002 to present) and Executive Vice President (2000 to 2002) of CenterState; President and Chief Executive Officer of CenterState Bank of Florida (2000 to 2003); Chairman of CenterState Bank of Florida (2003 to present); Chairman of CenterState Bank Mid Florida (2004 to present); Area President and Senior Vice President of First Union National Bank (1986 to 1999) | | 40,377

(i)

1.19% |

| | |

J. Thomas Rocker, 62 1999 | | Investor | | 27,672

(j)

0.82% |

| (a) | Information relating to beneficial ownership of CenterState Common Stock by directors is based upon information furnished by each person using “beneficial ownership” concepts set forth in rules of the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended. Under such rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such |

3

| | security. A person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under such rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may disclaim any beneficial interest. Accordingly, nominees and directors continuing in office are named as beneficial owners of shares as to which they may disclaim any beneficial interest. Except as otherwise indicated in the notes to this table, directors possessed sole voting and investment power as to all shares of CenterState Common Stock set forth opposite their names. |

| (b) | Consists of 69,910 shares held by his spouse, 24,161 shares held jointly with his spouse, 60,914 shares held as trustee, 14,766 shares held by his IRA, and presently exercisable options for 18,682 shares. |

| (c) | Includes 404 shares owned individually, and 5,050 shares held as trustee. |

| (d) | Includes 22,472 shares held as trustee, 808 shares held jointly with his spouse, 202 shares held by his spouse, 1,269 shares held by a company he controls, 120 held by a dependent child and 26,151 shares held individually. |

| (e) | Includes 1,593 shares held by his dependent child, 35,682 shares owned individually, and presently exercisable options for 6,704 shares. |

| (f) | Includes 400 shares owned individually and 33,709 shares held jointly with his spouse. |

| (g) | Includes 241,536 shares owned jointly with spouse and presently exercisable options for 6,704 shares. |

| (h) | Includes 1,343 shares owned individually, 32,242 shares held jointly with spouse and presently exercisable options for 6,704 shares. |

| (i) | Includes 5,787 shares owned individually and presently exercisable options for 34,590 shares. |

| (j) | Includes 14,419 shares owned individually, 4,050 shares held jointly with his spouse and 9,203 shares owned by his spouse. |

Information About the Board of Directors and Its Committees

The Board of Directors of CenterState held eight meetings during the year ended December 31, 2003. All of the directors attended at least 75% of the aggregate total number of meetings of the Board of Directors and meetings of the committees of the Board on which they serve. CenterState’s Board of Directors presently has four committees. Certain information regarding the function of these standing committees, their membership, and the number of meetings held during 2003 follows:

The Compensation Committee is responsible for establishing appropriate levels of compensation and benefits. The current members of this committee consist of Messrs. Maxwell (Chairman), Blanchard, Judge and Rocker. The committee held three meetings during 2003.

The Loan Committee is responsible for reviewing and approving credit requests in excess of certain limits established for the respective Boards of Directors of the Banks. The current members of this committee consist of Messrs. Bingham, Donley, Judge, Lupfer, Maxwell and Pinner. The committee held 14 meetings during 2003.

For information regarding CenterState’s Nominating Committee,see “Nominating Committee.”

For information regarding CenterState’s Audit Committee,see “Audit Committee Report.”

Directors of CenterState and the Banks receive $300 for each board meeting, $200 for each committee meeting not held on a board day ($100 if held on a board day), and $50 for each telephonic committee meeting.

4

Executive Officers

The following lists the executive officers of CenterState, all positions held by them in CenterState, including the period each such position has been held, a brief account of their business experience during the past five years and certain other information including their ages. Executive officers are appointed annually at the organizational meeting of the Board of Directors, which follows CenterState’s annual meeting of shareholders, to serve until a successor has been duly elected and qualified or until his death, resignation, or removal from office. Information concerning directorships, committee assignments, minor positions and peripheral business interests has not been included.

| | |

Executive Officers

| | Information About Executive Officers

|

James H. White, 78 | | Chairman of Board of CenterState; Director of First National Bank of Osceola County, Community National Bank of Pasco County, First National Bank of Polk County and CenterState Bank of Florida |

| |

G. Robert Blanchard, Sr., 77 | | Vice Chairman of the Board of CenterState; Chairman of The Bank of Tampa (1991 to 1999) |

| |

Ernest S. Pinner, 56 | | Chairman of First National Bank of Osceola County, Community National Bank of Pasco County, First National Bank of Polk County and CenterState Bank of Florida (2002 to present); Chief Executive Officer and President (2002 to present) and Executive Vice President (2000 to 2001) of CenterState; President and Chief Executive Officer of CenterState Bank of Florida (2000 to 2003); Chairman of CenterState Mid Florida (2004 to present); Area President and Senior Vice President of First Union National Bank (1986 to 1999) |

| |

George H. Carefoot, 60 | | Treasurer of CenterState; President and Chief Executive of First National Bank of Polk County |

| |

James J. Antal, 52 | | Senior Vice President, Chief Financial Officer and Secretary of CenterState (November 1999 to present); self-employed certified public accountant (November 1998 to November 1999); Senior Vice President, Chief Financial Officer and Treasurer of Trumbull Savings and Loan Company (August 1992 to November 1998) |

Management and Principal Stock Ownership

As of February 27, 2004, based on available information, all directors and executive officers of CenterState as a group (11 persons) beneficially owned 648,081 shares of CenterState Common Stock which constituted 19% of the number of shares outstanding at that date. This group also owns exercisable options (exercisable within 60 days) for an additional 94,769 shares. To the knowledge of CenterState, the only shareholders who owned more than 5% of the outstanding shares of CenterState Common Stock on February 27, 2004 were Chairman James H. White and Director Lawrence W. Maxwell.

5

PROPOSAL TWO

APPROVAL OF THE CENTERSTATE BANKS OF FLORIDA, INC.

EMPLOYEE STOCK PURCHASE PLAN

On February 26, 2004, the Board of Directors approved the CenterState Banks of Florida, Inc. Employee Stock Purchase Plan (the “Employee Plan”). If approved by the shareholders, the Employee Plan will authorize the issuance and purchase by employees of up to 200,000 shares of Common Stock, which amount may be increased on December 31 of each calendar year for an amount equal to 6% of the increase in the outstanding shares of Common Stock from January 1 of such calendar year (from February 27, 2004, for the 2004 calendar year) excluding any increase in the outstanding shares as a result of sales of Common Stock pursuant to the Employee Plan. At the Annual Meeting, shareholders will be asked to consider approval of the Employee Plan for purposes of qualifying such shares for special tax treatment under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”).

