SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 333-95087

CENTERSTATE BANKS OF FLORIDA, INC.

(Name of registrant as specified in its charter)

| | |

| Florida | | 59-3606741 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 1101 First Street South, Suite 202, Winter Haven, Florida | | 33880 |

| (Address of principal executive offices) | | (Zip Code) |

Issuer’s telephone number, including area code: (863) 293-2600

Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.01 per share

Securities registered pursuant to Section 12(g) of the Act: None

The registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

The registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Check whether the issuer has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation SK contained in this form, and no disclosure will be contained, to the best of issuer’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark if:

The issuer is a large accelerated filer, an accelerated filer, or a non-accelerated filer as defined in Rule 12b-2 of the Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

The registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. YES ¨ NO x

The aggregate market value of the Common Stock of the issuer held by non-affiliates of the issuer (7,821,226 shares) on June 30, 2006, was approximately $160,335,000. The aggregate market value was computed by reference the last sale of the Common Stock of the issuer at $20.50 per share on June 30, 2006. For the purposes of this response, directors, executive officers and holders of 5% or more of the issuer’s Common Stock are considered the affiliates of the issuer at that date.

As of March 8, 2007 there were outstanding 11,153,562 shares of the issuer’s Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on April 24, 2007 to be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days of the issuer’s fiscal year end are incorporated by reference into Part II and Part III, of this Annual Report on Form 10-K.

TABLE OF CONTENTS

2

3

PART I

General

CenterState Banks of Florida, Inc. (“We,” “CenterState” or the “Company”) was incorporated under the laws of the State of Florida on September 20, 1999. CenterState is a registered bank holding company under the Bank Holding Company Act of 1956, as amended (the “BHC Act”) and owns all the outstanding shares of CenterState Bank Central Florida (“Central”), CenterState Bank West Florida (“CSWFL”), CenterState Bank of Florida (“CSB”) and CenterState Bank Mid Florida (“Mid FL”), (collectively, the “Banks”).

In January 2006, two of our Company’s subsidiary banks (First National Bank of Polk County and CSB merged with the resulting bank named CenterState Bank of Florida (“CSB”). At the close of business on March 31, 2006, we acquired another bank, CenterState Bank Mid Florida (“Mid FL”). Mid FL was a de novo bank that began operations in January 2004.

CenterState/Central and CSWFL commenced operations in 1989. First National/Polk, now merged with CenterState Bank, commenced operations in 1992 and CenterState Bank commenced operations in 2000. CenterState/Central’s operations are conducted from its main office located in Kissimmee, Florida, and branch offices located in St. Cloud, Poinciana, Ocoee and Orlando, Florida. CSWFL operations are conducted from its main office located in Zephyrhills, Florida, and branch offices located in Zephyrhills, Bushnell, Wildwood, Dade City, Inverness, Spring Hill and Crystal River, Florida. CenterState Bank (previously First National/Polk and CenterState Bank), operates through twelve banking locations all within Polk County, Florida. These cities within Polk County include Winter Haven, Haines City, Davenport, Lake Alfred, Auburdale, Lakeland and Lake Wales. Mid FL’s operations are conducted from its main office located in Leesburg, Florida, and branch offices located in Clermont, Groveland and Eustis, Florida. Our Company’s three national bank subsidiaries are subject to the supervision of the Office of the Comptroller of the Currency and our state bank subsidiary (Mid FL) is under the supervision of the Florida Office of Financial Regulation and the FDIC. As of December 31, 2006, we operate through our now four wholly owned subsidiary banks, with 30 banking locations located in eight counties in central Florida.

Our Company provides a range of consumer and commercial banking services to individuals, businesses and industries. The basic services we offer include: demand interest-bearing and noninterest-bearing accounts, money market deposit accounts, time deposits, safe deposit services, cash management, direct deposits, notary services, money orders, night depository, travelers’ checks, cashier’s checks, domestic collections, savings bonds, bank drafts, automated teller services, drive-in tellers, and banking by mail and by internet. In addition, we make secured and unsecured commercial and real estate loans and issue stand-by letters of credit. Our Company provides automated teller machine (ATM) cards, thereby permitting customers to utilize the convenience of larger ATM networks. We also offer internet banking services to our customers. In addition to the foregoing services, our offices provide customers with extended banking hours. We do not have a trust department, however, trust services are available to customers through a business relationship with another bank. We also offer other financial products to our customers, including mutual funds, annuities and other products, through a relationship with Infinex Investment, Inc.

4

The revenue of our Company is primarily derived from interest on, and fees received in connection with, real estate and other loans, and from interest and dividends from investment securities and short-term investments. The principal sources of funds for our lending activities are customer deposits, repayment of loans, and the sale and maturity of investment securities. Our principal expenses are interest paid on deposits, and operating and general administrative expenses.

As is the case with banking institutions generally, our Company’s operations are materially and significantly influenced by general economic conditions and by related monetary and fiscal policies of financial institution regulatory agencies, including the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Deposit flows and costs of funds are influenced by interest rates on competing investments and general market rates of interest. Lending activities are affected by the demand for financing of real estate and other types of loans, which in turn is affected by the interest rates at which such financing may be offered and other factors affecting local demand and availability of funds. We face strong competition in the attraction of deposits (our primary source of lendable funds) and in the origination of loans.See “Competition.”

C.S. Processing, Inc. (“CSP”) is a wholly owned subsidiary of our Company’s subsidiary banks. CSP processes checks and renders statements (i.e. “item processing center”) and provides certain information technology services for our subsidiary banks.

In November 2006, we entered into a definitive agreement to acquire Valrico Bancorp, Inc. (“VBI”) and its wholly owned subsidiary bank, Valrico State Bank. VBI operates in Hillsborough County which is contiguous to Pasco and Polk Counties, where we currently have banking locations. VBI operates through four banking locations, all within Hillsborough County, and has total assets of approximately $150,000,000. We expect to operate VBI as a wholly owned subsidiary bank, similar to our other banks. We expect the transaction to close in April 2007.

At December 31, 2006, our Company’s primary assets were our ownership of stock of each of our four Banks. At December 31, 2006, we had total consolidated assets of $1,077,102,000, total consolidated deposits of $892,806,000, and total consolidated stockholders’ equity of $117,332,000.

Note about Forward-Looking Statements

This Form 10-K contains forward-looking statements, such as statements relating to our financial condition, results of operations, plans, objectives, future performance and business operations. These statements relate to expectations concerning matters that are not historical facts. These forward-looking statements reflect our current views and expectations based largely upon the information currently available to us and are subject to inherent risks and uncertainties. Although we believe our expectations are based on reasonable assumptions, they are not guarantees of future performance and there are a number of important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. By making these forward-looking statements, we do not undertake to update them in any manner except as may be required by our disclosure obligations in filings we make with the Securities and Exchange Commission under the Federal securities laws. Our actual results may differ materially from our forward-looking statements.

Lending Activities

We offer a range of lending services, including real estate, consumer and commercial loans, to individuals and small businesses and other organizations that are located in or conduct a substantial portion

5

of their business in our market area. The Company’s consolidated loans at December 31, 2006 and 2005 were $657,963,000, or 61% and $516,658,000 or 59%, respectively, of total consolidated assets. The interest rates charged on loans vary with the degree of risk, maturity, and amount of the loan, and are further subject to competitive pressures, money market rates, availability of funds, and government regulations. We have no foreign loans or loans for highly leveraged transactions.

Our loans are concentrated in three major areas: commercial loans, real estate loans, and consumer loans. A majority of our loans are made on a secured basis. As of December 31, 2006, approximately 81% of our consolidated loan portfolio consisted of loans secured by mortgages on real estate and 10% of the loan portfolio consisted of commercial loans (not secured by real estate). At the same date, 9% of our loan portfolio consisted of consumer and other loans.

Our commercial loan portfolio includes loans to individuals and small-to-medium sized businesses located primarily in Polk, Osceola, Pasco, Hernando, Citrus, Sumter, Lake and Orange counties for working capital, equipment purchases, and various other business purposes. A majority of commercial loans are secured by equipment or similar assets, but these loans may also be made on an unsecured basis. Commercial loans may be made at variable or fixed rates of interest. Commercial lines of credit are typically granted on a one-year basis, with loan covenants and monetary thresholds. Other commercial loans with terms or amortization schedules of longer than one year will normally carry interest rates which vary with the prime lending rate and will become payable in full and are generally refinanced in three to five years. Commercial and agricultural loans not secured by real estate amounted to approximately 10% of the our Company’s total loan portfolio as of December 31, 2006, compared to 12% at December 31, 2005.

Our real estate loans are secured by mortgages and consist primarily of loans to individuals and businesses for the purchase, improvement of or investment in real estate, for the construction of single-family residential and commercial units, and for the development of single-family residential building lots. These real estate loans may be made at fixed or variable interest rates. Generally, we do not make fixed-rate commercial real estate loans for terms exceeding five years. Loans in excess of five years are generally adjustable. Our residential real estate loans generally are repayable in monthly installments based on up to a 15-year or a 30-year amortization schedule with variable or fixed interest rates.

Our consumer loan portfolio consists primarily of loans to individuals for various consumer purposes, but includes some business purpose loans which are payable on an installment basis. The majority of these loans are for terms of less than five years and are secured by liens on various personal assets of the borrowers, but consumer loans may also be made on an unsecured basis. Consumer loans are made at fixed and variable interest rates, and are often based on up to a five-year amortization schedule.

For additional information regarding the Company’s loan portfolio,see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Loan originations are derived from a number of sources. Loan originations can be attributed to direct solicitation by our loan officers, existing customers and borrowers, advertising, walk-in customers and, in some instances, referrals from brokers.

Certain credit risks are inherent in making loans. These include prepayment risks, risks resulting from uncertainties in the future value of collateral, risks resulting from changes in economic and industry conditions, and risks inherent in dealing with individual borrowers. In particular, longer maturities increase the risk that economic conditions will change and adversely affect collectibility. We attempt to

6

minimize credit losses through various means. In particular, on larger credits, we generally rely on the cash flow of a debtor as the source of repayment and secondarily on the value of the underlying collateral. In addition, we attempt to utilize shorter loan terms in order to reduce the risk of a decline in the value of such collateral.

Deposit Activities

Deposits are the major source of our funds for lending and other investment activities. We consider the majority of our regular savings, demand, NOW and money market deposit accounts to be core deposits. These accounts comprised approximately 54% and 63% of our consolidated total deposits at December 31, 2006 and 2005, respectively. Approximately 46% of our consolidated deposits at December 31, 2006, were certificates of deposit compared to 37% at December 31, 2005. Generally, we attempt to maintain the rates paid on our deposits at a competitive level. Time deposits of $100,000 and over made up approximately 25% of consolidated total deposits at December 31, 2006 and 18% at December 31, 2005. The majority of the deposits are generated from Polk, Osceola, Orange, Pasco, Hernando, Sumter, Lake and Citrus counties. We do not currently accept brokered deposits and we do not solicit deposits on a national level. We obtain all of our deposits from customers in our local markets. For additional information regarding the Company’s deposit accounts,see “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Deposits.”

Investments

A portion of our assets are invested in U.S. Treasury securities, obligations of U.S. government agencies, municipal securities, mortgage backed securities and federal funds sold. Our investments are managed in relation to loan demand and deposit growth, and are generally used to provide for the investment of excess funds at minimal risks while providing liquidity to fund increases in loan demand or to offset fluctuations in deposits.

With respect to our investment portfolio, we invest in U.S. Treasury securities, obligations of U.S. government agencies, mortgage backed securities and municipal securities, because such securities generally represent a minimal investment risk. Occasionally, we may purchase certificates of deposits of national and state banks. These investments may exceed $100,000 in any one institution (the limit of FDIC insurance for deposit accounts). Federal funds sold and money market accounts represent the excess cash we have available over and above daily cash needs. This money is invested on an overnight basis with approved correspondent banks.

We monitor changes in financial markets. In addition to investments for our portfolio, we monitor daily cash positions to ensure that all available funds earn interest at the earliest possible date. A portion of the investment account is invested in liquid securities that can be readily converted to cash with minimum risk of market loss. These investments usually consist of U.S. Treasury securities, obligations of U.S. government agencies, mortgage backed securities and federal funds. The remainder of the investment account may be placed in investment securities of different type and/or longer maturity. Daily surplus funds are sold in the federal funds market for one business day. We attempt to stagger the maturities of our securities so as to produce a steady cash-flow in the event cash is needed, or economic conditions change.

7

Correspondent Banking

Correspondent banking involves one bank providing services to another bank which cannot provide that service for itself from an economic or practical standpoint. We purchase correspondent services offered by larger banks, including check collections, purchase of federal funds, security safekeeping, investment services, coin and currency supplies, overline and liquidity loan participations and sales of loans to or participation with correspondent banks.

We have established correspondent relationships with Federal Home Loan Bank, Independent Bankers’ Bank of Florida, First American Bank and SunTrust Banks. The Company pays for such services.

Data Processing

Each of our subsidiary banks use the same third party core data processing service bureau which provides an automated general ledger system, deposit accounting, and commercial, mortgage and installment lending data processing. The output of each of these comprehensive systems is then consolidated at the holding company level.

Our banks’ wholly owned subsidiary, CSP, provides item processing services and certain information technology (“IT”) services for our subsidiary banks. These services include; sorting, encoding, processing, and imaging checks and rendering checking and other deposit statements to commercial and retail customers, as well provide IT services for each subsidiary bank and the Company overall. The total cost of providing these services are charged to each subsidiary bank based on usage.

Effect of Governmental Policies

The earnings and business of our Company are and will be affected by the policies of various regulatory authorities of the United States, especially the Federal Reserve. The Federal Reserve, among other things, regulates the supply of credit and deals with general economic conditions within the United States. The instruments of monetary policy employed by the Federal Reserve for these purposes influence in various ways the overall level of investments, loans, other extensions of credit and deposits, and the interest rates paid on liabilities and received on assets.

Interest and Usury

Our Company is subject to numerous state and federal statutes that affect the interest rates that may be charged on loans. These laws do not, under present market conditions, deter us from continuing the process of originating loans.

Supervision and Regulation

Banks and their holding companies, and many of their affiliates, are extensively regulated under both federal and state law. The following is a brief summary of certain statutes, rules, and regulations affecting our Company, and our subsidiary Banks. This summary is qualified in its entirety by reference to the particular statutory and regulatory provisions referred to below and is not intended to be an exhaustive description of the statutes or regulations applicable to the business of our Company and subsidiary Banks. Supervision, regulation, and examination of banks by regulatory agencies are intended primarily for the protection of depositors, rather than shareholders.

8

Bank Holding Company Regulation. Our Company is a bank holding company, registered with the Federal Reserve under the BHC Act. As such, we are subject to the supervision, examination and reporting requirements of the BHC Act and the regulations of the Federal Reserve. The BHC Act requires that a bank holding company obtain the prior approval of the Federal Reserve before (i) acquiring direct or indirect ownership or control of more than 5% of the voting shares of any bank, (ii) taking any action that causes a bank to become a subsidiary of the bank holding company, or (iii) merging or consolidating with any other bank holding company.