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE EMPLOYEE PLAN.

Summary of the Employee Plan

The full text of the Employee Plan is set forth as Appendix A hereto and readers are urged to refer to it for a complete description of the proposed Employee Plan. The summary of the principal features of the Employee Plan which follows is qualified entirely by such reference.

General. The purpose of the Employee Plan is to provide CenterState employees an opportunity to become shareholders of CenterState or increase their stock ownership and, therefore, to have an additional incentive to enhance the value of CenterState. The Employee Plan will further align the interests of employees with those of shareholders through increased stock ownership.

Administration. The Employee Plan will be administered by the Compensation Committee of the Board of Directors. This Committee may establish rules for administration of the Employee Plan, interpret the Employee Plan, make determinations about Employee Plan entitlements, and take other actions consistent with the delegation from the Board. The decisions by the Board and the Committee are final and binding upon all participants.

Eligibility. Any employee of CenterState or its subsidiaries who is employed on an Enrollment Date and has been employed for at least one year as of the first day of the month immediately preceding such Enrollment Date, and is in good standing, will be eligible to participate in the Employee Plan for that offering period. Officers of CenterState (except its Chairman, President and Chief Executive Officer) are eligible to participate under the Employee Plan,provided, however, that the Committee may provide in any offering period that certain employees who are highly compensated employees within the meaning of certain provisions of the Code may not be eligible to participate.

Participation in an Offering. The Employee Plan will be implemented by purchase periods beginning with the Enrollment Date and ending on a date to be determined by the Committee. Pursuant to the plan, there will be a series of offering periods. Common Stock will be purchased under the Employee Plan during each offering period, unless the participant terminates employment earlier. An employee may exercise the employee’s grant to purchase Common Stock at any time immediately subsequent to each Enrollment Date through the last day of each offering period.

Purchase Price, Shares Purchased. Employees who participate in the Employee Plan, will receive an option to purchase shares of Common Stock at a discount. Under the option, the purchase price of the shares will not be less than 85% of the fair market value of the Common Stock, which means the average closing price, as reported by Nasdaq over the five trading days immediately preceding the Enrollment Date. The number of shares of Common Stock a participate may purchase in any offering will be determined by an award of option granted by the Committee.

6

Termination of Employment. If a participant’s employment is terminated for any reason whatsoever, any outstanding option not exercised will terminate.

Adjustments upon Changes in Capitalization or Corporate Transactions. If the Common Stock is changed by reason of any stock dividend, stock split, recapitalization, reorganization, merger, consolidation, split up, combination or exchange of shares or any similar change affecting the Common Stock, the number and kind of shares which are subject to the option or otherwise are available for purchase under the Employee Plan will be adjusted automatically consistent with the change to prevent substantial dilution or enlargement of the rights granted to, or available for, participants in the Employee Plan.

Transferability. Options under the Employee Plan cannot be transferred or assigned. The shares of Common Stock acquired under the Employee Plan will be freely transferable, except as otherwise determined by the Committee.

Amendment and Termination of the Employee Plan. The Committee has the right to amend, modify, or terminate the plan at any time without notice, except that it may not adversely affect the rights of outstanding options and no amendment may be effected without shareholder approval, to the extent required under the Code or other applicable law.

Federal Income Tax Consequences. If the shareholders approve the Employee Plan, it, and the right of employees to make purchases thereunder, is intended to qualify under the provisions of Sections 421 and 423 of the Code. Under these provisions, no income will be taxable to a participant until the shares purchased under the Employee Plan are sold or otherwise disposed of. Upon sale or other disposition of the shares, the employee will generally be subject to tax, and the amount of the tax will depend upon the holding period. If the shares are sold or otherwise disposed of more than two years after the beginning of the offering period in which the shares were purchased and more than one year from the date of transfer of the shares to the employee, then the employee generally will recognize ordinary income measured as the lesser of (i) the actual gain (the amount by which the fair market value of the shares at the time of the sale or disposition exceeds the purchase price), or (ii) an amount equal to 15% of the fair market value of the shares as of the grant date, if the shares were purchased at no less than 85% of the fair market value of the shares on the grant date. Any additional gain should be treated as long-term capital gain. If the shares are sold or otherwise disposed of before the expiration of this holding period, the employee will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price. Any additional gain or loss on the sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period. CenterState is not entitled to a deduction for the amounts taxed as ordinary income or capital gain to an employee, except to the extent ordinary income is recognized by employees upon the sale or disposition of shares prior to the expiration of the holding periods described above. In all other cases, no deduction is allowed to CenterState.

The foregoing is only a summary of the effect of federal income taxation upon the employee and CenterState with respect to the shares purchased under the Employee Plan. It does not purport to be complete. Reference should be made to the applicable provisions of the Code. In addition, the summary does not discuss the tax consequences arising in the context of an employee’s death or the income tax laws of any municipality, state or foreign country in which the employee’s income or gain may be taxable.

7

EXECUTIVE COMPENSATION AND BENEFITS

The following table sets forth all cash compensation for CenterState’s Chief Executive Officer and its Senior Vice President, Chief Financial Officer and Corporate Secretary for services to CenterState and the Banks in 2003.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | |

Long Term Compensation

| |

Annual Compensation

| | | Awards

| | Payouts

| | | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual Compensation

| | | Restricted Stock Award(s)

| | Options/

SARs

| | LTIP Payouts

| | All Other Compensation

| |

Ernest S. Pinner | | 2003 | | $ | 175,400 | | $ | 6,400 | | $ | 662 | (1) | | -0- | | -0- | | -0- | | $ | 3,412 | (2) |

Chief Executive Officer | | 2002 | | $ | 51,000 | | $ | 3,800 | | $ | 531 | (1) | | -0- | | -0- | | -0- | | $ | -0- | |

James J. Antal | | 2003 | | $ | 109,000 | | $ | 3,800 | | $ | 3,883 | (1) | | -0- | | -0- | | -0- | | $ | 3,412 | (2) |

Senior Vice President, | | 2002 | | $ | 104,000 | | $ | 2,968 | | $ | 2,427 | (1) | | -0- | | -0- | | -0- | | $ | 3,396 | (2) |

Chief Financial Officer and Corporate Secretary | | 2001 | | $ | 94,000 | | $ | 10,620 | | $ | 5,223 | (1) | | -0- | | -0- | | -0- | | $ | 4,296 | (2) |

| (1) | Represents 401(k) employer contribution. |

| (2) | Represents country club dues paid by CenterState. |

Stock Option Plan. Prior to the July 1, 2000 formation of CenterState, each of its subsidiary banks had its own separate employee stock option plan. At July 1, 2000, the outstanding options under these plans were converted to CenterState options at each bank’s respective exchange ratio. At December 31, 2003, there were 24,599 such options remaining, with an average exercise price of $8.86 per share. These options have a weighted average remaining life of approximately 3.3 years, with the last options terminating in 2008.

CenterState adopted a new stock option plan in connection with its formation which authorizes the issuance of options for 365,000 shares. At December 31, 2003, options for an aggregate of 153,020 shares of CenterState Common Stock were outstanding. The weighted average exercise price of these options is $14.83 per share. These options have a weighted remaining life of approximately eight years, with the last options terminating in 2013.

In the acquisition of CenterState Bank, the Company issued options for 71,138 shares of common stock on December 31, 2002 in exchange for CenterState Bank stock options outstanding. All of these options vested immediately upon the closing. The exercise price is $14.92 per share. At December 31, 2003 there were 67,467 such options remaining. These options have a weighted average remaining life of approximately 6.5 years, with the last options terminating in 2011.

The following table provides information on option grants in 2003 to each of the name executive officers.

Individual Grants

| | | | | | | | | | |

Name

| | Number of Securities

Underlying Options

Granted (1)

| | % of Total Options

Granted to

Employees in

Fiscal Year

| | | Exercise Price

($/Share)

| | Expiration Date (2)

|

Ernest S. Pinner | | 5,000 | | 12 | % | | $ | 19.50 | | January 14, 2013 |

James J. Antal | | 5,000 | | 12 | % | | $ | 19.51 | | December 9, 2013 |

8

The following table provides information on the values of each named executive officer’s unexercised options at December 31, 2003.

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End

Option/SAR Values

| | | | | | | | | |

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options/SARs at FY-End (#) Exercisable/ Unexercisable

| | Value of Unexercised in-the-Money Options/SARs at FY-End($) Exercisable/ Unexercisable

|

Ernest S. Pinner | | — | | — | | 30,590/6,500 | | $ | 139,927/$24,760 |

James J. Antal | | — | | — | | 8,750/6,250 | | $ | 46,425/$15,475 |

The Company has assumed stock options issued by its subsidiary banks that were outstanding as of the time of their acquisition. In addition, the Company has an officers and employees stock option plan. All of the foregoing plans were approved by the respective shareholders of the Bank and the Company. The following sets forth certain information regarding these plans:

Equity Compensation Plan Information

| | | | | | | |

| | | Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights (a)

| | Weighted-average

exercise price of

outstanding

options, warrants

and rights (b)

| | Number of

securities

remaining available

for future issuance

under equity

compensation plans (excluding

securities reflected

in column (a)) (c)

|

Equity compensation plans approved by security holders | | 245,086 | | $ | 14.25 | | 208,230 |

Equity compensation plans not approved by security holders | | -0- | | | -0- | | -0- |

| | |

| |

|

| |

|

Total | | 245,086 | | $ | 14.25 | | 208,230 |

| | |

| |

|

| |

|

Change in Control Provisions. CenterState has adopted resolutions that provide for payments to its executive officers, as well as the executive officers of its subsidiary banks, if within one year following a change in control (as defined in the resolutions), the employment of the executive is terminated (i) by CenterState or its subsidiary bank for any reason other than cause (as defined) or the death of the executive, or (ii) by the executive for good reason (as defined). In such circumstances, the executive is entitled to receive a lump sum cash amount (subject to applicable payroll and taxes required to be withheld) equal to 2.99 times the current annual base salary (in the case of CenterState executive officers and the president and chief executive officers of CenterState’s subsidiary banks) and one times the annual base salary in the case of all other executive officers. The executives also are entitled to the foregoing amounts if the employment is terminated (i) by the executive for good reason (as defined) or (ii) CenterState or its subsidiary bank for any reason other than cause (as defined) or the death of the executive, and the termination occurs after the first anniversary of the change in control. These payments to the executive after the first anniversary of a change

9

in control are reduced by one-sixth for each three months of employment of the executive by CenterState or its subsidiary bank subsequent to such first anniversary of the change in control. In addition to the foregoing payments, the executive is entitled to reimbursement for COBRA health insurance coverage.

Certain Transactions

CenterState’s subsidiary banks have outstanding loans to certain CenterState directors, executive officers, their associates and members of the immediate families of such directors and executive officers. These loans were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not affiliated with the banks and did not involve more than the normal risk of collectibility or present other unfavorable features.

NOMINATING COMMITTEE

CenterState has established a nominating committee of the Board of Directors consisting of Messrs. Rocker, Maxwell, Oakley, Donley, Judge, Blanchard and Bingham, each of whom is an independent director as defined under the rules of the National Association of Securities Dealers. The committee held one meeting during 2003. The nominating committee operates pursuant to a written charter that has the exclusive right to recommend candidates for election as directors to the Board. A copy of the committee’s charter is set forth as Appendix B. Board candidates are considered based upon various criteria, such as their broad-based business and professional skills and experience, their business and social perspective, concern for the long-term interests of the shareholders, and personal integrity and judgment. In addition, candidates must be aware of the directors vital part in CenterState’s good corporate citizenship and corporate image, have time available for meetings and consultation on CenterState matters, and be willing to assume broad, fiduciary responsibility. Qualified candidates for membership on the Board will be considered without regard to race, color, religion, sex, ancestry, national origin or disability. The nominating committee will review the qualifications and backgrounds of the directors, as well as the overall composition of the Board, and recommend to the full Board the slate of directors to be nominated for election at the annual meeting of shareholders. The nominating committee will consider director candidates recommended by shareholders, provided the recommendation is in writing and delivered to the President of CenterState at the principal executive offices of CenterState not later than the close of business on the 120th day prior to the first anniversary of the date on which CenterState first mailed its proxy materials to shareholders for the preceding year’s annual meeting of shareholders. The nomination and notification must contain the nominee’s name, address, principal occupation, total number of shares owned, consent to serve as a director, and all information relating to the nominee and the nominating shareholder as would be required to be disclosed in solicitation of proxies for the election of such nominee as a director pursuant to the Securities and Exchange Commission’s proxy rules. The committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a shareholder or not.