The BHC Act further provides that the Federal Reserve may not approve any transaction that would result in a monopoly or would be in furtherance of any combination or conspiracy to monopolize or attempt to monopolize the business of banking in any section of the United States, or the effect of which may be substantially to lessen competition or to tend to create a monopoly in any section of the country, or that in any other manner would be in restraint of trade, unless the anticompetitive effects of the proposed transaction are clearly outweighed by the public interest in meeting the convenience and needs of the community to be served. The Federal Reserve is also required to consider the financial and managerial resources and future prospects of the bank holding companies and banks concerned and the convenience, and needs of the community to be served. Consideration of financial resources generally focuses on capital adequacy and consideration of convenience and needs issues includes the parties’ performance under the Community Reinvestment Act of 1977 (the “CRA”), both of which are discussed below.

Banks are subject to the provisions of the CRA. Under the terms of the CRA, the appropriate federal bank regulatory agency is required, in connection with its examination of a bank, to assess such bank’s record in meeting the credit needs of the community served by that bank, including low- and moderate-income neighborhoods. The regulatory agency’s assessment of the bank’s record is made available to the public. Further, such assessment is required of any bank which has applied to:

| • | | obtain deposit insurance coverage for a newly chartered institution, |

| • | | establish a new branch office that will accept deposits, |

| • | | merge or consolidate with, or acquire the assets or assume the liabilities of, a federally regulated financial institution |

In the case of a bank holding company applying for approval to acquire a bank or other bank holding company, the Federal Reserve will assess the record of each subsidiary bank of the applicant bank holding company, and such records may be the basis for denying the application.

The BHC Act generally prohibits a bank holding company from engaging in activities other than banking, or managing or controlling banks or other permissible subsidiaries, and from acquiring or retaining direct or indirect control of any company engaged in any activities other than those activities determined by the Federal Reserve to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. In determining whether a particular activity is permissible, the Federal Reserve must consider whether the performance of such an activity can reasonably be expected to produce benefits to the public, such as greater convenience, increased competition, or gains in efficiency that outweigh possible adverse effects, such as undue concentration of resources, decreased or unfair competition, conflicts of interest, or unsound banking practices. For example, factoring accounts receivable, acquiring or servicing loans, leasing personal property, conducting securities brokerage activities, performing certain data processing services, acting as agent or broker in selling credit life

9

insurance and certain other types of insurance in connection with credit transactions, and certain insurance underwriting activities have all been determined by regulations of the Federal Reserve to be permissible activities of bank holding companies. Despite prior approval, the Federal Reserve has the power to order a holding company or its subsidiaries to terminate any activity or terminate its ownership or control of any subsidiary, when it has reasonable cause to believe that continuation of such activity or such ownership or control constitutes a serious risk to the financial safety, soundness, or stability of any bank subsidiary of that bank holding company.

Gramm-Leach-Bliley Act. Enacted in 1999, the Gramm-Leach-Bliley Act reforms and modernizes certain areas of financial services regulation. The law permits the creation of new financial services holding companies that can offer a full range of financial products under a regulatory structure based on the principle of functional regulation. The legislation eliminates the legal barriers to affiliations among banks and securities firms, insurance companies, and other financial services companies. The law also provides financial organizations with the opportunity to structure these new financial affiliations through a holding company structure or a financial subsidiary. The new law reserves the role of the Federal Reserve Board as the supervisor for bank holding companies. At the same time, the law also provides a system of functional regulation which is designed to utilize the various existing federal and state regulatory bodies. The law also sets up a process for coordination between the Federal Reserve Board and the Secretary of the Treasury regarding the approval of new financial activities for both bank holding companies and national bank financial subsidiaries.

The law also includes a minimum federal standard of financial privacy. Financial institutions are required to have written privacy policies that must be disclosed to customers. The disclosure of a financial institution’s privacy policy must take place at the time a customer relationship is established and not less than annually during the continuation of the relationship. The act also provides for the functional regulation of bank securities activities. The law repeals the exemption that banks were afforded from the definition of “broker,” and replaces it with a set of limited exemptions that allow the continuation of some historical activities performed by banks. In addition, the act amends the securities laws to include banks within the general definition of dealer. Regarding new bank products, the law provides a procedure for handling products sold by banks that have securities elements. In the area of Community Reinvestment Act activities, the law generally requires that financial institutions address the credit needs of low-to-moderate income individuals and neighborhoods in the communities in which they operate. Bank regulators are required to take the Community Reinvestment Act ratings of a bank or of the bank subsidiaries of a holding company into account when acting upon certain branch and bank merger and acquisition applications filed by the institution. Under the law, financial holding companies and banks that desire to engage in new financial activities are required to have satisfactory or better Community Reinvestment Act ratings when they commence the new activity.

Bank Regulation. CenterState/Osceola, CenterState Bank and CSWFL are chartered under the national banking laws. Mid FL is a State chartered Bank. Each of the deposits of the Banks is insured by the FDIC to the extent provided by law. The Banks are subject to comprehensive regulation, examination and supervision by the OCC. The Banks also are subject to other laws and regulations applicable to banks. Such regulations include limitations on loans to a single borrower and to its directors, officers and employees; restrictions on the opening and closing of branch offices; the maintenance of required capital and liquidity ratios; the granting of credit under equal and fair conditions; and the disclosure of the costs and terms of such credit. The Banks are examined periodically by the OCC. The Banks submit to their examining agencies periodic reports regarding their financial condition and other matters. The bank regulatory agencies have a broad range of powers to enforce regulations under their jurisdiction, and to take discretionary actions determined to be for the protection and safety and soundness of banks, including

10

the institution of cease and desist orders and the removal of directors and officers. The bank regulatory agencies also have the authority to approve or disapprove mergers, consolidations, and similar corporate actions.

There are various statutory limitations on the ability of our Company to pay dividends. The bank regulatory agencies also have the general authority to limit the dividend payment by banks if such payment may be deemed to constitute an unsafe and unsound practice. For information on the restrictions on the right of our Banks to pay dividends to our Company,see Part II - Item 5 “Market for the Registrant’s Common Equity, Related Stockholder Matters and Purchases of Equity Securities.”

Under federal law, federally insured banks are subject, with certain exceptions, to certain restrictions on any extension of credit to their parent holding companies or other affiliates, on investment in the stock or other securities of affiliates, and on the taking of such stock or securities as collateral from any borrower. In addition, banks are prohibited from engaging in certain tie-in arrangements in connection with any extension of credit or the providing of any property or service.

The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (“FIRREA”) imposed major regulatory reforms, stronger capital standards for savings and loan associations and stronger civil and criminal enforcement provisions. FIRREA also provides that a depository institution insured by the FDIC can be held liable for any loss incurred by, or reasonably expected to be incurred by, the FDIC in connection with:

| • | | the default of a commonly controlled FDIC insured depository institution; or |

| • | | any assistance provided by the FDIC to a commonly controlled FDIC insured institution in danger of default. |

The FDIC Improvement Act of 1993 (“FDICIA”) made a number of reforms addressing the safety and soundness of deposit insurance funds, supervision, accounting, and prompt regulatory action, and also implemented other regulatory improvements. Annual full-scope, on-site examinations are required of all insured depository institutions. The cost for conducting an examination of an institution may be assessed to that institution, with special consideration given to affiliates and any penalties imposed for failure to provide information requested. Insured state banks also are precluded from engaging as principal in any type of activity that is impermissible for a national bank, including activities relating to insurance and equity investments. The Act also recodified current law restricting extensions of credit to insiders under the Federal Reserve Act.