CenterState’s Board has adopted a formal process by which shareholders may communicate with the Board. Shareholders who wish to communicate with the Board may do so by sending written communications addressed to the Board of Directors of CenterState at 1101 First Street South, Suite 202, Winter Haven, Florida 33880, attention: President and Chief Executive Officer. All communications will be compiled by the President and Chief Executive Officer and submitted to the members of the Board. CenterState does not have a policy that requires directors to attend the Annual Meeting. All members of the Board attended last year’s Annual Meeting.

10

COMPENSATION COMMITTEE REPORT

During 2003, the Compensation Committee of the Board of Directors was composed of four members, each of whom is an independent director as defined under the rules of the National Association of Securities Dealers.

Compensation Policy. The Company’s compensation policy is designed to make changes in total compensation with changes in the value created for the Company’s shareholders. The Compensation Committee believes that compensation of executive officers and others should be a result of the Company’s operating performance and should be designed to aid the Company in attracting and retaining high-performing executives.

The objectives of the Compensation Committee’s compensation strategy are to establish incentives for certain executives and others to achieve and maintain short-term and long-term operating performance goals for the Company, and to provide compensation that recognizes individual contributions as well as overall business results. At the Company, executive officer compensation comprises three areas: base salary, cash based short-term annual incentives, and long-term stock incentives.

In establishing executive officer salaries and increases, the Compensation Committee considers individual annual performance in the areas of customer service, morale, completed projects, team work and communication, and the relationship of total compensation to the salary market of similarly situated institutions. The decision to increase base pay is determined by the Compensation Committee using performance results measured annually. The Company’s general approach to executive compensation is to provide market competitive base salary, and to reward performance through cash bonuses consistent with individual contributions to the Company’s financial performance.

Chief Executive Officer Compensation. Effective January 1 of each year, the Compensation Committee reviews the compensation paid to the Chief Executive Officer of the Company. Final approval of Chief Executive Officer compensation is made by the Board of Directors. Changes in base salary and the awarding of cash and stock incentives are based on the Company’s profitability, growth and loan quality. The Compensation Committee also considers the Chief Executive Officer’s abilities in the areas of leadership and morale, community involvement and communication. Also, utilizing published surveys, databases and other means, the Compensation Committee surveyed the total compensation of chief executive officers of comparable-sized financial institutions located from across the nation as well as locally.

Prior to December 31, 2002, Ernest S. Pinner was serving as the Company’s President. During 2002 the Company paid him an annual salary of $51,000. During 2002, Mr. Pinner was also President and Chief Executive Officer of CenterState Bank of Florida, which was acquired by the Company on December 31, 2002. Mr. Pinner received a salary of $109,200 during 2002 from this bank, which was not part of the Company during 2002. As such, Mr. Pinner received combined salaries of $160,200 ($51,000 plus $109,200) during 2002, of which only $51,000 of this amount was paid by the Company.

Effective immediately subsequent to the December 31, 2002 acquisition of CenterState Bank of Florida by the Company, the Board of Directors elected Mr. Pinner Chief Executive Officer of the Company. After reviewing appropriate data, based on specific accomplishments and the overall financial performance of the Company, and the recommendation from the Compensation Committee, the board increased Mr. Pinner’s combined annual salary by $15,200 to $175,400 for 2003. Mr. Pinner also was awarded a cash bonus of $6,400 paid in 2003.

Summary. In summary, the Compensation Committee believes that the Company’s compensation program is reasonable and competitive with compensation paid by other financial institutions similarly situated. The program is designed to reward strong performance.

11

Compensation Committee Interlock and Insider Participation

Mr. Pinner did not serve as a member of the Compensation Committee in 2003. Mr. Pinner was not present for any discussion or decisions that relate to his compensation with the Bank. Mr. Pinner is also the Chairman of First National Bank of Osceola County, Community National Bank of Pasco County, First National Bank of Polk County and CenterState Bank of Florida.

AUDIT COMMITTEE REPORT

CenterState has established an Audit Committee for the Board of Directors consisting of Messrs. Rocker, Oakley and Blanchard, each of whom is an independent director as defined under the rules of the National Association of Securities Dealers. Pursuant to the provisions of the Sarbanes-Oxley Act of 2002, the SEC has adopted rules requiring companies to disclose whether or not at least one member of the audit committee is a “financial expert” as defined in such rules, and, if not, why. None of the current members of the Audit Committee meet the criteria set forth in such rules qualifying them as a “financial expert,” which is basically limited to those who have prepared or audited comparable public company financial statements. CenterState’s Board of Directors has not yet recruited an independent director who is able to qualify as an “Audit Committee Financial Expert.” The Board is continuing its search for such a qualified candidate to fill this position. The Committee held 11 meetings during 2003. The Audit Committee of the Board is responsible for providing independent, objective oversight and review of CenterState’s accounting functions and internal controls. The Audit Committee is governed by a written charter adopted and approved by the Board of Directors.

The responsibilities of the Audit Committee include recommending to the Board an auditing firm to serve as CenterState’s independent auditors. The Audit Committee also, as appropriate, reviews and evaluates, and discusses and consults with CenterState’s management, CenterState’s internal audit personnel and the independent auditors regarding the following:

| | • | the plan for, and the independent auditors’ report on, each audit of CenterState’s financial statements |

| | • | changes in CenterState’s accounting practices, principles, controls or methodologies, or in CenterState’s financial statements, and recent developments in accounting rules |

This year the Audit Committee reviewed the Audit Committee Charter and, after appropriate review and discussion, the Audit Committee determined that the Committee had fulfilled its responsibilities under the Audit Committee Charter. The Audit Committee also considered and concluded that the independent auditor’s provision of non-audit services in 2003 was compatible with applicable independence standards.

The Audit Committee is responsible for recommending to the Board that CenterState’s financial statements be included in CenterState’s annual report. The Committee took a number of steps in making this recommendation for 2003. First, the Audit Committee discussed with CenterState’s independent auditors, those matters the auditors communicated to the Audit Committee under applicable auditing standards, including information concerning the scope and results of the audit. These communications and discussions are intended to assist the Audit Committee in overseeing the financial reporting and disclosure process. Second, the Audit Committee discussed the auditor’s independence with the auditors and received a letter from the auditors regarding independence as required under applicable independence standards for auditors of public companies. This discussion and disclosure informed the Audit Committee of the auditor’s independence, and assisted the Audit Committee in evaluating such independence. Finally, the Audit Committee reviewed and discussed with CenterState management and the auditors, CenterState’s audited financial statements as of, and for the year ended, December 31, 2003. Based on the discussions with the auditors concerning the audit, the independence discussions, and the financial statement review, and additional matters deemed relevant and appropriate by the Audit Committee, the Audit Committee recommended to the Board that CenterState’s Annual Report on Form 10-K include these financial statements.

Audit Committee

G. Robert Blanchard

Thomas E. Oakley

J. Thomas Rocker, Chairman

12

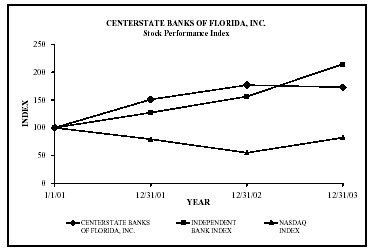

PERFORMANCE GRAPH

The shares of Common Stock commenced trading on the OTC Bulletin Board on January 26, 2001 and on the Nasdaq National Market System on February 20, 2001. The following graph compares the yearly percentage change in cumulative shareholder return on the Company’s common stock, with the cumulative total return of the NASDAQ stock index and The Carson Medlin Company’s Independent Bank Index, since January 1, 2001 (assuming a $100 investment on January 1, 2001 and reinvestment of all dividends).

| | | | | | | | |

| | | 1/1/2001

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

|

CENTERSTATE BANKS OF FLORIDA, INC. | | 100 | | 151 | | 177 | | 173 |

INDEPENDENT BANK INDEX | | 100 | | 127 | | 156 | | 215 |

NASDAQ INDEX | | 100 | | 79 | | 55 | | 82 |

INDEPENDENT AUDITORS

Pursuant to recent amendments to the securities laws, the Audit Committee of the Board of Directors has the authority to select the independent public accountants to audit the consolidated financial statements of the Company for the current year ending December 31, 2004. KPMG LLP has served as independent auditors for CenterState since 1999. A representative of the accounting firm is expected to be present at the Annual Meeting, where he will be available to respond to questions and, if so desired, to make a statement.

Fees Paid to the Independent Auditor

The following sets forth information on the fees paid by the Company to KPMG LLP for 2002 and 2003.

| | | | | | |

| | | 2002

| | 2003

|

Audit Fees | | $ | 89,900 | | $ | 67,100 |

Audit-Related Fees | | | -0- | | | -0- |

Tax Fees | | | 38,585 | | | 40,220 |

| | |

|

| |

|

|

Subtotal | | | 128,485 | | | 107,320 |

All Other Fees | | | 32,475 | | | -0- |

| | |

|

| |

|

|

Total Fees | | $ | 160,960 | | $ | 107,320 |

| | |

|

| |

|

|

13

Services Provided by KPMG LLP

All services rendered by KPMG LLP are permissible under applicable laws and regulations, and are pre-approved by the Audit Committee. (The Audit Committee’s pre-approval policy with respect to non-audit services is shown as Appendix C to this proxy statement.) Pursuant to new rules of the SEC, the fees paid to KPMG LLP for services are disclosed in the table above under the categories listed below.

| | 1) | Audit Fees – These are fees for professional services perform for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s 10-Q filings, and services that are normally provided in connection with statutory and regulatory filings or engagements. |

| | 2) | Audit-Related Fees – These are fees for assurance and related services performed that are reasonably related to the performance of the audit or review of the Company’s financial statements. No such services were performed in 2003. |

| | 3) | Tax Fees – These are fees for professional services performed by KPMG LLP with respect to tax compliance, tax advice and tax planning. This includes preparation of original and amended tax returns for the Company and its consolidated subsidiary; refund claims; payment planning; tax audit assistance; and tax work stemming from “Audit-Related” items. |

| | 4) | All Other Fees – These are fees for other permissible work performed by KPMG LLP that does not meet the above category descriptions. All of this work involved the acquisition of CenterState Bank of Florida. |

These services are actively monitored (both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence in the core work of KPMG LLP, which is the audit of the Company’s consolidated financial statements.

SHAREHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Proposals of shareholders of CenterState intended to be presented at the 2005 Annual Meeting of Shareholders must be received by CenterState at its principal executive offices on or before December 1, 2004, in order to be included in CenterState’s Proxy Statement and form of proxy relating to the 2005 Annual Meeting of Shareholders.

SECTION 16(a) REPORTING REQUIREMENTS

Section 16(a) of the Securities Exchange Act of 1934 requires CenterState’s directors and executive officers and persons who beneficially own more than 10% of CenterState Common Stock, to file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission. To CenterState’s knowledge, based solely upon a review of forms furnished to CenterState or written representations that no other reports were required, CenterState believes that during the year ended December 31, 2003, all Section 16(a) filings applicable to its officers and directors were complied with in a timely fashion, with the exception of one late report filed by each of Messrs. Pinner and Antal with regard to stock option grants awarded to them in 2003.

14

OTHER INFORMATION

Proxy Solicitation

The cost of soliciting proxies for the Annual Meeting will be paid by CenterState. In addition to solicitation by use of the mail, proxies may be solicited by directors, officers, and employees of CenterState in person or by telephone, telegram or other means of communication. Such directors, officers and employees will not be additionally compensated, but may be reimbursed for out-of-pocket expenses incurred in connection with such solicitation. Arrangements also will be made to furnish copies of proxy materials to custodians, nominees, fiduciaries and brokerage houses for forwarding to beneficial owners of CenterState Common Stock. Such persons will be paid for reasonable expenses incurred in connection with such services.

Miscellaneous

Management of CenterState does not know of any matters to be brought before the Annual Meeting other than those described in this Proxy Statement. If any other matters properly come before the Annual Meeting, the persons named as proxies in the enclosed form of proxy and acting thereunder will vote on such matters in accordance with the recommendation of the Board of Directors.