Also important in terms of its effect on banks has been the deregulation of interest rates paid by banks on deposits and the types of deposit accounts that may be offered by banks. Most regulatory limits on permissible deposit interest rates and minimum deposit amounts expired several years ago. The effect of the deregulation of deposit interest rates generally has been to increase the costs of funds to banks and to make their costs of funds more sensitive to fluctuations in money market rates. A result of the pressure on banks interest margins due to deregulation has been a trend toward expansion of services offered by banks and an increase in the emphasis placed on fee or noninterest income.

Capital Requirements. The Federal Reserve Board and bank regulatory agencies require bank holding companies and financial institutions to maintain capital at adequate levels based on a percentage of assets and off-balance sheet exposures, adjusted for risk weights ranging from 0% to 100%. Under the risk-based standard, capital is classified into two tiers. Tier 1 capital consists of common shareholders’ equity (excluding the unrealized gain (loss) on available-for-sale securities), trust preferred securities

11

subject to certain limitations, and minus certain intangible assets. Tier 2 capital consists of the general allowance for credit losses except for certain limitations. An institution’s qualifying capital base for purposes of its risk-based capital ratio consists of the sum of its Tier 1 and Tier 2 capital. The regulatory minimum requirements are 4% for Tier 1 and 8% for total risk-based capital. At December 31, 2006, our Tier 1 and total risk-based capital ratios were 15.6% and 16.6%, respectively.

Bank holding companies and banks are also required to maintain capital at a minimum level based on total assets, which is known as the leverage ratio. The minimum requirement for the leverage ratio is 3%, but all but the highest rated institutions are required to maintain ratios 100 to 200 basis points above the minimum. At December 31, 2006, our leverage ratio was 11.2%.

FDICIA contains “prompt corrective action” provisions pursuant to which banks are to be classified into one of five categories based upon capital adequacy, ranging from “well capitalized” to “critically undercapitalized” and which require (subject to certain exceptions) the appropriate federal banking agency to take prompt corrective action with respect to an institution which becomes “significantly undercapitalized” or “critically undercapitalized.”

The OCC and the FDIC have issued regulations to implement the “prompt corrective action” provisions of FDICIA. In general, the regulations define the five capital categories as follows:

| • | | an institution is “well capitalized” if it has a total risk-based capital ratio of 10% or greater, has a Tier 1 risk-based capital ratio of 6% or greater, has a leverage ratio of 5% or greater and is not subject to any written capital order or directive to meet and maintain a specific capital level for any capital measures; |

| • | | an institution is “adequately capitalized” if it has a total risk-based capital ratio of 8% or greater, has a Tier 1 risk-based capital ratio of 4% or greater, and has a leverage ratio of 4% or greater; |

| • | | an institution is “undercapitalized” if it has a total risk-based capital ratio of less than 8%, has a Tier 1 risk-based capital ratio that is less than 4% or has a leverage ratio that is less than 4%; |

| • | | an institution is “significantly undercapitalized” if it has a total risk-based capital ratio that is less than 6%, a Tier 1 risk-based capital ratio that is less than 3% or a leverage ratio that is less than 3%; and |

| • | | an institution is “critically undercapitalized” if its “tangible equity” is equal to or less than 2% of its total assets. |

The OCC and the FDIC, after an opportunity for a hearing, have authority to downgrade an institution from “well capitalized” to “adequately capitalized” or to subject an “adequately capitalized” or “undercapitalized” institution to the supervisory actions applicable to the next lower category, for supervisory concerns.

Generally, FDICIA requires that an “undercapitalized” institution must submit an acceptable capital restoration plan to the appropriate federal banking agency within 45 days after the institution becomes “undercapitalized” and the agency must take action on the plan within 60 days. The appropriate federal banking agency may not accept a capital restoration plan unless, among other requirements, each company having control of the institution has guaranteed that the institution will comply with the plan until the institution has been adequately capitalized on average during each of the three consecutive calendar quarters and has provided adequate assurances of performance. The aggregate liability under this provision of all companies having control of an institution is limited to the lesser of:

| • | | 5% of the institution’s total assets at the time the institution becomes “undercapitalized” or |

12

| • | | the amount which is necessary, or would have been necessary, to bring the institution into compliance with all capital standards applicable to the institution as of the time the institution fails to comply with the plan filed pursuant to FDICIA |

An “undercapitalized” institution may not acquire an interest in any company or any other insured depository institution, establish or acquire additional branch offices or engage in any new business unless the appropriate federal banking agency has accepted its capital restoration plan, the institution is implementing the plan, and the agency determines that the proposed action is consistent with and will further the achievement of the plan, or the appropriate Federal banking agency determines the proposed action will further the purpose of the “prompt corrective action” sections of FDICIA.

If an institution is “critically undercapitalized,” it must comply with the restrictions described above. In addition, the appropriate Federal banking agency is authorized to restrict the activities of any “critically undercapitalized” institution and to prohibit such an institution, without the appropriate Federal banking agency’s prior written approval, from:

| • | | entering into any material transaction other than in the usual course of business; |

| • | | engaging in any covered transaction with affiliates (as defined in Section 23A(b) of the Federal Reserve Act); |

| • | | paying excessive compensation or bonuses; and |

| • | | paying interest on new or renewed liabilities at a rate that would increase the institution’s weighted average costs of funds to a level significantly exceeding the prevailing rates of interest on insured deposits in the institution’s normal market areas. |

The “prompt corrective action” provisions of FDICIA also provide that in general no institution may make a capital distribution if it would cause the institution to become “undercapitalized.” Capital distributions include cash (but not stock) dividends, stock purchases, redemptions, and other distributions of capital to the owners of an institution.

Additionally, FDICIA requires, among other things, that:

| • | | only a “well capitalized” depository institution may accept brokered deposits without prior regulatory approval and |

| • | | the appropriate federal banking agency annually examine all insured depository institutions, with some exceptions for small, “well capitalized” institutions and state-chartered institutions examined by state regulators. |

FDICIA also contains a number of consumer banking provisions, including disclosure requirements and substantive contractual limitations with respect to deposit accounts.

As of December 31, 2006, each of our subsidiary Banks met the capital requirements of a “well capitalized” institution.

Enforcement Powers. Congress has provided the federal bank regulatory agencies with an array of powers to enforce laws, rules, regulations and orders. Among other things, the agencies may require that institutions cease and desist from certain activities, may preclude persons from participating in the affairs of insured depository institutions, may suspend or remove deposit insurance, and may impose civil money penalties against institution-affiliated parties for certain violations.

13

Maximum Legal Interest Rates. Like the laws of many states, Florida law contains provisions on interest rates that may be charged by banks and other lenders on certain types of loans. Numerous exceptions exist to the general interest limitations imposed by Florida law. The relative importance of these interest limitation laws to the financial operations of the Banks will vary from time to time, depending on a number of factors, including conditions in the money markets, the costs and availability of funds, and prevailing interest rates.

Branch Banking. Banks in Florida are permitted to branch state wide. Such branch banking, however, is subject to prior approval by the bank regulatory agencies. Any such approval would take into consideration several factors, including the bank’s level of capital, the prospects and economics of the proposed branch office, and other conditions deemed relevant by the bank regulatory agencies for purposes of determining whether approval should be granted to open a branch office.

Change of Control. Federal law restricts the amount of voting stock of a bank holding company and a bank that a person may acquire without the prior approval of banking regulators. The overall effect of such laws is to make it more difficult to acquire a bank holding company and a bank by tender offer or similar means than it might be to acquire control of another type of corporation. Consequently, shareholders of the Company may be less likely to benefit from the rapid increases in stock prices that may result from tender offers or similar efforts to acquire control of other companies. Federal law also imposes restrictions on acquisitions of stock in a bank holding company and a state bank. Under the federal Change in Bank Control Act and the regulations thereunder, a person or group must give advance notice to the Federal Reserve before acquiring control of any bank holding company, the OCC before acquiring control of any national bank and the FDIC and the Florida Department before acquiring control of a state bank. Upon receipt of such notice, the bank regulatory agencies may approve or disapprove the acquisition. The Change in Bank Control Act creates a rebuttable presumption of control if a member or group acquires a certain percentage or more of a bank holding company’s or state bank’s voting stock, or if one or more other control factors set forth in the Act are present.

Interstate Banking. Federal law provides for nationwide interstate banking and branching. Under the law, interstate acquisitions of banks or bank holding companies in any state by bank holding companies in any other state are permissible subject to certain limitations. Florida has a law that allows out-of-state bank holding companies (located in states that allow Florida bank holding companies to acquire banks and bank holding companies in that state) to acquire Florida banks and Florida bank holding companies. The law essentially provides for out-of-state entry by acquisition only (and not by interstate branching) and requires the acquired Florida bank to have been in existence for at least three years.

Effect of Governmental Policies. Our earnings and businesses are affected by the policies of various regulatory authorities of the United States, especially the Federal Reserve. The Federal Reserve, among other things, regulates the supply of credit and deals with general economic conditions within the United States. The instruments of monetary policy employed by the Federal Reserve for those purposes influence in various ways the overall level of investments, loans, other extensions of credit, and deposits, and the interest rates paid on liabilities and received on assets.

Sarbanes-Oxley Act. In 2002, the Sarbanes-Oxley Act was enacted which imposes a myriad of corporate governance and accounting measures designed that shareholders are treated and have full and accurate information about the public companies in which they invest. All public companies are affected by the Act. Some of the principal provisions of the Act include:

| | • | | the creation of an independent accounting oversight board (“PCAOB”) to oversee the audit of public companies and auditors who perform such audits; |

14

| | • | | auditor independence provisions which restrict non-audit services that independent accountants may provide to their audit clients; |

| | • | | additional corporate governance and responsibility measures which (a) require the chief executive officer and chief financial officer to certify financial statements and internal controls and to forfeit salary and bonuses in certain situations, and (b) protect whistleblowers and informants; |

| | • | | expansion of the authority and responsibilities of the company’s audit, nominating and compensation committees; |

| | • | | mandatory disclosure by analysts of potential conflicts of interest; and |

| | • | | enhanced penalties for fraud and other violations. |

USA Patriot Act. In 2001, the USA Patriot Act was enacted. The Act requires financial institutions to help prevent, detect and prosecute international money laundering and financing of terrorism. The effectiveness of a financial institution in combating money laundering activities is a factor to be considered in any application submitted by the financial institution with the bank regulatory agencies. Our Banks have adopted systems and procedures designed to comply with the USA Patriot Act and regulations adopted thereunder by the Secretary of the Treasury.

Competition

We encounter strong competition both in making loans and in attracting deposits. The deregulation of the banking industry and the widespread enactment of state laws which permit multi-bank holding companies as well as an increasing level of interstate banking have created a highly competitive environment for commercial banking. In one or more aspects of its business, our Company competes with other commercial banks, savings and loan associations, credit unions, finance companies, mutual funds, insurance companies, brokerage and investment banking companies, and other financial intermediaries. Most of these competitors, some of which are affiliated with bank holding companies, have substantially greater resources and lending limits, and may offer certain services that we do not currently provide. In addition, many of our non-bank competitors are not subject to the same extensive federal regulations that govern bank holding companies and federally insured banks. Recent federal and state legislation has heightened the competitive environment in which financial institutions must conduct their business, and the potential for competition among financial institutions of all types has increased significantly.

To compete, we rely upon specialized services, responsive handling of customer needs, and personal contacts by its officers, directors, and staff. Large multi-branch banking competitors tend to compete primarily by rate and the number and location of branches while smaller, independent financial institutions tend to compete primarily by rate and personal service.

15

Employees

As of December 31, 2006, we had a total of approximately 320 full-time equivalent employees. The employees are not represented by a collective bargaining unit. We consider relations with employees to be good.

Statistical Profile and Other Financial Data

Reference is hereby made to the statistical and financial data contained in the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for statistical and financial data providing a review of our Company’s business activities.

Availability of Reports furnished or filed with the Securities and Exchange Commission (SEC)

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available on our internet website atwww.csflbanks.com. The Company’s code of ethics is also included on our internet website.

We have identified risk factors described below, which should be viewed in conjunction with the other information contained in this document and information incorporated by reference, including our consolidated financial statements and related notes. If any of the following risks or other risks which have not been identified or which we may believe are immaterial or unlikely, actually occur, our business, financial condition and results of operations could be harmed. As noted previously, this report contains forward-looking statements that involve risks and uncertainties, including statements about our future plans, objectives, intentions and expectations. Many factors, including those described below, could cause actual results to differ materially from those discussed in forward-looking statements.

Our business strategy includes the continuation of significant growth plans, and our financial condition and results of operations could be negatively affected if we fail to grow or fail to manage our growth effectively

We intend to continue pursuing a significant growth strategy for our business. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in significant growth stages of development. There is no assurance we will be able to expand our market presence in our existing markets or successfully enter new markets or that any such expansion will not adversely affect our results of operations. Failure to manage our growth effectively could have a material adverse effect on our business, future prospects, financial condition or results of operations, and could adversely affect our ability to successfully implement our business strategy. Also, if our growth occurs more slowly than anticipated or declines, our operating results could be materially adversely affected.

Our ability to successfully grow will depend on a variety of factors including the continued availability of desirable business opportunities, the competitive responses from other financial institutions in our market areas and our ability to manage our growth. While we believe we have the management resources and internal systems in place to successfully manage our future growth, there can be no assurance growth opportunities will be available or growth will be successfully managed.

16

Our business is subject to the success of the local economies where we operate

Our success significantly depends upon the growth in population, income levels, deposits and housing starts in our primary and secondary markets. If the communities in which we operate do not grow or if prevailing economic conditions locally or nationally are unfavorable, our business may not succeed. Adverse economic conditions in our specific market area could reduce our growth rate, affect the ability of our customers to repay their loans to us and generally affect our financial condition and results of operations. We are less able than a larger institution to spread the risks of unfavorable local economic conditions across a large number of diversified economies. Moreover, we cannot give any assurance we will benefit from any market growth or favorable economic conditions in our primary market areas if they do occur.

Any adverse market or economic conditions in the State of Florida may disproportionately increase the risk our borrowers will be unable to make their loan payments. In addition, the market value of the real estate securing loans as collateral could be adversely affected by unfavorable changes in market and economic conditions. As of December 31, 2006, approximately 81% of our loans held for investment were secured by real estate. Of this amount, approximately 55% were commercial real estate loans, 34% were residential real estate loans and 11% were construction and development loans. Any sustained period of increased payment delinquencies, foreclosures or losses caused by adverse market or economic conditions in the State of Florida could adversely affect the value of our assets, our revenues, results of operations and financial condition.