Upon the written request of any person whose proxy is solicited by this Proxy Statement, CenterState will furnish to such person without charge (other than for exhibits) a copy of CenterState’s Annual Report on Form 10-K for its fiscal year ended December 31, 2003, including financial statements and schedules thereto, as filed with the Securities and Exchange Commission. Written requests may be made to CenterState Banks of Florida, Inc., 1101 First Street South, Suite 202, Winter Haven, FL 33880, Attention: James J. Antal.

15

Appendix A

CENTERSTATE BANKS OF FLORIDA, INC.

EMPLOYEE STOCK PURCHASE PLAN

CenterState Banks of Florida, Inc. (the “Company”) hereby establishes its Employee Stock Purchase Plan (the “Plan”) as follows:

| | 1. | Purpose of the Plan. This Plan is adopted to provide eligible employees an opportunity to become shareholders in the Company and/or to increase their share ownership. The Company’s management and Board of Directors believe that employee participation in the ownership of the business is to the mutual benefit of the employees and the Company. The Company intends that the rights to purchase stock of the Company granted under the Plan be considered options issued under an “employee stock purchase plan” as that term is defined in Section 423(b) of the Code. |

| | 2.1 | “Board” means the Board of Directors of the Company. |

| | 2.2 | “Code” means the Internal Revenue Code of 1986, as amended. |

| | 2.3 | “Committee” means the Compensation Committee (also referred to as H.R. Committee) comprised of non-employee CSFL board members. |

| | 2.4 | “Common Stock” means the Company’s common stock, $0.01 par value. |

| | 2.5 | “Compensation” means regular base pay and shall exclude other compensation including commissions and bonuses. |

| | 2.6 | “Designated Subsidiary” means any Subsidiary which has been designated by the Committee from time to time in its sole discretion as eligible to have its employees participate in the Plan. |

| | 2.7 | “ESPP Agent” means the Company or such financial services or brokerage firm designated by the Company to act as administrative agent of the Plan. |

| | 2.8 | “Effective Date” means the date of approval of the Plan by the shareholders of the Company. |

| | 2.9 | “Employee” shall mean any individual employed by the Company or any Designated Subsidiary, including any individual on leave or other leave of absence approved by the Company; provided that where the period of leave exceeds 90 days and the individual’s right to re-employment is not guaranteed either by statute or by contract, the employment relationship will be deemed to have terminated on the 91st day of such leave. |

| | 2.10 | “Enrollment Date” means the grant date, which shall be the first day of each Offering Period, as determined by the Committee. It is the intention of the Company that the Committee may grant options to purchase common stock of the Company under this Plan, to eligible Employees each Enrollment Date only, and at no other time during the Offering Period. Further, it is the Company’s intention that the Committee select no more than one Offering Period each twelve month period. |

| | 2.11 | “Fair Market Value” means, the average closing price, as reported by NASDAQ, over the five trading days immediately preceding the Enrollment Date. As of any date, the value of Common Stock determined as follows: (a) the last reported sale of the Common Stock of the Company on the NASDAQ National Market System or, if no such reported sale takes place on any such day, the average of the closing bid and asked prices, or (b) if such Common Stock is listed on a national securities exchange, the last reported sale price or, if no such reported sale takes place on any such day, the average of the closing bid and asked prices on the principal national securities exchange on which the Common Stock is listed or admitted to trading, or (c) if such Common Stock is not quoted on such National Market System nor listed or admitted to trading on a national securities exchange, then the average of the closing bid and asked prices , as reported byThe Wall Street Journal for the over the counter market, or (d) if none of the foregoing is applicable, then the fair market value of a share of Common Stock as determined by the Committee in its discretion. |

| | 2.12 | “Offering Period” or “Offering” means the period beginning with the Enrollment Date and ending on a date to be determined by the Committee. Pursuant to the plan, there will be a series of Offering Periods during the term of the Plan. However, there shall not be more than one Offering Period in any twelve month period. |

| | 2.13 | “Purchase Price” shall be not less than the lesser of: |

| | (i) | an amount equal to eighty-five percent (85%) of the Fair Market Value of the shares of Common Stock on the Enrollment Date, or |

| | (ii) | an amount equal to eighty-five percent (85%) of the Fair Market Value of the shares of Common Stock on the applicable Exercise Date. |

Example: The Company’s first Offering Period begins on May 3, 2004 (Enrollment Date) and ends on December 15, 2004. The Fair Market Value of the Common Stock on May 3, 2004 is $19.00 per share. Eighty-five percent of $19.00 is $16.15, the Purchase Price.

(a) An eligible Employee exercises his/her option on November 30, 2004 (the Exercise Date), when the Fair Market Value of the Common Stock is $21.00 per share ($21.00 times 85% equals $17.85). What is the Employee’s Purchase Price? Answer: $16.15 per share.

(b) An eligible Employee exercises his/her option on December 4, 2004 (the Exercise Date), when the Fair Market Value of the Common Stock is $15.00 per share ($15.00 times 85% equals $12.75). What is the Employee’s Purchase Price? Answer: $16.15 per share.

| | 2.14 | “Subsidiary” shall mean any corporation, domestic or foreign, whether or not such corporation now exists or is hereafter organized or acquired by the Company or by a Subsidiary, in an unbroken chain of corporations beginning with the Company if, at the time the option is granted, each of the corporations other than the last corporation in an unbroken chain owns stock possessing greater than 50% of the total combined voting power of all classes of stock in one of the other corporations in such chain and provided that such corporation is consolidated with the Corporation for purposes of financial reporting. |