We may face risks with respect to future expansion

We may acquire other financial institutions or parts of those institutions in the future and we may engage in additional de novo branch expansion. We may also consider and enter into new lines of business or offer new products or services. We also may receive future inquiries and have discussions with potential acquirors of us. Acquisitions and mergers involve a number of risks, including:

| | • | | the time and costs associated with identifying and evaluating potential acquisitions and merger partners; |

| | • | | the estimates and judgments used to evaluate credit, operations, management and market risks with respect to the target institution may not be accurate; |

| | • | | the time and costs of evaluating new markets, hiring experienced local management and opening new offices, and the time lags between these activities and the generation of sufficient assets and deposits to support the costs of the expansion; |

| | • | | our ability to finance an acquisition and possible dilution to our existing shareholders; |

| | • | | the diversion of our management’s attention to the negotiation of a transaction, and the integration of the operations and personnel of the combining businesses; |

| | • | | entry into new markets where we lack experience; |

| | • | | the introduction of new products and services into our business; |

| | • | | the incurrence and possible impairment of goodwill associated with an acquisition and possible adverse short-term effects on our results of operations; and |

17

| | • | | the risk of loss of key employees and customers. |

We may incur substantial costs to expand, and we can give no assurance such expansion will result in the levels of profits we seek. There can be no assurance integration efforts for any future mergers or acquisitions will be successful. Also, we may issue equity securities, including common stock and securities convertible into shares of our common stock in connection with future acquisitions, which could cause ownership and economic dilution to our current shareholders. There is no assurance that, following any future mergers or acquisition, our integration efforts will be successful or our company, after giving effect to the acquisition, will achieve profits comparable to or better than our historical experience.

If the value of real estate in our core Florida market were to decline materially, a significant portion of our loan portfolio could become under-collateralized, which could have a material adverse effect on us

With most of our loans concentrated in Central Florida, a decline in local economic conditions could adversely affect the values of our real estate collateral. Consequently, a decline in local economic conditions may have a greater effect on our earnings and capital than on the earnings and capital of larger financial institutions whose real estate loan portfolios are geographically diverse.

In addition to the financial strength and cash flow characteristics of the borrower in each case, the Banks often secure loans with real estate collateral. At December 31, 2006, approximately 81% of our loans have real estate as a primary or secondary component of collateral. The real estate collateral in each case provides an alternate source of repayment in the event of default by the borrower and may deteriorate in value during the time the credit is extended. If we are required to liquidate the collateral securing a loan to satisfy the debt during a period of reduced real estate values, our earnings and capital could be adversely affected.

An inadequate allowance for loan losses would reduce our earnings

The risk of credit losses on loans varies with, among other things, general economic conditions, the type of loan being made, the creditworthiness of the borrower over the term of the loan and, in the case of a collateralized loan, the value and marketability of the collateral for the loan. We maintain an allowance for loan losses based upon, among other things, historical experience, an evaluation of economic conditions and regular reviews of delinquencies and loan portfolio quality. Based upon such factors, management makes various assumptions and judgments about the ultimate collectibility of the loan portfolio and provides an allowance for loan losses based upon a percentage of the outstanding balances and for specific loans when their ultimate collectibility is considered questionable. If management’s assumptions and judgments prove to be incorrect and the allowance for loan losses is inadequate to absorb losses, or if the bank regulatory authorities require the Banks to increase the allowance for loan losses as a part of their examination process, our earnings and capital could be significantly and adversely affected.

The building of market share through our de novo branching strategy could cause our expenses to increase faster than revenues

We intend to continue to build market share in Central Florida through our de novo branching strategy. We currently plan to open several new branches in 2007 and 2008. There are considerable costs involved in opening branches and new branches generally do not generate sufficient revenues to offset

18

their costs until they have been in operation for at least a year or more. Accordingly, our new branches can be expected to negatively impact our earnings for some period of time until the branches reach certain economies of scale. Our expenses could be further increased if we encounter delays in the opening of any of our new branches. Finally, we have no assurance our new branches will be successful even after they have been established.

Our recent results may not be indicative of our future results

We may not be able to sustain our historical rate of growth or may not even be able to grow our business at all. In addition, our recent and rapid growth may distort some of our historical financial ratios and statistics. In the future, we may not have the benefit of several recently favorable factors, such as a generally favorable interest rate environment or the ability to find suitable expansion opportunities. Various factors, such as economic conditions, regulatory and legislative considerations and competition, may also impede or prohibit our ability to expand our market presence. If we experience a significant decrease in our historical rate of growth, our results of operations and financial condition may be adversely affected due to a high percentage of our operating costs being fixed expenses.

Our continued pace of growth may require us to raise additional capital in the future, but that capital may not be available when it is needed

We are required by federal and state regulatory authorities to maintain adequate levels of capital to support our operations. We anticipate our capital resources following this offering will satisfy our capital requirements for the foreseeable future. We may at some point, however, need to raise additional capital to support our continued growth.

Our ability to raise additional capital, if needed, will depend on conditions in the capital markets at that time, which are outside our control, and on our financial performance. Accordingly, we cannot assure you of our ability to raise additional capital if needed on terms acceptable to us. If we cannot raise additional capital when needed, our ability to further expand our operations through internal growth and acquisitions could be materially impaired.

Increases in interest rates may negatively affect our earnings and the value of our assets

Changes in interest rates may affect our level of interest income, the primary component of our gross revenue, as well as the level of our interest expense, our largest recurring expenditure. In a period of rising interest rates, our interest expense could increase in different amounts and at different rates while the interest that we earn on our assets may not change in the same amounts or at the same rates. Accordingly, increases in interest rates could decrease our net interest income.

Changes in the level of interest rates also may negatively affect our ability to originate real estate loans, the value of our assets and our ability to realize gains from the sale of our assets, all of which ultimately affect our earnings. A decline in the market value of our assets may limit our ability to borrow additional funds or result in our lenders requiring additional collateral from us under our loan agreements. As a result, we could be required to sell some of our loans and investments under adverse market conditions, upon terms that are not favorable to us, in order to maintain our liquidity. If those sales are made at prices lower than the amortized costs of the investments, we will incur losses.

19

Competition from financial institutions and other financial service providers may adversely affect our profitability

The banking business is highly competitive and we experience competition in each of our markets from many other financial institutions. We compete with commercial banks, credit unions, savings and loan associations, mortgage banking firms, consumer finance companies, securities brokerage firms, insurance companies, money market funds, and other mutual funds, as well as other super-regional, national and international financial institutions that operate offices in our primary market areas and elsewhere.

We compete with these institutions both in attracting deposits and in making loans. In addition, we have to attract our customer base from other existing financial institutions and from new residents. Many of our competitors are well-established, larger financial institutions. While we believe we can and do successfully compete with these other financial institutions in our primary markets, we may face a competitive disadvantage as a result of our smaller size, lack of geographic diversification and inability to spread our marketing costs across a broader market. Although we compete by concentrating our marketing efforts in our primary markets with local advertisements, personal contacts, and greater flexibility and responsiveness in working with local customers, we can give no assurance this strategy will be successful.

We are subject to extensive regulation that could limit or restrict our activities

We operate in a highly regulated industry and are subject to examination, supervision, and comprehensive regulation by various federal and state agencies. Our compliance with these regulations is costly and restricts certain of our activities, including payment of dividends, mergers and acquisitions, investments, loans and interest rates charged, interest rates paid on deposits and locations of offices. We are also subject to capitalization guidelines established by our regulators, which require us to maintain adequate capital to support our growth.

The laws and regulations applicable to the banking industry could change at any time, and we cannot predict the effects of these changes on our business and profitability. Because government regulation greatly affects the business and financial results of all commercial banks and bank holding companies, our cost of compliance could adversely affect our ability to operate profitably.

We are dependent upon the services of our management team

Our future success and profitability is substantially dependent upon the management and banking abilities of our senior executives. We believe that our future results will also depend in part upon our attracting and retaining highly skilled and qualified management and sales and marketing personnel. Competition for such personnel is intense, and we cannot assure you that we will be successful in retaining such personnel. We also cannot guarantee that members of our executive management team will remain with us. Changes in key personnel and their responsibilities may be disruptive to our business and could have a material adverse effect on our business, financial condition and results of operations.

| Item 1B. | Unresolved Staff Comments |

None

Our Holding Company owns no real property. We occupy office space in the main office building of CenterState Bank, one of our subsidiary Banks, which is located at 1101 First Street South, Suite 202,

20

Winter Haven, Florida 33880. Our Company, through our Banks, currently operates a total of 30 banking offices. Of these offices there are two “mini” offices in active adult communities. These offices are leased for nominal amounts, and generally consist of a room that is set aside for us in the community club house or community center. These offices are opened for abbreviated periods and cater to the residents of the gated community. Of the 28 full service offices, we lease two (downtown Lakeland office and our Leesburg office), we constructed two branch buildings on leased land (Kissimmee office and south Lakeland office), we are operating three offices in temporary locations during the construction of their permanent sites (Crystal River, Deer Creek and Eustis), and all the remaining offices (21) we own without encumbrances.See Note 4 to the Consolidated Financial Statements of our Company included in this Annual Report on Form 10-K beginning at page 63 for additional information regarding our premises and equipment.

Our Banks are periodically parties to or otherwise involved in legal proceedings arising in the normal course of business, such as claims to enforce liens, claims involving the making and servicing of real property loans, and other issues incident to their respective businesses. We do not believe that there is any pending or threatened proceeding against the Banks which would have a material adverse effect on our consolidated financial position.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of our Company security holders during the fourth quarter of the year ended December 31, 2006.

21

PART II

| Item 5. | Market for Common Equity, Related Stockholder Matters, Purchases of Equity Securities and Performance Graph |

The shares of our Common Stock are traded on the Nasdaq National Market System. The following sets forth the high and low trading prices for trades of our Common Stock that occurred during 2006 and 2005. Historical per share data has been adjusted to reflect our May 2006 two for one stock split.

| | | | | | | | | | | | |

| | | 2006 | | 2005 |

| | | High | | Low | | High | | Low |

1st Quarter | | $ | 19.57 | | $ | 17.08 | | $ | 17.25 | | $ | 14.91 |

2nd Quarter | | | 22.74 | | | 17.88 | | | 20.43 | | | 16.18 |

3rd Quarter | | | 21.05 | | | 18.16 | | | 17.47 | | | 16.25 |

4th Quarter | | | 22.26 | | | 19.10 | | | 17.48 | | | 16.75 |

As of December 31, 2006, there were 11,129,020 shares of common stock outstanding. There were approximately 970 registered shareholders as of that date, as reported by our transfer agent, Continental Stock Transfer & Trust Company.

Dividends

We have historically paid cash dividends on a quarterly basis, on the last business day of the calendar quarter. The following sets forth per share cash dividends paid during 2006 and 2005. Historical per share data has been adjusted to reflect our May 2006 two for one stock split.

| | | | | | |

| | | 2006 | | 2005 |

1st Quarter | | $ | 0.035 | | $ | 0.03 |

2nd Quarter | | $ | 0.035 | | $ | 0.03 |

3rd Quarter | | $ | 0.035 | | $ | 0.035 |

4th Quarter | | $ | 0.035 | | $ | 0.035 |

The payment of dividends is a decision of our Board of Directors based upon then-existing circumstances, including our rate of growth, profitability, financial condition, existing and anticipated capital requirements, the amount of funds legally available for the payment of cash dividends, regulatory constraints and such other factors as the Board determines relevant. The source of funds for payment of dividends by our Holding Company is dividends received from our Banks, or excess cash available at the Holding Company level. Payments by our subsidiary Banks to our Holding Company are limited by law and regulations of the bank regulatory authorities. There are various statutory and contractual limitations on the ability of our Banks to pay dividends to our Holding Company. The bank regulatory agencies also have the general authority to limit the dividends paid by banks if such payment may be deemed to constitute an unsafe and unsound practice. Our subsidiaries may not pay dividends from their paid-in surplus. All dividends must be paid out of undivided profits then on hand, after deducting expenses, including reserves for losses and bad debts. In addition, a national bank is prohibited from declaring a dividend on its shares of common stock until its surplus equals its stated capital, unless there has been transferred to surplus no less than one/tenth of the bank’s net profits of the preceding two consecutive half-year periods (in the case of an annual dividend). The approval of the OCC is required if the total of all

22

dividends declared by a national bank in any calendar year exceeds the total of its net profits for that year combined with its retained net profits for the preceding two years, less any required transfers to surplus. As to a state bank, no dividends may be paid at a time when the Bank’s net income from the preceding two years is a loss or which would cause the capital accounts of the Bank to fall below the minimum amount required by law, regulation, order or any written agreement with the Florida Department or a Federal regulatory agency.

Share Repurchases

We did not repurchase any shares of our common stock during 2006.

Stock Plans

With respect to information regarding our securities authorized for issuance under equity incentive plans, the information contained in the section entitled “Equity Compensation Plan Information” in our Definitive Proxy Statement for the 2007 Annual Meeting of Shareholders is incorporated herein by reference.

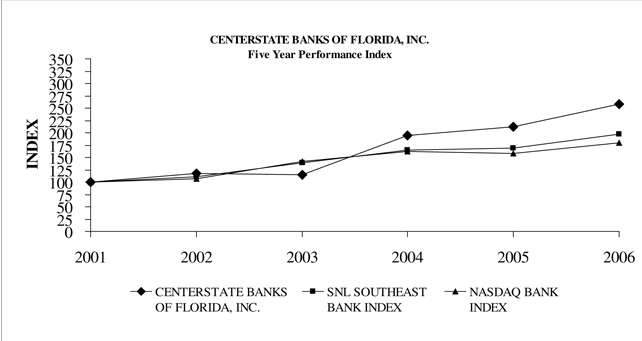

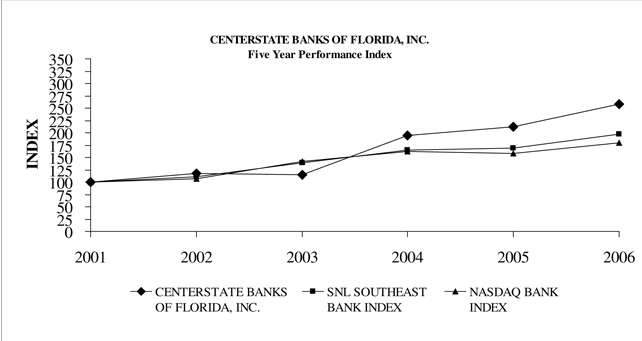

Performance Graph

Shares of our common stock commenced trading on the OTC Bulletin Board on January 26, 2001 and on the NASDAQ National Market System on February 20, 2001. The following graph compares the yearly percentage change in cumulative shareholder return on the Company’s common stock, with the cumulative total return of the SNL Southeast Bank Index and the NASDAQ Bank Index, since January 1, 2001 (assuming a $100 investment on January 1, 2001 and reinvestment of all dividends).

| | | | | | | | | | | | |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 |

CenterState Banks of Florida, Inc. | | 100 | | 117 | | 115 | | 194 | | 212 | | 258 |

SNL Southeast Bank Index | | 100 | | 110 | | 139 | | 165 | | 168 | | 197 |

NASDAQ Bank Index | | 100 | | 107 | | 142 | | 162 | �� | 158 | | 180 |

23

| Item 6. | Selected Consolidated Financial Data |

The selected consolidated financial data presented below should be read in conjunction with management’s discussion and analysis of financial condition and results of operations, and the consolidated financial statements and footnotes thereto, of the Company at December 31, 2006 and 2005, and the three year period ended December 31, 2006, presented elsewhere herein.