2

| | 3.1 | The Plan will be administered by the Committee. The Committee will have the final power to determine all questions of policy and administrative procedure that may arise in the administration of the Plan and will administer, or will direct the ESPP Agent to administer, the Plan to qualify as an “employee stock purchase plan” under Section 423 of the Code and the regulations thereunder, as amended from time to time. |

| | 3.2 | The Committee has the power, subject to the express provisions of the Plan, to: (a) determine whether a grant of options to purchase Common Stock will be made at the commencement of each Offering Period; (b) designate from time to time which Subsidiaries of the Company will be eligible to have their employees participate in the Plan; (c) construe and interpret the Plan and options granted under it, and to establish, amend and revoke rules and regulations for its administration, including correcting any defect, omission or inconsistency in the Plan, in a manner and to the extent it shall deem appropriate to make the Plan fully effective; (d) amend the Plan, or recommend to the Board any Plan amendments which require shareholder approval, as provided in Section 14; and (e) exercise such other powers and to perform such acts in connection with the Plan as the Committee determines will promote the best interests of the Company. |

| | 4. | Shares Subject to the Plan |

| | 4.1 | The number of shares of Common Stock for which options may be granted under the Plan shall be equal to 200,000, which amount shall be increased on December 31 of each calendar year for an amount equal to 6% of the increase in the outstanding shares of Common Stock from January 1 of such calendar year (from February 27, 2004, for the 2004 calendar year) excluding any increase in the outstanding shares as a result of sales of Common Stock pursuant to this Plan. The foregoing number of shares shall be subject to substitution or adjustment as provided in Section 15 of the Plan. If any option granted under the Plan terminates for any reason without having been exercised, the Common Stock not purchased under such option will again become available for issuance under the Plan. Shares to be grated or issued under the Plan may be authorized and unissued shares or may be treasury shares. |

| | 4.2 | The Common Stock subject to the Plan may be unissued shares or reaquired shares, purchased on the market or otherwise. If the total number of shares for which options are to be granted on any date exceeds the number of shares then available under the Plan (after deduction of all shares for which options have been exercised or are then outstanding), the Committee will make a pro rata allocation of the shares remaining available in as nearly a uniform manner as is practicable and equitable. |

| | 5.1 | Any Employee who is employed by the Company or a Designated Subsidiary on a given Enrollment Date and has been an employee for at least one year as of the first day of the month immediately preceding the Enrollment Date month, and is in good standing, will be eligible to participate in the Plan for that Offering Period, except as otherwise provided in the Plan. |

3

| | 5.2 | An employee will not be granted an option under the Plan (a) if, immediately after the grant, such Employee (or any other persona whose stock would be attributed to such Employee pursuant to Section 424(d) of the Code) would own stock and/or hold outstanding options to purchase stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or of any Subsidiary of the Company, or (b) if such option, together with any other options granted under any employee stock purchase plan of the Company or its Subsidiaries results in such Employee having the right to purchase in a calendar year stock whose Fair Market Value exceeds $25,000 (determined based on the Fair Market Value of the shares at the time such option is granted) as provided in Section 423(b)(8) of the Code. |

| | 5.3 | Officers of the Company (except the Chairman, President and CEO) are eligible to participate in Offerings under the Plan; provided, however, that the Committee may provide in an Offering that certain employees who are highly compensated employees within the meaning of Section 423(b)(4)(D) of the Code shall not be eligible to participate. |

| | 5.4 | For purposes of this Plan, an eligible Employee shall not include any individual who performs services for the Company or a Designated Subsidiary solely as an independent contractor, consultant or employee of a third party employment or leasing agency. |

| | 6. | Grant of Options. The Committee may grant options to purchase Common Stock of the Company under the Plan to eligible employees each Enrollment Date. |

| | 7. | Participation. An eligible Employee may exercise his/her grant to purchase Common Stock of the Company at any time immediately subsequent to each Enrollment Date through the last day of each Offering Period. |

| | 8. | Tax Withholding. On the Exercise Date, or at the time some or all of the Company’s Common Stock issued under the Plan is disposed of by the Employee, the Employee must make adequate provision for the Company’s federal, state, or other tax withholding obligations, if any, which arise upon the exercise of the option or the disposition of the Common Stock. At any time, the Company may, but will not be obligated to, withhold from the Employee’s compensation the amount necessary for the Company to meet applicable withholding obligations, including any withholding required to make available to the Company any tax deductions or benefit attributable to sale or early disposition by the Employee of Common Stock under the Plan. |

| | 9. | Employee’s Rights as a Shareholder. No Employee will have any right as a shareholder with respect to any shares until the shares have been purchased in accordance with this Plan and the Common Stock has been issued by the Company. |

| | 10. | Evidence of Stock Ownership. An employee may exercise his/her grant and purchase Common Stock of the Company written notice of intent to exercise with respect to the number of shares of stock, which is delivered by hand delivery or registered or certified mail, return receipt requested, to the Company at its principal office, Attention: Corporate Secretary; and (2) payment in full to the Company at such office of the amount of the grant price for the number of shares of stock with respect to which the option is then being exercised. Payment shall be made by certified check, cashier’s check, or personal check (and if made by personal check the shares of stock issued upon exercise shall be held by the Company until the check has cleared). |

4

| | 11. | No Employment Rights. Neither the Plan nor any option granted hereunder will confer upon the Employee any right with respect to continuance of employment by the Company or any Subsidiary nor shall the Plan or any option granted under the Plan interfere in any way with the right of the Company or any Subsidiary to terminate the employment of the Employee at any time, with or without cause consistent with applicable law. |

| | 12. | Rights Not Transferable. No Employee may sell, assign, transfer, pledge or otherwise dispose of or encumber any rights with regard to the exercise of an option or to receive shares under the Plan, and such right and interest shall not be liable for, or subject to, the debts, contracts, or liabilities of the Employee. If any such action is taken by the Employee, or any claim is asserted by any other party in respect of such right and interest whether by garnishment, levy, attachment or otherwise, such action or claim will be treated as an election to withdraw. An option can only be exercised by the Employee to whom the option has been granted. |

| | 13. | Termination of Employment. Upon termination of employment for any reason whatsoever, including but not limited to death or retirement, any outstanding option shall terminate. |

| | 14. | Amendment or Discontinuance of the Plan. The Committee will have the right to amend, modify, or terminate the Plan at any time without notice, provided that no Employee’s existing rights under any Offering already made under Section 6 hereof may be adversely affected thereby, and provided that any amendment will be subject to shareholder approval if shareholder approval is required under the Code or other applicable law. |

| | 15. | Changes in Capitalization. In the event of any change in the Common Stock of the Company by reason of any stock dividend, stock split, recapitalization, reorganization, merger consolidation, split-up, combination, or exchange of shares, or of any similar change affecting the Common Stock, the number and kind of shares authorized under Section 4, the number and kind of shares which thereafter are subject to an option under the Plan or otherwise available for purchase under the Plan and the number and kind of shares set forth in options or otherwise under outstanding agreements and the price per share thereunder shall be adjusted automatically consistent with such change to prevent substantial dilution or enlargement of the rights granted to, or available for, participants in the Plan. |