Selected Consolidated Financial Data

December 31

| | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands except for share and per share data) | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

SUMMARY OF OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Total interest income | | $ | 59,113 | | | $ | 40,266 | | | $ | 29,088 | | | $ | 25,802 | | | $ | 21,048 | |

Total interest expense | | | (22,010 | ) | | | (11,722 | ) | | | (7,874 | ) | | | (7,532 | ) | | | (6,892 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 37,103 | | | | 28,544 | | | | 21,214 | | | | 18,270 | | | | 14,156 | |

Provision for loan losses | | | (717 | ) | | | (1,065 | ) | | | (1,270 | ) | | | (1,243 | ) | | | (644 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 36,386 | | | | 27,479 | | | | 19,944 | | | | 17,027 | | | | 13,512 | |

Non-interest income | | | 6,136 | | | | 5,380 | | | | 4,932 | | | | 4,687 | | | | 3,660 | |

Gain on sale of branches | | | — | | | | — | | | | 1,844 | | | | — | | | | — | |

Non-interest expense | | | (29,204 | ) | | | (22,805 | ) | | | (19,780 | ) | | | (17,547 | ) | | | (13,397 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 13,318 | | | | 10,054 | | | | 6,940 | | | | 4,167 | | | | 3,775 | |

Income taxes | | | (4,859 | ) | | | (3,724 | ) | | | (2,567 | ) | | | (1,541 | ) | | | (1,406 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 8,459 | | | $ | 6,330 | | | $ | 4,373 | | | $ | 2,626 | | | $ | 2,369 | |

| | | | | | | | | | | | | | | | | | | | |

PER COMMON SHARE DATA: | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share | | $ | 0.77 | | | $ | 0.675 | | | $ | 0.585 | | | $ | 0.390 | | | $ | 0.42 | |

Diluted earnings per share | | $ | 0.75 | | | $ | 0.655 | | | $ | 0.570 | | | $ | 0.385 | | | $ | 0.41 | |

Book value per share | | $ | 10.54 | | | $ | 9.26 | | | $ | 7.09 | | | $ | 6.23 | | | $ | 5.94 | |

Tangible book value per share | | $ | 9.38 | | | $ | 8.77 | | | $ | 6.45 | | | $ | 5.18 | | | $ | 5.19 | |

Dividends per share | | $ | 0.14 | | | $ | 0.13 | | | $ | 0.12 | | | $ | 0.11 | | | $ | 0.10 | |

Actual shares outstanding | | | 11,129,020 | | | | 10,500,772 | | | | 8,137,426 | | | | 6,738,760 | | | | 6,724,136 | |

Weighted average shares outstanding | | | 10,964,890 | | | | 9,357,046 | | | | 7,500,316 | | | | 6,729,648 | | | | 5,646,426 | |

Diluted weighted average shares outstanding | | | 11,232,059 | | | | 9,629,194 | | | | 7,656,308 | | | | 6,857,638 | | | | 5,757,540 | |

| | | | | |

BALANCE SHEET DATA: | | | | | | | | | | | | | | | | | | | | |

Assets | | $ | 1,077,102 | | | $ | 871,521 | | | $ | 753,779 | | | $ | 608,896 | | | $ | 494,800 | |

Total loans, net | | | 650,608 | | | | 510,167 | | | | 435,320 | | | | 409,048 | | | | 329,666 | |

Total deposits | | | 892,806 | | | | 717,337 | | | | 659,630 | | | | 538,235 | | | | 441,462 | |

Short-term borrowings | | | 52,792 | | | | 42,811 | | | | 24,627 | | | | 17,465 | | | | 10,005 | |

Corporate debenture | | | 10,000 | | | | 10,000 | | | | 10,000 | | | | 10,000 | | | | — | |

Shareholders’ equity | | | 117,332 | | | | 97,241 | | | | 57,664 | | | | 41,963 | | | | 39,915 | |

Tangible capital | | | 104,386 | | | | 92,087 | | | | 52,438 | | | | 36,651 | | | | 34,868 | |

Goodwill | | | 9,863 | | | | 4,675 | | | | 4,675 | | | | 4,675 | | | | 4,308 | |

Core deposit intangible (CDI) | | | 3,083 | | | | 479 | | | | 551 | | | | 637 | | | | 739 | |

Average total assets | | | 981,640 | | | | 808,177 | | | | 673,669 | | | | 550,866 | | | | 374,008 | |

Average loans, net | | | 598,106 | | | | 476,676 | | | | 415,864 | | | | 370,029 | | | | 258,232 | |

Average interest earning assets | | | 894,286 | | | | 744,298 | | | | 618,589 | | | | 503,292 | | | | 343,541 | |

Average deposits | | | 807,471 | | | | 678,149 | | | | 584,442 | | | | 488,952 | | | | 340,123 | |

Average interest bearing deposits | | | 610,732 | | | | 496,046 | | | | 445,358 | | | | 393,528 | | | | 277,466 | |

Average interest bearing liabilities | | | 670,562 | | | | 544,663 | | | | 481,468 | | | | 412,457 | | | | 281,651 | |

Average shareholders’ equity | | | 109,794 | | | | 78,037 | | | | 51,340 | | | | 40,955 | | | | 28,581 | |

24

Selected Consolidated Financial Data - continued

December 31

| | | | | | | | | | | | | | | |

(Dollars in thousands except for share and per share data) | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

SELECTED FINANCIAL RATIOS: | | | | | | | | | | | | | | | |

Return on average assets | | 0.86 | % | | 0.78 | % | | 0.65 | % | | 0.48 | % | | 0.63 | % |

Return on average equity | | 7.70 | % | | 8.11 | % | | 8.52 | % | | 6.41 | % | | 8.29 | % |

Dividend payout | | 18 | % | | 19 | % | | 21 | % | | 28 | % | | 24 | % |

Efficiency (1) | | 68 | % | | 67 | % | | 76 | % | | 76 | % | | 75 | % |

Net interest margin (2) | | 4.15 | % | | 3.84 | % | | 3.43 | % | | 3.63 | % | | 4.12 | % |

Net interest spread (3) | | 3.33 | % | | 3.26 | % | | 3.06 | % | | 3.30 | % | | 3.68 | % |

| | | | | |

CAPITAL RATIOS: | | | | | | | | | | | | | | | |

Tier 1 leverage ratio | | 11.23 | % | | 12.35 | % | | 8.60 | % | | 7.84 | % | | 8.54 | % |

Risk-based capital | | | | | | | | | | | | | | | |

Tier 1 | | 15.60 | % | | 18.10 | % | | 13.40 | % | | 11.30 | % | | 9.95 | % |

Total | | 16.60 | % | | 19.23 | % | | 14.61 | % | | 12.48 | % | | 11.16 | % |

Average equity to average assets | | 11.18 | % | | 9.66 | % | | 7.62 | % | | 7.43 | % | | 7.64 | % |

| | | | | |

ASSET QUALITY RATIOS: | | | | | | | | | | | | | | | |

Net charge-offs to average loans | | 0.08 | % | | 0.05 | % | | 0.07 | % | | 0.12 | % | | 0.13 | % |

Allowance to period end loans | | 1.12 | % | | 1.26 | % | | 1.29 | % | | 1.17 | % | | 1.22 | % |

Allowance for loan losses to non-performing loans | | 1,206 | % | | 430 | % | | 634 | % | | 366 | % | | 290 | % |

Non-performing assets to total assets | | 0.06 | % | | 0.18 | % | | 0.17 | % | | 0.27 | % | | 0.30 | % |

| | | | | |

OTHER DATA: | | | | | | | | | | | | | | | |

Banking locations | | 30 | | | 26 | | | 25 | | | 25 | | | 21 | |