| | 16. | Notices. All notices or other communications by an Employee to the Company under or in connection with the Plan shall be deemed to have been duly given when received by the Company or when received in the form specified by the Company at the location, or by the person, designated by the Company for the receipt thereof. |

| | 17. | Termination of the Plan. This Plan shall terminate at the earliest of the following: (a) last business day in December 2013; (b) the date the Committee acts to terminate the Plan in accordance with Section 14 above; or (c) the date when all shares reserved under the Plan have been purchased. |

| | 18. | Limitation on Sale of Common Stock Purchased Under the Plan. The Plan is intended to provide Common Stock for investment and not for resale. The Company does not, however, intend to restrict or influence any Employee in the conduct of his own affairs. An Employee, therefore, may sell stock purchased under the Plan at any time he chooses, subject to compliance with the terms of the Plan, any applicable Federal or state securities laws and applicable withholding taxes. THE EMPLOYEE ASSUMES THE RISK OF ANY MARKET FLUCTUATIONS IN THE PRICE OF THE STOCK. |

5

| | 19. | Governmental Regulation. The Company’s obligation to sell and deliver shares of the Common Stock under this Plan is subject to the approval of any governmental authority required in connection with the authorization, issuance, or sale of such shares of Common Stock. |

| | 20. | Governing Law. To the extent not inconsistent with the provisions of the Internal Revenue Code that relate to the purchase of stock of the Company under the Plan, the Plan and any agreement adopted pursuant to it shall be construed under the laws of the State of Florida. |

Adopted by the Board of Directors: February 26, 2004

Approved by Shareholders: April 27, 2004

6

Appendix B

CENTERSTATE BANKS OF FLORIDA, INC.

CHARTER OF NOMINATING COMMITTEE

OF THE BOARD OF DIRECTORS

(Originally adopted on February 26, 2004)

COMPOSITION

The Nominating Committee (the“Committee”)of the Board of Directors of CenterState Banks of Florida, Inc., a Florida corporation (the“Company”),shall consist of at least two (2) independent members of the Board of Directors of the Company (the“Board”).

Each member shall be free from any relationship that would interfere with the exercise of his or her independent judgment, as determined by the Board and shall meet, as applicable, the standards for independence set forth in the rules and regulations of the Securities and Exchange Commission (the “SEC”) and The Nasdaq Stock Market(“Nasdaq”).

The Board shall appoint the members of the Committee and the Committee chairperson. The Board may remove any Committee member at any time.

PURPOSE

The purpose of the Committee shall be to:

| | • | Identify, review and evaluate candidates to serve as directors of the Company and recommend director candidates to the Board. |

| | • | Serve as a focal point for communication between candidates, non-committee directors and the Company’s management. |

| | • | Determine whether existing directors should be re-nominated. |

| | • | Make other recommendations to the Board regarding affairs relating to the directors of the Company. |

OPERATING PRINCIPLESAND PROCESSES

In fulfilling its functions and responsibilities, the Committee should give due consideration to the following operating principles and processes:

| • | Communication – Regular and meaningful contact with the Chairman of the Board, other committee chairpersons, members of senior management and independent professional advisors to the Board and its various committees, as applicable, is important for strengthening the Committee’s knowledge of relevant current and prospective corporate governance issues. |

| • | Resources – The Committee shall be authorized to access such internal and, in consultation with senior management, external resources as the Committee deems necessary or appropriate to fulfill its defined responsibilities, including engagement of independent legal counsel, consultants and other professional advisors, as well as executive search firms to help identify director candidates. The Committee shall have sole authority to approve fees, costs and other terms of engagement of such outside resources. |

| • | Meeting Agendas – Committee meeting agendas shall be the responsibility of the Committee chairperson with input from the Committee members and other members of the Board as well as, to the extent deemed appropriate by the chairperson, from members of senior management and outside advisors. |

| • | Committee Meeting Attendees – The Committee shall be authorized to require members of senior management and to request that outside counsel and other advisors attend Committee meetings. |

| • | Reporting to the Board of Directors – The Committee, through the Committee chairperson, shall report all material activities of the Committee to the Board from time to time, or whenever so requested by the Board. |

| • | Other Functions – The Committee shall have the authority to perform such other functions, and shall have such powers, as may be necessary or appropriate in the efficient and lawful discharge of its responsibilities hereunder. |

FUNCTIONSAND AUTHORITY

The operation of the Committee will be subject to the provisions of the Bylaws of the Company and the Florida Business Corporation Act, each as in effect from time to time. The Committee will have the full power and authority to carry out the following primary responsibilities:

| • | Criteria for Board Membership; Director Nominations – The Committee, in consultation with the Chairman of the Board, has the primary responsibility for identifying, evaluating, reviewing and recommending qualified candidates to serve on the Board, including consideration of any potential conflicts of interest. The Committee shall also have the primary responsibility, following the Board assessment provided for below, for evaluating, reviewing and considering the recommendation for nomination of current Directors for reelection to the Board. The selection of nominees for Director to be presented to the stockholders for election or reelection, and the selection of new Directors to fill vacancies and newly created directorships on the Board, shall be made by the full Board based on the recommendations of the Committee. |

2

| • | Board Assessment – The Committee shall periodically review, discuss and assess the performance of the Board, seeking input from senior management, the full Board and others. The assessment shall include evaluation of the performance of the members of the Board of Directors, individually and collectively, the Board’s contribution as a whole, specific areas in which the Board and/or management believe better contributions could be made, and overall Board composition and makeup, including whether it is desirable for each member of the Board to continue to serve on the Board based upon the designated functional needs of the Board. The factors to be considered shall include whether the Directors, both individually and collectively, can and do provide the skills and expertise appropriate for the Company. The Committee shall also consider and assess each Director’s satisfaction of the criteria established for Board membership or membership on any committee of the Board, including the independence of Directors and whether a majority of the Board continue to be independent from management, in both fact and appearance as well as within the meaning prescribed by SEC or Nasdaq. The results of such assessments shall be provided to the Board for further discussion as appropriate. |

| • | Director Change of Position – The Committee shall review and make recommendations to the Board regarding the continued service of a Director in the event (i) an employee Director’s employment with the Company is terminated for any reason or (ii) a nonemployee Director changes his/her primary job responsibility or primary employer since the time such Director was most recently elected to the Board. In this regard, the Committee may consider the establishment of procedures for retirement or resignation of Directors under such circumstances. |